#SAP System Audit

Explore tagged Tumblr posts

Text

SAP Audit Services | SAP Authorization and Security Audit Services | ToggleNow

At ToggleNow, we offer comprehensive audit solutions tailored specifically for SAP, guaranteeing that your SAP systems operate in a well secured stature. We evaluate various areas such as optimization, security, and adherence to industry standards, ensuring your SAP systems are not just compliant but also optimized for efficiency. Our team comprises certified audit professionals adept at navigating the intricacies of SAP systems, equipped with extensive experience in conducting thorough audits. Through our services, we assist businesses like yours in effectively managing risks, enhancing overall performance, and unlocking the maximum value from your investments in SAP.

With a dedicated focus on SAP auditing, we recognize the critical importance of safeguarding your systems. Our team’s proficiency in this niche domain allows us to provide meticulous assessments that go beyond mere compliance, aiming to streamline operations and fortify the integrity of your SAP infrastructure. By partnering with us, you gain access to expert insights, enabling you to make informed decisions, address vulnerabilities, and capitalize on the full potential of your SAP environment.

Read more: https://togglenow.com/services/sap-audit-services/

#SAP Audit Services#SAP Security Audit Services#SAP System Audit#SAP Compliance Audit#SAP Audit Management#Audit Management System#SAP Audit Management System#SAP Security Audit

0 notes

Text

Effectively using SAP SOD analysis to meet audit needs | Manual SoD Analysis | Quick SoD Analysis | ToggleNow

ToggleNow's offline SAP SoD Analysis solution offers a customizable, 150+k SoD ruleset to achieve 100% SOX compliance. Analyze SoD violations in SAP without implementing a solution.

Our offline risk analysis service revolutionizes risk assessment by providing a comprehensive and secure solution that doesn’t rely on constant connectivity. This innovative service enables organizations to conduct thorough risk evaluations and Segregation of Duties (SoD) analysis without the need implementing any solution. By utilizing this offline approach, businesses can efficiently identify, evaluate, and mitigate critical risks while ensuring data security and compliance. This service empowers companies to conduct in-depth risk assessments at their convenience, offering flexibility and reliability in managing potential vulnerabilities within their SAP systems and processes.

Read More :

0 notes

Text

Unlock Your Career Potential with an Online SAP FICO Course !

Unlock Your Career Potential with an Online SAP FICO Course

In today's business world, enterprise resource planning (ERP) software such as SAP is a career changer for financial professionals. Among all of SAP's core modules, SAP FICO (Financial Accounting and Controlling) is an essential financial data management and strategic decision-making software. If you're interested in further developing your skills, and SAP FICO course online provides a convenient, cost-effective route to certification and professional advancement.

What is SAP FICO?

SAP FICO brings together two flagship modules:

• Financial Accounting (FI): Is responsible for external financial reporting, e.g., balance sheets, profit/loss statements, and compliance.

• Controlling (CO): Oversees internal cost control, budgeting, and performance measurement.

Used by industries like retail, healthcare, and manufacturing, SAP FICO integrates operating and financial data to support business decisions and process automation for organizations.

Why to Get SAP FICO Certification? 1. High Demand: Businesses globally look for SAP FICO specialists to streamline financial processes. 2. Lucrative Salaries: Certified experts earn good salaries due to their specialized expertise. 3. Career Flexibility: Career roles range from SAP FICO consultant, financial analyst, project manager, and others.

Advantages of Studying an SAP FICO Course Online: Choosing an SAP FICO online course provides unparalleled benefits: • Flexibility: Learn at your own pace, fitting work or personal schedules. •Global Access: Learn from world-class teachers and students globally. • Cost Savings: Save on travel and accommodation costs related to on-site training. •Hands-On Training: Top courses utilize simulations, real projects, and working with the SAP system

Most Significant Elements of a Great SAP FICO Course Online: When choosing a course, choose courses that: 1. Full Curriculum: From FI and CO modules, through configuration, reporting, to integration with other SAP systems. 2. Professional Teachers: Enjoy the experience of seasoned professionals with practical exposure. 3. Certification Prep: Study guide to pass SAP FICO certification exams. 4. Post-Course Support: Resume writing assistance, interview coaching, and job placement assistance. SAP FICO certified experts perform well in the following job positions: • SAP FICO Consultant • Financial Controller • ERP Analyst

• Audit specialist

Conclusion: An SAP FICO online training is your passport to becoming a master of a much-needed ERP platform and propelling your finance career. Flexible learning, hands-on training, and career-oriented curriculum, such trainings transfer skills that employers require. Career transition or upskilling, SAP FICO certification results in high-impact roles and ongoing growth. Get your career wheels turning? Join an accredited SAP FICO online training today and set the stage for financial transformation!

Contact us: +918408878222

Visit: www.erpvits.com

Mail id: [email protected]

#SAPFICO#SAPFICOOnlineTraining#SAPFICOCourse#SAPFICOCertification#FinanceERP#SAPFinance#CareerInER#FinanceProfessionals#ERPExperts#CareerGrowth#OnlineLearning#EdTech#LearnSAP#SkillUp#TechTraining#CertificationCourse

1 note

·

View note

Text

Unlock Business Insights with SAP Predictive Analytics for Growth

In the fast-evolving landscape of business technology, finance transformation is at the forefront of discussions. With companies increasingly looking for solutions that improve decision-making, streamline processes, and ensure regulatory compliance, SAP solutions are becoming essential. CBS Consulting is proud to support businesses in Malaysia with cutting-edge technologies such as SAP Predictive Analytics, SAP Low Code No Code (LCNC) platforms, and comprehensive e-invoicing Malaysia solutions that ensure full compliance with Malaysia E-Invoicing Compliance regulations.

Unlock the Power of SAP Predictive Analytics

SAP Predictive Analytics is a game-changer for businesses looking to harness the power of data for better decision-making. By leveraging machine learning and advanced data models, SAP Predictive Analytics helps companies anticipate market trends, optimize operations, and reduce risks. Whether in finance, operations, or customer management, the insights derived from predictive analytics can drive efficiency and profitability. CBS Consulting's expertise in implementing SAP Predictive Analytics allows businesses in Malaysia to stay ahead of the curve by turning data into actionable insights.

Accelerating Finance Transformation with SAP

The finance transformation journey is complex but crucial for businesses seeking agility, accuracy, and scalability. Finance Transformation SAP solutions provide robust systems that empower finance departments to automate processes, enhance reporting accuracy, and improve financial forecasting. CBS Consulting helps organizations seamlessly integrate SAP finance transformation solutions, ensuring a smooth transition with minimal disruption. By leveraging SAP's cloud-based and on-premise financial systems, businesses can manage their resources more effectively, reduce manual errors, and drive strategic growth.

SAP Low Code No Code (LCNC) Revolution

SAP Low Code No Code (LCNC) platforms are revolutionizing how businesses build and deploy applications. With minimal coding expertise required, these platforms enable companies to develop custom applications quickly, making innovation more accessible. Businesses can automate workflows, streamline data management, and accelerate digital transformation without the need for complex coding. CBS Consulting leverages SAP LCNC platforms to help businesses in Malaysia create tailor-made solutions that address their unique challenges, empowering them to innovate faster and improve operational efficiency.

E-Invoicing in Malaysia: Compliance and Efficiency

Malaysia's mandatory e-invoicing Malaysia regulation is reshaping how businesses handle invoicing. Starting in 2025, all companies must comply with the Malaysia E-Invoicing Compliance requirements, a significant shift towards digital transformation. E invoicing Malaysia streamlines the invoicing process, reduces errors, and enhances transparency. CBS Consulting provides expert guidance on integrating SAP e-invoicing Malaysia solutions to ensure that businesses in Malaysia meet compliance standards effortlessly. Our solutions help companies adopt e-invoicing Malaysia quickly, minimizing risks of non-compliance and ensuring smoother audits and reporting.

Why Choose CBS Consulting?

At CBS Consulting, we understand the unique challenges faced by businesses in Malaysia. Our team of SAP-certified professionals ensures the successful implementation of SAP Predictive Analytics, Finance Transformation SAP solutions, SAP Low Code No Code (LCNC) platforms, and SAP e-invoicing systems, all while ensuring compliance with Malaysia E-Invoicing Compliance regulations. We are committed to helping businesses enhance their operational efficiency and stay compliant with the latest technological advancements.

If you're ready to embrace the future of finance transformation SAP, predictive analytics, and e-invoicing compliance, CBS Consulting is here to guide you through the journey. Contact us today to learn how we can help your business thrive in the digital age.

1 note

·

View note

Text

Asha Kanta Sharma - Finance & Accounts

Asha Kanta Sharma is a competent professional with 14+ Years of Post Qualification (Bachelor's of Commerce with Accountancy Major) experience with rich exposure in Finance, Accounting Systems & Operations, IFRS, GAAP, Auditing, Direct & Indirect Taxation, Company Law Rules/Regulations, Financial and Statutory Statements, Compliances, Reports, and industry trends. He is conversant in Online/Offline ERP Packages i.e. SAP ERP (IB, FICO, SD & MM Module), Tally ERP9, QuickBooks, Zoho, and having Sound knowledge of Microsoft Excel & Microsoft Word.

Asha Kanta Sharma is willing to engage in a career that will allow for progress in terms of expertise, socio-economic development, and innovation through exposure to new ideas for professional growth, as well as the growth of the company.

The prime reason for hiring him will be his passion for what he does. He is trustworthy, truthful, Open Minded, Lifelong Learner, Helps others rise and give support, Responsible, and I love working in his areas of expertise and it is not a job for him. He can be trusted and reliable and he has in the past helped a lot of businesses to further improve their processes and systems and automate a lot of things saving time and energy.

https://www.linkedin.com/in/ashakantasharma

Email - [email protected]

Mobile +91.975.993.1111

Mobile +91.911.997.1155

#jobs#jobsearch#online jobs#jobseekers#job hunting#career#opportunities#employment#working#employees

2 notes

·

View notes

Text

Mother currently nagging me and saying I should go to college.

Me absolutely loathing in anything to do with my own education and despise the grading system that makes no sense

Mother: You could even take classes in writing and become a real author.

Me staring at her in silence as I debated on how best to say that I am not creative enough to come up with my own characters, places, and plots in order to keep a reader engaged long enough for a single page let alone chapter.

My partner in the other room knows better than to speak in this moment as they complete their own classes in religious studies.

My mother is waiting for an answer cause she thinks I'm stalling: or how about theater you loved that in high school.

Me continuing to stare at her because while it was enjoyable every character I played sapped all my energy to portray. Also why do I need to take classes in it when I can just walk up and audition? I don't need a masters to perform. A piece of paper ain't gonna tell you all my accents, in-depth emotions or monologs. I mean it could but I prefer to improve.

My mother thinking about the ideas i mentioned before: a hairdresser?

Me knowing she's grasping at strings right now: You're a great mom, you know that, don't you?

Her turn to be silent.

Me: You don't tell me to go to school to be a doctor or a lawyer. You tell me to pursue my interests. You remember what I like and try to engage me and meet me halfway while I remain stubborn. I can't tell you how much I appreciate you doing that. Because you're not giving up on me. And while I think I'm good, you're thinking of my future still and how I could be better. You want me to succeed in anything I might do in the future. I know this.

Me standing up and starts cleaning up: I can't do physical school. I hate being locked up in a classroom. But...

I pause to make my point: I might look into online courses, but please stop pushing. Otherwise, I'm not going to take any because I'll think it's your idea. I need it to be my idea if I wanna successfully make that leap and keep going.

After mom leaves my partner looks at me: I will never understand how you can talk to her without screaming.

Me: We have dealt with each other for over 20 years. I'm not sure why you and your mother can't have a discussion without screaming since you've known each other for the same amount of time.

My partner: Cause my mother's a dumbass who still calls me by my dead name.

Me being 100% grateful to have a mother like mine and not one like theirs who can't adapt.

3 notes

·

View notes

Text

Career Paths for SAP S/4 HANA FI Certified Professionals

In today's rapidly evolving business landscape, organizations need to leverage data and technology to stay competitive. One of the key players in this arena is SAP, a global leader in enterprise software solutions. SAP's S/4 HANA Financial Accounting (FI) module has become integral to the operations of countless organizations, making certified professionals in this field highly sought after.

If you're considering a career in SAP S/4 HANA FI, you'll be pleased to know that there are numerous career paths open to you. In this article, we'll explore nine exciting career options for SAP S/4 HANA FI certified professionals.Before we get into these job choices, Finprov Learning is a reliable platform that offers high-quality SAP training and certification programs. Finprov Learning can help you succeed in this industry and obtain your needed skills.

Careers in SAP S/4 HANA FI

SAP S/4 HANA FI Consultant

To implement, adapt, and improve your client's financial accounting systems, you will collaborate closely with them as a SAP S/4 HANA FI consultant. This position includes reviewing business procedures, setting up SAP systems, and offering continuous assistance and training.

Financial Analyst

S/4 HANA SAP Professionals with FI certification are well-suited for employment as financial analysts. They can use their knowledge of SAP systems to analyze financial data, provide reports, and offer insights to help organizations make better decisions.

SAP S/4 HANA FI Project Manager

In SAP implementations, project management is essential. Strong communicators and project managers who are SAP S/4 HANA FI certified may successfully oversee the planning and implementation of SAP projects.

SAP S/4 HANA FI System Administrator

SAP systems need to be maintained and troubleshot by system administrators. You can operate as a system administrator, ensuring the efficient operation of financial modules and resolving any technical issues if you have certification in SAP S/4 HANA FI.

SAP S/4 HANA FI Trainer

If you enjoy teaching and are passionate about SAP, consider becoming an SAP S/4 HANA FI trainer. Many organizations require in-house employee training, and your expertise can be invaluable in this role.

SAP S/4 HANA FI Data Analyst

Data analytics is a growing field, and SAP S/4 HANA FI-certified professionals can apply their skills to extract valuable insights from financial data. This career path involves using tools like SAP Analytics Cloud to analyze and visualize financial information.

SAP S/4 HANA FI Auditor

Financial audits are a crucial part of any business. SAP S/4 HANA FI certified professionals can work as auditors, ensuring financial compliance, risk management, and fraud detection within organizations.

SAP S/4 HANA FI Solution Architect

Solution architects design and plan the implementation of SAP solutions, ensuring they align with business objectives. With certification in SAP S/4 HANA FI, you can become a solution architect, shaping the financial systems of the future.

SAP S/4 HANA FI Business Analyst

Business analysts bridge the gap between technical SAP knowledge and business processes. They evaluate how SAP solutions can meet specific business needs and work on improving financial processes.

Conclusion

The certified SAP S/4 HANA FI professional opens doors to numerous exciting and financially rewarding opportunities. Whether you're inclined to work closely with clients, delve into data analysis, or manage projects, there's a career path tailored to your unique skills and interests. The demand for SAP S/4 HANA FI experts is on a consistent rise, cementing it as a prudent choice for those seeking success in the dynamic realm of finance and technology. And if you're contemplating a career in this field, rest assured that the possibilities are extensive, and the future looks promising. To kickstart your SAP S/4 HANA FI journey, consider Finprov Learning, where you'll find top-notch resources and guidance to excel in this flourishing domain. With Finprov Learning, your career possibilities in SAP S/4 HANA FI are bound to expand.

2 notes

·

View notes

Text

Importance of Internal Audits

Internal audits are essential for assessing an organization's operations, identifying risks, ensuring compliance with regulations, and improving overall efficiency. They provide insights into financial, operational, and compliance-related aspects of your business.

Why Use Software for Internal Audits?

Efficiency: Software automates many audit processes, reducing the time and effort required to conduct audits.

Accuracy: Manual audits can be error-prone. Audit software helps ensure accuracy in data collection and analysis.

Consistency: Software enforces consistent audit procedures and documentation across your organization.

Real-time Reporting: With audit software, you can generate real-time reports, making it easier to track progress and address issues promptly.

Data Security: Audit software enhances data security, protecting sensitive information from unauthorized access.

Top Software Solutions for Internal Audits

ACL GRC: ACL GRC offers a comprehensive solution for internal audits, including risk assessment, data analysis, and reporting. It's known for its user-friendly interface and robust analytics.

TeamMate+: TeamMate+ is a widely used audit management software that streamlines the entire audit process, from planning to reporting. It offers customizable templates and powerful reporting tools.

AuditBoard: AuditBoard is a cloud-based platform that provides tools for risk assessment, audit management, and compliance. Its user-friendly interface makes it accessible to auditors at all levels.

Wolters Kluwer TeamMate Analytics: This software focuses on data analytics, helping auditors identify trends and anomalies in data. It integrates seamlessly with other audit management systems.

SAP Audit Management: If your organization uses SAP, their Audit Management software is a natural choice. It offers a unified platform for audit planning, execution, and reporting.

Conclusion

In today's fast-paced business environment, efficient and accurate internal audits are crucial for staying competitive and compliant. Investing in audit software can streamline your audit processes, improve accuracy, and provide valuable insights for decision-making. Evaluate your organization's needs and explore the options mentioned above to find the best software for doing internal audits that align with your goals and objectives.

For more details - https://m2iconsulting.com/blog-detail.php?name=Software%20for%20Doing%20Internal%20Audit&id=64

2 notes

·

View notes

Text

Navigating the Future of GRC and Access Governance in SAP Ecosystems

A New Era of Security and Access Governance

Governance, Risk, and Compliance (GRC) and Access Governance are undergoing major changes due to digital growth and stricter regulations. As organizations connect more data and systems, they’re shifting from isolated security practices to proactive, integrated compliance processes. Raghu Boddu, founder of ToggleNow and a seasoned leader in SAP GRC, has observed these shifts closely.

“Fifteen years ago, most companies didn’t treat security as a separate function—it was part of Basis administration,” Raghu explains. “Today, security is essential, and organizations know it’s crucial for protecting data, compliance, and brand reputation.”

New Market Realities and Demand for Integrated GRC Solutions

SAP has long been at the forefront of GRC, offering tools to help both finance and IT teams tackle compliance challenges. Solutions like SAP Access Control and Identity Access Governance (IAG) provide the flexibility to manage today’s security needs while adapting to future ones. As businesses adopt hybrid and multi-cloud systems, managing security across different platforms has become more complex. This is where SAP’s Business Technology Platform (BTP) shines. BTP connects SAP and non-SAP applications seamlessly, creating a secure, compliant ecosystem. “BTP and SAP Identity Services have changed the game for multi-cloud environments,” says Raghu. “Today, integration is nearly seamless thanks to SAP’s open APIs and connectors. This has allowed companies to manage security across hybrid systems without needing extensive customization.”

Regional Insights: GRC Maturity and Market Growth

The GRC and Identity Access Management (IAM) markets vary widely across regions, shaped by local regulations and market maturity. In the U.S., SoX compliance has driven strict GRC standards for years. Many American companies have developed sophisticated GRC processes, particularly around data security and financial compliance. Meanwhile, regions like India are rapidly catching up.

“The growth potential in India is huge,” Raghu shares. “Over the last five years, Indian businesses have started treating GRC as essential, not optional.”

In both the U.S. and other markets, companies are increasingly adopting automation and hybrid identity solutions to handle complex regulations. This shift reflects a global move toward integrated compliance, with GRC becoming a core business priority rather than a “tick-the-box” function. As Raghu adds, “It’s inspiring to see GRC prioritized as part of strategy, not just an audit requirement.”

The Future of GRC: AI-Driven Compliance and Embedded Solutions

a) AI and Automation in GRC

Automation and AI are quickly transforming GRC from a reactive function into a proactive one, identifying risks before they become problems. With AI-driven GRC, systems can automatically analyze data to help companies detect potential compliance issues and manage risk more intelligently. SAP’s GRC tools with AI simplify compliance processes and improve decision-making, allowing teams to focus on strategic priorities.

Raghu highlights the potential of AI in GRC: “AI has incredible potential in the GRC space. It’s about giving businesses more power to manage risk with accuracy, while reducing manual efforts and errors.”

b) Embedding Compliance into Daily Processes

Looking forward, GRC will be embedded directly within applications and workflows, constantly monitoring for risks and responding to threats as they arise. Raghu envisions this future: “In the next five years, GRC as a standalone system may fade. Instead, it will be part of daily workflows, where applications flag risks and suggest controls in real time. AI will automate many compliance tasks, cutting down manual efforts.”

He adds, “Imagine GRC as a tool that proactively flags a potential access issue based on historical patterns—like a security recommendation engine. This proactive risk management approach is where AI will make the most impact.”

About Raghu Boddu and ToggleNow: Innovating in GRC and SAP Integration

Raghu Boddu, founder of ToggleNow, has over two decades of experience in SAP GRC and has witnessed the industry’s evolution firsthand. He started ToggleNow to address complex GRC challenges, helping companies make compliance efficient and accessible. With solutions that streamline risk management and improve security, ToggleNow has become a trusted partner for organizations operating in SAP environments.

Raghu is also a published author, with books such as SAP Access Control 12.0 Comprehensive Guide, SAP Process Control 12.0 Comprehensive Guide, and SAP Cloud IAG eBite. The books offer practical insights into implementing SAP GRC solutions effectively. His books emphasize not only the technical aspects but also strategic best practices, making them valuable resources for GRC professionals.

ToggleNow has been particularly impactful in areas like SAP integration and GRC automation, where Raghu’s team develops innovative tools that simplify complex processes. “At ToggleNow, our focus is to help clients build a compliant, adaptable GRC framework that meets today’s demands while preparing for tomorrow’s,” says Raghu.

Conclusion: Building a Future-Ready GRC Strategy

For companies looking ahead, the time to adapt is now. As GRC evolves, adopting flexible, AI-driven, and integrated solutions is key. Businesses should prepare for a future where compliance is embedded in every workflow and AI-driven insights make risk management smarter.

“The future of GRC is all about integration, intelligence, and ease,” Raghu emphasizes. “Companies investing in these areas today will be well-prepared to navigate tomorrow’s challenges.”

In an increasingly interconnected world, the ability to proactively manage risk and compliance is more than a regulatory need—it’s a strategic advantage. By embracing AI, automation, and integration, companies can transform GRC from a support function to a driver of resilience and growth.

Read More: https://togglenow.com/blog/navigating-the-future-of-grc-and-access-governance-in-sap-ecosystems/

#SAPSODanalyzer#SAPSODanalysistool#SAPSODanalysis#SAPGRCandsecurity#SAPs4security#SAPgovernanceriskandcompliance

0 notes

Text

SAP Audit Services | SAP Authorization and Security Audit Services | ToggleNow

At ToggleNow, we offer comprehensive audit solutions tailored specifically for SAP, guaranteeing that your SAP systems operate in a well secured stature. We evaluate various areas such as optimization, security, and adherence to industry standards, ensuring your SAP systems are not just compliant but also optimized for efficiency. Our team comprises certified audit professionals adept at navigating the intricacies of SAP systems, equipped with extensive experience in conducting thorough audits. Through our services, we assist businesses like yours in effectively managing risks, enhancing overall performance, and unlocking the maximum value from your investments in SAP.

With a dedicated focus on SAP auditing, we recognize the critical importance of safeguarding your systems. Our team’s proficiency in this niche domain allows us to provide meticulous assessments that go beyond mere compliance, aiming to streamline operations and fortify the integrity of your SAP infrastructure. By partnering with us, you gain access to expert insights, enabling you to make informed decisions, address vulnerabilities, and capitalize on the full potential of your SAP environment.

Read more: https://togglenow.com/services/sap-audit-services/

#SAP Audit Services#SAP Security Audit Services#SAP System Audit#SAP Compliance Audit#SAP Audit Management#Audit Management System#SAP Audit Management System#SAP Security Audit

0 notes

Text

SAP ABAP Development | SAP Fiori Development | SAP BTP Development | SAP API Development | ToggleNow

Unlock Exceptional SAP Development Expertise with ToggleNow. From Core SAP ABAP to Cutting-Edge SAP BTP Development, Trust Our Proficiency for Comprehensive Solutions.

ToggleNow specializes in unlocking the full potential of SAP, enabling clients to extend, integrate, and construct scalable, intelligent, and perceptive enterprise applications. With a seasoned team of professionals well-versed in all SAP modules, we continuously innovate solutions. From automating repetitive tasks to enhancing decision-making! Our aim is to deliver comprehensive visibility and insights across processes.

Read More :

0 notes

Text

United States Sales Tax Compliance Software Market Size, Restraints & Future Trends 2032

United States Sales Tax Compliance Software Market Overview The United States Sales Tax Compliance Software Market is experiencing significant momentum, currently valued at approximately USD 2.3 billion in 2024. With the ever-evolving regulatory environment and the increasing digitalization of tax reporting processes, the market is projected to grow at a compound annual growth rate (CAGR) of 9.1% through 2032, reaching an estimated value of USD 4.6 billion. Key growth drivers include the complexity of U.S. state and local tax regulations, a surge in e-commerce transactions, and heightened enforcement by tax authorities. The integration of AI-based tax analytics and cloud-based platforms is further propelling the adoption of automated tax compliance solutions among enterprises, especially SMEs and large e-retailers. United States Sales Tax Compliance Software Market Dynamics Drivers: The growing complexity of multistate tax regulations, coupled with the rise of remote sales and digital marketplaces, is prompting businesses to adopt robust tax compliance tools. Automation minimizes the risk of non-compliance and audit exposure. Additionally, government mandates around real-time tax data submission and digitized audit trails are reinforcing the need for advanced solutions. Restraints: High initial implementation costs and the complexity of integrating sales tax solutions with legacy ERP systems are limiting adoption among small enterprises. Data security concerns and inconsistencies in regulatory frameworks across states also present challenges. Opportunities: The market holds lucrative potential in verticals such as e-commerce, SaaS platforms, logistics, and finance. As businesses expand their footprint across jurisdictions, demand for scalable, cloud-native, and AI-driven tax engines is expected to soar. Regulatory harmonization and federal-level digital initiatives could unlock new avenues for software vendors. Role of Technology, Regulations, and Sustainability: Cloud computing, AI, and machine learning are revolutionizing the way businesses manage transactional tax obligations. Real-time compliance, predictive tax forecasting, and digital tax dashboards are becoming essential. Sustainability is influencing back-office transformations, driving the shift to paperless, cloud-based operations that reduce carbon footprints and increase efficiency. Download Full PDF Sample Copy of United States Sales Tax Compliance Software Market Report @ https://www.verifiedmarketresearch.com/download-sample?rid=75281&utm_source=PR-News&utm_medium=353 United States Sales Tax Compliance Software Market Trends and Innovations Emerging technologies such as AI-powered tax calculation engines, blockchain-enabled audit trails, and API-first integrations are shaping the competitive landscape. Vendors are increasingly offering plug-and-play integrations with popular ERP platforms like SAP, Oracle, QuickBooks, and NetSuite. Innovations in user experience, such as intuitive dashboards and predictive analytics, are simplifying tax filing processes. Strategic collaborations between fintech firms and compliance software providers are fostering rapid innovation and expanding feature sets. Moreover, Software-as-a-Service (SaaS) delivery models are gaining traction due to their cost efficiency and scalability. Increased focus on cybersecurity features, like end-to-end encryption and SOC 2 compliance, is enhancing trust among enterprise users. United States Sales Tax Compliance Software Market Challenges and Solutions Challenges: One of the primary obstacles is the fragmented and frequently changing nature of tax codes across more than 13,000 U.S. jurisdictions. This creates a substantial compliance burden. Additionally, supply chain disruptions and inflationary pressures are impacting pricing models, particularly for small businesses evaluating software ROI. Limited tax expertise among internal staff also adds complexity. Solutions: Vendors are offering modular,

cloud-based solutions with regular regulatory updates and jurisdiction-specific tax mapping. Training modules, AI-based knowledge centers, and real-time customer support are improving usability. Partnerships with tax consultants and automation of data collection through e-invoicing and OCR technologies are enhancing compliance accuracy and reducing human error. United States Sales Tax Compliance Software Market Future Outlook The market’s future outlook is robust, driven by continuous regulatory changes, increasing adoption of e-invoicing mandates, and the rise of digital-first business models. The adoption of real-time tax engines will become mainstream, especially as more states move toward automated digital tax reporting. SMEs will gradually embrace automated compliance due to falling costs and simplified deployment models. Cloud-native platforms, cross-border tax solutions, and mobile-compatible compliance tools will dominate future product strategies. AI and big data analytics will play a pivotal role in enabling proactive compliance and real-time decision-making. As tax authorities push for higher transparency and digital audits, businesses will increasingly turn to agile, scalable solutions that ensure seamless and future-ready tax compliance. Key Players in the United States Sales Tax Compliance Software Market United States Sales Tax Compliance Software Market are renowned for their innovative approach, blending advanced technology with traditional expertise. Major players focus on high-quality production standards, often emphasizing sustainability and energy efficiency. These companies dominate both domestic and international markets through continuous product development, strategic partnerships, and cutting-edge research. Leading manufacturers prioritize consumer demands and evolving trends, ensuring compliance with regulatory standards. Their competitive edge is often maintained through robust R&D investments and a strong focus on exporting premium products globally. Avalara Vertex Inc Thomson Reuters Corporation Taxjar Ryan LLC Sovos Compliance LLC TaxCloud Wolters Kluwer Xero Limited and Sage Group. Get Discount On The Purchase Of This Report @ https://www.verifiedmarketresearch.com/ask-for-discount?rid=75281&utm_source=PR-News&utm_medium=353 United States Sales Tax Compliance Software Market Segments Analysis and Regional Economic Significance The United States Sales Tax Compliance Software Market is segmented based on key parameters such as product type, application, end-user, and geography. Product segmentation highlights diverse offerings catering to specific industry needs, while application-based segmentation emphasizes varied usage across sectors. End-user segmentation identifies target industries driving demand, including healthcare, manufacturing, and consumer goods. These segments collectively offer valuable insights into market dynamics, enabling businesses to tailor strategies, enhance market positioning, and capitalize on emerging opportunities. The United States Sales Tax Compliance Software Market showcases significant regional diversity, with key markets spread across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa. Each region contributes uniquely, driven by factors such as technological advancements, resource availability, regulatory frameworks, and consumer demand. United States Sales Tax Compliance Software Market, By Type • Cloud Based• On-premises United States Sales Tax Compliance Software Market, By Application • Large Enterprises• SMEs United States Sales Tax Compliance Software Market By Geography • North America• Europe• Asia Pacific• Latin America• Middle East and Africa For More Information or Query, Visit @ https://www.verifiedmarketresearch.com/product/united-states-sales-tax-compliance-software-market/ About Us: Verified Market Research Verified Market Research is a leading Global Research and Consulting firm servicing over 5000+ global clients.

We provide advanced analytical research solutions while offering information-enriched research studies. We also offer insights into strategic and growth analyses and data necessary to achieve corporate goals and critical revenue decisions. Our 250 Analysts and SMEs offer a high level of expertise in data collection and governance using industrial techniques to collect and analyze data on more than 25,000 high-impact and niche markets. Our analysts are trained to combine modern data collection techniques, superior research methodology, expertise, and years of collective experience to produce informative and accurate research. Contact us: Mr. Edwyne Fernandes US: +1 (650)-781-4080 US Toll-Free: +1 (800)-782-1768 Website: https://www.verifiedmarketresearch.com/ Top Trending Reports https://www.verifiedmarketresearch.com/ko/product/credit-rating-market/ https://www.verifiedmarketresearch.com/ko/product/credit-risk-database-market/ https://www.verifiedmarketresearch.com/ko/product/cremation-equipment-market/ https://www.verifiedmarketresearch.com/ko/product/cricket-batting-gloves-market/ https://www.verifiedmarketresearch.com/ko/product/crisis-management-software-market/

0 notes

Text

RISE with SAP S4HANA: Transforming Business Operations with CBS Consulting

In today’s fast-paced digital economy, businesses are constantly seeking ways to streamline operations, reduce inefficiencies, and drive growth. CBS Consulting offers cutting-edge solutions that leverage RISE with SAP S4HANA, a comprehensive suite of tools designed to transform enterprise resource planning (ERP) systems. Whether it’s simplifying supply chain management, enhancing financial operations, or optimizing analytics, CBS Consulting ensures your business stays ahead in the competitive market.

What is RISE with SAP S4HANA?

RISE with SAP S4HANA is a transformative offering from SAP that integrates cloud solutions, SAP S/4HANA, and a range of business applications to streamline and modernize enterprise processes. This intelligent suite helps businesses achieve their goals with real-time insights, improved collaboration, and enhanced decision-making capabilities. CBS Consulting is here to guide you through every step of the process—from initial planning and implementation to optimization and maintenance.

The Power of SAP GTS

One of the key features that businesses gain access to through RISE with SAP S4HANA is SAP Global Trade Services (GTS). SAP GTS enables companies to simplify global trade processes, including import and export management, trade compliance, and customs management. With automation of these crucial tasks, businesses can significantly reduce the risks associated with international trade, ensure compliance with regulations, and streamline cross-border transactions.

At CBS Consulting, we work with you to customize and implement SAP GTS, ensuring that your company can scale globally with greater efficiency.

SAP E-Invoicing: A Smarter Way to Invoice

SAP E-Invoicing is another game-changing tool integrated into RISE with SAP S4HANA. This feature digitizes invoicing processes, automating tasks like invoice generation, approval, and payment. With SAP E-Invoicing, companies can drastically reduce manual errors, shorten processing times, and improve overall cash flow. Moreover, SAP E-Invoicing enhances compliance with tax authorities, making it easier to adhere to regulatory requirements.

CBS Consulting’s expertise in SAP E-Invoicing ensures that your invoicing process is both automated and compliant, giving you more time to focus on growth.

SAP Business Intelligence: Unlocking the Power of Data

In the modern business landscape, data is one of the most valuable assets any company possesses. SAP Business Intelligence (BI) tools enable organizations to unlock actionable insights from vast amounts of data. Through real-time analytics, predictive modeling, and data visualization, SAP BI empowers companies to make informed decisions faster.

At CBS Consulting, we integrate SAP BI into your systems, providing you with customized dashboards and reports that help you make data-driven decisions and stay ahead of the competition.

Chart of Account Harmonisation: Standardizing Financial Records

A consistent and standardized Chart of Accounts (COA) harmonisation is crucial for any business that wants to maintain a strong financial foundation. Through RISE with SAP S4HANA, CBS Consulting helps companies achieve Chart of Account harmonisation, ensuring that financial records are aligned across all business units. This harmonisation improves reporting accuracy, simplifies financial audits, and enhances strategic planning, enabling businesses to make informed financial decisions and stay compliant.

Conclusion: Why Choose CBS Consulting?

With RISE with SAP S4HANA, CBS Consulting offers an end-to-end solution for companies looking to revolutionize their ERP systems and stay ahead in the digital age. Our expertise in SAP GTS, SAP E-Invoicing, SAP Business Intelligence, and Chart of Account Harmonization ensures that your business is always running at its peak performance.

1 note

·

View note

Text

SimpliContract Reinvents Legal Operations with Advanced AI-Powered Contract Management Software

SimpliContract, a leading innovator in legal and business process automation, has once again raised the bar by delivering state-of-the-art Contract Management Software AI capabilities to streamline and secure the end-to-end lifecycle of contracts. With an eye on digital transformation and operational excellence, SimpliContract is shaping the future of Contract Management Technology with its AI-powered platform tailored for enterprises, legal teams, procurement officers, and sales professionals.

In today’s dynamic and compliance-driven environment, managing contracts manually leads to inefficiencies, risks, and missed opportunities. SimpliContract’s platform addresses these challenges with intelligent automation, predictive analytics, and best-in-class collaboration features—making it one of the most preferred Contract Management Vendors in the global enterprise ecosystem.

AI Meets Contract Lifecycle Management

At the heart of SimpliContract’s innovation is the integration of artificial intelligence that empowers organizations to automate routine tasks, extract insights, and ensure compliance at scale. The AI-powered contract management software allows users to draft, review, approve, and monitor contracts with greater speed and accuracy. Through intelligent clause extraction, risk scoring, and deviation analysis, legal and business teams gain complete visibility and control over their contract workflows.

Contracts are more than just documents; they are strategic assets. Our goal is to transform contract management from a back-office function into a proactive, data-driven capability using intelligent Contract Management Technology.

Streamlined Contract Monitoring & Compliance

SimpliContract empowers organizations to implement Contract Monitoring Best Practices through real-time tracking, smart alerts, and obligation management. Whether managing renewals, deadlines, or compliance milestones, the platform ensures that no critical task falls through the cracks. The AI-powered contract intelligence provides executives with actionable insights that support audit readiness, vendor evaluations, and strategic negotiations.

Trusted by Global Enterprises

SimpliContract is trusted by a growing number of global enterprises across industries such as manufacturing, healthcare, technology, finance, and retail. Providing seamless integrations with popular enterprise systems such as Salesforce, SAP, and Microsoft Dynamics, the AI-powered contract management solution fit easily into existing business workflows, delivering immediate ROI and long-term value.

Clients praise SimpliContract for its intuitive interface, flexibility, and enterprise-grade security. With SOC 2 compliance, role-based access, and data encryption, organizations can rely on the platform to meet their stringent regulatory and security requirements.

The Future of Contract Management

As organizations strive to become more agile and resilient, embracing AI-driven solutions is no longer optional—it is essential. SimpliContract is poised to lead this transformation by continuously evolving its platform to address emerging trends, regulatory changes, and user needs.

The company offers flexible deployment options, robust support services, and dedicated onboarding teams to ensure clients succeed in their digital transformation journey. Whether you are a growing startup or a global enterprise, SimpliContract stands out among Contract Management Vendors as a scalable, intelligent, and reliable partner.

For more information on SimpliContract and to request a demo, visit https://www.simplicontract.com

0 notes

Link

0 notes

Text

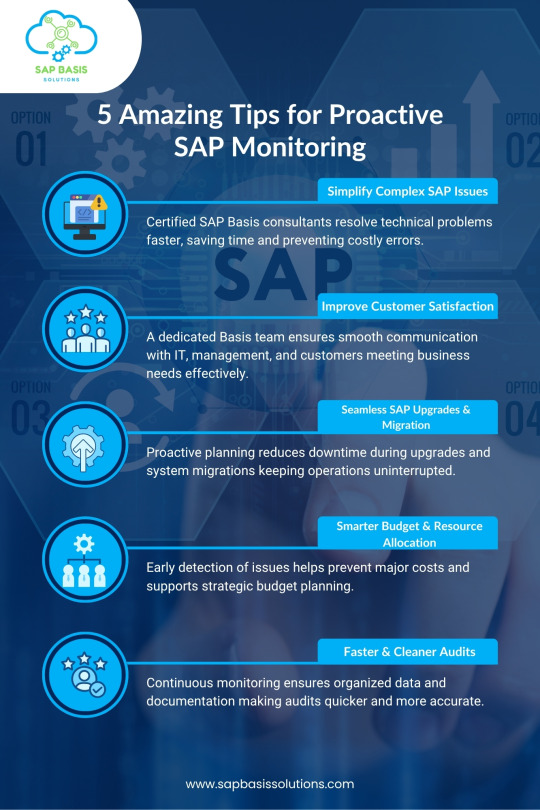

This infographic highlights 5 powerful tips to help enterprises enhance system reliability, reduce downtime, and improve audit readiness through expert SAP Basis support. Don’t just react—get proactive!

👉 Read the full blog here: 5 Amazing Tips to Get Proactive SAP Monitoring for Your Enterprise

1 note

·

View note