#Quickbooks File Repair

Explore tagged Tumblr posts

Text

How an Audit Trail Removal Service can help reduce file size, improving overall performance and speed of QuickBooks

Kingston, July 20, 2025: An Audit Trail in QuickBooks is a powerful feature that records every transaction made in the system, providing a transparent history of changes, including edits, deletions, and updates to financial data. While this feature is invaluable for tracking activity and ensuring accountability, there are situations where businesses may need an Audit Trail Removal Service.

Businesses that handle sensitive financial data or are required to comply with data protection regulations may find that retaining extensive audit logs creates unnecessary exposure. Removing the audit trail can help businesses ensure that personal or confidential information is not inadvertently accessible, reducing the risk of unauthorized access.

As QuickBooks files grow over time, the audit trail can become quite large, potentially slowing down the system. The Audit Trail Removal Service can help reduce the file size, improving the overall performance and speed of QuickBooks. This is especially useful for businesses dealing with high volumes of transactions and large company files.

Over time, the audit trail can accumulate a significant amount of data that may no longer be necessary for day-to-day operations. In some cases, businesses may no longer need to track every change made to financial records. Removing outdated or irrelevant audit trail data can clean up the system, making it easier to navigate and manage current transactions.

While some businesses may choose to remove the audit trail for privacy or efficiency reasons, it is crucial to understand the regulatory requirements for your industry. Certain businesses may still need to maintain an audit trail for tax reporting or compliance purposes. An Audit Trail Removal Service can ensure that you’re adhering to legal requirements while also clearing unnecessary data from the system.

An over-accumulated audit trail may result in outdated or incorrect data being referenced in reports. By removing obsolete entries or cleaning up the audit trail, businesses can reduce the risk of errors in financial reporting, providing a clearer and more accurate picture of the company’s financial health.

While the Audit Trail feature in QuickBooks is essential for ensuring accountability and transparency, there are valid reasons why businesses might want to remove or clean up their audit trail. Whether it’s for privacy concerns, system performance, compliance, or reducing clutter, an Audit Trail Removal Service can help streamline QuickBooks and ensure that businesses maintain accurate, relevant data.

https://quickbooksrecovery.co.uk/quickbooks-file-data-services/quickbooks-audit-trail-removal-service/ has more information.

About E-Tech

E-Tech is the leading service provider of QuickBooks File Repair, Data Recovery, QuickBooks Conversion and QuickBooks SDK programming in the UK and Ireland. In our 20 years plus of experience with Intuit QuickBooks, we have assisted over a thousand satisfied customers with their requirements.

We offer a range of services for existing QuickBooks users and provide comprehensive solutions for small businesses. Additionally, our expertise covers the US, UK, Canadian, Australian (Reckon Accounts), and New Zealand versions of QuickBooks (PC and Mac platforms).

For media inquiries regarding E-Tech, individuals are encouraged to contact Media Relations Director, Melanie Ann via email at [email protected].

Melanie Ann

Media Relations

ETech

61 Bridge St

Kingston HR5 3DJ

www.quickbooksrecovery.co.uk

0 notes

Text

How to Track Your Expenses for Maximum Tax Savings?

For trucking professionals, effective expense tracking is one of the most powerful tools for reducing tax liabilities and improving financial health. Whether you're an owner-operator or managing a small fleet, keeping accurate and organized financial records ensures that you’re claiming every possible deduction and staying compliant with tax regulations. By understanding how to properly track your expenses, you can unlock significant tax savings and reduce the risk of audits or penalties.

Understand What Counts as a Deductible Expense

The first step to maximizing tax savings is knowing which expenses qualify as deductions. In the trucking industry, deductible expenses often include fuel, repairs and maintenance, insurance, licensing fees, tolls, meals, lodging, parking, office supplies, and depreciation on vehicles and equipment. Even items like your cell phone plan, GPS systems, and trucking-specific software may be deductible if used for business purposes. Knowing the full range of eligible expenses ensures you don’t leave money on the table when tax season comes around.

Use Technology to Simplify Recordkeeping

Manually tracking expenses with paper receipts and handwritten logs can be overwhelming and prone to error. Instead, take advantage of digital tools designed specifically for truckers. Mobile apps and accounting software allow you to take photos of receipts, log fuel and maintenance expenses in real-time, and even categorize transactions automatically. These tools not only save time but also help keep your records audit-ready.

Some popular apps for trucking expense tracking include TruckLogics, KeepTruckin, and QuickBooks Self-Employed. Using these platforms ensures that your financial data is stored securely and can be easily exported during tax preparation.

Separate Personal and Business Finances

One of the most important practices for expense tracking is maintaining separate bank accounts and credit cards for your business. Mixing personal and business expenses makes it harder to identify legitimate deductions and may raise red flags with the IRS. A dedicated business account simplifies bookkeeping and provides a clear financial trail that makes filing taxes more accurate and efficient.

Maintain a Consistent System

Consistency is key when it comes to tracking expenses. Make it a habit to record every purchase, no matter how small, on a daily or weekly basis. Set aside time each week to review your records, categorize expenses, and ensure everything is up to date. Waiting until the end of the year to organize your finances can lead to missed deductions and costly mistakes.

Work With Professionals Who Know the Industry

To truly maximize your tax savings, consider partnering with experts offering trucking tax preparation services. These professionals understand the unique financial landscape of the trucking industry and can help you identify often-overlooked deductions, stay compliant with tax laws, and plan effectively throughout the year. Their guidance not only simplifies the process but can also lead to thousands of dollars in savings.

In summary, tracking your expenses is essential for reducing your tax bill and staying financially organized. With the right tools, consistent habits, and professional support, you can ensure that every mile you drive is working toward your financial goals.

0 notes

Text

Your Complete Checklist for Smart Financial Planning in 2025

In today’s fast-paced world, managing your finances wisely has never been more important. As we enter 2025, financial planning isn't just about saving a portion of your income—it’s about creating a roadmap for long-term stability and wealth. Whether you're an individual, a growing entrepreneur, or a small business owner, the right strategy can help you meet your financial goals, reduce risk, and prepare for the unexpected.

At Robert Ricco, Inc, An Accountancy Corp, we offer comprehensive accounting services in Santa Monica to help you make informed financial decisions every step of the way. In this guide, you'll find everything you need to build your financial checklist for 2025—from budgeting and debt reduction to investment planning and tax optimization.

Define Your Financial Goals for 2025

Setting clear goals is the foundation of smart financial planning. Begin by categorizing your objectives into three types:

Short-term goals: Emergency fund, debt repayment, vacation

Mid-term goals: Saving for a home, expanding a business

Long-term goals: Retirement planning, college funds for children

Build a Practical Budget

A budget is a financial blueprint that ensures you're spending within your means and allocating money wisely. In 2025, inflation, interest rates, and economic uncertainty may impact everyday expenses—making budgeting even more crucial.

Popular budgeting strategies:

50/30/20 Rule: 50% on needs, 30% on wants, 20% on savings/debt

Zero-based budgeting: Every dollar is assigned a purpose

Use apps like YNAB, Mint, or QuickBooks to track spending

If you own a business or work as a freelancer, our Bookkeeping Services in Santa Monica ensure your financial records are always up-to-date and accurate.

Create a Reliable Emergency Fund

An emergency fund acts as a safety net for unexpected events such as job loss, medical expenses, or urgent repairs. In 2025, aim to save 3–6 months’ worth of essential expenses. Store this fund in a high-yield savings account to earn interest while keeping it accessible.

At Robert Ricco, Inc, our Santa Monica accounting experts can help you automate your savings and develop cash flow strategies to build your emergency reserves.

Strategically Manage Debt

Debt management is essential to maintaining financial freedom. High-interest debt like credit cards or unsecured loans can hinder your progress.

Popular repayment strategies:

Avalanche method: Pay off the highest-interest debt first

Snowball method: Pay off the smallest debts first to build momentum

Our CPA in Santa Monica works closely with clients to review liabilities, assess credit impact, and develop debt payoff plans that align with their income.

Maximize Your Income and Career Potential

Whether you're seeking a promotion, changing careers, or launching a new business, maximizing income in 2025 is vital.

Here’s how to grow your earnings:

Upskill with certifications or online courses

Explore side hustles or part-time consulting

Network and negotiate effectively

Develop a Smart Investment Strategy

Smart investing helps grow your wealth over time. In 2025, trends such as automation, green tech, and global diversification are shaping new opportunities.

Investment areas to consider:

ETFs and mutual funds

Stocks and dividend portfolios

Real estate and REITs

Roth IRAs and 401(k) plans

Our CPA firm Santa Monica CA provides personalized investment planning services to help clients diversify their portfolios based on goals and risk tolerance.

Prepare for Tax Season All Year Long

Proactive tax planning can save you thousands over the long term. With constant changes in tax codes, it's critical to stay up-to-date.

Tax planning tips for 2025:

Maximize deductions and credits (home office, business expenses)

Contribute to tax-advantaged accounts (401(k), HSA, SEP IRA)

Keep detailed records year-round

Let our CPA in Santa Monica manage your filings, minimize liabilities, and ensure full IRS compliance.

Review Insurance Coverage

Protecting your assets and income through insurance is an essential part of financial planning.

Types of insurance to consider:

Health and disability insurance

Life insurance (term or whole)

Home, auto, and renters insurance

We'll help assess your current policies and ensure you're adequately covered for life's unpredictable moments.

Set Up Estate Planning Documents

Estate planning ensures your assets are distributed according to your wishes. It's not just for the wealthy—it's smart financial planning for everyone.

Key documents to have in place:

A legally binding will

Power of attorney

Healthcare proxy

Living trust (if applicable)

Our firm connects you with trusted estate planning professionals to protect your legacy.

Use Technology and Financial Tools

In 2025, digital tools make financial planning more accessible than ever. Whether you're managing a business or household, automation and software streamline decision-making.

Recommended tools:

QuickBooks or Xero for small business finances

Robo-advisors like Betterment for hands-off investing

Personal finance dashboards for budget tracking

At Robert Ricco, Inc, we integrate these tools into our Bookkeeping Services in Santa Monica to give you real-time financial clarity.

Review and Adjust Your Plan Regularly

A successful financial plan is dynamic—not static. We recommend scheduling quarterly or biannual reviews to adjust your budget, savings goals, and investment strategies.

Our clients benefit from regular strategy sessions with a dedicated CPA in Santa Monica, ensuring that their plans evolve with their lives and business goals.

Why Choose Robert Ricco, Inc for Your Financial Planning?

At Robert Ricco, Inc, An Accountancy Corp, we’re more than just number crunchers. We’re a strategic partner in your financial success. With deep expertise in Santa Monica accounting, tax compliance, and investment planning, we help clients build wealth, reduce risk, and meet their financial goals with confidence.

📞 Call Now for Smart Financial Planning (310) 729-3705

👉 Related Blog

Source Page

0 notes

Text

Solving Accounting Challenges for Medium-Sized Real Estate Businesses

Introduction Accounting plays a pivotal role in the success of real estate businesses, particularly for medium-sized firms navigating between rapid growth and compliance with financial regulations. Whether managing property portfolios, handling rental income, or staying updated with tax rules, real estate accounting presents complex challenges. A missed reconciliation, inaccurate expense tracking, or delayed tax filing can disrupt operations, impact profitability, and invite penalties.

This blog post offers practical solutions to common accounting challenges faced by real estate businesses. From managing cash flow and streamlining expense tracking to understanding evolving tax regulations, these insights will help firms strengthen their financial management and achieve sustainable growth.

1. Cash Flow Management in Real Estate: A Balancing Act

Managing cash flow is critical for real estate businesses because of irregular income streams and significant upfront costs for maintenance, taxes, and property acquisitions. A gap in cash flow management can lead to payment delays and disruptions in business operations.a

Solutions for Cash Flow Management:

Accurate Cash Flow Forecasting: Real estate firms should forecast cash inflows and outflows to anticipate gaps and align payments with revenue streams.

Automated Rent Collection Systems: Platforms like Buildium and Propertyware automate rent collections, sending reminders and reducing late payments.

Maintain a Reserve Fund: Setting aside a portion of revenue as a cash reserve helps cover unexpected expenses such as repairs or property vacancies.

Research by the Royal Institute of Chartered Surveyors (RICS) highlights that 35% of real estate businesses report liquidity issues due to inconsistent cash flows, stressing the importance of forecasting and automated collection tools.

2. Tracking Income and Expenses for Multiple Properties

Handling income and expenses across various properties is challenging, especially without a streamlined system. Overlooking even minor expenses can lead to inaccurate financial reports and tax filings.

Best Practices for Expense Management:

Use Property Management Software (PMS): Software like AppFolio or Yardi centralizes expense tracking, allowing firms to categorize income and outgoings for each property.

Integrate Accounting Software with PMS: Connecting PMS with QuickBooks or Xero offers seamless data flow between property records and financial statements.

Automate Bank Reconciliation: Automated reconciliation ensures all transactions match bank records, reducing errors and saving time.

A study by McKinsey & Company reveals that automated tracking tools can reduce accounting errors by 30%, ensuring that businesses maintain accurate financial records across multiple properties.

3. Navigating Taxation in the Real Estate Industry

Real estate tax regulations differ across regions, and staying compliant is a constant challenge for firms. Tax implications vary based on property type, income sources, and market activities, making tax management a complicated task.

Strategies to Simplify Tax Compliance:

Hire Real Estate Tax Specialists: A dedicated tax consultant helps real estate firms interpret tax codes, utilize deductions, and file returns accurately.

Use Automated Tax Software: Solutions like TaxJar or Avalara automate tax calculations, ensuring businesses meet regional filing deadlines.

Leverage Tax Benefits: Many regions offer tax incentives for energy-efficient buildings and affordable housing projects. Firms should explore and apply these incentives to reduce tax burdens.

Failure to manage taxes properly can result in fines and audits. In 2023, real estate firms in Australia faced penalties exceeding AUD 10 million due to inaccurate filings, underscoring the need for expert tax management.

4. Handling Property Depreciation and Amortization

Depreciation and amortization play a significant role in determining the financial health of real estate businesses. Properly recording depreciation helps firms spread the cost of a property over its useful life, impacting profit calculations and tax liabilities.

Depreciation Management Tips:

Create a Depreciation Schedule: Work with accounting software to generate automated depreciation schedules for each property.

Consult with an Accountant: Professional accountants ensure accurate reporting of depreciation values, aligning with regional tax laws.

Stay Updated with Tax Code Changes: The USA, UK, and Australia periodically revise depreciation rules. Businesses must stay informed to adjust their calculations accordingly.

A survey by Deloitte found that 60% of real estate businesses mismanage property depreciation, leading to inflated taxable income. With automated systems and expert advice, firms can avoid these pitfalls and optimize their financial performance.

5. The Role of Technology in Real Estate Accounting

Technology adoption in real estate accounting has revolutionized how businesses handle financial operations. From cloud-based systems to AI-powered tools, firms are leveraging technology to streamline processes and improve accuracy.

Technological Solutions for Accounting Efficiency:

Cloud Accounting Software: Tools like Xero and QuickBooks Online allow real-time access to financial data, making collaboration easier between property managers and accountants.

AI-based Bookkeeping: Artificial intelligence tools automate repetitive tasks like invoice processing and bank reconciliation, reducing human errors.

Document Management System Integration: Integrating accounting software with document management systems ensures all financial records are securely stored and easily accessible.

The adoption of cloud-based solutions has grown rapidly, with 88% of real estate businesses now using cloud software for financial management, according to a report by PwC. This shift enhances transparency and allows firms to make data-driven decisions.

Conclusion

Medium-sized real estate businesses face complex accounting challenges, from cash flow management to compliance with tax regulations. Efficiently managing multiple income sources, tracking property depreciation, and leveraging technology are essential for maintaining financial stability and fostering growth.

By adopting automated tools, consulting with tax specialists, and staying informed about regulatory changes, real estate firms can optimize their accounting processes and avoid costly errors. These strategies not only enhance operational efficiency but also position businesses for long-term success in a competitive market.

Need help with your accounting needs? Contact us today for expert solutions tailored to the unique challenges of real estate businesses. Let us help you streamline your financial operations and achieve sustainable growth.

0 notes

Text

0 notes

Text

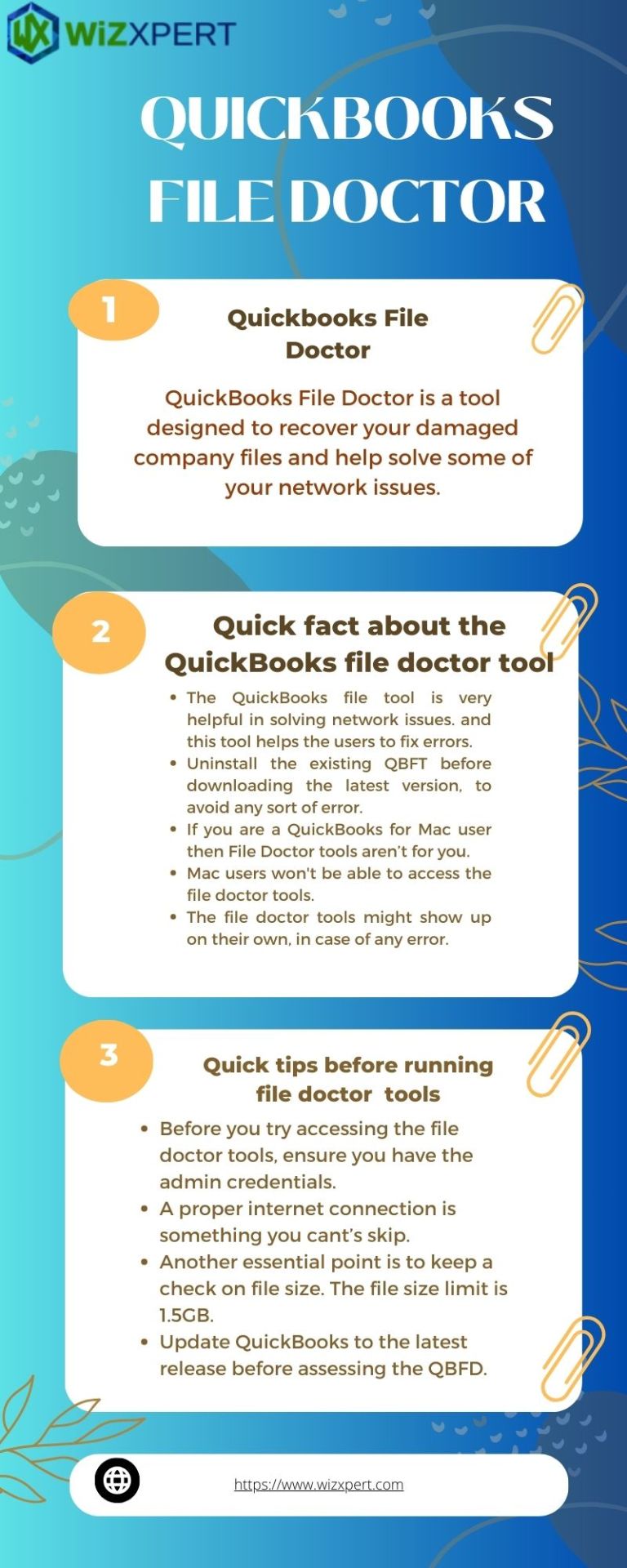

What is QuickBooks file doctor?

A QuickBooks File Doctor is a diagnostic tool provided by intuit that helps users resolve various issues related to QuickBooks company files and network connectivity.

It is designed to fix errors like corrupt files, problems opening company files,and network setup issues in multi-user mode.

The tool scans and repairs file issues Automatically,making it easier to troubleshoot and prevent data loss or access problems within QuickBooks.

QuickBooks file Doctor helps in following issues

Corrupted or damaged company Files

Network Issues

Error code

Some of the Benefits of QuickBooks File Doctor-

Centralized Access Tools

User-Friendly Interface

Efficient Diagnosis Repair

Comprehensive Analysis

Data Integrity Assurance

0 notes

Text

ErrorsFixs

ErrorsFixs is your ultimate solution for resolving mail related problem errors like forget password, Account Registration failure, Account suspend, folder can’t create, Spam mail efficiently. Our comprehensive software suite detects and fixes a wide array of issues, from registry errors to DLL conflicts, boosting your device's performance and stability. With ErrorsFixs enjoy smoother operation and enhanced productivity without the hassle of troubleshooting. Our user-friendly interface makes resolving errors a breeze, whether you're a novice or an expert. Say goodbye to frustrating crashes and slowdowns with ErrorsFixs – your trusted partner in maintaining a flawless computing experience. Try ErrorsFixs today and experience the difference in system reliability and performance.

1 note

·

View note

Text

0 notes

Text

For businesses focused on local operations, removing multi-currency functionality helps keep your QuickBooks setup lean and efficient

Brandon, MB- July 20, 2025: QuickBooks offers powerful features for businesses, including the ability to handle multi-currency transactions, making it easier for companies that deal with international customers and vendors. However, for some businesses, removing multi-currency support from QuickBooks can offer several benefits, particularly when they no longer need to manage transactions in multiple currencies. Here’s why removing multi-currency functionality might be a good move for your business:

When multi-currency support is enabled, QuickBooks requires you to track and manage exchange rates, currency conversions, and the impacts on your financial reports. Removing multi-currency simplifies your accounting processes by eliminating the need to manage multiple currencies, allowing you to focus solely on the local currency. This makes invoicing, expense tracking, and financial reporting more straightforward.

Currency fluctuations can create complex accounting challenges, especially if you are not dealing with international transactions regularly. By disabling multi-currency support, you eliminate the risk of exchange rate errors and the potential financial impact of fluctuating currency values. This can improve the accuracy of your financial data and reduce potential discrepancies in your records.

With multi-currency enabled, QuickBooks automatically converts foreign transactions into your base currency, which can sometimes create confusion when generating reports. By removing multi-currency, your financial reporting becomes more straightforward, as all transactions will be handled in one consistent currency, making it easier to understand and analyze your company’s financial health.

Reconciliation in QuickBooks can become more complicated when dealing with multiple currencies, especially if you have international bank accounts or credit card transactions. Removing multi-currency simplifies your reconciliation process by consolidating everything into a single currency, allowing for faster and more accurate reconciliations.

Maintaining multi-currency settings in QuickBooks requires monitoring exchange rates, updating them regularly, and ensuring that transactions are converted correctly. By removing multi-currency, your system becomes easier to maintain, as you no longer need to manage currency updates or track changes in foreign exchange rates.

If your business operates solely within one country and does not engage in international transactions, removing multi-currency eliminates unnecessary features. This allows you to streamline your QuickBooks setup, making it more efficient for your specific needs without the complexity of multi-currency functionality.

Removing multi-currency in QuickBooks can benefit businesses that no longer require handling foreign currencies, especially those that deal with domestic transactions. Simplified accounting, reduced exchange rate risks, streamlined financial reporting, and easier reconciliation processes are just some of the advantages of disabling this feature. For businesses focused on local operations, removing multi-currency functionality helps keep your QuickBooks setup lean and efficient.

About E-Tech

Founded in 2001, E-Tech is the leading file repair, data recovery, and data conversion services provider in the United States and Canada. The company works to stay up to date on the latest technology news, reviews, and more for their customers.

For media inquiries regarding E-Tech, individuals are encouraged to contact Media Relations Director, Melanie Ann via email at [email protected].

To learn more about the company, visit: www.e-tech.ca

Melanie Ann

Media Relations

E-Tech

136 11 th St

Brandon, MB R7A 4J4

www.e-tech.ca

0 notes

Text

Unleashing the Power of QuickBooks Tool Hub: Your Ultimate Solution

Welcome to the dynamic realm of QuickBooks, where financial management meets user-friendly tools. If you've ever found yourself caught in the web of accounting challenges, QuickBooks Tool Hub is here to untangle the knots. Imagine it as your digital Swiss Army knife, ready to troubleshoot and optimize your QuickBooks experience seamlessly. In this article, we'll embark on a journey through the multifaceted world of QuickBooks Tool Hub, uncovering its features, benefits, and how it can transform your financial management game.

QuickBooks Tool Hub: A Panacea for Accounting Woes

What is QuickBooks Tool Hub?

Before we dive into the labyrinth of functionalities, let's unravel the mystery of QuickBooks Support. In essence, it's a toolbox, a virtual haven for QuickBooks users facing technical glitches and quandaries. This hub consolidates various diagnostic tools and utilities under one digital roof, making it your go-to troubleshooter when things go awry.

Navigating Through the Features

Imagine you're a ship captain navigating treacherous waters. The QuickBooks Tool Hub serves as your compass, guiding you through stormy technical seas. Here's a breakdown of its key features:

Installation Diagnostic Tool: This tool acts like a diagnostic stethoscope, pinpointing installation errors and ensuring your QuickBooks is set up for smooth sailing.

Connection Diagnostic Tool: Just like a skilled navigator ensures the ship's connection to the stars for direction, this tool troubleshoots network issues, ensuring seamless communication between your QuickBooks and the server.

PDF Repair Tool: Ever felt like your financial documents are trapped in a digital Bermuda Triangle? The PDF Repair Tool is your rescue ship, retrieving and restoring lost or damaged PDFs.

File Doctor Tool: Think of this tool as your ship's mechanic. It repairs damaged company files, resolving errors that could potentially sink your financial ship.

The Seamless Integration Dance

Picture a symphony orchestra where each instrument plays a crucial role. QuickBooks Tool Hub orchestrates a harmonious integration of its tools, ensuring they work together seamlessly. It's not just a collection of utilities; it's a synchronized dance of problem-solving prowess.

The QuickBooks Tool Hub Advantage: Why Bother?

Saves Time and Frustration

In the high-speed world of finance, time is money, and frustration is the iceberg waiting to sink your productivity ship. QuickBooks Tool Hub is your lifeboat, rescuing you from the time-consuming abyss of technical issues. It streamlines troubleshooting, ensuring that you spend more time steering your financial ship than fixing its sails.

Cost-Efficient Troubleshooting

In the vast sea of financial software solutions, many come with a hefty price tag. QuickBooks Tool Hub stands as a beacon of cost-efficiency. Why invest in expensive technical support when you have a virtual toolbox at your disposal? It's like having a skilled sailor on board without the added expense.

User-Friendly Interface: Navigating the Seas with Ease

Smooth navigation is the hallmark of any reliable ship, and QuickBooks Tool Hub takes this principle to heart. Its user-friendly interface is designed for both seasoned captains and those setting sail on the financial seas for the first time. No need for a degree in information technology – the hub speaks the language of simplicity.

Unwrapping the Toolbox: How to Access QuickBooks Tool Hub

Step 1: Download the Tool Hub

Getting your hands on this digital lifesaver is a breeze. Head to the official Intuit website and download QuickBooks Tool Hub. It's like receiving a treasure map that leads you straight to the chest of solutions.

Step 2: Installation Jamboree

Installation is as easy as raising the anchor. Follow the prompts, and soon you'll see the QuickBooks Tool Hub icon on your desktop – your ticket to a world of troubleshooting magic.

Step 3: Navigating the Seas of Solutions

Click on the icon, and the hub unfolds like a treasure trove. The various tools at your disposal are neatly organized, ready to be summoned at a moment's notice. It's like having a trustworthy crew awaiting your command.

Frequently Asked Questions: Unraveling the Mysteries

1. Is QuickBooks Tool Hub compatible with all QuickBooks versions?

Absolutely! QuickBooks Tool Hub is the Swiss Army knife compatible with various QuickBooks versions. Whether you're sailing with QuickBooks Pro, Premier, or Enterprise, the hub adapts to the wind of your financial voyage.

2. Can I trust the PDF Repair Tool with sensitive documents?

Indeed, you can. The PDF Repair Tool is like a vault specialist, ensuring the security and integrity of your financial documents. It's not just about fixing; it's about safeguarding your treasure trove of information.

3. How often should I use the Connection Diagnostic Tool?

Think of it as routine maintenance for your ship. While it's not necessary daily, a periodic check ensures a smooth sailing experience. Don't wait for stormy seas – preventive measures keep your financial ship resilient.

Conclusion: Setting Sail into a Seamless Financial Odyssey

In the vast ocean of financial management, QuickBooks Tool Hub stands as your trusty navigator, your compass through choppy waters. Its seamless integration, user-friendly interface, and cost-efficiency make it the ultimate solution for QuickBooks users navigating the complexities of accounting.

So, fellow financial sailors, don't let technical glitches and installation storms deter you. Equip yourself with the QuickBooks Tool Hub, and let your financial ship sail smoothly through the digital tides. It's not just a toolbox; it's your co-captain in the journey of financial success. Bon voyage!

youtube

1 note

·

View note

Text

Run QuickBooks File Doctor To Fix All Network Issues

QuickBooks file doctor tool can be used to repair your damaged and corrupted company files. As you already understand the name doctor, is like the profession. It also recovered certain damage. The Quickbook file doctor tool is very helpful in solving all network issues and it is used for file and data repair.

1 note

·

View note

Text

A Comprehensive Guide to Resolving QuickBooks Error 6069

Introduction:

QuickBooks is an indispensable tool for businesses when it comes to managing finances and keeping track of transactions. However, like any software, it is not immune to errors. One such error that users may encounter is QuickBooks Error 6069. This error can be frustrating, but fear not, as we have prepared a comprehensive guide to help you resolve QuickBooks Error 6069 and get back to smooth financial management.

Understanding QuickBooks Error 6069:

QuickBooks Error 6069 typically occurs when a user tries to open a company file. The error message may read something like "QuickBooks has encountered a problem and needs to close. We are sorry for the inconvenience." There can be several reasons behind this error, ranging from issues with the company file to problems with the QuickBooks installation.

Steps to Fix QuickBooks Error 6069:

Update QuickBooks:

Ensure that you are using the latest version of QuickBooks. Intuit regularly releases updates and patches to address known issues and improve software stability.

Install the QuickBooks File Doctor:

QuickBooks File Doctor is a tool provided by Intuit to diagnose and resolve various QuickBooks issues. Download and run this tool to scan and fix errors in your company file.

Check for Data Corruption:

Run the Verify Data utility within QuickBooks to check for data corruption. If issues are detected, use the Rebuild Data utility to fix them. This process may take some time, depending on the size of your company file.

Ensure Sufficient System Resources:

QuickBooks may encounter errors if your system is low on resources. Close unnecessary programs and ensure your computer has enough RAM to run QuickBooks smoothly.

Repair QuickBooks Installation:

If the error persists, you may need to repair your QuickBooks installation. Go to the Control Panel, select Programs and Features, find QuickBooks in the list, and choose the Repair option.

Review the QBWin.log File:

The QBWin.log file can provide valuable information about the error. Review the log file for any specific error codes or messages that can guide you in troubleshooting the issue.

Run QuickBooks in Compatibility Mode:

Right-click the QuickBooks desktop icon, go to Properties, and navigate to the Compatibility tab. Check the box for "Run this program in compatibility mode for" and select an earlier version of Windows. Click Apply and then OK.

Conclusion:

QuickBooks Error 6069 can be a stumbling block in your financial management, but with the right steps, you can overcome it. By following the troubleshooting tips outlined in this guide, you should be able to resolve the error and get back to using QuickBooks seamlessly. Remember, if you ever find yourself stuck, QuickBooks Support is just a call away. Happy accounting!

Read More:

If you've followed the initial steps and still find yourself grappling with QuickBooks Error 6069, don't worry—there are additional strategies you can employ to tackle the issue. Click Here

1 note

·

View note

Text

What is QuickBooks file doctor?

A QuickBooks File Doctor is a diagnostic tool provided by intuit that helps users resolve various issues related to QuickBooks company files and network connectivity.

It is designed to fix errors like corrupt files, problems opening company files,and network setup issues in multi-user mode.

The tool scans and repairs file issues Automatically,making it easier to troubleshoot and prevent data loss or access problems within QuickBooks.

QuickBooks file Doctor helps in following issues

Corrupted or damaged company Files

Network Issues

Error code

Some of the Benefits of QuickBooks File Doctor-

Centralized Access Tools

User-Friendly Interface

Efficient Diagnosis Repair

Comprehensive Analysis

Data Integrity Assurance

1 note

·

View note

Text

The thing to know about Quickbooks file recovery

To get an insight into Quickbooks file recovery you need to know that it is accounting software. There are several small to medium businesses that use Quickbooks and it has a cloud-based version as well. It makes the accounting easier by managing payroll function, business payments, paying bills, etc. As the software does so many works at the same time so files may get lost. It is not a task of a regular person to recover the file, you need a professional.

What kind of help service provides?

● Professional service offers data recovery that is followed by Quickbooks File Repair.

● The professional service like E-Tech is capable of fixing the corruption of the file so that you can verify, and rebuild the data to resume the task.

● E-Tech offers Quickbooks Canada to UK conversion so that data can be downgraded from Premier, or online, or Pro.

● They also offer migration services from SAP, Sage Business Works, and Net Suite, to Quickbooks.

Identifying data corruption

E-Tech reviews the logs after verifying the data and then step in rebuilding the data. The logs will let you know whether there is any problem so that you can go back to fix it. Once you have the information you can delete or replace the corrupted data. To perform the task accurately E-Tech continues to address each file.

How to stop data corruption?

● To stop corruption E-Tech creates journal entries to summarize the activities. The summary of the data will help in Quickbooks US to UK conversion as well.

● The journal entries will also help in cleaning up the balance sheet of a particular company.

● E-Tech removes the transaction data so that new entrants can be done smoothly without burdening.

● They also start a new QuickBooks file for opening balances.

● Opening a new file will reduce the size so there will be a lesser chance of corruption.

So, here are the steps that a professional service provider like E-Tech offers to stop the possible corruption of QuickBooks data. Despite that, if the file gets corrupted then they opt for garbage in, garbage out process to recover the essential data from being corrupted. If the files are prevented from being corrupted, then an organization can perform an accurate financial calculation. Availing service from a professional service provider like E-Tech will help your business to grow further.

One can outsource the design of QuickBooks system and the setup so that you can do the strategic tasks easily. E-Tech helps to perform the bookkeeping functions effectively as well because they are in the industry for around 20 years. They offer their service all across the world and with their quality-service they have earned a reputation in the industry. They offer a wide range of affordable services. They can work with all the versions of Quickbooks so they can merge files to create a condense file, reduce the size of the files, and many more.

2 notes

·

View notes

Text

QUICKBOOKS FILE REPAIR – E-Tech

Quickbooks File Repair - We can repair almost any version of your Quickbooks data files, from the first version for DOS to the latest Pro / Premier / Accountant or Enterprise versions. Due to our firm commitment to quality, we are proud of our success rate of over 95%. Unlike any other service, we guarantee ours which means you pay nothing for the files we cannot repair.

1 note

·

View note