#Remote Working

Explore tagged Tumblr posts

Text

Great Article By Ashkan Rajaee

24 notes

·

View notes

Text

A new job on a rainy day.

Today is the first day of my new job. I’ve been preparing for the start for about two weeks, so it’s felt very smooth transitioning into it. I’m getting some good work done while the rain pelts down on the windows and skylight.

#aelstudies#studyblr#university#dark academia#university studyblr#dark acadamia aesthetic#academia aesthetic#study motivation#study#new job#rain#rainy day#working#remote working

9 notes

·

View notes

Text

3 notes

·

View notes

Text

#meme#mattsmemes#memes that make you go hmmm#accurate#memes#100% accurate#remember#job#work#remote#remote work#disassociate#disassociation#disassociating#remote working#shout it out loud#shout it from the rooftops#💯

6 notes

·

View notes

Text

Create a tranquil space to work from home with an insulated garden office building. A dedicated space to work without disruption, where you can separate work from your home life. And all just a short walk from the house!

#work from home#remote working#wfh#homeofficesetup#office space#garden room#outdoor space#outdoorlivingspace#outdoorliving#businesssetup#home business#summer house#home and garden#garden#home & lifestyle#gardendesign#home and living#work life#home life#businesssolutions#homeofficevibes

2 notes

·

View notes

Text

Taxation of Remote Workers in Turkey: Essential Information for Foreigners

With the increase in remote work and the appeal of Turkey as a base, understanding taxation of remote workers in Turkey is essential for foreigners planning to work, live, or set up a business in the country. Turkey’s tax regulations impact foreign workers differently based on residency status, the source of income, and the duration of their stay. This article provides key insights into taxes in Turkey for foreigners, helping digital nomads, freelancers, and remote employees understand their tax obligations.

Overview of Turkish Tax Obligations for Foreigners

Turkey’s tax laws classify individuals as either resident or non-resident taxpayers, which plays a crucial role in determining tax obligations. Generally, those who stay in Turkey for over six months are considered residents and are subject to taxation on their global income, while non-residents are taxed only on Turkish-sourced income. The primary taxes affecting foreign remote workers include income tax, VAT (value-added tax), and corporate tax for entrepreneurs.

Foreign nationals are advised to work with professional tax consultants or legal advisors, especially because certain categories, like freelancers or employees working for foreign companies, may encounter additional complexity in meeting Turkish tax requirements.

Key Laws Governing Taxation in Turkey for Foreigners

Taxation in Turkey is based on a few core laws. The Income Tax Code applies to individuals earning in Turkey, including foreign residents. The Corporate Tax Code is relevant for business owners or freelancers registered as companies, while the Value Added Tax Code impacts goods and services transactions. For foreigners, Turkey’s digital nomad framework outlines responsibilities for those residing in Turkey but earning income from abroad.

Importance of Compliance with Tax Regulations

Foreigners working remotely or as freelancers in Turkey need to navigate these tax rules carefully. Failure to meet tax obligations can lead to serious consequences, such as fines, penalties, or legal action. Understanding Turkey’s taxation system, particularly for digital nomads or foreign freelancers, can help prevent unexpected tax liabilities. The guidance of tax advisors is often essential for those unfamiliar with the Turkish tax system, as they can help ensure that all compliance requirements are met.

Digital Nomad Tax Rules and Remote Work Permits

Currently, there is no specific “digital nomad visa” in Turkey; however, foreigners working remotely can stay on tourist visas initially. After this period, a residence permit is required, which may necessitate obtaining a work permit depending on the duration and nature of their stay. According to Turkish law, a work permit is also considered a residence permit, giving foreign nationals both the right to work and to reside in the country legally.

Foreigners should note that spending over six months in Turkey typically triggers residency status, which then requires filing income tax returns on worldwide earnings. This regulation applies even to those without work permits, highlighting the importance of understanding residency-based tax obligations.

Double Taxation Agreements and Tax Residency Rules

Turkey has agreements with several countries to prevent double taxation, which can help foreign workers avoid paying taxes on the same income in both their home country and Turkey. Double taxation treaties outline tax responsibilities for individuals based on their primary country of residence and income sources. These agreements are particularly beneficial for foreign nationals working remotely in Turkey for an international employer, as they may qualify for tax credits or exemptions under certain conditions.

Practical Steps for Tax Compliance

For foreign remote workers, staying compliant with Turkish tax rules means securing the right permits, if required, and keeping accurate records of income and expenses. They should ensure they have a tax identification number, a bank account for transactions, and if needed, register their business activities. Additionally, international tax agreements between Turkey and their home country can influence how their income is taxed.

Conclusion

Working remotely from Turkey offers numerous advantages, from cultural enrichment to diverse opportunities. However, it also brings tax obligations that should be carefully managed. Foreigners should understand their tax residency status, familiarize themselves with Turkish tax codes, and seek professional advice to ensure they meet all regulatory requirements.

In summary, taxes in Turkey for foreigners can vary widely based on individual circumstances, making professional assistance invaluable. By understanding taxation in Turkey for foreigners, remote workers can focus on their careers while staying fully compliant with Turkey’s tax laws.

4 notes

·

View notes

Text

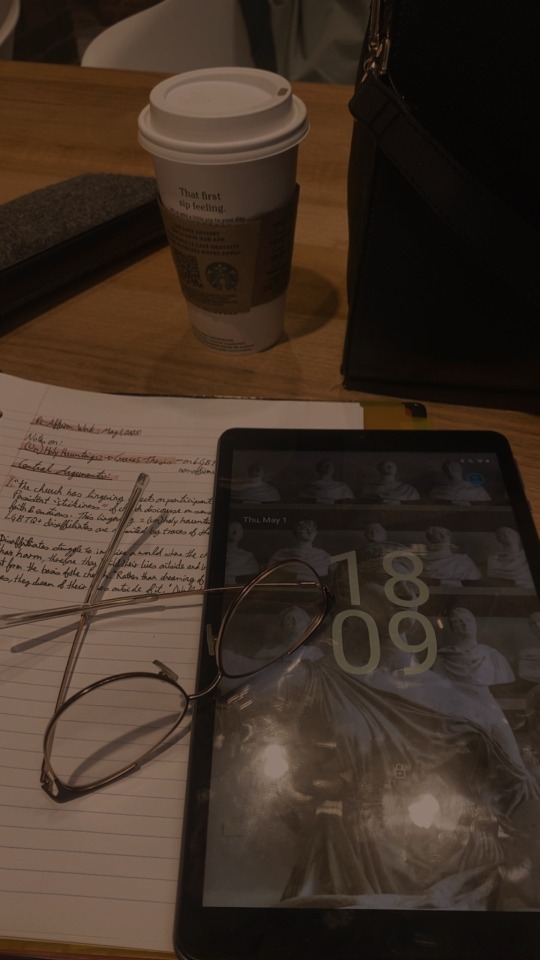

Home office on rainy days.

5 notes

·

View notes

Text

How do you stay professional while being friendly at work?

In my experience, I've come to realize how crucial it is to maintain the right balance between friendship and professionalism in the workplace. Building and keeping good relationships is important but it's just as essential to establish clear boundaries between causual conversation and work tasks.

Here are some of key points I've found helpful:

Set boundaries - it's vital to differentiate between casual chats and focusing on the tasks at hand

Respect other's space and time - always keep in mind that we're at work and everyone has their duties that need attention and completion on time

Communicate respectfully - being polite and professional in all situations, even informal ones is key. One careless word can negatively affect the workplace dynamic

Stay positive - a supportive attitude makes a huge difference. Being in a constant bad mood can influence the entire team and make work progress harder

How do you balance being friendly while staying professional at work?

...

#workfromhome #workfromhomeonline #remotework

#employees#employers#work together#home office#comfy#comfy work#work from anywhere#proffesional life#collaboration#workbalance#flexibility#productivity hacks#team work#office life#office productivity#office problem#remotework#remote working#work from home#daily english#english education

4 notes

·

View notes

Text

I want to obliterate anyone who thinks remote working is bad with ten bajillion black holes.

"But businesses are dying!"

Good. They exist solely to act as a middleman and take money away from the middle and lower class workers. They are leeches. They provide nothing of value except ones that they create by conjuring a demand that doesn't need to exist out of thin air.

Remote working is more climate friendly, more productive, and safer in every way. Anyone who can do remote work should be able to by law.

2 notes

·

View notes

Text

disappearing under mysterious circumstances (logging off at 5pm)

1 note

·

View note

Text

4 Tips to be more efficient while working remotely in a Coliving space

While working remotely has become quite a trend yet being efficient in doing so depends on various factors. Today, many organizations prefer their employees working remotely and showing up in office just once or twice a week. This might seem like the most comfortable work setup but challenges do follow especially when you are working remotely from your coliving space. So, Colive reviews some useful tips to help you be more productive while working remotely from a coliving space.

4 Tips to work more efficiently from your Coliving space:

1. Have a dedicated workspace- To shift yourself to work mode, it’s important to have a dedicated work space. Nothing elaborate, just a basic table to keep your work essentials and a comfortable chair to sit and work is what you desire. While colive reviews these essentials and keeps updating its space for most comfortable remote working environment within the room yet we also have dedicated coworking spaces in many of Colive powered properties. So, coliving and coworking go hand in hand for colive residents.

2. Set a routine- A proper routine can make your personal as well as work life more disciplined and focused. Setting up a routine becomes even more important for remote workers as otherwise it’s tough to manage time.

3. Cut down the distractions- Depending upon where your PG is located, there could be different sorts of distractions interrupting your workflow. If your PG is located on the main road then traffic noise can be very distracting which could be overcome by using noise –canceling headphones. However,if you are a Colive resident then any kind of distraction cannot interrupt your workflow as dedicated coworking spaces are provided inclusive of monthly rent for ease of working.

4. Connect with community-While staying in a community based coliving environment; you get the opportunity to engage and interact with the community members that can prove helpful in boosting your productivity. You can have group work sessions with other remote workers, get constructive feedback, learn new skills and also use common workspaces wisely.

Platforms like Colive make is easier to work remotely while staying in a coliving space as all necessary amenities for comfortable living and working are available without any hassle. Team colive reviews the needs of the colive residents from time to time with the aim to upgrade the services for maximum comfort. You can browse through different Colive PG accommodations and choose the one that best suits your interest. Happy Coliving!!

#co-living#remote working#working remotely#coliving space#colive#colive reviews#colive properties#colive coliving spaces

1 note

·

View note

Text

Remote working is more than just a workplace trend, it’s a fundamental shift in how modern businesses operate.

In our latest blog, we break down what remote work really means, the different models such as hybrid and freelance, and the key benefits it offers to both employers and employees, including flexibility, reduced costs, and global talent access.

We also explore the common challenges like communication gaps and isolation, bust some popular myths, and offer practical tips to succeed in a remote-first environment. Whether you're looking to build a remote team or adapt your own working style, this guide is essential reading.

#remote work#remote working#working remotely#business#outsourcing#offshoring#employer of record#payroll services#uk business#employment#offshoring service

0 notes

Text

I’ve been a Virtual Assistant since the year 2020. 🥰

0 notes

Text

Reskill Your Employees for the Future of Digital Transformation

I really believe that everyone has a talent, ability, or skill that he can mine to support himself and to succeed in life. – Dean Koontz Reskilling has become a cornerstone for organisations to maintain a competitive edge. The rise of automation and artificial intelligence (AI) has disrupted traditional job roles, necessitating a proactive approach to workforce development. Reskilling, which…

View On WordPress

0 notes