#algorithmic trading

Explore tagged Tumblr posts

Text

UAITrading (Unstoppable AI Trading): AI-Powered Trading for Stocks, Forex, and Crypto

https://uaitrading.ai/ UAITrading For On trading volumes offers, many free trade analysis tools and pending bonuses | Unstoppable AI Trading (Uaitrading) is a platform that integrates advanced artificial intelligence (AI) technologies to enhance trading strategies across various financial markets, including stocks, forex, and cryptocurrencies. By leveraging AI, the platform aims to provide real-time asset monitoring, automated portfolio management, and optimized trade execution, thereby simplifying the investment process for users.

One of the innovative features of Unstoppable AI Trading is its UAI token farming, which offers users opportunities to earn additional income through decentralized finance (DeFi) mechanisms. This approach allows traders to diversify their investment strategies and potentially increase returns by participating in token farming activities.

The platform's AI-driven systems are designed to analyze vast amounts of market data, identify profitable trading opportunities, and execute trades without human intervention. This automation not only enhances efficiency but also reduces the emotional biases that often affect human traders, leading to more consistent and objective trading decisions.

By harnessing the power of AI, Unstoppable AI Trading aims to empower both novice and experienced traders to navigate the complexities of financial markets more effectively, offering tools and strategies that adapt to dynamic market conditions

#Uaitrading#AI Trading#Automated Trading#Forex Trading AI#Crypto Trading Bot#UAI Token#Token Farming#Decentralized Finance (DeFi)#AI Investment Platform#Smart Trading Algorithms#AI Stock Trading#Machine Learning in Trading#AI-Powered Portfolio Management#Algorithmic Trading#Uaitrading AI Trading#Forex AI#Smart Trading#Stock Market#AI Investing#Machine Learning Trading#Trading Bot#Crypto AI#DeFi#UAI#Crypto Investing

2 notes

·

View notes

Text

DeepSeek AI Can Enhance Algo Trading and Option Trading Strategies.

DeepSeek AI - Algo Trading

DeepSeek AI is a low - cost advanced chatbot. DeepSeek AI can excel in many areas of technology and business, one of these areas is Algo Trading and Option Trading.

Read more..

#Algo Trading#DeepSeek V3#DeepSeek AI#DeepSeek R1#Algorithmic Trading#bigul#ipo price band#algo trading app#algo trading india#algo trading platform#algo trading strategies#algorithm software for trading#bigul algo#finance#free algo trading software#best algo trading app in india#AI#algorithm#algo trading software india#algorithmictradingsoftware#investment#Investment Platform#Investment Platform in India#Best share trading app in India#trading with algo#algorithmic trading software free#best algorithmic trading software#bigul algo trading#best online trading platforms#bigul algo trading review

4 notes

·

View notes

Text

Riding the Digital Wave: Algorithmic Trading in India

Brief Introduction :-

Algorithmic Trading in India has emerged as a transformative force, leveraging advanced algorithms and cutting-edge technology to revolutionize financial markets. It uses intricate mathematical models to execute trades at blazing speed, giving traders speed and accuracy. We investigate available resources, negotiate regulatory frameworks, and look forward to the bright future of algorithmic trading in this ever-changing scene, which is revolutionizing our understanding of and interactions with finance in the Indian market.

History of Algorithmic Trading in India :-

In India, algorithmic trading began in the early 2000s and gained popularity when computerised trading platforms were introduced. An important turning point was the transition from conventional floor trading to screen-based systems, which set the stage for algorithmic trading techniques. Edelweiss Financial Services was a trailblazing organisation in this regard, having adopted algorithmic trading due to its effectiveness and speed, particularly when it came to processing big orders. As technology evolved, financial institutions in India followed suit, with the advent of Direct Market Access (DMA) further quickening the adoption and enabling traders to directly communicate with exchanges. The market has grown increasingly sophisticated over time as a result of Indian companies using artificial intelligence and creating their own proprietary algorithms. Algorithmic trading is currently a major participant in the financial ecosystem in India.The market has grown increasingly sophisticated over time as a result of Indian companies using artificial intelligence and creating their own proprietary algorithms. Algorithmic trading is becoming a major force in India's financial sector, changing the nature of the market and providing new opportunities for both investors and traders.

What is HFT?

High-frequency trading, or HFT for short, is a type of algorithmic trading that uses sophisticated algorithms to execute a large number of orders at speeds never seen before in the financial industry. HFT has emerged as a major force in the Indian financial scene, using cutting-edge technology to take advantage of tiny price differences and inefficiencies in the market. HFT seeks to take advantage of momentary opportunities by analysing data quickly and acting quickly, improving market efficiency and liquidity. Its function is scrutinised, too, and this has sparked debates about how it affects market stability and the necessity of regulatory regimes.

Regulations for Algorithmic Trading in India :-

The Securities and Exchange Board of India oversees algorithmic trading in India (SEBI). The "Algorithmic Trading Framework," a set of recommendations published by SEBI in 2011, was designed to guarantee equitable and transparent market operations. To protect against systemic risks associated with algorithmic trading and to promote market integrity, the laws include requirements for the use of "unique client codes" to track individual trades, risk controls, and order-to-trade ratio limitations.

Skills Required for Algorithmic Trading :-

Econometrics is a tool used in algorithmic trading to model and analyse economic data, offering insights into market movements and possible trading opportunities.

Programming abilities are necessary for developing and putting trading algorithms into practice, which allows for the automation and quick execution of strategies in volatile market environments.

Quantitative analysis: Used to assess market dynamics and financial instruments, enabling traders to spot trends and create data-driven algorithmic trading methods.

Probability and statistics are used to evaluate the chance of market events, which helps with risk management and the development of algorithms that adapt to shifting market conditions.

Proficiency in Financial Markets and Trading: Essential for comprehending market subtleties, allowing traders to create algorithms that conform to current market structures and circumstances.

The ability to reason logically is essential for creating algorithmic trading strategies with clear rules and logic that enable methodical decision-making in the face of changing market conditions.

Conclusion and Future Scope :-

In summary, algorithmic trading has improved market efficiency and opened up new trading opportunities for traders, dramatically changing the Indian financial scene. As the sector continues to be shaped by technological breakthroughs, machine learning, and regulatory frameworks, the future prospects are bright. Algorithmic trading is expected to become increasingly prevalent and play a crucial part in the future of India's financial markets, which are active and growing at a quick pace.

5 notes

·

View notes

Text

Integrated margin calculators are undoubtedly a robust and powerful computational tool that can significantly benefit algo traders. These calculators can precisely determine margin requirements by analysing an asset's volatility, leverage, position size, and market conditions.

2 notes

·

View notes

Text

As algorithmic trading becomes more mainstream in India’s financial markets, regulatory oversight has evolved to keep pace. Recently, the Securities and Exchange Board of India (SEBI) has introduced a fresh set of regulatory measures aimed at promoting a more secure, transparent, and equitable trading environment for all market participants.

0 notes

Text

Definedge: Empowering Algo Strategies & Intelligent Trading

Definedge Securities offers a holistic platform for traders and investors, extending beyond traditional brokerage. Our robust ecosystem supports various algorithmic trading approaches, whether you're a tech-savvy individual using APIs or seeking sophisticated Black/White Box solutions. We provide cutting-edge tools, in-depth research, and comprehensive education to help you develop, backtest, and execute your algo strategies effectively across NSE, F&O, BSE, MCX, and CDS. Open a Demat account and gain FREE, real-time access to our advanced resources, enabling smarter, data-driven trading and investing decisions.

0 notes

Text

NSE Sets Up Framework To Monitor Retail Algos, Empanel Providers For Investor Safety

Last Updated:July 24, 2025, 14:20 IST The National Stock Exchange (NSE) has released comprehensive operational guidelines for the empanelment of algo providers NSE will be maintaining an updated list of all the registered algo providers on its website The National Stock Exchange (NSE) has released comprehensive operational guidelines for the empanelment of algo providers and registration of…

#algo ID#algo providers#algo strategy registration#algorithmic trading#automated trading#broker responsibility#Client Direct API#empanelment of algo vendors#investor protection#market regulation#NSE#NSE circular#NSE norms#PAN disclosure#retail algo trading#retail investors#SEBI rules#Stock Exchange#trading members#UCC

0 notes

Text

Unleash 5 HFT Secrets: Retail Traders' Ultimate Guide to High-Frequency Trading Domination!

Unleash 5 HFT Secrets: Retail Traders’ Ultimate Guide to High-Frequency Trading Domination! Unleash 5 HFT Secrets: Retail Traders’ Ultimate Guide to High-Frequency Trading Domination! Hey there, fellow traders! Ever felt like the stock market moves at warp speed, leaving you in the dust? You’re not alone. It’s a common feeling, especially when you hear whispers of “High-Frequency Trading” or…

0 notes

Text

DeepSeek AI vs Algo Trading: Automate Your Stock Trading Strategies

DeepSeek AI is a low cost Artificial intelligence chatbot Integrating DeepSeek AI with Algo Trading can improve the decision making process in stock market.

Read more..

#deepseek ai#open ai#algo trading india#artificial intelligence#open AI#algo trading#algo trading app#algo trading platform#algo trading strategies#algorithm software for trading#bigul#bigul algo#finance#free algo trading software#ai#stock market#share market#share market news#DeepSeek LLM#DeepSeek Coder#Python#Algorithmic Trading#algorithm#algo trading software india#best algo trading app in india#Best share trading app in India#best algorithmic trading software

5 notes

·

View notes

Text

Does Algorithmic Trading Work in 2025?

In today's data-driven markets, the rise of algorithmic trading, or algo trading, has sparked both fascination and skepticism. The burning question many investors ask is, “Does algorithmic trading work?” The short answer is yes—but with important caveats.

Let’s learn more about automated trading.

What Is Algorithmic Trading?

Algorithmic trading refers to using computer programs to automate the process of placing and managing trades. These programs follow defined sets of rules—based on price, volume, timing, or other market data—to execute trades faster and more accurately than a human could.

Evolution of Algo Trading:

1970s: Program trading begins with institutional traders.

2000s: Rise of high-frequency trading (HFT) on Wall Street.

2020s: Widespread access for retail traders through platforms like MetaTrader, QuantConnect, and Alpaca.

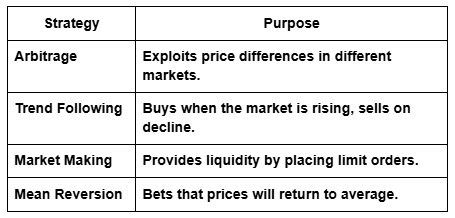

Types of Algorithmic Trading Strategies

Why Algorithmic Trading Appeals to Investors

In February 2025, London Stock Exchange Group highlighted rising algorithmic execution uptake that is rising demand for the sub-milisecond order execution and consistent profit. Besides, some other reasons include:

Speed: Trades are executed in milliseconds.

Objectivity: No emotional decision-making.

Scalability: Multiple markets traded simultaneously.

Backtesting: Strategies tested against historical data.

These advantages have made algo trading a favorite among hedge funds, proprietary firms, and even retail traders with a tech background.

Key Success Factors for Algorithmic Trading

Clean, high-quality data

Thorough backtesting and walk-forward analysis

Understanding market microstructure

Regular optimization and monitoring

Successful traders treat algo development like engineering—not gambling.

Common Misconceptions About Algorithmic Trading

“It’s a money printer” – Not true. Poor strategies lose money fast.

“Set it and forget it” – Markets evolve. Algorithms need updates.

“There’s zero risk” – Flash crashes and bad code can cause disaster.

Who Should Use Algorithmic Trading?

Beginner traders

Tech-Savvy Retail Traders

Institutional Hedge Funds

Data Scientists with Trading Knowledge

If you love data, code, and logic—algo trading could be for you.

Can a beginner do algorithmic trading?

Yes, with algo traders like SureShotFx Algo, beginners can easily get started and trade without any manual input or even with zero trading knowledge.

How much capital do I need?

Retail algo traders can start with $500–$5,000, but institutional-grade systems often need millions.

Is algorithmic trading profitable?

It can be. However, profitability depends on strategy robustness, risk management, and execution quality.

Is Algorithmic Trading Worth It?

Algorithmic trading works—but not for everyone.

If treated seriously, backed by data, and properly maintained, it can be highly effective. But for those hoping for easy, passive profits with zero effort—it will likely disappoint.

0 notes

Text

AI Meets Finance: How Data Science is Revolutionizing the Fintech Industry in 2025

Introduction

The financial world is no longer just numbers on a spreadsheet—it’s a fast-moving ecosystem driven by data, automation, and machine learning. In 2025, data science has become the engine behind fintech innovation. From detecting fraud in milliseconds to automating investment strategies and personalizing banking experiences, data science is transforming the way we save, spend, and invest.

In this blog, let’s explore how data science is shaping the future of fintech and why this synergy is one of the hottest tech trends of the year.

1. Real-Time Fraud Detection

Gone are the days of waiting hours to detect suspicious activity. With real-time data analytics, financial institutions can spot fraud as it happens.

🔹 How it works: Machine learning models analyze transaction patterns and flag anomalies instantly. If something looks off—like an unusual location or spending spike—alerts are triggered immediately.

✅ 2025 Trend: Deep learning combined with behavioral biometrics is enhancing fraud detection accuracy by over 95%.

2. Personalized Banking Experiences

Data science is helping banks tailor their services to individual users. Whether it’s recommending a credit card, offering a loan, or managing your savings goals, AI-driven insights create more meaningful customer experiences.

🔹 Example: AI chatbots trained on customer interaction data can now provide hyper-personalized financial advice 24/7.

3. Robo-Advisors and Smart Investments

Robo-advisors powered by data science use algorithms to manage portfolios based on risk appetite, market trends, and user goals.

🔹 Benefits: Low-cost, automated investment strategies that outperform many human-managed portfolios.

📈 2025 Insight: Generative AI is now being used to simulate multiple economic scenarios for even smarter investment planning.

4. Credit Scoring Reimagined

Traditional credit scores are rigid and often exclude underbanked populations. In 2025, data scientists are redefining credit scoring using alternative data—social behavior, transaction history, and mobile usage.

🔹 Impact: Millions of people without formal credit histories can now access loans and financial services.

5. Predictive Analytics in Lending

Lenders now use predictive analytics to assess loan risk and determine borrower reliability more accurately than ever.

🔹 Example: Models forecast the likelihood of repayment using real-time income, employment patterns, and spending behavior.

💡 Bonus: This reduces default rates and accelerates loan approvals.

6. Algorithmic Trading with AI

In stock markets, milliseconds matter. AI algorithms can analyze market data at lightning speed and execute trades based on complex patterns.

🔹 2025 Trend: Hybrid human-AI trading desks are emerging where analysts work alongside real-time ML models.

7. Blockchain Data Analysis

With the rise of decentralized finance (DeFi), data science tools are being used to analyze blockchain transactions, detect money laundering, and monitor crypto market trends.

🔹 Example: Graph analytics is helping trace illegal wallet activity and prevent crypto scams.

8. Regulatory Technology (RegTech)

Data science is helping financial institutions stay compliant with ever-evolving regulations. By automating compliance checks, reporting, and monitoring, companies save both time and money.

✅ 2025 Insight: NLP models now extract key regulatory updates from documents and integrate them into risk models in real-time.

Conclusion

The fusion of fintech and data science is creating a smarter, faster, and more inclusive financial world. Whether you're a consumer enjoying seamless digital banking or a startup using AI to innovate, data is at the core of it all.

As we move deeper into 2025, one thing is clear: mastering data science isn’t just for techies—it’s essential for anyone shaping the future of finance.

#nschool academy#data science#fintech#ai in finance#machine learning#fraud detection#personalized banking#robo advisors#credit scoring#predictive analytics#algorithmic trading#blockchain analytics#regtech#financial data#smart investing#data driven finance

0 notes

Text

In today’s dynamic financial markets, savvy traders are constantly on the lookout for tools that offer an edge. Algorithmic trading, traditionally seen as complex and reserved for institutional players, has become increasingly accessible. Share India’s Algo Tool is revolutionising this access by providing a powerful suite of pre-built algo strategies. These strategies offer a straightforward path for traders to automate their trading and enhance their market performance.

0 notes

Text

Tired of missing crypto trading opportunities? Learn how to build a Kraken trading bot with Node.js that automates buys and sells 24/7. This step-by-step guide covers everything from setting up Kraken’s API to implementing real-time WebSocket alerts—no more emotional trading or sleepless nights watching charts. Whether you're a developer looking to automate your strategy or a trader seeking an edge, this 2025 tutorial delivers the code and architecture to launch your own algorithmic trading system. Ready to turn market volatility into profits? Let’s dive in!

#Algorithmic trading#Automate Kraken trades#Crypto arbitrage bot#Crypto developer guides#Crypto trading bot#Cryptocurrency automation#Kraken API tutorial#Kraken trading bot#Node.js crypto bot#Node.js trading bot#TechBreeze tutorials#WebSocket trading bot

0 notes

Text

Psychology of Algorithmic Trading – How Emotions Impact Bots

The Psychology of Algorithmic Trading: What Really Goes On in the Mind of a Trader?

Introduction

Algorithmic trading may sound like a world dominated by machines, numbers, and emotionless execution. But the reality? It’s still deeply human. While the algorithms do the heavy lifting—executing trades at lightning speed based on code and logic—behind every trading bot is a human being driven by ambition, fear, greed, and countless other emotions.

Let’s take a stroll into the mental maze of the people behind the machines and understand how psychology shapes algorithmic trading decisions. If you’re thinking this is all math and zero mindset—you’re in for a surprise!

Explore the psychology of algorithmic trading and how human behavior impacts strategy, emotion, and algo trading software price, algorithmic trading software price.

What is Algorithmic Trading?

Algorithmic Trading—often called algo trading—uses computer programs to follow a defined set of rules for placing, modifying, and closing orders. These rules are based on timing, price, quantity, and other mathematical models.

But while the execution may be automated, the creation of those strategies is still very human. Think of it like a self-driving car: you may not touch the wheel, but someone had to design the GPS.

The Role of Emotions in Traditional vs. Algorithmic Trading

In traditional trading, human emotions take the driver's seat. Decisions are often fueled by impulse, panic, or overconfidence. In contrast, algorithmic trading tries to bypass these emotions by relying on pre-set logic.

Yet, here’s the catch: the logic itself is created by humans. The moment a trader adjusts the algorithm due to recent losses or market noise, emotions sneak back in.

Can Algorithms Be Emotionless?

Technically, yes. Algorithms don’t feel—but their creators do. So when emotions influence the design or tweaking of these bots, the algorithms inherit those emotional fingerprints.

Think of an algorithm as a mirror. It reflects whatever mindset it was built with.

The Trader’s Mind Behind the Code

Every piece of algo logic is born from a trader’s mindset. Did the developer just suffer a loss? Are they trying to beat the market aggressively? Are they being too cautious after a recent downturn?

The mental state of the developer affects how conservative or aggressive the rules will be. A confident trader might set looser parameters; a fearful one might over-tighten stop-loss triggers.

Fear and Greed: Invisible Forces

You’ve heard the saying: “Markets are driven by fear and greed.” These two emotions are also the silent puppeteers behind many algorithmic strategies.

A trader trying to maximize gains may write an aggressive strategy, pushing for every pip. Another might build a risk-averse bot, prioritizing preservation over profit—rooted in fear of loss.

Overconfidence and Cognitive Bias in Algo Strategies

Overconfidence can lead developers to believe their system is flawless. They might ignore backtest inconsistencies or dismiss warning signs during live trading.

Biases like confirmation bias (seeing only what you want to see) or recency bias (favoring recent data) can also skew algorithmic decisions. These cognitive traps are human, but they leak into the machine.

Behavioral Finance Meets Technology

Behavioral finance studies how psychology affects investment decisions. When combined with algorithmic trading, this creates a fascinating hybrid:

Emotions inform the algorithm.

The algorithm executes emotionally-rooted logic.

Traders react emotionally to the algorithm's performance.

It’s a feedback loop of psychology and code.

FOMO and the Algorithm

FOMO—Fear of Missing Out—is not just for manual traders. Many algorithmic strategies are triggered by breakouts or volume spikes, which can often be rooted in FOMO behaviors.

A trader might modify the algorithm to enter trades faster or increase size after missing a big move. These decisions are not logic—they're fear disguised as urgency.

Designing for Discipline: Psychology in Coding Logic

Great algo traders know this: the best algorithms are the ones that enforce discipline.

By baking discipline into the code—like max daily losses, cool-off periods, or win/loss ratios—they help counteract emotional overreactions. It’s like building a digital “coach” that keeps you on track.

When Traders Blame the Bot

When trades go wrong, it’s tempting to say: “It’s the bot’s fault!”

But in reality, the algorithm only did what it was told. If it lost money, the real issue may lie in emotional coding, insufficient testing, or rash updates. The responsibility remains human.

The Myth of Fully Automated Decision-Making

Even with automation, decision-making is rarely 100% hands-off. Traders monitor, tweak, and override when needed.

This introduces new psychology: hesitation to intervene, fear of missing an update, or post-loss regret. The bot might trade—but the trader still feels everything.

Managing Risk Through Psychological Awareness

Understanding your psychological tendencies—like revenge trading, fear of loss, or impulsive decision-making—can help design smarter, safer bots.

Think of it as therapy for traders. Self-awareness leads to better algorithm design and risk management.

The Role of Mindfulness and Mental Conditioning

Top algorithmic traders treat their mental fitness like physical fitness.

They practice mindfulness, stay detached from outcomes, and stick to their process. These habits don’t just help in coding—they prevent irrational reactions during drawdowns or unexpected market shifts.

How Algo Trading Software Price Influences Psychology

Algo trading software price isn't just a number—it impacts psychology. A high price might create a “premium confidence bias,” making traders over-rely on the software. Conversely, a cheaper tool might make them hesitant, thinking it's not robust.

But in truth, performance depends more on logic and discipline than price. Still, perception plays a powerful role in decision-making.

Final Thoughts: Trading the Mind First

Ultimately, while machines do the work, humans still drive the outcome.

By understanding the psychology behind algorithmic trading, we don’t just build better bots—we become better traders. Discipline, awareness, and emotional balance will always be as critical as strategy, speed, or the algorithmic trading software price.

FAQs

Can emotions still affect algorithmic trading? Yes, even though algorithms are emotionless, their design and modifications often reflect the emotions of the trader.

Does the price of algo trading software guarantee better results? Not necessarily. While higher-priced software may offer more features, success depends on the trader’s strategy and discipline.

How can traders manage fear in algorithmic trading? Through mindfulness, self-awareness, and building disciplined logic into their algorithms to minimize emotional interference.

Is algorithmic trading fully automated? While execution is automated, human oversight, strategy updates, and emotional reactions still play a role.

What’s the biggest psychological mistake traders make with algorithms? Overconfidence in their bots or constantly tweaking them due to fear or loss can undermine performance.

0 notes

Text

#automated crypto trading#AI trading bots#machine learning#crypto investment strategies#trading automation#risk management#cryptocurrency market#Intellectia.ai#predictive analytics#algorithmic trading

0 notes

Text

Automate Your Trading with Definedge Securities'

Auto Trade EngineStreamline your trading by automating strategies using Definedge Securities' Auto Trade Engine. Integrate with Ultra Scanner, set entry/exit rules, and execute trades without coding knowledge

#Automated Trading#Trading Automation#Definedge Securities#Algorithmic Trading#Ultra Scanner Integration

0 notes