#andrew lapthorne

Explore tagged Tumblr posts

Text

📸 🎥 Paralympics' official YT

The second set became a similar affair to the first set once Sam/Niels became even more dialed in. The first seed then started the game with an early break to 1-0 only to be broken back due to Niels' forehand errors (1-1), which also was continued with a fumbling of Andy/Greg's game point before Greg's wide forehand secured the Dutch pair's break point, followed by Niels' trademark backhand winner to break back again 2-1. Subsequently, even if Sam/Niels held their serves to 3-1, Andy's exquisite forehand finish minimized the gap for the British pair.

Subsequently, Sam/Niels doubled their break lead to 4-1 thanks to their clean groundstrokes, followed by a massive hold to 5-1 once a forehand error was fired too long from Andy/Greg. Niels' utilization of the angles became helpful for them to set up their one-point lead, followed by his slice finish to secure their match point. Ultimately, the Dutch pair also baked the second-set breadstick, thus securing their gold medal in the quad wheelchair doubles sector.

#itf tennis#itf wheelchairs#itf wheelchair tennis#wheelchair tennis#wheelchair tennis at the summer paralympics 2024#wheelchair tennis at the summer paralympics#summer paralympics 2024#summer paralympics#paris 2024#paralympics#sam schroder#niels vink#andrew lapthorne#gregory slade#WatchMoreDOUBLES

5 notes

·

View notes

Text

Mobile navigation 🧭

Just Aidan

Movies:

Reggie Rules | Slate McHale The Sound of People | Father Matterhorn | Theodoro Porcelain | Kevin (Unreleased) Alarm | Mal The Hobbit | Kili The Mortal Instruments: City of Bones | Luke Garroway The Secret Scripture | Jack Conroy Loving Vincent | Boatman The Man Who Killed Hitler and Then the Bigfoot | Young Calvin Barr Love Is Blind | Russell The Way of the Wind | Saint Andrew Paso Doble | Liam Riley Grendel | Unferth

Television:

The Tudors | Bedoli The Clinic | Ruairi McGowan Desperate Romantics | Dante Gabriel Rossetti Being Human | John Mitchell Resonance | TT Hattie | John Schofield And Then There Were None | Philip Lombard Poldark | Ross Poldark Leonardo | Leonardo da Vinci Toast of Tinseltown | Barney The Suspect | Joseph O'Loughlin Fifteen-Love | Glenn Lapthorn Rivals | Declan O’Hara

Theatre:

The Crock of Gold | Pan Drive-by Cyrano | Christian Romeo and Juliet | Paris The Lieutenant of Inishmore | Padraic Lemons, Lemons, Lemons, Lemons, Lemons | Oliver Les Liaisons Dangereuses | Vicomte de Valmont

Audiobook:

The Sandman | Cluracan

Other:

Premieres Interviews Photo shoots Videos Fan art

41 notes

·

View notes

Link

Last week, I published a chart described by its creator as the “most depressing chart ever” for asset managers. Andrew Lapthorne, chief quantitative strategist at Societe Generale SA, pointed out that over the last two years, barely one in five stocks globally have managed to beat the S&P 500.

[...]

Bessembinder has also published some research on the chances of individual stocks beating the S&P, and in the long term it shows that the phenomenon is even more acute. Beating the S&P 500 is the least of their problems. Of the stocks available to buy in and since 1990, 56% of U.S. stocks and 61% of equities in the rest of the world have failed even to beat the return on cash — as represented by the return on one-month Treasury bills. Meanwhile, the top-performing 1.3% of companies accounted for all of the $44.7 trillion in global stock market wealth creation from 1990 to 2018. Outside the US, less than 1% of firms account for $16 trillion in net wealth creation over that period.

The phenomenon dates back even further. For the U.S., Bessembinder and his colleagues looked at how many stocks have beaten T-bills over their lifetime, starting in 1926. They found that four out of every seven common stocks in the Chicago Center for Research in Securities Prices database since 1926 have lifetime buy-and-hold returns less than one-month Treasuries. Put differently, the best-performing 4% of listed companies explained the entire net gain of the U.S. stock market since 1926. All the others between them did no more than match T-bills.

Put in a more technical way, stock pickers faced a classic difficult distribution, with very thick tails — large proportions of their potential investments doing much better or much worse than the mean:

Peter Lynch, the legendary fund manager, used to talk about looking for “ten-baggers” — companies that multiplied 10-fold. This chart shows that was sensible. There are quite a number of ten-baggers to be found, even though they are a tiny proportion of the universe of opportunities. But it isn’t so much that finding a ten-bagger will make you rich. It is more that in the long term, the only way to do significantly better than cash is to find a few ten-baggers.

[...]

Bessembinder’s chart also tells us something about the innate savagery and cruelty of capitalism and creative destruction. Most who get as far as setting up their own company and floating on the markets will fail; the few who win, win big. Many think they see an opportunity, but only a few get to take advantage.

It is a great, polemical book, attacking the lack of competition in contemporary capitalism, and arguing that without competition, capitalism dies. This, it strikes me, is a built-in flaw in the capitalist economic model. In any given environment, all players want to achieve dominance. They can do that by beating the competition, and then enjoying monopoly rents, or colluding with them, and then enjoying monopoly rents. This is the natural incentive. The huge rewards for the few who win ensure that enough people are prepared to play the game.

As the book chronicles, antitrust enforcement has been pathetically weak in recent years. Inequality and all the other ills of contemporary capitalism have risen. But is this a bug that can be fixed with better government regulation, or an inherent flaw? The Bessembinder research suggests that it may well be the latter.

Either way, I suspect the “myth” of capitalism is that it can somehow be counterposed against government regulation, or that there is a choice between markets and governments. Left to their own devices, markets shower rewards on a few winners, and force everyone else out. Greater intervention by governments turns out to be the only way to ensure greater competition. That intervention need not necessarily be so much greater than that of a referee in a game, ensuring that the rules are followed. But without such enforcement, athletes’ competitive energy can turn into an ugly spectacle.

Bloomberg news preparing for Bloomberg’s presidential run. More seriously I guess it’s interesting to compare this to “Triumph of the optimists“

6 notes

·

View notes

Text

Next stock market crash: Shrinking profit growth threatens rally 2020

Next stock market crash: Shrinking profit growth threatens rally 2020

According to Andrew Lapthorne, quantum director of Societe Generale, the profitability gap between the largest and the smallest public company is greatest in at least 30 years.

In a recent release, he explained why this gap is part of a larger "valuation problem" for investors and shared his recommendation to avoid the consequences.

Click here for more BI Prime stories.

The ongoing stock…

View On WordPress

1 note

·

View note

Text

If this is a ‘proper’ bear market, stocks ‘are only at the beginning of the selloff’: SocGen

There’s been a lot of handwringing over the inventory marketplace’s unpleasant end to 2018, however a true bear marketplace would most likely imply a lot more ache is forward for buyers in 2019, in step with knowledge compiled by means of Société Générale. In a Wednesday observe, Andrew Lapthorne, head of quantitative fairness analysis at…

If this is a ‘proper’ bear market, stocks ‘are only at the beginning of the selloff’: SocGen was originally published on Daily Cryptocurrency News

0 notes

Text

Stock exchange crash dangers after COVID-19 vaccine is readily available: SocGen

Investors may be overstating how rapidly an effective COVID-19 vaccine can restore lost financial activity and company incomes, according to Andrew Lapthorne, the international head of quantitative research at Societe Generale.

He states disadvantage dangers are plentiful following the enormous rally that has actually currently occurred.

Click on this link to sign up for our weekly newsletter Investing Insider

Check out Company Expert’s homepage for more stories

Stocks are recuperating from their coronavirus-induced losses so quickly that even numerous of the world’s most significant financiers are being proven wrong.

2 things broadly discuss the speed of the snapback: the federal government’s swift shipment of stimulus to Americans of all income levels, and the consistent development that pharmaceutical business are making towards releasing an efficient vaccine

That 2nd catalyst is why financiers are preparing for a permanent option to the worst global health crisis since the 1918 Spanish influenza. A vaccine would assist reconstruct economic activity that has actually been on ice because the very first quarter, and reverse the fortunes of business that have experienced sharp losses ever since.

But it is possible that a vaccine will not immediately be the silver bullet that Wall Street expects. Andrew Lapthorne, the global head of quantitative research study at Societe Generale, is taking this view with a word of caution on what it means for a stock exchange that has already overshot.

” With questions on the efficiency and broad schedule of vaccines staying, along with the potential effects of the pandemic’s damage to the economy, there may be more downside threat from markets overshooting,” Lapthorne stated in a recent note.

Find Out More: BANK OF AMERICA: Purchase these 7 pharma stocks now as they race to develop COVID-19 treatments and vaccines

His concerns are both market- and vaccine-related.

On the marketplace front, he thinks financiers are taking a premature triumph lap that is out of line with historical recoveries, even after considering that stocks had actually plunged at record-breaking speed. On average, the S&P 500 recuperated by 27%within a year after all 15 drawdowns of a minimum of 30%given that1929 This time around, stocks leapt 45%in four months.

First, he flags that in spite of the almost 200 vaccines under development, there is no warranty that any will be reliable on a huge scale.

Second, there is no warranty that the vaccine will be extensively available.

4th, it will take some time for individuals to unlearn their new pandemic routines and return to pre-COVID behavior even after a vaccine is readily available.

But something is more specific to Lapthorne: Financiers, in their forward-looking nature, have a routine of stating triumph prior to battles are over. And this rally might wind up the history books as another example.

%%.

from Job Search Tips https://jobsearchtips.net/stock-exchange-crash-dangers-after-covid-19-vaccine-is-readily-available-socgen/

0 notes

Text

📸 🎥 Paralympics' official YT

The earliest Paralympics medal matches came from the quad wheelchair doubles, where first seeds Sam Schroder/Niels Vink, who defeated eventual vronze medallist Donald Ramphadi/Lucas Sithole 6-1, 6-1 in the semifinals, and second seeds Andy Lapthorne/Gregory Slade, who also stunned Leandro Pena/Ymanitu Silva 6-1, 7-5 in the previous round. While this could have been a tricky match at their best, the point construction favored the former pair more as they stood out at the end of the match.

Sam/Niels had a slightly nervy start due to a forehand error, but Sam compensated it with a winner before taking the opening game to 1-0. Niels' slice then secured their one-point lead, followed by a working smash to secure their other lead before breaking early to 2-0, then held to 3-0 thanks to Sam's forehand winner to close the rally.

Interestingly, in the next game, Sam/Niels smoothly constructed their third break point before a working backhand from Niels converted it to 4-0. However, Andy/Greg sliced their way to a 2-point lead before breaking back to 4-1 only to be broken back again to 5-1 thanks to the Dutch pair's clean streak. As a result, Sam/Niels earned the opportunity to serve for the first-set breadstick, which they did (6-1) to secure the first set.

#itf tennis#itf wheelchairs#itf wheelchair tennis#wheelchair tennis#wheelchair tennis at the summer paralympics 2024#wheelchair tennis at the summer paralympics#summer paralympics 2024#summer paralympics#paris 2024#paralympics#tennis updates#hot shots#break point#set point#sam schroder#niels vink#andrew lapthorne#gregory slade#WatchMoreDOUBLES

5 notes

·

View notes

Text

Sesto Australian Open per Dylan Alcott

Sesto Australian Open per Dylan Alcott

Dylan Alcott ha sconfitto Andrew Lapthorne in due set Il campione del tennis in carrozzina si aggiudica il sesto titolo consecutivo nell’open di casa

Poca storia tra Alcott e il britannico Lapthorne nella finale del torneo di tennis in carrozzina dell’Australian Open 2020.

L’atleta di casa, già vincitore nelle cinque passate stagioni, ha imposto il suo gioco e si è portato a casa il trofeo con un…

View On WordPress

0 notes

Text

In 2019 Dylan won the Aus Open, French Open, and Wimbledon. Lost US Open to Andrew Lapthorne, who he is currently playing.

0 notes

Text

警訊!美股頻刷高 但去年上市美企近4成虧損

美股頻創新高,特斯拉股價更在三個月間翻倍。但是令人震驚的是,企業股價狂飆之際,美國上市企業有將近40%賠錢,比例創網路泡沫以來新高。

華爾街日報、ZeroHedge報導,過去12個月來,美國上市公司有將近40%呈現虧損,不計經濟衰退後時期,此一比例為1990年代末期來新高。虧錢公司中,特斯拉是投資人的最愛,儘管該公司最近一季賺錢,整體而言,過去12個月仍為赤字。但是特斯拉市值已經超過900億美元,高於福特(Ford)和通用汽車(General Motors)總和。

不只如此,法興的量化研究全球主管Andrew Lapthorne指出,2019年美國上市公司中,連續三年虧錢的企業,比例也創1990年代後期有紀錄以來新高。投資人對虧損的容忍度大增,從新上市公司可見端倪。佛州大學財經教授Jay Ritter研究稱,去年IPO(股票首次公開發行)的公司,有3/4為賠錢業者。

哪個產業的虧損公…

View On WordPress

0 notes

Text

"The worst may not be over yet": Why a Wall Street analyst fears the market rally 2020

"The worst may not be over yet": Why a Wall Street analyst fears the market rally 2020

OHANNES EISELE / AFP / Getty Images

Societe Generale analysts are concerned about the recovery of the market from the 23 March lows.

"The fluctuating cyclical performance and the continuation of momentum show the fragility of the underlying impending economic recovery," wrote analysts led by Andrew Lapthorne in a release on May 28.

This could suggest that the worst in the markets may not be…

View On WordPress

0 notes

Text

Wheelchair tennis • Dylan Alcott • Wimbledon • Andrew Lapthorne

http://dlvr.it/R8Lsbr

0 notes

Text

Es geht erst los: SocGen-Analysten erwarten Einbruch von 50 Prozent an den Märkten

Ich habe Andrew Lapthorne von der Societe Generale vor einigen Jahren am Rande einer Konferenz kennengelernt und halte ihn für einen brillanten Analysten. Wenig verwunderlich, dass er mit Albert Edwards zusammenarbeitet und mindestens genauso skeptisch ist. Leider bin ich nicht auf deren E-Mail-Verteiler und muss mich deshalb auf Zweitquellen wie Zero Hedge verlassen. So auch heute, […] http://dlvr.it/Qwk4Fw

0 notes

Text

Stock exchange crash: 1929 depression parallel points to slow recovery

Since the market’s bottom in March, cyclicals have mainly underperformed the more comprehensive market and are indicating to Societe Generale strategists that the healing is not as airtight as the rally indicates.

Click here to sign up for our weekly newsletter Investing Expert

Click here for more BI Prime stories

Stock-market investors got two doses of reality recently that disrupted an apparently unstoppable rally.

They came via cautions of a extended financial recovery from the Federal Reserve chairman, and an increase in new coronavirus infections and hospitalizations in states that are reopening their economies. The newsflow culminated in the S&P 500 recording its longest day-to-day losing streak because the thick of the crash in March.

This short sell-off regardless of, financiers have been facing the concern of whether the market’s roaring return from its 33?crease was too far ahead of financial reality. Quantitative strategists at Societe Generale dove into history to come up with an answer– and what they found is yet another gut check for the bulls.

The group led by Andrew Lapthorne analyzed the market crash of 1929 that preceded the Great Depression, as well as the one that followed in1932 Their aims were to find how the market advanced from its bear-market bottoms, how those compare to the 2020 rally, and what the outcomes suggest about the months ahead.

Cyclicals fell more than 35%in the first year after the 1929 market bottom. The broader market ripped nearly 50%in the first four months from the bottom.

The contrasting patterns in cyclicals are displayed in the chart below.

.

Societe Generale.

He included that continued gains in cyclicals would be an encouraging signal for the strength of the recovery.

.

Societe Generale.

Lapthorne noted that other equity aspects which traditionally pattern in particular methods followed the messages cyclicals sent out in 1929 and1932

The size factor– which includes a strategy of purchasing small-cap stocks and offering large-cap– fell by as much as 40%from its trough in 1929 however blew up 250%within two years after 1932.

Small caps resemble cyclicals in that they are likewise sensitive to economic growth. And in 2020, they largely lagged the more comprehensive market from the March low till mid-May.

Put together, the recent gains for small-cap and cyclical stocks in 2020 might be analyzed as strong, forward-looking signals of the economy’s v-shaped rebound. And on some level, it’s not worth fighting the broader uptrend.

But Lapthorne is erring on the side of caution before leaping to any firm conclusions. After all, the economy is still in economic crisis, customer demand has not recuperated, and there’s a weight of unpredictability about the pandemic’s future. All these danger factors were mostly avoided by financiers up until last week.

Read more:

MORGAN STANLEY: The stock market is entering a brand-new stage of a playbook that’s flourished in past recessions.

Baillie Gifford cashed in on Amazon and Tesla before the large bulk of financiers. A 33- year partner at the firm breaks down a danger that frightens him more than the pandemic– and information 3 stocks he’s buying for the new age.

%%.

from Job Search Tips https://jobsearchtips.net/stock-exchange-crash-1929-depression-parallel-points-to-slow-recovery/

0 notes

Text

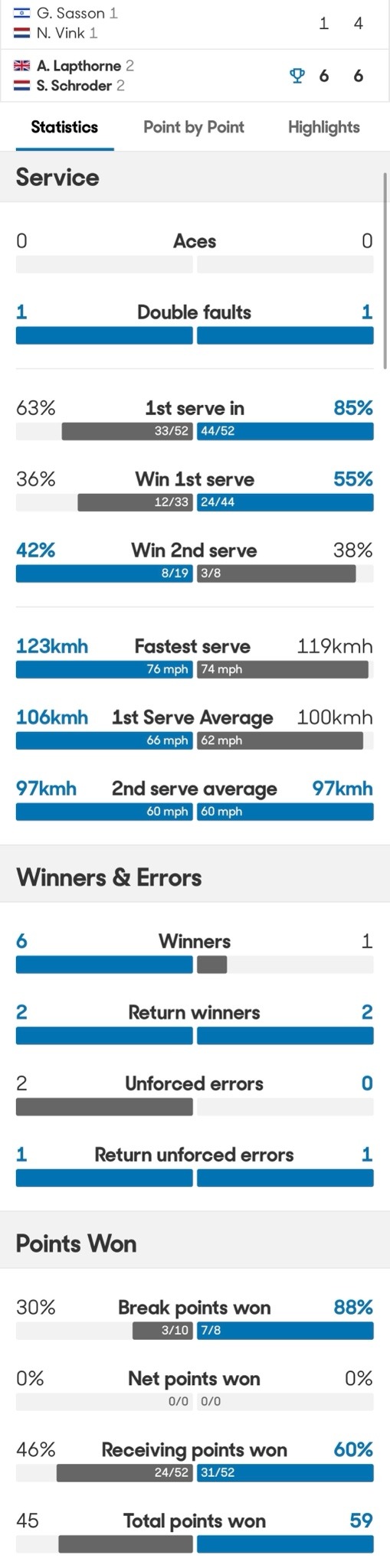

AO QWD F: Andy Lapthorne/Sam Schroder [2] def. Guy Sasson/Niels Vink 6-1, 6-4 Match Stats

📸 AO official app

Guy/Niels' slow start from the first set cost them the setup, where Sam/Andy's balance struck through. The latter's ability to nail the crucial points also allowed them to come through the second set even though the second seeds had the momentum earlier on thanks to their aggressive play, but they could not sustain it. As a result of this error-prone game, the first seeds converted 88% of their break points even though Guy/Niels generated 10 break points, even scoring 6 shot winners along the way.

Besides, it was an excellent serving day for the second seeds. Even though both players did not score an ace, Sam/Andy landed 85% of their first serves, winning 55% of their first serve points as they control the flow. However, the first seeds turned out to have the slight edge on their second serves by 4%, winning 42% of their second serve points thanks to their step-up attempts in the second set.

This marked Sam/Andy's first Grand Slam-level title as a pair, considering Sam and Niels' split by the end of the season as both pairs had intriguing start of the year. To add, Sam also won the quad wheelchair singles title in a very competitive showing as he defeated Niels 7-6(7), 7-5 in the finals to win his fourth consecutive Australian Open title in quad singles. With this, the possibility of the Big 3-4 in quad wheelchair singles continues as the standing singles went into its own chaos era.

#itf tennis#itf wheelchairs#itf wheelchair tennis#wheelchair tennis#grand slam#australian open#australian open 2025#tennis updates#match stats#guy sasson#niels vink#sam schroder#andrew lapthorne#WatchMoreDOUBLES

0 notes

Text

Trader: The US Has A "Grotesque" Debt Problem

http://earthsfinalcountdown.com/wp/?p=86014

The last time SocGen strategist Andrew Lapthorne commented on the extent of the massive US debt problem, was back in November when the outspoken analyst didn't hold back as usual, emphasizing "risks associated with highly leveraged US companies, particularly among the smaller capitalisation names"

Zero Hedge

0 notes