#Production Linked Incentive (PLI) scheme

Explore tagged Tumblr posts

Text

"Reliance Industries' Strategic Investment: A Boost for Alok Industries and the Indian Textile Sector"

Title: “Reliance Industries’ Strategic Investment: A Boost for Alok Industries and the Indian Textile Sector” Introduction: In a significant development for the Indian textile industry, Alok Industries, a leading player in the sector, witnessed a remarkable surge of 20% in its share price on Tuesday following a substantial investment by Reliance Industries. The investment, totaling ₹3,300…

View On WordPress

#Alok Industries#Insolvency and Bankruptcy Code#Investment impact#Production Linked Incentive (PLI) scheme#Reliance Industries#Textile industry

0 notes

Text

Hiranandani’s Greenbase to Expand Industrial and Logistics Parks in Chennai to 391 Acres

Greenbase Industrial and Logistics Parks, a collaboration between the Hiranandani Communities and Blackstone Group, has announced plans to acquire 211 acres of land in Chennai, expanding its total land holdings in the region to an impressive 391 acres. This strategic move underscores the group's commitment to scaling its operations in Hiranandani Chennai, one of the most promising industrial and logistics hubs in India.

The company plans to invest ₹700 crore to transform these newly acquired parcels into cutting-edge industrial parks, which will add 7.5 million sq. ft. of premium logistics and industrial space to its portfolio. This expansion will bring Greenbase’s total footprint in Chennai to 11 million sq. ft., with an ambitious target to deliver 20 million sq. ft. of industrial spaces across India in the next five years.

“We are in advanced stages of acquiring these land parcels, and the deals are expected to close soon,” said N. Shridhar, CEO of Greenbase Industrial and Logistics Parks.

The new acquisitions include strategically located parcels in South West Chennai’s Oragadam area and North Chennai. Two of these parcels are close to Greenbase’s existing industrial park in Oragadam, which spans 135 acres and generates annual rental revenue of ₹150–200 crore.

Having already delivered 3.5 million sq. ft. of built-to-suit space in Oragadam, Greenbase has catered to a diverse clientele, including sectors like e-commerce, electronics, renewable energy, automotive, and manufacturing. This development highlights the expertise of Hiranandani Communities in creating world-class industrial ecosystems.

Boosting Chennai’s Industrial Landscape

Chennai accounts for 40% of Greenbase’s growth portfolio, thanks to its skilled workforce, business-friendly environment, and favorable industrial policies. The planned expansion is expected to create around 1,000 new jobs, spanning both direct and indirect opportunities, further boosting the local economy.

Hiranandani Parks, a flagship project by the Hiranandani Communities in Oragadam, has also played a pivotal role in positioning the area as a key destination for residential, commercial, and industrial growth. Oragadam’s strategic location, robust infrastructure, and proximity to ports and airports make it an ideal hub for businesses across diverse sectors.

Supporting India’s Logistics Revolution

Greenbase’s expansion is fueled by rising demand for Grade A industrial assets, driven by initiatives like the Make in India programme, the production-linked incentive (PLI) scheme, and the China-plus-one strategy. The company is optimistic about India’s logistics sector, with Chennai playing a central role in this growth story.

This expansion reflects Hiranandani Chennai’s rising prominence in India’s industrial and logistics landscape, aligning with the Hiranandani Communities’s vision of sustainable and inclusive growth.

8 notes

·

View notes

Text

CNC Press Brake Machine in India: Shaping the Future of Metal Bending

In the dynamic world of metal fabrication, CNC Press Brake Machines have become indispensable. These machines are critical in industries that demand precision bending and forming of sheet metal components. In India, the rising focus on infrastructure development, automotive manufacturing, and localized production has driven the adoption of CNC press brake technology across various sectors.

From small workshops to large-scale factories, CNC press brakes are revolutionizing how Indian manufacturers handle metal forming—efficiently, accurately, and consistently.

What is a CNC Press Brake Machine?

A CNC (Computer Numerical Control) Press Brake Machine is used to bend and shape metal sheets with precision. It uses a punch and die to perform various bends, guided by a CNC system that ensures exact specifications for angle, length, and repetition.

Modern CNC press brakes are far more advanced than traditional mechanical or hydraulic versions. They come with programmable controls, automated back gauges, and advanced sensors to deliver high-speed and high-precision bending.

Why CNC Press Brakes are Gaining Popularity in India

1. Precision and Consistency

In sectors like automotive, aerospace, and electronics, even minor deviations in part dimensions can lead to quality issues. CNC press brakes eliminate human error and ensure consistent output across batches.

2. Growing Industrialization

India’s expanding industrial base, especially in Tier 2 and Tier 3 cities, is fueling demand for reliable fabrication equipment. CNC press brakes allow businesses to scale up production without compromising on accuracy.

3. Labour Efficiency

With a skilled labor shortage and rising wages, automation is becoming more attractive. CNC press brakes require minimal human intervention, reducing labor costs and dependency on manual operators.

4. Government Incentives

Government initiatives like Make in India and Production Linked Incentive (PLI) Schemes are encouraging manufacturers to invest in advanced machinery, including CNC press brakes, for higher productivity.

Key Features of CNC Press Brake Machines in the Indian Market

High-Tonnage Capability: Machines ranging from 30 to 1000+ tons to suit various applications.

CNC Control Systems: Brands like Delem, ESA, and Cybelec offer intuitive interfaces for programming and automation.

Servo-Electric or Hydraulic Drive Systems: Depending on precision, energy efficiency, and speed requirements.

Multi-Axis Back Gauge: Enables complex bends and reduces setup time.

Automatic Tool Changers (ATC): For higher production environments.

Leading Indian and International Brands

India has a strong presence of both domestic and international CNC press brake manufacturers. Some notable names include:

Hindustan Hydraulics

Electropneumatics

Energy Mission

LVD India

Amada (Japan)

Durma (Turkey)

Yawei (China)

These companies offer machines tailored to the needs and budget of Indian manufacturers.

Applications in India

Automobile Body & Chassis Manufacturing

Kitchen Equipment Fabrication

Electrical Enclosures & Cabinets

Elevator and Escalator Components

Construction and Infrastructure Products

Railways and Defence Equipment

Challenges for Indian Buyers

High Initial Investment: CNC press brakes can be capital intensive, though the ROI is excellent over time.

Skill Development: Operators need training to use CNC systems effectively.

After-Sales Service: Choosing a vendor with reliable local support is crucial for maintenance and uptime.

The Road Ahead: Smart Factories & Industry 4.0

India is steadily moving towards smart manufacturing. CNC press brakes are now integrating with IoT, ERP systems, and robotic automation, enabling real-time monitoring, predictive maintenance, and remote troubleshooting. This evolution is making Indian factories more agile and globally competitive.

Conclusion

The CNC Press Brake Machine is no longer a luxury—it's a necessity in modern Indian manufacturing. With its unmatched accuracy, efficiency, and automation capabilities, it empowers businesses to meet rising customer expectations while optimizing operational costs.

As India continues to climb the global manufacturing ladder, CNC press brake machines will play a pivotal role in shaping the future—quite literally.

2 notes

·

View notes

Text

Union Budget 2025: Rajasthan Minister Col Rajyavardhan Rathore Highlights Boost for MSMEs & Startups

The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has placed a strong emphasis on fostering entrepreneurship, innovation, and economic self-reliance. Rajasthan’s Minister Rajyavardhan Singh Rathore has lauded the budget’s focus on Micro, Small & Medium Enterprises (MSMEs) and Startups, calling it a game-changer for India’s business ecosystem.

This budget introduces bold incentives, funding support, and digital transformation initiatives to empower small businesses and young entrepreneurs, ensuring that they remain the backbone of India’s growing economy.

Key Announcements for MSMEs & Startups

1. Enhanced Credit Support for MSMEs

✅ ₹50,000 Crore Expansion in Credit Guarantee Scheme — Making loans easily accessible for small businesses. ✅ Interest Subvention for MSMEs — Lower borrowing costs to promote business expansion. ✅ Tax Relief for MSMEs — Increased turnover threshold for tax exemptions.

2. Startup India 3.0 — A New Era of Entrepreneurship

✅ ₹25,000 Crore Startup Growth Fund — Supporting early-stage and high-impact startups. ✅ Easier Compliance & Single Window Clearance for business registrations. ✅ Tax Holiday Extension for eligible startups, reducing financial stress.

3. Technology & Digital Transformation

✅ AI, Blockchain & Cloud Support for MSMEs — Helping businesses adopt advanced technology. ✅ Digital Payment Incentives — Encouraging a cashless economy and financial inclusion. ✅ Boost for FinTech & E-commerce Startups — Simplified regulations and incentives.

4. Skill Development & Job Creation

✅ New Entrepreneurship Hubs in Tier-2 & Tier-3 Cities to nurture local talent. ✅ ₹10,000 Crore Allocation for Digital Skilling & AI Training — Preparing the youth for high-growth industries. ✅ Expansion of Production-Linked Incentive (PLI) Scheme to generate employment in key sectors.

Rajasthan’s Gains: A Thriving Hub for MSMEs & Startups

Minister Rajyavardhan Singh Rathore highlighted how Rajasthan stands to benefit immensely from these policies, stating:

“This budget reflects the Modi government’s unwavering commitment to empowering MSMEs and startups. Rajasthan, with its strong entrepreneurial spirit, will see a surge in new businesses, innovation hubs, and employment opportunities.”

He emphasized three major gains for Rajasthan’s business ecosystem:

Tourism & Handicrafts MSMEs will receive enhanced support for global market expansion.

Renewable Energy Startups in Rajasthan will gain access to Green Funds.

Agritech & Rural Startups will benefit from new funding and digital infrastructure.

A Vision for Aatmanirbhar Bharat

The Union Budget 2025 ensures that India’s MSMEs and startups thrive in a competitive global economy. With tax incentives, credit support, and technology integration, this budget paves the way for a self-reliant and prosperous India.

Col. Rajyavardhan Rathore’s message to entrepreneurs:

“This is the best time to be an entrepreneur in India. With government support and strong policies, MSMEs and startups are set to become the driving force behind ‘Viksit Bharat’.”

🚀 A New Era of Business Begins! Jai Hind! Jai Rajasthan! 🇮🇳

4 notes

·

View notes

Text

The Surge of Mobile Exports from India in 2024

In recent years, India has emerged as a formidable player in the global electronics landscape, particularly in the realm of mobile exports. As of 2024, the Indian mobile export industry is witnessing significant growth, driven by favorable government policies, foreign direct investment, and a burgeoning domestic market. This article explores the current state of mobile export from India, the key players involved, and the implications for the global smartphone market.

Overview of Mobile Exports from India

The mobile export from India has seen a meteoric rise, with projections indicating that exports could exceed $12 billion in value by the end of 2024. This impressive growth can be attributed to several factors, including the government’s "Make in India" initiative and the Production Linked Incentive (PLI) scheme, both designed to bolster domestic manufacturing and attract international investments.

Growth Drivers

Several factors are propelling the growth of mobile exports in India:

1. Government Initiatives

The Indian government has introduced various programs to promote local manufacturing, such as tax breaks, subsidies, and the establishment of electronics manufacturing clusters. These initiatives aim to attract both domestic and foreign manufacturers to set up production facilities in India, which has proven effective in enhancing the mobile export sector.

2. Investment in Infrastructure

Investment in infrastructure has also played a critical role in boosting mobile exports. Improved logistics, reliable power supply, and streamlined regulatory processes make India an attractive destination for mobile manufacturers. This investment is crucial for facilitating large-scale production and ensuring timely exports.

3. Technological Advancements

The rapid advancement of technology has enabled Indian manufacturers to produce high-quality smartphones that meet global standards. Companies are increasingly investing in research and development to innovate and improve their product offerings, further enhancing their competitiveness in the international market.

4. Skilled Workforce

India’s vast pool of skilled labor is another significant factor driving mobile exports. The country boasts a workforce proficient in electronics manufacturing and engineering, enabling companies to maintain high production standards and innovate effectively. This skilled labor force is essential for both domestic and foreign companies seeking to enhance their manufacturing capabilities in India.

Key Mobile Exporters in India

Several major players dominate the mobile export landscape in India, Leading mobile exporter in India are:

1. Apple Inc.

Apple has been a trailblazer in the Indian mobile export sector, establishing manufacturing facilities through its contract manufacturers like Foxconn and Wistron. The production of iPhones in India has not only bolstered local employment but has also significantly contributed to India’s mobile export data.

2. Samsung Electronics

Samsung operates one of the largest smartphone manufacturing plants in Noida, where it produces a wide range of devices, from budget models to flagship smartphones. The company has ramped up its export operations, making it a critical player in the Indian mobile export market.

3. Xiaomi

Xiaomi has rapidly gained a significant market share in India, thanks to its affordable smartphones. The company has invested heavily in local manufacturing, exporting a considerable volume of devices to countries across Southeast Asia and Africa.

4. Vivo and Oppo

Both Vivo and Oppo, Chinese smartphone manufacturers, have established substantial production facilities in India. They focus on catering to the growing demand for mid-range smartphones, further enhancing India’s export capabilities.

5. Lava International

As a homegrown brand, Lava International has also made strides in mobile exports. The company primarily targets budget-conscious markets, exporting feature phones and affordable smartphones to various countries.

Analyzing Mobile Export Data

The mobile export data for 2024 indicates robust growth, with significant exports to key markets including:

1. North America

India has become an essential supplier of smartphones to North America, with Apple’s production in India catering to a large portion of the U.S. market. This trend is expected to continue as more brands establish manufacturing operations in India.

2. European Union

Countries in the EU, particularly Germany and the UK, have seen increased imports of Indian-manufactured smartphones. Samsung and Xiaomi lead this charge, exporting a diverse range of devices to meet consumer demand.

3. Southeast Asia

Indian smartphone manufacturers are tapping into the growing demand in Southeast Asian countries like Indonesia, Vietnam, and Thailand. Competitive pricing and quality have made Indian smartphones increasingly popular in these regions.

4. Middle East and Africa

The demand for affordable smartphones in the Middle East and Africa has surged, making these regions vital markets for Indian manufacturers. Brands like Lava and Xiaomi are successfully exporting budget-friendly smartphones, addressing the needs of price-sensitive consumers.

Understanding Mobile Phone HS Code

The Harmonized System (HS) code plays a crucial role in facilitating international trade. The mobile phone hs code is 8517.12, which covers smartphones capable of connecting to cellular networks. Accurate classification using the HS code is essential for mobile exporters in India to ensure compliance with customs regulations and to expedite the export process.

Conclusion

The mobile export landscape in India is poised for significant growth in 2024, with the country solidifying its position as a key player in the global smartphone market. Supported by government initiatives, foreign investments, and a skilled workforce, India is well-equipped to meet the growing demand for mobile devices worldwide.

As Indian manufacturers continue to innovate and expand their production capabilities, the outlook for mobile exports remains positive. By leveraging its strengths and addressing challenges, India can capitalize on its position in the global supply chain, ensuring sustainable growth and economic benefits for years to come. The future of mobile exports from India is bright, and the country is set to make its mark on the international stage. However if you need the list of smartphone exports by country, mobile phone HS code or global trade data connect with import and export data provider platforms like Seair Exim solutions.

Post By:

Seair Exim Solutions

Phone No.: 099900 20716

Address: B1/E3 Mohan Cooperative Industrial Estate Near Mohan Estate Metro Station Opposite Metro Pillar No:-336, NH-19, New Delhi, Delhi 110044

Also Read : A Comprehensive Guide to Garment Exports from India in 2024

#global trade data#international trade#export#trade data#trade market#global market#import export data#mobile#mobile export data#mobile hs code#mobile export#mobile exporter#mobile market#mobile industry#mobile trade

2 notes

·

View notes

Text

FDI in India: Unleashing Growth Potential in 2024

Introduction

Foreign Direct Investment (FDI) has been a cornerstone of India's economic growth, driving industrial development, technological advancement, and job creation. As we move into 2024, the FDI landscape in India is poised for substantial growth, bolstered by a favorable policy environment, a burgeoning consumer market, and strategic government initiatives. This blog delves into the potential of FDI in India for 2024, examining the key sectors attracting investment, the regulatory framework, and the strategies investors can employ to navigate this dynamic market.

The Significance of FDI in India

FDI is crucial for India’s economic progress, providing the capital, technology, and expertise needed to enhance productivity and competitiveness. It facilitates the integration of India into the global economy, stimulates innovation, and creates employment opportunities. Over the past decade, India has emerged as one of the top destinations for FDI, reflecting its economic resilience and strategic importance.

Historical Context and Recent Trends

India's FDI inflows have shown a consistent upward trend, reaching record levels in recent years. According to the Department for Promotion of Industry and Internal Trade (DPIIT), India attracted FDI inflows worth $81.72 billion in 2021-22, highlighting its strong appeal among global investors. The sectors that have traditionally attracted significant FDI include services, telecommunications, computer software and hardware, trading, construction, and automobiles.

Key Factors Driving FDI in India

1. Economic Growth and Market Size

India's economy is one of the fastest-growing in the world, with a projected GDP growth rate of around 6-7% in 2024. The country’s large and youthful population offers a vast consumer base, making it an attractive market for foreign investors. The rising middle class and increasing disposable incomes further fuel demand across various sectors.

2. Strategic Government Initiatives

The Indian government has implemented several initiatives to make the country more investor-friendly. Programs like 'Make in India,' 'Digital India,' and 'Startup India' are designed to boost manufacturing, digital infrastructure, and entrepreneurial ventures. These initiatives, coupled with reforms in labor laws and ease of doing business, create a conducive environment for FDI.

3. Infrastructure Development

Significant investments in infrastructure development, including roads, railways, ports, and urban infrastructure, enhance connectivity and logistics efficiency. The development of industrial corridors and smart cities further improves the attractiveness of India as an investment destination.

4. Favorable Regulatory Environment

India has progressively liberalized its FDI policy, allowing 100% FDI in most sectors under the automatic route. This means that foreign investors do not require prior government approval, simplifying the investment process. The government has also streamlined regulatory procedures and improved transparency to facilitate ease of doing business.

Key Sectors Attracting FDI in 2024

1. Technology and Digital Economy

The technology sector continues to be a magnet for FDI, driven by India’s growing digital ecosystem, skilled workforce, and innovation capabilities. Investments in software development, IT services, and emerging technologies like artificial intelligence, blockchain, and cybersecurity are expected to surge.

2. Manufacturing and Industrial Production

The 'Make in India' initiative aims to transform India into a global manufacturing hub. Key sectors attracting FDI include electronics, automobiles, pharmaceuticals, and renewable energy. The Production-Linked Incentive (PLI) schemes introduced by the government provide financial incentives to boost manufacturing and attract foreign investment.

3. Healthcare and Biotechnology

The COVID-19 pandemic has underscored the importance of healthcare infrastructure and innovation. India’s pharmaceutical industry, known for its generic drug production, continues to attract substantial FDI. Additionally, biotechnology and medical devices are emerging as significant sectors for investment.

4. Infrastructure and Real Estate

Infrastructure development is critical for sustaining economic growth. Sectors like transportation, logistics, urban development, and real estate offer significant investment opportunities. The government's focus on developing smart cities and industrial corridors presents lucrative prospects for foreign investors.

5. Renewable Energy

With a commitment to achieving net-zero emissions by 2070, India is focusing on renewable energy sources. The solar, wind, and hydroelectric power sectors are witnessing substantial investments. The government's policies and incentives for green energy projects make this a promising area for FDI.

Regulatory Framework for FDI in India

Understanding the regulatory framework is essential for investors looking to enter the Indian market. The key aspects of India's FDI policy include:

1. FDI Policy and Routes

FDI in India can be routed through the automatic route or the government route. Under the automatic route, no prior approval is required, and investments can be made directly. Under the government route, prior approval from the concerned ministries or departments is necessary. The sectors open to 100% FDI under the automatic route include:

- Infrastructure

- E-commerce

- IT and BPM (Business Process Management)

- Renewable Energy

2. Sectoral Caps and Conditions

While many sectors allow 100% FDI, some have sectoral caps and conditions. For example:

- Defense: Up to 74% FDI under the automatic route, and beyond 74% under the government route in certain cases.

- Telecommunications: Up to 100% FDI allowed, with up to 49% under the automatic route and beyond that through the government route.

- Insurance: Up to 74% FDI under the automatic route.

3. Regulatory Authorities

Several regulatory authorities oversee FDI in India, ensuring compliance with laws and policies. These include:

- Reserve Bank of India (RBI): Oversees foreign exchange regulations.

- Securities and Exchange Board of India (SEBI): Regulates investments in capital markets.

- Department for Promotion of Industry and Internal Trade (DPIIT): Formulates and monitors FDI policies.

4. Compliance and Reporting Requirements

Investors must comply with various reporting requirements, including:

- Filing of FDI-related returns: Periodic filings to RBI and other regulatory bodies.

- Adherence to sector-specific regulations: Compliance with industry-specific norms and guidelines.

- Corporate Governance Standards: Ensuring adherence to governance standards as per the Companies Act, 2013.

Strategies for Navigating the FDI Landscape

1. Thorough Market Research

Conducting comprehensive market research is crucial for understanding the competitive landscape, consumer behavior, and regulatory environment. Investors should analyze market trends, identify potential risks, and evaluate the long-term viability of their investment.

2. Partnering with Local Entities

Collaborating with local businesses can provide valuable insights into the market and help navigate regulatory complexities. Joint ventures and strategic alliances with Indian companies can facilitate market entry and expansion.

3. Leveraging Government Initiatives

Tapping into government initiatives like 'Make in India' and PLI schemes can provide financial incentives and support for setting up manufacturing units and other projects. Staying updated on policy changes and leveraging these initiatives can enhance investment returns.

4. Ensuring Legal and Regulatory Compliance

Compliance with local laws and regulations is paramount. Engaging legal and financial advisors with expertise in Indian regulations can ensure that all legal requirements are met. This includes obtaining necessary approvals, adhering to reporting norms, and maintaining corporate governance standards.

5. Focusing on Sustainable Investments

Given the global emphasis on sustainability, investments in green technologies and sustainable practices can offer long-term benefits. The Indian government’s focus on renewable energy and sustainable development provides ample opportunities for environmentally conscious investments.

Conclusion

India's FDI landscape in 2024 is ripe with opportunities across various sectors, driven by robust economic growth, strategic government initiatives, and a favorable regulatory environment. However, navigating this dynamic market requires a deep understanding of the legal and regulatory framework, thorough market research, and strategic partnerships.

For investors looking to unleash the growth potential of their investments in India, staying informed about policy changes, leveraging government incentives, and ensuring compliance with local laws are critical. By adopting a strategic approach and focusing on sustainable investments, foreign investors can tap into the immense opportunities offered by the Indian market and contribute to its economic transformation.

In conclusion, FDI in India in 2024 presents a compelling opportunity for global investors. With the right strategies and guidance, investors can navigate the complexities of the Indian market and achieve significant growth and success.

This post was originally published on: Foxnangel

#fdi in india#fdi investment in india#foreign direct investment in india#economic growth#foreign investors#startup india#pli schemes#renewable energy#indian market#foxnangel

2 notes

·

View notes

Text

How Government Reforms Are Reshaping FDI in India

Introduction

The history of Indian economic growth has strongly been associated with the inflow of Foreign Direct Investment (FDI). The Indian government has been making efforts to liberalize the FDI regime in the last decade, and this has made the country an international investing paradise. In a bid to enter India as a business, one must appreciate the effects of government reforms.

These policy changes are not only attracting foreign investment but have also led to easing of processes, as well as the opening of business ventures to other sectors. They are redefining the entry of international businesses into India. How strategic government plans are transforming FDI in India The efficacy of FDI and global investors in India are opening new avenues with the help of serious strategic government plans.

1. Liberalization of Sectoral Caps

Liberalization of the FDI restrictions has also occurred in many critical sectors, which has been one of the most significant reforms. Even industries that were once highly controlled, like the defense, insurance, telecom, and retail industries, have experienced their FDI limits being hugely reduced. For example:

Defense: 74 percent FDI to be permitted via automatic route

Insurance: the FDI ceiling was raised to 74 percent (as against 49 percent)

Single-brand retailing: 100 percent under automatic route.

Such shifts make a very strong statement to international investors. India is business-friendly and in the process of minimizing its bureaucracy in some of the key sectors.

2. Ease of Doing Business and Digitization

The increased attention by the government to the ease of doing business has had a direct effect on the FDI inflow. India has moved far up in the ease of doing business index with the World Bank, and this is owing to a number of important reform measures:

The introduction of the Goods and Services Tax (GST) that led to a unified market across the country

Digital India, in which the regulatory and compliance processes became easier

Introduction of web-based portals such as the Foreign Investment Facilitation Portal (FIFP) in order to speed up the approval of FDIs

Such reforms have simplified industries, minimized red tape, and increased the faith of investors. Entering the Indian market has now become transparent, quick, and less complicated than it used to be in the earlier days in the minds of companies that intend to venture into it.

3. Incentive Schemes to Attract Investment

The government has also launched a number of incentive schemes in order to enhance FDI in India further:

Production Linked Incentive (PLI) Schemes in different sectors, which motivate foreign businesses to establish a manufacturing unit in India

Startup India and Make in India initiatives, which were designed to promote innovation and local entrepreneurship

Specific industry packages in the areas of electronics, pharmaceuticals, automotive, and textiles in order to bring in strategic global investments

Such programs are not merely attracting foreign investment but are motivating businesses to come up with enduring relations together with exchanges of technology and employment. India is perceived by the international businesses to be a promising destination both as a place of consumption and production.

4. Streamlined Approvals and Policy Clarity

The foreign investment has been dampened by uncertainty in policy. To curb this, the Indian government has undertaken steps in order to provide more clarity and consistency on their FDI policies:

Clearly spelled out rules and eligibility criteria within the FDI framework

The timely revision of the policy by issuance of the Consolidated FDI Policy, restaurant regulations are easily accessible and comprehensible.

Formation of facilitation centers such as Invest in India that provides one-window services to foreign investors

This strategy has not only aided in lowering the risk but also in better planning of strategic operations of international-based firms seeking to invest in India.

Conclusion

The FDI market in India is changing shape due to the reforms by the government, which is creating a better environment conducive to business. Relaxed FDI restrictions, simplification of the process, digital initiatives, and incentive programs are some of the changes that are making India a popular destination of international investors.

It is the best time for businesses willing to invest in India. The environment in itself is very helpful, the policies are conducive, and the potential for growth is just astronomical.

At Fox&Angel we also take our clients through the vibrant Indian market, helping them with the business strategy of how to enter India.

Contact us today to see how we can assist you in the process of becoming well planted in India.

#FDI in India#Invest in India#Government Reforms#Business Expansion India#Fox&Angel#Foreign Investment#Ease of Doing Business#Make in India#Startup India#PLI India

0 notes

Text

India's Textile Industry: A Global Leader Powering Growth

The Indian textile industry is one of the oldest and most important industries in the country. It plays a major role in India’s economy, jobs, and exports. Today, India is the second-largest producer of textiles and garments in the world, and the industry continues to grow rapidly.

If you want to explore more, visit the official Indian textile industry page on IBEF.

Key Facts at a Glance

Market Size: Over US$ 150 billion

Target by 2025: US$ 250 billion

Exports: Around US$ 44 billion (2023)

Jobs: Over 45 million people directly employed

GDP Contribution: About 2.3%

Main Segments of the Industry

Cotton India is the largest producer of cotton in the world. Cotton is grown in many Indian states and is a key raw material for fabrics and clothing.

Man-Made Fibres (MMF) and Technical Textiles These are used for sportswear, medical products, and industrial fabrics. This segment is growing quickly due to new demand and strong government support.

Readymade Garments India exports a wide range of clothes to many countries, including the United States and Europe. Indian garments are known for their good quality and competitive prices.

Handlooms and Crafts This sector is rooted in Indian tradition and helps support rural communities. Handmade fabrics and products are in demand both in India and abroad.

Why the Industry is Growing

Increased online shopping and fashion awareness

Strong government incentives and investment policies

Growing foreign direct investment (FDI)

Trade agreements helping with easier exports

Rising global demand for eco-friendly and sustainable fashion

Government Support

PLI Scheme The Production Linked Incentive scheme supports manufacturers with financial incentives for producing high-value textiles.

PM MITRA Parks Seven mega textile parks are being built with modern infrastructure to help reduce costs and improve efficiency.

ATUFS This scheme encourages textile factories to modernize their machinery and improve productivity.

SAMARTH A skill development program to train over a million people in textile-related jobs.

Top Export Markets

India exports textiles to more than 100 countries. Major export destinations include:

United States

European Union

United Arab Emirates

Bangladesh

Vietnam

Common export products:

Cotton and polyester garments

Home textiles like bedsheets and towels

Technical and industrial fabrics

Major Textile Production Areas in India

Some of the top textile hubs in India include:

Tiruppur – Known for knitwear and T-shirts

Surat – Famous for synthetic fabrics

Ludhiana – Leading in woolen and winter garments

Ahmedabad – Known for cotton and denim

Panipat – Specializes in home furnishings like rugs and mats

Sustainability Efforts

India is focusing on making its textile industry environmentally friendly through:

Use of recycled materials

Water-saving technologies

Waste reduction in production

Growth of organic cotton farming

Future Goals by 2030

Reach a market size of US$ 350 billion

Achieve US$ 100 billion in textile exports

Provide employment to over 55 million people

Become a global leader in sustainable and smart textiles

Conclusion

India’s textile industry is on a strong growth path. With the help of government support, skilled workers, and increasing global demand, the country is on track to become one of the world’s top textile exporters. From cotton shirts to technical fabrics to handmade scarves, India is preparing to lead the global textile market.

0 notes

Text

Mobile Phone Exports Jump To Rs 2 Lakh Cr In 2024–25: Jitin Prasada

New Delhi, July 24 (KNN) Mobile phone exports from India have surged 127-fold, reaching Rs 2 lakh crore in 2024–25, up from just Rs 1,500 crore in 2014–15, Minister of State for Electronics and IT Jitin Prasada informed the Lok Sabha on Wednesday. In a written reply to Parliament, Prasada attributed the growth largely to the Production Linked Incentive (PLI) Scheme for Large Scale Electronics…

0 notes

Text

India’s Role in Global Healthcare: Growth of Pharmaceutical Exports

India has emerged as a leading player in the global pharmaceutical industry, consistently ranking among the top exporters of medicines and healthcare products. With a strong manufacturing base, skilled workforce, and affordable pricing, Indian pharmaceutical companies have successfully penetrated international markets across Asia, Africa, Europe, and the Americas. The demand for Indian drugs continues to grow due to their compliance with global quality standards and cost-effectiveness.

One of the major driving forces behind pharmaceutical exports from India is its dominance in the production of generic medicines. Indian companies have mastered the art of producing high-quality generics at affordable prices, making healthcare more accessible in developing and underdeveloped nations. With WHO-GMP and USFDA certifications, these drugs meet stringent global norms, earning trust from healthcare providers and patients worldwide.

In addition to affordability and quality, government support through export incentives, simplified regulations, and promotional bodies like Pharmexcil (Pharmaceuticals Export Promotion Council of India) plays a vital role in sustaining export momentum. The implementation of policies such as the Production Linked Incentive (PLI) scheme further encourages growth by enhancing competitiveness.

India is not only exporting formulations but also raw materials like Active Pharmaceutical Ingredients (APIs), boosting its credibility as a complete pharma hub. Countries like the USA, UK, Russia, South Africa, and Brazil are major importers, contributing to India’s rising global pharma reputation.

Furthermore, Generic Medicine Export from India has significantly contributed to global health programs, including vaccine distribution and treatments for chronic diseases such as diabetes, cancer, and cardiovascular conditions.

As the global need for affordable healthcare continues to rise, India is well-positioned to expand its pharmaceutical footprint. With innovation, scalability, and compliance at its core, the country is set to remain a key supplier in the international pharmaceutical supply chain.

#PharmaExport#IndianPharma#PharmaceuticalIndustry#ExportFromIndia#MedicineExport#PharmaBusiness#PharmaManufacturing#GenericMedicine#PharmaOpportunities#MadeInIndia#ExportBusinessIndia#IndianManufacturers#PharmaTrade#HealthcareExports#PharmaGrowth#ayurvedicproductsexportfromindia

0 notes

Photo

Some of the actual success tales of the PLI schemes in enhancing exports are in textile sector, an official launch mentioned. Representational file picture. | Photo Credit: EMMANUAL YOGINI The authorities’s Production-Linked Incentive scheme has seen the federal government present ₹21,534 crore price of incentives in numerous sectors, thereby attracting investments price ₹1.76 lakh crore, based on an official launch. The scheme has generated manufacturing or gross sales price ₹16.5 lakh crore as of March 2025. The launch was issued following a assessment assembly held by Commerce Minister Piyush Goyal of the PLI schemes. During the assessment, the Minister mentioned that India should prioritise the sectors by which it has a aggressive edge over different nations. “Cumulative incentive quantity of Rs. 21,534 crore has been disbursed underneath PLI Schemes for 12 sectors viz. large-scale electronics manufacturing (LSEM), IT {hardware}, bulk medication, medical gadgets, prescription drugs, telecom & networking merchandise, meals processing, white items, cars & auto parts, specialty metal, textiles, and drones & drone parts,” the discharge mentioned. Some of the actual success tales of the PLI schemes in enhancing exports are within the pharmaceutical, bulk medication, meals processing, and textile sectors, it added. The pharmaceutical sector noticed cumulative gross sales of ₹2.66 lakh crore, together with exports of ₹1.70 lakh crore within the first three years of the scheme. The pharma export gross sales underneath the scheme in 2024-25, at ₹0.67 lakh crore, was round 27% of the entire pharma exports of the nation that yr. In addition, 40% of the entire funding of ₹37,306 crore within the sector has been undertaken for analysis and improvement (R&D) functions. The general Domestic Value Addition within the Sector has been 83.70% as of March 2025. “The PLI scheme has contributed to India turning into a web exporter of bulk medication (Rs 2,280 crore) from web importer (Rs -1,930 crore) as was the case in FY 2021-22,” the discharge mentioned. “It has additionally resulted in vital discount within the hole between the home manufacturing capability and demand for crucial medication.” According to the federal government, the PLI scheme for meals merchandise has attracted investments price ₹9,032 crore, which has resulted in manufacturing of ₹3.8 lakh crore and direct and oblique employment of three.4 lakh individuals. Published - June 25, 2025 06:07 pm IST Read More: https://news.unicaus.in/economy/govt-has-offered-21535-crore-of-incentives-underneath-pli-schemes/

0 notes

Text

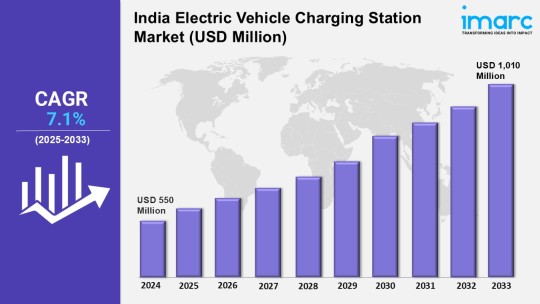

India Electric Vehicle Charging Station Market Trends 2025, Size, Share, Industry Report by 2033

Electric Vehicle Charging Station Market in India 2025:

How Big is the India Electric Vehicle Charging Station Market?

The India electric vehicle charging station market size was valued at USD 550 Million in 2024. Looking forward, IMARC Group estimates the market to reach USD 1,010 Million by 2033, exhibiting a CAGR of 7.1% during 2025-2033.

Base Year: 2024

Historical Years: 2019-2024

Forecast Years: 2025-2033

Market Size in 2024: USD 550 Million

Market Size in 2033: USD 1,010 Million

Market Growth Rate (CAGR) 2025-2033: 7.1%

India Electric Vehicle Charging Station Market Trends and Drivers:

The India electric vehicle charging station market is experiencing a strong makeover driven by increasing environmental awareness and supportive government initiatives toward eco-friendly mobility. Urbanization coupled with increasing fuel prices is compelling consumers to embrace EVs, hence driving demand for effective and affordable charging infrastructure. Additionally, government schemes such as the FAME (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) scheme and production-linked incentives (PLI) are strongly supporting public and private investments in charging points. Besides, state governments are also establishing EV-friendly policies, such as subsidies, tax rebates, and infrastructure incentives, which are further consolidating the market scenario. The use of renewable energy sources like solar-charging points is picking up, consistent with India's overall ambitions for clean energy transition.

Generally, technology developments, including ultra-fast charging and smart charging, are transforming the customer experience and enhancing the operational efficiency of charging networks. The increasing popularity of electric two-wheelers and three-wheelers is also contributing to growing the market, primarily in urban and semi-urban markets. Further, joint ventures among automotive OEMs, utility companies, and technology firms are promoting innovation and scalability for the EV charging ecosystem. Additionally, the increase in the number of fleet operators and last-mile delivery services using electric mobility is fuelling steady demand for dependable charging solutions. Smart city projects and highway infrastructure development are also encouraging strategic location of fast-charging corridors. With growing awareness and a change in consumer behavior toward clean mobility, the India electric vehicle charging station market has great long-term potential with policy support, technological advancements, and private sector involvement.

Request for a sample copy of this report: https://www.imarcgroup.com/india-electric-vehicle-charging-station-market/requestsample

India Electric Vehicle Charging Station Market Report and Segmentation:

The report has segmented the market into the following categories:

Analysis by Charging Station Type:

AC Charging

DC Charging

Inductive Charging

Analysis by Vehicle Type:

Battery Electric Vehicle (BEV)

Plug-in Hybrid Electric Vehicle (PHEV)

Hybrid Electric Vehicle (HEV)

Analysis by Installation Type:

Portable Charger

Fixed Charger

Analysis by Charging Level:

Level 1

Level 2

Level 3

Analysis by Connector Type:

Combines Charging Station (CCS)

CHAdeMO

Normal Charging

Tesla Supercharger

Type-2 (IEC 621196)

Others

Analysis by Application:

Residential

Commercial

Regional Analysis:

North India

West and Central India

South India

East India

Ask Analyst for Customization: https://www.imarcgroup.com/request?type=report&id=6272&flag=C

Competitive Landscape:

The report offers an in-depth examination of the competitive landscape. It includes a thorough competitive analysis encompassing market structure, key player positioning, leading strategies for success, a competitive dashboard, and a company evaluation quadrant.

Key highlights of the Report:

Market Performance (2019-2024)

Market Outlook (2025-2033)

COVID-19 Impact on the Market

Porter’s Five Forces Analysis

Strategic Recommendations

Historical, Current and Future Market Trends

Market Drivers and Success Factors

SWOT Analysis

Structure of the Market

Value Chain Analysis

Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

About Us:

IMARC Group is a global management consulting firm that helps the world’s most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: [email protected]

Tel No:(D) +91 120 433 0800

United States: +1-631-791-1145

#India electric vehicle charging station market 2025#India electric vehicle charging station market size#India electric vehicle charging station mark et share#India electric vehicle charging station market growth#India electric vehicle charging station market report

0 notes

Text

PLI Schemes See Actual Investment Of Rs 1.76 Lakh Crore, Create Over 12 Lakhs Jobs: Minister | Economy News

New Delhi: The production-linked incentive (PLI) schemes have realised actual investment of Rs. 1.76 lakh crore till March 2025 across 14 sectors, which has resulted in incremental production/sales of over Rs. 16.5 lakh crore and employment generation of over 12 lakhs (direct and indirect), the Parliament was informed on Tuesday. To date, 806 applications have been approved under PLI schemes…

0 notes

Text

India Poised to Become the Next Global Manufacturing Hub: Opportunities, Challenges, and the Critical Role of Supply Chain Solutions

In today’s dynamic global economy, the manufacturing sector is undergoing a massive transformation. As companies seek to diversify and build resilient supply chains post-pandemic and amid geopolitical shifts, India is emerging as a prime candidate to become the next global manufacturing powerhouse. Its strategic location, evolving policy landscape, expanding infrastructure, and cost advantages are making it increasingly attractive for investors and manufacturers worldwide.

This blog explores why India is well-positioned to lead the next manufacturing wave, what this means for supply chains, and how logistics and warehousing players like MRS Supply Chain are pivotal in supporting this growth.

The Manufacturing Shift: Why India Is on the Rise

For decades, China has been the epicentre of global manufacturing, driven by vast scale, efficient infrastructure, and export-focused policies. However, rising labour costs, geopolitical tensions, and supply chain disruptions have pushed many global players to explore alternatives. The emerging China+1 strategy, where companies diversify manufacturing beyond China, has turned attention toward India.

Key Advantages India Offers

Large Workforce & Competitive Labor Costs : India’s young, trainable population offers a labour cost advantage over China and Southeast Asia (World Bank report on labour costs).

Favorable Policy Environment : Initiatives like Make in India, Atmanirbhar Bharat, and Production Linked Incentives (PLI) encourage domestic manufacturing growth.

Expanding Infrastructure : Major investments in ports, freight corridors, and logistics hubs improve connectivity.

Geopolitical Stability :India offers a stable environment to build long-term manufacturing facilities (UNCTAD Investment Trends Monitor) .

According to industry reports, India’s manufacturing Purchasing Managers’ Index (PMI) and export orders are growing steadily, signaling robust industrial activity and global demand for Indian-made products (Source: IHS Markit, 2024).

India’s Policy Push: Make in India & Production Linked Incentives (PLI)

The Government of India has introduced landmark policies to catalyse manufacturing:

Make in India (2014) : This flagship program aims to increase the manufacturing sector’s contribution to GDP from 16% to 25%, generating millions of jobs and promoting foreign direct investment (FDI).

Production Linked Incentive (PLI) Schemes : Spanning over 14 sectors such as electronics, automotive, pharmaceuticals, textiles, and defense, the PLI programs offer financial incentives to firms for scaling manufacturing. With an outlay of approximately ₹2 trillion (US$23 billion), PLI is expected to significantly boost domestic production and exports.

For example, the electronics sector alone is targeted with a ₹22,919 crore (approx. US$2.8 billion) scheme to move India from being an assembler to a more innovation-focused manufacturer. This is a crucial move as electronics and smartphone manufacturing become key growth drivers.

Learn more about government initiatives to boost manufacturing here.

Infrastructure Investments: Building the Backbone for Manufacturing

Strong infrastructure is essential to translate policy into action. India’s government has launched several mega-projects to improve connectivity:

Dedicated Freight Corridors (DFC) : The Eastern and Western DFCs provide high-speed rail connectivity dedicated exclusively to freight, reducing transit times and costs.

East Coast Economic Corridor (ECEC) : Stretching from Kolkata to Chennai, the ECEC aims to develop industrial clusters focused on sectors like automotive, petrochemicals, textiles, and food processing.

PM Gati Shakti : This national master plan integrates multiple infrastructure projects — roads, railways, ports, and airports — for seamless multimodal transport.

The state of Tamil Nadu, often called the “Detroit of Asia,” is a hotspot for automotive manufacturing, supported by these transport corridors and infrastructure upgrades (Tamil Nadu Industrial Policy).

Manufacturing Growth Stories in India

Several sectors have already seen success:

Electronics and Smartphones : Companies like Dixon Technologies and Foxconn are ramping up production. Apple has ambitious plans to increase iPhone manufacturing in India to 35% of global output by 2027 (Reuters report on Apple’s plans).

Defense Manufacturing : The government is boosting domestic arms production with emergency procurements worth US$4.6 billion and promoting exports.

Fast Fashion and Apparel : With players like SHEIN and Reliance planning exports from India to global markets, the apparel sector is gearing up for growth.

Logistics and Warehousing: The Critical Link in India’s Manufacturing Ecosystem

Growth in manufacturing goes hand in hand with supply chain efficiency. Manufacturing hubs need reliable logistics, transport, and warehousing solutions to handle raw materials, in-process goods, and finished products.

This is where MRS Supply Chain plays a crucial role as a provider of top supply chain solutions in India- offering logistics, warehousing, and transport services designed to support manufacturing clusters.

Strategic Connectivity & Rail Freight Advantages

One key enabler is rail transport, especially for connecting industrial hubs and ports. Rail freight is cost-effective, energy-efficient, and capable of moving large volumes over long distances.

The rail corridor connecting Mundra Port to Delhi, for instance, exemplifies how rail logistics enhances freight movement by cutting transit time and reducing road congestion. This corridor supports the transport of bulk commodities and manufactured goods, contributing to smoother supply chains and lower costs. You can explore more about the benefits of this rail connection in this detailed blog on MRS Supply Chain.

Rail transport aligns well with sustainability goals, as it produces fewer carbon emissions per ton-kilometer compared to road transport (International Energy Agency report).

Warehousing: Beyond Storage to Value Addition

Warehousing in key industrial states like Gujarat is expanding rapidly, supporting manufacturing growth with:

Grade-A Warehousing Facilities : These modern warehouses offer advanced storage solutions with optimised space usage. Efficient warehouse space utilisation is vital to meet the storage demands of diverse industries. For insights, see this blog on space optimisation in warehouses.

Cold Chain Solutions : Temperature-controlled warehousing is critical for sectors like pharmaceuticals, perishables, and chemicals. The growing importance of cold chain logistics near ports is discussed in this post on the future of cold chain logistics.

Duty-Free Warehousing : Bonded warehouses facilitate duty deferment, enabling exporters and importers to manage cash flows better. MRS Supply Chain’s pioneering duty-free warehousing solutions support such specialised needs.

The combination of efficient warehousing and integrated transport solutions enables manufacturers to reduce lead times, control inventory costs, and improve responsiveness. For manufacturers looking to optimize storage near key industrial hubs, read more about warehousing in Gujarat and its importance as well as choosing reliable storage in Mundra.

The B2B Nature of Supply Chain Services for Manufacturing

The services offered by companies like MRS Supply Chain — logistics, warehousing, and transport — primarily serve other businesses. This business-to-business (B2B) model caters to manufacturers, retailers, distributors, and exporters, rather than individual consumers.

The specificity of these services means that manufacturers looking to establish or expand production in India must carefully evaluate logistics partners capable of providing tailored solutions that handle complex supply chain demands. MRS Supply Chain’s expertise across these core operational pillars makes it a strong contender to support India’s manufacturing ambitions.

If you want to learn how to avoid common import delays or smoothen your supply chain operations, consider reading this insightful blog on how to avoid import delays.

Challenges on the Road Ahead

While the outlook is promising, India faces challenges to becoming a global manufacturing hub:

Skill Gaps : Despite a large workforce, there is a need for skilled labor trained in modern manufacturing technologies.

Infrastructure Bottlenecks : Despite progress, certain regions lack robust last-mile connectivity.

Regulatory Complexity : India’s regulatory environment can be complicated, requiring smoother processes for ease of doing business .

Energy & Sustainability : Access to reliable power and green energy options must improve for sustainable industrial growth.

Addressing these challenges will require continued collaboration between government, industry players, and supply chain providers.

Challenges on the Road Ahead

India’s emergence as a global manufacturing hub is no longer just a vision — it is underway. With the right policies, infrastructure investments, and a growing industrial base, India is attracting global brands to set up or expand manufacturing operations.

However, these manufacturing ambitions can only be realised with robust logistics and warehousing networks that ensure timely, cost-effective movement and storage of goods. Supply chain solutions providers like MRS Supply Chain, with their focus on key manufacturing regions and comprehensive services in logistics, warehousing, and transport across India, play an indispensable role in this transformation.

For businesses ready to leverage India’s manufacturing potential, exploring expert supply chain services is critical. To learn more about MRS Supply Chain’s offerings, visit the home page, or connect directly via their contact page.

0 notes

Text

India’s Growing Edge in PCB Fabrication: A New Era for Electronics Manufacturing

Printed Circuit Board (PCB) fabrication is a critical process that forms the backbone of today’s electronic devices. Whether it's consumer electronics, automotive systems, industrial equipment, or telecommunication infrastructure—PCBs are essential. In recent years, India has positioned itself as a competitive hub for PCB fabrication, offering reliable, cost-effective, and scalable solutions to both domestic and global markets.

This article explores the rise of PCB fabrication companies in India, their capabilities, industry demand, and the future outlook for the sector.

What is PCB Fabrication?

PCB fabrication is the process of producing the physical board that connects and supports electronic components. It involves several complex steps including:

Design layout printing

Copper etching

Drilling of vias and holes

Application of solder mask

Surface finishing

Quality testing and inspection

Unlike PCB assembly, fabrication deals only with creating the raw circuit board—without components soldered to it. The quality and precision in this process directly impact the performance and reliability of electronic products.

Why India is Becoming a Global Choice for PCB Fabrication

India’s electronics manufacturing industry has expanded rapidly in the last decade, and PCB fabrication is a key area of this growth. Several factors have contributed to the rise of PCB fabrication companies across India:

✅ Government Support

Initiatives like Make in India, PLI (Production Linked Incentive) Scheme, and Electronics Manufacturing Clusters have spurred investments in high-end PCB manufacturing infrastructure.

✅ Cost-Efficiency

Indian companies offer cost-effective PCB fabrication without compromising on international quality standards, making them competitive suppliers in global markets.

✅ Skilled Engineering Base

India's strong engineering workforce allows companies to maintain strict design tolerances, perform complex fabrication, and implement new technologies like HDI PCBs and flexible circuits.

✅ Global Certifications

Most Indian PCB fabrication companies comply with IPC standards and hold certifications such as ISO 9001, UL, RoHS, IATF 16949, which ensures credibility for export markets.

Capabilities of PCB Fabrication Companies in India

Today’s PCB fabricators in India serve industries with both standard and complex design requirements. Here’s what most companies are capable of delivering:

Single-layer, Double-layer & Multilayer PCBs (up to 32+ layers)

Rigid, Flexible, and Rigid-Flex Boards

HDI (High-Density Interconnect) PCBs

High-speed and High-frequency PCBs

Metal Core PCBs for thermal applications

Blind, Buried, and Microvias

Lead-Free & RoHS Compliant Fabrication

ENIG, HASL, Immersion Silver/Gold Surface Finishes

Prototype to mass production volumes

These capabilities allow Indian fabricators to serve a diverse range of sectors including automotive, industrial automation, telecommunications, consumer electronics, defense, and aerospace.

Industries Driving Demand for PCB Fabrication in India

The shift toward electronics in every sector is fueling demand for quality PCB fabrication in India. Major contributing industries include:

1. Automotive & EV Industry

Advanced Driver Assistance Systems (ADAS), battery management, and infotainment systems rely heavily on high-precision PCBs.

2. Telecommunications

With the rollout of 5G infrastructure, telecom companies need reliable, high-frequency PCBs.

3. Industrial Automation

Smart factories, robotics, and IoT-based monitoring systems are increasing the need for complex multilayer boards.

4. Medical Devices

From diagnostic equipment to wearable health monitors, medical PCBs must meet exacting standards for safety and performance.

5. Defense & Aerospace

Indian PCB companies certified with AS9100 and MIL-STD are now supplying mission-critical boards for satellite systems, communication modules, and radar technology.

Benefits of Choosing a PCB Fabrication Company in India

Choosing an Indian PCB manufacturer provides several advantages, especially for businesses looking to scale:

Faster Turnaround Times Local production reduces lead times for prototyping and full-scale manufacturing.

Customization & Design Support Many companies offer in-house design validation and layout improvements to optimize manufacturing.

High Quality at Competitive Costs Indian fabricators deliver international-grade quality with better cost efficiency compared to Western or East Asian markets.

Integration with Assembly Services Many fabricators now offer one-stop PCB manufacturing—including fabrication, assembly, testing, and logistics.

Export-Ready and Globally Recognized

India’s PCB fabrication companies are expanding their global footprint. Several firms now cater to clients across North America, Europe, Southeast Asia, and the Middle East. With robust infrastructure, scalable production, and international certifications, Indian manufacturers are becoming preferred vendors for OEMs and EMS providers worldwide.

Trends Driving the Indian PCB Fabrication Industry

As technology evolves, Indian PCB companies are adapting to global trends:

Rise in HDI and Miniaturized Boards To support IoT and mobile devices, companies are investing in laser drilling and microvia technologies.

Flexible and Rigid-Flex PCBs Used in wearables and foldable electronics, this is a fast-growing segment in India.

Green Manufacturing Indian manufacturers are adopting eco-friendly materials and processes to meet RoHS and WEEE regulations.

AI & Smart Automation in Fabrication Lines Smart factories are improving productivity, reducing defects, and enabling real-time tracking in production lines.

How to Choose the Right PCB Fabrication Company in India

When selecting a fabrication partner, consider the following:

Technical Capabilities: Can the supplier meet your design, layer, and material specifications?

Quality Standards: Are they compliant with IPC, UL, and ISO certifications?

Turnaround Time: Do they support quick prototyping and timely delivery?

Volume Flexibility: Can they handle both low-volume prototyping and high-volume production?

Support Services: Do they offer design-for-manufacturability (DFM), testing, and logistics?

A smart way to find reliable partners is by using B2B manufacturing platforms like FindingMFG.com, where you can browse vetted companies, compare services, and send RFQs instantly.

Conclusion: India’s PCB Fabrication Industry is Ready for the Future

The rise of PCB fabrication companies in India signals a powerful shift in the global electronics supply chain. With modern facilities, technical expertise, and cost advantages, India is becoming a strategic destination for companies seeking reliable PCB solutions.

Whether you’re a startup developing a new IoT product or a global OEM scaling production, India offers a robust and forward-looking manufacturing base for your PCB needs.

🔍 Looking for Trusted PCB Fabrication Companies in India?

Explore top-rated, certified manufacturers on FindingMFG.com—India’s leading platform for electronics and mechanical manufacturing services.

0 notes

Text

AirPods India Output Hit by Rare Earth Snag; Vietnam May Benefit

Apple’s ambitious plan to scale AirPods production in India has hit a critical roadblock. According to sources familiar with the situation, Chinese export restrictions on rare earth elements—particularly dysprosium, a metal vital for compact speakers and haptic systems—have disrupted supply chains to Foxconn’s Telangana-based facility. This delay could shift competitive advantage to Apple’s other major suppliers—Luxshare and Goertek—whose factories in Vietnam remain unaffected.

Why Dysprosium Matters for Apple’s India Operations

The rare earth metal dysprosium is essential in creating high-performance magnets used in AirPods. In April, China tightened export licensing rules on seven rare earths, including dysprosium and terbium, impacting global supply chains.

Foxconn, Apple's key manufacturing partner, had reportedly repatriated over 300 Chinese engineers from India around the time these restrictions intensified. The Telangana government, along with India’s Ministry of Electronics and Information Technology (MeitY), DPIIT, and PMO, have been alerted about the situation.

Despite these disruptions, AirPods production in India has not stopped. Sources say Apple and Foxconn had anticipated potential shortages and made temporary adjustments, although delays remain inevitable.

Vietnam Suppliers Could Benefit

According to Counterpoint Research VP Neil Shah, China’s grip on the global rare earth supply chain is evident. He notes that China accounts for 95% of global dysprosium production, making it a chokepoint for high-end electronics manufacturing.

This supply crunch could strengthen the position of Luxshare and Goertek, which currently dominate AirPods production and operate out of Vietnam, a region not impacted by current export restrictions. While Foxconn's India plant was expected to gradually take on a larger share, this setback might slow that transition.

Regulatory Hurdles and Delays

Foxconn reportedly sought an End User Certificate (EUC) from the Ministry of External Affairs and Chinese Embassy to comply with China’s export rules. Although India completed its part of the documentation, approval from China’s authorities is still pending—a process now taking 45–50 days, up from the previous 30-day timeline.

India’s Electronics Sector Feels the Pressure

The ripple effect of China’s evolving rare earth policy is now being felt across India’s electronics manufacturing ecosystem. Industry associations like ICEA and ELCINA have flagged concerns over supply disruptions, rising costs, and potential downgrades in product quality.

In letters to Indian ministries, ICEA warned that prolonged shortages could harm India’s $32 billion export-driven electronics ambition under the Production Linked Incentive (PLI) scheme. Apple, Foxconn, Tata Electronics, Dixon, and other key players are part of the ICEA consortium.

Apple’s Contingency Plans in Motion

Amid these supply challenges, Apple has begun implementing contingency measures, including redeploying engineers from other countries to support Foxconn’s India operations. The situation remains fluid, hinging on geopolitical negotiations and China’s willingness to process export approvals.

#AirPods India Production Delay#Apple Foxconn Dysprosium Supply Issue#Rare Earth Metals Export China#business news

0 notes