#Silicon Carbide (SIC) Power Modules Market share

Explore tagged Tumblr posts

Text

Silicon Carbide (SIC) Power Modules Market, Report Industry, Trends, Share 2025-2033

The Reports and Insights, a leading market research company, has recently releases report titled “Silicon Carbide (SIC) Power Modules Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033.” The study provides a detailed analysis of the industry, including the global Silicon Carbide (SIC) Power Modules Market share, size, trends, and growth forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the Silicon Carbide (SIC) Power Modules Market?

The global silicon carbide (SIC) power modules market was valued at US$ 956.6 million in 2024 and is expected to register a CAGR of 16.8% over the forecast period and reach US$ 3,870.1 million in 2033.

What are Silicon Carbide (SIC) Power Modules?

Silicon Carbide (SiC) power modules are advanced semiconductor devices used for power conversion in various applications like electric vehicles, renewable energy systems, and industrial equipment. These modules employ SiC, a compound known for its superior electrical properties compared to traditional silicon-based semiconductors, enabling higher efficiency, temperature operation, and lower switching losses. SiC power modules typically comprise SiC chips mounted on a substrate, along with driver and protection circuitry, all enclosed in a module package. They offer benefits such as reduced size, weight, and cooling requirements compared to silicon-based modules, making them ideal for high-performance, compact, and energy-efficient power electronics systems.

Request for a sample copy with detail analysis: https://www.reportsandinsights.com/sample-request/1857

What are the growth prospects and trends in the Silicon Carbide (SIC) Power Modules industry?

The silicon carbide (SiC) power modules market growth is driven by various factors and trends. The market for Silicon Carbide (SiC) power modules is rapidly expanding, driven by the increasing demand for efficient power electronics across industries like automotive, renewable energy, and telecommunications. SiC power modules offer advantages such as higher efficiency, faster switching speeds, and reduced size and weight compared to traditional silicon-based modules. Growth is fueled by factors like the growing adoption of electric vehicles, increasing demand for renewable energy sources, and the need for higher power density and efficiency in industrial applications. However, challenges such as high initial costs and limited availability of SiC materials may pose constraints on market growth. Hence, all these factors contribute to silicon carbide (SiC) power modules market growth.

What is included in market segmentation?

The report has segmented the market into the following categories:

By Power Module Type:

Full SiC Modules

Hybrid SiC Modules

By Voltage Range:

Low Voltage (600V and Below)

Medium Voltage (601V - 1200V)

High Voltage (Above 1200V)

By Sales Channel:

Direct Sales

Distributor Sales

By End-Use:

OEMs (Original Equipment Manufacturers)

Aftermarket

By Industry Vertical:

Automotive and Transportation

Industrial Automation

Energy and Power

Telecommunication

Consumer Electronics

Others

Market Segmentation By Region:

North America:

United States

Canada

Europe:

Germany

United Kingdom

France

Italy

Spain

Russia

Poland

BENELUX

NORDIC

Rest of Europe

Asia Pacific:

China

Japan

India

South Korea

ASEAN

Australia & New Zealand

Rest of Asia Pacific

Latin America:

Brazil

Mexico

Argentina

Rest of Latin America

Middle East & Africa:

Saudi Arabia

South Africa

United Arab Emirates

Israel

Rest of MEA

Who are the key players operating in the industry?

The report covers the major market players including:

Infineon Technologies AG

ROHM Semiconductor

Cree, Inc.

Mitsubishi Electric Corporation

Wolfspeed (a Cree Company)

ON Semiconductor

STMicroelectronics

Fuji Electric Co., Ltd.

GeneSiC Semiconductor Inc.

United Silicon Carbide Inc.

Microsemi Corporation (Microchip Technology Inc.)

Monolith Semiconductor Inc.

SEMIKRON International GmbH

Littelfuse, Inc.

Power Integrations, Inc.

View Full Report: https://www.reportsandinsights.com/report/Silicon Carbide (SIC) Power Modules-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

Reports and Insights consistently mееt international benchmarks in the market research industry and maintain a kееn focus on providing only the highest quality of reports and analysis outlooks across markets, industries, domains, sectors, and verticals. We have bееn catering to varying market nееds and do not compromise on quality and research efforts in our objective to deliver only the very best to our clients globally.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

Reports and Insights Business Research Pvt. Ltd. 1820 Avenue M, Brooklyn, NY, 11230, United States Contact No: +1-(347)-748-1518 Email: [email protected] Website: https://www.reportsandinsights.com/ Follow us on LinkedIn: https://www.linkedin.com/company/report-and-insights/ Follow us on twitter: https://twitter.com/ReportsandInsi1

#Silicon Carbide (SIC) Power Modules Market share#Silicon Carbide (SIC) Power Modules Market size#Silicon Carbide (SIC) Power Modules Market trends

0 notes

Text

SiC MOSFET Chips (Devices) and Module Market 2025

Silicon Carbide (SiC) MOSFET chips (devices) and modules are semiconductor components made from silicon carbide material. Compared to traditional silicon-based MOSFETs, SiC MOSFETs offer superior properties such as lower on-resistance, higher thermal conductivity, and reduced switching losses. These features make SiC MOSFETs highly suitable for high-frequency circuits, electric vehicles (EVs), renewable energy systems, industrial automation, and telecommunications applications.

Get more reports of this sample : https://www.intelmarketresearch.com/download-free-sample/639/sic-mosfet-chips-devices-and-module-market

Market Size & Growth Projections

The global SiC MOSFET chips (devices) and module market was valued at USD 540.9 million in 2022 and is projected to reach USD 2731.9 million by 2029, growing at a CAGR of 26.0% during the forecast period. The increasing adoption of electric vehicles and renewable energy solutions, coupled with advancements in semiconductor technology, is driving this growth. The demand for higher efficiency power electronics in industrial applications is also a significant contributor.

Key Market Drivers

Surge in Electric Vehicle Adoption: The rapid shift towards EVs is driving demand for SiC MOSFETs due to their superior efficiency in powertrain and charging applications.

Growing Renewable Energy Demand: SiC MOSFETs improve efficiency in solar inverters and wind power converters, significantly reducing energy losses.

High Performance & Energy Efficiency: Compared to silicon-based alternatives, SiC MOSFETs deliver better power density, thermal performance, and overall efficiency.

Industrial Automation & Power Electronics Expansion: Industries are integrating SiC MOSFETs in high-power applications such as motor drives, UPS, and power supplies.

Market Challenges & Restraints

High Manufacturing Costs: The production of SiC wafers is expensive, increasing the overall cost of SiC MOSFETs.

Complex Fabrication Process: SiC MOSFET manufacturing involves intricate and advanced processes, limiting large-scale production.

Limited Supply Chain & Market Consolidation: A few key players dominate the SiC MOSFET market, leading to supply chain constraints.

Opportunities for Growth

Expanding Applications in 5G & Aerospace: SiC MOSFETs are increasingly used in telecom infrastructure and satellite power systems.

Advancements in Manufacturing Technologies: The development of 6-inch and 8-inch SiC wafers will enhance production efficiency and reduce costs.

Rising Demand in Smart Grids & Power Infrastructure: SiC MOSFETs play a crucial role in modernizing energy distribution systems.

Regional Market Insights

North America

Strong demand due to the increasing adoption of EVs, 5G networks, and renewable energy solutions.

The United States leads the region, supported by a robust semiconductor industry and government incentives.

Europe

Germany dominates the European market, driven by its strong automotive and renewable energy sectors.

Government policies favoring energy-efficient technologies fuel market growth.

Asia-Pacific

China and Japan lead in SiC MOSFET production, accounting for a significant portion of global output.

The region’s booming EV and semiconductor markets are key growth drivers.

South America & Middle East-Africa

Brazil is the leading market in South America, with increasing investments in renewable energy and EV adoption.

Saudi Arabia and UAE are gradually adopting SiC MOSFETs in renewable energy projects.

Get more reports of this sample : https://www.intelmarketresearch.com/download-free-sample/639/sic-mosfet-chips-devices-and-module-market

Competitive Landscape

The SiC MOSFET market is highly competitive, with the top five companies holding approximately 80% market share. Key players include:

Infineon Technologies

Wolfspeed (Cree)

ROHM Semiconductor

STMicroelectronics

ON Semiconductor

Mitsubishi Electric

These companies are investing in manufacturing expansion, product development, and strategic partnerships to strengthen their market position.

Market Segmentation (by Application)

Electric Vehicles (EVs) and Hybrid Vehicles: SiC MOSFETs improve battery performance and efficiency.

Renewable Energy Systems: Used in solar inverters, wind turbines, and power converters.

Industrial Power Electronics: Deployed in motor drives, UPS, and power grid applications.

5G & Telecommunications: Enhances power efficiency in base stations and network equipment.

Aerospace & Defense: Integrated into satellites, aircraft power systems, and radar electronics.

Market Segmentation (by Type)

SiC MOSFET Chips/Devices: Used in standalone power conversion applications.

SiC MOSFET Modules: Integrated solutions for high-power industrial applications.

Key Developments & Innovations

June 2021: Infineon Technologies acquired Cypress Semiconductor to expand its automotive and IoT portfolio.

May 2021: Wolfspeed expanded SiC MOSFET production for EV and renewable energy applications.

February 2021: ON Semiconductor introduced high-voltage SiC MOSFETs for renewable energy.

January 2021: STMicroelectronics launched a SiC MOSFET power module for EVs.

October 2021: ROHM Semiconductor developed a low on-resistance SiC MOSFET chip for higher efficiency.

Geographic Segmentation

Asia-Pacific: Largest market due to China, Japan, and South Korea’s semiconductor and EV industries.

North America: Strong growth in EVs and 5G infrastructure.

Europe: Germany, France, and the UK lead in automotive and energy applications.

Frequently Asked Questions (FAQs) :

▶ What is the current market size of the SiC MOSFET market?

A: The market was valued at USD 540.9 million in 2022 and is expected to reach USD 2731.9 million by 2029.

▶ Which are the key companies in the SiC MOSFET market?

A: Leading players include Infineon Technologies, Wolfspeed, Rohm Semiconductor, STMicroelectronics, ON Semiconductor, and Mitsubishi Electric.

▶ What are the key growth drivers in the SiC MOSFET market?

A: Major growth factors include EV adoption, high-efficiency power electronics, and renewable energy expansion.

▶ Which regions dominate the SiC MOSFET market?

A: Asia-Pacific leads the market, followed by North America and Europe.

▶ What are the emerging trends in the SiC MOSFET market?

A: Trends include 8-inch wafer production, high-voltage SiC MOSFETs, and aerospace/industrial applications.

Get more reports of this sample : https://www.intelmarketresearch.com/download-free-sample/639/sic-mosfet-chips-devices-and-module-market

0 notes

Text

Float-Zone Silicon Crystal Market: Demand Rising Across Industrial Sectors

MARKET INSIGHTS

The global Float-Zone Silicon Crystal Market was valued at US$ 542 million in 2024 and is projected to reach US$ 834 million by 2032, at a CAGR of 5.6% during the forecast period 2025-2032. The U.S. market accounted for 35% of global revenue share in 2024, while China is expected to witness the fastest growth with a projected CAGR of 6.8% through 2032.

Float-Zone Silicon Crystal is a high-purity form of monocrystalline silicon produced through the float-zone refining process, which eliminates impurities and defects. These crystals are essential for manufacturing high-performance semiconductor devices due to their superior resistivity uniformity and lower oxygen content compared to Czochralski (CZ) silicon. Primary diameter variants include below 100mm, 100-150mm, 150-200mm, and above 200mm wafers, with the 150-200mm segment currently dominating the market with 42% revenue share.

The market growth is driven by increasing demand for power electronics and advanced semiconductor devices across automotive and industrial applications. However, supply chain constraints for high-purity polysilicon feedstock pose challenges. Key players like Shin-Etsu Chemical and SUMCO CORPORATION are expanding production capacities, with Shin-Etsu commissioning a new 300mm wafer facility in 2023 to meet growing demand for electric vehicle power modules.

MARKET DYNAMICS

MARKET DRIVERS

Rising Demand for High-Purity Silicon in Semiconductor Manufacturing Accelerates Market Growth

The global semiconductor industry’s relentless pursuit of miniaturization and performance enhancement is significantly driving demand for float-zone silicon crystals. These ultra-pure silicon wafers exhibit exceptional resistivity and minority carrier lifetime characteristics, making them indispensable for power devices, RF components, and radiation detectors. The ongoing transition to smaller process nodes below 5nm has elevated the importance of defect-free silicon substrates, with market leaders increasingly adopting float-zone silicon for specialized applications where conventional Czochralski silicon falls short. The semiconductor industry’s projected expansion at a compounded annual growth rate of over 6% through 2030 underscores this upward trajectory.

Electrification of Automotive Sector Creates New Application Horizons

Automotive electrification represents a transformative opportunity for float-zone silicon crystal manufacturers. The proliferation of electric vehicles demanding high-voltage power semiconductors has triggered unprecedented demand for silicon wafers with superior breakdown voltage characteristics. Float-zone silicon’s unique properties enable the production of insulated-gate bipolar transistors (IGBTs) and silicon carbide (SiC) power devices that can withstand the rigorous thermal and electrical stresses in EV drivetrains. With the electric vehicle market projected to grow at over 25% annually through 2030, tier-one suppliers are increasingly securing long-term contracts with silicon wafer manufacturers to ensure stable supply chains.

Strategic collaborations between automotive OEMs and wafer producers are emerging as a prominent market trend. For example, several leading German automakers have recently entered into joint development agreements with major silicon wafer manufacturers to co-engineer next-generation power semiconductor solutions.

MARKET RESTRAINTS

High Production Costs and Complex Manufacturing Process Limit Market Penetration

The float-zone process presents formidable economic challenges that restrict broader adoption. Compared to conventional Czochralski crystal growth methods, float-zone refinement requires specialized equipment and consumes significantly more energy per wafer produced. The capital expenditure for establishing a float-zone silicon production facility can exceed $100 million, creating substantial barriers to market entry. Additionally, the stringent purity requirements for feedstock silicon rods – typically requiring 99.9999% pure polysilicon – contribute to elevated production costs that are ultimately passed on to end users.

Yield optimization remains an ongoing challenge in float-zone crystal growth, with even leading manufacturers experiencing rejection rates between 15-20% for diameter control and crystallographic perfection. These technical hurdles constrain production scalability at a time when wafer diameters are transitioning from 200mm to 300mm standards.

MARKET CHALLENGES

Competition from Alternative Semiconductor Materials Intensifies

The silicon wafer industry faces mounting pressure from emerging wide-bandgap semiconductor materials that threaten to displace certain float-zone silicon applications. Silicon carbide and gallium nitride substrates are gaining traction in high-power and high-frequency applications, offering superior performance characteristics in some use cases. While float-zone silicon maintains cost advantages for mainstream applications, the accelerating adoption of these alternative materials in automotive and industrial power electronics presents a significant long-term challenge.

The materials science community continues to debate whether incremental improvements in float-zone silicon properties can compete with the fundamental material advantages of wide-bandgap semiconductors. This technological uncertainty creates hesitation among some device manufacturers considering long-term capital investments in float-zone silicon production capacity.

MARKET OPPORTUNITIES

Expansion in Photovoltaic and Sensor Applications Opens New Growth Channels

Beyond traditional semiconductor applications, float-zone silicon is finding growing acceptance in advanced photovoltaic systems and precision sensors. The solar industry’s pivot towards high-efficiency N-type silicon heterojunction cells has created demand for ultra-pure substrates that maximize carrier lifetimes. Similarly, emerging MEMS sensor applications in medical devices and industrial automation systems increasingly specify float-zone silicon for its superior mechanical and electrical consistency.

Forward-thinking manufacturers are capitalizing on these opportunities through vertical integration strategies. Several leading wafer producers have begun offering customized doping profiles and surface treatments tailored specifically for these emerging applications, creating value-added product lines with improved margins.

FLOAT-ZONE SILICON CRYSTAL MARKET TRENDS

Rising Demand for High-Purity Silicon in Semiconductor Manufacturing

The float-zone silicon crystal market is experiencing significant growth due to the increasing demand for high-purity silicon in semiconductor applications. Unlike conventional Czochralski (CZ) silicon, float-zone (FZ) silicon offers superior resistivity and lower oxygen content, making it ideal for power devices, sensors, and high-frequency chips. The global semiconductor shortage has further accelerated investments in advanced wafer production, with the FZ silicon segment projected to grow at a CAGR of over 7% from 2024 to 2032. Emerging applications in electric vehicles and 5G infrastructure are driving demand for larger wafer diameters, particularly in the 150-200 mm segment, which accounts for nearly 35% of total market revenue.

Other Trends

Miniaturization of Electronic Components

The relentless push toward smaller, more efficient electronic components continues to influence silicon wafer specifications. Float-zone silicon’s excellent minority carrier lifetime and defect uniformity make it indispensable for manufacturing advanced MOSFETs and IGBTs. Recent innovations in epitaxial layer deposition have enabled wafer thickness reductions below 725 microns while maintaining structural integrity. This trend aligns with the consumer electronics sector’s requirements, where over 60% of new smartphones and tablets now utilize power management ICs built on FZ silicon substrates.

Geopolitical Factors Reshaping Supply Chains

The float-zone silicon crystal market is undergoing supply chain realignments due to geopolitical tensions and export restrictions. While China continues aggressive capacity expansion—targeting 300,000 wafers/month by 2025—Western manufacturers are diversifying production facilities across Southeast Asia and Europe. The U.S. CHIPS Act has allocated $52 billion for domestic semiconductor infrastructure, directly benefiting specialty silicon producers. Furthermore, Japan’s recent partnership with GlobalWafers to establish a new 200mm FZ silicon plant underscores the strategic importance of securing high-purity silicon supplies outside traditional manufacturing hubs.

COMPETITIVE LANDSCAPE

Key Industry Players

Market Leaders Invest in R&D and Production Capacity to Maintain Dominance

The global float-zone silicon crystal market features a moderately consolidated competitive landscape, with Japanese manufacturers currently holding the strongest positions. Shin-Etsu Chemical emerges as the clear market leader, commanding approximately 25% of global revenue share in 2024. The company’s dominance stems from its vertical integration strategy and proprietary crystal growth technologies that deliver superior resistivity and purity levels exceeding 99.9999%.

SUMCO Corporation and Siltronic follow closely, collectively accounting for around 30% of market share. These companies have strengthened their positions through strategic long-term supply agreements with major semiconductor manufacturers. While Japanese firms currently lead in technology, Taiwanese player GlobalWafers has been rapidly expanding its market presence through a combination of acquisitions and capacity expansions, particularly in the 200mm wafer segment.

The competitive environment is intensifying as Chinese manufacturers like Sino-American Silicon Products and GRINM Semiconductor Materials increase their production capabilities. These companies benefit from strong government support and growing domestic demand, though they still face challenges in matching the purity standards of established Japanese producers. Across the industry, companies are allocating 15-20% of revenues to R&D, focusing on improving crystal uniformity and reducing oxygen content for high-power device applications.

List of Key Float-Zone Silicon Crystal Manufacturers

Shin-Etsu Chemical (Japan)

SUMCO CORPORATION (Japan)

Siltronic (Germany)

GlobalWafers (Taiwan)

Wafer World Quality Management System (U.S.)

Sino-American Silicon Products (China)

SVM (South Korea)

FSM (U.S.)

GRINM Semiconductor Materials (China)

Segment Analysis:

By Type

Below 100 mm Segment Holds Significant Share Due to Cost-Effective Production for Niche Applications

The market is segmented based on type into:

Below 100 mm

100-150 mm

150-200 mm

Above 200 mm

By Application

Semiconductor Segment Leads Owing to High Demand for Power Devices and IC Manufacturing

The market is segmented based on application into:

Semiconductor

Consumer Electronic

Automotive

Others

By Region

Asia Pacific Emerges as Dominant Regional Market Due to Concentration of Semiconductor Manufacturers

The market is segmented based on region into:

North America

Europe

Asia Pacific

South America

Middle East & Africa

Regional Analysis: Float-Zone Silicon Crystal Market

North America The North American float-zone silicon crystal market is driven by strong demand from the semiconductor and consumer electronics industries. The U.S. alone accounts for a significant portion of the region’s market share, supported by extensive R&D investments in advanced semiconductor manufacturing. Government initiatives, such as the CHIPS and Science Act allocating $52 billion for domestic semiconductor production, are further accelerating market growth. Leading manufacturers like Shin-Etsu Chemical and SUMCO CORPORATION have a strong presence here, catering to the high-purity requirements of U.S.-based tech firms. However, stringent environmental regulations regarding silicon production processes add complexity to operations.

Europe Europe’s market is characterized by stringent quality standards and a focus on sustainable production methods. Germany remains the regional leader due to its robust semiconductor ecosystem, with companies like Siltronic playing a pivotal role. The European Union’s push for self-sufficiency in semiconductor production through initiatives like the European Chips Act is expected to drive demand for high-quality float-zone silicon crystals in the coming years. Challenge-wise, energy-intensive manufacturing processes face scrutiny under the EU’s Green Deal framework, pushing manufacturers toward cleaner production techniques. Meanwhile, the U.K. and France are emerging as key markets, supported by localized government incentives for semiconductor component production.

Asia-Pacific The Asia-Pacific region dominates global float-zone silicon crystal consumption, accounting for over 50% of market share, led by manufacturing hubs in China, Japan, and South Korea. China’s aggressive semiconductor self-sufficiency policies and its $150 billion investment in domestic chip production continue to fuel demand. Meanwhile, Japanese players like SUMCO and Shin-Etsu maintain technological leadership in high-purity crystal production. Cost competitiveness remains a key advantage for the region as manufacturers optimize production scales, though geopolitical trade tensions occasionally disrupt supply chains. Southeast Asia is also emerging as an alternative manufacturing base to diversify away from China, with Thailand and Malaysia attracting investments in silicon material production facilities.

South America The South American market remains small but shows gradual growth potential. Brazil represents the primary market, with increasing adoption in automotive electronics and industrial applications. However, the region faces significant challenges, including limited local manufacturing capabilities and reliance on imported silicon materials. Economic instability in key markets like Argentina further restricts investments in semiconductor-grade material production. While some local players are attempting to establish float-zone silicon capabilities, the market currently depends on global suppliers, with price sensitivity influencing purchasing decisions more than pure technical specifications.

Middle East & Africa This region is in early stages of market development. Saudi Arabia and UAE are showing initial interest in semiconductor material production as part of broader economic diversification strategies, though current consumption remains minimal. South Africa has some niche applications in specialized electronics. The lack of established semiconductor ecosystems and high energy costs for crystal production continue to hinder market growth. However, long-term potential exists as regional governments increase technology investments, and global suppliers begin evaluating the area for future manufacturing footprint diversification strategies outside traditional Asian production bases.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Float-Zone Silicon Crystal markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global Float-Zone Silicon Crystal market was valued at USD 380.5 million in 2024 and is projected to reach USD 520.8 million by 2032, growing at a CAGR of 4.8%.

Segmentation Analysis: Detailed breakdown by product type (Below 100 mm, 100-150 mm, 150-200 mm, Above 200 mm), application (Semiconductor, Consumer Electronic, Automotive, Others), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis where relevant. Asia-Pacific dominates with 42% market share in 2024, driven by semiconductor manufacturing growth in China, Japan, and South Korea.

Competitive Landscape: Profiles of leading market participants including Shin-Etsu Chemical, SUMCO CORPORATION, Siltronic, GlobalWafers, their product offerings, R&D focus, manufacturing capacity, pricing strategies, and recent developments such as mergers, acquisitions, and partnerships.

Technology Trends & Innovation: Assessment of emerging fabrication techniques, high-purity crystal growth methods, and evolving industry standards for power electronics and advanced semiconductor applications.

Market Drivers & Restraints: Evaluation of factors driving market growth including 5G infrastructure, electric vehicles, and IoT devices along with challenges such as high production costs and supply chain constraints.

Stakeholder Analysis: Insights for semiconductor manufacturers, wafer suppliers, equipment vendors, investors, and policymakers regarding the evolving ecosystem and strategic opportunities.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/global-gaas-power-amplifier-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ambient-light-sensor-for-display-system.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/solar-obstruction-light-market-to-reach.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ac-dc-power-supply-converter-market-to.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/boost-charge-pump-ics-market-to-reach.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-motion-detector-sensor-market-to.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/x-ray-inspection-for-security-market-to.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-spatial-filters-market-to-reach.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-e-beam-liner-market-advancements.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-active-quartz-crystal-oscillator.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-ultrasonic-radar-market-share.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-ammeter-shunt-resistors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-wifi-and-bluetooth-rf-antenna.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-industrial-control-printed.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/global-scanning-transmission-electron.html

0 notes

Text

Power Electronics Market: Unlocking Steady Growth with Expanding Industrial Applications

The Power Electronics Market is projected to witness steady growth at a CAGR of 4.53% between 2025 and 2030, driven by increased adoption across electric vehicles, industrial automation, and renewable energy sectors.

Market Overview

The power electronics market is undergoing a phase of transformation, driven by the surging demand for energy-efficient devices and systems. Power electronics, which manage and convert electrical power using semiconductor technologies, have become essential in a wide array of applications — from automotive and consumer electronics to renewable energy and industrial automation. With technological advancements and growing emphasis on electrification, the power electronics industry size is expanding steadily across regions.

The rise in electric vehicles, deployment of smart grids, and integration of renewable energy sources are significantly contributing to the power electronics market growth. Moreover, the emergence of wide-bandgap semiconductors like SiC and GaN is reshaping product performance expectations in this space.

Key Trends

Surge in Electric Vehicle Integration The power electronics market is witnessing a boost due to the rapid adoption of electric vehicles (EVs). Power modules and inverters are integral components in EVs, impacting battery performance, range, and efficiency.

Wide Adoption in Renewable Energy Systems Solar inverters, wind turbine converters, and energy storage systems are heavily reliant on power electronics. As countries push for carbon neutrality, the power electronics market share in the renewable sector is expanding rapidly.

Rise of Wide-Bandgap Semiconductors Materials like silicon carbide (SiC) and gallium nitride (GaN) are offering higher switching efficiency, reduced thermal loss, and compact design benefits, thereby enhancing the overall power electronics market value.

Industrial Automation and Smart Manufacturing Factories and production facilities are increasingly leveraging intelligent power control systems. This boosts demand in the power electronics industry for efficient power management solutions across variable frequency drives, robotics, and control systems.

Government Incentives and Energy Efficiency Regulations Policies promoting clean energy and mandates around energy efficiency standards are positively impacting the power electronics market trends. These regulatory pushes are driving innovation in low-power loss components.

Challenges

Despite favorable trends, the power electronics market faces a few headwinds. The high initial cost of wide-bandgap components like GaN and SiC-based devices is a significant restraint. Additionally, supply chain constraints and the complexity of integrating advanced systems in legacy infrastructure slow down broader adoption. Technical challenges in thermal management and packaging further add to product development costs and timelines.

Conclusion

The power electronics industry is positioned for sustainable growth over the coming years, propelled by its increasing relevance across automotive, industrial, and energy domains. While technological and cost-related challenges persist, ongoing R&D and policy support are expected to mitigate these constraints. As market demand continues to diversify, stakeholders focusing on innovation, cost efficiency, and scalability will be best placed to capitalize on the growing power electronics market size.

Other Related Reports:

Chiller Market

Paper Straw Market

Switchgear Market

Esports Industry

#power electronics market#power electronics industry#power electronics market size#power electronics market growth#power electronics market trends

0 notes

Text

Automotive and Renewable Energy Sectors Power Global SiC Device Market Expansion

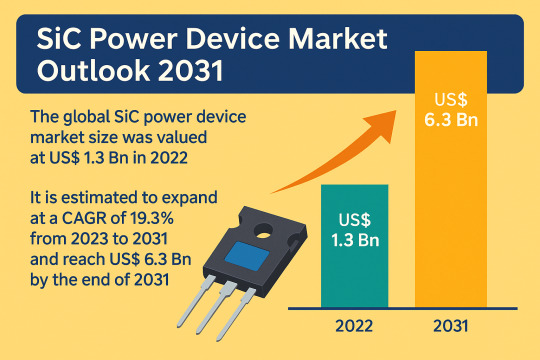

The global silicon carbide (SiC) power device market was valued at US$ 1.3 billion in 2022 and is projected to expand at a robust CAGR of 19.3% from 2023 to 2031, reaching an estimated US$ 6.3 billion by the end of 2031, according to the latest industry analysis. SiC devices, known for their high efficiency, low power loss, and durability in high-voltage and high-temperature conditions, are increasingly being adopted across automotive, industrial, renewable energy, and consumer electronics sectors.

Market Overview

SiC power devices have emerged as a critical solution for next-generation power electronics, offering significant improvements over traditional silicon-based components. With the ability to reduce power loss, increase switching speed, and operate under higher temperatures and voltages, SiC semiconductors are transforming industries that demand high reliability and energy efficiency.

Their unique material characteristics are particularly beneficial in wide bandgap applications, where reducing system size, weight, and cost are essential. The automotive industry, especially the electric vehicle (EV) segment, is a primary adopter, leveraging SiC to improve vehicle performance and energy efficiency.

Market Drivers & Trends

The growing push toward electrification, decarbonization, and energy efficiency is propelling the demand for SiC power devices globally. Key market drivers include:

Rising demand for high-efficiency power systems in industrial and renewable energy applications.

Accelerated EV adoption, requiring robust power electronics for traction inverters, battery chargers, and onboard systems.

Reduction in system size and complexity, thanks to superior properties of SiC MOSFETs and diodes.

Government incentives and mandates for cleaner transportation and energy storage systems.

These trends align with global sustainability goals, where power efficiency and reduced carbon footprint are paramount.

Latest Market Trends

SiC MOSFETs Dominate the Market: Representing over 32% of global share in 2022, the MOSFET segment continues to gain traction due to its high reliability, critical breakdown strength, and thermal performance.

600V–1000V Segment Leading by Voltage Range: With 31.89% share in 2022, this voltage range supports applications such as solar inverters, UPS systems, EV charging, and industrial drives.

High Power Modules in EV Applications: Companies like STMicroelectronics and WOLFSPEED have introduced SiC modules aimed at improving the driving range and energy management of electric vehicles.

Download Sample PDF Copy Now: https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=22034

Key Players and Industry Leaders

The SiC power device market is consolidated, with a few dominant players accounting for a majority of the market share. These include:

Coherent Corp.

Fuji Electric Co., Ltd

Infineon Technologies AG

Microchip Technology Inc.

Mitsubishi Electric Corporation

ON Semiconductor Corp

Renesas Electronics Corporation

ROHM Co., Ltd

Toshiba Electronic Devices & Storage Corporation

WOLFSPEED, INC.

These companies are investing heavily in R&D, expanding wafer production capabilities, and launching new product lines to meet surging demand.

Recent Developments

Mitsubishi Electric (March 2023): Constructed a new wafer facility to meet soaring demand for SiC power semiconductors.

Toshiba (December 2022): Developed advanced SiC MOSFETs with enhanced reliability and low resistance.

Microchip Technology (March 2022): Unveiled 3.3 kV SiC power devices for next-generation renewable energy and transportation solutions.

STMicroelectronics: Launched SiC high-power modules for EV traction systems in December 2022.

Market Opportunities

Emerging opportunities include:

Electrification of transportation: As EV adoption scales, SiC’s role becomes more critical in powertrain efficiency.

Expansion in renewable energy and grid infrastructure: Solar and wind energy systems benefit from SiC’s efficiency and reliability.

Adoption in aerospace and defense sectors: Where lightweight, high-performance power systems are increasingly necessary.

High-growth emerging economies in Asia-Pacific and Latin America provide untapped potential for SiC deployment.

Future Outlook

By 2031, the SiC power device market will be defined by:

Continued penetration into mainstream automotive platforms, including hybrid and electric vehicles.

Broad industrial adoption of SiC for high-efficiency motor drives, UPS, and energy storage.

Increased investment in supply chain capacity and localized SiC wafer manufacturing, especially in Asia and North America.

Analysts emphasize the role of SiC in enabling sustainable energy systems and expect the technology to be foundational to next-gen power semiconductors.

Market Segmentation

By Product Type:

Diode

Power Module

MOSFETs

Gate Driver

By Voltage:

Up to 600V

600V – 1000V

1000V – 1500V

Above 1500V

By Application:

Inverter / Converter

Power Supply

Motor Drive

Photovoltaic / Energy Storage Systems

Flexible AC Transmission Systems (FACTs)

RF Devices & Cellular Base Stations

Others (Traction Systems, Induction Heating)

By End-use Industry:

Automotive & Transportation

Aerospace & Defense

Consumer Electronics

IT & Telecommunication

Others (Healthcare, Energy & Utility)

Regional Insights

Asia Pacific held the largest market share (44.23%) in 2022 due to high demand from the electronics, automotive, and industrial sectors in countries like China, Japan, and India. Government policies supporting EV adoption and renewable energy integration are also fostering market growth.

North America (26.12% share) is poised for strong growth, with major semiconductor companies investing in product innovation and strategic partnerships. The U.S. remains a hub for electric vehicle innovation and renewable power generation.

Europe continues to strengthen its position through green energy mandates and rapid EV expansion in countries like Germany and the U.K.

Why Buy This Report?

Comprehensive Market Coverage: Includes qualitative and quantitative analysis with segment-wise and region-wise forecasts.

Strategic Insights: Covers key drivers, trends, and market dynamics shaping the SiC power device industry.

Competitive Intelligence: Profiles leading companies and details on recent innovations, partnerships, and expansions.

Decision-Making Support: Aids industry stakeholders in understanding growth opportunities and market trajectories to align their strategies accordingly.

Customizable Format: Available in PDF and Excel with deep-dive access to historical and projected data.

0 notes

Text

Power Electronics Market Set for Growth Owing to Renewable Integration

The Global Power Electronics Market is estimated to be valued at US$ 51.01 Bn in 2025 and is expected to exhibit a CAGR of 5.9% over the forecast period 2025 to 2032.

The power electronics market comprises semiconductor-based devices and systems that control and convert electric power efficiently across applications such as renewable energy, electric vehicles, industrial drives, and consumer electronics. These products—including inverters, converters, rectifiers, and power modules—offer advantages such as higher energy efficiency, reduced heat loss, compact design, and enhanced reliability. Rising demand for grid modernization, growing adoption of solar and wind energy, and the shift toward electric mobility have amplified the need for advanced power electronics. Power Electronics Market Insights is manufacturers are leveraging wide bandgap materials like silicon carbide (SiC) and gallium nitride (GaN) to deliver higher switching frequencies and lower conduction losses, driving down overall system costs and improving energy density. Additionally, innovations in digital power management and embedded control enable predictive maintenance and real-time monitoring, supporting industry trends of smarter and more connected energy systems. With increasing market share among key companies and expanding product portfolios, the sector is poised for robust market growth.

Get more insights on,Power Electronics Market

#Coherent Market Insights#Power Electronics Market#Power Electronics#Power Electronics Market Insights#Silicon Carbide

0 notes

Text

GaN and SiC Power Semiconductor Market Size, Share, Trends, Demand, Future Growth, Challenges and Competitive Analysis

"GaN and SiC Power Semiconductor Market - Size, Share, Demand, Industry Trends and Opportunities

Global GaN and SiC Power Semiconductor Market, By Product (Sic Power Module, GaN Power Module, Discrete SiC, Dicrete GaN), Application (Power Supplies, Industrial Motor Drives, H/EV, PV Inverters, Traction, Others) – Industry Trends.

Access Full 350 Pages PDF Report @

**Segments**

- **By Component**: GaN (Gallium Nitride) and SiC (Silicon Carbide) are two key components driving the power semiconductor market. GaN offers advantages in terms of efficiency and size reduction, making it ideal for high-frequency applications. On the other hand, SiC provides better thermal conductivity and can withstand higher voltages, making it suitable for high-power applications. - **By Material**: GaN semiconductors are known for their wide bandgap, allowing for high breakdown voltage and low conduction resistance. SiC, on the other hand, offers lower on-state resistance and higher operating temperatures than traditional silicon semiconductors. Both materials contribute significantly to the growth of power semiconductor solutions. - **By End-Use Industry**: The market for GaN and SiC power semiconductors spans across various industries such as automotive, industrial, aerospace, and consumer electronics. These industries benefit from the unique properties of GaN and SiC, enabling advancements in electric vehicles, renewable energy systems, and power electronics applications.

**Market Players**

- **Infineon Technologies AG**: A leading player in the GaN and SiC power semiconductor market, Infineon offers a wide range of products catering to different voltage and power requirements. Their focus on innovation and sustainability has propelled them to the forefront of the industry. - **ON Semiconductor**: Known for its high-quality SiC power modules and GaN devices, ON Semiconductor has established itself as a reliable supplier for various applications ranging from automotive to industrial sectors. - **STMicroelectronics**: With a strong portfolio of SiC and GaN solutions, STMicroelectronics has captured a significant market share in the power semiconductor industry. Their emphasis on performance and efficiency drives their competitiveness in the market.

The GaN and SiC power semiconductor market is witnessing rapid growth and technological advancements, driven by the demand for energy-efficient solutions across industries. As these two materials offer superior performance characteristics compared to traditional silicon semiconThe GaN and SiC power semiconductor market is experiencing significant growth and evolution, propelled by the increasing demand for energy-efficient solutions in various industries worldwide. GaN and SiC components have revolutionized the power semiconductor landscape by offering enhanced performance capabilities compared to traditional silicon semiconductors. GaN, with its inherent advantages in efficiency and size reduction, is particularly well-suited for high-frequency applications where power conversion efficiency is crucial. On the other hand, SiC stands out for its superior thermal conductivity and ability to withstand high voltages, making it an ideal choice for high-power applications where reliability and performance under extreme conditions are paramount.

In terms of materials, GaN semiconductors are characterized by their wide bandgap, which enables them to achieve high breakdown voltages and low conduction resistance. This feature makes GaN highly desirable for applications requiring high efficiency and power density. SiC, with its lower on-state resistance and capability to operate at higher temperatures compared to traditional silicon semiconductors, offers improved performance and reliability in demanding environments. Both GaN and SiC materials play a crucial role in driving the growth of power semiconductor solutions, catering to a wide range of applications across industries.

The market segmentation by end-use industry highlights the diverse applications of GaN and SiC power semiconductors across key sectors such as automotive, industrial, aerospace, and consumer electronics. In the automotive industry, GaN and SiC technologies are instrumental in enabling the transition to electric vehicles by enhancing power conversion efficiency and reducing overall system size and weight. In the industrial sector, these advanced materials are being adopted to improve the performance and reliability of power electronics systems, leading to increased automation and energy savings. The aerospace industry benefits from the high temperature capabilities of SiC semiconductors for aircraft power systems, while the consumer electronics sector leverages GaN's efficiency and compact size for applications like smartphone chargers and power adapters.

Market players such as Infineon Technologies AG, ON Semiconductor, and**Segments**

- **By Product**: SiC Power Module, GaN Power Module, Discrete SiC, Discrete GaN. - **By Application**: Power Supplies, Industrial Motor Drives, H/EV, PV Inverters, Traction, Others.

The Global GaN and SiC Power Semiconductor Market continues to evolve rapidly, driven by the increasing demand for energy-efficient solutions across industries. GaN and SiC components have significantly impacted the power semiconductor sector by offering enhanced performance capabilities compared to traditional silicon semiconductors. GaN's efficiency and size reduction benefits make it well-suited for high-frequency applications where power conversion efficiency is critical. In contrast, SiC's superior thermal conductivity and high voltage tolerance make it an optimal choice for high-power applications where reliability and performance under extreme conditions are essential.

In terms of materials, GaN semiconductors with their wide bandgap characteristics enable high breakdown voltages and low conduction resistance, making them highly attractive for applications requiring high efficiency and power density. SiC, on the other hand, boasts lower on-state resistance and the ability to operate at higher temperatures than traditional silicon semiconductors, offering improved performance and reliability in challenging environments. Both GaN and SiC materials are pivotal in propelling the growth of power semiconductor solutions across various industries, catering to a broad spectrum of applications.

The market segmentation by end-use industry underscores the diverse applications of GaN and SiC power semiconductors across vital sectors such

Table of Content:

Part 01: Executive Summary

Part 02: Scope of the Report

Part 03: Global GaN and SiC Power Semiconductor Market Landscape

Part 04: Global GaN and SiC Power Semiconductor Market Sizing

Part 05: Global GaN and SiC Power Semiconductor Market Segmentation by Product

Part 06: Five Forces Analysis

Part 07: Customer Landscape

Part 08: Geographic Landscape

Part 09: Decision Framework

Part 10: Drivers and Challenges

Part 11: Market Trends

Part 12: Vendor Landscape

Part 13: Vendor Analysis

GaN and SiC Power Semiconductor Key Benefits over Global Competitors:

The report provides a qualitative and quantitative analysis of the GaN and SiC Power Semiconductor Market trends, forecasts, and market size to determine new opportunities.

Porter’s Five Forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make strategic business decisions and determine the level of competition in the industry.

Top impacting factors & major investment pockets are highlighted in the research.

The major countries in each region are analyzed and their revenue contribution is mentioned.

The market player positioning segment provides an understanding of the current position of the market players active in the Personal Care Ingredients

Browse Trending Reports:

Soil Monitoring System Market Medical Imaging (3D and 4D) Software Market Near-infrared Fluorescence Imaging Systems Market Rice Cakes Market Vegetable Snacks Market Water-Based High-Performance Coatings Market Metal Trauma Implants Market Radiotheranostics Market Sailing Yatch Market Cerebral Vasospasm Market Tularemia Market In-Vivo Imaging Market

About Data Bridge Market Research:

Data Bridge set forth itself as an unconventional and neoteric Market research and consulting firm with unparalleled level of resilience and integrated approaches. We are determined to unearth the best market opportunities and foster efficient information for your business to thrive in the market. Data Bridge endeavors to provide appropriate solutions to the complex business challenges and initiates an effortless decision-making process.

Contact Us:

Data Bridge Market Research

US: +1 614 591 3140

UK: +44 845 154 9652

APAC : +653 1251 975

Email: [email protected]"

0 notes

Text

Digital Power Conversion Market Growth Driven by Renewable Energy Integration and Electric Vehicle Expansion Trends

The digital power conversion market is undergoing a significant transformation, driven by technological advancements, the global push for energy efficiency, and the increasing adoption of renewable energy sources. This evolution is reshaping how electrical power is managed, distributed, and utilized across various sectors.

Technological Advancements and Market Dynamics

Digital power conversion refers to the use of digital control techniques to manage electrical power, replacing traditional analog methods. This shift enables more precise control, improved efficiency, and enhanced flexibility in power systems. Key technological trends influencing the market include:

Integration of Wide-Bandgap Semiconductors: Materials like silicon carbide (SiC) and gallium nitride (GaN) are gaining traction due to their ability to operate at higher frequencies and temperatures, leading to more efficient power conversion systems.

Adoption of Digital Twin Technology: This technology allows for real-time simulation and monitoring of power systems, facilitating predictive maintenance and optimization of performance.

Focus on Cybersecurity: As power systems become more digitized, ensuring robust cybersecurity measures is crucial to protect against potential threats.

Development of Digital Power Modules: Integrated modules that combine power conversion and digital control functions are simplifying designs and reducing component counts.

Market Drivers

Several factors are propelling the growth of the digital power conversion market:

Demand for Energy Efficiency: Industries are increasingly seeking solutions that minimize energy losses and reduce carbon footprints. Digital power converters offer precise control over voltage and current, making them ideal for applications requiring high efficiency.

Expansion of Renewable Energy: The integration of solar and wind energy into the power grid necessitates efficient power conversion systems to handle variable outputs and ensure stable energy supply.

Growth of Electric Vehicles (EVs): The rise in EV adoption is driving the need for efficient power conversion in charging stations, onboard inverters, and battery management systems.

Infrastructure Development: Investments in smart grids and telecommunication infrastructure are further boosting the demand for advanced power conversion solutions.

Regional Insights

North America currently holds a significant share of the digital power conversion market, driven by technological advancements and the presence of major industry players. However, the Asia-Pacific region is expected to witness the highest growth rate due to rapid industrialization, urbanization, and increasing demand for consumer electronics.

Challenges and Opportunities

Despite the promising growth, the market faces challenges such as high initial costs and the complexity of integrating advanced power conversion systems into existing infrastructures. However, these challenges also present opportunities for innovation and development of cost-effective solutions.

Conclusion

The digital power conversion market is poised for substantial growth, driven by technological innovations and the global emphasis on energy efficiency and sustainability. As industries continue to adopt digital power solutions, the landscape of energy management is set to evolve, offering new opportunities and challenges in the coming years.

0 notes

Text

Power Integrated Module Market: Trends, Growth, and Future Opportunities

The Power Integrated Module (PIM) market is experiencing rapid expansion, driven by advancements in power electronics, the rise of electric vehicles (EVs), and the global push for energy efficiency. These compact modules, which integrate multiple power semiconductor devices like transistors, diodes, and passive components, are essential for optimizing power conversion in industries ranging from automotive to renewable energy. This article explores the current landscape, key trends, challenges, and future prospects of the Power Integrated Module market.

Market Overview and Growth Projections

The global Power Integrated Module market was valued at USD 2.03 billion in 2024 and is projected to grow at a CAGR of 8.61%, reaching USD 4.88 billion by 203425. This growth is fueled by:

Rising demand for energy-efficient solutions in industrial automation, consumer electronics, and EVs.

Government regulations promoting renewable energy and carbon emission reductions.

Technological advancements in semiconductor materials like Silicon Carbide (SiC) and Gallium Nitride (GaN), which enhance power density and thermal performance14.

Asia-Pacific dominates the market, accounting for the largest share due to strong manufacturing bases in China, Japan, and South Korea, along with increasing EV adoption511.

Key Drivers of the Power Integrated Module Market

1. Electrification of Automotive Industry

The shift from internal combustion engines to electric and hybrid vehicles is a major growth catalyst for the Power Integrated Module market. PIMs are critical in EVs for managing battery systems, motor control, and charging infrastructure. The global EV market is expected to grow at a 23.2% CAGR, further propelling demand for high-efficiency PIMs7.

2. Expansion of Renewable Energy Systems

Solar and wind power systems rely on PIMs for efficient energy conversion and grid integration. With governments worldwide investing in clean energy, the demand for Power Integrated Modules in inverters and energy storage solutions is surging46.

3. Miniaturization and High Power Density

The trend toward smaller, more efficient electronic devices is pushing manufacturers to develop compact PIMs with higher power density. Innovations in packaging technologies, such as 3D integration and embedded cooling, are enabling more efficient thermal management in power modules10.

Challenges in the Power Integrated Module Market

Despite strong growth, the market faces several hurdles:

High Manufacturing Costs: Advanced materials like SiC and GaN increase production expenses, limiting adoption in price-sensitive markets7.

Thermal Management Issues: High-power applications generate significant heat, requiring sophisticated cooling solutions to maintain reliability1.

Supply Chain Constraints: Shortages of raw materials like lithium and cobalt impact production timelines7.

Emerging Trends and Future Opportunities

1. AI and Smart Power Management

Artificial Intelligence is being integrated into Power Integrated Modules to optimize energy consumption in real time, particularly in EVs and industrial automation7.

2. Wide Bandgap Semiconductors (SiC & GaN)

These materials offer superior efficiency and faster switching speeds compared to traditional silicon, making them ideal for next-gen PIMs in high-power applications411.

3. Sustainable and Recyclable Modules

With increasing environmental regulations, manufacturers are focusing on eco-friendly PIM designs that reduce electronic waste10.

Conclusion

The Power Integrated Module market is poised for significant growth, driven by electrification, renewable energy adoption, and technological advancements. While challenges like high costs and thermal management persist, innovations in AI, wide-bandgap semiconductors, and sustainable designs present lucrative opportunities. As industries continue to prioritize energy efficiency, the demand for advanced PIMs will only accelerate, shaping the future of power electronics.

By staying ahead of these trends, businesses can capitalize on the expanding Power Integrated Module market and contribute to a more energy-efficient world.

1 note

·

View note

Text

Global Silicon Carbide market analysis by product type, including size, segmentation, regional trends, company share, key players, and forecast from 2025 to 2035.

Silicon Carbide Market Outlook: Growth, Trends, and Future Projections

Industry Outlook

The Silicon Carbide (SiC) Market was valued at USD 4.38 billion in 2024 and is projected to reach USD 15.85 billion by 2035, growing at a CAGR of 12.4% from 2025 to 2035. This global market revolves around the development, production, and application of silicon carbide materials, which are essential in various industries.

Get free sample Research Report - https://www.metatechinsights.com/request-sample/2161

Key Market Drivers

Superior Properties: Silicon carbide offers high thermal conductivity, voltage tolerance, and power efficiency, making it a preferred semiconductor material.

Expanding Applications: SiC materials are extensively used in electric vehicles (EVs), renewable energy, aerospace, defense, and industrial applications.

Technological Advancements: The market is growing due to innovations in wafer production and device fabrication techniques.

However, high manufacturing costs and production complexities hinder market expansion. The industry is expected to overcome these challenges through technological advancements and economies of scale.

Market Dynamics

Rising Adoption of Electric Vehicles (EVs) Driving SiC Demand

The increasing adoption of electric vehicles is significantly boosting the demand for SiC power electronics. Silicon carbide-based MOSFETs and diodes outperform conventional silicon devices by offering:

Better temperature resistance

Faster switching speeds

Enhanced efficiency in inverters and onboard chargers

Government policies promoting electric mobility further support market growth. SiC technology is also crucial in developing fast-charging infrastructure, improving EV range, and increasing system efficiency.

Growing Renewable Energy Sector Increasing Demand for SiC Devices

The renewable energy sector requires high-efficiency power semiconductor devices, making silicon carbide an essential material for:

Solar inverters

Wind power systems

Smart grids

Energy storage solutions

The demand for SiC-based power electronics is rising as global investments in sustainable energy infrastructure increase. Large SiC wafers enable higher voltage operations, improving system efficiency and reliability.

High Production Costs and Manufacturing Complexities

Despite its advantages, silicon carbide adoption faces challenges due to:

High production costs (due to high-temperature processing and precise crystal growth)

Lower yield rates compared to silicon wafers

Specialized equipment and skilled labor requirements

Companies are investing in R&D and manufacturing advancements to reduce costs and improve production efficiency.

Read Full Research Report https://www.metatechinsights.com/industry-insights/silicon-carbide-market-2161

Advancements in Wafer Production Driving Cost Reduction

Innovations in wafer production technology are making silicon carbide more affordable. Key developments include:

Larger 200mm SiC wafers, improving manufacturing efficiency and reducing costs

Enhanced crystal growth techniques, increasing yield and reducing defects

Wider adoption in industries like 5G, industrial automation, and AI-powered electronics

Increasing Investments in Aerospace and Defense Applications

The aerospace and defense industries are adopting SiC for:

High-frequency radar systems

Power management in satellites

Electronic warfare technologies

Electric propulsion for aircraft and space exploration

Research and development in radiation-resistant SiC components are further driving demand in this sector.

Industry Expert Insights

Seok Joo Jang, Director of Module Engineering at SemiQ: “A new family of three 1200V SiC full-bridge modules simplifies system design and enables faster time-to-market for next-generation solar, storage, and charging solutions.”

D. Muralidhar, Director at SNAM Group of Companies: “The launch of our high-purity silicon carbide product line is a testament to our commitment to innovation. We believe this product will play a pivotal role in advancing technologies across multiple industries.”

Segment Analysis

By Product Type

Black Silicon Carbide: Dominates the market due to its use in abrasives, refractories, and metallurgical applications.

Green Silicon Carbide: High purity makes it ideal for semiconductors, precision grinding, and ceramics.

Other Grades: Used in specialized industrial applications.

By Device Type

SiC Wafers: Essential for semiconductor production, with increasing demand in EVs and power electronics.

SiC Discrete Devices (MOSFETs & Diodes): Preferred for high-voltage applications.

SiC Modules: Used in renewable energy systems and industrial controls.

Regional Analysis

Asia-Pacific: The Largest Market

China leads with government support for EVs and semiconductor investment.

Japan and South Korea focus on high-performance SiC wafer production.

Growing EV and industrial sectors fuel market expansion.

North America: Fastest-Growing Region

Strong investments in EVs, defense, and 5G infrastructure.

Key players like Wolfspeed and ON Semiconductor are expanding SiC wafer production.

Government policies supporting domestic semiconductor production.

Competitive Landscape

Major Players in the SiC Market

STMicroelectronics N.V.: Strengthening SiC supply through partnerships and acquisitions.

ROHM Co., Ltd. & ON Semiconductor Corporation: Expanding SiC wafer production for EVs.

Renesas Electronics & Microsemi Corporation: Focus on SiC-based power management for aerospace and defense.

Wolfspeed: Leading in SiC wafer production and high-power solutions.

Toshiba & General Electric (GE): Investing in SiC-based power electronics for renewable energy.

Imerys, Tokai Carbon Co., Ltd., Schunk Ingenieurkeramik GmbH, and Morgan Advanced Materials: Supplying SiC raw materials and ceramics.

Buy Now https://www.metatechinsights.com/checkout/2161

Recent Developments

February 2025: SemiQ launched a new 1200V SiC full-bridge module, enhancing efficiency in solar, energy storage, and DC applications.

January 2025: SNAM Abrasives introduced SNAM High Purity Silicon Carbide (HP SiC), offering 99.99% purity for cutting-edge applications.

0 notes

Text

Silicon Carbide Wafer Market Analysis, Size, Share, Growth, Trends, and Forecasts by 2031

The Global Silicon Carbide Wafer Market stands as a testament of semiconductor technology, where precision and efficiency play pivotal roles. Silicon carbide (SiC) wafers, integral components in this market, have garnered attention for their exceptional properties that propel technological advancements in various sectors.

𝐆𝐞𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭:https://www.metastatinsight.com/request-sample/2302

Companies

Cree

SK siltron Co.,Ltd.

SiCrystal

II-VI Advanced Materials

Showa Denko K.K.

STMicroelectronics

Aymont Technology

TankeBlue

Hebei Synlight Crystal

CETC

T𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭:@https://www.metastatinsight.com/report/silicon-carbide-wafer-market

Silicon carbide, a compound of silicon and carbon, presents a unique blend of characteristics that make it an ideal material for semiconductor applications. The Global Silicon Carbide Wafer Market revolves around the production and utilization of these wafers, showcasing their significance in cutting-edge technological developments.

One of the key drivers behind the demand for silicon carbide wafers is their ability to operate at higher temperatures and withstand extreme conditions. This resilience is particularly crucial in industries such as power electronics, where SiC wafers enable the creation of devices capable of handling elevated temperatures and harsh environments. As the world witnesses a growing reliance on electronic devices in various sectors, the demand for silicon carbide wafers in power electronics continues to surge.

Moreover, the Global Silicon Carbide Wafer Market plays a vital role in the realm of renewable energy. SiC wafers contribute to the development of efficient power devices, facilitating the conversion and management of energy in renewable sources like solar and wind. The unique electronic properties of silicon carbide make it an essential material in enhancing the overall efficiency and performance of power systems in the renewable energy sector.

In the automotive industry, silicon carbide wafers find applications in electric vehicles (EVs) as power electronics components. The high-temperature tolerance and superior electrical conductivity of SiC wafers contribute to the development of compact and efficient power modules, enhancing the performance of EVs and supporting the global shift towards sustainable transportation.

Furthermore, the Global Silicon Carbide Wafer Market extends its influence into the realm of communication technologies. The deployment of SiC wafers in high-frequency and high-power devices for radio frequency (RF) applications is on the rise. The ability of silicon carbide to handle high-power levels with minimal losses makes it an attractive choice for RF components, paving the way for advancements in wireless communication systems.

The Global Silicon Carbide Wafer Market is not merely a segment of the semiconductor industry; it is a catalyst for innovation and progress across diverse sectors. Silicon carbide wafers, with their unique properties, contribute significantly to the development of advanced technologies that shape the future of power electronics, renewable energy, automotive systems, and communication networks. As industries continue to evolve, the demand for silicon carbide wafers is set to rise, propelling the market forward as a key player in the transformative journey of modern technology.

Global Silicon Carbide Wafer market is estimated to reach $1,290.0 Million by 2030; growing at a CAGR of 11.2% from 2023 to 2030.

Contact Us:

+1 214 613 5758

#SiliconCarbideWafer#SiliconCarbideWafermarket#SiliconCarbideWaferindustry#marketsize#marketgrowth#marketforecast#marketanalysis#marketdemand#marketreport#marketresearch

0 notes

Text

Silicon Carbide (SIC) Power Modules Market Report 2024-2032 | Share

The Reports and Insights, a leading market research company, has recently releases report titled “Silicon Carbide (SIC) Power Modules Market: Global Industry Trends, Share, Size, Growth, Opportunity and Forecast 2024-2032.” The study provides a detailed analysis of the industry, including the global Silicon Carbide (SIC) Power Modules Market Size share, trends, and growth forecasts. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Report Highlights:

How big is the Silicon Carbide (SIC) Power Modules Market?

The global Silicon Carbide (SIC) power modules market size reached US$ 868.2 million in 2023. Looking forward, Reports and Insights expects the market to reach US$ 4,615.9 million in 2032, exhibiting a growth rate (CAGR) of 20.4% during 2024-2032.

What are Silicon Carbide (SIC) Power Modules?

Silicon Carbide (SiC) power modules are advanced semiconductor devices used for power conversion in various applications like electric vehicles, renewable energy systems, and industrial equipment. These modules employ SiC, a compound known for its superior electrical properties compared to traditional silicon-based semiconductors, enabling higher efficiency, temperature operation, and lower switching losses. SiC power modules typically comprise SiC chips mounted on a substrate, along with driver and protection circuitry, all enclosed in a module package. They offer benefits such as reduced size, weight, and cooling requirements compared to silicon-based modules, making them ideal for high-performance, compact, and energy-efficient power electronics systems.

Request for a sample copy with detail analysis: https://www.reportsandinsights.com/sample-request/1857

What are the growth prospects and trends in the Silicon Carbide (SIC) Power Modules industry?

The silicon carbide (SiC) power modules market growth is driven by various factors and trends. The market for Silicon Carbide (SiC) power modules is rapidly expanding, driven by the increasing demand for efficient power electronics across industries like automotive, renewable energy, and telecommunications. SiC power modules offer advantages such as higher efficiency, faster switching speeds, and reduced size and weight compared to traditional silicon-based modules. Growth is fueled by factors like the growing adoption of electric vehicles, increasing demand for renewable energy sources, and the need for higher power density and efficiency in industrial applications. However, challenges such as high initial costs and limited availability of SiC materials may pose constraints on market growth. Hence, all these factors contribute to silicon carbide (SiC) power modules market growth.

What is included in market segmentation?

The report has segmented the market into the following categories:

By Power Module Type:

Full SiC Modules

Hybrid SiC Modules

By Voltage Range:

Low Voltage (600V and Below)

Medium Voltage (601V - 1200V)

High Voltage (Above 1200V)

By Sales Channel:

Direct Sales

Distributor Sales

By End-Use:

OEMs (Original Equipment Manufacturers)

Aftermarket

By Industry Vertical:

Automotive and Transportation

Industrial Automation

Energy and Power

Telecommunication

Consumer Electronics

Others

Market Segmentation By Region:

North America:

United States

Canada

Europe:

Germany

United Kingdom

France

Italy

Spain

Russia

Poland

BENELUX

NORDIC

Rest of Europe

Asia Pacific:

China

Japan

India

South Korea

ASEAN

Australia & New Zealand

Rest of Asia Pacific

Latin America:

Brazil

Mexico

Argentina

Rest of Latin America

Middle East & Africa:

Saudi Arabia

South Africa

United Arab Emirates

Israel

Rest of MEA

Who are the key players operating in the industry?

The report covers the major market players including:

Infineon Technologies AG

ROHM Semiconductor

Cree, Inc.

Mitsubishi Electric Corporation

Wolfspeed (a Cree Company)

ON Semiconductor

STMicroelectronics

Fuji Electric Co., Ltd.

GeneSiC Semiconductor Inc.

United Silicon Carbide Inc.

Microsemi Corporation (Microchip Technology Inc.)

Monolith Semiconductor Inc.

SEMIKRON International GmbH

Littelfuse, Inc.

Power Integrations, Inc.

View Full Report: https://www.reportsandinsights.com/report/Silicon Carbide (SIC) Power Modules-market

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

About Us:

Reports and Insights consistently mееt international benchmarks in the market research industry and maintain a kееn focus on providing only the highest quality of reports and analysis outlooks across markets, industries, domains, sectors, and verticals. We have bееn catering to varying market nееds and do not compromise on quality and research efforts in our objective to deliver only the very best to our clients globally.

Our offerings include comprehensive market intelligence in the form of research reports, production cost reports, feasibility studies, and consulting services. Our team, which includes experienced researchers and analysts from various industries, is dedicated to providing high-quality data and insights to our clientele, ranging from small and medium businesses to Fortune 1000 corporations.

Contact Us:

Reports and Insights Business Research Pvt. Ltd. 1820 Avenue M, Brooklyn, NY, 11230, United States Contact No: +1-(347)-748-1518 Email: [email protected] Website: https://www.reportsandinsights.com/ Follow us on LinkedIn: https://www.linkedin.com/company/report-and-insights/ Follow us on twitter: https://twitter.com/ReportsandInsi1

#Silicon Carbide (SIC) Power Modules Market share#Silicon Carbide (SIC) Power Modules Market size#Silicon Carbide (SIC) Power Modules Market trends

0 notes

Text

Silicon Carbide (SiC) Transistors Market Poised for $15.2B by 2034 (CAGR: 15.7%) ⚙️💡