#WACC (Weighted Average Cost of Capital)

Explore tagged Tumblr posts

Text

What Are Contributory Asset Charges (CAC)?

Contributory Asset Charges (CAC) represent the fair return required for the use of assets that support revenue generation. They ensure that all assets contributing to cash flows—whether tangible or intangible—are fairly compensated.

When Are CACs Used?

CACs are primarily applied in: ✔ Intangible asset valuation (e.g., patents, trademarks, customer relationships) ✔ Transfer pricing (ensuring intercompany transactions are fairly priced) ✔ Royalty rate analysis (determining fair licensing fees)

How Are CACs Calculated?

The formula for CAC is:

text

Copy

Download

CAC = Asset Value × Required Rate of Return

Asset Value: The fair market value of the contributory asset.

Required Rate of Return: The expected return an investor would demand for holding the asset (often derived from WACC or industry benchmarks).

Example: A company owns a trademark valued at $5 million. If the required return is 10%, the CAC would be $500,000 annually.

2. What Are Capital Charges?

Definition

Capital Charges represent the cost of invested capital—the minimum return a company must generate to satisfy investors and lenders. It is a key component in Economic Value Added (EVA) and residual income models.

When Are Capital Charges Used?

Capital Charges help assess: ✔ Corporate profitability (whether returns exceed the cost of capital) ✔ Investment efficiency (identifying value-creating projects) ✔ Performance metrics (used in EVA and shareholder value analysis)

How Are Capital Charges Calculated?

The standard formula is:

text

Copy

Download

Capital Charge = Invested Capital × Cost of Capital (WACC)

Invested Capital: Debt + Equity – Non-operating assets.

Cost of Capital (WACC): Weighted average of debt and equity costs.

Example: A firm with $10M in invested capital and a WACC of 8% would have a $800,000 annual capital charge.

Read More - Contributory Asset Charges vs. Capital Charges: Key Differences Explained

3. Key Differences Between CAC and Capital Charges

Feature

Contributory Asset Charges (CAC)

Capital Charges

Purpose

Compensates supporting assets in cash flow generation

Measures the cost of all invested capital

Used in

Intangible asset valuation, transfer pricing

EVA, corporate performance analysis

Calculation

Asset-specific return rate

WACC-based (company-wide)

Scope

Individual asset level

Entire firm level

Industry Use

Common in IP valuation, licensing

Used in financial management, M&A

4. Practical Applications in Valuation

A. Business Valuation

CAC helps determine fair royalty rates for licensed assets.

Capital Charges assess whether a company is truly profitable after covering capital costs.

B. Mergers & Acquisitions (M&A)

Buyers use CAC to evaluate intangible assets in a target company.

Capital Charges help assess whether an acquisition will generate sufficient returns.

C. Tax and Compliance

CAC is crucial for transfer pricing compliance (e.g., intercompany licensing).

Capital Charges impact tax-efficient capital structuring.

5. Common Misconceptions

❌ Myth 1: CAC and Capital Charges are the same.✅ Reality: CAC applies to specific assets, while Capital Charges measure overall cost of capital.

❌ Myth 2: Only large corporations need to consider these charges.✅ Reality: Startups and SMEs also benefit—especially when valuing IP or seeking investors.

❌ Myth 3: Capital Charges only matter for debt-heavy firms.✅ Reality: Even equity-financed companies must cover their cost of capital.

6. Industry Case Studies

Case 1: Technology Company Licensing IP

A software firm licenses its patent to a subsidiary. CAC ensures the parent company receives fair compensation, while Capital Charges evaluate if the subsidiary’s operations justify the cost.

Case 2: Private Equity Investment

A PE firm assesses a target company’s Capital Charges to determine if the business generates excess returns. CAC helps value intangible assets like brand reputation.

7. Conclusion

Understanding Contributory Asset Charges (CAC) and Capital Charges is vital for accurate Business Valuation, M&A, and financial planning.

#“Difference between CAC and Capital Charges”#“Why are Capital Charges important in valuation?”#“Contributory Asset Charges in intangible asset valuation”#“How WACC affects Capital Charges”#“Real-world examples of Capital Charges”#“When to use CAC in financial modeling”#“Impact of Capital Charges on M&A deals”#“Best practices for calculating CAC”#“How EVA incorporates Capital Charges”#Return on Invested Capital (ROIC)#Residual Income Valuation#Discounted Cash Flow (DCF)#Intellectual Property Valuation#Fair Market Value#Business valuation services for CAC analysis#Contributory Asset Charges#Capital Charges#Business Valuation#Cost of Capital#Intangible Asset Valuation#CAC vs. Capital Charges#WACC (Weighted Average Cost of Capital)#Economic Value Added (EVA)#Fair Value Accounting#Transfer Pricing#How to calculate Contributory Asset Charges#“Expert advice on Capital Charge calculations”#“How to optimize WACC for your business”#“Valuation consultant for intangible assets”#“Transfer pricing compliance and CAC”

0 notes

Note

andy! how about an americano with frat!jack 🤭🤭 I miss him

- 🧢

“This sucks,” Jack complains, spinning in his wheely chair. He pushes back from his desk and twirls until the chair stops on its own. “I’m bored.”

“You’re not bored, you just don’t want to study.” You tap your pen on the textbook in front of you, looking at Jack with an unimpressed glare. “This is kind of important, J.”

“It’s not that important. I’ll still pass if I get a C. I could get a C in my sleep.” He tosses his pen up in the air and catches it again. “Let’s do something.”

“I am studying,” you tell Jack. You highlight a line on your study guide and read it out loud to Jack. “‘How does the Modigliani-Miller theorem affect a company’s Weighted Average Cost of Capital?”

Jack points at you with the tip of his pen. “Doesn’t. M&M doesn’t matter when it comes to WACC. Can I fuck you?”

You sputter on a cough, shocked by how brazen he is. “Oh my God, Jack, no.”

“You need to loosen up for a second, take a break before you try and cram more information into that pretty head of yours. We’re losing brain cells, baby. You taught me everything I know about WACC.” He swivels over to your side, tugging the arm of your desk chair until you’re facing him. “Get up, I want to ‘wacc’ this ass.”

You groan at the pun. “Really? We’re in the study room.”

“So what? Would you be more comfortable in the bathroom?” Jack asks, feigning chivalry. He tucks his hands beneath your knees and pulls you towards him.

You kick in his direction, nearly catching Jacks’ elbow. “We’re studying.”

“I’ll quiz you after. Or you can keep studying while I do something,” Jack bargains. His fingers dip between your legs, sliding up the inseam of your athletic shorts. “Please? I’m so bored.”

“You’re not going to stop asking until you get your way,” you say knowingly. “Are you?”

Jack grins. “Nope. I’m very persuasive.”

“Hm, just like all frat boys,” you ponder. “You don’t know what no means.”

Jack pulls his hands back and frowns at you. “Stop it, I’m not doing that.”

“I mean, you’re pressuring me. Aren’t you?”

“No,” Jack drawls, groaning in annoyance. “Don’t, you’re making me feel like an asshole. I’m not pressuring.”

“Sure sounds like it to me.”

Jack sits back in his chair and spins away, covering his face with his baseball cap.

You chuckle at his dramatics. “Give me fifteen minutes and I’ll be ready for you.”

Jack studies for maybe five of the next fifteen minutes, torn between trying to look busy and pleased that he gets to fuck you like he had planned. He taps the table with his pencil, playing the drums as he pretends not to look at you.

When fifteen minutes are up, you close your textbook with your pencil still inside, marking your spot. You push it to the side and hop up on the table, spreading your legs for Jack to wheel between.

His hands are greedy as he meets you, squeezing the meat of your thighs as he bites his bottom lip and zeroes in on your cunt. “Do I get to fuck you on the table?”

“You get to eat me out on the table,” you correct. You turn Jack’s baseball cap so it’s backwards on his head, then you tweak his cheek. “How about that?”

“Ugh, you know I don’t like that,” Jack says. “Let me fuck you.”

“You know, I could go for more studying,” you tell him. You cross one leg over the other and hum noncommittally, shrugging. “I don’t feel ready for this exam.”

“If I make you come with my mouth, can I come inside you?”

“Yeah, later though.”

“Sick.” Jack digs his fingers into your waistband and drags your shorts down, taking your panties with them. He surges forward with his tongue out and ready, looking the same as he does when he’s drunk and gearing up to grab the beer funnel for his keg stand.

You place a hand on the back of his head, encouraging Jack closer. His hair curls under the brim of the hat, shaking out as he licks up your slit. His tongue jabs at your entrance, blunt and probing. He hums in satisfaction, nodding up and down so that his head is doing most of the work.

Jack likes to say that he’s not good at eating pussy, but when you incentivize him the right way, he’s very into it. His button nose hits your clit as he moves, his vigor replacing any fancy trick that an orally motivated man could use.

He wraps his arms around your middle, tugging you right to the edge of the table. Jack slurps, his tongue curling and folding as he eats you out. You let your eyes flutter shut and your head fall back, sighing softly.

Jack grins and sucks your clit into his mouth, lips pursed around the bundle of nerves and shooting sparks through your abdomen.

“Ugh, been thinking about this cunt all day,” Jack says happily. “So tight. Can’t wait to feel it around my cock.”

#1 year of puck-luck!#andy writes anything🍄#jack hughes#jack hughes smut#jack hughes x reader#jack hughes fanfiction#jack hughes blurb#jh blurb#jh86#frat jack!#frat jack anon🧢#andy's frat multiverse🧢

288 notes

·

View notes

Text

EY Interview Direct Questions & Answers (2023)

EY Interview Direct Questions & Answers (2023)

EY, often known as Ernst & Young Global Ltd., is a multinational professional services partnership with its main office in London, England. One of the world’s largest networks for professional services is EY. This company is regarded as one of the “Big Four” accounting firms, along with Deloitte, KPMG, and PwC. Its main services to clients include assurance (which includes financial audit), tax, consulting, and advisory.

Apply in EY careers.

EY Technical Questions

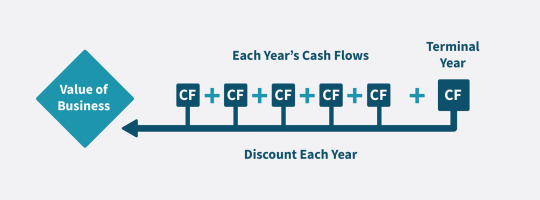

Q1. DCF and explain briefly

Discounted cash flow (DCF) valuation is a type of financial model that determines whether an investment is worthwhile based on future cash flows. The DCF model operates on the principle that the worth of a company is dependent on its ability to generate positive cash flows for its investors in the future.

Discounted cash flow analysis helps determine an investment’s value based on its future cash flows.

The present value of expected future cash flows is estimated using a projected discount rate.

If the DCF is higher than the current cost of the investment, the opportunity could result in positive returns and may be worthwhile.

Companies typically use the weighted average cost of capital (WACC) for the discount rate because it accounts for the rate of return shareholders expect.

A disadvantage of DCF is its reliance on estimations of future cash flows, which could prove inaccurate.

DCF Formula

DCF=(1+r)1CF1+(1+r)2CF2+(1+r)nCFn

where: CF1=The cash flow for year one

CF2=The cash flow for year two

CFn=The cash flow for additional years

r=The discount rate

Q2. Explain the time value of money.

The time value of money (TVM) is the concept that a sum of money is worth more now than it will be at a future date due to its earnings potential in the interim. The time value of money is a core principle of finance. A sum of money in the hand has greater value than the same sum to be paid in the future.

If the rate of inflation is actually higher than the rate of your investment return, then even though your investment shows a nominal positive return, you are losing money in terms of purchasing power. For example, if you earn 10% on investments, but the rate of inflation is 15%, you’re losing 5% in purchasing power each year (10% – 15% = -5%).

Q3. What is the difference between Futures and options?

Futures

Futures are derivative financial contracts that obligate parties to buy or sell an asset at a predetermined future date and price. The buyer must purchase or the seller must sell the underlying asset at the set price, regardless of the current market price at the expiration date.

Underlying assets include physical commodities and financial instruments. Futures contracts detail the quantity of the underlying asset and are standardized to facilitate trading on a futures exchange. Futures can be used for hedging or trade speculation.

Options

The term option refers to a financial instrument that is based on the value of underlying securities, such as stocks. An options contract offers the buyer the opportunity to buy or sell—depending on the type of contract they hold—the underlying asset. Unlike futures, the holder is not required to buy or sell the asset if they decide against it.

Each option contract will have a specific expiration date by which the holder must exercise their option. The stated price on an option is known as the strike price. Options are typically bought and sold through online or retail brokers.

Difference

Options and futures are two varieties of financial derivatives investors can use to speculate on market price changes or hedge risk. Both options and futures allow an investor to buy an investment at a specific price by a specific date. But there are important differences in the rules for options and futures contracts, and in the risks, they pose to investors.

Q4. Hedge fund strategies?

A hedge fund is a limited partnership of private investors whose money is managed by professional fund managers who use a wide range of strategies, including leveraging or trading non-traditional assets, to earn above-average investment returns.

Hedge fund investing is often considered a risky alternative investment choice and usually requires a high minimum investment or net worth, often targeting wealthy clients.

Strategies

1. Global macro strategies

In the global macro strategy, managers make bets based on major global macroeconomic trends such as moves in interest rates, currencies, demographic shifts, and economic cycles. Fund managers use discretionary and systematic approaches in significant financial and non-financial markets by trading currencies, futures, options contracts, and traditional equities and bonds. Bridgewater is the most famous example of a global macro fund.

2. Directional hedge fund strategies

In the directional approach, managers bet on the directional moves of the market (long or short) as they expect a trend to continue or reverse for some time. A manager analyses market movements, trends, or inconsistencies, which can then be applied to investments in vehicles such as long or short equity hedge funds and emerging markets funds.

3. Event-driven hedge fund strategies

Event-driven strategies are used in situations wherein the underlying opportunity and risk are associated with an event. Fund managers find investment opportunities in corporate transactions such as acquisitions, consolidations, recapitalization, liquidations, and bankruptcy. These transactional events form the basis for investments in distressed securities, risk arbitrage, and special situations.

4. Relative value arbitrage strategies

Relative value arbitrage hedge fund strategies take advantage of relative price discrepancies between different securities whose prices the manager expects to diverge or converge over time. Sub-strategies in the category include fixed income arbitrage, equity market neutral positions, convertible arbitrage, and volatility arbitrage, among others.

5. Long/short strategies

In long/short hedge fund strategies, managers make what are known as “pair trades” to bet on two securities in the same industry. For example, if they expect Coke to perform better than Pepsi, they would go long Coke and short Pepsi. Regardless of overall market trends, they will be okay as long as Coke performs better than Pepsi on a relative basis.

6. Capital structure strategies

Some hedge funds take advantage of the mispricing of securities up and down the capital structure of one single company. For example, if they believe the debt is overvalued, then they short the debt and go long the equity, thus creating a hedge and betting on the eventual spread correction between the securities.

Q5. what is a long/short strategy?

Long-short equity is an investing strategy that takes long positions in stocks that are expected to appreciate and short positions in stocks that are expected to decline. A long-short equity strategy seeks to minimize market exposure while profiting from stock gains in the long positions, along with price declines in the short positions. Although this may not always be the case, the strategy should be profitable on a net basis.

The long-short equity strategy is popular with hedge funds, many of which employ a market-neutral strategy, in which dollar amounts of both long and short positions are equal.

Q6. NPV vs IRR?

Net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over some time. By contrast, the internal rate of return (IRR) is a calculation used to estimate the profitability of potential investments.

Both of these measurements are primarily used in capital budgeting, the process by which companies determine whether a new investment or expansion opportunity is worthwhile. Given an investment opportunity, a firm needs to decide whether undertaking the investment will generate net economic profits or losses for the company.

Q7. How will you value a company stock?

Investing has a set of four basic elements that investors use to break down a stock’s value. In this article, we will look at four commonly used financial ratios—price-to-book (P/B) ratio, price-to-earnings (P/E) ratio, price-to-earnings growth (PEG) ratio, and dividend yield—and what they can tell you about a stock. Financial ratios are powerful tools to help summarize financial statements and the health of a company or enterprise.

Price-To-Book (P/B) Ratio

Price-To-Earnings (P/E) Ratio

Price-to-Earnings Growth (PEG) Ratio

Dividend Yield

The Bottom Line

Q8. What is the duration of bonds?

Bond duration is a way of measuring how much bond prices are likely to change if and when interest rates move. In more technical terms, bond duration is a measurement of interest rate risk. Understanding bond duration can help investors determine how bonds fit into a broader investment portfolio.

Q9. What is YTM?

YTM is yield to maturity which means the total return you expect from your investment in bonds/debt mutual funds if the same is held till maturity. It is expressed as a percentage of the current market price. It is used for comparing different bonds and debt funds with different maturities.

Q10. If zero coupon bonds are issued at 98 and redeemed at 100, after 6 months? (Click for this concept)

Q11. What is VLOOKUP

VLOOKUP stands for “Vertical Lookup” and is used to search for a specific value in the first column of a dataset and retrieve a corresponding value from a different column within the same row. It takes four arguments: lookup value, table array, col_index_num, and [range lookup]

Q12. What are the limitations of V Lookup?

The main limitations of the VLOOKUP function are:

VLOOKUP can only look up values to the right on the lookup_value. i.e. the lookup only works left to right. You’ll need XLOOKUP, or INDEX MATCH for a right-to-left lookup.

VLOOKUP can only perform a vertical lookup across columns. It cannot search across rows. For a horizontal lookup, you’ll need HLOOKUP or XLOOKUP.

A VLOOKUP function does not automatically update when a formula is added.

By default, the VLOOKUP function does not find an exact match. It returns a #N/A. To return an approximate match using VLOOKUP, you must set the final parameter as TRUE or 1.

Q13. Syntax of VLOOKUP

The LOOKUP function vector form syntax has the following arguments: lookup_value Required. A value that LOOKUP searches for in the first vector. Lookup_value can be a number, text, a logical value, or a name or reference that refers to a value.

For example: =VLOOKUP(A2,A10:C20,2,TRUE)

Q14. What does valuation mean?

Valuation is the process of determining the worth of an asset or company. Valuation is important because it provides prospective buyers with an idea of how much they should pay for an asset or company and prospective sellers, how much they should sell for.

Q15. Enterprise value

As its name implies, enterprise value (EV) is the total value of a company, defined in terms of its financing. It includes both the current share price (market capitalization) and the cost to pay off debt (net debt, or debt minus cash).

Q16. Depreciation

Depreciation represents how much of the value of an asset has been used. Depreciating assets helps companies earn revenue from an asset while expensing a portion of its cost each year the asset is in use. Depreciation is wear and tear.

Depreciation is referred to as the reduction in the cost of a fixed asset in sequential order, due to wear and tear until the asset becomes obsolete. Machinery, vehicle, equipment, and building are some examples of assets that are likely to experience wear and tear or obsolescence.

Q17. Index function in VLOOKUP.

VLOOKUP in Excel is a very useful function used for lookup and reference. It looks for the desired values from one row to another to find a match. Using a combination of INDEX and MATCH, we can perform the same operations as VLOOKUP. INDEX returns the value of a cell in a table based on the column and row number.

Q18. What are the advanagtes of vlookup

When you need to find information in a large spreadsheet, or you are always looking for the same kind of information, use the VLOOKUP function. VLOOKUP works a lot like a phone book, where you start with the piece of data you know, like someone’s name, to find out what you don’t know, like their phone number.

Q19. Difference between VLOOKUP and index function.

VLOOKUP must be utilized for looking into values from Left to Right. INDEX MATCH can look into the qualities from Left to Right as well as Right to Left. VLOOKUP just can query through vertical lines, for example, segments, and not through columns. INDEX MATCH can query values through lines as well as segments.

Q20. What is arbitrage and DCF (Discounted Cash Flow)

Arbitrage describes the act of buying a security in one market and simultaneously selling it in another market at a higher price, thereby enabling investors to profit from the temporary difference in cost per share.

Discounted cash flow (DCF) is a method of valuation used to determine the value of an investment based on its return in the future–called future cash flows. DCF helps to calculate how much an investment is worth today based on the return in the future.

Q21. Derivatives

A derivative is a product whose value is derived from the value of one (or more) basic variables, based on underlying financial assets can be bonds, commodities, currencies, interest, rates, stocks, markets, indexes (or) any other asset.

E.g.: Wheat former may wish to sell their harvest at a future date to eliminate the risk of a change in prices by that date.

Derivatives can be classified based on the underlying asset (such as forex derivatives, equity derivatives, etc). It is mainly classified into four “generic” types forward, futures, option, and swap.

Q22. Swaps

A swap is a derivative contract through which two parties exchange the cash flows or liabilities from two different financial instruments. Most trades involve cash flows based on a notional principal amount such as a loan or bond, although the instrument can be almost anything. Usually, the principal does not change hands. Each cash flow comprises one leg of the swap. One cash flow is generally fixed, while the other is variable and based on a benchmark interest rate, floating currency exchange rate, or index price.

In simple, Swaps are agreements between two parties to exchange cash flows in the future according to a pre-arranged formula.

The two commonly used swaps are:

Interest rate swaps: This entails swapping only the interest-related cash flows between the parties in the same currency.

Currency Swaps: These entail swapping both principal and interest between the parties, with the cash flows in one direction being in a different currency than those in the opposite direction.

Q23. F&O (Future & Option)

Future and Option are two derivative instruments where the traders buy or sell an underlying asset at a pre-determined price. The trader makes a profit if the price rises. In case, he has a buy position and if he has a sell position, a fall in price is beneficial for him.

Q24. Financial Statements

The financial statements are used by investors, market analysts, and creditors to evaluate a company’s financial health and earnings potential. The three major financial statement reports are the balance sheet, income statement, and statement of cash flows. Not all financial statements are created equally.

Q25. Risk in Bonds

Bonds as an investment tool are considered mostly safe. However, no investment is devoid of risks. Investors who take greater risks accrue greater returns and vice versa. Investors averse to risk feel unsettled during intermittent periods of slowdown, while risk-loving investors take such incidents of a slowdown positively with the expectation of gaining significant returns over time. Hence, it becomes imperative for us to understand the various risks that are associated with bond investments and to what extent they can affect the returns.

Types of Risks in Bonds

Inflation Risk

Interest Rate Risk

Call Risk

Reinvestment Risk

Credit Risk

Liquidity Risk

Market Risk

Default Risk

Rating Risk

Q26. Debt sculpting (+25 More Questions) Buy Remaining Questions

All the Questions and Answers related to EY interview are in one Download PDF file provided below for only Rs. 499/-

Download EY Interview Q&A

EY General/HR Questions

Note: Focus on fundamental questions regarding internship experience, valuation techniques, and financial concepts. Anyway, almost all those questions are covered in this file.

EY’s most frequently asked interview questions and answers.

Q1. DCF and explain briefly

Discounted cash flow (DCF) valuation is a type of financial model that determines whether an investment is worthwhile based on future cash flows. The DCF model operates on the principle that the worth of a company is dependent on its ability to generate positive cash flows for its investors in the future.

Discounted cash flow analysis helps determine an investment’s value based on its future cash flows.

The present value of expected future cash flows is estimated using a projected discount rate.

If the DCF is higher than the current cost of the investment, the opportunity could result in positive returns and may be worthwhile.

Companies typically use the weighted average cost of capital (WACC) for the discount rate because it accounts for the rate of return shareholders expect.

A disadvantage of DCF is its reliance on estimations of future cash flows, which could prove inaccurate.

DCF Formula

DCF=(1+r)1CF1+(1+r)2CF2+(1+r)nCFn

where: CF1=The cash flow for year one

CF2=The cash flow for year two

CFn=The cash flow for additional years

r=The discount rate

Q2. Explain the time value of money.

The time value of money (TVM) is the concept that a sum of money is worth more now than it will be at a future date due to its earnings potential in the interim. The time value of money is a core principle of finance. A sum of money in the hand has greater value than the same sum to be paid in the future.

If the rate of inflation is actually higher than the rate of your investment return, then even though your investment shows a nominal positive return, you are losing money in terms of purchasing power. For example, if you earn 10% on investments, but the rate of inflation is 15%, you’re losing 5% in purchasing power each year (10% – 15% = -5%).

Q3. What is the difference between Futures and options?

Futures

Futures are derivative financial contracts that obligate parties to buy or sell an asset at a predetermined future date and price. The buyer must purchase or the seller must sell the underlying asset at the set price, regardless of the current market price at the expiration date.

Underlying assets include physical commodities and financial instruments. Futures contracts detail the quantity of the underlying asset and are standardized to facilitate trading on a futures exchange. Futures can be used for hedging or trade speculation.

Options

The term option refers to a financial instrument that is based on the value of underlying securities, such as stocks. An options contract offers the buyer the opportunity to buy or sell—depending on the type of contract they hold—the underlying asset. Unlike futures, the holder is not required to buy or sell the asset if they decide against it.

Each option contract will have a specific expiration date by which the holder must exercise their option. The stated price on an option is known as the strike price. Options are typically bought and sold through online or retail brokers.

Difference

Options and futures are two varieties of financial derivatives investors can use to speculate on market price changes or hedge risk. Both options and futures allow an investor to buy an investment at a specific price by a specific date. But there are important differences in the rules for options and futures contracts, and in the risks, they pose to investors.

Q4. Hedge fund strategies?

A hedge fund is a limited partnership of private investors whose money is managed by professional fund managers who use a wide range of strategies, including leveraging or trading non-traditional assets, to earn above-average investment returns.

Hedge fund investing is often considered a risky alternative investment choice and usually requires a high minimum investment or net worth, often targeting wealthy clients.

Strategies

1. Global macro strategies

In the global macro strategy, managers make bets based on major global macroeconomic trends such as moves in interest rates, currencies, demographic shifts, and economic cycles. Fund managers use discretionary and systematic approaches in significant financial and non-financial markets by trading currencies, futures, options contracts, and traditional equities and bonds. Bridgewater is the most famous example of a global macro fund.

2. Directional hedge fund strategies

In the directional approach, managers bet on the directional moves of the market (long or short) as they expect a trend to continue or reverse for some time. A manager analyses market movements, trends, or inconsistencies, which can then be applied to investments in vehicles such as long or short equity hedge funds and emerging markets funds.

3. Event-driven hedge fund strategies

Event-driven strategies are used in situations wherein the underlying opportunity and risk are associated with an event. Fund managers find investment opportunities in corporate transactions such as acquisitions, consolidations, recapitalization, liquidations, and bankruptcy. These transactional events form the basis for investments in distressed securities, risk arbitrage, and special situations.

4. Relative value arbitrage strategies

Relative value arbitrage hedge fund strategies take advantage of relative price discrepancies between different securities whose prices the manager expects to diverge or converge over time. Sub-strategies in the category include fixed income arbitrage, equity market neutral positions, convertible arbitrage, and volatility arbitrage, among others.

5. Long/short strategies

In long/short hedge fund strategies, managers make what are known as “pair trades” to bet on two securities in the same industry. For example, if they expect Coke to perform better than Pepsi, they would go long Coke and short Pepsi. Regardless of overall market trends, they will be okay as long as Coke performs better than Pepsi on a relative basis.

6. Capital structure strategies

Some hedge funds take advantage of the mispricing of securities up and down the capital structure of one single company. For example, if they believe the debt is overvalued, then they short the debt and go long the equity, thus creating a hedge and betting on the eventual spread correction between the securities.

Q5. what is a long/short strategy?

Long-short equity is an investing strategy that takes long positions in stocks that are expected to appreciate and short positions in stocks that are expected to decline. A long-short equity strategy seeks to minimize market exposure while profiting from stock gains in the long positions, along with price declines in the short positions. Although this may not always be the case, the strategy should be profitable on a net basis.

The long-short equity strategy is popular with hedge funds, many of which employ a market-neutral strategy, in which dollar amounts of both long and short positions are equal.

Q6. NPV vs IRR?

Net present value (NPV) is the difference between the present value of cash inflows and the present value of cash outflows over some time. By contrast, the internal rate of return (IRR) is a calculation used to estimate the profitability of potential investments.

Both of these measurements are primarily used in capital budgeting, the process by which companies determine whether a new investment or expansion opportunity is worthwhile. Given an investment opportunity, a firm needs to decide whether undertaking the investment will generate net economic profits or losses for the company.

Q7. How will you value a company stock?

Investing has a set of four basic elements that investors use to break down a stock’s value. In this article, we will look at four commonly used financial ratios—price-to-book (P/B) ratio, price-to-earnings (P/E) ratio, price-to-earnings growth (PEG) ratio, and dividend yield—and what they can tell you about a stock. Financial ratios are powerful tools to help summarize financial statements and the health of a company or enterprise.

Price-To-Book (P/B) Ratio

Price-To-Earnings (P/E) Ratio

Price-to-Earnings Growth (PEG) Ratio

Dividend Yield

The Bottom Line

Q8. What is the duration of bonds?

Bond duration is a way of measuring how much bond prices are likely to change if and when interest rates move. In more technical terms, bond duration is a measurement of interest rate risk. Understanding bond duration can help investors determine how bonds fit into a broader investment portfolio.

Q9. What is YTM?

YTM is yield to maturity which means the total return you expect from your investment in bonds/debt mutual funds if the same is held till maturity. It is expressed as a percentage of the current market price. It is used for comparing different bonds and debt funds with different maturities.

Q10. If zero coupon bonds are issued at 98 and redeemed at 100, after 6 months? (Click for this concept)

Q11. What is VLOOKUP

VLOOKUP stands for “Vertical Lookup” and is used to search for a specific value in the first column of a dataset and retrieve a corresponding value from a different column within the same row. It takes four arguments: lookup value, table array, col_index_num, and [range lookup]

Q12. What are the limitations of V Lookup?

The main limitations of the VLOOKUP function are:

VLOOKUP can only look up values to the right on the lookup_value. i.e. the lookup only works left to right. You’ll need XLOOKUP, or INDEX MATCH for a right-to-left lookup.

VLOOKUP can only perform a vertical lookup across columns. It cannot search across rows. For a horizontal lookup, you’ll need HLOOKUP or XLOOKUP.

A VLOOKUP function does not automatically update when a formula is added.

By default, the VLOOKUP function does not find an exact match. It returns a #N/A. To return an approximate match using VLOOKUP, you must set the final parameter as TRUE or 1.

Q13. Syntax of VLOOKUP

The LOOKUP function vector form syntax has the following arguments: lookup_value Required. A value that LOOKUP searches for in the first vector. Lookup_value can be a number, text, a logical value, or a name or reference that refers to a value.

For example: =VLOOKUP(A2,A10:C20,2,TRUE)

Q14. What does valuation mean?

Valuation is the process of determining the worth of an asset or company. Valuation is important because it provides prospective buyers with an idea of how much they should pay for an asset or company and prospective sellers, how much they should sell for.

Q15. Enterprise value

As its name implies, enterprise value (EV) is the total value of a company, defined in terms of its financing. It includes both the current share price (market capitalization) and the cost to pay off debt (net debt, or debt minus cash).

Q16. Depreciation

Depreciation represents how much of the value of an asset has been used. Depreciating assets helps companies earn revenue from an asset while expensing a portion of its cost each year the asset is in use. Depreciation is wear and tear.

Depreciation is referred to as the reduction in the cost of a fixed asset in sequential order, due to wear and tear until the asset becomes obsolete. Machinery, vehicle, equipment, and building are some examples of assets that are likely to experience wear and tear or obsolescence.

Q17. Index function in VLOOKUP.

VLOOKUP in Excel is a very useful function used for lookup and reference. It looks for the desired values from one row to another to find a match. Using a combination of INDEX and MATCH, we can perform the same operations as VLOOKUP. INDEX returns the value of a cell in a table based on the column and row number.

Q18. What are the advanagtes of vlookup

When you need to find information in a large spreadsheet, or you are always looking for the same kind of information, use the VLOOKUP function. VLOOKUP works a lot like a phone book, where you start with the piece of data you know, like someone’s name, to find out what you don’t know, like their phone number.

Q19. Difference between VLOOKUP and index function.

VLOOKUP must be utilized for looking into values from Left to Right. INDEX MATCH can look into the qualities from Left to Right as well as Right to Left. VLOOKUP just can query through vertical lines, for example, segments, and not through columns. INDEX MATCH can query values through lines as well as segments.

Q20. What is arbitrage and DCF (Discounted Cash Flow)

Arbitrage describes the act of buying a security in one market and simultaneously selling it in another market at a higher price, thereby enabling investors to profit from the temporary difference in cost per share.

Discounted cash flow (DCF) is a method of valuation used to determine the value of an investment based on its return in the future–called future cash flows. DCF helps to calculate how much an investment is worth today based on the return in the future.

Q21. Derivatives

A derivative is a product whose value is derived from the value of one (or more) basic variables, based on underlying financial assets can be bonds, commodities, currencies, interest, rates, stocks, markets, indexes (or) any other asset.

E.g.: Wheat former may wish to sell their harvest at a future date to eliminate the risk of a change in prices by that date.

Derivatives can be classified based on the underlying asset (such as forex derivatives, equity derivatives, etc). It is mainly classified into four “generic” types forward, futures, option, and swap.

Q22. Swaps

A swap is a derivative contract through which two parties exchange the cash flows or liabilities from two different financial instruments. Most trades involve cash flows based on a notional principal amount such as a loan or bond, although the instrument can be almost anything. Usually, the principal does not change hands. Each cash flow comprises one leg of the swap. One cash flow is generally fixed, while the other is variable and based on a benchmark interest rate, floating currency exchange rate, or index price.

In simple, Swaps are agreements between two parties to exchange cash flows in the future according to a pre-arranged formula.

The two commonly used swaps are:

Interest rate swaps: This entails swapping only the interest-related cash flows between the parties in the same currency.

Currency Swaps: These entail swapping both principal and interest between the parties, with the cash flows in one direction being in a different currency than those in the opposite direction.

Q23. F&O (Future & Option)

Future and Option are two derivative instruments where the traders buy or sell an underlying asset at a pre-determined price. The trader makes a profit if the price rises. In case, he has a buy position and if he has a sell position, a fall in price is beneficial for him.

Q24. Financial Statements

The financial statements are used by investors, market analysts, and creditors to evaluate a company’s financial health and earnings potential. The three major financial statement reports are the balance sheet, income statement, and statement of cash flows. Not all financial statements are created equally.

All the Questions and Answers related to EY interview are in one Download PDF file provided below for only Rs. 499/-Buy Now All EY Interview Q&A

Queries Solved:

ey interview process,

ey interview experience,

ey interview,

ey interview questions for software engineer,

ey interview process timeline,

ey interview results,

ey interview questions for business analyst,

ey interview process for experienced india,

ernst and young interview questions,

ernst and young interview,

ernst and young interview preparation,

why ernst and young interview answer,

ernst and young video interview questions,

ernst and young internship interview questions,

ernst and young testing interview questions,

ernst and young partner interview,

ernst young interview process experienced hire,

ernst and young case study interview,

EY Interview Direct Questions & Answers (2023)

1 note

·

View note

Text

WACC: Sermaye Maliyetini Hesaplama ve Yönetme Rehberi

İstanbul E-5’te bir pazar sabahı ışıklarda durmuşken telefonum titredi: 📱 “Melisa, şirketimiz yeni yatırım turuna hazırlanıyor. Riskin ne kadarını yansıtmalıyım?” diye soruyordu bir girişimci arkadaşım. Saniyeler içinde WACC’ın o gizemli amcası devreye girdi. WACC (Weighted Average Cost of Capital), yani Ağırlıklı Ortalama Sermaye Maliyeti, aslında bir karnaval; borç, özkaynak ve aranan bütçe…

0 notes

Text

How ESG Investing is Changing the Way We Value Companies

Environmental, Social, and Governance (ESG) investing is no longer a niche. It's now a core strategy for global investors, asset managers, and corporations. In 2025, ESG factors are driving decisions in capital allocation, risk management, and even financial modeling.

As sustainability becomes central to corporate performance, financial analysts must now integrate ESG metrics into valuation frameworks. This has created a growing demand for professionals trained in modern valuation techniques—often gained from the best Financial Modelling Course in Kolkata.

What is ESG Investing?

ESG investing involves evaluating companies based not just on financial performance but also on how they manage:

Environmental impact (carbon emissions, resource use)

Social responsibility (labor practices, community impact)

Governance standards (board diversity, ethics, transparency)

Investors now believe that companies with strong ESG scores are more resilient, better managed, and likely to deliver long-term returns.

Why ESG is Transforming Financial Modeling

Traditionally, valuation models like Discounted Cash Flow (DCF) or Comparable Company Analysis focused purely on profits, growth rates, and market risk. Today, ESG inputs are being woven into those models.

For example:

Carbon tax implications can affect free cash flow projections.

Regulatory penalties for non-compliance may be added as risk factors.

Social sentiment can influence brand equity and future revenues.

Professionals who understand how to incorporate these ESG dimensions are highly valued in the job market—and many acquire these skills from the best Financial Modelling Course in Kolkata, where practical ESG case studies are now part of the curriculum.

ESG Metrics in Practice: Real-World Examples

Tata Group has made major investments in clean energy and social inclusion—factors that positively influence their ESG ratings.

Adani Group faces scrutiny on environmental grounds, which affects how global analysts model long-term risks in their equity valuations.

Global funds like BlackRock and Vanguard now screen investments heavily using ESG scores.

This makes ESG literacy and integrated financial modeling an essential combination for analysts and finance students alike.

How ESG Data Affects Company Valuation

1. Cost of Capital Adjustments

Firms with poor ESG scores may face higher borrowing costs, leading to an increased Weighted Average Cost of Capital (WACC) in models.

2. Cash Flow Forecasting

Green initiatives might lead to short-term expenses but long-term savings or tax benefits, impacting Net Present Value (NPV) projections.

3. Terminal Value Calculations

Companies with strong ESG policies are expected to be more sustainable long-term, influencing the growth rate assumptions in terminal value estimations.

These are exactly the kinds of challenges tackled in the best Financial Modelling Course in Kolkata, where learners work with real-time ESG datasets and simulation models.

Career Impact: ESG Finance Roles on the Rise

As ESG finance becomes a $50+ trillion market globally, new roles are emerging:

ESG Risk Analyst

Sustainability Investment Associate

Impact Valuation Specialist

ESG Data Scientist

To enter these roles, strong skills in financial modeling with ESG integration are required—skills taught at top institutions offering the best Financial Modelling Course in Kolkata.

Why Choose the Best Financial Modelling Course in Kolkata?

Institutes like the Boston Institute of Analytics offer a world-class program in Kolkata with:

Live training in Excel and financial modelling tools

ESG-integrated valuation frameworks

Hands-on case studies from Indian and global companies

Training by top finance professionals and placement support

This course equips you not just with technical modeling abilities, but also with the analytical mindset required to evaluate 21st-century investment risks and opportunities.

Conclusion: ESG is the Future of Finance—Are You Ready?

As investors align with sustainability and social impact, finance professionals must adapt. Learning how to integrate ESG into financial models is no longer optional—it's essential.

If you’re looking to build a career in modern finance, enroll in the best Financial Modelling Course in Kolkata and future-proof your skills in a rapidly evolving industry.

0 notes

Text

The secret of the profit margin of 80% that only the top 1% know: How to avoid competition and conquer the monopoly market

To achieve overwhelming results in business, a detailed design of financial strategy and market selection is essential. We will explain how to build a competitive advantage by combining the core theories taught in Harvard and Stanford MBA programs with examples of companies that are actually successful in the world. We will dig deep into evidence-based strategies, from proper utilization of liabilities, optimization of capital costs, and acquisition of exclusive positions in niche markets.

Table of contents

1. Strategic benefits of raising funds using debt

・How to maximize ROE with leverage effect

・The actual cost reduction of capital by taking advantage of tax incentives

2. The essential meaning of profit indicators that investors pay attention to

・The true efficiency of companies in terms of ROE and ROA

・Cash flow generation capacity indicated by EBITDA

3. Selection criteria for niche markets that achieve high profit margins

・Market analysis methods for competition avoidance and differentiation

・The secret of brand building learned from Tesla and Patagonia

4. Sales vs Profit Margin: Investor Decision-Making Process

・A trade-off between economies of scale for large companies and profitability of small and medium-sized enterprises

・How to choose the best investment destination according to risk tolerance

1. Strategic benefits of raising funds using debt

In corporate growth, debt is not just a "debt", but a strategic resource. A properly designed debt structure achieves a scale that cannot be achieved with shareholder capital alone.

・How to maximize ROE with leverage effect

Debt leverage dramatically increases the return on equity (ROE). If you develop a business of 2 billion yen with a capital of 1 billion yen, the ROE will double if you use the debt. However, because excessive leverage suppresses cash flow with the interest burden, it is considered an international safety standard to maintain an EBIT-to-interest ratio of more than three times.

・The actual cost reduction of capital by taking advantage of tax incentives

Since the interest paid can be included in the loss, the actual tax burden is reduced. In the case of a corporate tax rate of 30%, an interest payment of 100 million yen will create a tax savings of 30 million yen. Considering this "Tax Shield" effect, the cost of debt is lower than the surface interest rate, contributing to the optimization of WACC (weighted average capital cost).

2. The essential meaning of profit indicators that investors pay attention to

It is important to understand the "nature of the company" shown by each indicator, not superficial numbers.

・The true efficiency of companies in terms of ROE and ROA

Companies with a ROE of 15% or more are evaluated to use shareholder capital efficiently, but if the high ROE is debt-dependent, financial risks are lurking. On the other hand, ROA shows the utilization efficiency of total assets, and 5% or more is a guideline for excellent companies. In asset-intensive industries (e.g. manufacturing industry), ROA tends to be low, so it is essential to compare it with industry standards.

・Cash flow generation capacity indicated by EBITDA

EBITDA is a proxy indicator of operating cash flow and represents the earning power of a company's main business. In order to add depreciation costs, it is effective in understanding the actual situation of companies with a lot of capital investment. However, if the EBITDA margin is below 20%, it is likely to be caught up in a price competition.

3. Selection criteria for niche markets that achieve high profit margins

Finding a blue ocean, not a competitive Red Sea market, is the key to a sustained high profit margin. In the niche market, the entry barrier is high and price control is possible, so an amazing figure such as a profit margin of 80% is possible.

・Market analysis methods for competition avoidance and differentiation

The true niche market is hidden in the "unresolved issues of customers". In the B2B field, a component supplier that requires expertise in a specific industry, and in B2C, a product specialized in environmentally conscious groups such as Patagonia is a typical example. Even if the market size is small, it has the characteristics of extremely high customer loyalty and low price sensitivity.

・The secret of brand building learned from Tesla and Patagonia

The champion of the niche market differentiates not only in terms of technology but also in terms of "story". It is essential to appeal directly to consumer values so that Tesla brings forward the vision of a "sustainable energy society" and Patagonia puts "environmental protection activities" at the core of the brand. There is research data that shows that the marketing cost-effectiveness of such companies is more than 3 times higher than normal.

4. Sales vs Profit Margin: Investor Decision-Making Process

Scale or profitability - this is the dilemma that investors always face. Here, we will explain a way of thinking that goes beyond the trade-off between the two.

・A trade-off between economies of scale for large companies and profitability of small and medium-sized enterprises

Companies with sales of 10 trillion yen and a profit margin of 1% will generate an absolute profit of 10 billion yen, but if the market is saturated, growth will face the limit. On the other hand, companies with sales of 10 billion yen and a profit margin of 80% have made the same profit of 8 billion yen as small ones, but there is still room for market expansion. Investors expect a "growth multiplier effect" in the latter.

・How to choose the best investment destination according to risk tolerance

Conservative investors tend to choose large companies that create stable cash flows, but the real growth opportunities are in "medium-sized, high-profit" companies. It is important for companies in this category not to miss a turning point in which valuation is soaring, as their financial foundation is stable and still has the potential to expand the market.

At the end

In order to continue to win in the business world, an essential understanding of financial figures and strategic market choices are essential. Capital efficiency using debt as a weapon, in-depth analysis of profit indicators, and niche market development - by implementing these in an integrated way, you can use the theories learned by the Harvard MBA at a practical level. Please put these frameworks that can be applied from tomorrow into your own business.

0 notes

Text

Mastering Valuation: How Discounted Cash Flow Holds the Edge

When it comes to valuing a business or an investment, few methods command the respect and widespread use as the Discounted Cash Flow (DCF) analysis. Despite the emergence of newer valuation tools and models, DCF remains a cornerstone in finance for a reason—it provides a fundamental, intrinsic value based on the actual cash the business is expected to generate over time.

In an age where markets can be volatile and speculative, understanding why DCF still reigns supreme is essential for investors, analysts, and finance professionals alike. This blog unpacks the core mechanics of DCF, its advantages, and why it continues to be a trusted valuation method in today's complex financial environment.

What is Discounted Cash Flow (DCF)?

At its essence, DCF is a valuation technique that estimates the present value of an investment based on its expected future cash flows. The key idea is simple: money available today is worth more than the same amount in the future due to its earning potential—this is the time value of money.

The DCF formula discounts future cash flows back to the present using a discount rate, often the company’s weighted average cost of capital (WACC). This process accounts for risk and opportunity cost, helping investors arrive at a value that reflects both potential and uncertainty.

Why DCF is So Widely Used

Intrinsic Value Focus: Unlike market-based methods that rely on peer comparisons or multiples, DCF looks inward at the company’s own fundamentals. It isn’t swayed by market sentiment or trends.

Flexibility: DCF can be tailored to virtually any company or project, regardless of industry or size, as long as reasonable cash flow projections can be made.

Forward-Looking: Instead of relying on historical data alone, DCF forces analysts to forecast future performance, encouraging a deep understanding of the business drivers.

Risk Adjustment: By adjusting the discount rate, investors can factor in different levels of risk, making the model adaptable across sectors and economic cycles.

Breaking Down the Components of DCF

To appreciate why DCF remains a vital valuation tool, it’s important to understand its main components:

Cash Flow Projections: These are estimates of the company’s free cash flows (FCF), often forecasted over 5-10 years. Free cash flow represents the cash generated after accounting for operating expenses and capital expenditures.

Terminal Value: Since businesses often last beyond the forecast period, terminal value estimates the value of all future cash flows beyond the forecast horizon, typically calculated using a perpetuity growth model or exit multiple.

Discount Rate: This rate reflects the required return investors expect, often influenced by the risk profile of the company and market conditions.

Common Misconceptions About DCF

Many investors shy away from DCF because they view it as complicated or overly sensitive to assumptions. While it is true that small changes in inputs can significantly affect valuation, this sensitivity is a strength rather than a flaw. It forces analysts to be thorough and transparent about their assumptions.

Moreover, DCF’s complexity encourages a more disciplined investment process, one that goes beyond superficial comparisons and market hype. It demands a granular understanding of the company’s business model, competitive landscape, and growth prospects.

DCF in Today’s Market Environment

In 2025, with global markets facing inflation pressures, geopolitical tensions, and rapid technological disruptions, DCF analysis remains relevant and invaluable. Its forward-looking nature helps investors cut through noise and focus on sustainable value creation.

Recent news highlights from financial markets emphasize how volatile interest rates impact discount rates, thereby influencing valuations. For example, as central banks adjust monetary policies worldwide, companies with stable and predictable cash flows become increasingly attractive—a dynamic clearly captured in DCF models.

Additionally, sectors such as renewable energy, technology, and healthcare are seeing heightened investor interest, driven by long-term growth potential. Applying DCF analysis in these industries helps quantify that potential amid market uncertainties.

The Rise of Finance Education in the Region

With the expanding global interest in sophisticated valuation methods, the demand for finance education has surged. Professionals in regions with burgeoning financial hubs are keen to master valuation techniques like DCF.

For instance, the popularity of the online CFA course in UAE has grown remarkably, reflecting the desire among finance professionals to gain deep analytical skills that include valuation mastery. These educational programs equip candidates to confidently apply tools such as DCF in real-world scenarios, enhancing their credibility and decision-making prowess.

Practical Tips for Using DCF Effectively

To get the most out of DCF, consider these best practices:

Use Conservative Assumptions: Overly optimistic cash flow forecasts can inflate valuations. Base projections on historical data and realistic growth rates.

Stress Test Inputs: Run multiple scenarios with varying discount rates and growth assumptions to understand the range of possible valuations.

Focus on Quality of Cash Flows: Differentiate between recurring operational cash flow and one-time items.

Don’t Rely Solely on DCF: Use it in conjunction with other valuation methods to get a holistic view.

Limitations to Keep in Mind

Despite its advantages, DCF is not without limitations:

Dependence on Estimates: Future cash flows are uncertain, and errors in projections can lead to inaccurate valuations.

Terminal Value Sensitivity: Often, a large portion of valuation comes from terminal value, which can be speculative.

Complexity: Requires deep understanding and data availability, which might be challenging for some businesses.

Why DCF Remains an Authority in Valuation

The staying power of DCF comes from its grounding in finance theory and practical utility. It directly links valuation to the fundamental cash-generating capacity of the business, which is the ultimate driver of shareholder value. For finance professionals aiming to sharpen their valuation expertise, the CFA curriculum 2025 offers a deeper, more updated approach to mastering key financial concepts like DCF. With its expanded focus on practical applications and real-world case analysis, the curriculum equips candidates for roles in investment banking, equity research, and portfolio management—where valuation acumen is essential.

Final Thoughts

Discounted Cash Flow analysis is far from obsolete; in fact, it’s more relevant than ever. Its ability to adapt to various industries, incorporate risk, and provide intrinsic valuations makes it indispensable in today’s investment toolkit.

As global finance professionals increasingly embrace rigorous valuation standards, education and practical application of DCF continue to grow, especially in fast-evolving markets. Whether you are an investor, analyst, or student, mastering DCF can elevate your financial insight and decision-making.

The method’s durability proves that when it comes to valuing assets, understanding the true worth beneath market noise will always matter. DCF doesn’t just survive—it thrives as the gold standard for valuation.

0 notes

Text

Understanding DCF Valuation: A Comprehensive Guide by CompaniesNext

Discounted Cash Flow (DCF) valuation is one of the most widely used methods for determining the intrinsic value of a business. At CompaniesNext, we aim to empower entrepreneurs, investors, and analysts with clear, actionable financial insights. In this guide, we’ll break down what DCF valuation is, why it matters, and how to perform one.

What is DCF Valuation?

DCF (Discounted Cash Flow) valuation is a financial model used to estimate the value of an investment based on its expected future cash flows. These cash flows are projected and then discounted back to their present value using a discount rate that reflects the investment’s risk.

Why Use DCF Valuation?

Accurate Reflection of Future Potential

Unlike other valuation methods, DCF focuses on the fundamentals of a business rather than market trends or comparables. It provides a more accurate view of what a company is truly worth based on its future performance.

Ideal for Long-Term Decision Making

DCF is especially useful for investors and business owners with a long-term view, as it considers the entire life cycle of a business or project.

Key Components of a DCF Model

1. Forecasted Free Cash Flows (FCFs)

Free Cash Flow is the cash a company generates after accounting for capital expenditures. It represents the cash available to investors and is the foundation of any DCF model.

2. Discount Rate

The discount rate is typically the company’s Weighted Average Cost of Capital (WACC). It reflects the opportunity cost of investing capital elsewhere at a similar risk level.

3. Terminal Value

Since it's difficult to forecast cash flows indefinitely, the terminal value estimates the business’s value beyond the forecast period. It usually accounts for a large portion of the total valuation.

Steps to Perform a DCF Valuation

Step 1: Project Free Cash Flows

Start by estimating the company’s free cash flows for the next 5–10 years based on historical performance, growth expectations, and industry trends.

Step 2: Calculate the Discount Rate

Determine the WACC by factoring in the cost of equity and the cost of debt, weighted by their respective portions in the company’s capital structure.

Step 3: Estimate the Terminal Value

Use either the Gordon Growth Model or Exit Multiple Method to estimate the terminal value.

Step 4: Discount the Cash Flows

Bring all future cash flows and the terminal value to present value using the WACC. Sum them to arrive at the total enterprise value.

Limitations of DCF Valuation

While DCF is powerful, it relies heavily on assumptions. Minor changes in growth rate, discount rate, or cash flow projections can significantly affect the final valuation.

Conclusion

DCF valuation is a cornerstone of corporate finance and investment analysis. At CompaniesNext, we help businesses and investors leverage this method to make informed, forward-thinking decisions. Whether you're assessing a startup, planning a merger, or investing in a new venture, a solid DCF model is a valuable tool in your financial toolkit.

0 notes

Text

CEEDEE LAMB'S AWESOME ROUTES, 1-on-1 PLAYS & CATCHES FROM 2023!

youtube

YAConomy

Flanker: The flanker, or "Z receiver," lines up off the line of scrimmage, usually on the same side as the tight end. They are versatile players who can excel in various routes, including short and intermediate passes.

The NFL route tree is a numbering system used by both the offensive and defensive side of the ball to identify specific stems/breaks/directions that receivers run on passing plays.

YAC Above Expectation (or xYAC +/-). Another derivative of the model -- YAC Success Rate -- controls for outliers and measures whether the receiver gained more or less than expectation on a per-play basis.

Average Cushion (CUSH)

Average Separation (SEP)

Catch Rate Over Expected (CROE)

PHILOSOPHY

Toe Tap A Drag: Plant Back Leg and Lag then Drag Front Front

Shoulder Adjustment: Lats Rotation Shoulder Adjustment; 4 Window Panel with Border; Above Waist Pointer to Pointer Diamond to Below Waist Pinky to Pinky Diamond

Gallop Posterior Pelvic Tilt Spacing: Push Off, Line Hesitation, Pivot Hook, Acceleration

Back Hip Funnel: Soft Hands to Tuck Transfer to Back Hip

DISCOUNTED CASH FLOW MODEL

Companies

YAC Above Expectation

YAC Success Rate

Average Cushion

Average Separation

Average Targeted Air Yards (TAY)

% Share of Team's Air Yards (TAY%)

Key Metric

With Weighted Average Cost of Capital (WACC) being Replaced Catch Rate Over Expected (CROE)

MARLËVOIX

0 notes

Text

Accurate WACC Calculator Excel Tool by Icrest Models

Looking for a reliable WACC calculator Excel template? Icrest Models offers a professionally designed, easy-to-use Excel tool to help finance professionals and business owners accurately calculate the Weighted Average Cost of Capital (WACC). Ideal for valuation, investment analysis, and strategic planning, our WACC calculator ensures precise results with a clean, user-friendly interface. Whether you're preparing a business plan or conducting a financial assessment, this template simplifies complex calculations and saves time. Trusted by analysts and startups alike, Icrest Models delivers tools that drive smarter financial decisions.

Download your WACC calculator Excel today from Icrest Models and streamline your financial modeling.

0 notes

Text

Unlock Incredible Discount Rates with LogyxPress

Are you in search of Discount Finance solutions that are tailored for startups, SMEs, and enterprises in India? At LogyxPS, we offer exclusive Discount Rates to help businesses thrive in competitive markets. Whether you're calculating the discount rate and WACC for financial modeling or exploring the implications of the discount rate in economics, we have the expertise to support you.

Why Choose LogyxPS?

LogyxPS stands out as a reliable platform for businesses aiming to optimize their financial strategies. Here's how we help:

Discount Rates for Startups: We understand the unique challenges startups face. From early-stage funding to capital budgeting, our specially designed discount rate for startups ensures you have the financial edge to grow and compete in India's dynamic market.

Discount Rate and WACC Support: Whether you're assessing project feasibility or valuing investments, our experts simplify the calculation of the Weighted Average Cost of Capital (WACC). This includes determining the appropriate discount rate for accurate valuations.

Expert Insights on Discount Rate in Economics: Businesses often struggle to align their financial goals with macroeconomic trends. Our professionals offer deep insights into how the discount rate in economics impacts market dynamics, helping you make informed decisions.

Comprehensive Discount Finance Solutions: With LogyxPS, you gain access to holistic financial services tailored for Indian businesses. From managing cash flow to evaluating risks, we make Discount Finance accessible and effective.

Tailored Solutions for Indian Businesses

India's business landscape demands flexibility and adaptability. LogyxPS provides:

Affordable Plans: Our discounted rates are crafted to cater to startups and SMEs without compromising on quality.

Expert Consultation: We guide businesses through financial complexities, from understanding discount rate concepts to implementing them effectively.

Localized Focus: With a deep understanding of India's economic environment, we ensure that our services align with regional and national financial goals.

How Our Discount Rates Work

Our transparent approach to offering Discount Finance ensures clarity and trust. Here's what you can expect:

Flexible Payment Terms: Get the benefit of tailored financial solutions with competitive discount rates.

Customized Services: Our team works with you to create solutions that match your business goals.

On-Demand Support: Receive guidance on WACC, financial modeling, and discount rate economics to make better business decisions.

Why LogyxPS is Your Ideal Partner

By choosing LogyxPS, you're not just opting for discounted services; you're investing in sustainable growth. Our expertise in discount rate and WACC, coupled with a customer-centric approach, makes us the preferred choice for businesses across India.

Whether you're a startup looking for tailored financial solutions or an established business seeking cost-effective options, LogyxPS has the expertise to elevate your financial game.

Get Started Today!

Don't let financial complexities hold your business back. Visit our Discounted Rates page to explore a wide range of services. With LogyxPS, your success is our priority!

#Discount Rates#discount rate for startups#discount rate and wacc#discount rate economics#Discount Finance

0 notes

Text

Unlocking L&T's Financial Excellence: A Student's Perspective

As a finance enthusiast eager to explore the nuances of corporate performance, my recent analysis of Larsen & Toubro (L&T) was nothing short of eye-opening. What began as a simple exercise in evaluating financial metrics quickly evolved into a fascinating exploration of one of India’s leading engineering and construction giants. Here’s a closer look at the insights I uncovered, going beyond the surface of financial reports.

Free Cash Flow: A Tale of Efficiency

L&T’s remarkable free cash flow (FCFF) of ₹13,813.84 Cr stood out as a testament to its operational efficiency. What makes this figure extraordinary is how it was achieved. Despite significant investments in capital expenditures (₹3,352.17 Cr), the company maintained impressive cash flow generation. This showcases the strength of L&T's business model, where operational efficiency and effective contract execution drive results.

To put it into perspective, L&T generates ₹15.2 in free cash flow for every ₹100 in revenue. This level of efficiency is exceptional, especially in the construction and engineering sector, where working capital is often heavily tied up. Their tightly managed cash conversion cycle of 65 days further highlights their operational precision.

Balancing Capital: L&T’s Financial Strategy

L&T’s financial structure reflects a thoughtful approach to managing equity and debt. With a Weighted Average Cost of Capital (WACC) of 11%, the company demonstrates an optimal blend of stability and flexibility. Maintaining an equity-heavy structure (83.33%) with a moderate reliance on debt (16.67%) allows L&T to weather uncertainties while still leveraging debt to fuel growth. This conservative yet strategic approach ensures the company remains agile and resilient.

Delivering Returns: A Shareholder-Focused Strategy

L&T’s profitability metrics paint a picture of sustained growth. With an Earnings Per Share (EPS) of ₹66.95 and a 12.3% annual increase, the company consistently generates strong returns. Their shareholder-friendly approach is further evident in their generous dividend policy. A 1700% dividend rate, amounting to ₹843.39 Cr in equity dividends, underscores their commitment to rewarding investors and reinforcing confidence in their future performance.

Future Potential: A Robust Order Book

L&T’s vast order book, valued at ₹386,200 Cr, offers a glimpse into its promising future. This diverse portfolio includes 45% from infrastructure, 18% from power, 15% from defense, and the rest spread across other sectors. Such diversification is not accidental but a well-thought-out strategy to ensure steady growth while managing risks.

Driving Innovation: Embracing Digital Transformation

One of the most exciting aspects of L&T’s journey is its investment in digital transformation. With ₹850 Cr allocated to digital initiatives, the company is leveraging technologies like AI for project management and IoT for construction optimization. These initiatives, with an expected return of 22%, place L&T at the forefront of innovation, blending engineering expertise with cutting-edge technology.

Building Responsibly: Environmental and Social Commitment

In today’s world, sustainability is key, and L&T is making strides in this area. With a carbon intensity of 45 tCO2e/Cr and a 75% waste recycling rate, they demonstrate a strong commitment to environmentally responsible practices. Their investment in Corporate Social Responsibility (CSR) initiatives, amounting to ₹150 Cr, along with an emphasis on employee development (42 training hours annually), underscores their dedication to social and environmental well-being.

A Promising Outlook

Reflecting on L&T’s performance and strategy, it’s clear that the company is poised for long-term growth. With a current market price of ₹2,180 and a projected target of ₹2,650, there’s an estimated upside potential of 21.6%. This growth trajectory is supported by their strong order book, digital advancements, and sustainability efforts.

Lessons Beyond the Classroom

Analyzing L&T’s financials has been an enriching experience, reinforcing the importance of looking beyond numbers to understand the broader narrative of strategy, execution, and growth potential. For a finance student like me, this exercise has been more than an academic task—it has been a window into the workings of a company that blends financial discipline with forward-looking strategies.

As L&T continues its journey, backed by innovation and a focus on sustainability, it stands as an inspiring example of how companies can thrive in a competitive landscape.

1 note

·

View note

Text

A Student's Deep Dive into ABB India's Financial Performance: Beyond the Numbers

As a finance student passionate about understanding corporate performance, I recently analyzed ABB India's financial statements. What started as an academic exercise turned into a fascinating exploration of how theoretical concepts translate into real-world business success. Let me share my insights into what the numbers reveal about this industrial technology leader.

Understanding Cash Generation: Free Cash Flow to Firm (FCFF)

The cornerstone of any financial analysis begins with understanding how much cash a company actually generates. Free Cash Flow to Firm (FCFF) tells us exactly that – it's the lifeblood that keeps a company growing and investors happy.

Breaking down ABB India's FCFF components:

Net Operating Profit After Tax (NOPAT): ₹1,248.18 Crore

This represents the company's core operational performance

Excludes the impact of financing decisions, showing pure business efficiency

Depreciation & Capital Expenditure:

Depreciation: ₹119.92 Crore (added back as it's a non-cash expense)

CAPEX: -₹3,352.17 Crore (significant investment in growth)

Working Capital Changes:

Positive contributions from increased payables and other liabilities

Optimized inventory and receivables management

Demonstrates efficient operational management

Final FCFF: ₹4,550.71 Crore