#Tally on cloud

Explore tagged Tumblr posts

Text

Best Tally, Cloud, App Development Services Provider | Cevious Technologies.

CEVIOUS was founded in 2009 in Delhi, having 14+ years of experience as a 5-Star Tally Sales, Service & GVLA Partner, catering to 12000+ customers & 4500 Tally License Host in our datacenter. We provide Tally Prime, Customization, Tally AWS Cloud, Datacenter Service, App Development and business automation solutions.

2 notes

·

View notes

Text

Expanding your business to multiple locations can be a great way to increase sales, reach new customers, and grow your brand. However, it can also be a challenge to manage multiple locations effectively. Suvit is an all-in-one accounting automation platform that strives to make finance cool again! Suvit is more than just a platform; it's a financial game-changer.

#tally solutions#automation for accountants#accounting automation software#automated bank statement processing#1950s#e invoice in tally#tally on cloud#tally automation

2 notes

·

View notes

Text

Home - Monetta Software Solutions - Tally

Monetta Software Solutions are Certified Sales & Service Partner for Tally since 2009 serving more than 3500 clients for their business accounting needs.

Know More :- https://monettaindia.com/

#Tally#Tally Cloud#Tally Software#Tally Renewal#Tally Customization#GreytHR#TSS#TDS#Tally Prime#Tally ERP-9#Tally Monetta#Tally on Cloud#CloudAccounting#BusinessGrowth#tallyprime#tally#tallysolutions#databackup#tallysoftware#tallysupport#monettasoftware#monettaindia#tallyprimeaws#silver#tallyoncloud#monetta#business#software#businessmanagement#TallyERP9

2 notes

·

View notes

Text

Best Tally on Cloud Price Plans for Your Business Needs

In today’s fast-paced digital world, businesses are shifting to cloud platforms to improve efficiency, flexibility, and security. One of the smartest moves for accounting and financial management is adopting Tally on Cloud. If you're searching for the best Tally on Cloud price, iZoe Solutions offers reliable and cost-effective packages that suit businesses of all sizes.

Why Choose Tally on Cloud?

Tally on Cloud means hosting your licensed Tally Prime software on a secure cloud server instead of a local desktop or LAN. This cloud-based access offers multiple benefits:

Access Anytime, Anywhere

No Infrastructure Headache

Automatic Data Backup

Enhanced Security

Multi-user Collaboration

Whether you are a startup, an SME, or a large enterprise, switching to cloud hosting ensures your team can manage accounts, GST filing, inventory, and financial reports seamlessly—no matter where they are.

What Affects Tally on Cloud Price?

The Tally on Cloud price depends on several factors:

Number of Users – Single-user or multi-user access

Cloud Server Type – Shared VPS or Dedicated VPS

Backup & Storage Needs – Daily backup, retention period

Customization & Support – Add-ons, integration, and tech support

Tally License Type – You need to purchase a valid Tally Prime license (Silver or Gold), if not already owned.

iZoe Solutions – Your Trusted Tally on Cloud Partner

As a certified Tally partner, iZoe Solutions not only provides competitive Tally on Cloud prices, but also ensures:

✅ Fast Cloud Deployment ✅ 99.9% Uptime & Performance ✅ WhatsApp & Call Support ✅ Fully Encrypted Data Access ✅ Daily Auto Backup & Recovery

We host your Tally data on secure cloud servers in India, ensuring both speed and compliance. Our experts handle setup, migration, support, and upgrades—so you can focus on running your business.

Get the Best Tally on Cloud Price Today

Looking for the right Tally on Cloud solution without overpaying? iZoe offers one of the most affordable and feature-rich cloud Tally services in India. Contact us for a free demo, custom pricing, or expert consultation.

🌐 Visit: www.izoe.in

0 notes

Text

Tally On Cloud Software Services In Delhi

We Provide Best Tally Prime Software Services and give many facility and features to tally prime software . Tally on Cloud it’s a solution for easy, economical, efficient and with securely to use Tally from anywhere, anytime and from any devices with the help on just an internet connection.

Tally Prime is a rearranged arrangement that runs the unpredictable parts of your business, for example, bookkeeping, tally software team chat messaging apps accounting marg accounting software consistence and procedures out of sight. Count is anything but difficult to learn and can with least assets.

#tally on cloud#accountingsoftware#tallysoftware#tallyprime#tally customization#cloud accounting software

0 notes

Text

Managing Multi-Location Business Operations with Tally on Cloud

Streamline Multi-Location Accounting with Tally on Cloud by Antraweb

Managing finances across growing business locations can be challenging. While traditional Tally setups handle basic functions like payroll, expenses, and revenue well, they struggle as operations scale—leading to data inconsistencies, limited remote access, and rising infrastructure costs.

Tally on Cloud emerges as a smart solution for modern businesses. It offers centralized data management, anytime-anywhere access, and high-level security—all without the need for costly hardware or multiple licenses. Businesses can streamline operations, make real-time decisions, and reduce communication gaps across locations.

Some key benefits include:

Centralized and consistent data across branches

Single license usage, saving costs on software and infrastructure

Remote access for business owners and teams from any device

Secure cloud backup and user-level access control

Scalable features that grow with your business

Smart reporting dashboards for real-time insights

When compared to traditional setups, Tally on Cloud eliminates the burden of managing separate systems, local installations, and security concerns—making it an ideal solution for multi-location businesses.

Antraweb Technologies, with 35+ years of Tally expertise, supports businesses in transitioning smoothly to the cloud. From customized consultations to centralized server setup and continuous support, Antraweb ensures your financial management becomes simpler, faster, and more cost-effective.

Looking to upgrade your accounting system? Choose Tally on Cloud by Antraweb for reliable, scalable, and secure financial operations across all your locations.

Click Here To Read The Full Blog Now:

visit our Website To Learn More:

0 notes

Text

The Tally on Cloud Server cloud conveys more flexibility and reliability, improved performance and efficiency, and helps to lower IT costs.

https://hostnetindia.com/tally-cloud-server

0 notes

Text

Tally on Cloud

Tally on Cloud: Access Tally Anytime, Anywhere with Secure Cloud Hosting! Run your accounting software on the cloud for seamless performance, data security, and multi-user access. No installation hassles—experience remote access, automatic backups, and 24/7 availability. Upgrade to Tally on Cloud today

✅ 24/7 Remote Access ✅ Fast & Secure Cloud Hosting ✅ Automatic Data Backup & Security ✅ Compatible with All Devices

Upgrade your business operations with Tally on Cloud today! Get the best hosting solutions at Hosting Safari.

🌐 Learn More & Get Started: https://www.hostingsafari.com/tally-on-cloud

1 note

·

View note

Text

Best Tally Cloud Pricing and Get Secure Tally on Cloud Solutions

Find the latest Tally Cloud pricing and choose a plan that fits your business needs. iZoe Solutions offers secure Tally on Cloud services for seamless access, data safety, and multi-user collaboration. Run Tally anytime, anywhere with high performance and reliability. Get expert support and ensure smooth business operations with our cloud-based Tally solutions. Explore flexible plans designed for small and large enterprises. Switch to Tally on Cloud today for efficiency and convenience.

0 notes

Text

Through our advanced solution, you can access your tally from anywhere, anytime, and at any device. It Palak provides you with the with the best tally on cloud solution for your business. Grow your business now with tally on cloud software.

#best tally on cloud service provider#tally cloud price#tally on cloud#tally on cloud price#tally on cloud multi user#tally on cloud service provider#tally prime cloud price#tally erp 9#tallyprime#tally on cloud services

0 notes

Text

Integrating Tally On Cloud With Other Business Applications

Tally on Cloud has revolutionized the management of financial data for businesses by providing them with the flexibility, scalability of the cloud, and the strong accounting backbone of Tally ERP. But as businesses expand, their operational requirements quickly outgrow the capabilities of a standalone accounting package. Tally on Cloud can be easily integrated with other business applications such as CRM, ERP, and HR software which makes the entire process streamlined and more accurate, boosting productivity. This guest post will cover some more advanced techniques for Tally on Cloud integration with other business software.

1. Why Integrate Tally on Cloud with Other Business Applications?

Integrating Tally with other essential business applications can bring several benefits, including:

• Centralized Data Management: Eradicate the data silos, and integrate tally with other business systems, so that all departments are working off of the same financial data.

• Improved Efficiency: The automation of the data stream between Tally and other software eliminates much of the manual data input, thereby saving time and decreasing the possibility of human error.

• Real-Time Insights: Integrated systems provide a holistic view of business performance by consolidating financial, customer, and operational data, enabling informed decision-making.

2. Common Applications to Integrate with Tally on Cloud

There are many different business softwares that when combined with Tally can make the business run so much more smoothly.

• Customer Relationship Management (CRM): Integrating Tally with CRM tools like Salesforce or Zoho CRM ensures that sales and finance teams are aligned. With this interface, invoices, customer payments and credit history will all be automatically updated from the CRM.

• Enterprise Resource Planning (ERP): Tally itself is an ERP tool for accounting, but by interfacing it with a full-blown ERP like SAP or Oracle, a company can have all its finance, supply chain and inventory information under one umbrella.

• Human Resource Management Systems (HRMS): Tally can be linked with HRMS platforms such as Workday or BambooHR allowing payroll to be automated as well as tax calculations and financial reporting, this would greatly improve compliance and efficiency.

• E-Commerce Platforms: Tally on Cloud services allow for integration with e-commerce sites such as Shopify or WooCommerce, so that sales transactions, inventory levels, and financial reports are all in sync, making it easier to run an online retail business.

3. Methods for Integrating Tally on Cloud with Other Applications

There are many ways to connect Tally on Cloud to other business systems, ranging from simple to complex, depending on what the business requires.

• APIs for Real-Time Integration: The best way to do this is through Application Programming Interfaces (APIs). Tally on Cloud can also be integrated with other systems using APIs so that real time data can be transferred. For example, when a CRM sends sales data via its API to tally, tally in turn sends the data to the financial records that are automatically updated.

• Middleware for Complex Integrations: In a more enterprise world, middleware such as Zapier or Integromat can be used to facilitate the flow of data between applications. Middleware is kind of like a translator that allows Tally to communicate with other software, it translates the data into a format that Tally can understand and vice versa so that the two can integrate seamlessly.

• Custom Scripts and Webhooks: Also, for unique integration needs, custom scripts and webhooks can be utilized to perform certain tasks in Tally only when corresponding events are fired in other applications. Like, when a sale is made on an e-commerce site, then a webhook can generate an invoice on Tally automatically.

• Database Integration: Tally can be easily integrated directly at the database level in order to synchronize data with other systems. This process is quite technical and if not done correctly, can lead to data integrity problems.

4. Best Practices for Seamless Integration

To ensure that Tally on Cloud works smoothly with other business systems, it is important to follow these best practices:

• Data Mapping and Validation: Before integration, ensure that data fields from both systems align correctly. Establish mappings for customer information, invoice numbers, and product Ids so that there will never be conflicts.

• Error Handling and Monitoring: Set up monitoring systems to identify integration errors early. And log the data transfer between applications and be able to send alerts on failed transactions or syncs.

• Secure Data Transmission: Since financial data is sensitive, ensure that all data transmitted between Tally and other applications is encrypted and transferred using secure protocols such as HTTPS or SSL.

• Regular Testing and Maintenance: Test it periodically to make sure the integration still works after any software updates. Schedule down time to keep the systems in sync.

5. Challenges and Solutions in Integration

There are many advantages to integrating Tally on Cloud with other business applications, but there are also some difficulties:

• Data Inconsistency: One of the general problems is syncing the data between Tally and other applications. However, this problem can be eliminated with strong data validation rules and automated reconciliation procedures.

• Customization Requirements: Some businesses may have unique processes that require customized integration solutions. In such cases, it’s essential to work with experienced developers who can create custom APIs or scripts tailored to your specific needs.

• System Downtime and Latency: Cloud-based integrations depend on the availability of both systems. Use failover systems and synchronize periodically so that in case of a sudden shutdown no data is lost.

Conclusion

With the integration of Tally on Cloud to other business applications, the automation, data accuracy, and operational efficiency can be taken to a new level. Using APIs, middleware and custom scripts companies can build an integrated environment that promotes interdepartmental cooperation, better decision making, and overall efficiency. While there may be challenges, following best practices such as secure data transmission and regular testing will ensure a seamless and successful integration. With the advancement of cloud technology, Tally like systems will be the driving force behind operational excellence of future businesses.

1 note

·

View note

Text

Top Causes of GST Notices Demystified

Goods & Service Tax (GST) was implemented in India to create an efficient, simple and error-free tax structure. Since its implementation it has seen an exponential rise in compliance requests that has resulted in numerous GST notifications to taxpayers that signal potential ambiguities or lack of compliance with GST laws; an in-depth knowledge of major factors contributing to such notifications is key for businesses navigating its complex tax system successfully.

What exactly are GST notices, and why do taxpayers typically receive them? Continue reading for answers to these queries. Top Eight Reasons for Taxpayers to Get GST Notice

Taxpayers Should Read GST Notices mes Understanding GST notices is crucial for taxpayers in quickly addressing any ambiguities or problems with their GST returns promptly. Tax agencies use notices as a tool to notify taxpayers about errors, delays or compliance violations regarding GST rules.

GST notices range in severity, from basic inquiries to more complex matters. They may be issued to highlight violations with filings or incorrect data or to provide details about penalties associated with irregularities. Below are 8 reasons taxpayers could receive notices from GST:

Filing issues. Filing issues. Filing problems

GST notices could be issued for taxpayers for various reasons, but one of the more frequent ones is when taxpayers fail to submit their GST returns by their due dates and miss filing them on time. When this occurs, authorities send GST notices.

Failure to submit GST tax returns according to the deadline set forth by authorities could incur an expensive fine; thus all businesses (big and small alike) should ensure they file their GST tax returns by their due dates.

ITC Discrepancies

GST’s Input Tax Credit (ITC) allows businesses to claim credits if they’ve paid tax on imports. To be eligible for ITC credits, invoices must be filed accurately to claim your credits.

Tax authorities may issue warning notices to businesses who submit incorrect invoices, or those filing tax credits incorrectly, should they identify any discrepancies. companies should check that their invoices are correct before submitting them to authorities for tax credit on inputs in order to qualify for this credit and avoid receiving GST notices that could have negative repercussions for their business.

GSTR-1 and GSTR-3B Do Not Match Up

Filing their GST tax returns requires businesses to complete multiple forms. Of these forms, GSTR-1 and GSTR-3B are two that businesses should carefully complete so as to submit their returns without issue.

GSTR-1 provides all information regarding supplies made to companies while GSTR-3B contains all of the details tax authorities require in order to assess tax liabilities as well as credit (input tax credit) of these same companies.

To ensure that GST returns are successfully filed, information in these two reports should match. If authorities detect any discrepancies between them and numbers mentioned in either report, they may issue GST notices to companies. Depending on the circumstances surrounding each notice issued by authorities, additional explanations may be requested or audit reports filed to prove inconsistencies or mismatches or submit returns accurately.

Tax Payment Errors

Payment errors are one of the primary reasons taxpayers receive tax notices from authorities. When taxpayers do not calculate their taxes correctly or incorrectly categorise goods or services they sell, choose incorrect tax rates or underpay their due taxes they may receive an GST notice from authorities.

Taxpayers who fail to calculate and pay their correct tax payments correctly could incur fines or penalties, and to prevent incurring them it would be wise for companies to hire an expert who could assess their filing processes to ensure they submit correct GST returns with every filing, and pay the correct amounts of taxes each time.

E-Way Bill Noncompliance

Businesses involved in transporting products that exceed GST thresholds must abide by E-way invoice guidelines. Any violations to this or failure to produce E-way bills when needed could result in notices being issued from GST authorities; to prevent these from being issued, businesses should always file appropriate bills when transporting items that surpass these thresholds.

Are there issues related to transactions of high value?

Tax authorities remain extremely diligent when reviewing transactions that exceed the threshold amounts set out in the GST Act. When these transactions involve high value items such as input tax credits or taxes claimed by businesses, tax authorities ensure all relevant rules are being observed.

Businesses failing to abide by the rules and regulations related to transactions of high value can receive notices of GST issued by authorities, which may ask them to pay penalties fees or provide an audit report in detail.

GSTIN/PAN Mismatch

One of the most frequent mistakes companies can make when filing their first GST return is entering incorrect Permanent Account Number or GST Identification Number data. This mistake should never occur!

Companies filing returns should ensure their registration details have been double-checked with the GST database prior to filing returns.

GST Audit Compliance Issues

U.S. law mandates that companies undergo GST audits at regular intervals and submit audit reports within specified timelines; failure to do so could lead to authorities issuing GST notices against these firms.

Notices could require businesses to pay penalties for not adhering to tax auditing procedures, and so it is crucial for all legally eligible companies to undergo GST audits regularly in order to avoid receiving notices of noncompliance.

Bottom Line

Businesses receiving GST notices that require additional processing time or involve penalties or fines that lead to cash loss for their business should take measures to avoid this scenario by checking off all relevant issues prior to filing their GST returns on time and precisely.

0 notes

Text

Common Mistakes to Avoid When Managing GST Ledgers in Tally

Goods and Services Tax (GST) is a comprehensive indirect tax levy on the manufacture, sale, and consumption of most goods and services in Bharat. It was introduced on July 1, 2017, to subsume multiple indirect taxes, such as excise duty, value-added tax (VAT), service tax, and central sales tax (CST). GST ledgers in Tally are used to record all GST transactions, such as sales, purchases, and expenses. It is important to avoid mistakes in GST ledgers, as this can lead to penalties from the GST authorities.

#accounting automation software#GST Ledgers#GST#tally on cloud#automated bank statement processing#e invoice in tally#tally solutions

2 notes

·

View notes

Text

Cost-Effective Tally on Cloud Services in India - SpectraCloud

Tally on Cloud is a service that will take your offline Tally Software on cloud. You will be able to access your Tally data from anywhere and at anytime and from any device.

An easy low maintenance and economical way of running your Tally Prime is through Tally On cloud. Save numerous costs like operational costs, backup and data maintenance costs, server hardware costs, and many other hybrid costs through cloud computing.

You run your business while we take care of your IT requirements. This cloud computing service will help you access your data from anywhere and at anytime taking your business to a new level of productivity. Sometimes due to strikes or natural disaster or any other unforeseen reason employees may not be able to work from home. The challenge is to keep your business 100% productive at such times. To make this possible, SepctraCloud will give business owners and employees the freedom to access their work from anywhere and at anytime which will in turn improve the overall productivity of the business.

Understanding Tally on Cloud

Tally on Cloud is a service that allows businesses to host their Tally Software on a cloud platform. This eliminates the need for on-given servers and provides access to Tally from anywhere, anytime. Whether you’re at the office, home, or on the go, Tally on Cloud ensures that your Accounting Software is always within reach, offering superb access to real-time data. The benefits of Tally on Cloud go beyond accessibility. It provides enhanced security, automatic backups, and regular updates, ensuring that your business operations are not disrupted. Moreover, the cloud environment supports multi-user access, making it an ideal solution for businesses with teams spread across different locations.

Why Choose SpectraCloud for Tally on Cloud Services?

1. Affordable Solutions

A major concern for businesses considering new technology is often the expense involved. SpectraCloud recognizes this challenge and provides competitive Tally on Cloud Price, suitable for companies of any size. Whether you're a small startup or a large enterprise, SpectraCloud pricing model is crafted to be budget-friendly, guaranteeing you’ll receive excellent value for your expenditure.

With a range of pricing plans available, including the widely-used Tally Prime Cloud price options, SpectraCloud tailors its offerings to address the unique requirements of various businesses. This pricing flexibility means you’ll only pay for what you truly need, making it a financially sensible choice for your organization.

2. High-Quality Cloud Hosting

When it comes to cloud services, reliability is key. SpectraCloud Tally Cloud Hosting services are built on a robust infrastructure that guarantees high uptime and fast access speeds. With servers located in secure data centers across India, SpectraCloud ensures that your data is stored safely and is readily accessible whenever you need it.

The quality of service provided by SpectraCloud is unmatched, offering a seamless user experience that enhances productivity. The hosting environment is optimized for Tally, ensuring that the software runs smoothly without any lags or downtimes. This level of reliability is key for businesses that depend on Tally for their day-to-day operations.

3. Scalable Solutions

As your business grows, so do your needs. SpectraCloud Tally on Cloud services are designed to scale with your business. Whether you need to add more users, increase storage, or enhance security features, SpectraCloud makes it easy to upgrade your plan without any disturbance to your service.

This scalability ensures that your business can continue to grow without the limitations of traditional on-given software. You can add or remove users as needed, making it a flexible solution that adapts to your business’s changing requirements.

4. Enhanced Security

Data security is very essential for secure your data. SpectraCloud takes this seriously by implementing advanced security measures to protect your data. From encryption and firewalls to regular security audits, SpectraCloud ensures that your Tally data is safe from unauthorized access and cyber threats.

Additionally, SpectraCloud offers regular backups and disaster recovery options, ensuring that your data is not only secure but also recoverable in the event of an unexpected incident. This level of security provides peace of mind, allowing you to focus on running your business without worrying about data breaches or losses.

5. 24/7 Support

SpectraCloud understands that businesses operate around the clock, and technical issues can arise at any time. That’s why they offer 24/7 customer support to ensure that any issues are resolved quickly and efficiently. Whether you need help setting up your Tally on Cloud service or troubleshooting a problem, SpectraCloud dedicated support team is always available to assist you.

This 24/7 support is a valuable asset, particularly for businesses that operate in different time zones or have extended working hours. With SpectraCloud, you can rest sure that help is just a call or click away.

Tally on Cloud Price in India: What to Expect

The cost of Tally on Cloud Services in India varies depending on several factors, including the number of users, the level of customization required, and the specific features you need. SpectraCloud offers transparent pricing, ensuring that there are no hidden costs or unexpected charges.

Their pricing plans are designed to be competitive, making it easier for businesses to budget for their Tally on Cloud Services. Whether you’re looking for a basic plan or a more complete package, SpectraCloud has options to suit your needs and budget. SpectraCloud Tally Prime Cloud Price is designed to offer maximum value for businesses. Tally Prime, the latest version of Tally software, offers enhanced features and a more automatic user interface. Hosting Tally Prime on the cloud with SpectraCloud ensures that you get the most out of this powerful software without the encounter.

The Future of Tally Cloud Hosting

As more businesses in India recognize the benefits of cloud computing, the demand for Tally on Cloud services is expected to grow. SpectraCloud is at the forefront of this trend, offering innovative solutions that make it easier and more affordable for businesses to migrate to the cloud.

With advancements in cloud technology, the future of Tally Cloud Hosting looks promising. Businesses can expect even more features, improved security, and greater flexibility as cloud providers like SpectraCloud continue to enhance their offerings.

Conclusion

Tally on Cloud is changing the way businesses manage their accounting processes in India. By partnering with SpectraCloud, you can take advantage of cost-effective, reliable, and secure Tally Cloud Hosting Services Provider that enhance your business operations. With competitive Tally on Cloud prices, Tally Prime Cloud price options, and a commitment to quality, SpectraCloud is the ideal choice for businesses looking to catch the power of cloud computing.

Don’t let outdated technology hold your business back. Discover the benefits of Tally on Cloud with SpectraCloud today and take your business to new heights.

0 notes

Text

Top Benefits of Tally Cloud Services

Businesses are rapidly embracing cloud platforms to improve flexibility, security, and operational efficiency. Tally, a trusted accounting software used by millions across India, plays a crucial role in managing financial operations. When integrated with cloud technology, Tally becomes even more powerful and accessible. At iZoe Solution, our Tally Cloud Services are built to enhance your accounting experience—offering smarter, safer, and more convenient access to your financial data.

What is Tally on Cloud?

Tally on Cloud is the deployment of the Tally ERP software on a cloud server, allowing users to access it from anywhere, at any time, via the internet. Instead of installing Tally on a local desktop or server, it’s hosted on a secure cloud platform. This ensures real-time data access and collaboration while maintaining the core functionality and interface of Tally.

Benefits of Using Tally Cloud Services

Improved Collaboration: Tally Cloud Services enable multiple users to work simultaneously on the same data. This collaborative environment fosters teamwork and enhances productivity, as team members can share insights and updates in real-time.

Increased Efficiency: By automating mundane tasks and simplifying complex processes, Tally Cloud Services free up valuable time for finance teams. Employees can focus on strategic initiatives rather than getting bogged down by manual data entry and reconciliations.

Comprehensive Reporting: Tally Cloud Services come equipped with advanced reporting features that allow businesses to generate detailed financial reports quickly. This capability enables management to analyze performance, track expenses, and identify trends, facilitating informed decision-making.

Integration with Other Tools: Tally Cloud Services can seamlessly integrate with other business applications, such as CRM systems and inventory management tools. This integration creates a more cohesive ecosystem that improves data flow and enhances overall operational efficiency.

User-Friendly Interface: Despite its advanced features, Tally remains user-friendly. iZoe Solutions provides training and support, ensuring that users can easily navigate the software and maximize its capabilities.

Who Should Use Tally Cloud Services?

Our services are ideal for:

Small and medium businesses (SMBs)

Chartered accountants and accounting firms

Enterprises with remote teams or multiple locations

Businesses seeking cost-effective and secure Tally hosting

Organizations looking to eliminate local server dependency

Conclusion

Switching to Tally Cloud Services at iZoe Solution is not just a tech upgrade—it’s a strategic move toward greater efficiency, flexibility, and business continuity. Whether you’re a startup or an established enterprise, our solutions can help you streamline operations, redu ce costs, and enable remote work effortlessly.

Contact iZoe Solution today to schedule a free consultation and take your Tally accounting to the cloud—securely and confidently.

0 notes

Text

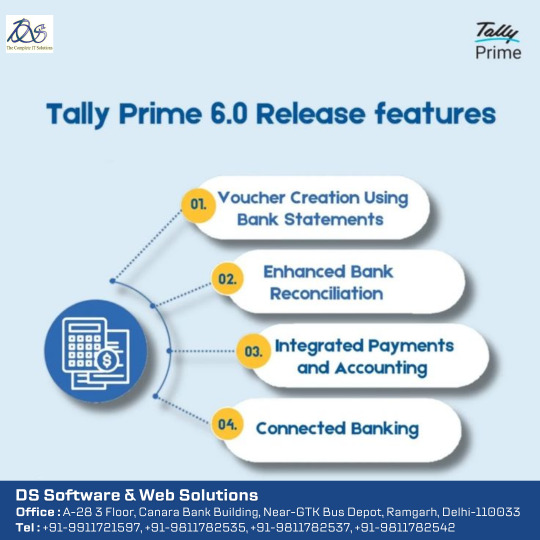

TALLY PRIME 6.0 RELEASE FEATURES

Here’s a comprehensive overview of the new capabilities in TallyPrime 6.0, officially released on 9 April 2025

1. Connected Banking & Automation:-

Real‑time bank integration: Connect securely to your bank using Tally.NET credentials to view live balances and statements inside Tally.

Auto‑voucher creation: Import bank statements to automatically generate payment/receipt vouchers with full details (narration, instrument no/date), in bulk or merged.

Smart reconciliation & e‑payments: One-click matching with rule-based and bulk options; create and track NEFT/IMPS payment files via e-Payment module supporting 18+ Indian banks.

2. Enhanced Banking Reports & Dashboards:-

New Banking Activities dashboard tile: shows pending reconciliations, balances, e‑payment statuses with drill-down reports.

Improved reporting in vouchers/day‑books, capturing bank account, instrument and reconciliation status; detailed Edit Log now tracks changes to UPI, bank date/instrument.

3. Streamlined Data Split & Verification:-

Simplified Data Split: new interface with enhanced options—single or dual company splits, progress bar, and robust pre‑split verification.

Resolves memory glitches and errors during large data operations .

4. Profile Management & Notifications:-

In‑app Profile section: modify contact info tied to serial number directly in Tally.

Semi‑annual reminders ensure your contact details stay current.

5. GST, TDS, VAT & Tax Enhancements:-

GSTR‑1 improvements: smarter filing with Excel Utility v5.4 for GSTR‑3B and breakup of B2B/B2C HSN summaries (Phase III from 1 April 2025).

Enhanced TDS/VAT reporting: precise calculations and correct state-wise reporting.

GCC compliance: bilingual (English/Arabic) invoicing, Arabic numerals, VAT formats for Kuwait/Qatar.

6. Income‑Tax & Regulatory Updates:-

Updated support for Income-Tax slabs under the 2025–26 Finance Bill, including rebate (87A), marginal relief, revised Form 16/24Q annexures.

7. Developer (TDL) Enhancements:-

New attributes & functionality: Skip-Forward, Disable Period on Tile, Multi‑Objects, IsPatternMatch, and Recon Status collection filter.

Internal optimization: Opening BRS details moved out of bank master to improve performance.

#tallyprime#tally on cloud#accountingsoftware#tallysoftware#cloud accounting software#cloudcomputing

0 notes