#RF Modules transmitter

Explore tagged Tumblr posts

Text

https://www.futureelectronics.com/p/semiconductors--wireless-rf--rf-modules-solutions--gps/neo-m8q-0-u-blox-9122422

RF transmitter, wireless alarm systems, Bluetooth adapter, GPS Module

NEO-M8 Series 3.6 V -167 dBm Surface Mount u-blox M8 Concurrent GNSS Module

#u-blox#NEO-M8Q-0#Wireless & RF#RF Modules & Solutions#GPS#transmitter#wireless alarm systems#Bluetooth adapter#GPS Module#Accessories#RF Modules transmitter#Power#USB#Bluetooth devices accessories#RF transceiver

1 note

·

View note

Text

#Buy GSM 3G Module#RF module types#RF module 433Mhz#RF Transmitter Module#5G modules#Modules distributors in india

0 notes

Text

https://www.futureelectronics.com/p/semiconductors--wireless-rf--rf-modules-solutions--gps/max-8q-0-u-blox-3122418

RF Modules, Digital rf modulator, Proprietary RF Module, Radio frequency module

MAX-8 Series 3.6 V u-blox 8 GNSS TCXO ROM Green 9.7x10.1 mm LCC Module

#u-blox#MAX-8Q-0#Wireless & RF#RF Modules & Solutions#GPS#Digital rf modulator#Proprietary RF Module#Radio frequency#USB Adapter#Bluetooth transmitter module#Balanced modulator#Demodulator#Bluetooth Accessories#Transceiver radio waves

1 note

·

View note

Text

https://www.futureelectronics.com/p/semiconductors--wireless-rf--transceiver-ics/sp4082een-l-tr-maxlinear-6164468

High speed data transmission, Bus Transceiver, USB RFreceiver

SP4082E Series 115 kbps 5 V RS-485 / RS-422 Transceiver - NSOIC-8

#MaxLinear#SP4082EEN-L/TR#Wireless & RF#Transceiver ICs#rf transceiver module#usb rf transmitter#High speed data transmission#Bus Transceiver#usb rf receiver#Replacement USB Receiver

1 note

·

View note

Text

Low-Latency & High Fidelity Wireless Audio Module SA326

For consultation, please contact NiceRF (Email: [email protected])

1 note

·

View note

Text

High performance circuit, High speed data transmission, module bluetooth

SP3077E Series 16 Mbps ±15 kV ESD Protected RS-485/RS-422 Transceiver-NSOIC-8

#MaxLinear#SP3077EEN-L#Wireless & RF#Transceiver ICs#RF Transceiver utilizes#band signals#wireless transmitter#Wifi#Bluetooth transceiver#usb wireless transceiver#High performance circuit#High speed data transmission#module

1 note

·

View note

Note

Hey I have one of those little tvs too howd u do the broadcast setup

I've been trying to research how it works but a lot of the technical details confuse me

required equipment: RF modulator with correct format for your TV (PAL for european, NTSC for north american/japanese), HDMI to AV downscaler (unless you're using a device with AV output for the stream source, or your RF modulator has HDMI input), TV antenna (i just used a little pair of rabbit ears from target), and, optional but recommended: signal amplifier. and of course a tv with an antenna.

connect your TV antenna and optional amplifier to the RF modulator's output - normally you would use a coaxial cable to connect this directly to the TV's antenna input, but in this case we're being silly and sending the signal over the air instead, which it is not designed for.

connect your source device (i'm using a roku) to the HDMI downscaler if necessary. then, connect the downscaler (or the source device if not using a downscaler) to the RF modulator's input.

plug in any devices that need external power, and then tune your TV to the channel the RF modulator is set to - on NTSC modulators, this is usually by default channel 3 or 4. the one i'm using defaults to whatever it was set to last, which was NTSC 14.

enjoy your low fidelity! using this setup WITH the amplifier the broadcast range is about 3 feet, but it drops off significantly over one foot away. if you used a real transmitter the results would be better. but we're not doing that.

8 notes

·

View notes

Text

This RF Transmitter and Receiver module can be used with 433Mhz RF Radio modules for better communication and to avoid cross-connection with other transmitters and receiver modules working at the same radio frequency. This RF Transmitter Module uses the HT12E IC for encoding the message and the RF Receiver Module uses the HT12D IC for decoding.

3 notes

·

View notes

Text

🎯 "Think no one’s watching you? Think again…" 👀📡

This pocket-sized bug detector is blowing minds on TikTok! Here’s why everyone’s grabbing one:

🔍 Detects hidden devices — even wireless cameras & transmitters 📶 Scans 40–3800MHz — covers GSM, 3G, 4G, DECT, Bluetooth, Wi-Fi & more 📊 Real-time reports + modulation ID — get smart alerts, not just beeps 🚀 Adaptive scanning — finds what others miss 👖 Fits in your pocket — spy-level tech without the spy price

👉 Tag someone who needs this — before it’s too late.

1 note

·

View note

Text

#433 mhz antenna#rf antenna#rf antenna manufacturer#wireless rf#rf antenna types#rf connector for tv#rf booster antenna#rf antenna booster#solid rf signal booster#rf to antenna connector#433mhz rf antenna#433mhz rf module range#433mhz transmitter antenna#433mhz rf transmitter and receiver antenna#433 mhz rf module antenna#rf connector antenna#outdoor rf antenna#rf radio antenna#lmr400 coaxial#433mhz remote control arduino#antenna for rf module 433mhz#mmcx connector antenna#helical rf antenna#rf antenna suppliers#rf antenna cables

0 notes

Text

Wireless Power Transmission Market: Is This the Key to Unlocking U.S. Smart Cities Faster

TheWireless Power Transmission Market Size was valued at USD 14.14 Billion in 2023 and is expected to reach USD 39.54 Billion by 2032 and grow at a CAGR of 12.1% over the forecast period 2024-2032.

Wireless Power Transmission Market is witnessing a surge in adoption across various industries, from consumer electronics to automotive and healthcare. With growing demand for cord-free solutions and enhanced device mobility, businesses are investing in efficient, scalable wireless energy systems. Technologies such as inductive, resonant, and radio frequency-based transmission are gaining traction globally, reshaping how power is delivered and consumed.

U.S. leads the innovation wave in wireless power transmission with strong investment and advanced R&D capabilities

Wireless Power Transmission Market continues to innovate as the push for sustainable, contactless energy delivery accelerates. Key players are developing compact, high-efficiency solutions to cater to smart devices, EVs, and industrial equipment. The market is positioned at the forefront of next-gen energy infrastructure, driven by continuous R&D and growing commercial interest.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/6610

Market Keyplayers:

WiTricity Corporation (WiTricity Halo, WiCAD Simulation Software)

Qualcomm (Qualcomm Halo, Qualcomm WiPower)

Leggett and Platt (Qi-compatible wireless Charging Pads, Helios Wireless Power System)

Energizer (Energizer Wireless Charging Pad, Energizer Qi Charger Stand)

Plugless Power Inc. (Plugless L2 EV Charger, Plugless Power Wireless Charging System)

Texas Instruments (bq500212A Wireless Power Transmitter, bq51013B Wireless Power Receiver)

Murata Manufacturing Co., Ltd. (Wireless Power Supply Module LXWS Series, Power Transmitter Unit LXTX Series)

Unabiz Technology (UnaConnect Wireless Power IoT Module, UnaSensors with Energy Harvesting)

Energous Corporation (WattUp Mid Field Transmitter, WattUp PowerBridge)

Ossia Inc. (Cota Real Wireless Power System, Cota Power Receiver)

VoltServer Inc. (Digital Electricity Line Cards, Digital Electricity Gateway Modules)

Market Analysis

The Wireless Power Transmission Market is expanding rapidly due to increased use of electronic devices, electric vehicles, and demand for clean energy solutions. In the U.S., technological maturity and strong patent activity fuel growth, while Europe emphasizes safety standards and energy efficiency in adoption. Asia-Pacific is also emerging as a key manufacturing hub for components.

WPT systems are now integrated into consumer gadgets, smart homes, and public EV charging stations, showcasing their flexibility and long-term economic value. Enterprises are focusing on miniaturization, fast charging, and multi-device compatibility.

Market Trends

Surge in EV wireless charging infrastructure

Rise of near-field technologies for mobile and wearable charging

Advancements in long-range power delivery using microwave and RF

Integration with IoT and smart building ecosystems

Increased R&D funding for high-power industrial applications

Consumer demand for clutter-free charging in smart homes

Focus on sustainability and reduced electronic waste

Market Scope

The Wireless Power Transmission Market is no longer limited to phones and personal gadgets—it's reshaping entire industries. It provides seamless, low-maintenance, and safe power alternatives suitable for modern tech-driven ecosystems.

Contactless charging solutions for consumer electronics

EV wireless charging pads and public station rollouts

Industrial automation with cable-free power access

Healthcare devices powered remotely for sterilized environments

Enhanced mobility for robotics and drones

Integration with renewable sources for off-grid applications

Access Complete Report: https://www.snsinsider.com/reports/wireless-power-transmission-market-6610

Forecast Outlook

The future of Wireless Power Transmission is poised for transformative growth. With advancements in magnetic resonance and far-field transmission, the market is evolving beyond convenience into strategic necessity. In the U.S., federal backing and automotive demand are strong growth levers, while Europe’s green energy agenda supports wide-scale adoption. Globally, businesses will increasingly prioritize wireless infrastructure to enhance flexibility, user experience, and operational efficiency.

Conclusion

Wireless Power Transmission Market stands at the edge of revolutionizing energy delivery—from living rooms to highways. As industries push for smarter, cleaner, and cable-free environments, WPT technology offers a compelling pathway forward. With the U.S. setting innovation benchmarks and Europe reinforcing sustainability, the global shift to wireless power is no longer a trend—it's the future in motion.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Related Reports:

U.S.A File Integrity Monitoring Market: Boosting data protection efforts and meeting compliance demands

U.S.A Data Center Accelerator Market: Driving AI and high-performance computing innovations

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

Mail us: [email protected]

0 notes

Text

GaAs Wafer Market Size Accelerating Semiconductor Innovation through High-Speed Performance

The GaAs Wafer Market Size is gaining significant momentum, driven by the growing demand for high-speed, high-frequency, and energy-efficient semiconductors across applications such as 5G, optoelectronics, satellite communication, and consumer electronics. According to Market Size Research Future, the global GaAs wafer market is projected to reach USD 1.67 billion by 2030, growing at a robust CAGR of 12.6% during the forecast period from 2023 to 2030.

Market Size Overview

Gallium Arsenide (GaAs) wafers are compound semiconductor substrates that offer superior electron mobility and frequency handling compared to silicon. This makes them ideal for RF components, LEDs, laser diodes, solar cells, and high-speed integrated circuits.

GaAs wafers outperform silicon in power efficiency, temperature tolerance, and signal amplification, making them essential in next-gen wireless technologies, automotive radar systems, and aerospace communication. As global data traffic surges and demand for low-latency communication rises, GaAs wafers are becoming indispensable in 5G networks and satellite-based infrastructure.

Additionally, innovations in optoelectronics and photonics, along with defense electronics modernization, are further expanding the application landscape for GaAs-based devices.

Enhanced Market Size Segmentation

By Product Type:

Semi-insulating GaAs

Semi-conducting GaAs

By Application:

RF Electronics

Optoelectronics

Photovoltaics

LED and Laser Devices

Others

By Wafer Size:

2-inch

4-inch

6-inch

Others

By End-User Industry:

Consumer Electronics

Aerospace & Defense

Telecommunications

Automotive

Industrial Automation

Energy

Others

By Region:

North America

Europe

Asia-Pacific

Middle East & Africa

Latin America

Market Size Trends

1. Expansion of 5G Infrastructure

With the rollout of 5G, the use of GaAs wafers in RF front-end modules, base stations, and small cells is increasing due to their superior speed and power efficiency.

2. Rise in Automotive Radar and LiDAR Systems

GaAs technology is pivotal for automotive radar sensors and LiDAR modules used in advanced driver assistance systems (ADAS), owing to its ability to support high-frequency transmission with low signal loss.

3. Surging Demand for Optoelectronic Devices

High-speed optical communication systems, especially in data centers, are adopting GaAs-based lasers and photodiodes for their precision and bandwidth efficiency.

4. Growth in Satellite Communication

Low Earth Orbit (LEO) satellites, integral to global internet access and defense, rely heavily on GaAs components for secure and high-speed communication systems.

Segment Insights

By Product Type:

Semi-insulating GaAs wafers dominate the market, primarily used in RF applications due to their high resistance and performance in high-frequency signal transmission.

By Application:

RF electronics account for the largest market share, thanks to the widespread use of GaAs in mobile phones, wireless communication, and radar systems. Optoelectronics is the fastest-growing segment, driven by the demand for fiber-optic transmitters and receivers.

By Wafer Size:

4-inch GaAs wafers are widely used due to their balance between cost-efficiency and functional performance. However, the industry is witnessing a shift toward 6-inch wafers for mass production, especially in consumer electronics and telecom equipment.

End-User Insights

Telecommunications:

The telecom industry remains the largest consumer of GaAs wafers, employing them in RF amplifiers, switches, and antenna tuning components for mobile and satellite communication.

Consumer Electronics:

Smartphones and wearables use GaAs wafers for power amplifiers and efficient battery performance. With the emergence of foldable phones and AR/VR devices, this segment is witnessing rapid adoption.

Aerospace & Defense:

Military radar systems, electronic warfare tools, and secure satellite networks rely on GaAs technology for high-performance communication and signal detection.

Automotive:

As the industry transitions to connected and autonomous vehicles, GaAs wafers are key to ensuring reliable radar-based object detection and vehicle-to-vehicle communication.

Key Players

Major companies in the GaAs wafer market are focusing on production capacity expansion, vertically integrated supply chains, and advanced wafer design to meet the demands of evolving technologies:

IQE Plc – One of the world’s largest GaAs epiwafer producers serving telecom and optical markets.

WIN Semiconductors Corp. – A major player in GaAs-based RF foundry services.

AXT, Inc. – Supplies semi-insulating GaAs wafers used in mobile devices and defense systems.

Freiberger Compound Materials – Specializes in high-purity GaAs substrates for optoelectronics.

Sumitomo Electric Industries, Ltd. – Offers both GaAs wafers and epitaxial services for telecom and photonics.

Advanced Wireless Semiconductor Company – Known for GaAs MMIC solutions catering to 5G infrastructure.

Future Outlook

The future of the GaAs wafer market is anchored in its ability to support high-frequency, high-efficiency semiconductor devices. With growing investments in 5G, autonomous transportation, renewable energy, and defense modernization, GaAs wafers will continue to see expanded applications.

Technological advancements in wafer thinning, wafer bonding, and epitaxial growth will reduce production costs and enhance the performance of GaAs-based devices. Additionally, strategic collaborations between foundries and OEMs will accelerate innovation and commercialization of next-gen GaAs solutions.

Trending Report Highlights

Explore more cutting-edge technologies shaping semiconductor and electronics markets:

Asia-Pacific Warehouse Automation Market Size

Thyristor Electric Power Controller Market Size

Wafer Level Packaging Market Size

Bitcoin ATM Machine Market Size

Japan High Precision GNSS Module Market Size

Semiconductor Capital Equipment Market Size

North America 4 Inches Semi-Insulating Silicon Carbide Wafer Market Size

Wafer Process Control Equipment Market Size

3D Snapshot Sensor Market Size

Thyristor Rectifier Electric Locomotive Market Size

Microelectronics Material Market Size

0 notes

Text

[IOTE2025 Shenzhen Exhibitor] IMSEMI, a national high-tech enterprise, will appear at the IOTE International Internet of Things Exhibition

With the rapid development of artificial intelligence (AI) and Internet of Things (IoT) technologies, their integration is becoming increasingly close and is profoundly influencing technological innovation across various industries. AGIC + IOTE 2025, the 24th International Internet of Things Exhibition - Shenzhen Station, will take place from August 27 to 29, 2025, at the Shenzhen World Exhibition & Convention Center. IOTE 2025 is set to be an unprecedented professional exhibition event in the field of AI and IoT. The exhibition scale will expand to 80,000 square meters, focusing on the cutting-edge progress and practical applications of "AI + IoT" technology. It will also feature in-depth discussions on how these technologies will reshape our future world. It is expected that over 1,000 industry pioneers will participate to showcase their innovative achievements in areas such as smart city construction, Industry 4.0, smart home life, smart logistics systems, smart devices, and digital ecosystem solutions.

IMSEMI will be exhibiting at this exhibition. Let us learn about what wonderful displays they will bring to the exhibition.

Exhibitor Introduction

IMSEMI

Booth number: 10B10-2

August 27-29, 2025

Shenzhen World Convention and Exhibition Center (Bao'an New Hall)

Company Profile

IMSEMI was established in 2010 and is headquartered in Phase II of Xiamen Software Park. It has R&D capabilities covering the entire chain of microwave/millimeter wave integrated circuits, including the entire process of design, testing and system development. Products are widely used in intelligent transportation, smart home, industrial control, Internet of Things and other fields.

The company is a national high-tech enterprise, Xiamen's "specialized and new" enterprise and the first batch of "Double Hundred Plan" high-tech enterprises, and serves as a governing unit of the Xiamen Integrated Circuit Industry Association and the governing unit of the Xiamen Internet of Things Industry Association. It has won the "China Core" award from the Ministry of Industry and Information Technology for two consecutive terms (the most potential product award in 2016 and the most investment-worthy enterprise in 2017). The products have been verified by the market for a long time, and its customers include leading companies in the fields of automotive ADAS, drones, smart home appliances, smart bathrooms, etc.

Product Recommendation

IMSEMI's one-transmitter and two-receiver RF chip SG24TR12 integrates one transmission and two receptions, and adopts mature and reliable low-cost SiGe technology to realize the functions of distance measurement, speed measurement and angle measurement. It has the advantages of high resolution, good directionality, good anti-electronic interference, and is not affected by the environment all day and all weather. It is widely used in drones, vehicles, security, smart transportation, smart bathroom, smart home, consumer electronics and other fields, and the market demand in various industries continues to grow.

Product name: 24GHz corner radar

Product model: IMC3220HBP

The 24GHz millimeter wave sensor module adopts Xiamen Yixing's self-developed one-transmitter and two-receiver RF chip, with a high-performance processor, to achieve real-time detection of multiple targets, stable tracking and accurate distance measurement and angle measurement. The functions of wind avoiding people and wind following people are realized on smart home appliances such as air conditioners and fans; the camera follows people in the field of security and lightning vision integrated machines; and the regional flip cover and seat ring are realized on smart toilets. Yixing has its own core technology developed independently, and can carry out customized development according to customer needs to meet the personalized needs of different customers.

At present, industry trends are changing rapidly, and it is crucial to seize opportunities and seek cooperation. Here, we sincerely invite you to participate in the IOTE 2025, the 24th International Internet of Things Exhibition, Shenzhen Station, held at the Shenzhen World Convention and Exhibition Center (Bao'an New Hall) from August 27 to 29, 2025. At that time, you are welcome to discuss the cutting-edge trends and development directions of the industry with us, explore cooperation opportunities, and look forward to your visit!

0 notes

Text

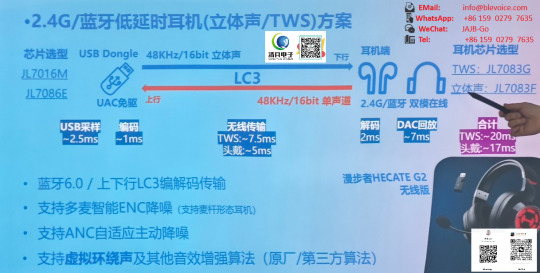

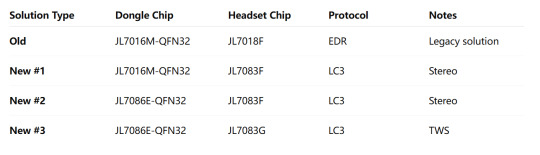

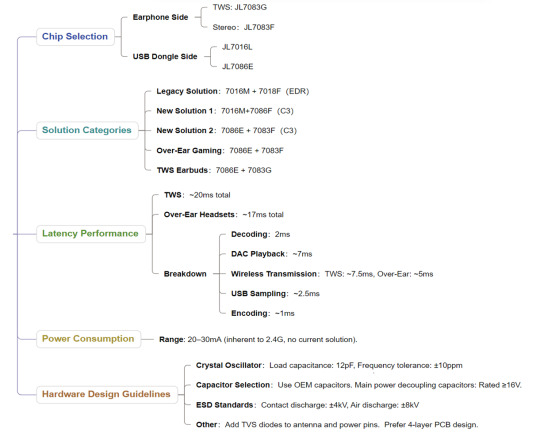

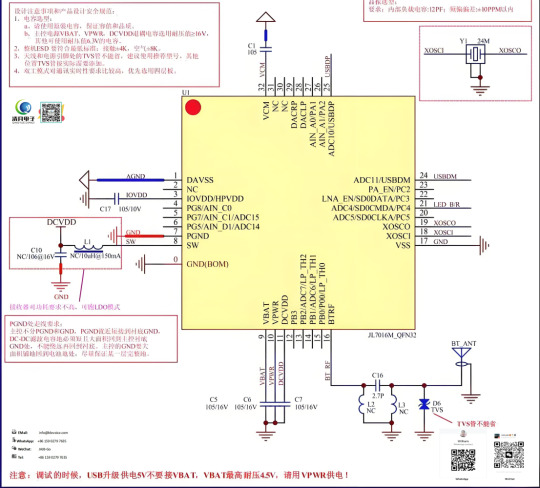

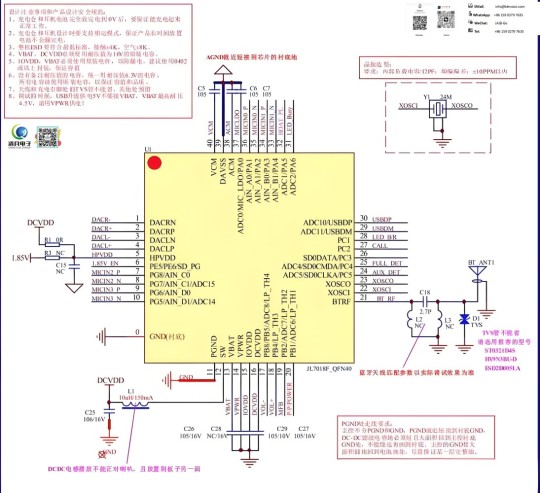

JL 2.4G Bluetooth Low-Latency Audio Headset Solution: Chip Selection, Latency, Hardware Design

This document introduces JL’s low-latency audio headset solution using 2.4G/Bluetooth technology. For chip selection, the USB dongle side uses JL7016M or JL7086E, capable of 48KHz/16bit stereo output and supports UAC (USB Audio Class), meaning no driver installation is required. On the headset side, JL7083G is used for TWS, and JL7083F for stereo headphones.

The audio transmission and decoding process includes:

Uplink (microphone to host): Audio is sampled via USB (~2.5ms), encoded (~1ms), and transmitted over 2.4G/Bluetooth using LC3 codec at 48KHz/16bit mono.

Downlink (host to headset): Audio is LC3 encoded at 48KHz/16bit stereo, transmitted wirelessly to the headset, decoded (~2ms), then played back via DAC (~7ms).

The overall latency:

Around 20ms for TWS headphones

Around 17ms for over-ear/headband-style headphones These values are considered excellent for gaming and multimedia scenarios where low latency is crucial.

1. JL 2.4G Bluetooth Low-Latency Headset Solution Overview

(1) Chipset & Basic Capabilities:

JL7016M or JL7086E for USB Dongle (receiver/transmitter)

Outputs 48KHz/16bit stereo

Supports UAC (plug-and-play with no driver required)

(2) Encoding - Transmission - Decoding Flow:

Uplink (mic to host device):

Downlink (host to headset):

(3) Latency Performance:

TWS headphones total latency: ~20ms

Over-ear headphones total latency: ~17ms

Excellent for low-latency needs in gaming/video applications

2. Chip Solution Comparison

Headband-style gaming headset: JL7086E + JL7083F

TWS-style earbuds: JL7086E + JL7083G

Note on Power Consumption: 2.4G wireless inherently consumes more power. The typical power consumption is around 20-30mA, and currently, this is a design limitation that cannot be significantly reduced.

3. High-Level Hardware Block Diagram (Dongle Side)

Diagram omitted here — typically includes USB interface, JL7016M/7086E chip, 2.4G RF module, and antenna

4. High-Level Hardware Block Diagram (Headset Side)

Diagram omitted here — typically includes microphone, JL7083F/G chip, speaker/DAC output, battery/power management, and antenna

0 notes

Text

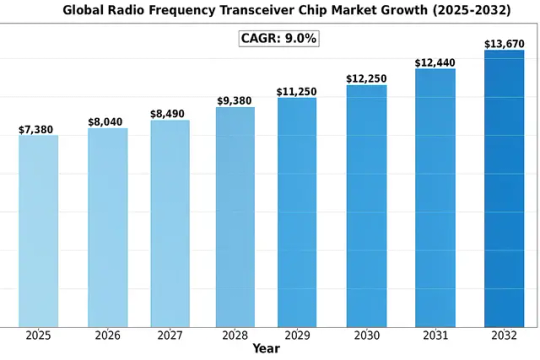

Global Radio Frequency Transceiver Chip Market : Key Insights, and Forecast from 2025 to 2032.

Global Radio Frequency Transceiver Chip Market size was valued at US$ 7,380 million in 2024 and is projected to reach US$ 13,670 million by 2032, at a CAGR of 9.0% during the forecast period 2025-2032.

Radio Frequency (RF) transceiver chips are integrated circuits that combine both transmitter and receiver functions in a single package, enabling wireless communication across various frequencies. These components are fundamental to modern wireless systems, supporting technologies such as 5G networks, Wi-Fi 6/6E, IoT devices, and automotive radar systems. The chips typically include mixers, amplifiers, filters, and digital signal processing units to handle modulation/demodulation tasks efficiently.

The market growth is primarily driven by escalating demand for high-speed data transmission, proliferation of connected devices, and rapid 5G infrastructure deployment worldwide. However, design complexities and stringent power consumption requirements pose significant challenges for manufacturers. Recent technological advancements like beamforming capabilities and AI-powered signal processing are creating new opportunities in this space. Key players such as Qualcomm, Broadcom, and Texas Instruments are investing heavily in R&D to develop energy-efficient solutions for emerging applications.

Get Full Report with trend analysis, growth forecasts, and Future strategies : https://semiconductorinsight.com/report/global-radio-frequency-transceiver-chip-market/

Segment Analysis:

By Type

RF Microwave Segment Dominates the Market Due to Widespread Use in Wireless Communication Systems

The market is segmented based on type into:

RF Microwave

Millimeter Wave

Other

By Application

Civil Applications Lead the Market Driven by 5G Infrastructure and IoT Devices

The market is segmented based on application into:

Military

Civil

Space

Automobile

Other

By Frequency Range

Sub-6GHz Segment Holds Major Share Due to Balanced Performance and Cost Efficiency

The market is segmented based on frequency range into:

Sub-6GHz

24-39GHz

60GHz

Other

By Technology

CMOS Technology Preferred for Commercial Applications Due to Cost Advantages

The market is segmented based on technology into:

CMOS

SiGe

GaAs

Other

Regional Analysis: Global Radio Frequency Transceiver Chip Market

North America The North American RF transceiver chip market remains a leader in innovation and adoption, propelled by significant investments in 5G infrastructure and IoT applications. With major players like Qualcomm, Broadcom, and Texas Instruments headquartered in the region, there is a strong emphasis on developing advanced mmWave and sub-6GHz solutions. The U.S. Federal Communications Commission’s recent spectrum allocations for 5G deployment have accelerated demand for high-performance RF chips, particularly in telecommunications and defense applications. However, stringent export controls and supply chain vulnerabilities pose challenges for manufacturers. The region is expected to maintain its technological leadership with a projected CAGR of 8-10% through 2028, driven by upgrades to private networks and autonomous vehicle communication systems.

Europe Europe’s RF transceiver market is characterized by strict regulatory frameworks and a focus on energy-efficient designs. The EU’s Horizon Europe program has allocated substantial funding for semiconductor research, with particular attention to reducing power consumption in 5G applications. Countries like Germany and France are seeing increased demand for industrial IoT chips, while Nordic nations continue to dominate in low-power wireless solutions for logistics and smart cities. The region faces pressure to reduce dependence on non-European supply chains following recent global shortages. Automotive RF applications are growing steadily, supported by mandates for vehicle-to-everything (V2X) communication systems. Despite slower 5G rollout compared to other regions, the market benefits from strong R&D partnerships between academic institutions and semiconductor firms.

Asia-Pacific Asia-Pacific represents the fastest-growing RF transceiver market, with China accounting for over 40% of global production capacity. The region benefits from complete semiconductor ecosystems, from wafer fabrication to end-device manufacturing. While China leads in volume production, countries like Taiwan and South Korea specialize in advanced RF front-end modules. India’s telecom expansion and Japan’s automotive electronics sector create diverse demand patterns. The APAC market is highly price-sensitive, driving innovations in cost-optimized designs. However, geopolitical tensions and export restrictions present ongoing supply chain risks. Millimeter-wave development lags behind North America, but massive IoT deployment across smart factories and cities ensures steady demand for conventional RF solutions. The region’s growth is further supported by government initiatives like China’s Semiconductor Industry Investment Fund.

South America South America’s RF transceiver market remains in early growth stages, constrained by limited local manufacturing capabilities and economic instability. Brazil and Argentina show potential for growth in consumer electronics and basic IoT applications, but rely heavily on imports from Asia and North America. The telecommunications sector drives most demand, though infrastructure investments are often delayed due to financial constraints. Recent spectrum auctions for 5G have sparked interest, but adoption rates remain low compared to other regions. Local assembly operations are emerging in Mexico and Brazil, focusing on cost-effective solutions for automotive and industrial applications. The market shows long-term potential with improving economic conditions and increasing smartphone penetration, though progress is hindered by inconsistent regulatory environments and foreign exchange volatility.

Middle East & Africa The MEA RF transceiver market is bifurcated between oil-rich Gulf states investing in smart city projects and developing African nations focusing on basic connectivity solutions. The UAE and Saudi Arabia are driving demand for high-end RF components through 5G deployments and digital transformation initiatives. Israel’s robust semiconductor design ecosystem contributes specialized military and aerospace RF solutions. In contrast, Sub-Saharan Africa primarily consumes low-cost chips for mobile handsets and base stations. The region presents opportunities for growth in satellite communication and rural connectivity solutions, though market expansion faces challenges from limited technical infrastructure and political instability in certain areas. Strategic partnerships with Chinese and European suppliers are helping bridge technology gaps, particularly in telecommunications infrastructure development.

MARKET OPPORTUNITIES

Emerging Satellite Communication Markets Opening New Frontiers

The rapid development of low Earth orbit (LEO) satellite networks presents a transformative opportunity for RF transceiver suppliers, with the satellite communication chip market projected to grow at over 25% CAGR through 2030. These applications demand highly reliable RF solutions capable of operating across extreme temperature ranges while maintaining precise frequency stability. Leading manufacturers are developing specialized space-grade transceivers with radiation-hardened designs, creating a high-margin niche segment. Terrestrial applications are also expanding, as 5G non-terrestrial networks (NTN) begin complementing traditional cellular infrastructure in remote areas.

Automotive Radar Innovation Driving Next-Generation Designs

Advanced automotive radar systems are evolving from 24GHz and 77GHz to 79GHz and higher frequencies, requiring RF transceivers with improved resolution and interference rejection capabilities. The integration of radar with other sensors in autonomous vehicle platforms is creating demand for multi-channel RF solutions that can process complex waveforms in real-time. Forward-looking industry initiatives aim to reduce radar module sizes by 50% while doubling detection ranges, presenting opportunities for highly integrated RF system-in-package (SiP) solutions.

Additionally, the growing adoption of ultra-wideband (UWB) technology for precise indoor positioning and secure access control is creating complementary markets for specialized RF transceivers, particularly in the automotive and smart home sectors.

GLOBAL RADIO FREQUENCY TRANSCEIVER CHIP MARKET TRENDS

5G Network Expansion Driving Demand for Advanced RF Transceiver Chips

The rapid global deployment of 5G infrastructure is significantly boosting the radio frequency transceiver chip market, with telecom operators investing heavily in next-generation networks. Modern RF transceivers now support multiple frequency bands from sub-6 GHz to millimeter wave (24-100 GHz), enabling high-speed data transmission with low latency. The shift towards spectrum aggregation technologies like carrier aggregation has further increased the complexity and functionality requirements of these chips. Additionally, the growing adoption of Massive MIMO (Multiple Input Multiple Output) antenna systems in 5G base stations is creating substantial demand for high-performance RF transceiver solutions.

Other Trends

Automotive Connectivity Advancements

The automotive sector is emerging as a key growth area for RF transceiver chips, driven by increasing integration of vehicle-to-everything (V2X) communication systems and advanced driver assistance features. Modern vehicles now incorporate numerous RF-based systems including radar, satellite navigation, and cellular connectivity, each requiring specialized transceiver solutions. The push towards autonomous vehicles is further accelerating this trend, with some luxury models containing over 50 RF connections per vehicle. This automotive transformation is prompting chip manufacturers to develop more robust, temperature-resistant transceiver solutions capable of operating in harsh vehicular environments.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Strategic Expansions Drive Market Leadership in RF Transceiver Space

The global RF transceiver chip market features a dynamic competitive landscape dominated by semiconductor giants and specialized manufacturers. Qualcomm Incorporated maintains a strong market position, leveraging its extensive 5G technology portfolio and robust partnerships with smartphone manufacturers. In 2023, the company secured approximately 32% market share in the mobile RF transceiver segment, driven by its Snapdragon platform adoption across flagship devices.

Broadcom Corporation and Texas Instruments represent other major players, collectively accounting for nearly 28% of industrial and automotive RF solutions. Their strength lies in high-performance analog chipsets for enterprise networking and vehicle-to-everything (V2X) communication systems. Both companies have significantly increased R&D investments, with Broadcom allocating $5.2 billion towards wireless innovation in their latest fiscal year.

Meanwhile, Qorvo and Analog Devices Inc. (ADI) are making strategic moves to capture emerging IoT opportunities. Qorvo recently expanded its ultra-wideband (UWB) product line, while ADI strengthened its position in millimeter-wave applications through key acquisitions. These developments highlight the industry’s focus on diversification beyond traditional markets.

List of Key RF Transceiver Chip Companies Profiled

Qualcomm Incorporated (U.S.)

Broadcom Corporation (U.S.)

Texas Instruments (U.S.)

Intel Corporation (U.S.)

Analog Devices, Inc. (U.S.)

NVIDIA Corporation (U.S.)

Qorvo, Inc. (U.S.)

Ericsson AB (Sweden)

Samsung Electronics (South Korea)

Semtech Corporation (U.S.)

Maxim Integrated (U.S.)

GCT Semiconductor (U.S.)

Learn more about Competitive Analysis, and Global Forecast of Global Radio Frequency Transceiver Chip Market : https://semiconductorinsight.com/download-sample-report/?product_id=95988

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Radio Frequency Transceiver Chip Market?

Radio Frequency Transceiver Chip Market size was valued at US$ 7,380 million in 2024 and is projected to reach US$ 13,670 million by 2032, at a CAGR of 9.0% during the forecast period 2025-2032.

Which key companies operate in Global RF Transceiver Chip Market?

Key players include Qualcomm, Broadcom, Texas Instruments, Intel, Samsung, Qorvo, and Analog Devices, among others.

What are the key growth drivers?

Key growth drivers include 5G network deployment, IoT expansion, automotive connectivity solutions, and increasing defense applications.

Which region dominates the market?

Asia-Pacific holds the largest market share (42% in 2023), driven by semiconductor manufacturing in China, South Korea, and Taiwan.

What are the emerging trends?

Emerging trends include AI-integrated RF systems, mmWave technology for 6G, energy-efficient designs, and advanced packaging solutions.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014 +91 8087992013 [email protected]

Follow us on LinkedIn: https://www.linkedin.com/company/semiconductor-insight/

0 notes