#account_manager

Explore tagged Tumblr posts

Link

The Ultimate Guide to IndusInd Bank Minimum Balance Requirements IndusInd Bank is a leading private sector bank in India, offering a wide range of banking services to individuals and businesses. One important aspect of maintaining a bank account is meeting the minimum balance requirements set by the bank. This guide aims to provide a comprehensive understanding of IndusInd Bank's minimum balance requirements and how to effectively manage your account to avoid penalties and enjoy the benefits offered. [caption id="attachment_63637" align="aligncenter" width="396"] IndusInd bank minimum balance[/caption] Understanding IndusInd Bank Minimum Balance The minimum balance requirement refers to the minimum amount of funds that must be maintained in a bank account at all times. This requirement varies from bank to bank and account type to account type. It ensures that the bank has a certain level of funds available to cover operational costs and provide services to customers. IndusInd Bank, like other banks, has minimum balance requirements to maintain the stability of its banking operations and offer various benefits to its customers. The minimum balance requirements are determined based on factors such as the type of account, location, and account holder's profile. Types of IndusInd Bank Accounts and their Minimum Balance Requirements Savings Accounts Savings accounts are designed for individuals to deposit and save their money while earning interest on the balance. IndusInd Bank offers different types of savings accounts, each with its minimum balance requirement. The minimum balance for regular savings accounts is typically higher than that of basic savings accounts. Regular savings accounts may require a minimum balance of INR 10,000, while basic savings accounts may have a lower requirement of INR 5,000. Savings accounts come with features such as ATM and debit cards, online banking, and mobile banking services. They also provide access to various financial products and services offered by the bank. Current Accounts Current accounts are primarily designed for businesses, self-employed individuals, and professionals who have high transaction volumes. IndusInd Bank offers current accounts with different minimum balance requirements based on the type and size of the business. The minimum balance for current accounts can range from INR 25,000 to INR 1,00,000 or more. Current accounts provide features such as overdraft facilities, checkbooks, and specialized banking services tailored to the needs of businesses. They also offer online banking and mobile banking facilities for convenient account management. Fixed Deposit Accounts Fixed deposit accounts are investment options offered by IndusInd Bank, where customers can deposit a lump sum amount for a fixed period and earn higher interest rates compared to regular savings accounts. These accounts do not have any minimum balance requirements as the funds are locked in for a specific duration. Fixed deposit accounts provide flexibility in choosing the tenure and offer different interest rates based on the duration of the deposit. They are ideal for individuals looking for a secure investment option with guaranteed returns. NRI Accounts IndusInd Bank also offers NRI (Non-Residential Indian) accounts for individuals living abroad. These accounts cater to the banking needs of NRIs and have specific minimum balance requirements. The minimum balance for NRI accounts may vary based on the type of account, such as NRE (Non-Residential External) or NRO (Non-Residential Ordinary) accounts. NRI accounts provide features such as remittance services, foreign currency deposits, and the ability to hold and manage funds in different currencies. They also offer convenient online banking and 24/7 customer support to assist NRIs with their banking needs. Consequences of Not Maintaining the Minimum Balance Failure to maintain the minimum balance in your IndusInd Bank account can result in certain consequences: Penalty Charges: The bank may levy penalty charges for not meeting the minimum balance requirements. These charges can vary depending on the type of account and the shortfall in the balance. Impact on Account Features and Benefits: Not maintaining the minimum balance may lead to a downgrade in account features and benefits. For example, you may lose access to certain privileges like free checkbooks, preferential interest rates, or waived charges on transactions. Tips to Maintain the Minimum Balance To ensure you meet the minimum balance requirements and avoid penalties, consider the following tips: Understanding the Minimum Balance Calculation Cycle: Familiarize yourself with the specific calculation cycle for minimum balance requirements. This will help you plan your deposits and withdrawals accordingly. Strategies to Ensure Minimum Balance Requirements are Met: Plan your expenses and income to maintain the required minimum balance. Consider setting up automatic transfers or standing instructions to ensure a sufficient balance is maintained. Utilizing Digital Banking Tools and Services: Take advantage of IndusInd Bank's digital banking tools and services. Use online banking, mobile banking, and SMS alerts to keep track of your account balance and receive notifications about any potential shortfall. Frequently Asked Questions What happens if I fail to maintain the minimum balance in my IndusInd Bank account? If you fail to maintain the minimum balance in your IndusInd Bank account, the bank may levy penalty charges as per their policy. These charges can vary depending on the type of account and the shortfall in the balance. Can I convert my regular savings account into a basic savings account to avoid minimum balance requirements? Yes, you can request to convert your regular savings account into a basic savings account if you wish to avoid the higher minimum balance requirements. However, keep in mind that basic savings accounts may have certain limitations on features and benefits compared to regular savings accounts. Is there a grace period for maintaining the minimum balance? IndusInd Bank may provide a grace period to maintain the minimum balance in some cases. It is advisable to check with the bank regarding the specific terms and conditions applicable to your account. Can I request a waiver for the minimum balance requirement? IndusInd Bank may offer waivers for minimum balance requirements in certain cases, such as for senior citizens or students. It is recommended to inquire with the bank about any available waivers or concessions. How often are the minimum balance requirements revised by IndusInd Bank? IndusInd Bank may revise the minimum balance requirements from time to time based on various factors such as market conditions and regulatory guidelines. It is advisable to stay updated with the bank's notifications or contact their customer service for the latest information. Are there any special concessions for senior citizens or students regarding minimum balance requirements? Yes, IndusInd Bank may offer special concessions for senior citizens or students, such as lower minimum balance requirements or waivers. It is recommended to inquire with the bank about any available concessions specific to your category. Can I transfer funds from another IndusInd Bank account to meet the minimum balance requirement? Yes, you can transfer funds from another IndusInd Bank account to meet the minimum balance requirement in your account. This can help you avoid penalties and maintain the required balance. What happens if I close my IndusInd Bank account before the minimum balance requirement is met? If you close your IndusInd Bank account before meeting the minimum balance requirement, the bank may deduct the applicable penalty charges from your account balance. It is important to ensure that the minimum balance is maintained or to close the account after fulfilling the requirements to avoid any penalties. Can I open a joint account with someone to share the minimum balance requirement? Yes, you can open a joint account with someone to share the minimum balance requirement. In a joint account, the minimum balance is typically calculated based on the total balance of the account rather than individual contributions. It is important to communicate and coordinate with the joint account holder to ensure the minimum balance is maintained collectively. How can I check the current minimum balance in my IndusInd Bank account? You can check the current minimum balance in your IndusInd Bank account through various channels: Online Banking: Log in to your IndusInd Bank online banking portal and navigate to the account summary or balance section to view the minimum balance requirement. Mobile Banking App: Install the IndusInd Bank mobile banking app on your smartphone and access your account details, including the minimum balance requirement. Bank Statements: Review your bank statements, either physical or electronic, to find information about the minimum balance requirement. Contact Customer Service: Reach out to IndusInd Bank's customer service through phone, email, or chat to inquire about the current minimum balance requirement in your account. Maintaining the minimum balance in your IndusInd Bank account is crucial to avoid penalties and enjoy the benefits provided by the bank. Understanding the minimum balance requirements for different account types and implementing effective strategies to meet those requirements can help you manage your account efficiently. By utilizing digital banking tools and services, staying informed about waivers or concessions, and proactively monitoring your account balance, you can ensure compliance with the minimum balance requirements and make the most of your banking experience with IndusInd Bank.

#account_balance#account_holders#account_holders_responsibilities#account_maintenance#account_management#account_requirements#account_types#Bank_Account#banking#banking_policies#banking_regulations#banking_services#charges#current_account#fees#finance#financial_institution#IndusInd_Bank#minimum_balance#penalty#savings_account

0 notes

Text

The Great Data Cleanup: A Database Design Adventure

As a budding database engineer, I found myself in a situation that was both daunting and hilarious. Our company's application was running slower than a turtle in peanut butter, and no one could figure out why. That is, until I decided to take a closer look at the database design.

It all began when my boss, a stern woman with a penchant for dramatic entrances, stormed into my cubicle. "Listen up, rookie," she barked (despite the fact that I was quite experienced by this point). "The marketing team is in an uproar over the app's performance. Think you can sort this mess out?"

Challenge accepted! I cracked my knuckles, took a deep breath, and dove headfirst into the database, ready to untangle the digital spaghetti.

The schema was a sight to behold—if you were a fan of chaos, that is. Tables were crammed with redundant data, and the relationships between them made as much sense as a platypus in a tuxedo.

"Okay," I told myself, "time to unleash the power of database normalization."

First, I identified the main entities—clients, transactions, products, and so forth. Then, I dissected each entity into its basic components, ruthlessly eliminating any unnecessary duplication.

For example, the original "clients" table was a hot mess. It had fields for the client's name, address, phone number, and email, but it also inexplicably included fields for the account manager's name and contact information. Data redundancy alert!

So, I created a new "account_managers" table to store all that information, and linked the clients back to their account managers using a foreign key. Boom! Normalized.

Next, I tackled the transactions table. It was a jumble of product details, shipping info, and payment data. I split it into three distinct tables—one for the transaction header, one for the line items, and one for the shipping and payment details.

"This is starting to look promising," I thought, giving myself an imaginary high-five.

After several more rounds of table splitting and relationship building, the database was looking sleek, streamlined, and ready for action. I couldn't wait to see the results.

Sure enough, the next day, when the marketing team tested the app, it was like night and day. The pages loaded in a flash, and the users were practically singing my praises (okay, maybe not singing, but definitely less cranky).

My boss, who was not one for effusive praise, gave me a rare smile and said, "Good job, rookie. I knew you had it in you."

From that day forward, I became the go-to person for all things database-related. And you know what? I actually enjoyed the challenge. It's like solving a complex puzzle, but with a lot more coffee and SQL.

So, if you ever find yourself dealing with a sluggish app and a tangled database, don't panic. Grab a strong cup of coffee, roll up your sleeves, and dive into the normalization process. Trust me, your users (and your boss) will be eternally grateful.

Step-by-Step Guide to Database Normalization

Here's the step-by-step process I used to normalize the database and resolve the performance issues. I used an online database design tool to visualize this design. Here's what I did:

Original Clients Table:

ClientID int

ClientName varchar

ClientAddress varchar

ClientPhone varchar

ClientEmail varchar

AccountManagerName varchar

AccountManagerPhone varchar

Step 1: Separate the Account Managers information into a new table:

AccountManagers Table:

AccountManagerID int

AccountManagerName varchar

AccountManagerPhone varchar

Updated Clients Table:

ClientID int

ClientName varchar

ClientAddress varchar

ClientPhone varchar

ClientEmail varchar

AccountManagerID int

Step 2: Separate the Transactions information into a new table:

Transactions Table:

TransactionID int

ClientID int

TransactionDate date

ShippingAddress varchar

ShippingPhone varchar

PaymentMethod varchar

PaymentDetails varchar

Step 3: Separate the Transaction Line Items into a new table:

TransactionLineItems Table:

LineItemID int

TransactionID int

ProductID int

Quantity int

UnitPrice decimal

Step 4: Create a separate table for Products:

Products Table:

ProductID int

ProductName varchar

ProductDescription varchar

UnitPrice decimal

After these normalization steps, the database structure was much cleaner and more efficient. Here's how the relationships between the tables would look:

Clients --< Transactions >-- TransactionLineItems

Clients --< AccountManagers

Transactions --< Products

By separating the data into these normalized tables, we eliminated data redundancy, improved data integrity, and made the database more scalable. The application's performance should now be significantly faster, as the database can efficiently retrieve and process the data it needs.

Conclusion

After a whirlwind week of wrestling with spreadsheets and SQL queries, the database normalization project was complete. I leaned back, took a deep breath, and admired my work.

The previously chaotic mess of data had been transformed into a sleek, efficient database structure. Redundant information was a thing of the past, and the performance was snappy.

I couldn't wait to show my boss the results. As I walked into her office, she looked up with a hopeful glint in her eye.

"Well, rookie," she began, "any progress on that database issue?"

I grinned. "Absolutely. Let me show you."

I pulled up the new database schema on her screen, walking her through each step of the normalization process. Her eyes widened with every explanation.

"Incredible! I never realized database design could be so... detailed," she exclaimed.

When I finished, she leaned back, a satisfied smile spreading across her face.

"Fantastic job, rookie. I knew you were the right person for this." She paused, then added, "I think this calls for a celebratory lunch. My treat. What do you say?"

I didn't need to be asked twice. As we headed out, a wave of pride and accomplishment washed over me. It had been hard work, but the payoff was worth it. Not only had I solved a critical issue for the business, but I'd also cemented my reputation as the go-to database guru.

From that day on, whenever performance issues or data management challenges cropped up, my boss would come knocking. And you know what? I didn't mind one bit. It was the perfect opportunity to flex my normalization muscles and keep that database running smoothly.

So, if you ever find yourself in a similar situation—a sluggish app, a tangled database, and a boss breathing down your neck—remember: normalization is your ally. Embrace the challenge, dive into the data, and watch your application transform into a lean, mean, performance-boosting machine.

And don't forget to ask your boss out for lunch. You've earned it!

8 notes

·

View notes

Link

Account Manager Jobs 2022 in Pakistan https://www.gigspk.com/account-manager-jobs-2022-in-pakistan/?feed_id=139310&_unique_id=61e41d7e2b3fc #gigspk #careers #News #Results #Entertainment #DateSheets #Admissions #PPSC #FiaJobs #FPSC Latest, Today, Fresh, New & Upcoming Jobs 2022, Admissions, Results, Date Sheets, Past Papers, News, Politics, Home Remedies, Telecom Packages & More.

#All_Jobs#Blog#Express_Newspaper_Jobs#Government_Jobs#Karachi_Jobs#Newspaper_Jobs#Province_Jobs#Sindh_Jobs#University_Jobs#University_of_Karachi_Jobs#account_director#account_manager#account_manager_job#account_manager_jobs_2022#download_application_form#Fresh_Career_Opportunities#Gigspk_jobs#gigspk_jobs_2021#gigspk_jobs_2022#gigspk_pakistan_jobs#Government_Jobs_2022#Govt._Jobs_2022#Govt._Jobs_Application_Sample#how_to_apply#jobs_gigs#karachi_university_jobs#key_account_manager_jobs_2022#latest_jobs_in_universit_of_karachi#latest_newspaper_jobs#Public_Sector_Jobs_2022

0 notes

Photo

Jobs at #qatar_airways UAE #Account_Manager #Digital_Marketing_Coordinator Location: Dubai. Apply directly here👇 http://bit.ly/3aGPEPS (at Dubai, United Arab Emirates) https://www.instagram.com/p/CMG7ULsDwtN/?igshid=a1ldycs2d3wn

0 notes

Photo

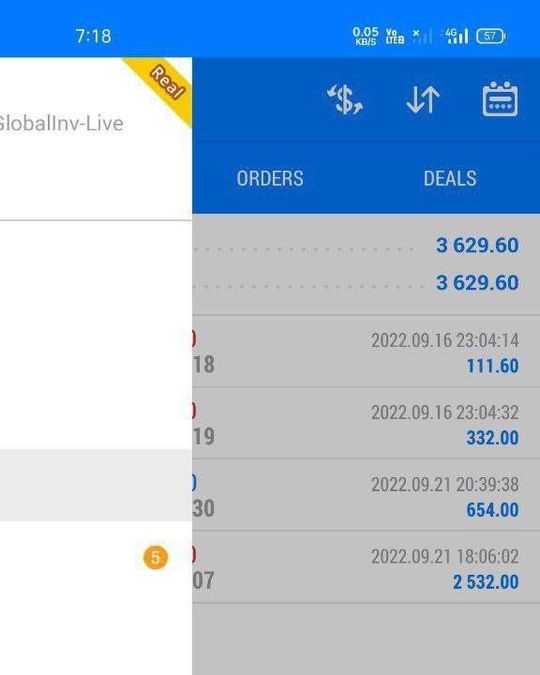

The best preparation for tomorrow is doing your best today. Invest today and let your investment work for you ,there is never a perfect time for investing Cause a step of a thousands miles starts with one good step. Invest today and start earning money weekly DM if interested.... #Forex_trader #binary_options #bitcoin #cryptocurrency #binary_expert #bitcoin_mining #forex_signal #investment #success #profitable #account_manager #winning #expert_trader #miner (at Los Angeles, California) https://www.instagram.com/p/CKNZymVBB1g/?igshid=vchvodn5lfoo

#forex_trader#binary_options#bitcoin#cryptocurrency#binary_expert#bitcoin_mining#forex_signal#investment#success#profitable#account_manager#winning#expert_trader#miner

0 notes

Text

Advantage of account software

Financial data is the company’s most value information and must be prevented from falling into the wrong hands or getting lost by mistake. Account management software designates all the tools and strategies used by a company to build relationships with current and potential customers collecting and analyzing customer data.

Advantages of our Account management:

01. Easy to Customization.

02. Automatic update.

03. Simple and first data entry.

04. Reduction of manual errors.

05. Able to continuous financial monitoring.

06. We are easily tracks inventory.

07. Eases tax compliance.

Contact Us- Article Link : http://hrsoftbd.com/services/best-accounting-software-in-bangladesh Website : www.hrsoftbd.com Phone : +8801722158130, +8801709372481

#hrsoftbd#software#account_management#account_news#account_management_news#account_system#best_account_software

0 notes

Photo

A complete accounting + inventory management & tax management software designed for your business.Create estimates and invoices, receipts & payments, record expenses, bills and purchases, Banking/Journal vouchers etc. For details, log on to www.innobins.com

0 notes

Photo

#Account_management ❤ 👉let's DM for our services💥 https://www.instagram.com/p/CEoXmhdg-m-/?igshid=1kowv643b4mgh

0 notes

Text

Accounting Software

Financial data is the company’s most value information and must be prevented from falling into the wrong hands or getting lost by mistake. Account management software designates all the tools and strategies used by a company to build relationships with current and potential customers collecting and analyzing customer data. Advantages of our Account management: Easy to Customization. Automatic update. Simple and first data entry. Reduction of manual errors. Able to continuous financial monitoring. We are easily tracks inventory. Eases tax compliance.

Contact Us- Article Link : http://hrsoftbd.com/services/best-accounting-software-in-bangladesh Website : www.hrsoftbd.com Phone : +8801722158130, +8801709372481

#hrsoftbd #software #account_management #account_news #account_management_news #account_system #online_accounting_system #online_application #system_development #best_account_software #best_account-management_system

0 notes

Photo

When you're looking at any eCommerce system, it's important to know what you need. We'll help you for that and give you better response. Our developers can use 'Open Cart' a powerful eCommerce solution that makes your eCommerce store with making a backend panel called 'CMS' that can help you to update and maintain eCommerce features

Dnationsoft.com [email protected] +8801714 07 07 70 #software #account_management #account_management_software #dnationsoft #online #offline #softwaredevelopment #management #accounting #business

0 notes

Note

يمديني اغير الايميل تبع تمبلري؟ واذا يمديني ما راح يتغير او ينقص احد من الفولوزر؟

تقدري وما أظن حينقص عدد المتابعين https://www.tumblr.com/docs/account_management

0 notes

Text

https://www.theverge.com/users/Blogging%20Hunt https://visual.ly/users/litebluedl/portfolio https://loop.frontiersin.org/people/865249/overview https://8tracks.com/blogging-h https://express.yudu.com/profile/account_management

0 notes

Photo

PERFORMANCE.🔥🔥🔥 #Account_Management☝️☝️ https://www.instagram.com/p/Ci0lHl4jvp5/?igshid=NGJjMDIxMWI=

0 notes

Text

Feature of Account software

HRSOFTBD are design and develop user friendly and attractive design application and software for account management system. Account management designates all the tools and strategies used by a company to build relationships with current and potential customers collecting and analyzing customer data.

Features of our Account management:

01. User friendly.

02. Balance sheet.

03. Payroll system.

04. Financial information.

05. Suspicious payment alert.

06. Advance payment scheduling.

07. Inventory management.

08. Credit card payment support.

09. Offline and online version.

10. Secure sensitive data.

Contact Us- Article Link : http://hrsoftbd.com/services/best-accounting-software-in-bangladesh Website : www.hrsoftbd.com Phone : +8801722158130, +8801709372481

#hrsoftbd#software#account_management#best_account_software#online_application#system_development#account_system

0 notes

Text

How cloud-based accounting solution can fight COVID-19 in 2020 locked down

The Covid-19 pandemic is impacting society and the overall economy across the world. The impact of coronavirus is growing day by day as well as affecting the supply chain. The Covid-19 crisis is creating uncertainty in the stock market, massive slowing of the demand and supply chain, falling business confidence, and increasing panic among the customer segments.

By opting for Accountpe accounting billing software for your business, you can fight the inconvenience brought about by this scenario (Covid-19). Accountpe can communicate, delegate, and monitor all work and also ensure the safety of their team. Thus, even in this time of great turmoil, businesses can keep a track of accounting and compliance.

Accountpe billing software is a convenient tool where the application is hosted by a service provider; this curtails the problem of installation and maintenance of software. An automated cloud accounting software has humongous benefits for all companies or businesses:

Universal Accessibility:

* View your data

* Track your inventory

* Expenses

* Sales, etc.

Anytime and from anywhere. Opt for Accountpe accounting and billing software.

This technology makes it possible for you to view your real-time data and access everything without any hassles. As the entire data is stored in a single software solution and can be accessed by authorized people (admin), from anywhere, you can select who can access these data.

In a scenario like this, when Covid-19 has created havoc and your employees are homebound for many days, this application helps you keep all accounting and compliance-related matters updated.

Read Also. Keep your Business relevant in an evolving Marketplace

Visit us at https://accountpe.com/

#accountpe_web_development#accounting_software_in_covid#android_app_development#billing_software_with_accountpe#account_billing_software#account_management#accountpe

0 notes

Link

0 notes