#UAT 978

Explore tagged Tumblr posts

Text

Adding the UAT 978 to an ADS-B 1090 receiver for FlightAware, Virtual Radar, and ADSBexchange

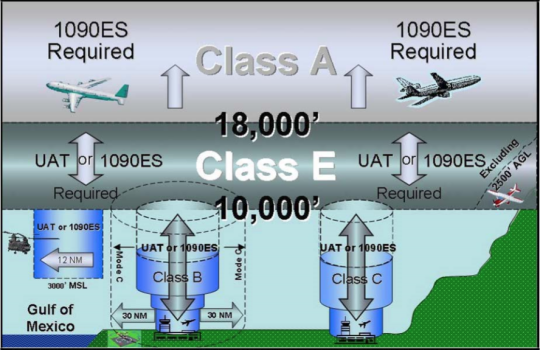

I’ve been running a FlightAware ADS-B receive since May 2019 and it has been feeding FlightAware, Virtual Radar, and ADSBexchange without issue for 4 years now (wow!). It has been servicing the Mineral, Virginia area, specifically my nearest airport which is (K)LKU. Recently, I became interested in UAT 978 (978 MHz) which is alternative to ADS-B 1090 (1090 MHz) with certain caveats. The theory…

View On WordPress

0 notes

Text

Currency Trading for Dummies

Currency Trading for Dummies https://www.projectdroid.com/wp-content/uploads/2018/04/word-image-288.png https://www.projectdroid.com/ebook/currency-trading-for-dummies/ Compliments of A Reference for the Rest of Us!® FREE eTips at dummies.com® Capitalize on the growing forex market Mark Galant Chairman and founder, GAIN Capital Group Brian Dolan Chief currency strategist, FOREX.com Welcome to FOREX.com There has never been a more challenging and exciting time to be trading in the foreign exchange market. What started out as a market for professionals is now attracting traders from all over the world and of all experience levels. At FOREX.com, we focus exclusively on the needs of individual forex trader, offering an advanced trading platform, premium tools, and customized services for the way you trade. Our commitment to your success extends to our professional dealing practices and world class service. After reading this Getting Started Edition, I encourage you to explore our Web site for additional information about the forex market and our trading services, and to sign up for a free practice account to experience both firsthand. Mark Galant Chairman & Founder GAIN Capital Group Currency Trading FOR DUMmIES‰ GETTING STARTED EDITION

by Mark Galant and Brian Dolan

Authors of Currency Trading For Dummies Currency Trading For Dummies®, Getting Started Edition Published by Wiley Publishing, Inc. 111 River Street Hoboken, NJ 07030-5774 Copyright © 2007 by Wiley Publishing, Inc., Indianapolis, Indiana Published by Wiley Publishing, Inc., Indianapolis, Indiana No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning or otherwise, except as permitted under Sections 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the Publisher. Requests to the Publisher for permission should be addressed to the Legal Department, Wiley Publishing, Inc., 10475 Crosspoint Blvd., Indianapolis, IN 46256, (317) 572-3447, fax (317) 572-4355, or online at www.wiley.com/go/permissions. Trademarks: Wiley, the Wiley Publishing logo, For Dummies, the Dummies Man logo, A Reference for the Rest of Us!, The Dummies Way, Dummies Daily, The Fun and Easy Way, Dummies.com, and related trade dress are trademarks or registered trademarks of John Wiley & Sons, Inc. and/or its affiliates in the United States and other countries, and may not be used without written permission. All other trademarks are the property of their respective owners. Wiley Publishing, Inc., is not asso- ciated with any product or vendor mentioned in this book. LIMIT OF LIABILITY/DISCLAIMER OF WARRANTY: THE PUBLISHER AND THE AUTHOR MAKE NO REPRESENTATIONS OR WARRANTIES WITH RESPECT TO THE ACCURACY OR COM- PLETENESS OF THE CONTENTS OF THIS WORK AND SPECIFICALLY DISCLAIM ALL WAR- RANTIES, INCLUDING WITHOUT LIMITATION WARRANTIES OF FITNESS FOR A PARTICULAR PURPOSE. NO WARRANTY MAY BE CREATED OR EXTENDED BY SALES OR PROMOTIONAL MATERIALS. THE ADVICE AND STRATEGIES CONTAINED HEREIN MAY NOT BE SUITABLE FOR EVERY SITUATION. THIS WORK IS SOLD WITH THE UNDERSTANDING THAT THE PUBLISHER IS NOT ENGAGED IN RENDERING LEGAL, ACCOUNTING, OR OTHER PROFESSIONAL SERV- ICES. IF PROFESSIONAL ASSISTANCE IS REQUIRED, THE SERVICES OF A COMPETENT PRO- FESSIONAL PERSON SHOULD BE SOUGHT. NEITHER THE PUBLISHER NOR THE AUTHOR SHALL BE LIABLE FOR DAMAGES ARISING HEREFROM. THE FACT THAT AN ORGANIZATION OR WEBSITE IS REFERRED TO IN THIS WORK AS A CITATION AND/OR A POTENTIAL SOURCE OF FURTHER INFORMATION DOES NOT MEAN THAT THE AUTHOR OR THE PUBLISHER ENDORSES THE INFORMATION THE ORGANIZATION OR WEBSITE MAY PROVIDE OR REC- OMMENDATIONS IT MAY MAKE. FURTHER, READERS SHOULD BE AWARE THAT INTERNET WEBSITES LISTED IN THIS WORK MAY HAVE CHANGED OR DISAPPEARED BETWEEN WHEN THIS WORK WAS WRITTEN AND WHEN IT IS READ. For general information on our other products and services, please contact our Customer Care Department within the U.S. at 800-762-2974, outside the U.S. at 317-572-3993, or fax 317-572-4002. For details on how to create a custom For Dummies book for your business or organization, contact [email protected]. For information about licensing the For Dummies brand for products or services, contact BrandedRights&[email protected]. ISBN: 978-0-470-25143-0 Manufactured in the United States of America 10 9 8 7 6 5 4 3 2 1

Introduction

hanks to the Internet, tens of thousands of individual traders and investors all over the world are discovering T the excitement and challenges of online trading in the forex market. Yet in contrast to the stock market, the forex market somehow remains more elusive and seemingly complicated to newcomers. Currency Trading For Dummies, Getting Started Edition, strips away the mystique of the forex market for smart, intelligent investors like you who know something about the potential of the forex market but don’t have the foggiest how it actually works. Read this book and then, if you like what you’ve read, put your knowledge and intuition to the test by getting a practice trading account with an online forex brokerage before you put any actual money at risk. Note: Trading foreign currencies is a challenging and poten- tially profitable opportunity for educated and experienced investors. However, before deciding to participate in the forex market, you should carefully consider your investment objectives, level of experience, and risk appetite. Most impor- tant, don’t invest money you can’t afford to lose.

About This Book

Currency Trading For Dummies, Getting Started Edition, contains the no-nonsense information you need to take the first step into the world of currency trading: Chapter 1: What Is the Forex Market? introduces you to the global forex market and gives you an idea of its size and scope. Chapter 2: The Mechanics of Currency Trading exam- ines how currencies are traded in the forex market: which currency pairs are traded, what price quotes mean, how profit and loss is calculated, and how the global trading day flows, just to name a few. Chapter 3: Choosing Your Trading Style reviews the various approaches used by professional currency traders and how they influence trading decisions, as well as how to develop a disciplined trading plan and to stick with it. Chapter 4: Getting Started with Your Practice Account walks you through the various ways of establishing a position in the market, how to manage the trade while it’s open, how to close out the position, and how to eval- uate your results critically.

Icons Used in This Book

Throughout this book, you see icons in the margins next to certain paragraphs. Here are the icons and what they mean: Theories are fine, but anything marked with a Tip icon tells you what currency traders really think and respond to. These are the tricks of the trade. Paragraphs marked with the Remember icon contain the key takeaways from this book and the essence of each subject’s coverage. Achtung, baby! The Warning icon highlights errors and mis- takes that can cost you money, your sanity, or both. You can skip anything marked by the Technical Stuff icon with- out missing out on the main message, but you may find the information useful for a deeper understanding of the subject. Want to go deeper? Try the big book If you want to delve more deeply market really works, what moves it, into currency trading, consider pick- and how you can actively trade it. ing up the full version of Currency We also provide you with the tools Trading For Dummies, from which to develop a structured game plan this special edition was derived. The you need to seriously trade in the full version of Currency Trading For forex market. Dummies shows you how the forex Chapter 1 What Is the Forex Market? In This Chapter Getting inside the forex market Understanding that speculating is the name of the game Trading currencies around the world Linking other financial markets to currencies he foreign exchange market — most often called the forex market, or simply the FX market — is the most traded finan- T cial market in the world. We like to think of the forex market as the “Big Kahuna” of financial markets. The forex market is the crossroads for international capital, the intersection through which global commercial and investment flows have to move. International trade flows, such as when a Swiss electronics company purchases Japanese-made components, were the original basis for the development of the forex markets. Today, however, global financial and investment flows dominate trade as the primary non-speculative source of forex market volume. Whether it’s an Australian pension fund investing in

Treasury bonds, or a British insurer allocating assets to the Japanese equity market, or a German conglomerate purchasing a Canadian manufacturing facility, each cross-border transac- tion passes through the forex market at some stage.

More than anything else, the forex market is a trader’s market. It’s a market that’s open around the clock six days a week, enabling traders to act on news and events as they happen. It’s a market where half-billion-dollar trades can be executed in a matter of seconds and may not even move prices notice- ably. Try buying or selling a half billion of anything in another market and see how prices react. Getting Inside the Numbers Average daily currency trading volumes exceed $2 trillion per day. That’s a mind-boggling number, isn’t it? $2,000,000,000,000 — that’s a lot of zeros, no matter how you slice it. To give you some perspective on that size, it’s about 10 to 15 times the size of daily trading volume on all the world’s stock markets combined.

Speculating in the currency market

While commercial and financial transactions in the currency markets represent huge nominal sums, they still pale in compar- ison to amounts based on speculation. By far the vast majority of currency trading volume is based on speculation — traders buying and selling for short-term gains based on minute-to- minute, hour-to-hour, and day-to-day price fluctuations. Estimates are that upwards of 90 percent of daily trading volume is derived from speculation (meaning, commercial or investment-based FX trades account for less than 10 percent of daily global volume). The depth and breadth of the specula- tive market means that the liquidity of the overall forex market is unparalleled among global financial markets. The bulk of spot currency trading, about 75 percent by volume, takes place in the so-called “major currencies,” which represent the world’s largest and most developed economies. Additionally, activity in the forex market frequently functions on a regional “currency bloc” basis, where the bulk of trading takes place between the USD bloc, JPY bloc, and EUR bloc, representing the three largest global economic regions.

Getting liquid without getting soaked

Liquidity refers to the level of market interest — the level of buying and selling volume — available at any given moment for a particular asset or security. The higher the liquidity, or the deeper the market, the faster and easier it is to buy or sell a security. From a trading perspective, liquidity is a critical consideration because it determines how quickly prices move between trades and over time. A highly liquid market like forex can see large trading volumes transacted with relatively minor price changes. An illiquid, or thin, market tends to see prices move more rapidly on relatively lower trading volumes. A market that only trades during certain hours (futures contracts, for example) also represents a less liquid, thinner market.

Around the World in a Trading Day

The forex market is open and active 24 hours a day from the start of business hours on Monday morning in the Asia-Pacific time zone straight through to the Friday close of business hours in New York. At any given moment, depending on the time zone, dozens of global financial centers — such as Sydney, Tokyo, or London — are open, and currency trading desks in those financial centers are active in the market. Currency trading doesn’t even stop for holidays when other financial markets, like stocks or futures exchanges, may be closed. Even though it’s a holiday in Japan, for example, Sydney, Singapore, and Hong Kong may still be open. It might be the Fourth of July in the United States, but if it’s a business day, Tokyo, London, Toronto, and other financial centers will still be trading currencies. About the only holiday in common around the world is New Year’s Day, and even that depends on what day of the week it falls on.

The opening of the trading week

There is no officially designated starting time to the trading day or week, but for all intents the market action kicks off when Wellington, New Zealand, the first financial center west of the international dateline, opens on Monday morning local time. Depending on whether daylight saving time is in effect in your own time zone, it roughly corresponds to early Sunday afternoon in North America, Sunday evening in Europe, and very early Monday morning in Asia. The Sunday open represents the starting point where currency markets resume trading after the Friday close of trading in North America (5 p.m. Eastern time). This is the first chance for the forex market to react to news and events that may have happened over the weekend. Prices may have closed New York trading at one level, but depending on the circumstances, they may start trading at different levels at the Sunday open.

Trading in the Asia-Pacific session

Currency trading volumes in the Asia-Pacific session account for about 21 percent of total daily global volume, according to a 2004 survey. The principal financial trading centers are Wellington, New Zealand; Sydney, Australia; Tokyo, Japan; Hong Kong; and Singapore. In terms of the most actively traded currency pairs, that means news and data reports from New Zealand, Australia, and Japan are going to be hitting the market during this session Because of the size of the Japanese market and the importance of Japanese data to the market, much of the action during the Asia-Pacific session is focused on the Japanese yen currency pairs (explained more in Chapter 2), such as USD/JPY – forex- speak for the U.S. dollar/Japanese yen -- and the JPY crosses, like EUR/JPY and AUD/JPY. Of course, Japanese financial insti- tutions are also most active during this session, so you can fre- quently get a sense of what the Japanese market is doing based on price movements. For individual traders, overall liquidity in the major currency pairs is more than sufficient, with generally orderly price movements. In some less liquid, non-regional currencies, like GBP/USD or USD/CAD, price movements may be more erratic or nonexistent, depending on the environment.

Trading in the European/London session

About midway through the Asian trading day, European finan- cial centers begin to open up and the market gets into its full swing. European financial centers and London account for over 50 percent of total daily global trading volume, with London alone accounting for about one-third of total daily global volume, according to the 2004 survey. The European session overlaps with half of the Asian trading day and half of the North American trading session, which means that market interest and liquidity is at its absolute peak during this session. News and data events from the Eurozone (and individual countries like Germany and France), Switzerland, and the United Kingdom are typically released in the early-morning hours of the European session. As a result, some of the biggest moves and most active trading takes place in the European currencies (EUR, GBP, and CHF) and the euro cross- currency pairs (EUR/CHF and EUR/GBP). Asian trading centers begin to wind down in the late-morning hours of the European session, and North American financial centers come in a few hours later, around 7 a.m. ET.

Trading in the North American session

Because of the overlap between North American and European trading sessions, the trading volumes are much more significant. Some of the biggest and most meaningful directional price movements take place during this crossover period. On its own, however, the North American trading ses- sion accounts for roughly the same share of global trading volume as the Asia-Pacific market, or about 22 percent of global daily trading volume. The North American morning is when key U.S. economic data is released and the forex market makes many of its most sig- nificant decisions on the value of the U.S. dollar. Most U.S. data reports are released at 8:30 a.m. ET, with others coming out later (between 9 and 10 a.m. ET). Canadian data reports are also released in the morning, usually between 7 and 9 a.m. ET. There are also a few U.S. economic reports that variously come out at noon or 2 p.m. ET, livening up the New York after- noon market. London and the European financial centers begin to wind down their daily trading operations around noon eastern time (ET) each day. The London, or European close, as it’s known, can frequently generate volatile flurries of activity. On most days, market liquidity and interest fall off signifi- cantly in the New York afternoon, which can make for chal- lenging trading conditions. On quiet days, the generally lower market interest typically leads to stagnating price action. On more active days, where prices may have moved more signifi- cantly, the lower liquidity can spark additional outsized price movements, as fewer traders scramble to get similarly fewer prices and liquidity. Just as with the London close, there’s never a set way in which a New York afternoon market move plays out, so traders just need to be aware that lower liquidity conditions tend to prevail, and adapt accordingly.

Currencies and Other Financial Markets

As much as we like to think of the forex market as the be all and end all of financial trading markets, it doesn’t exist in a vacuum. You may even have heard of some these other mar- kets: gold, oil, stocks, and bonds. There’s a fair amount of noise and misinformation about the supposed interrelationship among these markets and curren- cies or individual currency pairs. To be sure, you can always find a correlation between two different markets over some period of time, even if it’s only zero (meaning, the two mar- kets aren’t correlated at all). Always keep in mind that all the various financial markets are markets in their own right and function according to their own internal dynamics based on data, news, positioning, and sentiment. Will markets occasionally overlap and display varying degrees of correlation? Of course, and it’s always important to be aware of what’s going on in other financial markets. But it’s also essential to view each market in its own perspective and to trade each market individually. Let’s look at some of the other key financial markets and see what conclusions we can draw for currency trading.

Gold

Gold is commonly viewed as a hedge against inflation, an alternative to the U.S. dollar, and as a store of value in times of economic or political uncertainty. Over the long term, the relationship is mostly inverse, with a weaker USD generally accompanying a higher gold price, and a stronger USD coming with a lower gold price. However, in the short run, each market has its own dynamics and liquidity, which makes short-term trading relationships generally tenuous. Overall, the gold market is significantly smaller than the forex market, so if we were gold traders, we’d sooner keep an eye on what’s happening to the dollar, rather than the other way around. With that noted, extreme movements in gold prices tend to attract currency traders’ attention and usually influ- ence the dollar in a mostly inverse fashion.

Oil

A lot of misinformation exists on the Internet about the sup- posed relationship between oil and the USD or other curren- cies, such as CAD or JPY. The idea is that, because some countries are oil producers, their currencies are positively (or negatively) affected by increases (or decreases) in the price of oil. If the country is an importer of oil (and which countries aren’t today?), the theory goes, its currency will be hurt (or helped) by higher (or lower) oil prices. Correlation studies show no appreciable relationships to that effect, especially in the short run, which is where most cur- rency trading is focused. When there is a long-term relation- ship, it’s as evident against the USD as much as, or more than, any individual currency, whether an importer or exporter of black gold. The best way to look at oil is as an inflation input and as a lim- iting factor on overall economic growth. The higher the price of oil, the higher inflation is likely to be and the slower an economy is likely to grow. The lower the price of oil, the lower inflationary pressures are likely (but not necessarily) to be. We like to factor changes in the price of oil into our inflation and growth expectations, and then draw conclusions about the course of the USD from them. Above all, oil is just one input among many.

Stocks

Stocks are microeconomic securities, rising and falling in response to individual corporate results and prospects, while currencies are essentially macroeconomic securities, fluctuat- ing in response to wider-ranging economic and political devel- opments. As such, there is little intuitive reason that stock markets should be related to currencies. Long-term correla- tion studies bear this out, with correlation coefficients of essentially zero between the major USD pairs and U.S. equity markets over the last five years. The two markets occasionally intersect, though this is usually only at the extremes and for very short periods. For example, when equity market volatility reaches extraordinary levels (say, the Standard & Poor’s loses 2+ percent in a day), the USD may experience more pressure than it otherwise would — but there’s no guarantee of that. The U.S. stock market may have dropped on an unexpected hike in U.S. interest rates, while the USD may rally on the surprise move.

Bonds

Fixed-income or bond markets have a more intuitive connec- tion to the forex market because they’re both heavily influ- enced by interest rate expectations. However, short-term market dynamics of supply and demand interrupt most attempts to establish a viable link between the two markets on a short-term basis. Sometimes the forex market reacts first and fastest depending on shifts in interest rate expectations. At other times, the bond market more accurately reflects changes in interest rate expectations, with the forex market later playing catch-up. Overall, as currency traders, you definitely need to keep an eye on the yields of the benchmark government bonds of the major-currency countries to better monitor the expectations of the interest rate market. Changes in relative interest rates (interest rate differentials) exert a major influence on forex markets. Chapter 2 The Mechanics of Currency Trading In This Chapter Understanding currency pairs Going long and short Calculating profit and loss Reading a price quote he currency market has its own set of market trading con- ventions and related lingo, just like any financial market. If T you’re new to currency trading, the mechanics and terminol- ogy may take some getting used to. But at the end of the day, most currency trade conventions are pretty straightforward. Buying and Selling Simultaneously The biggest mental hurdle facing newcomers to currencies, especially traders familiar with other markets, is getting their head around the idea that each currency trade consists of a simultaneous purchase and sale. In the stock market, for instance, if you buy 100 shares of Google, you own 100 shares and hope to see the price go up. When you want to exit that position, you simply sell what you bought earlier. Easy, right? But in currencies, the purchase of one currency involves the simultaneous sale of another currency. This is the exchange in foreign exchange. To put it another way, if you’re looking for the dollar to go higher, the question is “Higher against what?” The answer is another currency. In relative terms, if the dollar goes up against another currency, that other currency also has gone down against the dollar. To think of it in stock- market terms, when you buy a stock, you’re selling cash, and when you sell a stock, you’re buying cash.

Currencies come in pairs

To make matters easier, forex markets refer to trading curren- cies by pairs, with names that combine the two different cur- rencies being traded, or “exchanged,” against each other. Additionally, forex markets have given most currency pairs nicknames or abbreviations, which reference the pair and not necessarily the individual currencies involved. Major currency pairs The major currency pairs all involve the U.S. dollar on one side of the deal. The designations of the major currencies are expressed using International Standardization Organization (ISO) codes for each currency. Table 2-1 lists the most fre- quently traded currency pairs, what they’re called in conven- tional terms, and what nicknames the market has given them. Table 2-1 The Major U.S. Dollar Currency Pairs

ISO Currency Pair Countries Long Name Nickname EUR/USD Eurozone*/U.S. Euro-dollar N/A USD/JPY U.S./Japan Dollar-yen N/A GBP/USD United Kingdom/U.S. Sterling-dollar Sterling or Cable USD/CHF U.S./Switzerland Dollar-Swiss Swissy USD/CAD U.S./Canada Dollar-Canada Loonie AUD/USD Australia/U.S. Australian-dollar Aussie or Oz

NZD/USD New Zealand/U.S. New Zealand-dollar Kiwi * The Eurozone is made up of all the countries in the European Union that have adopted the euro as their currency. Major cross-currency pairs Although the vast majority of currency trading takes place in the dollar pairs, cross-currency pairs serve as an alternative to always trading the U.S. dollar. A cross-currency pair, or cross or crosses for short, is any currency pair that does not include the U.S. dollar. Cross rates are derived from the respective USD pairs but are quoted independently. Crosses enable traders to more directly target trades to spe- cific individual currencies to take advantage of news or events. For example, your analysis may suggest that the Japanese yen has the worst prospects of all the major currencies going for- ward, based on interest rates or the economic outlook. To take advantage of this, you’d be looking to sell JPY, but against which other currency? You consider the USD, potentially buying USD/JPY (buying USD/selling JPY) but then you con- clude that the USD’s prospects are not much better than the JPY’s. Further research on your part may point to another cur- rency that has a much better outlook (such as high or rising interest rates or signs of a strengthening economy), say the Australian dollar (AUD). In this example, you would then be looking to buy the AUD/JPY cross (buying AUD/selling JPY) to target your view that AUD has the best prospects among major currencies and the JPY the worst. The most actively traded crosses focus on the three major non- USD currencies (namely EUR, JPY, and GBP) and are referred to as euro crosses, yen crosses, and sterling crosses. Table 2-2 highlights the most actively traded cross currency pairs.

Table 2-2 Most Actively Traded Cross Pairs

ISO Currency Pair Countries Market Name EUR/CHF Eurozone/Switzerland Euro-Swiss EUR/GBP Eurozone/United Kingdom Euro-sterling EUR/JPY Eurozone/Japan Euro-yen GBP/JPY United Kingdom/Japan Sterling-yen AUD/JPY Australia/Japan Aussie-yen NZD/JPY New Zealand/Japan Kiwi-yen Base currencies and counter currencies When you look at currency pairs, you may notice that the currencies are combined in a seemingly strange order. For instance, if sterling-yen (GBP/JPY) is a yen cross, then why isn’t it referred to as “yen-sterling” and written “JPY/GBP”? The answer is that these quoting conventions evolved over the years to reflect tra- ditionally strong currencies versus traditionally weak currencies, with the strong currency coming first. It also reflects the market quoting convention where the first currency in the pair is known as the base cur- rency. The base currency is what you’re buying or selling when you buy or sell the pair. It’s also the notional, or face, amount of the trade. So if you buy 100,000 EUR/JPY, you’ve just bought 100,000 euros and sold the equivalent amount in Japanese yen. If you sell 100,000 GBP/CHF, you just sold 100,000 British pounds and bought the equivalent amount of Swiss francs. The second currency in the pair is called the counter currency, or the secondary currency. Hey, who said this stuff isn’t intuitive? Most impor- tant for you as an FX trader, the counter currency is the denomina- tion of the price fluctuations and, ultimately, what your profit and losses will be denominated in. If you buy GBP/JPY, it goes up, and you take a profit, your gains are not in pounds, but in yen. (We run through the math of calculating profit and loss later in this chapter.)

The long and the short of it

Forex markets use the same terms to express market position- ing as most other financial markets. But because currency trading involves simultaneous buying and selling, being clear on the terms helps — especially if you’re totally new to finan- cial market trading. Going long No, we’re not talking about running out deep for a football pass. A long position, or simply a long, refers to a market posi- tion in which you’ve bought a security. In FX, it refers to having bought a currency pair. When you’re long, you’re looking for prices to move higher, so you can sell at a higher price than where you bought. When you want to close a long position, you have to sell what you bought. If you’re buying at multiple price levels, you’re adding to longs and getting longer. Getting short A short position, or simply a short, refers to a market position in which you’ve sold a security that you never owned. In the stock market, selling a stock short requires borrowing the stock (and paying a fee to the lending brokerage) so you can sell it. In forex markets, it means you’ve sold a currency pair, meaning you’ve sold the base currency and bought the counter currency. So you’re still making an exchange, just in the opposite order and according to currency-pair quoting terms. When you’ve sold a currency pair, it’s called going short or getting short and it means you’re looking for the pair’s price to move lower so you can buy it back at a profit. If you sell at various price levels, you’re adding to shorts and getting shorter. In currency trading, going short is as common as going long. “Selling high and buying low” is a standard currency trading strategy. Currency pair rates reflect relative values between two cur- rencies and not an absolute price of a single stock or com- modity. Because currencies can fall or rise relative to each other, both in medium and long-term trends and minute-to- minute fluctuations, currency pair prices are as likely to be going down at any moment as they are up. To take advantage of such moves, forex traders routinely use short positions to exploit falling currency prices. Traders from other markets may feel uncomfortable with short selling, but it’s just some- thing you have to get your head around. Squaring up Having no position in the market is called being square or flat. If you have an open position and you want to close it, it’s called squaring up. If you’re short, you need to buy to square up. If you’re long, you need to sell to go flat. The only time you have no market exposure or financial risk is when you’re square.

Profit and Loss

Profit and loss (P&L) is how traders measure success and fail- ure. A clear understanding of how P&L works is especially critical to online margin trading, where your P&L directly affects the amount of margin you have to work with. Changes in your margin balance determine how much you can trade and for how long you can trade if prices move against you.

Margin balances and liquidations

When you open an online currency trading account, you’ll need to pony up cash as collateral to support the margin requirements established by your broker. That initial margin deposit becomes your opening margin balance and is the basis on which all your subsequent trades are collateralized. Unlike futures markets or margin-based equity trading, online forex brokerages do not issue margin calls (requests for more collateral to support open positions). Instead, they establish ratios of margin balances to open positions that must be maintained at all times. Here’s an example to help you understand how required margin ratios work. Say you have an account with a leverage ratio of 100:1 (so $1 of margin in your account can control a $100 position size), but your broker requires a 100% margin ratio, meaning you need to maintain 100% of the required margin at all times. The ratio varies with account size, but a 100% margin requirement is typical for small accounts. That means to have a position size of $10,000, you’d need $100 in your account, because $10,000 divided by the leverage ratio of 100 is $100. If your account’s margin balance falls below the required ratio, your broker probably has the right to close out your positions without any notice to you. If your broker liqui- dates your position, that usually means your losses are locked in and your margin balance just got smaller. Be sure you completely understand your broker’s margin requirements and liquidation policies. Requirements may differ depending on account size and whether you’re trading stan- dard lot sizes (100,000 currency units) or mini lot sizes (10,000 currency units). Some brokers’ liquidation policies allow for all positions to be liquidated if you fall below margin require- ments. Others close out the biggest losing positions or portions of losing positions until the required ratio is satisfied again. You can find the details in the fine print of the account opening con- tract that you sign. Always read the fine print to be sure you understand your broker’s margin and trading policies.

Unrealized and realized profit and loss

Most online forex brokers provide real-time mark-to-market calculations showing your margin balance. Mark-to-market is the calculation that shows your unrealized P&L based on where you could close your open positions in the market at that instant. Depending on your broker’s trading platform, if you’re long, the calculation will typically be based on where you could sell at that moment. If you’re short, the price used will be where you can buy at that moment. Your margin bal- ance is the sum of your initial margin deposit, your unrealized P&L, and your realized P&L. Realized P&L is what you get when you close out a trade posi- tion, or a portion of a trade position. If you close out the full position and go flat, whatever you made or lost leaves the unrealized P&L calculation and goes into your margin balance. If you only close a portion of your open positions, only that part of the trade’s P&L is realized and goes into the margin bal- ance. Your unrealized P&L continues to fluctuate based on the remaining open positions, as does your total margin balance. If you’ve got a winning position open, your unrealized P&L is positive and your margin balance increases. If the market is moving against your positions, your unrealized P&L is nega- tive and your margin balance is reduced. Forex prices change constantly, so your mark-to-market unrealized P&L and total margin balance also change constantly.

Calculating profit and loss with pips

Profit-and-loss calculations are pretty straightforward in terms of math — they’re all based on position size and the number of pips you make or lose. A pip is the smallest incre- ment of price fluctuation in currency prices. Pips can also be referred to as points; we use the two terms interchangeably. Looking at a few currency pairs helps you get an idea what a pip is. Most currency pairs are quoted using five digits. The placement of the decimal point depends on whether it’s a JPY currency pair, in which case there are two digits behind the decimal point. All others currency pairs have four digits behind the decimal point. In all cases, that last itty-bitty digit is the pip. Here are some major currency pairs and crosses, with the pip underlined: EUR/USD: 1.2853 USD/CHF: 1.2267 USD/JPY: 117.23 EUR/JPY: 150.65 Focus on the EUR/USD price first. Looking at EUR/USD, if the price moves from 1.2853 to 1.2873, it’s just gone up by 20 pips. If it goes from 1.2853 down to 1.2792, it’s just gone down by 61 pips. Pips provide an easy way to calculate the P&L. To turn that pip movement into a P&L calculation, all you need to know is the size of the position. For a 100,000 EUR/USD posi- tion, the 20-pip move equates to $200 (EUR 100,000 0.0020 = $200). For a 50,000 EUR/USD position, the 61-point move trans- lates into $305 (EUR 50,000 0.0061 = $305). Whether the amounts are positive or negative depends on whether you were long or short for each move. If you were short for the move higher, that’s a – in front of the $200, if you were long, it’s a +. EUR/USD is easy to calculate, especially for USD-based traders, because the P&L accrues in dollars. If you take USD/CHF, you’ve got another calculation to make before you can make sense of it. That’s because the P&L is going to be denominated in Swiss francs (CHF) because CHF is the counter currency. If USD/CHF drops from 1.2267 to 1.2233 and you’re short USD 100,000 for the move lower, you’ve just caught a 34-pip decline. That’s a profit worth CHF 340 (USD 100,000 0.0034 = CHF 340). Yeah but how much is that in real money? To convert it into USD, you need to divide the CHF 340 by the USD/CHF rate. Use the closing rate of the trade (1.2233), because that’s where the market was last, and you get USD 277.94. Even the venerable pip is in the process of being updated as electronic trading continues to advance. Just a couple para- graphs earlier, we tell you that the pip is the smallest incre- ment of currency price fluctuations. Not so fast. The online market is rapidly advancing to decimalizing pips (trading in 1⁄10 pips) and half-pip prices have been the norm in certain currency pairs in the interbank market for many years.

Factoring profit and loss into margin calculations

The good news is that online FX trading platforms calculate the P&L for you automatically, both unrealized while the trade is open and realized when the trade is closed. So why did we just drag you through the math of calculating P&L using pips? Because online brokerages only start calculating your P&L for you after you enter a trade. To structure your trade and manage your risk effectively (How big a position? How much margin to risk?), you’re going to need to calculate your P&L outcomes before you enter the trade. Understanding the P&L implications of a trade strategy you’re considering is critical to maintaining your margin balance and staying in control of your trading. This simple exercise can help prevent you from costly mistakes, like putting on a trade that’s too large, or putting stop-loss orders beyond prices where your account falls below the margin requirement. At the minimum, you need to calculate the price point at which your position will be liquidated when your margin balance falls below the required ratio.

Understanding Rollovers and Interest Rates

One market convention unique to currencies is rollovers. A rollover is a transaction where an open position from one value date (settlement date) is rolled over into the next value date. Rollovers represent the intersection of interest-rate markets and forex markets.

Currency is money, after all

Rollover rates are based on the difference in interest rates of the two currencies in the pair you’re trading. That’s because what you’re actually trading is good old-fashioned cash. When you’re long a currency, it’s like having a deposit in the bank. If you’re short a currency, it’s like having borrowed a loan. Just as you would expect to earn interest on a bank deposit or pay interest on a loan, you should expect an interest gain/expense for holding a currency position over the change in value. Think of an open currency position as one account with a pos- itive balance (the currency you’re long) and one with a nega- tive balance (the currency you’re short). But because your accounts are in two different currencies, the two interest rates of the different countries apply. The difference between the interest rates in the two countries is called the interest-rate differential. The larger the interest- rate differential, the larger the impact from rollovers. The nar- rower the interest-rate differential, the smaller the effect from rollovers. You can find relevant interest-rate levels of the major currencies from any number of financial-market Web sites. Look for the base or benchmark lending rates in each country.

Applying rollovers

Rollover transactions are usually carried out automatically by your forex broker if you hold an open position past the change in value date. Rollovers are applied to your open position by two offsetting trades that result in the same open position. Some online forex brokers apply the rollover rates by adjusting the aver- age rate of your open position. Other forex brokers apply rollover rates by applying the rollover credit or debit directly to your margin balance. Here’s what you need to remember about rollovers: Rollovers are applied to open positions after the 5 p.m. ET change in value date, or trade settlement date. Rollovers are not applied if you don’t carry a position over the change in value date. So if you’re square at the close of each trading day, you’ll never have to worry about rollovers. Rollovers represent the difference in interest rates between the two currencies in your open position, but they’re applied in currency-rate terms. Rollovers constitute net interest earned or paid by you, depending on the direction of your position. Rollovers can earn you money if you’re long the currency with the higher interest rate and short the currency with the lower interest rate. Rollovers cost you money if you’re short the currency with the higher interest rate and long the currency with the lower interest rates.

Understanding Currency Quotes

Here, we look at how online brokerages display currency prices and what they mean for trade and order execution. Keep in mind that different online forex brokers use different formats to display prices on their trading platforms.

Bids and offers

When you’re in front of your screen and looking at an online forex broker’s trading platform, you’ll see two prices for each currency pair. The price on the left-hand side is called the bid and the price on the right-hand side is called the offer (some call this the ask). The “bid” is the price at which you can sell the base currency. The “offer” is the price at which you can buy the base currency. Some brokers display the prices above and below each other, with the bid on the bottom and the offer on top. The easy way to tell the difference is that the bid price is always lower than the offer price. The price quotation of each bid and offer you see will have two components: the big figure and the dealing price. The big figure refers to the first three digits of the overall currency rate and is usually shown in a smaller font size or even in shadow. The dealing price refers to the last two digits of the overall cur- rency price and is brightly displayed in a larger font size. For example, in Figure 2-1 the full EUR/USD price quotation is 1.3493/95. The 1.34 is the big figure and is there to show you the full price level (or big figure) that the market is currently trading at. The 93/95 portion of the price is the bid/offer deal- ing price. Figure 2-1: A dealing box from the FOREX.com trading platform for EUR/USD shows the current bid and offer price. The “bid” (on the left) is the price at which you can sell Euros. The “offer” on the right, is the price at which you can buy Euros.

Spreads

A spread is the difference between the bid price and the offer price. Most online forex brokers utilize spread-based trading platforms for individual traders. Look at the spread as the compensation the broker receives for being the market-maker and executing your trade. Spreads vary from broker to broker and by currency pairs at each broker as well. Generally, the more liquid the currency pair, the narrower the spread; the less liquid the currency pair, the wider the spread. This is especially the case for some of the less-traded crosses. Chapter 3 Choosing Your Trading Style In This Chapter Determining what trading style fits you best Understanding the different trading styles Developing and maintaining market discipline efore you get involved in actively trading the forex market, take a step back and think about how you want B to approach the market. There is more to currency trading than meets the eye, and we think the trading style you choose is one of the most important determinants of overall trading success. This chapter takes you through the main points to consider as you define your own approach to trading currencies. We review the characteristics of some of the most commonly applied trading styles and discuss what they mean in concrete terms. We also run you through the essential elements of developing and sticking to a trading plan. Finding the Right Trading Style for You We’re frequently asked, “What’s the best way to trade the forex market?” That’s a loaded question that seems to imply there’s a right way and a wrong way to trade currencies. Unfortunately, there is no easy answer. Better put, there is no standard answer — one that applies to everyone. The forex market’s trading characteristics have something to offer every trading style (long-term, medium-term, or short- term) and approach (technical, fundamental, or a blend). So in terms of deciding what style or approach is best suited to currencies, the starting point is not the forex market itself, but your own individual circumstances and way of thinking.

Real-world and lifestyle considerations

Before you can begin to identify the trading style and approach that works best for you, give some serious thought to what resources you have available to support your trading. As with many of life’s endeavors, when it comes to financial-market trading, there are two main resources that people never seem to have enough of: time and money. Deciding how much of each you can devote to currency trading helps to establish how you pursue your trading goals. If you’re a full-time trader, you have lots of time to devote to market analysis and actually trading the market. But because currencies trade around the clock, you still have to be mindful of which session you’re trading, and of the daily peaks and troughs of activity and liquidity. (See Chapter 1 for trading- session specifics.) Just because the market is always open doesn’t mean it’s necessarily always a good time to trade. If you have a full-time job, your boss may not appreciate your taking time to catch up on the charts or economic data reports while you’re at work. That means you’ll have to use your free time to do your market research. Be realistic when you think about how much time you’ll be able to devote on a regular basis, keeping in mind family obligations and other personal circumstances. When it comes to money, we can’t stress enough that trading capital has to be risk capital and that you should never risk any money that you can’t afford to lose. The standard defini- tion of risk capital is money that, if lost, will not materially affect your standard of living. It goes without saying that bor- rowed money is not risk capital — you should never use bor- rowed money for speculative trading. When you determine how much risk capital you have avail- able for trading, you’ll have a better idea of what size account you can trade and what position size you can handle. Most online trading platforms typically offer generous leverage ratios that allow you to control a larger position with less required margin. But just because they offer high leverage doesn’t mean you have to fully utilize it.

Making time for market analysis

The full version of Currency Trading For Dummies talks about the amount of data and news that flows through the forex market on a daily basis — and it can be truly overwhelming. So how can an individual trader possibly keep up with all the data and news? The key is to develop an efficient daily routine of market analysis. Thanks to the Internet and online currency broker- ages, independent traders can access a variety of information. Your daily regimen of market analysis should focus on: Overnight forex market developments: Who said what, which data came out, and how the currency pairs reacted. Daily updates of other major market movements over the prior 24 hours and the stories behind them: If oil prices or U.S. Treasury yields rose or fell substantially, find out why. Data releases and market events (for example, the retail sales report, Fed speeches, central bank rate announcements) expected for that day: Ideally, you’ll monitor data and event calendars one week in advance, so you can be anticipating the outcomes along with the rest of the market. Multiple-time-frame technical analysis of major cur- rency pairs: There is nothing like the visual image of price action to fill in the blanks of how data and news affected individual currency pairs. Current events and geopolitical themes: Stay abreast on issues of major elections, political scandals, military con- flicts, and policy initiatives in the major currency nations.

Technical versus fundamental analysis

Ask yourself on what basis you’ll make your trading decisions — fundamental analysis or technical analysis? Fundamentals are the broad grouping of news and information that reflects the macroeconomic and political fortunes of the countries whose currencies are traded. Most of the time, when you hear someone talking about the fundamentals of a cur- rency, he’s referring to the economic fundamentals. Economic fundamentals are based on: Economic data reports Interest rate levels Monetary policy International trade flows International investment flows The term technicals refers to technical analysis, a form of market analysis most commonly involving chart analysis, trend-line analysis, and mathematical studies of price behav- ior, such as momentum or moving averages, to mention just a couple. We don’t know of too many currency traders who don’t follow some form of technical analysis in their trading. Even the stereotypical seat-of-the-pants, trade-your-gut traders are likely to at least be aware of technical price levels identified by others. If you’ve been an active trader in other financial markets, chances are, you’ve engaged in some technical analysis or at least heard of it. Followers of each discipline have always debated which approach works better. Rather than take sides, we suggest fol- lowing an approach that blends the two disciplines. In our experience, macroeconomic factors such as interest rates, relative growth rates, and market sentiment determine the big-picture direction of currency rates. But currencies rarely move in a straight line, which means there are plenty of short- term price fluctuations to take advantage of — and some of them can be substantial. Technical analysis can provide the guideposts along the route of the bigger price move, allowing traders to more accurately predict the direction and scope of future price changes. Most important, technical analysis is the key to constructing a well- defined trading strategy. For example, your fundamental analy- sis, data expectations, or plain old gut instinct may lead you to conclude that USD/JPY is going lower. But where exactly do you get short? Where do you take profit, and where do you cut your losses? You can use technical analysis to refine trade entry and exit points, and to decide whether and where to add to posi- tions or reduce them. Sometimes forex markets seem to be more driven by funda- mental factors, such as current economic data or comments from a central bank official. In those times, fundamentals pro- vide the catalysts for technical breakouts and reversals. At other times, technical developments seem to be leading the charge — a break of trend-line support may trigger stop-loss selling by market longs and bring in model systems that are selling based on the break of support. Subsequent economic reports may run counter to the directional breakout, but data be damned — the support is gone, and the market is selling. Approaching the market with a blend of fundamental and technical analysis improves your chances of both spotting trade opportunities and managing your trades more effec- tively. You’ll also be better prepared to handle markets that are alternately reacting to fundamental and technical develop- ments or some combination of the two.

Different Strokes for Different Folks

After you’ve given some thought to the time and resources you’re able to devote to currency trading and which approach you favor (technical, fundamental, or a blend), the next step is to settle on a trading style that best fits those choices. There are as many different trading styles and market approaches in FX as there are individuals in the market. But most trading styles can be grouped into three main categories that boil down to varying degrees of exposure to market risk. The two main elements of market risk are time and relative price movements. The longer you hold a position, the more risk you’re exposed to. The more of a price change you’re anticipating, the more risk you’re exposed to. In the next few sections we detail the three main trading styles and what they really mean for individual traders. Our aim here is not to advocate for any particular trading style, because styles frequently overlap, and you can adopt different styles for different trade opportunities or different market conditions. Instead, our goal is to give you an idea of the vari- ous approaches used by forex market professionals so you can understand the basis of each style.

Short-term, high-frequency day trading

Short-term trading in currencies is unlike short-term trading in most other markets. A short-term trade in stocks or commodi- ties usually means holding a position for a day to several days at least. But because of the liquidity and narrow bid/offer spreads in currencies, prices are constantly fluctuating in small increments. The steady and fluid price action in curren- cies allows for extremely short-term trading by speculators intent on capturing just a few pips (explained in Chapter 2) on each trade. Short-term forex trading typically involves holding a position for only a few seconds or minutes and rarely longer than an hour. But the time element is not the defining feature of short- term currency trading. Instead, the pip fluctuations are what’s important. Traders who follow a short-term trading style are seeking to profit by repeatedly opening and closing positions after gaining just a few pips, frequently as little as 1 or 2 pips. In the interbank market, extremely short-term, in-and-out trading is referred to as jobbing the market; online currency traders call it scalping. (We use the terms interchangeably.) Traders who follow this style have to be among the fastest and most disciplined of traders because they’re out to cap- ture only a few pips on each trade. In terms of speed, rapid reaction and instantaneous decision-making are essential to successfully jobbing the market. When it comes to discipline, scalpers must be absolutely ruth- less in both taking profits and losses. If you’re in it to make only a few pips on each trade, you can’t afford to lose much more than a few pips on each trade. Jobbing the market requires an intuitive feel for the market. (Some practitioners refer to it as rhythm trading.) Scalpers don’t worry about the fundamentals too much. If you were to ask a scalper for her opinion of a particular currency pair, she would be likely to respond along the lines of “It feels bid” or “It feels offered” (meaning, she senses an underlying buying or selling bias in the market — but only at that moment). If you ask her again a few minutes later, she may respond in the opposite direction. Successful scalpers have absolutely no allegiance to any single position. They couldn’t care less if the currency pair goes up or down. They’re strictly focused on the next few pips. Their position is either working for them, or they’re out of it faster than you can blink an eye. All they need is volatility and liquidity. Retail traders are typically faced with bid/offer spreads of between 2 and 5 pips. Although this makes jobbing slightly more difficult, it doesn’t mean you can’t still engage in short- term trading — it just means you’ll need to adjust the risk parameters of the style. Instead of looking to make 1 to 2 pips on each trade, you need to aim for a pip gain at least as large as the spread you’re dealing with in each currency pair. The other basic rules of taking only minimal losses and not hang- ing on to a position for too long still apply. Here are some other important guidelines to keep in mind when following a short-term trading strategy: Trade only the most liquid currency pairs, such as EUR/USD, USD/JPY, EUR/GBP, EUR/JPY, and EUR/CHF. The most liquid pairs have the tightest trading spreads and fewer sudden price jumps. Trade only during times of peak liquidity and market interest. Consistent liquidity and fluid market interest are essential to short-term trading strategies. Market liquidity is deepest during the European session when Asian and North American trading centers overlap with European time zones — about 2 a.m. to noon Eastern time (ET). Trading in other sessions can leave you with far fewer and less predictable short-term price move- ments to take advantage of. Focus your trading on only one pair at a time. If you’re aiming to capture second-by-second or minute-by-minute price movements, you’ll need to fully concentrate on one pair at a time. It’ll also improve your feel for the pair if that pair is all you’re watching. Preset your default trade size so you don’t have to keep specifying it on each deal. Look for a brokerage firm that offers click-and-deal trading so you’re not subject to execution delays or requotes. Adjust your risk and reward expectations to reflect the dealing spread of the currency pair you’re trading. With 2- to 5-pip spreads on most major pairs, you proba- bly need to capture 3 to 10 pips per trade to offset losses if the market moves against you. Avoid trading around data releases. Carrying a short- term position into a data release is very risky because prices can gap sharply after the release, blowing a short- term strategy out of the water. Markets are also prone to quick price adjustments in the 15 to 30 minutes ahead of major data releases as nearby orders are triggered. This can lead to a quick shift against your position that may not be resolved before the data comes out.

Medium-term directional trading

Medium-term positions are typically held for periods ranging anywhere from a few minutes to a few hours, but usually not much longer than a day. Just as with short-term trading, the key distinction for medium-term trading is not the length of time the position is open, but the amount of pips you’re seeking/risking. Where short-term trading looks to profit from the routine noise of minor price fluctuations, almost without regard for the overall direction of the market, medium-term trading seeks to get the overall direction right and profit from more significant currency rate moves. Almost as many currency speculators fall into the medium- term category (sometimes referred to as momentum trading and swing trading) as fall into the short-term trading category. Medium-term trading requires many of the same skills as short-term trading, especially when it comes to entering/ exiting positions, but it also demands a broader perspective, greater analytical effort, and a lot more patience. Capturing intraday price moves for maximum effect The essence of medium-term trading is determining where a currency pair is likely to go over the next several hours or days and constructing a trading strategy to exploit that view. Medium-term traders typically pursue one of the following overall approaches, with plenty of room to combine strategies: Trading a view: Having a fundamental-based opinion on which way a currency pair is likely to move. View trades are typically based on prevailing market themes, like interest rate expectations or economic growth trends. View traders still need to be aware of technical levels as part of an overall trading plan. Trading the technicals: Basing your market outlook on chart patterns, trend lines, support and resistance levels, and momentum studies. Technical traders typically spot a trade opportunity on their charts, but they still need to be aware of fundamental events, because they’re the cat- alysts for many breaks of technical levels. Trading events and data: Basing positions on expected outcomes of events, like a central bank rate decision or a G7 meeting, or individual data reports. Event/data traders typically open positions well in advance of events and close them when the outcome is known. Trading with the flow: Trading based on overall market direction (trend) or information of major buying and sell- ing (flows). To trade on flow information, look for a broker that offers market flow commentary, like that found in FOREX.com’s Forex Insider (www.forex.com/forex_ research.html). Flow traders tend to stay out of short- term range-bound markets and jump in only when a market move is under way. When is a trend not a trend? When it’s a range. A trading range or a range-bound market is a market that remains confined within a relatively narrow range of prices. In currency pairs, a short-term (over the next few hours) trading range may be 20 to 50 pips wide, while a longer-term (over the next few days to weeks) range can be 200 to 400 pips wide. For all the hype that trends get in various market literature, the reality is that most markets trend no more than a third of the time. The rest of the time they’re bouncing around in ranges, consolidating, and trading sideways. Although medium-term traders are normally looking to cap- ture larger relative price movements — say, 50 to 100 pips or more — they’re also quick to take smaller profits on the basis of short-term price behavior. For instance, if a break of a technical resistance level suggests a targeted price move of 80 pips higher to the next resistance level, the medium-term trader is going to be more than happy capturing 70 percent to 80 percent of the expected price move. They’re not going to hold on to the position looking for the exact price target to be hit.

Long-term macroeconomic trading

Long-term trading in currencies is generally reserved for hedge funds and other institutional types with deep pockets. Long-term trading in currencies can involve holding positions for weeks, months, and potentially years at a time. Holding positions for that long necessarily involves being exposed to significant short-term volatility that can quickly overwhelm margin trading accounts. With proper risk management, individual margin traders can seek to capture longer-term trends. The key is to hold a small enough position relative to your margin balance that you can withstand volatility of as much as 5 percent or more.

Carry trade strategies

A carry trade happens when you buy a high-yielding currency and sell a relatively lower-yielding currency. The strategy prof- its in two ways: By being long the higher-yielding currency and short the lower-yielding currency, you can earn the interest- rate differential between the two currencies, known as the carry. If you have the opposite position — long the low-yielder and short the high-yielder — the interest-rate differential is against you, and it is known as the cost of carry. Spot prices appreciate in the direction of the interest- rate differential. Currency pairs with significant interest- rate differentials tend to move in favor of the higher- yielding currency as traders who are long the high yielder are rewarded, increasing buying interest, and traders who are short the high yielder are penalized, reducing selling interest. So let me get this straight, you may be thinking: All I have to do is buy the higher-yielding currency/sell the lower-yielding currency, sit back, earn the carry, and watch the spot price move higher? What’s the catch? The catch is that downside spot price volatility can quickly swamp any gains from the carry trade’s interest-rate differen- tial. The risk can be compounded by excessive market posi- tioning in favor of the carry trade, meaning a carry trade has become so popular that everyone gets in on it. Figure 3-1 illus- trates the trending price gains of a carry trade, punctuated by sudden price setbacks. Carry trades usually work best in low-volatility environments, meaning when financial markets are relatively stable and investors are forced to chase yield. Keep in mind that carry trades need to have a significant interest-rate differential between the two currencies (typically more than 2 percent) to make them attractive. And carry trades are definitely a long- term strategy, because depending on when you get in, you may get caught in a downdraft that could take several days or weeks to unwind before the trade becomes profitable again. Daily NZD/JPY Carry trades can see significant spot price gains punctuated by rapid price reversals. Figure 3-1: NZD/JPY trends higher in line with carry trade fundamentals (New Zealand’s interest rates are much higher than Japan’s), but it meets sharp setbacks along the way.

Developing a Disciplined Trading Plan

No matter which trading style you decide to pursue, you need an organized trading plan, or you won’t get very far. The dif- ference between making money and losing money in the forex market can be as simple as trading with a plan or trading with- out one. A trading plan is an organized approach to executing a trade strategy that you’ve developed based on your market analysis and outlook. Here are the key components of any trading plan: Determining position size: How large a position will you take for each trade strategy? Position size is half the equation for determining how much money is at stake in each trade. Deciding where to enter the position: Exactly where will you try to open the desired position? What happens if your entry level is not reached? Setting stop-loss and take-profit levels: Exactly where will you exit the position, both if it’s a winning position (take profit) and if it’s a losing position (stop loss)? Stop- loss and take-profit levels are the second half of the equa- tion that determines how much money is at stake in each trade. That’s it — just three simple components. But it’s amazing how many traders, experienced and beginner alike, open posi- tions without ever having fully thought through exactly what their game plan is. Of course, you need to consider numerous finer points when constructing a trading plan, and we focus on them more in the full version of Currency Trading For Dummies. But for now, we just want to drive home the point that trading without an organized plan is like flying an air- plane blindfolded — you may be able to get off the ground, but how will you land? And no matter how good your trading plan is, it won’t work if you don’t follow it. Sometimes emotions bubble up and distract traders from their trade plans. Other times, an un- expected piece of news or price movement causes traders to abandon their trade strategy in midstream, or midtrade, as the case may be. Either way, when this happens, it’s the same as never having had a trade plan in the first place. Developing a trade plan and sticking to it are the two main ingredients of trading discipline. If we were to name the one defining characteristic of successful traders, it wouldn’t be technical analysis skill, gut instinct, or aggressiveness — though they’re all important. Nope, it would be trading disci- pline. Traders who follow a disciplined approach are the ones who survive year after year and market cycle after market cycle. They can even be wrong more often than right and still make money because they follow a disciplined approach.

Taking the Emotion Out of Trading

If the key to successful trading is a disciplined approach — developing a trading plan and sticking to it — why is it so hard for many traders to practice trading discipline? The answer is complex, but it usually boils down to a simple case of human emotions getting the better of them. Don’t under- estimate the power of emotions to distract and disrupt. So exactly how do you take the emotion out of trading? The simple answer is: You can’t. As long as your heart is pumping and your synapses are firing, emotions are going to be flowing. And truth be told, the emotional highs of trading are one of the reasons people are drawn to it in the first place. There’s no rush quite like putting on a successful trade and taking some money out of the market. So just accept that you’re going to experience some pretty intense emotions when you’re trading. The longer answer is that because you can’t block out the emotions, the best you can hope to achieve is understanding where the emotions are coming from, recognizing them when they hit, and limiting their impact on your trading. It’s a lot easier said than done, but keep in mind some of the following to keep your emotions in check: Focus on the pips and not the dollars and cents. Don’t be distracted by the exact amount of money won or lost in a trade. Instead, focus on where prices are and how they’re behaving. The market has no idea what your trade size is and how much you’re making or losing, but it does know where the current price is. It’s not about being right or wrong; it’s about making money. The market doesn’t care if you were right or wrong, and neither should you. The only true way of measuring trading success is in dollars and cents. You’re going to lose in a fair number of trades. No trader is right all of the time. Taking losses is as much a part of the routine as taking profits. You can still be suc- cessful over time with a solid risk-management plan. Chapter 4 Getting Started with Your Practice Account In This Chapter Getting the most out of your practice account Pulling the trigger Managing the trade Evaluating your results he best way for newcomers to get a handle on what cur- rency trading is all about is to open a practice account. T Almost every forex broker offers a free practice account to prospective clients; all you need to do is sign up for one on the broker’s Web site. Practice accounts are funded with “vir- tual” money, so you’re able to make trades with no real money at stake and gain experience in how margin trading works. Practice accounts give you a great chance to experience the forex market. You can see how prices change at different times of the day, how various currency pairs may differ from each other, and how the forex market reacts to new informa- tion when major news and economic data is released. You also can start trading in real market conditions without any fear of losing money, experiment with different trading strategies to see how they work, gain experience using different orders and managing open positions, improve your understanding of how margin trading and leverage work, and start analyzing charts and following technical indicators. Practice accounts are a great way to experience the forex market up close and personal. They’re also an excellent way to test-drive all the features and functionality of a broker’s platform. However, the one thing you can’t simulate is the emotion of trading with real money. To get the most out of your practice-account experience, treat your practice account as if it were real money. Pulling the Trigger It’s trigger-pulling time, pardner. This section assumes you’ve signed up for a practice account at an online forex broker and you’re ready to start executing some practice trades. You make trades in the forex market one of two ways: You can trade at the market, or the current price, using the click-and- deal feature of your broker’s platform; or you can employ orders, such as limit orders and one-cancels-the-other orders (OCOs).

Clicking and dealing

Many traders like the idea of opening a position by trading at the market as opposed to leaving an order that may or may not be executed. They prefer the certainty of knowing that they’re in the market. Actively buying and selling are also elements that make trading and speculating as much fun as hard work. Most forex brokers provide live streaming prices that you can deal on with a simple click of your computer mouse. To exe- cute a trade on those platforms:

Specify the amount of the trade you want to make.

Click on the Buy or Sell button to execute the trade.

The forex trading platform responds back, usually within a second or two, to let you know whether the trade went through: If the trade went through, you’ll receive a pop-up confir- mation from the platform and see your open position list- ing updated to reflect the new trade. If the trade fails because the trading price changed before your request was received, you receive a response indicating “rates changed,” “price not available,” or something along those lines. You then need to repeat the steps to make another trade attempt. Attempts to trade at the market can sometimes fail in very fast-moving markets when prices are adjusting quickly, like after a data release or break of a key techni- cal level or price point. Part of this stems from the latency effect of trading over the Internet, which refers to time lags between the platform price reaching your computer and your trade request reaching the platform’s server. If the trade fails because the trade was too large based on your margin, you need to reduce the size of the trade. Understand from the get-go that any action you take on a trad- ing platform is your responsibility. You may have meant to click Buy instead of Sell, but no one knows for sure except you.

Using Orders

Orders are critical trading tools in the forex market. Think of them as trades waiting to happen, because that’s exactly what they are. If you enter an order and a subsequent price action triggers its execution, you’re in the market, so be as careful as you are thorough when placing your orders in the market. Currency traders use orders to catch market movements when they’re not in front of their screens. Remember: The forex market is open 24 hours a day, five days a week. A market move is just as likely to happen while you’re asleep or in the shower as while you’re watching your screen. If you’re not a full-time trader, then you’ve probably got a full-time job that requires your attention when you’re at work. (At least your boss hopes he has your attention.) Orders are how you can act in the market without being there. Experienced currency traders also routinely use orders to: Implement a trade strategy from entry to exit Capture sharp, short-term price fluctuations Limit risk in volatile or uncertain markets Preserve trading capital from unwanted losses Maintain trading discipline Protect profits and minimize losses We can’t stress enough the importance of using orders in cur- rency trading. Forex markets can be notoriously volatile and difficult to predict. Using orders helps you capitalize on short- term market movements while limiting the impact of any adverse price moves. While there is no guarantee that the use of orders will limit your losses or protect your profits in all market conditions, a disciplined use of orders helps you to quantify the risk you’re taking and, with any luck, gives you peace of mind in your trading. Bottom line: If you don’t use orders, you probably don’t have a well-thought-out trading strategy — and that’s a recipe for pain.

Types of orders