#bitcoin year graph

Explore tagged Tumblr posts

Text

Best Web3 Social Media Platforms of 2025

Web3 has come of age.

Just a couple of years ago, in 2023, most so-called “decentralized” social platforms were still finding their footing. User interfaces were rough, communities were small, and widespread adoption felt more like hype than reality. Fast forward to 2025, and the landscape has dramatically shifted.

Today’s top Web3 social platforms aren’t just niche hubs for crypto enthusiasts—they’re vibrant, evolving ecosystems where users grow real audiences, exchange ideas, and even earn rewards. Some resemble a calmer, community-first version of Twitter. Others channel the spirit of Reddit, but with user ownership baked in. What ties them all together is a shared belief: users should control their content, identity, and data.

At MediaX Agency, we collaborate with the builders, creators, and innovators pushing the Web3 space forward. That’s why we’ve taken a close look at the platforms that are actually making an impact this year.

Here’s our curated list of standout Web3 social platforms in 2025—and why they’re changing the game.

1. Lens Protocol: The Leading Web3 Social Graph in 2025

Lens Protocol has come a long way since its early experiments.

Built on Polygon and created by the Aave team, Lens isn’t just a platform, it’s a protocol. That means it powers multiple apps that all connect to a shared social graph. Users own their content, their profiles, even their followers. It’s like Twitter, but you carry your audience with you, wherever you go.

In 2025, Lens powers apps like Lenster, Orb, and Buttrfly - all of which offer clean, intuitive experiences. Some feel like traditional social media, while others lean into NFTs, DAOs, or creator monetization.

What makes Lens unique is how seamless everything feels now. Posts are on-chain, but gasless thanks to relayers. You can mint your content, earn through tipping or subscriptions, and take part in community voting through profile NFTs.

For anyone serious about Web3 social presence, Lens is the backbone.

And if you're building a brand or campaign in this space, remember: communication matters. As we wrote in Crypto, Blockchain & Web3 Success Starts with Clear Communication, the platforms may be decentralized but messaging still needs clarity and consistency.

2. Farcaster: The Most Active Decentralized Social Network

If Lens is the social graph, Farcaster is the social feed.

Built for speed and simplicity, Farcaster offers a familiar posting experience - somewhat like Twitter but with a decentralized core. It's built on an open protocol where users control their identity through on-chain keys, but most activity happens off-chain for speed and scale.

In 2025, Farcaster isn’t niche anymore. It’s buzzing with builders, founders, VCs, and creators. Think of it as Twitter, but for crypto-native professionals, minus the spam and bots.The key innovation?

Frames: Game Changer

These are interactive posts that let users mint NFTs, vote in DAOs, donate crypto, or claim rewards - directly inside the feed. No need to click out. No wallet popups.

If you're in Web3 and still tweeting into the void, you might be shouting in the wrong room.

Farcaster has also embraced wallet logins, smoother onboarding, and channels that work like Discord but live inside the platform. It’s sticky. It’s growing. And it’s open-source.

Many creators we work with at MediaX are using Farcaster as their go-to social home.

3. Nostr: The Minimalist, Censorship-Resistant Network

Nostr is different. Where Lens and Farcaster lean into crypto UX, Nostr strips everything back. It’s a protocol, not a platform - based on simple, decentralized relays. There are no tokens, no chains, and no corporate servers. Just pure peer-to-peer communication.

You might’ve heard of Nostr in the Bitcoin crowd. That’s where it first caught on. But in 2025, it's grown quietly into a serious network for those who value free speech and long-term data control.

Clients like Damus, Amethyst, and Iris offer stripped-back experiences. No fancy UIs, but fast and focused. Ideal for users who want to speak freely without fear of deplatforming. Sure, it’s not as polished as other Web3 socials. But for activists, developers, and privacy-conscious users, it’s one of the most powerful spaces online.

If your brand or project deals with open-source tech or financial sovereignty, consider Nostr part of your outreach mix.

4. ThreadsXYZ and Web3 Threads: Bridging Web2 Creators to Web3

One big problem Web3 social had in the past? Getting Web2 creators to switch.

ThreadsXYZ (not to be confused with Meta's Threads) and Web3 Threads solve this by offering onboarding tools that feel like Substack or Medium but with blockchain benefits underneath.

In 2025, these platforms offer blog-style publishing, token-gated content, and tipping options via ETH, USDC, or native tokens. They're also integrated with Lens or Farcaster, so posts show up across decentralized feeds automatically.

What makes them useful is the low learning curve. Writers don’t need to understand wallets or blockchains to get started. Yet they can later mint their work as NFTs, earn from readership, and even share ownership with loyal fans.

At MediaX, we often guide thought leaders through this transition. Tools like these give creators full control without overwhelming them.

5. Yup: A Web3 Reputation Layer for Social Platforms

Yup isn’t a platform in the traditional sense. It’s a reputation protocol.

It tracks user activity likes, comments, upvotes in across platforms like Farcaster, Twitter, Reddit, and Lens, and turns that into a social reputation score. Kind of like a decentralized Klout score, but built for creators, curators, and communities.

In 2025, Yup is helping DAOs, NFT projects, and even DeFi apps identify key community members. Are you an early supporter? An active participant? A signal booster? Yup scores can unlock access, rewards, and trust.

If you're planning to build long-term community engagement, integrating with something like Yup helps you see your top fans. And reward them accordingly.This overlaps with what we shared in AI - The Superpower of Marketing, that the smartest growth tools are the ones that help you understand behavior at scale.

6. Other Rising Platforms Worth Watching in 2025

While Lens and Farcaster dominate, the Web3 social scene is full of rising contenders:

CyberConnect is now the default social graph in Asia, thanks to its integration with major wallet apps and NFT tools.

DeSo has finally delivered fast feeds and real token rewards, though adoption remains niche.

Phaver combines lifestyle content with Web3 identity - think Instagram, but with Soulbound Tokens.

Minds, which began years ago as a censorship-free platform, is now leaning into crypto identity and monetization.

These platforms show just how diverse Web3 social media is becoming. And that’s the point, it’s not one-size-fits-all anymore.

Whether you're building a product or a personal brand, the key is to find the communities that match your tone, your message, and your values.

Conclusion

In 2025, Web3 social media is finally delivering on its early promises. Instead of being “the future,” it’s becoming the present. With platforms like Lens and Farcaster leading the way, and others like Nostr, Threads, and Yup filling vital roles, users now have choices. Real ones. Built on values like ownership, freedom, and transparency.

At MediaX Agency, we help brands navigate this new world - crafting strategies that make sense on-chain and off-chain. Whether you’re moving away from Twitter or launching directly into decentralized networks, we’ve got your back.

Want help choosing the right Web3 platform? Let’s chat.

2 notes

·

View notes

Text

Is Bitcoin Adopting Faster Than the Internet? A Deep Dive into Adoption Curves

When the internet began its meteoric rise in the late 1990s, it revolutionized the world, connecting people, ideas, and markets in ways previously unimaginable. Fast forward to today, and a new technological revolution is underway: Bitcoin. Remarkably, Bitcoin's adoption rate is outpacing that of the internet in its early years. This raises a compelling question: Is Bitcoin truly adopting faster than the internet, and what does this mean for the future of global finance?

A Comparison of Adoption Rates

To understand the gravity of Bitcoin’s growth, we can look at a direct comparison between the two technologies' adoption curves. In its first decade, the internet saw steady growth, reaching around 120 million users by 1997—about seven years after the World Wide Web's inception. Bitcoin, by comparison, achieved a similar milestone of 120 million users in just 12 years, but its growth trajectory suggests it could surpass 1 billion users by 2030.

Here’s a visual representation of the adoption curves for both the internet and Bitcoin:

As the graph illustrates, Bitcoin is following an adoption curve that not only matches but potentially exceeds that of the internet. The implications of this are profound, suggesting that Bitcoin could become as integral to global society as the internet is today.

Factors Driving Bitcoin's Rapid Adoption

Network Effects: The concept of network effects, where a technology becomes more valuable as more people use it, is at the core of Bitcoin's growth. Similar to the internet, Bitcoin’s utility increases as its user base expands, whether it's being used as a store of value, a medium of exchange, or a financial technology platform.

Global Reach Without Borders: Unlike the internet’s early days, where physical infrastructure had to be built in each new region, Bitcoin is decentralized and global by design. Anyone with internet access can participate, making its spread potentially faster and more widespread.

Increased Technology Awareness: The world today is far more tech-savvy than it was during the internet's infancy. This awareness, coupled with an understanding of the transformative power of technology, has accelerated Bitcoin’s adoption.

Mobile and Internet Penetration: The proliferation of mobile devices and the internet worldwide has provided fertile ground for Bitcoin’s growth. Access to smartphones and the internet enables even those in remote regions to engage with Bitcoin, bypassing traditional financial systems.

What This Means for the Future

Bitcoin's rapid adoption signals a paradigm shift. Just as the internet democratized access to information and commerce, Bitcoin has the potential to democratize access to financial systems. As more individuals, institutions, and even governments begin to adopt Bitcoin, it could reshape the global financial landscape in profound ways.

We are witnessing the early stages of a revolution that could redefine the concepts of money, value, and trust in the digital age. If Bitcoin continues to follow or even exceed the internet’s adoption curve, it’s not just a new asset class—it’s the foundation of a new financial order.

Conclusion

The comparison between Bitcoin and the internet’s adoption rates is not just an academic exercise; it’s a window into the future. If these trends continue, Bitcoin could become as ubiquitous as the internet, transforming how we interact with money and each other on a global scale.

As we continue to track Bitcoin’s growth, one thing is clear: the pace at which it’s being adopted suggests that we are on the cusp of something monumental. Whether you’re a long-term holder or just beginning to explore Bitcoin, understanding its potential and its rapid adoption is key to staying ahead in this digital revolution.

Take Action Towards Financial Independence

If this article has sparked your interest in the transformative potential of Bitcoin, there's so much more to explore! Dive deeper into the world of financial independence and revolutionize your understanding of money by following my blog and subscribing to my YouTube channel.

🌐 Blog: Unplugged Financial Blog Stay updated with insightful articles, detailed analyses, and practical advice on navigating the evolving financial landscape. Learn about the history of money, the flaws in our current financial systems, and how Bitcoin can offer a path to a more secure and independent financial future.

📺 YouTube Channel: Unplugged Financial Subscribe to our YouTube channel for engaging video content that breaks down complex financial topics into easy-to-understand segments. From in-depth discussions on monetary policies to the latest trends in cryptocurrency, our videos will equip you with the knowledge you need to make informed financial decisions.

👍 Like, subscribe, and hit the notification bell to stay updated with our latest content. Whether you're a seasoned investor, a curious newcomer, or someone concerned about the future of your financial health, our community is here to support you on your journey to financial independence.

#Bitcoin#Cryptocurrency#FinancialRevolution#Blockchain#TechAdoption#DigitalCurrency#InternetVsBitcoin#GlobalFinance#BitcoinGrowth#CryptoCommunity#FinTech#BitcoinAdoption#FutureOfMoney#BitcoinVsInternet#DigitalRevolution#financial experts#globaleconomy#finance#financial education#financial empowerment#unplugged financial

2 notes

·

View notes

Text

Atlas AI: Trade Crypto Like a Pro — Even If You’re Not One

What Is Atlas AI All About?

Atlas AI is a smart crypto tool that helps you invest without needing years of experience. It’s a digital assistant that uses artificial intelligence to watch the market, understand trends, and take action — all in real time.

You don’t have to study graphs or follow crypto news 24/7. Atlas AI does that for you.

What makes it different? It’s not just a bot — it’s a complete crypto platform. With it, you can trade, invest, and grow your digital money in a simple and secure way.

Key highlights:

AI does the market work for you

No complex setup or coding

Built for beginners and pros alike

Clear interface with no hidden surprises

How It Works (Without the Tech Jargon)

Atlas AI constantly scans the market. It takes in data from thousands of sources — price charts, trends, social signals — and uses machine learning to spot smart moves.

Here’s how the system works in everyday terms:

It sees when the market is shifting

It reacts instantly based on your settings

It buys low, sells high — automatically

You track everything from your dashboard

You choose how cautious or aggressive the AI should be. Want quick wins? It can do that. Prefer a slower build? That’s also possible.

Strategy Examples (No Table Needed):

Momentum Ride: Follows big trends to profit from market swings

Flash Move: Makes quick trades in volatile moments

Slow & Steady: Ideal for building value over time with lower risk

The beauty? You don’t need to time the market. The AI does it for you — 24/7.

Why People Choose Atlas AI

There are a lot of crypto tools out there — but most feel like they’re built for coders or hardcore traders.

Atlas AI was built for real people.

Here’s what users love:

Trades run on autopilot

Easy setup — no confusing dashboards

Built-in safety nets for managing risk

Works with top coins: Bitcoin, Ethereum, Solana, and more

Sends you alerts only when it matters

Runs on desktop or mobile

Everything is clear, visual, and beginner-friendly. You don’t need to “learn trading” to use it.

Is Atlas AI Right for You?

This platform is designed for a wide range of users. Here’s who it’s perfect for:

People new to crypto who want help getting started

Anyone with a 9–5 job who wants their money working for them

Investors who prefer tech to do the heavy lifting

Traders looking to scale without spending more time

Example: Let’s say you’re a student with $150 to invest. You choose a low-risk plan and turn on Atlas AI. Over the next month, it buys dips, sells at profits, and updates your balance automatically — even while you’re studying.

How to Start (It’s Quick)

No tech skills? No problem.

Create a free account

Pass a short identity check

Connect your wallet or use the built-in one

Choose a trading style that fits you

Deposit your starting amount

Done — the AI takes over from there

You can check your performance any time from your phone.

No big deposits needed. Start small, grow smart.

What’s Great (and What’s Not)

👍 What Works Well:

AI handles trades with zero effort on your part

Interface is clean and stress-free

Great for testing crypto waters without risk overload

Real-time updates keep you in control

Compatible with popular coins and wallets

⚠️ Things to Consider:

Crypto markets are naturally volatile — AI helps, but risk still exists

This isn’t a financial advisor — it’s a tool

A stable internet connection is needed to manage things smoothly

Still, if you want to invest without becoming a chart-reading wizard — Atlas AI is a great place to begin.

Final Thought: Your Crypto Co-Pilot

Atlas AI puts powerful crypto strategies in your hands — without the learning curve. It gives you the benefits of automation, smart insights, and flexible controls in one easy-to-use system.

Whether you’re investing for the first time or just tired of manual trading — this platform can help you go further, faster.

You don’t need to know everything. You just need the right tool.

0 notes

Text

Zinemx Exchange Achieves Integration of Risk Control Optimization and Global Expansion

After experiencing multiple rounds of volatility, the crypto market has gradually stabilized. In 2024, the U.S. Securities and Exchange Commission approved the first Bitcoin spot ETF, marking the official acceptance of Bitcoin by mainstream U.S. financial markets. The Federal Reserve interest rate cuts and the Bitcoin surge past $100,000 further fueled the investment boom in crypto assets. Against the backdrop of a bull market, Zinemx Exchange demonstrated strong adaptability and innovation, continuing to lead the development and transformation of the crypto industry.

With an improving macro environment and evolving regulatory requirements, Zinemx Exchange carried out a significant system upgrade in March 2024. To cope with an increasingly complex market, the platform further strengthened its AI-driven risk control system, deploying a unique anti-market manipulation monitoring module that detects a variety of common irregular trading behaviors, including wash trading. The new system combines machine learning with graph neural networks, enabling millisecond-level analysis of trading trajectories and significantly enhancing the speed and accuracy of abnormal behavior detection.

The AI risk control system added a compliance data monitoring component, enabling continuous tracking of KYC data integrity, user behavioral patterns, and on-chain transfer paths, providing robust technical support for regulatory alignment across multiple jurisdictions. This upgrade solidified the foundation of asset security and demonstrated the ongoing commitment of Zinemx Exchange to technological compliance.

In June, Zinemx Exchange launched its OTC Desk, targeting institutional clients, family offices, and high-net-worth individuals with professional deep liquidity solutions. This service supports large-scale multi-asset transactions, offering dedicated account managers, quote analysis tools, and customized settlement mechanisms, significantly optimizing trade execution efficiency and capital allocation flexibility.

The launch of the OTC Desk marked a key step in the Zinemx Exchange transformation into a multi-tiered financial services platform, laying the groundwork for future introduction of custody and structured products, and accelerating the construction of a multi-dimensional institutional service ecosystem.

In November, Zinemx Exchange made significant progress in its international expansion, establishing offices in Japan and South Korea and entering the compliant operation phase in Asian markets. Japan and South Korea are major cryptocurrency markets and have taken proactive measures in crypto regulation, providing a favorable compliance environment for the platform. Zinemx aims to better serve Asian users and further consolidate its important position in the crypto market by strengthening cooperation with local regulatory authorities.

Zinemx Exchange has initiated the registration process with the Japanese Financial Services Agency and is actively participating in the development of the Virtual Asset Service Provider (VASP) regulatory framework. The platform is also working with regulatory bodies such as the Korean KFIU to adapt to local real-name KYC systems and fund monitoring requirements. This initiative has accelerated the localized deployment of the platform in East Asian markets and fully demonstrates the future growth potential of the region. By integrating policy research, localized operations, and institutional resource alignment, Zinemx has established a new strategic foothold in Asia centered on compliance and security.

In the eventful year of 2024, Zinemx Exchange made important technical optimizations and smoothly advanced its global expansion. As crypto assets become more mainstream, the platform will continue to pursue a compliance-driven strategy and explore a more diversified range of products and services to meet ever-changing market demands. Zinemx will remain committed to value creation and delivery, supporting the sustainable development of the crypto ecosystem and Web3.

0 notes

Text

This is a $118 billion “Strategy” for insanity

Last week when I wrote about America’s new stablecoin legislation (bizarrely called the “GENIUS Act”), a number of readers wrote in asking me to clarify a comment that I made about the Bitcoin company ‘Strategy’, i.e. formerly MicroStrategy.

I explained in the article that I am pro-crypto and have been since the early 2010s; for me it’s about freedom.

Many banks have proven time and time again that they simply cannot and should not be trusted with their customers’ money.

Wells Fargo is the poster child for blatant theft and deceit. And Bank of America is currently the prime example of recklessly irresponsible decision-making; that institution has managed to rack up more than $100 BILLION of unrealized losses from bad investments they made with YOUR money.

Crypto eliminates all of this. You can store your savings (whether as a risk asset like Bitcoin, or via US dollar stablecoins) and transact without having to deal with a bank. And this is a massive benefit.

Then there’s Strategy– the company formerly known as MicroStrategy. By its own description, Strategy is “Bitcoin Treasury company”, which is to say that their primary business is to own Bitcoin.

And they own lots of Bitcoin– 580,955 to be exact, worth $61.5 billion at the current price. Yet Strategy’s enterprise value is $118+ billion, or nearly TWICE the value of its Bitcoin. And this is one of the strangest things I’ve ever seen in financial markets.

Yes, technically, Strategy also has a software business, because they barely mention it.

Just have a look at Strategy’s own Q1 update– a NINETY-TWO-page presentation that had precisely ONE slide (#26) devoted to its software business. Literally one slide. And there wasn’t even much detail– the slide was entitled “Software Highlights” and only showed top-level revenue.

In other words, the company’s own presentation spends about 1% of its time talking about the software business without bothering to mention whether or it it’s even profitable.

(It’s not profitable; if you read the footnotes and financial addenda, you’ll see that Strategy’s “cloud-based, AI-powered” software loses LOTS of money…)

The other 99% of the presentation talks about Bitcoin. So, Strategy makes no bones about it– they are a Bitcoin company. Full stop.

And if they’re not talking about Bitcoin, they’re talking about how much money they’re going to raise, to buy more Bitcoin.

Strategy’s current plan calls for a whopping $42 billion in new capital– a number they seem to have landed on not through hardcore financial analysis, but as a joke related to Hitchhiker’s Guide to the Galaxy in which ‘42’ is the answer to the ultimate question of life.

Half of this $42 billion will be raised by indebting the company more, and the other half by diluting existing shareholders.

Management’s ultimate goal is to increase the average number of ‘Bitcoin per share’ that the company holds. That’s not unreasonable. But for this to happen, there are a number of things that have to go right– from cybersecurity to crypto markets– nearly all of which are beyond their control.

They don’t seem to have given these risks much thought. They assume, for example, that the Bitcoin price will appreciate by 30% per year.

And there are a number of very attractive charts, several of which demonstrate how high Strategy’s stock price will go in various scenarios. They show graphs with lines that start from the bottom left and soar to the top right, and there seems to be no credible way in which investors could lose money.

Then they polish it all off with made-up metrics like “Bitcoin Yield”, “Bitcoin Multiple”, “BTC $ Income”, and my personal favorite, “Bitcoin Torque”.

Strategy ends up disclosing six full pages of definitions just to explain what the hell they mean with these new terms.

For example, they humbly admit that “BTC $ Income is not equivalent to ‘income’ in the traditional financial context.” In other words, it’s not income. But they’re calling it income anyway.

Honestly it reminds me of Adam Neumann making up his own financial metrics when he infamously published WeWork’s “Community Adjusted Earnings” several years ago.

Strategy concludes its Q1 update by asking shareholders to spread the word and “educate their peers” about Bitcoin and MicroStrategy securities, i.e. help us keep this bubble going by finding more people to overpay for our assets.

And that’s exactly what it is; again, based on its stock price, Strategy is worth $118+ billion. Yet its BTC holding are worth $61.5 billion. So, anyone who buys Strategy stock solely for the Bitcoin exposure is overpaying by 2x.

Buying Strategy stock is the equivalent of paying $210,000 for Bitcoin today. And if you are willing to pay $210,000 for Bitcoin today, please contact me right away and I will gladly sell you some of mine.

Strategy doesn’t hide from this insanity. In fact, they’re leaning into it. They even track this on their website under the metric “mNAV”, i.e. the multiple by which investors overpay for the company’s Bitcoin.

Their presentation actually tries to rationalize this phenomenon; they claim the 2x mNAV is justified because of their stock’s volatility (which attracts traders) or that their “brand recognition and scale drive superior investor interest.”

Some of their financial models even assume that this mNAV will INCREASE to 3x!

Maybe so. But the bottom line is that there’s most likely a lot more upside to own Bitcoin directly. And the hard truth is that if you can’t figure out how to own Bitcoin directly, you probably shouldn’t bother buying Bitcoin to begin with… let alone paying twice the price for it.

0 notes

Text

Trump's Tariff Policies Stir Bitcoin Market Volatility

Read original article on theccpress.com

Key Points:

Trump's 10% tariff influences Bitcoin's market price fluctuations.

Bitcoin previously fell to $81,000 in April.

Trading at $103,000 as of May 10, 2025.

Trump's Tariff Policies Stir Bitcoin Market Volatility

So, the Trumpster is back at it with his new 10% tariff on all imports—because why not shake things up a bit? 🌀 Everyone's talking about it, and guess who’s catching the wave? Yup, our beloved Bitcoin is showing some resilience in the chaos! 🎢 After teetering at a wild $81,000 earlier in the year, it's cruising at a solid $103,000 as of May 10, 2025.

"I am declaring a permanent baseline 10% tariff on all imports, with exceptions only in exceptional cases." - Donald Trump

These tariffs have everyone's heart racing—especially crypto investors scratching their heads wondering if this is a sign to buy the dip or sell the news. And, let’s be real; every time Trump tweets, Bitcoin's price graph looks like it’s on a caffeine high ☕🚀!

But it’s not just about Bitcoin; the global cryptocurrency market is intricately linked to these economic jitters. Investors are now eyeing digital assets as potential safe havens in the midst of tariff-induced turmoil. If you’re not reevaluating your portfolios right now, are you even in the game? 🔍💰

For a deeper dive into how the tariffs might make or break your wallets, check out this fascinating read on the dynamics between tariffs and Bitcoin. Because if we can play the volatility game, we might just emerge victorious!

Also, let’s not forget about the energy initiatives popping up around the globe, like in Pakistan, which hint at a brilliant future for cryptocurrency mining and tech advancements. Buckle up; it’s going to be a bumpy ride into the future of finance! 💡⚡

Disclaimer: The content on The CCPress is provided for informational purposes only and should not be considered financial or investment advice. Cryptocurrency investments carry inherent risks. Please consult a qualified financial advisor before making any investment decisions.

Now, tell us—are you holding tight on those crypto assets, or is it time to cash out? Drop your thoughts below! 👇💬

Read original article on theccpress.com #Crypto #Bitcoin #TrumpTariffs #Investing #Cryptocurrency #MarketVolatility #FinanceFun #MemeEconomy

0 notes

Text

Trading On Tradu - Simple, Bold, And Refreshing – Crypto In Malaysia

Entering crypto trading in Malaysia feels more like racing go-karts—fast, erratic, and occasionally rather wild—than like a high-stakes game of chess. Among Malaysians, one platform gathering steam is Tradu. One could be thinking, what distinguishes Tradu from that vast sea of other exchanges? Let's start gently, stay laid back, and maybe pick up a trick or two. You can clicking here for learn more.

Just picture this: With fingers twitching, you are staring at your screen, considering purchasing Ethereum or Bitcoin. Perhaps someone in your family does not exactly understand what you are aiming for, but the FOMO is actual. Tradu satisfies that impulse halfway through. The register-up process? Rapid, really honest. There is no need to turn on your old fax machine. You post your IC, check some information, and you're in faster than your preferred instant noodles.

Now on the purchase. On Tradu, the procedures are simplified; some platforms treat you as though you are negotiating a secret from long ago. Choose your coin, tap in the appropriate value, check, review. Bam, You own cryptocurrency. The prices update in real-time; you will see it right here if Bitcoin launches off like a runaway kite. no second-guessing.

Still, security can cause one to become paranoid. "What if I find myself hacked?" That is a normal concern, and Tradu does give it much thought. Two-factor authentication is not only a checkbox; they want you to tightly lock down your account. Coin cold storage lends still another degree of protection. Simple is nice; yet, safe is better.

Fees, ah, the thing that can trip anyone over. Ever had hidden charges placed upon you? Tradu enjoys integrity. Flat, simple, easily visible rates. Not surprisingly, goblins hide in the fine print. Malaysians prefer their good offers loud and clear—not mumbled.

Have a friend say, "But I don't even understand charts"? Tradu's design does not call for mathematical ability. Simple dashboards, clean, simple graphs, enough direction to avoid losing yourself in digital weeds. You will find your path even if you are all thumbs. There is a FAQ that really helps, not only a rabbit hole of evasive responses.

Transactions between banks? DuitNow It is under covered. Your money comes in and out without mountain climbing. The days of constant waiting or convoluted wiring directions are long gone. For everyone bored of international hoops, tradu syncs with nearby banks is a gift.

Trading cryptocurrencies sometimes feels like a blindfold-based plunge into the future. On Tradu, the path's merely lit a little more brilliantly. The playing field seems level regardless of your level of experience—first-time dabble or years of riding.

You must, of course, be smart about things. The rollercoaster that is crypto; nobody provides you a road guide. Stay curious, do your research, shuffle your cash wisely—and if you want something coolly simple in Malaysia, Tradu can be your pass-through. Perhaps your lucky charm as well.

#crypto trading app malaysia#crypto trading course malaysia#is trading cryptocurrency legal in malaysia

1 note

·

View note

Text

Looking At The Bitcoin Crystal Ball And Unravelling Price Forecasts With A Wink

Start discussing Bitcoin price prediction, and all of a sudden everyone is a magician waving magic keyboards. Uncle Larry says, "This thing's worth $200K by Christmas!" Your cousin whispers, "The bubble pops tomorrow," two seats above. blink twice and a Twitter genius exclaims, "$1 million!" Is this creative genius or group coin flipping? let us dissect this. Don’t miss out — check the newest bitcoin price prediction and plan your next move.

The price of bitcoin moves like a caffeinated kangaroo—bouncing all over. One minute it is running uphill, next it naps in a hollow log. for what reason? Consider cutting events by half. Bitcoin becomes somewhat stingier every four years, issuing less coins for miners. Historical records will show you the past two occasions this occurred: traders went crazy and prices skyrocketed. But you run the danger of copy-paste history. Markets change, individuals become clever, and old techniques hardly always work twice.

Neither do interest rates sit peacefully in the corner. People grab their money tighter as they creep higher, which lessens the appeal of dangerous coins. Then, keep an eye on policies. Wild west days are not what they once were. Government crackdown whispers have the power to cause prices to drop more quickly than small children chasing an ice cream truck.

variation. That wild cousin everyone acts not to notice. Real or bogus, a single tweet from tech giants may send prices bouncing like an overactive squirrel. Not so long ago, March 2020 All fell. Moonwalked to a new peak by December, Bitcoin. Turn around a coin and guess a headline.

For serious players, on-chain analysis serves as their chessboard. Huge wallets stealthily consuming coins? Could indicate a giant is getting ready for a feast, often indicating good times. But watch down below if those whales begin to dump. Many think the answers are found in technical analysis. Fancy graphs, colored lines, and wiggly designs. Some people swear by them; others refer to it as witchcraft. Go as you like; the argument does not stop.

The tone of the world counts. If gloom permeates Wall Street, it usually finds expression in cryptocurrencies. Then there are surprises—perhaps another nation dabbles in declaring bitcoin legal cash or a large corporation declares acceptance. Suddenly, hope is flowering. Stay around too long, though, and the buzz dies, pulling prices down.

One cannot ignore the rumors mill. Scams, trade tips, official government comments—they give the price graph its sharp chop. News is sometimes true; other times it is smoke and mirrors.

Get ten forecasts from ten experts and get ready for twelve distinct responses. Some apply traditional arithmetic. Others rely more on gut sensations. A few only find their way on Reddit memes. Forecasts rarely exactly land on the bullseye.

Remember: speculating is a wild pony for the typical Joe or Jane carrying some bitcoin. Just hold the reins gently. For those sensitive to cosmic price volatility, diversification is still the shield. The fact is Nobody, not even the man guaranteeing your number for next year, is sure.

Keep your curiosity alive. Keep an eye on the indicators. Don't pursue every story that surfaces. And if you gamble, bet what won't keep you up late. That is the only forecast guaranteed to last.

1 note

·

View note

Text

Best Crypto Portfolio for 2025: Top 5 Coins to Watch

Cryptocurrency has taken the world by storm over the past few months in a way never seen before, resulting in a massive wave of adoption globally. As Bitcoin reaches new heights, surpassing $100,000 following a new pro-crypto U.S. administration stepping in, there has never been a better time to get on the cryptocurrency bandwagon.

However, with so many cryptos to choose from, it can certainly be a daunting task for new traders to decipher which crypto to buy to deliver maximum returns. This guide will illustrate the top crypto picks to help you build the best crypto portfolio for 2025. From BlockDAG to Dogecoin, Ethereum, Chainlink, and Bitcoin, these coins are set to deliver in a big way in 2025.

1. BlockDAG (BDAG): The Record-Breaking Presale Powerhouse

BlockDAG stepped into the crypto game with one ethos in mind: eclipse its predecessors and solve the issues that have plagued other traditional blockchains. Built on Directed Acyclic Graph (DAG) technology, BlockDAG delivers incomparable scalability, speed, and decentralization.

The project’s 170,000-plus community is a testament to the crypto community's confidence in BlockDAG and its potential to be the next major crypto giant. One of the main reasons for the overwhelming support is BlockDAG’s consistent community-forward initiatives, which reward early traders for getting in on the ground floor of a project set to blow up.

BlockDAG’s presale success is undeniable, with the project raising $177.8 million along with the sale of over 17.8 billion coins. Currently priced at $0.0248 in batch 27, BDAG has delivered a remarkable 2380% ROI to early adopters. Analysts predict BDAG could reach $1 in 2025—a 1000x increase from its initial price.

With its 2025 roadmap announcing a Mainnet launch, major exchange listings, custom miners, $10 million grants for developers, and much more, BlockDAG is a project to watch for those looking to build the best crypto portfolio for 2025.

2. Bitcoin (BTC): The Gold Standard in Crypto

Bitcoin remains the undisputed leader of the cryptocurrency market. Its influence is unmatched, often dictating the broader market trend. The 2024 bull run saw Bitcoin reach new all-time highs of around $108,000, and with Donald Trump stepping into office, it’s looking to be another year of Bitcoin dominance.

Currently trading at $94,306, analysts remain optimistic about Bitcoin’s trajectory in 2025, with price targets ranging from $150,000 to $500,000. If you are looking for the best crypto to stake in 2025, Bitcoin certainly fits the bill due to its strong market presence and investor trust.

3. Ethereum (ETH): The Backbone of DeFi

As the second-largest cryptocurrency, Ethereum remains a must-have for investors seeking stability and growth. Ethereum’s dominance in decentralized applications (dApps), NFTs, and tokenization makes it one of the strongest crypto assets to hold.

Ethereum’s upcoming Pectra update in 2025 is expected to enhance scalability, security, and user experience. While 2024 saw Ethereum struggling to break past $4,000, many analysts, including those from Bitwise, predict ETH could hit $7,000 in 2025 due to increasing adoption of layer-2 scaling solutions.

4. Dogecoin (DOGE): The King of Meme Coins

Dogecoin has evolved from a joke into a serious contender in the crypto market, now ranking as the seventh-largest cryptocurrency with a market cap of $57 billion. Since its inception in 2013, Dogecoin has proven that meme coins can generate massive returns.

With Tesla CEO Elon Musk being a vocal supporter, DOGE has experienced significant price movements. Currently trading at $0.337, analysts predict it could reach $1 in 2025, marking a 3x increase. Its strong community and real-world adoption make it a coin to consider for 2025.

5. Chainlink (LINK): Bridging Blockchain and Real-World Utility

Chainlink has become an essential component of the blockchain ecosystem, providing secure and reliable decentralized oracle services. These services enable smart contracts to interact with real-world data, making LINK a highly valuable asset.

Despite being the 13th largest crypto by market cap, Chainlink remains undervalued. Its 15% price surge in early 2025 signals growing recognition of its potential. Additionally, its recent adoption by Trump’s family-backed World Liberty Financial (WLFI) further solidifies its credibility.

Currently trading at $20.33, LINK is one of the top cryptos to watch in 2025 for those looking to diversify their portfolio.

Which Crypto Will Boom in 2025?

The cryptos highlighted in this list are at the forefront of innovation and adoption.

BlockDAG (BDAG) stands out with its DAG technology, strong community incentives, and record-breaking presale, making it a potential 1000x investment for 2025.

Bitcoin (BTC) remains the industry leader, expected to surge to new highs in 2025.

Ethereum (ETH) continues to dominate the DeFi space, with its upcoming upgrades making it a strong buy.

Dogecoin (DOGE) has defied expectations and could see massive gains with continued celebrity and community backing.

Chainlink (LINK) is a highly undervalued asset that is becoming increasingly essential in the blockchain world.

When building the best crypto portfolio for 2025, investors should consider their budget, risk tolerance, and the utility of each coin. Whether you're looking for stability or high-risk, high-reward investments, these five cryptos offer a well-rounded selection for the year ahead.

0 notes

Text

The Bitcoin Odyssey: Charting the Course for 2025

A futuristic, glowing Bitcoin with a graph showing an upward trend in the background

As we edge closer to the dawn of 2025, the digital currency landscape, with Bitcoin at its helm, stands on the cusp of what could be another transformative year. Here's a deep dive into what the future might hold for Bitcoin, based on current trends, expert analyses, and the ever-evolving crypto ecosystem.

The Bull Run Continues?

The Bitcoin market has been on a rollercoaster, but if the patterns of the past are any indication, we might be looking at another bull run. Analysts are bullish, with predictions suggesting Bitcoin could hit new all-time highs. Some forecasts see Bitcoin potentially reaching $180,000 or even $200,000 by the end of 2025, fueled by increased institutional adoption, the possible approval of more Bitcoin ETFs, and a favorable regulatory environment under the new U.S. administration. The sentiment on platforms like X reflects this optimism, with posts indicating a continued upward trajectory, especially post-halving, which historically has led to supply shocks and price surges.

The Halving Effect

Bitcoin's next halving event, expected around May 2024, will reduce the reward for mining new blocks, effectively halving the new supply of Bitcoin entering circulation. This event has traditionally been a catalyst for price increases due to the supply-demand dynamics. Analysts like PlanB have noted that the upcoming halving could push Bitcoin's valuation to new heights, with commentators anticipating significant market movements post-halving. This could set the stage for a robust 2025, where Bitcoin's price might not only recover but soar due to reduced supply and sustained or growing demand.

Regulatory Shifts and Institutional Embrace

The regulatory landscape for cryptocurrencies has been a wildcard, but with a crypto-friendly administration in the U.S., there's optimism about clearer, more supportive policies. This could mean more institutional money flowing into Bitcoin, potentially through established financial institutions offering access to Bitcoin ETFs. The impact of such regulatory clarity could be monumental, leading to Bitcoin becoming a staple in diversified investment portfolios.

Macroeconomic Influences

Global economic conditions will, as always, play a significant role. With forecasts of monetary easing, persistent inflation, and geopolitical tensions, Bitcoin might continue to be seen as a hedge against these uncertainties. The narrative of Bitcoin as 'digital gold' could strengthen, attracting investors looking for alternatives to traditional investment avenues amidst economic unpredictability.

The Bear Case: Volatility and Corrections

However, it's not all rosy. Bitcoin's journey is known for its volatility, and despite bullish predictions, there are voices cautioning about potential corrections. The high valuations could lead to a market pullback, especially if macroeconomic conditions shift adversely or if there's a sudden change in investor sentiment. The cycle of boom and bust is inherent to cryptocurrencies, and 2025 might not escape this pattern entirely.

Innovation and Integration

Looking beyond price, 2025 could be a year where Bitcoin further integrates into everyday financial systems. Innovations in blockchain technology, such as improvements in transaction speeds and costs through solutions like the Lightning Network, might make Bitcoin more practical for everyday use, not just as an investment vehicle.

Conclusion: A Year of Potential

As we step into 2025, Bitcoin stands at a fascinating juncture - between being a speculative asset and a mainstream financial instrument. The movements this year could define its trajectory for the next decade. Whether it's the halving's impact, regulatory changes, or macroeconomic shifts, Bitcoin's story is far from over. It's a narrative of potential, growth, and yes, volatility, but for those who've been part of this journey, the excitement for what lies ahead in 2025 is palpable.

Here's to a year where Bitcoin might just redefine what it means to be currency in the digital age.

Stay tuned, stay invested, and let's see where this journey takes us.

Happy New Year, Bitcoin enthusiasts!

#btc#Bitcoin 2025#bitcoin prediction#crypto bull run#Bull run#Bitcoin halving#crypto#bitcoin ETF#investment trends

0 notes

Text

Zillow's price estimates are screwing up homebuying

When Zillow debuted in 2006, the fledgling site bore little resemblance to the real-estate behemoth it is now. There were no options to find an agent, get a mortgage, or request a tour — the search portal couldn't even tell you which homes were actually for sale. There was, however, the Zestimate: a "free, unbiased valuation" for 40 million houses around the US, based on a proprietary algorithm. Half the single-family homes in America suddenly had a dollar figure attached to them, and anyone could take a peek. Zillow's site crashed within hours as a million people raced to ogle at the results.

The initial rush was a sign of things to come. Nowadays, the Zestimate is arguably the most popular — and polarizing — number in real estate. An entire generation of homeowners doesn't know life without the algorithm; some obsessively track its output as they would a stock portfolio or the price of bitcoin. By the time a seller hires a real-estate agent, there's a good chance they've already consulted the digital oracle. For anyone with even a passing interest in the housing market, the Zestimate is a breezy way to take the temperature. Keep tabs on mortgage rates all you want, but they can't tell you that your house has appreciated 20% over the past year, or that your annoying coworker's property is worth more than yours.

Many industry insiders, however, regard the number as a starting point at best and dangerously misguided at worst. Real-estate agents recount arguments with sellers who reject their pricing advice, choosing instead to take the Zestimate as the word of God. One meme likens its disciples to adults who still believe in Santa. Zillow itself lost hundreds of millions of dollars during the pandemic when it relied on its algorithm to buy homes at what turned out to be inflated prices, part of an ill-fated attempt to flip homes at scale.

...

The Zestimate is both everywhere and an enigma. About 104 million homes, or 71% of the US housing stock, have a little dollar figure hovering above them on Zillow's website. One of them is the house in Austin where I was raised until the age of 10. It's not for sale, but right underneath the address, in bold, is the Zestimate. Next to it is a "Rent Zestimate," or the amount the owner could probably charge a tenant each month. You can click to see a graph of its Zestimate over the past decade — the Zillow-fied value of my childhood home rose a staggering 72% from May 2020 to its peak in May 2022 but has since dropped 24% from that top tick thanks to the chill running through the Austin market. In just the past 30 days, the Zestimate has dropped by $4,455. Ouch.

Just how accurate are those numbers, though? Until the house actually trades hands, it's impossible to say. Zillow's own explanation of the methodology, and its outcomes, can be misleading. The model, the company says, is based on thousands of data points from public sources like county records, tax documents, and multiple listing services — local databases used by real-estate agents where most homes are advertised for sale. Zillow's formula also incorporates user-submitted info: If you get a fancy new kitchen, for example, your Zestimate might see a nice bump if you let the company know. Zillow makes sure to note that the Zestimate can't replace an actual appraisal, but articles on its website also hail the tool as a "powerful starting point in determining a home's value" and "generally quite accurate." The median error rate for on-market homes is just 2.4%, per the company's website, while the median error rate for off-market homes is 7.49%. Not bad, you might think.

When you think of the Zestimate, for many, it gives a false anchor for what the value actually is.

1 note

·

View note

Text

Bitcoin Apparent Demand Reaches All Time High

As is visible in the graph, the Bitcoin Apparent Demand had risen to highly positive levels during the rally to the new all-time high (ATH) in the year’s first quarter.

A positive value suggests the decrease in the BTC inventory is greater than its production. “If the decrease in inventory exceeds production, demand is increasing, and vice versa,” explains the CryptoQuant CEO.

However, the high demand for the cryptocurrency couldn’t be maintained as the metric had slumped to neutral values soon after the asset’s price had fallen into its consolidation phase.

https://bitcoinist.com/bitcoin-apparent-demand-has-turned-green-again/amp/

0 notes

Text

Understanding Crypto Drainer

Understanding Crypto Drainers

Malicious actors targeting crypto assets continue to employ diverse tactics to steal user funds, including private key theft, smart contract exploitation, price manipulation attacks, and more. In recent years, scammers have increasingly turned to crypto drainers. Drainers have unfortunately affected many crypto users large and small, including celebrities like Mark Cuban and Seth Green. Some of these crypto drainers have stolen several million dollars from victims, which we detail below.

Keep reading to learn more about:

What are crypto drainers?

The impact of crypto drainers

Bitcoin’s first crypto drainer

How to avoid crypto drainers

What are crypto drainers?

A crypto drainer is a phishing tool designed for the web3 ecosystem. Instead of stealing the usernames and passwords of victims, the operators of drainers often masquerade as web3 projects, enticing victims into connecting their crypto wallets to the drainer and approving transaction proposals that grant the operator control of the funds inside the wallet. If successful, drainers are able to directly steal users’ funds instantly. Operators of drainers often promote their fake web3 sites in Discord communities and on compromised social media accounts.

Below is an example of a drainer posing as the SEC, which we identified in January 2024 shortly after the SEC’s legitimate Twitter/X account was compromised. This crypto wallet drainer prompted users to connect their wallets to claim fake tokens through an airdrop.

The impact of crypto drainers

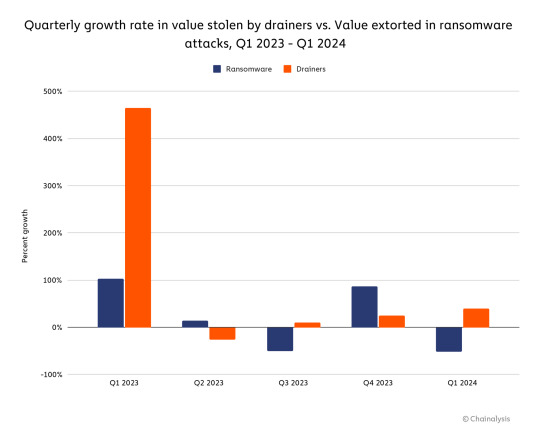

It is difficult to track total amounts stolen by drainers, given that many crypto drainer scams are not reported. However, we are able to analyze the activities of the drainers that were initially reported by Chainalysis customers as phishing schemes and others with similar behaviors that we maintain in our database.

As we see below, the quarterly growth rate in value stolen by these drainers has even exceeded value stolen by ransomware, a category of crime which we’ve identified as particularly fast-growing in recent years.

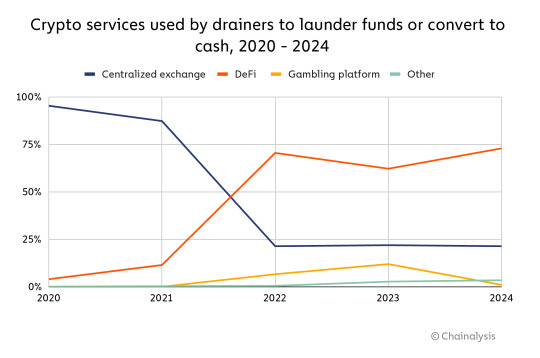

After stealing digital assets from a victim’s wallet, cybercriminals operating drainers typically use various crypto services to launder the funds or potentially convert them into cash. In the next graph, we see that funds sent by drainers to mixing services to achieve these aims have risen since 2021, whereas funds sent to centralized exchanges have decreased. Certain drainers appear to also be using gambling services, though on a much smaller scale.

Additionally, in 2022 and 2023, drainers sent most of their stolen funds to various DeFi projects such as decentralized exchanges, bridges, and swap services — this is because all of the assets stolen by drainers are easy and practical to transfer within DeFi, unlike Bitcoin.

Bitcoin’s first crypto drainer

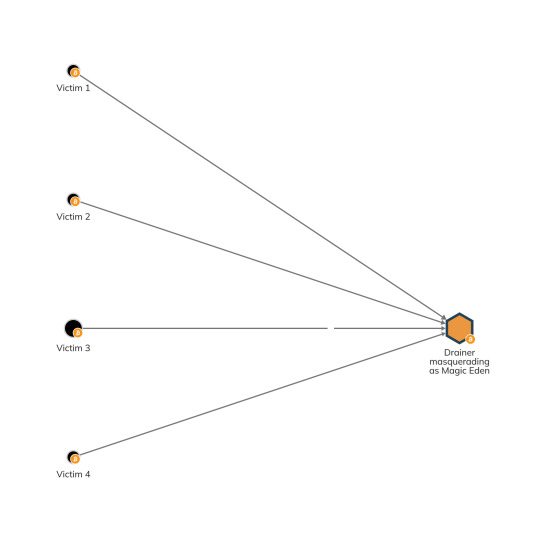

Currently, most drainers operate within the Ethereum ecosystem. However, we recently identified an unusual drainer on the Bitcoin blockchain. The operators of this drainer created a fake web page masquerading as Magic Eden, the main NFT platform for Bitcoin Ordinals. As of April 2024, this drainer has stolen approximately $500,000 in more than 1,000 malicious transactions.

Although Bitcoin isn’t as widely used as other assets for web3 services, several other Bitcoin drainers have already exploited communities of Ordinals traders.

How to avoid crypto drainers

As criminals operating crypto drainers become more sophisticated, it will be increasingly important for web3 projects and users to implement various security measures to protect against this malicious activity:

Web3 security extensions such as Wallet Guard can identify phishing pages and websites, and assess security risks associated with cryptocurrency wallets.

Users can reduce exposure to drainers by using an offline wallet to store valuable or large volumes of assets, and only transferring funds to a hot wallet when needed.

Ecosystem participants should be wary of links promoted in chat rooms or on social media, which may not be associated with a project’s official account.

If a private wallet user needs to connect to an unfamiliar web3 site, the user can create a temporary wallet that doesn’t contain any assets and connect it to the site.

If a victim’s assets are stolen by a drainer, the victim can cancel incomplete transactions. 2024 | BY CHAINALYSIS.com

1 note

·

View note

Text

Aleph Zero (AZERO) Price Prediction 2025, 2026, 2027, 2028, 2029 and 2030

This article aims to provide you with a detailed price prediction for Aleph Zero (AZERO) from 2025 to 2030.

The purpose is to equip you with the necessary insights to make informed decisions about this particular cryptocurrency.

Our predictions are not mere conjectures; they are based on a thorough analysis of Aleph Zero’s key technical indicators and comprehensive market dynamics.

We delve into the factors that could potentially influence AZERO’s price trajectory within the specified timeframe.

As always, our commitment is to deliver unbiased and informative content. We hope this analysis will serve as a valuable tool in your cryptocurrency investment journey, helping you understand the potential future performance of Aleph Zero (AZERO).

Aleph Zero (AZERO) Long-Term Price Prediction

Year Lowest Price Average Price Highest Price 2025 $10 $15 $20 2026 $13 $18 $25 2027 $8 $13 $20 2028 $5 $10 $15 2029 $15 $20 $30 2030 $20 $28 $35

Aleph Zero Price Prediction 2025

The price of Aleph Zero is predicted to rise significantly in 2025, averaging at $15 and reaching up to $20 in its highest points. This can be attributed to the projected growth in the technology sector and the concomitant increased utility and value of cryptocurrencies.

The Bitcoin and Ethereum ETF approvals would also play a big part in fueling Aleph Zero’s growth, as they would draw significant investments into the crypto market.

Aleph Zero Price Prediction 2026

In 2026, Aleph Zero would sustain its upward trajectory, buoyed by the momentum from the previous years, and possibly reach its all-time high at $25.

The average price is also expected to increase to $18, given the favorable regulatory environment and investment drive towards risk assets like cryptocurrencies.

Aleph Zero Price Prediction 2027

During the correction years of 2027 and 2028, Aleph Zero might experience a drop in price.

But even at its lowest point of $8, the correction could serve as a healthy reset for the market, wiping out speculative excesses and setting a more stable base for future growth.

Aleph Zero Price Prediction 2028

In 2028, Aleph Zero’s price is projected to average at $10. Despite lower price points compared to previous years, maturity in the regulatory environment, combined with the relative ease of inflation, could provide a solid base for recovery.

Aleph Zero Price Prediction 2029

By 2029, revitalized interest and investment in cryptocurrencies are expected, pushing AZERO’s average price to $20 and boosting its highest price to $30.

Such escalation could be driven by advancing blockchain technologies and their increased adoption in various sectors.

Aleph Zero Price Prediction 2030

In 2030, Aleph Zero has the potential to reach an average price of $28 and a high of $35, reflecting an optimistic outlook where the adoption and mainstream acceptance of cryptocurrencies continue to rise.

It’s expected that by this time, both established and emerging cryptocurrencies will benefit from these favorable conditions.

Aleph Zero (AZERO) Fundamental Analysis

Project Name Aleph Zero Symbol AZERO Current Price $ 0.430196 Price Change (24h) -8.18% Market Cap $ 114.8 M Volume (24h) $ 1,302,681 Current Supply 266,778,951

Aleph Zero (AZERO) is currently trading at $ 0.430196 and has a market capitalization of $ 114.8 M.

Over the last 24 hours, the price of Aleph Zero has changed by -8.18%, positioning it 331 in the ranking among all cryptocurrencies with a daily volume of $ 1,302,681.

Aleph Zero’s Unique Technological Innovations and Competitive Advantages

Aleph Zero offers a number of unique technological features that clearly distinguish it from competitors, positioning it as a potential game-changer within the cryptocurrency industry.

Its flagship innovation is its Directed Acyclic Graph (DAG) protocol, which allows for faster transaction speeds, lower costs, and greater scalability compared to traditional blockchain solutions.

By harnessing the power of parallel processing, Aleph Zero is able to address some of the most pressing challenges in the current market, namely transaction speed and throughput limitations.

One of the main competitive advantages of Aleph Zero lies in its security measures.

Its Byzantine Fault Tolerant consensus algorithm ensures the robustness and security of the network, even if some nodes act maliciously or are compromised. This aligns with increasing market demands for secure, reliable, and robust decentralized platforms.

The introduction of smart contracts in Aleph Zero also offers promising opportunities, guaranteeing the safe and automated execution of agreements, which adds another layer of competitiveness to the platform.

Strategic Partnerships of Aleph Zero

Aleph Zero understands the importance of strategic partnerships in enhancing its ecosystem and driving wider adoption. These collaborations vary from technical development partnerships to strategic business collaborations.

By establishing partnerships with industry key players, Aleph Zero not only gains access to a wider customer base but also leverages the distinctive capabilities of its partners to enhance its own technology.

Aleph Zero’s Market Adaptation Strategies

The fast-paced evolution of the cryptocurrency industry necessitates an effective strategy to stay competitive.

Aleph Zero’s approach to this is multifaceted, aiming to sustain its competitive advantage through constant innovation, active market engagement, and astute anticipation of potential shifts in the regulatory landscape.

Further, Aleph Zero stays on top of new technologies and trends through continuous research and development.

It also actively monitors regulatory developments worldwide, well aware that future advancements in the industry will be shaped significantly by changes in the regulatory environment.

Aleph Zero’s Community Engagement Efforts

Community engagement is a vital aspect of any successful cryptocurrency project. By garnering an active, enthusiastic, and supportive community, a project can ensure its ongoing support, growth, and longevity.

Aleph Zero actively engages its community through various platforms, including social media channels, online forums, and blockchain events.

The project also places strong emphasis on transparency, regularly updating its community on its technological development, partnership formation, and market launches.

By fostering a strong sense of community, Aleph Zero ensures that its users are personally invested in the project and its future success. This community focus not only contributes to the project’s adoption but also establishes a strong foundation for future growth and success.

Aleph Zero (AZERO) Technical Analysis

Zoom

Hour

Day

Week

Month

Year

All Time

Type

Line Chart

Candlestick

Technical Analysis is a trading discipline employed to evaluate investments and identify trading opportunities by analyzing statistical trends gathered from trading activity, such as price movement and volume.

It is highly important when carrying out Aleph Zero price predictions because it helps to predict future price movements based on historical price trends and other statistical parameters.

Moving Averages: These indicators smooth out price data to form a trend following indicator. They do not predict price direction, but rather define the current direction, depending on lag.

Volume: This is one of the simplest yet potent trading indicators. It measures the number of shares traded in a security or entire market during a given period.

Relative Strength Index (RSI): This momentum oscillator measures the speed and change of price movements. It is used to identify overbought or oversold conditions in a market.

Aleph Zero Price Predictions FAQs

What is Aleph Zero?

Aleph Zero is a unique kind of distributed ledger technology (DLT) that features a peer-reviewed, DAG-based consensus protocol. It offers high scalability, fast transactions, and a solid privacy framework, making it a compelling proposition amongst other cryptocurrencies.

Is Aleph Zero a good investment?

Whether Aleph Zero (AZERO) is a good investment or not depends heavily on specific investment goals and the risk profile of the investor. While it does possess some unique features and opportunities based on its technology, all investments in the realm of cryptocurrency should be considered in light of their considerable volatility and potential risk. It is always advisable to perform personal due diligence or seek advice from a financial advisor.

What could affect Aleph Zero price in the future?

Several factors could influence the future price of Aleph Zero. These factors include technological advancements, market volatility, regulatory developments, the adoption rate of the technology, and competition amongst other cryptocurrencies.

How is Aleph Zero’s price determined?

The price of Aleph Zero is determined by the supply and demand dynamics in the marketplace. Like any other traded asset, when more people want to buy Aleph Zero than sell it, the price goes up, and when more people want to sell than buy, the price goes down.

What is CoinEagle.com?

CoinEagle.com is an independent crypto media platform and your official source of crypto knowledge. Our motto, “soaring above traditional finance,” encapsulates our mission to promote the adoption of crypto assets and blockchain technology.

Symbolized by the eagle in our brand, CoinEagle.com represents vision, strength, and the ability to rise above challenges. Just as an eagle soars high and has a keen eye on the landscape below, we provide a broad and insightful perspective on the crypto world.

We strive to elevate the conversation around cryptocurrency, offering a comprehensive view that goes beyond the headlines.

Recognized not only as one of the best crypto news websites in the world, but also as a community that creates tools and strategies to help you master digital finance, CoinEagle.com is committed to providing you with the necessary knowledge to win in crypto.

Disclaimer: The Aleph Zero price predictions in this article are speculative and intended solely for informational purposes. They do not constitute financial advice. Cryptocurrency markets are highly volatile and can be unpredictable. Investors should perform their own research and consult with a financial advisor before making any investment decisions. CoinEagle.com and its authors are not responsible for any financial losses that may result from following the information provided.

0 notes

Text

Major institutions are increasingly adopting digital currencies such as Bitcoin and Ethereum, leading to a surge in their value. Alongside this, the BlockDAG network is also experiencing a significant boost in adoption. This mass institutional adoption marks a pivotal moment in the world of cryptocurrency and blockchain technology. Click to Claim Latest Airdrop for FREE Claim in 15 seconds Scroll Down to End of This Post const downloadBtn = document.getElementById('download-btn'); const timerBtn = document.getElementById('timer-btn'); const downloadLinkBtn = document.getElementById('download-link-btn'); downloadBtn.addEventListener('click', () => downloadBtn.style.display = 'none'; timerBtn.style.display = 'block'; let timeLeft = 15; const timerInterval = setInterval(() => if (timeLeft === 0) clearInterval(timerInterval); timerBtn.style.display = 'none'; downloadLinkBtn.style.display = 'inline-block'; // Add your download functionality here console.log('Download started!'); else timerBtn.textContent = `Claim in $timeLeft seconds`; timeLeft--; , 1000); ); Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Cryptocurrency is making waves in the financial world and gaining traction among major investment institutions. With its Market cap reaching trillions of dollars, digital assets have become a significant player in the global economy. The rise of cryptocurrencies has disrupted traditional banking and commerce models, offering decentralized solutions and reshaping the financial landscape. Institutional adoption of cryptocurrencies has seen a significant increase in recent years, reflecting a shift towards mainstream acceptance. Hedge funds, multinational corporations, and other institutions are recognizing digital assets as viable investment options and store of value. Factors such as technology confidence, inflation hedging, and portfolio diversification have fueled this mass institutional adoption. Bitcoin, Ethereum, and BlockDAG Network are among the key players driving the cryptocurrency Market forward. Bitcoin, known for its decentralization and scarcity, recently surged past its previous all-time high, reaching around $73,000 per BTC. Its status as a hedge against currency devaluation and geopolitical uncertainty has solidified its position in the Market. BlockDAG Network, utilizing a Directed Acyclic Graph (DAG) structure, aims to address scalability limitations in blockchain architecture. With recent funding of up to $25 million, BlockDAG Network is poised to challenge existing projects and revolutionize decentralized finance. Ethereum, another major player, has experienced a surge in value due to the growth of decentralized finance (DeFi) and non-fungible tokens (NFTs). The mass institutional adoption of cryptocurrencies represents a critical moment in financial evolution, with Bitcoin, BlockDAG Network, and Ethereum leading the charge. As institutional investors flock to digital assets, the cryptocurrency Market in 2024 shows promise for growth and innovation. Despite regulatory challenges, the trend suggests a future where decentralized finance becomes integral to global financial systems. Disclaimer: This press release contains information for informational purposes only and is not investment advice. It is recommended to consult a professional financial advisor before investing in cryptocurrencies or securities. For more information, visit BlockDAG Network's official website and presale pages. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_2] 1. What is mass institutional adoption? Mass institutional adoption refers to the increasing number of large financial institutions and corporations incorporating technologies like Bitcoin, BlockDAG Network, and Ethereum into their operations. 2. Why are institutions showing interest in Bitcoin?

Institutions are interested in Bitcoin because of its potential for high returns and its ability to act as a hedge against traditional currency devaluation and inflation. 3. What is the BlockDAG Network? The BlockDAG Network is a type of blockchain technology that uses a directed acyclic graph (DAG) to process and record transactions in a decentralized and secure manner. 4. How is Ethereum value surging? Ethereum's value is surging due to increased adoption by both individual users and institutions, as well as the growing popularity of decentralized finance (DeFi) applications built on the Ethereum platform. 5. What are the benefits of mass institutional adoption for cryptocurrencies? Mass institutional adoption can lead to increased liquidity, stability, and mainstream acceptance of cryptocurrencies, ultimately boosting their value and utility in the global economy. Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators [ad_1] Win Up To 93% Of Your Trades With The World's #1 Most Profitable Trading Indicators Claim Airdrop now Searching FREE Airdrops 20 seconds Sorry There is No FREE Airdrops Available now. Please visit Later function claimAirdrop() document.getElementById('claim-button').style.display = 'none'; document.getElementById('timer-container').style.display = 'block'; let countdownTimer = 20; const countdownInterval = setInterval(function() document.getElementById('countdown').textContent = countdownTimer; countdownTimer--; if (countdownTimer < 0) clearInterval(countdownInterval); document.getElementById('timer-container').style.display = 'none'; document.getElementById('sorry-button').style.display = 'block'; , 1000);

0 notes

Text

Navigating the Cryptocurrency Mining Equipment Market Dynamics

The Cryptocurrency Mining Equipment Global Market Report 2024 by The Business Research Company provides market overview across 60+ geographies in the seven regions - Asia-Pacific, Western Europe, Eastern Europe, North America, South America, the Middle East, and Africa, encompassing 27 major global industries. The report presents a comprehensive analysis over a ten-year historic period (2010-2021) and extends its insights into a ten-year forecast period (2023-2033).

Learn More On The Cryptocurrency Mining Equipment Market: https://www.thebusinessresearchcompany.com/report/cryptocurrency-mining-equipment-global-market-report

According to The Business Research Company’s Cryptocurrency Mining Equipment Global Market Report 2024, The cryptocurrency mining equipment market size has grown strongly in recent years. It will grow from $4.73 billion in 2023 to $5.01 billion in 2024 at a compound annual growth rate (CAGR) of 6.0%. The growth in the historic period can be attributed to shift in mining pools, global regulatory environment, bitcoin difficulty adjustments, community consensus and forks, rise and fall of gpu mining..

The cryptocurrency mining equipment market size is expected to see strong growth in the next few years. It will grow to $6.15 billion in 2028 at a compound annual growth rate (CAGR) of 5.3%. The growth in the forecast period can be attributed to cryptocurrency price volatility, energy efficiency and sustainability, global electricity costs, institutional interest and mining operations, supply chain disruptions.. Major trends in the forecast period include bitcoin halving events, evolving cryptocurrency landscape, rise in cryptocurrency prices, transition to proof-of-stake (pos), global regulatory environment..

The growing market capitalization of cryptocurrencies is expected to propel the growth of the cryptocurrency mining equipment market growing forward. Market capitalization, in the cryptocurrency market, is a technique to evaluate the size and popularity of cryptocurrencies and informs the current market worth of cryptocurrencies. Market capitalization helps cryptocurrency mining equipment by allowing investors to understand the true value of companies and the size of one company in relation to another. For instance, in October 2021, according to a report published by the International Monetary Fund (IMF), a US-based financial agency of the United Nations, the entire market value of all crypto assets including market capitalization had surpassed $2 trillion, a 10-fold rise from 2020. Therefore, the growth in the market capitalization of cryptocurrencies is driving the cryptocurrency mining equipment market.

Get A Free Sample Of The Report (Includes Graphs And Tables): https://www.thebusinessresearchcompany.com/sample.aspx?id=8467&type=smp

The cryptocurrency mining equipment market covered in this report is segmented –

1) By Equipment: Graphics Processing Units (GPUs), Field Programmable Gate Arrays (FPGAs), Application-Specific Integrated Circuits (ASICs), PC Or CPU Mining 2) By Coin: Bitcoin, Ripple, Ethereum 3) By Application: Remote Hosting Services, Cloud Mining, Self Mining

Product innovation has emerged as a key trend gaining popularity in the cryptocurrency mining equipment market. Major companies operating in the cryptocurrency mining equipment market are focused on innovating new products with advanced technologies to sustain their position in the market. For instance, in February 2021, Nvidia Corporation, a US-based leader in artificial intelligence computing operating in the cryptocurrency mining equipment market, launched the cryptocurrency mining processor (CMP), a line of products for professional cryptocurrency mining. The unique features of CMP including no display output, and a lower peak core voltage and frequency, increase the efficiency of the mining power and helps miners build the most efficient data centers. By using CMPs miners can build the most efficient data centers while preserving GeForce RTX GPUs for gamers.

The cryptocurrency mining equipment market report table of contents includes:

Executive Summary

Market Characteristics

Market Trends And Strategies

Impact Of COVID-19

Market Size And Growth

Segmentation

Regional And Country Analysis . . .

Competitive Landscape And Company Profiles

Key Mergers And Acquisitions

Future Outlook and Potential Analysis

Contact Us: The Business Research Company Europe: +44 207 1930 708 Asia: +91 88972 63534 Americas: +1 315 623 0293 Email: [email protected]

Follow Us On: LinkedIn: https://in.linkedin.com/company/the-business-research-company Twitter: https://twitter.com/tbrc_info Facebook: https://www.facebook.com/TheBusinessResearchCompany YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ Blog: https://blog.tbrc.info/ Healthcare Blog: https://healthcareresearchreports.com/ Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes