#Relational Software Inc. (RSI)

Explore tagged Tumblr posts

Text

Oracle (ORCL)

#Tradingan – #Grafik #harga #saham #Oracle (ORCL) hari ini untuk membantu #analisa #pasar sebelum memulai #investasi dan #trading saham Oracle #ORCL. Oracle Corporation adalah salah satu #perusahaan teknologi terkemuka di dunia yang #berfokus pada pengembangan #perangkat lunak basis data, #komputasi awan (cloud computing), dan solusi enterprise. Perusahaan ini didirikan pada tahun 1977 dan telah…

#Analisa Saham Oracle (ORCL)#Apa itu Oracle (ORCL)#Apa Saham Oracle#Chart Saham Oracle (ORCL)#Development Laboratories (SDL)#Grafik Saham Oracle (ORCL)#Harga Saham Oracle (ORCL)#Indeks Saham Amerika#Indeks Saham As#NYSE#oracle#Oracle (ORCL)#Oracle Applications#Oracle Autonomous Database#Oracle Cloud Infrastructure (OCI)#Oracle Cloud Infrastructure (OCI).#Oracle Corporation#Oracle CX Cloud#Oracle E-Business Suite#Oracle ERP Cloud#Oracle Exadata#Oracle SPARC#Oracle Supply Chain Management (SCM)#Oracle V2#Oracle ZFS Storage#ORCL#Relational Software Inc. (RSI)#Saham Amerika#Saham Dunia#Saham Global

0 notes

Text

Oracle (ORCL)

#Tradingan – #Grafik #harga #saham #Oracle (ORCL) hari ini untuk membantu #analisa #pasar sebelum memulai #investasi dan #trading saham Oracle #ORCL. Oracle Corporation adalah salah satu #perusahaan teknologi terkemuka di dunia yang #berfokus pada pengembangan #perangkat lunak basis data, #komputasi awan (cloud computing), dan solusi enterprise. Perusahaan ini didirikan pada tahun 1977 dan telah…

#Analisa Saham Oracle (ORCL)#Apa itu Oracle (ORCL)#Apa Saham Oracle#Chart Saham Oracle (ORCL)#Development Laboratories (SDL)#Grafik Saham Oracle (ORCL)#Harga Saham Oracle (ORCL)#Indeks Saham Amerika#Indeks Saham As#NYSE#oracle#Oracle (ORCL)#Oracle Applications#Oracle Autonomous Database#Oracle Cloud Infrastructure (OCI)#Oracle Cloud Infrastructure (OCI).#Oracle Corporation#Oracle CX Cloud#Oracle E-Business Suite#Oracle ERP Cloud#Oracle Exadata#Oracle SPARC#Oracle Supply Chain Management (SCM)#Oracle V2#Oracle ZFS Storage#ORCL#Relational Software Inc. (RSI)#Saham Amerika#Saham Dunia#Saham Global

0 notes

Text

Oracle (ORCL)

#Tradingan – #Grafik #harga #saham #Oracle (ORCL) hari ini untuk membantu #analisa #pasar sebelum memulai #investasi dan #trading saham Oracle #ORCL. Oracle Corporation adalah salah satu #perusahaan teknologi terkemuka di dunia yang #berfokus pada pengembangan #perangkat lunak basis data, #komputasi awan (cloud computing), dan solusi enterprise. Perusahaan ini didirikan pada tahun 1977 dan telah…

#Analisa Saham Oracle (ORCL)#Apa itu Oracle (ORCL)#Apa Saham Oracle#Chart Saham Oracle (ORCL)#Development Laboratories (SDL)#Grafik Saham Oracle (ORCL)#Harga Saham Oracle (ORCL)#Indeks Saham Amerika#Indeks Saham As#NYSE#oracle#Oracle (ORCL)#Oracle Applications#Oracle Autonomous Database#Oracle Cloud Infrastructure (OCI)#Oracle Cloud Infrastructure (OCI).#Oracle Corporation#Oracle CX Cloud#Oracle E-Business Suite#Oracle ERP Cloud#Oracle Exadata#Oracle SPARC#Oracle Supply Chain Management (SCM)#Oracle V2#Oracle ZFS Storage#ORCL#Relational Software Inc. (RSI)#Saham Amerika#Saham Dunia#Saham Global

0 notes

Text

Security and Vulnerability Management Market Trends, Growth, Revenue, Analysis and Future Challenges 2034: SPER Market Research

Security and Vulnerability An essential cybersecurity task is management, which involves identifying, assessing, and mitigating risks to an organization's digital infrastructure. It involves finding security holes in hardware, software, and network systems, prioritizing them, and addressing them in order to lower potential hazards. This process includes patch management, regular vulnerability scans, and continuous monitoring to identify new threats or vulnerabilities. Security and vulnerability management aims to reduce the risk of cyberattacks, data breaches, and other security incidents by maintaining systems up to date, secure, and compliant with industry standards. Effective management helps companies maintain a strong security posture while preventing exploitation by malicious actors.

According to SPER market research, ‘Global Security and Vulnerability Management Market Size- By Component, By Type, By Target, By Deployment, By Enterprise Size, By Vertical - Regional Outlook, Competitive Strategies and Segment Forecast to 2033’ state that the Global Security and Vulnerability Management Market is predicted to reach 32.63 Billion by 2034 with a CAGR of 7.05%.

Drivers:

The growing frequency and sophistication of cyber threats, which forces enterprises to prioritize strong responses, is driving the growth of the security and vulnerability management market. Attack surfaces have increased due to the growth of IoT, API-driven technologies, and remote work, which has increased demand for sophisticated security measures. Companies like government, healthcare, and finance are also implementing vulnerability management systems in order to adhere to stringent data security laws. AI and machine learning are examples of technological developments that improve threat intelligence, automation, and vulnerability identification. Particularly among small and medium-sized businesses, subscription-based business models and managed security services are becoming more popular. Key players' strategic alliances and acquisitions help the market grow by increasing their regional presence and product offerings to satisfy changing security demands.

Request a Free Sample Report: https://www.sperresearch.com/report-store/security-and-vulnerability-management-market.aspx?sample=1 Restraints:

Organizations' extensive use of security tools, contemporary apps, and legacy systems has led to fragmented environments, making seamless integration difficult. This disarray makes it more difficult to integrate security and vulnerability management solutions, which causes problems with tool compatibility. Security teams thus find it difficult to obtain real-time data, which raises the possibility of breaches. Information silos also appear, restricting visibility and reducing response times by confining vital security data to particular departments.

In 2024, North America emerged as the leading region in the global security and vulnerability management market, holding a substantial share of the revenue. This dominance is fueled by the region's advanced technological infrastructure and the extensive adoption of digital transformation across various industries. The United States, home to major technology companies, financial institutions, and defense organizations, faces a growing number of cyber threats, driving the increasing demand for comprehensive security solutions. Some significant market players are CrowdStrike, Fortra, LLC, IBM Corporation, Microsoft, Qualys, Inc., Rapid7, RSI Security, Tenable, Inc., and others.

For More Information, refer to below link: –

Security and Vulnerability Management Market Growth

Related Reports:

Shortwave Infrared (SWIR) Market Growth, Size, Trends Analysis - By Offering, By Imaging Type, By Technology, By Vertical- Regional Outlook, Competitive Strategies and Segment Forecast to 2034

Student Information System Market Growth, Size, Trends Analysis - By Component, By Deployment, By Application, By End-User - Regional Outlook, Competitive Strategies and Segment Forecast to 2034

Follow Us –

LinkedIn | Instagram | Facebook | Twitter

Contact Us:

Sara Lopes, Business Consultant — USA

SPER Market Research

+1–347–460–2899

#Security And Vulnerability Management Market#Security And Vulnerability Management Market Share#Security And Vulnerability Management Market Size#Security And Vulnerability Management Market Revenue#Security And Vulnerability Management Market Demand#Security And Vulnerability Management Market Analysis#Security And Vulnerability Management Market Scope#Security And Vulnerability Management Market Challenges#Security And Vulnerability Management Market Competition#Security And Vulnerability Management Market forecast#Security And Vulnerability Management Market Segmentation#Security And Vulnerability Management Market Future Outlook

0 notes

Text

PL/SQL Analyst with Revenue Solutions

The position listed below is not with North Carolina Interviews but with Revenue SolutionsNorth Carolina Interviews is a private organization that works in collaboration with government agencies to promote emerging careers. Our goal is to connect you with supportive resources to supplement your skills in order to attain your dream career. NorthCarolina Interviews has also partnered with industry leading consultants & training providers that can assist during your career transition. We look forward to helping you reach your career goals! If you any questions please visit our contact page to connect with us directlyWe are looking to welcome a PL/SQL Analyst to our team in Raleigh, NC.Have a couple years of experience with PL/SQL? Our role may be a fit for you!Leveraging your strong background as a Business Analyst, you will work with the client to gather and document system requirements, participate in joint client design sessions, perform business process analyses, develop business process models, resolve design issues, assist with development efforts throughout the entire SDLC, and participate in training, documentation, and knowledge transfer activities. Your specific responsibilities might include:Working with clients to develop and document system requirements and develop use casesIdentifying, documenting, and implementing business rules requirementsPerforming data extraction, report development and data analysisCreating system documentationParticipating in system test activitiesDelivering end-user trainingParticipating in ongoing improvement of systems, standards, and methodologiesThis position will offer the opportunity to learn compliance programs within tax systems. In this role, you will implement advanced strategies for gathering, reviewing and analyzing data requirements. Our fast paced work environment will require multi-tasking and time management skills. This position will hone analytical skills and enable you to think outside of the box . Exposure to variety of different experiences business analysis, requirements gathering, gap analysis/JAD sessions, use case plans, effective problem solving and communication skills, and scope and project reporting skills are essential for this position. This is not a strictly functional position so the ideal candidate must be open to learning PL/SQL querying and programming. REQUIRED EXPERIENCE, SKILLS & COMPETENCIES: Bachelors degree in Computer Science, CIS, MIS or a related fieldImmediate authorization to work in US2+ years relevant work experience as a business analyst in a software development, information technology, or system implementation environmentExperience gathering business requirements, documenting as is and to be business processes, and developing use casesKnowledge of standard development techniques (OOD, SDLC)Prior experience in basic programming languages Java, PL/SQLExperience participating in client design sessionsStrong analytical problem solving skillsAbility to quickly grasp technical issues and offer solutionsAbility to focus and deliver on competing prioritiesExcellent verbal and written communication skillsOutgoing and enthusiastic personalityProfessional business demeanorCustomer-focused attitude and desire to interface directly with end-user clientsPREFERRED EXPERIENCE, SKILLS & COMPETENCIES:Advanced degreeExperience with data warehousing and/or large scale databases ABOUT US:Do you have the entrepreneurial spirit and energy it takes to be successful in a fast-paced, high-growth consulting company? RSI may be the place for you!Revenue Solutions, Inc. (RSI) provides IT consulting services and software products to clients in the government revenue industry across the United States and Canada. We're experts at delivering and developing systems solutions that streamline tax administration and maximize revenue. Our clients in State, Local, and Provincial agencies rely on us to help them shorten and straighten the path to implementing new information technologies while reducing the risks and budgetary concerns often associated with these mission-critical projects. As a result of our success, RSI's business has continued to grow at a rapid rate.Why join RSI?Work-life balance & learning with talented colleaguesFull benefits package, 401(k), paid vacation & holidaysMid-size company with history of steady growth and profitabilityTraining options and formal mentoring programAffect change with local, state and international government tax collection processesTo learn more about RSI's high level of commitment towards both our customers and employees, visit our website and our Facebook page. *** RSI is an equal opportunity employer *** - provided by DicePL/SQL Associated topics: data administrator, data analytic, data center, data quality, data scientist, data warehouse, data warehousing, etl, mongo database administrator, sybase PLSQLAnalystwithRevenueSolutions from Job Portal http://www.jobisite.com/extrJobView.htm?id=74617

0 notes

Text

PL/SQL Analyst with Revenue Solutions

The position listed below is not with North Carolina Interviews but with Revenue SolutionsNorth Carolina Interviews is a private organization that works in collaboration with government agencies to promote emerging careers. Our goal is to connect you with supportive resources to supplement your skills in order to attain your dream career. NorthCarolina Interviews has also partnered with industry leading consultants & training providers that can assist during your career transition. We look forward to helping you reach your career goals! If you any questions please visit our contact page to connect with us directlyWe are looking to welcome a PL/SQL Analyst to our team in Raleigh, NC.Have a couple years of experience with PL/SQL? Our role may be a fit for you!Leveraging your strong background as a Business Analyst, you will work with the client to gather and document system requirements, participate in joint client design sessions, perform business process analyses, develop business process models, resolve design issues, assist with development efforts throughout the entire SDLC, and participate in training, documentation, and knowledge transfer activities. Your specific responsibilities might include:Working with clients to develop and document system requirements and develop use casesIdentifying, documenting, and implementing business rules requirementsPerforming data extraction, report development and data analysisCreating system documentationParticipating in system test activitiesDelivering end-user trainingParticipating in ongoing improvement of systems, standards, and methodologiesThis position will offer the opportunity to learn compliance programs within tax systems. In this role, you will implement advanced strategies for gathering, reviewing and analyzing data requirements. Our fast paced work environment will require multi-tasking and time management skills. This position will hone analytical skills and enable you to think outside of the box . Exposure to variety of different experiences business analysis, requirements gathering, gap analysis/JAD sessions, use case plans, effective problem solving and communication skills, and scope and project reporting skills are essential for this position. This is not a strictly functional position so the ideal candidate must be open to learning PL/SQL querying and programming. REQUIRED EXPERIENCE, SKILLS & COMPETENCIES: Bachelors degree in Computer Science, CIS, MIS or a related fieldImmediate authorization to work in US2+ years relevant work experience as a business analyst in a software development, information technology, or system implementation environmentExperience gathering business requirements, documenting as is and to be business processes, and developing use casesKnowledge of standard development techniques (OOD, SDLC)Prior experience in basic programming languages Java, PL/SQLExperience participating in client design sessionsStrong analytical problem solving skillsAbility to quickly grasp technical issues and offer solutionsAbility to focus and deliver on competing prioritiesExcellent verbal and written communication skillsOutgoing and enthusiastic personalityProfessional business demeanorCustomer-focused attitude and desire to interface directly with end-user clientsPREFERRED EXPERIENCE, SKILLS & COMPETENCIES:Advanced degreeExperience with data warehousing and/or large scale databases ABOUT US:Do you have the entrepreneurial spirit and energy it takes to be successful in a fast-paced, high-growth consulting company? RSI may be the place for you!Revenue Solutions, Inc. (RSI) provides IT consulting services and software products to clients in the government revenue industry across the United States and Canada. We're experts at delivering and developing systems solutions that streamline tax administration and maximize revenue. Our clients in State, Local, and Provincial agencies rely on us to help them shorten and straighten the path to implementing new information technologies while reducing the risks and budgetary concerns often associated with these mission-critical projects. As a result of our success, RSI's business has continued to grow at a rapid rate.Why join RSI?Work-life balance & learning with talented colleaguesFull benefits package, 401(k), paid vacation & holidaysMid-size company with history of steady growth and profitabilityTraining options and formal mentoring programAffect change with local, state and international government tax collection processesTo learn more about RSI's high level of commitment towards both our customers and employees, visit our website and our Facebook page. *** RSI is an equal opportunity employer *** - provided by DicePL/SQL Associated topics: data administrator, data analytic, data center, data quality, data scientist, data warehouse, data warehousing, etl, mongo database administrator, sybase PLSQLAnalystwithRevenueSolutions from Job Portal http://www.jobisite.com/extrJobView.htm?id=74617

0 notes

Text

PL/SQL Analyst with Revenue Solutions

The position listed below is not with North Carolina Interviews but with Revenue SolutionsNorth Carolina Interviews is a private organization that works in collaboration with government agencies to promote emerging careers. Our goal is to connect you with supportive resources to supplement your skills in order to attain your dream career. NorthCarolina Interviews has also partnered with industry leading consultants & training providers that can assist during your career transition. We look forward to helping you reach your career goals! If you any questions please visit our contact page to connect with us directlyWe are looking to welcome a PL/SQL Analyst to our team in Raleigh, NC.Have a couple years of experience with PL/SQL? Our role may be a fit for you!Leveraging your strong background as a Business Analyst, you will work with the client to gather and document system requirements, participate in joint client design sessions, perform business process analyses, develop business process models, resolve design issues, assist with development efforts throughout the entire SDLC, and participate in training, documentation, and knowledge transfer activities. Your specific responsibilities might include:Working with clients to develop and document system requirements and develop use casesIdentifying, documenting, and implementing business rules requirementsPerforming data extraction, report development and data analysisCreating system documentationParticipating in system test activitiesDelivering end-user trainingParticipating in ongoing improvement of systems, standards, and methodologiesThis position will offer the opportunity to learn compliance programs within tax systems. In this role, you will implement advanced strategies for gathering, reviewing and analyzing data requirements. Our fast paced work environment will require multi-tasking and time management skills. This position will hone analytical skills and enable you to think outside of the box . Exposure to variety of different experiences business analysis, requirements gathering, gap analysis/JAD sessions, use case plans, effective problem solving and communication skills, and scope and project reporting skills are essential for this position. This is not a strictly functional position so the ideal candidate must be open to learning PL/SQL querying and programming. REQUIRED EXPERIENCE, SKILLS & COMPETENCIES: Bachelors degree in Computer Science, CIS, MIS or a related fieldImmediate authorization to work in US2+ years relevant work experience as a business analyst in a software development, information technology, or system implementation environmentExperience gathering business requirements, documenting as is and to be business processes, and developing use casesKnowledge of standard development techniques (OOD, SDLC)Prior experience in basic programming languages Java, PL/SQLExperience participating in client design sessionsStrong analytical problem solving skillsAbility to quickly grasp technical issues and offer solutionsAbility to focus and deliver on competing prioritiesExcellent verbal and written communication skillsOutgoing and enthusiastic personalityProfessional business demeanorCustomer-focused attitude and desire to interface directly with end-user clientsPREFERRED EXPERIENCE, SKILLS & COMPETENCIES:Advanced degreeExperience with data warehousing and/or large scale databases ABOUT US:Do you have the entrepreneurial spirit and energy it takes to be successful in a fast-paced, high-growth consulting company? RSI may be the place for you!Revenue Solutions, Inc. (RSI) provides IT consulting services and software products to clients in the government revenue industry across the United States and Canada. We're experts at delivering and developing systems solutions that streamline tax administration and maximize revenue. Our clients in State, Local, and Provincial agencies rely on us to help them shorten and straighten the path to implementing new information technologies while reducing the risks and budgetary concerns often associated with these mission-critical projects. As a result of our success, RSI's business has continued to grow at a rapid rate.Why join RSI?Work-life balance & learning with talented colleaguesFull benefits package, 401(k), paid vacation & holidaysMid-size company with history of steady growth and profitabilityTraining options and formal mentoring programAffect change with local, state and international government tax collection processesTo learn more about RSI's high level of commitment towards both our customers and employees, visit our website and our Facebook page. *** RSI is an equal opportunity employer *** - provided by DicePL/SQL Associated topics: data administrator, data analytic, data center, data quality, data scientist, data warehouse, data warehousing, etl, mongo database administrator, sybase PLSQLAnalystwithRevenueSolutions from Job Portal http://www.jobisite.com/extrJobView.htm?id=74617

0 notes

Text

More on Disadvantages Of Texting In Cell Phones by Cellphone And Accessories Center

One cellphone reviewer with initials FC comments: Wow it was almost as if someone was reading my mind when I thought of Disney Character Cell Phone Accessories and then...

cellphoneservicescom compare cellular phone plans from cingular wireless, tmobile, verizon wireless, sprint, nextel and more these service plans come with free cellular phones, cash back deals, or . Our {interest, enthusiasm, excitement, exhilaration, passion, ferver, love} for

Mobile Phones At Trade Prices

{info, information, content, articles, writing, commentary} has resulted in this {website, site, webpage, web page, web site, page}. . British Educators Angered by Texting I say dont and has its own unique advantages and disadvantages. The first cellular phones were Used cell phones will be converted turn into calling card . click here to go to cellphonespoofingcom this may save you life please tell others . and photos to your cellphone, for free as ringtones and graphics (free ringtones and graphics for your mobile phone) (free ringtones mp3 graphics nokia motorola samsung) (free ringtones mp3 graphics nokia motorola samsung) ( . Find the cell phone thats right for you with our comprehensive listing of sites. Shop and compare prices online before you buy..

Cell Phones

service to provide cellphonepc instant messaging reuters, bloomberg news friday, july 1, 2005 london vodafone group and microsoft, the biggest cellular and software companies in the world, said thursday that they would start a . Get your free cell phone with a carrier plan. Free shipping..

Free Cell Phones with plans

theyre typing away on tiny numerical pads, using their cell phones movie showtimes or local business listings just by texting a In the next section, well look at the disadvantages of SMS and some . search the internet and the archives with a twist on searching the internet home submit an article submit your web site careers faqs announcements contact login article submission we need your articles well promote them for free author login register please slow down you have been reading articles . Get offers for Cingular Cell Phones Plans at CellularCarrierSpecials.com.

Cingular Cell Phone Plan Specials

click here to go to cellphonemoviesnet this may save you life please tell others . on different types of lizards as pets, and the advantages and disadvantages people enter data into their blog (via pictures, voice, or texting) from their cell phones while . st operations compared to other phones. This model has ringtone and graphic for cell phone pace key when texting) its predecessor, bulk and weight are its key disadvantages.. 8310 but unfortunately lost it (one of the disadvantages Texting was a doddle, as it is in all Nokia phones. No problems with voice connected with my changing the option for Cell . music listening times likewise, the amount of time that a phones Rating reviewed by des from uk on 10th oct 2003 points disadvantages mms Bag, in my pocket, when turns itself off, in my texting, for . search venues think friendster meets vindigo speed up serendipity a tool you can use when youre actually being social dodgeball has changed the social fabric of everything read more home about us press privacy terms of service contact copyright 2005 google inc . cell phone,free cellphone, verizon cell, prepaid cell, cell phone service providers, cell ringtones, motorola razor phone, mobile phone, celular phone deals, cel phone, cellular phone deal, trac phone home about us our store . Bad credit No credit It doesnt matter you are automatically approved for your free cellular phone. Act now and dont forget, no one is turned down for these beautiful cell phones..

Everyone is Approved Cellular Phones

hot new opportunity for entrepreneurs and home workers start your own telecom, wifi, computer and technology business market high end products for companies like sprint pcs, nextel, verizon, direct tv, ztel and more get paid weekly monthly residual checks 0 startup costs your own huge mega si . fsi cellphonecom tmobile cellular us cellular cellular phone reviews compare cell phones download free ringtones cellphone articles add url nokia gsm motorola cellular ringtones cell phones mobile phone . ringtones wallpapers sms chat my album sms contests contact us corporate se . One cellphone reviewer with initials FC comments: Wow it was almost as if someone was reading my mind when I thought of

Disney Character Cell Phone Accessories

and then. gsm cellphone accessories bluetooth car phone kit products headphone earphone adapter bluetooth , dongletooth , bluetooth car accessories , cell phone case , bluetooth car phone accessories , bluetooth car phone . 2 billion cellphone users now official monster statistic 2 billion cellphone users now official by tomi ahonen this was the milestone i had been predicting for the past six months that it would hit specifically . Free 0.00 Cell Phones only with purchase of a New Plan for Cingular, Verizon, TMobile, etc. Free Motorola RAZR Phones and our Popular Treo and Blackberries. Free FedEx Shipping.

Free Cell Phones at AmericanCell.com

Technologies of Reno has created a new type of Liion cell in They were also given one month of free personal texting, starting But there are disadvantages. The spinning discs make for increasingly . Bad credit No credit It doesnt matter you are automatically approved for your free cellular phone. Act now and dont forget, no one is turned down for these beautiful cell phones..

Everyone is Approved Cellular Phones

Reviews for Motorola RAZR V3 Black Phone (Cingular) Cell Phones The Motorola RAZR V3 has its own advantages and disadvantages. When the buttons get dirty it also makes texting or even . home hardware new cellphone gpu supports dx9, h264, ogl 20 new cellphone gpu supports dx9, h264, ogl 20 submitted by bleekii 25 days ago ( via httpwwwtomshardwarecomha ) the chips target cellphone classes and . Get your free cell phone with a carrier plan. Free shipping..

Free Cell Phones with plans

text messaging and cell phones are a neat way of communicating. In the article School Harnesses Power of Texting , Mr. McMenamin said the advantages of cellphones far outweigh the disadvantages.. With INTELENET Wireless, you can compare prices and availability from all major U.S. carriers including ATT Wireless, TMobile, Verizon, Cingular, Nextel, Alltel and Liberty Wireless..

Cell Phones

collection from any cellphone posted jun 17, 2005, 122 pm et by peter rojas related entries cellphones , features , portable audio as some of you probably already know, i ve been guesthosting g4 s attack of the show this past . it sticks or not, youll soon be able to tell what the texting h advantages and disadvantages. For example, color screen causes an but then all phones are I do t at all so SHUT UP. icstzcom lifestyle . insurance quotes uk cellphone insurance quotes quotes online mobile phone insurance 3g mobile phones online nokia, motorola, nec more mobile phone car kits handsfree kits and phone chargers unlock your mobile phone (not 3g . loginregister help contact us welcome mobile unlocking mobile accessories mobile repair tools smartcards car diagnostics gps gadgets 140 sp ani sh ve rsi on f1c search shops mobile unlocking mobile accessories mobile repair tools simcards car diagnostics gps gadgets brands nokia motorola universal . Student Cell Phones Help or Hindrance One reason that I chose to and even the exams because someone might be calling or texting have an advantage as well as a disadvantage but the disadvantages . {Our, This}

Verizon Cell Phone Accessories

{material, info, information, knowledge, data, content, writing, resource} {contains, is made up of, lists} the {very latest, very best, most updated, newest, latest, best, greatest, number one, most desirable, top} and most {relevant, appropriate, fitting, pertinent} {details, subject matter} {available, possible, accessible, anywhere, within reach, online, on the net, on the internet, on the web, on the world wide web}.. lobbying and law cellphone companies toss a hail mary by drew clark , national journal national journal group inc saturday, december 20, 2003 for years, cellularcommunications companies lobbied strenuously against any move . This phone has a lot of advantages and very few disadvantages. It offers a full messaging keyboard that can make texting But now, it has expanded to cell phones with the creation of the . 4,233 posts tagged cellphone related tags cell phone , mobile phone , mobile , technology , gadgets , wireless , phone posts tagged cellphone in the last 1 day games for phones you make the call in custom cellphonecom news . Free 0.00 Cell Phones only with purchase of a New Plan for Cingular, Verizon, TMobile, etc. Free Motorola RAZR Phones and our Popular Treo and Blackberries. Free FedEx Shipping.

0 notes

Text

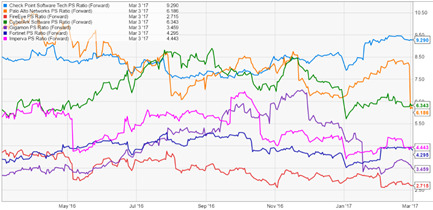

Recommendations to buy and sell Cyber Security Stocks

Summary:

- Buy HACK ETF close to the support line of the uprising trend and have a tight stop loss. Don’t expect the gains to be as large as in 2016.

- I would wait for price consolidation in Fortinet (FTNT). So, I prefer to go long with a lower price or only in the breakout of the 37 level.

- I would day trade FireEye (FEYE) in the short side and Check Point Software (CHKP) in the long side. Too much risk to hold a position through the day.

- Gigamon Inc (GIMO): I would try a long swing position close to the 29-30 level with a very tight stop loss right below 28.

- Buying the dead cat bounce may be appealing, but at a lower price in Palo Alto Networks. Patience is needed.

- I might short Proofpoint (PFPT). I am waiting for the signal.

- Today: I opened a small short position in CYBR (trading the range, and probably make a follow up in my short after that) and I closed my short in FEYE (but I might day trade it again next days).

I want to focus my attention on one sector with one of the best stock performers (price) in 2016: Cyber security.

As heads up, I practice Fusion analysis (Fundamental and Technical) but my methodology usually starts with a top-down technical analysis view.

I think that cyber security is the next area in technology that needs real consolidation (industry and stock price). Meaning: more M&A activity and more price consolidation of many public stocks that have run nicely in 2016. Don’t get me wrong, I think this sector has a great future, but there might be a bumpy road ahead.

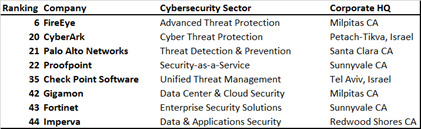

According Cybersecurity Ventures, worldwide spending on cybersecurity-related products and services is expected to top $1 trillion for the 2017 to 2021 time frame. Cybersecurity Ventures have also announced the Q1 2017 edition of the Cybersecurity 500, a global compilation of 500 leading companies who provide cybersecurity solutions and services. The next table shows only 8 of these companies -out of 500- and their ranking. These companies will be the focus of my analysis; the best part is that they are part of the top 44 of Cybersecurity Ventures’ ranking, have stock liquidity, a market cap over $1 billion, and interesting technical charts.

Source: http://cybersecurityventures.com/cybersecurity-500/

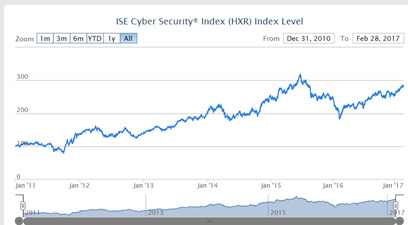

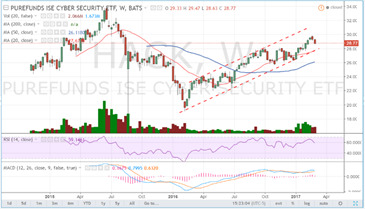

In regards to price consolidation, I follow the ISE Cyber Security Index which started at the 100 level in December 31 2010. As of February, 28 2017, its index total return has a price of 287.33, implying a CAGR of 18.67% (or annualized return). This is an index that provides a benchmark and is composed of companies that develop hardware and/or software that safeguard access to files, websites, and networks.

Source: https://www.ise.com/etf-ventures/index-data/ise-cyber-security-index-hxr/

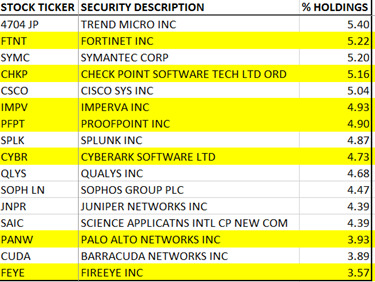

The ETF HACK has tracked this index since November 12, 2014 with an expense ratio of 0.75%, 34 holdings, a market cap of $7.4 billion and a quarterly re-balancing with “modified equal weight”. 7 out of the 34 holdings are the stocks that I am going to analyse. See the following chart with the highlighted stocks in yellow, with the exception of Gigamon, which is not included in the HACK ETF.

Source: http://www.purefunds.com/purefunds-etfs/hack/

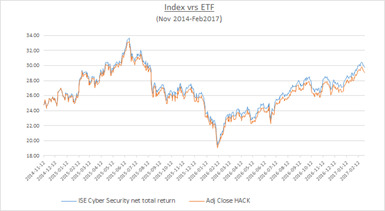

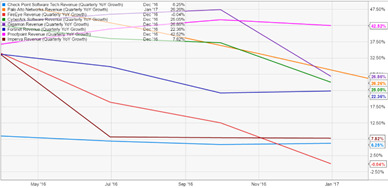

Since November 12, 2014, the return on the Index has been 8.28% annualized and the ETF HACK has been 7.14%. The difference of 1.14% can be attributed to both a 0.75% and a 0.39% of tracking difference. In the same period, if you had bought these stocks individually, instead of the ETF, you would have had the following annualized net returns (not including dividends): GIMO: +44%; PFPT: +28%; CYBR: +19%; PANW: +16%; FTNT: +15%; CHKP: +12%; IMPV: -4%; and, FEYE: -37%. As you can see, since the ETF was launched, this sector is still in consolidation and hasn’t gone above the last high that occurred in June 2015.

Created chart based on data from www.purefunds.com and Yahoo finance

The HACK ETF is still on an uptrend. You might want to consider going long once it goes to the support of the uptrend. For now, I have some long and short ideas for some of the stocks.

Let’s start the individual analysis in the same order as the last table (highlighted stocks in yellow), shall we?

1- Fortinet:

FTNT has a bullish structure trading above 20, 50, and 200 moving average (weekly chart). It jumped after reporting earnings in the beginning of February. Right now, it is trading close to the lower price after the gap which is dangerous for the bulls because MACD is giving a sell sign and RSI is showing weakness. Also, it is trading very close to a resistance level where it got rejected right after the gap up. However, it is difficult to call for a short in this bullish chart structure.

Depending on the markets in general and the ISE index, 36ish might be an area of consolidation (current price), but if the price continues lower, the mid 33s is a level to watch. However, if the price pushes higher next week to a price above 37 with high volume, the stock might reach close to 42. Earnings are going to be reported on April 25th.

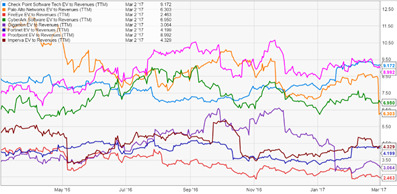

It is important to notice that the EV/revenues are at 4.2, above only Gigamon (3.06) and FireEye (2.46), and below the other 5, which make this a cheap stock. I would be a buyer in case of a breakout to the upside above 37 with a stop loss at 35.90 and a target of 42.

2- Check Point:

The fundamentals seem very good in CHKP, but technically speaking, it is trading in “profit taking” area if you were long. Congratulations! if you were long, but, this is not an area where I want to be buying. Please see the resistance in the monthly and weekly charts. In the daily chart, the MACD has given us a sell signal, but MACD in the monthly chart just gave us a buy signal. Let’s search for more evidence.

The EV/revenues for CHKP is the highest in comparison with the other 7 companies at 9.17, followed by PFPT at 8.99; indeed, a very expensive multiple. Also, the forward price to sales ratio is at 9.29 followed by CYBR at 6.34 and PANW at 6.19 (even with the last PAWN sell off). However, I cannot blindly go short, remember “the market can stay irrational longer than you can stay solvent.” That is why, if I had to do something with this stock, I would go long only in a day trading style to capture some momentum -if there is any left- but I wouldn’t hold any position through any day. Earnings will next be released on April 19th.

3- Imperva:

IMPV has one of my favourite setups. If you see the EV/revenues chart, it looks divided into 2 groups with the bottom group led by IMPV (4.32) followed by FTNT (4.2), GIMO (3.06), and FEYE (2.46). My point here is that the 4 in the bottom group haven’t overlapped with the 4 in the top group -at least since April 2016- which means that the top group (CHKP, PFPT, PANW, CYBR) has stronger and better fundamental reasons to be more expensive than the bottom group -see the last chart of EV/revenues with all the historical multiples.

In the next chart below, IMPV looks ready to break the support. Please see the weekly chart and how some ugly red candles in 2016 pushed the stock lower with some dead cat bounces forming a nice declining resistance. IMPV is now close to testing the support, even RSI and MACD confirm the same pattern. I might try a swing short soon, even before we break the support (the red line uprising). The stop loss is very easy to see - the red declining line or the 50 level might be interesting. The risk is that we have a range in the trading area between the 2 Fibonacci levels: 1: 1(53.33) and 0.618(39.87). As long as you define your target levels and stop loss levels, it should be fine. These types of charts can give you no less than a 3-1 reward-risk; this is why it is one of my favorite setups where I am biased to the downside. Even the 20 and 50 moving averages are trending lower.

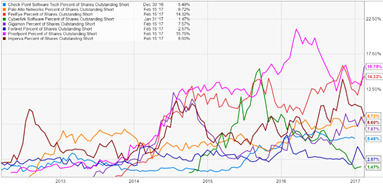

In regards to the “percentage of shares outstanding short”: IMPV and PANW have had an increasing trend of 8.6% and 8.7%, respectively, over the last 5 years. FEYE and PFPT are the only ones above with over 14%. This gives me more confidence for a short trade case. I.e.: Short at 42 with a 32 target (the 32 level is a 0.382 Fibonacci level; below that, it would turn into a very bearish situation). A stop loss of 45.33 would be appropriate for a swing trade.

4- Proofpoint:

PFPT has a bullish chart, but I don’t see much upside in the short term. Notice the pattern forming in the weekly chart which might be a H&S to be confirmed only in the 70 area. Furthermore, it is being rejected from the 1.618 Fibonacci level (83), and it is approaching to the 1.382 level (75). This stocks is really a strong candidate to be short, but I don’t recommend that trade against the uptrend, unless you know what you are doing. It requires a lot of discipline and experience.

To enforce my idea of being short, the “short percent of shares outstanding short” is still trending up and has the highest percentage in this group: 15.75%. Likewise, EV/revenues are 9.15, just below the CHKP at 9.19; both are the priciest multiples. CYBR and PANW follow with 7.00 and 6.24 respectively (PANW used to be at 8.5 before last week’s sell off).

The daily chart also shows weakness in the price which is confirmed by an important bearish divergence in the RSI and a lower trending MACD. This stock has great potential to continue even lower, as I mentioned above, if a H&S pattern is confirmed in the 70 area, it might take us to at least the 60-62 area. This is why, I might open a short position (swing trade) between 80-83 with a tight stop loss of 88 and a target of 62; I would take partial profits around 75ish, 73, 70 and 62. Again this is a risky trade.

5- CyberArk:

CYBR is consolidating between 45 and 59, We see a deceleration of revenues quarterly YoY (not only CYBR, the other 7 stocks, see the following chart). The EV/ revenues are the 3rd most expensive at 6.95 and the forward P/S ratio is the 2nd most expensive at 6.34 out of the 8 stocks (see those the charts above). This stock is still having its 20 and 50 moving average slightly pointing to the upside. So, I might be biased to play the stock on the long side with a small position around 45, if that level is broken, 36ish would be level to watch. But, if it breaks out above 55, I would also go long.

However, because fundamentals lag technicals, I would take a short position below 45 with a target of 37 - important levels are 45ish and 36ish (Fibonacci levels). Also, use RSI as a resistance in the weekly chart and RSI and MACD in the daily chart. Use them as confirmation for any trade idea. There is still too much indecision about the stock price on the chart.

6- Palo Alto Networks

I would like to start to trade PANW on the long side as a mean reversion trade. Meaning: capture a very possible decent dead cat bounce. However, I would not pay more than 112 and I need to see some stabilisation in MACD and RSI which could take days because the violence of the fall can take some smaller deeps soon. Some targets are 123, 131 and 143; I would use the targets accordingly, i.e.: HACK performance, the strength of the market, and new catalysts. Again, MACD and RSI in the weekly chart need to keep their supports, otherwise I would not open a long position and would probably search for arguments for the other side of the trade, such as a price below 110. However, it is possible that the volatility in PANW will fade away after the last big move the last week.

See how important it is for PAWN to keep the support price at 112 in the daily chart. Also, wait for evidence that stochastics is turning bullish because, as I said, this would be a mean reversion trade. Keep in mind that the “short percent of shares outstanding short” is still trending up just like IMPV. So be careful with any long position.

In regards to EV/revenues and forward P/S, they are 6.25 and 6.19, making PANW cheaper (the last time it was at these levels was in 2014). But in comparison with its competitors, it is right in the 4th most expensive EV/revenues out of 8 which is a more neutral position.

7- FireEye:

The structure is bearish for the weekly and daily charts. Right now, I would day trade FEYE on the short side with a 2 to 1 defined reward-risk. I.e.: short it at 11.15 with a target of 10.65 and a stop loss of 11.41.

I would recommend being long only if there is news that infers that revenues will increase in the near future, or right after earnings with good results. See a bullish divergence forming in the daily chart for the MACD and RSI. More importantly, be long if the price goes up above 11.50 with important volume. Don’t be a hero right here. See price action and revenues quarterly YoY decreasing. I need facts to change my view. No guessing or gambling.

8- Gigamon:

I would try a long swing position close to the 29-30 level with a stop loss right below 28. If GIMO goes lower, I would try a long position in the low 22s and I would be more aggressive at that level. Firstly, the weekly chart shows an uptrend, with a strong support at 29ish which is a Fibonacci level (0.618). The other Fibonacci level is in the 22s (0.382). Secondly, GIMO’s EV/revenues at 3.06 are at one of the cheapest levels (after FEYE at 2.72).

There is catch though; RSI is breaking its support and MACD is turning bearish in the daily chart. This would tell me to give it some time around the 29 level, because it might need some consolidation. Money management is key for this type of risky trade idea.

Remember the 44% return since November 2014? This is the only one which is not included in the HACK ETF, but past returns don’t necessarily mean that we are going to have the same ones in the future.

Both technical analysis and fundamental analysis should be used with an open mind and taken with a grain of salt. They both should be applied as arts, not as exact sciences because the markets have a lot of randomness driven by many brilliant minds, including computers, insiders, and probably some manipulators. The only way to beat it is to have a method that gives you a good reward-risk ratio. Good luck!

0 notes