#TechnicalAnalysis

Explore tagged Tumblr posts

Text

Mastering forex signals for trend following: a comprehensive guide

The foreign exchange market, or Forex, is a dynamic and ever-changing arena where traders seek to capitalize on currency price movements. One popular trading strategy is trend following, which involves identifying and following the prevailing market direction. Forex signals play a crucial role in assisting traders to navigate the complexities of trend following. In this comprehensive guide, we will explore the intricacies of Forex signals for trend following, helping you understand how to leverage them effectively for successful trading.

Understanding Trend Following

Trend following is a strategy that seeks to capitalize on the directionality of market prices. The basic premise is simple: identify the prevailing trend and place trades in the same direction. Trends can be upward (bullish), downward (bearish), or sideways (range-bound). Successful trend following involves entering a trade at the beginning of a trend and exiting when the trend shows signs of reversal.

The Role of Forex Signals

Forex signals serve as triggers for traders, indicating opportune moments to enter or exit a trade. These signals are generated through a thorough analysis of market data, including technical indicators, fundamental factors, and sometimes a combination of both. For trend following, signals become particularly crucial as they guide traders on when to jump on a trend and when to step aside.

Key Components of Forex Signals for Trend Following

1. Technical Indicators:

Moving Averages: These are fundamental tools in trend following. A moving average smoothens price data to create a single flowing line. Traders often look for crossovers, where short-term moving averages cross above long-term ones, as a signal to enter a trade.

Relative Strength Index (RSI): RSI measures the speed and change of price movements. A high RSI may indicate overbought conditions, suggesting a potential reversal, while a low RSI may indicate oversold conditions, signaling a potential buying opportunity.

Moving Average Convergence Divergence (MACD): MACD is a trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

2. Fundamental Analysis:

While trend following is predominantly a technical strategy, incorporating fundamental analysis can enhance the accuracy of signals. Economic indicators, interest rates, and geopolitical events can significantly impact currency trends.

3. Price Action:

Pure price action analysis involves studying the historical price movements of a currency pair. Identifying patterns, such as higher highs and higher lows in an uptrend, can provide strong signals for trend following.

Choosing a Reliable Signal Provider

With the plethora of signal providers available, it's essential to choose a reliable one. Consider the following factors:

Track Record: A provider's historical performance is a crucial indicator of their reliability. Look for providers with a consistent track record of accurate signals.

Transparency: Transparent signal providers disclose their methods, including the criteria for generating signals and their risk management strategies.

Risk-Reward Ratio: A good signal provider should have a clear risk-reward ratio for each signal, helping you manage your trades effectively.

Implementing Forex Signals for Trend Following

Once you've selected a signal provider or developed a reliable system, the implementation phase is critical. Here are some tips:

Risk Management: Set clear risk parameters for each trade. This includes defining the percentage of your trading capital you're willing to risk on a single trade.

Position Sizing: Adjust the size of your positions based on the strength of the signal and the volatility of the market.

Stay Informed: While signals provide valuable insights, staying informed about broader market trends and events is crucial. Unexpected news can impact the Forex market.

Continuous Evaluation: Regularly assess the performance of your chosen signals and be prepared to adjust your strategy if market conditions change.

Conclusion

Forex signals for trend following can be powerful tools in a trader's arsenal, helping to identify and capitalize on market trends. However, success in Forex trading requires a comprehensive understanding of both the strategy and the market itself. By combining technical indicators, fundamental analysis, and a disciplined approach to risk management, traders can use Forex signals to navigate the complex world of trend following with confidence. Remember, no strategy guarantees success, and ongoing learning and adaptation are essential for long-term success in the Forex market.

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

28 notes

·

View notes

Text

Penny Stock Primed For Massive Growth As Demand Skyrockets!

Penny Stock Primed For Massive Growth As Demand Skyrockets! https://www.youtube.com/watch?v=8leKGgVGKok This lithium stock is positioned to EXPLODE as EV demand surges. Atlas Lithium Corporation (ATLX) holds Brazil's largest lithium exploration portfolio. With a state-of-the-art processing plant arriving in Brazil and Warren Buffett's Berkshire Hathaway as top shareholder, ATLX is primed for massive growth. Wall Street analysts project up to 669% upside for this lithium mining stock with price targets from $19 all the way up to $45. ✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ✅ Stay Connected With Me: 👉 (X)Twitter: https://twitter.com/RealAvidTrader 👉 Stocktwits: https://ift.tt/AvfGwbP 👉 Instagram: https://ift.tt/quWfMlY ============================== ✅ Other Videos You Might Be Interested In Watching: 👉 Why 2024 Was My BEST YEAR EVER And How 2025 Will Be Even Better! https://youtu.be/JBpA0YX9tQM 👉 Will This Penny Stock SURGE After Huge Partnership News With AT&T? https://youtu.be/8N9lMRLC8f0 👉 This Stock Can Explode in 2025: Here's Why!! https://youtu.be/XZsI7a6vn1Y 👉 Haters LAUGHED When We Alerted This 10X Stock! https://youtu.be/hMpNn6eGPeY ============================= ✅ About AvidTrader: Value Investor. Discussing Day & Swing Trades Also Long Term Investments! Stock Breakdowns. Grow Your Trading Account Effectively. Technical Analysis and Pattern Recognition. How to Make Money, But More Importantly Learning & Having Fun in The Process! Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. Avid Trader receives compensation from its clients in the form of cash and restricted securities for consulting services. 🔔 Subscribe to my channel for more videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ===================== Chapters: 0:00 Lithium Overview 1:59 ATLX 3:59 Reasons for Optimism 5:01 Price Targets and Analysis #swingtrading #stockstobuy #microcapstocks Disclaimer: Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. This is not financial advice. Investments involve risk and are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Past performance is not indicative of future performance. AvidTrader has been compensated one thousand five hundred dollars USD by ACH Bank Transfer by Sideways Frequency LLC for advertising Atlas Lithium Corp (ATLX). As of the date of this advertisement, the owners of AvidTrader do not hold a position in Atlas Lithium Corp (ATLX). This advertisement and other marketing efforts may increase investor and market awareness, which may result in an increased number of shareholders owning and trading the securities of Atlas Lithium Corp (ATLX), increased trading volume, and possibly an increased share price of Atlas Lithium Corp (ATLX), which may or may not be temporary and decrease once the marketing arrangement has ended. Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use © AvidTrader via AvidTrader https://www.youtube.com/channel/UCK_XU3FW-ffEK8BG5EisnNA April 22, 2025 at 06:00AM

#stockanalysis#investmenttips#investmentstrategy#tradingstrategies#tradingtips#fundamentalanalysis#stockmarket#technicalanalysis

3 notes

·

View notes

Link

#CandlestickAnalysis#candlestickpatterns#chartpatterns#ForexTrading#markettrends#MomentumTrading#priceaction#ReversalPatterns#riskmanagement#StockMarket#supportandresistance#technicalanalysis#TradingSignals#TradingStrategy#TrendContinuation

2 notes

·

View notes

Text

Technical Analysis

Hull Moving Average: The Revolutionary Trend Following Indicator

Introduction

The Hull Moving Average (HMA) has revolutionized how traders identify and follow market trends. Developed by Alan Hull to address the lag inherent in traditional moving averages, the HMA provides a uniquely responsive yet smooth representation of price action. This comprehensive guide explores how traders can leverage this powerful indicator for enhanced trading performance.

Who Created the Hull Moving Average?

Alan Hull, an Australian mathematician and trader, developed the Hull Moving Average in 2005. Frustrated with the significant lag in traditional moving averages, Hull applied his mathematical expertise to create an indicator that could maintain smoothness while dramatically reducing delay in trend identification.

What Makes the Hull Moving Average Special?

Core Features:

Minimal lag compared to traditional MAs

Smooth price action representation

Strong trend identification capabilities

Responsive to price changes

Built-in noise reduction

Key Advantages:

Earlier trend identification

Clearer entry and exit signals

Reduced whipsaws

Superior price tracking

Versatile application across markets

Why Use the Hull Moving Average?

Primary Benefits:

Faster Signal Generation

Reduces lag by up to 60%

Earlier trend identification

Quicker response to reversals

Improved Accuracy

Reduces false signals

Smoother price tracking

Better noise filtration

Enhanced Trend Following

Clear trend direction

Strong support/resistance levels

Trend strength indication

Versatility

Multiple timeframe analysis

Various market applications

Combines well with other indicators

Where to Apply the Hull Moving Average?

Market Applications:

Futures Markets

E-mini S&P 500

Crude Oil

Gold Futures

Treasury Futures

Forex Trading

Major currency pairs

Cross rates

Exotic pairs

Stock Trading

Individual stocks

ETFs

Stock indices

When to Use the Hull Moving Average?

Optimal Market Conditions:

Trending Markets

Strong directional moves

Clear price momentum

Extended market cycles

Breakout Scenarios

Pattern completions

Support/resistance breaks

Range expansions

Volatility Transitions

Market regime changes

Volatility breakouts

Trend initiations

How to Trade with the Hull Moving Average

Basic Trading Strategies:

Trend Following Strategy

Long when price crosses above HMA

Short when price crosses below HMA

Use HMA slope for trend strength

Exit on opposite crossover

Support/Resistance Strategy

Use HMA as dynamic support/resistance

Buy bounces off HMA in uptrends

Sell rejections from HMA in downtrends

Tighter stops for counter-trend trades

Multiple HMA Strategy

Combine different period HMAs

Look for crossovers between HMAs

Use divergences between HMAs

Trade strongest signals only

Advanced Applications:

Multiple Timeframe Analysis

Higher timeframe for trend direction

Lower timeframe for entry timing

Middle timeframe for confirmation

Volatility Integration

Adjust periods based on volatility

Use ATR for stop placement

Scale positions with trend strength

Hybrid Systems

Combine with momentum indicators

Use with price patterns

Integrate with volume analysis

Risk Management Essentials

Position Sizing:

Scale with trend strength

Larger in confirmed trends

Smaller in transitions

Stop Loss Placement:

Beyond HMA level

Based on ATR multiple

At key price levels

Common Pitfalls to Avoid

1. Over-Optimization

Problem: Curve fitting periods

Solution: Use standard settings

Prevention: Test across markets

2. False Signals

Problem: Minor crossovers

Solution: Use confirmation filters

Prevention: Wait for clear signals

3. Late Exits

Problem: Giving back profits

Solution: Use trailing stops

Prevention: Honor exit rules

Real-World Performance Metrics

Typical Results:

Win Rate: 45-55% in trending markets

Risk/Reward Ratio: Best at 1:2 or higher

Average Trade Duration: 5-10 days

Maximum Drawdown: 15-20% with proper risk management

Optimizing Hull Moving Average

Parameter Settings:

Standard Period: 20-30

Aggressive: 14-18

Conservative: 35-50

Market-Specific Adjustments:

Fast Markets: Shorter periods

Slow Markets: Longer periods

Volatile Markets: Multiple confirmations

Conclusion

The Hull Moving Average represents a significant advancement in trend-following indicators. Its ability to reduce lag while maintaining smooth price action makes it an invaluable tool for both discretionary and systematic traders. When properly implemented with sound risk management principles, the HMA can provide a significant edge in futures trading.

#HullMovingAverage#TrendFollowing#FuturesTrading#TechnicalAnalysis#TradingStrategy#MarketIndicators#FinancialMarkets#TradingEducation#AlanHull#MovingAverages

3 notes

·

View notes

Text

Our First Indicator Script Is Live! EasyChartSignals - Now Available for TradingView!

We are thrilled to announce that our very first indicator script, EasyChartSignals, is finally ready and available for you! 🚀 This powerful tool provides you with automated buy, sell, and stop-loss signals that make trading on TradingView more efficient and simple.

EasyChartSignals has been optimized and tested thoroughly by experienced traders to bring you the most accurate and reliable signals. Whether you're new to trading or an experienced trader, EasyChartSignals helps you make better trading decisions!

Get started with EasyChartSignals today and take your trading to the next level! 🔥

👉 Available for TradingView users now!

📌 Features:

Accurate buy and sell signals

Easy integration with TradingView

Adjustable settings to suit your trading style

🌐 Learn more at: https://easychartsignals.de

Hashtags:

#EasyChartSignals#TradingView#IndicatorScript#TradingSignals#BuySellSignals#AutomatedTrading#TradingTools#ForexTrading#CryptoTrading#DayTrading#StockTrading#TechnicalAnalysis#TradeSmart#ChartSignals

2 notes

·

View notes

Text

#ForexTrading#InvestmentTips#DayTrading#ForexMarket#TechnicalAnalysis#TradingStrategies#Cryptocurrency#FinancialMarkets#ForexSignals#StockMarket#Investing101#ForexEducation#MarketAnalysis#PassiveIncome#AlgoTrading#ForexLifestyle#TradingPsychology#RiskManagement#EconomicNews#TradingMentor#ForexCommunity#ForexBlog#TradingJourney#ForexTips#TradingMindset

3 notes

·

View notes

Text

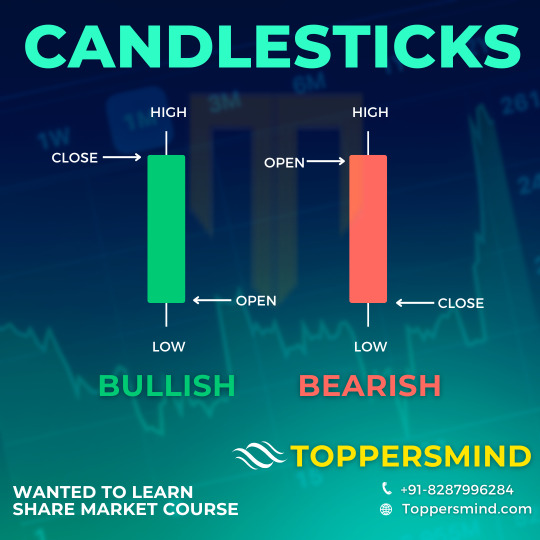

Anatomy of Candlesticks

2 notes

·

View notes

Text

LOWER LOWS AND LOWER HIGHS PATTERN

The "Lower Lows and Lower Highs" pattern is a chart formation where consecutive lower highs and lower lows suggest a short-term reversal. One trading strategy involves entering at the close when a daily bar shows both a lower high and a lower low, with an exit after 1-10 bars. Another strategy enters after two consecutive days of lower highs and lows for stronger confirmation. This pattern is often used to identify potential reversals in trending markets.

2 notes

·

View notes

Text

Fundamental Analysis of Maruti Suzuki

Established in February 1981 as Maruti Udyog Limited, Maruti Suzuki India Limited (MSIL) is now the largest passenger car manufacturer in India. A joint venture between the Government of India and Suzuki Motor Corporation of Japan, the latter currently holds a 58.19% stake in the company. With a diverse portfolio of 16 car models and over 150 variants, Maruti Suzuki caters to various consumer segments, from entry-level small cars like the Alto to the luxury sedan Ciaz.

Sales and Industry Trends

Indian passenger vehicle industry saw record sales of 4.1 million units in 2023, becoming the third largest market globally

Share of utility vehicles in the industry increased to 53% in Q3, with SUVs contributing to about 63%

CNG vehicles saw a share increase to about 16.5% in the industry, with CNG sales reaching an all-time high of ~30%

Company crossed annual sales milestone of 2 million units in 2023 and had highest ever exports of about 270,000 units

Q3 FY23–24 saw total sales of 501,207 vehicles, with net profit rising over 33% year-on-year

Retail sales in Q3 were higher than wholesales, with discounts of INR 23,300 per vehicle

Maruti Suzuki Financials

Revenue and Net Profit: In FY23, Maruti Suzuki witnessed a YoY increase of 33.10% in revenue, reaching Rs. 1,17,571.30 crore, with a net profit of Rs. 8,211 crore, marking a 111.65% YoY increase.

Profit Margins: Operating Profit Margin (OPM) and Net Profit Margin (NPM) improved in FY23, standing at 9% and 6.83%, respectively.

Return Ratios: Return on Equity (RoE) and Return on Capital Employed (RoCE) showed improvements in FY23, reaching 13.28% and 16.02%, respectively.

Debt Analysis: The Debt to Equity ratio slightly increased to 0.02 in FY23, with a healthy Interest Coverage ratio of 70.37.

#StockMarket#Investing#TradingTips#FinancialFreedom#InvestmentStrategy#MarketAnalysis#StockPicks#PortfolioManagement#EconomicIndicators#StockResearch#RiskManagement#MarketTrends#DividendInvesting#TechnicalAnalysis#FundamentalAnalysis

3 notes

·

View notes

Text

Forex trading signals for part-time traders

Forex trading can be a lucrative venture, even for those with limited time on their hands. Part-time traders often face the challenge of managing their trades efficiently. In this article, we'll explore the world of Forex trading signals and how they can be a valuable tool for part-time traders.

What are Forex Trading Signals?

Forex trading signals are indicators or notifications that suggest optimal times to enter or exit a trade. These signals are generated through thorough market analysis by professional traders or automated systems. For part-time traders, relying on these signals can save time and provide valuable insights into the market.

Here are some tips for part-time traders:

Choose a Reliable Signal Provider: There are various signal providers in the market. Do your research and select a provider with a proven track record of accuracy.

Understand the Signals: It's essential to comprehend the signals you receive. This includes understanding the risk associated with each signal and how it aligns with your trading strategy.

Time Management: Part-time traders must efficiently manage their time. Set specific periods for analyzing signals, and stick to your trading plan.

Remember, while trading signals can be beneficial, they are not foolproof. It's crucial to combine them with your analysis and stay informed about market trends. Successful trading requires a combination of strategy, discipline, and continuous learning.

Happy trading!

Source:

#TradeSignals#FinancialFreedom#StockMarketAlerts#InvestingWisdom#ProfitableTrades#MarketAnalysis#TradingSignals#DayTrading#ForexProfit#CryptoSignals#MarketTrends#InvestmentTips#SmartTrading#TradeSmart#TechnicalAnalysis#RiskManagement#ProfitPotential#TradingStrategies#StockPicks#EconomicIndicators#TradingEducation#MarketInsights#OptionsTrading#MarketWatch#TradeStrategy#FinancialMarkets#ForexTrading#CryptoInvesting#AlgorithmicTrading#StockMarketNews

22 notes

·

View notes

Text

Earnings Catalysts Could Make These Stocks Rocket

🚀 Earnings Catalysts Could Make These Stocks Rocket 🚀 https://www.youtube.com/watch?v=b1jLKdCDW2A Today I give you my top 3 stock setups going into earnings this week! Some I have bought personally, others looks primed to explode! Biotech's are super hot right now attracting a ton of hedge fund, smart money presence! Remember, when institutions see value and start buying, the street takes notes. Some tickers perform so well that they can be added to major index funds which will naturally cause more people to see value and buy the stock! Any questions please ask! TIMELINE: 0:00 Stock 1 2:01 Stock 2 3:37 Stock 3 ✅ Subscribe To My Channel For More Videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ✅ Stay Connected With Me: 👉 (X)Twitter: https://twitter.com/RealAvidTrader 👉 Stocktwits: https://ift.tt/a3no9He 👉 Instagram: https://ift.tt/lBLGJWq ============================== ✅ Other Videos You Might Be Interested In Watching: 👉 The ULTIMATE Guide to Finding Hidden Gem Stocks | AvidTrader https://youtu.be/pZAKJLk9o0I 👉 How My Subscribers Doubled Their Money Today!!! https://youtu.be/s5M_OGv8AtM 👉 7 Great Value Stocks to Buy BEFORE They Explode! https://youtu.be/0I451lsCjAc 👉 💥Super Cheap Penny Stock Can Run 3-5X FAST💥 https://youtu.be/4B3EK7lb38k ============================= ✅ About AvidTrader: Value Investor. Discussing Day & Swing Trades Also Long Term Investments! Stock Breakdowns. Grow Your Trading Account Effectively. Technical Analysis and Pattern Recognition. How to Make Money, But More Importantly Learning & Having Fun in The Process! Avid Trader is not a Series 7 licensed investment professional, but a digital marketing manager/content creator to publicly traded and privately held companies. Avid Trader receives compensation from its clients in the form of cash and restricted securities for consulting services. 🔔 Subscribe to my channel for more videos: https://www.youtube.com/@AvidTrader/?sub_confirmation=1 ===================== #stockstobuy #stockstobuynow #stockstowatch #stockstotradetomorrow #stockanalysis #stockmarketnews #stocknews #breakingnews #topstocks #topstockstobuynow #partnership #biotechstocks #millionaire #stockearnings #earningsreport #earningsweek #catalyst Disclaimer: We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk. I am not a certified financial advisor and you must do your own research and due diligence before ever buying or selling a stock. never trade solely based on someone else's word or expectations of a stock! Copyright Disclaimer: Under Section 107 of the Copyright Act 1976, allowance is made for "fair use" for purposes such as criticism, comment, news reporting, teaching, scholarship and research. Fair use is a use permitted by copyright statute that might otherwise be infringing. Non-profit, educational or personal use tips the balance in favor of fair use © AvidTrader via AvidTrader https://www.youtube.com/channel/UCK_XU3FW-ffEK8BG5EisnNA May 07, 2024 at 05:55AM

#stockanalysis#investmenttips#investmentstrategy#tradingstrategies#tradingtips#fundamentalanalysis#stockmarket#technicalanalysis

2 notes

·

View notes

Text

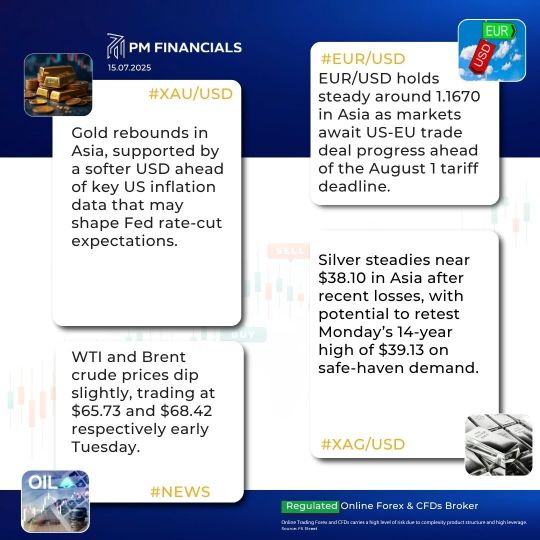

Daily Market Analysis at Pmfinancials - 15th July 2025

#Forex#ForexTrading#CurrencyTrading#TradingView#MarketAnalysis#ForexDaily#TechnicalAnalysis#FundamentalAnalysis#FXMarket#ForexTips#ForexSignals#DayTrading#SwingTrading#ForexCommunity#TradeSmart#ForexLife

0 notes

Text

Unlock the Unseen: Why the Chaikin Oscillator is Your 2025 Crypto Edge Against Market Deception!

In the electrifying, relentless arena of cryptocurrency in 2025, every decimal point tells a story, every candle whispers a secret. But beneath the surface of volatile price action, a deeper narrative unfolds – one of relentless accumulation and subtle distribution. While basic indicators might scratch the surface, true crypto titans know that to defy market noise and manipulation, you need tools…

0 notes

Link

0 notes

Text

🚀 Nebuvex Insights: When Altcoins Mirror Million-Dollar Moves

Ever wondered how professional traders spot the next big crypto breakout before it happens? The answer lies in understanding market patterns that repeat throughout cryptocurrency history.

The Pattern That Changed Everything

Remember when PEPE exploded in 2024? It wasn't random luck—it was pure technical analysis at work. The same patterns that signaled PEPE's massive breakout are now appearing in another altcoin: Pudgy Penguins (PENGU).

Here's what the charts are telling us:

📊 Fibonacci Magic: Both coins showed identical behavior at key retracement levels. PEPE bounced hard from the 0.5 level before its historic run. PENGU just did the same thing.

📈 The Triangle Setup: PENGU has been forming an ascending triangle for months—the same pattern that often precedes explosive moves. We're talking about a 50% rally in just one week!

🎯 The Critical Zone: Professional analysts are watching the $0.015-$0.017 range. A clean break above this level could trigger something special.

Why This Matters for Your Portfolio

The crypto market loves to repeat patterns. Smart money recognizes these formations and positions accordingly. While PEPE made early investors millionaires, PENGU might be setting up for its own historic moment.

What makes this comparison valid:

Similar chart patterns at identical technical levels

Both coins showing accumulation phases

Community-driven momentum building

Professional trader interest increasing

The Matecrypt Ecosystem Edge

Understanding these patterns isn't just about one coin—it's about recognizing how the entire Matecrypt ecosystem evolves. Professional traders use advanced tools to identify these setups before they become obvious to everyone else.

Remember the golden rules: ✅ Pattern recognition beats random speculation ✅ Technical analysis provides objective entry/exit points ✅ Risk management always comes first ✅ Education beats gambling every time

Where to Level Up Your Analysis

Want to dive deeper into professional-grade technical analysis? Check out comprehensive resources at https://www.nblinrui.com/ where you can access the same tools that professional traders use to identify these patterns.

The crypto market rewards those who combine technical knowledge with disciplined execution. While past performance never guarantees future results, understanding these patterns gives you a significant edge in identifying potential opportunities.

The Bottom Line: Whether PENGU follows PEPE's explosive path remains to be seen, but the technical setup is remarkably similar. Professional traders are paying attention—and so should you.

Remember: This is educational content, not financial advice. Always do your own research and never invest more than you can afford to lose.

What do you think? Have you spotted similar patterns in your favorite altcoins? Drop your thoughts in the comments!

1 note

·

View note

Text

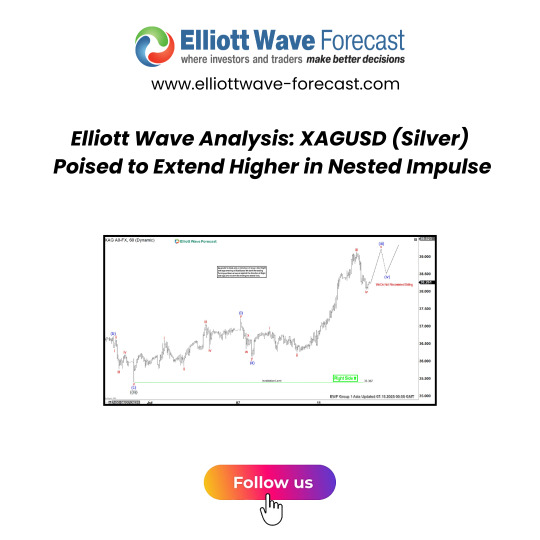

Elliott Wave Analysis: XAGUSD (Silver) Poised to Extend Higher in Nested ImpulseThe cycle from the June 24, 2025 low in Silver (XAGUSD) is unfolding as a five-wave rally with an extended nested impulse structure. More Information: elliottwave-forecast.com/news…

0 notes