#UPI without OTP in India

Explore tagged Tumblr posts

Text

Use UPI With International SIMs Cards From These 12 Countries For Free Of Cost; Know How

Last Updated:June 25, 2025, 14:20 IST NRI customers of this Bank can now make UPI payments in India using their international mobile numbers; Here’s how UPI Transaction Using International SIM UPI Transactions From International Numbers: Non-Resident Indian (NRI) customers of IDFC First Bank can now make UPI payments in India using their international mobile numbers, without any additional…

#free UPI for NRIs#how to use UPI from abroad#IDFC First Bank#IDFC UPI abroad#IDFC UPI registration#international mobile number UPI#international UPI access#mobile payments for NRIs.#NRI banking India#NRI UPI payments#UPI apps for NRI#UPI for Indian bank abroad#UPI for NRE accounts#UPI for NRIs#UPI for NRO accounts#UPI in Australia#UPI in Canada#UPI in UAE#UPI in UK#UPI in USA#UPI payments without charges#UPI with international number#UPI without Indian SIM#UPI without OTP in India

0 notes

Text

Angel One Demat Account Opening Process: Step-by-Step Guide

Angel One Demat Account Opening Process: Complete 7-Step Guide

Opening a demat account is the essential first step in your investment journey. If you’ve been researching online, chances are you’ve come across Angel One, one of India’s most trusted and user-friendly stockbroking platforms. This article will walk you through the Angel One demat account opening process, giving you everything you need to get started quickly, securely, and completely online.

Whether you’re a beginner or a seasoned trader, understanding the Angel One demat account opening process ensures that you can start investing without confusion or delays. So let’s break down each step and get you started on your path to financial growth.

Why Choose Angel One?

Before diving into the actual process, it’s important to understand why Angel One stands out. With zero brokerage on equity delivery and flat ₹20 per order for intraday and F&O trades, it offers one of the most cost-effective solutions in the market. Additionally, features like real-time portfolio tracking, ARQ Prime (AI-based advisory), and access to U.S. stocks make it a powerful tool for investors.

Most importantly, the Angel One account opening process is fast, digital, and designed for convenience. With the right documents, your account could be live in just 1–3 working days.

Documents Required for Angel One Demat Account

To avoid delays during the Angel One demat account opening process, make sure you have the following documents ready in PDF or JPEG format:

PAN Card (mandatory for KYC)

Aadhaar Card (linked to your mobile for e-signature)

Bank Proof – Cancelled cheque or latest bank statement

Signature on white paper

Live Selfie (captured during registration)

If you're planning to trade in Futures & Options (F&O), also prepare:

Income Proof – Latest salary slip, 6-month bank statement, or ITR

Additional Address Proof (only if requested)

Angel One Demat Account Opening Process – Step-by-Step

Now that your documents are in order, let’s walk through the Angel One demat account opening process. The entire registration can be completed in under 30 minutes.

1. Verify Your Mobile Number

Visit the official Angel One website or download the mobile app. Enter your mobile number and verify it using the OTP sent to your phone.

2. Enter Personal Details

Next, provide your full name and email ID. You’ll receive a second OTP on your email for verification.

3. Complete KYC Verification

This is a critical step in the Angel One demat account opening process. You’ll need to link your Aadhaar using DigiLocker and enter your PAN details to proceed.

4. Link Your Bank Account

Upload a cancelled cheque or a recent bank statement. You can also verify your account via UPI. This step enables secure fund transfers.

5. Upload Selfie and Signature

Take a live selfie using your webcam or phone camera and upload your scanned signature. These help confirm your identity.

6. Add Nominee and Income Details

Although optional, adding a nominee provides extra security. If you’re going to trade in F&O, this is where you’ll upload income proof.

7. E-sign the Application

To complete the Angel One account opening process, e-sign your application using your Aadhaar credentials. After submitting, your application enters review.

What Happens After You Submit?

Once you complete the steps, Angel One typically verifies and activates your account within 1–3 business days. After activation, you can begin trading and investing in:

Equity (delivery and intraday)

Mutual Funds

IPOs

F&O

Commodities

U.S. Stocks

Thanks to a user-friendly dashboard, navigating through these options becomes seamless.

Benefits After Completing the Angel One Demat Account Opening Process

Upon successful account activation, you unlock a host of features that enhance your investing experience:

Real-time portfolio monitoring

NSDL Speed-e integration

Tax-ready e-statements

One-click demat/remat services

24x7 customer support and advanced research tools

These features ensure that the Angel One demat account opening process is not just about setting up an account—but about building a complete investment ecosystem.

Final Thoughts

In conclusion, the Angel One demat account opening process is streamlined, efficient, and beginner-friendly. From verifying your mobile number to uploading essential documents and completing Aadhaar e-signing, each step is designed to simplify onboarding.

With just a few clicks and minimal documentation, the Angel One account opening process enables you to access a wide range of investment options. If you’re ready to take control of your financial future, prepare your documents and follow this guide to open your account with ease.

0 notes

Text

🌐 How UPB is Empowering Rural India through Digital Banking

🌐 How UPB is Empowering Rural India through Digital Banking

🔹 Introduction – Digital Desh Ki Nayi Pehchaan

India is growing rapidly in the digital space, but rural areas still lag behind when it comes to modern banking. Long distances, lack of documents, and limited awareness have kept banking out of reach for many.

This is where UPB—Universal Payment Bank—is playing a game-changing role. It’s not just making banking digital��it’s making it accessible, easy, and inclusive for people in villages and small towns.

🔹 The Rural Banking Problem

Many people in rural India face challenges like

🚶♂️ Banks are too far.

📄 No proper ID documents

🕒 Time wasted in long lines

📉 No idea about digital transactions

As a result, they depend on cash and informal systems, which are unsafe and slow.

🔹 UPB—A Ray of Hope in the Villages

UPB brings banking to people's fingertips, even if they live miles away from a bank branch.

✅ No paperwork

✅ No travel

✅ No waiting

All you need is a phone with internet and basic documents.

🔹 Key Benefits of UPB for Rural India

1. 📱 Easy Account Opening

Villagers can open a bank account with Aadhaar and PAN from home. No branch visit needed.

2. 🧾 Access to Subsidies and Govt. Schemes

Now people can receive government payments like pensions, DBT, or subsidies directly into their UPB account.

3. 💸 Direct Money Transfer

Migrants can send money home instantly using UPI or IMPS without visiting any bank.

4. 🧍 Self-Employment Opportunity

People in villages can become UPB agents and earn by offering services like recharge, bill payment, and money transfer.

🔹 Real-Life Example

🚜 Ram, a farmer from Bihar, never had a bank account due to travel and documentation issues. Through UPB, he opened an account in 10 minutes using his Aadhaar. Today, he receives his crop subsidies and electricity bill discounts directly into his account.

🔹 UPB Services Popular in Rural Areas

Service Impact in Villages Mobile Recharge No more traveling to town stores. Bill Payment Pay electricity bills from home. Micro ATM Service Withdraw money using Aadhaar QR Code Payments. Local shops now accept digital pay. Loan Applications Access to small credit digitally

🔹 Creating Rural Entrepreneurs

UPB is also creating self-reliant micro-entrepreneurs. How?

By giving villagers the power to open accounts for others

Earning commission on each service

Building trust in their area as local “banking partners”

This is a big step toward financial independence in rural Bharat.

🔹 Government and UPB Together

Many UPB platforms work with government programs like

Jan Dhan Yojana

Direct Benefit Transfer (DBT)

PM-Kisan and pension schemes

Aadhaar-enabled Payment System (AEPS)

Together, they ensure speed, safety, and transparency in money flow to rural people.

🔐 Is UPB Safe for Rural Users?

Yes, absolutely. UPB uses:

OTP-based login

Aadhaar + biometric verification

Safe UPI/IMPS/NEFT systems

RBI-compliant processes

So even first-time users can trust the platform.

🔚 Conclusion: UPB—A New Lifeline for Rural India

UPB is not just a bank; it’s a digital bridge connecting Bharat to India's mainstream economy. It gives

✅ Farmers a place to save and receive funds

✅ Women's control over money

✅ Shopkeepers a chance to go digital

✅ Youth a path to self-employment

In short, UPB is powering India’s villages with the strength of smartphones and the promise of equality.

🔖 Captions:

“Bank nahi, Bharat badal raha hai—UPB ke saath.”

“Gaon tak banking laaya UPB—Digital Bharat ki asli shuruaat.”

“Smartphone + UPB = Smart Gaon”

🏷️ Hashtags:

#UPB #RuralBanking #DigitalIndia #SmartVillage #FinancialInclusion #MobileBanking #UPBForVillages #TechInRural #UPBChangeMakers #BankingForBharat

Visit here :- https://www.tumblr.com/

0 notes

Text

Instant Personal Loan Without Documents – No Income Proof or CIBIL Needed in 2025

Are you tired of hearing "No" from banks just because of a low salary or poor credit score? You're not alone. Thousands of hardworking individuals across India face the same rejection every day. But here's the good news: In 2025, getting an Instant Personal Loan, even with low income or bad CIBIL, is not only possible but also effortless, thanks to a growing digital lending ecosystem.

In this guide, we'll show you exactly how to get instant funds online without stepping into a bank, uploading heavy documents, or worrying about your past credit mistakes.

Who Can Benefit from This Guide?

If you're someone who:

Earns less than ₹10,000 per month

Has a low or no CIBIL score

Needs urgent cash loans or instant money loan

Is self-employed without income proof

Wants quick loan approval online without the headache of paperwork

This article is tailor-made for you.

Why Traditional Banks Say No

Banks typically reject personal loan applications for these reasons:

Low salary threshold not met

CIBIL score below 650

No formal income proof like salary slips or ITRs

Lack of collateral or banking history

But fintech platforms have changed the game by offering Insta Loan solutions based on your alternative data like mobile usage, UPI activity, bank SMS, and more.

The Digital Lending Revolution: Your Shortcut to Instant Loans

With the rise of technology, you can now apply for a personal loan online with just your phone and Aadhaar card. Whether you need instant cash loans, quick personal loans, or even a personal loan without visiting a bank, everything is now accessible via apps and digital platforms.

Top Features of Instant Personal Loan Online

Top 5 Personal Loan Apps in India for Bad CIBIL & Low Salary (2025)

These apps are changing the way Insta Loans are given — with easy steps, low documents, and zero judgment on your past.

Real Case Example: How Rahul Got ₹50,000 in 20 Minutes

Rahul, a freelancer from Lucknow, had no CIBIL and only earned around ₹11,000/month. He got rejected by banks twice. Then he tried a digital app (KreditBee), uploaded Aadhaar + PAN, verified bank SMS, and got instant approval for ₹50,000 within 20 minutes — no calls, no branch visit, no salary slip.

This is not luck. It’s fintech power in your pocket.

How to Apply for a Personal Loan Online (Step-by-Step)

Download the best personal loan app (like KreditBee, Nira, PaySense, etc.)

Complete KYC with Aadhaar + PAN or Voter ID

Enter your income source (salary, freelance, small business)

Submit your mobile-linked bank account

Get Personal Loan Instant Approval within minutes

Receive Instant Funds in your bank account

Smart Tips to Boost Instant Personal Loan Approval

Use the same mobile number linked to UPI & bank

Don’t fake income — apps verify through bank SMS

Enable auto KYC to speed up the process

Repay small loans first to unlock higher limits

Link Aadhaar to your phone for OTP-based access

Key Benefits

No Income Proof Needed

No CIBIL? No problem!

Apply Anytime, Anywhere

Instant Disbursement

No Bank Visit Required

Trusted by Salaried & Small Business Owners

Whether you're from Delhi NCR, Lucknow, Indore, Nagpur, or Guwahati, you can apply from your mobile right now.

FAQs: Instant Personal Loan in India

1. Can I get an instant loan online with a low CIBIL score?

Yes. Many fintech lenders offer instant personal loans without a CIBIL check or accept scores below 600.

2. Is income proof mandatory for online loan approval?

No. You can get a personal loan without income proof using bank SMS or UPI data.

3. How fast can I receive funds after applying?

Most apps offer to get a personal loan in 5 minutes or within 1 hour after approval.

4. Are these platforms available in smaller cities like Indore or Guwahati?

Yes. You can get a quick personal loan in Indore, apply for a personal loan in Guwahati, and many other Tier 2 cities.

5. Is PAN or Aadhaar mandatory?

Most platforms need at least one for KYC, but some offer a personal loan without PAN or Aadhaar on special terms.

Final Word: No Documents? No Problem Anymore

We understand that life isn’t always financially smooth. That’s why 2025 is all about freedom from paperwork, no CIBIL roadblocks, and instant online loan disbursement from the comfort of your phone.

Whether you’re in Delhi NCR, Nagpur, Indore, or Guwahati, you no longer need to stand in queues or beg the bank manager.

Just tap, verify, and get funded. Because your dreams shouldn’t wait for a credit score.

Ready to Apply? Your Loan is 5 Minutes Away

Choose a trusted app

Upload Aadhaar or PAN

Enter your basic details

Get funds in your account — instantly!

#Personal Loan#Instant Loan#Instant Personal Loan#Personal Loan Apply Online#Personal Loan Online Apply#Personal Loan Apply#Instant Loan Online#Cash Loans#Personal Loan Online#Instant Personal Loan Online#Instant Cash Loans#Instant Money Loan#Insta Loan#Personal Loan Instant Approval#Quick Loans Online#Get Instant Personal Loan#Quick Personal Loans#Quick Money Loans#Personal Loan India#Insta Personal Loan#personal loan for low cibil score#instant funds#Instant Personal Loan without income proof#Instant Personal Loan without cibil#Personal loan for self-employed without proof#Personal loan with ₹10#000 salary#Loan without bank statement or salary slip#Personal loan for small business owners#Easy loan approval without CIBIL check

0 notes

Text

Universal Payment Bank (UPB)Revolutionizing Digital Finance in India

What is UPB (Universal Payment Bank)?

Universal Payment Bank (UPB) is a next-generation digital bank focused on bringing secure, accessible, and efficient financial services to every Indian – from urban professionals to rural households. Built on the pillars of speed, simplicity, and transparency, UPB is reshaping the way people save, pay, and manage money.

🚀 Key Features of Universal Payment Bank

1. 100% Digital Onboarding

Open a bank account in minutes using Aadhaar and PAN

Fully paperless KYC process

Available through app and web portals

2. UPI & Mobile Wallet Integration

Seamless UPI transfers

Scan-and-pay with QR codes

Instant balance alerts and payment history

3. Zero Balance Accounts

No minimum balance requirement

Ideal for students, freelancers, and micro-entrepreneurs

Auto-sweep to savings for interest-earning benefits

4. Government Subsidy Direct Benefit Transfers (DBT)

Receive LPG subsidies, pensions, and welfare benefits directly

Aadhaar-linked and secure

Widely adopted in rural and semi-urban areas

5. 24/7 Customer Support & AI Chatbot

Real-time assistance via in-app chat

Phone and email support

Regional language support for inclusivity

📱 The UPB App Experience

The UPB mobile app is designed for accessibility and usability:

Dashboard Overview: Track expenses, savings, and UPI payments in one view

Recharge & Bill Pay: Mobile, DTH, electricity, and water bill payments

Savings Goals: Set targets and auto-save small amounts weekly or monthly

🌍 Financial Inclusion & Impact

Universal Payment Bank plays a pivotal role in India’s Digital India and Jan Dhan missions:

Enables banking access in remote areas

Empowers women and daily wage workers through mobile-first banking

Offers micro-insurance and pension schemes for gig and informal workers

🛡️ Security & Trust

RBI-regulated under the Payments Bank license framework

Advanced fraud detection and OTP authentication

Account-level transaction limits to safeguard small savers

📚 Frequently Asked Questions (FAQs)

1. What does UPB stand for?

UPB stands for Universal Payment Bank, a digital-first banking platform licensed by the Reserve Bank of India (RBI).

2. Can I open an account without visiting a branch?

Yes. UPB allows full digital onboarding through Aadhaar-based e-KYC. No physical visit required.

3. Is UPB a regular bank?

UPB is a Payments Bank, meaning it can:

Accept deposits up to ₹2 lakh per customer

Offer UPI, debit cards, and bill payments But it cannot provide loans or issue credit cards.

4. Is there a minimum balance requirement?

No. UPB offers zero balance savings accounts with full digital access.

5. How do I get a debit card from UPB?

You can request a virtual or physical debit card via the UPB app. It works with all ATMs and online merchants.

6. Does UPB support UPI and QR payments?

Absolutely! UPB offers seamless UPI integration, QR code-based payments, and scan-to-pay features.

7. Are my funds safe with UPB?

Yes. Deposits up to ₹5 lakh are insured under DICGC (Deposit Insurance and Credit Guarantee Corporation) as per RBI norms.

✅ Why Choose UPB?

Simplified banking for everyone

Instant payments with real-time tracking

No hidden fees or charges

Empowering rural and underbanked segments

✨ Final Thoughts

In a rapidly digitizing world, Universal Payment Bank (UPB) bridges the gap between innovation and inclusion. Whether you're a salaried employee, a daily wage worker, or a student, UPB gives you the tools to manage your money smarter, faster, and safer.

Open your account today and step into the future of digital banking.#upb #whatisupb #upbonly

0 notes

Text

Top Digital Banking Features You Should Be Using in 2025

As banking continues to go digital in 2025, customers are enjoying greater convenience, security, and efficiency than ever before. From managing finances on the go to accessing AI-powered insights, the modern digital banking ecosystem is transforming how individuals and businesses interact with their money. If you're still only using basic features like balance check and fund transfers, it's time to explore what more your bank offers.

1. AI-Based Financial Planning Tools

Most leading banks in India now offer AI-powered financial planning tools through their mobile apps or net banking platforms. These tools analyze your spending habits, categorize expenses, and provide personalized saving and investment suggestions. Some even offer predictive alerts to help avoid overspending or missing bill payments.

2. UPI Integration and QR Code Payments

Unified Payments Interface (UPI) has revolutionized real-time payments. In 2025, it has become even more versatile with features like UPI Lite, UPI AutoPay, and Credit Card-linked UPI. Banks now enable seamless QR code scanning for in-store purchases, merchant payments, and even donations, all directly through their official apps.

3. Cardless Cash Withdrawals at ATMs

Security and convenience come together with cardless ATM withdrawals. By generating a one-time passcode or using biometric verification via the bank’s mobile app, customers can withdraw cash without carrying their debit card. This is particularly useful in emergencies or if your card is lost or stolen.

4. Voice and Chatbot Assistance

Banking support has moved beyond customer care numbers. Now, intelligent chatbots and voice assistants can help you check balances, block cards, track transactions, and get loan information 24/7. These bots are integrated across apps, websites, and even WhatsApp channels.

5. Customizable Alerts and Spending Insights

Modern digital banking allows users to set up real-time alerts for low balances, large withdrawals, or unusual login activity. Alongside this, visual dashboards in banking apps show spending trends across categories like food, shopping, and travel—helping users stay in control of their finances.

6. Digital Onboarding and Instant Account Opening

Banks now let you open savings accounts, FD/RD, or even apply for personal loans and credit cards without visiting a branch. With Aadhaar-based eKYC, verification and onboarding are done in minutes, making banking more accessible than ever.

7. Secure Biometric and Two-Factor Authentication

With cybercrime threats on the rise, banks have strengthened their login and transaction processes. Features like fingerprint/face recognition, OTP verification, and device binding ensure that your money remains safe during every transaction.

Conclusion

In 2025, digital banking is no longer just a convenience—it's a necessity. By exploring and using these advanced features offered by your bank, you can manage your finances smarter, faster, and more securely. Stay updated with your bank's app updates and new features to make the most of what digital banking has to offer.

0 notes

Text

Online Donation to Temples: Secure, Simple, and Spiritually Fulfilling

Promoting Vrindavan Chandrodaya Mandir – https://vcm.org.in

A New Era of Devotion

In an age where almost everything has shifted online—shopping, learning, banking—it’s only natural that spiritual offerings have followed. Today, donating to temples is no longer bound by geography or time. Thanks to modern technology, online donation to temples has emerged as a powerful, seamless, and meaningful way for devotees to support their faith from anywhere in the world. Whether you are sitting in Chennai or California, you can now offer your seva to temples like the majestic Vrindavan Chandrodaya Mandir with just a few clicks, while being assured of both spiritual satisfaction and digital security.

The Purpose of Temple Donations

For centuries, Hindu temples have been maintained and nourished through the generous contributions of devotees. These donations support daily rituals, pujas, annadaan (food distribution), Goshala (cow shelters), temple upkeep, festivals, and the construction of new shrines. For the devotee, offering donations is an expression of gratitude, a way to earn spiritual merit, and a sincere service to God and the community. The act of giving is deeply rooted in dharma, the moral path, and strengthens the connection between devotee and deity.

The Rise of Online Giving in Spiritual Spaces

With the advent of technology and increasing internet penetration, temples across India have embraced digital transformation. Platforms like https://vcm.org.in now allow devotees to contribute online to sacred causes such as the construction of the world’s tallest temple—Vrindavan Chandrodaya Mandir, a divine project dedicated to Lord Krishna. This digital shift has not only made giving more accessible but also more transparent and trackable, offering devotees a sense of involvement in the temple’s growth even from afar.

Secure and Trustworthy Transactions

One of the key reasons why online donations to temples have gained traction is the assurance of safety and security. Gone are the days of worrying about whether your offering reaches the right hands. With encrypted payment gateways, OTP verifications, and instant digital receipts, temples like Vrindavan Chandrodaya Mandir ensure that your contributions are securely processed and properly acknowledged.

The donation portal at https://vcm.org.in is built to handle transactions with complete integrity. Whether you’re donating through UPI, net banking, credit card, or international payment systems, the platform maintains high standards of cybersecurity. This allows devotees to focus on the bhakti—the devotion—without anxiety about the transaction itself.

Unmatched Simplicity for Every Devotee

What makes online donation particularly attractive is its simplicity. It removes logistical barriers like travel, standing in queues, or limited donation hours. Anyone, at any time, can access the temple website, choose the cause they wish to support—be it temple construction, food distribution, or Goseva—and complete the offering in minutes. It’s devotion without delay.

Moreover, the user interface is built to serve everyone, from tech-savvy millennials to elderly devotees with limited digital experience. Whether you’re donating ₹100 or ₹10,000, the experience is smooth and satisfying, leaving more room for prayer and connection rather than technical confusion.

Deepening the Spiritual Experience

Online donation may seem like a modern practice, but at its core, it preserves the ancient intent of seva (selfless service). Every rupee offered is still an offering to the Divine, whether made by hand or through a mobile screen. In fact, for many devotees, the act of donating online is accompanied by a prayer, a silent request, or an expression of thanks—just like placing money in the temple hundi.

Vrindavan Chandrodaya Mandir understands this spiritual significance and enhances the donor experience by sharing photos, videos, and updates on how your seva is contributing to the temple’s progress. You’re not just sending money; you’re becoming part of a living, breathing spiritual movement.

Connecting Global Devotees to Vrindavan

One of the most beautiful outcomes of online donations is that they connect devotees from all over the world to the sacred land of Vrindavan. Many followers of Sanatana Dharma live outside India and feel a deep longing to contribute to their spiritual heritage. With online giving, they are able to support the creation of a temple that celebrates Lord Krishna’s leelas, even from thousands of miles away.

The donation portal at https://vcm.org.in serves as a digital bridge between these global hearts and the holy land of Krishna’s childhood. The Mandir itself is a once-in-a-lifetime project, and by contributing online, devotees become spiritual stakeholders in this divine legacy.

From Janmashtami to Gopashtami—Always Stay Involved

Festivals are some of the most spiritually charged times of the year, and temples often receive the highest number of offerings during these periods. But what if you can’t be there in person for Janmashtami, Holi, or Gopashtami? Online donation ensures that your participation is not missed.

Vrindavan Chandrodaya Mandir allows you to sponsor special pujas, prasadams, flower decorations, and gosevas during these festivals—all online. This means that your prayers and offerings are part of the celebrations, even if you are continents away. The temple’s social media and live broadcasts add to the immersion, making the spiritual connection real and heartfelt.

A New Form of Digital Dharma

In our fast-paced digital lives, we often forget that technology can be used not only for convenience but for compassion and karma. Donating to a temple online is one of the easiest and most effective ways to practice dharma in today’s world. You can feed a hungry child, shelter a cow, fund a festival, or build a temple—all with the tools you use every day.

By embracing this form of digital dharma, you are not compromising tradition—you are strengthening it for future generations. Vrindavan Chandrodaya Mandir is leading this path forward by making it easier for every devotee to become a part of Krishna’s eternal mission.

Conclusion: Click with Devotion, Serve with Intention

Online donation to temples is not just a technological feature—it is a spiritual revolution. It is the confluence of modern ease and timeless belief. At a time when the world is moving faster than ever, the ability to pause, connect, and give to a divine cause is more valuable than ever.

Vrindavan Chandrodaya Mandir is more than a construction project—it is a sacred movement to revive Krishna Bhakti on a global scale. Your online donation can help this temple rise as a beacon of spirituality for generations to come. It is secure, simple, and spiritually fulfilling—just as seva was always meant to be.

To offer your heartfelt seva, visit https://vcm.org.in and become a part of this divine journey. Because in every click lies a blessing, and in every offering, the soul grows closer to the Lord.

0 notes

Text

How to Create CoinDCX Account & Start Crypto in Minutes

Beginner’s Guide: Create a CoinDCX Account in Just a Few Steps

Thinking of investing in crypto but confused about where to begin? You're not alone. With so many platforms out there, it can be overwhelming. However, if you're in India, CoinDCX stands out for being user-friendly, secure, and beginner-focused. In this guide, we’ll take you through how to coindcx open account easily and start trading in just a few minutes.

Whether you’re planning to buy Bitcoin, Ethereum, or explore other altcoins — the first step is setting up your account. Let’s break it down for you.

Why CoinDCX Is Perfect for Beginners

Before we dive into the coindcx open account process, let’s understand what makes CoinDCX so popular among Indian crypto investors.

Low entry barrier – Start investing with as little as ₹100

Quick INR deposits – Add funds instantly via UPI

Over 200+ coins available – You get access to all major cryptocurrencies

Easy interface – Even if you’re a complete beginner, the app makes navigation simple

Secure platform – Backed by strong encryption and 2FA support

So, if you're searching for a reliable exchange, this is a great place to begin. But first, you need to coindcx open account and verify it.

Step-by-Step: CoinDCX Open Account Process

Here’s how you can create your account on CoinDCX in a few quick steps:

1. Download the App or Visit the Website

Head over to the Play Store or App Store and search for the CoinDCX app. You can also use their official website. Once you’re on the homepage, tap on “Sign Up”.

2. Enter Your Details

You’ll need to enter your mobile number and email ID. After that, verify it using the OTP sent to your phone. Simple and quick.

3. Set Your Password

Choose a strong password. This will help keep your account secure in the long run. Don’t use something predictable — stay safe from the start.

4. Complete KYC Verification

This is the most important part of the coindcx open account process. Upload your PAN card and Aadhaar card, and take a quick selfie. The system usually approves accounts within a few hours, if not sooner.

5. Add Your Bank Details

For smooth INR deposits and withdrawals, link your bank account. Make sure your bank details match your name used in KYC.

6. Start Trading

Done with all the above? Congrats! Your coindcx open account is now active. Add some funds via UPI or net banking, and you're ready to buy or sell crypto.

What to Do After Your CoinDCX Account Is Live

Opening your account is just the start. Now that your coindcx open account is up and running, here’s what you should do next:

Enable 2FA (Two-Factor Authentication) — For extra safety

Explore the “Learn” section — CoinDCX provides helpful guides

Track live prices — You can even set alerts for price drops or spikes

Practice caution — Don’t invest big right away; get a feel of the market first

By following these tips, you’ll feel more confident using the platform. Many users rush in, but taking a little time to understand the basics makes a big difference.

Why Timing Matters in Crypto

Once your coindcx open account is active, timing becomes super important. Prices in crypto can change fast — sometimes within minutes. That’s why being able to react quickly with an active and verified account gives you an advantage.

Also, CoinDCX often runs special campaigns, rewards, and referral bonuses — all of which require a verified account. So if you're just browsing without signing up, you might be missing out.

1 note

·

View note

Text

How to Open Angel One Account Online in 12 Easy Steps

How to Open Angel One Account Online: Step-by-Step Guide

If you're planning to start your investment journey, learning how to open Angel One account online is your first and most crucial step. With a seamless digital onboarding process, Angel One allows you to open a trading and Demat account without visiting any branch. The best part? It takes less than 15 minutes and requires only a few essential documents.

In this guide, we’ll take you through the Angel One Demat account opening process, explain the benefits, and help you understand what documents you’ll need to complete your application without delays.

Why Choose Angel One?

Before jumping into how to open Angel One account online, it’s important to understand why the platform is a favorite among investors in India. Here’s what makes Angel One stand out:

Zero brokerage on equity delivery trades

Flat ₹20 per trade on intraday and F&O

Access to AI-based research via ARQ Prime

A highly intuitive mobile and web trading platform

Fully digital and paperless account setup

Given these advantages, it’s clear why thousands of users choose Angel One every day.

Documents Required for Angel One Account

To make your onboarding quick and easy, gather these documents before you begin:

PAN Card – Mandatory for identity verification

Aadhaar Card – Must be linked with your mobile number for OTP-based verification

Cancelled Cheque or Bank Statement – To validate your bank account

Digital Signature – Either drawn digitally or uploaded as an image

Income Proof – Only needed if you're applying for F&O or commodities (e.g., salary slip or ITR)

Having these ready will make your Angel One Demat account opening process smooth and efficient.

How to Open Angel One Account Online in 12 Easy Steps

Now, let’s break down the Angel One Demat account opening process in 12 straightforward steps. Follow them, and you’ll be ready to invest in no time:

Visit the Angel One Website Go to the official site and click on “Open an Account.”

Enter Your Mobile Number Type your number and verify it via OTP.

Add Personal Information Provide your full name and referral code, if available.

Verify Your Email Input your email address and verify it through OTP.

Provide PAN Details Enter your PAN number to fetch KYC details from DigiLocker.

Complete Aadhaar Verification Authenticate using an OTP sent to your Aadhaar-linked mobile number.

Link Your Bank Account Add UPI or bank details for smooth fund transfers.

Take a Live Selfie For identity verification, you’ll need to click a real-time photo.

Upload or Draw Signature Sign digitally or upload a clear image of your signature.

Submit Income Documents (if applicable) Upload salary slips, ITR, or bank statements for F&O access.

Fill Out Financial Information Choose your employment status, income range, and trading preferences.

Authorize DDPI and Final eSign Complete the Demat Debit and Pledge Instruction and e-sign the form with Aadhaar OTP.

Once submitted, the application goes under review. Typically, you’ll receive your login credentials within 1 to 3 working days if everything checks out.

What Happens After You Apply?

After you’ve followed the steps on how to open Angel One account online, the platform reviews your application. Once verified, you’ll receive your login credentials via SMS and email. You can then:

Start trading in equities, F&O, and commodities

Apply for IPOs effortlessly

Access AI-driven portfolio suggestions

Set up real-time alerts on price movements

Why Accurate Documentation Matters

An error in documentation can stall your progress. That’s why it's important to ensure that all documents are valid, legible, and updated before you begin the Angel One Demat account opening process. Even a small mismatch in details can delay account activation.

Benefits of Having an Angel One Demat Account

Once you're onboard, Angel One offers several tools to grow your portfolio:

Mutual Funds & SIPs – Build long-term wealth easily

ETFs – Diversify with low-cost instruments

Commodities & F&O – For advanced trading strategies

Real-Time Data & Research – Make smarter decisions with updated insights

These features make Angel One an excellent choice, especially for new investors who prefer a guided experience.

Final Thoughts

Knowing how to open Angel One account online saves you time and opens the door to countless investment opportunities. By keeping your documents ready and following the digital steps outlined above, you’ll be able to complete the Angel One Demat account opening process without a hitch.

So, why delay? Prepare your documents today and start trading with one of India’s most reliable platforms.

0 notes

Text

Reddybook - India’s #1 Trusted Betting Platform

In recent years, online betting has become more popular in India, especially with cricket lovers and casino game fans. With many platforms available, it can be tough to choose the one that’s truly safe and reliable. This is where Reddybook stands out.

Known for its smooth user experience, wide game variety, and secure payments, Reddybook has earned the title of India’s #1 trusted betting platform.

Why Reddybook is the Most Trusted Platform in India

1. A Platform Made for Indian Users

Reddybook is designed to suit Indian users. Whether you’re in Mumbai, Delhi, Hyderabad, or any small town, the platform offers easy access in both English and Hindi. From beginners to expert bettors, everyone can enjoy a seamless experience with Reddybook’s simple interface.

You don’t need to be tech-savvy to use it – just sign up, verify your ID, and start playing your favourite games or betting on cricket.

2. Strong Focus on Security

Security is a top concern for online bettors. Reddybook Club ensures your data and transactions are protected with high-end encryption. Whether you’re using UPI or bank transfer, your money is always safe.

Plus, the platform offers 2-step verification (2FA), giving you even more control and peace of mind over your account.

3. Thousands of Games and Live Casino Options

From Teen Patti to Dragon Tiger, Lucky Seven, Sicbo, and more – Reddybook brings you over 5000+ games. It also features live casinos where you can enjoy real-time action, just like in a real casino.

If you’re a sports lover, you can bet on cricket, football, tennis, kabaddi, and more. During IPL or World Cup seasons, Reddybook becomes the go-to platform for exciting live betting.

4. Reddybook Club – Exclusive for Indian Players

The Reddybook Club is a special section made for regular users. It offers extra benefits, cashback, promotions, and access to exclusive betting tools. Whether you play every day or only during big matches, the Club gives you more chances to win.

New users can even try the platform using a Reddybook Demo ID, which lets you explore games without using real money. It’s a great way to learn before you start betting for real.

How to Get Started with Reddybook

Starting your journey on Reddybook is simple and takes only a few minutes.

Step-by-step Guide:

Visit the official Reddybook website

Click Sign Up

Fill in your name, email, phone number, and password

Complete OTP verification

Submit KYC ID for full access

Start playing or betting!

You can also download the Reddybook mobile app for Android and iOS and enjoy gaming on the go.

24/7 Support for All Your Needs

Whether it’s a payment issue or game confusion, Reddybook’s customer support is available 24/7 via live chat and WhatsApp. This shows their strong focus on user satisfaction and trust.

Why Indians Trust Reddybook

Designed for Indian betting habits

Multiple language support

Safe payment methods (UPI, Net Banking)

Massive game selection

Fast withdrawal process

Trusted by millions of users

Responsible gaming tools and deposit limits

Conclusion: Join Reddybook and Bet Smarter

Whether you’re passionate about cricket betting or love casino games like Teen Patti and Andar Bahar, Reddybook has everything you need. It’s no surprise that Reddybook Club is gaining popularity among Indian bettors.

With trust, transparency, and top-class support, Reddybook truly lives up to its title of India’s #1 trusted betting platform.

0 notes

Text

Jalwa Game Download – How to Install, Play, and Win Real Cash in 2025

Jalwa Game Download – Start Playing & Earning Instantly

📌 Summary:

Looking for a fast, secure, and rewarding online gaming app? The Jalwa Game Download option gives you direct access to one of India’s most popular real-cash gaming platforms. In this guide, we’ll explain how to download the app, its features, system requirements, and answer the most common user questions. Whether you're a beginner or an experienced player, everything starts with a smooth and safe Jalwa Game Download.

📖 Biography: About Jalwa Game Download

The Jalwa Game Download is the first step to enter the exciting world of online real-money gaming. Jalwa Game is an app-based platform offering a wide range of games like color prediction, card games, number guessing, and more. With easy-to-understand gameplay and real cash prizes, it has attracted thousands of users across India. Available directly from the official website, the Jalwa Game Download is secure, lightweight, and optimized for Android smartphones. Once installed, users can register using their mobile number and start earning real cash in minutes.

📲 How to Complete the Jalwa Game Download Process

Here’s a simple step-by-step guide to get started:

Click on the Jalwa Game Download button or banner.

Allow downloads from unknown sources (for Android users).

Download the APK file and install it on your phone.

Open the app and complete registration via OTP.

⚠️ Note: The app is not available on the Google Play Store due to real-money gaming policies, so only trust the official website for your Jalwa Game Download.

🎮 Features After Jalwa Game Download

Once you've completed the Jalwa Game Download, here’s what you get access to:

✅ Easy Login via Mobile OTP

✅ Color prediction, number games, and lucky draw options

✅ Daily login rewards and bonus cash

✅ Real-time UPI and bank withdrawals

✅ Refer & Earn system for inviting friends

✅ Live customer support for player help

✅ Low minimum withdrawal threshold

Whether you want to play casually or earn daily, the Jalwa Game Download opens doors to exciting possibilities.

📱 System Requirements for Jalwa Game Download

Before you begin the Jalwa Game Download, ensure your device meets these basic requirements:

📲 Android Version: 6.0 or above

💾 Storage Space: Minimum 100 MB

🌐 Internet Connection: Stable 3G/4G or Wi-Fi

📞 Active mobile number for OTP login

❓ Frequently Asked Questions (FAQs)

Q1: Where can I find the official Jalwa Game Download link? A1: You can find the official Jalwa Game Download link on the verified website, usually listed as a banner or button on the homepage. Avoid third-party download sites.

Q2: Is Jalwa Game Download free? A2: Yes, the Jalwa Game Download is completely free. There are no installation charges. You can deposit money later to play cash games.

Q3: Do I need to register again after downloading the app? A3: If you're a new user, you must register using your mobile number after the Jalwa Game Download. Existing users can simply log in using OTP.

Q4: Is Jalwa Game Download available for iPhone or iOS? A4: Currently, the Jalwa Game Download is only available for Android users. iOS support is not yet officially launched.

Q5: Is the Jalwa Game app safe to install? A5: Yes. If you use the official website, the Jalwa Game Download is safe and does not contain malware or adware. Just ensure that “Install from unknown sources” is enabled in your settings.

Q6: Can I play without making a deposit after Jalwa Game Download? A6: Yes, you can explore the games, earn from referral bonuses, and play demo versions before making any deposit.

Q7: How do I update the app after Jalwa Game Download? A7: Visit the official site again and click on the latest Jalwa Game Download link. Reinstalling the APK will update your app to the newest version.

💡 Tips for New Users After Jalwa Game Download

🎁 Claim your first login bonus within the app.

👥 Use your referral code to invite friends and earn.

💳 Link your UPI or bank account early for smooth withdrawals.

🕒 Play at peak times (evening) to increase winning chances.

⚠️ Always log out after use for extra security.

🎯 Final Thoughts

The Jalwa Game Download is your gateway to fun, excitement, and real cash rewards. With easy registration, simple games, and instant withdrawals, it’s perfect for anyone looking to combine entertainment with earnings. Remember to only download from the official website to avoid scams or fake apps. Once you’ve completed the Jalwa Game Download, you're all set to play and win.

So what are you waiting for? Complete your Jalwa Game Download today and enter a world full of winning opportunities!

1 note

·

View note

Text

Coindcx Account Opening Process: Fast, Easy & 100% Digital

Cryptocurrency has moved beyond just finance experts and tech enthusiasts. In 2025, everyday Indians—from students to working professionals—are actively stepping into the digital asset space. And when it comes to starting that journey, CoinDCX makes it incredibly easy. If you're wondering how to coindcx open account without any confusing steps, this guide is for you.

Thanks to a seamless and paperless experience, the coindcx account opening process is one of the fastest in India. Whether you’re switching from another crypto exchange or taking your first step into crypto, you’ll be ready to trade in under 10 minutes. Let’s break it down.

Why Choose CoinDCX?

Before diving into the steps, it's helpful to know why CoinDCX has become the go-to crypto platform for so many. First of all, it gives you access to more than 100 digital assets, including big names like Bitcoin, Ethereum, and trending altcoins.

Even better, CoinDCX charges zero fees on INR deposits and withdrawals. So more of your money stays invested where it belongs. Importantly, it also provides strong security features like biometric login, two-factor authentication, and cold wallet storage for 95% of user funds.

However, what truly makes the platform stand out is the coindcx account opening process. It’s designed for speed and simplicity—with zero paperwork, no printing, and no scanning required.

Step-by-Step: Coindcx Account Opening Process

Getting started on CoinDCX is refreshingly simple. Here's how you can coindcx open account in just a few minutes:

1. Download the App

Go to the Google Play Store or Apple App Store and install the CoinDCX app. Then tap “Create Account for Free” to begin.

2. Enter Your Details

Fill in your full name (as it appears on your PAN card), email ID, and create a password. Hit "Continue" to proceed.

3. Verify Contact Info

You’ll receive OTPs on your email and Aadhaar-linked mobile number. Enter them to verify your identity.

4. Submit PAN Number

Enter your PAN card number accurately. This step is essential for the coindcx account opening process, so double-check for typos to avoid delays.

5. Complete KYC with DigiLocker

Choose the DigiLocker option for instant verification. Enter your Aadhaar number, confirm via OTP, and finish by clicking a quick selfie. No documents to upload—just fast, automatic KYC.

Tip: If your DigiLocker is already active, this part takes less than a minute.

6. Link Your Bank Account

Add your bank account number, IFSC code, and a few personal financial details like occupation and income range. A ₹1 verification is done and refunded almost instantly.

7. Apply a Referral Code

If you’ve got a referral or promo code, now’s the time to use it. You can earn bonus crypto or discounted trading fees—another great reason to go through the coindcx account opening process.

8. Fund Your Account and Start Trading

Once verified, add funds via UPI or net banking (starting from just ₹100). You’re all set to buy, sell, and trade crypto straight from your phone.

What Makes the Coindcx Account Opening Process So Smooth?

Unlike many other platforms, CoinDCX cuts out the usual friction. The coindcx account opening process uses automation and smart integrations to save you time. There’s no need to upload multiple documents or wait days for manual approval.

Additionally, the app is incredibly intuitive. New users often mention how easy it is to navigate. Meanwhile, experienced traders appreciate the real-time charts and fast order execution. It caters to both beginners and pros equally well.

What Are People Saying?

Thousands of Indians have already chosen to coindcx open account, and reviews have been very encouraging. Users consistently praise the app’s clean interface and quick verification process. Many note that onboarding via DigiLocker is smoother here than on other exchanges.

Moreover, CoinDCX’s customer support is responsive, and regular updates keep the platform fresh and reliable. It’s clear that the platform is built with the user in mind—whether you’re trading daily or just starting out.

0 notes

Text

📲 Go Paperless with Ekychub: The Future of KYC is Digital

In today’s digital-first economy, businesses need to onboard users quickly, securely, and without unnecessary paperwork. Manual KYC (Know Your Customer) methods are not only time-consuming but also prone to delays and errors.

Ekychub’s Paperless KYC API service is the perfect solution for businesses looking to verify customer identities instantly—without printing, scanning, or uploading physical documents.

🔍 What is Paperless KYC?

Paperless KYC refers to the process of verifying a customer’s identity using digital methods, without any need for physical paperwork. It’s faster, more secure, and fully compliant with Indian regulatory standards.

Using Aadhaar-based OTP eKYC, PAN validation, and bank account verification, businesses can now complete onboarding processes in less than a minute—all from within their app or website.

⚙️ Ekychub's Paperless KYC API Features

✅ Real-Time Verification

Verify Aadhaar, PAN, UPI, and more instantly using secure and fast APIs.

🔐 Secure & Compliant

Fully encrypted and aligned with UIDAI and regulatory compliance standards.

🧾 No Paperwork Required

No more document uploads or manual checks—go fully digital.

💼 Designed for Businesses

Built for fintech, lending apps, insurance firms, payment gateways, and any business that requires identity verification.

🔄 Bulk KYC Options

Need to verify multiple users at once? Ekychub supports bulk verification for large onboarding campaigns.

🚀 How Does It Work?

User submits Aadhaar or PAN

Ekychub verifies through secure API calls

Response with verified details is returned in seconds

You onboard the user instantly, with confidence

It’s that simple. No uploads, no delays.

🎯 Why Choose Ekychub?

⚡ Fastest verification APIs in India

🔍 Accurate & real-time data

💰 Flexible pricing & free trial available

📚 Developer-friendly documentation

🛡️ Regulatory & audit compliant

🧠 Use Cases

Fintech: Fast user onboarding for wallets, UPI apps, and credit services

Lending: Instant borrower verification with Aadhaar & PAN APIs

Insurance: Digitally onboard policyholders without paperwork

Gaming & eCommerce: Verify users before transactions or withdrawals

Marketplaces & Aggregators: Onboard vendors, delivery agents, and freelancers smoothly

🌐 Transform Your KYC Process Today

Whether you’re a startup or an enterprise, Ekychub’s paperless KYC API makes identity verification simple, fast, and secure. Say goodbye to physical documents and hello to digital onboarding.

#technology#tech#identityvalidation#aadhaarintegration#technews#techinnovation#fintech#ekychub#kycverificationapi#aadhaarverificationapi#PaperlessKYC#eKYCIndia#DigitalKYC#KYCAPI#OnlineVerification#Ekychub#CustomerOnboarding#FintechIndia#DigitalTransformation#RegTech

0 notes

Text

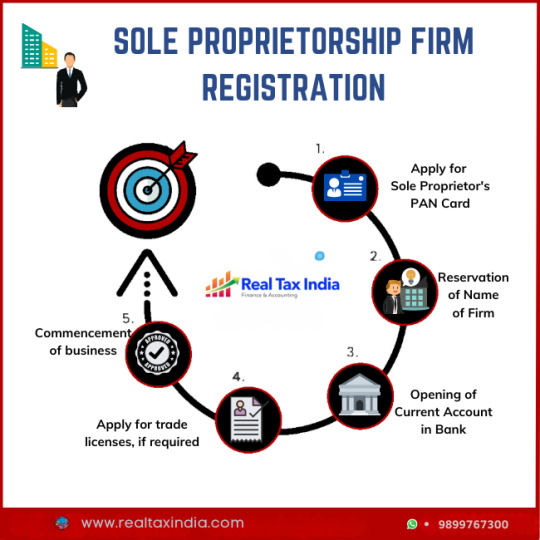

Sole Proprietorship Registration : A Step-by-Step Guide

How to Register a Sole Proprietorship in India Online — Process, Documents, Fees, and Expert Assistance

Are you a small business owner looking to start your entrepreneurial journey in India? Registering as a sole proprietorship is the simplest and most economical way to begin. With minimal compliance and straightforward registration, it’s ideal for individual entrepreneurs. In this blog, we’ll guide you through the sole proprietorship registration process, required documents, fees, and how to obtain a sole proprietorship certificate online in India. Whether you’re running a shop, offering freelance services, or operating a consultancy, registering your sole proprietorship is essential to legitimize your business.

And the best part? You don’t have to navigate the legalities alone. Real Tax India offers expert help for sole proprietorship registration, ensuring accuracy and timely compliance.

✅ What is a Sole Proprietorship?

A sole proprietorship is a type of business structure where a single individual owns and operates the business. It’s not considered a separate legal entity, meaning the owner is personally liable for business debts and obligations. Despite that, it remains the most popular and flexible choice for small businesses and startups in India.

📋 Why Register a Sole Proprietorship?

While a sole proprietorship can operate without formal registration, registering provides several benefits:

Business legitimacy and trust with clients or customers

Access to business bank accounts and UPI payments

Ability to apply for government tenders

Eligibility for GST registration

Smooth operations for e-commerce, supply chains, or vendor onboarding

Availing startup benefits and subsidies

🛠️ Sole Proprietorship Registration Process (Online)

You can easily register your sole proprietorship online in India with professional support. Here’s a simplified breakdown of the sole proprietorship online process:

Step 1: Choose a Business Name

Pick a unique business name that is not already in use or trademarked.

Step 2: Obtain Required Licenses & Registrations

Depending on your business type and turnover, you may need one or more of the following to establish proof of proprietorship:

GST Registration Mandatory if your turnover exceeds the threshold or you sell online.

Shop & Establishment Registration Required by most state governments for businesses with physical offices.

Udyam/MSME Registration Recommended for availing subsidies, loans, and MSME benefits.

Professional Tax Registration Applicable in select states like Maharashtra and Karnataka.

FSSAI Registration Required for food-related businesses.

Step 3: PAN Card & Aadhaar Card of Proprietor

You must have a valid PAN card and Aadhaar card for authentication and verification.

Step 4: Open a Business Bank Account

Once you obtain your sole proprietorship certificate or proof like GST or MSME registration, you can open a current account in your business name.

📁 Documents Required for Sole Proprietorship Registration

Here are the essential documents required for sole proprietorship online registration in India:

PAN card of the proprietor

Aadhaar card of the proprietor

Passport-size photo

Registered office proof — Rent agreement, utility bill, NOC from the owner

Bank account details (if applicable)

Business address proof

Email ID and mobile number for OTP verification

Depending on the registration type (GST, Udyam, etc.), Real Tax India will guide you through the precise list of documents required.

💰 Sole Proprietorship Registration Fees/Cost in India

The cost of registering a sole proprietorship can vary depending on the services opted and the state. However, with Real Tax India, the process is simplified and made affordable:

GST Registration — ₹500 to ₹1000 (one-time fee)

Udyam/MSME Registration — FREE or nominal fee

Shop & Establishment Registration — ₹1000 to ₹2000 (varies by state)

FSSAI Registration — ₹1000 to ₹2000 (basic license)

👉 For the most accurate and budget-friendly pricing, get in touch with Real Tax India for a customized quote based on your requirements.

📨 How to Apply for a Sole Proprietorship Certificate Online

The term sole proprietorship certificate usually refers to any document that proves your business’s legal existence — such as GST registration, MSME certificate, or Shop & Establishment certificate.

Here’s how to apply:

Visit the official registration portal or use a trusted service provider like Real Tax India

Submit your application form and upload documents

Complete OTP/email verification

Pay applicable government and service fees

Receive the certificate on your registered email ID

You can also apply for these certificates with the assistance of experts who will complete the end-to-end process for you.

🛡️ Why Choose Real Tax India for Sole Proprietorship Registration?

Registering your sole proprietorship correctly is crucial. Mistakes in application or document submission can delay your operations. Here’s why you should trust the experts at Real Tax India:

✅ Expert Guidance — Trained professionals will handle all legal formalities ✅ Affordable Pricing — No hidden fees ✅ Quick Turnaround — Get registered within days ✅ PAN-India Support — Available across India ✅ Free Consultation — Know what’s best for your business

📞 Get Started with Real Tax India Today!

Don’t let confusion delay your registration. Trust Real Tax India to register your startup on time and with 100% accuracy.

📞 Call: 9899767300 📧 Email: [email protected] 🌐 Website: https://realtaxindia.com

Whether you need help with a sole proprietorship certificate, understanding the online process, or estimating your registration cost, Real Tax India is your one-stop solution.

🏁 Final Thoughts

Starting a business as a sole proprietor in India is a smart and straightforward move. With low costs, minimal compliance, and complete control, it suits small traders, freelancers, and service providers. However, to operate professionally and avoid legal hassles, proper registration is essential. Let Real Tax India take care of it while you focus on growing your business.

1 note

·

View note

Text

How to Choose the Best Stock Broker for Your Investment Style in 2025

Are you waiting for the perfect moment to start investing and enter the stock market? We've got you covered! The Indian stock market has evolved significantly in recent months, thanks to new technologies that have made investing easier and more exciting than ever before.

However, not all brokers offer the same experience. Choosing the best stock brokers in india can makes your investment journey smooth and enjoyable. In this guide, we’ll walk you through how to select the best stock broker in India. Let’s get started and trade smartly, not hard.

Steps to Choose the Best Stock Broker in India

Understand Yourself: What Type of Investor Are You?

Before opening an account or downloading a trading app, it’s important to identify your investment style:

Are you someone who enjoys taking quick risks for fast gains?

Or are you a calm, strategic investor focused on long-term wealth or retirement planning?

Maybe you’re a casual trader who likes to buy or sell occasionally or just explore the market.

Ask yourself these quick questions:

How often do you plan to check your portfolio?

What level of risk can you tolerate without panic?

Are your goals short-term profits, long-term growth, income generation, or learning?

How much time can you dedicate to studying and monitoring the markets?

Answering these will help you understand your risk appetite and select a stockbroker that fits your investing style.

Understand Brokerage Fees and Other Charges

Many platforms advertise “zero brokerage” or “free trading,” but it’s essential to understand the associated costs before opening your Demat or trading account.

Here are key fees to keep in mind:

Brokerage Charges: Some brokers charge a flat fee, others take a percentage of your trade. Delivery trades often have no brokerage, but intraday trades may incur fees.

DP (Depository Participant) Charges: These apply when you sell shares from your Demat account.

Annual Maintenance Charges (AMC): A yearly fee to keep your Demat account active.

Hidden Fees: These could include charges for research tools, SMS alerts, margin interest, or call-and-trade services.

Make sure to review all these costs carefully before finalizing your broker.

Tips to Save on Costs:

Opt for discount brokers if you don’t need advisory services.

Thoroughly read the fee structure.

Avoid excessive trading to reduce unnecessary charges.

Choose the Right Trading Platform

Your trading platform is your primary tool for analyzing markets and placing trades. Selecting the right one can make all the difference.

Look for these essential features:

Real-time market data with no delays

Fast and secure fund transfers via UPI or net banking

A simple and intuitive user interface

Advanced charting and technical analysis tools

Easy access to educational resources

Pick a platform that’s user-friendly, equipped with powerful tools, and easy to navigate.

Reliability and Customer Support Matter

When it comes to your investments, trust and transparency are paramount. Always choose a reliable and registered stockbroker.

Before deciding, ensure your broker:

Is registered with SEBI (Securities and Exchange Board of India), guaranteeing regulatory oversight.

Offers strong security features like two-factor authentication to protect your funds.

Provides responsive customer support through live chat, email, and phone.

How to Open a Trading Account in Minutes

Opening a trading account has never been easier. Follow these simple steps and get started within 15 minutes:

Documents Required:

PAN card

Aadhaar card linked to your mobile number

Bank account details with IFSC code

A real-time selfie for identity verification

Step-by-Step Process:

Visit your broker’s app or website.

Fill out the KYC form.

Upload the necessary documents.

Complete the eSign process via Aadhaar OTP.

Get verified and start trading immediately.

Pro Tips for First-Time Investors

Avoid chasing hype and resist investing based on FOMO (fear of missing out).

Use demo accounts many brokers offer to practice risk-free trading.

Begin with a small investment amount and only invest what you can afford to lose.

Keep learning by following reliable sources like SEBI, Moneycontrol, ET Markets, YouTube channels, and investor forums.

Be patient; successful investing is a long-term game.

Conclusion: Take the First Step with Confidence

To sum up, smart investing is not just about picking the right stocks; it’s about selecting the best stock broker in india. Keep these points in mind:

Know your investor profile and choose a broker accordingly.

Understand all fees, including brokerage and hidden charges.

Opt for a platform with an easy-to-use interface and advanced features.

Verify that your broker is SEBI registered and trustworthy.

Check for reliable customer support.

Start small, keep learning, and invest wisely.

Begin your investment journey today with confidence, knowledge, and patience!

0 notes

Text

How to Secure a Tatkal Ticket: A Quick Guide for Last-Minute Train Travel

In a country like India, where train travel remains one of the most affordable and widely used modes of transportation, securing a last-minute seat can be a real challenge. That's where the Tatkal scheme by Indian Railways becomes a game changer. Whether it’s an urgent work trip, a sudden family emergency, or an impromptu vacation, understanding the tatkal ticket procedure can help you book your journey without hassle.

If you’re looking to book rail ticket tatkal online, or want to know how to confirm tatkal ticket with better chances, this article breaks down the essentials. Powered by insights from Afre Studios, this quick guide will help you master the art of tatkal for train ticket reservation.

What is a Tatkal Ticket?

Tatkal, meaning “immediate” in Hindi, is a fast-track booking system introduced by Indian Railways for passengers who need to travel on short notice. Unlike regular bookings which open 120 days in advance, tatkal ticket bookings are allowed only one day before the date of the journey.

Tatkal applies to both AC and non-AC classes, but the number of seats is limited and tickets sell out in minutes—sometimes seconds—especially during holiday seasons.

Tatkal Ticket Procedure: Step-by-Step Guide

Here’s a clear breakdown of the tatkal ticket procedure to help you avoid confusion:

Account Preparation

Before anything, create an IRCTC account if you don’t already have one. Keep the login credentials, passenger details (name, age, ID proof), and payment options ready.

Know the Timing

Tatkal booking opens one day before the journey:

10:00 AM for AC Classes

11:00 AM for Non-AC Classes

So, if your train is scheduled on the 5th, tatkal opens on the 4th.

Login Early

Login to IRCTC at least 10-15 minutes before booking time. If you’re using a third-party platform like Afre Studios’ smart rail tools, you may get a faster and more responsive booking interface.

Quickly Fill Passenger Info

Have passenger names, ages, and ID numbers ready in advance. Autofill tools or browser plugins can help save time during the rush.

Payment Speed is Key

Use fast payment gateways like UPI, credit cards with OTP autofill, or net banking with saved credentials. Avoid payment failure at this stage, as it can cost you the ticket.

Booking Confirmation

Once payment is done, you will see the confirmation screen. Download or screenshot the ticket immediately.

How to Confirm Tatkal Ticket: Pro Tips

Getting a confirm tatkal ticket is a mix of preparation, speed, and luck. Here are some smart tips:

Choose Less Popular Routes: Trains on major routes (e.g., Delhi-Mumbai, Chennai-Bangalore) get filled quickly. If feasible, choose alternate stations.

Book Through Faster Apps: IRCTC can be slow. Platforms like Afre Studios often provide optimized APIs and quicker checkout.

Travel Light: Avoid opting for lower berths or preferences that can slow down your booking.

0 notes