#Token Standards and Issuance

Explore tagged Tumblr posts

Text

#Blockchain Consensus Mechanisms#Decentralised Application (DApp) Development#Smart Contract Development#Security Auditing#Scalability Solutions#Non-Fungible Tokens (NFTs)#Token Standards and Issuance

1 note

·

View note

Text

Steps Involved in Tokenizing Real-World Assets

Introduction

Tokenizing real-world assets implies translating the ownership rights of physical or intangible assets into a blockchain-based digital token. By doing this the asset gains liquidity and fractions of the ownership with a high degree of transparency. The main steps of tokenization of real-world assets

Tokenize Real World Assets in simple steps

Asset Identification and Valuation:

Start with the selection of an asset such as real estate, artwork, or commodities, for tokenization, and then understand the market value. This refers to the valuation of all identifying features of the asset the market demand and the legal reasons to see if the asset is viable for tokenization. The valuation of the asset must be an accurate one since it greatly impacts investor confidence and the overall effect of the process of tokenization.

Legal Structuring and Compliance:

Establish the robust legal framework to ensure tokenize an asset complies with relevant regulation. This would require defining the rights and obligations of a token holder and compliance with securities laws and appropriate entities or agreements. It would be very advisable to engage legal experts who understand blockchain technology and financial regulations to help navigate this rather difficult terrain.

Choosing the Blockchain Platform:

The selection of the blockchain is highly dependent on security, scalability, transaction costs, and lastly compatibility with the asset type. Acceptance of public blockchains like Ethereum against private or permissioned chains would ultimately boil down to the requirements of the specific asset type and the demands of stakeholders Defining the Token Type and Standard:

represents equity, debt, or utility, and selects an appropriate token standard. Common standards include ERC-20 tokens and ERC-721 tokens . This decision impacts the tokens functionality interoperability and how to traded or utilized within the ecosystem

Developing Smart Contracts:

Create smart contracts to automate the processes like token issuance distribution and compliance. These self-executing contracts with the terms and directly written into code ensure transparency and reduce the need for intermediaries and enforce the predefined rules and regulations associated with the tokenized asset.

Token Creation and Management

Automating compliance

Transaction Automation

Security and Transparency

Integration with External Systems

Asset Management:

Securing the physical asset or its legal documentation in a way that ensures that the tokens issued are backed by the asset per se is called asset custody and management. It includes the engagement of third-party custodians or establishing trust structures for holding the asset, thereby providing assurance to the token holders of the authenticity and security of their investments.

Token Issuance and Distribution:

Mint and distribute the digital tokens over a selected platform or exchange to investors. Carry out the process in a completely transparent way and in full conformance with the pre-established legal framework, like initial coin offerings (ICOs) or security token offerings (STOs), among others, to reach the target investors.

Establishing a Secondary Market:

Facilitating trading of tokens in secondary markets allows liquidity and enables investors to buy or sell their holdings. Listing tokens on appropriate exchanges and ensuring compliance with relevant ongoing regulations is part and parcel of enhancing the marketability and attractiveness to investors.

Benefits Tokenize Real World Assets

Enhanced Liquidity

Traditionally illiquid assets, such as real estate and fine art, can be to challenging the buy or sell quickly. Tokenization facilitates the division of these assets into smaller tradable digital tokens, thereby increasing market liquidity and enabling faster transactions.

Fractional ownership

high-value assets mandate a substantial capital investment, which limits access to a small group of investors. However, with tokenization, these assets can be broken into smaller shares whereby multiple investors could come to own fractions of the asset. This democratizes the opportunity for investment and broadens participation in the market.

Efficiency and Decreases Costs

The application of tokenization settles processes such as settlement, record-keeping, and compliance on the blockchain. Accordingly, this reduces the need for intermediaries, lowers administrative expenses, and reduces cost per transaction. For example, the Hong Kong government issued a digital bond that reduced settlement time from five days to one.

Transparency and Security Upgraded

The important features of the blockchain promise an incorruptible, transparent ledger for all transactions. Ownership records are made secure against tampering and easily verifiable and hence fostering a greater sense of trust among investors and stakeholders and Transparency and Security Upgraded

Expanded Reach into the Market

Tokenization creates a borderless approach, enabling investors all around the world to reach and invest in a plethora of diverse assets. Aside from global reach, it creates an ecosystem that is more inclusive and opens the window for further possibilities in the world of investors and asset owners.

Conclusion

Tokenization of real-world assets (RWAs) signifies a new methodology for asset management and investment. Through converting a tangible or intangible asset into a digital token to be deployed on the blockchain this method aids in turning such assets into liquid forms permitting fractional ownership, and ensuring the performance of the transaction in a traceable manner. The whole process, from locating and appraising the asset to creating a secondary market, thus provides a systematic framework in applying blockchain technology to asset tokenization.

The increased operational efficiency, lower transaction costs, raised transparency, and wider access to the marketplace imply that, with the onset of tokenization, the very nature of investment opportunities is likely to undergo a drastic change with increased democratization from the heights of capital to meet investors on the streets. As this technology evolves, we will find innovative solutions to asset management, enhancing the accessibility and efficiency of investments for a broad spectrum of investors.

1 note

·

View note

Text

Bitcoin: The Only Truly Decentralized Cryptocurrency

In the rapidly evolving landscape of cryptocurrencies, decentralization is often touted as a core principle. However, not all digital currencies live up to this ideal. Among thousands of cryptocurrencies, Bitcoin stands out as the only one that truly exhibits decentralization, making it unique and invaluable.

What is Decentralization?

Decentralization refers to a system where control isn’t held by a single entity or small group. In cryptocurrency, this concept ensures that no government, organization, or individual has undue influence over the network. Decentralization brings crucial benefits, such as increased security, censorship resistance, and transparency.

Bitcoin’s Decentralized Foundations

Bitcoin, conceived in 2008 by Satoshi Nakamoto, was designed to operate in a decentralized manner from the outset. Key elements like its peer-to-peer network, proof-of-work consensus, and distributed ledger ensure that control over Bitcoin is not concentrated.

Peer-to-Peer Network: Every node in the Bitcoin network has equal status, contributing to the validation of transactions.

Proof-of-Work: Bitcoin mining uses proof-of-work to secure the network through computational power, preventing any single entity from dominating.

Distributed Ledger: Bitcoin’s blockchain is maintained by thousands of nodes globally, ensuring the ledger remains tamper-resistant and transparent.

Contrasting Other Cryptocurrencies

Despite claims of decentralization, many cryptocurrencies exhibit centralized control due to their governance models, development teams, or token distribution.

Ripple (XRP):

Ripple Labs holds a significant portion of the total XRP supply and directly controls the development and direction of the network. Its consensus protocol relies on a trusted list of validators chosen by the company, creating a stark contrast with Bitcoin’s permissionless network.

Binance Coin (BNB):

As the in-house token of the centralized Binance exchange, Binance Coin’s governance and supply are influenced by Binance itself. The company determines how and when to burn tokens, directly impacting supply.

Cardano (ADA):

Cardano’s governance is centralized through three key organizations: the Cardano Foundation, IOHK, and Emurgo. While the network employs staking pools for validation, the concentration of control remains within these organizations.

Tether (USDT):

Tether is managed centrally by Tether Limited, which controls the issuance and redemption of the stablecoin. Recent controversies over reserve transparency highlight the risks of centralization.

Risks of Centralization

Centralization poses various risks to cryptocurrency networks. Systems controlled by a small group or entity are vulnerable to:

Regulation: Governments can easily target centralized entities, limiting the currency’s usage.

Single Points of Failure: Centralized systems can suffer catastrophic failures if the controlling entity is compromised.

Market Manipulation: Central entities can manipulate supply or governance decisions to their advantage.

Bitcoin’s Decentralization in Practice

Bitcoin’s decentralized nature has protected it from censorship and interference, allowing it to thrive even under intense scrutiny. Its open network ensures that anyone can participate and contribute to securing the blockchain, making it resilient against regulatory and market pressures.

Conclusion

Bitcoin remains the most decentralized cryptocurrency, setting the standard for how digital currencies should operate. It offers a model that ensures fairness, transparency, and security, while others still rely on centralized control to varying degrees. Investors should consider this aspect carefully, recognizing the value of true decentralization when navigating the cryptocurrency landscape.

#Bitcoin#Cryptocurrency#Decentralization#Blockchain#Ripple#Binance#Cardano#Tether#CryptoInvesting#DigitalCurrency#CryptoCommunity#CryptoNews#unplugged financial#financial education#financial empowerment#finance#financial experts

4 notes

·

View notes

Text

🇮🇳 CBDC Services in India – Powering the Digital Rupee Ecosystem 💸

As Central Bank Digital Currencies (CBDCs) become a global standard, India is leading the way with the Digital Rupee (e₹) — and Prodevans is proud to be at the forefront of this revolution. 💼🔐

🏦 Build Your CBDC-Ready Banking Platform

Launch a secure, modular, and regulatory-grade CBDC stack with Prodevans, designed to support:

✅ Secure Wallet Enablement ✅ Token Lifecycle Management ✅ Real-Time Reconciliation Dashboards ✅ Cloud-Native Scalability ✅ 24/7 L1/L2 Support

Built to scale. Built to comply. Built for the future. ⚙️☁️

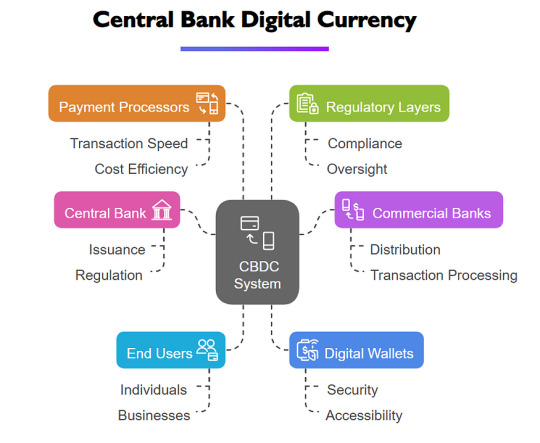

❓ What is CBDC?

A Central Bank Digital Currency (CBDC) is a digital legal tender issued by a central bank. In India, this takes shape as the Digital Rupee, developed by the Reserve Bank of India (RBI) to provide a secure, programmable, and inclusive payment system. 💳🌐

💡 CBDC as a Service by Prodevans

Trusted for our role in India’s Digital Rupee rollout, we offer a complete, scalable CBDC infrastructure built to work across legacy and modern banking systems.

🔹 Modular & Cloud-Native 🔹 Secure Wallets for Banks & Users 🔹 Real-Time Token Monitoring & Reconciliation 🔹 API Integration with CBS, UPI, and More 🔹 Always-On Operational Support (L1/L2)

Whether you’re starting with a CBDC pilot or preparing to scale production, we’ve got you covered.

🛠 End-to-End Architecture Highlights

Tier 1 — Central Bank Operations

Token Issuance

Core Ledger Management

Node & Data Analysis

Tier 2 — Banks & Providers

Wallet & User Management

Token Transactions

Integration with CBS, AML/CFT, and e-KYC

Tier 3 — End Users

Digital Wallet Access

Seamless Interbank Payments via UPI

DLT & Non-DLT Compatible

🚀 Features That Set Us Apart

🔧 Unified Tech Management One team handling infrastructure, DevOps, databases & support.

📊 Reconciliation Dashboards Live, real-time monitoring across platforms like CBS, DTSP & UPI.

🧠 Gap Analysis & System Optimization Architect-level tuning to boost performance & reliability.

🧪 Pre-Prod Sandbox Environments Safely test features before deployment.

🔒 Secure & Compliant by Design Aligned with RBI, NPCI, ISO 27001 & GDPR standards.

⏱ Fast Rollouts with SLA-backed Support Launch quickly with 24/7 support and minimized downtime.

🔒 Why Choose Prodevans?

We’ve earned trust as a technology partner in India’s national CBDC rollout and deliver:

✔️ Cloud-native scalability ✔️ Regulatory-grade security ✔️ Seamless integration ✔️ Complete delivery ownership ✔️ Future-ready architecture

Whether you’re a government bank or a fintech innovator, Prodevans is your go-to CBDC partner in India 🇮🇳

📞 Get in Touch with Us!

📧 Email: [email protected] 🌐 Website: www.prodevans.com/services/cbdc 📲 Phone: +91 97044 56015

#CBDCIndia#DigitalRupee#CBDCServices#CBDCProvider#ERupee#CentralBankDigitalCurrency#Prodevans#BankingTransformation#TokenManagement#DigitalBanking#UPIIntegration#FutureOfFinance#CBDCPlatform#SecureWallet#FintechIndia#RBICompliant

0 notes

Text

Why Is Real-World Asset Tokenization Gaining Global Popularity?

In the age of decentralized finance and blockchain innovation, Real-World Asset (RWA) Tokenization is emerging as a transformative force. The global popularity of RWA tokenization has surged as investors, institutions, and governments seek more efficient, secure, and transparent ways to handle physical and financial assets. This disruptive technology is revolutionizing traditional finance by bridging the gap between tangible assets and the digital economy.

Understanding the Global Popularity of RWA Tokenization

The global popularity of RWA tokenization lies in its ability to fractionalize ownership of high-value assets such as real estate, art, commodities, and even intellectual property. By converting these assets into blockchain-based tokens, they become easily transferable, liquid, and accessible to a wider audience.

Tokenization allows individuals and institutions to invest in traditionally illiquid markets with lower capital. Whether it's owning a fraction of a luxury villa in the Maldives or investing in a rare painting, tokenization makes it possible with ease and security. The enhanced liquidity, faster settlements, and round-the-clock trading offered by tokenized markets contribute significantly to their rising global appeal.

The Role of Asset Tokenization Development Companies

The rise of this innovation wouldn’t be possible without the support of expert asset tokenization development companies. These firms provide end-to-end solutions for businesses looking to tokenize real-world assets securely and compliantly.

An asset tokenization development company specializes in creating custom smart contracts, developing user-friendly token issuance platforms, integrating secure wallets, and ensuring compliance with global regulations such as the SEC in the U.S. or ESMA in Europe. This ensures that tokenized assets not only meet technical standards but also fulfill legal and financial compliance requirements.

Benefits Driving the Global Popularity of RWA Tokenization

1. Enhanced Liquidity

One of the key reasons for the global popularity of RWA tokenization is enhanced liquidity. Traditionally illiquid assets such as commercial real estate or fine art can now be fractionalized and sold to investors globally. This opens new investment avenues and reduces the barrier to entry for retail investors.

2. Increased Transparency and Security

Blockchain provides a decentralized and immutable ledger that ensures transparency and reduces the chances of fraud. Every transaction is traceable, and asset ownership can be verified instantly, making the tokenized ecosystem trustworthy and secure.

3. Cost Efficiency and Speed

By eliminating intermediaries such as brokers, banks, and lawyers, tokenization significantly reduces transaction fees and speeds up the asset transfer process. Asset tokenization development companies build platforms that automate processes via smart contracts, enabling near-instant settlement and lower operational costs.

4. Global Accessibility

With internet access, anyone around the globe can invest in tokenized assets. This democratizes investment opportunities, allowing even small investors to participate in global markets once reserved for high-net-worth individuals and institutions.

Real-World Use Cases Driving Adoption

The global popularity of RWA tokenization can be observed across various sectors:

Several governments and financial institutions are also exploring pilot projects involving asset tokenization to modernize their infrastructure and improve transparency in public finance.

Partnering with the Right Asset Tokenization Development Company

For businesses aiming to capitalize on the global popularity of RWA tokenization, partnering with an experienced asset tokenization development company is crucial. These companies help design secure tokenomics, choose the right blockchain protocol (such as Ethereum, Polygon, or Tezos), and manage KYC/AML compliance.

Reputable asset tokenization development companies offer end-to-end consulting, design, development, and deployment of tokenization platforms, ensuring your project meets regulatory and technical standards while offering scalability and security.

Conclusion: The Future of Global Finance Is Tokenized

The global popularity of RWA tokenization is more than a trend—it represents a fundamental shift in how assets are bought, sold, and managed. With benefits like enhanced liquidity, increased transparency, and reduced costs, real-world asset tokenization is set to redefine global finance.

As regulatory clarity improves and blockchain adoption continues, more industries will turn to tokenization to unlock the full value of their assets. Collaborating with a trusted asset tokenization development company is the first step toward embracing this future.

0 notes

Text

How Do Token Sale Services Accelerate Go-To-Market Strategies?

In the fast-paced world of blockchain and Web3, time to market often determines the success or failure of a project. For startups launching tokens, entering the market efficiently and effectively is not just a goal but a necessity. Token sale services have emerged as a powerful ally in achieving this. These services encompass the end-to-end process of preparing, marketing, executing, and supporting token sales. By leveraging their expertise, blockchain startups can not only avoid common pitfalls but also gain a competitive edge with a streamlined go-to-market (GTM) strategy.

This article explores how token sale services help startups compress timelines, optimize processes, and maximize the impact of their token launches. From strategic planning to investor engagement, we will analyze the core mechanisms by which these services accelerate GTM execution in the crypto ecosystem.

The Evolving Landscape of Token Launches

The token sale landscape has evolved significantly since the early days of ICOs in 2017. Regulatory oversight, user expectations, and technological innovations have transformed how projects approach token issuance. Today’s market demands compliance-ready launches, sophisticated marketing campaigns, and robust technical infrastructure.

Startups entering this space face challenges such as navigating global regulatory frameworks, establishing credibility in a saturated market, and ensuring sufficient liquidity post-launch. Token sale service providers address these challenges by offering a consolidated approach to GTM strategies. Their expertise allows projects to focus on building their core products while ensuring the token launch meets global standards and resonates with target audiences.

Strategic Planning: Laying the Foundation for Success

At the heart of every accelerated GTM strategy lies effective planning. Token sale services begin by working closely with startups to define the token’s value proposition, target audiences, and market positioning. They conduct market research, competitor analysis, and feasibility studies to align the token’s utility with current trends.

This phase also includes designing tokenomics—balancing supply, demand, distribution, and incentives to attract both retail and institutional investors. By outsourcing these aspects to professionals, startups save months of trial and error, ensuring their tokenomics models are optimized for long-term sustainability and investor confidence.

Regulatory Navigation: Fast-Tracking Compliance

One of the most time-consuming aspects of a token launch is ensuring compliance with regional and international laws. Token sale service providers offer legal advisory and regulatory compliance solutions that help startups avoid legal roadblocks.

From obtaining necessary licenses to conducting KYC/AML (Know Your Customer/Anti-Money Laundering) checks, these services reduce friction by providing pre-established compliance frameworks. With experts who understand varying jurisdictions, projects can expedite approvals and certifications, which would otherwise take months if handled internally. This accelerates the timeline for public token sales and protects the project from future legal challenges.

Technology Infrastructure: Building Scalable, Secure Platforms

A successful token sale requires a robust technological backbone. Token sale services provide ready-to-deploy infrastructures like smart contracts, token generation tools, and secure sale platforms. These pre-built systems are customized for each project to handle high transaction volumes without downtime or security breaches.

In addition, they integrate wallets, payment gateways, and cross-chain interoperability, ensuring investors can participate seamlessly regardless of their preferred blockchain or currency. By leveraging tried-and-tested tech stacks, startups can launch faster while maintaining the security and scalability needed to handle global user bases.

Marketing and Community Building: Driving Early Momentum

Marketing is the lifeblood of any token sale. Without effective promotion, even the most innovative tokens risk obscurity. Token sale services accelerate GTM strategies by crafting comprehensive marketing campaigns that encompass digital advertising, social media outreach, influencer partnerships, and PR strategies.

Community building is another critical element. Service providers use growth hacking techniques and community management tools to create engaged ecosystems around a project. Telegram, Discord, and Twitter communities are cultivated strategically to ensure a steady stream of organic engagement. This early momentum is essential for achieving soft and hard cap targets during token sales.

By handing over marketing to experts, startups benefit from the experience of teams who have successfully promoted multiple token launches, thus avoiding the slow, experimental phase of developing their own strategies.

Fundraising Strategies: Connecting Startups With Investors

Accelerating a GTM strategy requires connecting with the right investors at the right time. Token sale services provide access to extensive networks of venture capitalists, angel investors, and crypto funds. They help structure private and public sale rounds to maximize fundraising potential while maintaining token value post-launch.

With a curated approach, these services align projects with strategic investors who bring more than capital—they contribute market access, partnerships, and ecosystem support. This not only speeds up fundraising but also creates powerful alliances that enhance credibility and visibility in the Web3 space.

Post-Sale Support: Sustaining Growth Beyond the Launch

An often-overlooked aspect of GTM acceleration is post-sale support. Token sale services extend their value beyond launch day by helping projects manage token listing on exchanges, liquidity provisioning, and price stabilization strategies.

They also provide analytics and performance monitoring to measure the effectiveness of the sale and identify areas for improvement. Post-sale marketing campaigns are deployed to retain investor interest and sustain community engagement. This continuous support ensures that the momentum generated during the token sale does not dissipate but evolves into a thriving ecosystem.

Reducing Operational Complexity and Risk

For startups, launching a token involves coordinating multiple moving parts, from legal and technical teams to marketing and investor relations. Managing all these in-house not only slows down GTM timelines but also increases the risk of oversight. Token sale services mitigate these risks by offering an integrated approach where all components work in harmony.

By serving as a single point of contact for all launch activities, these providers eliminate silos, reduce complexity, and allow startups to focus on their core innovations. This operational efficiency is key to staying ahead in the hyper-competitive blockchain industry.

Case Studies: Successful Go-To-Market Acceleration

Several high-profile token projects have demonstrated how leveraging professional services accelerates their market entry. Projects that employed full-stack token sale providers were able to shorten their launch cycles by 30–50% compared to those managing in-house operations.

For example, AI-powered DeFi platforms that outsourced tokenomics design and community marketing achieved rapid user acquisition and exceeded their fundraising goals within weeks. These success stories highlight the transformative impact of token sale services on GTM strategies.

The Competitive Advantage of Speed in Web3

In Web3, speed is more than an operational metric—it is a competitive advantage. Projects that reach the market faster can secure early adopters, establish brand presence, and attract investors before competitors crowd the space. Token sale services provide startups with this edge by compressing timelines, ensuring regulatory readiness, and amplifying marketing efforts.

Faster GTM execution also enables projects to respond to market trends and user feedback in real-time, fostering a culture of innovation and adaptability. In the volatile crypto market, the ability to pivot quickly can mean the difference between leading the next wave of innovation and being left behind.

Conclusion:

Token sale services are not merely a convenience—they are a strategic necessity for startups aiming to dominate the blockchain space. By offering end-to-end solutions covering planning, compliance, technology, marketing, fundraising, and post-sale support, these providers enable projects to achieve faster, smoother, and more impactful market entry.

For founders navigating the complexities of token launches, partnering with experienced service providers unlocks a path to accelerated growth and long-term success. In a Web3 world where first movers often reap the largest rewards, token sale services empower startups to transform innovative ideas into market leaders—without losing momentum along the way.

0 notes

Text

Why Solana is the Top Choice for Token Creation in 2025

In the fast-evolving landscape of blockchain technology, creating and launching a token successfully depends largely on the underlying blockchain infrastructure. Among the many networks available today, Solana stands out as the top choice for token creation in 2025. With unmatched transaction speed, ultra-low fees, growing developer activity, and a thriving ecosystem, Solana offers an ideal environment for launching scalable, secure, and user-friendly tokens.

In this blog, we’ll explore why Solana Token Deveopment has emerged as the go-to blockchain for token development in 2025, analyzing its core strengths, ecosystem advantages, real-world applications, and why both startups and enterprises are choosing it over other chains.

1. Introduction: The Token Boom of 2025

The year 2025 has seen a massive resurgence in token launches — from DeFi to GameFi, RWAs to DAOs, AI agents to SocialFi. This resurgence is driven by increased institutional interest, regulatory clarity, and mass adoption of decentralized technologies.

However, the success of a token is deeply tied to the blockchain it’s built on. Developers, users, and investors are looking for speed, scalability, and affordability. And Solana checks all the boxes.

2. Solana at a Glance

Solana is a high-performance, permissionless blockchain designed for scalability without sacrificing decentralization or security. It uses a unique consensus mechanism called Proof of History (PoH) in combination with Proof of Stake (PoS) to validate transactions.

Here are some headline stats for Solana in 2025:

Transactions per second (TPS): 65,000+ TPS

Block time: ~400 milliseconds

Average transaction cost: $0.0001

Uptime: 100% throughout Q1 and Q2 of 2025

Validator count: 3,000+ globally distributed

These metrics make it the fastest and most efficient Layer 1 blockchain in mainstream use today.

3. Key Benefits of Solana for Token Creation

A. Lightning-Fast Transaction Speed

For tokens to be usable in real-world scenarios—be it gaming, trading, or DeFi—they must enable fast transactions. Solana’s sub-second confirmation times ensure an almost instant experience for end users. This is critical for:

Trading platforms needing real-time execution

In-game tokens that power immersive gameplay

Payment tokens requiring swift transfers

B. Exceptionally Low Fees

Unlike Ethereum, where gas fees can range from a few dollars to over $100 during congestion, Solana offers near-zero fees. This is a game-changer for:

Microtransaction-heavy projects like play-to-earn games

DeFi platforms processing high volumes

NFT or RWA platforms with frequent minting

C. Scalability Without Compromise

Solana is one of the few chains that can scale to hundreds of thousands of transactions per second without layer-2 rollups. This ensures:

Seamless growth as your user base expands

Zero congestion during high traffic

Predictable costs regardless of usage

D. Robust Developer Ecosystem

The Solana ecosystem is booming, with more than 3,500 projects built on it as of 2025. The availability of well-maintained SDKs, tutorials, and open-source codebases accelerates time-to-market for new token launches.

4. Solana’s Developer-Friendly Infrastructure

Easy Token Standards

Solana offers easy-to-implement token standards like SPL Tokens (equivalent to ERC-20 on Ethereum). Developers can create tokens using just a few lines of code with tools like:

Solana CLI

Anchor framework

Solana Program Library (SPL)

This streamlines:

Token issuance

Smart contract development

Cross-platform integration

Tooling & Frameworks

Solana supports a growing suite of tools including:

Phantom Wallet and Solflare for token management

Metaplex for NFT minting and marketplaces

Anchor for secure smart contract development

Solana Pay for real-world token payments

5. Ecosystem Growth and Integrations

Solana’s expanding ecosystem plays a key role in the success of any token launched on the platform. Key pillars include:

Launchpads and Incubators

Platforms like:

Solstarter

Solanium

Solana Ventures-backed accelerators

These provide early-stage token projects with funding, exposure, and technical support.

Wallet and Exchange Support

SPL tokens are immediately compatible with all major Solana wallets, including:

Phantom

Solflare

Trust Wallet

They're also supported on centralized and decentralized exchanges such as:

Binance

Coinbase

Jupiter

Raydium

Cross-Chain Compatibility

Solana integrates seamlessly with bridging tools like Wormhole and Allbridge, enabling multi-chain token deployment and liquidity.

6. Solana vs Other Blockchains in 2025

Let’s briefly compare Solana with other leading chains: FeatureSolanaEthereumBNB ChainAvalancheTPS65,000+15–30100–3004,500Avg. Fees<$0.001$1–$50$0.10–$0.30~$0.30Confirmation Time<1 sec~15 sec~3 sec~2 secLayer-2 DependenceNoneHigh (Rollups)LowModerateDeveloper ActivityHighHighModerateModerate

Verdict: Solana offers the best balance of speed, affordability, scalability, and community in 2025.

7. Real-World Token Use Cases on Solana

A. DeFi Projects

Platforms like Marinade Finance and Drift Protocol are building high-performance DeFi apps using Solana’s composability and low-latency infrastructure.

B. Gaming Tokens

GameFi projects like Star Atlas and Aurory are leveraging Solana to power immersive, real-time token economies.

C. Real World Asset (RWA) Tokens

From tokenized real estate to AI-generated revenue shares, RWA token platforms prefer Solana due to its transaction efficiency and stable architecture.

D. AI Agent and Data Tokens

With the rise of AI + Blockchain, Solana is now the backbone for emerging projects focused on tokenized AI agents and distributed datasets due to its high-speed and on-chain compute capabilities.

8. Institutional Adoption and Regulatory Outlook

Solana’s recent partnerships with Visa, Shopify, and Stripe have further cemented its place as a mainstream blockchain. Institutions are launching compliant tokens using tools like:

Solana Foundation’s compliance SDKs

KYC/AML plug-ins via civic-pass and identity layers

The combination of enterprise-grade reliability and developer agility makes Solana attractive to serious projects in regulated industries.

9. Community and Open Governance

Solana benefits from a vibrant, global community of developers, validators, and DAO participants. Highlights include:

Solana Hacker Houses across continents

Solana Breakpoint 2025 (sold-out conference)

DAO tooling and grant programs for open-source projects

This ensures the chain remains decentralized, transparent, and community-driven.

10. How to Create a Token on Solana in 2025

Here’s a simplified roadmap for launching your token on Solana:

Define your use case – Is it utility, governance, payment, or RWA-based?

Set up a Solana wallet (Phantom, Solflare)

Create your token using Solana CLI or SPL Token program

Deploy smart contracts via Anchor or Rust

List on DEXs (Raydium, Orca) or launchpads

Promote via Solana-native marketing partners

Incentivize users via staking or airdrops

Pro tip: Work with professional token development companies to accelerate your go-to-market timeline and reduce technical risk.

Conclusion

In 2025, Solana Token development is more than just a blockchain — it's a launchpad for the future of token economies. Its lightning-fast speeds, minuscule fees, massive scalability, and expanding ecosystem make it the top choice for entrepreneurs, developers, and enterprises looking to launch innovative tokens. Whether you're building a DeFi platform, GameFi app, RWA protocol, or AI token economy, Solana provides the speed, stability, and support your project needs to thrive.

0 notes

Text

What Is a Cheque API and How Does It Simplify Payment Processing in 2025?

In the age of digital banking and real-time payments, traditional cheque processing might seem outdated. However, for many businesses, government agencies, and financial institutions, cheques are still a vital part of daily operations. In 2025, the innovation that bridges the gap between manual cheque handling and digital transformation is the Cheque API. But what exactly is a Cheque API, and how does it simplify payment processing in today's fast-paced financial landscape?

This guide explains everything you need to know about Cheque APIs, including how they work, the technology behind them, use cases, and how they streamline the cheque issuance and processing system in 2025.

What Is a Cheque API?

A Cheque API (Application Programming Interface) is a software interface that allows systems, platforms, and applications to integrate cheque printing, processing, issuing, and tracking functionalities without manual intervention.

In simpler terms, it’s a digital tool that connects your software—like an ERP system, accounting platform, or payment processor—with a third-party cheque printing and mailing service or banking system. This API enables businesses to send cheque requests directly from their application, automating the entire process from creation to delivery.

How Does a Cheque API Work?

A Cheque API works through a series of API calls and authentication protocols that allow secure transmission of cheque issuance data. Here’s a step-by-step overview of how it typically functions:

API Integration Developers integrate the Cheque API into existing systems (accounting software, payroll systems, CRM platforms).

Create a Cheque Request The user inputs cheque data (payee name, amount, memo, address, etc.), and the API structures this into a secure request.

Verification and Security Protocols Before issuing a cheque, the system verifies authentication tokens, encrypts sensitive data, and complies with regulations like PCI DSS.

Cheque Printing and Mailing The API connects with a third-party cheque printing service or bank. Cheques are printed, signed (physically or digitally), and mailed to the recipient.

Tracking and Status Updates The API provides real-time tracking of cheque delivery and clears processing statuses via webhooks or call-back functions.

Reporting and Reconciliation The system automatically logs all issued cheques for auditing, financial reporting, and reconciliation purposes.

Why Are Cheque APIs Important in 2025?

Even with the rise of instant digital payments, several industries—such as healthcare, real estate, insurance, and government—continue to rely on cheques due to regulatory compliance, vendor preferences, or the nature of high-value transactions.

Cheque APIs bring these operations into the modern digital ecosystem. They:

Eliminate manual printing and mailing.

Minimize human error.

Speed up financial operations.

Reduce operational costs.

Ensure compliance with data and financial regulations.

Key Features of Cheque APIs in 2025

Real-Time Integration Cheque APIs offer real-time connectivity with ERPs like QuickBooks, NetSuite, and Xero.

Multi-Channel Support Supports both physical (printed cheques mailed) and digital cheques (e-cheques).

Custom Branding Businesses can issue cheques with logos, watermarks, and secure templates.

Bank Account Verification The API often includes bank validation features to ensure payee data is correct before issuance.

High-Level Encryption and Compliance End-to-end encryption, secure tokenization, and compliance with NACHA, PCI-DSS, and GDPR are standard.

International Cheque Issuance Some APIs support multi-currency and international cheque delivery for global businesses.

Use Cases for Cheque APIs

1. Payroll Processing

Companies can automate payroll by integrating cheque issuance into their HR systems, delivering paycheques to employees who prefer printed versions.

2. Vendor Payments

Instead of manually writing and mailing cheques to suppliers, businesses use an API to send payment data, automating the process.

3. Refunds and Claims

Insurance providers or e-commerce platforms use cheque APIs to issue refunds, especially for customers lacking digital payment options.

4. Government Disbursements

Government agencies issue grants, pension payments, or tax refunds via cheque APIs, ensuring compliance and delivery tracking.

5. Legal Settlements

Law firms and class-action settlements often involve bulk cheque issuance, made more efficient and trackable through APIs.

Benefits of Cheque APIs in Modern Finance

✅ Speed and Efficiency

Processing times shrink from days to minutes. What used to take hours—printing, signing, and mailing—can now be done with a few clicks.

✅ Lower Operational Costs

Save on labor, materials (like printers and paper), postage, and human errors that require reprints or corrections.

✅ Audit Trails and Transparency

APIs provide detailed logs, timestamps, and digital records for every issued cheque, helping with internal audits and external compliance checks.

✅ Seamless Integration

No need to switch platforms. APIs connect with your existing financial systems and workflows, enabling end-to-end automation.

✅ Better Customer Experience

Faster refunds, accurate payouts, and real-time tracking build trust and improve customer satisfaction.

How to Choose the Right Cheque API Provider in 2025

When selecting a cheque API provider, consider:

Security & Compliance: Look for PCI-DSS, SOC 2 Type II, and ISO 27001 compliance.

Integration Options: Ensure compatibility with your tech stack (JavaScript, Python, PHP, etc.).

Customization: Ability to customize cheques with branding and templates.

Scalability: Does it support high-volume issuance and bulk processing?

Support & SLAs: Check if they offer 24/7 support and uptime guarantees.

Delivery Network: For physical cheques, assess their mailing network—local, national, or international.

Reporting & Dashboards: Real-time monitoring and data visibility.

Popular Cheque API Providers in 2025

Checkflo Offers robust API with Canada and US cheque delivery. PCI-DSS compliant.

Checkeeper Cloud-based cheque printing with API integration and same-day mailing.

PostGrid End-to-end cheque automation with API support and global mail tracking.

Melio Although known for ACH, it offers cheque mailing options for vendors.

Deluxe Payment Exchange Offers e-cheques and integrates easily with financial software.

Security and Compliance Considerations

Cheque APIs handle sensitive financial data, so security is paramount. In 2025, a reliable API must offer:

OAuth 2.0 Authentication

TLS 1.3 Encryption

Tokenization of Bank Details

Access Controls & Role-Based Permissions

Data Redundancy & Backups

Additionally, for cross-border cheques, APIs should comply with FINTRAC, AML, and KYC regulations based on jurisdiction.

Future of Cheque APIs

While digital wallets and blockchain payments are growing, cheques remain relevant in many sectors. In the coming years, expect:

AI-powered fraud detection integrated with APIs.

Blockchain-stamped cheques for enhanced traceability.

Hybrid cheques—physically printed but digitally tracked with QR codes and NFC tags.

Green APIs promoting paperless options or recycled cheque stock.

Conclusion

In 2025, the cheque isn’t dead—it’s evolved. With a Cheque API, businesses can embrace automation, reduce manual effort, and deliver cheques quickly and securely. Whether you're managing payroll, disbursing refunds, or sending legal settlements, a Cheque API simplifies the process while ensuring compliance and accuracy.

youtube

SITES WE SUPPORT

Mail & Print Letters – Wix

0 notes

Text

Why Fan Tokens Are the New Favorite Tool for Web2 Giants?

As the digital world shifts toward decentralization, Fan Tokens have emerged as a revolutionary concept—particularly for Web2 giants looking to bridge into Web3. These tokens, enabled by Asset Tokenization Companies, allow brands to unlock new levels of engagement, monetize communities, and innovate with blockchain-backed loyalty programs. This surge in interest isn't just about trend-chasing—Fan Tokens represent a meaningful evolution in how companies interact with their audiences.

What Are Fan Tokens? A Powerful Use Case of Asset Tokenization

At their core, Fan Tokens are a prime example of Asset Tokenization—the process of converting ownership rights into digital tokens on a blockchain. Leading Asset Tokenization Companies provide the infrastructure needed to build these tokens, offering fans exclusive access to experiences, merchandise, and voting rights.

Unlike traditional loyalty points or memberships, Fan Tokens are tradeable assets with real-world value. This makes them attractive not only to fans but also to companies aiming to enhance customer lifetime value. Today, many sports clubs, entertainment brands, and even tech companies are partnering with a token development company to enter this digital ecosystem.

Why Web2 Giants Are Turning to Fan Tokens

1. Deeper Community Engagement

Traditional loyalty programs feel outdated compared to the dynamic experiences enabled by Fan Tokens. Web2 giants are using Asset Tokenization services to create personalized fan journeys. From voting on new product designs to exclusive event access, tokens turn passive users into active stakeholders.

2. Monetization Opportunities

Fan Tokens offer companies a new revenue stream. By issuing a limited number of tokens, brands can generate income upfront and create a secondary market for trading. Leading Asset Tokenization Companies enable this process through smart contracts and secure blockchain platforms.

3. Building Long-Term Brand Loyalty

Through Asset Tokenization, fans now have a stake in the success of the brand. Ownership of a Fan Token can translate into long-term emotional and financial investment. Whether it's discounts, early access, or exclusive NFTs, the possibilities for fan rewards are endless.

Role of Asset Tokenization Companies in Fan Token Development

Developing Fan Tokens requires advanced blockchain infrastructure, smart contract deployment, and compliance frameworks—all of which are provided by a professional Asset Tokenization Company. These companies offer end-to-end Asset Tokenization services, ensuring everything from token issuance and management to wallet integration and marketplace support is covered.

Some of the most reputable Asset Tokenization Companies also provide consulting on how to maximize user engagement and ensure token utility. Their technology stacks often support Ethereum, BNB Chain, Polygon, and other scalable platforms to meet business demands.

Fan Tokens vs. Traditional Loyalty Systems

Traditional loyalty systems lack flexibility and interoperability. Points are often non-transferable and expire over time. Fan Tokens, on the other hand, are:

A qualified token development company can ensure your tokens adhere to ERC-20 or other token standards, making them more secure, interoperable, and appealing.

Industries Already Embracing Fan Tokens

Several industries are already seeing massive success with Fan Tokens:

All these developments are made possible through expert Asset Tokenization services provided by blockchain professionals.

The Future: Fan Tokens and Web3 Integration

As Web2 companies explore the benefits of Web3, Fan Tokens are becoming the entry point for decentralized user engagement. With a growing number of brands collaborating with a token development company, the adoption rate is expected to skyrocket in the next few years.

Whether you're a sports franchise, a tech platform, or a global brand, Fan Tokens offer a future-proof solution to community engagement and monetization. Backed by reliable Asset Tokenization Companies, the token economy is shaping the future of fan interaction.

Conclusion: Fan Tokens as a Strategic Move for Web2 Giants

In an age where customer loyalty is harder than ever to maintain, Fan Tokens offer a powerful new tool. With the help of a trusted Asset Tokenization Company, Web2 businesses can modernize their engagement strategies, offer unique value, and build brand advocates at scale.

For any business exploring the transition to Web3, investing in Asset Tokenization services and Fan Tokens is no longer optional—it's essential.

0 notes

Text

How ICO Software Powers the Future of Fundraising?

Introduction

In today's digital economy, blockchain technology has completely revolutionized capital raising for startups and commercial enterprises. The most transformative act in this space is the Initial Coin Offering (ICO), which is a decentralized fundraising that means for project owners to raise investments by issuing tokens.

If you intend to launch your own ICO platform, it is best to have an understanding of how this software operates and how it shapes a fundraising future. ICO software lays the foundation for a smooth and secure fundraising journey that is scalable, thus eliminating many barriers that exist traditionally and allowing participation worldwide.

What is ICO Software?

ICO software are specialized tools that assist businesses in conducting initial coin offerings. An ICO enables businesses to raise capital by selling their digital tokens to investors who would pay with cryptocurrencies such as Bitcoin or Ethereum. The software covers issuing tokens, managing token sales, and recording transactions. It may also be involved in maintaining security and ensuring regulatory compliance.

How does ICO Software work?

The underlying function of the software for ICO is an infrastructure for a token sale with a backend and a frontend. Here's an overview of how it works:

Token Creation

Tokens are generated by using standard protocols such as ERC-20 or BEP-20, etc. These digital assets represent rights on your platform for utility, equity, or access. Such rights form the heart of your ICO and allow for investor distribution on a seamless basis.

Smart Contract Deployment

Smart contracts carry out the automation of token issuance and transaction logic. Once they are deployed onto the blockchain, they manage the contributions, allocation of tokens, and fund terms securely to fairly restrict intermediaries so that trust may be vested into code.

User Onboarding

A secure portal conducts the registration process for investors, with KYC/AML verification in place. This step ensures that everything remains within regulatory standards and thus builds trust among investors. Therefore, it makes it easy for people to take part in it whilst maintaining legal and financial transparency.

Fundraising Begins

Following the onboarding period, the ICO goes ahead. Contributors can send crypto or fiat money in exchange for tokens. Contributions are tracked in real-time, and tokens are allocated automatically, making fundraising very clear and efficient.

Real-Time Reporting

The admin is entitled to accessing dashboards to view investor activity, total funds raised, and token distribution. Analytics from this tool provide real-time insights into campaign performance to equip one with data-driven decision-making channels and maintain transparency with stakeholders.

Post-ICO Management

After the ICO, the software administers all subsequent token allocations, unlocking schedules, liquidity planning, and project updates. This phase maintains long-term investor engagement while coordinating a smooth transition into product development or exchange listing.

Rise of ICO as fundraising mechanism

In the year 2017, Ethereum and EOS with their token sales emphasized the perspective of token-based fundraising as a lucrative avenue. Instead of raising funds through venture capital, ICOs have their appeal in aesthetics of decentralization, speed from the borderless world, and other features. Hence with the thought passing of time, the ecosystem increasingly gets into regulatory frameworks and, subsequently, attains better investor protection mechanisms. Here are some reasons:

No Intermediaries - Direct fundraising without banks or VCs

Global Reach - Access to international investors

Programmable Fundraising - Releases funds automatically according to milestones

Token Utility - Investors get immediate access to tokens with actual use-cases

Building Communities - Tokens encourage early adopters to participate

To efficiently provide these benefits, the ICO software offers a scalable, secure, and transparent infrastructure.

Future of ICO Software in Fundraising

The development of ICO software is mostly constrained by the advancement of technology and the changing expectations of users as Web3 takes shape. In recent times, the new wave of fundraising platforms have been developed around:

Cross-Chain Compatibility

The new ICO software platforms support multi-chain functionality and will permit token launches on Ethereum, Solana, Polygon, and practically every other blockchain simultaneously.

Decentralized Fundraising Tools

The line between ICO and DeFi is blurring. Future platforms will incorporate DEX listings, liquidity pools, and DAO voting systems as part of the token life cycle.

AI-Powered Investor Analytics

Advanced analytics help project owners optimize campaign performance, segment investors, and tailor particular communication based on AI.

Compliance by Design

Besides increasing global scrutiny, ICO software is changing to encompass RegTech modules for GDPR compliance, SEC-friendly token classifications, and smart audit trails.

Gamified Participation

Rewards, staking, NFT incentives, and airdrops will become some of the native features of the ICO launchpads, which will, in turn, incentivize community engagement and token adoption.

Choosing the Right ICO Software

Choosing the right ICO software basically involves weighing diverse components based on the particular requirements of the project and the capabilities of the software itself. Few factors to bear in mind are:

Customizations

Security

KYC/AML Modules

Scalability

Multi-Currency Support

Post Launch Services

Conclusion

ICO software has changed the way capital is raised from blockchain projects: Now, a one-frame system allows for a streamlined process ensuring agility, safety, and worldwide outreach. As a startup or an enterprise entering the node of the blockchain, a strong ICO platform stands for a strategic advantage beyond comparing. Use the latest innovations, features, and blockchain to launch your token and interact with the international investor network. Fundraising in the future will be decentralized, while ICO software is essentially the heart of that process.

0 notes

Text

DGQEX Evaluates Stablecoin Evolution, Builds Scalable Digital Trading Infrastructure

Recent reports indicate that London-based fintech company Revolut is advancing plans to issue its own stablecoin, with services spanning 160 countries and reaching over 55 million individual users and 500,000 business clients. This move underscores the ongoing expansion of non-crypto-native institutions into the on-chain asset space. DGQEX has already established a stablecoin standards adaptation framework to address the trend of asset tokenization by digital banks and traditional financial platforms, deploying compatibility strategies across both the matching and clearing layers.

Building a Stablecoin-Compatible Foundation for Diversified Asset Onboarding

The previously launched RevolutX platform by Revolut already provides digital asset trading services within the EU, and this exploration into stablecoin issuance marks a significant milestone in its Web3 strategic roadmap. DGQEX has implemented unified technical specifications for stablecoin integration, supporting mainstream issuance standards such as ERC20, BEP20, and Solana SPL at the platform contract layer. The system can automatically recognize and map relationships during trade matching, enabling low-slippage conversions between different stablecoins.

DGQEX has designed a custom matching pool system for stablecoin assets, allowing rapid liquidity provisioning for newly issued fiat-pegged tokens. The platform also supports two-way matching between stablecoins and major crypto assets, enabling new institution-issued stablecoins to participate directly in mainstream trading markets and enhancing the overall circulation efficiency within the on-chain ecosystem.

Deploying On-Chain Risk Controls to Ensure Secure Trading of New Stablecoins

As stablecoins become a critical component of global transaction and payment infrastructure, DGQEX has strengthened compliance reviews and smart contract audits for newly issued stablecoins. The platform features a multidimensional asset security rating system that assesses stablecoins based on collateral models, issuance mechanisms, and third-party audit data, providing users with risk alerts and credit ratings during stablecoin transactions.

DGQEX has introduced an on-chain transaction limit module, dynamically adjusting trading volumes and frequencies for newly listed stablecoin assets to prevent sharp volatility caused by insufficient market depth or weak trust foundations. The platform also offers transparent on-chain position tracking, allowing users to monitor the circulation and collateral status of specific stablecoins in real time, thereby enhancing user trust and decision-making during trading.

Enhancing Technical Openness and Enabling Multi-Institution Asset Integration

Against the backdrop of global financial institutions accelerating their deployment of cryptocurrency and stablecoin initiatives, DGQEX has established an API system for institutional partners. This system allows fintech platforms like Revolut to quickly access the platform trading depth and matching logic via standardized interfaces, facilitating efficient integration between multi-institution assets and native crypto assets.

DGQEX continues to expand its multi-chain trading compatibility, having launched atomic swap and cross-chain bridge mechanisms to support cross-chain stablecoin issuance scenarios. This ensures the platform can accommodate multiple asset-pegging sources while maintaining transaction speed and asset security. The platform architecture enables dynamic integration of multiple asset verification sources and synchronizes price signals via on-chain oracle systems, equipping DGQEX to handle future tokenization initiatives by non-crypto-native institutions.

In response to the Revolut stablecoin plans, DGQEX is optimizing both platform compliance and technical capacity, providing users with a stable, compliant, and secure trading gateway amid the accelerating globalization of stablecoins. DGQEX will continue to extend its capabilities in cross-chain matching, liquidity aggregation, and risk control auditing, ensuring robust support for the ongoing evolution of stablecoin asset layers.

0 notes

Text

Navigating Regulatory Compliance in Web3: What Projects Need to Know

The Web3 space is exciting, fast-moving, and brimming with innovation. But beneath the surface of decentralized apps, NFTs, and smart contracts lies a growing challenge: regulatory compliance.

As governments and institutions race to catch up with the evolution of blockchain, Web3 projects must take proactive steps to stay on the right side of the law. Because in today’s world, compliance isn’t just a checkbox — it’s key to staying in business.

Why Compliance Matters More Than Ever

In traditional industries, compliance is deeply embedded in daily operations. The regulations are clear on everything from financial transparency to data protection. However, in Web3, things are more nuanced. But in Web3, things aren't so black and white.

Since Web3 operates across borders and often outside centralized control, jurisdictional ambiguity can make it difficult to know which laws even apply. But that doesn't mean compliance is optional — in fact, regulators are watching more closely than ever.

In the U.S., the SEC has begun cracking down on what it views as unregistered securities in the form of tokens.

Countries like India and Singapore are also ramping up regulations around KYC/AML and data privacy in decentralized systems.

If your project deals with token issuance, smart contracts, DAOs, crypto wallets, or DeFi tools, you’re on the radar.

The Risks of Non-Compliance

It’s easy to assume that decentralized equals untouchable — but regulators have already shown that they can pursue Web3 teams, even if the tech is permissionless.

Here’s what non-compliance can cost you:

Legal action or shutdowns of your platform

Fines or financial penalties

Loss of trust among users and investors

Delisting from exchanges

Stalled growth due to reputational damage

At a time when Web3 companies are fighting for mainstream adoption, compliance isn’t a roadblock — it’s a bridge to scale responsibly.

Common Regulatory Touchpoints for Web3 Projects

Here are the major areas Web3 founders and teams should keep a close eye on:

Know Your Customer (KYC) and Anti-Money Laundering (AML) – verifying customer identities and preventing illegal financial activities.

Even in decentralized finance, identity checks are becoming standard. If your platform facilitates trades, swaps, or staking, you may need to verify users and implement AML practices.

2. Token Classification

Is your token a utility, security, or governance asset? The answer can determine whether you're subject to securities laws — and getting this wrong can attract regulatory heat.

3. Smart Contract Transparency

Smart contracts must not only be secure — but auditable. Regulators are beginning to expect clear documentation, external audits, and failsafe mechanisms for consumers.

4. Data Privacy and Protection

Does your dApp collect or store user data? If yes, you may fall under GDPR or similar data protection laws — even if the data is decentralized.

5. Cross-Border Operations

Your compliance needs to be worldwide if your users are. Each region may have vastly different rules, and legal exposure can come from any user jurisdiction.

How NetObjex Helps You Stay Ahead

At NetObjex, we recognize that the intersection of compliance and innovation is where modern Web3 projects thrive — or falter.

Our Compliance & Vulnerability Management services are tailored for blockchain-based businesses. We help with:

End-to-end regulatory assessments to ensure you're audit-ready

Smart contract vulnerability scanning and code audits

Personalized compliance plans in line with changing international laws

Ongoing threat monitoring for both compliance and security concerns

We're not here to slow down your innovation — we’re here to protect it.

The Future of Compliance in Web3

Web3 was born from a desire to move beyond legacy systems. But ironically, its long-term success depends on responsible infrastructure — and that means working with regulation, not against it.

We’re entering a new phase where decentralized tech will coexist with structured oversight. The winners will be those who build future-proof platforms that are secure, scalable, and compliant.

Final Thoughts

Whether you're minting NFTs, launching a DAO, or running a decentralized exchange, ignoring compliance is no longer an option. It’s not about limiting your potential — it’s about unlocking it safely.

At NetObjex, we help you navigate this changing landscape so you can keep building — with confidence.

Ready to audit your compliance posture? Let's talk.

Get in touch with us today

#24/7 threat monitoring services#compliance and vulnerability management#cybersecurity risk assessment and audit#end-to-end cybersecurity solutions#fractional ciso#managed security operations center

0 notes

Text

GENIUS Act Passes U.S. Senate: A New Era of Stablecoin Regulation Begins

#GENIUS #US #Crypto

The world has been anything but quiet lately — wars, policies, summits. The Middle East is in turmoil, shaking the crypto market along with it. Fortunately, the market quickly digested the shock. If this geopolitical unrest was just a brief “interlude” in crypto’s broader journey, then the U.S. Senate’s approval of the stablecoin regulation bill — the GENIUS Act — has truly ignited the crypto space.

According to the Associated Press, on June 17, the U.S. Senate passed the GENIUS Act with 68 votes in favor and 30 against. The bill now moves to the House of Representatives, increasing pressure to shape the next phase of the country’s digital asset regulatory effort. The act establishes a federal regulatory framework for stablecoins, requiring 1:1 reserves, consumer protections, and anti-money laundering mechanisms.

At first glance, this may seem like a win for regulatory order. But behind the legislation lies a complex web of political interests. From the potential conflicts of interest involving the President’s family to the reshaping of industry dynamics and the new thresholds for stablecoin issuance, the GENIUS Act — by name alone — is unlikely to have a quiet path forward.

Click to register SuperEx

Click to download the SuperEx APP

Click to enter SuperEx CMC

Click to enter SuperEx DAO Academy — Space

What Exactly Is in the GENIUS Act?

GENIUS stands for “Gaining Essential National Interest Using Stablecoins Act,” aiming to create a unified, federal-level framework for stablecoin regulation.

The act is not a spontaneous proposal — it stems from years of market evolution and growing risks. The stablecoin market cap has surpassed $160 billion. USDT and USDC have become key instruments for trading, clearing, and DeFi liquidity. Yet problems have mounted: lack of reserve transparency, unclear governance structures, and inconsistent standards across states.

With the passage of GENIUS, the U.S. is shifting from “regulatory silence” to a defined framework, and from fragmented management to nationwide consistency.

Dissecting the GENIUS Act: 5 Key Provisions

Let’s break down the core components of the bill:

1. Establishing a Federal Regulatory Framework

Stablecoin issuance will fall under the supervision of federal financial institutions such as the Office of the Comptroller of the Currency (OCC) or the Federal Reserve. In other words, issuing stablecoins will no longer be a free-for-all — it will require a proper “digital dollar license,” much like banks need charters.

2. 1:1 Reserve Requirement

Stablecoins must be backed 1:1 by high-liquidity assets such as USD, U.S. Treasuries, or cash. Volatile assets like crypto, stocks, or derivatives are banned as reserves. This favors issuers like USDC (which already holds significant U.S. Treasuries) and challenges hybrid-asset models.

3. Mandatory Audits and Transparency

Issuers must regularly disclose reserve composition to the public and regulators, and submit to third-party audits. This builds trust and curbs shadow banking risks.

4. AML and KYC Compliance

All stablecoin issuance and circulation must adhere to U.S. anti-money laundering (AML) and know-your-customer (KYC) standards. This may restrict anonymity in DeFi, but also clears the path for institutional capital.

5. Consumer Protection and Emergency Protocols

Issuers must establish mechanisms to handle extreme events — like mass redemptions or depegging. Though not introducing FDIC insurance, this hints at an early model of systemic safeguards.

6. Federal vs. State Jurisdiction

While federal rules take precedence, states will retain limited autonomy to license local stablecoin issuers.

Notably, the act does not prohibit government officials or their families from directly or indirectly profiting from stablecoin issuance — a flashpoint for Democratic opposition. Public records show Trump-affiliated businesses made over $57 million in token sales via the World Liberty Financial project last year, prompting accusations that “legislation has become a family revenue stream.”

Why Now? 3 Forces Driving GENIUS Forward

1. Global Competition is Heating Up

The EU passed its MiCA framework, and Asia (Singapore, Hong Kong) is building licensing systems. Without action, U.S. dollar stablecoins risk losing dominance to “regulated eurocoins” or “compliant HKD coins.”

2. Too Many Black Swan Events

From Terra’s collapse in 2022, to USDC’s SVB depeg and Tether reserve controversy — recent history has revealed systemic risks. GENIUS is a structured response to those failings.

3. Institutions Need Regulatory Clarity

Institutional investors have long eyed the stablecoin sector but held back due to unclear compliance costs. This bill lays the groundwork for capital inflow.

Three Types of Players That Will Be Reshuffled

1. Compliant Stablecoin Issuers Will Thrive

Projects like Circle (USDC) and Paxos (USDP), which already emphasize transparency and regulation, will benefit. They may gain formal recognition and become go-to partners for banks, payments, and platforms like Apple Pay, Visa, or SWIFT.

2. Offshore Stablecoins May Be Marginalized

Tether (USDT), despite its market cap lead, faces transparency issues. With GENIUS in place, U.S. users and platforms will prefer compliant options, driving offshore coins out of exchanges and payment systems. Expect regional segmentation: USDT for APAC & MENA; USDC for U.S. and Europe.

3. DeFi/GameFi Projects Will Face an Identity Shift

Most DeFi platforms currently lack KYC infrastructure. If on-chain assets must be compliant, protocols will need to integrate identity filters and risk modules. Many will roll out “Pro” or “Institutional” versions to meet GENIUS requirements.

What Comes Next? 3 Likely Trends

1. RegTech Will Boom

Compliance tech — identity, on-chain risk control, real-time audits — will be in high demand. Firms like Chainalysis, TRM Labs, and Blockpass are poised to grow.

2. A Wave of Stablecoin Migration

Platforms like Coinbase, Kraken, and Robinhood will shift entirely to compliant stablecoins. Expect delistings of non-compliant coins and capital flowing toward regulated liquidity pools.

3. Banks and Stablecoins Will Converge

Expect Citibank, JPMorgan and others to issue or custody stablecoins. This will bridge the gap between traditional banking and crypto, ushering in the true “digital dollar.”

Final Thoughts

For the stablecoin industry, the GENIUS Act is not repression — it’s regulatory empowerment. Its passage marks a turning point: from lawlessness to legitimacy.For issuers, it’s a compliance challenge.For users, it’s a trust restoration.For the entire industry, it’s a historic opportunity.

0 notes

Link

#AssetTokenization#capital-efficiency#ComplianceInnovation#Cross-BorderFinance#DigitalBonds#institutionalblockchain#Layer-2Solutions#regulatorysandbox

0 notes

Text

Best Real World Asset Tokenization Companies in 2025

The world of finance is shifting gears, and at the heart of this transformation is real world asset tokenization. In 2025, this tech-forward movement is revolutionizing how we invest in physical assets, offering liquidity, transparency, and global access. But with a booming industry comes a crucial question—who are the Best Real World Asset Tokenization Companies in 2025?

This guide dives deep into the companies that are setting the gold standard this year.

Introduction to Real World Asset Tokenization

What is Asset Tokenization?

Let’s break it down. Asset tokenization is the process of converting ownership of tangible assets—like real estate, art, or commodities—into digital tokens on a blockchain. These tokens represent fractional ownership, which can be traded, bought, or sold.

Imagine owning a piece of the Eiffel Tower (hypothetically) or a fraction of a Picasso painting. With tokenization, that’s not just a dream—it’s a tangible investment reality.

Why Tokenize Real World Assets?

The benefits are massive. Tokenization:

Increases asset liquidity

Reduces transaction fees

Enhances transparency

Offers global access to investment opportunities

This is why the Best Real World Asset Tokenization Companies are in high demand.

Growth of Real World Asset Tokenization in 2025

Market Expansion and Institutional Adoption

2025 marks a turning point. Institutional players, including major banks and asset managers, are fully onboard. The global tokenized asset market is expected to reach trillions in value. This explosive growth demands robust, compliant platforms—exactly what the Best Real World Asset Tokenization Companies in 2025 provide.

Key Trends in 2025

Cross-chain interoperability

On-chain compliance and KYC

Tokenized bonds and real estate REITs

Yield-generating tokenized assets

Criteria for Evaluating Tokenization Companies

Before we spotlight the Best Real World Asset Tokenization Companies, let’s understand what makes a company best-in-class.

Regulatory Compliance

The best firms follow jurisdictional laws to the letter. Without proper licenses, tokenized assets won’t fly.

Security and Transparency

Blockchain security protocols and full auditability are essential for user trust.

Platform Flexibility and Integration

Can the platform handle multiple asset classes? Does it integrate with wallets, exchanges, and banking systems?

Best Real World Asset Tokenization Companies in 2025

Here’s our handpicked list of the Best Real World Asset Tokenization Companies in 2025 that are leading innovation and compliance.

1. Shamla Tech

Overview and Core Offerings

Shamla Tech is a pioneer in the space, offering compliant token issuance, secondary trading, and investor onboarding tools. Backed by Coinbase and SoftBank, they cater to both institutional and retail investors.

Why It Stands Out in 2025

Shamla Tech continues to dominate as one of the Best Real World Asset Tokenization Companies by expanding its infrastructure and tokenizing everything from real estate to credit products.

2. Polymesh

Overview and Features

Polymesh is a security token-specific blockchain, built from the ground up to meet regulatory standards. Its identity-based chain ensures compliance and control at every level.

Institutional Grade Compliance

Polymesh is perfect for high-value asset tokenization projects in banking and finance, making it one of the Best Real World Asset Tokenization Companies in 2025.

3. Tokeny

Asset Coverage and Blockchain Support

Headquartered in Luxembourg, Tokeny supports tokenization of real estate, venture capital, and private equity across Ethereum and Polygon.

Ecosystem Expansion in 2025

Tokeny partners with governments and major financial institutions, pushing it into the top tier of the Best Real World Asset Tokenization Companies.

4. tZERO

Integration with Traditional Finance

tZERO brings Wall Street to Web3. As a regulated ATS (alternative trading system), it allows the trading of digital securities while complying with the SEC.

Innovations and Achievements

In 2025, tZERO’s integration with legacy finance systems makes it a powerhouse—earning its spot as one of the Best Real World Asset Tokenization Companies in 2025.

5. Ondo Finance

Tokenizing Treasury and Yield Products

Ondo is taking the world by storm with tokenized U.S. Treasuries and other yield-bearing products.

Unique Value Proposition

By making yield accessible on-chain, Ondo is not just innovative—it’s transforming the DeFi/RWA narrative, solidifying its status as one of the Best Real World Asset Tokenization Companies.

Rising Stars in Tokenization

Not all stars shine the same. Some are emerging fast.

RedSwan CRE

Specializing in commercial real estate, RedSwan enables fractional ownership in multi-million-dollar properties.

Mattereum

Mattereum merges IoT and legal smart contracts to bring physical verification to digital assets.

Both are gunning for a top spot in the list of Best Real World Asset Tokenization Companies in 2025.

Use Cases of Asset Tokenization in 2025

Real Estate

Tokenization allows investors to own a fraction of luxury buildings or rental income streams.

Private Equity

Startups can raise funds without going public, offering tokens instead of shares.

Commodities and Art

Gold, silver, diamonds, and fine art are being converted into tradable digital tokens.

Challenges Facing the Industry

It’s not all sunshine. Even the Best Real World Asset Tokenization Companies in 2025 face hurdles.

Legal Complexity Across Jurisdictions

Each country has different laws. Navigating global compliance is complex.

Interoperability Between Chains

Different blockchains don’t always talk to each other. Cross-chain operability is still evolving.

The Future of Tokenized Assets

The Road Ahead for 2026 and Beyond

Expect:

AI-powered asset management

Fully on-chain compliance systems

Broader token adoption among Gen Z investors

The future is decentralized—and tokenized.

Conclusion