#Wireless Transceiver Module

Explore tagged Tumblr posts

Text

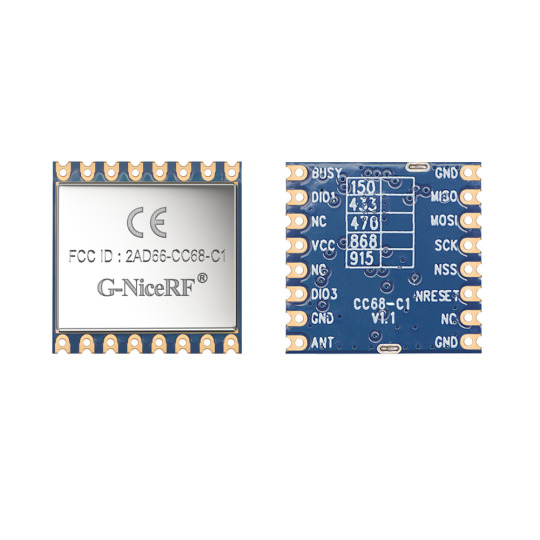

Mini3060: 100mW Wireless transceiver module Ultra-compact size

Mini3060 is a module based on the low-power, long-range wireless transceiver chip that uses ChirpIoTTM modulation and demodulation technology. It supports half-duplex wireless communication and utilizes a TCXO crystal oscillator, offering high anti-interference capability, high sensitivity, low power consumption, and ultra-long transmission range. It features a maximum sensitivity of -129dBm and a maximum output power of 20dBm, providing an industry-leading link budget, making it the best choice for long-distance transmission and applications with high reliability requirements.

Mini3060 strictly uses lead-free technology for production and testing, complying with RoHS and Reach standards.

For details, please click:https://www.nicerf.com/products/ Or click:https://nicerf.en.alibaba.com/productlist.html?spm=a2700.shop_index.88.4.1fec2b006JKUsd For consultation, please contact NiceRF (Email: [email protected]).

0 notes

Text

https://www.futureelectronics.com/p/semiconductors--wireless-rf--rf-modules-solutions--bluetooth/da14531mod-00f01002-dialog-semiconductor-8189021

Proprietary RF Module, wireless technology, Transceiver ICs, Bluetooth device

DA14531MOD Series 3.6 V -93 dBm Sensitivity Surface Mount Bluetooth LE Module

#Dialog Semiconductor#DA14531MOD-00F01002#Wireless & RF#RF Modules#Bluetooth#USB Bluetooth Adapter#GPS Module#Bluetooth Module#Proprietary RF Module#wireless technology#Transceiver ICs#Bluetooth device#RF Transceiver#Wireless detectors

1 note

·

View note

Text

https://www.futureelectronics.com/p/semiconductors--wireless-rf--rf-modules-solutions--gps/max-8q-0-u-blox-3122418

RF Modules, Digital rf modulator, Proprietary RF Module, Radio frequency module

MAX-8 Series 3.6 V u-blox 8 GNSS TCXO ROM Green 9.7x10.1 mm LCC Module

#u-blox#MAX-8Q-0#Wireless & RF#RF Modules & Solutions#GPS#Digital rf modulator#Proprietary RF Module#Radio frequency#USB Adapter#Bluetooth transmitter module#Balanced modulator#Demodulator#Bluetooth Accessories#Transceiver radio waves

1 note

·

View note

Text

https://www.futureelectronics.com/p/semiconductors--wireless-rf--rf-modules-solutions--gps/neo-m8q-0-u-blox-9122422

RF transmitter, wireless alarm systems, Bluetooth adapter, GPS Module

NEO-M8 Series 3.6 V -167 dBm Surface Mount u-blox M8 Concurrent GNSS Module

#u-blox#NEO-M8Q-0#Wireless & RF#RF Modules & Solutions#GPS#transmitter#wireless alarm systems#Bluetooth adapter#GPS Module#Accessories#RF Modules transmitter#Power#USB#Bluetooth devices accessories#RF transceiver

1 note

·

View note

Text

https://www.futureelectronics.com/p/semiconductors--wireless-rf--rf-modules-solutions--80211-wlan/lbwa1uz1gc-958-murata-5143837

WI FI module manufacturers, RF Solutions, RF Modules, industrial remote controls

2.4/5 GHz 3.3V Shielded Ultra Small Dual Band WiFi 11a/b/g/n+Ethernet+MCU Module

#Wireless & RF#RF Modules & Solutions#802.11/WLAN#LBWA1UZ1GC-958#Murata#alarm systems#GPS#RFID modules#WI FI module manufacturers#industrial remote controls#transceiver radio waves#garage door opener#proprietary RF modules

1 note

·

View note

Text

https://www.futureelectronics.com/p/semiconductors--wireless-rf--transceiver-ics/sp4082een-l-tr-maxlinear-6164468

High speed data transmission, Bus Transceiver, USB RFreceiver

SP4082E Series 115 kbps 5 V RS-485 / RS-422 Transceiver - NSOIC-8

#MaxLinear#SP4082EEN-L/TR#Wireless & RF#Transceiver ICs#rf transceiver module#usb rf transmitter#High speed data transmission#Bus Transceiver#usb rf receiver#Replacement USB Receiver

1 note

·

View note

Text

High performance circuit, High speed data transmission, module bluetooth

SP3077E Series 16 Mbps ±15 kV ESD Protected RS-485/RS-422 Transceiver-NSOIC-8

#MaxLinear#SP3077EEN-L#Wireless & RF#Transceiver ICs#RF Transceiver utilizes#band signals#wireless transmitter#Wifi#Bluetooth transceiver#usb wireless transceiver#High performance circuit#High speed data transmission#module

1 note

·

View note

Text

RF Transmitter and Receiver: Key Components in Wireless Communication

RF (Radio Frequency) transmitters and receivers are fundamental components in modern wireless communication systems. These components play a pivotal role in enabling various wireless technologies, from mobile phones to Wi-Fi routers, to operate seamlessly. In this article, we will explore the significance of RF transmitter and receiver in wireless communication and delve into their essential functions and applications.

RF Transmitter: Sending Signals Wirelessly

An RF transmitter is a crucial element in any wireless communication system. It is responsible for converting electrical signals into radio waves that can travel through the air and be received by compatible devices. RF transmitters are found in a wide range of applications, including radio broadcasting, remote control systems, and data transmission.

One of the key features of an RF transmitter is its ability to modulate the carrier signal with the information to be transmitted. This modulation process allows the transmitter to encode data, voice, or other forms of information onto the radio waves. The modulated signal is then amplified and broadcasted through an antenna.

In modern wireless technologies, such as Bluetooth and Wi-Fi, RF transmitters are the driving force behind the wireless connectivity that allows devices to communicate with each other over short or long distances.

RF Receiver: Capturing and Decoding Signals

On the receiving end, the RF receiver is responsible for capturing the transmitted radio waves, demodulating them, and converting them back into electrical signals that can be processed by electronic devices. RF receivers are integral components in devices like car radios, GPS systems, and satellite television receivers.

The receiver's demodulation process is crucial because it extracts the original information from the modulated carrier signal. This process allows the receiver to recover the transmitted data, audio, or video signal accurately. In essence, the RF receiver acts as the gateway for converting radio waves into usable information.

Applications of RF Transmitters and Receivers:

Wireless Communication: RF transmitters and receiver is the backbone of wireless communication system, enabling devices to transmit voice, data, and multimedia content over the airwaves. They are vital for mobile phones, two-way radios, and wireless Internet connections.

Remote Control Systems: Many remote control devices, including TV remotes, garage door openers, and toy controllers, rely on RF transmitters and receivers to send and receive signals.

Telemetry and Data Acquisition: In industries like agriculture and environmental monitoring, RF technology is used to collect data wirelessly from remote sensors and devices.

Security Systems: Wireless security systems, such as home alarms and surveillance cameras, use RF transmitter and receiver for communication between sensors and control panels.

Conclusion:

RF transmitters and receivers are the unsung heroes of the wireless world, making it possible for us to communicate, control devices remotely, and access information seamlessly. As technology continues to advance, these essential components will continue to evolve and play a pivotal role in our increasingly connected world. Whether it's sending a text message, streaming a video, or unlocking your car with a remote, RF transmitter and receiver is at the heart of it all, making our lives more convenient and interconnected.

For details, please click:

Or click:https://www.alibaba.com/product-detail/G-NiceRF-CC68-C1-160mW-433MHz_1600914212665.html?spm=a2747.manage.0.0.78e071d2L4s02Q

For consultation, please contact NiceRF (Email: [email protected])

0 notes

Text

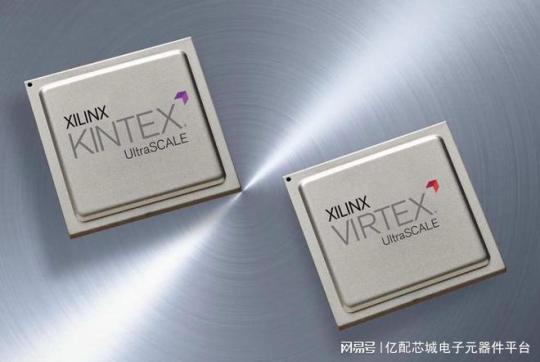

Beginner's learning to understand Xilinx product series including Zynq-7000, Artix, Virtex, etc.

Xilinx (Xilinx) as the world's leading supplier of programmable logic devices has always been highly regarded for its excellent technology and innovative products. Xilinx has launched many excellent product series, providing a rich variety of choices for different application needs.

I. FPGA Product Series

Xilinx's FPGA products cover multiple series, each with its own characteristics and advantages.

The Spartan series is an entry-level product with low price, power consumption, and small size. It uses a small package and provides an excellent performance-power ratio. It also contains the MicroBlaze™ soft processor and supports DDR3 memory. It is very suitable for industrial, consumer applications, and automotive applications, such as small controllers in industrial automation, simple logic control in consumer electronics, and auxiliary control modules in automotive electronics.

The Artix series, compared to the Spartan series, adds serial transceivers and DSP functions and has a larger logic capacity. It achieves a good balance between cost and performance and is suitable for mid-to-low-end applications with slightly more complex logic, such as software-defined radios, machine vision, low-end wireless backhaul, and embedded systems that are cost-sensitive but require certain performance.

The Kintex series is a mid-range series that performs excellently in terms of the number of hard cores and logic capacity. It achieves an excellent cost/performance/power consumption balance for designs at the 28nm node, provides a high DSP rate, cost-effective packaging, and supports mainstream standards such as PCIe® Gen3 and 10 Gigabit Ethernet. It is suitable for application scenarios such as data centers, network communications, 3G/4G wireless communications, flat panel displays, and video transmission.

The Virtex series, as a high-end series, has the highest performance and reliability. It has a large number of logic units, high-bandwidth serial transceivers, strong DSP processing capabilities, and rich storage resources, and can handle complex calculations and data streams. It is often used in application fields with extremely high performance requirements such as 10G to 100G networking, portable radars, ASIC prototyping, high-end military communications, and high-speed signal processing.

II. Zynq Product Series

The Zynq - 7000 series integrates ARM and FPGA programmable logic to achieve software and hardware co-design. It provides different models with different logic resources, storage capacities, and interface numbers to meet different application needs. The low-power consumption characteristic is suitable for embedded application scenarios such as industrial automation, communication equipment, medical equipment, and automotive electronics.

The Zynq UltraScale + MPSoC series has higher performance and more abundant functions, including more processor cores, larger storage capacities, and higher communication bandwidths. It supports multiple security functions and is suitable for applications with high security requirements. It can be used in fields such as artificial intelligence and machine learning, data center acceleration, aerospace and defense, and high-end video processing.

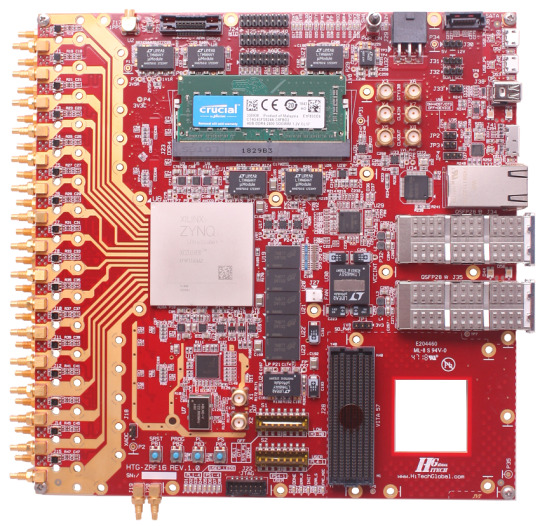

The Zynq UltraScale + RFSoC series is similar in architecture to the MPSoC and also has ARM and FPGA parts. However, it has been optimized and enhanced in radio frequency signal processing and integrates a large number of radio frequency-related modules and functions such as ADC and DAC, which can directly collect and process radio frequency signals, greatly simplifying the design complexity of radio frequency systems. It is mainly applied in radio frequency-related fields such as 5G communication base stations, software-defined radios, and phased array radars.

III. Versal Series

The Versal series is Xilinx's adaptive computing acceleration platform (ACAP) product series.

The Versal Prime series is aimed at a wide range of application fields and provides high-performance computing and flexible programmability. It has high application value in fields such as artificial intelligence, machine learning, data centers, and communications, and can meet application scenarios with high requirements for computing performance and flexibility.

The Versal AI Core series focuses on artificial intelligence and machine learning applications and has powerful AI processing capabilities. It integrates a large number of AI engines and hardware accelerators and can efficiently process various AI algorithms and models, providing powerful computing support for artificial intelligence applications.

The Versal AI Edge series is designed for edge computing and terminal device applications and has the characteristics of low power consumption, small size, and high computing density. It is suitable for edge computing scenarios such as autonomous driving, intelligent security, and industrial automation, and can achieve efficient AI inference and real-time data processing on edge devices.

In short, Xilinx's product series are rich and diverse, covering various application needs from entry-level to high-end. Whether in the FPGA, Zynq, or Versal series, you can find solutions suitable for different application scenarios, making important contributions to promoting the development and innovation of technology.

In terms of electronic component procurement, Yibeiic and ICgoodFind are your reliable choices. Yibeiic provides a rich variety of Xilinx products and other types of electronic components. Yibeiic has a professional service team and efficient logistics and distribution to ensure that you can obtain the required products in a timely manner. ICgoodFind is also committed to providing customers with high-quality electronic component procurement services. ICgoodFind has won the trust of many customers with its extensive product inventory and good customer reputation. Whether you are looking for Xilinx's FPGA, Zynq, or Versal series products, or electronic components of other brands, Yibeiic and ICgoodFind can meet your needs.

Summary by Yibeiic and ICgoodFind: Xilinx (Xilinx) as an important enterprise in the field of programmable logic devices, its products have wide applications in the electronics industry. As an electronic component supplier, Yibeiic (ICgoodFind) will continue to pay attention to industry trends and provide customers with high-quality Xilinx products and other electronic components. At the same time, we also expect Xilinx to continuously innovate and bring more surprises to the development of the electronics industry. In the process of electronic component procurement, Yibeiic and ICgoodFind will continue to provide customers with professional and efficient services as always.

4 notes

·

View notes

Text

Integrated Microwave Assembly Market Insights & Analysis 2032

Introduction

The global Integrated Microwave Assembly market is poised for substantial growth, driven by rising defense budgets, rapid advancements in 5G infrastructure, and technological innovations in RF module integration. Valued at USD 2.6 billion in 2023, the market is expected to expand at a CAGR of 6.9% over the forecast period. Increasing demand from aerospace, telecommunications, and automotive sectors is further propelling market expansion, creating lucrative opportunities for industry players.

Request Sample Report PDF (including TOC, Graphs & Tables): https://www.statsandresearch.com/request-sample/40613-global-integrated-microwave-assembly-market

Integrated Microwave Assembly Market Dynamics:

Integrated Microwave Assembly Market Growth Drivers

Rising Defense Investments – Governments worldwide are increasing defense budgets to enhance electronic warfare capabilities, secure communication systems, and advanced military radar technologies.

Proliferation of 5G Networks – The rollout of 5G and the growing need for high-frequency communication infrastructure are significantly boosting IMA adoption.

Advancements in Semiconductor Technologies – Miniaturization, improved efficiency, and high-performance microwave solutions are driving demand in the market.

Expansion of Autonomous Vehicles – Automotive radar and connectivity systems are increasingly integrating microwave assemblies for enhanced safety and autonomous driving capabilities.

Get up to 30% Discount: https://www.statsandresearch.com/check-discount/40613-global-integrated-microwave-assembly-market

Integrated Microwave Assembly Market Challenges

High Production Costs – Advanced materials and sophisticated manufacturing processes elevate production expenses.

Complex Design and Integration Requirements – The need for precision engineering and specialized expertise limits market entry for new players.

Emerging Trends

Compact & High-Performance IMAs – The industry is shifting toward smaller, energy-efficient, and high-power-density solutions.

IoT & AI-Driven Applications – Integration of IMAs with artificial intelligence and IoT is creating new growth avenues.

Sustainability Initiatives – Energy-efficient microwave solutions are becoming a priority to meet global environmental standards.

Integrated Microwave Assembly Market Segmentation

By Product Type

Amplifiers – The leading segment, vital for signal strength enhancement across telecommunications, aerospace, and defense.

Frequency Synthesizers – Fastest-growing segment due to the increasing need for precise frequency generation in wireless communication and radar systems.

Frequency Converters, Oscillators, Transceivers, and Others – These components play critical roles in optimizing microwave system performance.

By Frequency Band

S-Band (Dominant Segment) – Extensive usage in satellite communications, radar systems, and military applications.

X-Band (Fastest-Growing Segment) – Rising deployment in high-resolution imaging, maritime surveillance, and secure communications.

Other Bands – Ku-Band, C-Band, Ka-Band, and L-Band continue to support specialized applications.

By Technology

Silicon Germanium (SiGe) (Market Leader) – Superior high-frequency performance and cost-effectiveness drive adoption.

Gallium Arsenide (GaAs) (High Growth Potential) – High electron mobility makes it ideal for satellite communication, radar, and 5G applications.

Indium Phosphide (InP) and Gallium Nitride (GaNAs) – Emerging technologies for next-generation applications.

By End-Use Industry

Aerospace & Defense – Dominant segment, with increasing applications in secure military communications and radar technologies.

Telecommunications – Expanding due to 5G infrastructure rollout and the need for reliable high-speed networks.

Consumer Electronics, Automotive, Industrial, and Healthcare – Growing adoption across multiple industries, fueled by technological advancements.

Regional Analysis

North America (Market Leader, 35% Share) – Home to major industry players and high defense spending.

Europe (Second-Largest Market) – Increasing focus on defense modernization and 5G expansion.

Asia-Pacific (Fastest-Growing Region) – Rapid industrialization, increasing military expenditures, and expanding telecommunications infrastructure drive market growth.

South America & Middle East & Africa (Emerging Markets) – Growth fueled by rising demand for telecommunications and automotive applications.

Competitive Landscape

Leading players in the Integrated Microwave Assembly market include:

L3Harris Technologies

Qorvo

Wolfspeed

Mercury Systems

Broadcom

NXP Semiconductors

Infineon Technologies AG

Amphenol Corporation

Teledyne Technologies

Murata Manufacturing

MACOM Technology Solutions Holdings

Skyworks Solutions

Analog Devices

Recent Developments

Wolfspeed (2024) – Launched GaN-on-SiC-based IMA modules with superior power density and efficiency for aerospace and defense.

Broadcom (2024) – Introduced IMAs optimized for 5G infrastructure, enhancing bandwidth and reducing latency for next-gen wireless networks.

Integrated Microwave Assembly Market Future Outlook

The Integrated Microwave Assembly market is on a steady growth trajectory, driven by rising defense expenditures, expanding 5G networks, and continuous RF integration advancements. Companies are focusing on compact, high-performance, and energy-efficient solutions, ensuring sustained industry expansion.

Conclusion

The Integrated Microwave Assembly market presents substantial growth opportunities, particularly in aerospace, defense, and telecommunications. While challenges such as high production costs and complex integration exist, ongoing technological advancements and increasing global defense spending are driving market expansion. The shift toward miniaturized, high-efficiency microwave systems will be key in shaping the future of this industry.

Purchase Exclusive Report: https://www.statsandresearch.com/enquire-before/40613-global-integrated-microwave-assembly-market

Our Services:

On-Demand Reports: https://www.statsandresearch.com/on-demand-reports

Subscription Plans: https://www.statsandresearch.com/subscription-plans

Consulting Services: https://www.statsandresearch.com/consulting-services

ESG Solutions: https://www.statsandresearch.com/esg-solutions

Contact Us:

Stats and Research

Email: [email protected]

Phone: +91 8530698844

Website: https://www.statsandresearch.com

#Integrated Microwave Assembly Market#Microwave Assembly Trends#Integrated Microwave Assembly Forecast#Microwave Assembly Analysis#RF Microwave Market#Integrated Microwave Module#Electronics Market Trends#Microwave Systems Market#Defense Electronics Market#Aerospace Microwave Assembly#Global Microwave Assembly Market#Microwave Components Market#Microwave Module Forecast#Telecom Microwave Market#Microwave Market Growth

1 note

·

View note

Text

The SX1278 LoRa modules are used in Long Range communications. It is a type of low cost RF front-end transceiver module based on SX1278 from Semtech Corporation. The high sensitivity (-136dBm) in LoRa modulation and 20dBm high power output make the module suitable for low range and low data rate applications.

4 notes

·

View notes

Text

Seamless Connectivity Starts Here! Upgrade your wireless communication with the E-Pro Transceiver Module – designed for efficiency, range, and reliability. Perfect for your next smart project or industrial setup.

🔹 High performance 🔹 Compact & durable 🔹 Ideal for controllers, microprocessors & IoT devices

🚀 Get yours now at enrgtechglobal.com #EPro #TransceiverModule #IoT #WirelessTech #EmbeddedSystems #Microcontrollers #EnrgtechGlobal

0 notes

Text

Cellular IoT Module Chipset Market: Challenges in Standardization and Implementation, 2025-2032

MARKET INSIGHTS

The global Cellular IoT Module Chipset Market size was valued at US$ 4,670 million in 2024 and is projected to reach US$ 9,780 million by 2032, at a CAGR of 11.12% during the forecast period 2025-2032. The semiconductor industry backdrop shows robust growth, with global semiconductor revenues reaching USD 579 billion in 2022 and expected to expand to USD 790 billion by 2029 at 6% CAGR.

Cellular IoT Module Chipsets are specialized semiconductor components that enable wireless communication for IoT devices across cellular networks (4G LTE, 5G, NB-IoT). These chipsets integrate baseband processing, RF transceivers, power management, and security features into compact modules, facilitating machine-to-machine (M2M) connectivity in applications ranging from smart meters to industrial automation.

The market growth is driven by accelerating 5G deployments, with 5G chipset adoption projected to grow at 28% CAGR through 2030. While 4G LTE dominates current installations (72% market share in 2024), 5G chipsets are gaining traction in high-bandwidth applications. Key players like Qualcomm (holding 32% market share) and UNISOC are driving innovation through partnerships, such as Qualcomm’s recent collaboration with Bosch on industrial IoT modules featuring AI acceleration capabilities.

MARKET DYNAMICS

MARKET DRIVERS

Explosive Growth of IoT Applications to Accelerate Chipset Demand

The cellular IoT module chipset market is experiencing robust growth driven by the rapid expansion of IoT applications across industries. Global IoT connections are projected to surpass 29 billion by 2030, creating unprecedented demand for reliable connectivity solutions. Cellular IoT chipsets serve as the backbone for smart city infrastructure, industrial automation, and connected vehicles, enabling seamless machine-to-machine communication. The transition from legacy 2G/3G networks to advanced 4G LTE and 5G technologies is further fueling adoption, as these provide the necessary bandwidth and low latency for mission-critical applications.

5G Network Rollouts to Transform Industry Connectivity Standards

The global rollout of 5G networks represents a watershed moment for cellular IoT, with commercial 5G connections expected to reach 1.8 billion by 2025. 5G-enabled chipsets offer game-changing capabilities including ultra-reliable low latency communication (URLLC) and massive machine-type communication (mMTC) – essential for industrial IoT and autonomous systems. Major chipset manufacturers are introducing integrated 5G NR solutions that combine modem, RF transceiver, and power management, significantly reducing module footprint and power consumption while improving performance.

Moreover, the emergence of cellular vehicle-to-everything (C-V2X) technology is creating new revenue streams, with automakers increasingly embedding IoT modules for enhanced safety and navigation features. These technological advancements coincide with significant price reductions in 5G chipset manufacturing, making advanced connectivity accessible to mid-range IoT devices.

MARKET RESTRAINTS

Complex Certification Processes to Slow Market Penetration

Despite strong demand, the cellular IoT chipset market faces considerable barriers from stringent certification requirements. Each regional market maintains distinct regulatory frameworks for wireless devices, necessitating costly and time-consuming certification processes that can take 6-12 months per product. The situation is compounded for global IoT deployments requiring certifications across multiple jurisdictions, often representing 15-25% of total product development costs. This regulatory complexity particularly disadvantages smaller manufacturers lacking the resources for multi-market compliance.

Legacy System Integration Challenges to Constrain Adoption Rates

The integration of modern cellular IoT modules with legacy industrial systems presents significant technical hurdles. Many manufacturing facilities operate equipment with lifespans exceeding 20 years, designed before IoT connectivity became standard. Retrofitting these systems requires specialized gateways and protocol converters that add complexity and cost to deployments. Furthermore, the industrial sector’s conservative approach to technology upgrades means adoption cycles remain measured, despite the potential efficiency gains from cellular IoT implementation.

MARKET CHALLENGES

Power Consumption Optimization to Remain Critical Design Hurdle

While cellular connectivity offers superior range and reliability compared to alternatives like LPWAN, power efficiency remains an ongoing challenge for IoT module designers. Many industrial monitoring applications require 10+ year battery life from devices, pushing chipset manufacturers to develop increasingly sophisticated power management architectures. The introduction of advanced power saving modes like PSM and eDRX has helped, but achieving optimal battery life while maintaining responsive connectivity continues to require careful balancing of performance parameters.

Other Challenges

Supply Chain Volatility The semiconductor industry’s cyclical nature creates unpredictable component availability, with lead times for certain RF components occasionally exceeding 40 weeks. This volatility forces module manufacturers to maintain costly inventory buffers or redesign products based on component availability rather than optimal technical specifications.

Security Vulnerabilities As cellular IoT deployments scale, they become increasing targets for sophisticated cyber attacks. Chipset manufacturers must continuously update security architectures to address emerging threats while maintaining backward compatibility with deployed devices – a challenge that grows more complex with each product generation.

MARKET OPPORTUNITIES

AI-Enabled Edge Processing to Create Next-Generation Value Propositions

The convergence of cellular connectivity with artificial intelligence presents transformative opportunities for IoT module chipsets. Emerging architectures that combine cellular modems with neural processing units (NPUs) enable sophisticated edge analytics, reducing cloud dependency while improving response times. The edge AI chipset market is projected to grow at a CAGR of 18.8% through 2030, with cellular-equipped devices gaining particular traction in applications like predictive maintenance and autonomous surveillance systems.

Satellite IoT Convergence to Expand Addressable Markets

The integration of satellite connectivity with cellular IoT chipsets is opening new possibilities for global asset tracking and remote monitoring. Major chipset vendors are developing hybrid cellular-satellite solutions that automatically switch between terrestrial and non-terrestrial networks, ensuring connectivity in areas without cellular coverage. This technology holds particular promise for maritime logistics, agriculture, and energy infrastructure monitoring in underserved regions, potentially adding millions of new connections to the cellular IoT ecosystem.

CELLULAR IOT MODULE CHIPSET MARKET TRENDS

5G Adoption Accelerates Growth in Cellular IoT Module Chipsets

The rapid deployment of 5G networks worldwide is fundamentally transforming the Cellular IoT Module Chipset market, with the 5G segment projected to grow at a CAGR of over 28% from 2024 to 2032. Unlike previous generations, 5G-NR technology enables ultra-low latency (under 10ms) and high bandwidth (up to 10Gbps), making it ideal for mission-critical applications like autonomous vehicles and industrial automation. Recent advancements in 5G RedCap (Reduced Capability) chipsets are bridging the gap between high-performance and cost-sensitive IoT applications, with power consumption reductions of up to 60% compared to standard 5G modules. Furthermore, the integration of AI-powered edge computing capabilities directly into cellular modules is enabling real-time data processing at the device level, significantly reducing cloud dependency.

Other Trends

LPWAN Convergence Driving Hybrid Solutions

While traditional cellular technologies dominate, the market is witnessing a surge in LPWAN-cellular hybrid chipsets that combine NB-IoT/LTE-M with LoRaWAN or Sigfox support. This convergence addresses the growing need for flexible connectivity in smart cities and industrial IoT, where deployment scenarios might demand both wide-area coverage and deep indoor penetration. Industry data indicates that hybrid modules now represent over 35% of new industrial IoT deployments, particularly in asset tracking and smart utility applications. The emergence of 3GPP Release 18 features is further optimizing power management in these solutions, extending battery life for remote devices to 10+ years in some configurations.

Vertical-Specific Customization Reshapes Product Offerings

Chipset manufacturers are increasingly developing application-specific optimized solutions, moving beyond one-size-fits-all approaches. For automotive applications, chipsets now integrate vehicle-to-everything (V2X) communication alongside traditional cellular connectivity, with processing capabilities enhanced for ADAS data throughput. In healthcare, modules are being designed with built-in HIPAA-compliant security chips and ultra-low power modes for wearable devices. The industrial sector is driving demand for ruggedized chipsets capable of operating in extreme temperatures (from -40°C to 85°C) with enhanced EMI shielding. This specialization trend has led to over 200 new SKUs being introduced by major vendors in the past 18 months alone, creating a more fragmented but application-optimized market landscape.

COMPETITIVE LANDSCAPE

Key Industry Players

Leading Chipset Manufacturers Drive Innovation in Cellular IoT

The global Cellular IoT Module Chipset market features a highly competitive landscape dominated by semiconductor giants and specialized IoT solution providers. Qualcomm Technologies Inc. leads the market with its comprehensive 4G and 5G solutions, capturing approximately 35% market share in 2024. The company’s strength lies in its Snapdragon X55 and X65 modems that power IoT applications across industrial, automotive, and smart city deployments.

While Qualcomm maintains leadership, MediaTek and UNISOC have been gaining significant traction in the mid-range IoT segment. MediaTek’s Helio series chipsets, known for their power efficiency, secured about 18% market share last year. Meanwhile, UNISOC’s focus on cost-effective LTE Cat-1 solutions has made it the preferred choice for mass-market IoT applications in emerging economies.

Chinese players Hisilicon and ASR Microelectronics have been expanding aggressively, particularly in the Asia-Pacific region. Hisilicon’s Balong series chips helped Huawei capture 12% of the global cellular IoT module market before facing supply chain challenges. ASR has since filled this gap with its competitive LTE solutions, growing at an estimated 25% year-over-year since 2022.

The market also sees strong competition from Intel and newer entrants like Eigencomm, with the latter making waves through its patented antenna technology that improves signal reliability in challenging IoT environments. Meanwhile, Sequans Communications continues to dominate the LTE-M/NB-IoT segment with its Monarch platform, preferred by utilities and smart meter manufacturers.

List of Key Cellular IoT Module Chipset Manufacturers

Qualcomm Technologies Inc. (U.S.)

MediaTek Inc. (Taiwan)

UNISOC (China)

Hisilicon (China)

ASR Microelectronics (China)

Intel Corporation (U.S.)

Eigencomm (U.S.)

Sequans Communications (France)

Segment Analysis:

By Type

5G Chipset Segment Drives Market Growth with Accelerated IoT Connectivity

The market is segmented based on type into:

4G Chipset

5G Chipset

By Application

Industrial Applications Segment Leads Owing to Widespread Adoption in Smart Manufacturing

The market is segmented based on application into:

PC

Router/CPE

POS

Smart Meters

Industrial Application

Other

By Technology

NB-IoT Technology Gains Traction for Low-Power Wide-Area Applications

The market is segmented based on technology into:

NB-IoT

LTE-M

5G RedCap

Others

By End User

Enterprise Sector Dominates with Growing Demand for Connected Solutions

The market is segmented based on end user into:

Enterprise

Consumer

Government

Industrial

Regional Analysis: Cellular IoT Module Chipset Market

North America The North American market is characterized by advanced IoT adoption, driven by strong technological infrastructure and high investments in 5G deployment. The U.S. leads with significant contributions from key players such as Qualcomm and Intel, focusing on scalable and low-power solutions for industrial and smart city applications. Government initiatives, including funding for connected infrastructure, fuel demand for cellular IoT chipsets. However, stringent regulatory frameworks around spectrum allocation and data security pose challenges. The region is shifting toward 5G-ready chipsets, with an estimated 45% of IoT modules expected to support 5G by 2026, particularly for enterprise and automotive applications.

Europe Europe exhibits steady growth, propelled by EU-wide IoT standardization policies and rising demand for energy-efficient connectivity in smart manufacturing and logistics. Germany and France dominate due to strong industrial IoT adoption, with a focus on LPWA technologies (NB-IoT and LTE-M). Regulatory emphasis on data privacy (GDPR compliance) influences chipset design to prioritize security features. The region faces challenges from fragmented telecom regulations and higher costs of deployment. However, increasing partnerships between semiconductor firms and telecom providers (e.g., Vodafone and Ericsson collaborations) are accelerating ecosystem development.

Asia-Pacific APAC is the fastest-growing market, accounting for over 50% of global cellular IoT module shipments, led by China’s aggressive 5G rollout and India’s digital infrastructure projects. China dominates with local giants like Hisilicon and UNISOC supplying cost-optimized chipsets for smart meters and wearables. Japan and South Korea prioritize automotive and robotics applications, leveraging high-speed connectivity. While affordability drives 4G adoption, 5G chipsets are gaining traction in urban hubs. Challenges include supply chain dependencies and intellectual property constraints, but government-backed IoT initiatives (e.g., India’s Smart Cities Mission) sustain long-term potential.

South America The region shows moderate growth, with Brazil and Argentina leading IoT deployments in agriculture and asset tracking. Economic volatility limits large-scale investments, but rising demand for connected logistics and renewable energy monitoring creates niche opportunities. Reliance on imported 4G modules prevails due to cost sensitivity, though local telecom operators are piloting NB-IoT networks to expand coverage. Regulatory hurdles and underdeveloped local semiconductor industries slow progress, but FDI in smart infrastructure projects could unlock future demand.

Middle East & Africa MEA is an emerging market, with the UAE, Saudi Arabia, and South Africa driving adoption in smart utilities and oil & gas. 5G-compatible chipsets are prioritized for smart city initiatives like NEOM in Saudi Arabia. Limited local manufacturing and reliance on imports constrain growth, but partnerships with global vendors (e.g., Qualcomm’s collaborations with Etisalat) aim to strengthen IoT ecosystems. Africa’s growth is uneven, with urban centers adopting IoT for payment systems while rural areas lag due to connectivity gaps. The region’s potential hinges on improving telecom infrastructure and reducing module costs.

Report Scope

This market research report provides a comprehensive analysis of the global and regional Cellular IoT Module Chipset markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global Cellular IoT Module Chipset market was valued at USD 2.8 billion in 2024 and is projected to reach USD 5.9 billion by 2032, growing at a CAGR of 9.7%.

Segmentation Analysis: Detailed breakdown by product type (4G vs 5G chipsets), application (smart meters, industrial IoT, routers/CPE), and end-user industries to identify high-growth segments.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa, with China accounting for 42% of global demand in 2024.

Competitive Landscape: Profiles of leading market participants including Qualcomm (35% market share), UNISOC, MediaTek, and Hisilicon, covering their product portfolios and strategic initiatives.

Technology Trends: Assessment of LPWA technologies (NB-IoT, LTE-M), 5G RedCap adoption, and AI integration in cellular IoT modules.

Market Drivers & Restraints: Evaluation of factors including smart city deployments, Industry 4.0 adoption, and spectrum availability challenges.

Stakeholder Analysis: Strategic insights for chipset manufacturers, module vendors, and enterprise IoT adopters.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/laser-diode-cover-glass-market-valued.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/q-switches-for-industrial-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/ntc-smd-thermistor-market-emerging_19.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/lightning-rod-for-building-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/cpe-chip-market-analysis-cagr-of-121.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/line-array-detector-market-key-players.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/tape-heaters-market-industry-size-share.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/wavelength-division-multiplexing-module.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/electronic-spacer-market-report.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/5g-iot-chip-market-technology-trends.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/polarization-beam-combiner-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/amorphous-selenium-detector-market-key.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/output-mode-cleaners-market-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/digitally-controlled-attenuators-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/thin-double-sided-fpc-market-key.html

0 notes

Text

Accelerate Wireless Innovation with Wi-Fi 7 (802.11be) RF Transceiver IP Core

T2M IP, a global leader in semiconductor IP cores and advanced connectivity solutions, has announced the availability of its partner’s cutting-edge Dual-Band Wi-Fi 7 RF Transceiver IP Core. Featuring an integrated Front-End Module (FEM), this next-generation IP solution is optimized for both consumer and industrial applications and is now available for licensing in TSMC’s 22nm ULL process.

Designed to meet the growing demands of bandwidth-hungry and latency-sensitive applications, the new Wi-Fi 7 RF Transceiver IP core supports a broad range of high-performance use cases—from set-top boxes and smart TVs to AR/VR headsets, streaming devices, automotive infotainment systems, and industrial IoT applications. The integration of the FEM simplifies system design, reduces bill of materials (BoM), and enhances RF performance, making it a highly attractive solution for chipmakers developing the next wave of wireless SoCs.

Wi-Fi 7: The Future of Wireless Connectivity

As wireless data consumption continues to surge, Wi-Fi 7 (IEEE 802.11be) is set to become a game-changer in the world of connectivity. Offering data rates well into the multi-gigabit range, ultra-low latency, and significantly improved spectral efficiency, Wi-Fi 7 enables truly seamless connectivity across an array of smart devices.

The T2M IP partner’s transceiver IP fully complies with the Wi-Fi 7 standard and includes backward compatibility with Wi-Fi 6/6E. Supporting both 1024-QAM and 4096-QAM modulation schemes, this IP core delivers highly efficient and high-throughput wireless communications. The advanced modulation enables higher data rates within the same spectrum, resulting in better performance in environments crowded with competing wireless signals—such as smart homes, public venues, and industrial facilities.

Optimized for Performance and Efficiency

One of the core highlights of this IP solution is its compact design and power efficiency. Engineered for minimal die area, the transceiver operates with ultra-low power consumption, making it especially suitable for battery-powered and thermally constrained devices like wearables and AR/VR headsets.

In addition to superior RF performance, the IP core includes built-in features for robust interference mitigation, seamless roaming, and reliable data transmission in dynamic environments. These capabilities ensure high-quality connectivity for mobile and embedded systems that must operate in varying and often challenging RF conditions.

Tri-Band Support and Scalability

The transceiver IP supports operation across the 2.4GHz, 5GHz, and 6GHz bands, providing full tri-band coverage for maximum flexibility and network performance. This tri-band support enables a broader range of applications and ensures compatibility with existing Wi-Fi infrastructure, while also future-proofing devices for emerging Wi-Fi 7 deployments.

Currently, the IP supports bandwidths of up to 80MHz, which is suitable for a wide range of high-speed applications. Looking ahead, the roadmap includes support for 160MHz bandwidth by Q2 2025, which will further elevate the performance of multi-user MIMO and OFDMA (Orthogonal Frequency-Division Multiple Access) technologies. This scalability makes the IP ideal for building flexible, future-ready wireless SoCs that can evolve alongside the Wi-Fi standard.

Accelerating Next-Gen SoC Development

With the introduction of this highly integrated Wi-Fi 7 RF Transceiver IP core, T2M IP and its partner aim to accelerate innovation in the semiconductor industry. By providing a complete, production-ready IP solution that balances high performance, power efficiency, and small footprint, T2M IP enables SoC developers to meet tight design schedules and get their products to market faster.

This IP is particularly beneficial for Access Point applications, including home and enterprise routers, where enhanced range, bandwidth, and throughput are critical. Integrating this solution into next-generation SoCs will empower OEMs to deliver faster, smarter, and more reliable wireless experiences to users worldwide.

Availability and Licensing

The Dual-Band Wi-Fi 7 RF Transceiver IP Core is now available for immediate licensing. Interested parties can reach out to T2M IP for more information on licensing models, deliverables, and pricing details.

About T2M IP

T2M IP is a leading global technology provider specializing in the licensing of semiconductor IP cores. With a robust portfolio that includes wireless, cellular, analog, mixed-signal, and connectivity IP solutions, T2M IP serves semiconductor companies worldwide in developing innovative, next-generation products across consumer, automotive, and industrial markets.

1 note

·

View note

Text

How do self-healing protocols enhance IoT device longevity in harsh environments

TheIoT Communication Protocol Market Size was valued at USD 16.95 Billion in 2023 and is expected to reach USD 23.94 Billion by 2032 and grow at a CAGR of 4.2% over the forecast period 2024-2032.

The IoT Communication Protocol Market is experiencing unprecedented growth, driven by the pervasive integration of connected devices across industries. This market is crucial for enabling the seamless exchange of data between the billions of IoT devices, from smart home appliances to complex industrial sensors, forming the backbone of our increasingly interconnected world. The evolution of communication protocols is vital to unlock the full potential of the Internet of Things, ensuring efficiency, security, and scalability in every deployment.

U.S. Headline: IoT Communication Protocol Market Poised for Significant Expansion Driven by Smart Infrastructure Demands

IoT Communication Protocol Market continues its robust expansion, fueled by advancements in wireless technologies and the rising demand for real-time data exchange. As the Internet of Things ecosystem matures, the emphasis on interoperability, low-power consumption, and enhanced security features in communication protocols becomes paramount. This dynamic landscape necessitates continuous innovation to support the diverse and expanding array of IoT applications that are reshaping industries globally.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6554

Market Keyplayers:

Huawei Technologies (OceanConnect IoT Platform, LiteOS)

Arm Holdings (Mbed OS, Cortex‑M33 Processor)

Texas Instruments (SimpleLink CC3220 Wi‑Fi MCU, SimpleLink CC2652 Multiprotocol Wireless MCU)

Intel (XMM 7115 NB‑IoT Modem, XMM 7315 LTE‑M/NB‑IoT Modem)

Cisco Systems (Catalyst IR1101 Rugged Router, IoT Control Center)

NXP Semiconductors (LPC55S6x Cortex‑M33 MCU, EdgeLock SE050 Secure Element)

STMicroelectronics (STM32WL5x LoRaWAN Wireless MCU, SPIRIT1 Sub‑GHz Transceiver)

Thales (Cinterion TX62 LTE‑M/NB‑IoT Module, Cinterion ENS22 NB‑IoT Module)

Zebra Technologies (Savanna IoT Platform, SmartLens for Retail Asset Visibility)

Wind River (Helix Virtualization Platform, Helix Device Cloud)

Ericsson (IoT Accelerator, Connected Vehicle Cloud)

Qualcomm (IoT Services Suite, AllJoyn Framework)

Samsung Electronics (ARTIK Secure IoT Modules, SmartThings Cloud)

IBM (Watson IoT Platform, Watson IoT Message Gateway)

Market Analysis

The IoT Communication Protocol Market is on a clear upward trajectory, reflecting the global acceleration in IoT device adoption across consumer electronics, industrial automation, healthcare, and smart city initiatives. This growth is intrinsically linked to the demand for efficient, reliable, and secure data transmission. Key drivers include the proliferation of 5G networks, the imperative for edge computing, and the integration of AI for smarter decision-making, all of which heavily rely on robust communication foundations. The market is witnessing a strong shift towards wireless and low-power consumption technologies, with standardized protocols becoming increasingly critical for widespread interoperability.

Market Trends

Proliferation of Wireless Technologies: A dominant shift towards wireless protocols like Wi-Fi, Bluetooth, Zigbee, LoRaWAN, and NB-IoT, preferred for their flexibility and ease of deployment.

5G Integration: The rollout of 5G networks is revolutionizing IoT communication, offering unprecedented speeds, ultra-low latency, and enhanced capacity for real-time applications such, as autonomous vehicles and advanced telemedicine.

Edge Computing Synergy: Growing integration of edge computing with IoT protocols to process data closer to the source, significantly reducing latency and bandwidth consumption, crucial for time-sensitive applications.

Enhanced Security Protocols: A paramount focus on embedding advanced encryption, authentication, and data integrity layers within communication protocols to combat escalating cyber threats and ensure data privacy.

Standardization and Interoperability: A strong industry-wide push for unified communication frameworks to ensure seamless interaction between devices from diverse manufacturers, minimizing vendor lock-in and fostering a more cohesive IoT ecosystem.

AI-Enabled Communications: Increasing integration of Artificial Intelligence into IoT protocols to facilitate smarter decision-making, predictive analytics, and automated optimization of communication pathways.

Market Scope

The IoT Communication Protocol Market's reach is expansive, touching virtually every sector:

Smart Homes & Consumer Electronics: Enabling seamless connectivity for intelligent appliances, smart lighting, voice assistants, and wearables.

Industrial IoT (IIoT) & Manufacturing: Facilitating real-time monitoring, predictive maintenance, and operational efficiency in factories and industrial settings.

Healthcare: Powering remote patient monitoring, connected medical devices, and smart hospital infrastructure for improved patient care and operational insights.

Smart Cities & Utilities: Supporting intelligent traffic management, energy grids, environmental monitoring, and public safety applications.

Automotive & Transportation: Crucial for connected vehicles, intelligent transportation systems, and fleet management, enhancing safety and efficiency.

Agriculture: Enabling precision farming through sensor data for optimized irrigation, crop monitoring, and livestock management.

Forecast Outlook

The future of the IoT Communication Protocol Market appears incredibly promising, driven by relentless innovation and an ever-increasing global demand for connected solutions. Anticipate a landscape characterized by increasingly sophisticated protocols, designed for superior efficiency and adaptive intelligence. The convergence of emerging technologies, such as advanced AI and ubiquitous 5G connectivity, will further accelerate the market's trajectory, fostering an era of truly pervasive and intelligent IoT deployments across all verticals. Expect a future where communication is not just about connectivity, but about seamless, secure, and context-aware interactions that redefine possibility.

Access Complete Report: https://www.snsinsider.com/reports/iot-communication-protocol-market-6554

Conclusion

As we stand on the cusp of an even more interconnected era, the IoT Communication Protocol Market is not merely a segment of the tech industry; it is the fundamental enabler of digital transformation. For innovators, developers, and enterprises alike, understanding and leveraging the evolution of these protocols is critical to building the next generation of smart solutions. This market represents an unparalleled opportunity to shape a future where every device contributes to a smarter, safer, and more efficient world. Embrace these advancements, and together, we can unlock the full, transformative power of the Internet of Things.

Related reports:

U.S.A accelerates smart agriculture adoption to boost crop efficiency and sustainability.

U.S.A. IoT MVNO market: surging demand for cost-effective, scalable connectivity

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Mail us: [email protected]

0 notes

Text

Microwave Devices Market Is Driven by Rising Market Opportunities

Microwave devices encompass a broad range of high-frequency components—including amplifiers, oscillators, filters, and switches—designed to operate in the microwave spectrum (300 MHz to 300 GHz). These devices deliver exceptional performance through low noise figures, high power handling capabilities, compact form factors, and superior reliability under harsh environmental conditions. They play a pivotal role in telecommunications, radar systems, satellite communications, and medical imaging, meeting the surging global demand for faster data transmission and precise sensing.

The convergence of 5G deployment, Internet of Things (IoT) applications, and advanced driver-assistance systems (ADAS) has created substantial market opportunities, driving manufacturers to innovate with miniaturized modules and energy-efficient designs. Moreover, military and aerospace sectors rely heavily on rugged microwave components to ensure mission-critical communications and navigation. Continuous advancements in GaN and GaAs semiconductor technologies have further enhanced device power density and thermal management, enabling next-generation network infrastructures. Ongoing market research and analysis highlight robust Microwave Devices Market growth and expanding market shares for vendors that prioritize scalable architectures and integrated system solutions.

The microwave devices market is estimated to be valued at USD 8.94 Bn in 2025 and is expected to reach USD 13.53 Bn by 2032, growing at a compound annual growth rate (CAGR) of 6.1% from 2025 to 2032. Key Takeaways

Key players operating in the Microwave Devices Market are:

-Analog Devices, Inc.

-Teledyne Technologies

-Texas Instruments

-L3 Harris Technologies, Inc.

-Honeywell International Inc. Analog Devices, Inc. leverages extensive R&D investments to expand its portfolio of RF front-end modules, securing significant market share in wireless infrastructure applications. Teledyne Technologies focuses on high-reliability components for defense and aerospace, benefiting from stringent quality certifications and long-term service contracts. Texas Instruments capitalizes on industry trends toward system-on-chip integration by offering cost-effective, low-power transceivers for consumer electronics and industrial IoT platforms. L3 Harris Technologies, Inc. emphasizes strategic collaborations with government agencies to deliver mission-critical radar and communication solutions. Honeywell International Inc. targets the growing demand in aviation and space exploration with advanced satellite transceivers and navigation aids. Through continuous innovation and mergers & acquisitions, these market players are shaping competitive dynamics and unlocking new market segments worldwide. The growing demand for microwave devices is propelled by the rapid expansion of 5G network rollouts and the evolution of connected vehicles. Telecommunications service providers are investing heavily in small-cell deployments and MIMO (Multiple-Input Multiple-Output) architectures, boosting demand for compact, high-efficiency amplifiers and filters. In the automotive sector, radar-based ADAS features such as collision avoidance and blind-spot detection rely on reliable microwave transceivers to ensure passenger safety. Meanwhile, the medical imaging industry is adopting microwave diagnostics and therapeutic equipment to deliver non-invasive cancer treatments and precise tumor monitoring. This diversified application landscape is creating strong market growth trajectories across segments, as reflected in market research reports highlighting year-on-year revenue increases and expanding market opportunities in Asia Pacific and North America.

‣ Get More Insights On: Microwave Devices Market

‣ Get this Report in Japanese Language: マイクロ波デバイス市場

‣ Get this Report in Korean Language: 마이크로파장치시장

0 notes