#banking api

Explore tagged Tumblr posts

Text

Get Fintech API, Banking API, Travel API & Verification API

Are you looking for API solution to integrate into your software system to get addon services then this is for you?

Ezulix software is a leading fintech & banking API provider company in India. We provider you end-to-end fintech & banking API solution for your business.

Along with this, we facilitate you travel and verification APIs to support your business,

For more details visit our website or request a free live demo.

#fintech api#banking api#travel api#verification api#aeps api#bbps api#dmt api#pan verification api#aadhaar verification api#payout api#bus booking api#flight booking api#hotel booking api

3 notes

·

View notes

Text

The Best Banking API Software Solutions with WeGoFin

In the dynamic world of digital finance, the integration of robust and reliable banking API software has become crucial for businesses seeking to innovate and enhance their financial services. WeGoFin is proud to be at the forefront of this revolution, offering cutting-edge API solutions that empower businesses to create seamless, efficient, and secure financial experiences for their customers. In this blog, we’ll explore some of the best banking API software solutions available today, and how WeGoFin can help you leverage these tools to drive your business forward.

#wegofin#best payment gateway#best secure payment#api#banking api#banking#digital payment services#digital payments

0 notes

Text

Moved the bulk of my savings into a hysa and that is literally so scary. Not the hysa just transferring in general.

#I’m using a brick and mortar because I’m to scared when it comes to online banks#*too#even though they have the highest apy#even if they’re fdic insured#and even with the brick and mortar my anxiety is on 10

4 notes

·

View notes

Text

#background checks#fraud prevention#identity verification solutions#KYC API#kyc solution#kyc uk#fintech#banks#finance#identity verification system

3 notes

·

View notes

Text

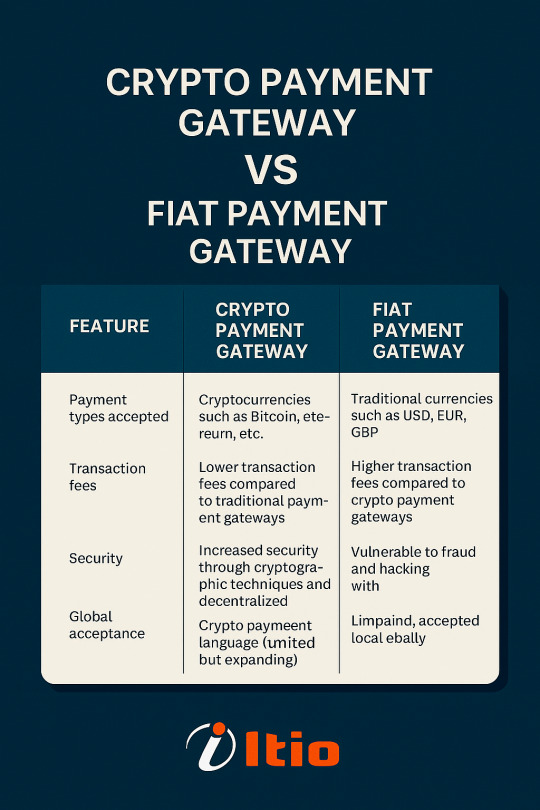

Connect everything, effortlessly. Our API Integrations streamline your tech stack for maximum efficiency. Ready to unlock seamless innovation?

#crypto#cybersecurity#digital banking licenses#digitalbanking#fintech#white label crypto exchange software#bitcoin#investors#digital marketing#financial advisor#payment api#software engineering#api development#api testing#github#api 5l#api manufacturer#api integration#itioinnovex

0 notes

Text

Get Quick Digital Loan Against Mutual Funds in 2025 – No CIBIL, Instant Approval, Low Interest!

In 2025, managing financial emergencies or funding major life goals has become faster and easier, thanks to the growing popularity of Loan Against Mutual Funds (LAMF). Whether you need funds for a wedding, a medical emergency, or to start a small business, your investments in mutual funds can help unlock instant liquidity without selling them.

But how does it work? What is the LAMF interest rate in 2025? What documents are required? How does LAMF compare to personal loans or gold loans? In this guide, you’ll find everything you need to know to make an informed decision.

What Is a Loan Against Mutual Fund (LAMF)?

A Loan Against a Mutual Fund is a type of secured loan where your mutual fund units are pledged as collateral. It’s one of the smartest ways to raise quick funds without selling your investments.

When you pledge mutual fund units, lenders assign a certain Loan-To-Value (LTV) ratio and disburse funds instantly. The units stay in your demat account but cannot be redeemed unless the loan is repaid.

Key Features of Loan Against Mutual Funds in 2025

Instant Online Approval via LAMF API integration

No income proof or credit score required

Flexible repayment tenure

Zero foreclosure charges with top lenders

Loans are available on both equity & debt mutual funds

Apply Loan Against Mutual Fund Online Instantly

With platforms like Investkraft, Volt Money LAMF, and Bajaj Finserv mutual fund loan options, applying online is seamless. You can complete the entire loan process in under 5 minutes with just your PAN and folio number.

No paperwork. No branch visits. Purely digital loan against mutual fund access.

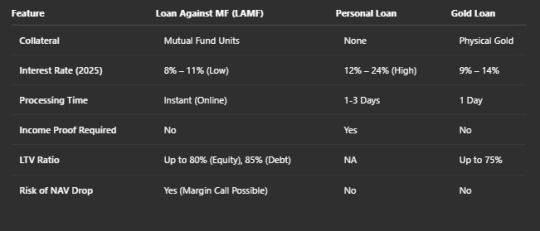

LAMF vs Personal Loan vs Gold Loan: A Real Comparison

Understanding LTV in Loan Against Mutual Funds

Loan-to-Value (LTV) is the percentage of your mutual fund’s current value that can be disbursed as a loan.

LAMF LTV for Equity Mutual Funds: Up to 80%

LAMF LTV for Debt Mutual Funds: Up to 85%

This means if your equity mutual fund value is ₹1,00,000, you can get a loan up to ₹80,000.

What Is the Interest Rate for a Loan Against Mutual Funds in 2025?

Interest rates are much lower than personal loans and depend on your mutual fund type and the lender.

LAMF interest rate 2025 (Equity Funds): 9% – 11.5%

LAMF interest rate 2025 (Debt Funds): 8% – 10.5%

Some top digital lenders offer rates as low as 7.99% for salaried investors.

Who Can Apply for a Loan Against Mutual Funds?

Eligible Individuals:

Salaried professionals

Self-employed individuals

Retirees with mutual fund holdings

LAMF Eligibility Requirements:

KYC-verified PAN

Active mutual fund folio in demat form

No need for income proof or CIBIL score

Use any LAMF eligibility calculator online (Investkraft, Volt, Bajaj) to check your loan limit.

Loan Against Mutual Funds: Documents Required

You’ll be surprised how minimal it is:

PAN card

Linked mobile number for OTP

Demat account login or mutual fund folio number

There is no need to upload salary slips, income proof, or ITR, unlike personal loans.

How Does a Loan Against a Mutual Fund Work?

Apply online on any LAMF platform (e.g., Investkraft, Bajaj Finserv)

Enter your PAN and validate your folio

The lender checks your eligible mutual fund units

The loan amount is calculated using the loan against mutual fund calculator

Get instant disbursal into your bank account

Your units are pledged, and you can unpledge anytime by repaying the loan.

Risks of LAMF: What You Must Know

Loan Against Mutual Fund Margin Call: If the NAV drops significantly, the lender may ask you to repay a portion or add more units

Risk of LAMF NAV Drop: Equity markets are volatile, so equity funds carry higher risk

Redemption Blocked: You can’t sell your pledged units until the loan is cleared

However, for debt mutual funds, risks are minimal, and LTV is higher.

Best Banks & Platforms for Loan Against Mutual Funds in 2025

Check recent loan against mutual fund reviews on Reddit or Google before choosing a platform.

Why Choose LAMF in 2025 for Financial Needs?

No EMI burden upfront

You stay invested while getting liquidity

Much cheaper than personal loans

Great for short-term or mid-term funding: weddings, emergencies, travel, education

Whether you're a young investor or a salaried individual, a digital loan against mutual fund is the smartest way to raise money today.

FAQs on Instant Loan Against Mutual Funds in 2025

Q1. What is the loan against mutual fund interest rate in 2025? Interest rates range from 8% to 11.5% based on the fund type and lender.

Q2. How much loan can I get against mutual funds? You can get up to 80% LTV on equity funds and up to 85% on debt mutual funds.

Q3. Are there any risks of taking LAMF? Yes, if NAV drops drastically, a margin call may be triggered. However, with proper planning, this can be managed.

Q4. Can I apply for LAMF without income proof or CIBIL? Yes. LAMF is completely collateral-based. No CIBIL or income proof is needed.

Q5. Which is better – LAMF or a personal loan? LAMF is cheaper, faster, and requires no documents. It’s ideal for mutual fund investors.

Final Words: Tap Your Investments, Not Your Savings

Why liquidate your funds when you can use them as leverage? In 2025, LAMF loans are empowering investors with easy access to capital, be it for a personal emergency, funding a wedding, or growing a side business.

If you have mutual funds, it’s time to make them work for you. Explore LAMF with trusted lenders like Investkraft, Volt Money, or Bajaj Finserv and unlock a world of digital, instant, low-interest funding.

Apply loan against a mutual fund online now – no income proof, no stress, only smart financing.

#loan against mutual fund interest rate#LAMF interest rate 2025#loan against mutual fund LTV#LAMF LTV equity vs debt mutual fund#loan against mutual fund calculator#LAMF eligibility calculator#loan against mutual fund documents required#apply loan against mutual fund online#LAMF vs personal loan#loan against mutual fund vs gold loan#loan against mutual fund margin call#risk of LAMF NAV drop#best banks for loan against mutual funds#Volt Money LAMF#Bajaj Finserv mutual fund loan#loan against mutual fund review#LAMF experiences reddit#lamf#loan against mutual funds limit#loan against mutual funds features#lamf eligibility#lamf loan#digital loan against mutual fund#investkraft loan#loan against mutual funds for financial needs#what is a loan against mutual fund#who can apply for loan against mutual funds#loan against mutual funds explained#loan against mutual funds processing fees and interest rates#lamf api

1 note

·

View note

Text

API Banking – Simplifying Financial Innovation

The fintech revolution is built on one key enabler: APIs. API Banking allows businesses and developers to connect with bank services quickly and securely. At Bharat Inttech, our API Banking platform delivers a powerful, plug-and-play gateway to modern financial services.

What is API Banking?

API Banking enables third-party applications to access bank data and functionalities—like account details, transactions, fund transfers, or KYC—via secure APIs. This technology helps banks and fintechs offer tailored solutions without rebuilding core infrastructure.

Key Offerings:

Account Access APIs: View balances, fetch statements, and validate account details.

Payment APIs: Enable UPI, IMPS, NEFT, and other fund transfer options.

Onboarding APIs: Perform eKYC and link bank accounts.

Lending APIs: Automate loan disbursement and repayment tracking.

Use Cases:

Neo-banks building full banking experiences

Lending apps integrating automated payments

Merchant platforms enabling real-time settlements

ERP tools integrating banking within dashboards

Why Inttech’s API Banking?

Quick Integration: Our SDKs and sandbox environment simplify the process.

Customizable APIs: Tailor workflows to match your business logic.

Secure & Compliant: Follows ISO, PCI-DSS, and RBI standards.

Technical Support: From onboarding to production, we support your journey.

Benefits for Businesses:

Faster go-to-market

Reduced development cost

Streamlined user experience

Real-time financial data access

Conclusion:

API Banking is no longer a tech trend—it’s the foundation of fintech. Whether you’re launching a digital bank or integrating payment services into your app, Bharat Inttech provides the tools you need to innovate confidently.

For More Information Visit Us:

0 notes

Text

Effortless Vendor Payments Across Banks

Paying vendors should be fast and simple. sprintNXT makes cross-bank vendor payments seamless, trackable, and automated. Say goodbye to delays and miscommunications — your vendors will thank you. #sprintNXT #VendorPayments #SimplifiedBanking #FinanceTech #DisbursementSolutions

0 notes

Text

API Banking Market Size 2033: Unlocking the Future of Digital Finance

Introduction

In the era of open banking and digital-first customer experiences, API Banking has transitioned from a buzzword to a foundational pillar of modern financial infrastructure. As banks, fintechs, and non-banking institutions alike race to embed financial services into seamless digital journeys, API Banking Market growth is accelerating at an unprecedented pace.

Market Overview

The Global API Banking Market Size is Expected to Grow from USD 20.35 Billion in 2023 to USD 140.45 Billion by 2033, at a CAGR of 21.31% during the forecast period 2023-2033.

API (Application Programming Interface) banking enables financial institutions to securely expose banking services to third-party developers, apps, and platforms. From payments and account aggregation to KYC and lending, APIs unlock innovation, foster collaboration, and fuel customer-centric banking models.

As global regulatory frameworks (e.g., PSD2, Open Banking UK, UPI in India) push for greater transparency and interoperability, the API banking ecosystem is rapidly expanding across regions and verticals.

Get More Information: https://www.sphericalinsights.com/our-insights/api-banking-market

Market Growth & Key Drivers

The API Banking Market is projected to grow at a CAGR of over 21.31% between 2023 and 2033, driven by several core factors:

Open Banking Regulations: Governments and central banks pushing interoperability and customer data ownership.

Digital Transformation in BFSI: Traditional banks seeking agility through third-party integration and microservices.

Rising Fintech Adoption: Startups leveraging APIs to deliver niche services without building backend banking infrastructure.

Embedded Finance Growth: Retailers, logistics platforms, and super apps integrating banking features via APIs.

Customer Expectations: Demand for real-time, personalized, and mobile-first banking experiences.

Market Challenges

Despite strong momentum, the road to widespread API banking adoption faces notable obstacles:

Legacy System Integration: Traditional banks face architectural limitations and high modernization costs.

Security & Compliance Risks: APIs expose banks to potential vulnerabilities if not secured properly.

Standardization Issues: Fragmented API formats and documentation across institutions slow down innovation.

Monetization Models: Defining ROI and pricing strategies for exposed services is still evolving.

Market Segmentation

By Type of Service:

Payment APIs

Account Information APIs

KYC/AML APIs

Lending APIs

Card & Wallet APIs

By Deployment Mode:

On-Premise

Cloud-Based

By End-User:

Retail & Commercial Banks

Fintech Companies

E-commerce Platforms

Third-Party Providers (TPPs)

Government Agencies

Regional Analysis

North America

Leads the market due to rapid fintech growth, VC funding, and supportive regulations. The U.S. market benefits from BigTech entries into financial services.

Europe

A mature API banking region fueled by PSD2 and the open banking mandate. The UK is a clear leader in regulatory-led innovation.

Asia-Pacific

Explosive growth, especially in India, China, and Southeast Asia. UPI in India has transformed digital payments via open APIs.

Latin America & Middle East

Emerging players with high potential. Brazil's open banking regulation is positioning it as a regional leader.

Competitive Landscape

Key players are deploying aggressive growth strategies, including:

Partnerships with fintechs and neobanks

Launch of API marketplaces and developer portals

Strategic acquisitions for platform expansion

Focus on open-source and interoperability frameworks

Leading Companies:

BBVA Open Platform

Finastra

Tink (Visa)

Plaid

Yodlee (Envestnet)

Banking-as-a-Service providers like Solaris, Marqeta, and Synapse

Positioning & Strategies

Modern financial institutions are rebranding themselves as platforms rather than just service providers. Their positioning now focuses on:

Developer-First Experience: Offering robust API documentation, SDKs, and sandbox environments.

Banking-as-a-Service (BaaS): Enabling third parties to launch financial products without a banking license.

API Monetization Models: Introducing freemium, pay-per-use, and tiered access strategies.

Buy This Report Now: https://www.sphericalinsights.com/checkout-insights/1041

Recent Developments

Visa’s acquisition of Tink expanded API coverage across Europe.

Mastercard’s partnership with Finicity enhanced its open banking capabilities.

India's Account Aggregator Framework rolled out a unified data-sharing model via APIs.

BBVA and HSBC launched new developer platforms to streamline integration with fintechs.

Trends & Innovations

AI-Powered APIs: Smart APIs capable of learning and adapting to transaction patterns.

Decentralized Finance Integration: APIs linking banks to DeFi platforms for hybrid finance models.

Real-Time Cross-Border Payments: Open APIs improving speed and transparency in global transfers.

Low-Code/No-Code API Development: Accelerating time-to-market for new integrations.

API Observability & Analytics: Monitoring performance and usage metrics for optimization.

Opportunities

Neo-Banking Expansion: Fueling digital-only bank launches with API-first models.

SME Banking Services: APIs catering to underserved small and medium-sized enterprises.

Insurance, WealthTech, and RegTech APIs: New verticals integrating financial services.

Public Sector Digitalization: APIs enabling smarter tax filing, identity management, and subsidy disbursement.

Related URLS:

https://www.sphericalinsights.com/our-insights/mountain-e-bikes-market

https://www.sphericalinsights.com/our-insights/home-healthcare-market

https://www.sphericalinsights.com/our-insights/miticides-market

https://www.sphericalinsights.com/our-insights/automotive-gigacasting-market

Future Outlook

By 2033, the API banking market will no longer be seen as a niche segment but rather the default infrastructure for all financial interactions. Institutions that fail to adopt API strategies risk losing relevance to more agile, tech-enabled competitors. Expect deeper integration across industries, government-backed frameworks, and the rise of autonomous finance powered entirely by real-time, interoperable APIs.

Conclusion

API Banking is not just a trend—it’s a paradigm shift in how financial services are created, consumed, and distributed. For decision-makers, product managers, entrepreneurs, and regulators, now is the time to align with this digital wave. Whether you're looking to monetize data, innovate services, or transform legacy infrastructure, the API banking market holds the key to unlocking scalable, efficient, and inclusive finance for all.

About the Spherical Insights

Spherical Insights is a market research and consulting firm which provides actionable market research study, quantitative forecasting and trends analysis provides forward-looking insight especially designed for decision makers and aids ROI.

which is catering to different industry such as financial sectors, industrial sectors, government organizations, universities, non-profits and corporations. The company's mission is to work with businesses to achieve business objectives and maintain strategic improvements.

Contact Us:

Company Name: Spherical Insights

Email: [email protected]

Phone: +1 303 800 4326 (US)

Follow Us: LinkedIn | Facebook | Twitter

0 notes

Text

Best API Banking Solutions for Businesses

API banking solutions are the easiest way to take control of your business finances. With quick integration and simple tools, you can send payments, check account details, and collect money without delays. These smart solutions work 24/7 and keep your work safe and error-free. Perfect for startups, growing businesses, and online platforms that want to handle money in a faster, better way.

0 notes

Text

https://www.wegofin.com/api-banking

0 notes

Text

Real Stories: How Businesses Grew Using SprintVerify

SprintVerify isn’t just an API provider—it’s a growth partner. From fintech startups reducing fraud rates to HR tech platforms onboarding workers 3x faster, real businesses are seeing measurable impact. One lending platform cut onboarding time from 2 days to 20 minutes. Another saw user drop-off fall by 35% after adopting SprintVerify’s instant KYC tools. These case studies show how fast, secure identity verification isn’t just about compliance—it’s about scaling operations, improving user experience, and driving revenue. Read how businesses across India are achieving growth through smart, API-driven verification with SprintVerify.

0 notes

Text

Mauricio Vergara, CEO & Co-Founder of Kapwork – Interview Series

New Post has been published on https://thedigitalinsider.com/mauricio-vergara-ceo-co-founder-of-kapwork-interview-series/

Mauricio Vergara, CEO & Co-Founder of Kapwork – Interview Series

Mauricio Vergara, CEO and Co-Founder of Kapwork, oversees the company’s operations, sales, and marketing. As a former small business owner, he experienced firsthand the strain that late payments place on growing companies. Later, during his time at Google and Unity, he saw how delayed payments negatively affected creators, stalling their ability to scale. Motivated to find a better solution, he began exploring the space—quickly realizing how limited the funding options are for small businesses and how challenging it is for funders to support them effectively.

This led to the creation of Kapwork, a platform that simplifies revenue-based financing by connecting businesses with capital providers through a transparent and frictionless experience. Designed to support the next generation of entrepreneurs, Kapwork helps businesses grow on their terms by turning future revenue into immediate funding.

What inspired you to start Kapwork, and how did your personal experience as a small business owner in Colombia shape your vision for transforming the factoring industry?

I used to run a restaurant and a catering business in Colombia. To this day, I remember when the first customer walked through the door and thinking to myself, “she is here because I have something to offer. Something that adds value.” It was such a surreal experience that I later validated at Google.

Working directly with app and game developers, I realized how much I loved helping people who can create something where nothing was before. Developers, like SMB owners, are the craftsmen and women of the modern age, and for me, there is nothing more satisfying than helping those who create value, generate wealth. That is why I started Kapwork with Pete Thomas. There was a whole sector, critical to our economy, that had been largely ignored by technology. AI has unlocked so much opportunity for transformation, why leave any frontier behind? It’s such a dense problem, and I was drawn to finally try my hand at building a company from the ground up. As Peter Thiel puts it in Zero to One: “A startup is the largest endeavor over which you can have definite mastery”.

You’ve described invoice factoring as a lifeline for small businesses. What does that lifeline look like today, and how is Kapwork reshaping it?

Cashflow is the lifeline for small businesses and without Factoring providing it for them, many of these companies would simply go out of business. In B2B it’s customary to see stretched out payment terms of 30 to 90 days outstanding. Imagine being at the mercy of large corporations waiting to get paid for services and products you’ve already delivered. Without Factoring providing the necessary working capital, these businesses can’t grow and in some cases, can even go out of business. Factoring has been around for more than 100 years to bridge these gaps, purchasing invoices and delivering capital–but it hasn’t scaled yet. It’s a highly manual, risky and time-intensive process for thousands of factors around the globe.

Kapwork was started to overhaul these operations; we’re putting AI and automation to work to accelerate workflows, reduce errors and scale more effectively. This means more money flowing to businesses. Factoring helps businesses thrive, and Kapwork helps those Factors and the small businesses who rely on them.

Kapwork’s platform includes a self-healing AI agent. Can you explain what that means in practical terms, and how it enhances the factoring process?

Kapwork functions by deploying agents across a huge number of vendor portals to pull and populate data. Traditionally, these types of automations are hard to build and really expensive to keep online, when something changes within the web portal, for example. In that case, the entire process creates more headaches than benefits, and throws reliability into question. We had to develop an approach to prevent this.

When we say that our AI agents are “self-healing,” we mean that when an existing Kapwork AI agent experiences a fatal error due to some new, external change that prevents it from achieving its goal, this same Agent can invoke an AI process to evaluate what changed and indicate how it needs to be modified or replaced to continue working again. This capability is what gives Kapwork our durability, we always retrieve the needed data. When our current approach breaks because a web site changed, we don’t go back and come up with a new approach, instead we let AI do that for us automatically.

What were the biggest technical hurdles in building an AI platform that integrates with 4,000+ vendor portals and financial systems?

The first big technical hurdle is that most Vendor Management Systems (VMS) do not provide APIs, so Kapwork AI Agents had to be designed to navigate the identical VMS interfaces that humans use. These interfaces can be unreliable when it comes to automating data retrieval, with some changing form and function every few months, so we really had to develop a robust error correction system in our agentic framework so Kapwork Agents remain durable despite the inherently unreliable environment and can seamlessly address errors as they notice them.

The second big technical hurdle is the fact that every VMS is different. Although debtors that use Ariba and Coupa generally offer the same user interface for data retrieval, thousands of other debtors in “the long tail” follow no interface standard and present the data funders need in all sorts of non-intuitive, cumbersome ways. To stay efficient, we had to develop an agentic AI system that can explore any portal it hasn’t seen before and quickly figure out where to get the required data and how to write a reliable program to get it.

Finally, the lack of APIs made determining responsible password management protocols to facilitate automation an incredibly challenging hurdle. Non-traditional finance is in general guilty of bad password hygiene. We often see multiple parties often sharing various account credentials to prove to each other that parties and counterparties are storing the right data in the right systems. So, when it comes to helping this industry automate data verification at scale, defining compliant security protocols and promoting best practices took a lot of research and discussions with operators working in the space today.

How does Kapwork use AI to verify invoices in seconds—something that used to take 1–2 days of manual effort?

Because Kapwork AI Agents work concurrently, for example, retrieving data from 20 portals simultaneously, we can verify invoice data at scale. The data can also then be populated automatically into a centralized dashboard for a comprehensive view of the pipeline. This is in contrast to most financial teams in the business of verification today, wherein one person can only log into one portal at a time, find the data they need, download it, log out, log back in for their next client, etc., and proceed to move onto the next VMS when they are finished with the first one. Until today, people were doing all this work by hand, in serial fashion, making their way through a large book of confirmations that can take a single person days to complete.

What kind of data validation or fraud detection capabilities does your AI system offer, and how do they compare with traditional approaches?

Regarding fraud detection today, Kapwork describes our unique capability as “anomaly detection.” We are not currently applying any specialized AI to this problem but instead leaning on the fact that the data aggregation by Kapwork AI Agents’ naturally builds up patterns of how two companies do business together, what the value ranges are for things like amount and due date, and whether there is always a purchase order associated with a receivable. As patterns establish over time, Kapwork can detect possible fraud by showing a recent transaction or set of transactions fall outside the range of what is considered “normal” business, and alert the customer. Much of this could be missed by the human eye and normal processes. It’s an area of exploration and we’re excited to do more here in the future.

What role does AI play in improving deal flow and conversion rates for invoice buyers on your platform?

A Factor typically needs one to three months to underwrite an invoice seller. During that time, the seller remains desperate for cash while the factor keeps their capital idle at the bank. Kapwork’s AI instantly verifies invoice data, pulling records directly from debtor systems and delivering a vetted “AP snapshot” that allows credit teams to approve or decline the receivables facility in days, not months. The system also allows factors to verify invoices from their existing customer base more frequently without assuming additional headcount, enabling them to deploy capital faster.

You’ve held leadership roles at Google and Unity. What lessons from Big Tech helped you when transitioning into startup life at Kapwork?

In three ways. It helped me realize that I didn’t want to spend more time watching paint dry, shaped me as a leader, and gave me the confidence to realize that I can always try and figure things out.

In the words of Marc Randolph, “everything is solvable if you’re willing to start and figure it out.” When I first worked at Google and Unity, I often felt impostor syndrome. Having come from a more humble background than my often IVY league colleagues, I used to doubt my worth but Google taught me that if I was there, it was for a reason. As I started to progress in my career, I gained the confidence to know that, even though I don’t know how to do something, all I need to do is start. With time, you can always figure it out.

Google also shaped me as a leader. It taught me that nothing scales faster than getting people behind a clear vision that they believe in. It also helped me understand what is needed to create a healthy environment where everyone can express their opinions without worry about retribution. Nothing helps a company grow faster than a smart team of proactive individuals rallied around a vision who are willing to challenge your thinking and commit.

Finally, Big Tech also helped me realise that I didn’t want to watch the paint dry any longer. There are so many hierarchies and embedded interests that it is always hard to challenge the status quo. The systems in place are designed to reduce risk and in some cases leads to employees being more preoccupied with signaling the good work they do than actually doing the work. I didn’t want that in my life anymore, especially when you see the world moving at the speed of light with all the recent developments in AI.

What’s your vision for how AI will further transform the financial services industry—particularly in underserved SMB segments?

Heterogeneity is good for society and bad for the lending industry. I find it fascinating how the diversity amongst small businesses makes it hard for them to find working capital solutions.

What literally makes SMBs special, makes it hard for them to grow. Just think about the diversity of SMBs. On one side, you have a family-owned hardware wholesaler and on the other, a boutique artisan bakery. Both are great in that they contribute uniquely, but the way these are run and operated is completely different. The variety of industries, financials, and business models makes it incredibly hard for lenders to make up their mind about them and for SMBs, to navigate the landscape. So how do you assess diverse businesses without a one size fits all approach? AI has been a tool to bridge that gap for a while but it was always cost prohibitive.

In my opinion, what is most interesting is that it finally makes economic sense to build solutions to tackle these challenges. More affordable AI will make it possible for the financial industry to build solutions for a highly fragmented and heterogenous SMB industry.

Thank you for the great interview, readers who wish to learn more should visit Kapwork.

#000#Affordable AI#agent#Agentic AI#agents#ai#ai agent#AI AGENTS#ai platform#anomaly#anomaly detection#APIs#app#approach#automation#B2B#background#bank#BIG TECH#book#bridge#Building#Business#career#CEO#challenge#change#Companies#comprehensive#creators

0 notes

Text

KYC Provider UK

KYC Verification is essential to onboard a new client in UK businesses to authenticate the identity of a person associated with the business and even to check involvement in money laundering. We are one of the leading KYC providers in the UK and assist with KYC API for financial and non-financial businesses.

#KYC UK#KYC Provider UK#KYC Solutions UK#KYC Solutions Provider UK#banking#finance#fintech#gaming#kyc api#kyc software#kyc companies#banks

4 notes

·

View notes

Text

Looking for One, We got you!

#crypto#cybersecurity#digital banking licenses#fintech#investors#digitalbanking#white label crypto exchange software#bitcoin#digital marketing#financial advisor#itioinnovex#paymentgateway#payment processing#payment gateway#payment api#payment solutions#payments

0 notes

Text

InStep Technologies is a trusted fintech software development company delivering secure, scalable, and innovative financial solutions. We build custom fintech apps, APIs, mobile wallets, blockchain integrations, and automation tools for startups, banks, and enterprises.

#fintech software development#custom fintech solutions#financial technology apps#fintech development company#banking app development#blockchain in finance#secure payment software#finance automation tools#investment software solutions#fintech API integration

0 notes