#QuickBooks File Doctor Tool

Explore tagged Tumblr posts

Text

How to Pay a Personal Assistant: Everything You Need to Know

“How should I pay my personal assistant?”

Whether you’re hiring someone to work in person or virtually, locally or internationally, it’s important to choose the right payment method and structure to ensure a smooth, legal, and professional working relationship.

1. Define the Working Relationship

Before you think about payment methods, start by defining the assistant's status:

🧾 Are They an Employee or a Contractor?

Employee: Works on your schedule under your direction. In this case, you may be responsible for payroll taxes, benefits, and compliance with labor laws.

Independent Contractor or Virtual Assistant: Often works remotely, sets their own hours, and invoices you directly. You don’t handle taxes or benefits for them.

Understanding this difference is essential to avoid legal and tax issues down the line.

2. Choose the Right Payment Structure

Depending on your needs and the assistant’s availability, here are the most common payment models:

⏱️ Hourly Pay

Ideal for assistants working flexible or part-time hours.

U.S.-based PAs: $20–$50/hour

Overseas virtual assistants: $5–$15/hour

Track hours using time-tracking tools like Toggl, Time Doctor, or Hubstaff.

💼 Fixed Monthly Salary

Great for full-time or long-term assistants who handle multiple responsibilities. A consistent salary builds loyalty and simplifies accounting.

📌 Per Task or Per Project

Best for personal assistants hired for occasional support like travel bookings, event planning, or market research.

🔁 Monthly Retainer

You pay for a set number of hours per month, and the assistant guarantees availability within that limit. Popular among virtual assistant agencies.

3. Select a Secure Payment Method

The way you pay depends on whether your assistant is local or international:

For Local/In-Person Assistants:

Direct Deposit (ACH transfers)

Checks

Payroll tools like Gusto, QuickBooks Payroll, or ADP

For Remote or International Assistants:

Wise (formerly TransferWise) – fast global transfers with low fees

Payoneer – ideal for paying assistants in different countries

Deel or Remote – compliant global payroll platforms

PayPal – commonly used, but has higher fees

Upwork/Fiverr – for platform-based freelance arrangements

4. Handle Taxes & Legal Requirements

If you’re in the U.S. or hiring locally:

Contractors: File Form 1099-NEC if they earn more than $600/year.

Employees: Withhold payroll taxes and issue Form W-2.

Consult an accountant or use a payroll service to stay compliant.

If you're outsourcing internationally:

You typically don’t need to handle taxes, but you should still have a written contract outlining responsibilities and payment terms.

5. Use a Written Agreement

A simple contract goes a long way. It should cover:

The nature of the work

Pay rate and frequency (weekly/monthly)

Scope of tasks

Confidentiality and privacy expectations

Payment platform used

Dispute resolution (just in case)

This protects both parties and sets the foundation for a successful relationship.

Final Thoughts

Knowing how to pay a personal assistant is more than just choosing a rate—it's about creating a smooth and professional system that respects their time and protects your business. Whether you’re working with someone locally or remotely, clarity and consistency are key.

0 notes

Text

“Application-Only Access: Why It’s the Most Secure Way to Work Remotely”

As remote work becomes the norm rather than the exception, businesses are rapidly re-evaluating how they provide employees and contractors access to digital resources. While traditional Remote Desktop and VPN solutions often grant users full desktop or network access, application-only access—as offered by platforms like RHosting—is emerging as a safer, smarter alternative.

Here’s why limiting remote access to specific applications is not only more secure, but also more efficient and scalable for modern teams.

🎯 What Is Application-Only Access?

Application-only access means users can remotely interact only with specific, pre-approved applications, rather than accessing the entire desktop or server environment. This is configured at the control panel level and enforced through advanced RDP software like RHosting.

Think of it as walking into a room and being allowed to touch only one object—everything else remains locked down.

🔐 Why Application-Only Access Is More Secure

1. Limits Attack Surface

Full desktop or network access allows more opportunities for malware injection, accidental misclicks, or unauthorized file access. Application-only access shuts those doors, making it extremely difficult for bad actors to exploit the system.

2. Prevents Data Leaks

Users can’t see or interact with files, folders, or apps they aren’t authorized to use. This reduces the risk of sensitive data exposure—especially for remote contractors, freelancers, or interns.

3. Zero Trust in Action

By default, users have access to nothing unless explicitly granted. This model aligns perfectly with Zero Trust Security frameworks, which are fast becoming industry standards.

🚀 Productivity Without Compromise

Application-only access doesn’t mean limitations—it means focus.

Users aren’t distracted by irrelevant system elements

They get faster load times and smoother performance

IT teams spend less time troubleshooting or configuring complex access paths

With RHosting, for example, you can even define user-level permissions for individual apps or folders—so your finance team sees QuickBooks, your designers see Adobe tools, and your developers only access the required IDEs.

🧩 Ideal Use Cases

🔧 IT Managed Services: Grant clients app-only access to their dashboards

👨⚕️ Healthcare: Doctors access only EMR software, not entire hospital systems

📊 Finance: Accountants access tally or tax apps without touching databases

🧑🎓 Education: Students use online exam tools without browsing system folders

🏢 SMEs & Startups: Reduce IT risk while keeping teams productive

✅ Why RHosting Leads the Pack

RHosting’s RDP platform is engineered for application-level access from the ground up. It offers:

🎯 Role-based access control

🔒 Application & folder-level permissions

🚫 No need for endpoint configurations

📈 Scalable for small teams to large enterprises

⚙️ Fully managed backend with simplified user onboarding

💡 Final Thoughts

In a world of distributed teams, growing cyber threats, and shrinking attention spans, less is more—especially when it comes to remote access. Application-only access is the future of secure digital workspaces.

With RHosting, you don’t just offer remote access—you offer smart access that protects your data, streamlines productivity, and future-proofs your infrastructure.

Ready to simplify and secure your remote operations? Switch to application-only access with RHosting today.

0 notes

Text

0 notes

Text

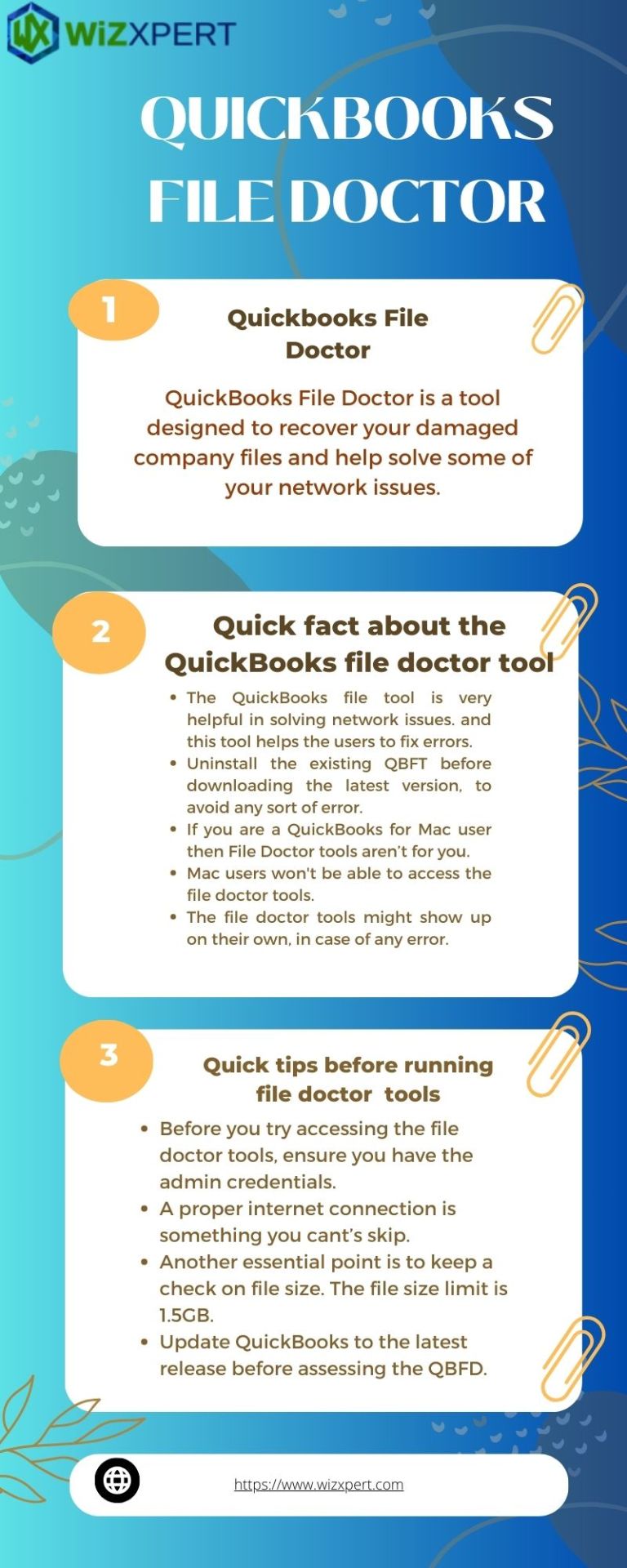

What is QuickBooks file doctor?

A QuickBooks File Doctor is a diagnostic tool provided by intuit that helps users resolve various issues related to QuickBooks company files and network connectivity.

It is designed to fix errors like corrupt files, problems opening company files,and network setup issues in multi-user mode.

The tool scans and repairs file issues Automatically,making it easier to troubleshoot and prevent data loss or access problems within QuickBooks.

QuickBooks file Doctor helps in following issues

Corrupted or damaged company Files

Network Issues

Error code

Some of the Benefits of QuickBooks File Doctor-

Centralized Access Tools

User-Friendly Interface

Efficient Diagnosis Repair

Comprehensive Analysis

Data Integrity Assurance

0 notes

Text

QuickBooks File Doctor Tool

This is one of the best inventions by intuit. This file is developed to solve the common quickbook problem like network and company file issues. It has both tools like a company diagnostic tool and network diagnostic tool. Quickbook file doctor tool can fix all the networks and company file bugs.

These are the following errors which can be solved by using the file doctor tools.

Blank lists for vendors, employees, or customers.

Failed to launch the company file.

QuickBooks H series error codes like H101, H202, H303, H505.

Damaged company file.

QuickBooks 6000 series errors like 6150, 6000 82, 6000 305, 6000 301, QuickBooks Error 6147, and QuickBooks Error 6130.

You have to uninstall the previous version of the quickbook file doctor tool to download the new version of this tool. it is recommended to use the external file doctor tool. It is helpful to solve the network issue. and also save a lot of time and effort to fix the tool.

1 note

·

View note

Text

0 notes

Text

Unleashing the Power of QuickBooks Tool Hub: Your Ultimate Solution

Welcome to the dynamic realm of QuickBooks, where financial management meets user-friendly tools. If you've ever found yourself caught in the web of accounting challenges, QuickBooks Tool Hub is here to untangle the knots. Imagine it as your digital Swiss Army knife, ready to troubleshoot and optimize your QuickBooks experience seamlessly. In this article, we'll embark on a journey through the multifaceted world of QuickBooks Tool Hub, uncovering its features, benefits, and how it can transform your financial management game.

QuickBooks Tool Hub: A Panacea for Accounting Woes

What is QuickBooks Tool Hub?

Before we dive into the labyrinth of functionalities, let's unravel the mystery of QuickBooks Support. In essence, it's a toolbox, a virtual haven for QuickBooks users facing technical glitches and quandaries. This hub consolidates various diagnostic tools and utilities under one digital roof, making it your go-to troubleshooter when things go awry.

Navigating Through the Features

Imagine you're a ship captain navigating treacherous waters. The QuickBooks Tool Hub serves as your compass, guiding you through stormy technical seas. Here's a breakdown of its key features:

Installation Diagnostic Tool: This tool acts like a diagnostic stethoscope, pinpointing installation errors and ensuring your QuickBooks is set up for smooth sailing.

Connection Diagnostic Tool: Just like a skilled navigator ensures the ship's connection to the stars for direction, this tool troubleshoots network issues, ensuring seamless communication between your QuickBooks and the server.

PDF Repair Tool: Ever felt like your financial documents are trapped in a digital Bermuda Triangle? The PDF Repair Tool is your rescue ship, retrieving and restoring lost or damaged PDFs.

File Doctor Tool: Think of this tool as your ship's mechanic. It repairs damaged company files, resolving errors that could potentially sink your financial ship.

The Seamless Integration Dance

Picture a symphony orchestra where each instrument plays a crucial role. QuickBooks Tool Hub orchestrates a harmonious integration of its tools, ensuring they work together seamlessly. It's not just a collection of utilities; it's a synchronized dance of problem-solving prowess.

The QuickBooks Tool Hub Advantage: Why Bother?

Saves Time and Frustration

In the high-speed world of finance, time is money, and frustration is the iceberg waiting to sink your productivity ship. QuickBooks Tool Hub is your lifeboat, rescuing you from the time-consuming abyss of technical issues. It streamlines troubleshooting, ensuring that you spend more time steering your financial ship than fixing its sails.

Cost-Efficient Troubleshooting

In the vast sea of financial software solutions, many come with a hefty price tag. QuickBooks Tool Hub stands as a beacon of cost-efficiency. Why invest in expensive technical support when you have a virtual toolbox at your disposal? It's like having a skilled sailor on board without the added expense.

User-Friendly Interface: Navigating the Seas with Ease

Smooth navigation is the hallmark of any reliable ship, and QuickBooks Tool Hub takes this principle to heart. Its user-friendly interface is designed for both seasoned captains and those setting sail on the financial seas for the first time. No need for a degree in information technology – the hub speaks the language of simplicity.

Unwrapping the Toolbox: How to Access QuickBooks Tool Hub

Step 1: Download the Tool Hub

Getting your hands on this digital lifesaver is a breeze. Head to the official Intuit website and download QuickBooks Tool Hub. It's like receiving a treasure map that leads you straight to the chest of solutions.

Step 2: Installation Jamboree

Installation is as easy as raising the anchor. Follow the prompts, and soon you'll see the QuickBooks Tool Hub icon on your desktop – your ticket to a world of troubleshooting magic.

Step 3: Navigating the Seas of Solutions

Click on the icon, and the hub unfolds like a treasure trove. The various tools at your disposal are neatly organized, ready to be summoned at a moment's notice. It's like having a trustworthy crew awaiting your command.

Frequently Asked Questions: Unraveling the Mysteries

1. Is QuickBooks Tool Hub compatible with all QuickBooks versions?

Absolutely! QuickBooks Tool Hub is the Swiss Army knife compatible with various QuickBooks versions. Whether you're sailing with QuickBooks Pro, Premier, or Enterprise, the hub adapts to the wind of your financial voyage.

2. Can I trust the PDF Repair Tool with sensitive documents?

Indeed, you can. The PDF Repair Tool is like a vault specialist, ensuring the security and integrity of your financial documents. It's not just about fixing; it's about safeguarding your treasure trove of information.

3. How often should I use the Connection Diagnostic Tool?

Think of it as routine maintenance for your ship. While it's not necessary daily, a periodic check ensures a smooth sailing experience. Don't wait for stormy seas – preventive measures keep your financial ship resilient.

Conclusion: Setting Sail into a Seamless Financial Odyssey

In the vast ocean of financial management, QuickBooks Tool Hub stands as your trusty navigator, your compass through choppy waters. Its seamless integration, user-friendly interface, and cost-efficiency make it the ultimate solution for QuickBooks users navigating the complexities of accounting.

So, fellow financial sailors, don't let technical glitches and installation storms deter you. Equip yourself with the QuickBooks Tool Hub, and let your financial ship sail smoothly through the digital tides. It's not just a toolbox; it's your co-captain in the journey of financial success. Bon voyage!

youtube

1 note

·

View note

Text

Resolving QuickBooks Error 6175: A Comprehensive Guide

A frustrating problem that might interfere with your workflow when using the accounting software is QuickBooks Error 6175. This problem normally happens when QuickBooks Desktop is unable to interface with the QuickBooks Database Server, prohibiting users from accessing the company file. This error needs to be fixed methodically, and the detailed guide that follows will walk you through the process of troubleshooting and fixing QuickBooks Error 6175.

Understanding QuickBooks Error 6175:

Prior to beginning the fix, it's critical to comprehend the potential reasons for QuickBooks Error 6175. This mistake could have a number of causes, including:

Issues with the QuickBooks Database Server Manager:

Miscommunications between the server and the company file may result from issues with the QuickBooks Database Server Manager.

Hosting Issues:

In a multi-user environment, incorrect hosting settings could prohibit QuickBooks from accessing the company file.

Firewall or Security Software Interference:

Firewalls or security software may block the necessary ports or interfere with QuickBooks communication.

Corrupted Network Data (.ND) File:

Error 6175 may arise from problems with the Network Data file, which is in charge of enabling multi-user access.

Outdated Version of QuickBooks:

Using an out-of-date version of QuickBooks might lead to errors and compatibility problems.

Read more: QuickBooks Error 3371

Let's now move on to the resolution procedures:

Step1: Check the Hosting Configuration

QuickBooks should be opened on the server PC.

Navigate to the "File" menu and select "Utilities."

Look for a setting labeled "Stop Hosting Multi-User Access." Choose it if you find it.

Select "Host Multi-User Access" if it is available to enable hosting. Restart QuickBooks.

Step 2: Confirm the Manager of the QuickBooks Database.

To launch the Run dialog box, use "Windows + R".

Enter "services.msc" after typing it.

Find the QuickBooksDBXX service (the version number is shown by XX).

Verify whether the service has begun. Otherwise, do a right-click and choose "Start."

Verify that the Startup type is "Automatic."

Step 3: Upgrade QuickBooks

Make sure QuickBooks is current.

Click the "Help" menu, then choose "Update QuickBooks."

To install the most recent updates, adhere to the on-screen directions.

Step 4: Configure Firewall Settings

Verify if QuickBooks is being blocked by the firewall.

Verify that ports 8019, 56726, and 55368-55372 are open for QuickBooks communication.

Make a QuickBooks exception in your firewall configuration.

Step 5: Make use of File Doctor QuickBooks

The QuickBooks File Doctor program can be downloaded and installed from the official Intuit website.

Run the tool to diagnose and correct issues with your company file.

Step 6: Set up QuickBooks Database Server Manager

To launch the Run dialog box, use "Windows + R".

Enter "services.msc" after typing it.

After locating and right-clicking on the QuickBooksDBXX service, choose "Properties."

Choose "This account" under the Log On menu, then navigate to the QuickBooks Desktop Installation folder.

Select the "QBDataServiceUserXX" file and input the password and username.

Select "Apply" and then "OK."

Step 7: Examine Several Instances

Make sure that QuickBooks Database Server Manager is only running in one instance.

Press Ctrl + Shift + Esc to launch Task Manager, then select the "Processes" tab.

Find and terminate any redundant "QBDBMgrN.exe" instances.

Step 8: Recreate the Network Data (.ND) File

Open the folder that has the file for your company.

Find the file (YourCompanyFile.qbw.nd, for example) that has the ".ND" extension, and rename it.

Click on the "Scan Folders" tab after launching QuickBooks Database Server Manager.

After adding the folder containing your company file, select "Scan."

Step 9: Turn Off Your Antivirus Program

Turn off your antivirus program for the time being and see whether the problem still occurs.

If the issue is fixed, make QuickBooks an exception in your antivirus configuration.

Step 10: Reinstall Database Server Manager for QuickBooks

Reinstall the most recent version after downloading it from the official Intuit website.

Reinstall Database Server Manager by uninstalling it from the Control Panel and downloading the most recent version from Intuit's website to fix QuickBooks problems.

Conclusion!

A methodical approach is needed to fix QuickBooks Error 6175, addressing problems with hosting settings, database server configuration, firewall settings, and other areas. Those who follow the thorough instructions and contact QuickBooks support when necessary can resolve this mistake and get back to smooth accounting operations.

Source URL : QuickBooks Error 6175

0 notes

Text

How to Work From Home as a Bookkeeper

Gone are the days of fluorescent lights and endless commutes! If you’re yearning for a flexible, financially rewarding career you can manage from the comfort of your PJs, then bookkeeping might be your perfect match.

>> Financial Freedom Awaits! Start Securing Your Future Wealth Today. <<

Master the tech symphony: Embrace the digital orchestra of cloud-based accounting software and online tools. Ditch paper mountains and embrace seamless data entry, automated tasks, and secure client access. Explore tools like QuickBooks, Xero, or Wave, and consider project management platforms like Trello or Asana to keep your workflow organized and on track. Remember, technology is your friend, freeing you from tedious tasks and letting you focus on strategic insights and client care.

These are just two initial notes in the beautiful melody of working from home as a bookkeeper. Remember, this is your solo, so keep exploring and adding your own unique notes! Embrace the flexibility, prioritize well-being, and let your accounting expertise dance to the beat of your own homegrown rhythm.

Table of Contents

Why Bookkeeping Rocks from Home:

Gear Up for Remote Bookkeeping Success:

Finding Your Remote Bookkeeping Dream Job:

Why Bookkeeping Rocks from Home:

1. Freedom and Flexibility:

Set your own schedule: No more rigid 9-to-5s! Work when your mind is sharp, whether it’s the crack of dawn or the quiet of the night. Take breaks for yoga, walks, or even impromptu jam sessions – your home office, your rules!

Design your workspace: Ditch the cubicle and create an inspiring haven. Fairy lights, ergonomic chairs, or a vibrant wall mural – personalize your space to boost creativity and focus.

Embrace the comfies: Ditch the power suit for fuzzy slippers and comfy clothes. Maximize comfort while staying productive – who says you can’t crush spreadsheets in your PJs?

2. Productivity Powerhouse:

Minimize distractions: Say goodbye to office chatter and water cooler gossip. Your home office is your sanctuary, allowing you to dive deep into your work without interruptions.

Reduce overhead costs: Ditch the expensive commute and office rent. Work from the comfort of your couch and watch your savings pile up.

Technology at your fingertips: Utilize cloud-based accounting software and online tools to access everything you need from anywhere. No more lugging heavy binders or scrambling for files.

>> Financial Freedom Awaits! Start Securing Your Future Wealth Today. <<

3. Work-Life Harmony:

Spend more time with loved ones: Fit work around your life, not the other way around. Catch your kids’ soccer games, cook family dinners, or volunteer in your community – home-based bookkeeping lets you be present for what matters most.

Maintain a healthy balance: No more rushing out the door or late-night commutes. Prioritize your well-being with home workouts, meditation breaks, or even impromptu dance parties – your mental and physical health will thank you.

Embrace the unexpected: Need to run an errand or attend a doctor’s appointment? No problem! Home-based bookkeeping gives you the freedom to handle life’s curveballs without disrupting your workflow.

So, ditch the traditional bookkeeping blues and rock out your own work-from-home symphony! With flexibility, productivity, and a healthy dose of work-life harmony, you’ll discover that home-based bookkeeping is more than just a job – it’s a lifestyle you can truly groove to.

Be Your Own Boss: Set your own hours, work at your own pace, and ditch the rigid office schedule.

Embrace the Comfy: Swap suits for sweatpants and ditch the daily commute. Work from your couch, your local coffee shop, or even a tropical beach (as long as you have Wi-Fi!).

Boost Your Balance: Enjoy more time with family, pursue hobbies, or hit the gym – all while managing your workload on your own terms.

Financial Freedom: Bookkeepers are in high demand, and remote positions often offer competitive salaries and benefits.

Gear Up for Remote Bookkeeping Success:

Establish a Dedicated Workspace:

Carve out a quiet, distraction-free zone in your home where you can focus and maintain a professional atmosphere.

Invest in ergonomic furniture to protect your body and create a comfortable working environment.

Personalize your space with inspiring decor or plants to boost creativity and motivation.

2. Master Technology Tools:

Choose cloud-based accounting software like QuickBooks Online, Xero, or FreshBooks for secure access from anywhere.

Explore project management platforms like Trello or Asana to organize tasks and track progress.

Utilize communication tools like Zoom, Skype, or Slack for seamless client interactions.

Implement time tracking software to ensure accurate billing and efficient time management.

Invest in high-speed internet and a reliable computer to avoid technical glitches.

3. Set Clear Boundaries and Schedules:

Establish regular work hours and communicate them to clients and family members.

Set boundaries between work and personal life to prevent burnout and maintain work-life balance.

Create a daily routine that includes breaks, exercise, and time for personal activities.

Utilize time management techniques to prioritize tasks and stay focused.

4. Prioritize Client Communication and Security:

Establish clear communication channels and expectations with clients.

Respond promptly to emails, calls, and messages to maintain trust and professionalism.

Implement robust security measures to protect client data, including strong passwords, two-factor authentication, and secure file sharing.

Stay updated on cybersecurity best practices to mitigate risks.

>> Financial Freedom Awaits! Start Securing Your Future Wealth Today. <<

5. Build Your Brand and Network:

Create a professional website and online presence to showcase your expertise and attract clients.

Network with other remote bookkeepers to share knowledge, resources, and support.

Join professional organizations to stay updated on industry trends and regulations.

Attend online webinars and training courses to expand your knowledge and skills.

6. Embrace Continuous Learning and Growth:

Stay up-to-date with accounting software updates and industry best practices.

Pursue professional development opportunities to expand your skillset and stay competitive.

Network with other bookkeepers and professionals to learn from their experiences.

Embrace new technologies and trends to enhance your efficiency and service offerings.

7. Prioritize Well-Being and Work-Life Balance:

Schedule regular breaks, exercise, and time for personal activities.

Set boundaries to protect your personal time and space.

Create a healthy work environment with ergonomic furniture, natural light, and a comfortable atmosphere.

Practice stress management techniques to maintain mental well-being.

8. Seek Support and Resources:

Connect with other remote bookkeepers through online communities and forums.

Join professional organizations for networking and resources.

Utilize online tutorials and training courses to enhance your skills.

Seek mentorship from experienced bookkeepers for guidance and support.

Tech Tools: Invest in a reliable laptop, high-speed internet, and cloud-based accounting software like QuickBooks or Xero.

Dedicated Workspace: Carve out a quiet, organized space in your home for maximum focus and productivity.

Stay Connected: Utilize communication tools like email, video conferencing, and project management platforms to stay in touch with clients and colleagues.

Sharpen Your Skills: Ongoing learning is key! Sign up for online courses, attend webinars, and stay updated on the latest accounting regulations.

Finding Your Remote Bookkeeping Dream Job:

Online Job Boards: Scour platforms like Indeed, FlexJobs, and Remote.co for remote bookkeeping positions.

Freelance Marketplaces: Upwork, Fiverr, and Guru offer opportunities to connect directly with clients and build your freelance portfolio.

Networking: Connect with other bookkeepers online or in local professional groups. Word-of-mouth recommendations can lead to fantastic remote gigs.

Building a successful remote bookkeeping career takes dedication and organization. But with the right skills, tools, and mindset, you can turn your home office into a hub of financial freedom and work-life harmony. So, grab your laptop, brew your favorite coffee, and get ready to conquer the world of remote bookkeeping – one balanced sheet at a time!

Finding your remote bookkeeping dream job requires strategic planning, proactive searching, and a sprinkle of passion. Here’s a roadmap to guide you:

1. Hone Your Skills and Craft Your Perfect Resume:

Identify your niche: Do you specialize in small businesses, startups, or a specific industry? Knowing your niche helps target relevant positions.

Brush up on your skills: Take online courses or attend workshops to stay updated on the latest accounting software and industry trends.

Craft a compelling resume: Highlight your remote work experience, quantifiable achievements, and relevant skills with keywords from job descriptions.

2. Explore Diverse Job Boards and Platforms:

Traditional job boards: Indeed, LinkedIn, Glassdoor, etc., offer a wide range of bookkeeping positions.

Remote-first job boards: Remote.co, FlexJobs, Working Nomads, etc., specialize in remote work opportunities.

Social media groups: Join Facebook groups or LinkedIn communities dedicated to remote bookkeeping jobs and networking.

Company websites: Check the career pages of your dream companies directly for open positions.

3. Ace Your Application and Interview:

Personalize your cover letter: Highlight how your skills and experience align with the specific job requirements.

Practice your interview skills: Prepare for common remote work and bookkeeping-related questions.

Showcase your tech-savviness: Discuss your proficiency in cloud-based accounting software and communication tools.

Negotiate confidently: Don’t be afraid to negotiate your salary and benefits, especially when highlighting your remote work value proposition.

4. Embrace Networking and Build Your Online Presence:

Connect with other remote bookkeepers: Attend online webinars and conferences to expand your network and learn from experienced professionals.

Become active on social media: Share your expertise, engage with potential employers, and showcase your personal brand.

Build a professional website or portfolio: This platform can showcase your skills, experience, and testimonials.

5. Remember, It’s a Marathon, Not a Sprint:

Finding your dream job takes time and effort. Be patient, persistent, and keep refining your skills and approach.

Bonus Tip: Consider freelancing platforms like Upwork or Fiverr to gain remote bookkeeping experience and build your client base while searching for your dream job.

Remember, landing your remote bookkeeping dream job is about showcasing your skills, highlighting your remote work value, and persistently chasing your career goals. So, put on your virtual power suit, grab your laptop, and embark on your exciting remote bookkeeping journey!

>> Financial Freedom Awaits! Start Securing Your Future Wealth Today. <<

Establish Clear Boundaries: Learn to say no to after-hours work and schedule breaks to avoid burnout.

Stay Active and Social: Get moving throughout the day to avoid physical and mental fatigue. Connect with friends and family to maintain a healthy work-life balance.

Market Yourself: Build a strong online presence with a professional website or social media profiles showcasing your skills and experience.

With a little planning and a lot of passion, you can turn your bookkeeping skills into a thriving remote career that lets you live life on your own terms. So, why wait? Start building your work-from-home bookkeeping dream today!

Thank you for taking the time to read my rest of the article, How to Work From Home as a Bookkeeper

1 note

·

View note

Text

Run QuickBooks File Doctor To Fix All Network Issues

QuickBooks file doctor tool can be used to repair your damaged and corrupted company files. As you already understand the name doctor, is like the profession. It also recovered certain damage. The Quickbook file doctor tool is very helpful in solving all network issues and it is used for file and data repair.

1 note

·

View note

Text

The Essential Guide to QuickBooks File Doctor, Fixing Common Errors

Intuit released the QuickBooks file doctor tool in 2010 because consumers were facing the problem regarding QuickBooks accounting software. It is a hybrid network diagnostic tool designed specifically for QuickBooks customers. By using this tool, users can solve lot’s of problems while opening a company file, such as completely corrupted files, network errors(such as Error H101, H202, H303, etc.), and error code-6000(QB Error -6000, -82, QB Error -6000, etc.). QuickBooks File Doctor automatically finds the issue and corrects it. But before this particular tool, Intuit had two different programs to solve different issues, and the name of the tools are QuickBooks company file diagnostic tool and the other name is QuickBooks network connectivity diagnostic tool. Both tools were Combined into one program called QuickBooks file doctor.

0 notes

Text

What is QuickBooks file doctor?

A QuickBooks File Doctor is a diagnostic tool provided by intuit that helps users resolve various issues related to QuickBooks company files and network connectivity.

It is designed to fix errors like corrupt files, problems opening company files,and network setup issues in multi-user mode.

The tool scans and repairs file issues Automatically,making it easier to troubleshoot and prevent data loss or access problems within QuickBooks.

QuickBooks file Doctor helps in following issues

Corrupted or damaged company Files

Network Issues

Error code

Some of the Benefits of QuickBooks File Doctor-

Centralized Access Tools

User-Friendly Interface

Efficient Diagnosis Repair

Comprehensive Analysis

Data Integrity Assurance

1 note

·

View note

Text

A Comprehensive Guide to Resolving QuickBooks Error 6069

Introduction:

QuickBooks is an indispensable tool for businesses when it comes to managing finances and keeping track of transactions. However, like any software, it is not immune to errors. One such error that users may encounter is QuickBooks Error 6069. This error can be frustrating, but fear not, as we have prepared a comprehensive guide to help you resolve QuickBooks Error 6069 and get back to smooth financial management.

Understanding QuickBooks Error 6069:

QuickBooks Error 6069 typically occurs when a user tries to open a company file. The error message may read something like "QuickBooks has encountered a problem and needs to close. We are sorry for the inconvenience." There can be several reasons behind this error, ranging from issues with the company file to problems with the QuickBooks installation.

Steps to Fix QuickBooks Error 6069:

Update QuickBooks:

Ensure that you are using the latest version of QuickBooks. Intuit regularly releases updates and patches to address known issues and improve software stability.

Install the QuickBooks File Doctor:

QuickBooks File Doctor is a tool provided by Intuit to diagnose and resolve various QuickBooks issues. Download and run this tool to scan and fix errors in your company file.

Check for Data Corruption:

Run the Verify Data utility within QuickBooks to check for data corruption. If issues are detected, use the Rebuild Data utility to fix them. This process may take some time, depending on the size of your company file.

Ensure Sufficient System Resources:

QuickBooks may encounter errors if your system is low on resources. Close unnecessary programs and ensure your computer has enough RAM to run QuickBooks smoothly.

Repair QuickBooks Installation:

If the error persists, you may need to repair your QuickBooks installation. Go to the Control Panel, select Programs and Features, find QuickBooks in the list, and choose the Repair option.

Review the QBWin.log File:

The QBWin.log file can provide valuable information about the error. Review the log file for any specific error codes or messages that can guide you in troubleshooting the issue.

Run QuickBooks in Compatibility Mode:

Right-click the QuickBooks desktop icon, go to Properties, and navigate to the Compatibility tab. Check the box for "Run this program in compatibility mode for" and select an earlier version of Windows. Click Apply and then OK.

Conclusion:

QuickBooks Error 6069 can be a stumbling block in your financial management, but with the right steps, you can overcome it. By following the troubleshooting tips outlined in this guide, you should be able to resolve the error and get back to using QuickBooks seamlessly. Remember, if you ever find yourself stuck, QuickBooks Support is just a call away. Happy accounting!

Read More:

If you've followed the initial steps and still find yourself grappling with QuickBooks Error 6069, don't worry—there are additional strategies you can employ to tackle the issue. Click Here

1 note

·

View note

Text

QuickBooks Tool Hub is a launchpad for the tools you'll use to fix your issue. Each tab has a set of tools to help with different types of problems: Company File Issues: Run the Quick Fix my file or the QuickBooks File Doctor to fix common data issues.

1 note

·

View note

Text

1 note

·

View note