#Radio Frequency (RF) Front End Module Market

Explore tagged Tumblr posts

Text

Futuristic Perspective: RF Front End Module Market Targeting US$ 33 Billion by 2033

The size of the worldwide radio frequency front end module market is anticipated to surge at a CAGR of 6.9% from 2023 to 2033. It is anticipated that its valuation will increase from US$ 17.0 billion in 2023 to US$ 33.0 billion by 2033.

Demand for technologically advanced products in the weapons of both domestic and foreign armed forces is anticipated to support growth in the global market. Military budgets of both industrialized and emerging nations are rising steadily. Military applications for radio frequency and aircraft carriers, along with drones and autonomous vehicles, are predicted to expand.

Hence, each central server for wireless and mobile infrastructure must contain radio frequency power amplifiers (PA), which are essential. They are a few of the most expensive sub-assembly components found in modern infrastructure gear.

Radiofrequency semiconductors used in these power amplifiers and generative adversarial networks (GaN), must adjust to the financial and technological challenges that are faced by producers and users of radio frequency power amplifiers. During the forecast period, it is predicted that these factors will increase demand for distinctive radio frequency front end designs.

Get Your Sample Report: https://www.futuremarketinsights.com/reports/sample/rep-gb-16740

Modern mobile devices contain radio frequency front-end modules that transform data from baseband signals with near-zero frequencies into radio signals. These can be sent or received wirelessly. Consequently, radio frequency front-end modules are frequently employed in smartphones.

Compared to other components, the radio frequency front-end module aids in faster and more reliable data transfer in 3G, 4G, 4G LTE, and 5G technologies. Radiofrequency front-end modules are widely used in personal computers, tablets, wearable technology, the industrial internet of things, and mobile broadband.

Key Takeaways from Radio Frequency Front End Module Market Study:

The USA radio frequency front end module market is expected to be valued at US$ 5.5 billion by 2033.

China radio frequency front end module market is projected to reach a valuation of US$ 8.4 billion by 2033.

Japan radio frequency front end module market is set to create an incremental opportunity of US$ 2.6 billion in the evaluation period.

South Korea radio frequency front end module market is likely to reach US$ 2.0 billion by 2033.

Based on connectivity, the Wi-Fi category is anticipated to register a CAGR of 6.7% in the forecast period.

“Radio frequency front end modules are frequently employed in military applications. For instance, high-power tactical and military communication radios frequently employ GaN-powered radio frequency front end modules. These radios operate at up to 2.6 GHz of frequency. High demand for military equipment worldwide would spur radio frequency front end module sales,” says a lead analyst at Future Market Insights.

Access Full Report: https://www.futuremarketinsights.com/reports/radio-frequency-front-end-module-market

Competitive Landscape: Radio Frequency Front End Module Market

The worldwide market is extremely fragmented as a result of fierce rivalry. Due to growing innovation, partnerships, and mergers, the industry is predicted to experience high competition throughout the expected period.

A few renowned companies in the global radio frequency front end module market included in the report are STMicroelectronics N.V., Infineon Technologies, Texas Instruments Incorporated, NXP Semiconductors N.V., Broadcom Inc., Qualcomm, Qorvo Inc., Taiyo Yuden Co. Ltd., Murata Manufacturing Co. Ltd., Teradyne Inc., Skyworks Solutions Inc., and TDK Corporation among others.

For instance,

In September 2021, Murata Manufacturing, a Japan-based semiconductor manufacturer, announced that they have acquired Eta Wireless Incorporation. It is a Massachusetts-based semiconductor company. The reason behind this acquisition is to work on a new technology that can reduce power consumption of radio frequency circuits that are used in wireless communication. Digital envelope tracking technology developed by Eta Wireless Incorporation optimizes voltage of the radio frequency circuit.

In October 2019, Murata Manufacturing Company Limited announced that they have partnered with Resonant Incorporation, a California-based radio frequency manufacturer. This partnership is expected to allow Murata to use multiple designs of Resonant Incorporation’s XBAR technology. Also, Murata has done a strategic investment of US$ 7 million in Resonant Inc. The XBAR technology is expected to offer high frequency and superior performance, especially in 5G filters.

Get More Valuable Insights into Radio Frequency Front End Module Market

Future Market Insights, in its new offering, provides an unbiased analysis of the radio frequency front end module market presenting historical demand data (2018 to 2022) and forecast statistics for the period from 2023 to 2033. The study incorporates compelling insights on the radio frequency front end module market based on component (radio frequency switches, low noise amplifiers, power amplifiers, radio frequency filters), mounting style (through-hole, surface mount device/surface-mount technology), connectivity (Wi-Fi, Bluetooth, ZigBee), cellular technology (3G, 4G, 5G), frequency (less than 2.5 GHz, 2.5GHz to 3.5GHz, above 3.5GHz to 5GHz), application (smartphones, personal computer, tablets, wearables, industrial internet of things, mobile broadband), end-use industry (consumer electronics, automotive, military & defense, medical), and region.

Inquire for a Discount on this Premium Report: https://www.futuremarketinsights.com/ask-question/rep-gb-16740

Radio Frequency Front End Module Market Outlook by Category

By Application:

Smartphones

Tablets

Wearables

Personal Computer

Industrial Internet of Things

Mobile Broadband

Others

By Components:

Radio Frequency Switches

Low Noise Amplifiers

Power Amplifiers

Radio Frequency Filters

By Mounting Style:

Through Hole

Surface Mount Device/Surface-mount Technology

By Connectivity:

Wi-Fi

Wi-Fi 5,

Wi-Fi 6/6E

Others

Bluetooth

ZigBee

Others

By Cellular Technology:

3G

4G

5G

Others

By Frequency:

Less than 2.5 GHz

2.5 to 3.5 GHz

Above 3.5 GHz to 5 GHz

Others

By End-use Industry:

Consumer Electronics

Automotive

Military and Defense

Medical

Others

By Region:

North America

Europe

Asia Pacific

Latin America

Middle East & Africa

0 notes

Text

5G Radio Frequency Front End Module Market: Emerging Applications and End-User Demand 2025-2032

MARKET INSIGHTS

The global 5G Radio Frequency Front End Module Market size was valued at US$ 4,830 million in 2024 and is projected to reach US$ 9,740 million by 2032, at a CAGR of 10.2% during the forecast period 2025-2032. This growth is fueled by rapid 5G network deployments worldwide, with China leading the charge by accounting for over 60% of global 5G base stations as of 2022.

5G Radio Frequency Front End Modules (RFFEM) are critical components in wireless communication systems that manage signal transmission and reception. These modules integrate multiple technologies including RF filters, power amplifiers, switches, and low-noise amplifiers to ensure efficient high-frequency signal processing required for 5G's enhanced mobile broadband and low-latency applications.

The market expansion is driven by three key factors: accelerating 5G infrastructure investments (global mobile operators are projected to invest USD 1.1 trillion in 5G between 2020-2025), increasing smartphone penetration with 5G capabilities (GSMA forecasts 5G will account for 51% of mobile connections by 2030), and growing demand for IoT applications. Major players like Skyworks Solutions and Qorvo are innovating with integrated module solutions to address the complex frequency bands in 5G NR deployments.

MARKET DYNAMICS

MARKET DRIVERS

Expansion of 5G Infrastructure Deployment Accelerating Market Growth

The global push for 5G network expansion is driving unprecedented demand for RF front end modules. With telecom operators investing heavily in infrastructure upgrades, the market is witnessing exponential growth. Countries worldwide are racing to achieve nationwide 5G coverage, with China already deploying over 2.3 million 5G base stations - representing more than 60% of the global total. This infrastructure boom creates a ripple effect across the semiconductor supply chain, particularly benefiting RF front end module manufacturers. The technology's ability to handle higher frequencies and increased data throughput makes it indispensable for modern 5G networks. Recent product launches incorporating advanced packaging technologies and improved power efficiency demonstrate how manufacturers are rising to meet this demand.

Smartphone Proliferation and 5G Device Penetration Fueling Market Expansion

The smartphone industry's rapid transition to 5G-compatible devices serves as a powerful market catalyst. With global mobile users exceeding 5.4 billion, device manufacturers are under constant pressure to integrate advanced RF front end solutions that support multiple frequency bands and power modes. The average 5G smartphone now contains 30-40% more RF components than its 4G predecessor, directly translating to higher module demand. Market data reveals that 5G smartphone shipments grew by over 25% in 2023 compared to the previous year, indicating strong consumer adoption. This trend is particularly pronounced in Asia-Pacific markets where 5G adoption rates outpace other regions, creating localized demand surges for high-performance RF components.

MARKET RESTRAINTS

Complex Integration Challenges Impeding Widespread Adoption

While 5G's technological promise is undeniable, integrating RF front end modules into modern devices presents significant engineering hurdles. The need to support an expanding array of frequency bands while maintaining signal integrity and power efficiency creates complex design challenges. Module manufacturers must balance performance requirements against physical space constraints, particularly in compact mobile devices. This complexity often results in extended development cycles and higher production costs. Recent industry reports indicate that nearly 40% of 5G device failures can be traced back to RF front end integration issues, highlighting the technical barriers that continue to restrain market growth. As spectrum allocations become more fragmented globally, these integration challenges are expected to persist.

Supply Chain Vulnerabilities Creating Market Volatility

The RF front end module market remains susceptible to ongoing global supply chain disruptions. Concentrated production of specialized semiconductor components in specific geographical regions creates potential bottlenecks. Recent geopolitical tensions and trade restrictions have further exacerbated these vulnerabilities, leading to fluctuating component prices and extended lead times. The industry's reliance on advanced compound semiconductor materials like gallium arsenide and silicon germanium adds another layer of supply chain complexity, as these materials require specialized manufacturing processes. Such constraints have caused intermittent shortages, prompting some manufacturers to maintain elevated inventory levels despite the associated cost burdens.

MARKET OPPORTUNITIES

Emerging mmWave Applications Opening New Revenue Streams

The gradual rollout of millimeter wave (mmWave) 5G networks presents significant growth opportunities for advanced RF front end module developers. While current deployments primarily utilize sub-6GHz spectrum, the transition to higher frequency bands necessitates specialized components capable of handling extreme bandwidth requirements. Early movers in mmWave-optimized module development are positioning themselves to capture premium market segments. Industry projections suggest that mmWave-compatible RF front end modules will command price premiums of 35-50% over conventional solutions, representing a high-value market niche. The automotive sector's growing interest in 5G-enabled vehicle-to-everything (V2X) communication systems further amplifies this opportunity, creating parallel demand across multiple industries.

Integration of AI and Machine Learning Creating Competitive Differentiation

Forward-thinking manufacturers are leveraging artificial intelligence to create next-generation intelligent RF front end solutions. Machine learning algorithms are being employed to optimize power consumption, dynamically adjust signal parameters, and predict component failures before they occur. Several industry leaders have already announced products featuring embedded AI capabilities, with early adopters reporting performance improvements of 15-20% in real-world conditions. This technological evolution is particularly valuable for power-sensitive applications like IoT devices and wearables, where energy efficiency directly impacts product viability. As these intelligent systems mature, they're expected to redefine performance benchmarks across the entire RF front end module market.

MARKET CHALLENGES

Technical Complexity and Power Consumption Issues

The increasing technical complexity of 5G RF front end modules presents ongoing development challenges. Supporting the growing number of frequency bands while maintaining power efficiency requires innovative architectural approaches. Current modules must handle more than 20 different bands, with each addition introducing new interference and thermal management concerns. Power consumption remains a critical pain point, particularly for battery-operated devices, where RF components can account for up to 40% of total energy usage. Recent field tests show that thermal issues cause approximately 15% of premature module failures, underscoring the need for improved thermal design methodologies. These technical hurdles require substantial R&D investments, creating barriers to entry for smaller market players.

Rapid Technology Obsolescence Pressuring Profit Margins

The breakneck pace of 5G standard evolution creates significant challenges for RF front end module manufacturers. Frequent specification updates and new feature requirements often render existing product designs obsolete within 12-18 months. This rapid technology turnover forces companies to maintain aggressive development cycles while managing product lifecycle risks. The resulting pressure on profit margins is particularly acute for manufacturers serving price-sensitive consumer electronics markets. Industry analysis indicates that average selling prices for mainstream RF front end modules have declined by approximately 8% annually since 2021, despite increasing technical complexity. This trend is forcing market participants to seek alternative revenue streams through value-added services and customized solutions.

5G RADIO FREQUENCY FRONT END MODULE MARKET TRENDS

Expansion of 5G Infrastructure Driving RF Front-End Module Demand

The global rollout of 5G networks is accelerating the demand for Radio Frequency (RF) Front-End Modules (FEMs), which are critical components in 5G-enabled devices. As telecom operators worldwide invest heavily in infrastructure deployment, the market for RF FEMs is projected to grow at a CAGR of over 10% through 2032, reaching multimillion-dollar valuations. China currently leads in 5G infrastructure, accounting for more than 60% of global 5G base stations—highlighting the immense demand for high-performance RF components. Furthermore, innovations in 5G mmWave and sub-6GHz technologies necessitate advanced FEMs with superior power efficiency and signal integrity.

Other Trends

Miniaturization and Integration of RF Components

The push toward smaller, more efficient devices has led to significant advancements in RF front-end module designs. System-on-Chip (SoC) and heterogeneous integration techniques are enabling manufacturers to combine multiple components—such as filters, switches, and power amplifiers—into compact modules. This trend is particularly crucial for smartphones and IoT devices, where space constraints demand high integration densities. Recent developments in RF SOI (Silicon-on-Insulator) and GaN (Gallium Nitride) technologies are further enhancing performance while reducing power consumption, making them increasingly preferred in both consumer and military applications.

Increasing Demand Across Military and Civil Applications

The adoption of 5G FEMs is expanding rapidly across both military and civil sectors. In defense applications, 5G-enabled communication systems rely on ruggedized RF FEMs to support secure, high-bandwidth transmissions for unmanned systems and battlefield networks. Meanwhile, in civilian applications, the proliferation of 5G smartphones, smart cities, and industrial IoT is fueling demand. Commercial shipments of 5G smartphones surpassed 700 million units in 2023, reinforcing the need for high-quality RF front-end solutions. Additionally, advancements in AI-driven RF optimization are helping manufacturers tailor modules for specific use cases, further driving market diversification.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Strategic Collaborations Drive Market Competition

The global 5G Radio Frequency Front End Module (RFFEM) market is characterized by intense competition among semiconductor giants, with Skyworks Solutions and Broadcom emerging as dominant players. These companies collectively held over 35% market share in 2024, owing to their comprehensive product portfolios spanning RF filters, power amplifiers, and switches. Their technological leadership in millimeter-wave and sub-6GHz solutions positions them strongly as 5G deployment accelerates worldwide.

Murata Manufacturing and Qorvo have demonstrated remarkable growth, particularly in the Asia-Pacific region where 5G infrastructure investments are surging. Murata's advanced filtering technologies and Qorvo's integrated front-end modules have become critical components for smartphone OEMs and base station manufacturers. Both companies are investing heavily in BAW (Bulk Acoustic Wave) filter development to address the complex frequency requirements of 5G networks.

The competitive landscape is further intensified by strategic maneuvers from Qualcomm and Taiwan Semiconductor Manufacturing Company (TSMC). Qualcomm's system-level expertise in 5G modem-RF integration gives it a unique advantage in smartphone applications, while TSMC's cutting-edge wafer fabrication processes enable superior performance in high-frequency modules. Recent industry reports indicate these companies are allocating 18-22% of their R&D budgets specifically toward 5G RF innovations.

Meanwhile, NXP Semiconductors and Analog Devices are strengthening their positions through targeted acquisitions and partnerships. NXP's 2023 collaboration with a major Chinese telecom equipment provider and Analog Devices' acquisition of a specialist RF assets underscore the industry's consolidation trend. These moves enable faster time-to-market for next-generation solutions while addressing the growing demand for energy-efficient RF components.

List of Key 5G RFFEM Companies Profiled

Skyworks Solutions, Inc. (U.S.)

Broadcom Inc. (U.S.)

Murata Manufacturing Co., Ltd. (Japan)

Qorvo, Inc. (U.S.)

Qualcomm Technologies, Inc. (U.S.)

Taiwan Semiconductor Manufacturing Company (Taiwan)

NXP Semiconductors N.V. (Netherlands)

Analog Devices, Inc. (U.S.)

Texas Instruments Incorporated (U.S.)

STMicroelectronics N.V. (Switzerland)

Infineon Technologies AG (Germany)

MACOM Technology Solutions (U.S.)

Segment Analysis:

By Type

RF Filter Segment Leads Due to Its Critical Role in 5G Signal Processing

The market is segmented based on type into:

RF Filter

Subtypes: SAW, BAW, and others

RF Switch

Power Amplifier

Subtypes: GaN-based, Si-based, and others

Duplexer

Low-Noise Amplifier

Others

By Application

Civil Applications Dominate Owing to Widespread 5G Infrastructure Deployment

The market is segmented based on application into:

Military

Civil

Subtypes: Smartphones, IoT devices, and others

By Frequency Band

Sub-6 GHz Segment Holds Major Share Due to Broader Network Coverage

The market is segmented based on frequency band into:

Sub-6 GHz

mmWave

By Component Integration

Integrated Modules Gain Traction for Space-Constrained Devices

The market is segmented based on component integration into:

Discrete Components

Integrated Modules

Regional Analysis: 5G Radio Frequency Front End Module Market

North America North America represents a highly advanced market for 5G RF front-end modules, driven by substantial investments in next-generation infrastructure and the presence of leading semiconductor manufacturers. The U.S. accounts for over 65% of regional demand, fueled by early 5G deployment initiatives like the FCC’s $20.4 billion Rural Digital Opportunity Fund. Carrier aggregation technologies and mmWave spectrum utilization are pushing innovation in power amplifiers and antenna tuners. However, geopolitical tensions affecting semiconductor supply chains and complex spectrum allocation policies create moderate adoption barriers. Key players like Skyworks Solutions and Qorvo dominate component supply with specialized solutions for high-frequency bands.

Europe European adoption focuses on sub-6GHz deployments with strong emphasis on energy-efficient designs to align with the EU Green Deal initiative. Germany and the UK lead installations, collectively hosting 38% of regional 5G base stations. The presence of NXP Semiconductors and STMicroelectronics supports localized production of RF filters and switches. Strict radio equipment directives (RED) mandate rigorous certification processes, slowing time-to-market but ensuring quality standardization. Recent collaborations between telecom operators and automotive manufacturers are creating new application avenues for integrated RF modules in connected vehicles and smart city infrastructure.

Asia-Pacific China's dominance in 5G infrastructure is reshaping global RF front-end module dynamics, with domestic suppliers like Murata Manufacturing capturing 28% of the regional market share. The country's 2.3 million active 5G base stations generate unparalleled demand for power amplifiers and duplexers. India emerges as the fastest-growing market (projected 42% CAGR through 2030), driven by ₹14,000 crore (∼$1.7 billion) government allocations for indigenous 5G development. Southeast Asia shows divergent trends - while Singapore adopts cutting-edge mmWave solutions, Indonesia and Vietnam prioritize cost-effective sub-6GHz modules for broader population coverage.

South America Brazil constitutes 60% of regional demand, with major carriers deploying 5G NSA networks across 26 state capitals. However, economic instability limits investment in advanced RF components, causing reliance on mid-tier Chinese imports. Argentina and Chile show promising pilot projects in industrial IoT applications, requiring ruggedized front-end solutions. The lack of local semiconductor fabrication facilities creates complete import dependency, with average lead times exceeding 12 weeks during peak demand cycles. Recent trade agreements with Asian manufacturers aim to stabilize supply but face bureaucratic hurdles in customs clearance.

Middle East & Africa Gulf Cooperation Council nations drive premium segment growth through extensive smart city projects - Dubai's 5G network already covers 95% of urban areas using advanced massive MIMO configurations. In contrast, Sub-Saharan Africa experiences slower uptake due to 4G/LTE prioritization, with South Africa being the notable exception having allocated 5G spectrum to three major operators. The region faces unique challenges including extreme temperature operation requirements and limited technical expertise for mmWave deployment. Emerging partnerships between infrastructure providers and module manufacturers aim to address these constraints through customized thermal management solutions.

Report Scope

This market research report provides a comprehensive analysis of the global and regional 5G Radio Frequency Front End Module markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global 5G RF Front End Module market was valued at USD 5.2 billion in 2024 and is projected to reach USD 12.8 billion by 2032, growing at a CAGR of 11.7% during the forecast period.

Segmentation Analysis: Detailed breakdown by product type (RF Filters, RF Switches, Power Amplifiers, etc.), technology (sub-6GHz, mmWave), application (military, civil), and end-user industry to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific (China dominates with over 60% global 5G base stations), Latin America, and Middle East & Africa.

Competitive Landscape: Profiles of 16 leading market participants including Skyworks Solutions, Qorvo, Broadcom, and Murata Manufacturing, covering their product portfolios, R&D investments, and strategic partnerships.

Technology Trends: Assessment of emerging innovations including AI-integrated RF modules, advanced packaging techniques, and energy-efficient designs for 5G networks.

Market Drivers & Restraints: Evaluation of growth drivers (5G infrastructure expansion, IoT proliferation) and challenges (semiconductor shortages, design complexity).

Stakeholder Analysis: Strategic insights for component suppliers, telecom operators, device manufacturers, and investors navigating the 5G ecosystem.

The research methodology combines primary interviews with industry leaders and analysis of verified market data from regulatory filings, trade associations, and financial reports to ensure accuracy.

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global 5G RF Front End Module Market?

-> 5G Radio Frequency Front End Module Market size was valued at US$ 4,830 million in 2024 and is projected to reach US$ 9,740 million by 2032, at a CAGR of 10.2% during the forecast period 2025-2032.

Which companies lead the 5G RF Front End Module Market?

-> Top players include Skyworks Solutions, Qorvo, Broadcom, Murata Manufacturing, and Qualcomm, collectively holding 68% market share.

What drives market growth?

-> Key drivers are 5G network deployments (2.31M+ base stations in China alone), smartphone upgrades, and IoT expansion.

Which region dominates 5G RF module adoption?

-> Asia-Pacific leads with 72% market share, driven by China's 561 million 5G users and massive infrastructure investments.

What are emerging technology trends?

-> Emerging trends include integrated mmWave modules, GaN-based power amplifiers, and AI-optimized RF designs for 5G-Advanced networks.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/automotive-magnetic-sensor-ics-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ellipsometry-market-supply-chain.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/online-moisture-sensor-market-end-user.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/computer-screen-market-forecasting.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/high-power-gate-drive-interface.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/strobe-overdrive-digital-controller.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/picmg-half-size-single-board-computer.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/automotive-isolated-amplifier-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/satellite-messenger-market-regional.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/sic-epi-wafer-market-innovations.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/heavy-duty-resistor-market-key-players.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/robotic-collision-sensor-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/gas-purity-analyzer-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/x-ray-high-voltage-power-supply-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/reflection-probe-market-industry-trends.html

0 notes

Text

Carrier Aggregation Solutions Market Set to Transform Next-Gen Connectivity Worldwide

The Carrier Aggregation Solutions Market was valued at USD 3.92 billion in 2023 and is expected to reach USD 17.77 billion by 2032, growing at a CAGR of 18.35% from 2024-2032.

Carrier Aggregation Solutions Market is witnessing rapid expansion as mobile operators intensify efforts to meet rising data demands and ensure seamless connectivity. The technology, which allows simultaneous use of multiple frequency bands, is crucial in delivering enhanced user experiences, particularly as 5G networks continue to scale across key regions.

USA leads the adoption of advanced carrier aggregation to improve mobile broadband capacity and performance in dense urban regions

Carrier Aggregation Solutions Market is evolving as telecom infrastructure providers and network operators invest in bandwidth optimization. The growing need for high-speed data, reduced latency, and network reliability is pushing both developed and emerging markets to adopt carrier aggregation across LTE-Advanced and 5G deployments.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6671

Market Keyplayers:

Anritsu (MD8430A Signaling Tester, MT8821C Radio Communication Analyzer)

Artiza Networks, Inc. (DuoSIM-5G, 5G Load Tester)

Cisco Systems Inc. (Cisco Ultra Packet Core, Cisco 5G Cloud Core)

Huawei Technologies (SingleRAN LTE, SingleRAN@Broad)

Nokia Corporation (AirScale Baseband, AirScale Radio Access)

Qualcomm Technologies, Inc. (Snapdragon X75 Modem-RF System, Snapdragon X65 Modem-RF System)

Rohde and Schwarz GmbH and Co. KG (CMW500 Tester, SMW200A Vector Signal Generator)

Sprint.com (Sprint Spark, Sprint LTE Advanced Pro)

Telefonaktiebolaget LM Ericsson (Ericsson Radio System, Ericsson Cloud RAN)

ZTE Corporation (Uni-RAN, 5G NR Base Station)

Broadcom Inc. (5G RF Front-End Modules, 5G Modem SoCs)

Verizon Communications Inc. (5G Ultra Wideband, LTE Advanced)

Qorvo Inc. (RF Front-End Modules, High Band PADs)

Alcatel Lucent S.A. (9926 eNodeB, 9768 Metro Cell Outdoor)

Market Analysis

Carrier aggregation has become a core enabler of 5G and LTE-Advanced technologies, allowing carriers to combine multiple channels into a single data stream. This results in faster download/upload speeds and improved spectrum efficiency. Network congestion, user demand, and spectrum fragmentation are key drivers prompting global operators to prioritize aggregation deployments.

The U.S. market is characterized by strong R&D initiatives and partnerships among telecom giants, while Europe emphasizes spectrum optimization through regulatory support and multi-operator collaborations.

Market Trends

Growing deployment of 5G NR (New Radio) carrier aggregation

Rising demand for multi-band smartphones and compatible devices

Expansion of telecom infrastructure in urban and rural zones

Increasing spectrum licensing and government policy alignment

Integration of AI and automation in network optimization

Shift towards dynamic spectrum sharing (DSS) technologies

Collaboration between chipset manufacturers and mobile operators

Market Scope

The Carrier Aggregation Solutions Market holds strong growth potential as mobile networks modernize to support heavy data applications and real-time services. With next-gen mobile use cases emerging rapidly, spectrum efficiency is now a critical priority.

Enabler of high-speed mobile broadband

Supports better spectral efficiency and network throughput

Integral to rural and underserved area connectivity

Key for seamless 4G–5G transition

Widely adopted by telecom operators and device OEMs

Enhances video streaming, gaming, and cloud-based app performance

Forecast Outlook

The Carrier Aggregation Solutions Market is poised for significant evolution as telecom operators accelerate their 5G rollout plans and seek to deliver consistent, ultra-fast connectivity. The interplay between carrier aggregation, MIMO, and beamforming technologies is expected to redefine mobile network capabilities. With regulatory alignment, device compatibility improvements, and global vendor collaboration, the market is expected to gain momentum across both urban and remote geographies.

Access Complete Report: https://www.snsinsider.com/reports/carrier-aggregation-solutions-market-6671

Conclusion

As mobile experiences shift toward ultra-reliable, high-bandwidth services, carrier aggregation stands as a foundational pillar in shaping the future of wireless communication. From New York to Berlin, the demand for uninterrupted, high-speed access is driving unprecedented investment in aggregation technologies. In a hyperconnected era, stakeholders who prioritize scalable, efficient, and adaptive network strategies will lead the next wave of telecom innovation.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

U.S.A experiences strong growth in fleet management software market driven by fleet optimization needs

U.S.A drives innovation as Conversational Systems transform customer engagement nationwide

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Mail us: [email protected]

0 notes

Text

Gallium Arsenide GaAs Radio Frequency RF Semiconductor Industry Insights Opportunities, Key Applications & Market Dynamics

The Gallium Arsenide GaAs Radio Frequency RF Semiconductor Market is witnessing strong momentum due to the rising adoption of high-frequency electronics in telecommunications, satellite systems, radar, and mobile devices. As of 2024, the market is valued at approximately USD 2.3 billion and is expected to grow to around USD 4.1 billion by 2032, registering a notable CAGR of about 7.6 %. GaAs RF semiconductors are preferred over traditional silicon devices in RF applications because of their superior electron mobility, higher frequency capabilities, and greater resistance to heat.

With the evolution of wireless communication, especially 5G and satellite broadband, GaAs components have become essential in supporting high-frequency signal amplification, data transmission, and power efficiency. Increasing demand for low-noise amplifiers, power amplifiers, and switches in mobile phones, base stations, and defense communication systems continues to fuel market expansion.

GaAs semiconductors are also widely adopted in aerospace and military applications due to their radiation resistance and ability to operate in extreme environments. As IoT networks, autonomous vehicles, and satellite-based internet services continue to grow, the role of GaAs RF semiconductors in ensuring stable, high-speed signal processing becomes even more critical.

Market Segmentation

By Product Type

Power Amplifiers Low Noise Amplifiers Switches Attenuators Phase Shifters Voltage-Controlled Oscillators

By Material Type

Single-Crystal GaAs Polycrystalline GaAs Semi-Insulating GaAs

By Technology

MESFET (Metal Semiconductor Field Effect Transistor) HEMT (High Electron Mobility Transistor) HBT (Heterojunction Bipolar Transistor)

By Application

Mobile Devices Wireless Infrastructure Satellite Communication Radar Systems Aerospace and Defense Automotive Radar Consumer Electronics

By End-user

Telecommunication Operators Defense and Aerospace Contractors Consumer Electronics Manufacturers Automotive OEMs Satellite System Providers

By Region

North America Europe Asia-Pacific Middle East and Africa Latin America

Key Market Trends

The rollout of 5G networks is a primary growth driver, with GaAs RF semiconductors playing a critical role in ensuring low signal loss, high gain, and robust network coverage for mobile operators

Satellite communication networks, particularly for remote areas and defense missions, rely heavily on GaAs devices for secure, high-speed transmission over long distances

Consumer demand for high-performance smartphones with advanced RF front ends is accelerating GaAs integration into mobile devices for signal reception and transmission

Growing investment in automotive radar systems, especially for advanced driver-assistance systems in electric and autonomous vehicles, is expanding the application of GaAs semiconductors in transportation

Defense sectors across countries are adopting GaAs-based radar and communication modules for secure and efficient communication in challenging environments

Segment Insights

Power amplifiers account for the largest share of the GaAs RF semiconductor market due to their essential role in boosting RF signals across communication and radar systems. These amplifiers are extensively used in mobile phones, base stations, and military radios

Low noise amplifiers are increasingly in demand for satellite communication and defense systems, where signal integrity and minimal distortion are critical

HEMT and HBT technologies dominate the market for their ability to handle high frequencies and deliver fast switching speeds, making them suitable for millimeter-wave and microwave applications

Radar and wireless infrastructure applications are expected to grow significantly, driven by global military modernization efforts and rapid mobile broadband expansion

Consumer electronics, especially smartphones and Wi-Fi routers, continue to be the highest volume users of GaAs RF components due to the need for high-speed connectivity and battery efficiency

End-User Insights

Telecommunication operators are major consumers of GaAs RF devices for use in 4G and 5G base stations, ensuring enhanced performance and reliability in densely populated urban areas

Defense and aerospace contractors utilize GaAs semiconductors in radar, navigation, and encrypted communications, where high frequency and radiation resistance are vital

Consumer electronics manufacturers integrate GaAs RF components to improve connectivity in smartphones, tablets, wearables, and wireless accessories

Automotive OEMs are exploring GaAs devices for next-gen radar and sensor systems that assist in vehicle detection, parking assistance, and collision avoidance

Satellite system providers rely on GaAs technology to deliver robust, high-speed signals to and from Earth stations, particularly in low Earth orbit satellite constellations

Key Players

Leading players in the GaAs RF semiconductor market are continuously innovating to improve performance, scalability, and integration of GaAs devices into modern electronic systems

Qorvo, Inc. is a key supplier of RF solutions using GaAs and GaN technologies, offering amplifiers and filters for mobile, defense, and satellite communications

Skyworks Solutions, Inc. specializes in high-performance GaAs power amplifiers and front-end modules used in smartphones, IoT devices, and base stations

Wolfspeed (Cree Inc.) provides GaAs RF and microwave devices for high-frequency communications and radar applications

MACOM Technology Solutions offers a broad range of GaAs-based products for telecom infrastructure, aerospace, and automotive radar systems

Win Semiconductors Corp. is a leading GaAs foundry serving global clients in wireless communications, offering wafer fabrication and device packaging services

These companies are focusing on vertical integration, miniaturization, and high-volume production to meet growing demand across commercial and defense sectors

Trending Report Highlights

Photonic Integrated Circuit Market

Track Geometry Measurement System Market

Microprocessor and GPU Market

Predictive Emission Monitoring System Market

Soft Robotics Market

0 notes

Text

CMOS Power Amplifiers Market Drivers Enhancing Efficiency, Integration, and Cost-Effective Wireless Communication Solutions

The CMOS power amplifiers market is witnessing a steady growth trajectory driven by multiple technological, commercial, and application-oriented factors. With wireless communication becoming more pervasive and devices getting smaller and smarter, the demand for compact, energy-efficient, and cost-effective power amplification solutions has risen sharply. CMOS (Complementary Metal-Oxide-Semiconductor) technology, traditionally known for its applications in microprocessors and memory chips, has increasingly found a strong foothold in RF (Radio Frequency) front-end modules, especially power amplifiers.

Rising Demand for Wireless Connectivity

One of the key market drivers is the explosive growth in wireless communication technologies, including 4G, 5G, Wi-Fi 6, and the upcoming 6G. These technologies demand highly efficient and reliable RF components. CMOS power amplifiers provide a suitable balance of performance and affordability, making them ideal for use in smartphones, tablets, IoT devices, wearables, and connected home solutions. As more industries adopt wireless systems for communication, automation, and control, the reliance on CMOS amplifiers continues to expand.

Integration with System-on-Chip (SoC) Solutions

CMOS technology enables easy integration of power amplifiers with digital and analog circuits on the same die, a key driver pushing its adoption in consumer electronics and mobile devices. System-on-Chip integration reduces component count, lowers power consumption, and enables the development of ultra-compact devices. Manufacturers prefer CMOS PAs because of their scalability and compatibility with large-scale semiconductor manufacturing processes, leading to economies of scale and reduced production costs.

Cost Efficiency and Mass Production Benefits

Another important market driver is the cost-effectiveness of CMOS technology. Unlike GaAs (Gallium Arsenide) or other compound semiconductor-based amplifiers, CMOS-based designs are more suitable for high-volume, low-cost manufacturing. This makes them ideal for mass-market applications like smartphones and IoT sensors, where price sensitivity is critical. The use of CMOS also simplifies the supply chain and shortens development cycles, encouraging faster time-to-market for OEMs.

Expansion of IoT and Smart Devices

The rapid growth of the Internet of Things (IoT) ecosystem is a significant catalyst for the CMOS power amplifiers market. Billions of devices—from smart meters and industrial sensors to home automation systems and connected healthcare devices—require efficient RF amplification. CMOS power amplifiers meet the low power, small form factor, and cost demands of such devices, making them an indispensable component in this domain. The proliferation of IoT across both industrial and consumer landscapes ensures long-term demand for CMOS PAs.

Evolution of 5G and Future Networks

As the world shifts toward 5G and beyond, there is an increasing need for high-speed, high-frequency data transmission. Although early 5G implementations relied heavily on GaN and GaAs technologies for their high power capabilities, CMOS-based amplifiers are becoming viable alternatives in specific frequency bands and low-power use cases. The need for a large number of small cell deployments and low-power devices for edge communication is boosting CMOS PA adoption.

Emphasis on Power Efficiency and Battery Life

In mobile and wearable devices, power consumption is a critical factor. CMOS power amplifiers offer better power efficiency at lower costs, helping extend battery life while maintaining signal integrity. As consumers demand longer battery runtime and more powerful features in compact devices, the adoption of CMOS PAs becomes a strategic necessity for device manufacturers.

Growth in Automotive and Industrial Applications

Automotive electronics and industrial automation are increasingly incorporating wireless modules for connectivity and control. From advanced driver-assistance systems (ADAS) to vehicle-to-everything (V2X) communication, these systems benefit from the integration capabilities and robustness of CMOS power amplifiers. Similarly, in industrial automation and remote monitoring, the ability to have low-cost, power-efficient communication modules is pushing the use of CMOS-based RF components.

Government Support and Technological Advancements

Government policies promoting 5G infrastructure, digital transformation, and Industry 4.0 are encouraging the deployment of advanced communication networks that rely on CMOS-based power amplifier technologies. At the same time, advancements in CMOS fabrication and design techniques have helped close the performance gap between CMOS and traditional compound semiconductor technologies. Innovations such as envelope tracking, digital predistortion, and linearization techniques are helping CMOS amplifiers achieve better performance metrics, including linearity and efficiency.

Conclusion

The CMOS power amplifiers market is being driven by a confluence of technological advancements and application needs. As the global economy becomes increasingly digital and wireless-dependent, the demand for scalable, cost-effective, and power-efficient amplification solutions will continue to grow. CMOS power amplifiers, with their integration capability, cost benefits, and evolving performance levels, are well-positioned to address the diverse needs of consumer electronics, automotive, industrial, and telecom sectors.

0 notes

Text

Antenna in Package AiP Market Opportunities Rising with Expansion of Millimeter Wave Technology Globally

The Antenna in Package (AiP) market is gaining significant traction as wireless communication technologies become increasingly integrated into compact, high-performance electronic devices. AiP technology incorporates antennas directly into semiconductor packages, enabling advanced radio frequency (RF) performance while saving space. This innovation is particularly relevant in 5G, millimeter-wave (mmWave), automotive radar, satellite communications, and IoT applications.

Market Drivers

One of the primary drivers of the AiP market is the global rollout of 5G technology, which operates at higher frequencies such as mmWave. These frequencies require advanced antenna solutions capable of handling high data rates and low latency. Traditional printed circuit board (PCB) antennas often fall short in terms of integration and performance. AiP offers a more efficient alternative by reducing interconnect losses and supporting beamforming technologies critical for 5G.

Another major factor is the increasing miniaturization of consumer electronics. Smartphones, wearables, and IoT devices demand compact components that deliver excellent performance. AiP technology meets this requirement by integrating the antenna and RF front-end into a single compact module, freeing up space and improving system-level efficiency.

Technological Advancements

Recent advancements in substrate materials, system-in-package (SiP) technologies, and 3D packaging are making AiP solutions more cost-effective and scalable. Low-temperature co-fired ceramic (LTCC) and organic substrates have enabled better thermal and electrical performance. Integration of multiple functions such as filters, power amplifiers, and transceivers within the package has allowed manufacturers to create multi-functional modules tailored for specific end-uses.

In addition, the evolution of advanced simulation tools and design automation has shortened development cycles and reduced costs, making AiP more accessible to a broader range of industries. These advancements have facilitated faster prototyping and more reliable testing environments.

Key Market Segments

The AiP market can be segmented based on frequency band, end-user application, and geography.

By frequency, the market includes sub-6 GHz and mmWave segments, with mmWave seeing higher growth due to its necessity in 5G and automotive radar applications.

By application, the market is divided into consumer electronics, automotive, telecommunications, aerospace and defense, and industrial IoT.

Geographically, North America and Asia-Pacific dominate the AiP landscape, thanks to the presence of major semiconductor companies and 5G infrastructure deployment.

Regional Insights

Asia-Pacific leads the AiP market due to robust electronics manufacturing ecosystems in countries like China, South Korea, Taiwan, and Japan. Government initiatives to boost 5G and smart city projects further support AiP growth in the region. North America, especially the United States, sees significant demand from telecom providers, defense contractors, and autonomous vehicle manufacturers. Europe is also emerging as a key region, driven by automotive and industrial automation applications.

Competitive Landscape

The AiP market is highly competitive, with key players including Qualcomm, ASE Group, Amkor Technology, Murata Manufacturing, TSMC, and MediaTek. These companies are investing in research and development to improve integration, reduce power consumption, and enhance RF performance. Collaborations, joint ventures, and strategic acquisitions are common strategies to gain market share and accelerate product development.

Startups and mid-sized players are also entering the space with niche AiP solutions for IoT and wearable devices, contributing to market dynamism and innovation.

Challenges and Opportunities

Despite its promise, AiP adoption faces several challenges. High design complexity, thermal management issues, and initial manufacturing costs are significant barriers. Additionally, maintaining signal integrity in densely packed modules remains a technical hurdle.

However, opportunities abound. As mmWave adoption expands and edge computing grows in importance, AiP is poised to play a pivotal role in enabling low-latency, high-speed communication across various devices and systems. The trend toward smart cities, connected vehicles, and AR/VR applications also offers long-term growth potential.

Future Outlook

The AiP market is expected to grow at a CAGR exceeding 15% over the next five years, driven by surging demand across multiple industries. Technological advancements, cost optimization, and expanding 5G infrastructure will be key enablers. As device manufacturers strive to balance performance, size, and power efficiency, AiP is likely to become a standard in RF design and packaging.

#AntennaInPackage#AiPMarket#5GTechnology#MillimeterWave#WirelessCommunication#IoTDevices#RFTechnology

0 notes

Text

0 notes

Text

0 notes

Text

Semiconductorinsight reports

Wide Bandgap Semiconductor Market - https://semiconductorinsight.com/report/wide-bandgap-semiconductor-market/

Wireless Charging Market - https://semiconductorinsight.com/report/wireless-charging-market/

3D IC Market - https://semiconductorinsight.com/report/3d-ic-market/

Analog-to-Digital Converter (ADC) Market - https://semiconductorinsight.com/report/analog-to-digital-converter-adc-market/

Application Processor Market - https://semiconductorinsight.com/report/application-processor-market/

Audio IC Market - https://semiconductorinsight.com/report/audio-ic-market/

Bluetooth IC Market - https://semiconductorinsight.com/report/bluetooth-ic-market/

CMOS Image Sensor Market - https://semiconductorinsight.com/report/cmos-image-sensor-market/

Data Converter Market - https://semiconductorinsight.com/report/data-converter-market/

Digital Signal Processor (DSP) Market - https://semiconductorinsight.com/report/digital-signal-processor-dsp-market/

Display Driver IC Market - https://semiconductorinsight.com/report/display-driver-ic-market/

Embedded Non-Volatile Memory (eNVM) Market - https://semiconductorinsight.com/report/embedded-non-volatile-memory-envm-market/

Field-Programmable Gate Array (FPGA) Market - https://semiconductorinsight.com/report/field-programmable-gate-array-fpga-market/

Flash Memory Market - https://semiconductorinsight.com/report/flash-memory-market/

Graphics Processing Unit (GPU) Market - https://semiconductorinsight.com/report/graphics-processing-unit-gpu-market/

High-Brightness LED Market - https://semiconductorinsight.com/report/high-brightness-led-market/

Image Sensor Market - https://semiconductorinsight.com/report/image-sensor-market/

Integrated Passive Devices (IPD) Market - https://semiconductorinsight.com/report/integrated-passive-devices-ipd-market/

Laser Diode Market - https://semiconductorinsight.com/report/laser-diode-market/

Light Sensor Market - https://semiconductorinsight.com/report/light-sensor-market/

Magnetoresistive RAM (MRAM) Market - https://semiconductorinsight.com/report/magnetoresistive-ram-mram-market/

Micro LED Market - https://semiconductorinsight.com/report/micro-led-market/

Microprocessor Market - https://semiconductorinsight.com/report/microprocessor-market/

Mixed Signal System-on-Chip (SoC) Market - https://semiconductorinsight.com/report/mixed-signal-system-on-chip-soc-market/

NAND Flash Market - https://semiconductorinsight.com/report/nand-flash-market/

Non-Volatile Memory (NVM) Market - https://semiconductorinsight.com/report/non-volatile-memory-nvm-market/

Organic Light Emitting Diode (OLED) Market - https://semiconductorinsight.com/report/organic-light-emitting-diode-oled-market/

Photonic Integrated Circuit (PIC) Market - https://semiconductorinsight.com/report/photonic-integrated-circuit-pic-market/

Power Management IC (PMIC) Market - https://semiconductorinsight.com/report/power-management-ic-pmic-market/

Printed Electronics Market - https://semiconductorinsight.com/report/printed-electronics-market/

Radio Frequency (RF) Front-End Module Market - https://semiconductorinsight.com/report/radio-frequency-rf-front-end-module-market/

Semiconductor Assembly and Testing Services (SATS) Market - https://semiconductorinsight.com/report/semiconductor-assembly-and-testing-services-sats-market/

Semiconductor Laser Market - https://semiconductorinsight.com/report/semiconductor-laser-market/

Silicon Carbide (SiC) Market - https://semiconductorinsight.com/report/silicon-carbide-sic-market/

Smart Card IC Market - https://semiconductorinsight.com/report/smart-card-ic-market/

Smart Sensor Market - https://semiconductorinsight.com/report/smart-sensor-market/

System-in-Package (SiP) Market - https://semiconductorinsight.com/report/system-in-package-sip-market/

Thin Film Transistor (TFT) Market - https://semiconductorinsight.com/report/thin-film-transistor-tft-market/

Touch Controller IC Market - https://semiconductorinsight.com/report/touch-controller-ic-market/

Ultraviolet (UV) LED Market - https://semiconductorinsight.com/report/ultraviolet-uv-led-market/

0 notes

Text

Global Top 15 Companies Accounted for 58% of total Electrosurgical Pencil market (QYResearch, 2021)

Electrosurgical pencil is a medical device used to fulgurate, coagulate, cut or dissect biological tissue by the applying electric current. It uses Radio Frequency Alternating Current or RFAC. Electrosurgical pencils are versatile and can suit all operating needs as they come with universal size connector that makes it compatible with most branded electrode tips.

Electrosurgical pencils, also known as cautery pencils used during electrosurgery procedures. They are used to cut biological tissue and control bleeding through Radio Frequency Alternating Current (RFAC).

According to the new market research report "Global Electrosurgical Pencil Market Report 2023-2029", published by QYResearch, the global Electrosurgical Pencil market size is projected to grow from USD xx million in 2023 to USD xx million by 2029, at a CAGR of xx% during the forecast period.

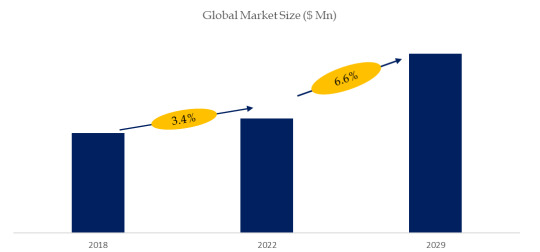

Figure. Global Electrosurgical Pencil Market Size (US$ Million), 2018-2029

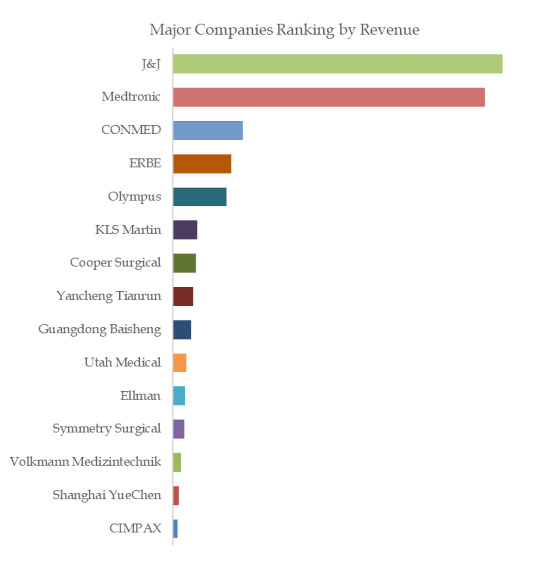

Figure. Global Electrosurgical Pencil Top 15 Players Ranking and Market Share (Ranking is based on the revenue of 2022, continually updated)

The global key manufacturers of Electrosurgical Pencil include J&J, Medtronic, CONMED, ERBE, Olympus, KLS Martin, Cooper Surgical, Yancheng Tianrun, Guangdong Baisheng, Utah Medical, etc. In 2022, the global top five players had a share approximately 58.0% in terms of revenue.

About QYResearch

QYResearch founded in California, USA in 2007.It is a leading global market research and consulting company. With over 16 years’ experience and professional research team in various cities over the world QY Research focuses on management consulting, database and seminar services, IPO consulting, industry chain research and customized research to help our clients in providing non-linear revenue model and make them successful. We are globally recognized for our expansive portfolio of services, good corporate citizenship, and our strong commitment to sustainability. Up to now, we have cooperated with more than 60,000 clients across five continents. Let’s work closely with you and build a bold and better future.

QYResearch is a world-renowned large-scale consulting company. The industry covers various high-tech industry chain market segments, spanning the semiconductor industry chain (semiconductor equipment and parts, semiconductor materials, ICs, Foundry, packaging and testing, discrete devices, sensors, optoelectronic devices), photovoltaic industry chain (equipment, cells, modules, auxiliary material brackets, inverters, power station terminals), new energy automobile industry chain (batteries and materials, auto parts, batteries, motors, electronic control, automotive semiconductors, etc.), communication industry chain (communication system equipment, terminal equipment, electronic components, RF front-end, optical modules, 4G/5G/6G, broadband, IoT, digital economy, AI), advanced materials industry Chain (metal materials, polymer materials, ceramic materials, nano materials, etc.), machinery manufacturing industry chain (CNC machine tools, construction machinery, electrical machinery, 3C automation, industrial robots, lasers, industrial control, drones), food, beverages and pharmaceuticals, medical equipment, agriculture, etc.

0 notes

Text

Digital Demodulator IC Market: Packaging Technology Trends by 2025-2032

MARKET INSIGHTS

The global Digital Demodulator IC Market size was valued at US$ 345 million in 2024 and is projected to reach US$ 523 million by 2032, at a CAGR of 6.1% during the forecast period 2025-2032. The U.S. market accounted for 32% of global revenue in 2024, while China is expected to witness the highest growth rate of 8.1% CAGR through 2032.

Digital demodulator ICs are specialized integrated circuits that convert modulated signals into baseband signals for digital processing. These components are fundamental in decoding various modulation schemes including QAM, QPSK, and OFDM used in modern communication systems. The technology finds applications across television broadcasting, automotive infotainment, radio communications, and IoT devices, enabling efficient signal processing with reduced power consumption.

Market growth is primarily driven by the increasing demand for high-speed data transmission in 5G networks and the proliferation of digital broadcasting standards. However, design complexity in multi-channel ICs presents technical challenges. The Single Channel segment currently dominates with 68% market share, though Dual Channel variants are gaining traction in advanced applications. Key players like Skyworks and Analog Devices are investing in integrated solutions that combine demodulation with RF front-end functionality to address evolving industry requirements.

MARKET DYNAMICS

MARKET DRIVERS

Expanding 5G Infrastructure and Smart Devices to Accelerate Demand

The global rollout of 5G networks is creating substantial demand for digital demodulator ICs. These components are essential for processing high-frequency signals in 5G base stations and smartphones. With over 2.3 billion 5G connections projected by 2026, telecom operators are accelerating infrastructure investments, driving adoption of demodulator ICs. Furthermore, the proliferation of IoT devices requires advanced signal processing capabilities that digital demodulators provide. Major markets like China and the U.S. are leading deployments, with infrastructure investments exceeding $200 billion annually to support next-generation connectivity.

Growing Automotive Infotainment Systems Fuel Market Expansion

Modern vehicles increasingly incorporate sophisticated infotainment systems requiring digital demodulators for radio and satellite signal processing. The automotive IC market is projected to grow at 6-8% CAGR through 2032 as manufacturers add more digital features. Luxury vehicles now average 20-30 ICs for entertainment systems alone, with mid-range models following this technological adoption. This represents a significant opportunity, especially in dual-channel ICs which allow simultaneous processing of multiple signals.

➤ Premium audio systems in vehicles increasingly utilize digital demodulators for HD Radio, satellite radio, and digital broadcast reception, enhancing the driving experience.

The transition from analog to digital broadcasting worldwide also contributes to steady demand. Over 85% of television markets have completed their digital transitions, requiring demodulator ICs in set-top boxes and smart TVs. This creates replacement cycles as consumers upgrade older equipment.

MARKET CHALLENGES

Global Semiconductor Shortages Continue to Disrupt Supply Chains

The digital demodulator IC market faces persistent challenges from ongoing semiconductor supply constraints. Production interruptions during pandemic recovery, coupled with surging demand across industries, have created quarterly shipment delays. Lead times for certain ICs extended to 40+ weeks in 2023, forcing manufacturers to revise production schedules. Smaller firms particularly struggle to secure stable supplies, creating market consolidation pressures.

Other Challenges

Design Complexity Advanced demodulator ICs require sophisticated RF and mixed-signal design expertise. Shrinking process nodes below 28nm demand substantial R&D investment, with development costs for new IC designs often exceeding $10 million. This creates significant barriers for new entrants.

Testing Requirements Stringent quality control for RF components adds cost and time to production. Automotive-grade ICs require extensive temperature cycling and reliability testing, with qualification periods extending 6-12 months. These requirements limit production scalability during demand surges.

MARKET RESTRAINTS

Design Integration Challenges Restrain Adoption

System integrators increasingly demand single-chip solutions combining multiple functions, posing technical hurdles for demodulator IC manufacturers. Achieving optimal performance while integrating additional RF, DSP, and power management functions requires complex trade-offs. Many designs struggle with interference issues, forcing OEMs to use discrete components instead.

Additionally, the shift toward software-defined radios introduces compatibility challenges. While offering flexibility, these systems require demodulator ICs with exceptional programmability and dynamic range – specifications that add 20-30% to component costs. This creates adoption resistance in price-sensitive consumer applications.

MARKET OPPORTUNITIES

Edge AI Integration Opens New Application Frontiers

The convergence of RF signal processing with edge AI presents significant growth potential. Digital demodulators enhanced with machine learning algorithms can dynamically optimize signal reception based on environmental conditions. This proves valuable for:

Smart city infrastructure monitoring

Industrial IoT condition monitoring

Next-generation satellite communication systems

Leading manufacturers are developing AI-enhanced demodulators that reduce power consumption by 15-20% while improving signal integrity. These innovations create opportunities in emerging markets like private 5G networks and automated industrial systems.

The defense sector also presents opportunities as modern electronic warfare systems require advanced digital receivers. Military RF applications accounted for nearly 20% of the high-performance IC market in 2023, with projected growth of 8-10% annually through 2030.

DIGITAL DEMODULATOR IC MARKET TRENDS

Increasing Demand for High-Speed Data Transmission to Drive Market Growth

The global digital demodulator IC market is experiencing robust growth, propelled by escalating demand for high-speed data transmission across telecommunications, broadcasting, and consumer electronics sectors. In 2024, the market was valued at $million and is projected to expand at a CAGR of % to reach $million by 2032. This surge is largely attributed to advancements in 5G infrastructure, where demodulator ICs play a critical role in signal processing efficiency. Particularly, the television segment holds a significant market share due to the ongoing digital transition in emerging economies.

Other Trends

Miniaturization and Integration in Semiconductor Design

As semiconductor technology evolves, there is a marked shift toward miniaturization and integration of demodulator ICs into multi-functional chipsets. Leading manufacturers are investing heavily in System-on-Chip (SoC) solutions that combine demodulation with other RF functionalities, reducing footprint and power consumption by up to 30%. This trend is particularly dominant in automotive applications, where space constraints demand compact designs without compromising signal integrity.

Emergence of AI-Optimized Signal Processing

The integration of artificial intelligence in demodulator ICs is revolutionizing signal processing capabilities. AI-enhanced algorithms now enable real-time adaptive demodulation, improving error correction rates by over 40% in noisy environments. This technological leap is critical for satellite communication systems, where maintaining signal clarity amidst atmospheric interference remains a persistent challenge.

While North America currently leads in market share at $million, Asia-Pacific is projected as the fastest-growing region, with China alone expected to reach $million valuation. This regional shift coincides with increased semiconductor manufacturing capacity and government investments in digital infrastructure across developing nations.

COMPETITIVE LANDSCAPE

Key Industry Players

Strategic Product Innovation Defines Market Leadership in Digital Demodulator IC Space

The digital demodulator IC market exhibits a moderately consolidated structure, dominated by established semiconductor players with specialized RF and mixed-signal expertise. Skyworks Solutions holds a prominent position, capturing approximately 18% revenue share in 2024, owing to its comprehensive portfolio spanning single and dual-channel demodulators for broadcast and telecommunications applications.

Analog Devices Inc. (ADI) and NXP Semiconductors collectively account for nearly 30% of the market, with their advanced demodulator ICs seeing strong adoption in automotive infotainment systems and digital television receivers. Their success stems from vertical integration capabilities and patented signal processing architectures that improve noise immunity in crowded RF spectrums.

Mid-sized specialists like MaxLinear and Cermetek MicroElectronics are gaining traction through application-specific designs, particularly in software-defined radio and satellite communication equipment. Recent product launches featuring adaptive equalization algorithms have helped these players secure design wins in 5G infrastructure projects.

The competitive intensity is further heightened by regional players like Nisshinbo Micro Devices and AltoBeam who are aggressively expanding beyond domestic Asian markets. Their cost-optimized solutions for consumer electronics are driving price pressure across entry-level market segments.

List of Key Digital Demodulator IC Manufacturers

Skyworks Solutions, Inc. (U.S.)

STMicroelectronics (Switzerland)

MaxLinear, Inc. (U.S.)

Analog Devices, Inc. (U.S.)

Cermetek MicroElectronics (U.S.)

IXYS Corporation (U.S.)

Infineon Technologies (Germany)

NXP Semiconductors (Netherlands)

onsemi (U.S.)

Nisshinbo Micro Devices Inc. (Japan)

AltoBeam (China)

Digital Demodulator IC Market

Segment Analysis:

By Type

Single Channel Segment Dominates the Market Due to Rising Demand in Compact Electronics

The market is segmented based on type into:

Single Channel

Subtypes: Low-power, High-speed, and others

Dual Channel

Subtypes: Synchronous, Asynchronous, and others

Others

By Application

Television Segment Leads Due to Widespread Adoption in Digital TVs and Set-Top Boxes

The market is segmented based on application into:

Television

Car

Radio

Industrial Automation

Others

By Architecture

Software-Defined Architecture Gains Preference for Its Flexibility in Multi-Standard Applications

The market is segmented based on architecture into:

Hardware-based demodulators

Software-defined demodulators

Hybrid demodulators

By End-User

Consumer Electronics Segment Leads Owing to Massive Adoption in Smart Devices

The market is segmented based on end-user into:

Consumer Electronics

Automotive

Telecommunications

Industrial

Others

Regional Analysis: Digital Demodulator IC Market

North America The North American Digital Demodulator IC market is driven by advanced technological adoption across industries such as telecommunications, automotive, and consumer electronics. With the U.S. leading the charge in 5G infrastructure deployment—backed by over $100 billion in private and public sector investments—demand for high-performance demodulator ICs is accelerating. Key players like Skyworks and Analog Devices (ADI) dominate the landscape through innovation in spectrum-efficient solutions tailored to next-generation networks. However, semiconductor supply chain constraints and stringent FCC regulations pose challenges for smaller manufacturers. The region’s focus remains on miniaturization and energy efficiency to cater to IoT and smart device proliferation.

Europe Europe’s market thrives on its robust automotive sector (accounting for 20% of global demodulator IC demand for in-car infotainment systems) and the EU’s push for digital broadcasting standardization. Companies like STMicroelectronics and Infineon leverage the region’s strict EMC directives to develop EMI-resistant ICs. The transition from analog to digital radio (DAB+) in countries like Germany and the UK further stimulates growth. Nonetheless, high R&D costs and competition from Asian manufacturers pressure profit margins. Collaborative initiatives such as the European Chips Act aim to bolster local semiconductor production, offering long-term stability.

Asia-Pacific Accounting for over 40% of global Digital Demodulator IC consumption, the Asia-Pacific region is powered by China’s electronics manufacturing dominance and India’s expanding broadcast infrastructure. Affordable single-channel ICs dominate sectors like budget televisions and radios, while dual-channel variants gain traction in premium automotive applications. Japanese and South Korean firms lead in technological advancements—Nisshinbo Micro Devices recently unveiled a low-power demodulator for 5G small cells. Price sensitivity remains a critical factor, driving mergers between local suppliers and global giants to optimize production costs. Urbanization and smart city projects present sustained growth opportunities despite trade tensions affecting chip supply chains.

South America This emerging market shows gradual adoption of Digital Demodulator ICs, primarily for television and radio applications amidst analog signal phase-outs. Brazil’s Pro TV 3.0 initiative aims to complete digital terrestrial TV migration by 2025, creating a $50 million incremental opportunity. Economic instability, however, limits investment in cutting-edge demodulator technologies, with most demand fulfilled through imports. Local assembly partnerships—such as NXP’s production facility in Mexico serving neighboring countries—offer a compromise between cost and quality. Regulatory inconsistencies across nations further complicate market entry strategies for global suppliers.

Middle East & Africa The MEA region exhibits niche growth driven by satellite TV adoption in rural areas and luxury automotive sales in Gulf countries. Digital demodulator ICs with enhanced signal recovery capabilities are prioritized to overcome infrastructural gaps in terrestrial networks. While the UAE and Saudi Arabia invest in local semiconductor testing facilities, most components are imported due to limited fabrication capabilities. Political instability in parts of Africa disrupts supply routes, though pan-regional trade agreements show potential to stabilize IC distribution networks over the next decade.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Digital Demodulator IC markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global Digital Demodulator IC market was valued at USD 720 million in 2024 and is projected to reach USD 1.1 billion by 2032, growing at a CAGR of 5.8% during the forecast period.

Segmentation Analysis: Detailed breakdown by product type (Single Channel, Dual Channel), application (Television, Car, Radio, Others), and end-user industry to identify high-growth segments and investment opportunities. The Single Channel segment is expected to grow at a CAGR of 6.2% from 2025 to 2032.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis. Asia-Pacific accounted for 42% of the global market share in 2024.

Competitive Landscape: Profiles of leading market participants including Skyworks, ST, MaxLinear, ADI, and NXP, covering their product offerings, R&D focus, manufacturing capacity, pricing strategies, and recent developments such as mergers, acquisitions, and partnerships. The top five players held approximately 58% market share in 2024.

Technology Trends & Innovation: Assessment of emerging technologies, integration of AI/IoT in demodulation, semiconductor design trends, fabrication techniques, and evolving industry standards like 5G and advanced broadcasting protocols.

Market Drivers & Restraints: Evaluation of factors driving market growth (increasing demand for digital broadcasting, automotive infotainment systems) along with challenges (supply chain constraints, regulatory issues in spectrum allocation).

Stakeholder Analysis: Insights for component suppliers, OEMs, system integrators, investors, and policymakers regarding the evolving ecosystem and strategic opportunities in digital demodulation technologies.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/chip-solid-tantalum-capacitor-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-electrical-resistance-probes.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/high-temperature-tantalum-capacitor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-link-choke-market-innovations.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/multirotor-brushless-motors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/planar-sputtering-target-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ferrite-core-choke-market-opportunities.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/float-zone-silicon-crystal-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/carbon-composition-resistors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/resistor-network-array-market-analysis.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/melf-resistors-market-key-drivers-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/metal-foil-resistors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/metal-oxidation-resistors-market-size.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ferrite-toroid-coils-market-growth.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/vacuum-fluorescent-displays-market.html