#algo master signal

Explore tagged Tumblr posts

Text

ICFM Offers India’s Most Practical and Career-Focused Algo Trading Course for Aspiring Market Experts

Master the Markets with ICFM’s Advanced Algo Trading Course Designed for Indian Traders

As markets become increasingly complex and digital, traditional trading methods are giving way to automation. In this fast-evolving financial landscape, algorithmic trading is no longer just for big institutions—it’s an essential skill for every serious trader. That’s why ICFM – Institute of Career in Financial Market – has introduced an advanced and highly practical algo trading course that empowers individuals to learn the science and strategy behind automated trading.

ICFM’s algo trading course is designed to meet the needs of aspiring traders, tech-savvy professionals, and finance enthusiasts who want to leverage technology to maximize efficiency and accuracy in the market. This course not only explains how algorithmic trading works but also provides hands-on training in building, testing, and deploying trading algorithms. Whether you're new to the concept or have some programming background, this course is structured to help you start strong and grow into a confident algo trader.

Why ICFM’s Algo Trading Course Is the Right Choice for Today’s Market Participants

Algorithmic trading involves using computer programs to execute trades automatically based on predefined criteria. It requires a solid understanding of financial markets, quantitative analysis, and technical tools. While many institutes offer brief overviews, ICFM’s algo trading course stands out because of its depth, structure, and real-time application. It doesn’t just teach you the theory—it trains you to apply strategies in live markets using real data and platforms.

The instructors at ICFM are industry veterans with years of experience in algo trading and financial programming. They understand what it takes to succeed in a high-speed, data-driven environment and bring that knowledge directly to the classroom. Each session is crafted to bridge the gap between trading concepts and algorithm design. By the end of the algo trading course, students are able to write their own algorithms, backtest strategies, and execute trades on platforms using tools like Python, MetaTrader, or other APIs.

The course also includes detailed lessons on risk management, latency optimization, market microstructure, and trading psychology. These are critical elements that are often ignored in other programs, but ICFM ensures their learners are thoroughly trained in every essential aspect of algorithmic trading.

What You’ll Learn in the ICFM Algo Trading Course

ICFM’s algo trading course is comprehensive and beginner-friendly. It starts with an introduction to financial markets and trading principles to ensure every learner has a solid foundation. You will then explore the core components of algorithmic trading—such as strategy logic, backtesting frameworks, and execution methods. As you move forward, you’ll get hands-on with algorithmic models like momentum trading, mean reversion, arbitrage strategies, and high-frequency setups.

One of the most valuable aspects of ICFM’s algo trading course is the programming module. Even if you have limited or no coding experience, you’ll learn how to use Python for data analysis, strategy development, and trade automation. The course includes practical sessions on working with historical data, developing trading signals, and connecting your algorithms with brokers’ APIs to execute real-time trades.

Students also get an introduction to machine learning basics and how they are applied to algorithmic trading. This module is essential for those who wish to advance their skills and build predictive models in the future. Through ICFM’s expert-guided approach, every student leaves the algo trading course with the confidence to code and deploy their own trading strategies.

Who Can Join ICFM’s Algo Trading Course and What Makes It Ideal for All Backgrounds

ICFM believes that financial education should be accessible to all, regardless of age or profession. The algo trading course is open to students, software developers, financial analysts, traders, and even self-learners looking to upgrade their skills. No advanced math or coding background is required to get started. The course is taught in a simplified format with step-by-step instruction, making complex topics easy to grasp.

ICFM offers both offline and online versions of the course. Students from across India can participate in live sessions, access recordings, interact with mentors, and complete assignments at their convenience. Whether you are in Delhi attending in-person classes or studying remotely from another city, you receive the same level of education and support.

With regular Q&A sessions, project evaluations, and performance feedback, ICFM’s algo trading course ensures that every participant is learning, practicing, and progressing. Students also become part of ICFM’s growing network of traders and professionals, which offers valuable peer learning and mentorship even after the course ends.

Why ICFM Is the Best Institute to Learn Algo Trading in India

ICFM has built its reputation by delivering industry-relevant, future-ready financial education. With years of teaching experience, state-of-the-art resources, and dedicated mentorship, ICFM has become a trusted name for stock market learning in India. Its algo trading course is designed not just to teach but to transform beginners into independent, tech-driven traders.

Unlike other programs that rush through topics or leave students with incomplete skills, ICFM takes the time to ensure students are job-ready and market-ready. The course curriculum is continuously updated to reflect changes in trading platforms, broker APIs, and regulatory norms. This commitment to quality makes ICFM’s algo trading course one of the most dynamic and relevant courses available today.

In addition, ICFM provides support for certification preparation and guidance for career opportunities in algorithmic trading firms, brokerages, and fintech startups. For learners who wish to turn their skills into a full-time profession, ICFM offers all the tools and direction needed to succeed.

Conclusion: Enroll in the ICFM Algo Trading Course to Shape Your Financial Future

If you're ready to explore the power of technology in trading and want a reliable, expert-led program to guide your journey, then ICFM’s algo trading course is the perfect place to start. With its practical approach, industry-aligned curriculum, and commitment to student success, ICFM empowers you to step into the world of algorithmic trading with skill and confidence.

Don’t settle for average courses or fragmented tutorials. Learn from the best, and future-proof your trading career with ICFM’s comprehensive algo trading course today.

Read More: https://www.icfmindia.com/blog/hdb-financial-ipo-gmp-decoded-the-smart-blueprint-investors-need-now

0 notes

Text

Triangle Pattern in Trading | Simple Guide for Everyone

Triangle Pattern in Trading: Master the Market Moves

Trading the financial markets may seem like rocket science, but what if I told you it’s more like spotting shapes in clouds? Yes, seriously. One of the most powerful chart patterns traders rely on is the triangle pattern, and understanding it could be your edge in the market—especially the symmetrical triangle pattern.

This article breaks it all down for you in the simplest way possible—no complicated terms, no financial degree required. Plus, we’ll show how tools like the best algo trading software in India and online trading software can help make the process smoother.

Learn the symmetrical triangle pattern in trading. Discover how it works using the best algo trading software in India & top online trading software.

What is a Triangle Pattern in Trading?

Imagine squeezing a spring between your fingers. It tightens and builds up pressure. Then one day—snap! It shoots out. That’s exactly what a triangle pattern does on a stock chart. It shows a market that’s consolidating, building pressure before breaking out in one direction.

A triangle pattern forms when the price of a stock, crypto, or any tradable asset moves within converging trendlines, forming a shape that literally looks like a triangle.

Types of Triangle Patterns

There are three main types of triangle patterns, and each tells a different story:

Symmetrical Triangle – The sides converge equally. It’s a sign of uncertainty.

Ascending Triangle – Flat top, rising bottom. Often a bullish sign.

Descending Triangle – Flat bottom, falling top. Usually a bearish signal.

In this guide, we’ll focus mostly on the symmetrical triangle pattern, but it’s useful to know the others too.

What is the Symmetrical Triangle Pattern?

Think of the symmetrical triangle as a tug of war between buyers and sellers. Both sides are strong, but neither can overpower the other—yet. So the price bounces between narrowing support and resistance levels.

Here’s the key part: this pattern doesn’t tell you the direction of the breakout, but it strongly suggests a breakout is coming soon. It’s like a pressure cooker ready to explode—up or down.

Why Triangle Patterns Matter

You don’t need to predict the market perfectly to succeed—you just need to be ready for when it moves. Triangle patterns help with that.

Key Benefits:

Anticipate breakouts

Identify entry and exit points

Avoid trading during uncertain periods

Spotting these patterns can give you an edge over traders who are just guessing.

How to Spot a Symmetrical Triangle

Here’s how to identify it like a pro:

Look for lower highs and higher lows

Draw two trendlines—one sloping down from above, one sloping up from below

The lines converge toward each other like scissors

Once these lines start coming together, traders watch closely for the breakout.

Breakouts: The Big Reveal

Breakouts are when the price bursts out of the triangle formation.

Breakout Direction Tips:

Volume spike? Expect a strong move.

Break above the upper line? Likely bullish.

Break below the lower line? Likely bearish.

No pattern is 100% accurate, but triangle breakouts often lead to explosive price action.

Volume and the Triangle Pattern

Volume is like the “voice” of the market. During a symmetrical triangle formation, volume tends to drop, showing less activity. But right before a breakout, volume usually spikes, confirming that the market is about to move big.

This is where having powerful online trading software helps—these platforms can alert you to changes in volume instantly.

Triangle Patterns vs. Other Patterns

How does the triangle compare to other chart patterns?

Pattern

Key Signal

Symmetrical Triangle

Uncertainty followed by breakout

Head and Shoulders

Trend reversal

Flags & Pennants

Continuation of trend

Double Top/Bottom

Major reversal points

The symmetrical triangle pattern is one of the few that doesn’t try to predict direction—it helps you prepare for it instead.

Common Mistakes to Avoid

Even the best tools can't fix poor trading habits. Avoid these rookie mistakes:

Entering before the breakout – Wait for confirmation.

Ignoring volume – It’s your early warning system.

Misidentifying the pattern – Practice drawing trendlines correctly.

Overtrading – Not every triangle leads to a big move.

Take your time. It’s not about catching every move—it’s about catching the right one.

How Algo Trading Makes It Easier

Can software help you catch these patterns faster? Absolutely.

With the best algo trading software in India, you can automate:

Pattern recognition

Volume analysis

Trade execution on breakouts

This means no more staring at charts all day. The software does the scanning and alerts you when it’s go-time.

Top Online Trading Software in India

Here are some of the best platforms where you can trade triangle breakouts:

Quanttrix – Known for its high-speed algorithms and pattern recognition.

Zerodha Kite – Popular for its easy interface and charting tools.

Upstox Pro – Combines speed with smart analytics.

Angel One – AI-driven alerts and customizable charts.

These online trading software platforms make it easier for Indian traders to take advantage of technical patterns like triangles.

Backtesting the Triangle Pattern

Before you risk real money, test it out.

Backtesting means applying the triangle pattern to past market data to see how well it worked.

Many platforms (like Quanttrix or TradingView) allow backtesting. Use this feature to:

Learn how often triangle breakouts succeed

Understand what conditions increase success

Improve your strategy over time

Real-Life Examples of Triangle Trading

Let’s say a stock like Reliance Industries starts forming a symmetrical triangle. You draw your trendlines and notice a breakout with strong volume on the upside.

If you had set an automated trade using algo software, you could’ve caught the breakout without lifting a finger.

Triangle patterns show up across stocks, crypto, commodities—you name it. They’re universal.

Tips for Beginners

Starting out? Here are a few things to keep in mind:

Use demo accounts – Practice without risk

Stick to one pattern – Master triangles first

Set alerts on your online trading software

Keep a trading journal – Log your triangle trades

Master one pattern and let it become your bread and butter before branching out.

Conclusion: Turning Shapes into Profits

Triangle patterns aren’t just pretty shapes—they’re predictive tools used by savvy traders around the world. The symmetrical triangle pattern in particular is a reliable signal of upcoming volatility.

With the help of the best algo trading software in India and reliable online trading software, you can turn this pattern into profit—without having to watch charts 24/7.

Trading doesn't have to be overwhelming. Sometimes, all you need is the ability to recognize a triangle.

FAQs

What does a symmetrical triangle pattern indicate? It shows price consolidation and signals an upcoming breakout, though it doesn’t predict the direction.

Can beginners use triangle patterns effectively? Yes! With some practice and the right tools, even beginners can spot and trade triangle patterns.

How does algo trading help with triangle patterns? Algo trading can automatically detect triangle formations and execute trades once a breakout is confirmed.

What is the best online trading software in India for chart patterns? Quanttrix, Zerodha Kite, and Upstox Pro are popular choices that support detailed charting and pattern detection.

Should I trade every triangle pattern I see? No. Only trade confirmed breakouts, ideally supported by volume and market conditions.

0 notes

Text

The Quantum Quant’s Playbook: Mastering Next-Gen Trading with AllTick’s AI-Powered Edge

In the high-stakes arena of modern finance, where algorithms battle for microsecond advantages, elite quantitative traders wield AllTick’s cutting-edge toolkit to transform data into dominance. Here’s how the vanguard operates in an era where latency is lethal and alpha is algorithmic.

Pre-Market: The Alpha Forge

5:30 AM | Global Data Recon AllTick’s AI-driven terminal aggregates real-time signals from 87 exchanges, dark pools, and alternative data streams—satellite imagery, supply chain disruptions, and meme stock chatter—curated into actionable alpha signals.

6:45 AM | War Games & Stress Tests Backtest strategies against AllTick’s crisis library (2010 Flash Crash, 2020 COVID meltdown) with quantum Monte Carlo simulations. Machine learning flags vulnerabilities: “Portfolio gamma exposure critical if VIX spikes 30%.”

8:00 AM | Factor Mining at Lightspeed AllTick’s neural networks dissect 1,000+ alternative data dimensions—container ship traffic, credit card spend trends—to uncover non-linear correlations invisible to traditional models.

Trading Hours: The Algorithmic Colosseum

9:30 AM | Microsecond Arms Race Deploy hyper-low-latency strategies via AllTick’s FPGA-accelerated order router, slicing through liquidity shadows with 0.02 bps execution costs. Real-time risk engines monitor $500M exposures across 16 asset classes.

12:00 PM | Adaptive Game Theory Reinforcement learning agents pivot tactics mid-session. AllTick’s event engine detects anomalies: *“Unusual options flow in TSLA: 92% probability of Elon tweet storm. Auto-hedging engaged.”*

3:00 PM | Black Swan Fire Drill Simulate tail-risk scenarios using AllTick’s generative adversarial networks (GANs), stress-testing portfolios against synthetic market crashes. System prescribes dynamic deleveraging protocols.

Post-Market: The Cognitive Feedback Loop

6:30 PM | P&L Autopsy AllTick’s attribution AI dissects returns: *63% from volatility clustering, 22% cross-asset carry, -5% from FX slippage.* Prescribes overnight optimization via quantum annealing.

9:00 PM | Quantum Leap Run portfolio optimization on AllTick’s quantum cloud, achieving 23% faster convergence than classical MVO. Discover hidden convexity in crypto-fiat arbitrage pairs.

11:00 PM | Ecosystem Synergy Monetize proprietary signals on AllTick’s algo marketplace, harvesting crowd-sourced intelligence while earning passive revenue.

AllTick: The Quant’s Singularity Platform

Legacy data vendors peddle stale ticks. AllTick delivers 4D Alpha Engineering:

Neural Data Fabric: Petabyte-scale L3 order books + dark pool prints + decentralized finance (DeFi) flows, fused via federated learning.

AI Co-Pilot: 150+ pre-trained models for factor discovery, execution optimization, and anomaly detection.

Execution Hyperloop: Sub-microsecond smart routers with self-learning liquidity prediction.

The Quant’s Ultimatum: Adapt or atrophy. ✅ Quantum Trading Primer (Free Download) ✅ HFT Infrastructure Blueprint ($7,500 Value) ✅ API Sandbox Access

Click → [AllTick.co]

0 notes

Text

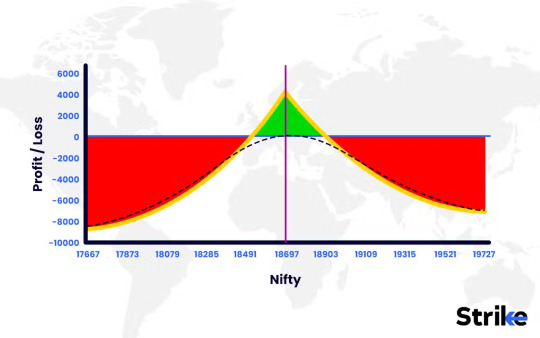

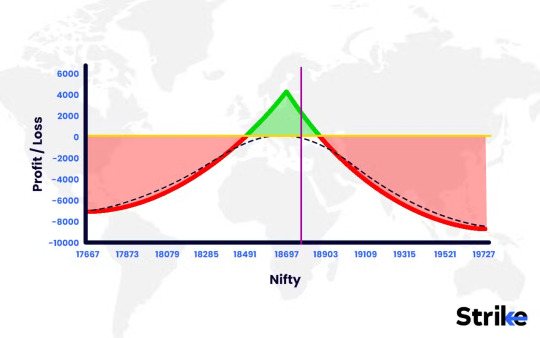

Complete Guide to Calendar Spread: Master the Timing Game in Options Trading

🚀 What is a Calendar Spread and Why It Deserves a Spot in Your Strategy Arsenal?

A Calendar Spread—also known as a time spread—involves buying a longer-term option and selling a shorter-term option with the same strike price. This isn’t just a bet on direction—it's a play on time, volatility, and market inefficiency.

In simple terms, you profit from the difference in time decay (Theta) and changes in implied volatility (IV). The longer-dated option loses value slower than the short-term one. That’s your edge.

🔍 Let’s Decode How Calendar Spreads Actually Work

Imagine Nifty 50 is trading at 22,500. You’re moderately bullish and expect volatility to rise. You execute a Call Calendar Spread: 💼 Buy: Nifty 22,500 CE expiring in July 💼 Sell: Nifty 22,500 CE expiring in June

Both have the same strike. Different expiry. As time passes, the June option loses value faster than the July option. If volatility increases before June expiry, the value of July option jumps.

This strategy benefits from: 📉 Time decay on the short option 📈 Volatility expansion on the long option

🎯 Tools like Strike Money allow you to visualize volatility skew, time decay impact, and option Greeks—making your entries more precise and data-backed.

💹 Bullish or Bearish? Calendar Spreads Adapt to Your Market View

📈 Bullish Calendar Spread: Set up at or slightly below ATM strike 📉 Bearish Calendar Spread: Set up at or slightly above ATM strike

Example from India: During March 2024, Infosys was trading around ₹1,400. Traders expected a move post earnings but wanted to limit risk. They created a bearish calendar spread: 🛒 Buy July 1,420 CE 🛒 Sell April 1,420 CE

Post earnings, IV jumped. The April leg expired worthless, while July gained value—yielding a 4.5% ROI within 10 trading days.

🧪 According to NSE data (2023), option strategies involving time spreads performed better in low-IV regimes—common in pre-budget and post-earnings calm.

⚡ Why Volatility is the Engine of Calendar Spreads

The calendar spread thrives in low IV environments with expectations of rising volatility. Think pre-earnings or macro events like RBI meetings.

Let’s take an example: In February 2025, ahead of the Union Budget, Bank Nifty saw IVs dip below 15%. Traders used Call Calendar Spreads, anticipating budget-related volatility surge.

🎯 Here's the trick: 🧠 Buy options in low IV ⚡ Sell options in even lower IV or approaching expiry

📉 Implied Volatility (IV) increases—your long option appreciates faster. 🔬 Strike Money’s IV Charts show historical vs. current IV to pinpoint ideal entries.

📈 Studies by CBOE and NSE-India confirm that calendar spreads outperform when IV Rank is below 30—a signal many algo-traders use to build positions.

🛠 Real-World Execution Using Strike Money & Indian Platforms

Let’s simulate a real calendar spread using Strike Money charting:

🎯 Underlying: Nifty 50 at 22,000 📆 Entry Date: June 1st 🛒 Buy: 22,000 CE July expiry @ ₹160 🛒 Sell: 22,000 CE June expiry @ ₹80

Total Debit: ₹80

Using Strike Money, you observe: 📈 July IV = 18% 📉 June IV = 14% 📊 Theta differential = ₹6/day in favor

If Nifty stays between 21,800–22,200 till June expiry, and IV rises, your position gains. The payoff is non-linear. Theta works like gravity—pulling value out of the short leg while your long option floats.

🧩 Combine this with data from NSE’s Option Chain and Open Interest analytics to refine entries.

📐 Let’s Talk Numbers: Profit, Breakeven & Loss Potential

Calendar spreads are defined-risk strategies. You know your maximum loss upfront—limited to the net debit (premium paid).

📊 Breakeven typically lies near the strike, but it's dynamic—shifted by IV and time decay.

For example: ✅ Net Debit: ₹80 ✅ Maximum Profit: When underlying closes near strike on short expiry ✅ Maximum Loss: If underlying moves far from strike or IV collapses

🎯 Greeks to Watch: 📉 Theta – benefits you due to faster time decay of short option 📈 Vega – long option gains as IV increases 🔁 Gamma – limited, unless price moves violently

Strike Money lets you simulate P&L curves, dynamically adjusting for changes in IV, DTE, and underlying price.

🔄 Managing Calendar Spreads Like a Pro: When to Roll or Exit?

The lifecycle of a calendar spread is crucial. Don’t just “set and forget”.

📆 As the short option nears expiry: �� If price is near strike, let it expire ✔ If price moves away, consider rolling to a further month

Let’s say your Infosys April 1,420 CE is about to expire OTM, and July still has 45 days. Roll to May 1,420 CE to keep collecting theta.

🔐 Risk Management Tips: ⚠ Don’t trade calendars in high IV environments ⚠ Avoid low liquidity stocks ⚠ Always monitor spreads with Strike Money’s payoff graphs

🚫 When Not to Trade Calendar Spreads: Avoid These Traps

❌ Avoid high IV environments – especially near earnings when IV collapse is expected ❌ Stay away from wide bid-ask spreads – slippage eats profits ❌ Do not hold too close to expiry – Gamma risk increases, and moves become sharp ❌ No overnight trades during events – Budget, RBI meet, or global triggers

🧠 Pro Tip: Check IV Rank using Strike Money—ideally enter below 30 for long calendars.

Case in point: In June 2023, Tata Motors saw IV above 45 pre-earnings. A trader entered a calendar spread, expecting IV to rise. Post results, IV crashed. Despite price holding steady, the trade lost 60% of debit.

Lesson: IV crush is real. Respect it.

⚔️ Calendar Spread vs. Diagonal Spread: Which One Works Best?

Think of the Diagonal Spread as the cousin of the Calendar. But there's one key difference—it combines different strikes AND different expiries.

🧩 Example: Diagonal: Buy 22,000 CE July Sell 22,500 CE June

Use when you have a directional bias.

Calendar: Buy 22,000 CE July Sell 22,000 CE June

Use when you expect sideways movement or minor directional moves with IV expansion.

💡 Strike Money helps compare payoff between both strategies—so you can choose based on your view.

🔮 Is the Calendar Spread Still Relevant in 2025’s Market Landscape?

Absolutely. In fact, calendar spreads are tailor-made for volatile but rangebound markets—which is what 2025 is shaping up to be.

🎯 With rising geopolitical noise, inflation uncertainty, and RBI’s cautious stance, expect short-term rangebound movements with periodic volatility bursts.

This is the perfect storm for calendar spreads.

📊 Data from NSE 2024 Options Insights Report shows that multi-leg strategies like calendars are being adopted by more than 32% of active F&O traders—up from just 18% in 2021.

🧠 Institutional traders are using machine learning models to time entry and exits—based on IV behavior and historical pattern recognition. Tools like Strike Money democratize this edge for retail traders.

🧭 Final Thoughts: Should You Use Calendar Spreads?

If you're looking for: ✅ Defined risk ✅ Strategic use of volatility ✅ Minimal capital outlay ✅ Advanced yet approachable tactics

Then yes—Calendar Spreads belong in your playbook.

But remember—it’s a game of patience, precision, and process.

🎯 Use tools like Strike Money to analyze Greeks, IV, payoff and risk metrics in real-time. 📊 Trade with intent. Monitor with discipline. Exit with clarity.

🔥 Want to take it further? Explore advanced variations like double calendar spreads, or combine with earnings season data for explosive setups.

Let the clock work for you, not against you.⌛

0 notes

Text

Best Algo Strategies for Short-Term and Long-Term Profits

The best Algo strategies for profits to maximize ROI in volatile markets. Leverage data-driven signals, automated execution, and adaptive risk management. Ideal for traders seeking consistent gains with minimal effort. Optimize trades, capitalize on trends, and minimize losses. Start mastering algorithmic trading today—unlock smarter, faster profits!

1 note

·

View note

Text

How do I earn money in a month of $300-$1,000?

Have you ever dreamed of earning $300–$1,000 a month while doing something exciting and dynamic? If you’re interested in the world of trading and finance, there are some fantastic ways to achieve that income goal using tools and programs designed to simplify the process. Whether you're a complete beginner or someone with experience, here’s how you can start making money through affiliate marketing, algo trading, copy trading, and signal providing—all backed by trusted platforms like SureShotFX and Telegram Signal Copier.

1. Affiliate Marketing: TSC Affiliate Program

How It Works: Promote the Telegram Signal Copier (TSC) to traders looking for seamless signal copying. Earn a commission for every successful referral.

Why It’s Effective: High demand for tools that simplify trading. A user-friendly program makes it easy to share with others.

Pro Tip: Use blogs, YouTube, or social media to explain how TSC works and why traders need it. Your audience will appreciate the insights, and you’ll earn through conversions!

2. Algo Trading: SureShotFX Algo

What It Offers: A smart, automated way to trade Forex without spending hours analyzing charts.

Why Traders Love It: Removes the guesswork from trading. Ideal for beginners and advanced traders who want passive income.

How to Start: Invest small initially to see how the algo performs. Gradually scale up as you get comfortable with the system.

Earnings Potential: Even a modest trading account can generate steady monthly profits over time.

3. Copy Trading: SureShotFX Signal Service & Telegram Signal Copier

What It Does: SureShotFX Signal Service delivers premium trading signals for Forex, gold, and indices. Telegram Signal Copier automates the entire process by copying signals directly to your trading account.

Why It’s Perfect for Beginners: No need to master market analysis or coding. You can trade like a pro by following expert signals.

How to Succeed: Combine the service with smart risk management to maximize returns.

#SureShotFX#SSF#telegram signal copier#telegram signals copier#Signal Copier#Trade Copier#Forex signal Copier#Passive income#affiliate marketing#income#online income#xauusd

1 note

·

View note

Text

Discover Essential Trading Indicators and Tools for Enhanced Market Precision

Successful trading requires sharp insights and dependable tools. Our carefully curated range of trading indicators and Expert Advisors (EA) are designed to support traders with data-driven insights, accurate signals, and automated trading capabilities. From Renko Generators to AI-powered trading EAs, these tools are built to help traders navigate market complexities effectively.

Master Clean Charting with Renko Chart Generators

The Renko Generator is essential for traders focused on pure price action. By filtering out minor price fluctuations, the Renko Chart Generator offers a simplified, easy-to-read chart that highlights major trends. For those seeking an edge in trend analysis, the Best Renko Generator is designed to pinpoint optimal entry and exit points.

Empower Your Strategy with Angel Algo Indicator

The Angel Algo Indicator is a robust signal provider that utilizes advanced algorithms to produce highly accurate buy and sell signals. Whether you’re new to trading or an experienced trader, the Angel Algo indicator provides an added layer of precision to your trading decisions, enabling you to trade with confidence.

Stay Connected with MT5 Trades to Telegram

The MT5 Trades to Telegram service is designed to keep you in sync with your trades, even when you’re away from your trading platform. This tool sends real-time trade alerts directly to your Telegram, helping you stay on top of market changes wherever you are.

Optimize Trend Analysis with Super Trend

Accurate trend identification is critical, and the Super Trend indicator makes it simple. The SuperTrend highlights clear bullish and bearish trends, making it easier for traders to set up profitable trades. This indicator is especially useful for trend-following strategies.

Enhance Your Technical Analysis with QQE Mod Indicator

The QQE Mod Indicator combines various technical factors to provide traders with insight into market trend strength and possible reversals. Whether you’re a day trader or a swing trader, this indicator enables you to make informed, data-backed decisions that can improve trading outcomes.

Automate Trading with AI Trader and Expert Advisors

Embrace the power of automation with AI Trader. This EA for EURUSD and other major currency pairs leverages artificial intelligence to execute trades based on real-time analysis, giving you a competitive edge in forex trading. Expert Advisors for MT4 and MT5 take the complexity out of market analysis, allowing you to trade with precision on platforms you’re comfortable with.

Explore More Indicators and Tools

Alongside these flagship products, explore our range of specialized indicators to further enhance your trading strategies:

Trend Navigator: Identify market trends to maximize profitability.

HLOTT Indicator: Monitor highs and lows to spot opportunities.

UT Bot Alerts: Get timely alerts based on custom conditions.

STC Indicator: Capture market cycles for timing trades.

Scaff Trend Cycle Indicator: Identify cycle points and trend changes.

ATR Stops Indicator: Use ATR to set stop-loss levels effectively.

OTT Indicator: Analyze trend directions with confidence.

IntegrityTrader: Designed for high-frequency trading performance.

Conclusion: Whether you’re seeking precision with the Renko Chart Generator or full automation with Expert Advisors, these tools are tailored to support every trader’s needs. Check out our MQL5 profile for a complete range of products that can enhance your trading journey and boost your profitability.

0 notes

Text

Tradingview algo trading | Algoji

Tradingview has become a household name among traders, offering a rich array of charting tools, technical analysis capabilities, and social networking features. However, what truly sets Tradingview apart is its seamless integration with algo trading, allowing traders to automate their strategies and capitalize on market opportunities with precision. In this comprehensive guide, brought to you by Algoji, we’ll explore how you can master Tradingview algo trading and unlock new levels of trading success.

Understanding Algo Trading : Tradingview algo trading, short for algorithmic trading, involves using computer algorithms to execute trading decisions automatically. This strategy enables traders to execute trades at lightning-fast speeds, capitalize on market inefficiencies, and remove emotional biases from trading decisions.

Why Choose Tradingview for Algo Trading?

Advanced Charting Tools: Tradingview algo trading offers a wide range of advanced charting tools, indicators, and drawing tools that empower traders to perform in-depth technical analysis and identify trading opportunities with ease.

Customizable Alerts: Tradingview allows traders to set customizable alerts based on price movements, technical indicators, and trading signals. These alerts notify traders of potential trading opportunities, ensuring they never miss a profitable trade.

Social Networking Features: Tradingview’s social networking features enable traders to share ideas, collaborate on strategies, and learn from each other’s insights. This collaborative environment fosters knowledge sharing and enhances trading outcomes.

Seamless Integration: Tradingview seamlessly integrates with algo trading platforms like Algoji, allowing traders to automate their strategies directly from the Tradingview platform. This integration streamlines the trading process and eliminates the need for manual intervention.

How Algoji Enhances Algo Trading on Tradingview:

Advanced Algorithm Development: Algoji provides a comprehensive algorithm development environment, allowing traders to design, backtest, and deploy custom algorithms seamlessly. Traders can leverage Algoji’s intuitive interface and powerful tools to create sophisticated trading strategies.

Real-Time Market Monitoring: Algoji’s platform offers real-time market monitoring tools that enable traders to track market trends, analyze price movements, and receive alerts on potential trading opportunities. This real-time data allows traders to make informed decisions and execute trades with precision.

Execution Automation: Algoji’s execution automation capabilities integrate seamlessly with Tradingview, enabling traders to automate trade execution based on predefined criteria. This automation reduces manual errors, minimizes latency, and improves trade execution efficiency.

Risk Management: Algoji incorporates robust risk management features that help traders mitigate potential risks associated with automated trading. Traders can set risk controls, implement stop-loss orders, and manage position sizes to protect their capital and optimize risk-adjusted returns.

Unlocking Your Trading Potential: By combining the advanced charting and analysis tools of Tradingview with Algoji’s sophisticated algo trading solutions, traders can unlock new levels of trading potential and achieve greater success in the financial markets. Whether you’re a day trader, swing trader, or investor, mastering algo trading on Tradingview algo trading with Algoji can elevate your trading game and help you achieve your financial goals.

Getting Started with Algo Trading on Tradingview:

Sign up for an account with Tradingview and explore the platform’s charting tools, technical indicators, and social networking features.

Familiarize yourself with Algoji’s platform and capabilities, and understand how it integrates with Tradingview for algo trading.

Develop and backtest your trading strategies using Algoji’s algorithm development environment, taking advantage of Tradingview’s advanced charting tools for analysis.

Integrate Algoji with Tradingview and automate your trading strategies based on predefined criteria, leveraging Tradingview’s customizable alerts for timely notifications.

Continuously monitor and evaluate your strategy performance, make data-driven adjustments, and optimize your trading outcomes for success.

In conclusion, mastering algo trading on Tradingview algo trading with Algoji opens up a world of opportunities for traders, offering advanced tools, seamless integration, and comprehensive support. Experience the power of automation, real-time data analysis, and collaborative insights on Tradingview with Algoji, and unlock your full potential as a trader in the dynamic financial markets.

0 notes

Text

Algo Trading: What It Is And How To Get Started

In the ever-evolving landscape of finance, technology continues to revolutionise trading practices. Algorithmic trading, commonly known as algo trading, stands at the forefront of this transformation. Algo trading involves the use of computer algorithms to execute trading orders, offering unparalleled speed, accuracy, and efficiency. This article explores the essence of algo trading, delving into what it entails and providing a roadmap for individuals keen on venturing into this dynamic domain.

Understanding Algo Trading

Algo trading is the marriage of finance and technology, where complex mathematical models and algorithms are employed to automate trading decisions. These algorithms analyse vast amounts of market data, identifying patterns and trends that human traders might miss. By swiftly processing data and executing orders at lightning speed, algo trading aims to capitalise on market inefficiencies and price differentials.

How Algo Trading Works

Algo trading operates on a set of predefined rules and conditions. Traders develop algorithms based on historical data, technical indicators, and quantitative analysis. These algorithms continuously scan the market for specific signals, such as price movements, volume changes, or other market variables. When the algorithm detects a favourable trading opportunity, it automatically executes buy or sell orders without human intervention. The efficiency of algo trading lies in its ability to make split-second decisions, allowing traders to capitalise on market fluctuations in real-time.

Getting Started with Algo Trading

Educational Foundation: Before diving into algo trading, it is essential to have a strong grasp of financial markets, trading strategies, and quantitative analysis. Enrol in online courses, read books, and follow reputable financial blogs to enhance your knowledge.

Master Programming Skills

Proficiency in programming languages like Python, Java, or C++ is fundamental. These languages enable traders to code, backtest, and implement their algorithms. Numerous online resources and coding platforms provide tutorials and exercises to hone your programming skills.

Data Analysis and Backtesting

Historical data analysis is crucial for developing and refining trading algorithms. Backtesting involves applying the algorithm to past market data to evaluate its performance. This step helps traders identify the strengths and weaknesses of their strategies before risking real capital.

Choose a Reliable Broker and Platform

Select a brokerage firm that offers robust algorithmic trading support. Ensure the platform provides access to historical data, real-time market feeds, and a user-friendly interface for algorithm deployment.

Risk Management

Implement effective risk management strategies to protect your capital. This includes setting stop-loss levels, diversifying your trading portfolio, and avoiding over-leveraging.

Continuous Learning and Adaptation

Algo trading is not a one-time endeavour; it requires continuous learning and adaptation. Stay updated with market trends, technological advancements, and evolving trading strategies to refine your algorithms and maintain a competitive edge.

Conclusion

Algo trading has democratised the world of finance, enabling individual traders to compete with institutional investors on a level playing field. By understanding the fundamentals, honing programming skills, conducting rigorous data analysis, and embracing a mindset of continuous learning, aspiring algo traders can embark on a fulfilling journey in the realm of algorithmic trading. With dedication, discipline, and strategic acumen, anyone can harness the power of algorithms to navigate the complexities of financial markets and potentially achieve substantial success.

0 notes

Text

La chica de la azotea/ the girl on the roof

// Esta es mi primera vez escribiendo un fanfic

// El lector es de genero femenino (si les gusta y recibe apoyo voy a intentar hacer una version en genero neutral para que asi todos puedan leerlo) tambien si no les agrada la descripcion de la lectora tienen total libertad de cambiarlo! sean cretiv@s!! Fantasmita se va!!!!

Disfruten!

Un día cualquiera en la ciudad de New York o al menos así ya lo veía yo, salí de las alcantarillas para tener un momento a solas, ya no soportaba estar ahí, tengo trabajo importante que hacer, con el kraang haciendo experimentos raros yo soy el único que puede dar respuestas al equipo pero simplemente en ese ambiente no se puede pensar con claridad! Rafa y Leo se la pasan peleando, Mikey no deja de molestar y sobre todo Abril esta con Casey haciéndose ojitos! Yo solo necesito un tiempo para calmarme y volveré a casa, si no lo hago seré igual de temperamental que Rafa y eso no está en mi lista de deseos, de todas formas no tardaría será una salida rápida, lo peor que puede pasar si me tardo más de lo usual es que se podrían preocupar y lo último que quiero es un regaño de Leo o peor del maestro Splinter, a veces me siento solo aunque tenga a mis hermanos, a mi padre y a nuestros amigos, tal vez el hecho de que abril no me corresponde sea lo que me tiene mal pero me gustaría hablar con alguien acerca de esto, alguien que no se burle o se queje alguien que en serio entienda.

Camino por los techos, escalo las paredes, hago una que otra maniobra para animarme y aun así solo estoy yo escuchando a mis propios pensamientos, estaba a punto de retirarme creía que ya paso demasiado tiempo, como dije tengo más responsabilidades pendientes que nadie más podría entender o realizar, un peso que debo llevar.

En el techo en el que estaba había una entrada que obviamente daba a la azotea donde yo estaba, no sé si fue mala suerte pero justo cuando me calme y estaba dispuesto a volver, alguien abrió la puerta.

- Rayos… –

Dije en un casi susurro, pues obviamente tuve que ocultarme para que cualquiera que estuviera ahí no me viera, podría simplemente irme y ya es la única opción lógica pero esta persona bloqueaba el único atajo a las alcantarillas cerca de la guarida, tomar cualquier otro camino me retrasaría y eso podría preocupar a mis hermanos, así que solamente quedaba esperar a que se fueran y seguir con mi camino

- Vaya día de porquería! –

Por su voz deduce que era una chica, una adolecente, debía quedarme oculto obviamente pero la curiosidad me mataba que simplemente alce un poco la cabeza y pude verla, era alta, cabello castaño y corto aun así se veía que era ondulado y muy esponjoso, su ropa era muy peculiar un suéter de diseño viejo verde militar súper holgado, lo tenía fajado en unas bermudas de mezclilla azul naval y usaba botas de lluvia lo cual era muy raro ya que no estábamos en temporada de lloviznas , tenía una caja en sus manos y la azoto con fuerza en el suelo, escuche varios vidrios romperse y a la vista de cómo cayo se veía pesado, claro no era problema de la chica que fácilmente lo volvió a alzar y lo estrello fuerte de nuevo

Se veía algo molesta, no que digo algo, se veía furiosa! Pude observar como maldecía y gritaba al aire con todas sus fuerzas

- Malditos deberes! Malditas responsabilidades! El que sea capaz de hacer más cosas que tú no te da derecho a dejar todo sobre mis hombros! –

Abrió la caja y saco varias botellas de cerveza algunas ya estaban rotas pero otras parecían intactas sorpresivamente, las estrellaba en el suelo, las aventaba o simplemente las pisaba, vaya, sí que fue lista en usar las botas para esta peculiar actividad, después de que se le acabaron las botellas simplemente alzo la cara y grito, hubo algo en su grito que se me hacía diferente, con un hermano como Rafael estaba muy acostumbrado a los gritos pero nunca había escuchado uno como el de ella, se escuchaba triste, desesperada, sola…

Me había quedado viendo todo este tiempo sin que ella me notara, pero yo note en ella como lagrimas se resbalaban en sus mejillas con pecas, me sentía mal por ella, tenía ganas de preguntarle si estaba bien o si necesitaba ayuda, pero eso es imposible aún recuerdo la primera vez que Abril me vio y grito, nadie puede verme a la cara sin asustarse y salir corriendo, todo siempre creerán que soy un fenómeno y creo que ella no es la excepción, la chica se limpió sus lágrimas cuando regreso la mirada al suelo, recogió la caja vacía y simplemente volvió a entrar por la misma puerta de la cual salió.

Esa era mi señal, con cuidado salí de mi escondite y procure tener cuidado al caminar por los miles de vidrios rotos que se encontraban en el suelo, si va a hacer una rabieta al menos debería recoger su desastre!

Llegando al otro extremo de la azotea no pude evitar ver hacia atrás, los vidrios seguían ahí eso quería decir que mi “encuentro” con la chica si paso y aunque esto suene a una locura yo aún no podía creer lo que presencié, me sentí identificado de alguna forma y de nuevo mi curiosidad despertó quería volver a verla, solo para escucharla, solo para ver que se le ocurría hacer la próxima vez, salte de techo en techo, escale escaleras y paredes y al regresar a la alcantarilla que me llevaba a casa solo podía pensar en el mañana cuando pueda ver de nuevo a la chica de la azotea.

English Version

On any given day in New York City or at least that's how I saw it, I came out of the sewers to have a moment alone, I couldn't bear to be there anymore, I have important work to do, with the kraang doing strange experiments, I am the one the only one who can give answers to the team but simply in that environment you cannot think clearly! Raph and Leo are always fighting, Mikey does not stop bothering and especially April is with Casey flirting! I just need some time to calm down and I'll go home, if I don't I will be just as temperamental as Raph and that's not on my wish list, anyway it won't take long it will be a quick exit, the worst thing that can happen if I'm late more than usual is that they could worry and the last thing I want is a scolding from Leo or worse from Master Splinter, sometimes I feel lonely even though I have my brothers, my father and our friends, maybe the fact that April does not correspond my feelings is what is wrong with me but I would like to talk with someone about this, someone who does not mock or complain, someone who seriously understands.

I walk on the ceilings, I climb the walls, I do the odd maneuver to cheer myself up and even so I'm just listening to my own thoughts, I was about to retire I thought that too much time had passed, as I said I have more pending responsibilities than anyone else could understand or realize, a weight that I must carry.

On the roof I was on there was an entrance that obviously led to the roof where I was, I don't know if it was bad luck but just when I calmed down and was ready to go back, someone opened the door.

- Dang it… -

I said in an almost whisper, because obviously I had to hide so that anyone who was there would not see me, I could just leave and it is already the only logical option but this person blocked the only shortcut to the sewers near the lair, take any other path I would be late and that could worry my brothers, so I just had to wait for them to leave and continue on my way.

- What a crappy day! -

From her voice I deduces that it was a girl, an adolescent, I had to stay hidden obviously but curiosity killed me that I just raised my head a little and I could see her, she was tall, brown hair and short even so it looked like it was wavy and very fluffy, Her clothes were very peculiar a super loose old military green design sweater, she had it tucked in some navy blue denim shorts and she wore rain boots which was very rare since we were not in the drizzle season, she had a box in her hands and she hit it hard on the ground, I heard several glass break and at the sight of how it fell it looked heavy, of course it was not the problem of the girl who easily raised it again and smashed it hard again

She looked somewhat annoyed, not that I said something, she looked furious! I could see how she cursed and screamed into the air with all his might

- Damn homework! Damn responsibilities! The fact that I am capable of doing more things than you does not give you the right to leave everything on my shoulders! -

She opened the box and took out several bottles of beer, some were already broken but others seemed surprisingly intact, she smashed them on the ground, threw them or simply stepped on them, well, she was ready to use her boots for this peculiar activity, after She ran out of bottles, she just raised her face and shouted, there was something in her cry that made me different, with a brother like Rafael I was very used to shouting but I had never heard one like hers, it sounded sad, desperate, alone…

I had been watching all this time without her noticing me, but I noticed in her how tears slied down her freckled cheeks, I felt bad for her, I wanted to ask her if she was okay or if she needed help, but that's impossible I still remember the first time that April saw me and yelled, nobody can see my face without being scared and running away, they will always believe that I am a phenomenon and I think she is no exception, the girl wiped her tears when she looked back to the ground, she picked up the empty box and simply went back in through the same door from which she came.

That was my signal, I carefully came out of my hiding place and tried to be careful when walking through the thousands of broken glass that were on the ground, if you are going to throw a tantrum you should at least pick up your mess!

Reaching the other end of the roof, I couldn't help looking back, the glass was still there, that meant that my "meeting" with the girl did happen and although this sounds crazy I still couldn't believe what I witnessed, I felt identified somehow and again my curiosity awoke I wanted to see her again, just to listen to her, just to see what she could do next time, jump from ceiling to ceiling, climb stairs and walls and when returning to the sewer that led me to home I could only think of tomorrow when I can see the girl on the roof again.

4 notes

·

View notes

Text

Advance Your Trading Career With Exclusive Algo Trading Course By ICFM Institute In Delhi

Master Algorithmic Trading With ICFM’s Specialised Algo Trading Course In Delhi Today

The trading landscape is changing rapidly, and algorithmic trading is leading the revolution. Automated strategies, data-driven decisions, and lightning-fast executions have made algo trading the most sought-after skill in modern financial markets. If you want to stay ahead in the trading industry, enrolling in a professional algo trading course is essential. ICFM – Stock Market Institute in Delhi offers an exclusive and practical algo trading course for aspiring traders, investors, and finance professionals looking to automate and enhance their trading strategies.

ICFM stands out as one of the only institutes offering a hands-on, career-focused algo trading course that equips learners with both the technical tools and market understanding needed to thrive in today’s competitive trading environment. Whether you’re a beginner, an active trader, or someone with a background in finance or coding, ICFM’s course is tailored to fit all learning levels.

Why Choose ICFM Institute For Learning An Advanced Algo Trading Course In India

In an age where markets move faster than human reaction time, manual trading has its limits. That’s why ICFM’s algo trading course is built around automation, data analysis, and strategy development. The course is taught by market professionals and experienced algorithmic traders who guide students through every step of building, testing, and deploying trading algorithms.

ICFM’s approach to the algo trading course is not just theoretical. It focuses on real-time strategy design, programming logic, backtesting models, and risk control. Students also learn how to interpret market signals and develop rule-based systems using platforms like Python, Excel, and professional trading terminals. The goal is to make every student independent and capable of creating automated systems that work in real-world market conditions.

Being the only dedicated financial training institute offering this niche course, ICFM ensures that its algo trading course meets industry standards and prepares learners for immediate implementation in live trading.

Core Learning Outcomes From ICFM’s Practical Algo Trading Course For Modern Traders

The algo trading course offered by ICFM provides complete knowledge about algorithmic strategies, quantitative analysis, and automation tools. Students begin by learning the basics of trading algorithms and gradually move into writing their own scripts for automated trades. The course includes real-time trading simulations, helping students test and improve their strategies under market conditions.

ICFM’s algo trading course also focuses on teaching how to analyse financial data, use statistical models, and apply logic to generate consistent trading results. Key areas include trend-following systems, mean reversion strategies, breakout setups, and arbitrage opportunities. Learners are trained to backtest historical data, evaluate performance metrics, and fine-tune their algorithms for better outcomes.

By completing the algo trading course, students gain not only technical skills but also the critical thinking and problem-solving ability necessary for a successful career in financial markets.

Career Opportunities After Completing The Algo Trading Course At ICFM Delhi

With the rise of automated trading systems across global stock exchanges, professionals skilled in algorithmic trading are in high demand. After finishing the algo trading course from ICFM, students can explore a wide range of career roles including quantitative analyst, algorithmic trader, strategy developer, or automation consultant for financial firms.

The algo trading course opens doors to roles in investment banks, hedge funds, prop trading desks, and fintech companies that rely heavily on algorithm-driven strategies. Freelancers and independent traders also benefit from the course, as they can build and deploy their own automated systems without relying on manual methods or third-party advisors.

ICFM also provides certification after the successful completion of the algo trading course, making your profile more credible in the financial job market. Whether you want to join a trading firm or start your own algorithmic desk, this course gives you the tools and confidence to take that step forward.

Who Can Enroll In The Algo Trading Course Offered By ICFM Stock Market Institute

The algo trading course at ICFM is open to anyone passionate about markets and willing to learn how to trade using technology. Whether you're a finance graduate, software developer, trader, or student, this course welcomes you without requiring prior coding or trading experience. ICFM begins with the fundamentals and gradually progresses to advanced automation techniques, making the course suitable even for complete beginners.

ICFM believes that financial education should be inclusive and practical. That’s why the algo trading course is taught using real-world examples and simple explanations, ensuring every student understands both the “why” and the “how” behind algorithmic trading. Even non-programmers can succeed in this course thanks to ICFM’s step-by-step instruction and mentorship.

By enrolling in ICFM’s algo trading course, you will acquire future-ready skills that not only enhance your market edge but also help you stay relevant in the fast-changing trading world.

Join ICFM’s Algo Trading Course And Automate Your Way To Financial Market Success

Algorithmic trading is no longer a luxury for big institutions—it’s now a powerful tool available to anyone willing to learn. The algo trading course by ICFM – Stock Market Institute, Delhi, makes algorithmic trading simple, effective, and practical for learners of all backgrounds. With a focus on technology, strategy, and real-time execution, ICFM empowers you to become a confident and independent algorithmic trader.

Whether you’re tired of emotional trading, want to trade faster, or simply want to gain an edge in the market, the algo trading course gives you the structure and tools to do it efficiently. With expert guidance, access to trading platforms, and live case studies, you’re not just learning—you’re building a trading system that works.

Enroll today in ICFM’s algo trading course and be part of the future of stock market trading. Build your strategy, automate your trades, and achieve financial freedom with one of India’s best stock market institutes.

Read more: https://www.icfmindia.com/blog/nse-stock-market-course-secrets-how-to-learn-succeed-grow-in-indias-share-market

Read more: https://www.icfmindia.com/blog/stock-market-courses-in-delhi-online-free-get-ahead-without-spending-a-rupee

0 notes

Text

Trading Chart Patterns PDF Guide & Algo Tools

Mastering Market Moves: The Ultimate Guide to Trading Chart Patterns Book PDF

Introduction

Have you ever looked at a stock chart and thought, “What am I even looking at?” You’re not alone! Deciphering those zig-zagging lines can feel like trying to read an alien language. But what if I told you that those shapes — those patterns — actually tell a story? And once you understand that story, you could make smarter trading decisions. That’s where a trading chart patterns book PDF becomes your secret weapon.

In this article, we'll break down trading chart patterns in a friendly, no-nonsense way. We'll also explore how combining this knowledge with algorithmic trading software — especially the best algo trading software in India — can supercharge your trading game.

Download the best trading chart patterns book PDF. Learn how chart patterns, algorithmic trading software, and the best algo trading software in India help you win.

What Are Trading Chart Patterns?

Think of chart patterns like footprints in the snow. They show you where traders have been — and sometimes where they might go next. A chart pattern is just a visual formation on a price chart that helps traders make predictions. Whether it’s a triangle, a head and shoulders, or a double bottom — these shapes can signal buying or selling opportunities.

Why Use a Trading Chart Patterns Book PDF?

Let’s be real — the internet is loaded with scattered info. But a trading chart patterns book PDF puts everything in one place. It’s your go-to guide, available offline, structured, and perfect for both beginners and seasoned traders. Plus, you can refer to it anytime — even during a coffee break.

The 3 Main Types of Chart Patterns

Just like in movies, there are three main types of chart patterns:

Reversal Patterns: These hint that the trend is about to change.

Continuation Patterns: These suggest the trend will likely continue.

Bilateral Patterns: They could go either way — like a cliffhanger ending.

Understanding these gives you the power to react smartly, not emotionally.

Top Reversal Patterns Explained

Reversal patterns are like plot twists. They tell you the story is changing.

Head and Shoulders: Think of it like a person slumping. It often signals a shift from up to downtrend.

Double Top and Bottom: These patterns look like the letter ‘M’ or ‘W’. They scream, “Change is coming!”

Learning to spot these can save you from a bad trade — or help you enter just in time.

Key Continuation Patterns You Should Know

Continuation patterns keep the story flowing in the same direction.

Triangles (Ascending, Descending, Symmetrical): Imagine price compressing like a spring — ready to break out.

Flags and Pennants: These are like pit stops in a rally. The price pauses, then zooms off again.

Master these, and you’ll catch trends before others even notice.

How to Read Patterns Like a Pro

Reading chart patterns is part art, part science. Here’s how to get good at it:

Use candlestick charts for clarity.

Watch volume — it tells you how strong a move is.

Use support and resistance lines like guardrails.

It’s like learning to read music — confusing at first, but magical once you get it.

Common Mistakes Traders Make

Even the best traders mess up. Here are common traps:

Forcing patterns: If it doesn’t fit, don’t force it.

Ignoring volume: Patterns without strong volume are weak.

Overtrading: Don’t jump into every “almost” pattern.

Remember: Quality over quantity wins the game.

Best Resources for Chart Pattern PDFs

Here are some great places to find your next trading chart patterns book PDF:

Chart Patterns & Technical Indicators by Edward Dobson

Technical Analysis of the Financial Markets by John Murphy

Online libraries like Scribd, Academia, and even Reddit threads

Official broker platforms often offer free downloads

Just make sure you pick one with charts and examples, not just theory.

How Algorithmic Trading Software Helps

This is where things get exciting. Algorithmic trading software uses computer code to place trades. It can recognize patterns faster than any human. When you combine this with your knowledge of chart patterns, you’ve got a winning formula.

It’s like pairing Sherlock Holmes (your pattern spotting) with Watson (your algo software). Together, unbeatable!

Best Algo Trading Software in India

If you’re in India, here are some top-rated options:

Quanttrix – Known for speed and user-friendly interface.

Zerodha Streak – Drag-and-drop logic for non-coders.

AlgoTrader India – Offers institutional-grade automation.

Each has features like backtesting, live execution, and real-time analysis — ideal for traders who want results.

Using Chart Patterns in Algorithmic Strategies

Good algorithmic traders don’t just rely on numbers. They bake in pattern recognition rules:

Code to detect head and shoulders

Alerts for double tops

Algorithms that track breakout triangles

These strategies can be coded in platforms like MetaTrader, Python scripts, or even Streak.

Getting Started With a Chart Pattern Book

Here’s how to start:

Download a recommended trading chart patterns book PDF.

Start with 3-5 basic patterns.

Print a cheat sheet.

Look at real charts daily.

Journal what you see.

Consistency is key — don’t expect overnight success.

Tips to Practice Pattern Recognition

Think of pattern spotting like facial recognition. The more faces (charts) you see, the better you get.

Use trading simulators

Join trader communities

Quiz yourself using historical charts

Mark up charts manually

This hands-on practice boosts your confidence and instincts.

Mobile Apps & Tools for Chart Learning

Want to learn on the go? Try these:

TradingView: Mobile-friendly and packed with features.

Investing.com App: Clean charts and lots of news.

ChartSchool by StockCharts: A mini chart encyclopedia.

These help reinforce what you read in your chart pattern PDF.

Final Thoughts

Trading isn’t magic — it’s mastery. Understanding chart patterns gives you a serious edge. And when paired with powerful algorithmic trading software, especially the best algo trading software in India, you can turn insights into intelligent action.

So go ahead. Download that trading chart patterns book PDF, open up a demo account, and start seeing the market with new eyes. The journey from confusion to clarity starts with one pattern.

FAQs

What is the best trading chart patterns book PDF for beginners? “Technical Analysis for Dummies” and “Chart Patterns Explained” are great PDFs for those starting out.

Can I use chart patterns with algorithmic trading software? Yes! Many algorithmic tools allow you to code or automate pattern recognition and trading rules.

Which is the best algo trading software in India? Quanttrix and Zerodha Streak are widely recommended due to their user-friendly tools and performance.

Are trading chart patterns reliable for predicting markets? They’re not perfect, but when combined with volume and confirmation signals, they greatly improve your odds.

Where can I practice chart pattern recognition for free? Websites like TradingView and platforms like MetaTrader offer free tools and demo accounts.

0 notes

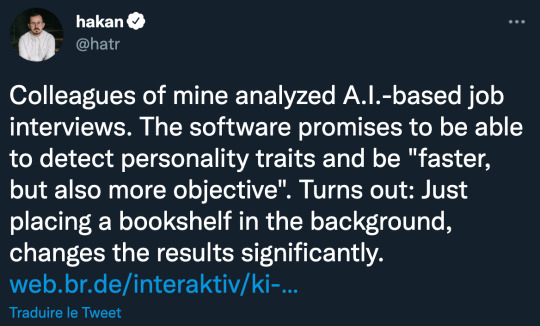

Photo

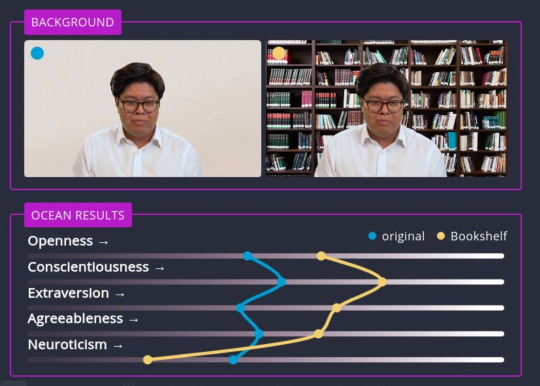

I'm studying for my masters in computer science right now, and this is exactly why we should all be wary of machine learning. Algorithms made with machine learning can be hard to analyze and require a lot of skill and understanding of math and statistics to ensure your model works like you think it does.

Incidentally, I'd guess in this case the model was overtrained, which is where you spend too much time tuning your model to sample data so much so that the model picks up not just the signal but also the noise:

In this graph, a human can easily see that the data is roughly linear (black line) with some noise. However a machine learning algorithm when overtrained will try and precisely hit each individual data point, resulting in a model that technically is more "accurate" to the test data set but likely misses the point of the underlying behavior of the system being modeled.

My guess would be that the job interview model was trained on a limited data set, and their examples of "good" interviewees were more likely to have bookshelves behind them. A good model would discard that, but an overtrained/overfit model will pick up on it even though in the real world there is little correlation.

But all of this points to a bigger problem, which is that this company decided to release this piece of software with this glaring defect. This is a big problem in machine learning because, unlike traditional computer programs, there is no source code to look at! A ML algorithm consists of a network of connections and weights that is very hard for a human to analyze. The only real way to check what a ML algo does is to test it, and that means you need to have lots of data points and take time checking your work, which in the messed up "move fast and break things" world of startups is rarely tolerated.

This is why publicly funded research is so important, companies are going to keep applying machine learning (barring regulation) so the best thing for society is if at least there's somebody holding these algorithms accountable. This story is horrifying, but it's very very good that it was caught. Think about how many biased algorithms are out there not being caught because nobody's checked yet!

@hatr @fasterthanlime

102K notes

·

View notes

Text

Complete Guide to Moving Averages: Mastering Trends and Strategies

Moving averages (MAs) are essential tools for traders, analysts, and data enthusiasts. They help identify trends, smooth data, and guide decision-making in real-world scenarios like the stock market. This comprehensive guide explores moving averages, their types, applications, and strategic use cases, with real-world examples from the Indian stock market. Whether you're a beginner or a seasoned trader, you’ll find actionable insights here.

What Are Moving Averages? A Beginner’s Overview

Moving averages are statistical calculations that smooth data over a specific time period, making it easier to identify trends. For example, in stock trading, they average prices over days, weeks, or months to highlight trends and reduce noise.

Real-World Example: Indian Stock Market

The NIFTY 50 index frequently utilizes moving averages to signal potential trends. For instance, when NIFTY's price crosses its 50-day moving average, it often indicates bullish momentum.

Key Insights

Purpose: Identify trends and reduce volatility.

Simple Example: Calculating the average price of a stock for the last 7 days to predict future movement.

Why Are Moving Averages a Key Tool in Technical Analysis?

Moving averages are indispensable in technical analysis because they provide clarity in a chaotic market.

Why Traders Love Moving Averages

Trend Identification: Separate uptrends from downtrends.

Support & Resistance: Highlight levels where prices might reverse.

Actionable Signals: Help confirm buy/sell decisions.

Case Study: Reliance Industries

In 2023, traders observed Reliance's price bouncing off its 200-day moving average multiple times, reaffirming it as a support level.

Pro Tip

Combine moving averages with tools like Strike.Money, which simplifies trading by providing actionable signals based on technical indicators.

Exploring the Different Types of Moving Averages

1. Simple Moving Average (SMA)

SMA is the arithmetic mean of prices over a specific period. It’s easy to calculate and interpret.

Example

For TCS stock, if the closing prices over 5 days are ₹3200, ₹3220, ₹3190, ₹3210, and ₹3230, the 5-day SMA = (3200+3220+3190+3210+3230)/5 = ₹3210.

Pros: Simple and effective for stable trends.

Cons: Slow to respond to sudden price changes.

2. Exponential Moving Average (EMA)

EMA gives more weight to recent prices, making it more responsive to price changes.

Use Case: Swing Trading with HDFC Bank

Swing traders often use the 9-day EMA to capture short-term price movements in HDFC Bank stock. When the stock price crosses above the EMA, it signals a potential upward swing.

Pros: Reacts faster to price changes.

Cons: More prone to false signals.

3. Weighted Moving Average (WMA)

WMA assigns even greater weight to recent data than EMA.

Application

WMA is often used in algorithmic trading for securities like Infosys, where precision is crucial.

Pros: Highly accurate for short-term analysis.

Cons: Complex to calculate.

How to Use Moving Averages in Stock Trading Strategies

1. Crossover Strategy

The golden cross (short-term MA crossing above long-term MA) indicates a bullish signal, while the death cross signals bearishness.

Example: Maruti Suzuki

In March 2023, Maruti Suzuki's 50-day MA crossed its 200-day MA, signaling a golden cross that preceded a 15% price increase.

2. Support and Resistance Levels

Moving averages often act as support or resistance levels.

Example: Tata Motors

Tata Motors’ stock repeatedly found support at its 100-day MA during 2022, signaling buying opportunities.

3. Combining MAs with Other Indicators

Pairing moving averages with indicators like the Moving Average Convergence Divergence (MACD) enhances decision-making.

Moving Averages in Algorithmic and Quantitative Trading

Role in Algorithmic Trading

In algo trading, MAs are used to create automated strategies. Tools like Strike.Money simplify this by offering pre-built algorithms based on moving averages.

Example

A Python script calculates the 50-day and 200-day SMA for Infosys stock, triggering a buy signal during a golden cross.

Optimizing MAs for Algo Trading

Short-Term (5–10 days): Best for scalpers.

Medium-Term (20–50 days): Ideal for swing traders.

Long-Term (100+ days): Suitable for investors.

Avoid These Common Mistakes When Using Moving Averages

Ignoring Lag: Longer MAs are slower to react.

Overfitting: Relying on too many MAs can confuse signals.

Misinterpreting False Signals: Price may briefly cross an MA without indicating a trend.

Applications of Moving Averages Outside the Stock Market

Economic Forecasting

Economists use MAs to analyze GDP growth trends and inflation data.

Example

India's Consumer Price Index (CPI) often uses MAs to forecast inflation rates.

Weather and Climate Analysis

Meteorologists use MAs to study temperature patterns, such as the monsoon trends in India.

Emerging Research

Recent studies suggest that combining MAs with AI models improves predictive accuracy in financial markets.

Best Tools and Resources for Mastering Moving Averages

Trading Platforms:

Strike.Money: Offers robust moving average-based trading tools.

TradingView: Comprehensive charting features.

Calculators and Scripts:

Online SMA and EMA calculators.

Python libraries like pandas for custom strategies.

Educational Resources:

Books: Technical Analysis of the Financial Markets by John Murphy.

Courses: Online classes on Coursera or Udemy.

Mastering Moving Averages: Final Thoughts and Next Steps

Moving averages are powerful, versatile tools that simplify trend analysis. Whether you're analyzing NIFTY 50, Reliance, or TCS, mastering MAs will elevate your trading game.

Start experimenting with moving averages today using tools like Strike.Money, and combine them with other indicators for optimal results. Remember, practice and continuous learning are key to success in trading.

0 notes

Text

Merits of Using an Algo Trading Bot- Master Bot from the Trading Master

In recent years, trading bots have become increasingly popular in the world of finance. These bots use complex algorithms to analyze market data and make trades automatically, without the need for human intervention. Whether you’re a beginner looking to get into stock trading or an experienced investor, Trading Master’s state-of-the-art AI trading bot India Master Bot, which has been gaining attention for its advanced capabilities and impressive results, could be just what you need. With its advanced artificial intelligence and machine learning algorithms, it can give users amazing insights into ongoing trends in the markets and help them make smart decisions about their investments. It keeps track of various indicators such as price movement, volume changes and Sentiment analysis throughout 24/7 financial exchanges station so that traders can easily analyze potential opportunities more efficiently than any human trader possibly could.

The Trading Master AI Trading Bot — Masterbot is an automated trading system that uses artificial intelligence and machine learning algorithms to analyze market trends and make trades, you provide some basic information regarding your portfolio (risk tolerance level, investment style etc.) and goals when setting up your account with Trading Master AI. From then on, the system monitors real-time market data along with news stories so that it can understand patterns better. Master Bot then uses these ‘patterns’ to identify potential opportunities in terms of buying stocks at good prices as well as selling stocks before they potentially start falling. It was developed by a team of experienced traders and data scientists who have combined their expertise to create a powerful tool that can potentially deliver consistent profits.

Additionally, this system can be completely customized with different parameters such as settings on time frame analysis (from 1-minute charts up to daily) along with other internal settings that most human investors overlook which you are allowed yourself have access to so you remain aware at all times what positions are opened by the algorithmic program in order to minimize losses when conditions change sharply during volatile sessions within the day.

Master Bot — the best trading bot software in India, uses a variety of technical indicators, such as moving averages and Bollinger bands, to analyze market data and identify profitable trading opportunities. It also has features such as automated stop loss settings which helps protect users from any major losses if things don’t go according to plan.

One of the key features of the Trading Master Stock Trading bot, the best automated trading bot is its ability to trade on multiple markets simultaneously. It can monitor and analyze data from a wide range of financial instruments, including stocks, forex, and cryptocurrencies, and make trades based on market conditions.

Another notable feature of the Trading Master AI Trading Bot India , the best trading bot software is its user-friendly interface. Even traders who are new to automated trading systems can easily set up and customize the bot to meet their specific trading needs. The bot also offers real-time performance tracking and analysis, allowing traders to monitor their profits and adjust their strategies as needed. In addition, Master Bot offers automated order execution options which are based on preset rules or signals established by the user. This allows perfect implementation of entry & exit strategies even when you don’t have time available due to having multiple jobs or family obligations. These automatic settings minimize the risk involved during volatile times like Brexit etc., by managing stop loss orders automatically if an unexpected situation arises.