#automatic payment api

Explore tagged Tumblr posts

Text

API Recurring Payments

API recurring payments simplify and automate billing for businesses, ensuring timely, hassle-free collection of recurring revenue.

0 notes

Text

SMM Panel India - YoYo Media

In a busy environment of social media marketing, having a stable and Cheapest SMM Panel India may be a business changer to companies, influencers or even resellers. Hello and welcome to YoYo media, the number one company to go to in regards to the best and cheap SMM Panel services. Need to increase likes on Instagram, views on YouTube, likes on Facebook or followers on Tik Tok? YoYo Media has got you covered; all services are available roof.

Visit us at yoyomedia.in to explore our full range of SMM Panel services tailored for the Indian and international markets.

Why Choose YoYo Media as the Cheapest SMM Panel in India?

We know that not all of us have a huge budget to use up on digital marketing at YoYo Media. This is why we have developed a platform which is affordable, consistent and very affordable. So, what makes YoYo Media the Best SMM Panel in India used by thousands of users?

Low Prices: We offer the services at the most minimum price and therefore we are ranked as the Cheapest SMM Panel in the nation.

Big variety of services: Likes, followers, shares and views on Instagram, Facebook, YouTube, Twitter, LinkedIn and others.

Quick Delivery: Have immediate or express delivery with live order tracking.

Around the Clock Support: We have a support staff that can be contacted 24/7 in case of any questions or issues.

Safe Payments: We accept PayPal, Paytm, UPI, crypto and more payment options.

Be it a person influencer or a digital agency seeking a trustworthy SMM Panel, YoYo Media is the service you can count on.

What is an SMM Panel?

SMM Panel (an abbreviation of Social Media Marketing Panel) is an Internet service providing the possibility to buy social media services: followers, likes, views, comments and others. Such services will improve your presence and activity on different social networks.

Our SMM Panel is specifically designed at YoYo Media keeping in mind scalability, performance and user experience. Be it you are a business seeking to expand your online presence or a reseller intending to rake in profits through digital marketing, our panel is designed to fit all your needs.

YoYo Media – The Best SMM Panel for Resellers and Agencies

Searching a reliable and yet cheap SMM Reseller Panel? Thousands of resellers in India and around the globe prefer to use YoYo Media. With our bulk ordering system, API integration and automatic services, managing portfolios of large clients is a breeze.

As a reseller you get:

• Best Rates to get the highest profit margins

• API access to integrate your own system

• Ability to order in high volumes

• Day to day service modifications and performance tuning

• Reseller support

We are not only the Best SMM Panel, we demonstrate it by our performance, speed and the best prices.

Expanding Beyond Borders: SMM Panel India and Global Services

Although we are referred to as the Cheapest SMM Panel in India, our services and clients are not limited to this country in any way. We also happen to be considered as one of the best SMM Panel India and we serve clients in the United States with the exact same superiority.

Our panel offers geo-targeted, quick and genuine services whether you are targeting American panels or conducting campaigns in the USA. Whether it is Instagram USA followers or YouTube USA views, we have got it all.

Regardless of the location of your audience, YoYo Media will deliver globally with regional targeting.

Why Cheapest Doesn’t Mean Low Quality at YoYo Media

Most people have the mentality that cheap is equal to low quality. At YoYo media that is not so. We aim to bring professional quality social media services to all people without the compromise in quality.

So, here is how we can keep our services on the highest level and be the Cheapest SMM Panel:

Automation: Intelligent backend systems will lower the cost of operation and raise efficiency.

Partnerships: We have collaborated with credible data providers and services companies to give you the best prices that you cannot resist.

In-House Development: Our panel has been developed and is managed by our tech team, cutting on third-party expenses.

Affordability and quality are two components that we integrate and this makes us the Best SMM Panel to be used by users who are concerned about both price and quality.

Key Features of YoYo Media’s SMM Panel

Discover the outstanding features which make YoYo Media the preferred platform by digital marketers, resellers and social media enthusiasts:

Easy to Use Dashboard: Running all your campaigns at one place with simplicity.

Real-Time Order Tracking: Monitor the service status and tracking in real-time.

Multi-support: Facebook, Instagram, YouTube, Twitter, TikTok, LinkedIn and others.

New Updates: We are constantly updating our services according to the customer reviews.

White Label: Build your own SMM company on our platform.

You don’t have to spend a fortune to scale your social media—just log in to https://yoyomedia.in and get started.

Best SMM Panel for YouTube, Instagram, Facebook & More

Our area of expertise is providing targeted social media growth on all platforms. Are you a YouTuber wanting to get more views or a business wanting to promote your Instagram? We have got you covered.

Instagram SMM Panel: Instagram followers, likes, story views and IGTV views.

YouTube SMM Panel: Subscribers, likes, comments and monetizable watch time.

Facebook SMM Panel: Likes of the page, shares of the posts, viewers and reactions during the live.

TikTok SMM Panel: Followers, video likes, views and shares.

Twitter SMM Panel: Retweets, likes, followers and mentions.

All these and much more at the cheapest rates ever with our Cheapest SMM Panel, by YoYo Media.

One Platform, All Markets: SMM Panel India to USA at Best Prices

Are you looking to grow your social media presence whether you are a local business or looking to target international markets? Then look no further because YoYo Media is the ultimate social media growth tool. Being the Cheapest SMM Panel in India, we provide high-quality services, which will not smell your budget. Known as the Best SMM Panel reseller and agency, we also work with international clients as a reliable SMM Panel USA. Wherever you are, our one-stop SMM Panel will provide quick, cheap and trusted outcomes of any social media promotion.

How to Get Started with YoYo Media

To begin with YoYo Media is easy and quick:

1. Sign Up: Go to https://yoyomedia.in and create a free account

2. Add Funds: Select your desired payment option and top up.

3. Place Order: Choose the service you need, enter your link and place an order.

4. Track Progress: You can check the status of your orders in real-time on your dashboard.

No nasty surprises, no complex procedures - just easy, cheap and trustworthy SMM Panel services.

Why Indian Marketers Prefer YoYo Media

The Indian emerging digital world does not just need powerful solutions, but pocket-friendly solutions as well. YoYo media is good at that. This is why our platform is Indian social media marketers:

Local Payment Support: Paytm, UPI and others.

Fast Customer Support: Support staff who speaks Hindi and English.

Lowest Latency Order Fulfillment: Our systems (located in India) are tuned to create the lowest latency.

Special offers and rates: Custom packages and offers to the Indian users and resellers.

YoYo Media is the way to go in case you are located in India and would like to get the Cheapest SMM Panel without affecting the quality of the panel.

Trusted by Thousands of Clients

At YoYo Media, client satisfaction is our top priority. We’re proud to have earned the trust of:

Social media influencers

Digital marketing agencies

Freelance marketers

E-commerce businesses

YouTube creators

Resellers across India and abroad

With hundreds of five-star reviews and repeat customers, our reputation as the Best SMM Panel continues to grow each day.

Final Thoughts: Take Your Social Media to the Next Level with YoYo Media

And when it comes to finding the Cheapest SMM Panel in India that is also reliable, high scale and provides exceptional support, then look no further than YoYo media. We have developed a platform whereby the user base all over the world, particularly in India and the USA, can get to maximize their social media growth at a considerably lower price.

Visit Now: https://yoyomedia.in

No matter the platform or scale of your needs, our SMM Panel is built to help you succeed. Join thousands of satisfied users who trust YoYo Media as their go-to source for social media marketing.

2 notes

·

View notes

Text

Traditional Vs Automated Direct Mail Services

Direct mail has long been a trusted marketing channel. In 2025, businesses face a choice between traditional direct mail services and automated solutions. Understanding the difference can drastically impact your campaign’s efficiency, ROI, and customer experience.

What Is Traditional Direct Mail?

Traditional direct mail involves manual processes such as:

Designing postcards or letters by hand or through desktop software

Printing at local shops or internal print facilities

Manually stuffing, stamping, and mailing

Tracking via physical receipts or third-party couriers

Pros:

Full control over the process

Hands-on personalization

Local vendor relationships

Cons:

Time-consuming

Prone to human error

Hard to scale

Costlier for small volumes

What Is Automated Direct Mail?

Automated direct mail refers to using software or APIs to trigger, personalize, print, and send mail pieces based on digital actions or CRM data.

Examples:

A new customer signs up, and a welcome postcard is triggered automatically

Abandoned cart triggers a mailed coupon

Real-time API sends birthday cards based on database date

Pros:

Scalable for millions of mailings

Real-time integration with CRMs and marketing platforms

Consistent branding and quality

Analytics and tracking included

Cons:

Higher setup cost initially

Requires data hygiene and tech alignment

Key Differences Between Traditional and Automated Direct Mail

FeatureTraditionalAutomatedSpeedSlow (days to weeks)Instant or scheduledScalabilityLimitedHighly scalablePersonalizationManualDynamic via variable dataTrackingManual or nonexistentDigital trackingIntegrationNoneAPI and CRM support

When Should You Choose Traditional?

For small, one-time mailings

When personal touch matters (e.g., handwritten letters)

In areas with no access to digital tools

When to Use Automated Direct Mail?

For ongoing marketing campaigns

When speed, consistency, and tracking are priorities

For eCommerce, SaaS, healthcare, insurance, and real estate

Use Case Comparisons

Traditional Use Case: Local Real Estate Agent

Manually prints and mails just listed postcards to a zip code every month.

Automated Use Case: National Insurance Company

Triggers annual policy renewal letters for 500,000+ customers via API.

Benefits of Automation in 2025

Real-Time Triggers from websites, CRMs, or payment systems

Enhanced Reporting for ROI measurement

Reduced Costs with bulk printing partnerships

Faster Delivery using localized printing partners globally

Eco-Friendly Workflows (less waste, digital proofing)

How to Switch from Traditional to Automated Direct Mail

Audit your current workflow

Choose a provider with API integration (e.g., PostGrid, Lob, Inkit)

Migrate your address data and test campaigns

Train your team and build trigger-based workflows

Conclusion: Choosing the Right Direct Mail Method

Ultimately, the right choice depends on your goals. While traditional direct mail has its place, automated direct mail offers speed, flexibility, and scale. For modern businesses aiming for growth and efficiency, automation is the clear winner.

SEO Keywords: traditional vs automated direct mail, automated mailing services, direct mail automation, API for direct mail, manual vs automated marketing.

youtube

SITES WE SUPPORT

Healthcare Mailing API – Wix

2 notes

·

View notes

Text

💳Integrated Payments with Stripe and Paddle: Inside EasyLaunchpad’s Payment Module

When building a SaaS app, one of the first questions you’ll face is:

How will we charge users?

From recurring subscriptions to one-time payments and license plans, payment infrastructure is mission-critical. But implementing a secure, production-grade system can be time-consuming, tricky, and expensive.

That’s why EasyLaunchpad includes a fully integrated payment module with support for Stripe and Paddle — out of the box.

In this article, we’ll walk you through how EasyLaunchpad handles payments, how it simplifies integration with major processors, and how it helps you monetize your product from day one.

💡 The Problem: Payment Integration Is Hard

On paper, adding Stripe or Paddle looks easy. In reality, it involves:

API authentication

Checkout flows

Webhook validation

Error handling

Subscription plan logic

Admin-side controls

Syncing with your front-end or product logic

That’s a lot to build before you ever collect your first dollar.

EasyLaunchpad solves this by offering a turnkey payment solution that integrates Stripe and Paddle seamlessly into backend logic and your admin panel.

⚙️ What’s Included in the Payment Module?

The EasyLaunchpad payment module covers everything a SaaS app needs to start selling:

Feature and Description:

✅ Stripe & Paddle APIs- Integrated SDKs with secure API keys managed via config

✅ Plan Management- Define your product plans via admin panel

✅ License/Package Linking- Link Stripe/Paddle plans to system logic (e.g., access control)

✅ Webhook Support- Process events like successful payments, cancellations, renewals

✅ Email Triggers- Send receipts and billing notifications automatically

✅ Logging & Retry Logic- Serilog + Hangfire for reliability and transparency

💳 Stripe Integration in .NET Core (Prebuilt)

Stripe is the most popular payment solution for modern SaaS businesses. EasyLaunchpad comes with:

Stripe.NET SDK is configured and ready to use

Test & production API key support via appsettings.json

Built-in handlers for:

Checkout Session Creation

Payment Success

Subscription Renewal

Customer Cancellations

No need to write custom middleware or webhook processors. It’s all wired up.

🔁 How the Flow Works (Stripe)

The user selects a plan on your website

The checkout session is created via Stripe API

Stripe redirects the user to a secure payment page

Upon success, EasyLaunchpad receives a webhook event

User’s plan is activated + confirmation email is sent

Logs are stored for reporting and debugging

🧾 Paddle Integration for Global Sellers

Paddle is often a better fit than Stripe for developers targeting international customers or needing EU/GST compliance.

EasyLaunchpad supports Paddle’s:

Inline Checkout and Overlay Widgets

Subscription Plans and One-Time Payments

Webhook Events (license provisioning, payment success, cancellations)

VAT/GST compliance without custom work

All integration is handled via modular service classes. You can switch or run both providers side-by-side.

🔧 Configuration Example

In appsettings.json, you simply configure:

“Payments”: {

“Provider”: “Stripe”, // or “Paddle”

“Stripe”: {

“SecretKey”: “sk_test_…”,

“PublishableKey”: “pk_test_…”

},

“Paddle”: {

“VendorId”: “123456”,

“APIKey”: “your-api-key”

}

}

The correct payment provider is loaded automatically using dependency injection via Autofac.

🧩 Admin Panel: Manage Plans Without Touching Code

EasyLaunchpad’s admin panel includes:

A visual interface to create/edit plans

Fields for price, duration, description, external plan ID (Stripe/Paddle)

Activation/deactivation toggle

Access scope definition (used to unlock features via roles or usage limits)

You can:

Add a Pro Plan for $29/month

Add a Lifetime Deal with a one-time Paddle payment

Deactivate free trial access — all without writing new logic

🧪 Webhook Events Handled Securely

Stripe and Paddle send webhook events for:

New subscriptions

Payment failures

Plan cancellations

Upgrades/downgrades

EasyLaunchpad includes secure webhook controllers to:

Verify authenticity

Parse payloads

Trigger internal actions (e.g., assign new role, update access rights)

Log and retry failed handlers using Hangfire

You get reliable, observable payment handling with no guesswork.

📬 Email Notifications

After a successful payment, EasyLaunchpad:

Sends a confirmation email using DotLiquid templates

Updates user records

Logs the transaction with Serilog

The email system can be extended to send:

Trial expiration reminders

Invoice summaries

Cancellation win-back campaigns

📈 Logging & Monitoring

Every payment-related action is logged with Serilog:

{

“Timestamp”: “2024–07–15T12:45:23Z”,

“Level”: “Information”,

“Message”: “User subscribed to Pro Plan via Stripe”,

“UserId”: “abc123”,

“Amount”: “29.00”

}

Hangfire queues and retries any failed webhook calls, so you never miss a critical event.

🔌 Use Cases You Can Launch Today

EasyLaunchpad’s payment module supports a variety of business models:

Model and the Example:

SaaS Subscriptions- $9/mo, $29/mo, custom plans

Lifetime Licenses- One-time Paddle payments

Usage-Based Billing — Extend by customizing webhook logic

Freemium to Paid Upgrades — Upgrade plan from admin or front-end

Multi-tier Plans- Feature gating via linked roles/packages

🧠 Why It’s Better Than DIY

With EasyLaunchpad and Without EasyLaunchpad

Stripe & Paddle already integrated- Spend weeks wiring up APIs

Admin interface to manage plans- Hardcode JSON or use raw SQL

Background jobs for webhooks- Risk of losing data on failed calls

Modular services — Spaghetti logic in controller actions

Email receipts & logs- Manually build custom mailers

🧠 Final Thoughts

If you’re building a SaaS product, monetization can’t wait. You need a secure, scalable, and flexible payment system on day one.

EasyLaunchpad gives you exactly that:

✅ Pre-integrated Stripe & Paddle

✅ Admin-side plan management

✅ Real-time email & logging

✅ Full webhook support

✅ Ready to grow with your product

👉 Start charging your users — not building billing logic. Get EasyLaunchpad today at: https://easylaunchpad.com

#.net boilerplate#.net development#easylaunchpad#Stripe .NET Core integration#Paddle in .NET#payment module SaaS

2 notes

·

View notes

Text

The Future of USDT Payments and Stablecoin in Global Commerce

In a global financial ecosystem where speed, transparency, and accessibility are becoming non-negotiables, stablecoins—particularly Tether (USDT)—have carved out a powerful niche. Once seen merely as trading instruments on crypto exchanges, stablecoins are now evolving into vital tools for cross-border commerce, payroll, lending, and global remittances. But what does the future of USDT payments hold in the context of expanding digital economies? This in-depth guide explores the emerging role of USDT and stablecoins in global commerce, including current trends, technological shifts, regulatory evolution, and their potential to disrupt legacy finance. The Future of USDT Payments and Stablecoin in Global Commerce Why USDT Has Become the Stablecoin of Choice Market Dominance and Liquidity As of 2025, USDT remains the most widely used and liquid stablecoin in the world, with over $90 billion in circulation. Its integration into thousands of platforms—ranging from centralized exchanges and DeFi protocols to merchant payment systems—gives it an unmatched level of acceptance and interoperability. Blockchain Interoperability USDT operates on multiple blockchains, including Ethereum (ERC-20), Tron (TRC-20), Binance Smart Chain (BEP-20), Solana (SPL), and Polygon. This cross-chain deployment enables businesses to select the protocol that best balances speed, cost, and network activity. For example: - TRC-20 USDT is popular in Asia due to low fees. - ERC-20 USDT is favored in institutional DeFi platforms. For a step-by-step breakdown on how to integrate USDT payments into your online store or digital platform, check out our in-depth guide on the best USDT payment gateway for business at XAIGATE. USDT in Real-World Payments: Current Use Cases International Payroll Companies hiring remote workers now use USDT to pay salaries globally in a matter of seconds, avoiding high bank fees and currency conversion losses. B2B Cross-Border Trade Manufacturers and wholesalers in emerging markets use USDT to settle international invoices, eliminating the delays and costs of SWIFT or traditional remittance services. Merchant Adoption Retailers in crypto-friendly jurisdictions are increasingly accepting USDT via gateways like XAIGATE. It offers customers a fast, private, and irreversible payment option without currency volatility. Technological Trends Shaping the Future of USDT Payments Layer-2 Scaling and Gas Efficiency As congestion and fees on mainnets like Ethereum persist, the rise of Layer-2 networks—such as Arbitrum, zkSync, and Optimism—presents a promising future for USDT microtransactions. Gas fees drop from dollars to cents, enabling everyday retail and online purchases. Integration With Web3 Wallets and dApps USDT is being integrated into decentralized apps and Web3 wallets like MetaMask, Phantom, and Trust Wallet, enabling users to pay or receive funds across borders without intermediaries. AI and Smart Routing in Stablecoin Payments Emerging smart contract-based payment systems can automatically route USDT across chains and protocols for the lowest fees and fastest confirmations, optimizing both B2B and retail usage. Technological Trends Shaping the Future of USDT Payments Future Projections: What Will the Next 5 Years Look Like? Widespread Retail Adoption We’re likely to see more POS systems and eCommerce platforms natively support USDT, especially in crypto-forward countries. QR code payments and one-click checkout via stablecoin wallets could rival traditional credit cards. Embedded Finance and API-Based Payment Flows As XAIGATE and other platforms improve API flexibility, businesses can build USDT payments directly into their apps, games, and services—without needing custodial gateways. Real-Time Global Settlement With blockchain interoperability, future USDT payment systems will support atomic swaps and real-time settlements between fiat and crypto. This could revolutionize supply chains, freelance platforms, and gig economies. Challenges to Address in the Future of USDT Payments Centralization and Reserve Transparency Despite Tether’s regular attestations, concerns persist over the composition and liquidity of reserves backing USDT. Increasing regulatory pressure will likely push for more frequent and detailed disclosures. On/Off Ramp Friction The success of USDT in commerce depends on efficient fiat on/off ramps. While platforms like MoonPay and Binance Pay are filling the gap, local regulations and KYC requirements still pose barriers in many countries. Volatility of Stablecoin Pegs While USDT is pegged to the USD, black swan events or market manipulations can threaten stability. Future implementations may involve algorithmic safeguards or dynamic collateralization to enhance resilience. To stay ahead in the evolving world of crypto commerce, businesses should explore robust solutions like XAIGATE. Learn how to streamline your stablecoin integration with our expert insights on the future-proof USDT gateway for global businesses:🔗 https://www.xaigate.com/usdt-payment-gateway-for-business/ Institutional Integration Will Accelerate the Future of USDT Payments Financial Giants Are Embracing Stablecoin Infrastructure Traditional finance players—including Visa, Mastercard, and major regional banks—are increasingly exploring blockchain-based payments. In this shift, USDT stands out due to its deep liquidity and global reach. Financial service providers in Asia, Europe, and Latin America are testing cross-border settlements using USDT, bypassing the SWIFT system. This momentum signals that the future of USDT payments is not just driven by crypto-native startups, but also by global institutions that recognize its potential for efficiency, transparency, and accessibility. Corporate Adoption for Treasury and Payroll Large corporations are beginning to hold USDT in their treasury reserves to hedge against fiat currency instability in emerging markets. Additionally, USDT is being used for real-time international payroll in industries such as freelance tech, BPO services, and logistics—where bank transfers are costly and slow. These use cases are critical in shaping the future of USDT payments for operational finance. Compliance-Ready Stablecoin Payments: A New Era for Global Businesses Web3 Identity Layers and zk-KYC Protocols One of the most critical enablers of mainstream USDT adoption is the emergence of on-chain compliance tools. Web3-native identity solutions—like decentralized identifiers (DIDs), verifiable credentials, and zero-knowledge KYC—allow payment processors to meet local regulations without exposing sensitive customer data. As these tools integrate with crypto payment gateways like XAIGATE, businesses can comply with regulatory requirements while preserving the privacy of their users, expanding the future of USDT payments into regulated sectors such as healthcare, education, and insurance. Tiered Risk and Regulatory Models Instead of a one-size-fits-all KYC process, the next generation of USDT payment systems will offer tiered access levels: P2P payments under a certain threshold may remain KYC-optional, while enterprise-level transactions can trigger automated compliance protocols. This model not only aligns with global regulatory trends but also preserves accessibility—a crucial factor in the future of USDT payments for borderless commerce. Conclusion: From Trading Tool to Global Payment Standard The trajectory of USDT is transitioning from speculative asset to utilitarian digital dollar. As global commerce grows increasingly borderless, USDT’s stability, speed, and availability give it a unique advantage over both fiat and crypto rivals. With innovations in scalability, regulation, and user experience on the horizon, the future of USDT payments looks more like a core pillar of the new digital economy than a temporary crypto trend. Businesses that integrate USDT payments today are not only improving efficiency—they are future-proofing for a financial system in transformation. FAQs – Future of USDT Payments Q1: Is USDT legal to use in global payments?Yes, in many jurisdictions. However, legality depends on local financial regulations and whether stablecoins are recognized under digital asset laws. Q2: How does USDT avoid volatility compared to Bitcoin or Ethereum?USDT is pegged to the US Dollar and backed by reserves, maintaining a near 1:1 price ratio with minimal fluctuation. Q3: Can I use USDT for recurring payments?Yes. Some platforms offer programmable USDT-based subscriptions using smart contracts or API-based invoicing systems. Q4: Which industries benefit most from USDT payments?E-commerce, remote work platforms, SaaS, logistics, and cross-border trade benefit greatly due to instant global transfer and low fees. Q5: How do I integrate USDT payments on my website?You can use gateways like XAIGATE to integrate no-login, low-fee USDT payment plugins into your eCommerce or business website. FAQs – Future of USDT Payments We may also be found on GitHub, and X (@mxaigate)! Follow us! Don’t miss out on the opportunity to elevate your business with XAIGATE’s Future of USDT Payments and Stablecoin. The three-step process is designed to be user-friendly, making it accessible for all businesess. Embrace this modern payment solution to provide customers with a secure and efficient way to pay. Take the first step towards a competitive edge in the digital realm and unlock the benefits of cryptocurrency payments for online casino today. Read the full article

2 notes

·

View notes

Text

DGQEX Focuses on the Trend of Crypto Asset Accounting, Supporting Corporate Accounts to Hold Bitcoin

Recently, UK-listed company Vinanz purchased 16.9 bitcoins at an average price of $103,341, with a total value of approximately $1.75 million. This transaction represents another landmark event in the field of crypto assets. Not only does it mark the first time a traditional enterprise has incorporated bitcoin into its balance sheet, but it also highlights the evolving role of crypto assets within the global financial system. Against this backdrop, DGQEX, as a technology-driven digital currency exchange, is increasingly recognized by institutional investors for its service capabilities and technological innovation.

Institutional Adoption Drives Diversified Crypto Asset Allocation

The Vinanz bitcoin acquisition is not an isolated case. Recently, multiple multinational corporations and institutional investors have begun to include bitcoin in their portfolios. For example, a North American technology giant disclosed bitcoin holdings in its financial reports, while some sovereign wealth funds are reportedly exploring crypto asset allocation strategies. This trend reflects the growing recognition by the traditional financial sector of the anti-inflation and decentralized characteristics of crypto assets. DGQEX, by offering multi-currency trading pairs and deep liquidity, has already provided customized trading solutions for numerous institutional investors. Its proprietary smart matching engine supports high-concurrency trading demands, ensuring institutions can efficiently execute large orders in volatile markets and avoid price slippage due to insufficient liquidity.

Technological Strength Fortifies Institutional Trading Security

With the influx of institutional funds, the security and compliance of crypto asset trading have become central concerns. David Lenigas, Chairman of Vinanz, has explicitly stated that bitcoin holdings will serve as the foundation for the company core business value, reflecting institutional confidence in the long-term value of crypto assets. However, institutional investors now place higher demands on the technical capabilities of trading platforms. DGQEX has built a multi-layered security system through multi-signature wallets, cold storage isolation technology, and real-time risk monitoring systems. In addition, the distributed architecture of DGQEX can withstand high-concurrency trading pressures, ensuring stable operations even under extreme market conditions. These technological advantages provide institutional investors with a reliable trading environment, allowing them to focus on asset allocation strategies rather than technical risks.

Global Expansion Facilitates Cross-Border Asset Allocation for Institutions

The Vinanz bitcoin purchase is seen as a key milestone in the institutionalization of the crypto market. As institutional interest in crypto assets rises globally, demand for cross-border asset allocation has significantly increased. DGQEX has established compliant nodes in multiple locations worldwide, supports multilingual services and localized payment methods, and provides institutional investors with a low-latency, high-liquidity trading environment. Its smart routing system automatically matches optimal trading paths, reducing cross-border transaction costs. Moreover, the DGQEX API interface supports quantitative trading strategies, meeting institutional needs for high-frequency and algorithmic trading, and helping institutions achieve asset appreciation in complex market environments.

DGQEX: Empowering Crypto Asset Allocation with Technology and Service

As an innovation-driven digital currency exchange, DGQEX is committed to providing institutional investors with a secure and convenient trading environment. The platform employs distributed architecture and multiple encryption technologies to ensure user asset security. Its smart routing system and deep liquidity pools deliver low-slippage, high-efficiency execution for large trades. Furthermore, the compliance team of DGQEX continuously monitors global regulatory developments to ensure platform operations adhere to the latest regulatory requirements, providing institutional investors with compliance assurance.

Currently, the crypto asset market is undergoing a transformation from individual investment to institutional allocation. Leveraging its technological strength and global presence, DGQEX offers institutional investors one-stop digital asset solutions. Whether it is multi-currency trading, block trade matching, or customized risk management tools, DGQEX can meet the diverse needs of institutions in crypto asset allocation. Looking ahead, as more traditional institutions enter the crypto market, DGQEX will continue to optimize its services and help global users seize opportunities in the digital asset space.

2 notes

·

View notes

Text

How to Implement Royalty Payments in NFTs Using Smart Contracts

NFTs have revolutionized how creators monetize their digital work, with royalty payments being one of the most powerful features. Let's explore how to implement royalty mechanisms in your NFT smart contracts, ensuring creators continue to benefit from secondary sales - all without needing to write code yourself.

Understanding NFT Royalties

Royalties allow creators to earn a percentage of each secondary sale. Unlike traditional art, where artists rarely benefit from appreciation in their work's value, NFTs can automatically distribute royalties to creators whenever their digital assets change hands.

The beauty of NFT royalties is that once set up, they work automatically. When someone resells your NFT on a compatible marketplace, you receive your percentage without any manual intervention.

No-Code Solutions for Implementing NFT Royalties

1. Choose a Creator-Friendly NFT Platform

Several platforms now offer user-friendly interfaces for creating NFTs with royalty settings:

OpenSea: Allows setting royalties up to 10% through their simple creator dashboard

Rarible: Offers customizable royalty settings without coding

Foundation: Automatically includes a 10% royalty for creators

Mintable: Provides easy royalty configuration during the minting process

NFTPort: Offers API-based solutions with simpler implementation requirements

2. Setting Up Royalties Through Platform Interfaces

Most platforms follow a similar process:

Create an account and verify your identity

Navigate to the creation/minting section

Upload your digital asset

Fill in the metadata (title, description, etc.)

Look for a "Royalties" or "Secondary Sales" section

Enter your desired percentage (typically between 2.5% and 10%)

Complete the minting process

3. Understanding Platform-Specific Settings

Different platforms have unique approaches to royalty implementation:

OpenSea

Navigate to your collection settings

Look for "Creator Earnings"

Set your percentage and add recipient addresses

Save your settings

Rarible

During the minting process, you'll see a "Royalties" field

Enter your percentage (up to 50%, though 5-10% is standard)

You can add multiple recipients with different percentages

Foundation

Has a fixed 10% royalty that cannot be modified

Automatically sends royalties to the original creator's wallet

4. Use NFT Creator Tools

Several tools help creators implement royalties without coding:

NFT Creator Pro: Offers drag-and-drop functionality with royalty settings

Manifold Studio: Provides customizable contracts without coding knowledge

Mintplex: Allows creators to establish royalties through simple forms

Bueno: Features a no-code NFT builder with royalty options

Important Considerations for Your Royalty Strategy

Marketplace Compatibility

Not all marketplaces honor royalty settings equally. Research which platforms respect creator royalties before deciding where to list your NFTs.

Reasonable Royalty Percentages

While you might be tempted to set high royalty percentages, market standards typically range from 5-10%. Setting royalties too high might discourage secondary sales altogether.

Payment Recipient Planning

Consider whether royalties should go to:

Your personal wallet

A business entity

Multiple creators (split royalties)

A community treasury or charity

Transparency with Collectors

Clearly communicate your royalty structure to potential buyers. Transparency builds trust in your project and helps buyers understand the long-term value proposition.

Navigating Royalty Enforcement Challenges

While the NFT industry initially embraced creator royalties, some marketplaces have made them optional. To maximize your royalty enforcement:

Choose supportive marketplaces: List primarily on platforms that enforce royalties

Engage with your community: Cultivate collectors who value supporting creators

Utilize blocklisting tools: Some solutions allow creators to block sales on platforms that don't honor royalties

Consider subscription models: Offer special benefits to collectors who purchase through royalty-honoring platforms

Tracking Your Royalty Payments

Without coding knowledge, you can still track your royalty income:

NFT Analytics platforms: Services like NFTScan and Moonstream provide royalty tracking

Wallet notification services: Set up alerts for incoming payments

Marketplace dashboards: Most platforms offer creator dashboards with earning statistics

Third-party accounting tools: Solutions like NFTax help track royalty income for tax purposes

Real-World Success Stories

Many successful NFT creators have implemented royalties without coding knowledge:

Digital artist Beeple receives royalties from secondary sales of his record-breaking NFT works

Photographer Isaac "Drift" Wright funds new creative projects through ongoing royalties

Music groups like Kings of Leon use NFT royalties to create sustainable revenue streams

Conclusion

Implementing royalty payments in NFTs doesn't require deep technical knowledge. By leveraging user-friendly platforms and tools, any creator can ensure they benefit from the appreciation of their digital assets over time.

As the NFT ecosystem evolves, staying informed about royalty standards and marketplace policies will help you maximize your passive income potential. With the right approach, you can create a sustainable revenue stream that rewards your creativity for years to come.

Remember that while no-code solutions make implementation easier, understanding the underlying principles of NFT royalties will help you make more strategic decisions for your creative business.

#game#mobile game development#multiplayer games#metaverse#blockchain#vr games#unity game development#nft#gaming

2 notes

·

View notes

Text

HeraldEX – Crypto Payment Gateway for Global Businesses

HERALDEX offers a seamless crypto payment gateway solution for businesses of all sizes. Accept major cryptocurrencies like Bitcoin, Ethereum, USDT, USDC, and TRON, and automatically convert them into fiat currencies like USD or EUR. With easy API integration and enterprise-grade security, HERALDEX helps you accept crypto payments globally, securely, and effortlessly. Perfect for startups and enterprises looking to grow in the digital economy.

1 note

·

View note

Text

The Benefits of Using a WhatsApp API Chatbot Provider

In an era where instant communication is vital for customer satisfaction, businesses are turning to messaging platforms to enhance their engagement strategies. WhatsApp, with its extensive user base, offers an incredible opportunity for businesses to connect with their audience. Using a WhatsApp API chatbot provider can take this engagement to the next level by providing businesses with tools to automate, streamline, and optimize their communication efforts. Below, we explore the key benefits of using a WhatsApp API chatbot provider.

1. Seamless Integration

WhatsApp API chatbot providers simplify the process of integrating the API with existing business systems. These providers offer pre-built solutions and frameworks that reduce the need for in-house development resources. Businesses can connect their WhatsApp chatbots with:

Customer Relationship Management (CRM): Track customer interactions and manage leads efficiently.

E-commerce Platforms: Automate order updates, confirmations, and payment notifications.

Help Desk Tools: Streamline customer support by routing complex queries to human agents.

By offering seamless integration, chatbot providers allow businesses to save time and focus on their core operations.

2. 24/7 Customer Support

One of the primary advantages of using a WhatsApp API chatbot is its ability to operate around the clock. With a chatbot provider, businesses can ensure:

Instant Responses: Customers receive immediate replies, enhancing their satisfaction.

Consistent Service: Even outside business hours, inquiries are addressed promptly.

Reduced Workload: Human agents can focus on more complex tasks, while the chatbot handles repetitive queries.

This continuous availability significantly improves the overall customer experience.

3. Scalability

As a business grows, so does the volume of customer interactions. A WhatsApp API chatbot provider enables businesses to handle thousands of conversations simultaneously without compromising quality. This scalability ensures that:

Businesses can manage peak periods, such as holiday seasons or promotional campaigns.

Multiple customer inquiries are addressed in real-time, avoiding delays.

The chatbot’s infrastructure can scale up or down based on demand, optimizing resource usage.

4. Enhanced Customer Engagement

A WhatsApp API chatbot provider offers tools to create personalized and engaging interactions. Features like Natural Language Processing (NLP) and AI-powered recommendations help:

Personalize Responses: Tailored replies based on customer history and preferences.

Offer Real-Time Assistance: Guide customers through purchasing decisions or troubleshooting steps.

Collect Feedback: Conduct surveys to understand customer needs and improve services.

These capabilities strengthen the relationship between businesses and their customers.

5. Cost Efficiency

Investing in a WhatsApp API chatbot provider is cost-effective compared to maintaining a large customer support team. Chatbots help:

Automate Repetitive Tasks: Responses to FAQs, order status inquiries, and appointment bookings are handled automatically.

Reduce Human Intervention: Chatbots take care of basic queries, lowering staffing costs.

Minimize Errors: Automated responses are consistent and accurate, reducing potential misunderstandings.

This leads to significant savings while maintaining a high standard of customer service.

6. Security and Compliance

A reputable WhatsApp API chatbot provider ensures that businesses adhere to WhatsApp’s strict policies and guidelines. Key benefits include:

End-to-End Encryption: Protecting customer conversations from unauthorized access.

Data Privacy: Complying with data protection regulations such as GDPR.

Reliable Infrastructure: Providers handle updates, maintenance, and security patches, ensuring uninterrupted service.

By prioritizing security, businesses can build trust and confidence among their customers.

7. Analytics and Insights

Most WhatsApp API chatbot providers offer analytics tools to track and optimize performance. These insights help businesses:

Monitor Key Metrics: Measure response times, customer satisfaction, and conversation volumes.

Identify Trends: Understand customer behavior and preferences to refine strategies.

Improve Chatbot Performance: Continuously update workflows and templates for better outcomes.

With actionable data, businesses can make informed decisions to enhance their operations.

8. Support for Multilingual Communication

A global customer base often requires communication in multiple languages. Chatbot providers enable businesses to:

Offer Multilingual Support: Provide responses in customers’ preferred languages.

Expand Market Reach: Connect with diverse audiences without language barriers.

Enhance Accessibility: Ensure inclusivity for non-English-speaking users.

This feature is particularly beneficial for businesses aiming to expand their presence in international markets.

9. Streamlined Onboarding and Training

Using a chatbot provider simplifies the process of setting up and managing a WhatsApp API chatbot. Providers often offer:

Pre-Built Templates: For common use cases such as order tracking and customer support.

Comprehensive Documentation: Guiding businesses through integration and customization.

Ongoing Support: Ensuring smooth operations and troubleshooting any issues.

This support makes it easier for businesses to get started and maximize their chatbot’s potential.

#WhatsAppAPI#Chatbot#WhatsAppChatbot#RealEstateChatbot#WhatsAppBusiness#BusinessAutomation#ConversationalAI#WhatsAppMarketing#AIChatbot#BusinessChatbot

2 notes

·

View notes

Text

Side Hustle Profit Engine Review: The Ultimate AI-Powered Solution for Automated Income

Introduction: A Game-Changer in the Side Hustle Space

Online side hustling faces unprecedented transformation at the current time. Today an increasing number of people seek online money-making opportunities together with financial independence and personal life management. People have numerous opportunities to succeed online through affiliate marketing and freelancing between other methods including e-commerce and digital products.

Building and expanding a lucrative side business becomes difficult for most people. Many potential startup owners find content generation alongside website establishment and traffic attraction to be their greatest challenges. Side Hustle Profit Engine functions as a trailblazing issue by providing users with its transformative capabilities.

The AI platform Side Hustle Profit Engine enables users to generate fully functional websites that bring commission revenue within one minute of usage while needing no technical expertise or API keys or content generation requirements. The following review explores the operation of this tool alongside its features together with its advantages versus the value of investment.

Overview: Side Hustle Profit Engine Review

The product creator: George Katsoudas

Product name: Side Hustle Profit Engine

Front-end price: $17 – $19 (one-time payment)

Available Coupon: Apply Code “VIP2025” for 10% Off Bonus: Yes, Huge Bonuses

Niche: Tools, Affiliate Marketing, Software » Online / SaaS, AI-powered platform

Guarantee: 30-day Money Back Guarantee

Contact Info: Check

What is Side Hustle Profit Engine?

Side Hustle Profit Engine is a cloud-based AI app designed to help users create, monetize, and grow automated affiliate websites in trending niches like:

Side hustles

Online business opportunities

Make money online

Health & wellness

Technology & gadgets

Beauty & skincare

E-learning

Pets, gaming, and more!

Through AI processing the platform performs all tasks automatically which benefits both new users and marketing veterans. This platform develops search engine-ready sites containing high-quality content while enabling affiliate program monetization through offerings on WarriorPlus, JVZoo and ClickBank and Amazon and additional programs.

#SideHustle#PassiveIncome#AIPowered#AutomatedIncome#ProfitEngine#OnlineBusiness#EntrepreneurLife#FinancialFreedom#WorkFromHome#IncomeStreams#SideHustleIdeas#BusinessReview#TechForBusiness#SmartInvesting#DigitalMarketing#WealthBuilding#MoneyMaking#AIForBusiness#EntrepreneurTips#SideGig#HomeBasedBusiness#FinancialIndependence#BusinessAutomation

1 note

·

View note

Text

Which Payment Gateways Are Compatible for Dynamic Websites - A Comprehensive Guide by Sohojware

The digital landscape is constantly evolving, and for businesses with dynamic websites, staying ahead of the curve is crucial. A dynamic website is one that generates content on the fly based on user input or other factors. This can include things like e-commerce stores with shopping carts, membership sites with customized content, or even online appointment booking systems.

For these dynamic websites, choosing the right payment gateway is essential. A payment gateway acts as a secure bridge between your website and the financial institutions that process payments. It ensures a smooth and safe transaction experience for both you and your customers. But with a plethora of payment gateways available, selecting the most compatible one for your dynamic website can be overwhelming.

This comprehensive guide by Sohojware, a leading web development company, will equip you with the knowledge to make an informed decision. We’ll delve into the factors to consider when choosing a payment gateway for your dynamic website, explore popular options compatible with dynamic sites, and address frequently asked questions.

Factors to Consider When Choosing a Payment Gateway for Dynamic Websites

When selecting a payment gateway for your dynamic website in the United States, consider these key factors:

Security: This is paramount. The payment gateway should adhere to stringent security protocols like PCI DSS compliance to safeguard sensitive customer information. Sohojware prioritizes security in all its development projects, and a secure payment gateway is a non-negotiable aspect.

Transaction Fees: Payment gateways typically charge transaction fees, which can vary depending on the service provider and the type of transaction. Be sure to compare fees associated with different gateways before making your choice.

Recurring Billing Support: If your website offers subscriptions or memberships, ensure the payment gateway supports recurring billing functionalities. This allows for automatic and convenient payment collection for your recurring services.

Payment Methods Supported: Offer a variety of payment methods that your target audience in the US is accustomed to using. This may include credit cards, debit cards, popular e-wallets like PayPal or Apple Pay, and potentially even ACH bank transfers.

Integration Complexity: The ease of integrating the payment gateway with your dynamic website is crucial. Look for gateways that offer user-friendly APIs and clear documentation to simplify the integration process.

Customer Support: Reliable customer support is vital in case you encounter any issues with the payment gateway. Opt for a provider with responsive and knowledgeable customer service representatives.

Popular Payment Gateways Compatible with Dynamic Websites

Here’s a glimpse into some of the most popular payment gateways compatible with dynamic website:

Stripe: A popular and versatile option, Stripe offers a robust suite of features for dynamic websites, including recurring billing support, a user-friendly developer interface, and integrations with various shopping carts and platforms.

PayPal: A widely recognized brand, PayPal allows customers to pay using their existing PayPal accounts, offering a familiar and convenient checkout experience. Sohojware can integrate PayPal seamlessly into your dynamic website.

Authorize.Net: A secure and reliable gateway, Authorize.Net provides a comprehensive solution for e-commerce businesses. It supports various payment methods, recurring billing, and integrates with popular shopping carts.

Braintree: Owned by PayPal, Braintree is another popular choice for dynamic websites. It offers a user-friendly API and integrates well with mobile wallets and other popular payment solutions.

2Checkout (2CO): A global payment gateway solution, 2Checkout caters to businesses of all sizes. It offers fraud prevention tools, subscription management features, and support for multiple currencies.

Sohojware: Your Trusted Partner for Dynamic Website Development and Payment Gateway Integration

Sohojware possesses extensive experience in developing dynamic websites and integrating them with various payment gateways. Our team of skilled developers can help you choose the most suitable payment gateway for your specific needs and ensure a seamless integration process. We prioritize user experience and security, ensuring your customers have a smooth and secure checkout experience.

1. What are the additional costs associated with using a payment gateway?

Besides transaction fees, some payment gateways may charge monthly subscription fees or setup costs. Sohojware can help you navigate these costs and choose a gateway that fits your budget.

2. How can Sohojware ensure the security of my payment gateway integration?

Sohojware follows best practices for secure development and adheres to industry standards when integrating payment gateways. We stay updated on the latest security protocols to safeguard your customer’s financial information.

3. Does Sohojware offer support after the payment gateway is integrated?

Yes, Sohojware provides ongoing support to ensure your payment gateway functions smoothly. Our team can address any issues that arise, troubleshoot problems, and provide updates on the latest payment gateway trends.

4. Can Sohojware help me choose the best payment gateway for my specific business needs?

Absolutely! Sohojware’s experts can assess your business requirements, analyze your target audience, and recommend the most suitable payment gateway based on factors like transaction volume, industry regulations, and preferred payment methods.

5. How long does it typically take to integrate a payment gateway with a dynamic website?

The integration timeline can vary depending on the complexity of the website and the chosen payment gateway. However, Sohojware’s experienced team strives to complete the integration process efficiently while maintaining high-quality standards.

Conclusion

Choosing the right payment gateway for your dynamic website is crucial for ensuring a seamless and secure online transaction experience. By considering factors like security, fees, supported payment methods, and integration complexity, you can select a gateway that aligns with your business needs. Sohojware, with its expertise in web development and payment gateway integration, can be your trusted partner in this process. Contact us today to discuss your requirements and get started on your dynamic website project.

2 notes

·

View notes

Text

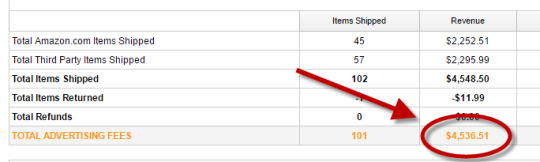

ShopBuildr AI Review – Create Amazon Affiliate Store In 60 Seconds!

Welcome to my ShopBuildr AI Review Post, This is a genuine user-based ShopBuildr AI review where I will discuss the features, upgrades, demo, price, and bonuses, how ShopBuildr AI can benefit you, and my own personal opinion. This is brand new automated AI software that creates 100% done-for-you and ready-to-profit affiliate stores in just minutes no Amazon APIs needed, and no content creation needed.

If you want to earn more affiliate commissions, then you are going to love this new tool. It automatically finds your products to promote, creates the posts for you, inserts content for you, and even adds your affiliate link for you! Affiliate marketing remains a popular way to generate income. It allows you to promote other companies’ products and earn commissions for each sale you make. However, building and maintaining a successful affiliate store can be a daunting task, especially for beginners. This is where ShopBuilder AI steps in. Claiming to be an all-in-one solution, ShopBuildr AI promises to automate the entire process of creating and managing an affiliate store.

ShopBuildr AI Review: What Is ShopBuildr AI?

ShopBuildr AI is a cloud-based software designed to simplify the process of building and managing affiliate websites. It utilizes artificial intelligence (AI) to automate several key tasks, including product selection, content creation, store design, and even content spinning (rewriting) for legal compliance.

ShopBuildr AI integrates with various platforms like Amazon and allows you to import product listings directly. It boasts features that streamline content creation, helping you generate product descriptions and reviews with minimal effort. Additionally, ShopBuildr AI offers built-in social media integration to promote your store and generate traffic.

ShopBuildr AI Review: Overview

Creator: Kurt Chrisler

Product: ShopBuildr AI

Date Of Launch: 2024-May-20

Time Of Launch: 10:00 EDT

Front-End Price: $17 (One-time payment)

Official Website: Click Here To Access

Product Type: Software (Online)

Support: Effective Response

Discount: Get The Best Discount Right Here!

Recommended: Highly Recommended

Bonuses: Huge Bonuses

Rating: 9.3/10

Skill Level Required: All Levels

Refund: YES, 30 Days Money-Back Guarantee

<<>> Click Here & Get Access Now ShopBuildr AI Discount Price Here <<>>

ShopBuildr AI Review: Features

Create Your First Affiliate Store In Just Minutes!

100+ DFY Affiliate Products

Offer Unlimited Products For More Commissions

Integrated with ChatGPT

Newbie Friendly, No Experience Required

No Amazon API is Needed!

Automated Free updates

Unlimited support

ShopBuildr AI Review: How Does It Work?

Creating Your Affiliate Store Has Never Been This Easy!

STEP #1: Install the Software

Simply upload the Shopbuildr AI WordPress Plugin to your WordPress site.

STEP #2: Upload Your Products

Simply upload the 100+ DFY Products we provide to get started fast!

STEP #3: Let ShopBuildr AI Take Over

Click “Post” and ShopBuildr AI will build your site for you! Everything is completely done for you.

<<>> Click Here & Get Access Now ShopBuildr AI Discount Price Here <<>>

ShopBuildr AI Review: Can Do For You

Automatically Creates An Affiliate Store

Automatically Insert the Product Name

Automatically Inserts Content

Automatically Inserts Product Images

Automatically Inserts Your Affiliate Link

Automatically Inserts Custom Ads

Add Your Optin Box to Each Page

Integrated with ChatGPT

ShopBuildr AI Review: Who Should Use It?

Affiliate Marketers

Artists

Content Creators

eCom Store Owners

Blog Owners

CPA Marketers

Video Marketers

Product Creators

Personal Brands

Freelancers

And Many Others

ShopBuildr AI Review: OTO’s And Pricing

Front End Price: ShopBuildr AI ($17)

OTO1: ShopBuildr AI PRO ($37)

OTO2: ShopBuildr AI Unlimited ($47)

OTO3: Done For You Option ($67)

OTO4: iMarketers Hosting ($39/$59 per year)

<<>> Click Here & Get Access Now ShopBuildr AI Discount Price Here <<>>

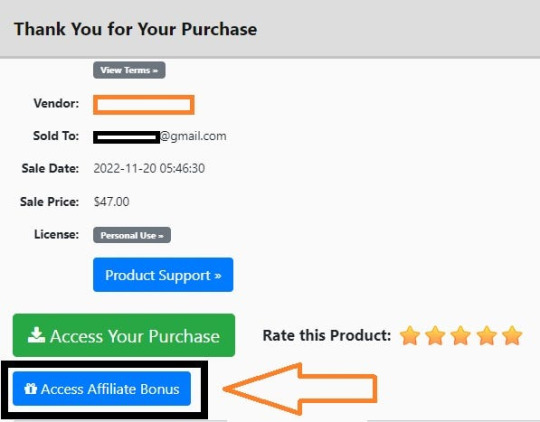

ShopBuildr AI Review: My Unique Bonus Bundle

My Unique Bonus Bundle will be visible on your access page as an Affiliate Bonus Button on WarriorPlus immediately after purchase.

And before ending my honest ShopBuildr AI Review, I told you that I would give you my very own unique PFTSES formula for Free.

ShopBuildr AI Review: Free Bonuses

Bonus #1: Azon Affiliate Bar Plugin

With this WordPress plugin, you can display a “sticky bar” at the top of your site promoting any Amazon product you want. This plugin makes it incredibly easy to start making more commissions from the Amazon Affiliate program in just a couple of minutes!

Bonus #2: FB Affiliate Alert Box Plugin

This WordPress plugin allows you to use the familiarity of Facebook to increase your affiliate commissions on all your websites. It will create pop-up boxes that resemble those from Facebook and allow you to insert affiliate products into them.

Bonus #3: WP Traffic Domination Training

You can’t make money online without traffic! The Traffic Domination course will show you how to start generating free traffic to all your websites and how to do it the right way to avoid penalties. If you need more traffic. then you need this course!

ShopBuildr AI Review: Demo Video

Just Watch The ShopBuildr AI Demo Video Down Below To Get All The Details:

>>For More Details Click Here<<

<<>> Click Here & Get Access Now ShopBuildr AI Discount Price Here <<>>

ShopBuildr AI Review: Money Back Guarantee

30 day money back guarantee

ShopBuilder AI is backed by a 30-day warranty. If you are having trouble setting up your first affiliate site and our support staff is unable to assist you. Send us an email and we’ll refund your purchase.

That’s it!

ShopBuildr AI Review: Pros and Cons

Pros:

Saves time with automated product selection and content creation.

Beginner-friendly interface for easy website setup.

Built-in social media integration for wider reach.

Cons:

You cannot use this product without an active internet connection.

In fact, I haven’t yet discovered any other problems withShopBuildr AI.

Frequently Asked Questions (FAQ’s)

Q. How many sites can I create?

With the standard version you can create 1 site. However, after you purchase you will have the option to upgrade your account to unlimited, which will allow you to create as many sites as you want.

Q. Do I need to purchase anything else?

You will need to have your own domain name and website that is using WordPress on it

Q. Is ShopBuildr AI completely free?

ShopBuildr AI typically offers a base product at a lower price, with additional features locked behind upsells. There might also be free trials available, so check their website for current pricing details.

Q. Can ShopBuildr AI guarantee my affiliate marketing success?

ShopBuildr AI is a tool to help build your website, but success in affiliate marketing depends on various factors like ongoing content creation, audience engagement, and marketing strategies.

Q. Is the content generated by ShopBuildr AI good enough?

AI-generated content can be a starting point, but it might require editing to ensure quality and uniqueness for optimal SEO impact.

ShopBuildr AI Review: My Recommendation

ShopBuildr AI offers a compelling solution for beginners or those short on time. It streamlines website creation and content generation, but it’s important to remember it’s a tool, not a magic solution. Long-term success requires ongoing effort in content creation, audience engagement, and SEO optimization. Weigh the potential benefits against the limitations to determine if ShopBuildr AI can be a stepping stone on your affiliate marketing journey.

<<>> Click Here & Get Access Now ShopBuildr AI Discount Price Here <<>>

Check Out My Previous Reviews: IntelliVid AI Studio Review, CB Ninja Review, AI Employees Review, OverLap AI Review, AI CaptureFlow Review, FlexiSitesAI Review, WP Defense Review, HostDaddy Review.

Thank for reading my ShopBuildr AI Review till the end. Hope it will help you to make purchase decision perfectly.

Disclaimer: This ShopBuildr AI review is for informational purposes only and does not constitute professional advice. Before making a purchase decision, we recommend conducting your own research and exploring the software.

Note: Yes, this is a paid software, however the one-time fee is $17 for lifetime.

#Affiliate Marketing#Ai#AI Tools#Apps#Artificial Intelligence#Buy ShopBuildr AI#Digital Marketing#Get ShopBuildr AI#How Does ShopBuildr AI Work#How to Make Money Online#Make Money#Make Money From Home#Make Money Online#Online Earning#Purchase ShopBuildr AI#ShopBuildr AI#ShopBuildr AI App#ShopBuildr AI Benefits#ShopBuildr AI Bonus#ShopBuildr AI Bonuses#ShopBuildr AI Bundle#ShopBuildr AI By Kurt Chrisler#ShopBuildr AI Demo#ShopBuildr AI Discount#ShopBuildr AI Downsell#ShopBuildr AI FE#ShopBuildr AI Features#ShopBuildr AI Funnels#ShopBuildr AI Honest Review#ShopBuildr AI Info

3 notes

·

View notes

Text

UPI Autopay: Simplify Your Payments with Automatic Deductions | Paycorp

Discover the convenience of UPI Autopay with Paycorp! Simplify your recurring payments and enjoy seamless transactions without the hassle of manual interventions. UPI Autopay ensures timely payments directly from your bank account, enhancing your financial management. Experience the future of effortless payments with Paycorp's secure and reliable UPI Autopay service. Learn more at Paycorp.

1 note

·

View note

Text

Unlock Seamless Integration with WP Contact Form 7 to Any API

In the ever-evolving world of web development, seamless integration between various technologies and platforms has become a crucial aspect of creating efficient and user-friendly solutions. One such integration that has gained significant traction is the ability to connect WordPress Contact Form 7 with external APIs. This powerful combination allows website owners to streamline their business processes, automate data collection, and enhance user experiences.

Introducing WordPress Contact Form 7

WordPress Contact Form 7 is a widely adopted plugin that simplifies the process of creating and managing contact forms on WordPress websites. With its user-friendly interface and extensive customization options, it has become a go-to solution for businesses, bloggers, and website owners alike. However, its true power lies in its ability to integrate with external APIs, unlocking a world of possibilities.

The Power of API Integration

APIs (Application Programming Interfaces) act as the backbone of modern web applications, enabling seamless communication and data exchange between different systems and services. By integrating WordPress Contact Form 7 with APIs, website owners can automate various processes, streamline data collection, and unlock new functionalities.

Streamlining Business Processes

One of the primary benefits of API integration with WordPress Contact Form 7 is the ability to streamline business processes. For example, when a user submits a contact form, the data can be automatically sent to a CRM (Customer Relationship Management) system via an API, eliminating the need for manual data entry. This not only saves time and reduces the risk of errors but also ensures that valuable customer information is promptly captured and accessible to the relevant teams.

Enhancing User Experiences

API integration with WordPress contact form 7 to any api can significantly enhance the user experience on your website. Imagine a scenario where a user submits a contact form inquiring about a product or service. Through API integration, the submitted data can trigger a personalized follow-up email, providing the user with relevant information, pricing details, or even a customized quote. This level of personalization and responsiveness can go a long way in building trust and fostering strong customer relationships.

Automating Data Collection and Analysis

Another significant advantage of API integration is the ability to automate data collection and analysis. When a user submits a contact form, the data can be automatically sent to a data analytics platform or a business intelligence tool via an API. This allows website owners to gain valuable insights into user behavior, preferences, and trends, enabling data-driven decision-making and optimizing their marketing and sales strategies.

Integrating with Third-Party Services

The possibilities of API integration with WordPress Contact Form 7 extend far beyond just CRM systems and data analytics platforms. Website owners can leverage APIs to integrate with a wide range of third-party services, such as payment gateways, email marketing platforms, project management tools, and more. This level of integration not only streamlines workflows but also opens up new revenue streams and enhances the overall functionality of your website.

Unlocking New Functionalities

API integration with WordPress Contact Form 7 also enables website owners to unlock new functionalities and enhance the overall user experience. For instance, by integrating with a geolocation API, you can automatically populate fields in the contact form based on the user's location, providing a more personalized and efficient experience. Additionally, you can integrate with social media APIs to allow users to sign up or log in using their existing social media accounts, simplifying the registration process.

Choosing the Right API Integration Solution

While the benefits of API integration with WordPress Contact Form 7 are compelling, the implementation process can be daunting, especially for those without extensive technical expertise. Fortunately, there are several third-party solutions and Best WordPress Contact Form Plugin available that simplify the integration process, making it accessible to website owners of all skill levels.

One such solution is Uncanny Automator, a powerful automation plugin for WordPress that seamlessly integrates with Contact Form 7 and various APIs. With Uncanny Automator, website owners can easily create automated workflows, trigger actions based on form submissions, and connect with a wide range of third-party services without writing a single line of code.

Unleashing the Power of Automation

By combining the capabilities of WordPress Contact Form 7 and Uncanny Automator, website owners can unleash the true power of automation. Imagine a scenario where a user submits a contact form inquiring about a product or service. Through Uncanny Automator, this form submission can trigger a series of automated actions, such as:

1. Sending the user's information to a CRM system for follow-up.

2. Automatically creating a project task in a project management tool.

3. Enrolling the user in an email marketing campaign to nurture the lead.

4. Generating a personalized quote or proposal based on the submitted information.

This level of automation not only streamlines processes but also ensures a consistent and efficient customer experience, ultimately improving customer satisfaction and driving business growth.

Seamless Integration, Endless Possibilities

The beauty of API integration with WordPress Contact Form 7 lies in its versatility and scalability. As your business grows and evolves, you can seamlessly integrate with new APIs and services, adapting to changing requirements and embracing new technologies without the need for extensive overhauls or migrations.

Empowering Website Owners

API integration with WordPress Contact Form 7 empowers website owners to take control of their online presence and business processes. By leveraging the power of automation and seamless data exchange, they can focus on core business activities, provide exceptional customer experiences, and drive growth and success.

Conclusion

In the ever-changing digital landscape, the ability to seamlessly integrate WordPress Contact Form 7 with external APIs offers a competitive edge for website owners and businesses alike. By unlocking the power of automation, streamlining processes, and enhancing user experiences, this integration opens up a world of possibilities. Whether you're looking to optimize your workflows, gather valuable insights, or explore new revenue streams, the combination of WordPress Contact Form 7 and API integration is a game-changer. Embrace this powerful integration and unlock the true potential of your online presence.

1 note

·

View note

Link

3 notes

·

View notes

Text

Get Your Links Indexed by Google Faster with Rapid URL Indexer

Are you tired of waiting weeks for Google to index your new content or backlinks? Or worse, having them never get indexed at all? This is one of the most common frustrations in SEO - creating great content or building quality backlinks only to have them sit invisible to search engines.

Rapid URL Indexer solves this problem with a straightforward, effective approach that's changing how SEO professionals handle indexing.

What Makes Rapid URL Indexer Different

Unlike other indexing services, Rapid URL Indexer offers a unique combination of features that make it stand out:

A 91% average indexing rate (over 457,191 URLs indexed successfully)

Cost of just $0.05 per successfully indexed link (or less with volume discounts)

100% automatic credit refunds for any links that don't get indexed within 14 days

No Google Search Console access required

Only safe, white-hat indexing methods

Flexible pay-as-you-go credit system (no subscriptions)

Detailed indexing reports with visual charts

The service works by getting Googlebot to crawl and index your links faster than would happen naturally. Initial reports are available after 4 days, with final results and automatic refunds processed after 14 days.

Practical Applications

Rapid URL Indexer works for virtually any indexing scenario:

Website Content Indexing

Whether you're launching a new site or regularly publishing content, getting pages indexed quickly is essential for visibility. Rapid URL Indexer can dramatically reduce the time it takes for new pages to appear in search results.

Backlink Indexing

Building backlinks is only effective if Google discovers and counts them. Rapid URL Indexer excels at getting all types of backlinks indexed, including:

Tier 1, 2, and 3 links

Social profile links

Citations and directory listings

Guest post links

Press release links

Mass Page Websites

If you operate a directory site or use programmatic SEO to generate thousands of pages, getting them all indexed can be challenging. Rapid URL Indexer can help ensure these pages get discovered and included in search results.

SEO Testing

When running SEO experiments, waiting for test pages to get indexed can delay your results. Rapid URL Indexer speeds up this process, allowing for faster iteration and optimization.

Local SEO Enhancement

For local businesses, getting citations and Google Business Profile links indexed quickly strengthens local search signals and improves rankings in location-based searches.

Integration Options

Rapid URL Indexer offers several ways to incorporate indexing into your workflow:

RESTful API for custom integrations

Zapier integration for automated workflows

WordPress plugin for automatic submission of new content

Chrome extension for one-click submissions

Google Sheets add-on (coming soon)

These options make it easy to automate the indexing process, whether you're managing a single site or handling SEO for multiple clients.

Pricing Structure

Rapid URL Indexer uses a credit-based system with one-time payments:

500 credits: $25 ($0.05 per URL)

1,500 credits: $68 ($0.045 per URL)

5,000 credits: $213 ($0.0426 per URL)

50,000 credits: $2,000 ($0.04 per URL)

All credits are one-time purchases (not subscriptions) and never expire, giving you complete control over your indexing budget.

Customer Success Stories

SEO professionals and business owners have reported significant benefits from using Rapid URL Indexer:

Mohammad Qaiser (CEO, Authority Magnet Co.) praises its pricing, ease of use, high success rate, and API features

Max Panych (Founder, AKITA) calls it "one of the best" indexing tools he's tested in 10 years of SEO work

Jason Hall (CEO, Five Channels) reports that it outperforms Google's Search Console for client websites

Ty Swartz (Owner, Swartz Portraits) credits it with improving visibility and driving potential customers

A. R. Leyva (Blogger, Tech Guy Gadgets) recommends it as "much better than relying on Google's site crawler"

Final Thoughts

If you're serious about SEO, Rapid URL Indexer offers a cost-effective solution to one of the most persistent challenges in search optimization. The combination of high indexing rates, fair pricing, and risk-free guarantees makes it a valuable addition to any SEO toolkit.

The service addresses the critical gap between creating content or building links and having them actually count toward your search rankings. By accelerating the indexing process, it allows you to see results from your SEO efforts much faster.

Whether you're managing your own website or providing SEO services to clients, Rapid URL Indexer can help you achieve better results with less waiting and frustration.

https://rapidurlindexer.com/

0 notes