#Secure Payroll

Explore tagged Tumblr posts

Text

Payroll Software: Revolutionize Your Payroll Process with Ease

Introduction: Is Payroll Taking Too Much Time?

Are you buried in tons of calculations for employee salaries, tax, deductions, etc.? Does payroll feel like a long, boring task that never ends and gives opportunities for errors? You aren’t alone. Many businesses deal with payroll in a very manual way. But can you imagine if there was an easy way to make an important task easier, faster, and mistake-free? Payroll Software is the answer. Payroll Software automates the entire payroll process and helps you stay accurate and compliant.

What is Payroll Software?

Payroll Software will automate all tasks related to employee pay. Payroll Software can calculate salary, tax, deduction, and pay similar to other payroll programs you may be using. Payroll Software can also be integrated to check attendance and any benefits information and link the payroll process with such systems. Automation may help to avoid errors, which could be costly to your business.

Payroll Software Key Features

1.Automatic Calculations of Salaries

Payroll system calculates salaries, bonuses, taxes, and deductions accurately and with unprecedented speed.

2.Tax Compliance

Keeps you up to date with all the latest tax rules; so you never miss an important change.

3.Generate Payslips

automatically creates and distributes paystubs to your staff.

4.Attendance & Leave Integration

Integrates with your attendance system to ensure salaries are based on hours worked.

5.Multi-Currencies & Multi-Language Support

Payroll management software perfect for organizations that have team members located in various countries and regions.

6.Easy-to-Use Interface

Makes it easy for HR and finance, so they can read reports and understand payroll data.

7.Secure Data Management

Payroll data should be kept confidential and secure.

Why Use Payroll Software?

Processing payroll manually wastes time and introduces more chances for mistakes, which can annoy workers and put you at risk of being penalized.best Payroll software in India automates repetitive work, reduces mistakes, speeds processing, and helps you stay compliant with tax legislation— giving your team more time to engage in higher level, strategic work.

Conclusion

Every company needs a payroll system that is both accurate and effective. Payroll software delivers a reliable, secure, and easy way to pay employees without the hassle. It allows you to worry and stress less and spend more time making your business better.

Looking to make your payroll easier? See the benefits Payroll Software can bring to give time back to you, help eliminate errors, and make payday hassle-free for everyone.

TO KNOW MORE VISIT: Savvyhrms

#best payroll software in india#smart payroll software#smart pay solution#Payroll Automation#ayroll Solutions#Secure Payroll#payroll management software

0 notes

Text

Why Accurate Payroll Calculations Matter for Employee Satisfaction

When employees receive their salary on time, with every component calculated correctly, it builds a deep sense of trust. But behind that payslip lies a system that must be precise, compliant, and fair. This is where basic payroll calculations play a powerful role in shaping employee satisfaction.

Let’s break down why getting payroll right isn’t just about numbers — it’s about people.

What Are Basic Payroll Calculations?

Payroll isn’t just salary in and salary out. Basic payroll calculations involve:

Gross Pay: Total salary before deductions (includes overtime, bonuses)

Deductions: Income tax, Provident Fund (PF), insurance, professional tax

Net Pay: The actual take-home salary after deductions

Even a small mistake in this process can lead to confusion, frustration, or even legal issues.

How Payroll Accuracy Affects Employee Satisfaction

Here’s how payroll accuracy directly impacts your team:

✅ Builds Trust

Employees expect to be paid fairly and on time. Any delay or error in payroll damages trust and can lower morale.

✅ Reduces Queries and Complaints

When calculations are clear and correct, HR teams spend less time handling disputes or explaining payslips.

✅ Improves Transparency

Employees appreciate understanding how their salary is broken down — it builds confidence in the company’s systems.

✅ Reflects Professionalism

A smooth payroll system shows that your company values its people and follows professional practices.

When to Consider Outsource Payroll Services

If you’re spending too much time on spreadsheets, or struggling with compliance updates, it may be time to explore outsource payroll services.

Here’s how outsourcing can make a difference:

🔍 Accurate Calculations Payroll experts use automated tools to eliminate human errors.

📆 Timely Processing Your team is always paid on time — no stress or delays.

⚖️ Compliance Assurance Providers stay updated with tax laws and labor regulations.

🔐 Data Security Sensitive employee information is handled securely.

Final Thought

Getting payroll right isn’t optional — it’s essential. Whether you manage a small business or a growing team, basic payroll calculations form the foundation of employee satisfaction.

Choosing to outsource payroll services can ensure accuracy, save time, and most importantly, show your employees that they matter.

#payroll#payrollmanagement#payrollservices#payrollsolutions#futurexsolutions#employee satisfaction#payroll services#secure payroll

1 note

·

View note

Text

Tea time with Hassel is fucking wild. So far he told the director that:

- he bought a random woman a rose because it matched her clothes, then he was surprised when she came by the next day to ask him out? He then made a scene and demanded the rose back??

- he likes clean things because it's fun to make them dirty ??!?!?

- we're not getting rid of him unless the director personally sends him away ...

That last one btw was extra hilarious bc I was too lazy to look at recipes, so I was like eh let's make it super strong, let's put this salted plum in it too that's going to be disgusting (aka match his personality) and then he apparently was like yum you get an interaction and also you're not getting rid of me now lol

#not an otome game btw 😂#very entertaining character building#don't even get me started on his files#the public security bureau is like#you know what we'll just keep him on the payroll but he doesn't have to work#because both employing and firing him is a hazard to society#such a wild cannon#I'll keep reporting as I'm unlocking shit :P#ash echoes#nara's gaming adventures

29 notes

·

View notes

Text

it is kind of fucked how my apartments late fee is 10% of the rent per day its late when most places just have a flat fee. thats like $170 per day

#thinking about this since i have to pay tomorrow or say goodbye to any sense of financial security i was experiencing#also because like last year my friend was late by 10 days because their payroll got fucked up by company system changes and they had to pay#so fucking much#mannnnnn landlords :|#words words words

6 notes

·

View notes

Text

Why Digital Wallets Like WeGoFin Are the Future of Money Management

In a world where convenience, speed, and security drive financial transactions, digital wallets have emerged as the future of money management. Platforms like WeGoFin are transforming the way individuals and businesses handle finances, providing seamless, secure, and efficient payment solutions. Here’s why digital wallets are here to stay and how WeGoFin is leading the charge.

#wegofin#best payment gateway#digital payments#digital payment services#best secure payment#payroll#payroll software#upi#upi transactions

2 notes

·

View notes

Text

How to Pick a Payroll Service That Fits Your Needs

Payroll is crucial for any business, whether it’s a large enterprise or a small business. While big organizations have decent budgets to invest in good payroll software, small businesses have the option of hiring third-party payroll providers.

Finding the best payroll provider is like finding a needle in a haystack. There are so many options that may leave anyone confused about how to select the right one. If you’re looking for your payroll partner, we have this little guide where we’ve curated 8 tips that will help you choose the best payroll service provider.

For more info visit: How to Choose the Best Payroll Provider for Your Small Business

#Best payroll provider for small business#Payroll services for small business#Small business payroll solutions#Payroll outsourcing for small businesses#Payroll provider comparison#Small business payroll management#Payroll compliance services#Tips for selecting payroll services for small business#Questions to ask before hiring a payroll provider#Cost-effective payroll service options for SMEs#Secure and compliant payroll services for businesses

1 note

·

View note

Text

Craig Harrington at MMFA:

The Daily Signal, a media outlet supported by the right-wing Heritage Foundation, recently published two blogs fearmongering about the future of Social Security. The pieces pushed for reductions in benefits for future retirees, argued against raising taxes on the wealthy to cover the program’s long-term financial requirements, and advocated for a privatized retirement system through “personal ownership” of Social Security benefits or so-called “personal retirement” accounts. The Heritage Foundation has played a central role in organizing the planned conservative takeover of the federal government known as Project 2025, which aims to implement its reactionary right-wing agenda should Donald Trump succeed in his bid to return to the White House.

[...]

The Heritage Foundation wants to dismantle Social Security

The decadeslong conservative project to unwind popular and successful programs like Social Security is alive and well. The ideologues organizing against Social Security, like the Heritage Foundation, have been open about their intentions in the lead-up to the 2024 election. Making matters worse, the right's anti-Social Security narrative has worked its way into the general discourse at some mainstream outlets. The Washington Post and The New York Times, which are often derided as “liberal media” by their partisan opponents, subjected readers to conservative talking points in their news write-ups of the latest trustees report. In this instance, Heritage and The Daily Signal seem to be using overhyped concerns about future payroll tax increases to build support for their proposals to cut benefits (by raising the retirement age, lowering cost of living adjustments, and changing the way benefits are calculated) and using exaggerated promises of investment returns to encourage privatizing the Social Security system.

The tax complaint is a red herring. Simply eliminating the payroll tax cap, which is currently indexed to $168,600, without increasing outlays would extend full benefits payable from the Social Security trust fund to at least 2060, according to current projections. (The Daily Signal actually admitted this when it proclaimed that “eliminating the Social Security tax cap entirely would only solve about half of Social Security’s shortfalls.”) As it currently stands, every dollar earned after that $168,600 threshold is exempt from payroll taxes, resulting in people with extremely high incomes contributing a lower percentage of their income to Social Security than people who earn less. Only about 6% of workers are currently earning above this cap, but widening economic inequality has resulted in nearly 18% of taxable income becoming exempt from payroll taxation.

The Heritage Foundation and their "news" blog The Daily Signal are pushing propaganda that would eventually lead to the privatization of Social Security.

#Social Security#Project 2025#The Heritage Foundation#The Daily Signal#Payroll Tax Cap#Income Inequality#Social Security Privatization

5 notes

·

View notes

Text

All Congress has to do is to lift the cap on the payroll tax so that the wealthy will have to pay on their income above the current cap of $176,100. That would make Social Security solvent for years.

DON'T SACRIFICE THE WELL-BEING OF OUR SENIOR CITIZENS TO PROVIDE TAX BREAKS FOR THE RICH

[edited]

________________ Sources for meme background images (before edits): 01, 02

(CNN) — Social Security will not be able to fully pay monthly benefits to tens of millions of retirees and people with disabilities in 2034 if lawmakers don’t act to address the program’s pending shortfall, according to an annual report released Wednesday by Social Security’s trustees.

The combined Social Security trust funds – which help support payments to the elderly, survivors and people with disabilities – are expected to be exhausted in 2034, one year earlier than previously forecast, according to the trustees’ annual report. At that time, payroll tax revenue and other income sources will only be able to cover 81% of benefits owed.

#social security#senior citizens#cap on the payroll tax#it's time for the wealthy to pay their fair share#no more tax breaks for the rich#my memes#my edits

215 notes

·

View notes

Text

🌐 Your Digital Storefront: Why an E-Commerce Website is Non-Negotiable for Growth Today 🚀

For over a decade, I've observed the Indian business ecosystem evolve at a breathtaking pace. One of the most significant transformations has been the shift in consumer behaviour, moving decisively towards online purchasing. What was once a convenience has now become an expectation. If your business isn't actively leveraging an e-commerce website, you're not just missing an opportunity; you're actively falling behind in the race for market share and sustained growth.

The concept of an "E-Commerce website for your online business to grow" isn't merely about having a digital presence. It's about establishing a powerful, scalable, and perpetually open storefront that works tirelessly for you, reaching customers far beyond your physical boundaries. This isn't a luxury anymore; it's the fundamental engine driving modern business expansion in India.

The Inevitable Shift: Why Customers Are Already Online 📱🛍️

Consider this: India's e-commerce market is projected to reach US$274 billion by 2027, growing at a CAGR of 15% from 2024. Furthermore, by 2025, an additional 80 million new online shoppers are expected to join the ranks. This isn't just data; it's a clear signal from the market. Your customers, irrespective of whether they're in metro cities or Tier-2/3 towns, are already shopping online. In fact, two-tier cities and smaller towns now account for 60% of all online orders in India.

If your business isn't easily discoverable and accessible online through its own dedicated e-commerce platform, you are essentially invisible to a vast and rapidly expanding customer base. This creates a significant "fear of missing out" (FOMO) – the fear of being left out of this unprecedented digital gold rush while your competitors capture the lion's share.

Beyond a Website: The Unlocked Value of E-Commerce 🔑💰

An e-commerce website is far more than just an online catalogue. It's a strategic asset that delivers tangible value and impacts your business in multiple, profound ways:

24/7 Global Reach & Uncapped Sales: Unlike a physical store with fixed hours, an e-commerce website operates 24 hours a day, 7 days a week, 365 days a year. This means you can generate sales even while you sleep! It breaks geographical barriers, allowing you to sell to customers anywhere in India, and even globally. Imagine a small artisan from Jaipur selling their crafts directly to customers in Mumbai, or even beyond. This expansion was unimaginable a decade ago for many.

Reduced Operational Costs: Setting up and maintaining a physical store involves significant overheads: rent, utilities, staff, security, etc. An e-commerce website drastically reduces these costs. You can manage a substantial inventory and serve a massive customer base with a much leaner operational footprint. This cost efficiency directly translates into higher profit margins.

Enhanced Customer Experience & Convenience: Today's customers demand convenience. An e-commerce website offers exactly that – the ability to browse products, compare prices, read reviews, and make purchases from the comfort of their home, at any time. Features like detailed product descriptions, high-quality images, and customer reviews empower shoppers to make informed decisions, leading to higher satisfaction.

Powerful Data & Analytics: One of the most underrated benefits is the treasure trove of data an e-commerce platform provides. You can track customer behaviour, popular products, peak shopping times, abandonment rates, and much more. This data is invaluable for understanding your market, personalising marketing efforts, optimising product offerings, and making data-driven strategic decisions that fuel growth. For instance, a clothing brand discovered through website analytics that a particular colour of saree was performing exceptionally well in Southern India, allowing them to stock up strategically and target their marketing.

Stronger Brand Building & Credibility: A professional, well-designed e-commerce website instantly builds credibility and enhances your brand image. It serves as your official digital identity, a place where customers can trust the information, see customer testimonials, and engage directly with your brand. In today's digital-first world, a business without a robust online presence often struggles with perceived legitimacy.

Seamless Scalability: As your business grows, your e-commerce website can grow with you. Whether you need to add more products, expand into new categories, or handle increased traffic, e-commerce platforms are designed for scalability with minimal additional investment compared to opening new physical outlets.

The Imperative: Don't Be Left Behind ⏳

The Indian retail market is undergoing a seismic shift. If your business is still primarily offline, relying on traditional channels, you are at a distinct disadvantage. Your competitors who have embraced e-commerce are already reaching a wider audience, operating more efficiently, and building stronger brands. The trend of online shopping is not slowing down; it's accelerating. Statistics show that by 2028, e-commerce could account for 14% of the retail market in India, up from 8% in 2024.

Can your business afford to miss out on reaching these millions of active online shoppers? Can you afford to concede market share to those who are digitally empowered? The time to act is now.

Conclusion: Build Your Digital Future Today 🏗️🌟

An e-commerce website is no longer an optional add-on; it is the cornerstone of sustained growth for any business aspiring to thrive in modern India. It offers unparalleled reach, operational efficiency, deep customer insights, and the flexibility to scale. It empowers you to not just survive but to truly flourish in the digital economy.

The journey of digital transformation begins with a single, crucial step. Don't let the complexity deter you; the solutions available today are more accessible and user-friendly than ever before.

Ready to build your powerful online storefront and accelerate your business growth?

Visit SSVInfotech.Com today to explore our expert e-commerce website development services and transform your online business potential into a reality. Your growth story awaits!

#ecommerce#website builder#websecurity#web security#website hosting#website development#web hosting#website#ssvinfotech.com#software design#hrms payroll software#crm software#software development#software

0 notes

Text

Hey, cool, thanks for changing up the website where I check my pay to make sure I was paid correctly.

I do enjoy having even more extra steps to see my actual pay. Censoring my pay from me is a fantastic feature. I'm glad I have to look for the little "show/hide" toggle so I can see my pay at a glance. Really goes well with having to download my actual pay statement to see the actual pay codes with dollar amounts. I love having to click through multiple tabs to see if I was paid correctly this week.

#i heard that once upon a time my company used to do it's own payroll accounting instead of having a third party do it#they did everything in house once upon a time and it was actually more secure and problems were resolved faster#they managed 750000 workers using paper records far better than 50000 with multiple third party digital services

1 note

·

View note

Text

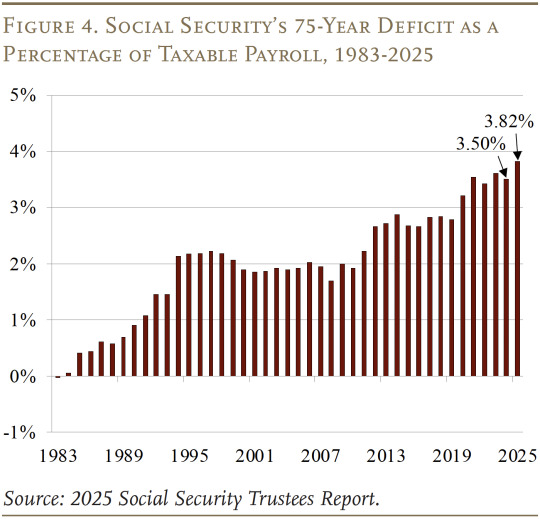

The brief’s key findings are:

The 2025 Trustees Report shows a modest increase in Social Security’s 75-year deficit, while the depletion date for the retirement trust fund remains at 2033.

The prospect of a 23-percent benefit cut only 8 years away should focus our attention on restoring balance to the program.

It’s important to note that these current estimates are based on the Trustees’ intermediate assumptions, which are not a sure thing.

Indeed, the deficit could well end up higher if the fertility rate remains low, millions of immigrants are deported, and people live longer than expected.

Even in this case, though, many revenue and benefit options are available to close the gap. All that is needed is the political will.

0 notes

Text

Simplifying Paydays: Why Every Business Needs Payroll Software

In today’s fast-paced business environment, relying on manual payroll systems is not only out of date but also foolish. With increased compliance obligations, a growing workforce, and an expectation for accuracy, the urgency of considering an automated payroll process is more prevalent than ever. This is where payroll software can transform your business.

What is Payroll Software?

Where payroll is done only through human calculation it becomes a lengthy process that is riddled with possible human error and often unreported. Payroll software fundamentally alters a person's ability to carry out these tasks and calculates most aspects of payroll transparently & reliably, along with books time for things that HR and finance can now be doing that relate to analysis or administrative work.

The greatest advantage of using payroll software is the accuracy of the results. Payroll calculations that are miscalculated may result in unhappy employees or even legal penalties. Automated systems will eliminate the chances of making erroneous human mistakes, and will ensure that deductions and additions always complete accurately and independently.

Compliance management will also be crucial. Tax laws and labor legislation is always changing, and manually tracking these changes can present an appropriation of work to the people responsible. As payroll software has built-in regulatory compliance features, the software will always be state-of-the-art and move seamlessly with rule changes that affect the payroll system to notify each company. Payroll system provides the opportunity to avoid fines, audits, and financial losses.

Features of Payroll Software Include:

Automated Salary Calculations: Determines employee wage and salary numbers, including but not limited to, earnings, deductions, taxes, net pay, and more.

Tax Preparation Support: Automatically creates tax form preparation and e-filing options.

Payslip Creation: Instantly generates an excellent payslip in a very professional manner, with complete burn-down wages.

Leave and Attendance Integrations: Assists in the processing of pay amounts from leave and attendance systems.

Multi-Currency and Multi-Location: Most useful for remote and global organizations.

Secure & Encrypted Data: All sensitive information is stored with high-grade encryption and backup.

Employee Self-Service Portals: Employees can log in to view their entire payslip history, tax documents, and leave balances without HR or other involved people.

Aside from features, real value lies in efficiency and peace of mind. With payroll automation, administrative workload decreases, payroll cycles shorten, and trust is built throughout the organization. Employees are paid on time, records are current and compliance is completed with the least amount of manual input.

Conclusion

Whether you are a start-up or budding business, investing in smart payroll software is not just a cost - it is a strategy. Investing in payroll software lays an initial foundation of trust, professionalism, and operational excellence for every business on their way to success.

#smart payroll software#best payroll software#smart pay solution#smart salary pay#accurate and secure payroll#payroll software#payroll

0 notes

Text

Cyber Security Beginner to Advance

Cyber Security Beginner to Advance course with hands-on training in ethical hacking, cryptography, networking, and CEH certification preparation.

#Cyber Security Beginner to Advance#Cyber Security Course#Python Full Course for Beginners#Best Dropshipping Course for E-Commerce#Payroll & HR Management#Best Social Media Marketing Certificates#Best Online Web Development Courses with Certificates#Advanced Excel Course Online#Best Business Management Courses in Zirakpur#Best Online Digital Marketing Course with Placement

1 note

·

View note

Text

The Fintech Revolution: How WeGoFin is Changing the Game

The world of finance is evolving at lightning speed, and at the heart of this transformation is financial technology—better known as fintech. Gone are the days of waiting in long bank lines or dealing with complex financial processes. Now, digital solutions are putting control back into the hands of consumers and businesses alike. Leading this charge is WeGoFin, a next-generation digital payments platform that is redefining how we transact, save, and manage our finances. Because at the end of the day, WeGoFin is the future.

#wegofin#best payment gateway#digital payment services#digital payments#best secure payment#payroll#payroll software#upi#upi transactions#hr payroll software

2 notes

·

View notes

Text

CRMLeaf Features Built to Improve Sales and Customer Relationships

In this blog, we’ll explore the key features of CRMLeaf that are designed to elevate your sales process and enhance customer relationships at every stage.

Read the full blog

#CRMLeaf#Sales CRM#Business CRM#CRM software#Lead management#Customer engagement#Project management#HR software#Payroll system#Billing CRM#Task tracking#Team collaboration#Pipeline management#Ticketing system#Employee tracking#Recruitment tool#Data security#Reports & insights#Role-based access

1 note

·

View note

Text

#SSVInfotechCom #SSVInfotech #WebDevelopment #AppDevelopment #SoftwareDevelopment #DigitalMarketing #Ecommerce #WebSecurity #DigitalTransformation #WebsiteDesign #OnlineStores #CRM #HRM #Payroll #SocialMedia

#SSVInfotech.Com#digital marketing#online marketing#web security#website development#app development#crm software#hrms software#payroll

0 notes