#Online Money Transfer API

Explore tagged Tumblr posts

Text

What if I just become an annoying ADHD money blogger sometimes

#adhd adult money liveblogging

If you have problems saving money (especially emergency savings money) because you always spend it on too many impulse purchases, or take money out of your savings to cover your fun money:

you need to open a savings account with a new bank. The more impulsive you are, the more I recommend a small credit union or online only bank, or a really local bank. Someone whose online fund transfers to other banks takes three whole business days, so you literally can't just instant transfer money from savings to your checking account to spur of the moment buy things. If you're afraid this defeats the point of an emergency savings fund in the case of, well, an emergency, set up a small checking account with a minimal amount at this bank too, and just set aside the debit card somewhere you won't frequently use because it won't have much money until you pull it from emergency savings and put it in the checking account.

Look for one with a high APY relative to having basically no deposit minimum (mine is like 3%) and no minimum deposit or monthly fees. The APY is basically when bank sometimes pays you money for not spending money. It will be like, cents at first. Change in the sofa cushions. But over time, it will be more. Don't worry about it. It's just surprise money for later. Not a lot, mind you. But you're a competitive winner and every cent they give you FREE is a success to zap your brain with dopamine. (Eventually if you have enough money you can do this by like, investing in shit or buying CDs and they just give you MORE MONEY. BUT!!! BABY STEPS.)

This is crucial: if you have some kind of direct deposit paycheck set up, see if you can SPLIT the direct deposit between multiple accounts. The company my job uses to pay people allows us to choose between depositing a fixed dollar amount to certain accounts (with "remainder of paycheck balance" being automatic for one account), OR depositing a percentage of my paycheck to certain accounts. (Percents of a paycheck tend to be higher to start). If you don't get paid this way, figure out a good date to set a recurring transfer from your checking to your savings for an amount so it won't sit in your spendy account long. The goal is to pretend like you just actually never had the savings money in that paycheck. Poof. Gone. Disappeared. It got saved before you became aware of the money.

Feel free to start with a small amount. It can be $5 or whatever. Once you start doing this for a few paychecks look at your money. If you're not genuinely struggling to stay afloat after 2-3 months and are still comfortable, try increasing the number a little. Repeat as needed.

Now you've saved money. 🎉

This is genuinely how I managed to save money more consistently than anything else I've ever tried. Savings money goes in the secret money account. 🤷🏽♀️ Incredibly silly but it works.

37 notes

·

View notes

Text

High-Yield Savings Accounts: Earn More with the Best Savings Rates in 2025

Meta Description:

Discover the benefits of high-yield savings accounts in 2025. Learn how to find the best savings rates and top-performing online savings accounts to grow your money faster.

In today’s fast-paced financial world, making your money work harder is more important than ever. One of the easiest and safest ways to do that is by opening a high-yield savings account. These accounts offer significantly better returns than traditional savings accounts, especially when paired with online banking platforms that provide the best savings rates.

If you’re looking to boost your savings without taking on risk, this article will guide you through everything you need to know about high-yield savings accounts, including where to find the top offers and how to make the most of them.

What Is a High-Yield Savings Account?

A high-yield savings account is a type of savings account that pays a much higher interest rate compared to a standard savings account offered by brick-and-mortar banks. While traditional savings accounts may offer around 0.01% to 0.10% APY (Annual Percentage Yield), high-yield accounts can offer anywhere from 4.00% to 5.50% APY in 2025.

These accounts are typically offered by online banks, which have fewer overhead costs and can pass the savings on to you in the form of better savings rates.

Top Benefits of High-Yield Savings Accounts

Higher Interest Earnings The standout benefit is earning significantly more on your savings with the best savings rates available today.

FDIC Insurance Just like traditional accounts, most online savings accounts are FDIC-insured up to $250,000, providing peace of mind.

Easy Online Access Manage your money from anywhere using secure apps and online dashboards.

No Monthly Fees Most high-yield accounts come with zero maintenance or service fees.

Low or No Minimums You can often open these accounts with $0–$100, making them accessible to everyone.

Best High-Yield Savings Accounts in 2025

Here are some of the top-performing online savings accounts offering the best savings rates:BankAPYMinimum BalanceMonthly FeeAlly Bank4.25%$0$0Marcus by Goldman Sachs4.40%$0$0Discover Online Savings4.35%$0$0SoFi Savings4.60%$0$0American Express Personal Savings4.30%$0$0

Note: Rates are accurate as of May 2025 and are subject to change.

How to Choose the Right High-Yield Savings Account

When comparing high-yield savings accounts, consider the following:

APY: Look for the highest yield, but watch out for promotional rates that may drop.

Fees: Choose an account with no maintenance or transaction fees.

Ease of Use: Opt for an intuitive mobile app and online platform.

Deposit & Withdrawal Limits: Some accounts limit the number of monthly withdrawals.

Customer Service: Choose banks known for reliable customer support.

Tips to Maximize Your High-Yield Savings

Automate Your Savings Set up recurring transfers from your checking account to your high-yield savings account.

Avoid Withdrawals Let your money grow uninterrupted by minimizing withdrawals.

Monitor APY Changes Interest rates can fluctuate, so stay updated and consider switching if better rates emerge.

Use for Short-Term Goals Perfect for emergency funds, vacation savings, or a new car—anything that requires a safe place to grow cash.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Final Thoughts

In 2025, there’s no reason to settle for pennies on your savings. With high-yield savings accounts, you can safely and easily grow your money faster. Whether you’re saving for a rainy day or planning for a large purchase, choosing the best online savings account with the highest savings rates is a smart move.

Start comparing today and take control of your financial future—your money deserves to work just as hard as you do.

Need Personal Or Business Funding? Prestige Business Financial Services LLC offer over 30 Personal and Business Funding options to include good and bad credit options. Get Personal Loans up to $100K or 0% Business Lines of Credit Up To $250K. Also credit repair and passive income programs.

Book A Free Consult And We Can Help - https://prestigebusinessfinancialservices.com

Email - [email protected]

Learn More!!

Prestige Business Financial Services LLC

"Your One Stop Shop To All Your Personal And Business Funding Needs"

Website- https://prestigebusinessfinancialservices.com

Email - [email protected]

Phone- 1-800-622-0453

#high yield savings account#best savings rates#online savings accounts#entrepreneur#businessfunding#personalfunding#personal finance

1 note

·

View note

Text

Empower Your Digital Projects with Expert Laravel Development Services at CloudKodeForm Technologies.

In today’s busy online world, picking the right tech partner can decide if your project succeeds or fails. CloudKodeForm Technologies focuses on Laravel development, providing strong, scalable web solutions with one of the most popular PHP frameworks, Laravel.

Whether you’re a startup building a custom app or a large company upgrading old systems, our skilled Laravel developers can transform your ideas into smooth digital products.

Why pick Laravel for your website? Laravel is a free PHP framework known for its simple and clean code. It offers many built-in tools and libraries that make hard coding tasks easier. Laravel helps speed up development while keeping the code clean, secure, and easy to change later. It includes features like routing, caching, sessions, and login tools, making it a top choice for modern web projects.

CloudKodeForm Technologies Laravel services We provide full-service Laravel web development, including:

Creating custom web apps with Laravel

Building and adding APIs

Creating online stores with Laravel

Transferring your site to Laravel from other platforms

Updating and upgrading existing Laravel sites

Providing ongoing maintenance and support

Our team of licensed Laravel experts follows best practices to deliver projects on time and ensure high quality. We focus on speed, user experience, and making sure your site can grow over time.

Why work with CloudKodeForm Technologies?

As a trusted Laravel partner, we stand out because of our quality work and focus on customer needs. Here’s why many businesses choose us:

Our team is experienced and certified in Laravel. We’ve worked with health, finance, logistics, and SaaS projects.

We create web apps that are easy to grow and maintain, saving you time and money.

We keep communication open from start to finish, so you’re always in the loop.

Security is key. We follow the latest rules to keep your app and data safe.

Get ahead with Laravel-based web apps in a competitive market, a strong framework like Laravel can set your business apart. Whether you need a customer management system, supply chain software, marketplace, or content site—we can help bring your ideas to life.

At CloudKodeForm Technologies, we not only build apps but create solid digital systems that can grow with your business.

0 notes

Text

Artificial Intelligence Course Online India: Your Complete 2025 Guide

Artificial Intelligence has officially moved out of labs and into real-world applications. Whether it's powering chatbots, personalizing recommendations, detecting fraud, or enabling autonomous systems — AI is everywhere. In India, the demand for skilled AI professionals is exploding, and if you’re reading this, chances are you’re thinking about how to get started.

Here’s the good news: You don’t need to relocate to Silicon Valley or enroll in a full-time university program. With the right Artificial Intelligence course online in India, you can build real skills from wherever you are — whether you’re a student, a working professional, or someone pivoting into tech.

But not all courses are worth your time or money. So how do you choose the right one? This guide breaks it down.

Why Learn Artificial Intelligence Online in India?

India has a booming AI job market, and online learning is no longer considered second-tier. In fact, many employers prefer candidates who can show initiative through hands-on, project-based online learning.

Here’s why online AI courses work especially well in India:

Flexible for working professionals or students

Cost-effective compared to offline or international programs

Accessible across cities — no matter if you're in Mumbai, Bhopal, Kochi, or Guwahati

Career-focused with real-world project work

Global exposure with instructors and mentors from top AI backgrounds

Who Should Take an AI Course Online?

A good Artificial Intelligence course online in India should cater to different backgrounds. Here’s who benefits the most:

1. Fresh Graduates

If you’re coming out of a computer science, engineering, or math degree, online AI training helps bridge the gap between academic theory and industry expectations.

2. Working Professionals

Whether you're in software development, analytics, finance, or marketing — learning AI lets you automate, predict, and optimize your work.

3. Career Switchers

People moving from non-tech backgrounds (mechanical, civil, MBA, operations) are increasingly taking AI courses to move into high-paying roles in tech and product.

4. Entrepreneurs

If you're building a startup, AI can give your product a competitive edge — from customer insights to automation and personalization.

What Should a Good AI Course Cover?

Before you pay for any course, make sure the syllabus isn’t just fluff. Here’s what the best online AI courses in India typically include:

✅ Core Foundations

Python programming

Data structures & logic building

Statistics and probability

Linear algebra

✅ Machine Learning

Supervised & unsupervised learning

Decision trees, random forests, SVM

Model evaluation & tuning

✅ Deep Learning

Neural networks, CNNs, RNNs

Transfer learning

Image and speech recognition

✅ Natural Language Processing (NLP)

Sentiment analysis

Text classification

Chatbots and transformers (like GPT)

✅ Tools & Platforms

scikit-learn, TensorFlow, Keras, PyTorch

OpenAI API, Hugging Face

Jupyter Notebook, Google Colab

Streamlit or Flask for deployment

✅ Real-World Projects

Predictive modeling

Recommendation systems

NLP-based ticketing systems or chatbots

Image classification or detection apps

If a course skips real project work or only teaches via slides — skip it.

How to Evaluate an Online AI Course in India

1. Live vs Self-Paced

Live classes offer mentorship, accountability, and doubt-clearing

Self-paced is flexible but requires self-discipline Choose based on your learning style and time availability.

2. Hands-On Focus

Does the course include:

Assignments after each module?

End-to-end capstone projects?

Code reviews or portfolio help?

If not, you won’t stand out during job interviews.

3. Instructors With Industry Experience

Look for trainers who’ve worked in AI/ML — not just trained in it. Check LinkedIn to verify.

4. Career Support

A great course doesn’t end with a certificate. You should get:

Resume + LinkedIn optimization

Mock interviews

Portfolio project guidance

Job referrals or placement support

Top Benefits of Taking an Artificial Intelligence Course Online in India

📌 Geographic Freedom

You can learn AI from any part of India — whether you’re in a metro or a Tier 2/3 city.

📌 Learn While You Work or Study

Even if you have a full-time job or academic schedule, you can study AI part-time online.

📌 Better Return on Investment

Online programs are often 3x to 5x cheaper than offline bootcamps or international degrees — but offer the same (or better) skill-building.

📌 Stay Current

The best online AI courses update their curriculum frequently — especially important in a fast-evolving field like artificial intelligence.

What Kind of Roles Can You Land After an Online AI Course?

The skills you learn in a well-designed AI course open doors to roles like:

Machine Learning Engineer

AI Research Assistant

Data Scientist

NLP Engineer

Computer Vision Developer

AI Product Analyst

AI Consultant

Business Intelligence Analyst (with AI skills)

The job market in India is growing fast — especially in cities like Bengaluru, Hyderabad, Pune, and Gurgaon — but remote jobs and freelance AI roles are also expanding.

A Word of Caution: Red Flags to Avoid

Not all online courses are worth your time. Avoid any program that:

Doesn’t show a clear syllabus

Avoids hands-on coding or skips real projects

Has generic instructors with no track record in AI

Promises 100% job placement but offers no proof

Sells certificates without substance

Your goal should be skills first, certificate second.

Why Boston Institute of Analytics Is a Top Choice in India?

If you're looking for a career-focused Artificial Intelligence course online in India, the Boston Institute of Analytics (BIA) is one of the strongest options available today.

Here’s what makes BIA stand out:

Globally recognized certification with local context

Curriculum built around industry use-cases

Covers Python, ML, Deep Learning, NLP, and AI tools in-depth

Fully online, live instructor-led sessions

Hands-on project work from the first week

One-on-one mentorship and post-course career support

Flexible for students, professionals, and career switchers

Affordable pricing compared to international programs

Whether you’re starting from scratch or building on an existing tech foundation, BIA helps you develop practical, job-ready AI skills that employers actually care about.

Final Thoughts

The future belongs to those who can work with data and intelligence systems. But simply watching videos or reading theory won’t get you there. You need practical experience, guidance, and a structured roadmap.

The right Artificial Intelligence course online in India should:

Match your career goals

Teach real skills with hands-on work

Offer mentorship and career support

Equip you to build, not just understand, AI systems

Don’t just collect certificates. Learn to think like an AI professional — and start solving real problems.

#Best Data Science Courses Online India#Artificial Intelligence Course Online India#Data Scientist Course Online India#Machine Learning Course Online India

0 notes

Text

What Is Varo Bank? A Deep Dive into the Digital Banking Platform

Understanding the Rise of Digital Banking

In recent years, the financial landscape has transformed dramatically with the emergence of neobanks, or digital-only banks. These institutions operate entirely online, offering streamlined services through mobile apps and websites, often without the hefty fees associated with traditional brick-and-mortar banks. This shift has left many consumers wondering about the different players in this new financial space. Understanding these platforms is key to managing your money effectively in the modern world. One actionable tip is to list your primary banking needs—such as checking, savings, loans, or cash advances—before you start comparing options. This will help you filter through the noise and find a service that truly fits your lifestyle.

What Exactly is Varo Bank?

Varo Bank stands out as one of the first fintech companies to be granted a national bank charter in the U.S., meaning it's a legitimate bank regulated like its traditional counterparts. Your deposits are FDIC-insured up to $250,000, providing a crucial layer of security. Varo offers core banking services, including a checking account, a high-yield savings account, and a small-dollar cash advance feature called Varo Advance. The platform aims to provide accessible, low-fee banking to everyone, leveraging technology to reduce overhead and pass those savings onto customers. Before signing up for any digital service, always verify its regulatory status and insurance coverage. For U.S. banks, you can confirm FDIC insurance on the FDIC's official website.

Varo's Core Financial Products

Varo's main offerings are designed to cover everyday financial needs. The Varo Bank Account comes with no monthly maintenance fees, no minimum balance requirements, and access to a vast network of fee-free ATMs. Their high-yield Varo Savings Account often features an Annual Percentage Yield (APY) significantly higher than the national average, encouraging users to grow their money. It also includes tools like Save Your Pay and Save Your Change, which automatically transfer money into your savings, making it easier to build a nest egg without actively thinking about it. A good practice is to enable automatic savings features whenever available, as they help build financial discipline effortlessly.

The Varo Advance Feature

For those moments when you're short on cash before payday, Varo offers Varo Advance. This feature allows eligible users to get a small, instant cash advance to help cover unexpected expenses. Eligibility depends on your account history and direct deposit activity. While convenient, it's important to note that Varo Advance is not entirely free. Depending on the advance amount, a small fee may apply. This fee structure is common among many cash advance services integrated into banking apps. When considering such a feature, always calculate the total cost to ensure it's a more affordable option than overdraft fees or other short-term credit.

How Varo Stacks Up Against Traditional Banks

The primary advantage of Varo over traditional banks is its cost structure and convenience. With no monthly fees and higher interest rates on savings, it presents a compelling case for the budget-conscious consumer. The mobile-first approach means you can manage your finances from anywhere, at any time. However, the lack of physical branches can be a drawback for those who prefer in-person customer service or need complex banking services like cashier's checks or international wire transfers. Your choice should depend on your comfort level with digital platforms and whether you anticipate needing services that require a physical bank branch.

Exploring Alternatives for Fee-Free Financial Support

As consumers explore modern financial tools, a common question is, what is varo and how does it compare to other fintech solutions? While Varo integrates banking and cash advances, some users may be looking for specialized apps that prioritize zero-cost support. If your main goal is to access cash advances or use Buy Now, Pay Later (BNPL) without ever worrying about fees, other platforms might be a better fit. For instance, the Gerald app offers fee-free instant cash advances and BNPL services. Unlike Varo Advance, which may charge for advances, Gerald's model is entirely free of interest, transfer fees, and late fees, providing a reliable safety net without the extra cost.

Making the Right Financial Choice for You

Choosing the right financial tool requires careful consideration of your personal needs and habits. If you want an all-in-one digital banking solution with a solid savings account and an occasional cash advance option, Varo is a strong contender. However, if your primary need is a flexible, cost-free way to manage unexpected expenses or make purchases over time, a dedicated app like Gerald could be more beneficial. The best approach is to evaluate the features that matter most to you and compare the fee structures of each service. The Consumer Financial Protection Bureau (CFPB) offers resources to help consumers make informed decisions about financial products.

Final Thoughts on Modern Financial Tools

The evolution of financial technology has given consumers more choices than ever before. Platforms like Varo have redefined digital banking by making it more accessible and affordable. At the same time, specialized apps have emerged to solve specific financial challenges, such as the need for interest-free cash advances or flexible payment options. By understanding the unique strengths of each platform, you can build a financial toolkit that empowers you to manage your money with confidence and avoid unnecessary fees, ensuring you are prepared for whatever comes your way.

0 notes

Text

What Is Varo Bank? A Deep Dive into the Digital Banking Platform

Discover Varo Bank, a digital banking platform offering checking, savings, and cash advance features. Learn how it works and compare it to other options.

Understanding the Rise of Digital Banking

In recent years, the financial landscape has transformed dramatically with the emergence of neobanks, or digital-only banks. These institutions operate entirely online, offering streamlined services through mobile apps and websites, often without the hefty fees associated with traditional brick-and-mortar banks. This shift has left many consumers wondering about the different players in this new financial space. Understanding these platforms is key to managing your money effectively in the modern world. One actionable tip is to list your primary banking needs—such as checking, savings, loans, or cash advances—before you start comparing options. This will help you filter through the noise and find a service that truly fits your lifestyle.

What Exactly is Varo Bank?

Varo Bank stands out as one of the first fintech companies to be granted a national bank charter in the U.S., meaning it's a legitimate bank regulated like its traditional counterparts. Your deposits are FDIC-insured up to $250,000, providing a crucial layer of security. Varo offers core banking services, including a checking account, a high-yield savings account, and a small-dollar cash advance feature called Varo Advance. The platform aims to provide accessible, low-fee banking to everyone, leveraging technology to reduce overhead and pass those savings onto customers. Before signing up for any digital service, always verify its regulatory status and insurance coverage. For U.S. banks, you can confirm FDIC insurance on the FDIC's official website.

Varo's Core Financial Products

Varo's main offerings are designed to cover everyday financial needs. The Varo Bank Account comes with no monthly maintenance fees, no minimum balance requirements, and access to a vast network of fee-free ATMs. Their high-yield Varo Savings Account often features an Annual Percentage Yield (APY) significantly higher than the national average, encouraging users to grow their money. It also includes tools like Save Your Pay and Save Your Change, which automatically transfer money into your savings, making it easier to build a nest egg without actively thinking about it. A good practice is to enable automatic savings features whenever available, as they help build financial discipline effortlessly.

The Varo Advance Feature

For those moments when you're short on cash before payday, Varo offers Varo Advance. This feature allows eligible users to get a small, instant cash advance to help cover unexpected expenses. Eligibility depends on your account history and direct deposit activity. While convenient, it's important to note that Varo Advance is not entirely free. Depending on the advance amount, a small fee may apply. This fee structure is common among many cash advance services integrated into banking apps. When considering such a feature, always calculate the total cost to ensure it's a more affordable option than overdraft fees or other short-term credit.

How Varo Stacks Up Against Traditional Banks

The primary advantage of Varo over traditional banks is its cost structure and convenience. With no monthly fees and higher interest rates on savings, it presents a compelling case for the budget-conscious consumer. The mobile-first approach means you can manage your finances from anywhere, at any time. However, the lack of physical branches can be a drawback for those who prefer in-person customer service or need complex banking services like cashier's checks or international wire transfers. Your choice should depend on your comfort level with digital platforms and whether you anticipate needing services that require a physical bank branch.

Exploring Alternatives for Fee-Free Financial Support

As consumers explore modern financial tools, a common question is, what is varo and how does it compare to other fintech solutions? While Varo integrates banking and cash advances, some users may be looking for specialized apps that prioritize zero-cost support. If your main goal is to access cash advances or use Buy Now, Pay Later (BNPL) without ever worrying about fees, other platforms might be a better fit. For instance, the Gerald app offers fee-free instant cash advances and BNPL services. Unlike Varo Advance, which may charge for advances, Gerald's model is entirely free of interest, transfer fees, and late fees, providing a reliable safety net without the extra cost.

Making the Right Financial Choice for You

Choosing the right financial tool requires careful consideration of your personal needs and habits. If you want an all-in-one digital banking solution with a solid savings account and an occasional cash advance option, Varo is a strong contender. However, if your primary need is a flexible, cost-free way to manage unexpected expenses or make purchases over time, a dedicated app like Gerald could be more beneficial. The best approach is to evaluate the features that matter most to you and compare the fee structures of each service. The Consumer Financial Protection Bureau (CFPB) offers resources to help consumers make informed decisions about financial products.

Final Thoughts on Modern Financial Tools

The evolution of financial technology has given consumers more choices than ever before. Platforms like Varo have redefined digital banking by making it more accessible and affordable. At the same time, specialized apps have emerged to solve specific financial challenges, such as the need for interest-free cash advances or flexible payment options. By understanding the unique strengths of each platform, you can build a financial toolkit that empowers you to manage your money with confidence and avoid unnecessary fees, ensuring you are prepared for whatever comes your way.

0 notes

Text

Loan Lending App Development: Must-Have Features

Loan applications are no longer tied to physical paperwork or long waits. People today expect fast approvals, minimal documentation, and user-friendly experiences — all from their smartphones. From personal loans to small business finance, lending has moved online.

That’s where Loan Lending App Development makes a difference. A well-built loan app simplifies the borrowing process, protects user data, and builds trust. At Idiosys Tech, we help financial institutions and startups create powerful apps that put users first.

Easy Onboarding Builds Trust

The first step into your loan app should be quick and smooth. Simple sign-ups, phone-based login, and document upload features reduce friction. Our team ensures that users feel confident from the start.

As a leading Loan lending app development company in Kolkata, we use intuitive designs that guide users step by step. This encourages retention and builds early trust.

Streamlined Application Process

Filling out loan forms can feel overwhelming. We fix that with clean, mobile-optimized forms that ask only what’s needed. Our goal is to make applying feel easy, not stressful. We use smart forms with dropdowns, auto-fill, and tooltips to guide users without confusion.

Instant Eligibility and Credit Checks

No one wants to wait days to find out if they qualify. By integrating real-time credit scoring tools, we help apps offer instant results. This lets users see their options right away.

As an experienced Loan Lending app developer in Kolkata, we add backend intelligence that analyzes data safely and quickly. It’s fast, secure, and reliable.

Clear Loan Calculators That Guide Users

Users need to know what they’re signing up for. We design loan calculators that are simple to use and update instantly. Just enter the amount, interest, and duration — your app will do the rest.

This feature lets borrowers explore different plans and make better decisions.

Secure and Fast Document Upload

Uploading ID proof, income details, or bank statements shouldn’t be hard. Our Loan Lending mobile app development team adds secure upload options that work with the phone camera or file browser.

Files are encrypted and saved safely. The process is smooth and lets users know what to expect next.

Personalized Dashboards That Inform

Every borrower wants to stay updated. Our custom dashboards give users a full view of their loan status, EMI calendar, past payments, and special offers.

With strong design and clarity, these dashboards keep users engaged and reduce support requests. As one of the best mobile app development companies in Kolkata, we ensure both function and style.

Fast Disbursement and Payment Options

When a loan is approved, funds should arrive quickly. We connect apps with secure banking APIs that transfer money instantly. We also add trusted payment gateways for EMIs and auto-deductions.

All actions are logged and visible in the dashboard. This helps users feel in control.

Notifications That Keep Users Engaged

Users forget. That’s why we set up alerts for each step — approval, payment due, document needs, and reminders. Push notifications, SMS, or email — whichever users prefer.

It improves repayment rates and strengthens user communication.

Smart Admin Panels for Easy Loan Management

Lenders need control, too. We build admin dashboards that handle user management, document review, approval workflows, and EMI tracking.

Our dashboards come with role-based access to keep operations secure and organized.

AI for Smarter Lending

Risk scoring used to be manual. Not anymore. We use AI to track user behavior, detect red flags, and suggest personalized loan options.

It’s efficient, and it helps lenders make better decisions. As a leading mobile app development company in Kolkata, we make AI work for your business.

Security and Compliance at the Core

Loans mean sensitive data. We never compromise on protection. Our apps follow RBI and international standards. From encrypted logins to audit trails, we cover all the bases.

Our developers keep up with policy updates so your app stays compliant.

Modern Tech for Long-Term Growth

We build apps using proven stacks — Flutter, React Native, Node.js, and Kotlin. These tools make updates, integrations, and growth easier.

Whether you’re starting small or scaling big, our systems are ready to grow with you.

Why Choose Us?

Idiosys Tech is a top name in Loan Lending App Development. Based in Kolkata, we serve clients in India and abroad. We mix fintech knowledge with app-building skills to create solutions that really work.

We’ve helped clients in finance, retail, and insurance move faster.

Conclusion: Get Started with the Right Lending App

A smart lending app simplifies the loan process for users and gives lenders the tools to manage efficiently. With the right features — onboarding, AI, dashboards, and secure payments — you can build trust and grow fast.

At Idiosys Tech, we design and build user-focused loan apps with security and simplicity at the core. Partner with us and turn your app idea into reality.

__________________________________________________

What are the key features of a successful loan lending app?

Core features include easy onboarding, real-time eligibility checks, document uploads, loan calculators, EMI reminders, secure payment gateways, and AI-based risk scoring.

How secure are these apps for handling sensitive financial data?

Very secure. At Idiosys Tech, we implement encryption, two-factor authentication, secure APIs, and follow RBI and global compliance standards to protect user data.

Can the app support instant loan approvals?

Yes. By integrating with real-time credit scoring tools and financial APIs, we enable instant eligibility checks and approvals for a seamless user experience.

Can we integrate the app with third-party APIs and CRMs?

Absolutely. We offer full integration with CRMs, payment gateways, credit bureaus, and financial APIs to ensure smooth operations across systems.

Will the app work on both Android and iOS platforms?

Yes. We use modern frameworks like Flutter and React Native to create cross-platform apps that work efficiently on both Android and iOS devices.

Can users track their loan status and EMI history?

Yes. We build personalized dashboards where users can view their loan details, payment history, next due date, and other relevant information in real-time.

How does AI help in loan lending apps?

AI helps by analyzing user behavior, assessing risk, offering loan recommendations, and detecting fraud — resulting in smarter lending decisions and better customer service.

__________________________________________________

You May Also Read

The Role of AI in Enhancing Bidding Application Development

#Loan Lending App#Loan Lending App Deveelopment#App Development#Mobile App Development#App Development Company#Mobile App Development Company#App Developer

0 notes

Text

Transform Your Business with Future-Ready iGaming Solutions

The online gaming industry is more competitive than ever. To stand out, operators need more than a basic platform—they need advanced, scalable, and user-focused iGaming solutions. At Microbit Media, we deliver exactly that.

We specialize in helping you launch and grow high-performance iGaming platforms that engage users, boost retention, and maximize revenue. Whether you're starting from scratch or upgrading your current operation, our technology and expertise ensure you're always one step ahead.

What Sets Our iGaming Solutions Apart

1. Full-Service Technology Platform Our powerful backend system supports sports betting, casino, live games, and more. Built on a secure, scalable infrastructure, our iGaming solutions allow you to operate smoothly under any load—whether you're managing 100 or 100,000 players.

With modular architecture and customizable interfaces, we adapt the platform to fit your branding, business model, and geographic needs.

2. Quick Deployment, Full Control Time is money in the gaming industry. Our team helps you go live quickly with a turnkey solution—complete with licensing, payment integration, content, and user management tools. Once live, you stay in full control through an easy-to-use dashboard, allowing you to track data, manage users, and optimize performance in real-time.

Mobile-First Experience for Global Reach

More than 70% of online gaming happens on mobile devices. That’s why our iGaming solutions are designed mobile-first, ensuring fast, responsive gameplay on any device.

From the betting interface to secure wallet features, every component is optimized for smartphones and tablets—giving your players a seamless, on-the-go experience.

Integrated Payment & Security Systems

Our platform supports a wide range of global payment options including credit cards, e-wallets, bank transfers, and cryptocurrencies. Transactions are protected with industry-leading security protocols, ensuring both compliance and customer confidence.

We also handle all essential regulatory components—including KYC (Know Your Customer), AML (Anti-Money Laundering), and real-time fraud prevention—so your business stays secure and legally compliant at all times.

Player Engagement That Delivers Results

Our iGaming solutions are not just about performance—they’re built for retention and revenue growth. We provide:

Personalized user journeys

Smart segmentation and targeting

Loyalty programs and bonuses

Automated marketing workflows

Real-time analytics and A/B testing

These tools help you increase player lifetime value, reduce churn, and build long-term loyalty.

Ready-Made Casino & Sportsbook Content

Microbit Media partners with top-tier game providers to bring you a wide variety of games—from slots and table games to live dealer and sports betting. Our content library is constantly updated to keep players engaged and returning for more.

Our API-based integration allows you to add or switch content providers with ease, giving you total flexibility over your game offerings.

Global Reach, Local Expertise

Whether you’re targeting Europe, Asia, LATAM, or beyond, our iGaming solutions are built to support multi-language, multi-currency, and localized UI/UX. We understand the challenges of entering new markets—and we equip you with the tools to meet them.

Let’s Build Your iGaming Brand—Together

With Microbit Media, you don’t just get a platform—you gain a dedicated partner. From launch to growth, we’re here to provide support, strategy, and scalable tech. Our team of iGaming professionals is available 24/7 to guide your journey, troubleshoot issues, and ensure you’re always ahead of the curve.

Whether you're building a niche betting site or a global gaming platform, our customizable iGaming solutions help you get there faster—and smarter.

Ready to Launch? Start with a Free Demo.

Take the first step toward growing your iGaming business. Contact us today for a free consultation and discover how our complete iGaming solutions can power your success in the fast-moving world of online gaming.

0 notes

Text

What Business Payments Will Look Like

By 2030, your business will either be thriving with smart payment systems or struggling to survive with old manual processes. The businesses that embrace Integration with NetSuite through OnlineCheckWriter.com - Powered by Zil Money today are setting themselves up for success in a marketplace that demands efficient, reliable payment methods.

While your competitors are still printing checks manually and stuffing envelopes, you can be processing payments 10x faster, cutting costs by 80%, and building vendor relationships that will give you access to the best deals. Every day you implement this cloud-based check printing service is another day you pull further ahead of your competition.

The Amazing Advantages of Moving Forward

Your Vendors Will Love Working With You With this automated check issuance platform's advanced payment features, your vendors will view your business as their preferred partner. They'll offer better rates because dealing with reliable, trackable payments through this digital check management tool makes their lives easier. Major suppliers will provide preferential terms and priority service to businesses using this electronic check processing solution.

Your Customers Will Choose You Over Competitors Today's customers are impressed by businesses that show they're modern through smart payment capabilities. With this check printing software's advanced features, you'll win deals because potential customers see your professional payment processes as operational excellence. Your sales team will confidently showcase your cloud-based check printing service capabilities while competitors struggle with outdated systems.

Your Costs Will Drop Dramatically Businesses using this digital check management tool pay much less for each payment. The check mailing service costs from just $1.25 for First Class delivery, while manual processing costs $6-8 per transaction. Every year, you'll save thousands of dollars that you can reinvest in growth and business expansion.

Your Business Will Scale Effortlessly With this cloud-based check printing service's scalable system, your business can grow from 100 payments monthly to 1,000 payments with the same efficiency. The platform handles increasing volume automatically, allowing you to expand without operational bottlenecks.

Why OnlineCheckWriter.com - Powered by Zil Money Is Your Business Success Partner

Import Your NetSuite Data Instantly When you connect NetSuite to this electronic check processing solution, all your invoice details and payee information flow directly into the platform. No more typing vendor names, addresses, or payment amounts by hand. The system pulls everything automatically, saving hours of work and eliminating costly mistakes.

Choose From Multiple Payment Methods This automated check issuance platform gives you powerful payment options. Print professional checks on blank paper and save up to 80% on costs. Send eChecks electronically for immediate delivery. Use this check mailing service with options from $1.25 for First Class delivery to FedEx overnight. Process ACH transfers, wire transfers, and international payments.

Advanced API and Integration Capabilities The check printing software provides a powerful API that allows you to customize financial features for your specific business needs. Connect with top third-party applications, create payment links, process bulk payments, and use positive pay features with complete white label solutions.

Complete Financial Management Platform This cloud-based check printing service handles payroll management, expense tracking, check creation, and account reconciliation efficiently. Create invoices for customers and send payment links through email. Open online checking accounts with no hidden charges. Generate and print deposit slips for any bank with automatic tracking and reconciliation.

Professional Check Customization You can use the drag-and-drop feature to customize checks with professional templates. Add your logos, business names, fonts, and colors to create checks that match your brand. Send checks as printable PDFs with tracking facilities. Digitize paper checks and make payments via email.

Role-Based Access and Advanced Security Give access to accountants or clients with role-based user permissions and approval processes. This digital check management tool includes fraud detection, encryption, and infrastructure security. Connect and reconcile accounts from any financial institution automatically.

Affordable Mailing Options That Scale The Platform offers check mailing services with several delivery options to fit your needs. Basic First Class Check Mailing starts at just $1.25. For those who want to keep an eye on their mail, also have First Class with Tracking. If you need faster delivery, you can choose from Priority Mail, Express Mail, or even FedEx Overnight.

Your Choice: Lead the Market

The transformation to automated payment processing is creating winners and losers. The question is whether your business will be among the market leaders who embraced this cloud-based check printing service early, or among those who missed the opportunity and found themselves playing catch-up.

OnlineCheckWriter.com - Powered by Zil Money isn't just a software upgrade—it's your competitive advantage in an automated world. The question isn't whether you can afford to use this digital check management tool. The question is how much success you want to achieve with it.

0 notes

Text

Unlocking Seamless Transactions: Why a Reliable Payment Gateway Matters for Your Business

In today’s digital world, making payments online should be as easy as clicking a button. Whether you run a small local shop or a large e-commerce website, a secure and efficient payment gateway is no longer optional — it’s essential. But what exactly is a payment gateway, and why does your business need it? Let’s break it down in simple terms.

What is a Payment Gateway?

A payment gateway is like a digital bridge that connects your customer’s payment method (like their credit or debit card, wallet, or bank account) to your business’s bank account. It securely authorizes and processes online payments, making sure money gets from your customer to you — safely and quickly.

Whenever you buy something online, the checkout page you use is powered by a payment gateway. It handles sensitive card information, encrypts it, checks for fraud, and ensures that the transaction goes through without a hitch.

How Does a Payment Gateway Work?

Here’s a quick look at how a payment gateway works behind the scenes:

Customer Places an Order: Your customer picks a product or service and clicks ‘pay now’.

Payment Details Entered: The gateway securely collects card or wallet details.

Encryption & Verification: Sensitive data is encrypted and sent to the payment processor and card networks.

Authorization: The customer’s bank checks if they have enough funds and approves or declines the payment.

Confirmation: If approved, the payment gateway tells your website to confirm the order.

Settlement: The money is transferred to your business’s account within a few days.

All of this happens in just seconds!

Why a Good Payment Gateway Matters

Choosing the right payment gateway can have a big impact on your business. Here’s why:

✅ Security: A trusted payment gateway protects your customers’ card details with advanced encryption and PCI DSS compliance. This builds trust and reduces fraud.

✅ Speed: Fast processing means your customers enjoy a smooth checkout experience, and you get your money quickly.

✅ Multiple Payment Options: A modern gateway lets you accept credit and debit cards, mobile wallets, bank transfers, and even buy-now-pay-later options.

✅ Easy Integration: Good gateways are easy to connect to your website or app, often with simple plugins or APIs.

✅ Better Conversions: A hassle-free, secure payment experience reduces cart abandonment and boosts sales.

✅ Global Reach: Many gateways support international payments and multiple currencies, so you can reach customers worldwide.

Key Features to Look For

When choosing a payment gateway, don’t just pick the first one you find. Look for features that match your business needs:

Fraud Protection: Advanced fraud detection tools help spot suspicious transactions.

Mobile Optimization: Many customers pay from their phones — make sure the checkout is mobile-friendly.

Recurring Payments: If you offer subscriptions, your gateway should handle automatic billing.

Transparent Fees: Know what you’re paying — setup fees, transaction charges, refund fees, and hidden costs.

Good Support: Reliable customer support is important if something goes wrong.

Popular Payment Gateways

Depending on your location and business type, you have plenty of options. Popular global gateways include PayPal, Stripe, Square, and Authorize.Net. In the UAE and GCC region, Foloosi, Telr, and PayTabs are trusted local players that offer tailored solutions for businesses of all sizes.

How to Set Up a Payment Gateway

Setting up a payment gateway isn’t complicated, but it does require a few steps:

Sign Up: Register with a gateway provider that suits your business needs.

Integrate: Connect the gateway to your website, app, or POS system.

Get Verified: Most providers will check your business documents and bank details.

Go Live: Once verified, you can start accepting online payments securely!

Tips for Businesses

Test First: Always test your checkout flow before going live. Make sure it works smoothly on mobile and desktop.

Be Transparent: Clearly display all costs, taxes, and refund policies to your customers.

Stay Updated: Keep your gateway software up to date to benefit from new security features.

Monitor Transactions: Regularly check for chargebacks or fraudulent activities.

Final Thoughts

Online shopping and digital payments are growing fast — and your customers expect quick, secure, and flexible ways to pay. By investing in a reliable payment gateway, you’re not just adding a checkout button — you’re building trust, protecting your business, and making it easy for customers to pay you anytime, anywhere.

Whether you run an e-commerce store, a subscription service, or accept donations, the right payment gateway can help you grow with confidence.

Ready to take your business to the next level? Choose a secure, flexible, and user-friendly payment gateway that keeps your customers happy and your cash flow smooth.

#fintech solution#payment gateway#digital payments#payment gateway in uae#best payment gateway in UAE#abudhabipayments#uae business

0 notes

Text

UPB Crypto Bank The Future of Hybrid Banking is Here

In a world rapidly shifting toward digital finance, UPB Crypto Bank is emerging as a powerful platform that bridges the gap between traditional banking and blockchain technology. With its unique blend of services, UPB is not just another digital bank—it’s a complete ecosystem built to empower individuals and businesses to transact seamlessly using both fiat and cryptocurrency.

Whether you’re a crypto investor, trader, entrepreneur, or everyday user, UPB Crypto Bank delivers a secure, efficient, and all-in-one solution to manage your money, grow your assets, and embrace the decentralized future.

What is UPB Crypto Bank?

UPB (Universal Payment Bank) is a next-generation financial institution offering traditional banking services alongside cutting-edge crypto solutions. It aims to unify the best of both worlds: offering users the flexibility of cryptocurrencies with the reliability and structure of traditional financial systems.

Key highlights include:

Multi-currency wallets

Crypto-integrated UPI system

Instant exchange and staking

Business-friendly merchant tools

Decentralized and secure transaction systems

With a mission to promote financial freedom globally, UPB makes digital banking accessible even in underbanked regions.

Key Features of UPB Crypto Bank

1. Multi-Currency Wallets

Users can store, send, receive, and manage both fiat currencies (like INR, USD, EUR) and cryptocurrencies (such as BTC, ETH, USDT, BNB, and UPB Token) all within one secure interface. This eliminates the hassle of maintaining multiple wallets or switching between platforms.

2. Crypto-Enabled UPI

UPB introduces Crypto UPI—a revolutionary feature allowing users to make instant payments using cryptocurrency, modeled after India's popular Unified Payments Interface (UPI). This service enables faster, borderless, and decentralized transactions without the need for traditional banking intermediaries.

3. Built-in Exchange & Trading

Users can easily convert one asset to another using UPB’s fast and low-cost exchange engine. Whether you’re trading fiat to crypto or swapping between crypto pairs, the experience is intuitive and accessible for both beginners and seasoned investors.

4. Staking & Yield Farming

UPB allows users to stake supported tokens, including the native UPB Token, to earn attractive passive income. It’s a safe and efficient way to put your digital assets to work while supporting the network's growth.

5. Global Remittances

UPB’s blockchain-based remittance service enables lightning-fast and low-fee international money transfers. It’s particularly useful for migrant workers and international freelancers seeking cheaper alternatives to traditional banking routes.

6. Merchant & Business Tools

For entrepreneurs and online businesses, UPB provides secure APIs, crypto payment gateways, QR-based payment systems, and even NFC tap-to-pay options. These tools make it easy for businesses to accept payments in both fiat and crypto.

Why UPB is Different

Unlike conventional banks or isolated crypto wallets, UPB Crypto Bank operates as an integrated digital finance hub. Users don’t need to choose between fiat and crypto—they can utilize both simultaneously in a seamless ecosystem.

UPB stands out for:

Simple UI/UX for everyday users

Robust tools for crypto traders and businesses

DeFi features with secure staking

Global accessibility with low KYC barriers

Reliable infrastructure and user-first design

This versatility makes UPB a strong alternative to centralized exchanges and traditional banks alike.

The Role of UPB Token

The UPB Token plays a pivotal role within the ecosystem:

Fee Discounts: Users holding UPB Token enjoy lower transaction and service fees.

Staking Rewards: Earn returns by locking UPB Tokens in staking programs.

Loyalty Benefits: Receive access to VIP features and exclusive bonuses.

As UPB continues to grow, the utility and demand for the token are expected to rise, making it a compelling asset for both investors and everyday users.

Security and Compliance

Security is a core pillar of UPB Crypto Bank. The platform uses:

Multi-factor authentication (MFA)

Cold wallet storage for digital assets

End-to-end encryption

Anti-fraud systems powered by AI

Regular audits and KYC/AML compliance

Users can also opt for a non-custodial model, retaining full control over their private keys. This flexibility makes UPB suitable for both cautious users and crypto pros.

Accessibility & Inclusion

UPB’s vision goes beyond profit—it aims to democratize finance. By providing low-cost, mobile-first access to financial services, UPB empowers users in rural, remote, or unbanked regions to participate in the global economy.

With a strong focus on financial inclusion, UPB offers:

Fully online account creation

Low-cost transfers

Support for multiple local and global currencies

24/7 accessibility via smartphone

FAQ – Frequently Asked Questions

Q1: What do I need to open an account with UPB Crypto Bank? You simply need a smartphone, internet access, and valid ID for KYC verification. The process is fast and fully online.

Q2: Is UPB available globally? Yes, UPB offers services in most countries. However, some features like Crypto UPI may vary by region depending on regulations.

Q3: What cryptocurrencies can I store and use? UPB supports major cryptocurrencies including Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Binance Coin (BNB), and its own UPB Token.

Q4: Can I use UPB for business payments? Absolutely. UPB offers merchant tools including API access, payment gateway integration, and QR/NFC payment solutions.

Q5: How is UPB Crypto Bank different from other platforms? UPB integrates fiat banking, crypto trading, staking, payments, and remittance into a single ecosystem—something few platforms offer today.

Q6: What is the UPB Token used for? The UPB Token provides fee discounts, staking rewards, and platform benefits. It plays a central role in UPB’s loyalty and utility programs.

Q7: Is my money and data safe on UPB? Yes. UPB uses advanced security practices including cold storage, 2FA, and encryption to safeguard assets and data.

Conclusion

UPB Crypto Bank is not just an evolution in digital banking—it’s a revolution. By merging traditional finance with the dynamic world of crypto, it offers users the best of both realms in a single, secure, and user-friendly platform. Whether you’re a trader, merchant, or a first-time crypto user, UPB opens the door to a smarter, faster, and more inclusive financial future.

If you're ready to take control of your finances and explore new opportunities in crypto and digital banking, UPB Crypto Bank is the place to start.

0 notes

Text

What Are the Best High-Interest Savings Accounts in 2025?

With inflation still a concern and traditional savings accounts offering minimal returns, more people are asking: What are the best high-interest savings accounts in 2025? The right account can help you earn more on your idle cash, without taking on investment risk.

Whether you're building an emergency fund, saving for a major goal, or just parking your extra cash, a high-yield savings account is a smart choice—especially in today’s rate-conscious financial climate.

What Makes a Savings Account "High-Interest"?

A high-interest savings account (also known as a high-yield savings account) typically offers a significantly better interest rate than a traditional savings account. In 2025, the average traditional savings account may offer only around 0.40% APY, while top high-yield accounts offer 4.00% or more.

Key Features to Look For:

APY (Annual Percentage Yield): Higher rates mean faster growth.

No monthly fees: Avoid accounts that eat into your earnings.

FDIC or NCUA insured: Ensures your money is protected up to $250,000.

Easy access: Mobile apps, online transfers, and quick withdrawals.

Best High-Interest Savings Accounts in 2025

Here’s a look at the top contenders based on current APYs, customer reviews, and ease of access.

1. Ally Bank Online Savings Account

APY: ~4.25%

Pros: No fees, user-friendly mobile app, automatic savings tools

Cons: No physical branches

2. Synchrony High Yield Savings

APY: ~4.30%

Pros: Consistently high rates, optional ATM access

Cons: Limited account options beyond savings

3. SoFi Online Savings

APY: Up to 4.60% (with direct deposit)

Pros: Bonuses for new users, integrated investing and checking

Cons: Full APY requires qualifying direct deposit

4. Marcus by Goldman Sachs

APY: ~4.40%

Pros: Reliable brand, strong customer service

Cons: No ATM card or mobile check deposit

5. Capital One 360 Performance Savings

APY: ~4.25%

Pros: Access to Capital One branches, no fees or minimums

Cons: APY not the highest, but solid overall

For a complete list and updated comparisons, visit this detailed guide on the best high-interest savings accounts in 2025.

Why 2025 Is a Good Year to Switch

Interest rates remain historically elevated, giving savers a rare opportunity to earn real returns without locking money into long-term CDs or taking investment risks. Choosing the best high-interest savings account in 2025 can make a noticeable difference in your savings goals over time.

Pro Tips to Maximize Your Savings

Avoid fees: Even a $5 monthly fee can wipe out earnings.

Check transfer limits: Some banks limit how often you can withdraw.

Monitor rates regularly: Some banks adjust APYs without notice.

Use automation: Set up auto-transfers to build savings consistently.

Final Thoughts

With so many competitive options, there’s no reason to let your savings sit in a low-yield account. By choosing one of the best high-interest savings accounts in 2025, you’re taking a smart step toward growing your money with minimal risk.

0 notes

Text

0 notes

Text

1 Transfer That Can Pierce Your LLC Shield (Banking Compliance PSA)

You formed an LLC to protect your assets, right? Yeah, it’s tricky. But here’s the kicker: 62% of IRS audits targeting small businesses start with banking errors not tax filings. One client mixed personal groceries with business software purchases (oops!), triggering a $10k penalty and piercing their liability shield. Poof! Your protection disappears faster than free office snacks.

Let’s unpack why your business bank account for LLC isn’t just a formality it’s your legal moat.

The 3-Second Mistake That Pierces Your Liability Shield

Picture this: You pay your kid’s tuition from your LLC account. Seems harmless? Big mistake. Courts call this “commingling” mixing personal and business funds and it’s the #1 reason judges ignore LLC protections. Suddenly, your house, car, and savings are lawsuit targets.

Fix it now (literally 10 minutes):

1. Open a dedicated business account (not your personal checking with a new label). 2. Document every transfer as “owner’s draw” or “expense reimbursement.” 3. Cancel LLC debit cards used for personal errands yesterday.

| Pro Tip: Use apps like Relay (free ACH/wires) to auto-categorize transfers. No more “oops” moments .

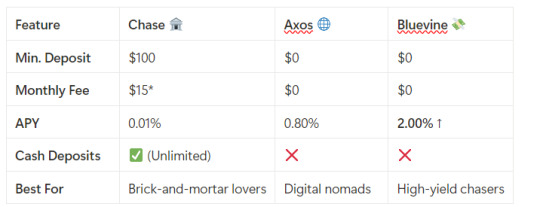

Chase vs. Axos vs. Bluevine: The LLC Banking Thunderdome

-Chase fees waived with $2k min balance. Bluevine’s 2% APY covers balances up to $250k free money, folks .

-Why it matters: Axos refunds all ATM fees globally crucial if you travel. But Bluevine wins for growth-stage LLCs hoarding cash. Chase? Only if you’re depositing cash weekly.

The EIN Trap: When Your SSN Isn’t Enough

Single-member LLCs think: “I’ll just use my Social Security Number for banking.” Stop! Banks like Mercury freeze accounts without an EIN (Employer Identification Number). Why? Fraud prevention.

Worse: If your LLC has foreign owners (e.g., a Chinese investor with 25%+ stake), you must file Form 5472 or face $25k+ fines. Yeah, the IRS doesn’t play .

Action plan:

-Get an EIN online (http://irs.gov/), 4-minute process). - Update EVERY account banking, payroll, utilities. - Foreign members? Hire a CPA who knows international KYC.

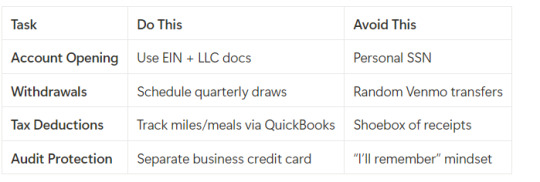

Tax Savings: How to Withdraw Cash Like a Mob Boss (Legally!)

Withdrawing LLC profits isn’t a free-for-all. Do it wrong, and you’ll pay 15.3% self-employment tax plus income tax. Ouch.

Smart moves:

- Owner’s Draw (Single-Member LLC): Take cash anytime. But: Set aside 30% for taxes (use Form 1040-ES quarterly) . - Guaranteed Payments (Multi-Member LLC): Pay yourself a “salary” pre-profit split. Deducts from company income. - S Corp Election: Slash self-employment tax by paying yourself a “reasonable salary” (e.g., $80k) and taking excess as distributions.

| Example: $200k profit? Save $12,000+ by electing S corp status.

Deduct EVERYTHING:

-Home office? Deduct 30% of rent. - Business meals? 50% off (keep receipts!). - Car use? Track miles 2025 rate: 67¢/mile.

The Compliance Bomb Hiding in Your Statements

Think “low fees” are the holy grail? Wait till you miss these landmines:

-BOI Report (2025): New law! LLCs must file Beneficial Ownership Info with FinCEN. Penalty: $500/day . - $10k+ Deposits: Banks file CTRs (Currency Transaction Reports). If your coffee shop deposits $9,999 weekly? Structured a federal crime. - PayPal/Stripe Freezes: Platforms hate “disregarded entities” (single-member LLCs). Solution: Incorporate as C-Corp if scaling globally .

Contrarian Take: Ditch Your LLC (Sometimes)

Here’s the twist: LLCs aren’t magic. For SaaS founders eyeing VC funding? Incorporate as a C-Corp. Delaware C-Corps avoid the 5472 foreign-owner trap and attract investors. E-commerce sellers? Stick with LLCs pass-through taxes keep it simple.

| Real talk: I’ve seen LLC owners lose $37k in tax savings by ignoring entity structure. Don’t be them.

Your 10-Minute Audit Fix:

1. Open Bluevine/Axos for high-yield, no-fee business banking. 2. Get an EIN. 3. Move all business transactions to this account. 4. Elect S corp status if earning >$80k profit (ask your CPA). 5. File that damn BOI report!

| CONTACT ME FOR MORE INFORMATION

| Mail: [email protected]

0 notes

Text

Casino Merchant Accounts in Latin America: Your Complete Payment Solution Guide

Introduction to Casino Payment Processing in Latin America

The online casino industry in Latin America is experiencing explosive growth, with markets like Brazil, Mexico, and Argentina leading the charge. At Radiant Pay, we specialize in providing secure, reliable casino merchant accounts tailored to the unique needs of gaming operators across the region.

Why Casino Businesses Need Specialized Merchant Accounts

Challenges Facing Latin American Casino Operators

High-risk classification by traditional banks

Strict financial regulations varying by country

Payment method fragmentation across markets

Currency volatility in some countries

Key Benefits of a Dedicated Casino Merchant Account

Higher approval rates for player deposits

Faster payouts to winners (2-5 days vs 7-14)

Lower processing fees than pieced-together solutions

Built-in fraud prevention for gaming transactions

Multi-currency support for regional players

RadiantPay's Casino Merchant Account Solutions

We offer comprehensive payment processing designed specifically for Latin American gaming operators:

1. Core Account Features

High deposit acceptance rates (85%+)

Payouts in local currencies (BRL, MXN, ARS)

Chargeback protection (<1% target)

24/7 account management

2. Payment Method Coverage

Local cards are widely used in markets such as Brazil, Mexico, and Chile, offering instant processing times for transactions. Bank transfers are available across all countries but typically take between 1 to 3 days to process. E-wallets, which include various regional solutions, provide instant payments, making them a convenient option for users in supported areas. Cryptocurrency payments, such as Bitcoin and USDT, are processed within minutes, offering a fast and secure alternative. Lastly, vouchers like OXXO and PagoEfectivo are popular in specific regions and also enable instant transaction processing.

3. Country-Specific Solutions

Brazil: Pix payments integration

Mexico: SPEI bank transfers

Argentina: MercadoPago support

Colombia: PSE processing

Regional: Cross-border solutions

Latin American Casino Regulations Overview

Navigating the complex regulatory landscape:

1. Licensing Requirements

Country-specific gambling licenses

Payment processor approvals

Anti-money laundering compliance

2. Key Markets Breakdown

Brazil: Emerging regulated market

Mexico: Established licensing framework

Argentina: Province-by-province rules

Colombia: Coljuegos regulator

Chile: Developing legal framework

3. Financial Compliance

Player verification (KYC)

Transaction monitoring

Reporting obligations

Tax withholding requirements

Implementation Process

Getting your casino payment solution operational:

Documentation (Submit business paperwork)

Underwriting (Risk assessment)

Integration (API or plugin)

Testing (Deposit/withdrawal flows)

Launch (Go live with real transactions)

Why Latin American Casinos Choose RadiantPay

Regional Expertise - Local payment knowledge

95% Deposit Approval - Industry-leading rates

Fraud Prevention - AI-powered tools

Multi-Currency - 10+ LATAM currencies

Scalable Solutions - Grow without limits

Cost Structure & Fees

Transparent pricing for casino operators:

The setup fee typically ranges from $0 to $500, though it may be waived for high-volume accounts. A deposit fee of 2.5% to 5% is usually charged, depending on the risk level. Payout fees range between 1% and 3%, varying by payout method. Monthly fees fall between $50 and $300, often covering support services. Additionally, a foreign exchange (FX) fee of 1% to 2% applies for currency conversions.

Compared to alternatives: More features at competitive rates

Success Story: São Paulo Sportsbook

"After struggling with payment rejections, RadiantPay's solution increased our deposit success rate to 92% and reduced cashout times by 60%." - Carlos M., Operations Director

Getting Started with Your Casino Merchant Account

Analyze your player payment preferences

Prepare licensing documentation

Apply for your merchant account

Integrate payment solution

Launch and optimize performance

Ready to Solve Your Casino Payment Challenges? Contact Radiant Pay today for Latin American gaming payment solutions!

0 notes

Text

SMS Security in Finance: Protecting Clients and Ensuring Compliance with API Integration

In finance, where trust is currency, clients are looking for more than speedy service. They want a secure communication channel that protects their money and identity at every stage. This is where SMS security with API integration steps in.

SMS is not just an alert for logins or fraud detection. SMS can be a pivotal engagement tool designed to protect data, be compliant, and support seamless user experiences, all within 160 characters.

Why SMS Still Reigns Supreme

You may think that in-app notifications or e-mails have taken over, but when it comes down to alerts that are critical and time-sensitive, SMS is still king. Why? It’s instant, familiar, and can reach users who are not online.

Be it an alert of a suspicious transaction or sending a one-time password (OTP), SMS does what other platforms cannot. With API-based SMS integration, financial institutions can leverage secure, automated messaging into their systems. No manual work, just efficient scalability.

Compliance, Without the Complexity

The financial sector is one of the most regulated industries in the world. Messaging must follow rigorous compliance guidelines that vary from PCI-DSS, GDPR, and FFIEC compliance. The purpose of SMS APIs is to accomplish this through their end-to-end encryption, audit trails, opt-in verification, and delivery logs, all of which facilitate compliant and secure communication.

Additionally, APIs allow for easy consent management, automated alerts, and messaging policies that are applied consistently across every branch and department.

Building Trust, One Message at a Time

SMS service providers in India is creating a sense of transparency and trust between organizations and customers through two-factor authentication and transaction summaries. The introduction of APIs, banks, and fin-techs can produce hyper-personalized messaging flows triggered by certain events, such as large transfers, logging on a new device, or adjustments to a profile.

SMS APIs offer two-way messaging conversations, allowing customers to immediately report suspicious transactions or verify their identity in seconds. Quick, secure, and truly seamless.

The Bottom Line

In the financial sector, every second and every communication counts. With API-powered SMS security, financial organizations can lock down their sensitive data, satisfy regulators, and deliver real-time assurance to their customers.

0 notes