#Price Controls

Explore tagged Tumblr posts

Text

Tariffs and monopolies

I'm on a 20+ city book tour for my new novel PICKS AND SHOVELS. Catch me in PITTSBURGH on May 15 at WHITE WHALE BOOKS, and in PDX on Jun 20 at BARNES AND NOBLE. More tour dates here.

For all that orthodox economists hate tariffs in all their forms, the question, "do tariffs work?" is a complex one, which can't be answered unless you specify which tariffs, in what context:

https://pluralistic.net/2025/04/02/me-or-your-lying-eyes/#spherical-cows-on-frictionless-surfaces

The orthodox case against tariffs goes like this: tariffs raise the price of goods before they reach the market. Sellers will raise the price of goods to recover those costs from buyers, so it's you, the person buying a car, a phone, or a board-game, who will bear that additional cost:

https://www.sjgames.com/ill/archive/April_03_2025/Tariffs_Are_Driving_Up_Game_Prices_Now

As is ever the case with economics, this critique builds in certain assumptions. And as is especially the case with neoliberal economics, this critique builds in certain assumptions that are never tested for veracity – indeed, neoliberal economists pride themselves on their reliance on incorrect assumptions:

https://pluralistic.net/2025/02/17/caliper-ai/#racism-machine

The main assumption built into the orthodox case against tariffs is that sellers can't afford to eat the costs of tariffs. In the thought-experiment land of neoliberalism, market competition erodes sellers' profits so that everything being sold is only slightly marked up above the cost of making it, getting it to the store and selling it to you. Companies are said to be making a "competitive" rate of profit, which is tautologically defined as "whatever profit they're making." If Nike pays $20 to make a pair of shoes in Vietnam that it sells in America for $140, that $120 profit is "competitive" – if it wasn't, it would be lower, and it isn't, so it is.

Trump's own explanation for how the tariffs will work is no better. Trump has made a variety of incoherent claims about who will pay the tariffs. On the campaign trail, he insisted that the tariffs would somehow be paid by America's trading partners, either by their governments or by overseas companies. This is literally untrue: when you order something from overseas, the customs broker sends the bill to you, not the company that sold you the goods.

But the smarter elements in the Trump orbit have a slightly more reality-based theory: they claim that importers, faced with tariff costs, will push back on sellers and insist that they discount their products to offset the tariff bill. That's how the costs end up being paid by foreign sellers – and if their governments step in to help pay the bill, that's how foreign governments will pay the bill.

This explanation has the benefit of actually being an explanation, in that it is a series of cause-and-effect relationships that end up with the costs being borne by someone other than stateside buyers. However, this explanation is also founded on (at least) two demonstrably untrue assumptions: first, that buyers have the power to force sellers to lower their prices; and second, that this power comes from the availability of substitute goods that are made (or could be made) in the USA.

It's possible for there to be a market economy in which buyers can force sellers to eat tariff costs. For that to happen, the sellers have to be in real competition with one another. Competition requires competitors: companies that consider themselves rivals, directly attacking one another's margins. But that's not how American big business operates: 40 years of lax antitrust enforcement has produced an American economy in which nearly every sector is dominated by a monopoly, a duopoly, or a cartel:

https://www.openmarketsinstitute.org/learn/monopoly-by-the-numbers

Take Nike: Nike controls 86% of the US athletic shoe market. Nearly all the remaining market share is owned by its main rivals, Adidas and Reebok – companies that merged in 2005. It's clear that Adidas/Reebok would like to get some of Nike's market share, but in 20+ years of duopoly rule over the sector, neither Nike nor Adidas/Reebok have tried a serious discounting strategy to win that market. Instead, the duopoly has found it easy to tacitly collude to rig margins of more than 600%. What's more, the collusion may have been explicit, not tacit – when a sector is dominated by two giant firms, the upper ranks of both companies are dominated by people who've worked at both companies. These people aren't rivals, they're peers. They're executors of one another's estates, godparents to one another's children, members of the same charitable boards and pickup sports leagues. They're lifelong pals. If you think they never explicitly conspire to rig markets – over drinks at someone's wedding or funeral, say – then I envy you your touching faith in humanity.

A market controlled by a handful of firms doesn't have to solve the thorny "collective action problem" of deciding on a regulatory priority and then holding that line as the cartel captures its regulators:

https://pluralistic.net/2022/06/05/regulatory-capture/

That means that these companies end up with pricing power, because they can maintain solidarity while they raise prices. If everyone hikes prices together, consumers can't exert market discipline by buying from someone less greedy. And the same solidarity that confers pricing power to a cartel also insulates it from regulatory discipline, because all the companies will tell the same lie to regulators about why prices went up.

This was on display for all to see during the covid inflation shocks. Companies like Pepsi boasted to shareholders that "consumers are willing to pay more for our brands," as they hiked prices way above any inflationary rises, meaning that they didn't just force buyers to cover their higher costs, they actually raised prices more than was needed to cover those costs:

https://pluralistic.net/2023/03/11/price-over-volume/#pepsi-pricing-power

Needless to say, Coke didn't respond by slashing its prices in order to capture Pepsi's customers. They did the opposite: they also raised prices over and above the inflationary costs. Coke and Pepsi might be rivals on paper, but when it comes to questions like, "Should sugar-water have higher margins?" they are the best of friends.

The same is true of the fossil fuel industry, another highly concentrated sector with sky-high margins that raised prices over inflation during the covid supply-chain shocks, and boasted about it on investor calls, without facing any regulatory scrutiny:

https://pluralistic.net/2022/03/15/sanctions-financing/#soak-the-rich

Neoliberal economists have an answer to this kind of thing: "it's fine." In the self-referential world of economism, whatever happens was meant to happen, because markets are efficient, so whatever happens in the market is efficient, and can only be made worse by state intervention. This theory of efficient markets is full of beautiful, self-equilibriating processes that can be precisely modeled using equations, but only because the field discards all the nonquantifiable elements of society, assuming that because you can't do math on these qualitative factors, they must not matter:

https://locusmag.com/2021/05/cory-doctorow-qualia/

Of all the qualitative factors that clearly matter that are treated as if they don't matter, the most obvious, glaring omission is power. Power is hard to measure, but if you try to model a transaction without factoring power in, you end up in very dark places, for example, in systems where people should be allowed to "voluntarily" sell themselves into slavery.

It goes without saying that a theory of economics without a theory of power relationships is a great deal for powerful people. In Careless People, the whistleblower Sarah Wynn-Williams's excellent new tell-all memoir about Facebook, Wynn-Williams recounts how shocked and offended Sheryl Sandberg became when she was told that other countries wouldn't allow her to go and buy a kidney for her son, should he ever need one (her kid wasn't sick – she just wanted to know that if he ever did get sick…):

https://us.macmillan.com/books/9781250391230/carelesspeople/

This is economics without a theory of power: if I offer to buy your son's kidney, and you accept my offer, then we have achieved a voluntary exchange of value that is – tautologically – assumed to be fair. Indeed, this transaction isn't merely a way for kidneys to change hands – it's a way to "discover" the "market price" of a kidney. We're not just buyers and sellers, we're brave explorers of the vast, uncharted space of market prices.

Economics without power relies on tautology: if you assume the market is efficient, then whatever you get is what you were supposed to get. If Nike can charge a 600% markup on a $20 pair of shoes, then that is the "natural" price. Everyone in the chain – the workers who made the shoes, the subcontractors who employed the worker, the freighters who shipped the shoes, the logistics company that brought the shoe to the store, the clerk who rang up the purchase – is making what the market says they should be making. The price you pay? That's the price you should pay.

Perhaps you've heard people say that the most important thing is to "grow the pie," and that it's foolish to argue about how big any given "slice of the pie" is:

https://www.vox.com/future-perfect/405403/abundance-ezra-klein-building-costs-housing-energy-democrats-polarization

But this doesn't stand up to even cursory examination. If your slice of the pie is way too small to live on, and the pie grows, and your slice doesn't grow with it – or if it does, but not by enough to keep you solvent, then the size of your slice of the pie is the only thing that matters.

Economists call this the "distributional outcome" question, and orthodox economists insist that only fools and ideologues talk about distributional outcomes. They consider distributional outcomes to be a trap that sucks in well-meaning people who back "market-distorting interventions" that end up making everyone else poorer.

But you know who really cares about distributional outcomes? The finance sector. Think of the 2015 American Airlines pilot strike, which ended with a raise for pilots. When the company announced this on an investor call, Citibank analyst Kevin Crissey declared: "This is frustrating. Labor is being paid first again. Shareholders get leftovers":

https://www.thestreet.com/investing/american-airlines-flight-attendants-bash-citi-analyst-who-put-shareholders-before-workers-14134309

Investors have a lot of power. After all, capital is concentrated into just a few hands, with trillions being wielded by institutional investors – index funds, hedge funds, etc – and they get to elect the board, who have the power to hire and fire corporate executives. A corporate board is like a trade union for wealth, a small committee that wields solidaristic power to threaten companies with dire consequences if their interests aren't given priority over the interests of workers and buyers.

No wonder that corporations are so ardently opposed to other forms of solidaristic power, like trade unions – who might shift value from investors to workers – and regulators – who might shift value from investors to buyers. Without these sources of countervailing power, unified capital will not only pass on any additional costs to workers and shoppers, they'll raise prices over and above any inflationary hikes. This does indeed "grow the pie" – while beggaring both shoppers and workers.

In other words, Nike could eat the tariff costs on its goods, but it won't because it doesn't have to, because it's part of a duopoly that both tacitly and explictly colludes to screw its customers and workers. Indeed, the cartelized big businesses that run the US economy just spent the pandemic years doing greedflation – using the excuse of the pandemic and their monopolistic pricing power to raise the prices of everything, from your rent to a dozen eggs:

https://pluralistic.net/2025/03/10/demand-and-supply/#keep-cal-maine-and-carry-on

If you've got the right kind of especially smooth market-pilled brain, you insist that this is impossible. These giant margins are so tempting that they will inevitably coax "new market entrants" into opening competing businesses. That does happen – sometimes. But not when the dominant companies can figure out how to build Warren Buffett's cherished "moats and walls" around their businesses. For example, if you're Amazon and 90% of middle class US households prepay for their shipping through Prime, you can charge sellers whatever the traffic will bear, because they have to go through your chokepoint in order to reach their best customers. That's how Amazon ended up taking 45-51% out of every dollar platform sellers earn:

https://pluralistic.net/2024/08/14/the-price-is-wright/#enforcement-priorities

In Trumpland, the point of tariffs is to create friction on imports so that investors back businesses that do their production onshore. There's plenty of reasons to want things to be made in America. Manufacturing key resources in the US creates resiliency against geopolitical events (like wars), environmental disasters (like shipping-disrupting superstorms), and epidemiological events (like pandemics). Moreover, the low cost of overseas manufacturing often comes at the expense of human rights and environmental protection: making things in the US is no guarantee that they'll be made by fairly compensated workers in safe workplaces that don't pollute their environments, but it's a lot easier to enforce those priorities when production is within US borders.

But US investors spent the past 40 years gleefully demolishing the capacity of America to make things. As Apple CEO Tim Cook said:

[V]ocational expertise is very deep here [in China]. And I give the educational system a lot of credit for continuing to push on that even as others were de-emphasizing vocational.

https://www.forbes.com/sites/quora/2018/01/17/how-much-would-an-iphone-cost-if-apple-were-forced-to-make-it-in-america/

The US doesn't have enough qualified tool-and-die makers and other skilled tradespeople to produce the machines that will make the goods that Americans want to buy. New tradespeople can be trained, but acquiring these skilled trades is a process of many years. For the US to reshore its manufacturing, it needs substantial, sustained public investment in capacity-building: loans and grants to train workers and investment in basic research and other non-market goods needed to recover the US manufacturing base.

America should do all that, but if it wants to try, it needs a robust, predictable, orderly system of government to build upon. It needs the kind of reliable and orderly processes that make people feel safe about changing trades and going back to school. It needs imports of goods from overseas that can be used to restart the US manufacturing capacity that can replace those imports.

But in a market like this one, dominated by monopolies who needn't fear the Trump-gutted FTC, DOJ and CFPB; where cartels have captured their regulators; where Doge-style chaos spreads existential terror about the future, tariffs will only raise prices, without any significant re-shoring or capacity building. The Trump tariffs are a gift to giants like Nike, who have the logistics sophistication to exploit loopholes, demand preferential rates from shippers and brokers, and to pass on costs to their customers. Any domestic company that seeks to compete with Nike will not have these advantages. For Nike – and other dominant companies – the Trump tariffs are just another moat, another obstacle which they can hurdle, but which stops smaller competitors dead in their tracks:

https://www.thebignewsletter.com/p/with-high-tariffs-has-trump-ended

Trump's tariffs, weak antitrust and weak consumer regulation are a recipe for shifting billions from the American public to the investors in the largest companies. It's still going to result in a huge economic collapse, but the most profitable companies of today will be best poised to stay on top of the pile after the crash. One hopeful outcome of this is that a bunch of the One Percenters are extremely fucked off about the plan:

https://coreyrobin.com/2025/04/06/is-the-conservative-crackup-finally-here/

The New Civil Liberties Alliance is a nonprofit impact litigation shop funded by Leonard Leo, the mastermind of the Federalist Society and its takeover of the Supreme Court. They're the ones who got Chevron Deference overturned last year, and now they're suing the Trump administration over the tariffs:

https://www.washingtonpost.com/politics/2025/04/05/trump-tariffs-sink-conservatives-challenge-whether-theyre-legal/

As Corey Robin writes, tariffs have a long history of breaking up conservative coalitions, "the leading edge of political conflict in the 19th century." Robin writes that the conservative movement has spent years shifting tariff power from Congress to the president, never anticipating that someday, a president might preside over a Mad King tariff strategy. Now, Robin says:

The tariff is going to be the major issue that leads the judicial right to confront the empowered executive that they’ve turbo-charged in so many other ways.

Last year, Rick Perlstein pointed out that the true significance of Project 2025 lay in its contradictions, the irreconcilable, mutually exclusive policy prescriptions found in its pages:

https://pluralistic.net/2024/07/14/fracture-lines/#disassembly-manual

Perlstein said that these contradictions were a map of the fracture lines in the Trump coalition. Trump's tariffs clearly represent a major fault-line, and we need to seize this opportunity when it presents itself.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/04/07/it-matters-how-you-slice-it/#too-big-to-care

#tariffs#monopolies#monopolism#too big to care#trumpism#trump tariffs#distributional outcomes#economics#power#law and political economy#big tech#price controls#pluralistic

236 notes

·

View notes

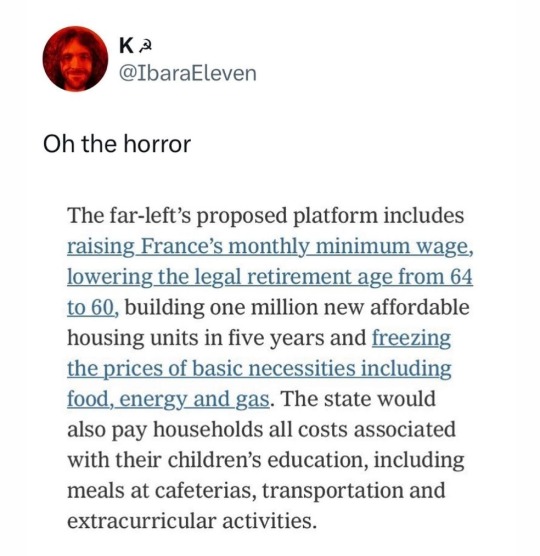

Text

The exact moment when the press has realized they have replaced a senile moron with a drunkard moron

#communism#price controls#kamala 2024#kamala harris#harris walz 2024#harris#harris 2024#kamala#vote trump#trump 2024#us politics#politics#american politics#american elections#presidential election#elections#us elections#election 2024

67 notes

·

View notes

Note

Price controls would help the middle class why do you on your side oppose them. Is there a reason other than it came form Democrats?

Price controls are a very bad idea. It doesn't matter if it comes from a Republican like Nixon or a Democrat like Harris. Price controls violate the law of supply and demand and are based on the idea that every supplier is gouging. Some do gouge, most do not and that is crucial.

If you look at the data most suppliers are making a very narrow profit. Their costs are up due to runaway inflation which was initiated by Biden's short sighted move to artificially shrink the energy supply, primarily petroleum based energy. Transportation, fertilizer, packaging, and processing costs have gone through the roof. This cost is naturally passed to the consumers or else the suppliers would soon be out of business.

It doesn't matter where price controls have been established. Nixon's America, Socialist Nicaragua, Cuba, East Germany, the Soviet Union. Mao's China or Xi's China the results are all the same. They will result in shortages, businesses going under, burgeoning black markets, civil unrest, unemployment, and in the end failure. Prices will not go down and products will be absent from the shelves.

79 notes

·

View notes

Text

The free market isn't free because we are forced to work to survive. That's not a free market, it's wage slavery. That's not freedom, people aren't buying what they'd like, people aren't doing what they want. Because they're trying to survive. Give people a birthright allowance, UBI, and put price controls on companies so that they can't just maneuver around it. That's a free market. Give money to poor people, they spend it right back into the economy. Boom, you're winning. Give money to a billionaire and it's as good as setting it on fire. It's permanently removed from the economy. Useless. You don't have to support communism to be against capitalism. This is basic post-economic shit. Come on, man.

9 notes

·

View notes

Text

Price Controls

Aloha kākou. It’s the economy, stupid. A campaign slogan democrat apparatchik Jim Carville used in the 1992 Bubba “Have a Cigar” Clinton presidential campaign. The lie worked even though the economy wasn’t in trouble then. The democrats used this lie so often enough people began to believe it. President George Herbert Bush lost his reelection and with it the Reagan economic revolution. Ross Perot…

View On WordPress

#Bidenonmics#Breadline#communism#CPI#democrat#economics#Economy#Joe Biden#Kamala Harris#MAGA#Marxism#Politics#President Donald J. Trump#Price Controls#Socialism#Trumpanomics

24 notes

·

View notes

Text

Because she has no intention to do anything constructive, and is just saying stuff to get elected.

6 notes

·

View notes

Text

Let’s examine some of the recent proposals by the Harris campaign, their effects, and why economists oppose them, shall we? Let's begin!

Read More: https://thefreethoughtproject.com/money/comrade-kamala-assessing-three-of-harriss-new-economic-proposals

#TheFreeThoughtProject

5 notes

·

View notes

Text

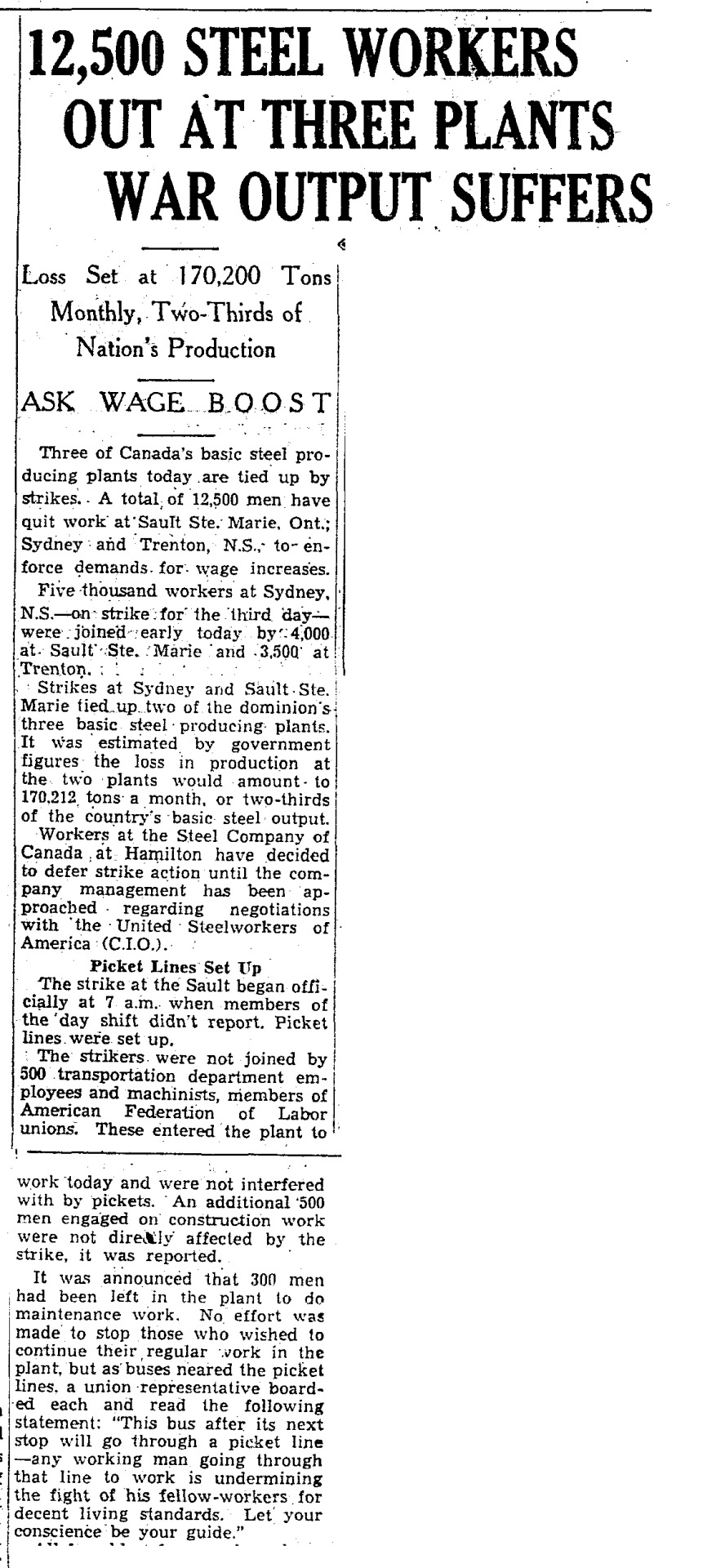

"12,500 STEEL WORKERS OUT AT THREE PLANTS; WAR OUTPUT SUFFERS," Toronto Star. January 14, 1943. Page 1. ---- Loss Set at 170,200 Tons Monthly, Two-Thirds of Nation's Production ---- ASK WAGE BOOST ---- Three of Canada's basic steel producing plants today are tied up by strikes. A total of 12,500 men have quit work at Sault Ste. Marie, Ont.; Sydney and Trenton, N.S., to enforce demands for wage increases.

Five thousand workers at Sydney, N.S. - on strike for the third day - were joined early today by 4,000 at Sault Ste. Marie and 3,500 at Trenton.

Strikes at Sydney and Sault Ste. Marie tied up two of the dominion's three basic steel producing plants. It was estimated by government figures the loss in production at the two plants would amount to; 170,212 tons a month, or two-thirds of the country's basic steel output.

Workers at the Steel Company of Canada at Hamilton have decided to defer strike action until the company management has been approached regarding negotiations with the United Steelworkers of America (C.I.O.).

Picket Lines Set Up The strike at the Sault began officially at 7 a.m. when members of the day shift didn't report. Picket lines were set up.

The strikers were not joined by 500 transportation department employees and machinists, members of American Federation of Labor unions. These entered the plant to work today and were not interfered with by pickets. An additional 500 men engaged on construction work were not direly affected by the strike, it was reported.

It was announced that 300 men had been left in the plant to do maintenance work. No effort was made to stop those who wished to continue their regular work in the plant, but as buses neared the picket lines, a union representative boarded each and read the following statement: "This bus after its next stop will go through a picket line - any working man going through that line to work is undermining the fight of his fellow-workers for decent living standards. Let your conscience be your guide."

#sault ste. marie#sydney nova scotia#trenton#strike#picket line#picketing#steel workers#steel plant#steel industry#algoma steel#dominion steel#united steel workers of america#central industrial organization#hamilton#wage demands#wage increase#wage freeze#price controls#canada during world war 2#working class struggle

9 notes

·

View notes

Text

Carteresque Price Controls

Aloha kākou. Over four years ago, inflation was 2.1%. The gas average was $1.90 a gallon. Food prices were affordable. Since the Marxist democrats used Covid to rig the 2020 election and installed Pedo-Joe Biden and Kommunist Karmela Harris, the economy has collapse into chaos. The cost of living has risen under Bidenomics to record levels. Inflation climbed over 9%, but that’s just the Consumer…

View On WordPress

#Bidenomics#Economy#energy#Environment#Fake News Media#Food Costs#Food Processing#Gouging#Illegal Immigration#national security#Price Controls#prices#Trump Economy

10 notes

·

View notes

Text

0 notes

Text

I get where liberals get the idea, but the devil is in the details, like grocery stores have only a few percent profit margin, so food inflation doesn't seem to be happening at that step in the supply chain

The wrong side of everything is an accurate description of the GOP.

MAGA will blame Biden for greedflation, then attack Harris when she goes after greedflation.

Ultimately, MAGA will get lower prices and never give credit to Democrats.

2K notes

·

View notes

Text

Mortgaged Economy

You have to respect Democratic dedication. Wait: no you don’t. Permanent remedial students adhere to the worst ideas possible in an illustration of commitment’s downside. The slowest learners don’t even mean to help with a bad example to avoid.

Doing more of what’s wrong will surely help if we believe strongly enough. Some diabolical capitalists must not be mustering sufficient faith, which is why printing more money isn’t making everyone wealthier.

Giving you money to buy a house sounds great. They’re expensive, after all, what with the walls and plumbing. Prices are especially high recently for mysterious cursed reasons. It’s much better to not pay, which is where Kamala Harris swoops in to save the economy and sanity with a coupon for $25,000 off a house. The money is free because it’s from the government. Why do houses suddenly cost $25,000 more?

Deciding how much something should cost is only okay when the government imposes. Punishing businesses for the crime of being too good at it is the very fair approach Democrats use to encourage progress. The Berlin Wall just wasn’t high enough.

Ranting against decadent success is the America-haters’ version of the American way. Taking the free in markets the wrong way may not be sufficient deterrent against selling something customers want so badly that they’ll trade money. That gets expensive. But it’s nothing compared to government declaring you can take what you wish. Trade is voluntary, which enrages coercion fans as much as gun ownership. Buy a firearm to really enrage the White House.

An item on a shelf may cost a different amount tomorrow. This whole supply and demand scheme leads to uncertainty. Aspiring president Harris needs you to put her in charge so she can enact price controls, which work great except for how they don’t control prices. But at least she’d get to tell you what to do, and you’ve certainly noticed how much smarter she is than you.

Timing is everything. It’s astounding how corporations discovered greed as soon as liberals got their way. Demonizing their victims in that charming Democratic style is their way of avoiding blame, which also explains why they’re sympathetic to muggers and not those relieved of property.

This is not the federal landlord’s first attempt to create homeless paired with vacancy. That may not be their stated goal, but it is the result. Things didn’t turn out too bad aside from melting down the global economy. Oh, and fewer people had homes, but anything can look bad if you check it.

Defying reality is for the imaginative. But the world’s not reacting positively to fantastical Democratic claptrap. Subprime mortgages were the inspirational attempt to let people who couldn’t afford houses try to buy them. We shouldn’t have even rented the notion. Trying more of what caused awfulness will surely expand the square footage.

These should be pleasing times, what with the kindly government buying us whatever we’d like. Yet acting like our grandparents hasn’t helped the case for replacing families.

Evading cruel prices was supposed to enrich life without money. The ability to live without spending somehow didn’t allow us to finally focus on our boutique pottery business instead of some boring job with a desk that leads to sales. Attempting to evade life’s expenses is sadly predictable. The White House has pulled off the reverse miracle of turning money into something that buys nothing.

It takes a visionary to come up with something so simple. Joe Biden wonders why nobody ever thought of free money when he’s not working on shoelace and bathrobe knots. Yet his genius wealth plan buys less and less. We’re not enduring a genie’s curse, as Democratic presidents are unable to grant wishes despite their claims. I’m starting to suspect they don’t dwell in lamps, either.

It’s tough for Trump devotees to indulge in their propensity for announcing everyone other than them sucks when they believe in slightly different sucky things. Republicans head forward and back to the ‘30s with their embrace of tariffs. The same conglomerates Democrats hate for dealing with their policies will merely pass along Trump’s charge to the consumer. They’re tricky with the loophole.

Ban raising prices next to be bipartisan in defiance of gouging. Either way, take comfort in knowing we’re going to end up with a president who will do everything possible to raise prices.

The willful ignorance required to pretend government gets us good deals on anything seems like personal contests to test the limits of daftness. Wondering how long before we hit rock bottom offers the only surprise. Even Argentina decided they wanted to stop being silly, and the fact we aspire to one day have as strong an economy as one of South America’s most historically silly enclaves apparently hasn’t created enough shame.

A lack of empathy defines those who boast of caring. It’s possible to understand how free markets work without running a business just like Brian Wilson could capture surfing’s spirit despite trying the tricky sport one time. By contrast, Democrats got into politics precisely because they’re unable to profit by creating value.

Kamala is running against the current president. Her campaign against whichever big meanie made cookies an unobtainable luxury makes zero sense considering her present job, but neither does anything else she claims. Running to reverse the deleterious policies of this criminally stupid White House doesn’t work unless she was a saboteur the whole time, and her destructiveness is inadvertent.

Never learning is crucial to those who know everything. Just ask them. Their habit of ruining everything in the same way every time just means we’re due for a different outcome. Boring life leads to the same thing every time. Failing to learn patterns would mean they didn’t know best how to run your life, and that can’t be right.

#housing#free market#Kamala Harris#2024 presidential election#price controls#economy#subprime mortgages#mortgages

0 notes

Text

In 2022, when inflation was surging and the dollar's declining purchasing power had many Americans looking for the sort of "solutions" that Harris now offers, Federal Reserve Bank of St. Louis economist Christopher J. Neely pointed out that schemes for government-imposed price controls date back to the Code of Hammurabi and "have costs whose severity depends on the broadness of the control and the degree to which it changes the price from the free-market price."

Free market prices, he emphasized, "allocate scarce goods and services to buyers who are most willing and able to pay for them" and "signal that a good is valued and that producers can profit by increasing the quantity supplied." In the absence of such allocation and signals, you get shortages of goods and services. With grocery stores, that means empty shelves—little to buy at the controlled prices.

There's more to it than that. Neely pointed out that you also get cheapened goods to reduce production costs, gamesmanship to get around rules, and black markets that entirely defy the law. He recommended that "price controls should stay in the history books."

The Washington Post editorial board, usually as protective of Democrats as the Times, agrees. It pointed out that Harris didn't define what constituted the "excessive" profits she wanted to target and that "thankfully, this gambit by Ms. Harris has been met with almost instant skepticism, with many critics citing President Richard M. Nixon's failed price controls from the 1970s."

From the Code of Hammurabi to former President Nixon, with a detour for the Roman Emperor Diocletian—who, economist John Cochrane notes, torpedoed production and trade with price restrictions—such controls have been irresistible for government officials. That's because bad economics all too often makes for good—or, at least, effective—public relations. People who tell pollsters they think corporations are raking in 36 percent profits (the real average across industries is closer to 8 percent) can be convinced by clever politicians that they're being ripped off and need government intervention.

What politicians won't admit is that it's their own policies that put the public in distress to begin with, and that their latest schemes, if implemented, will make matters worse.

0 notes

Text

The United States can't have social democracy because social democracy is like socialism, and we can't have socialism because socialism is like communism. So social democracy is exactly the same as communism.

France wants to give all their citizens meaningful social services and programs.

America is stuck trying to create a trillionaire through tax breaks and underfunding/cutting the social safety net.

4K notes

·

View notes

Text

Broken Fixing

Aloha kākou. If the economy wasn’t broken, then why are the Marxist democrats trying to fix it? Marxist democrats said Bidenomics was supposed to fix Trumpanomics. And now Karmelanomics is going to fix Bidenomics. Ever since the democrat coup to remove Pedo-Joe Biden and install Karmela Harris, the economy suddenly is in trouble. But we were told that Bidenomics was working. That’s what this…

View On WordPress

#Bidenomics#communism#Deep State#Economy#Election 2024#Fake News Media#Kamala Harris#Kamalanomics#Obamacare#Price Controls#Trump Economy

1 note

·

View note