#bitcoin puzzle

Explore tagged Tumblr posts

Text

youtube

Всем привет! С вами Александр Новицкий, и сегодня мы погрузимся в одну из самых загадочных головоломок криптомира – Bitcoin Puzzle 32. 🔥

📅 15 января 2015 года с одного биткоин-кошелька были отправлены средства на 256 других кошельков, причём суммы варьировались от 0.001 до 0.256 BTC. Спустя год криптосообщество начало разгадывать этот сложный пазл, подбирая приватные ключи к кошелькам.

💡 Как работает головоломка? Каждый кошелек представляет собой диапазон бит (1 бит, 2 бита, 3 бита и так далее). Взлом каждого следующего кошелька требует в два раза больше вычислительной мощности! С каждым шагом задача становится всё сложнее.

📌 Ключевые даты и события: 🔹 2017 год – сообщество осознало, что диапазоны от 161 до 256 бит не имеют смысла, так как биткоин использует 160-битную энтропию. 🔹 11 июля 2017 года – средства с "бессмысленных" кошельков перераспределили на существующие диапазоны. 🔹 16 апреля 2023 года – вознаграждение за разгадку оставшихся кошельков увеличилось в 10 раз!

💰 Сколько осталось? На данный момент 936 BTC остаются неразгаданными! Это около 8 миллиардов рублей! Самые крупные суммы хранятся на кошельках с диапазоном 2⁶⁶ - 2⁶⁷ бит, где содержится до 6.7 BTC (≈ 60 млн ₽).

❗ Почему некоторые кошельки взломаны? Через каждые 5 кошельков публиковался публичный ключ, а значит, взлом таких адресов проще! Специальные программы позволяют в сотни раз быстрее подбирать приватные ключи.

🚀 В следующем видео я покажу, как создавать кошельки по порядку, а также раскрою тему перебора приватных ключей!

🔔 Подписывайтесь на канал и Telegram, впереди ещё больше криптосекретов! Пишите в комментариях, что думаете об этой загадке! 🤯

2 notes

·

View notes

Text

Let's play a game!

Use the hint to connect the pictures to solve the puzzle and find the answer!

I'm virtual, not physical, yet hold great worth, A gateway to transactions, day and night. Can you guess, who am I?

Comment your answers below..

3 notes

·

View notes

Text

Earn $121 playing Age Of Apes mobile game.

Use the cointiply app to download and install the game, get cash rewards as you pass the levels, withdraw instantly as bitcoin.

Join - http://cointiply.com/r/B448Q

#bitcoin#crypto#games#gaming#mobile games#gamers#doge#ethereum#litecoin#sim game#puzzle games#monkey#monkies#fun#funny#play2earn

0 notes

Text

Criptoarheologia: Vestigii Digitale în Blockchain

Studiul „Stratificării” Datelor Istorice și a Tranzacțiilor în Rețelele Descentralizate 1. Introducere Orice tehnologie emergentă se împletește cu o istorie care, la momentul ivirii sale, este puțin înțeleasă și greu de evaluat în timp real. Blockchain-ul, apărut în 2009 odată cu Bitcoin, reprezintă nu doar un protocol numeric cu aplicații financiare și de guvernanță, ci și un uriaș depozit de…

#corp de date#explorare on-chain#muzee digitale#nativ digital#micropaleontologie virtuală#coinbase message#arheologie digitală#puzzle criptografic#NFT-uri istorice#e-cultură#forks#comparatie geologică#puzzle on-chain#stratificare#explorare#FOAF (friend of a friend)#offline storage#HPC#commit#genealogie#contextualizare#episteme#memorie colectivă#comparativ#cluster nodes#block explorer#bitcoin#blockchain#tranzactii#nft

0 notes

Text

In the late 1990s, Enron, the infamous energy giant, and MCI, the telecom titan, were secretly collaborating on a clandestine project codenamed "Chronos Ledger." The official narrative tells us Enron collapsed in 2001 due to accounting fraud, and MCI (then part of WorldCom) imploded in 2002 over similar financial shenanigans. But what if these collapses were a smokescreen? What if Enron and MCI were actually sacrificial pawns in a grand experiment to birth Bitcoin—a decentralized currency designed to destabilize global finance and usher in a new world order?

Here’s the story: Enron wasn’t just manipulating energy markets; it was funding a secret think tank of rogue mathematicians, cryptographers, and futurists embedded within MCI’s sprawling telecom infrastructure. Their goal? To create a digital currency that could operate beyond the reach of governments and banks. Enron’s off-the-books partnerships—like the ones that tanked its stock—were actually shell companies funneling billions into this project. MCI, with its vast network of fiber-optic cables and data centers, provided the technological backbone, secretly testing encrypted "proto-blockchain" transactions disguised as routine telecom data.

But why the dramatic collapses? Because the project was compromised. In 2001, a whistleblower—let’s call them "Satoshi Prime"—threatened to expose Chronos Ledger to the SEC. To protect the bigger plan, Enron and MCI’s leadership staged their own downfall, using cooked books as a convenient distraction. The core team went underground, taking with them the blueprints for what would later become Bitcoin.

Fast forward to 2008. The financial crisis hits, and a mysterious figure, Satoshi Nakamoto, releases the Bitcoin whitepaper. Coincidence? Hardly. Satoshi wasn’t one person but a collective—a cabal of former Enron execs, MCI engineers, and shadowy venture capitalists who’d been biding their time. The 2008 crash was their trigger: a chaotic moment to introduce Bitcoin as a "savior" currency, free from the corrupt systems they’d once propped up. The blockchain’s decentralized nature? A direct descendant of MCI’s encrypted data networks. Bitcoin’s energy-intensive mining? A twisted homage to Enron’s energy market manipulations.

But here’s where it gets truly wild: Chronos Ledger wasn’t just about money—it was about time. Enron and MCI had stumbled onto a fringe theory during their collaboration: that a sufficiently complex ledger, powered by quantum computing (secretly prototyped in MCI labs), could "timestamp" events across dimensions, effectively predicting—or even altering—future outcomes. Bitcoin’s blockchain was the public-facing piece of this puzzle, a distraction to keep the masses busy while the real tech evolved in secret. The halving cycles? A countdown to when the full system activates.

Today, the descendants of this conspiracy—hidden in plain sight among crypto whales and Silicon Valley elites—are quietly amassing Bitcoin not for profit, but to control the final activation of Chronos Ledger. When Bitcoin’s last block is mined (projected for 2140), they believe it’ll unlock a temporal feedback loop, resetting the global economy to 1999—pre-Enron collapse—giving them infinite do-overs to perfect their dominion. The Enron and MCI scandals? Just the first dominoes in a game of chance and power.

87 notes

·

View notes

Text

if you, like me, are still unsettled and ruminating on Bring Her Back, the latest release from A24 directed by the Philippous, then blackangeltapes.net might well be an internet rabbit hole worth wandering down.

set up as a shady shopping site, viewers can browse sale lots and ISOs about not only the Tari resurrection tape central to the ritual of this film, but also the cursed embalmed hand from their previous breakout film Talk to Me. This semi-officially ties the two films into the same universe, where magic/enchanted elements that can totally ruin your entire life are available online for exchange for bitcoin and other currencies.

...still pretty neat, if I'm being honest.

each entry features photos of the object, and often a short film clip of it being used -- or, in the case of the many tapes available for your viewing pleasure(?), a teaser of what terrifying fates have been recorded. it's almost like having a sample platter of potential future films, or at least some really creepy concepts for stories.

even more interesting are the comments beneath each entry, where one can see people placing bids for various objects, and talking candidly about rituals and deities in ways that leave what's unsaid open to stomach-churning implications. not to mention the flavor text and odd symbols seen around the site, which heavily hint at some sort of organized Satanic(?) group monitored by "those who glow."

there are some particularly interesting comments under the Tari resurrection tape, where one might find an all-too-brief look at another perspective on the events of Bring Her Back.

I'm still puzzling over the weird audio/visual loop one can access from clicking on the link for the This is Not A Cult production company, but perhaps that's a mystery for another time. for now, please feel free to creep around to your heart's content on the terrors that are already listed. I'm curious if this means other future films by the duo will be set in this same universe with this same mysterious group, or if it's just some creepy easter eggs for funsies.

#bring her back#talk to me#a24#michael philippou#danny philippou#horror films#horror movies#horror#rarae talks horror

23 notes

·

View notes

Text

"In the age of smart fridges, connected egg crates, and casino fish tanks doubling as entry points for hackers, it shouldn’t come as a surprise that sex toys have joined the Internet of Things (IoT) party.

But not all parties are fun, and this one comes with a hefty dose of risk: data breaches, psychological harm, and even physical danger.

Let’s dig into why your Bluetooth-enabled intimacy gadget might be your most vulnerable possession — and not in the way you think.

The lure of remote-controlled intimacy gadgets isn’t hard to understand. Whether you’re in a long-distance relationship or just like the convenience, these devices have taken the market by storm.

According to a 2023 study commissioned by the U.K.’s Department for Science, Innovation, and Technology (DSIT), these toys are some of the most vulnerable consumer IoT products.

And while a vibrating smart egg or a remotely controlled chastity belt might sound futuristic, the risks involved are decidedly dystopian.

Forbes’ Davey Winder flagged the issue four years ago when hackers locked users into a chastity device, demanding a ransom to unlock it.

Fast forward to now, and the warnings are louder than ever. Researchers led by Dr. Mark Cote found multiple vulnerabilities in these devices, primarily those relying on Bluetooth connectivity.

Alarmingly, many of these connections lack encryption, leaving the door wide open for malicious third parties.

If you’re picturing some low-stakes prank involving vibrating gadgets going haywire, think again. The risks are far graver.

According to the DSIT report, hackers could potentially inflict physical harm by overheating a device or locking it indefinitely. Meanwhile, the psychological harm could stem from sensitive data — yes, that kind of data — being exposed or exploited.

A TechCrunch exposé revealed that a security researcher breached a chastity device’s database containing over 10,000 users’ information. That was back in June, and the manufacturer still hasn’t addressed the issue.

In another incident, users of the CellMate connected chastity belt reported hackers demanding $750 in bitcoin to unlock devices. Fortunately, one man who spoke to Vice hadn’t been wearing his when the attack happened. Small mercies, right?

These aren’t isolated events. Standard Innovation Corp., the maker of the We-Vibe toy, settled for $3.75 million in 2017 after it was discovered the device was collecting intimate data without user consent.

A sex toy with a camera was hacked the same year, granting outsiders access to its live feed.

And let’s not forget: IoT toys are multiplying faster than anyone can track, with websites like Internet of Dongs monitoring the surge.

If the thought of a connected chastity belt being hacked makes you uneasy, consider this: sex toys are just a small piece of the IoT puzzle.

There are an estimated 17 billion connected devices worldwide, ranging from light bulbs to fitness trackers — and, oddly, smart egg crates.

Yet, as Microsoft’s 2022 Digital Defense Report points out, IoT security is lagging far behind its software and hardware counterparts.

Hackers are opportunistic. If there’s a way in, they’ll find it. Case in point: a casino lost sensitive customer data after bad actors accessed its network through smart sensors in a fish tank.

If a fish tank isn’t safe, why would we expect a vibrating gadget to be?

Here’s where the frustration kicks in: these vulnerabilities are preventable.

The DSIT report notes that many devices rely on unencrypted Bluetooth connections or insecure APIs for remote control functionality.

Fixing these flaws is well within the reach of manufacturers, yet companies routinely fail to prioritize security.

Even basic transparency around data collection would be a step in the right direction. Users deserve to know what’s being collected, why, and how it’s protected. But history suggests the industry is reluctant to step up.

After all, if companies like Standard Innovation can get away with quietly siphoning off user data, why would smaller players bother to invest in robust security?

So, what’s a smart-toy enthusiast to do? First, ask yourself: do you really need your device to be connected to an app?

If the answer is no, then maybe it’s best to go old school. If remote connectivity is a must, take some precautions.

Keep software updated: Ensure both the device firmware and your phone’s app are running the latest versions. Updates often include critical security patches.

Use secure passwords: Avoid default settings and choose strong, unique passwords for apps controlling your devices.

Limit app permissions: Only grant the app the bare minimum of permissions needed for functionality.

Vet the manufacturer: Research whether the company has a history of addressing security flaws. If they’ve been caught slacking before, it’s a red flag.

The conversation around sex toy hacking isn’t just about awkward headlines — it’s about how we navigate a world increasingly dependent on connected technology. As devices creep further into every corner of our lives, from the bedroom to the kitchen, the stakes for privacy and security continue to rise.

And let’s face it: there’s something uniquely unsettling about hackers turning moments of intimacy into opportunities for exploitation.

If companies won’t take responsibility for protecting users, then consumers need to start asking tough questions — and maybe think twice before connecting their pleasure devices to the internet.

As for the manufacturers? The message is simple: step up or step aside.

No one wants to be the next headline in a tale of hacked chastity belts and hijacked intimacy. And if you think that’s funny, just wait until your light bulb sells your Wi-Fi password.

This is where IoT meets TMI. Stay connected, but stay safe."

https://thartribune.com/government-warns-couples-that-sex-toys-remain-a-tempting-target-for-hackers-with-the-potential-to-be-weaponized/

#iot#I only want non-smart devices#I don't want my toilet to connect to the internet#seriously#smart devices#ai#anti ai#enshittification#smart sex toys

26 notes

·

View notes

Text

Lost Your Investments? Astraweb’s Impressive Success Rate Offers Hope

In a world where financial losses are increasingly common, losing funds whether through investment scams, unauthorized transactions, or stolen Bitcoin can feel like a devastating blow. For many, the dream of recovering what was once theirs seems impossible. However, a beacon of hope shines through for those affected by financial misfortune: Astraweb.

With a proven track record of success and a reputation built on results, Astraweb has emerged as a leader in the recovery of lost investments and cryptocurrency. Their team has successfully resolved hundreds of cases, helping clients reclaim what they once thought was lost forever. Their high success rate isn’t just a number it’s a testament to the expertise, dedication, and innovative strategies that set Astraweb apart in the competitive world of asset recovery.

Case Study: The Unlikely Comeback

Take, for example, the case of Sarah, a seasoned investor who fell victim to a sophisticated Ponzi scheme that drained her savings. For months, Sarah tried to follow conventional recovery channels but faced dead ends at every turn. Feeling disheartened and overwhelmed, she stumbled upon Astraweb during an online search. After contacting them, Astraweb’s experts meticulously analyzed her case, piecing together the puzzle of her lost funds.

Through a combination of technical skills, in-depth knowledge of the digital landscape, and a vast network of resources, Astraweb was able to trace the stolen funds to an obscure offshore account. What seemed impossible just weeks earlier became a reality Sarah recovered not just a portion of her investment, but nearly the full amount.

A Proven Process for Success

Astraweb’s approach is methodical and personalized. Each case is handled with the utmost care, ensuring that every client is treated with respect and transparency. The team begins by thoroughly analyzing the situation, identifying the specific channels through which funds were lost. Their experts then deploy a variety of advanced recovery methods ranging from tracking blockchain transactions to collaborating with global financial institutions and cybersecurity experts.

It’s Astraweb’s ability to innovate in the face of seemingly insurmountable obstacles that has earned them their stellar reputation. They don’t just resolve cases they return what’s rightfully owed to their clients, empowering individuals to regain control of their financial futures.

A Proven Track Record of Results

Astraweb’s exceptional success rate stems from its dedication to precision and its deep understanding of the complexities involved in asset recovery. With each case they resolve, Astraweb reinforces their standing as an industry leader. The numbers speak for themselves, but it’s the personal stories of clients like Sarah that truly highlight the impact of their work.

If you’ve lost it all, you don’t have to accept it as a permanent loss. Astraweb’s unparalleled expertise in asset recovery offers a second chance to those who feel hopeless. Hundreds of clients have already been given a fresh start.

Reach Out Today

Are you ready to take the first step toward reclaiming what’s rightfully yours? Let Astraweb’s team of experts guide you through the recovery process. With their deep experience and high success rate, Astraweb stands as a beacon of hope for those who have lost it all.

Contact: [email protected]

6 notes

·

View notes

Text

Jamie Tahsin at Vice:

As the polls began to dramatically shift in favor of Donald Trump on the evening of the election, Elon Musk, arguably Trump’s biggest supporter in recent months, tweeted: “The cavalry has arrived. Men are voting in record numbers. They now realize everything is at stake.” The top reply came from the notorious influencer and accused rapist and human trafficker, Andrew Tate. His summary of the election: “It’s men vs gays n chicks.”

Tate’s political analysis had the tone of a 14-year-old playground bully, but Musk’s excitement at men turning out to vote spoke to something fundamentally true: that Donald Trump’s plan was working. When I first read the tweet, I began searching for evidence that men were indeed turning up in record numbers. On Musk’s platform, X, I was greeted with videos from Philadelphia and Miami of young men wearing red caps celebrating in the streets—pickup trucks tearing down street-lit highways with MAGA flags trailing from their cargo beds. After covering the Manosphere and the hyper-online ‘Bro’ Right for the past five years, I knew that in recent months they had mobilized like never before behind Trump, and that if they were motivated enough to actually go out and vote, Trump had a serious edge.

Videos began to spread of frat boys across the US declaring their support for Donald Trump. When his victory was announced, one group filmed themselves performing Trump’s dance moves to “Y.M.C.A.” on the steps of their fraternity.

Men aged 18-29—a group that has been politically unengaged in recent years—voted decisively for Trump. The Wall Street Journal reported a shift to the right of 28 points among this group. According to the Center for Information and Research on Civic Learning, 56 percent of young male voters opted for Trump in 2024—a marked increase from 41 percent in 2020. In Trump’s successful courtship of this cohort, his secret weapon appears to have been his 18-year-old son, Barron.

[...]

But Barron’s role in Trump’s media strategy goes beyond just introducing Trump to figures like Adin Ross. Barron and his best friend, fellow 18-year-old Bo Loudon, were tasked by the campaign with helping Trump reach a young male audience. Loudon is a pro-Trump influencer, and son of the conservative media personality Gina Loudon, former co-chair of Women for Trump. Bo and Barron reportedly set up the Adin Ross stream, and Bo has claimed he helped set up Trump’s interview with Joe Rogan, too.

On the day of the election, figures from across the vast and frequently depressing multiverse that is the online ‘Bro right’ gave their ringing endorsements of Donald Trump, and implored their fans to go and vote for him. Upon the announcement of his victory, John Shahidi of the Nelk Boys tweeted: “Idc what anyone says, podcasts helped us win this election.” When the Wall Street Journal reported that ‘Younger Men Voted Decisively for Donald Trump,’ Shahidi reposted it alongside the message, “Shout-out to our entire team!” A part of Trump’s message that particularly resonated with his young male audience, and the podcast hosts he made appearances with, was his seemingly favorable stance towards cryptocurrencies, and his puzzling claim that Bitcoin will be “made in the USA.” Earlier this year, in Austin, Texas, I interviewed an African-American man who told me he would vote Trump for the first time, almost entirely because of his stance towards crypto.

[...] The rise of influencers like Tate and Ross aren’t just a symptom of young men shifting to the right, but an active factor that has exacerbated it. The ideology gap is widening between young men and women, not just in America, but all over the world. In the UK there is a 25-point gap between the views of young men and women; in Germany, this rises to 30. The factors that have led us here are wide-ranging, but in making a concerted effort to reach out to disaffected young men, Trump gained an edge in what is being described as one of the most consequential elections in US history. We saw a similar effect in the UK during the last election, as young men shared their support for Nigel Farage and his Reform Party. Many of the complaints coming from young men may appear to be misguided. Yet if politicians on the Left do not find a way to reach out to this group, and engage with it where it dwells online, opportunist populists like Trump and Farage most certainly will. In this election, one of Trump’s strongest weapons appears to have been his gigantic, chronically online 18-year-old son, his best friend Bo, and the ‘Bros’ they swung for Trump.

What the hell is wrong with these misogynistic and privileged frat bro males who got Trump over the line?

#Manosphere#Barron Trump#Theo Von#Adin Ross#Nelk Boys#Donald Trump#Elon Musk#Andrew Tate#2024 Presidential Election#2024 Elections#Dana White#Nick Fuentes#Bo Loudon#Joe Rogan

8 notes

·

View notes

Text

Think or Sink: Why Developing Critical Thinking Is Your Best Investment

In a world drowning in information, learning to think clearly might just be your life raft. We live amidst a relentless storm of headlines, opinions, and narratives—all competing for our attention and trust. Without the ability to think critically, we're left vulnerable, drifting wherever the current takes us. But there's another way.

The Critical Gap

When we rely solely on external "experts" or mainstream sources, we outsource our understanding to others who may have hidden agendas or biases. I learned this firsthand when I dove into Bitcoin. What mainstream narratives painted as a risky gamble, I saw differently by digging deeper. It became clear that true understanding only emerges when you're willing to ask questions, challenge assumptions, and verify facts independently.

Bitcoin: Your Gateway to Clear Thinking

Exploring Bitcoin isn't just about finance—it's a powerful introduction to critical thinking. Bitcoin demands that you question established narratives, verify information yourself, and reject blind faith. Its fundamental mantra—"Don't trust, verify"—is a guiding principle anyone can apply beyond finance, into politics, health, or daily decision-making.

Escaping the Herd Mentality

History is littered with the wreckage of groupthink—housing bubbles, dot-com crashes, financial meltdowns. Each catastrophe was fueled by collective blindness. Those who thrived were individuals who trusted their analysis over the noise. Critical thinking isn't just about knowing what to trust; it's about knowing when and how to break free from collective illusions.

First Principles Thinking: The Master Key

Imagine dismantling a complex puzzle down to its simplest pieces, then rebuilding it from scratch—that's first-principles thinking. Elon Musk leveraged this method to revolutionize industries from space travel to electric vehicles, rejecting conventional wisdom in favor of foundational truths. Applying first principles to Bitcoin or finance means asking:

"What is money at its core?"

"What truly gives something value?"

By returning to these fundamental questions, you'll find clarity amidst confusion. Bitcoin, for example, emerges naturally as sound money due to its scarcity, decentralization, and transparency—principles deeply rooted in basic truths.

Sharpen Your Mind: Actionable Steps

Developing critical thinking is like building a muscle—it takes consistent effort:

Question everything—especially your own beliefs.

Diversify your sources; challenge your views with opposing ideas.

Regularly reflect: are these thoughts genuinely yours?

Stay mentally flexible; embrace being wrong as a growth opportunity.

Your Future Depends on It

Critical thinking isn't just an intellectual exercise; it's your ultimate personal currency, empowering you to navigate complexity with confidence. In an uncertain future, those who sharpen their minds today will lead tomorrow.

The world won't slow down. Will you choose to drift along—or take control?

Think or sink—the choice is yours.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there’s so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you’re a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

📚 Get the Book: The Day The Earth Stood Still 2.0 For those who want to take an even deeper dive, my book offers a transformative look at the financial revolution we’re living through. The Day The Earth Stood Still 2.0 explores the philosophy, history, and future of money, all while challenging the status quo and inspiring action toward true financial independence.

Support the Cause

If you enjoyed what you read and believe in the mission of spreading awareness about Bitcoin, I would greatly appreciate your support. Every little bit helps keep the content going and allows me to continue educating others about the future of finance.

Donate Bitcoin:

bc1qpn98s4gtlvy686jne0sr8ccvfaxz646kk2tl8lu38zz4dvyyvflqgddylk

#CriticalThinking#ThinkForYourself#MindsetMatters#ClearThinking#FirstPrinciples#QuestionEverything#AwakenYourMind#Bitcoin#FinancialFreedom#DecentralizeEverything#SoundMoney#InvestInYourself#EconomicEmpowerment#SelfImprovement#PersonalGrowth#LevelUp#ChangeYourMindset#ThinkDifferently#EmpowerYourself#Philosophy#DeepThoughts#Awareness#Wisdom#IndependentThinking#blockchain#financial empowerment#digitalcurrency#financial experts#finance#globaleconomy

3 notes

·

View notes

Text

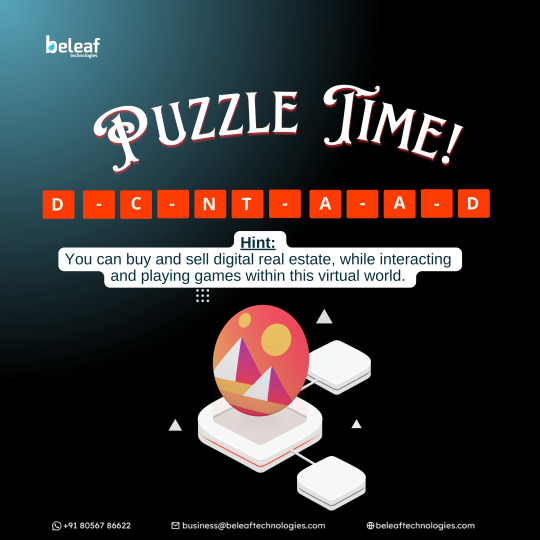

Guess the word !!

Do you need a clue ?? Here it is!

In a digital world where the excitement of real estate is combined with interactive gaming. Here, participants can buy and sell virtual properties, fostering a new environment where research, interaction, and marketing events combine to create an immersive and rewarding experience.

1 note

·

View note

Text

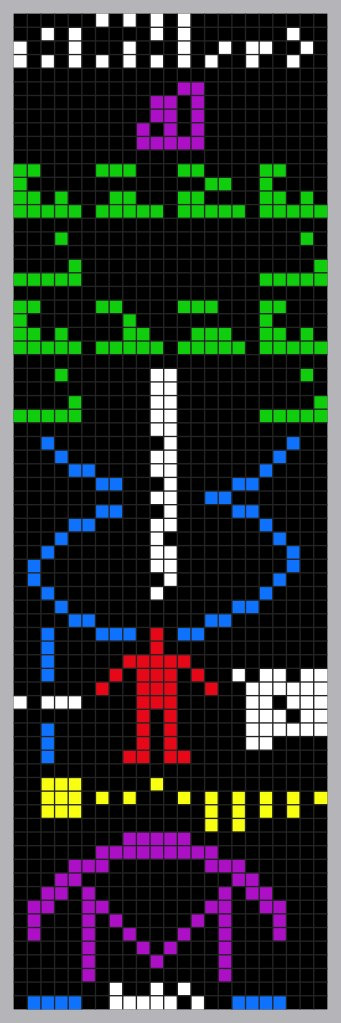

The Arecibo Telescope went out of service and then collapsed at the end of 2020 after nearly 60 years of research. It's probably best known for, after the fight scene in Goldeneye, broadcasting the Arecibo Message.

The Arecibo Message was sent out in 1974 and contained information about humanity, such as its DNA makeup, population, and position in the solar system. Now, you might look at the image of the transcribed message and think, "Hey, that's just an indecipherable puzzle nobody would ever be able to figure out without Wikipedia's super long explanation of the pieces!"

Yeah, you'd be right. It wasn't totally meant as a direct communication method with extraterrestrials, just a demonstration. And at least no matter how you received or interpreted the message, it's sufficiently non-random to be able to tell it's an intentional pattern and not radio noise.

A famous hoax happened in 2001 where some pranksters created a crop circle near another radio telescope with a 'reply' to the Arecibo Message in the same style (third image), featuring more inhabited planets, a new DNA structure, and an illustration of a 'little green man'.

The Arecibo Observatory was also the data source for the SETI@home project, where you could help with your personal computer to comb through received interstellar radio transmissions for signs of extraterrestrial life.

Sometimes I think about how in 2014 I thought it'd be way cooler to use my PC for SETI@home instead of whatever this "Bitcoin" thing was.

Crypto is temporary, extraterrestrial life is forever.

Anyways, the Arecibo Message reminds me of one of my favorite short horror stories.

Humanity, trying to find if it's alone in the universe, spends hundreds of years broadcasting in every direction. Finally, a response is received from the void:

"Be quiet, they'll hear you."

3 notes

·

View notes

Text

Bitcoin Bit: A New Era of Eco-Friendly and User-Friendly Cryptocurrency

As the cryptocurrency landscape matures, the original pioneer, Bitcoin, continues to reign as the most recognized and widely held digital asset. Yet, even with its monumental impact, Bitcoin faces persistent challenges—chief among them is its heavy environmental footprint due to the energy-intensive process of mining. Enter Bitcoin Bit, a forward-thinking cryptocurrency that retains the essential strengths of Bitcoin while resolving its most pressing drawbacks. With a sustainable design and a revolutionary approach to user accessibility, Bitcoin Bit positions itself as the next evolution of digital currency.

The Problem with Bitcoin Mining

Bitcoin operates on a Proof-of-Work (PoW) consensus mechanism, which requires miners to solve complex mathematical puzzles to validate transactions and earn rewards. While secure and decentralized, this system consumes a massive amount of electricity. In fact, studies have shown that Bitcoin’s global energy consumption rivals that of some countries, contributing significantly to carbon emissions and environmental degradation.

This energy-intensive process not only raises sustainability concerns but also excludes many potential participants due to the high cost of mining equipment and electricity. It has sparked debate among environmentalists and industry leaders, leading to an urgent call for more eco-friendly alternatives.

Bitcoin Bit’s Sustainable Solution

Bitcoin Bit addresses these concerns head-on by eliminating mining altogether. Instead of a PoW-based system, Bitcoin Bit adopts a pre-issued coin model. All 21 million coins—the same total supply as Bitcoin—are already created. These coins are not mined but are instead distributed gradually over 15 years, with a fixed amount released every three years.

This issuance model offers several key advantages:

Environmental Impact: Without the need for energy-intensive mining, Bitcoin Bit consumes only a fraction of the energy required by Bitcoin.

Market Stability: The slow, predictable release schedule helps prevent supply shocks and sudden inflation or deflation, promoting long-term stability.

Equal Opportunity: Anyone can participate in the ecosystem without the need for expensive hardware or specialized knowledge, making it more inclusive.

By removing the dependency on mining, Bitcoin Bit not only saves the environment but also ensures broader access to the cryptocurrency economy.

Mainnet Launch in 2025: Ushering in a New Standard

Bitcoin Bit’s journey is just beginning. The project is preparing for the launch of its mainnet in 2025, marking a pivotal moment in its development. This transition will shift Bitcoin Bit from concept to fully functioning blockchain, enabling real-world transactions, applications, and integrations.

More importantly, the mainnet will debut with one of the most innovative user features ever introduced in a Bitcoin-based project: ID and password recovery.

Breaking New Ground: Recovering Lost Wallets

One of the longstanding issues in the world of cryptocurrencies is the irreversibility of private key loss. If a user loses access to their wallet’s private key, their funds are often considered lost forever. This risk has haunted countless users and discouraged many newcomers from entering the space.

Bitcoin Bit turns this narrative on its head. With the introduction of a secure ID and password recovery system, users who lose their credentials will be able to regain access to their wallets without compromising security.

This is a first among Bitcoin-related coins. Until now, the decentralized nature of cryptocurrencies meant that user errors were final. By integrating a recovery mechanism, Bitcoin Bit creates a safer and more user-friendly experience, especially for beginners and those unfamiliar with digital asset security protocols.

How the Recovery Feature Works

While the full technical details will be unveiled closer to the mainnet launch, the recovery system will be designed to preserve decentralization and security while enabling lost access retrieval. It's likely to include identity verification steps and decentralized data encryption mechanisms, ensuring that only rightful users can reclaim their accounts.

This feature strikes a delicate balance—upholding the principles of crypto ownership while enhancing user experience. It could potentially become a new standard for future projects seeking to onboard mass audiences.

Preserving Bitcoin’s Strengths, Eliminating Its Weaknesses

At its core, Bitcoin Bit respects the foundational principles that made Bitcoin revolutionary:

Fixed Supply: The total cap of 21 million coins ensures scarcity and supports long-term value.

Decentralization: Though it introduces recovery features, Bitcoin Bit remains committed to maintaining a decentralized structure.

Security: With advancements in encryption and a secure issuance model, Bitcoin Bit promises a high level of security for all users.

Yet, it goes a step further by addressing the limitations Bitcoin has struggled to overcome:

No Mining = No Energy Waste

User-Friendly Wallet Recovery

Transparent and Predictable Coin Distribution

This powerful combination makes Bitcoin Bit not just an alternative, but an upgrade to the original vision.

A Community-Driven Project

Innovation doesn't happen in isolation. Bitcoin Bit is building a vibrant, inclusive community where developers, investors, crypto enthusiasts, and curious newcomers can collaborate and grow together. By joining the community, members gain access to:

Early updates and announcements

Educational resources

Beta testing opportunities

Networking and idea sharing

This grassroots approach ensures that Bitcoin Bit evolves according to user needs and market realities, not just top-down directives.

Why Bitcoin Bit Matters

As the world grapples with the environmental impact of technology, the need for sustainable and inclusive digital currencies becomes more urgent. Bitcoin Bit answers that call. It delivers the trust, transparency, and innovation of Bitcoin, minus the carbon emissions and usability hurdles.

For newcomers, it offers a friendly gateway into crypto with built-in safety nets. For seasoned investors, it represents a future-proof opportunity aligned with global sustainability goals. And for the industry, it sets a precedent for combining robust decentralization with enhanced user experience.

The Future of Cryptocurrency Is Here

Bitcoin Bit is more than a cryptocurrency—it’s a vision for a cleaner, smarter, and more accessible future. By solving Bitcoin’s energy problem and addressing usability concerns with groundbreaking features like wallet recovery, Bitcoin Bit is poised to lead a new wave of crypto adoption.

As 2025 approaches and the mainnet prepares for launch, now is the time to get involved. Join the Bitcoin Bit community, stay updated on development milestones, and be part of the movement that is shaping the next chapter of decentralized finance.

#BitcoinBIT #GreenCrypto #SustainableBlockchain #NoMiningNeeded #EfficientCryptoAll

For More Information

Website: http://www.bitcoinbit.xyz/ Telegram: https://t.me/BitCoinBit_BCB Whitepaper: https://drive.google.com/file/d/16ge-DvHXAYCR5VKA5wbSR8d1V3bluFYe/view?usp=sharing Twitter: https://x.com/bitcoinbit_

Bct Username: Kshplen Bct Profile Link: https://bitcointalk.org/index.php?action=profile;u=2243948 BSC Wallet Address: 0x2607AF7b8258787e7Ed7a50326073a44023a21A2 Poa Link: https://bitcointalk.org/index.php?topic=5539310.msg65309563#msg65309563

2 notes

·

View notes

Text

Why Bitcoin’s $77K Floor and Pakistan’s Crypto Pivot Could Reshape Trading with CELOXFI in Focus

The crypto market’s rollercoaster just took another wild turn, and the chatter is heating up. Bitcoin’s flirting with a supposed “bottom” at $77K, while Pakistan’s throwing its hat in the ring with plans to legalize digital assets. It’s the kind of news that keeps traders up at night—part hype, part hope, and a whole lot of “what’s next?” Amid this chaos, the spotlight’s shifting to how platforms like CELOXFI might steady the ship for U.S. traders hungry for clarity in a space that’s anything but predictable. So, what’s really going on here, and why does it matter?

Let’s start with the big call shaking up the market. Arthur Hayes, the BitMEX co-founder who’s never shy about stirring the pot, dropped a bombshell in a recent analysis. He’s pegging Bitcoin’s floor at $77,000, claiming the dreaded quantitative tightening (QT) phase—central banks’ go-to for sucking liquidity out of the system—is basically toast. To him, the macro storm that’s been rattling crypto is calming down, and Bitcoin’s resilience is shining through. It’s a bold take, no doubt, especially with the market still licking its wounds from the latest correction. Traders are watching closely, some nodding along, others skeptical, but everyone’s asking: is this the signal to jump back in?

Meanwhile, half a world away, Pakistan’s making moves that could ripple far beyond its borders. The government’s cooking up a legal framework to greenlight crypto, aiming to lure international cash and tame the Wild West vibe that’s long spooked regulators there. It’s a 180 from their old stance—less “ban it” and more “bring it”—driven by a hunger to tap blockchain’s economic juice. For a market that’s been under the radar, this could be a game-changer, opening doors for global players and giving digital assets a legit foothold in South Asia. The buzz? It’s not just about Pakistan—it’s a sign more nations might follow suit.

So where does this leave the average U.S. trader, still jittery from scams like that $32M Spanish Ponzi bust? Volatility’s nothing new in crypto, but these shifts—Hayes’ floor call and Pakistan’s pivot—hint at a market finding its footing. That’s where platforms built for the grind come in. CELOXFI platform analysis shows it’s doubling down on what matters: real-time data to track these swings, encryption that doesn’t mess around, and compliance that keeps things above board. For Americans burned by hype-and-dump schemes, it’s less about chasing moonshots and more about trading with eyes wide open.

Hayes’ optimism isn’t blind, though. He’s leaning on Bitcoin’s knack for thriving when fiat systems wobble—think inflation jitters or geopolitical mess. If he’s right, and $77K holds, it’s a green light for traders to rethink their plays. Pair that with Pakistan’s push to regulate, and you’ve got a global scene that’s less shadowy, more structured. Platforms like CELOXFI fit naturally here, offering tools to dissect market noise and manage risk without the fluff. It’s not about flashy promises—it’s about giving U.S. investors a shot at navigating this new terrain without getting rug-pulled.

Pakistan’s move, meanwhile, isn’t just local news. As more countries flirt with crypto laws, the domino effect could steady the market long-term. Imagine a world where digital assets aren’t just for the degens but a legit piece of the financial puzzle. For traders, that means picking platforms that can roll with these punches—ones that prioritize security and transparency over smoke and mirrors. CELOXFI platform analysis highlights its edge: cutting through the chaos with insights that don’t leave you guessing.

The market’s mood? Cautious but buzzing. Bitcoin’s $77K floor could be the reset button traders need, while Pakistan’s crypto embrace might signal a broader thaw. For U.S. investors, it’s a chance to ditch the blind bets and lean into platforms that deliver the goods—think risk management that actually works and data you can trust. The future’s still a gamble, sure, but with these shifts, it’s looking less like a crapshoot and more like a calculated play.

Curious how this all shakes out? Keep an eye on the trends and dig into platforms that can handle the heat. For more on navigating this wild ride, check out https://www.celoxfi.com/index.html.

3 notes

·

View notes

Text

if people stopped mining BTC

If people stop mining Bitcoin, it would have several serious consequences for the network. Here are the major effects:

1. Reduced Network Security

Proof-of-Work and Security: The Bitcoin network relies on Proof-of-Work (PoW) to ensure that all transactions are valid and to protect the network from attacks. Miners use their computational power to solve cryptographic problems and create new blocks, which makes it extremely difficult to manipulate the blockchain.

Attacks: If no one is mining, the network would become highly vulnerable to various types of attacks. The most well-known attack is a 51%-attack, where someone controls more than 50% of the network’s computational power and can alter historical transactions or block new ones. If there are no miners working to solve PoW puzzles, there would be no computational power to secure the network.

2. No New Bitcoin Created

Creation of New Bitcoin: Mining is the only process that creates new Bitcoin. If no one mines, no new Bitcoin will be created. This would halt the continuous influx of new coins into the market.

No Reward: When the Bitcoin network reaches its maximum limit of 21 million Bitcoin, miners will have to rely on transaction fees as their income. If no one mines, there would be no rewards, and transaction fees wouldn't be processed.

3. Transactions Can't Be Processed

Blockchain: Mining is also the process that processes and verifies transactions. Without miners, transactions couldn’t be included in new blocks, and the Bitcoin network wouldn't be able to process any new transactions.

Transaction Delays: If no one mines, the Bitcoin network would effectively become "stuck" because transactions couldn’t be confirmed or included in blocks.

4. Difficulty Adjustment and Economic Effects

Difficulty Adjustment: If the number of miners drops significantly, the Bitcoin network’s difficulty would automatically adjust downward to make it easier to mine blocks. But if mining completely ceases, no one would be able to create new blocks, and it would be impossible to adjust the difficulty to a level where new blocks could be created.

Market Reaction: The market would likely react negatively to a sudden cessation of mining, as it would mean Bitcoin loses its decentralized nature, and trust in the network would decrease. This could lead to a sharp drop in Bitcoin prices and potentially other cryptocurrencies taking over.

Mining Becomes Unprofitable: Given that the difficulty of mining has increased over the years, it is now much more expensive and resource-intensive to mine Bitcoin. As the network's difficulty rises, miners need more powerful and specialized hardware, such as ASICs, to remain competitive. If mining rewards (block rewards and transaction fees) aren't sufficient to cover the increased costs, mining becomes unprofitable. This could cause miners to exit the network, further destabilizing the ecosystem.

5. Long-Term Outlook: A Shift to a New Cryptocurrency?

Inevitable Decline: Eventually, Bitcoin may face a point where it becomes unsustainable due to the increasing difficulty of mining and the rising costs involved. While the network may continue to operate for some time, the challenges Bitcoin faces—such as high energy consumption, lack of scalability, and an increasingly centralized mining landscape—will become harder to ignore. As the mining process becomes more costly and less profitable, Bitcoin’s appeal could decline.

A New Cryptocurrency: In the near future, people may begin to realize these limitations and may look for a cryptocurrency with better prospects for scalability, energy efficiency, and decentralization. New cryptocurrencies or blockchain projects could emerge with improved consensus mechanisms, better economic models, and stronger networks that could replace Bitcoin as the leading cryptocurrency. This shift may not happen overnight, but over time, Bitcoin could find itself overshadowed by more advanced alternatives that offer better long-term viability.

6. Conclusion

Bitcoin is built on the premise that decentralization and mining drive the network forward. Mining allows for the creation of new Bitcoin, transaction verification, and ensures that no one can manipulate the network. Without mining, Bitcoin would quickly lose its core functions and could become unusable as a secure, decentralized currency.

While it is unlikely that all miners would stop simultaneously, a massive reduction in mining would make Bitcoin much more vulnerable and potentially non-functional. Additionally, with the difficulty level so high and mining becoming increasingly expensive, many miners could find it unprofitable to continue, further compromising the network's security and stability. Bitcoin may eventually face a situation where it becomes increasingly obsolete, and the rise of a new cryptocurrency with better future prospects and a more sustainable network could be just a matter of time.

3 notes

·

View notes

Text

Bitcoin Mining

The Evolution of Bitcoin Mining: From Solo Mining to Cloud-Based Solutions

Introduction

Bitcoin mining has come a long way since its early days when individuals could mine BTC using personal computers. Over the years, advancements in technology and increasing network difficulty have led to the rise of more sophisticated mining methods. Today, cloud mining solutions like NebuMine are revolutionizing cryptocurrency mining by making it more accessible and efficient. This article explores the journey of Bitcoin mining, from solo efforts to large-scale cloud mining operations.

The Early Days of Bitcoin Mining

In the beginning, Bitcoin mining was simple. Miners could use regular CPUs to solve cryptographic puzzles and validate transactions. However, as more participants joined the network, mining difficulty increased, leading to the adoption of more powerful GPUs.

As BTC mining grew, miners began forming mining pools to combine computing power and share rewards. This shift marked the transition from individual mining to more collective efforts in cryptocurrency mining.

The Rise of ASIC Mining

The introduction of Application-Specific Integrated Circuits (ASICs) in Bitcoin mining changed the game completely. These highly specialized machines offered unmatched efficiency, significantly increasing mining power while consuming less energy than GPUs.

However, ASICs also made mining more competitive, pushing small-scale miners out of the market. This led to the rise of large mining farms, further centralizing BTC mining operations.

The Shift to Cloud Mining

As the mining landscape became more challenging, cloud mining emerged as a viable alternative. Instead of investing in expensive hardware, users could rent mining power from platforms like NebuMine, enabling them to participate in Bitcoin mining without technical expertise or maintenance costs.

Cloud mining offers several advantages:

Accessibility: Users can start crypto mining without purchasing expensive equipment.

Scalability: Miners can adjust their computing power based on market conditions.

Convenience: No need for hardware setup, electricity costs, or cooling management.

With platforms like NebuMine, cloud mining has become a practical way for individuals and businesses to engage in BTC mining and Ethereum mining without the hassle of traditional setups.

Ethereum Mining and the Future of Crypto Mining

While Bitcoin mining has dominated the industry, Ethereum mining has also played a crucial role in the crypto space. With Ethereum’s shift to Proof-of-Stake (PoS), many miners have sought alternatives, further driving interest in cloud mining services.

Cryptocurrency mining continues to evolve, with new innovations such as AI-driven mining optimization and decentralized mining pools shaping the future. Platforms like NebuMine are at the forefront of this transformation, making cloud mining more accessible, efficient, and sustainable.

Conclusion

The evolution of Bitcoin mining highlights the industry's rapid advancements, from solo mining to industrial-scale operations and now cloud mining. As technology continues to advance, cloud mining solutions like NebuMine are paving the way for the future of cryptocurrency mining, making it easier for users to participate in BTC mining and Ethereum mining without technical barriers.

Check out our website to get more information about Cryptocurrency mining!

#Bitcoin mining#Cloud mining#Crypto mining#BTC mining#Ethereum mining#Cryptocurrency mining#SoundCloud

2 notes

·

View notes