#RFID EPC encoding

Explore tagged Tumblr posts

Text

Choosing the Right RFID Tag: A Breakdown of Different Types and Their Uses

Introduction to RFID Tags and Their Functionality

An RFID tag is composed of two fundamental components: an antenna for transmitting and receiving signals, and an RFID chip (or integrated circuit, IC) that stores the tag's ID and other relevant information.

RFID tags use radio waves to transmit data about an item to the antenna/reader combination. These tags typically do not have a battery, unless specified as Active or BAP tags. "They" refers to passive RFID tags, which do not have their own power source. Instead, they receive the energy required to operate from the radio waves generated by the RFID reader. When the tag receives the transmission from the antenna/reader, the energy flows through the internal antenna to the tag’s chip. This energy activates the chip, which then modulates the energy with the desired information and transmits a signal back to the antenna/reader.

On each chip, there are four memory banks – EPC, TID, User, and Reserved. Each of these memory banks contains information about the item that is tagged or the tag itself, depending on the bank and its specifications. Two of the memory banks, EPC and User, can store unique identifying information. The TID bank cannot be updated because it contains information about the tag itself and the unique tag identifier. The tag’s Reserved memory bank is used for special tag operations, such as locking the tag or expanding its available EPC memory. Different types of tags exist, including read-only tags that allow reading of stored data but not changing it, read/write tags that allow alteration or rewriting of stored data, and a combination of both, where some data is permanently stored while the remaining memory is left accessible for future encoding and updates.

RFID Tag Types and Operational Modes

Hundreds of different RFID tags are available in various shapes and sizes, each with features and options specific to certain environments, surface materials, and applications. Choosing the ideal tag for a specific application, environment, and item material is crucial for optimal tag performance.

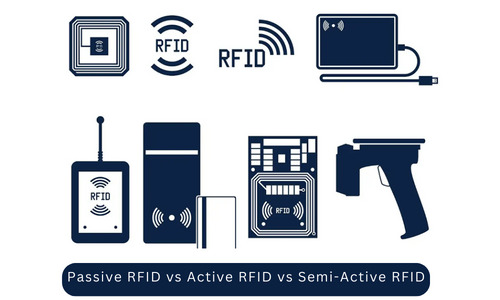

An RFID Tag can be categorized into passive, semi-passive, or active.

Passive tags, the more common variant, do not require direct line-of-sight to a reader, making them versatile but with a shorter read range. They are compact and lightweight, activated by the energy from an RFID reader. This tag has a limited range of 0-15 meters, which makes it suitable for short-range applications only. The reading range is constrained by the power required to activate the chip. Given their size and cost, passive tags are the most common and can be inlaid like labels or take the form of hard tags made from materials such as plastic or metal. Ideal for applications requiring close-range identification, such as inventory management, access control, and retail item tracking.

Active RFID tags, featuring a battery that requires replacement every 3-5 years, excel in live tracking applications, offering an extended read range compared to passive tags. They have a higher reading range (up to 100 meters) than passive tags. These tags are more expensive due to the cost of their battery and transmitter. Despite the higher cost, they are suited for real-time tracking of high-value assets, vehicle tracking, and monitoring large-scale operations like shipping and logistics.

Semi-Passive Tags, very rarely used, function somewhere between active and passive tags. These tags are battery-powered, helping extend the communication range. Find applications in environments where a longer communication range is needed but where the continuous transmission of active tags may not be necessary, such as environmental monitoring and equipment maintenance tracking.

To Get More Information Visit our Website: https://www.idsolutionsindia.com/product/rfid-tags/

#RFID tags#RFID readers#RFID solutions#RFID technology#RFID tags cost#Active RFID tags#RFID tags manufacturers#RFID clothing tags#RFID laundry tags#Inventory Management System#Animal warehouse management

0 notes

Text

Are RFID Reader-Writers Compatible with All Types of RFID Tags?

In the realm of RFID technology, the compatibility between RFID reader-writers and RFID tags is a crucial aspect that directly impacts the efficiency and effectiveness of RFID systems. This article aims to explore the intricate relationship between RFID reader-writers and RFID tags, deciphering whether they are universally compatible.

Introduction to RFID Reader-Writers and RFID Tags

RFID Reader-Writers

RFID reader-writers are sophisticated devices designed to interact with RFID tags, enabling the reading, writing, and manipulation of data stored on these tags. They serve as the bridge between the physical world and digital databases, facilitating seamless data exchange in various applications.

RFID Tags

RFID tags are small electronic devices equipped with an antenna and a microchip that store unique identifiers and other relevant data. These tags come in various forms, including passive, active, and semi-passive, each catering to specific requirements and use cases.

Exploring Compatibility

Understanding Compatibility Factors

The compatibility between RFID reader-writers and RFID tags depends on several key factors, including frequency, protocol, and encoding standards. These factors dictate the communication protocols and data exchange mechanisms supported by both the reader-writer and the tag.

Frequency Compatibility

RFID systems operate at different frequencies, such as low frequency (LF), high frequency (HF), and ultra-high frequency (UHF). It is essential to ensure that the RFID reader-writer and the RFID tags operate at the same frequency for seamless communication.

Protocol Compatibility

RFID systems utilize various protocols, such as EPC Gen2, ISO 14443, and ISO 15693, to govern communication between the reader-writer and the tag. Ensuring protocol compatibility is crucial to enabling interoperability and data exchange between different RFID devices.

Encoding Standards

RFID tags may use different encoding standards, such as ASCII, Binary, or proprietary formats, to store and transmit data. Compatibility with these encoding standards ensures that the reader-writer can effectively interpret and manipulate data stored on the RFID tags.

Applications and Use Cases

Inventory Management

In the context of inventory management, RFID reader-writers must be compatible with a wide range of RFID tags to track and monitor inventory items accurately. Compatibility ensures seamless integration with existing systems and workflows, enabling efficient inventory management operations.

Access Control

For access control systems, RFID readers must be compatible with RFID tags used for personnel identification and authentication. Compatibility ensures reliable access control and security, allowing authorized personnel to access restricted areas seamlessly.

Challenges and Considerations

Vendor Lock-In

Some RFID systems may suffer from vendor lock-in, where proprietary technologies and protocols restrict interoperability with third-party devices. Overcoming vendor lock-in requires careful consideration of open standards and interoperable solutions.

Interference and Read Range

RFID systems may experience interference from environmental factors such as metal surfaces, liquids, and electromagnetic interference. Ensuring compatibility with RFID tags designed to withstand such challenges is essential for reliable operation and read range.

Conclusion

In conclusion, the compatibility between RFID reader-writers and RFID tags is a critical factor that influences the effectiveness and reliability of RFID systems. By understanding the compatibility factors and addressing potential challenges, organizations can ensure seamless integration and optimal performance of RFID technology across various applications.

#rfid readers#rfid reader writer#rfid scanner#rfid card reader#rfid scanner device#rfid reader and writer

0 notes

Text

RFID Label Printers Market, Overview Development and Outlook on Key Growth Trends, Factors and Forecast 2032

RFID Label Printers Market Overview:

The RFID (Radio-Frequency Identification) Label Printers market is a dynamic segment within the broader realm of automatic identification and data capture technology. These specialized printers are designed to produce RFID labels, which contain embedded RFID tags that can store and transmit data wirelessly. The market's significance lies in its role as an enabler of efficient inventory management, supply chain optimization, and enhanced asset tracking across various industries. As organizations increasingly adopt RFID technology to improve operational efficiency and traceability, the RFID Label Printers market experiences sustained growth.

Market Share: The RFID Label Printers market is primarily dominated by a few key players, including Zebra Technologies, Honeywell International Inc., Avery Dennison Corporation, SATO Holdings Corporation, and Printronix, among others. These companies hold a significant share of the market due to their established presence and wide product offerings.

Types: RFID Label Printers come in various types, including desktop RFID printers, industrial RFID printers, and mobile RFID printers. Desktop RFID printers are compact and suitable for low to medium-volume printing, industrial RFID printers are designed for high-volume and rugged environments, while mobile RFID printers are portable and used for on-the-go printing applications.

Applications: RFID Label Printers are used across a range of industries and applications. Some common applications include inventory management, supply chain tracking, retail and apparel tagging, healthcare asset tracking, and access control. The ability to encode RFID tags while printing labels makes them invaluable in applications where tracking and tracing items are crucial.

Opportunities and Key Trends: The RFID Label Printers market continues to grow due to the increasing adoption of RFID technology across industries. Key trends include:

Integration with IoT: RFID Label Printers are increasingly being integrated with the Internet of Things (IoT) to enable real-time tracking and monitoring of assets and inventory. This integration enhances data visibility and analytics.

Customization and Flexibility: Customers are demanding more versatile and customizable RFID label printing solutions to meet specific needs. Manufacturers are responding by offering printers with greater flexibility in label design and encoding options.

Sustainability: Environmental concerns are driving the development of RFID Label Printers that are more energy-efficient and use eco-friendly materials. This aligns with the growing focus on sustainability in various industries.

Global Expansion: As RFID technology adoption continues to spread globally, there are opportunities for RFID Label Printer manufacturers to expand their presence in emerging markets and cater to the growing demand for RFID solutions.

The RFID Label Printers market's growth is intertwined with the broader adoption of RFID technology across industries, highlighting the critical role of these printers in enabling efficient data capture, tracking, and identification processes essential for modern businesses and organizations.

Market Dynamics:

Growing Adoption: The RFID Label Printers market is experiencing steady growth due to the increasing adoption of RFID technology across industries. This adoption is driven by the need for efficient inventory management, improved supply chain visibility, and enhanced asset tracking capabilities.

Regulatory Compliance: Regulatory requirements and industry standards, such as those in healthcare (e.g., UDI for medical devices) and retail (e.g., EPC Gen2 for apparel), are influencing the demand for RFID Label Printers as companies seek to comply with labeling and tracking mandates.

Products:

Desktop RFID Printers: These compact printers are suitable for low to medium-volume printing. They are commonly used in retail stores, offices, and small-scale warehouses for applications like price tagging and item tracking.

Industrial RFID Printers: Designed for high-volume and rugged environments, industrial RFID printers are favored in manufacturing, logistics, and distribution centers. They offer robust construction and high-speed printing capabilities to handle large-scale RFID labeling needs.

I recommend referring to our Stringent datalytics firm, industry publications, and websites that specialize in providing market reports. These sources often offer comprehensive analysis, market trends, growth forecasts, competitive landscape, and other valuable insights into this market.

By visiting our website or contacting us directly, you can explore the availability of specific reports related to this market. These reports often require a purchase or subscription, but we provide comprehensive and in-depth information that can be valuable for businesses, investors, and individuals interested in the market.

“Remember to look for recent reports to ensure you have the most current and relevant information.”

Click Here, To Get Free Sample Report: https://stringentdatalytics.com/sample-request/rfid-label-printers-market/1544/

Market Segmentations:

Global RFID Label Printers Market: By Company • Zebra • Toshiba • Honeywell • SATO • Printronix • Avery Dennison • Postek Global RFID Label Printers Market: By Type • Desktop RFID Printers • Industrial RFID Printers • Mobile RFID Printers Global RFID Label Printers Market: By Application • Industrial Application • Transportation & Logistics • Retail • Healthcare • Other Global RFID Label Printers Market: Regional Analysis All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global RFID Label Printers market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Click Here, To Buy Premium Report: https://stringentdatalytics.com/purchase/rfid-label-printers-market/1544/?license=single

Reasons to Purchase RFID Label Printers Market Report:

Market Understanding: Market reports offer a comprehensive overview of a specific industry or market segment, providing essential information about its current state, historical trends, and future projections. This knowledge is vital for making informed decisions.

Competitive Intelligence: Market reports often include detailed information about key players in the industry, their market shares, strategies, and strengths and weaknesses. This information can help you benchmark your business against competitors and identify opportunities for growth and improvement.

Market Size and Growth: Access data on the market's size, growth rate, and revenue projections. This information is crucial for assessing market potential, identifying emerging trends, and making strategic decisions.

Trends and Insights: Stay updated on the latest trends and developments in the industry. Reports provide insights into emerging technologies, consumer preferences, and market dynamics, helping you stay competitive.

Market Opportunities: Discover growth opportunities within the market, such as niche segments, emerging markets, or unmet customer needs. This insight can guide your business strategy and product/service offerings.

Risk Assessment: Identify potential risks and challenges in the market, including regulatory changes, market saturation, or economic fluctuations. Understanding these risks enables you to develop effective risk mitigation strategies.

Investment Decisions: If you are an investor or considering investment in a particular industry, a market report can provide essential data to support your investment decisions. It helps assess market attractiveness, growth potential, and ROI expectations.

Strategic Planning: Use the information from the report to develop or refine your business strategy. This includes identifying target markets, setting pricing strategies, and determining distribution channels based on market dynamics.

Customer Insights: Understand customer preferences, needs, and pain points within the market. This knowledge can guide product/service development, marketing campaigns, and customer engagement strategies.

Regulatory Compliance: Stay informed about relevant regulations and standards in the industry. Compliance is essential for ensuring that your business operates within legal boundaries.

Market Entry and Expansion: If you are considering entering a new market or expanding your existing presence, a market report can provide critical insights into market feasibility and potential barriers.

About US:

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client's needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs

Contact US:

Stringent Datalytics

Contact No - +1 346 666 6655

Email Id - [email protected]

Web - https://stringentdatalytics.com/

#RFID Label Printers Market#Overview Development and Outlook on Key Growth Trends#Factors and Forecast 2032

0 notes

Text

RFID Market Size, Share, Demand, Value & Future Scope: 2028

RFID Market, by Product Type (Tags, Readers, and Software and Services), Wafer Size, Tag Type (Passive Tags and Active Tags), Frequency, Applications, Form Factor, Material, and Region (North America, Europe, Asia-Pacific, Middle East and Africa and South America)

The global RFID Market size is projected to reach a CAGR of 10.9% from USD 10.7 billion in 2021, during the forecast period 2021-2028.

RFID referred to as Radio Frequency Identification is a technology, that uses radio waves to read and gather the information stored on a tag attached to an object, animal, or human. It is similar to bar codes and yet, it does not require to be within the range of an RFID reader. RFID is used across construction, engineering, chemical industries, manufacturing, retail, logistics, and the public sector among others.

Growing market competitiveness leading to availability of cost-effective RFID solutions, high returns on investment, increasing regulations and government initiatives for various industries, and increasing installation of RFID systems in manufacturing units are some of the factors that have supported long-term expansion for RFID Market.

Request for the Research Sample: https://www.delvens.com/get-free-sample/rfid-market-trends-forecast-till-2028

Regional Analysis

Americas is expected to register largest market share in terms of value for RFID tag market globally during the forecast period. The high adoption of RFID systems in the US is a major factor that has led to the prominent position of the Americas in the RFID market.

Key Players

Checkpoint Systems

Invengo

Smatrac

Avery Dennison

Alien Technology

NXP Semiconductors

Impinj

Mojix

Nedap

Zebra Technologies

Make an Inquiry Before Buying: https://www.delvens.com/Inquire-before-buying/rfid-market-trends-forecast-till-2028

Recent Developments

In September 2020, Avery Dennison introduced the AD-332u8 RAIN RFID inlay that excels in high density, close proximity conditions and can be used for inventory accuracy (item-level tagging) and supply chain management. AD-332u8 inlays are equipped with UCODE 8 chips from NXP, featuring 128 bits of EPC memory and a 96-bit Tag IDentifier (TID) with a 48-bit unique serial number factory-encoded into the TID. The new RAIN RFID inlay measures 70 x 14.5mm—the market’s smallest product that meets ARC category H specifications.

In September 2020, Avery Dennison launched its dual-technology AD-362r6-P inlay that combines item-level tracking and digital ID capabilities of a high-performance RAIN RFID (UHF) tag. This tag is suitable for a wide range of retail apparel products and applications with the secondary loss prevention functionality of an EAS tag. AD-362r6-P inlays are a unique dual-technology design incorporating a UHF RFID inlay and an electronic article surveillance (EAS) tag in a single die-cut label.

Reasons to Acquire

Increase your understanding of the market for identifying the best and suitable strategies and decisions on the basis of sales or revenue fluctuations in terms of volume and value, distribution chain analysis, market trends and factors

Gain authentic and granular data access for RFID Market so as to understand the trends and the factors involved behind changing market situations

Qualitative and quantitative data utilization to discover arrays of future growth from the market trends of leaders to market visionaries and then recognize the significant areas to compete in the future

In-depth analysis of the changing trends of the market by visualizing the historic and forecast year growth patterns

Direct Order for the Research Report: https://www.delvens.com/checkout/rfid-market-trends-forecast-till-2028

Report Scope

RFID Market is segmented into product type, wafer size, tag type, frequency, application, form factor, material and region.

On the basis of Product Type

Tags

Readers

Software and Services

On the basis of Wafer Size

8 inches

Others

On the basis of Tag Type

Active tags

Passive tags

On the basis of Frequency

Low Frequency

High Frequency

Ultra-high Frequency (UHF)

On the basis of Application

Agriculture

Commercial

Transportation

Healthcare

Logistics & Supply Chain

Aerospace

D��fense

Retail

Security and Access Control

Sports

Animal Tracking

Ticketing

On the basis of Form Factor

Card

Implant

Key Fob

Label

Paper Ticket

Band

Others

On the basis of Material

Plastic

Paper

Glass

Others

On the basis of Region

Asia Pacific

North America

Europe

South America

Middle East & Africa

About Us:

Delvens is a strategic advisory and consulting company headquartered in New Delhi, India. The company holds expertise in providing syndicated research reports, customized research reports and consulting services. Delvens qualitative and quantitative data is highly utilized by each level from niche to major markets, serving more than 1K prominent companies by assuring to provide the information on country, regional and global business environment. We have a database for more than 45 industries in more than 115+ major countries globally.

Delvens database assists the clients by providing in-depth information in crucial business decisions. Delvens offers significant facts and figures across various industries namely Healthcare, IT & Telecom, Chemicals & Materials, Semiconductor & Electronics, Energy, Pharmaceutical, Consumer Goods & Services, Food & Beverages. Our company provides an exhaustive and comprehensive understanding of the business environment.

Contact Us:

UNIT NO. 2126, TOWER B,

21ST FLOOR ALPHATHUM

SECTOR 90 NOIDA 201305, IN

+44-20-8638-5055

0 notes

Text

RFID Tags EPC Encoding service , RFID標籤EPC編碼服務 , METAsolution RFID Software Development Team

RFID 芯片通常由製造商提供,其出廠設置的 EPC 內存未使用樣本數據進行編程或編碼。 由於 RFID 標籤通常用於識別人、事物和事物,因此 EPC 必須被最終客戶端使用的標識符(客戶識別數據)覆蓋。 這就是 METAsolution RFID 軟件開發團隊提供 EPC 編程服務的原因。 除了 EPC 內存,我們還可以對 RFID 芯片的用戶內存(User Memory 如果有的話)進行編程。 編程可以由指定的、順序的或隨機的數據字符串組成。 #RFID #RFIDencoding #RFIDtags

RFID Tags EPC Encoding service , METAsolution RFID Software Development TeamRFID標籤EPC編碼服務 , METAs RFID 軟件開發團隊 —- METAs RFID Team METAsolution RFID Software Development METAs RFID 應用軟件開發團隊 RFID 芯片通常由製造商提供,其出廠設置��� EPC 內存未使用樣本數據進行編程或編碼。 由於 RFID 標籤通常用於識別人、事物和事物,因此 EPC 必須被最終客戶端使用的標識符(客戶識別數據)覆蓋。 這就是 METAsolution RFID 軟件開發團隊提供 EPC 編程服務的原因。 除了 EPC 內存,我們還可以對 RFID 芯片的用戶內存(User Memory…

View On WordPress

#RFID EPC 編碼#RFID EPC encoding#RFID 軟件#RFID 軟件開發#RFID software#RFID software Development#RFID tags encoding#RFID 標籤編碼

0 notes

Text

Barcode gs1

Key focus areas in retail include sustainability, data quality, compliance with regulatory requirements, traceability of products from their origin through delivery, and upstream integration between manufacturers and suppliers.Īs consumers continue to switch between in-store and e-commerce shopping channels, a consistent shopping experience, efficiency, safety and speed are expected. Today, GS1 operates in four retail sub-sectors on a global level: Apparel, Fresh Foods, CPG and General Merchandise. Retail was the first industry that GS1 began working with and has remained their primary focus.

Together they find and implement standards-based solutions to address common supply chain challenges. GS1 standards are developed and maintained through the GS1 Global Standards Management Process (GSMP), a community-based forum that brings together representatives from different industries and businesses. GS1 also acts as the secretariat for ISO's Automatic identification and data capture techniques technical committee ( ISO/IEC JTC 1/SC 31). Many GS1 standards are also ISO standards.

Global Shipment Identification Number (GSIN).

Global Service Relationship Number (GSRN).

Global Returnable Asset Identifier (GRAI).

Global Identification Number for Consignment (GINC).

Global Individual Asset Identifier (GIAI).

Global Data Synchronization Network (GDSN).

It identifies products uniquely around the world and forms the base of the GS1 system. The most influential GS1 standard is the GTIN. Some of the barcodes that GS1 developed and manages are: EAN/ UPC (used mainly on consumer goods), GS1 Data Matrix (used mainly on healthcare products), GS1-128, GS1 DataBar, and GS1 QR Code. In the UK alone, the introduction of the barcode in the retail industry has resulted in savings of 10.5 billion pounds per year. They have a crucial role in the retail industry - including today's online marketplaces -, moving beyond just faster checkout to improved inventory and delivery management and the opportunity to sell online on a global scale. They encode a product identification number that can be scanned electronically, making it easier for products to be tracked, processed, and stored.īarcodes improve the efficiency, safety, speed and visibility of supply chains across physical and digital channels. Barcodes īarcodes defined by GS1 standards are very common. Īug 2018 - GS1 Web URI Structure Standard is ratified allowing unique ID's to be added to products by storing a URI (a webpage-like address) as a QR code. Whilst "GS1" is not an acronym it refers to the organisation offering one global system of standards. īy 2005, the organisation was present in over 90 countries which started to use the name GS1 on a worldwide basis.

In 2004, EAN and UCC launched the Global Data Synchronization Network (GDSN), a global, internet-based initiative that enables trading partners to efficiently exchange product master data. In 1999, EAN and UCC launched the Auto-ID Centre to develop Electronic Product Code (EPC) enabling GS1 standards to be used for RFID. In 1990, EAN and UCC signed a global cooperation agreement and expanded overall presence to 45 countries. In 1977, the European Article Numbering Association (EAN) was established in Brussels and with founding members from 12 countries. In 1976, the original 12-digit code was expanded to 13 digits, which opened the doors for the identification system to be used outside the U.S. On 26 June 1974, a pack of Wrigley’s chewing gum became the first ever product with a barcode to be scanned in a shop. In 1973, the Universal Product Code (UPC) was selected by this group as the first single standard for unique product identification, and in 1974, the Uniform Code Council (UCC) was founded to administer the standard. The Ad Hoc Committee for a Uniform Grocery Product Identification Code was established to find a solution. In 1969, the retail industry in the US was searching for a way to speed up the check-out process in shops.

0 notes

Text

Labelview 8.6

#Labelview 8.6 how to#

#Labelview 8.6 serial#

#Labelview 8.6 full#

#Labelview 8.6 full#

The list of references with full details is included in section 11. The guideline does not provide guidance on the use of EPC/RFID technologies. GS1 Logistic Labels have always used GS1-128 barcodes, but this version of the guideline introduces the use of supplementary GS1 2D barcodes. Note: Carton / Outer Case Labels 1.2.3 Supported AIDC standardsĪutomatic Identification and Data Capture (AIDC) technology is an important component of the GS1 Logistic Label. However, notes have been included to explain how information may be provided on cartons and outer cases using a GS1-128 barcode. This guideline mainly addresses logistic labelling. It is important to note that such labels, when not containing an SSCC, are not considered to be GS1 Logistic Labels. The barcode may be an ITF-14, EAN/UPC, or when additional item data is needed, a GS1-128 barcode. Trade items such as cartons and outer cases will often have a barcode encoding the Global Trade Item Number (GTIN). 1.2.2 Labelling trade items such as cartons and outer cases Besides the SSCC other information can be included on the GS1 Logistic Label. Using the SSCC to identify individual units provides the opportunity to implement a wide range of applications such as cross docking, shipment routing, and automated receiving. Scanning the SSCC barcode on each logistic unit allows the physical movement of units to be matched with the electronic business messages that refer to them.

#Labelview 8.6 serial#

The only mandatory requirement is that each logistic unit must be identified with a unique serial number, the Serial Shipping Container Code (SSCC). The GS1 Logistic Label allows users to identify logistic units uniquely so that they can be tracked and traced throughout the supply chain. A logistic unit is an item of any composition established for transport and / or storage which needs to be managed throughout the supply chain. The main topic of this guideline is the labelling of logistic units. It is based on the GS1 Standards described in the GS1 General Specifications, and on best practices gathered in various implementation projects around the world.

#Labelview 8.6 how to#

This guideline provides guidance on how to physically identify logistic units using the GS1 Logistic Label. GS1 offers a standard to help accomplish this: The GS1 Logistic Label. The often complex logistics flows and the variety of involved parties imply there is a need for easy physical identification of logistic units. T&L processes involve a wide variety of parties such as consignor and consignee, freight forwarders and carriers as well as official bodies like customs and port authorities. The Transport & Logistics industry involves the movement of goods using multiple transport modes, including road, rail, air and maritime. The GS1 System is the most widely used supply chain standards system in the world and comprises the standards, guidelines, solutions and services created in formalised and collaborative processes.

0 notes

Text

Barcode Label Printer Market Competitive Strategy Analysis

Overview

The Global Barcode Label Printer Market is expected to reach USD 3,517.8 million by 2025 at a CAGR of 5.31% during the forecast period. Market Research Future (MRFR), in its report, envelops segmentation and drivers to provide a better glimpse of the market in the coming years. This printer is designed to print labels with barcodes or QR codes that are affixed on the outer packaging of the product. It stores and reads an international article number (EAN), a uniform product code (UPC), and codes used in mailing, accounting, and any other purpose when scanned by a barcode scanner. These printers either use direct thermal or thermal transfer printing technologies to print labels.

Competitive AnalysisADVERTISING

The key players of the global barcode label printer market are Avery Dennison Corporation (US), Dascom Holdings Ltd (China), OKI Electric Industry Co., Ltd (Japan), Printronix Auto Id Inc. (US), TSC Auto Id Technology Co., Ltd (Taiwan), Apogee Industries Inc. (US), Sato Holdings Corporation (Japan), Honeywell International Inc. (US), Zebra Technologies Corporation (US), Toshiba Tec Corporation (Japan), Canon Inc. ( Japan), and Fujitsu Ltd (Japan) among others.

In January 2020, Sato launched CL4NX Plus, a thermal industrial printer, which was developed due to increasing demand from various verticals such as automotive, retail, and manufacturing.

In October 2019, Avery Dennison Corporation launched a portable RFID label-printing device that allows the retailers to print, encode, and apply an EPC UHF RFID tag to a cargo package, product, or asset, which improves the efficiency of retailers in printing and affixing the labels.

Get Free Sample Copy Report of Barcode Label Printer Market @ https://www.marketresearchfuture.com/sample_request/9567

Segmental Analysis

The global barcode label printer market has been segmented based on product type, technology, resolution, end-user, and region.

Based on product type, the market has been segmented into an industrial printer, desktop printer, portable printer. The industrial printer segment accounted for the largest market share in 2018, with a higher market value. Industrial printers designed to handle any type of application, from commercial light-volume, need to rug. These printers are highly durable and capable of high-volume label printing. Desktop printers are flexible with USB, parallel, and serial connectivity interfaces. These printers are used for economic low-volume needs such as wristband printing to rugged, industry-grade printing requirements. Portable printers are used as labeling like shelf edge, pick and pack, and markdown. These are compact so easy to use, and thus they are widely used in retail outlets, warehouses, and in the transportation sector to enhance the productivity of processes.

Based on technology, the market has been classified into dot matrix, laser printing, thermal transfer, direct thermal, and inkjet. The direct thermal segment accounted for the largest market share in 2018, while laser printers are the fastest market segment. Direct thermal technology is suitable for indoor applications. It eliminates the need for ribbon, unlike thermal transfer printing. Thermal transfer technology is preferred over direct thermal printing. It provides improved image quality. Inkjet printing drives onto printing paper, creating a digital recreation of an image. This printing is suitable for high quality small as well as large font codes. Laser printing used to produce high-quality text and graphics. It can print more than one barcode label at a time using a sheet of labels. Dot-matrix is made of hammers and ribbons to create an impact on paper. These printers are used to print bar code labels in low resolution or pixel density.

Based on the resolution, the market is segmented into three sub-segments below 300 DPI, between 301 to 600 DPI, and above 600 DPI. The 300dpi segment accounted for the largest market share in 2018. It is expected to register the highest CAGR during the forecast period. 300dpi is standard print resolution, which is used to print large barcodes such as shipping labels. Between 301 to 600 DPI gives the result of fine print resolution. It provides better quality as compared to low-resolution printers. Above 600 DPI create sharp barcode labels, used for small text, intricate graphics, high-resolution barcode labels. These printers are more expensive than others.

Based on end-user, barcode label printers have applications in manufacturing, transportation & logistics, retail, government, and healthcare sectors in their day-to-day operations. The manufacturing segment accounted for the largest market share in 2018. The transportation & logistics segment was the second-largest market in 2018. Manufacturers keep printers in the workstations on the factory floor. Manufacturers trace the products and monitor the supply chain process through barcodes. It provides precise timing, tracking, and consistency to the logistic process. In retail, the barcode label accelerates several retail processes, thereby saving time and enhancing the customer experience in stores. It helps to create barcode labels for patient ID tracking, hospital admission, hospital nursery monitoring, specimen/blood labeling, medication tracking, and staff ID & access control.

The global barcode label printer market segmented into Europe, Asia-Pacific, North America, Middle East & Africa, South America. Europe accounted for the largest market share of 32.21% in 2018, with a market value of USD 799.6 million; it is expected to register a CAGR of 5.35% during the forecast period. Asia-Pacific was the second-largest market in 2018, valued at USD 727.2 million; it is projected to register the highest CAGR of 6.90%.

Access Report Details @ https://www.marketresearchfuture.com/reports/barcode-label-printer-market-9567

About Market Research Future:

At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Edibles.

MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions.

In order to stay updated with technology and work process of the industry, MRFR often plans & conducts meet with the industry experts and industrial visits for its research analyst members.

Contact:

Market Research Future

528, Amanora Chambers, Magarpatta Road, Hadapsar

Pune – 411028, Maharashtra, India

Email: [email protected]

0 notes

Text

ColorMax Printing manufactures RFID cards using best material at factory cost

RFID stands for Radio-Frequency IDentification. The acronym refers to small electronic devices that consist of a small chip and an antenna. The chip typically is capable of carrying 2,000 bytes of data or less.

The RFID device serves the same purpose as a bar code or a magnetic strip on the back of a credit card or ATM card; it provides a unique identifier for that object. And, just as a bar code or magnetic strip must be scanned to get the information, the RFID device must be scanned to retrieve the identifying information.

RFID Works Better Than Barcodes

A significant advantage of RFID devices over the others mentioned above is that the RFID device does not need to be positioned precisely relative to the scanner. We’re all familiar with the difficulty that store checkout clerks sometimes have in making sure that a barcode can be read. And obviously, credit cards and ATM cards must be swiped through a special reader. In contrast, RFID devices will work within a few feet (up to 20 feet for high-frequency devices) of the scanner. For example, you could just put all of your groceries or purchases in a bag, and set the bag on the scanner. It would be able to query all of the RFID devices and total your purchase immediately. (Read a more detailed article on RFID compared to barcodes.)

RFID technology has been available for more than fifty years. It has only been recently that the ability to manufacture the RFID devices has fallen to the point where they can be used as a “throwaway” inventory or control device. Alien Technologies recently sold 500 million RFID tags to Gillette at a cost of about ten cents per tag.

One reason that it has taken so long for RFID to come into common use is the lack of standards in the industry. Most companies invested in RFID technology only use the tags to track items within their control; many of the benefits of RFID come when items are tracked from company to company or from country to country.

For many of us, using a key to start a car, a card to access a building or room, using ski lifts on a winter sports holiday and validating a bus or underground ticket have become part of our daily routine. Without always realising it, we use automatic data capture technology that relies on radio-frequency electromagnetic fields. This technology is known as Radio-Frequency IDentification or RFID.

Just as people use RFID as they go about their daily lives, objects also use this technology, as they transit from manufacture to storage and finally the point of sale. Like us, they also carry RFID tags. The difference between objects and ourselves is that they don’t “voluntarily” present their RFID tag or card when asked. These tags are therefore read in very different conditions and often require greater detection distances.

RFID (Radio Frequency Identification) can be defined as follows: Automatic identification technology which uses radio-frequency electromagnetic fields to identify objects carrying tags when they come close to a reader.

However, RFID cannot be reduced to one technology. RFID uses several radio frequencies and many types of tag exist with different communication methods and power supply sources. RFID tags generally feature an electronic chip with an antenna in order to pass information onto the interrogator (also known as a base station or more generally, reader). The assembly is called an inlay and is then packaged to be able to withstand the conditions in which it will operate. This finished product is known as a tag, label or transponder. The information contained within an RFID tag’s electronic chip depends on its application. It may be a unique identifier (UII, Unique Item Identifier or EPC code, Electronic Product Code, etc.). Once this identifier has been written into the electronic circuit, it can no longer be modified, only read. (This principle is called WORM Write Once Read Multiple). Some electronic chips have another memory in which users can write, modify and erase their own data. These memories vary in size from a few bits to tens of kilobits.

Zebra’s passive RFID card provides advanced sensitivity for enhanced read rates and range. It offers full read/write capabilities, and you can use it worldwide with any EPC UHF operational band. The Zebra UHF RFID Cards contains Zebra’s patent-pending antenna design and Impinj’s state-of-the-art Monza 4QT chip.

These Zebra UHF Cards work well for applications like employee ID cards, student and faculty ID cards, access control cards, membership and loyalty cards, personalized gift cards, visitor ID cards, and government licenses.

ISO/IEC-7810-2002 compliant.

Zebra’s patent-pending inlay antenna design.

Passive operation (no battery required).

Ultrahigh-frequency technology.

Multi-application card available with and without magnetic stripe.

UHF RFID CARDS

Thickness: 30mil/0.76mm

50pcs

$119

Printing Encoding Order

100pcs

$189

Printing Encoding Select

500pcs

$749

Printing Encoding Select

1000pcs

$1399

Printing Encoding Select

Source: ColorMax Printing manufactures RFID cards using best material at factory cost

Need repost your products or artices, click Here

0 notes

Text

Huge Growth And Opportunities in Global Barcode Label Printer Market Till 2025

The Global Barcode Label Printer Market is expected to reach USD 3,517.8 million by 2025 at a CAGR of 5.31% during the forecast period. Market Research Future (MRFR), in its report, envelops segmentation and drivers to provide a better glimpse of the market in the coming years. This printer is designed to print labels with barcodes or QR codes that are affixed on the outer packaging of the product. It stores and reads an international article number (EAN), a uniform product code (UPC), and codes used in mailing, accounting, and any other purpose when scanned by a barcode scanner. These printers either use direct thermal or thermal transfer printing technologies to print labels.

Access Report Details @ https://www.marketresearchfuture.com/reports/barcode-label-printer-market-9567

Competitive Analysis

The key players of the global barcode label printer market are Avery Dennison Corporation (US), Dascom Holdings Ltd (China), OKI Electric Industry Co., Ltd (Japan), Printronix Auto Id Inc. (US), TSC Auto Id Technology Co., Ltd (Taiwan), Apogee Industries Inc. (US), Sato Holdings Corporation (Japan), Honeywell International Inc. (US), Zebra Technologies Corporation (US), Toshiba Tec Corporation (Japan), Canon Inc. ( Japan), and Fujitsu Ltd (Japan) among others.

In January 2020, Sato launched CL4NX Plus, a thermal industrial printer, which was developed due to increasing demand from various verticals such as automotive, retail, and manufacturing.

In October 2019, Avery Dennison Corporation launched a portable RFID label-printing device that allows the retailers to print, encode, and apply an EPC UHF RFID tag to a cargo package, product, or asset, which improves the efficiency of retailers in printing and affixing the labels.

Segmental Analysis

The global barcode label printer market has been segmented based on product type, technology, resolution, end-user, and region.

Based on product type, the market has been segmented into an industrial printer, desktop printer, portable printer. The industrial printer segment accounted for the largest market share in 2018, with a higher market value. Industrial printers designed to handle any type of application, from commercial light-volume, need to rug. These printers are highly durable and capable of high-volume label printing. Desktop printers are flexible with USB, parallel, and serial connectivity interfaces. These printers are used for economic low-volume needs such as wristband printing to rugged, industry-grade printing requirements. Portable printers are used as labeling like shelf edge, pick and pack, and markdown. These are compact so easy to use, and thus they are widely used in retail outlets, warehouses, and in the transportation sector to enhance the productivity of processes.

Based on technology, the market has been classified into dot matrix, laser printing, thermal transfer, direct thermal, and inkjet. The direct thermal segment accounted for the largest market share in 2018, while laser printers are the fastest market segment. Direct thermal technology is suitable for indoor applications. It eliminates the need for ribbon, unlike thermal transfer printing. Thermal transfer technology is preferred over direct thermal printing. It provides improved image quality. Inkjet printing drives onto printing paper, creating a digital recreation of an image. This printing is suitable for high quality small as well as large font codes. Laser printing used to produce high-quality text and graphics. It can print more than one barcode label at a time using a sheet of labels. Dot-matrix is made of hammers and ribbons to create an impact on paper. These printers are used to print bar code labels in low resolution or pixel density.

Based on the resolution, the market is segmented into three sub-segments below 300 DPI, between 301 to 600 DPI, and above 600 DPI. The 300dpi segment accounted for the largest market share in 2018. It is expected to register the highest CAGR during the forecast period. 300dpi is standard print resolution, which is used to print large barcodes such as shipping labels. Between 301 to 600 DPI gives the result of fine print resolution. It provides better quality as compared to low-resolution printers. Above 600 DPI create sharp barcode labels, used for small text, intricate graphics, high-resolution barcode labels. These printers are more expensive than others.

Based on end-user, barcode label printers have applications in manufacturing, transportation & logistics, retail, government, and healthcare sectors in their day-to-day operations. The manufacturing segment accounted for the largest market share in 2018. The transportation & logistics segment was the second-largest market in 2018. Manufacturers keep printers in the workstations on the factory floor. Manufacturers trace the products and monitor the supply chain process through barcodes. It provides precise timing, tracking, and consistency to the logistic process. In retail, the barcode label accelerates several retail processes, thereby saving time and enhancing the customer experience in stores. It helps to create barcode labels for patient ID tracking, hospital admission, hospital nursery monitoring, specimen/blood labeling, medication tracking, and staff ID & access control.

The global barcode label printer market segmented into Europe, Asia-Pacific, North America, Middle East & Africa, South America. Europe accounted for the largest market share of 32.21% in 2018, with a market value of USD 799.6 million; it is expected to register a CAGR of 5.35% during the forecast period. Asia-Pacific was the second-largest market in 2018, valued at USD 727.2 million; it is projected to register the highest CAGR of 6.90%

Free Report Sample @ https://www.marketresearchfuture.com/sample_request/9567

0 notes

Text

Barcode Label Printer Market Global Opportunities, Sales Revenue, Emerging Technologies, Competitive Landscape, Key Players Analysis and Trends by Forecast 2025

Overview

The Global Barcode Label Printer Market is expected to reach USD 3,517.8 million by 2025 at a CAGR of 5.31% during the forecast period. Market Research Future (MRFR), in its report, envelops segmentation and drivers to provide a better glimpse of the market in the coming years. This printer is designed to print labels with barcodes or QR codes that are affixed on the outer packaging of the product. It stores and reads an international article number (EAN), a uniform product code (UPC), and codes used in mailing, accounting, and any other purpose when scanned by a barcode scanner. These printers either use direct thermal or thermal transfer printing technologies to print labels. Access Report Details @ https://www.marketresearchfuture.com/reports/barcode-label-printer-market-9567

Competitive Analysis

The key players of the global barcode label printer market are Avery Dennison Corporation (US), Dascom Holdings Ltd (China), OKI Electric Industry Co., Ltd (Japan), Printronix Auto Id Inc. (US), TSC Auto Id Technology Co., Ltd (Taiwan), Apogee Industries Inc. (US), Sato Holdings Corporation (Japan), Honeywell International Inc. (US), Zebra Technologies Corporation (US), Toshiba Tec Corporation (Japan), Canon Inc. ( Japan), and Fujitsu Ltd (Japan) among others.

In January 2020, Sato launched CL4NX Plus, a thermal industrial printer, which was developed due to increasing demand from various verticals such as automotive, retail, and manufacturing.

In October 2019, Avery Dennison Corporation launched a portable RFID label-printing device that allows the retailers to print, encode, and apply an EPC UHF RFID tag to a cargo package, product, or asset, which improves the efficiency of retailers in printing and affixing the labels.

Segmental Analysis

The global barcode label printer market has been segmented based on product type, technology, resolution, end-user, and region.

Based on product type, the market has been segmented into an industrial printer, desktop printer, portable printer. The industrial printer segment accounted for the largest market share in 2018, with a higher market value. Industrial printers designed to handle any type of application, from commercial light-volume, need to rug. These printers are highly durable and capable of high-volume label printing. Desktop printers are flexible with USB, parallel, and serial connectivity interfaces. These printers are used for economic low-volume needs such as wristband printing to rugged, industry-grade printing requirements. Portable printers are used as labeling like shelf edge, pick and pack, and markdown. These are compact so easy to use, and thus they are widely used in retail outlets, warehouses, and in the transportation sector to enhance the productivity of processes.

Based on technology, the market has been classified into dot matrix, laser printing, thermal transfer, direct thermal, and inkjet. The direct thermal segment accounted for the largest market share in 2018, while laser printers are the fastest market segment. Direct thermal technology is suitable for indoor applications. It eliminates the need for ribbon, unlike thermal transfer printing. Thermal transfer technology is preferred over direct thermal printing. It provides improved image quality. Inkjet printing drives onto printing paper, creating a digital recreation of an image. This printing is suitable for high quality small as well as large font codes. Laser printing used to produce high-quality text and graphics. It can print more than one barcode label at a time using a sheet of labels. Dot-matrix is made of hammers and ribbons to create an impact on paper. These printers are used to print bar code labels in low resolution or pixel density.

Based on the resolution, the market is segmented into three sub-segments below 300 DPI, between 301 to 600 DPI, and above 600 DPI. The 300dpi segment accounted for the largest market share in 2018. It is expected to register the highest CAGR during the forecast period. 300dpi is standard print resolution, which is used to print large barcodes such as shipping labels. Between 301 to 600 DPI gives the result of fine print resolution. It provides better quality as compared to low-resolution printers. Above 600 DPI create sharp barcode labels, used for small text, intricate graphics, high-resolution barcode labels. These printers are more expensive than others.

Based on end-user, barcode label printers have applications in manufacturing, transportation & logistics, retail, government, and healthcare sectors in their day-to-day operations. The manufacturing segment accounted for the largest market share in 2018. The transportation & logistics segment was the second-largest market in 2018. Manufacturers keep printers in the workstations on the factory floor. Manufacturers trace the products and monitor the supply chain process through barcodes. It provides precise timing, tracking, and consistency to the logistic process. In retail, the barcode label accelerates several retail processes, thereby saving time and enhancing the customer experience in stores. It helps to create barcode labels for patient ID tracking, hospital admission, hospital nursery monitoring, specimen/blood labeling, medication tracking, and staff ID & access control.

The global barcode label printer market segmented into Europe, Asia-Pacific, North America, Middle East & Africa, South America. Europe accounted for the largest market share of 32.21% in 2018, with a market value of USD 799.6 million; it is expected to register a CAGR of 5.35% during the forecast period. Asia-Pacific was the second-largest market in 2018, valued at USD 727.2 million; it is projected to register the highest CAGR of 6.90%.

About Market Research Future: At Market Research Future (MRFR), we enable our customers to unravel the complexity of various industries through our Cooked Research Report (CRR), Half-Cooked Research Reports (HCRR), Raw Research Reports (3R), Continuous-Feed Research (CFR), and Market Research & Consulting Edibles. MRFR team have supreme objective to provide the optimum quality market research and intelligence services to our clients. Our market research studies by products, services, technologies, applications, end users, and market players for global, regional, and country level market segments, enable our clients to see more, know more, and do more, which help to answer all their most important questions. In order to stay updated with technology and work process of the industry, MRFR often plans & conducts meet with the industry experts and industrial visits for its research analyst members. Contact: Market Research Future 528, Amanora Chambers, Magarpatta Road, Hadapsar Pune – 411028, Maharashtra, India Email: [email protected]

0 notes

Text

Radio-Frequency Identification (RFID) in Pharmaceuticals Market will Register a CAGR of 10% through 2029

Future Market Insights (FMI), in its new study, finds that the radio-frequency identification (RFID) in pharmaceuticals market was valued at over US$ 950 Mn in 2018, and is estimated to register a Y-o-Y growth at approximately 10% in 2019. Prospects remain remarkable for the RFID in pharmaceuticals industry, as efficiency-led actions of players continue to enhance the reliability and accuracy of their business operations.

The study finds that drug tracing system remains the most lucrative application of RFID in pharmaceutical industry, accounting for approximately 60% sales. Efforts of the FDA, in collaboration with pharmaceutical suppliers, to maintain a secure drug supply in the wake of rising counterfeit drugs prevalence, has encouraged the pharmaceutical industry to use RFID in combination with the electronic product code (EPC) for real-time tracking, tracing, and authentication of drugs.

According to the study, such preventative measures against infiltration of counterfeit drugs are likely to have a positive economic influence on legitimate companies, who are now focusing on the deployment of anti-counterfeiting solutions. Focus of the organized players in the pharmaceutical sector to safeguard authenticity of their products, while creating moats for counterfeiters, will continue to favour growth of the RFID in pharmaceutical market.

Chipless RFID Sales Remain Over 2X of Chipped RFID

According to the study, chipless RFIDs continue to gain robust attractiveness in the pharmaceutical industry, as they eliminate the hardware-related challenges associated with their chipped counterparts. Additionally, RFIDs without ICs allude at significant cost reduction of the component, in turn complementing their development and demand on a wide scale. However, complexities linked with designing and development of chipless RFID, such as data transmission and encoding, continue to sustain the demand for the chipped RFID to a certain extent. The study finds that sales of chipless RFID will remain over 2X that of the chipped RFID in 2019.

The study expects RFID reader to remain the core component in the RFID in pharmaceutical market, with growing focus of pharma suppliers on effective identification of products prior to their collection, storage and shipping. Gains in the RFID in pharmaceutical market will remain complemented by sales of RFID tags, with revenues in 2018 accounting for over one-third market share.

Adoption Remains High among Drug Manufacturers

Application diversity of RFID in pharmaceutical industry has led its adoption among a wide range of end-users that range from drug manufacturers and drug wholesalers, to hospitals and clinics. The report estimates drug manufacturers to account for leading shares of the RFID in pharmaceutical market, who are constantly emphasizing on ensuring the authenticity of their products in the market. Adoption is expected to witness high-growth among drug wholesalers and hospitals and clinics, which collectively account for over two-fifth share of the market.

The study states that North America will remain the leading market for RFID in pharmaceutical, with Europe following the suit. Supremacy of developed economies in the RFID in pharmaceutical market is significantly attributed to stringent standards & regulations implemented for serialization, and relative greater prevalence of OTC and generic drugs in these regions. Additionally, focus of players in developed markets remains strong on brand protection, and preventing packaging-related product recalls, which in turn augurs well for growth of the RFID in pharmaceutical market.

Press Release Source: https://www.prnewswire.com/news-releases/rfid-in-pharmaceuticals-market-is-projected-to-expand-at-a-cagr-of-approximately-9-0-during-the-forecast-period-2018-to-2028--future-market-insights-300848683.html

More from FMI’s Electronics, Semiconductors, and ICT Market Intelligence:

· Connected Logistics Market

· Workstation Market

· Call Centre Market

About Future Market Insights (FMI)

Future Market Insights (FMI) is a leading provider of market intelligence and consulting services, serving clients in over 150 countries. FMI is headquartered in London, the global financial capital, and has delivery centers in the U.S. and India. FMI’s largest market research reports and industry analysis help businesses navigate challenges and take critical decisions with confidence and clarity amidst breakneck competition.

Contact

Mr. Abhishek Budholiya

Unit No: AU-01-H Gold Tower (AU), Plot No: JLT-PH1-I3A,

Jumeirah Lakes Towers, Dubai,

United Arab Emirates

MARKET ACCESS DMCC Initiative

For Sales Enquiries: [email protected]

For Media Enquiries: [email protected]

Future Market Insights

0 notes

Text

METAs HF RFID on Metal NFC Tag , 適用於金屬表面的 NFC 高頻 RFID標籤

METAs HF RFID on Metal NFC Tag , 適用於金屬表面的 NFC 高頻 RFID標籤

METAs HF RFID on Metal NFC Tag , 適用於金屬表面的 NFC 高頻 RFID標籤 METAs RFID tag METAs HF RFID on Metal NFC Tag / 適用於金屬表面的 NFC 高頻 RFID標籤 Chip 芯片NXP ICODE SLIXMemory 記憶體EEPROM : 1024 bits# of Blocks : 28Bytes per block : 4 byte28 x 4 x 8 = 896 bitsUID : 64 bitsCRC : 16 bitsPassword : 32 bitsPW identifier : 8 bitsIC Mfg code : 8 bitsEncoding options編碼選項EPC memory encoding — NOUser memory encoding — NOEPC…

View On WordPress

0 notes

Text

Máy in tem nhãn Zebra ZT410 giá rẻ - Máy in Zebra ZT410

Máy in tem nhãn Zebra ZT410 giá rẻ Long An, Hà Nội, TP.HCM. Tính năng kỹ thuật và ứng dụng máy in tem nhãn Zebra ZT410 ?

Bạn cần mua máy in tem nhãn mã vạch công nghiệp ZT410, máy in mã vạch công nghiệp ZT410, máy in tem barcode Zebra ZT410 hay máy in tem nhãn Zebra ZT410 203dpi, 300dpi và 600dpi. Hãy liên hệ Cty Vinh An Cư. Alo Mr.Vinh: 0914.175.928 >>> Tư vấn và báo giá tốt nhất !

Máy in tem nhãn Zebra ZT410 độ phân giải: 203dpi, 300dpi, 600dpi

Máy in mã vạch hiệu Zebra ZT410

Máy in tem nhãn Zebra ZT410 dòng máy in mã vạch có cấu hình mạnh mẽ với bộ nhớ 512MB Flash 256MB DRAM, in chiều rộng lên đến 104mm và đạt tốc độ 356mm/s. Máy in tem nhãn Zebra ZT410 được tích hợp cổng giao tiếp tiêu chuẩn kết nối USB và Ethernet ngay sẵn trên thân máy được lắp ngay phía sau, đem lại lợi ích cho khách hàng khi chia sẻ thực hiện lệnh in trong cùng một hệ thống mạng mà không bị phụ thuộc cố định vào vị trí như khi kết nối cổng USB. Không những vậy, máy in tem nhãn Zebra ZT410 có thiết kế trực quan như nút nhấn và màn hình LCD để giúp khách hàng hiệu chỉnh các thông số kỹ thuật khi không cần thiết phải chỉnh trên driver của máy.

Tính năng kỹ thuật máy in tem nhãn Zebra ZT410:

Model

ZEBRA ZT410

Công nghệ in

In nhiệt trực tiếp / in nhiệt qua ribbon mực

Tốc độ in (max)

14 ips (356mm / sec)

Độ phân giải

203 dpi / 8 dots per mm

300 dpi / 12 dots per mm

600 dpi / 24 dots per mm (Only ZT410 model)

Bộ nhớ

512 MB flash (64 MB user-available)

256 MB RAM (4 MB user-available)

Chiều rộng in

104mm

Khổ giấy

110mm

Bảng điều khiển

Black-kit, multiline graphic LCD display with intuitive menu and easy-to-use keypad for quick operation

Giao tiếp hệ thống

• USB 2.0 and RS-232 serial ports / Parallel (Option) /

• Wireless 802.11 a/b/g/n (option)

RFID

• Supports tags compatible with UHF EPC Gen 2 V1.2/ ISO 18000-6C

• Prints and encodes tags with a minimum pitch of 0.6"/16 mm

Kích thước máy

269 (W) x 495 (D) x 324 (H) mm

In mã vạch

Linear Barcodes: Code 11, Code16k, Code 39,

Code 93, Code 128 with subsets A/B/C and UCC

Case C Codes, UPC-A, UPC-E, EAN-8, EAN-13, UPC

and EAN 2 or 5 digit extensions, Plessey, Postnet,

Standard 2-of-5, Industrial 2-of-5, Interleaved 2-of-5,

Logmars, MSI, Codabar, Planet Code

• 2-Dimensional: Codablock, PDF417, Code 49,

Data Matrix, MaxiCode, QR Code, MicroPDF417,

TLC 39, GS1 DataBar (RSS), Aztec

Ứng dụng máy in tem nhãn Zebra ZT410.

+ In mã vạch cho chuỗi cửa hàng

+ In mã vạch cho hệ thống siêu thị

+ In mã vạch công nghiệp sản xuất

Máy in tem nhãn Zebra ZT410

Với chiều rộng in của 4 inch, máy in tem nhãn Zebra ZT410 có in tốc độ lên tới 14 ips và cung cấp độ phân giải cao (600 dpi) in ấn cho các ứng dụng nhỏ nhãn.

Máy in tem nhãn Zebra ZT410 dùng trong công nghiệp

o Chế tạo

o Giao thông vận tải & Logistics

o Bán lẻ

o Chăm sóc sức khỏe

o Quản lý tài sản

o Quản lý hàng tồn kho

o Theo dõi mẫu

o Tiếp nhận / Vận Chuyển

o Logistics

o Nhãn mác

o Nhãn thông tin

o Ghi nhãn mác thuốc

o Ghi nhãn theo thứ tự

o Quản lý chất lượng

Bán máy in tem nhãn Zebra ZT410 tại Bình Dương, máy in Zebra ZT420 Tây Ninh, Máy in mã vạch Zebra ZT230 Long An, Máy in nhãn Zebra ZT420 Cần Thơ, Máy in tem Zebra 105SL TP HCM, Máy in tem Zebra ZT410 Đồng Nai, Máy in tem nhãn Zebra ZT410 203DPI Nhơn Trạch, Máy in tem Zebra ZT410 600DPI Ninh Thuận, Máy in tem nhãn Zebra ZT410 300DPI Bình Thuận, Hải Phòng, Máy in tem Zebra Lạng Sơn, Máy in nhãn Zebra Lào Cai, mua máy in Zebra Hà Giang, giá bán máy in Zebra Bắc Giang, tìm mua máy in Zebra Hà Nội, nơi bán máy in Zebra Đà Nẵng…

Máy in tem nhãn Zebra ZT410 là một sự lựa chọn tối ưu trong hệ thống in ấn tem nhãn, tốc độ cực nhanh, bề rộng khổ in lớn sẽ giải quyết mọi vấn đề in ấn tem nhãn cho các bạn. Liên hệ Cty Vinh An Cư các bạn sẽ được giá máy in tốt nhất, giao hàng tận nơi, lắp đặt miễn phí. Alo ngay Mr.Vinh: 0914.175.928

0 notes

Text

SLP-TX400R RFID Printer is compatible with UHF EPC Class 1, Gen 2 RFID labels.

SLP-TX400R RFID Printer is suitable for retail, hospitality, warehousing and logistics applications. Unit provides printing and encoding speed of 7 IPS for 203 dpi printing and direct thermal and thermal transfer printing at 203 dpi and 300 dpi printing resolution. Printer includes USB, Ethernet and serial interfaces. Product can automatically detect media type such as gap media, black mark media and short length media paper using Smart Media Detection™ feature. This story is related to the following: Computer Hardware & Peripherals Labels Tags Signage & Equipment Search for suppliers of: Label Printers | Radio Frequency Identification (RFID) Printers from HVAC /fullstory/slp-tx400r-rfid-printer-is-compatible-with-uhf-epc-class-1-gen-2-rfid-labels-40009413 via http://www.rssmix.com/

0 notes