#Number of Units Sold by TCL Technology Group

Explore tagged Tumblr posts

Text

Number of Units Sold by TCL Technology Group

TCL Technology is an electronics company based in Huizhou, Guangdong Province. The semiconductor display business TCL CSOT (TCL China Star Optoelectronics Technology Co.) is segmented into large-sized, medium-to-small-sized products and Moka Technology.

The company’s main businesses are the semiconductor display business, new energy photovoltaic, and semi-conductor materials. The semiconductor display business TCL CSOT (TCL China Star Optoelectronics Technology Co.) is segmented into large-sized, medium-to-small-sized products and Moka Technology.

In the large-size segment, TCL CSOT sells TV panels that include 55-inch, 65-inch, and 75-inch products, 8K and 120 HZ high-end TV panels, interactive whiteboards, digital signage, and splicing screens. In FY2021, the company sold 63,324,000 units in this segment resulting in a 38% increase in sales volume compared to FY2020 YoY.

In the medium-to-small-sized segment, the company sells e-sports displays, LTPS (Low Temperature PolySilicon LCD) notebook panels, LTPS tablet PC panels, LTPS mobile phone panels, VR/AR display products, and laptop products equipped with Mini LED backlighting. During FY2021, the company sold 96,220,000 units resulting in a 3% decrease in sales volume as compared to FY2020 YoY. It is also expanding its 6th generation LTPS LCD display panel production line to meet consumer demand.

#Number of Units Sold by TCL Technology Group#Gross profit of TCL Technology 2011-2021#Tcl technology group annual report#Tcl net worth 2022

0 notes

Text

[Before the China Securities Marketplace] This year's first doubling fund was born; many businesses declared duty-free business qualifications; Tesla fell nearly 5%; gold costs approached historical highs

Everyday Finance Distinctive, Quick Follow

1. China's 1st Mars exploration mission probe was effectively launched, taking the first step in planetary exploration 2. The General Office of hawaii Council issued the "Key Tasks for Deepening the Reform of the Medical and Health Program in the Second Half of 2020", proposing in-depth implementation of the Healthy China Initiative to market the revitalization and growth of Chinese medicine 3. Xin Guobin, deputy minister of the Ministry of Sector and IT, stated on the 23rd that the next step is to accelerate the launch of the "New Energy Automobile Sector Development Plan (2021-2035)", which includes already been submitted to hawaii Council. 4. In 2020, the first doubling fund was born. As of July 23, the net value growth price of Rongtong Healthcare Fund has reached 100.29% this year 5. According to information released by the Association of Global Banks, Finance and Telecommunications (SWIFT), in June 2020, in the rating of worldwide payment currencies predicated on amount statistics, the RMB rose to 5th location, accounting for 1.76% Company focus 9 companies including China Micro and Microphone Technology Shareholders plan to reduce their holdings On the evening of July 23, 9 sci-tech innovation board firms including Guangfeng Technology, Hanchuan Intelligent, Wald, Xinguang Optoelectronics, Western Superconductor, Espressif Technology, Jiayuan Technology, Rongbai Technology, and China Microelectronics Corporation disclosed their shareholders. (Which includes directors, supervisors and senior executives) announcement of shareholding decrease. Among them, the biggest level of lifting of the ban, China and Micro, released the first single inquiry exchange plan. Western Superconductor's proposed reduction of shares accounted for the best proportion of overall equity at 14%. From the viewpoint of market value, in line with the most recent closing price by July 23, the full total market value of the shares that shareholders of 8 businesses except China and Micro Company intends to reduce is approximately 6.8 billion yuan. CSI Note: The agency believes that the concentrated reduction of shareholders of the Sci-tech Innovation Panel may have a short-term impact on the stock price, however the magnitude is bound. From a long-term viewpoint, concentrated reductions or "golden pits" will be created. Haili Bio (603718) Never mixed up in production and sales of human vaccines Haili Biology disclosed the share price change upon the evening of July 23, and stated that the business is not mixed up in production and sales of human vaccines. The business's main business is the research and development, manufacturing and sales of veterinary vaccines and its wholly-owned subsidiary Shanghai Jiemen Biotechnology Co., Ltd. is involved in the study, development, manufacturing and sales of clinical in vitro diagnostic reagents. CSI Note: Biological stocks have been trending very strongly recently. As well as the assistance of fundamentals, the main topic of the brand new crown pneumonia vaccine is an excellent help. However the rise of Haili Biology is indeed a bit inexplicable, the company's primary veterinary vaccine. It is well worth noting that one of the top ten shareholders of the business has a hot cash tycoon who has elevated the placard of Haili Biotech 3 x and spent a lot more than 1 billion yuan. Announcement selection Zhongbai Group (000759), BBK (002251): Submitted the request for declaration of duty-free business qualification You A Shares (002277): controlling shareholder applies for duty-free business qualification Sinopec (600028), PetroChina (601857): plan to transfer related company equity, oil and gas pipelines and supporting facilities to the Nationwide Pipeline Group Blue cursor (300058): Terminate the securitization deal of the company's foreign possessions in america market Hanbang Hi-Tech (300449): A wholly-owned subsidiary obtains Huawei ISV companion certification China Securities (601066): Net profit in the first fifty percent of the entire year increased by 96.54% year-on-year Ingenic Group (601216): Shareholders plan to reduce their holdings by no more than 2% Sheng Laida (002473): stocks implement additional risk warnings, investing will be suspended for one time on July 24 Nanfang Bearing (002553): The application form for listing on the Technology and Technology Innovation Panel of the Pan Asia Micro-Transportation Panel of the participating business has been approved by the Shanghai Stock Exchange Chengyitong (300430): The controlling shareholder transfers area of the company's shares by agreement Research report collection Ping A good Securities: Interest rates are difficult in order to decline significantly The bond marketplace has seen sustained growth recently. Ping An Securities believes that the bond market's rebound is tough to sustain: (1) From a fundamental viewpoint, the economic climate will continue steadily to repair in the next fifty percent of the entire year, and steadily improve from the prior month, which will restrict the decline of risk-free interest levels. (2) The focus of monetary policy in the next fifty percent of the entire year may be biased towards financial risk prevention, in fact it is tough to continue to relax considerably. (3) From the perspective of exchange rate expectations administration, maintaining a particular pass on between China and the United States helps keep up with the balance of RMB exchange rate expectations. China Merchants Securities: a growing number of profit improvement sectors China Merchants Securities Research Report remarked that the V-shaped reversal of the A-share marketplace yesterday. The current liquidity is fair, and under the history that the true estate chain, infrastructure chain, and developing investment chain may surpass expectations, the amount of industrial sectors with improved profit growth in the next season increase significantly. "Growth cycle stocks" will be the important direction of marketplace investment in the next stage, and the targets are hidden in the building materials, environmental defense and general public utilities, home appliances, gentle industry, non-ferrous metals, chemicals, electronics, insurance, securities companies, machinery, electric brand-new and other industries. Guosen Securities: Highlights of Cloud Video game Concept Frequently Guosen Securities Research Survey believes that cloud gaming is going to further open up the growth space for high-quality video games, and game content providers with high-quality game development capabilities is going to continue steadily to benefit. From concept to landing, the landing of cloud video games requires not only content, but also infrastructure (GPU cloud system, etc.) support; at the same time, from the viewpoint of business versions, cloud video games are expected to redefine the worthiness of the system. The big TV screen is likely to become an ideal landing scene for cloud gaming C-end, that may satisfy users' gaming experience not the same as mobile games and end games, and create a new blue ocean game market place. Main trend Northbound funds According to data through the Hong Kong Stock Exchange, the net outflow of northbound money on the 23rd was 3.654 billion yuan. Wuliangye, Kweichow Moutai, TCL Technologies, and Hengrui Pharmaceutical rated 1st, with net sales of 708 million yuan, 404 million yuan, 277 million yuan, and 261 million yuan respectively; Ping An of China and Muyuan experienced higher net buys, respectively 367 million yuan, 285 million yuan. Institutional Trends According to Longhuban data, upon July 23, institutional seat money were sold to get a internet 150 million yuan. 7 stocks were bought net and 9 stocks offered net. The stocks and shares with an increase of net buys are iKang Technologies, Kanghua Biology, Allwinner Technologies, etc.; Huida Sanitary Ware, Li Si Chen, Tongda shares and other net sales will be the top. The sales of the operating department's funds were net 221 million yuan. Net bought 26 stocks and internet sold 26 stocks. Compared with multiple stocks, the net purchase quantity is Recco Defense, Lisichen, Hongxiang Co., Ltd.; Yaguang Technologies, Xishui Co., Ltd., and Gongda Diansheng will be the top net sales. Overseas News European and United states markets U.S. stocks fell collectively, Nasdaq fell a lot more than 2% Investors are worried about the improvement of the US epidemic and corporate functionality. Simultaneously, marketplace rumors that the US fiscal stimulus policy may be stranded, and US stocks and shares fell collectively on Thursday.

Large US technology stocks fell across the board.

Financial stocks were mixed.

Intel's second-quarter internet revenue and profit exceeded expectations Intel announced the second-quarter financial review following the US stock market on Thursday, with net income of US$19.7 billion and marketplace anticipations of US$18.554 billion; adjusted earnings per share for the next one fourth were US$1.23 and marketplace estimates were Us all$1.12. Intel announced that the 7mnCPU production period will be delayed by about 6 months from the initial plan. The business's stock price fell a lot more than 8% following the market.

The U.S. requested unemployment advantages for the very first time last week, 1.416 million individuals exceeded market expectations On July 23, the latest data released by the US Department of Labor demonstrated that the amount of people trying to get unemployment benefits for the very first time in the week of July 18 was 1.416 million, that was higher than the prior value and expected 1.3 million, and it exceeded 1 million for the 18th consecutive week. Buffett increases his holdings of Us all$800 million in Bank of The united states stock SEC documents show that within the first three days of this week, Buffett bought nearly 34 million Bank of America stocks at the average price of approximately Us all$24 per share, costing a lot more than Us all$800 million, and boosting his shareholding ratio from 10.9% to 11.3%. Three major European stock indexes were mixed

The dollar index fell 0.31% Like of the end of the brand new York trading session, the US dollar index fell 0.31% to 94.6906. China Concept Stock Chinese stocks generally fell

Commodity International oil prices fall

NY gold costs rose for five consecutive years, approaching the best closing record in history, 1891.9 US dollars / ounce

1 note

·

View note

Text

[Before the China Securities Market] This year's initial doubling fund was created; many businesses declared duty-free business qualifications; Tesla fell nearly 5%; gold prices approached historical highs

Everyday Finance Exceptional, Quick Follow Financial News 1. China's initial Mars exploration mission probe was successfully launched, taking step one in planetary exploration 2. THE OVERALL Office of the State Council released the "Key Duties for Deepening the Reform of the Healthcare and Health Program in the Second 1 / 2 of 2020", proposing in-depth execution of the Healthy China Initiative to market the revitalization and development of Chinese medicine 3. Xin Guobin, deputy minister of the Ministry of Industry and Information Technology, mentioned on the 23rd that the next phase will be to accelerate the discharge of the "New Energy Automobile Sector Development Plan (2021-2035)", which includes been submitted to hawaii Council. 4. In 2020, the first doubling fund was created. As of July 23, the net value growth rate of Rongtong Health care Fund has reached 100.29% this year 5. According to data released by the Association of Worldwide Banks, Financing and Telecommunications (SWIFT), in June 2020, in the ranking of worldwide payment currencies based on amount data, the RMB rose to fifth place, accounting for 1.76% Company focus 9 companies including China Micro and Microphone Technology Shareholders intend to reduce their holdings On the evening of July 23, 9 sci-tech innovation board companies including Guangfeng Technology, Hanchuan Intelligent, Wald, Xinguang Optoelectronics, Western Superconductor, Espressif Technology, Jiayuan Technology, Rongbai Technology, and China Microelectronics Corporation disclosed their shareholders. (Which includes directors, supervisors and senior executives) announcement of shareholding decrease. Among them, the biggest level of lifting of the ban, China and Micro, released the initial single inquiry transfer strategy. Western Superconductor's proposed reduction of shares accounted for the highest proportion of overall equity at 14%. From the viewpoint of market worth, in line with the latest closing price as of July 23, the total market value of the shares that shareholders of 8 businesses except China and Micro Corporation intends to reduce is about 6.8 billion yuan. CSI Note: The agency believes that the concentrated reduced amount of shareholders of the Sci-tech Innovation Board could have a short-term effect on the stock price, however the magnitude is bound. From the long-term perspective, concentrated reductions or "golden pits" will undoubtedly be created. Haili Bio (603718) Never involved in the production and sales of human vaccines Haili Biology disclosed the share price change on the evening of July 23, and stated that the company is not mixed up in production and product sales of human vaccines. The business's main business is the research and development, production and sales of veterinary vaccines and its wholly-possessed subsidiary Shanghai Jiemen Biotechnology Co., Ltd. is engaged in the research, development, manufacturing and sales of medical in vitro diagnostic reagents. CSI Note: Biological stocks and shares have already been trending pretty strongly recently. In addition to the support of fundamentals, the subject of the new crown pneumonia vaccine is a good help. However the increase of Haili Biology is definitely a bit inexplicable, the business's main veterinary vaccine. It is well worth noting that certain of the top ten shareholders of the company has a hot money tycoon who offers raised the placard of Haili Biotech three times and spent more than 1 billion yuan. Announcement selection Zhongbai Group (000759), BBK (002251): Submitted the obtain declaration of duty-free business qualification You A Shares (002277): controlling shareholder applies for duty-free business qualification Sinopec (600028), PetroChina (601857): intend to transfer related company equity, coal and oil pipelines and supporting facilities to the National Pipeline Group Blue cursor (300058): Terminate the securitization transaction of the business's foreign possessions in america market Hanbang Hi-Tech (300449): A wholly-owned subsidiary obtains Huawei ISV companion certification China Securities (601066): Net profit in the first half of the entire year increased by 96.54% year-on-year Ingenic Group (601216): Shareholders intend to reduce their holdings by only 2% Sheng Laida (002473): stocks implement other risk warnings, trading will be suspended for one day time on July 24 Nanfang Bearing (002553): The application for listing on the Science and Technology Creativity Board of the Pan Asia Micro-Transportation Table of the participating corporation was approved by the Shanghai Stock Exchange Chengyitong (300430): The controlling shareholder transfers portion of the company's shares by agreement Research report collection Ping A good Securities: Interest levels are difficult in order to decline significantly

The bond market has seen sustained growth recently. Ping An Securities believes that the bond market's rebound will be challenging to sustain: (1) From the fundamental viewpoint, the economy will continue to restoration in the next fifty percent of the year, and slowly enhance from the previous month, which will restrict the decline of risk-free interest levels. (2) The focus of monetary plan in the second fifty percent of the year may be biased towards monetary risk prevention, and it is hard to continue to relax considerably. (3) From the perspective of trade rate expectations management, maintaining a particular pass on between China and america helps maintain the stability of RMB swap rate expectations. China Merchants Securities: increasingly more profit improvement sectors

China Merchants Securities Research Report pointed out that the V-shaped reversal of the A-share market yesterday. The existing liquidity is reasonable, and under the history that the real estate chain, infrastructure chain, and manufacturing purchase chain may surpass expectations, the number of industrial sectors with improved profit growth in the next calendar year increase significantly. "Growth cycle stocks and shares" are the key direction of market investment within the next stage, and the targets are concealed in the building materials, environmental security and general public utilities, kitchen appliances, gentle industry, non-ferrous metals, chemicals, electronics, insurance, securities companies, machinery, electric new along with other industries. Guosen Securities: Highlights of Cloud Video game Concept Frequently Guosen Securities Analysis Record believes that cloud gaming can further open up the growth space for high-quality video games, and game content suppliers with high-quality game development capabilities will continue steadily to benefit. From concept to landing, the landing of cloud games requires not only content, but additionally infrastructure (GPU cloud system, etc.) support; simultaneously, from the viewpoint of business versions, cloud games are expected to redefine the worthiness of the system. The large TV screen is expected to become a perfect landing scene for cloud gaming C-end, which can satisfy users' gaming experience not the same as cellular games and end games, and develop a new glowing blue ocean game market. Main trend Northbound funds According to data from the Hong Kong Stock Exchange, the net outflow of northbound money on the 23rd was 3.654 billion yuan. Wuliangye, Kweichow Moutai, TCL Technology, and Hengrui Pharmaceutical ranked very first, with net sales of 708 million yuan, 404 million yuan, 277 million yuan, and 261 million yuan respectively; Ping An of China and Muyuan got higher net purchases, respectively 367 million yuan, 285 million yuan. Institutional Trends In accordance with Longhuban data, upon July 23, institutional seat funds were sold with regard to a net 150 million yuan. 7 stocks were purchased net and 9 shares offered net. The stocks with an increase of net purchases are iKang Technologies, Kanghua Biology, Allwinner Technology, etc.; Huida Sanitary Ware, Li Si Chen, Tongda shares and other net product sales are the top. The sales of the operating department's funds were net 221 million yuan. Net purchased 26 shares and net sold 26 shares. Compared with multiple stocks, the web purchase amount is Recco Defense, Lisichen, Hongxiang Co., Ltd.; Yaguang Technologies, Xishui Co., Ltd., and Gongda Diansheng are the top net sales. Overseas News European and United states markets U.S. stocks fell collectively, Nasdaq fell a lot more than 2% Investors are concerned about the progress of the united states epidemic and corporate functionality. At the same time, market rumors that the US fiscal stimulus policy could be stranded, and US stocks fell collectively on Thursday. Large US technology stocks fell across the board. Financial stocks were mixed. Intel's second-quarter net revenue and profit exceeded expectations Intel announced its second-quarter financial statement after the US currency markets on Thursday, with net revenue of US$19.7 billion and marketplace anticipation of US$18.554 billion; adjusted earnings per share for the second quarter were US$1.23 and marketplace estimates were US$1.12. Intel announced that the 7mnCPU production period will be delayed by about six months from the original plan. The business's stock cost fell more than 8% following the market. The U.S. requested unemployment benefits for the first time the other day, 1.416 million people exceeded market expectations On July 23, the latest data launched by the united states Department of Labor showed that the amount of people applying for unemployment benefits for the first time in the week of July 18 was 1.416 million, that was higher than the prior value and expected 1.3 million, and it exceeded 1 million for the 18th consecutive week. Buffett boosts his holdings of People$800 million in Bank of America stock SEC docs show that within the initial three times of this week, Buffett bought almost 34 million Bank of America shares at an average price of around US$24 per share, costing a lot more than US$800 million, and escalating his shareholding ratio from 10.9% to 11.3%. Three major European stock indexes were mixed The dollar index fell 0.31% Seeing that of the end of the New York trading session, the US dollar index fell 0.31% to 94.6906. China Concept Stock Chinese stocks and shares generally fell Commodity

NEO International oil prices fall NY gold costs rose for 5 consecutive years, approaching the best closing record in history, 1891.9 US dollars / ounce Recommended reading ?Huge decrease in holdings is finally here! 9 sci-tech innovation plank businesses introduced that they can reduce their holdings, and some shareholders choose to liquidate ?Net income soared 10 times! The ��transcripts�� of the A-share businesses in the initial half of the year exceeded expectations ?Choose costly or cheap? FOLLOWING A shares deep V, institutional divergence increased ?The everyday limit tide! Good news from vaccines, crucial tasks for health care reform in the next half of the year have already been finalized stamp!

0 notes

Text

TCL 8-Series Roku TV Review

Of course, TCL Roku TVs have become the sensation of recent years in the middle segment of TVs. Several years in a row, many TCL models, including the phenomenally successful 6th series, are included in various top lists and are Best Sellers on the main trading floors. Moreover, their huge popularity is based not only on relatively low prices, but also on a huge number of enthusiastic consumer reviews. As a result, many experts are closely following the news from this Chinese company. Therefore, the presentation of the TCL TVs 8-Series at CES 2019 did not go unnoticed.

Unfortunately, today pre-order is only available at Best Buy. The 65-inch 65Q825 costs $ 2,000, and the 75-inch 75Q825 costs $ 3,000. In addition, the 8-series uses Roku TV, which rightfully claims to be the leader in popularity among built-in smart TV systems.

Many experts believe that Roku has largely ensured TCL's immense popularity in the United States. According to market research firm NPD, it grew by more than 60% in 2017 and 2018, trailing only Samsung and Vizio in units sold. Finally, TCL promises to expand the 8th series with a 8K model in early 2020.

Mini-LED backlight technology

But of course, the innovative mini-LED backlight technology has become the main advantage of the new series.

For the first time, these models use mini-LED technology, which many experts consider to be a real competitor to OLED technology. TCL its calls "Quantum Contrast." As known, the number of dimming zones directly affects image quality. In particular, their increase reduces the blooming effect, which is present in all LCD models with local dimming. It occurs due to insufficient accuracy of backlighting. Of course, expensive modern LCD models provide a fairly high quality, but even they cannot completely eliminate the "blooming". Mini-LED technology offers excellent prospects for solving this problem. Usually, modern models use LEDs about 1000 microns (0.04 inches) in size. But today companies produce mini-LEDs measuring about 200 microns (0.02 inches). Also, the improvement of mini-LED production technology has significantly improved their specs, including size, power consumption, brightness, heat dissipation, etc. This has allowed engineers to use a significantly larger number of mini-LEDs due to a decrease in their size. As a result, TCL developed Mini-LED backlight technology for their TVs. Today company places over 25,000 mini-LEDs the back of the TV, which are grouped into around 1,000 zones. In comparison, the 75-inch Vizio Quantum X uses only 485 local dimming zones, and the Sony XBR-85Z9G 8K TV costing about $ 13,000 has 720 zones.

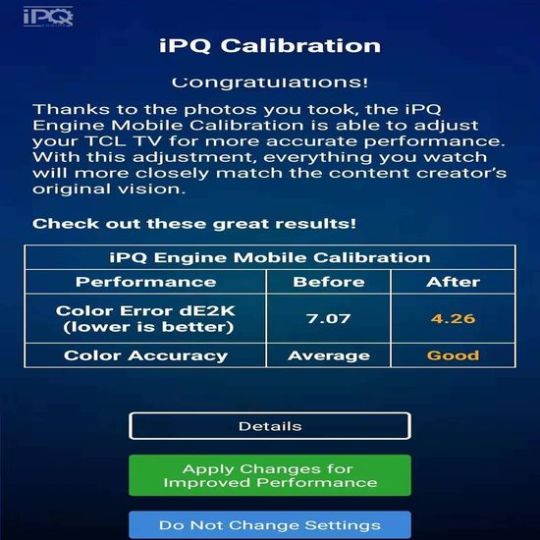

iPQ Calibration

In addition, the company announced an additional service with new iPQ Calibration app. According to the company, it will adjust the image settings. In fact, this option provides simplified calibration of the TV without specialized equipment. This function only requires an app to TV connection and a series of photo screens with gray and color test patterns. Next, the TV will automatically make all the necessary settings.

Unfortunately, the app will only work with some phones, including Google Pixels and iPhone, due to phone camera restrictions. The company promises that all TLC TVs 2019 and, possibly, earlier models will support this option.

Conclusion

Of course, TCL 8-series claims to repeat the success of 6-series due to the innovative Mini-LED backlight technology, Roku TV, iPQ Calibration and 8K resolution, which the company promises in the models of this series in 2020. However, this factor directly depends on the pricing strategy of the company. The huge popularity of the previous TCL series was largely due to their excellent price, which effectively complemented a fairly high quality. This video offers an overview of the TCL 8-series. Read the full article

#iPQCalibration#Mini-LEDbacklighttechnology#QuantumContrasttechnology#TCL65Q825RokuTV#TCL75Q825RokuTV#TCL8-seriesRokuTVs

0 notes