#OvernightTrading

Explore tagged Tumblr posts

Text

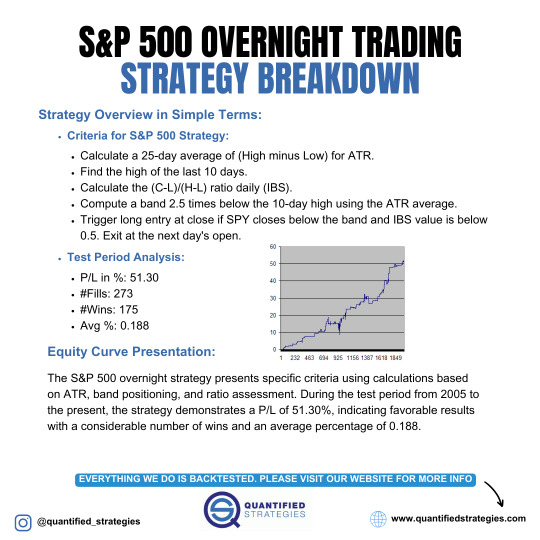

S&P 500 OVERNIGHT TRADING STRATEGY BREAKDOWN

This strategy leverages ATR, high-low bands, and IBS ratios to time SPY trades. Tested since 2005, it achieved a 51.3% P/L with 175 wins out of 273 trades, averaging 0.188% per trade.

1 note

·

View note

Text

REVEALING OVERNIGHT STRATEGY #3 IN S&P 500

This strategy leverages three unique variables, achieving a 13.57% P/L, a 3.8 profit factor, and 46 wins out of 59 trades. Its upward equity curve and solid performance metrics highlight its potential for consistent returns.

1 note

·

View note

Text

UNVEILING OVERNIGHT STRATEGY #2 IN S&P 500

This S&P 500 strategy leverages a new n-day low and added variables for better results, achieving a 12.6% profit, 2.6 profit factor, and 64 wins out of 90 trades. Shorting shows a negative edge, affirming the long strategy’s strength.

0 notes

Text

UNVEILING OPENING PRICE RETURNS

Many traders overlook that much of the market's gains occur when it’s closed. Analyzing the S&P 500’s returns from close to open reveals an average gain of 0.04% per trade, resulting in an annual return of 9.5%, nearly matching buy-and-hold. While implementing this approach has challenges, such as slippage and commissions, gains above 0.1% can help offset these costs.

1 note

·

View note

Text

UNLOCKING THE POWER OF OVERNIGHT TRADING

Unlock the potential of overnight trading by capitalizing on short bursts of opportunity, distinct from market timing. Unlike predicting market trends, overnight strategies focus on leveraging brief, profitable moments to boost risk-adjusted returns, akin to a barracuda's swift, targeted actions.

#tradingstrategies#OvernightTrading#MarketEdge#RiskAdjustedReturns#TradingStrategies#ShortTermGains#MarketTiming

1 note

·

View note

Text

UNIFIED OVERNIGHT STRATEGY PORTFOLIO KEY INSIGHTS

The unified overnight strategy portfolio delivers robust performance with a 14.6% CAGR, a 62% win ratio, and a max drawdown of 15%. Over 1373 trades, the average gain per trade is 0.3%, proving consistent returns since 2017. Automated execution is recommended for practicality. Explore more details in our Amibroker course.

#tradingstrategies#OvernightTrading#AutomatedTrading#SharpeRatio#Backtested#StockMarketSuccess#QuantTrading#AmibrokerStrategies

1 note

·

View note

Text

DIVERSE OVERNIGHT STRATEGIES: EQUITY CURVE INSIGHTS

This equity curve showcases diverse overnight strategies, including mean reversion, breakout, and gap trading, resulting in an average gain of 0.41% across 237 trades. These combined approaches highlight the effectiveness of overnight trading for steady portfolio growth.

#tradingstrategies#OvernightTrading#MeanReversion#BreakoutStrategy#GapTrading#StockMarket#BacktestedResults

0 notes

Text

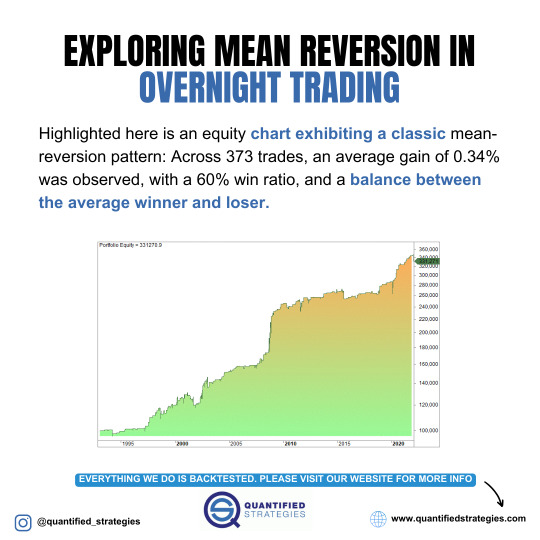

EXPLORING MEAN REVERSION IN OVERNIGHT TRADING

Exploring mean reversion in overnight trading reveals a compelling edge. With 373 trades, an average gain of 0.34%, and a 60% win ratio, this strategy showcases balanced performance between winners and losers, offering a robust opportunity for traders.

#tradingstrategies#MeanReversion#OvernightTrading#TradingStrategies#BacktestedResults#MarketEdge#QuantitativeTrading

0 notes

Text

OVERNIGHT TRADING EDGE UNVEILED

The overnight trading edge capitalizes on the market's behavior between the close and the next day's open. Historical data shows minimal gains during the trading day, making selling at the open more profitable. This strategy offers a stronger edge compared to day trading, as seen in the equity curve that highlights its success over time.

#tradingstrategies#OvernightTrading#StockMarketEdge#TradingStrategy#EquityCurve#MarketClose#DayTrading

0 notes

Text

UNLOCKING THE POWER OF OVERNIGHT TRADING

Unlock the power of #OvernightTrading for short-term gains, distinct from market timing. Capitalize on brief, lucrative opportunities to enhance #RiskAdjustedReturns. Distinguish the strategy's focus on seizing short windows from predicting market valuations.

#OvernightTrading#RiskAdjustedReturns#Diversification#AssetClasses#TradingStrategies#MarketVariations#PortfolioManagement

0 notes

Text

UNIFIED OVERNIGHT STRATEGY PORTFOLIO: KEY INSIGHTS

Explore the key metrics of a unified overnight strategy portfolio, boasting a CAGR of 14.6%, a 62% win ratio, and a Sharpe Ratio of 2.05. With 1373 trades and an average gain per trade of 0.3%, these strategies, developed in 2017 and traded from 2021, showcase realistic returns without survivorship bias or curve fitting. Discover the stability in out-of-sample performance since 2018, with notable gains during the Covid-19 period in 2020.

0 notes

Text

DIVERSE OVERNIGHT STRATEGIES EQUITY CURVE INSIGHTS

Explore the combined impact of diverse overnight strategies through a comprehensive equity curve. Witness the cumulative outcome over 237 trades, showcasing an average gain of 0.41%. Gain insights into the interplay of mean reversion, breakout, and gap trading strategies.

#OvernightTrading#EquityCurve#MeanReversion#BreakoutStrategies#TradingInsights#tradingtips#tradingstrategy

0 notes