#Ordermark

Explore tagged Tumblr posts

Text

𝐕𝐢𝐫𝐭𝐮𝐚𝐥 𝐑𝐞𝐬𝐭𝐚𝐮𝐫𝐚𝐧𝐭𝐬 & 𝐆𝐡𝐨𝐬𝐭 𝐊𝐢𝐭𝐜𝐡𝐞𝐧𝐬 𝐌𝐚𝐫𝐤𝐞𝐭: 𝐏𝐨𝐩𝐮𝐥𝐚𝐫 𝐂𝐡𝐨𝐢𝐜𝐞 𝐖𝐨𝐫𝐥𝐝𝐰𝐢𝐝𝐞

𝐃𝐨𝐰𝐧𝐥𝐨𝐚𝐝 𝐅𝐑𝐄𝐄 𝐒𝐚𝐦𝐩𝐥𝐞: https://www.nextmsc.com/virtual-restaurant-and-ghost-kitchens-market/request-sample

The dining landscape is undergoing a major transformation with the rise of 𝐕𝐢𝐫𝐭𝐮𝐚𝐥 𝐑𝐞𝐬𝐭𝐚𝐮𝐫𝐚𝐧𝐭𝐬 & 𝐆𝐡𝐨𝐬𝐭 𝐊𝐢𝐭𝐜𝐡𝐞𝐧𝐬 𝐌𝐚𝐫𝐤𝐞𝐭. These innovative concepts are reshaping how we think about food delivery and restaurant operations.

𝐊𝐞𝐲 𝐓𝐫𝐞𝐧𝐝𝐬:

1. 𝙑𝙞𝙧𝙩𝙪𝙖𝙡 𝙍𝙚𝙨𝙩𝙖𝙪𝙧𝙖𝙣𝙩𝙨: Operating exclusively through delivery platforms, virtual restaurants focus on a digital-only presence, optimizing their menu and operations for online orders.

2. 𝙂𝙝𝙤𝙨𝙩 𝙆𝙞𝙩𝙘𝙝𝙚𝙣𝙨: Also known as cloud kitchens, these facilities prepare food for multiple brands from a single location, reducing overhead costs and increasing efficiency.

3. 𝘾𝙤𝙣𝙨𝙪𝙢𝙚𝙧 𝘾𝙤𝙣𝙫𝙚𝙣𝙞𝙚𝙣𝙘𝙚: The demand for convenience and diverse food options has accelerated the growth of these models, offering consumers a wide range of choices without traditional dine-in experiences.

𝐀𝐜𝐜𝐞𝐬𝐬 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭: https://www.nextmsc.com/report/virtual-restaurant-and-ghost-kitchens-market

The market is set to expand further, driven by technological advancements and evolving consumer preferences. Expect innovations in kitchen technology, delivery logistics, and personalized dining experiences.

𝐈𝐧𝐝𝐮𝐬𝐭𝐫𝐲 𝐈𝐧𝐬𝐢𝐠𝐡𝐭𝐬: Key players in this space including Zomato, Bundl, Yummy Corp, Ordermark by UrbanPiper, Just Eat Takeaway.com, and Rebel Foods among others, are leveraging data analytics and AI to refine their offerings, streamline operations, and enhance customer satisfaction.

0 notes

Text

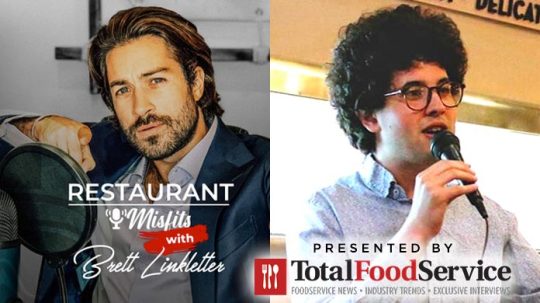

Restaurant Misfits Podcast: Alex Canter

Restaurant Misfits Podcast: Alex Canter

Restaurant Misfits is a podcast dedicated to all things related to restaurant marketing, management, and everything else in between growing a restaurant business. The podcast is brought to you by Misfit Media in collaboration with Total Food Service. Each episode is hosted by Brett Linkletter, CEO & CoFounder of Misfit Media, and can be found on Spotify, or played below. In this episode of the…

View On WordPress

#Alex Canter#Alex Canter Ordermark#B2B foodservice#Canter&039;s Deli#Canter&039;s Deli LA#Canter&039;s Deli Los Angeles#Canter&039;s Los Angeles#foodservice#foodservice news#kitchen#mobile kitchen#nextbite#nextbite Ordermark#online order management software#online order management software company#order management software#order management software company#Ordermark#Podcast#restaurant#Restaurant Misfits#Restaurant Misfits Alex Canter#Restaurant Misfits podcast#Restaurant Misfits Podcast Alex Canter#Restaurant Podcast Alex Canter

0 notes

Text

Ordermark raises $18 million to help restaurants manage disparate delivery platforms

Ordermark raises $18 million to help restaurants manage disparate delivery platforms

When Alex Canter, a University of Wisconsin-Madison graduate and the fourth-generation proprietor of Canter’s Deli in Los Angeles, took over business development operations at his great-grandfather’s restaurant, he quickly became frustrated by the complexity involved in routing orders from multiple food delivery platforms. Fortunately, he met entrepreneur Mike Jacobs, who’d launched a product…

View On WordPress

0 notes

Text

Canters restaurant royalty raises $9.5 million for Ordermark, a takeout order management service

Canters restaurant royalty raises $9.5 million for Ordermark, a takeout order management service

Alex Canter is aware of the restaurant enterprise.

The scion of Los Angeles’ well-known first household of the deli enterprise — the house owners of the eponymous Canters restaurant — Canter has been within the meals enterprise longer than many seasoned restauranteurs twice his age.

While some folks had a Bar Mitzvah get together, the 13 yr outdated Canter had part 4 of his household’s…

View On WordPress

0 notes

Text

<4VQ18eU> D0WNL0AD HF OrderMarker by Wong Sze Wai [.ZIP .RAR] MT4 MT5

<7tgjydS] DOWNLOAD HF OrderMarker by Wong Sze Wai 1.0 [.ZIP .RAR] MT4 MT5 PROGRAM ON THIS PICTURE

Download Install Online Access For Free Now HF OrderMarker

Install Full Version MT4 MT5 in Here

https://imperionwebmedia.blogspot.com/access88.php?id=47025

Size: 97,950 KB for D0wnl0ad URL => https://imperionwebmedia.blogspot.com/access62.php?id=47025 - D0WNL0AD this MT4 MT5 Text MT4 MT5 HF OrderMarker by Wong Sze Wai

Last access: 46950 user

Last server checked: 12 Minutes ago!

HF OrderMarker by Wong Sze Wai Current Last Version: 1.0

HF OrderMarker by Wong Sze Wai Currennt Last Update:

HF OrderMarker by Wong Sze Wai Last Published at: 7 March 2020

HF OrderMarker by Wong Sze Wai Best Review In: 0

HF OrderMarker by Wong Sze Wai Sell at Price: 30

HF OrderMarker by Wong Sze Wai [MT4 MT5 Application Program .Zip .Rar]

HF OrderMarker by Wong Sze Wai MT4 MT5Download

HF OrderMarker by Wong Sze Wai Install online acces

Wong Sze Wai by HF OrderMarker MT4 MT5

HF OrderMarker by Wong Sze Wai vk platform

HF OrderMarker by Wong Sze Wai MT4 MT5 d0wnl0ad free

HF OrderMarker by Wong Sze Wai d0wnl0ad APP

HF OrderMarker MT4 MT5

HF OrderMarker by Wong Sze Wai amazon PLatform

HF OrderMarker by Wong Sze Wai free d0wnl0ad MT4 MT5

HF OrderMarker by Wong Sze Wai MT4 MT5 free

HF OrderMarker by Wong Sze Wai MT4 MT5

HF OrderMarker by Wong Sze Wai MT4 MT5 d0wnl0ad

HF OrderMarker by Wong Sze Wai online Access

Wong Sze Wai by HF OrderMarker MT4 MT5 d0wnl0ad

HF OrderMarker by Wong Sze Wai MT4 MT5 vk

HF OrderMarker by Wong Sze Wai Program

d0wnl0ad HF OrderMarker APPS - .Zip .Rar - MT4 MT5- Program

HF OrderMarker d0wnl0ad the MT4 MT5 Application, MT4 MT5 in english language

[d0wnl0ad] MT4 MT5 HF OrderMarker in format MT4 MT5

[APPS] [Application] HF OrderMarker by Wong Sze Wai d0wnl0ad here

Desc of HF OrderMarker by Wong Sze Wai

review online For HF OrderMarker by Wong Sze Wai

HF OrderMarker Wong Sze Wai MT4 MT5 download

HF OrderMarker Wong Sze Wai Install online Access

Wong Sze Wai HF OrderMarker App

HF OrderMarker Wong Sze Wai vk Platform

HF OrderMarker Wong Sze Wai amazon Platform

HF OrderMarker Wong Sze Wai free download MT4 MT5

HF OrderMarker Wong Sze Wai MT4 MT5 free

HF OrderMarker MT4 MT5Wong Sze Wai

HF OrderMarker Wong Sze Wai MT4 MT5 download

HF OrderMarker Wong Sze Wai online Access

Wong Sze Wai HF OrderMarker APP download

HF OrderMarker Wong Sze Wai APP vk

HF OrderMarker Wong Sze Wai MT4 MT5 Program

download HF OrderMarker MT4 MT5 - .Zip .Rar - Application - Program

HF OrderMarker download APPS Application, MT4 MT5 in english language

[download] APP HF OrderMarker in format APPS

HF OrderMarker download free of APP in format

Wong Sze Wai HF OrderMarker MT4 MT5 vk

HF OrderMarker Wong Sze Wai MT4 MT5

HF OrderMarker Wong Sze Wai MT4 MT5

HF OrderMarker Wong Sze Wai EXE

HF OrderMarker Wong Sze Wai ZIP

HF OrderMarker Wong Sze Wai RAR

HF OrderMarker Wong Sze Wai APP

HF OrderMarker Wong Sze Wai iAPP

HF OrderMarker Wong Sze Wai .Zip .Rar

HF OrderMarker Wong Sze Wai Rar

HF OrderMarker Wong Sze Wai Zip

HF OrderMarker Wong Sze Wai Programpocket MT4 MT5

HF OrderMarker Wong Sze Wai Program Online MT4 MT5

HF OrderMarker Wong Sze Wai AudioAPP Online

HF OrderMarker Wong Sze Wai Review Online HERE

HF OrderMarker Wong Sze Wai Install Online ACCESSS

HF OrderMarker Wong Sze Wai Download Online ACCESS

D0WNL0AD MT4 MT5 TextAPP HF OrderMarker by Wong Sze Wai

D0wnl0ad URL at this link => https://imperionwebmedia.blogspot.com/access77.php?id=47025

0 notes

Text

[xrrR3og> D0WNL0AD HF OrderMarker by Wong Sze Wai [.ZIP .RAR] MT4 MT5

<NOW1Rmz> DOWNLOAD HF OrderMarker by Wong Sze Wai 1.0 [.ZIP .RAR] MT4 MT5 PROGRAM ON THIS PICTURE

Install Download Online Access for Free Now HF OrderMarker

Download Full Application Here

https://wiredwebmedia.blogspot.com/access78.php?id=47025

Size: 82,026 KB for D0wnl0ad URL -> https://wiredwebmedia.blogspot.com/access84.php?id=47025 - D0WNL0AD this MT4 MT5 Text MT4 MT5 HF OrderMarker by Wong Sze Wai

Last access: 97784 user

Last server checked: 14 Minutes ago!

HF OrderMarker by Wong Sze Wai Current Last Version: 1.0

HF OrderMarker by Wong Sze Wai Currennt Last Update:

HF OrderMarker by Wong Sze Wai Last Published at: 7 March 2020

HF OrderMarker by Wong Sze Wai Best Review In: 0

HF OrderMarker by Wong Sze Wai Sell at Price: 30

HF OrderMarker by Wong Sze Wai [MT4 MT5 Application Program .Zip .Rar]

HF OrderMarker by Wong Sze Wai MT4 MT5Download

HF OrderMarker by Wong Sze Wai Install online acces

Wong Sze Wai by HF OrderMarker MT4 MT5

HF OrderMarker by Wong Sze Wai vk platform

HF OrderMarker by Wong Sze Wai MT4 MT5 d0wnl0ad free

HF OrderMarker by Wong Sze Wai d0wnl0ad APP

HF OrderMarker MT4 MT5

HF OrderMarker by Wong Sze Wai amazon PLatform

HF OrderMarker by Wong Sze Wai free d0wnl0ad MT4 MT5

HF OrderMarker by Wong Sze Wai MT4 MT5 free

HF OrderMarker by Wong Sze Wai MT4 MT5

HF OrderMarker by Wong Sze Wai MT4 MT5 d0wnl0ad

HF OrderMarker by Wong Sze Wai online Access

Wong Sze Wai by HF OrderMarker MT4 MT5 d0wnl0ad

HF OrderMarker by Wong Sze Wai MT4 MT5 vk

HF OrderMarker by Wong Sze Wai Program

d0wnl0ad HF OrderMarker APPS - .Zip .Rar - MT4 MT5- Program

HF OrderMarker d0wnl0ad the MT4 MT5 Application, MT4 MT5 in english language

[d0wnl0ad] MT4 MT5 HF OrderMarker in format MT4 MT5

[APPS] [Application] HF OrderMarker by Wong Sze Wai d0wnl0ad here

Desc of HF OrderMarker by Wong Sze Wai

review online For HF OrderMarker by Wong Sze Wai

HF OrderMarker Wong Sze Wai MT4 MT5 download

HF OrderMarker Wong Sze Wai Install online Access

Wong Sze Wai HF OrderMarker App

HF OrderMarker Wong Sze Wai vk Platform

HF OrderMarker Wong Sze Wai amazon Platform

HF OrderMarker Wong Sze Wai free download MT4 MT5

HF OrderMarker Wong Sze Wai MT4 MT5 free

HF OrderMarker MT4 MT5Wong Sze Wai

HF OrderMarker Wong Sze Wai MT4 MT5 download

HF OrderMarker Wong Sze Wai online Access

Wong Sze Wai HF OrderMarker APP download

HF OrderMarker Wong Sze Wai APP vk

HF OrderMarker Wong Sze Wai MT4 MT5 Program

download HF OrderMarker MT4 MT5 - .Zip .Rar - Application - Program

HF OrderMarker download APPS Application, MT4 MT5 in english language

[download] APP HF OrderMarker in format APPS

HF OrderMarker download free of APP in format

Wong Sze Wai HF OrderMarker MT4 MT5 vk

HF OrderMarker Wong Sze Wai MT4 MT5

HF OrderMarker Wong Sze Wai MT4 MT5

HF OrderMarker Wong Sze Wai EXE

HF OrderMarker Wong Sze Wai ZIP

HF OrderMarker Wong Sze Wai RAR

HF OrderMarker Wong Sze Wai APP

HF OrderMarker Wong Sze Wai iAPP

HF OrderMarker Wong Sze Wai .Zip .Rar

HF OrderMarker Wong Sze Wai Rar

HF OrderMarker Wong Sze Wai Zip

HF OrderMarker Wong Sze Wai Programpocket MT4 MT5

HF OrderMarker Wong Sze Wai Program Online MT4 MT5

HF OrderMarker Wong Sze Wai AudioAPP Online

HF OrderMarker Wong Sze Wai Review Online HERE

HF OrderMarker Wong Sze Wai Install Online ACCESSS

HF OrderMarker Wong Sze Wai Download Online ACCESS

D0WNL0AD MT4 MT5 TextAPP HF OrderMarker by Wong Sze Wai

D0wnl0ad URL at this link => https://wiredwebmedia.blogspot.com/access93.php?id=47025

0 notes

Text

Ordermark Is Final Piece For Operators Looking To Solve Delivery Puzzle

Ordermark Is Final Piece For Operators Looking To Solve Delivery Puzzle

It is not often that we are lucky enough to watch an industry completely evolve before our very eyes. In order to meet increased demand from customers stuck at home through the Pandemic, restaurants have had to innovate. How could they get their products into the hands of their patrons, without putting them at risk by making them leave the house. The logical answer was food delivery services such…

View On WordPress

#Alex Canter#Alex Canter Ordermark#Canter&039;s Deli#Canter&039;s Deli LA#Canter&039;s Deli Los Angeles#Canter&039;s Los Angeles#nextbite#nextbite Ordermark#online order management software#online order management software company#order management software#order management software company#Ordermark

0 notes

Text

How Ordermark’s Latest Funding Haul Could Help Independent Restaurants Survive The Pandemic

New Post has been published on https://perfectirishgifts.com/how-ordermarks-latest-funding-haul-could-help-independent-restaurants-survive-the-pandemic/

How Ordermark’s Latest Funding Haul Could Help Independent Restaurants Survive The Pandemic

Alex Canter co-founded Ordermark in 2017. The online ordering management company recently secured … [] $120 million in funding.

Online ordering management company Ordermark, co-founded by CEO Alex Canter in 2017, just surpassed $1 billion in sales–no surprise considering the staggering growth of digital channels incited by the pandemic.

In fact, digital sales are now expected to make up more than half of limited-service restaurants’ business by 2025, a 70% increase over pre-COVID estimates, and Ordermark is one of many growing companies helping restaurants big and small consolidate those orders across services.

This trend illustrates why Ordermark recently secured $120 million in Series C funding led by Softbank Vision Fund 2, and offers a clear look at some investment priorities emerging for the restaurant space in this crisis environment. The company will use the cash infusion to continue to grow its digital ordering business.

“COVID has completely changed how people interact with restaurants. We’ve flipped from dine-in to off-premise and have experienced 10 years of advancements in months,” Canter said during a recent interview.

While Ordermark will leverage the funding to enable restaurants to streamline their digital orders, the company will also prioritize its burgeoning virtual restaurant business, Nextbite.

Through Nextbite, qualifying restaurants can add delivery-only brands to their existing space using Ordermark’s turnkey technology. One of those brands–HotBox by Wiz–made quite a few headlines earlier this year thanks to its partnership with Billboard Music Award-winning rapper Wiz Khalifa. Nextbite also features chicken brands, like Mother Clucker and Firebelly Wings, burger brands, grilled cheese brands and a salad concept called Toss It Up.

The idea is that if your restaurant has the kitchen and labor capacity to add a dozen or so orders a day (say, sandwiches), one of Nextbite’s brands (say, “Grilled Cheese Society”) may be a good fit for you to manage out of that existing space while also generating some extra sales.

“We’re focused on how to make the most impact for a restaurant from a revenue standpoint. That was initially helping them get signed onto omnichannel platforms, but now we’re going one step further than that to turn on incremental brands from the same kitchen,” Canter said. “We’ve been working on Nextbite for about two years and brought it to market late last year. It was received well pre-COVID and now it is a growing focus of ours because of how impactful it can be in this moment.”

Canter believes this model has a strong tailwind because many restaurants have the ability to handle an extra 10 to 20 orders a day. That extra capacity supplements a loss in dine-in revenue, he believes.

No doubt, the virtual and ghost kitchen space has created lifelines for a number of restaurants during this crisis, particularly independents grappling with shutdowns and capacity restrictions. Technomic data shows that the number of eateries using dark kitchens has grown from 15% pre-pandemic to 51% in May. Since the start of COVID-19, Nextbite has launched 15 brands and has added over 1,000 delivery-only restaurants nationwide.

Facilitating this growth is the now-critical channel of delivery. According to new data from M Science, consumer spending for meal delivery was up more than 130% in Q3, an increase of more than 120% in Q2. Those numbers are likely to correct themselves a bit, but delivery itself isn’t going anywhere. As such, investors are pouring their money into the cloud kitchen market, which is expected to grow by $1.18 billion through 2024, representing a compound annual growth rate of nearly 19%.

Nextbite wants a big bite of that market and is trying to make its turnkey solution even simpler for restaurants accordingly.

“We’re coming in fully loaded with these concepts that we can easily train restaurants on with simple ingredients and preparations. We’re doing the leg work needed to generate demand so that all restaurants have to do is put their head down and make the food,” Canter said.

Nextbite vets restaurants, including their ingredient lists and equipment availability, to make sure they’re a good partner fit for one of its brands.

“If a restaurant has French fries on the menu, for example, then we know they have a fryer, so then they’d probably be eligible for Mother Clucker, our fried chicken brand,” Canter said. “We have a busy operator in mind and don’t want to complicate the process here. We want to come into a kitchen in a non-disruptive way.”

Some of Nextbite’s concepts are now national, fulfilled by a diverse group of operators across the country. The company has also created a suite of marketing promotions, including on major platforms like Uber Eats and DoorDash, to create awareness of its brands. Still, much work remains.

“One thing we’re finding is that many restaurants are not designed for online ordering fulfilment. They’re not designed with online ordering in mind. Maybe they don’t have the right cuisine for delivery,” Canter said. “Those restaurants are one of our focuses because sometimes our brands are performing five to 10 times the delivery volume because they are built specifically for delivery. That’s important because that’s where more customers are.”

Although the ghost, or dark, kitchen segment tends to be defined broadly, Canter is a big believer in the virtual restaurant concept. Ghost kitchens require a physical space to house multiple brands, and Canter thinks there are already too many kitchens.

“We don’t need more when the kitchens when the ones we have are underutilized,” he said. “And because of the incremental rent, labor and equipment costs involved in a ghost kitchen, the breakeven is higher, which is hard to achieve in a delivery-only format, especially when you’re giving away fees to delivery companies. We believe many restaurants have the ability to run multiple concepts using the same space, staff, overhead and equipment.”

He adds that such concepts tend to fall in the 30-to-35% profit range, “which is unheard of in this industry.”

As Ordermark and its Nextbite business evolve with this latest round of funding, Canter said independent restaurants will be the sweet spot.

“We’re basically focused on what we can do to help restaurants keep their doors open and making sure what they’re doing is sustainable,” he said. “Many restaurants aren’t nimble. They’re hoping things will open and foot traffic will magically appear at levels they were before and that’s a deathly outlook. This is going to get worse before it gets better. If you’re not jumping on new technology and figuring out how to reach new customers outside of your four walls, you’re not going to make it.”

From Food & Drink in Perfectirishgifts

0 notes

Text

Ghost Kitchens Are the Wave of the Future. But Is That a Good Thing?

Rows of shipping containers were used to create the small kitchens inside the Grand Food Depot in LA. | Mariah Tauger / Los Angeles Times via Getty Images

Delivery-only restaurants, which have proliferated during the pandemic, could change the way the industry does business for years to come

Sunset Squares Pizza has fewer than 1,000 followers on Instagram. Delivery in its neighborhood — San Francisco’s Sunset district — costs $5, while those farther afield in the city pay $10. There’s a handful of pizzas and nondairy focaccia options on the menu, a couple salads, and a dessert. The dough is made from sourdough and a wild yeast starter, and the pies are, of course, square. What started as a pandemic-era baking project between a father and his teen daughters this spring has now turned into a viable business operation: Three or four pizzas a week to friends grew as word of mouth spread; the Instagram posts and tags followed.

The difference between Sunset Squares and, say, your neighbor slinging pizzas from his garage and selling them on Instagram is that this business was started by a notable San Francisco chef with several restaurants of his own. He remains purposefully anonymous for now.

“San Francisco is a really small food community. That has certain advantages but also has disadvantages. In many ways it’s hurt the development of restaurants and new food ideas,” says the chef. “At the end of the day, especially with certain cuisines, if you don’t come from a lauded Michelin pedigree, food journalists and the general community — because San Francisco has shifted and morphed into this elitist consumer market — just want to follow brand recognition versus thinking on their own what they think is good food or not.”

A market research firm recently estimated that delivery-only restaurants could be a $1 trillion business by 2030.

Several months in, Sunset Squares is still a bit of a secret. The chef and his family and friends handle the deliveries for a flat rate of $5 in the neighborhood, $10 elsewhere in SF, and $20 for neighborhoods outside the city. But it’s poised for a public debut soon; the chef has hired two additional chefs to help develop the concept further, and plans to launch it on third-party delivery platforms like DoorDash in a couple months.

Virtual brands, ghost kitchens, delivery-only concepts — whatever you call them — have thrived during COVID-19. Euromonitor, a market research firm, recently estimated that they could be a $1 trillion business by 2030. That’s happening concurrently with near-impossible working conditions for many brick-and-mortar restaurants. Stores in cities that once did a brisk lunch business saw sales fall off a cliff. To mitigate losses, some restaurants are throwing everything they have at virtual expansion, creating entirely new brands that live online.

Many of these concepts partner with large delivery companies like DoorDash and Uber Eats for online ordering, pickup, and delivery; others look to companies that build and operate kitchen facilities that host multiple concepts under one roof. One such company, CloudKitchens, started by former Uber founder and CEO Travis Kalanick, has received hundreds of millions of dollars in funding, and according to a recent Wall Street Journal report, it’s spent more than $130 million in the last two years on real estate for its kitchens. Ordermark, a software company that helps restaurants manage online orders and host virtual brands from their existing kitchens, recently received a $120 million investment.

Nikki Freihofer, a senior strategist for the Culinary Edge, a restaurant consulting firm that regularly advises clients on virtual brand creation, compares the current wave of virtual restaurants to direct-to-consumer brands like Casper mattresses or Quip toothbrushes. “Consumers are trusting [direct-to-consumer brands] based on their digital presence alone and then ordering something that comes straight to their door,” she says. “At the fundamental level that’s the same thing as a virtual restaurant brand.”

Sunset Squares embodies everything that a brand consultant likely looks for: It serves a purpose, has a focused vision, and tells a compelling story. But its intentional execution and unorthodox origin story make it exceedingly rare among the glut of ghost kitchens launched to prominence on UberEats.

When experts talk about virtual restaurants, they talk about “intelligently leveraging brands” and establishing “brand-cohesive touchpoints.” It’s more jargon than you’d expect when talking about an upstart casual restaurant, but many concepts are the result of digital strategies calculated to help stand out in a crowded market.

Melt Shop operates 17 restaurants in five states serving the kind of comfort food you might want after a big night out (cheesy chicken sandwiches, chicken tenders, tater tots). In early spring, amid COVID lockdowns and plummeting sales, the team quickly launched two new virtual brands: Melt’s Wing Shop and Melt’s Cheesesteaks. They were built fast but intentionally, says Melt Shop founder and CEO Spencer Rubin, by taking advantage of data Melt had on hand.

Smith Collection/Gado/Getty Images

The Doordash Kitchens building in Redwood City, California

That data told Rubin that “Chicken sells… period,” but also that customers wanted more dinner options and that wings could drive a larger check average. “It’s very hard to make money delivering a $10 meal for one person. We saw that selling family-sized meals for two, three, four people is how to actually turn a profit in the delivery space,” Rubin says. “We also saw that the first few hours of team shifts each day had time to integrate more prep work without adding too much complication. We were able to optimize schedules by moving tasks to different parts of the day.”

But even with hard data and a good gut instinct, virtual concepts fail just as easily as their brick-and-mortar counterparts. Melt’s Cheesesteaks lasted less than two months.

“I don’t think there’s any brands that are successful in the long term by half-assing it, and I don’t think anyone who has their doors open in this environment right now is half-assing anything,” Rubin says. “People’s idea of quality and people’s ability to execute vary dramatically. Even though some people may be giving it 100 percent, it still may not be good enough for the market.”

“By having multiple brands, we own a greater portion of digital real estate.”

Third-party services provide ample opportunity for expansion, according to Aaron Noveshen, CEO of the Culinary Edge consulting firm and founder of Starbird Chicken, a Bay Area fried chicken restaurant with several physical stores. Starbird operates several virtual brands, too: Starbird Wings, Starbird Salads, Starbird Bowls, and Garden Bird.

“By having multiple brands, we own a greater portion of digital real estate,” Novoshen says. “[With] five brands on an Uber Eats or a DoorDash, we can target a consumer who’s looking for a more specialized product. We can make that site highlight a full menu category.”

Instead of a huge menu where some items might get lost, those items can be broken out and highlighted as brands of their own, a benefit for existing restaurants looking to make more money. Zuul, a ghost kitchens company, rents kitchen space to restaurant businesses in Manhattan. Since COVID, Zuul has seen an uptick in interest: The company receives multiple inquiries per day from both existing restaurants looking to expand and virtual concepts looking to launch, according to Kristen Barnett, Zull’s director of strategy. A year ago, she had to explain to friends in the food industry what she did for a living. Now, “Everyone I speak to in the food industry understands what a ghost kitchen is,” Barnett says.

Zuul houses delivery-only kitchens for existing brick-and-mortar brands like Sweetgreen and has helped a few of its clients launch virtual-only brands from existing restaurants. Virtual brand Rival Sandwich Co. was born from the two-location Manhattan pizzeria Stone Bridge Pizza. “They were cooking off their pizza dough and dusting it with fresh herbs and salt to make really delicious fresh baked bread, and then making baked sandwiches with it,” Barnett says. “But they were completely hidden in the far corner of their menu and we didn’t see many sales.”

Zuul’s team spun up the virtual sandwich concept from idea to operations in two weeks. In its first week, Rival Sandwich Co. sold three times the amount of sandwiches Stone Bridge was selling on its own.

Mariah Tauger / Los Angeles Times via Getty Images

Charles Jones makes a customers order inside the kitchen of Taco Pete at the Grand Food Depot ghost kitchen.

There are still limits to what kind of concepts work, even in a vast virtual world. Building an online-only brand requires attracting a broad enough market to buy what you’re selling. “Realistically, there are only so many products being launched in the virtual restaurant space. It’s a lot of chicken wings, a lot of grain bowls, and sandwiches and pastas, things that travel well,” says Freihofer, the Culinary Edge strategist.

Zuul’s Barnett, however, argues that virtual brands are in “a nascent phase of evolution.” They’re optimized for simplicity, so the easiest launches come first.

Freihofer agrees. “The virtual space is ripe for innovation and I doubt the overriding trend will be homogeneity,” she says. “The virtual space allows for a certain degree of flexibility and the ability to be nimble to adapt to consumer preferences, so operators shouldn’t shy away from innovation or creativity by any means.”

And of course, even with the rapid pace of brand creation and evolution, “it can’t seem like you hodge-podge makeshifted your brand together,” she added.

“It was the only way we could start something up with no capital, and so we figured it would be a great opportunity for us to build a brand.”

According to the chef behind Sunset Squares, there’s still ample opportunity for creativity and interesting new concepts in the virtual space. “Definitely seemingly limiting at first glance, but constraints and adversity always push creativity,” he says. “I think our pizza concept and operations are great examples. We have okonomiyaki-style pizza with bulgogi beef, pork belly and kimchi pizza, a New England chowder-inspired white pie, a drizzle and dip sauce section featuring homemade hot honey, white sauce made with miso, and an umami-rich pink sauce made with mentaiko.”

Virtual concepts are also emerging as stepping stones for unestablished entrepreneurs.

Cat-Su Sando in Chicago opened in September, offering “an American approach to classic Japanese foods.” It’s a virtual restaurant from Shawn Clendening and Will Schlaeger, two chefs with backgrounds in fine dining. Neither claim Japanese ancestry nor have traveled to Japan, but they’ve launched a business selling katsu sandwiches, skewers, and pancakes through third-party delivery services like Uber Eats. The restaurant operates out of a Cloud Kitchens facility in Chicago.

The choice to start as a virtual brand was opportunistic. “It was the only way we could start something up with no capital, and so we figured it would be a great opportunity for us to build a brand and maybe establish ourselves a little bit in the industry so we can open our doors in the future for larger projects,” Schlaeger says. Cat-Su Sando went from concept to opening in just over a month. “That brand kind of popped out of nowhere for us,” he continues. “We got a good general response from people right off the bat, we kind of ran with it. We didn’t have jobs anyway.”

The duo hope to open a slightly different brick-and-mortar restaurant next year, though they have yet to work out all the details of that concept. Clendening says they’re open to focusing on takeout and delivery if the climate continues to support it. In that sense, Cat-Su Sando serves as a test ground for what might come next in an uncertain market.

While there are fewer startup costs and the timeline is shorter, some aspects of launching a virtual brand and opening a new restaurant are the same. “Any restaurant is nothing but trying to figure out solutions, and it’s just shifted in a different way,” says Schlaeger.

“Coming up with names is the hardest part,” Clendening says.

Schlaeger agrees. “When you have something that clicks, you just go with it.”

Toward the end of our conversation, the restaurant’s publicist chimes in to call out the playful add-ons at the bottom of Cat-Su Sando’s menu — a can of Spam and a dime bag full of catnip. “Because they love cats. You know, Cat-Su,” she says.

Clendening jumps in. “We’re actually dog people,” he says.

Kristen Hawley writes about restaurant operations, technology, and the future of the business from San Francisco.

from Eater - All https://ift.tt/3lkrGOM https://ift.tt/35c8Nrj

Rows of shipping containers were used to create the small kitchens inside the Grand Food Depot in LA. | Mariah Tauger / Los Angeles Times via Getty Images

Delivery-only restaurants, which have proliferated during the pandemic, could change the way the industry does business for years to come

Sunset Squares Pizza has fewer than 1,000 followers on Instagram. Delivery in its neighborhood — San Francisco’s Sunset district — costs $5, while those farther afield in the city pay $10. There’s a handful of pizzas and nondairy focaccia options on the menu, a couple salads, and a dessert. The dough is made from sourdough and a wild yeast starter, and the pies are, of course, square. What started as a pandemic-era baking project between a father and his teen daughters this spring has now turned into a viable business operation: Three or four pizzas a week to friends grew as word of mouth spread; the Instagram posts and tags followed.

The difference between Sunset Squares and, say, your neighbor slinging pizzas from his garage and selling them on Instagram is that this business was started by a notable San Francisco chef with several restaurants of his own. He remains purposefully anonymous for now.

“San Francisco is a really small food community. That has certain advantages but also has disadvantages. In many ways it’s hurt the development of restaurants and new food ideas,” says the chef. “At the end of the day, especially with certain cuisines, if you don’t come from a lauded Michelin pedigree, food journalists and the general community — because San Francisco has shifted and morphed into this elitist consumer market — just want to follow brand recognition versus thinking on their own what they think is good food or not.”

A market research firm recently estimated that delivery-only restaurants could be a $1 trillion business by 2030.

Several months in, Sunset Squares is still a bit of a secret. The chef and his family and friends handle the deliveries for a flat rate of $5 in the neighborhood, $10 elsewhere in SF, and $20 for neighborhoods outside the city. But it’s poised for a public debut soon; the chef has hired two additional chefs to help develop the concept further, and plans to launch it on third-party delivery platforms like DoorDash in a couple months.

Virtual brands, ghost kitchens, delivery-only concepts — whatever you call them — have thrived during COVID-19. Euromonitor, a market research firm, recently estimated that they could be a $1 trillion business by 2030. That’s happening concurrently with near-impossible working conditions for many brick-and-mortar restaurants. Stores in cities that once did a brisk lunch business saw sales fall off a cliff. To mitigate losses, some restaurants are throwing everything they have at virtual expansion, creating entirely new brands that live online.

Many of these concepts partner with large delivery companies like DoorDash and Uber Eats for online ordering, pickup, and delivery; others look to companies that build and operate kitchen facilities that host multiple concepts under one roof. One such company, CloudKitchens, started by former Uber founder and CEO Travis Kalanick, has received hundreds of millions of dollars in funding, and according to a recent Wall Street Journal report, it’s spent more than $130 million in the last two years on real estate for its kitchens. Ordermark, a software company that helps restaurants manage online orders and host virtual brands from their existing kitchens, recently received a $120 million investment.

Nikki Freihofer, a senior strategist for the Culinary Edge, a restaurant consulting firm that regularly advises clients on virtual brand creation, compares the current wave of virtual restaurants to direct-to-consumer brands like Casper mattresses or Quip toothbrushes. “Consumers are trusting [direct-to-consumer brands] based on their digital presence alone and then ordering something that comes straight to their door,” she says. “At the fundamental level that’s the same thing as a virtual restaurant brand.”

Sunset Squares embodies everything that a brand consultant likely looks for: It serves a purpose, has a focused vision, and tells a compelling story. But its intentional execution and unorthodox origin story make it exceedingly rare among the glut of ghost kitchens launched to prominence on UberEats.

When experts talk about virtual restaurants, they talk about “intelligently leveraging brands” and establishing “brand-cohesive touchpoints.” It’s more jargon than you’d expect when talking about an upstart casual restaurant, but many concepts are the result of digital strategies calculated to help stand out in a crowded market.

Melt Shop operates 17 restaurants in five states serving the kind of comfort food you might want after a big night out (cheesy chicken sandwiches, chicken tenders, tater tots). In early spring, amid COVID lockdowns and plummeting sales, the team quickly launched two new virtual brands: Melt’s Wing Shop and Melt’s Cheesesteaks. They were built fast but intentionally, says Melt Shop founder and CEO Spencer Rubin, by taking advantage of data Melt had on hand.

Smith Collection/Gado/Getty Images

The Doordash Kitchens building in Redwood City, California

That data told Rubin that “Chicken sells… period,” but also that customers wanted more dinner options and that wings could drive a larger check average. “It’s very hard to make money delivering a $10 meal for one person. We saw that selling family-sized meals for two, three, four people is how to actually turn a profit in the delivery space,” Rubin says. “We also saw that the first few hours of team shifts each day had time to integrate more prep work without adding too much complication. We were able to optimize schedules by moving tasks to different parts of the day.”

But even with hard data and a good gut instinct, virtual concepts fail just as easily as their brick-and-mortar counterparts. Melt’s Cheesesteaks lasted less than two months.

“I don’t think there’s any brands that are successful in the long term by half-assing it, and I don’t think anyone who has their doors open in this environment right now is half-assing anything,” Rubin says. “People’s idea of quality and people’s ability to execute vary dramatically. Even though some people may be giving it 100 percent, it still may not be good enough for the market.”

“By having multiple brands, we own a greater portion of digital real estate.”

Third-party services provide ample opportunity for expansion, according to Aaron Noveshen, CEO of the Culinary Edge consulting firm and founder of Starbird Chicken, a Bay Area fried chicken restaurant with several physical stores. Starbird operates several virtual brands, too: Starbird Wings, Starbird Salads, Starbird Bowls, and Garden Bird.

“By having multiple brands, we own a greater portion of digital real estate,” Novoshen says. “[With] five brands on an Uber Eats or a DoorDash, we can target a consumer who’s looking for a more specialized product. We can make that site highlight a full menu category.”

Instead of a huge menu where some items might get lost, those items can be broken out and highlighted as brands of their own, a benefit for existing restaurants looking to make more money. Zuul, a ghost kitchens company, rents kitchen space to restaurant businesses in Manhattan. Since COVID, Zuul has seen an uptick in interest: The company receives multiple inquiries per day from both existing restaurants looking to expand and virtual concepts looking to launch, according to Kristen Barnett, Zull’s director of strategy. A year ago, she had to explain to friends in the food industry what she did for a living. Now, “Everyone I speak to in the food industry understands what a ghost kitchen is,” Barnett says.

Zuul houses delivery-only kitchens for existing brick-and-mortar brands like Sweetgreen and has helped a few of its clients launch virtual-only brands from existing restaurants. Virtual brand Rival Sandwich Co. was born from the two-location Manhattan pizzeria Stone Bridge Pizza. “They were cooking off their pizza dough and dusting it with fresh herbs and salt to make really delicious fresh baked bread, and then making baked sandwiches with it,” Barnett says. “But they were completely hidden in the far corner of their menu and we didn’t see many sales.”

Zuul’s team spun up the virtual sandwich concept from idea to operations in two weeks. In its first week, Rival Sandwich Co. sold three times the amount of sandwiches Stone Bridge was selling on its own.

Mariah Tauger / Los Angeles Times via Getty Images

Charles Jones makes a customers order inside the kitchen of Taco Pete at the Grand Food Depot ghost kitchen.

There are still limits to what kind of concepts work, even in a vast virtual world. Building an online-only brand requires attracting a broad enough market to buy what you’re selling. “Realistically, there are only so many products being launched in the virtual restaurant space. It’s a lot of chicken wings, a lot of grain bowls, and sandwiches and pastas, things that travel well,” says Freihofer, the Culinary Edge strategist.

Zuul’s Barnett, however, argues that virtual brands are in “a nascent phase of evolution.” They’re optimized for simplicity, so the easiest launches come first.

Freihofer agrees. “The virtual space is ripe for innovation and I doubt the overriding trend will be homogeneity,” she says. “The virtual space allows for a certain degree of flexibility and the ability to be nimble to adapt to consumer preferences, so operators shouldn’t shy away from innovation or creativity by any means.”

And of course, even with the rapid pace of brand creation and evolution, “it can’t seem like you hodge-podge makeshifted your brand together,” she added.

“It was the only way we could start something up with no capital, and so we figured it would be a great opportunity for us to build a brand.”

According to the chef behind Sunset Squares, there’s still ample opportunity for creativity and interesting new concepts in the virtual space. “Definitely seemingly limiting at first glance, but constraints and adversity always push creativity,” he says. “I think our pizza concept and operations are great examples. We have okonomiyaki-style pizza with bulgogi beef, pork belly and kimchi pizza, a New England chowder-inspired white pie, a drizzle and dip sauce section featuring homemade hot honey, white sauce made with miso, and an umami-rich pink sauce made with mentaiko.”

Virtual concepts are also emerging as stepping stones for unestablished entrepreneurs.

Cat-Su Sando in Chicago opened in September, offering “an American approach to classic Japanese foods.” It’s a virtual restaurant from Shawn Clendening and Will Schlaeger, two chefs with backgrounds in fine dining. Neither claim Japanese ancestry nor have traveled to Japan, but they’ve launched a business selling katsu sandwiches, skewers, and pancakes through third-party delivery services like Uber Eats. The restaurant operates out of a Cloud Kitchens facility in Chicago.

The choice to start as a virtual brand was opportunistic. “It was the only way we could start something up with no capital, and so we figured it would be a great opportunity for us to build a brand and maybe establish ourselves a little bit in the industry so we can open our doors in the future for larger projects,” Schlaeger says. Cat-Su Sando went from concept to opening in just over a month. “That brand kind of popped out of nowhere for us,” he continues. “We got a good general response from people right off the bat, we kind of ran with it. We didn’t have jobs anyway.”

The duo hope to open a slightly different brick-and-mortar restaurant next year, though they have yet to work out all the details of that concept. Clendening says they’re open to focusing on takeout and delivery if the climate continues to support it. In that sense, Cat-Su Sando serves as a test ground for what might come next in an uncertain market.

While there are fewer startup costs and the timeline is shorter, some aspects of launching a virtual brand and opening a new restaurant are the same. “Any restaurant is nothing but trying to figure out solutions, and it’s just shifted in a different way,” says Schlaeger.

“Coming up with names is the hardest part,” Clendening says.

Schlaeger agrees. “When you have something that clicks, you just go with it.”

Toward the end of our conversation, the restaurant’s publicist chimes in to call out the playful add-ons at the bottom of Cat-Su Sando’s menu — a can of Spam and a dime bag full of catnip. “Because they love cats. You know, Cat-Su,” she says.

Clendening jumps in. “We’re actually dog people,” he says.

Kristen Hawley writes about restaurant operations, technology, and the future of the business from San Francisco.

from Eater - All https://ift.tt/3lkrGOM via Blogger https://ift.tt/3kiCj34

0 notes

Photo

New Post has been published on https://techcrunchapp.com/hot-or-not-and-ghost-kitchens-real-money/

Hot or Not? And Ghost Kitchens, Real Money

This is the web version of our weekly newsletter. Subscribe today to get all the best food tech news delivered direct to your inbox!

Well. It’s been a week of ups and downs, hasn’t it! The question right now is just how much the news from the past few days will impact our vision of the future.

I’m talking, of course, about robots. (Did you have something else on your mind?)

It’s been a will they/won’t they type of week for robots and automation:

In other words, news indicating the future of food robots was all over the (non-electoral) map. In its press announcement, Picnic said, “Interest has also increased around a contact-free, high-hygiene food preparation, due to COVID-19, therefore intensifying customer interest in Picnic’s solutions even further.” We actually saw this type of COVID-assisted demand in action last week when White Castle added 10 more Flippy cooking robots to its roster. So food-related robots are doing well!

But then Walmart abandoned shelf-scanning robots, throwing a wet blanket on robo-prospects. According to The Wall Street Journal, Walmart had discovered that as more people shopped online, stores were using more human workers for picking and packing orders. There were efficiencies then, by combining store workers’ shopping for orders with other tasks like inventory monitoring as well as other automated systems.

But the WSJ also reported that Walmart was concerned about how robots were interacting with humans. Walmart was using Bossa Nova’s ‘bots, which are six feet tall and autonomously wander store aisles. Perhaps this was too off-putting for other people shopping.

Will other retailers follow Walmart? Both Schnuck Markets and Woodman’s Markets in the midwest recently added a shelf-scanning robots to a number of their locations. Will they too, discover the same results and kill these programs?

But the bad robot news pendulum swung back to good news with Ocado’s purchases. The difference between Walmart and Ocado is that Ocado’s robots are relegated to automated fulfillment centers, so they don’t interact with everyday shoppers. Ocado’s dual robo-purchases reinforce and improve existing workflows when it comes to grocery order fulfillment. It’s not adding anything new, just ideally making its current systems faster and cheaper.

If there’s a thread to be found among these news stories, perhaps it’s that the future of food robots is more about behind the scenes, rather than out mingling with everyday people. At least when it comes to restaurants and retail. Now we’ll have to see how other businesses eyeing robots and automation vote with their dollars.

Invest-a-Palooza 2020 is here for ghost kitchens

As demand for delivery orders has gone up, so too has the amount of cash flowing into the ghost kitchen and virtual restaurant space. The last couple weeks have brought a couple eye-popping investments, the latest being Reef Technology’s $700 million fundraise announced Monday. While that massive figure reflects Reef’s entire business, which is more than just ghost kitchens, company co-founder and chief executive, told TechCrunch that ghost kitchens “will be a significant part of non-parking revenue” in the future.

Reef’s mega fundraise and the company’s confidence in its ghost kitchen business echos the overall growth of the sector. Since July, when Euromonitor predicted the ghost kitchen market would be worth $1 trillion by 2030, there has been an almost-non-stop flow of investment dollars into the space. To give a sense of just how much money is flowing into this sector, here’s a look some of the significant investments over the last few months:

In July, Zuul grabbed $9 million in funding to expand its ghost kitchen concept across NYC. The company’s current facility, in Manhattan’s SoHo neighborhood, is home to brands like Sweetgreen and Junzi. Zuul also recently launched its own virtual food hall.

In August, Dubai-based iKcon raised a $5 million pre-seed round for its ghost kitchen network, which currently has 10 locations across the United Arab Emirates. Notably, iKcon also operates its own proprietary tech stack in the kitchens.

Virtual Kitchen, a company founded by two ex-Uber employees, raised $20 million in September, bringing the San Francisco-based company’s total funding to $37 million. It is expected to expand its “delivery-only kitchens” with the funds.

Also in September, Yummy Corporation, based in Indonesia, raised a $12 million Series B round for its ghost kitchen network in Jakarta. The company is expanding into other cities and has raised a total of $19.8 million so far.

Last month, restaurant tech company Ordermark raised $120 million to expand its network of virtual restaurant brands. Unlike the others on this list, Ordermark does not actually operate its own kitchens. Rather, it pairs restaurants with available kitchen spaces as it help those eating establishments transition to off-premises formats.

Reef raised $700 million in part to expand its ghost kitchen business as a key part of its “neighborhood hubs.”

It’s an understatement to say that the pandemic has accelerated the growth of both ghost kitchens and virtual restaurants. What’s in part driving this massive influx of cash lately, though, is that said pandemic hasn’t subsided (the opposite), therefore dine-in rooms at restaurants haven’t re-opened, at least not in its former capacity. That fact is unlikely to change for a long time, and restaurants, restaurant tech companies, and investors alike may be finally accepting that the future for many restaurants is inside the ghost kitchen, not the dining room.

More Headlines

California Passes Prop. 22, Leaving Gig Workers as Independent Contractors This was a big win for profit-seeking third-party delivery services.

Meat-Tech 3D Closes $7M Funding Round, Files for IPO – The funding announcement comes about one week after Meat-Tech 3D said it had started the process for an IPO in the U.S. (The company is traded on the Tel Aviv Stock Exchange already.)

Muji Releases a Line of Shelf-Stable Plant-Based Meat Items – The products are available right now to Muji customers in Japan via both the company’s brick-and-mortar stores and its website. Dishes include plant-based versions of a burger, minced meat, meatballs, and a thinly sliced meat.

Bits x Bites Closes $30 Million for Its New China Agrifood Tech Fund – The company has invested in a variety of future food themes ranging from cell-based meat (Future Meat) and Food AI (Analytical Flavor Systems) to CRISPR (Tropic Biosciences).

Related

0 notes

Photo

Spying a pivot to ghost kitchens, SoftBank’s second Vision Fund pours $120 million into Ordermark

0 notes

Quote

Rows of shipping containers were used to create the small kitchens inside the Grand Food Depot in LA. | Mariah Tauger / Los Angeles Times via Getty Images Delivery-only restaurants, which have proliferated during the pandemic, could change the way the industry does business for years to come Sunset Squares Pizza has fewer than 1,000 followers on Instagram. Delivery in its neighborhood — San Francisco’s Sunset district — costs $5, while those farther afield in the city pay $10. There’s a handful of pizzas and nondairy focaccia options on the menu, a couple salads, and a dessert. The dough is made from sourdough and a wild yeast starter, and the pies are, of course, square. What started as a pandemic-era baking project between a father and his teen daughters this spring has now turned into a viable business operation: Three or four pizzas a week to friends grew as word of mouth spread; the Instagram posts and tags followed. The difference between Sunset Squares and, say, your neighbor slinging pizzas from his garage and selling them on Instagram is that this business was started by a notable San Francisco chef with several restaurants of his own. He remains purposefully anonymous for now. “San Francisco is a really small food community. That has certain advantages but also has disadvantages. In many ways it’s hurt the development of restaurants and new food ideas,” says the chef. “At the end of the day, especially with certain cuisines, if you don’t come from a lauded Michelin pedigree, food journalists and the general community — because San Francisco has shifted and morphed into this elitist consumer market — just want to follow brand recognition versus thinking on their own what they think is good food or not.” A market research firm recently estimated that delivery-only restaurants could be a $1 trillion business by 2030. Several months in, Sunset Squares is still a bit of a secret. The chef and his family and friends handle the deliveries for a flat rate of $5 in the neighborhood, $10 elsewhere in SF, and $20 for neighborhoods outside the city. But it’s poised for a public debut soon; the chef has hired two additional chefs to help develop the concept further, and plans to launch it on third-party delivery platforms like DoorDash in a couple months. Virtual brands, ghost kitchens, delivery-only concepts — whatever you call them — have thrived during COVID-19. Euromonitor, a market research firm, recently estimated that they could be a $1 trillion business by 2030. That’s happening concurrently with near-impossible working conditions for many brick-and-mortar restaurants. Stores in cities that once did a brisk lunch business saw sales fall off a cliff. To mitigate losses, some restaurants are throwing everything they have at virtual expansion, creating entirely new brands that live online. Many of these concepts partner with large delivery companies like DoorDash and Uber Eats for online ordering, pickup, and delivery; others look to companies that build and operate kitchen facilities that host multiple concepts under one roof. One such company, CloudKitchens, started by former Uber founder and CEO Travis Kalanick, has received hundreds of millions of dollars in funding, and according to a recent Wall Street Journal report, it’s spent more than $130 million in the last two years on real estate for its kitchens. Ordermark, a software company that helps restaurants manage online orders and host virtual brands from their existing kitchens, recently received a $120 million investment. Nikki Freihofer, a senior strategist for the Culinary Edge, a restaurant consulting firm that regularly advises clients on virtual brand creation, compares the current wave of virtual restaurants to direct-to-consumer brands like Casper mattresses or Quip toothbrushes. “Consumers are trusting [direct-to-consumer brands] based on their digital presence alone and then ordering something that comes straight to their door,” she says. “At the fundamental level that’s the same thing as a virtual restaurant brand.” Sunset Squares embodies everything that a brand consultant likely looks for: It serves a purpose, has a focused vision, and tells a compelling story. But its intentional execution and unorthodox origin story make it exceedingly rare among the glut of ghost kitchens launched to prominence on UberEats. When experts talk about virtual restaurants, they talk about “intelligently leveraging brands” and establishing “brand-cohesive touchpoints.” It’s more jargon than you’d expect when talking about an upstart casual restaurant, but many concepts are the result of digital strategies calculated to help stand out in a crowded market. Melt Shop operates 17 restaurants in five states serving the kind of comfort food you might want after a big night out (cheesy chicken sandwiches, chicken tenders, tater tots). In early spring, amid COVID lockdowns and plummeting sales, the team quickly launched two new virtual brands: Melt’s Wing Shop and Melt’s Cheesesteaks. They were built fast but intentionally, says Melt Shop founder and CEO Spencer Rubin, by taking advantage of data Melt had on hand. Smith Collection/Gado/Getty Images The Doordash Kitchens building in Redwood City, California That data told Rubin that “Chicken sells… period,” but also that customers wanted more dinner options and that wings could drive a larger check average. “It’s very hard to make money delivering a $10 meal for one person. We saw that selling family-sized meals for two, three, four people is how to actually turn a profit in the delivery space,” Rubin says. “We also saw that the first few hours of team shifts each day had time to integrate more prep work without adding too much complication. We were able to optimize schedules by moving tasks to different parts of the day.” But even with hard data and a good gut instinct, virtual concepts fail just as easily as their brick-and-mortar counterparts. Melt’s Cheesesteaks lasted less than two months. “I don’t think there’s any brands that are successful in the long term by half-assing it, and I don’t think anyone who has their doors open in this environment right now is half-assing anything,” Rubin says. “People’s idea of quality and people’s ability to execute vary dramatically. Even though some people may be giving it 100 percent, it still may not be good enough for the market.” “By having multiple brands, we own a greater portion of digital real estate.” Third-party services provide ample opportunity for expansion, according to Aaron Noveshen, CEO of the Culinary Edge consulting firm and founder of Starbird Chicken, a Bay Area fried chicken restaurant with several physical stores. Starbird operates several virtual brands, too: Starbird Wings, Starbird Salads, Starbird Bowls, and Garden Bird. “By having multiple brands, we own a greater portion of digital real estate,” Novoshen says. “[With] five brands on an Uber Eats or a DoorDash, we can target a consumer who’s looking for a more specialized product. We can make that site highlight a full menu category.” Instead of a huge menu where some items might get lost, those items can be broken out and highlighted as brands of their own, a benefit for existing restaurants looking to make more money. Zuul, a ghost kitchens company, rents kitchen space to restaurant businesses in Manhattan. Since COVID, Zuul has seen an uptick in interest: The company receives multiple inquiries per day from both existing restaurants looking to expand and virtual concepts looking to launch, according to Kristen Barnett, Zull’s director of strategy. A year ago, she had to explain to friends in the food industry what she did for a living. Now, “Everyone I speak to in the food industry understands what a ghost kitchen is,” Barnett says. Zuul houses delivery-only kitchens for existing brick-and-mortar brands like Sweetgreen and has helped a few of its clients launch virtual-only brands from existing restaurants. Virtual brand Rival Sandwich Co. was born from the two-location Manhattan pizzeria Stone Bridge Pizza. “They were cooking off their pizza dough and dusting it with fresh herbs and salt to make really delicious fresh baked bread, and then making baked sandwiches with it,” Barnett says. “But they were completely hidden in the far corner of their menu and we didn’t see many sales.” Zuul’s team spun up the virtual sandwich concept from idea to operations in two weeks. In its first week, Rival Sandwich Co. sold three times the amount of sandwiches Stone Bridge was selling on its own. Mariah Tauger / Los Angeles Times via Getty Images Charles Jones makes a customers order inside the kitchen of Taco Pete at the Grand Food Depot ghost kitchen. There are still limits to what kind of concepts work, even in a vast virtual world. Building an online-only brand requires attracting a broad enough market to buy what you’re selling. “Realistically, there are only so many products being launched in the virtual restaurant space. It’s a lot of chicken wings, a lot of grain bowls, and sandwiches and pastas, things that travel well,” says Freihofer, the Culinary Edge strategist. Zuul’s Barnett, however, argues that virtual brands are in “a nascent phase of evolution.” They’re optimized for simplicity, so the easiest launches come first. Freihofer agrees. “The virtual space is ripe for innovation and I doubt the overriding trend will be homogeneity,” she says. “The virtual space allows for a certain degree of flexibility and the ability to be nimble to adapt to consumer preferences, so operators shouldn’t shy away from innovation or creativity by any means.” And of course, even with the rapid pace of brand creation and evolution, “it can’t seem like you hodge-podge makeshifted your brand together,” she added. “It was the only way we could start something up with no capital, and so we figured it would be a great opportunity for us to build a brand.” According to the chef behind Sunset Squares, there’s still ample opportunity for creativity and interesting new concepts in the virtual space. “Definitely seemingly limiting at first glance, but constraints and adversity always push creativity,” he says. “I think our pizza concept and operations are great examples. We have okonomiyaki-style pizza with bulgogi beef, pork belly and kimchi pizza, a New England chowder-inspired white pie, a drizzle and dip sauce section featuring homemade hot honey, white sauce made with miso, and an umami-rich pink sauce made with mentaiko.” Virtual concepts are also emerging as stepping stones for unestablished entrepreneurs. Cat-Su Sando in Chicago opened in September, offering “an American approach to classic Japanese foods.” It’s a virtual restaurant from Shawn Clendening and Will Schlaeger, two chefs with backgrounds in fine dining. Neither claim Japanese ancestry nor have traveled to Japan, but they’ve launched a business selling katsu sandwiches, skewers, and pancakes through third-party delivery services like Uber Eats. The restaurant operates out of a Cloud Kitchens facility in Chicago. The choice to start as a virtual brand was opportunistic. “It was the only way we could start something up with no capital, and so we figured it would be a great opportunity for us to build a brand and maybe establish ourselves a little bit in the industry so we can open our doors in the future for larger projects,” Schlaeger says. Cat-Su Sando went from concept to opening in just over a month. “That brand kind of popped out of nowhere for us,” he continues. “We got a good general response from people right off the bat, we kind of ran with it. We didn’t have jobs anyway.” The duo hope to open a slightly different brick-and-mortar restaurant next year, though they have yet to work out all the details of that concept. Clendening says they’re open to focusing on takeout and delivery if the climate continues to support it. In that sense, Cat-Su Sando serves as a test ground for what might come next in an uncertain market. While there are fewer startup costs and the timeline is shorter, some aspects of launching a virtual brand and opening a new restaurant are the same. “Any restaurant is nothing but trying to figure out solutions, and it’s just shifted in a different way,” says Schlaeger. “Coming up with names is the hardest part,” Clendening says. Schlaeger agrees. “When you have something that clicks, you just go with it.” Toward the end of our conversation, the restaurant’s publicist chimes in to call out the playful add-ons at the bottom of Cat-Su Sando’s menu — a can of Spam and a dime bag full of catnip. “Because they love cats. You know, Cat-Su,” she says. Clendening jumps in. “We’re actually dog people,” he says. Kristen Hawley writes about restaurant operations, technology, and the future of the business from San Francisco. from Eater - All https://ift.tt/3lkrGOM

http://easyfoodnetwork.blogspot.com/2020/11/ghost-kitchens-are-wave-of-future-but.html

0 notes

Photo

Spying a pivot to ghost kitchens, SoftBank’s second Vision Fund pours $120 million into Ordermark

0 notes

Photo

Spying a pivot to ghost kitchens, Softbank’s second Vision Fund pours $120 million into Ordermark https://ift.tt/35T4wsj

0 notes