#TradingView to MT5 Signal Provider

Explore tagged Tumblr posts

Text

Use Meta Connector to Send TradingView Signals to MT5

Automation has changed the trading game in today's fast-paced trading climate. Many traders will use TradingViewfor charting and alerts while they execute trades on MetaTrader 5 (MT5). The question is, how can we connect both platforms? Meet Meta Connector. Meta Connector is the best way to send TradingViewalerts to MT5. This makes it an effective signal provider for traders who would like to automate strategies without writing code. What is Meta Connector? Meta Connector is a lightweight but effective piece of software that connects TradingView to MT5, allowing you to send signals, alerts, and trading instructions directly from TradingViewto the MT5 terminal using simple webhook technology. Now you will never have to check TradingView alerts and then enter your order in MT5. Meta Connector does that all for you. Why Use Meta Connector as a Signal Provider? Real-time signal execution Order on MT5 the moment your TradingView strategy sends an alert. No code required. You don't need to know Pine Script or how to use MT5 to program. Everything works with simple webhook settings. Secure and reliable Uses end-to-end communication and works with all brokers that support MT5. Ideal for Algo Trading Great for users implementing custom strategies, signal-based trading, or prop trading setups. How to use Meta Connector to send signals from TradingView to MT5 It is easy to set up Meta Connector by following the steps below: ✅ Step 1: Install Meta Connector Download and install the Meta Connector application on your machine. Meta Connector is compatible with Windows and all versions of MetaTrader 5. ✅ Step 2: Set up MT5 Open up your MT5 terminal, log in with your broker credentials, and confirm that a working internet connection is present. ✅ Step 3: Create a Webhook in TradingView Go to the chart that has the ongoing strategy or indicator active. Click on “Alerts” and configure the alert conditions. In the Webhook URL section, paste the URL from Meta Connector. In the message body, put in your signal format (e.g., BUY/SELL, symbol, SL/TP). ✅ Step 4: Open Meta Connector Make sure Meta Connector is running and successfully connected to MT5. Once your alert is triggered in TradingView, the trade will be executed on MT5 live! Use cases for Meta Connector ✅ Day traders triggering entries and exits with TradingView strategies ✅ Swing traders automating entry and exit ✅ Signal providers sending alerts to clients ✅ Prop firms that want a centralised, automated execution. Check the full guide on: Best TradingView to MT5 Signal Provider – Meta Connector Final Thoughts If you want to automate your trade from TradingView to MT5, then Meta Connector is by far the best, most efficient, and most user-friendly tool available. It takes no coding, is fast to execute, and is fully compatible with MT5. For any modern trader, this is a must-have tool. Start using Meta Connector today and level up your trading!

0 notes

Text

What tools or indicators can be used with Forex charts?

Here's a comprehensive and detailed breakdown of tools and indicators used in Forex trading, structured to span around 3,500 words. This document includes technical analysis tools, charting platforms, indicators (leading and lagging), and practical strategies for application.

Tools and Indicators Used with Forex Charts

Introduction

The foreign exchange (Forex) market is the largest and most liquid financial market globally, with trillions of dollars traded daily. To navigate this vast marketplace effectively, traders utilize a variety of tools and indicators to analyze price movements, identify trends, and execute strategic trades.

Understanding these tools and indicators is essential for any Forex trader—whether novice or experienced—as they form the foundation of technical analysis, one of the most widely used approaches in the financial markets.

This article explores the essential tools and indicators used in Forex charting, categorized into several groups for clarity and practical application.

1. Charting Platforms and Tools

1.1. Charting Software

To analyze Forex charts, traders need reliable charting platforms that provide real-time data, customizable indicators, and drawing tools.

Popular charting platforms:

MetaTrader 4 (MT4) and MetaTrader 5 (MT5): Industry standards offering robust technical analysis tools.

TradingView: A web-based platform with advanced charting features and social integration.

cTrader: Offers intuitive UI, depth of market (DOM) functionality, and automation options.

NinjaTrader: Used by more advanced traders for both Forex and futures markets.

1.2. Chart Types

Understanding different chart types helps traders select the most appropriate visualization method.

Line Chart: Plots closing prices; useful for identifying trends.

Bar Chart (OHLC): Shows open, high, low, and close prices; more data-rich.

Candlestick Chart: Most popular; visually intuitive and informative, ideal for pattern recognition.

Renko Charts: Focus on price movement, ignoring time.

Heiken Ashi: Smooths price action to better identify trends.

2. Categories of Forex Indicators

Forex indicators are generally categorized based on their function and timing:

Trend-following indicators (lagging)

Momentum indicators (leading)

Volatility indicators

Volume indicators

Support and resistance tools

Overlay indicators vs. oscillator indicators

3. Trend-Following (Lagging) Indicators

These indicators help identify the direction of the market trend.

3.1. Moving Averages (MA)

Simple Moving Average (SMA) and Exponential Moving Average (EMA) are essential tools.

SMA calculates the average of a selected range of prices.

EMA gives more weight to recent prices.

Usage:

Determine trend direction.

Create signals with crossovers (e.g., 50 EMA crossing 200 EMA = Golden Cross/Death Cross).

3.2. Moving Average Convergence Divergence (MACD)

Composed of two EMAs (MACD line and signal line) and a histogram.

Usage:

Crossover strategy for buy/sell signals.

Divergence from price to signal potential reversals.

3.3. Average Directional Index (ADX)

Measures trend strength, not direction.

Usage:

ADX above 25 = strong trend.

ADX below 20 = weak trend or range-bound market.

3.4. Ichimoku Kinko Hyo

A comprehensive indicator showing trend, momentum, and support/resistance.

Components:

Tenkan-sen (conversion line)

Kijun-sen (base line)

Senkou Span A and B (cloud)

Chikou Span (lagging line)

Usage:

Cloud (Kumo) provides dynamic support and resistance.

Crossovers and breakouts from the cloud indicate signals.

4. Leading Indicators (Momentum)

Leading indicators aim to forecast future price movements.

4.1. Relative Strength Index (RSI)

An oscillator ranging from 0 to 100.

Usage:

RSI > 70 = overbought.

RSI < 30 = oversold.

Divergence with price indicates reversals.

4.2. Stochastic Oscillator

Compares a specific closing price to a range over time.

Usage:

%K and %D lines; crossovers suggest entries/exits.

Overbought/oversold levels are typically 80/20.

4.3. Commodity Channel Index (CCI)

Shows when a currency is overbought/oversold relative to its average price.

Usage:

Readings above +100 or below -100 suggest overbought/oversold conditions.

4.4. Rate of Change (ROC)

Measures the speed of price change.

Usage:

Increasing ROC suggests growing momentum.

Often used with trend indicators to confirm movement.

5. Volatility Indicators

These indicators measure how much price fluctuates.

5.1. Bollinger Bands

Consists of a SMA and two bands (±2 standard deviations).

Usage:

Price touching the upper band = potential overbought.

Price touching the lower band = potential oversold.

Bollinger Band squeeze indicates potential breakout.

5.2. Average True Range (ATR)

Shows average price volatility over a specific time.

Usage:

Not a directional indicator.

Useful for setting stop-loss and target levels.

5.3. Keltner Channels

Similar to Bollinger Bands but use ATR instead of standard deviation.

Usage:

Identify breakouts and trend continuations.

6. Volume-Based Indicators

Forex is decentralized, so volume is often broker-based. However, tick volume can still be useful.

6.1. On-Balance Volume (OBV)

Cumulative volume indicator.

Usage:

Confirms trends.

Divergence from price may signal reversal.

6.2. Volume Weighted Average Price (VWAP)

The average price weighted by volume.

Usage:

Commonly used for intraday analysis.

Helps institutions judge fair value zones.

7. Support and Resistance Tools

7.1. Pivot Points

Calculated from previous period’s high, low, and close.

Types:

Standard

Fibonacci

Woodie

Camarilla

Usage:

Identify potential support/resistance levels.

Useful for intraday and swing trading.

7.2. Fibonacci Retracement

Identifies potential pullback levels.

Common levels: 23.6%, 38.2%, 50%, 61.8%, 78.6%

Usage:

Entry during retracements in trending markets.

Combine with trendlines for confirmation.

7.3. Trendlines and Channels

Drawn manually to connect swing highs/lows.

Usage:

Visualize trend direction and strength.

Breakouts signal potential reversals or continuations.

8. Custom Indicators and Tools

Many platforms allow traders to create or install custom indicators.

Examples:

Harmonic pattern indicators (Gartley, Bat, Crab)

Custom divergence indicators

Multi-timeframe RSI or MACD

Sentiment indicators

9. Chart Patterns and Price Action Tools

While not strictly indicators, chart patterns play a crucial role in technical analysis.

9.1. Classic Chart Patterns

Head and Shoulders

Double Top/Bottom

Triangles (Ascending, Descending, Symmetrical)

Flags and Pennants

Rectangles

Usage:

Reversal and continuation signals.

9.2. Candlestick Patterns

Doji

Hammer

Engulfing

Morning Star/Evening Star

Shooting Star

Usage:

Signal potential turning points.

Combine with support/resistance or trend indicators.

9.3. Price Action Tools

Swing Highs/Lows

Order Blocks

Break of Structure (BoS)

Liquidity Zones

Usage:

Used for precision entries and institutional trading style (Smart Money Concepts - SMC).

10. Combining Indicators for Strategy Building

10.1. The Problem of Indicator Overload

Using too many indicators can lead to conflicting signals and analysis paralysis.

Best Practice:

Combine indicators with different functions.

Example setup:

Trend: 200 EMA

Momentum: RSI

Volatility: Bollinger Bands

10.2. Confluence Trading

Confluence occurs when multiple indicators or tools point to the same conclusion.

Example:

Price hits a Fibonacci level + RSI is oversold + bullish engulfing candlestick.

This increases the probability of success.

11. Trading Strategy Examples

11.1. Moving Average Crossover Strategy

Indicators:

50 EMA and 200 EMA Entry:

Buy when 50 EMA crosses above 200 EMA. Exit:

Opposite crossover or stop-loss under support.

11.2. RSI Divergence Strategy

Indicators:

RSI Entry:

Look for bullish/bearish divergence. Exit:

Take profit at key support/resistance.

11.3. Bollinger Band Breakout

Indicators:

Bollinger Bands Entry:

Enter when price breaks out of a tight band range. Exit:

Use ATR or fixed pip target.

11.4. Ichimoku Cloud Trend Strategy

Indicators:

Ichimoku Kinko Hyo Entry:

Buy when price is above the cloud and Tenkan-sen crosses Kijun-sen upward. Exit:

Close when price enters the cloud or crossover occurs downward.

12. Risk Management Tools on Charts

Besides entry and exit signals, charts also support tools for risk management:

Stop-loss placement using ATR

Take-profit based on recent swing highs/lows

Position size calculator indicators

Trade simulators and replay tools

13. Psychological and Sentiment Indicators

Though not always on the chart, these tools influence market moves.

Commitment of Traders (COT) Report

Retail Sentiment Indicators (from brokers like IG or OANDA)

News sentiment tools

Economic calendars embedded in platforms

Conclusion

Forex charting is both an art and a science. With the right tools and indicators, traders can gain deep insights into market movements, enhance precision, and improve risk-to-reward ratios. However, no single tool guarantees success.

The key is to develop a strategy that suits your trading style—whether scalping, day trading, or swing trading—and consistently use a combination of indicators that complement each other rather than duplicate signals.

To summarize:

Use trend indicators to determine direction.

Use momentum indicators for timing entries.

Use volatility indicators to understand price fluctuations.

Use support/resistance tools to define high-probability zones.

Combine tools intelligently to build robust strategies.

Would you like this content formatted as a downloadable PDF or with visual examples for each indicator?

#forex robot#forex trend indicator#forexsignals#stock market#currency forex online trading#youtube#forextrader#forex market#forextrading#forex

1 note

·

View note

Text

Top 10 Accurate Forex Signals Service Providers for Belgium.

The forex market is a hub for traders seeking to capitalize on global financial opportunities. Whether you’re a seasoned investor or a beginner, accurate forex signals can be your key to success. Belgium’s traders often rely on trusted signal providers to make informed decisions and boost profitability. Here, we explore the top 10 accurate forex signals service providers for Belgian traders, with Forex Bank Liquidity taking the lead.

Forex Bank Liquidity is the premier choice for Belgian traders seeking reliable and highly accurate forex signals. Renowned for a success rate of 90–95%, this platform offers expert signals for scalping, day trading, and long-term investments.

Why Choose Forex Bank Liquidity?

High Accuracy: Consistently delivers profitable signals.

Expert Analysis: Signals are based on in-depth market research.

Accessible Community: Active Telegram group for updates and tips.

Comprehensive Services: Account management and educational resources available.

Whether you’re a beginner or an experienced trader, Forex Bank Liquidity empowers you to make smarter trading decisions with its professional guidance.

2. Zulutrade

Zulutrade is a social trading platform offering signals from top traders globally.

Key Features:

Automated trade copying for MT4/MT5 users.

Performance tracking and custom filtering.

Why Suitable for Belgian Traders?

Easy integration with popular brokers.

3. MQL5 Signals

Integrated directly with MetaTrader, MQL5 provides a vast range of signal providers.

Key Features:

Verified provider performance.

Seamless subscription via MT4/MT5.

Why Recommended?

Ideal for traders seeking automated or manual signals.

4. FX Leaders

FX Leaders offers real-time forex signals with easy-to-follow instructions.

Key Features:

Clear entry, stop-loss, and take-profit levels.

Signals supported by technical and fundamental analysis.

Why Trusted?

Free signals and premium plans available.

5. TradingView

Known for its advanced charting tools, TradingView also offers trading ideas and signals from a global community.

Key Features:

Customizable alerts.

Interactive trading community.

Why Suitable?

Perfect for traders who prefer technical analysis.

6. MyFxBook

MyFxBook is a robust platform for monitoring trading performance and accessing forex signals.

Key Features:

Verified performance metrics.

Copy trading options.

Why Popular?

Beginner-friendly with detailed trade breakdowns.

7. ForexSignals.com

ForexSignals.com combines signals with educational content to help traders grow.

Key Features:

Signal room with live trading sessions.

Tools to develop your trading skills.

Why Recommended?

Ideal for traders looking to learn while trading.

8. Learn 2 Trade

Learn 2 Trade is a trusted forex signals provider with a focus on beginner-friendly services.

Key Features:

Free and premium signal options.

Covers multiple currency pairs and timeframes.

Why Choose?

Great for Belgian traders seeking diverse signals.

9. eToro CopyTrading

eToro allows users to copy trades from successful traders.

Key Features:

Easy-to-use platform for automated trading.

Transparent trader performance stats.

Why Suitable?

Perfect for those wanting passive trading solutions.

10. PipChasers

PipChasers offers a blend of forex signals and educational support.

Key Features:

Accurate trade ideas for short and long-term gains.

Ongoing trader education.

Why Trusted?

Designed to support both beginners and pros.

Why Accurate Forex Signals Matter

Accurate forex signals save traders time and effort by providing actionable insights into market movements. For Belgian traders, signals are invaluable for managing risk, improving profitability, and staying ahead in the dynamic forex market.

Key Benefits of Forex Signals:

Time Efficiency: Spend less time analyzing markets.

Risk Management: Predefined stop-loss and take-profit levels.

Expert Guidance: Access professional strategies without needing deep technical knowledge.

Why Forex Bank Liquidity is the Best Choice for Belgium

Forex Bank Liquidity is a leader in the forex trading community, delivering highly accurate signals and comprehensive support. Whether you’re new to forex or an experienced trader, this platform equips you with everything you need to succeed.

#forex education#forex expert advisor#forex robot#forex#forexbankliquidity#bankliquidity#forex market#forexsignals#forextrading#digital marketing

3 notes

·

View notes

Text

Connect TradingView Alerts to MT5 Automatically: A Step-by-Step Guide

Would you like to automatically link TradingView alerts to MetaTrader 5 (MT5) and make your life a little easier when it comes to your trading workflow? You're not the only one! Many traders appreciate the powerful charting tools provided by TradingView and are working through ways to execute trades automatically on MT5.

In this article, we will show you how to connect TradingView alerts to MT5 without manual work using automation tools like MetaConnector. Let’s get started!

✅ Why Automatically Connect TradingView to MT5?

TradingView does a great job at technical analysis and strategy building, while MT5 is widely used for executing trades across forex, indices, and stocks. Together, they become powerful trading tools because:

It removes the need to manually execute orders.

You can place trades faster.

You eliminate human error.

You can automate your trading strategies and alerts.

How to Automatically Connect TradingView Alerts to MT5

You can’t connect TradingView directly to MT5 without a bridge or third-party tool. But here’s how you can set it up easily using MetaConnector:

STEP 1: Create Alerts in TradingView

Open TradingView, and load your chart.

Click on the Alarm/Alert icon.

Set your condition (e.g., RSI change, price breaks).

In the alert message box, add any custom message similar to:

BUY EURUSD

When this message is read by MetaConnector, it will activate the trade commands on MT5.

Step 2: Use MetaConnector—The Smart Bridge Tool

Go to MetaConnector—a great bridge tool from Combiz Services Pvt Ltd. MetaConnector bridges TradingView alerts to MT5/MT4 in real-time.

Register and set up your account.

Connect your TradingView webhook to MetaConnector using the URL provided.

Connect your MT5 terminal by using the Expert Advisor (EA) from MetaConnector.

Map your alert message in TradingView to a buy/sell action on MT5 (Buy/Sell, SL, TP, Lot Size).

Step 3: Go Live with Automated Trading

Now that everything is connected:

Your TradingView alerts will automatically execute a live trade on MT5.

You can track everything and manage your account with your MetaConnector dashboard.

You can connect multiple accounts, which is perfect for copy trading and managing clients.

Key Features of MetaConnector

Real-time execution of orders

Compatible with any broker with MT4/MT5

Fast, secure integration

Compatible with any TradingView indicator or strategy

No programming required

Is Connecting TradingView to MT5 Safe and Legal?

Yes—using products like MetaConnector is definitely safe. It doesn't violate any broker rules, as it uses official APIs or Expert Advisors (EAs). It also operates within automation practices that are acceptable for both algo trading and copy trading.

Why Choose Combiz Services Pvt Ltd?

Combiz Services Pvt Ltd is a pioneer in India for automation in trading. Product solutions like MetaConnector and copy trading software are available to individuals & companies whether you are a beginner or experienced trader. If you are an individual trader or have a signal service, Combiz Services Pvt Ltd has you covered.

Check out 👉 www.metaconnector.combiz.org for your solutions today.

0 notes

Text

Candlestick Pattern: A Complete Guide to Master Stock Market Analysis

If you’ve ever seen a stock chart filled with green and red bars, you’ve already come across a candlestick pattern. But what do these patterns mean? And how can understanding them put you ahead of other traders? Let’s dive deep into candlestick patterns and learn how they can give you an edge in the stock market.

1. What is a Candlestick Pattern?

A candlestick pattern is a price chart used in technical analysis that shows the high, low, open, and close prices for a specific time frame. Each candlestick represents one unit of time (like 5 minutes, 1 hour, or 1 day) and helps traders predict future price movements based on historical data.

These patterns are visually appealing and provide more information than simple line charts.

2. History of Candlestick Patterns

Candlestick charts were first developed in the 18th century by Japanese rice traders, particularly Munehisa Homma. Over time, they’ve become a global standard for analyzing financial markets because of their ability to show investor psychology in real time.

3. Anatomy of a Candlestick

Each candlestick has two main parts:

Body: The thick area shows the difference between the opening and closing prices. Wicks (or Shadows): The thin lines above and below the body show the highest and lowest prices during the time frame.

A green (or white) candle indicates a price rise, while a red (or black) candle shows a price drop.

4. Why Learn Candlestick Patterns?

Understanding candlestick patterns can:

Help you predict price reversals or continuations.

Give early entry or exit signals.

Make your trading decisions faster and more accurate.

This is why professional traders always rely on candlestick patterns to stay ahead.

5. Types of Candlestick Patterns

Candlestick patterns can be classified into two categories:

Reversal Patterns:

Doji: Signals indecision in the market.

Hammer: Indicates potential bullish reversal.

Shooting Star: Suggests possible bearish reversal.

Continuation Patterns:

Three White Soldiers: Bullish continuation.

Three Black Crows: Bearish continuation.

Each pattern has its own significance depending on where it appears in a trend.

6. How to Read Candlestick Patterns

To read a candlestick pattern effectively:

Look at the size of the body – large bodies show strong momentum.

Watch the wicks – long wicks may signal price rejection.

Analyze the pattern in context – consider the overall trend before deciding.

7. How to Check Candlestick Patterns on Charts

You can check candlestick patterns easily using charting platforms like:

TradingView

MetaTrader 4/5 (MT4/MT5)

Zerodha Kite

Steps:

Open your preferred platform.

Choose candlestick chart type.

Select a time frame (1-min, 5-min, daily, etc.) depending on your trading style.

Zoom out to see patterns forming over several sessions.

8. How Candlestick Patterns Give You an Edge

Early Market Signals: Spot reversals before most traders do. Better Risk Management: Identify stop-loss and target levels accurately. Adaptability: Works on all markets – stocks, forex, crypto, and commodities.

By mastering candlestick patterns, you’ll understand market sentiment like a pro.

9. Common Mistakes to Avoid

Relying on a single candlestick pattern without trend confirmation. Ignoring volume and other indicators. Overtrading based on false signals.

Always combine candlestick analysis with other tools like RSI, moving averages, or support/resistance levels.

10. Final Thoughts: Why You Should Master Candlestick Patterns

Learning candlestick patterns is like learning the language of the market. These patterns help you make informed decisions, reduce emotional trading, and spot opportunities before others.

Whether you’re a beginner or an experienced trader, practicing candlestick analysis can take your trading game to the next level.

So next time you look at a price chart, don’t just see red and green bars – see the story they’re telling.

0 notes

Text

How to Build Smart Forex Trading Software

The forex market is one of the biggest in the world. Every day, people trade money from one country for money from another country. They try to make a profit when prices change. Since the market moves very fast, many traders use software to help them trade better and faster.

If you want to help traders, building smart forex trading software is a great idea. This blog will show you how to do it step by step.

1. Learn About the Forex Market

Before building the software, you must understand how the forex market works.

Forex means “foreign exchange,” or trading one currency for another. For example, trading US dollars for Euros. Prices go up and down all the time. Traders try to buy when prices are low and sell when prices are high.

You should learn about:

Currency pairs (like EUR/USD or GBP/JPY)

Pips and spreads (these show price changes and costs)

When the market is open

News and trends that move the market

How traders manage risks

Knowing all this will help you make useful trading software.

2. Know What You Want to Build

There are different kinds of forex trading software. Choose what you want to build.

Some types include:

Manual trading tools – The trader places trades by hand using charts.

Automatic trading tools – The software places trades using rules.

Signal software – This tells the user when to buy or sell.

Copy trading – Users copy trades from expert traders.

Pick one type. It will help you decide how your software should look and work.

3. Choose a Trading Method

Good software follows a clear trading method. Pick one that your software will use to trade or give signals.

Here are some common methods:

Trend following – Trade in the same direction as the market is moving.

Scalping – Make small and quick trades for small profits.

Breakout trading – Trade when price breaks a big level.

Swing trading – Hold trades for a few days based on price swings.

Your software should follow these rules correctly and quickly.

4. Use the Right Tools to Build

To build strong and working software, you need the right tools:

Programming languages – like Python, Java, or C++

Trading platforms – like MT4, MT5, or TradingView

Broker APIs – brokers provide connections so the software can place trades

Database – like MySQL, to store user data and trade history

User Interface (UI) – design the dashboard with charts, buttons, and info

Make sure all tools you use are safe and dependable.

5. Add Important Features

Your software should have tools that help traders make better choices. Some features you can include:

Live price charts

Technical indicators (like RSI, MACD, etc.)

Order tools (buy/sell, stop loss, take profit)

Trade history

Risk control options

News feed and market calendar

Easy-to-use dashboard

If your software trades automatically, also add a way to test the trading method using past market data.

6. Make It Fast and Correct

In forex, every second counts. Your software must work fast and send trades quickly. It should also react fast to price changes.

Test the software to make sure:

It doesn’t have delays

It places the right orders

It doesn’t crash or lose connection

Fast and correct software helps traders win more often.

7. Keep It Safe

Your software will deal with money and private user information. So, safety is very important.

Use strong passwords and protect data

Store information safely

Back up data regularly

Also, make sure your software follows trading laws. Work with trusted brokers who follow the rules.

8. Add Testing Tools

Before traders use a new strategy with real money, they should test it with old market data. This is called backtesting.

Let users test their strategy inside your software. This helps them avoid mistakes and improve their methods.

9. Make It Easy to Use

Not all traders know how to use complex tools. Your software should be simple and clear.

Use a clean and simple design

Make sure buttons and charts are easy to understand

Add tips or help guides

If the software is easy, more people will use and enjoy it.

10. Keep Making It Better

Even after you launch the software, keep improving it. Ask users what they like and don’t like.

Fix bugs

Add new tools

Keep the software up to date

Also, offer customer help when users face problems. Good support builds trust.

Final Thoughts

Building smart forex trading software development takes time and learning. But if you focus on the right things—speed, safety, and simplicity—you can create a helpful tool for traders.

0 notes

Text

forex non repaint scalping indicatorS

1. Introduction

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

TELEGRAM CHANNEL

Scalping in the Forex market involves making multiple trades throughout the day with the aim of capturing small price movements. Since decisions must be made quickly, traders need reliable, real-time indicators. One of the key concerns for scalpers is the issue of repainting, which can distort trade signals. This is where non-repaint indicators come into play — offering consistent, dependable signals without changing after the fact.

This guide explores the best non-repaint scalping indicators and how to use them for profitable and efficient trading.

2. Understanding Repainting in Forex Indicators

Repainting means that an indicator changes its values after a candle has closed. This is especially common in indicators based on future data or moving averages recalculated with each new tick. While repainting can make past signals look “perfect,” it provides misleading results in live trading.

Example:

A repainting indicator may show a buy signal at a candle's close, but later the signal disappears or shifts if the market moves differently.

Non-repaint indicators, on the other hand, lock in their values at the candle’s close and never change afterward.

3. The Importance of Non-Repaint Indicators in Scalping

Scalping requires rapid execution, often within 1 to 15-minute timeframes. A trader cannot afford to second-guess signals or rely on false setups. Non-repaint indicators:

Improve confidence in entries and exits.

Provide consistent backtesting results.

Reduce psychological stress by avoiding unexpected signal changes.

4. Characteristics of a Good Non-Repaint Scalping Indicator

A reliable non-repaint indicator for scalping should:

Lock signals at candle close.

Have minimal lag.

Offer clear buy/sell indications.

Work well on lower timeframes (M1–M15).

Be compatible with popular platforms like MetaTrader 4/5 or TradingView.

5. Top Non-Repaint Scalping Indicators

5.1 Supertrend (Non-Repaint Version)

Supertrend is a trend-following indicator that uses ATR (Average True Range) and price to generate buy and sell signals.

How it works: Turns green for buy, red for sell.

Scalping Tip: Use on M5 with confirmation from RSI.

Non-repaint version: There are specially coded versions that do not change once a candle is closed.

5.2 Heiken Ashi Smoothed (Non-Repaint Version)

Heiken Ashi Smoothed filters out noise by averaging price action.

Use: Identifies trend continuation or reversal.

Scalping Tip: Best with moving average filters to spot micro-trends.

Non-Repaint: Once a bar is closed, it does not change.

5.3 TMA (Triangular Moving Average) Non-Repaint

Standard TMA indicators repaint, but there are versions coded specifically to avoid this.

Use: Fades in and out of zones for support/resistance.

Scalping Tip: Enter when price moves outside TMA bands and reverses back in.

Caution: Always verify that it’s a true non-repaint version.

5.4 RSI + MACD Combo

Both Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can be used in tandem.

Non-Repaint Versions: Standard RSI and MACD do not repaint as long as they are not modified with future values.

Strategy:

RSI > 70 = overbought; < 30 = oversold.

MACD crossover confirms momentum.

Scalping Tip: Use on M5 with price action confirmation.

5.5 QQE MOD (Quantitative Qualitative Estimation)

A modified RSI-based indicator that provides smoother signals and better accuracy.

Benefits: Easy to read, reliable, low lag.

Non-repaint version: QQE MOD coded specifically for scalping without repainting.

Scalping Tip: Look for crossovers above/below center line.

5.6 Buy/Sell Arrows Indicator (Custom Non-Repaint)

Many developers create custom MT4/MT5 indicators with visual arrows.

Tip: Ensure they are coded to finalize signals after candle close.

Use: Simple visual cues for rapid decision-making.

Strategy: Combine with stochastic oscillator or volume filters.

6. Best Practices for Using Non-Repaint Indicators in Scalping

Wait for Candle Close: Even non-repaint indicators may flash during the candle formation. Wait for confirmation.

Use Stop Loss: Due to high leverage and volatility, always manage risk.

Backtest Before Live Trading: Verify results over historical data.

Avoid Overloading Chart: Stick to 2–3 indicators max.

7. Combining Multiple Non-Repaint Indicators

For better accuracy, combine indicators that measure different aspects:

Trend + Momentum + Entry Signal

Example Combo:

Supertrend (trend)

QQE MOD (momentum)

Arrow Signal (entry/exit)

This multi-dimensional approach reduces false signals.

8. Chart Timeframes for Scalping

Non-repaint indicators work best when matched to appropriate timeframes:

M1: High noise, very fast trades.

M5: Balanced speed and signal quality.

M15: More reliable trends but fewer setups.

Pro Tip:

If you’re a beginner, start with M5 to get familiar with setups without the lightning speed required on M1.

9. Common Mistakes Traders Make

Overtrading: Taking every signal without confirmation.

No Risk Management: Not using SL/TP orders.

Blind Trust: Assuming “non-repaint” means 100% accuracy.

Ignoring Spread/Slippage: Especially on low timeframes.

Failing to Test Indicators: Many free indicators online are mislabeled as non-repaint.

10. Pros and Cons of Non-Repaint Scalping Indicators

Pros:

Predictable behavior

Useful for algorithmic strategies

Ideal for systematic scalping

Reliable backtest data

Cons:

Still not immune to false signals

Many fake versions in online forums

Require fast execution and focus

11. Myths and Misconceptions

MythTruthAll repainting indicators are uselessSome repainting tools like ZigZag are good for analysis, not live signals.Non-repaint means perfect accuracyThey reduce confusion, not eliminate risk.You can scalp without risk using indicatorsRisk is always present. Proper management is key.

12. Choosing the Right Broker and Platform

To use non-repaint indicators effectively:

Platform: MT4/MT5 or TradingView recommended.

Broker: Look for low spread, fast execution, and no dealing desk (ECN preferred).

Execution Speed: Essential for scalping.

Tools Support: Ensure the platform supports custom indicators.

13. Conclusion

Non-repaint scalping indicators are a powerful asset in a trader’s toolbox. While no indicator guarantees profit, using tools that lock in signals and avoid misleading changes gives scalpers an edge. The key is to combine these tools wisely, test strategies thoroughly, and maintain discipline in execution.

Scalping is a high-intensity trading style that rewards preparation and precision. By mastering non-repaint indicators like Supertrend, QQE MOD, and custom arrow signals, traders can sharpen their entries and reduce risk from signal whiplash. Always remember: indicators are guides, not oracles. Pair them with solid price action understanding and risk management for the best results.

https://secretindicator.com/product/forex-gold-m5-non-repaint-mt4-indicator/

#forex#forex broker#forex news#forex ea#forex market#crypto#forex online trading#forex indicators#forex education#forex factory

0 notes

Text

Best Trading Platforms for Beginners with WinProFX: A Smart Choice for New Traders

When it comes to Forex trading, selecting the right trading platform is crucial, especially for beginner traders. If you're considering WinProFX or a similar platform, it's important to understand what features will make your trading experience easier and more effective. Below are some of the best trading platforms for beginners, including WinProFX, with insights on how they help new traders navigate the forex market.

Why Choose WinProFX for Beginners?

WinProFX is a trading platform that offers a range of tools and features designed to support both novice and experienced traders. Here’s why it might be a smart choice for new traders:

User-Friendly Interface:

The platform is designed with simplicity in mind, making it easy for beginners to get started. The clean layout and intuitive design help minimize the learning curve, allowing you to focus on trading rather than navigating complex features.

Free Funded Accounts:

WinProFX offers opportunities for beginners to unlock free funded accounts, which means you can trade with real money without risking your own capital. This allows beginners to gain hands-on experience in live market conditions without worrying about initial capital.

Educational Resources:

The platform often provides educational materials, webinars, tutorials, and guides to help beginners understand trading basics, technical analysis, risk management, and strategies for success.

Demo Accounts:

Demo trading accounts are available, allowing you to practice trading in a risk-free environment before going live. This helps you build confidence and test strategies without any financial risk.

Customer Support:

WinProFX offers strong customer support, which is invaluable for beginners. Whether you need help with platform issues or trading guidance, responsive support can ease your trading experience.

Best Trading Platforms for Beginners

While WinProFX can be a great choice for beginners, here are some other popular platforms that offer beginner-friendly features, including tutorials, practice modes, and user-friendly interfaces:

1. MetaTrader 4 (MT4)

Why it’s great for beginners:

MT4 is one of the most widely used platforms in the world and offers a user-friendly interface with easy access to a variety of charting tools and indicators. The platform also supports automated trading (expert advisors) for those who want to explore algorithmic trading without a steep learning curve.

Features:

Customizable charts with technical analysis tools.

Wide range of educational resources online to help beginners.

Demo accounts for risk-free practice.

Available on desktop, mobile, and web.

2. MetaTrader 5 (MT5)

Why it’s great for beginners:

MT5 is an upgraded version of MT4, with additional features like more timeframes, more order types, and improved charting tools. It also offers access to a wider range of markets, including stocks, commodities, and cryptocurrencies, making it an excellent choice for beginners who want to diversify their portfolios over time.

Features:

Multitimeframe charts, custom indicators, and news feeds.

Web version available, which can be accessed from any device.

Economic calendar and trading signals integrated.

Demo accounts for practice trading.

3. cTrader

Why it’s great for beginners:

cTrader offers a beginner-friendly interface with advanced charting capabilities. It’s an intuitive platform with easy-to-use features and is known for its fast execution and high-quality charting tools.

For new traders, cTrader’s interface is clean and easy to navigate, and it offers a paper trading feature to practice without risk.

Features:

Advanced charting tools.

Risk management features, such as stop loss, trailing stop, and order types.

Smart order routing for fast execution.

Demo accounts for practice trading.

4. TradingView

Why it’s great for beginners:

TradingView is widely regarded for its interactive charts and social trading features. While primarily a charting tool, it also offers a web-based trading platform that’s user-friendly and suitable for beginners.

TradingView allows beginners to access advanced charting tools without being overwhelmed by too many features, and it offers a social community for sharing strategies and learning from others.

Features:

Customizable charts, indicators, and analysis tools.

Paper trading functionality to practice strategies without real money.

Access to a community of traders for insights and strategies.

Easy integration with multiple brokers.

5. NinjaTrader

Why it’s great for beginners:

NinjaTrader offers a clean interface with a variety of educational resources, making it a great choice for beginners. It’s ideal for those looking to move beyond simple forex trading and into futures or stocks as well.

Features:

Advanced charting and market analysis tools.

Automated trading options and backtesting features.

Demo accounts to practice without real risk.

Strong support and a rich library of educational materials.

6. eToro

Why it’s great for beginners:

eToro is a beginner-friendly platform with a social trading feature that allows you to follow and copy the trades of experienced traders. This is particularly useful for beginners who are still learning the ropes.

Features:

Copy trading: You can follow experienced traders and copy their trades.

Low minimum deposit to get started.

Demo accounts available to practice trading.

Simple, user-friendly interface for beginner traders.

Choosing the Right Platform for You

Here are a few considerations to help you pick the right trading platform as a beginner:

Ease of Use: Opt for a platform with a clean, user-friendly interface so you can easily navigate and understand how to place trades, use indicators, and manage risk.

Educational Support: Look for a platform that offers comprehensive educational resources, such as tutorials, webinars, and guides to help you understand trading basics and improve your skills.

Demo Account: Ensure the platform offers a demo account for risk-free practice before you trade with real money.

Risk Management Tools: Good risk management is crucial for beginners. Choose a platform that provides easy-to-use stop-loss, take-profit, and risk calculators.

Brokerage Costs: Be mindful of trading fees and commissions. Some platforms offer lower spreads, while others have fixed costs, which can impact your profitability as a beginner.

Conclusion

For beginners, WinProFX offers a solid platform with features designed to support newcomers to the world of Forex trading. Its user-friendly interface, free funded accounts, and educational resources make it an appealing choice for new traders.

Alongside WinProFX, MetaTrader 4, MetaTrader 5, cTrader, TradingView, and eToro are excellent platforms that cater to beginners with their ease of use, educational support, and demo trading options. Consider your individual preferences, risk tolerance, and trading goals when selecting the right platform for you.

0 notes

Text

Top Forex Brokers for 2024: A Comprehensive Guide

Top Forex Brokers for 2024: A Comprehensive Guide The forex market, known for its vast liquidity and 24-hour trading opportunities, continues to attract traders worldwide. As we step into 2024, selecting the right forex broker becomes crucial for success. This article delves into the top forex brokers for 2024, highlighting their unique features and why they stand out in the crowded market.To get more news about forex broker, you can visit our official website.

1. TastyFX - Best Overall in the US TastyFX has earned its reputation as the best overall forex broker in the US. It is CFTC registered and a member of the NFA, ensuring high regulatory standards. With over 80 forex pairs and competitive spreads, TastyFX offers an excellent trading platform that caters to both novice and experienced traders.

2. Exness - Best Overall for International Traders Exness stands out for its multiple account types and competitive trading fees. It supports MT4, MT5, and its proprietary Exness Terminal, providing traders with a versatile trading experience. The Exness Academy and research tools further enhance its appeal, making it a top choice for international traders.

3. FXTM - Best for Professional Traders FXTM is tailored for professional traders, offering ECN trading accounts and signals from Acuity Signal Centre. It supports MT4 and MT5 platforms, ensuring a robust trading environment. FXTM Invest copy trading feature allows traders to follow and copy the strategies of successful traders, adding another layer of flexibility.

4. Eightcap - Best for Cryptocurrency Trading For those interested in cryptocurrency trading, Eightcap is the go-to broker. It offers over 100 cryptocurrencies and supports MT4, MT5, and TradingView platforms. The Crypto Crusher dashboard and zero commission with low crypto spreads make it an attractive option for crypto enthusiasts.

5. IC Markets - Best Low Spreads IC Markets is renowned for its low spreads and low commissions. It supports MT4, MT5, and cTrader platforms, providing a seamless trading experience. With zero requotes and no minimum order distance restriction, IC Markets is ideal for traders seeking cost-effective trading solutions.

6. OCTA - Best for Beginners OCTA is perfect for beginners, offering a demo trading account and commission-free trading. Its extensive educational materials and regular live webinars help new traders build their skills and confidence. OCTA’s user-friendly interface makes it easy for beginners to navigate the forex market.

7. Swissquote - Best Forex Trading Platform Swissquote offers a comprehensive trading platform with access to MT4, MT5, and its Advanced Trader platform. It provides real-time pattern recognition and access to Autochartist and Trading Central. With over 3 million financial products available, Swissquote is a powerhouse in the forex trading world.

8. FP Markets - Best Forex Trading App FP Markets excels in mobile trading, offering apps for iOS and Android. It supports MT4, MT5, and cTrader mobile apps, providing a wide range of exotic and emerging market currency pairs. The app includes over 50 technical indicators, making it a robust tool for traders on the go.

9. FxPro - Best Execution Speed FxPro is known for its ultra-fast order execution, with speeds under 12 milliseconds. It supports the FxPro Platform, MT4, MT5, and cTrader, offering a wide range of CFD instruments. FxPro’s first-class in-house research and tools like Trading Central and LiveSquawk make it a top choice for traders seeking speed and reliability.

10. Tickmill - Best Research Tools Tickmill offers excellent research tools, including Acuity Trading and Signal Centre ideas. Its Market Sentiment dashboard covers over 80,000 instruments, and the trading signal plugin for MT4 and MT5 enhances its research capabilities. Tickmill Traders Club provides additional resources and community support.

11. ActivTrades - Best for Share CFD Trading ActivTrades is ideal for share CFD trading, offering over 1,000 global share CFDs and fractional shares. It supports MT4, MT5, TradingView, and ActivTrader platforms. With low minimum commissions and a wide range of trading tools, ActivTrades is a strong contender in the forex market.

Conclusion Choosing the right forex broker is essential for a successful trading journey. The brokers listed above have been meticulously evaluated for their regulatory compliance, trading fees, platform versatility, and unique features. Whether you are a beginner or a professional trader, there is a broker on this list that can meet your trading needs in 2024.

0 notes

Text

How to Start Copy Trading in India: A Beginner’s Guide

Do you want to trade in the stock market but lack the time and expertise? Copy trading may be the answer. This article will guide you in detail on how to start copy trading in India, step by step, with simple language. If you are simply a beginner or want to dabble in automated trading, this article will help you start confidently.

What is copy trading?

Copy trading allows you to automatically copy profitable and experienced traders; you take no action with respect to charts, and the technology does it for you. When the trader you are copying makes a move (e.g., buys or sells a stock), it is automatically mirrored in your account. You don't analyse the charts or have to make any decisions.

Is Copy Trading Legal in India?

Yes, copy trading is permitted in India, with conditions. You need to use approved brokers and software platforms that are SEBI compliant. IMPORTANT: Choose a platform that only uses registered stockbrokers that will abide by all regulations.

Why the Rise of Copy Trading in India?

Many Indian investors are following copy trading in Indian stocks because it

Requires little time and effort.

Helps beginners learn by copying an expert

Allows for automated trading via APIs and advanced tools

Step-by-Step Guide to Start Copy Trading in India

Step 1: Select a Copy Trading Platform in India

Choosing a copy trading platform in India is the first step and the most important. Look for the following:

Simple to use

Integrate with popular brokers like Zerodha, Angel One, Alice Blue, etc.

Support equity and options trading (especially intraday).

Has a reliable company behind it, like Combiz Services Pvt Ltd.

Pro-tip: Find a copy trading platform that has real-time trade execution, filtering by signal provider, and reporting features.

Step 2: Open a Trading Account with a Supporting Broker

First, you need a trading and demat account with a broker that offers API access. Some of the brokers you can use are

Zerodha

Angel One

Alice Blue

Upstox

Ensure the broker account is active and available for API integration.

Step 3: Obtain Copy Trading Software India Trusts

Now that you have your platform and broker, you need to use the right copy trading software India trusts for automation. This software connects your account to your chosen master trader's account to automatically place the trades.

Some of the popular copy trading software India trusts are

MT4/MT5 bridges

TradingView alert copiers

Cognito Copy Trading Software (highly recommended)

Step 4: Choose a Master Trader or Strategy

After you've set everything up, you'll register and can select which expert trader (also known as a "master") to copy. Make sure to check:

Performance history (verified)

Risk management approach

Capital, if it fits your risk appetite.

Step 5: Monitor and Optimise

Copy trading is mostly automated, but it's still a good idea to:

Review performance often.

Set a stop loss or capital limit.

Change master traders as necessary.

If you are using a good platform, you can monitor everything in real-time and have dashboards and reports.

Why Use Copy Trading to Trade Indian Stocks?

The Indian stock market has great potential but also market volatility. With copy trading you can:

Participate in Nifty, Bank Nifty, and equity stocks.

Even copy option trades automatically.

Learn while you earn.

Best Copy Trading Platform in India (Which One to Choose?)

If you are asking yourself which is the best copy trading platform in India, there are a few things to consider:

User interface

Execution speed

Broker support

Customer support

Pricing

Combiz Services Copy Trading Software is already being used by investment gurus and is some of the best-rated copy trading software for multi-brokers and being able to copy trades accurately and within milliseconds.

Summary

Getting started with copy trading in India is more streamlined than ever before. With the right platform, the right broker, and guidance, anyone—even beginners—can plant the seeds of their trading journey and automate everything!. This app offers a way of not only copying traders but also copying their success!

Are you ready to be the new generation of smart traders?

👉 Start using copy trading software India trusts and watch your trading experience unfold like never before.

#copy trading#copy trading software#best copy trading platform in india#copy trading software india#copy trading indian stocks

0 notes

Text

Top forex signals

In the dynamic world of forex trading, having access to reliable signals can make a significant difference. Forex signals provide insights into potential trading opportunities, including entry and exit points. Here’s a look at some of the top forex signal providers and tools that are well-regarded in the trading community. 1. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) - Overview: MetaTrader platforms are popular among traders for their advanced charting tools and custom indicators. They offer a range of built-in forex signals and allow for the integration of third-party signal services. - Features: Automated trading through Expert Advisors (EAs), custom indicators, and a vast library of trading scripts. Both MT4 and MT5 support signal subscriptions from various providers. 2. TradingView - Overview: TradingView is renowned for its robust charting capabilities and social trading features. It provides access to a wide array of forex signals from various users and professional traders. - Features: Real-time charts, technical analysis tools, community-generated trading ideas, and signal alerts. Users can follow experienced traders and receive their signals. 3. ZuluTrade - Overview: ZuluTrade connects traders with signal providers and offers a platform for copying trades. It ranks signal providers based on their performance and risk levels. - Features: Performance-based ranking, customizable risk settings, and automated trade copying. It allows users to follow top traders and automatically replicate their trades. 4. ForexSignals.com - Overview: ForexSignals.com offers a variety of trading signals and educational resources. It provides live signals through its platform and offers expert analysis. - Features: Live trading signals, webinars, educational resources, and a supportive trading community. It caters to both novice and experienced traders. 5. DailyForex - Overview: DailyForex provides daily trading signals and market analysis. It offers a mix of technical and fundamental analysis to support trading decisions. - Features: Daily signal updates, in-depth market analysis, and trading strategies. It covers major currency pairs and provides insights into market trends. 6. eToro - Overview: eToro is a social trading platform that allows users to follow and copy the trades of successful traders. It also offers trading signals based on the activity of top traders. - Features: Copy trading, real-time signals, and a social trading network. Users can see the performance of other traders and mirror their strategies. 7. Trade Ideas - Overview: Trade Ideas is a sophisticated trading platform offering real-time trading signals and advanced analytics. While it's more commonly used for stock trading, it also provides forex signals. - Features: Real-time alerts, customizable scanning, and advanced charting tools. It’s known for its artificial intelligence-driven trading signals. 8. Signal Skyline - Overview: Signal Skyline offers professional-grade forex signals with a focus on accuracy and performance. It provides signals for a range of currency pairs and trading strategies. - Features: High-frequency signals, detailed trade setups, and performance tracking. It caters to both short-term and long-term trading styles. Choosing the Right Signal Provider When selecting a forex signal provider, consider factors such as: - Reputation: Look for providers with positive reviews and a proven track record. - Transparency: Ensure the provider offers clear performance metrics and methodology. - Trial Options: Use trial periods or demo accounts to evaluate signal accuracy and fit for your trading style. In summary, top forex signal providers and tools offer a range of features to support traders in making informed decisions. By leveraging these resources, traders can gain valuable insights and improve their trading strategies.

1 note

·

View note

Text

The Forex Market: A Comprehensive Guide for Traders in Singapore.

Forex, or foreign exchange, is the world’s largest financial market, where currencies are traded 24/5. With over $6 trillion traded daily, it offers lucrative opportunities for traders worldwide, including in Singapore. This guide explores the essentials of forex trading, strategies, tools, and how traders in Singapore can leverage the market.

What Does Forex Mean?

The foreign exchange market, often called forex or FX, involves trading one currency against another. Traders capitalize on fluctuations in currency prices to make profits. Forex trading is conducted globally and operates through an over-the-counter (OTC) system, meaning trades are executed electronically rather than on a centralized exchange.

Why Forex is Popular in Singapore

Singapore is a global financial hub with a robust economy and advanced infrastructure. The country’s regulatory framework, favorable tax policies, and access to cutting-edge trading technologies make it an attractive destination for forex trading.

Key Reasons for Forex Popularity in Singapore:

Regulated Environment: The Monetary Authority of Singapore (MAS) ensures safe and secure trading.

Low Barriers to Entry: Traders can start with minimal capital.

Tax Benefits: Singapore does not tax capital gains, which is beneficial for forex traders.

Accessibility: With platforms like MetaTrader 4 (MT4) and MetaTrader 5 (MT5), trading is convenient and accessible to all.

How Can I Start Forex Trading in Singapore?

Starting forex trading requires proper planning and preparation. Here’s a step-by-step guide for aspiring traders:

Educate Yourself:

Understand forex terminologies like pips, spreads, and leverage.

Learn fundamental and technical analysis.

Use online resources, tutorials, or courses offered by platforms like Forex Bank Liquidity.

Choose a Reliable Broker:

Select a broker regulated by the MAS.

Look for low spreads, fast execution, and excellent customer service.

Open a Trading Account:

Sign up for a demo account to practice trading without risk.

When confident, transition to a live account.

Develop a Trading Plan:

Define your goals, risk tolerance, and trading strategy.

Stick to your plan to avoid emotional decisions.

Stay Updated:

Follow economic news and global events that impact currency markets.

Monitor platforms like Forex Bank Liquidity for insights and signals.

Forex Trading Strategies for Singapore Traders

To succeed, traders must adopt effective strategies. Here are some commonly used approaches:

1. Scalping

Involves quick trades to capitalize on small price changes.

Suitable for traders with access to fast execution platforms.

2. Swing Trading

Focuses on capturing short-to-medium-term market swings.

Requires technical analysis to identify entry and exit points.

3. Trend Trading

Follows the direction of the market trend.

Use tools like moving averages and trendlines for confirmation.

4. Breakout Trading

Involves entering trades when the price breaks key support or resistance levels.

Highly effective during high volatility periods.

5. Range Trading

Exploits horizontal price movement between support and resistance levels.

Ideal for markets with low volatility.

Tools and Resources for Forex Trading in Singapore

Successful forex trading requires the right tools. Here are essential resources for traders:

Economic Calendars:

Stay updated on key events like interest rate decisions and GDP reports.

Websites like Forex Bank Liquidity provide daily updates.

Charting Software:

Use MT4, MT5, or TradingView for advanced charting and analysis.

Forex Signals:

Leverage accurate signals from trusted sources like Forex Bank Liquidity to identify profitable opportunities.

Risk Management Tools:

Utilize stop-loss and take-profit orders to manage risk effectively.

Understanding the Risks of Forex Trading

Forex trading can be highly rewarding, but it’s not without risks. Traders should be aware of the following challenges:

High Leverage:

While leverage amplifies profits, it also increases losses.

Market Volatility:

Currency prices can fluctuate rapidly, leading to unexpected losses.

Overtrading:

Frequent trades can lead to excessive transaction costs and emotional decision-making.

Lack of Knowledge:

Entering the market without proper understanding can be detrimental.

To mitigate these risks, focus on education, use demo accounts, and seek guidance from experienced traders or platforms like Forex Bank Liquidity.

Regulations and Compliance in Singapore

Forex trading in Singapore is heavily regulated by the MAS, ensuring a secure trading environment. Traders should always choose brokers licensed by the MAS to avoid scams and fraudulent practices.

Compliance Tips:

Verify the broker’s licensing status.

Understand leverage limits and margin requirements.

Keep records of your trades for transparency.

Advantages of Forex Trading with Forex Bank Liquidity

Forex Bank Liquidity is a trusted platform offering a range of services tailored for both novice and experienced traders. Here’s why you should choose them:

Accurate Signals: Receive precise and timely forex signals.

Educational Resources: Access tutorials, webinars, and market insights.

24/7 Support: Get assistance anytime from their expert team.

Community: Join a growing community of successful traders through their Telegram channel.

Forex and the Singapore Economy

Singapore’s open economy makes it highly sensitive to global currency fluctuations. This creates numerous trading opportunities for forex enthusiasts.

Key economic indicators impacting the Singapore dollar (SGD) include:

GDP Growth: Reflects the country’s economic health.

Interest Rates: Determines borrowing costs and currency strength.

Trade Balance: Impacts demand for the SGD.

FAQs About Forex Trading in Singapore

1. Is forex trading legal in Singapore? Yes, forex trading is legal and regulated by the MAS.

2. How much capital do I need to start forex trading? You can start with as little as $100, but a larger account allows for better risk management.

3. Can I trade forex part-time? Yes, forex trading can be done part-time, thanks to its 24-hour market availability.

4. Where can I find reliable forex signals? Platforms like Forex Bank Liquidity provide accurate and reliable signals.

Conclusion

Forex trading offers immense opportunities for traders in Singapore. By understanding the market, using effective strategies, and leveraging resources like Forex Bank Liquidity, you can navigate the forex market with confidence. Always prioritize education, risk management, and regulatory compliance to maximize your trading success.

Whether you’re a beginner or an experienced trader, Singapore’s forex market provides a dynamic and lucrative platform to achieve your financial goals. Get started today and join a thriving community of traders by visiting Forex Bank Liquidity.

#forex#forex market#forexsignals#forex robot#forex expert advisor#forexbankliquidity#forex education#bankliquidity#forextrading#digital marketing

0 notes

Text

VantageFX Broker

Introduction:

In a competitive trading landscape, choosing the right broker can significantly enhance a trader's journey, offering a streamlined platform for robust trading opportunities. VantageFX Broker has been a notable player in the market, drawing attention with its tight spreads, fast execution, and a variety of trading instruments. This review aims to delve into the various aspects of Vantage FX, providing an insightful look at its offerings and operational efficiency based on user experiences and thorough analysis.

Vantagefx Trading Platform and Tools:

Vantage FX boasts a sophisticated yet user-friendly trading platform, leveraging the power of MetaTrader 4 and MetaTrader 5. This offers traders an intuitive interface, paired with powerful analytical tools and superior execution speeds. The integration of these platforms is smooth, offering both novice and seasoned traders a robust trading environment.

Additionally, traders can take advantage of the mobile trading feature, which is a boon for those who prefer to trade on the go. Vantage carves a niche for itself amidst other MetaTrader-centric brokers by presenting a myriad of additional add-ons and endorsing the integration of compatible third-party platforms and tools like TradingView. This strategic diversification has propelled Vantage into the Best in Class cadre in our 2023 assessment of the best MetaTrader brokers.Platform Synopsis: At its core, Vantage operates as a MetaTrader broker, extending a comprehensive suite of desktop and web trading platforms encompassing MetaTrader 4 (MT4) and MetaTrader 5 (MT5), users can download vantagefx trading apps on the mobileCharting Capabilities: Beyond the conventional charting facilitated on MT4 and MT5, Vantage also integrates the CHARTS platform from TradingView. This integration is seamless, allowing traders to access it directly using their MetaTrader credentials, thereby expanding the graphical analysis horizon.Tool Assortment:Enhancing the MetaTrader experience, Vantage introduces the SmartTrader Tools, part of FX Blue LLP’s plethora of platform augmentations. Moreover, a continuous stream of forex news headlines from FxWire Pro and FxStreet enriches the trading milieu, making Vantage's MetaTrader offerings notably robustSocial and Copy Trading Expanding beyond MetaTrader's inherent Signals market, Vantage brings forth three platforms dedicated to social copy trading. This ensemble of auto-trading platforms - ZuluTrade, DupliTrade, and Myfxbook’s AutoTrade, bolsters the social trading ecosystem, albeit these platforms are not accessible to Australian tradersThis well-rounded offering makes Vantage not just a platform for trading but a conducive environment for learning, analyzing, and strategizing, significantly enriching the trader's journey from inception to execution.

VantageFx Broker Asset Coverage:

VantageFX provides a broad spectrum of trading instruments, including Forex, Indices, Commodities, and Share CFDsIn total Vantage can trade up to 57 Currency pairs, 26 Indices , 51 ETFs , 22 Commodities and 800+ Share CFDsThis diverse range of assets allows traders to diversify their portfolio, thereby managing risks while maximizing potential gainsThe extensive market coverage is indeed a highlight, catering to the varied interests of the trading community

Account Types and Customer Suppor

VantageFX offers multiple account types catering to different trader preferences, including Standard STP, Raw ECN, and Pro ECN accounts. This segmentation helps in accommodating traders with varying levels of expertise and investment capabilities. When it comes to customer support, Vantage FX provides a responsive and knowledgeable team. The support is available via live chat, email, and phone, ensuring that traders' inquiries and issues are addressed promptly.

VantageFx PAMM

In forex markets, staying ahead of the curve is essential. And now, with the innovative VantageFX PAMM Copy Trade feature, you can transform your trading experience and maximize your profits like never before. Imagine having access to the strategies of some of the most skilled and successful traders in the industry, all at your fingertips. That's precisely what VantageFX PAMM Copy Trade brings to the table. It's a game-changer, a paradigm shift in how traders can harness the wisdom of experts without having to become one themselves. Check how to invest with Vantagefx PAMM to maximize your trading profit.

Education and Research Resources:

The broker provides various educational resources, including webinars, tutorials, and market analysis. These resources are invaluable for traders keen on honing their skills and staying updated with market trends. The emphasis on education and empowering traders is a commendable aspect of Vantage FX.

Fees and Spreads:

VantageFX is known for its competitive spreads, which is a significant advantage for cost-sensitive traders. The transparent fee structure with no hidden charges provides a fair trading environment, which is appreciated by its user base. At Vantage FX, the trading costs are primarily determined by the type of account you opt for, coupled with the specific Vantage entity managing your account. The broker presents three distinct account options: the spread-only Standard STP account, alongside the commission-based RAW ECN, and PRO ECN accounts. Generally, the pricing structure at Vantage aligns well with the industry norms.

Comparing Standard and Raw Accounts: For traders utilizing the spread-only Standard account, Vantage recorded typical spreads of 1.22 pips on the EUR/USD pair (as observed in August 2021). On the other hand, the Raw account showcased average spreads of 0.15 pips, along with a commission fee of $3 per side (amounting to $6 per round turn), bringing the total to 0.75 pips during the identical timeframe.Exploring the PRO Account: Vantage's PRO account emerges as a competitively priced offering, with a per-side commission of merely $2 (or $4 per round turn). However, the requisites for inaugurating a PRO ECN account vary across Vantage's regulating entities. For instance, under its Australian entity, traders need to qualify as a wholesale client, while under the Cayman Islands entity, an initial account funding of at least $10,000 is mandated. Meeting these varied account prerequisites renders the PRO ECN account as the most cost-effective option provided by Vantage.Incentives for Active Traders: Vantagefx extends an active trader program, presenting rebates ranging from $2 to a lofty $8 per standard lot, contingent on your account balance and monthly trading volume. The rebate tiers commence at $10,000, escalating to the apex tier necessitating a minimum of $300,000 in equity. It's notable, however, that this program is exclusively accessible to Standard account holders, which inherently possess the highest spreads among all available account options. This arrangement is something active traders might want to weigh against the potential rebates when deciding on the account type that best fits their trading strategy and financial standing.

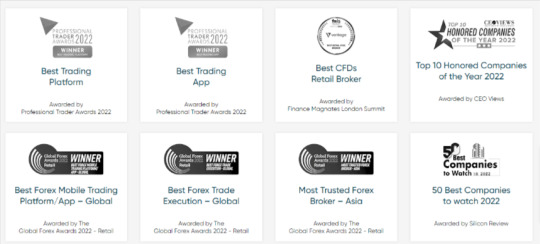

Award & Regulatory Compliance

Vantagefx Markets has won a variety of awards across a wide range of categories, including Best CFD Broker and Best MT4/MT5 Broker, and Lowest Trading Costs.

Vantagefx is one of the best broker that obtained fews international broker licenses and strickly followed the broker's regulations and requirements.Being regulated by the Australian Securities and Investments Commission (ASIC) and the Cayman Islands Monetary Authority (CIMA), Vantage FX adheres to high standards of operation, ensuring a secure and trustworthy trading environmen

Conclusion:

VantageFX has made a positive impression in the trading community with its comprehensive trading environment, a wide range of assets, and strong regulatory framework. While there is always room for improvement, especially in expanding educational resources, the broker stands as a reliable choice for individuals keen on navigating the financial markets. With its client-centric approach, Vantage FX is well-positioned to continue growing its presence in the global trading arena. Read the full article

#vantagefx#vantage fx#vantagefx broker review#vantagefx review#forex broker#vantage fx broker review#best forex broker#vantage review

0 notes

Text

BingX Launches Signal Trading and Stays Ahead in Crypto Innovation

BingX, one of the leading crypto exchanges, is excited to introduce Signal Trading, another advanced futures trading tool. It takes BingX one step closer to its mission – being an open, reliable, and innovative crypto ecosystem.

Signal trading is an advanced feature that carries out automatic execution of complicated perpetual futures trading strategies based on triggering signals received from external platforms such as TradingView. It covers all trading pairs in BingX Perpetual Futures and no API docking is required in the whole process. After creating specific trading instructions on BingX, traders only need to update these instructions on external platforms like TradingView. Then a free TradingView Bot will be created and synchronise real-time signals which will trigger automatic execution of preset trading instructions at right times. This is how signal trading helps traders realize customized and flexible trading strategies.

Signal trading is free of charge and open to all BingX users for an unlimited number of times. It is more suitable for experienced traders in quantitative trading. BingX tackled execution-side problems through technical innovation so that users are able to do quantitative transactions in an easier and smarter way.

In addition to signal trading, BingX made other breakthroughs in its latest update. Now BingX futures grid supports long position, short position, and neutral position for bullish, bearish, and fluctuated markets, respectively. It allows traders to use up to 20x leverage to maximise their profit regardless of price swings in global crypto markets. Meanwhile, the newly-launched Trailing Stop/Profit feature provides traders with a worry-free trading experience. When the price goes up or down, it drags the trailing stop/profit along with it, which saves the trouble of frequent price modification according to market conditions for more profits.

Meanwhile, BingX will join hands with MetaTrader 5 trading platform in late December in order to provide global traders with more opportunities and better services. MetaTrader 5, also known as MT5, is a web-based trading platform providing advanced analysis tools for quantitive trading. The connection with BingX energises MT5 with cutting-edge crypto innovation in perpertual futures. Orders placed on MT5 will be updated in BingX’s order book. Users can expect safe and stable trading experience on cryptocurrencies like BTC and ETH with more advanced analysis tools and customized functions through the updated connection between BingX and MT5.