#SBI SimplyClick Credit Card

Explore tagged Tumblr posts

Text

SBI Card Reward Changes: Why They’re Cutting Reward Points and What’s Next

“SBI Card slashes reward points on select credit cards like Elite, SimplyCLICK, and Prime. Learn how this impacts you, strategies to maximize rewards, and explore top alternatives. Stay informed and make smarter credit card choices.” SBI Card has announced a reduction in reward points for several of its popular credit cards. This change, effective from March 31, 2025, and April 1, 2025, will…

#best credit cards in India#credit card reward programs#maximize credit card rewards#SBI BPCL Octane Credit Card#SBI Card credit cards#SBI Card reward points#SBI Card reward points reduction#SBI Elite credit card#SBI Prime Credit Card#SBI SimplyCLICK Credit Card

0 notes

Text

SBI SimplyClick Credit Card

The SBI SimplyClick Credit Card is a popular credit card that offers a range of benefits and rewards for online shopping enthusiasts. This card is designed for individuals who frequently shop online and provides accelerated reward points on online spending across various categories such as dining, grocery, movie tickets, and more. It also offers milestone rewards, fuel surcharge waiver, easy EMI options, and a contactless payment feature to enhance convenience and savings for cardholders.

Experience hassle-free shopping with SBI Simply click credit card. Get reward points on all your online purchases and enjoy exciting offers only on Select by Finology. Apply now!

0 notes

Text

SBI SimplyCLICK Credit Card – Smart Savings for Online Shoppers

The SBI SimplyCLICK Credit Card is a popular entry-level credit card designed for online shoppers. It offers accelerated rewards on online purchases from partner sites like Amazon, BookMyShow, and more. Users earn 10X rewards, get milestone benefits, and enjoy annual fee reversal on reaching spend thresholds. Ideal for digital-savvy users looking to save smartly.

Apply Now :-

0 notes

Text

Major Changes to SBI Credit Card Rewards (Effective April 2025)

If you’re an SBI Credit Card holder, there’s some important news that could impact how you earn and redeem your reward points. Starting April 2025, SBI Card has announced major changes to its rewards program across various popular cards. Whether you use your SBI Credit Card for online shopping, flight bookings, or day-to-day expenses, it’s crucial to understand how these changes might affect your benefits.

In this article, we’ll break down the revised reward structure, discontinued benefits, and what it means for both new and existing SBI credit card users. If you're considering getting an Instant SBI Credit Card, this guide will help you make an informed decision.

Why the Changes?

The credit card landscape is constantly evolving. With rising operational costs, regulatory changes, and increased customer acquisition, SBI Card has reviewed its reward offerings to remain sustainable and competitive. However, these changes come at a cost for some loyal customers, especially those who heavily relied on SBI cards for travel and online purchases.

SimplyCLICK SBI Card – Reduced Reward Points

The SimplyCLICK SBI Card, known for its accelerated rewards on online platforms, is seeing significant modifications. Until now, users earned 10X reward points on partner platforms such as Swiggy, Myntra, Cleartrip, and others.

Effective April 2025, reward points on Swiggy have been reduced to 5X. However, you can still earn 10X on:

Apollo 24/7

BookMyShow

Cleartrip

Dominos

Myntra

Netmeds

Yatra

This means food delivery lovers will see a dip in point accumulation, while travel and fashion enthusiasts can continue to enjoy existing rewards.

Air India SBI Platinum and Signature – Major Reductions

If you hold an Air India SBI Platinum or Signature Credit Card, the reward downgrade might come as a disappointment. Previously, users earned:

15 reward points per ₹100 spent on Air India (Platinum Card)

30 reward points per ₹100 spent on Air India (Signature Card)

From April 2025, these rates are slashed to just:

5 points per ₹100 for Platinum

10 points per ₹100 for Signature

The reduction significantly impacts frequent flyers who used these cards to accumulate Air India miles. It’s advisable to reconsider your travel card if you relied on SBI for mileage benefits.

Club Vistara SBI Cards – Discontinuation of Milestones

For Club Vistara SBI Credit Card holders, another significant update is the removal of milestone benefits. Earlier, customers enjoyed complimentary Vistara flight tickets on achieving annual spends. However, SBI Card has now discontinued the milestone ticket vouchers and some renewal benefits.

While the annual fee waiver based on spending continues, the loss of ticket rewards reduces the overall value of the card for frequent Vistara travelers.

Insurance Benefits Discontinued

Another key change is the removal of complimentary air accident insurance. Previously, many premium SBI Credit Cards came with a ₹50 lakh air accident cover. As of July 26, 2025, this benefit will be completely discontinued.

This may be particularly relevant for customers who opted for SBI cards due to bundled insurance features. If travel protection is a priority, consider looking into third-party coverage or alternative premium cards.

Impact on Instant SBI Credit Card Applicants

The Instant SBI Credit Card option, available through online application or via YONO SBI, has gained popularity due to its quick approval process and virtual card availability within minutes. However, new applicants should carefully evaluate the revised benefits.

If you're planning to apply for an Instant SBI Credit Card primarily for rewards and travel perks, these recent changes might influence your decision. For example:

Instant approvals still offer convenience.

But the value you derive from rewards has decreased on key categories like flights and food delivery.

Be sure to check the updated terms and conditions before proceeding.

Should You Switch or Stay?

For existing SBI Credit Card users, these changes may feel like a downgrade. However, whether you should continue using your card depends on your individual spending habits.

Stick with SBI Credit Card if:

You shop regularly on Myntra, Apollo, Yatra, etc.

You value seamless integration with SBI banking services.

You prefer instant approvals and a large merchant acceptance network.

Consider switching if:

You primarily used the card for Air India or Vistara travel rewards.

You relied on air insurance coverage as a benefit.

You expect high reward returns on food delivery and offline shopping.

Final Thoughts

The major changes to SBI Credit Card rewards effective April 2025 reflect a broader shift in how credit card issuers are restructuring loyalty programs. While some reductions in benefits may seem drastic, SBI still offers reliable services, strong brand trust, and quick approval processes through Instant SBI Credit Card options.

Before applying or renewing, make sure to compare benefits, analyze your spending behavior, and choose a card that aligns with your financial goals.

Stay informed, spend wisely, and keep maximizing your credit card benefits—because every point still counts!

0 notes

Text

Top SBI Credit Cards in India: Benefits, Rewards & Review

Looking for the best credit card that matches your lifestyle? SBI offers a wide range of credit cards designed for different spending needs. Whether you love shopping, travelling, or dining out, there’s an SBI Credit Card made just for you! Some of the top SBI Credit Cards include:

SBI Card ELITE – Great for travel and premium lifestyle benefits.

SimplyCLICK SBI Card – Best for online shopping and digital spends.

SBI Card PRIME – Offers value-packed features with milestone benefits.

BPCL SBI Card – Ideal for fuel savings with 4.25% value back.

Air India SBI Signature Card – Perfect for frequent flyers with air miles rewards.

These cards come with exciting rewards, cashback, lounge access, fuel surcharge waivers, and more. Plus, SBI’s strong customer service and easy application process make them a reliable choice for every user.

Choosing the right SBI credit card can help you save more and enjoy exclusive benefits. Compare the cards and pick the one that fits your lifestyle and budget. Maximize your rewards with the best SBI credit card today!

0 notes

Text

Top Credit Cards for Fashion Lovers in India

Love fashion and shopping? If you're someone who enjoys keeping up with the latest trends, then the right credit card can make your shopping experience even more exciting. From earning cashback on clothing purchases to getting exclusive discounts on your favorite fashion brands, there are several credit cards in India that are perfect for fashion lovers.

Top credit cards for fashionistas in India include options that offer great rewards on fashion spends, extra benefits during festive sales, and complimentary access to partner brand stores. Some cards also provide milestone benefits and vouchers from popular fashion brands, helping you save more every time you shop.

Popular picks like HDFC Millennia Credit Card, ICICI Amazon Pay Card, SBI SimplyCLICK Card, and AU Bank LIT Card are loved by shoppers for their exclusive offers on fashion and lifestyle. These cards not only reward your fashion choices but also make your purchases more affordable through EMI options and welcome gifts.

Choose a card that matches your shopping habits and let your style shine - smartly and stylishly!

0 notes

Text

SBI Credit Card Users Alert: Big Changes Effective From Today 1 April 2025; Check What's New On Reward Points | Personal Finance News

New Delhi: SBI Cards has announced that with effect from today (Tuesday 1st April 2025), accrual of Reward Points on online spends will be revised. Important Notices for SBI Credit Cardholders –Check Details – Accrual of 10X Reward Points on online spends at Swiggy with SimplyCLICK SBI Card will be revised to 5X Reward Points w.e.f. 1st April 2025. Your card will continue to accrue 10X Reward…

0 notes

Text

Best Credit Cards for Shopping in India – Top Picks

Finding the perfect credit card for shopping can help you save more while enjoying great rewards. Whether you shop online or offline, choosing the right credit card for shopping in India can provide cashback, discounts, and exclusive deals on top brands.

Some of the best shopping credit cards include HDFC Millennia Credit Card, Amazon Pay ICICI Credit Card, SBI SimplyCLICK Credit Card, Flipkart Axis Bank Credit Card, and American Express SmartEarn Credit Card. These cards offer benefits like extra rewards on online shopping, welcome bonuses, and milestone benefits.

With features like zero annual fees, reward point redemptions, and easy EMI options, these credit cards help you manage your expenses better while maximizing savings. Whether you are an avid online shopper or prefer retail stores, these cards ensure that every purchase adds value.

Compare the best shopping credit cards in India and pick the one that suits your spending habits. Save more while shopping for fashion, electronics, groceries, and more. Get your ideal credit card today and enjoy amazing shopping benefits!

0 notes

Text

Best Credit Card in India for Rewards & Cashback

Credit cards have become an essential financial tool, offering convenience, security, and rewards on transactions. Choosing the best credit card in India for rewards and cashback can help maximize savings and enhance your spending experience. Whether you are looking for a lifetime free credit card or planning to apply for a credit card, this guide will help you make an informed decision.

Understanding Credit Card Rewards and Cashback

Credit cards offer various types of benefits, including reward points, cashback, and discounts. Understanding how they work can help you choose the right card based on your spending habits.

Rewards: Earn points on every purchase, which can be redeemed for vouchers, discounts, or travel bookings.

Cashback: A percentage of your spending is credited back to your account, reducing your overall expenses.

Milestone Benefits: Extra rewards when you spend a certain amount within a specific period.

Top Features to Look for in a Credit Card for Rewards & Cashback

When searching for the best credit card in India for rewards and cashback, consider these key features:

High Cashback Rates – Look for cards that offer high cashback on popular spending categories such as groceries, dining, fuel, and online shopping.

Reward Point Multipliers – Some cards offer accelerated reward points on travel, shopping, or entertainment.

Welcome Bonus – Many credit cards offer a welcome gift in the form of reward points or cashback upon activation.

Lifetime Free Credit Card Options – If you want to avoid annual fees, go for a lifetime free credit card that offers rewards without extra charges.

Easy Redemption Process – Ensure the reward points or cashback earned can be easily redeemed.

Low Interest Rates & Fees – Opt for cards with lower interest rates and minimal fees to maximize benefits.

Best Credit Cards in India for Rewards & Cashback

Here are some top credit cards that offer excellent rewards and cashback benefits:

HDFC Millennia Credit Card

5% cashback on Amazon, Flipkart, and other online merchants.

1% cashback on all offline spends and wallet reloads.

Annual fee waiver on spending above ₹1 lakh per year.

SBI SimplyCLICK Credit Card

10x reward points on online shopping at partnered merchants.

Amazon voucher worth ₹500 as a welcome gift.

Annual fee reversal on yearly spends above ₹1 lakh.

ICICI Amazon Pay Credit Card (Lifetime Free Credit Card)

5% cashback on Amazon for Prime members.

3% cashback for non-Prime members.

No joining or annual fees, making it a great lifetime free credit card option.

Axis Bank ACE Credit Card

5% cashback on bill payments, mobile recharges, and DTH via Google Pay.

4% cashback on Swiggy, Zomato, and Ola rides.

2% cashback on all other spends.

Flipkart Axis Bank Credit Card

5% cashback on Flipkart and Myntra.

4% cashback on Swiggy, Uber, and PVR.

No cost EMI offers and discounts on partner merchants.

How to Apply for a Credit Card in India

If you’re looking to apply for credit card, follow these simple steps:

Step 1: Compare Credit Cards

Check various options and compare their benefits, fees, and rewards. Consider whether you want a cashback card, a travel rewards card, or a lifetime free credit card with no annual fee.

Step 2: Check Eligibility

Each bank has different eligibility criteria, but in general, you must:

Be at least 21 years old.

Have a stable income source.

Maintain a good credit score (above 700 is preferred).

Step 3: Submit an Online Application

Visit the bank’s official website or an aggregator site to apply for a credit card online. Fill in the required details, such as:

Name, age, and address

Employment details

PAN card and Aadhaar card details

Step 4: Upload Necessary Documents

You may need to provide:

Identity proof (Aadhaar, PAN card, passport)

Address proof (utility bill, rent agreement)

Income proof (salary slips, ITR returns)

Step 5: Wait for Approval

Banks review your application and verify your details. If approved, you will receive your credit card within a few days.

How to Maximize Rewards and Cashback on Your Credit Card

Owning the best credit card in India is only beneficial if you use it wisely. Here are some tips to maximize rewards and cashback:

Use the Card for Everyday Purchases

Pay for groceries, fuel, and dining using your card to accumulate reward points and cashback.

Pay Bills Using Your Credit Card

Many credit cards offer cashback on utility bill payments, mobile recharges, and subscriptions.

Take Advantage of Bonus Offers

Look out for limited-time promotions that offer extra cashback or reward points.

Avoid Late Payments

To prevent interest charges and maintain your credit score, always pay your credit card bill on time.

Redeem Points Strategically

Use your accumulated points for high-value redemptions like flight tickets, hotel stays, or shopping vouchers.

Lifetime Free Credit Cards: Are They Worth It?

If you want a credit card without paying annual fees, consider a lifetime free credit card. These cards provide all the benefits of a regular credit card but without any yearly charges.

Pros of Lifetime Free Credit Cards:

No annual fee, saving money in the long run.

Rewards and cashback benefits similar to paid credit cards.

Helps in maintaining a good credit score without extra costs.

Cons of Lifetime Free Credit Cards:

May have fewer premium benefits like airport lounge access or insurance cover.

Cashback and reward rates may be slightly lower than paid credit cards.

Conclusion

Finding the best credit card in India for rewards and cashback depends on your spending habits and financial goals. Whether you prefer high cashback, travel rewards, or a lifetime free credit card, there are plenty of options available. Before you apply for a credit card, compare features, benefits, and fees to ensure you get the best value for your money.

0 notes

Text

Key Benefits of the SBI SimplyClick Credit Card

The SBI SimplyClick Credit Card provides rewards on online shopping, exclusive discounts, low fees, and a mobile app for easy tracking of expenses and rewards.

0 notes

Text

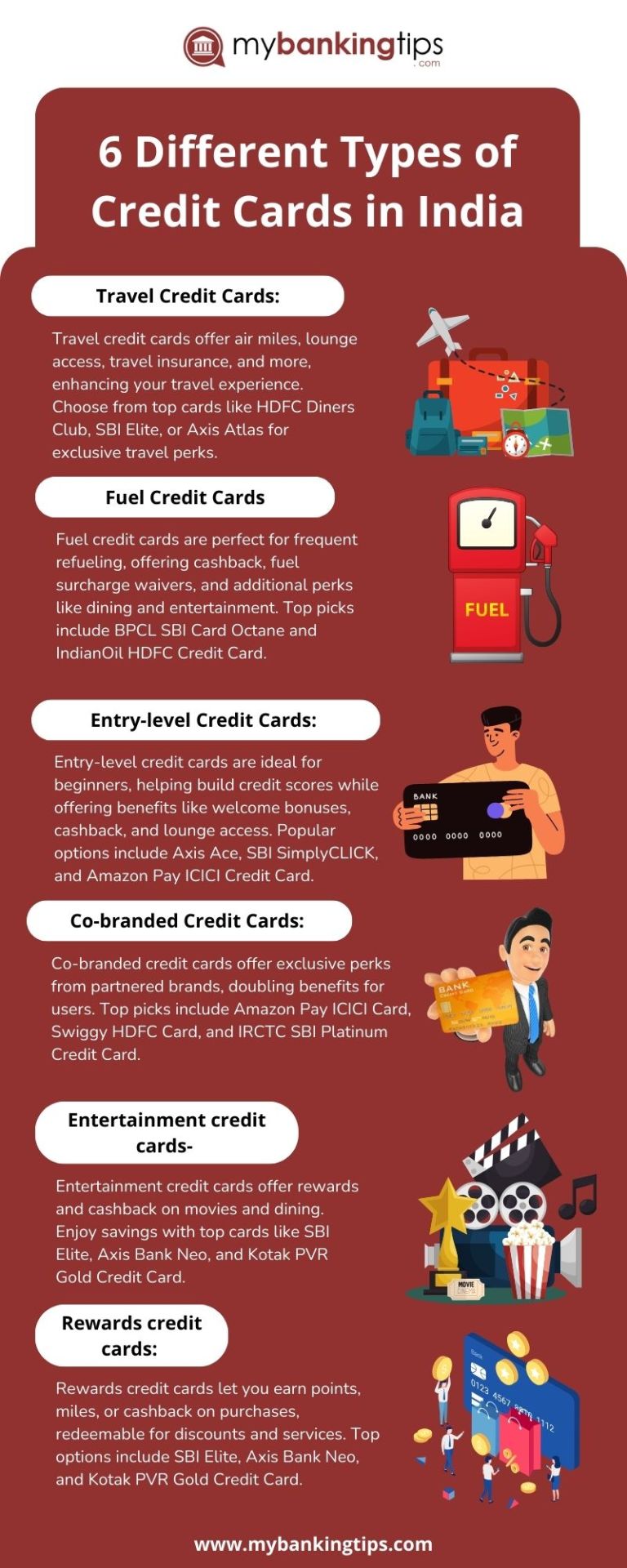

Top Credit Cards in India: Travel, Fuel, Rewards & Entertainment Benefits: Credit cards offer tailored benefits for travel, fuel, entertainment, and rewards. For frequent travelers, cards like BPCL SBI Card Octane and Axis Atlas Credit Card provide air miles, lounge access, and travel insurance. Save on refueling with IndianOil Kotak Credit Card or ICICI HPCL Super Saver Credit Card, offering cashback and surcharge waivers. Beginners can start with SBI SimplyCLICK Credit Card or Amazon Pay ICICI Credit Card, featuring welcome bonuses and cashback. Co-branded cards like Swiggy HDFC Credit Card and IRCTC SBI Platinum Credit Card offer exclusive partner perks. Entertainment lovers can enjoy savings on movies and dining with Kotak PVR Gold Credit Card or Axis Bank Neo Credit Card. Rewards cards like SBI Prime and Axis My Zone Credit Card let you earn points or cashback on every purchase. Choose a card that suits your lifestyle to maximize benefits!

0 notes

Text

Best SBI Cards for Online Shopping: Enhance Your Shopping Experience

The best SBI credit cards for online shopping include the SBI SimplyCLICK and SBI Card Prime. The SBI SimplyCLICK offers 10X reward points on partner websites like Amazon, Cleartrip, and BookMyShow, and 5X points on other online shopping, making it perfect for frequent shoppers. Additionally, it provides milestone benefits, such as gift vouchers for reaching specific spending thresholds.

For a more premium experience, the SBI Card Prime offers 2X reward points on all online purchases and 10X points on dining, groceries, and movies. It also features milestone e-gift vouchers worth ₹7,000 and complimentary domestic lounge access, making it suitable for both shopping and travel.

Both cards enhance your online shopping experience with exclusive discounts, accelerated rewards, and cashback options. Whether you prefer a budget-friendly card or a premium one, the best SBI credit cards for online shopping offer immense value and rewards for your purchases.

0 notes

Text

The SimplyCLICK SBI Card is ideal for online shopping, offering accelerated rewards on e-commerce purchases and exclusive discounts on popular platforms. In contrast, the Citibank Cashback Credit Card is tailored for everyday spending, providing straightforward cashback on utility bills, dining, and movie tickets, making it perfect for routine expenses.

0 notes

Text

Best SBI Credit Card for Amazon Shopping: An In-Depth Guide

When it comes to maximizing your Amazon shopping experience, the right SBI credit card can make all the difference. The SBI Card PRIME is a top choice, offering 2 reward points for every ₹100 spent on Amazon, along with a 10% instant discount. For those seeking premium benefits, the SBI Card ELITE provides 5X reward points on Amazon purchases and exclusive access to international airport lounges.

For avid online shoppers, the SBI Card SimplyCLICK is ideal, offering 5 reward points per ₹100 spent on Amazon and various e-commerce platforms. Additionally, these cards offer annual fee waivers, exclusive dining offers, and more, making them excellent choices for frequent shoppers.

Choosing the best SBI credit card for Amazon shopping involves considering reward points, discounts, fees, and additional perks to ensure you get the most value from your purchases.

0 notes

Text

SBI Credit Card – Your Gateway to Smart Spending

In today’s fast-paced digital world, smart spending is no longer a choice—it’s a necessity. With growing expenses and evolving lifestyles, managing finances wisely becomes crucial. That’s where the SBI Credit Card steps in—not just as a financial tool, but as a companion that rewards your lifestyle.

Why Choose SBI Credit Card?

SBI Credit Cards are among the most trusted in India, backed by the credibility of the State Bank of India. Whether you're a frequent traveler, an online shopper, a foodie, or someone who loves to earn rewards, there's an SBI Credit Card tailored just for you.

Here’s why users are switching to SBI Credit Card every day:

Wide Range of Cards: From entry-level cards to premium lifestyle cards, SBI has something for everyone.

Lucrative Rewards: Earn reward points on every spend, which you can redeem for exciting gifts, vouchers, or discounts.

EMI Conversion: Convert big purchases into affordable EMIs at attractive interest rates.

Global Acceptance: Use your card anywhere in the world, with 24x7 customer support at your fingertips.

Contactless Payments: Make secure and fast payments with just a tap.

Top SBI Credit Cards You Should Know

Let’s look at some of the best options under the SBI Credit Card umbrella:

1. SBI SimplyCLICK Credit Card

Perfect for online shoppers. Enjoy 10X rewards on partner e-commerce sites like Amazon, BookMyShow, and Cleartrip.

2. SBI Card ELITE

A premium card for those who love luxury. Get complimentary movie tickets, airport lounge access, and concierge services.

3. SBI IRCTC Card

Frequent train traveler? Save on train bookings and earn reward points for every IRCTC spend.

4. BPCL SBI Card

If fuel spends eat up your budget, this card gives you up to 13.25% savings on fuel purchases at Bharat Petroleum outlets.

The SBI Credit Card isn’t just about transactions—it’s about transformation. It helps you save, earn, and spend smartly. Whether you're booking your next vacation, shopping online, or enjoying a fine dining experience, SBI Credit Cards are designed to support your goals with maximum rewards.

Join the millions of satisfied users and take the first step toward smarter spending. Because with SBI, it’s not just a card—it’s confidence in your pocket.

0 notes