#building scalable fintech

Explore tagged Tumblr posts

Text

How to architect scalable infrastructure for B2B FinTech?

What does it take to build fintech products that actually work for SMEs? Not just code — but deep domain insight, strategic tech choices, and leadership that bridges product, engineering, and business.

In the latest Devico Breakfast Bar Podcast, Jakob Carlbring — founder of Strawbay, Blingdale, and Quiddly — joins host Oleg Sadikov to share hard-won lessons from building financial tools and ERP platforms from scratch.

From AI adoption services to software development outsourcing, this episode covers how to scale smart — without losing clarity or control.

Listen here: https://www.deviqa.com/podcasts/jakob-carlbring/

What we learned from Jakob Carlbring

SMEs don’t need more features — they need cash flow clarity

Jakob’s work with growing businesses revealed a recurring issue: cash flow tools that fail to reflect real-time realities.

The solution? Build systems that think like SMEs do — flexible, adaptive, and integrated.

Fintech products need to surface insights, not just provide data dumps.

Building an ERP from the ground up isn’t for the faint of heart

Jakob shares the architectural mindset required to develop a customizable, secure ERP system — not just for today’s users, but for tomorrow’s scaling.

Start with a strong core. Let the rest flex.

Design security and scalability in tandem.

Use modular thinking to reduce rework and accelerate delivery.

AI adoption: move fast, but not blind

AI is everywhere — but Jakob warns against rushing in.

Align AI use cases with real business problems.

Don’t offload decision-making to opaque models.

Maintain human-in-the-loop governance, especially in finance.

This is essential advice for leaders rolling out AI adoption services inside fast-moving product teams.

Outsourcing development without losing the plot

When building across multiple ventures, Jakob leaned on software development outsourcing — but with strategy.

Keep core architecture and vision in-house.

Choose partners who understand your domain, not just your stack.

Build systems for knowledge transfer to avoid single points of failure.

Tech teams that scale start with mindset

Jakob’s hiring philosophy focuses less on resumes and more on product intuition.

Prioritize engineers who understand business constraints.

Look for people who can ship fast and maintain long-term quality.

Build teams that communicate, challenge, and iterate with purpose.

Building great software isn’t about features — it’s about focus. Jakob’s story is a reminder that when tech, leadership, and business strategy align, you don’t just ship faster — you build platforms that last.

#fintech product development#SME financial tools#ERP platform strategy#AI adoption services#software development outsourcing#building scalable fintech#tech leadership#startup engineering teams

0 notes

Text

Transform Your Tomorrow with Zylentrix: Sustainable Innovation for Businesses, Careers, and Global Growth

🌐 Zylentrix: Redefining Success Through People-Centric Solutions

At Zylentrix, we’re on a mission to empower individuals, businesses, and communities through innovation, integrity, and sustainability. Our vision? To lead the world in integrated consultancy services, transforming challenges into stepping stones for growth. Whether you’re scaling a business, launching a career, or pursuing education, we’re here to equip you with the tools to thrive. Let’s unpack how our mission, values, and culture make us the partner you can trust.

🎯 Our Mission & Vision: The North Star of Zylentrix

Mission: “To empower individuals, businesses, and communities by delivering innovative and customised solutions across education, technology, recruitment, and business consulting. With a commitment to excellence, integrity, and sustainability, we strive to create opportunities, bridge gaps, drive transformation, and foster long-term success.”

Vision: “To be the global leader in integrated consultancy services, transforming lives and businesses through innovative, sustainable, and forward-thinking solutions that empower individuals, businesses, and communities to thrive and succeed.”

We’re not just consultants—we’re architects of progress, designing futures where everyone has the chance to excel.

💎 Core Values: The Pillars of Everything We Do

Our values are the blueprint for how we serve clients, collaborate with partners, and grow as a team:

Integrity: “Building Trust Through Transparency” Every decision is guided by ethics. No shortcuts, no compromises.

Innovation: “Driving Future-Ready Solutions” From AI-driven recruitment tools to sustainable business frameworks, we pioneer what’s next.

Excellence: “Delivering Impact & Measurable Growth” We set—and smash—high standards, ensuring clients see real results.

Customer-Centricity: “Putting Clients at the Centre of Everything” Your goals shape our strategies. We listen, adapt, and deliver.

Diversity, Inclusion & Collaboration: “Creating Equal Opportunities for All” Diverse teams = smarter solutions. We champion equity in every project.

Sustainability: “Responsible Business for a Better Future” Green tech, eco-friendly practices, and ethical growth are non-negotiables.

Empowerment: “Enabling People & Businesses to Thrive” We don’t just hand you tools—we teach you how to master them.

🤝 Our Commitment: Tailored Support for Every Journey

Zylentrix is your partner in growth, no matter your starting point:

For Businesses:

Tech Solutions: Streamline operations with scalable AI, cybersecurity, and cloud systems.

Strategic Recruitment: Access global talent pools curated for cultural and technical fit.

Consulting Excellence: Turn insights into action with market research and digital transformation plans.

For Job Seekers:

Career Mastery: Revamp resumes, ace interviews, and unlock roles in booming industries like fintech and clean energy.

Global Mobility: Navigate international job markets with visa support and relocation guidance.

For Students:

Education Pathways: Secure admissions and scholarships at top universities worldwide.

Future-Proof Skills: Gain certifications in AI, sustainability, and more through our partnerships.

For Startups & SMEs:

Scale Smart: Leverage data analytics and ESG frameworks to grow responsibly.

Funding Ready: Craft investor pitches that stand out in crowded markets.

🌱 Our Culture: Fueling Innovation from Within

At Zylentrix, our workplace is a launchpad for creativity and collaboration. Here’s what defines us:

Lifelong Learning: Monthly workshops, innovation challenges, and tuition reimbursements keep our team ahead of trends.

Agility in Action: When the world changes, we pivot faster—like shifting to virtual career fairs during the pandemic.

Collaborative Spirit: Cross-departmental “sprint teams” solve client challenges, blending tech experts, educators, and recruiters.

Ownership & Impact: Every employee, from interns to executives, contributes to client success stories.

Work-Life Harmony: Flexible hours, mental health resources, and sustainability days ensure our team thrives inside and out.

Join the Zylentrix Movement

Ready to transform your business, career, or community? Let’s build a future where innovation and integrity go hand in hand.

📩 Connect Today 👉 Explore our services: Zylentrix 👉 Follow us on Social Media for tips on tech, careers, and sustainability. LinkedIn Facebook Instagram TikTok X Pinterest YouTube Quora Medium 👉 Email [email protected] to schedule a free consultation.

27 notes

·

View notes

Text

How We Helped an Enterprise Achieve 5x Faster Releases with CI/CD?

DevOps CI/CD Services

In today’s modern digital environment, releasing and deploying software faster while maintaining its quality at par is crucial for enterprise success. One of our clients — a large enterprise in the fintech sector — was experiencing delays in software releases, inconsistent deployment processes, and siloed development teams. By implementing and assisting with a personalized approach customized DevOps CI/CD strategy, we helped them achieve 5x faster releases and significantly improve product stability.

DevOps transformation is complex and major and attempting towards it alone often can lead to delays, rework, and frustration. Investing in DevOps consulting aids organizations to adopt best practices, avoid common pitfalls, and achieve faster, more sustainable results.

Here’s how we did it -

The Challenge

The enterprise had multiple teams working in isolation, resulting in long-term release cycles and frequent post-deployment issues. Manual testing and common deployment processes were error-prone and time-consuming in the current modern times. Their infrastructure lacked automation, and there was little visibility into code changes across environments.

Our DevOps CI/CD Solution

We began with a thorough DevOps maturity assessment to understand their current workflow, infrastructure, and tooling. Once the gaps and potential loopholes were identified, our team of experts implemented a seamless DevOps CI/CD pipeline personalized to their specific needs. Here’s what it consisted as follows:

Automated Builds and Tests: We set up automated build pipelines using Jenkins and integrated unit and functional testing at every stage.

Version Control and Branching Strategy: Git workflows were standardized, enabling clear version control and easier rollbacks.

Containerization: Using Docker and Kubernetes, we enabled scalable and environment-independent deployments.

Continuous Deployment: We configured deployment automation across staging and production with rollback capabilities.

Monitoring and Feedback Loops: Real-time monitoring tools like Prometheus and Grafana provided immediate insights into application performance and deployment health.

The Outcome

After implementing our DevOps CI/CD framework:

Release frequency increased by 5x, from monthly to weekly (and in some cases, daily).

Post-deployment issues lowered to 50%.

While the developer productivity is significantly boosted due to reduced manual interruption and increased automation.

This transformation and shift not only speeds up their release cycles but also fosters a culture of collaboration and continuous improvement. Our DevOps CI/CD services empower the enterprise to adapt quickly and respond to market and business changes, and tend to craft value to its customers faster than ever before, establishing standard practices.

If you're facing similar challenges, it's time to consider how DevOps practices can help transform your delivery process.

#it services#technology#saas#software#saas development company#saas technology#digital transformation#usa#canada#devops testing#devops

2 notes

·

View notes

Text

Startup in India – The Next Big Leap for Aspiring Entrepreneurs

The business landscape is rapidly evolving, and one of the most exciting developments in recent years has been the rise of the startup in India movement. With a growing middle class, tech-savvy population, and strong digital infrastructure, India has become one of the most promising markets for innovation. More entrepreneurs are choosing India as the launchpad for their ventures, thanks to a favorable policy environment, increasing investor confidence, and a robust support system that encourages innovation and enterprise.

Why India is a Fertile Ground for Startups

India’s startup ecosystem has grown significantly over the last decade. From just a few thousand startups in 2015, the country now boasts over 100,000 registered startups, with more than 100 unicorns across various sectors.

Key Reasons to Start a Business in India:

Demographic Dividend: Over 65% of the population is under 35 years old, offering a large talent pool and a dynamic consumer base.

Digital Transformation: With over 800 million internet users, India presents massive opportunities for digital business models.

Supportive Policies: Government schemes such as Startup India, Digital India, and Atmanirbhar Bharat offer tax benefits, easier compliance, and access to funding.

Investment Opportunities: India continues to attract global venture capital and private equity investments, making funding accessible.

Steps to Launch a Startup in India

Building a startup in India is both exciting and challenging. Here’s a step-by-step guide for aspiring entrepreneurs:

1. Identify a Problem to Solve

Start with a real-world issue or inefficiency that your idea can address. Validate your solution with target customers.

2. Draft a Business Plan

Define your product or service, target market, competition analysis, revenue model, and marketing strategy.

3. Choose a Business Structure

You can register your company as a:

Private Limited Company

Limited Liability Partnership (LLP)

Sole Proprietorship Each has its legal implications and tax structures.

4. Register Your Startup

Register with the Ministry of Corporate Affairs (MCA) and also apply for recognition under the Startup India initiative for additional benefits.

5. Set Up Financial and Tax Systems

Obtain a PAN and TAN, register for GST, and open a business bank account.

6. Build a Prototype or MVP

Test your idea with a small, functioning product to collect feedback and improve before going to market.

7. Market and Scale

Use digital channels, SEO, social media, and email marketing to build awareness. Focus on scalability right from the beginning.

Promising Startup Sectors in India

If you're planning a startup in India, here are the most promising industries to explore:

Fintech: UPI, digital wallets, and neobanking

Healthtech: Telehealth platforms, wearable devices, AI diagnostics

AgriTech: Smart farming tools, farm-to-fork models

Edtech: Online learning platforms, virtual classrooms

EV and Clean Energy: Green transport, solar and battery startups

Government Schemes That Help Startups

To encourage entrepreneurship, the Indian government offers numerous startup-friendly initiatives:

Startup India: Income tax exemptions for three years, funding assistance, and IP support.

SIDBI Fund of Funds: Provides equity funding through venture capital firms.

MSME Schemes: Credit access and infrastructure support for small and medium enterprises.

Challenges to Consider

Launching a startup in India comes with its fair share of obstacles:

Navigating regulatory frameworks

Accessing early-stage funding

Building and retaining a skilled workforce

Balancing scalability and profitability

However, with determination and the right mentorship, these challenges can be turned into learning opportunities.

Conclusion

India is not just a growing market; it is a launchpad for innovation, disruption, and long-term success. The time to invest in a startup in India is now. With its blend of opportunity, talent, and support, India is shaping the future of entrepreneurship on a global scale. If you have an idea and the drive to build, the Indian startup ecosystem is ready to back you.

3 notes

·

View notes

Text

Why Quiwox Is the Future of Clean Tech and Crypto Investment

As the global economy pivots toward sustainability and digital finance, the convergence of clean technology and cryptocurrency is shaping a new era of wealth creation. In this transformation, Quiwox stands out as a powerful ecosystem offering users the opportunity to earn passive income through solar power, EV battery technology, and crypto investment—all under one platform.

Positioning itself as a global leader in green energy investment and digital finance, Quiwox Australia combines renewable infrastructure with blockchain-based assets to create a truly revolutionary financial opportunity. Whether you're an eco-conscious investor, a cryptocurrency beginner, or a seasoned network marketer, Quiwox delivers a sustainable and scalable solution for long-term income.

In this blog, we'll explore why Quiwox is considered the future of clean tech and crypto investment, diving into its innovative business model, income opportunities, and how it aligns with global trends in green finance and digital transformation.

🔋 1. Bridging Two Powerful Forces: Clean Tech & Crypto

The world is witnessing two powerful revolutions simultaneously—the clean energy transition and the digital asset boom. Quiwox sits at the intersection of these transformations, offering solar-powered EV battery investment combined with crypto trading strategies and blockchain-backed ROI models.

Clean Tech:

Investments in solar energy, EV infrastructure, and carbon-neutral technologies

Focus on solar-powered EV batteries, a rapidly growing sector in sustainable transport

Contribution to net-zero goals by reducing reliance on fossil fuels

Crypto Investment:

Secure access to the best crypto wallets

Opportunities to trade and invest in high-yield digital assets

Compliance with crypto regulations in Australia

24/7 earning potential with Every Hour Income systems

By merging these two sectors, Quiwox gives investors a chance to build wealth while participating in the most impactful industries of the 21st century.

⚙️ 2. The Quiwox Business Model: Innovation Meets Sustainability

At its core, Quiwox operates through a hybrid model that integrates:

Green infrastructure investment

Cryptocurrency-based returns

Multi-level marketing incentives

Binary Plan commission structures

Franchise ownership options

This model creates multiple streams of clean energy passive income, empowering users to invest, refer, earn, and grow.

Quiwox Plans and Pricing:

Users can start with accessible investment plans, scaling based on ROI preferences. Plans are tied to real-world assets like solar energy farms and EV battery franchises, ensuring tangible value while offering hourly, daily, and monthly payouts.

Whether you’re looking for the best investment plan in clean tech or a scalable affiliate opportunity, Quiwox has a solution.

⚡ 3. Solar-Powered EV Battery Plants: The Next Frontier

Electric Vehicles (EVs) are no longer a trend—they are the future. However, powering them sustainably is the real challenge. Quiwox addresses this by focusing on solar-powered EV battery plants, which significantly reduce the carbon footprint of vehicle manufacturing.

Investors can support and earn from these plants through Quiwox’s structured offerings, effectively owning a piece of the clean mobility revolution.

Benefits for Investors:

Stable, asset-backed returns

Contribution to global clean energy targets

Regular income from battery production and distribution

Opportunity to Earn from Quiwox every hour

This innovative use of solar energy in EV battery manufacturing makes Quiwox not just a fintech company, but a vital player in clean infrastructure development.

💰 4. Earn Every Hour: ROI That Works for You

One of Quiwox’s most unique features is the Earn Every Hour model. Unlike traditional investments that pay quarterly or annually, Quiwox enables investors to receive hourly ROI on their capital.

This feature is especially attractive for:

Users seeking consistent passive income

Crypto investors used to 24/7 earning models

Retirees and freelancers looking for sustainable cash flow

People who want ROI without market timing or day trading

Through its hourly earnings, Quiwox democratizes wealth generation and makes investing feel both rewarding and immediate.

🧩 5. Multiple Income Streams for Sustainable Wealth

Quiwox doesn’t limit you to a single income path. It offers diversified earning opportunities, including:

🔹 Direct ROI:

Earn hourly or daily income based on your investment tier. The higher your contribution, the greater your return—structured across a range of solar energy investment plans.

🔹 Referral Plan:

Earn commission by inviting others to invest through your referral link. As your network grows, so does your passive income.

🔹 Binary Plan:

Build left and right legs of a team to earn matching bonuses, leadership rewards, and team-based income. It’s a powerful form of multi-level marketing built into the Quiwox platform.

🔹 Franchise Investment:

Become a part-owner of a solar-powered EV battery unit and earn returns from operations. A long-term asset with real-world value.

🛡️ 6. Security, Regulations, and Trust

Trust is critical in both crypto and clean tech investments. Quiwox ensures transparency and security with:

Crypto Wallet Security features

Full compliance with crypto regulations in Australia

Regular audits and transparent reporting

Real-time dashboard access for performance tracking

For cryptocurrency investing beginners, Quiwox also offers tutorials and secure wallet options to make the onboarding process seamless.

🌍 7. Global Vision with Local Impact

Quiwox may be based in Australia, but its vision is global. The platform empowers users from any part of the world to invest in renewable energy and crypto finance—and benefit from the shift to a green economy.

As a global leader, Quiwox is expanding partnerships, opening more battery franchise plants, and onboarding users from diverse economic backgrounds—ensuring inclusivity in wealth building.

📘 8. Education and Community Empowerment

Quiwox goes beyond investment. It’s building a community. Through:

Regular webinars

Crypto trading strategy workshops

Access to top crypto investment strategies

Guides for cryptocurrency investing for beginners

Real-time support

Quiwox empowers users not just to invest, but to understand and grow. This educational foundation increases confidence and long-term engagement, especially important for those unfamiliar with blockchain or renewable technologies.

📈 9. Why Quiwox Is the Best Crypto-Backed Clean Energy Investment Today

Quiwox represents a new investment category—where solar power, blockchain, EV infrastructure, and network marketing combine to create sustainable wealth. Here’s what makes it unmatched:

Unique Selling Points:

Hourly ROI from real-world clean assets

Crypto-integrated investment ecosystem

Scalable business plans with binary/referral options

Franchise opportunities in the fast-growing EV market

Educational tools and regulated compliance

A brand dedicated to planetary health and investor prosperity

Whether you're looking for the best crypto to buy now, a secure way to diversify your income, or a chance to participate in the global green energy transition, Quiwox delivers.

✅ Getting Started with Quiwox

It takes just minutes to begin your clean energy investment journey:

Visit Quiwox.com

Choose your plan from the Quiwox Plans and Pricing page

Fund your wallet and start earning immediately

Refer friends, build your network, and rise in rank

Monitor and withdraw your Every Hour Income

🧠 Final Thoughts: The Future Is Now—And It’s Green

In 2025 and beyond, the most successful investors will be those who align financial goals with global sustainability. With the world shifting toward clean energy and digital currency, Quiwox emerges as a platform uniquely positioned at this intersection.

By making green energy investment simple, accessible, and rewarding, Quiwox invites you to join a movement—not just for profits, but for the planet.

Are you ready to invest in the future? Start with Quiwox today and create a legacy of wealth and responsibility.

🌱💸 Clean Tech. Smart Crypto. Earn Every Hour.

2 notes

·

View notes

Text

Fuel Your Growth with Performance Marketing

Turn clicks into customers with laser-focused strategies and real-time results.

Introduction: Marketing That Delivers, Not Just Promises

In today’s fast-paced digital landscape, businesses no longer have the luxury of spending blindly on ads and waiting for miracles. What they need is performance marketing—a results-driven approach that focuses on conversions, not just impressions. It's data-backed, ROI-focused, and scalable, making it the future of modern marketing.

🎯 What is Performance Marketing?

Performance marketing is a digital strategy where advertisers pay only for measurable results—be it clicks, leads, sales, or app installs. Unlike traditional branding methods, performance marketing demands proof. Every campaign is trackable, every rupee spent is accountable.

Key components include:

Pay-Per-Click (PPC) advertising

Affiliate marketing

Social media paid campaigns

Native and display ads

Retargeting & programmatic advertising

💡 Why Businesses Love Performance Marketing

Performance marketing offers powerful benefits for brands across industries:

✅ Cost-Effective – No upfront lump sums; pay only for outcomes ✅ Trackable & Transparent – Live dashboards show real-time performance ✅ Highly Targeted – Reach only your ideal audience with pinpoint accuracy ✅ Scalable – Start small, test, and grow based on results ✅ Optimized for ROI – Every ad is backed by metrics that matter

From startups to big brands, everyone wants results—and this strategy delivers.

📈 Lead Generation: The Lifeline of Sales

No leads = no business. Performance marketing supercharges your sales funnel with high-quality, intent-driven leads across platforms:

Google Search & Display Network

Meta (Facebook/Instagram) Ads

LinkedIn for B2B targeting

YouTube & OTT for awareness-based targeting

Landing pages with integrated lead capture forms

By using tools like A/B testing, heatmaps, and behavioral tracking, marketers ensure that visitors convert—not just click.

🔧 Tools & Techniques that Drive Results

The magic lies in optimization. A great campaign uses:

Advanced analytics (Google Analytics, Meta Pixel, UTM tracking)

Retargeting to re-engage bounced traffic

Conversion Rate Optimization (CRO) for better lead quality

Funnel building with precise customer journeys

AI and automation for budget control and ad performance

When campaigns are backed by smart data, results are not left to chance.

🧠 Who Should Use Performance Marketing?

E-commerce brands looking to scale sales

Startups wanting fast market penetration

Service-based businesses aiming for qualified leads

Real estate, education, fintech, and healthcare sectors for niche targeting

Agencies managing multiple client portfolios

🌟 Final Word: Measure More. Waste Less.

Marketing budgets are shrinking, but expectations are growing. Performance marketing strikes the perfect balance by focusing only on what works. It’s not about shouting louder—it’s about reaching smarter.

🔗 Ready to generate real leads and real growth?

Start your performance marketing journey today!

👉 [Click Here] to explore high-ROI digital strategies!

2 notes

·

View notes

Text

Hire Experts for Custom Mobile App Development Services in Indore – Young Decade

Looking for custom mobile app development services in Indore? Young Decade is your trusted partner for building high-performance, scalable, and secure mobile applications. Whether you need an Android or iOS app, our expert developers craft tailored solutions to meet your unique business needs.

With years of experience in the industry, Young Decade delivers feature-rich, user-friendly, and innovative mobile apps that enhance user engagement and boost business growth. We follow a customer-centric approach, ensuring that every app is designed with a seamless UI/UX, strong security, and optimized performance.

Why Choose Young Decade for Mobile App Development?

✔ Custom Solutions – Apps designed to align perfectly with your business goals. ✔ Android & iOS Expertise – Skilled developers with in-depth platform knowledge. ✔ Seamless User Experience – Intuitive designs for better user engagement. ✔ Secure & Scalable Apps – High-end security and future-ready technology. ✔ Global Clientele – Serving businesses in India, USA, Dubai (UAE), and Canada.

At Young Decade, we believe in delivering quality-driven mobile applications that give your business a competitive edge. Whether you need an eCommerce app, healthcare solution, fintech app, or enterprise software, we ensure top-notch development with the latest technologies.

Hire our expert developers today and transform your business with a powerful mobile app! 🚀

#software development company#android app developers#app development company#best android app development company#software development#developers & startups#Flutter app development company in Indore#react native app development company in Indore#Top IT company in Indore#Best Software development company in indore

2 notes

·

View notes

Text

How to Build a Seamless Payment Platform with Cash App Clone Script?

In the competitive landscape of digital finance, launching a peer-to-peer (P2P) payment app like Cash App presents a lucrative opportunity for entrepreneurs. With the rise of cashless transactions, businesses seeking to enter the fintech space can leverage a Cash App Clone Script to establish a robust and feature-rich payment solution. Bizvertex offers a scalable and cost-effective Cash App Clone Software tailored for startups and enterprises aiming to penetrate the digital payment sector.

Rapid Market Entry with White Label Cash App Clone Software

Developing a P2P payment application from scratch involves extensive research, development, and compliance measures, leading to high costs and prolonged time-to-market. A White Label Cash App Clone Software significantly reduces these challenges, allowing businesses to deploy a fully functional platform with minimal investment. By utilizing Bizvertex’s clone solution, entrepreneurs can customize the software to align with their brand identity, ensuring a seamless user experience while maintaining regulatory compliance.

Essential Features of a Cash App Clone Script

To compete in the fintech industry, a Cash App-like platform must offer key functionalities that enhance user engagement and transaction security. The Cash App Clone Script by Bizvertex includes:

Instant P2P Money Transfers – Enables users to send and receive money effortlessly.

QR Code Payments – Facilitates quick transactions via QR code scanning.

Multi-Currency Support – Allows users to transact in different fiat and digital currencies.

Bank Account Integration – Provides seamless linking with bank accounts for deposits and withdrawals.

Cryptocurrency Transactions – Supports Bitcoin and other digital assets for modern financial needs.

Robust Security Measures – Includes two-factor authentication, encryption, and fraud detection.

Bill Payments & Mobile Recharge – Enhances user convenience by integrating utility bill payments.

Custom Branding & UI/UX – Ensures a personalized experience for end-users.

Business Advantages of Choosing a Cash App Clone Software

1. Cost-Effective Development

Investing in a White Label Cash App Clone Software significantly reduces development costs compared to building a payment app from scratch. Bizvertex provides a ready-made yet customizable solution, ensuring a high return on investment (ROI) for entrepreneurs.

2. Faster Time-to-Market

Speed is crucial in the fintech industry. By opting for a Cash App Clone Script, businesses can launch their P2P payment app quickly and start acquiring users without delays.

3. Scalability & Customization

A pre-built clone solution from Bizvertex allows startups to scale as their user base grows. The software is fully customizable, enabling businesses to add unique features and branding elements.

4. Revenue Generation Opportunities

A Cash App-like platform offers multiple revenue streams, including transaction fees, subscription models, merchant partnerships, and cryptocurrency trading commissions.

Build a Profitable P2P Payment App with Bizvertex

For entrepreneurs aiming to establish a foothold in the fintech industry, Bizvertex’s Cash App Clone Software provides a reliable and efficient pathway. With advanced security features, a seamless user interface, and multi-currency support, businesses can create a successful and profitable P2P payment platform. Get started with Bizvertex today and build a fintech brand that stands out in the market.

3 notes

·

View notes

Text

In today’s fast-evolving digital economy, businesses need seamless, secure, and scalable payment solutions to thrive. A white label payment gateway offers an efficient, cost-effective way for businesses to enter the payments space under their own brand—without building the infrastructure from scratch.

💡 What is a White Label Payment Gateway?

A white label payment gateway is a ready-made payment infrastructure provided by a third-party company that allows businesses to rebrand and resell the gateway as their own. This means you get a complete payment processing solution—including APIs, dashboards, and integrations—customized with your branding.

✅ Why Choose a White Label Payment Gateway from Itio Innovex?

Itio Innovex is a leading provider of fintech solutions, delivering secure and customizable white label payment gateways that empower businesses to scale fast and innovate without limits.

Here are the top benefits:

1. Faster Time-to-Market

Launching your own branded payment gateway can take months or even years. With Itio Innovex’s white label solution, you can go live in a matter of days or weeks, thanks to plug-and-play integration and robust API documentation.

2. Brand Ownership & Customization

With Itio Innovex, the gateway is completely white-labeled, meaning your customers see your logo, your colors, your interface—not a third-party brand. You maintain full control of the user experience, which enhances brand trust and loyalty.

3. Reduced Development & Maintenance Costs

Building a secure, PCI-DSS-compliant payment system is resource-intensive. By leveraging Itio Innovex’s infrastructure, you avoid heavy upfront investments, ongoing maintenance, and compliance headaches.

4. Multi-Currency & Global Support

Itio Innovex supports multi-currency transactions, international payment methods, and global compliance, allowing you to scale across markets effortlessly.

5. Scalable and Secure Infrastructure

Security is non-negotiable. Itio Innovex offers enterprise-grade security features including tokenization, encryption, fraud detection, and real-time monitoring—ensuring that your transactions are protected 24/7.

6. Advanced Analytics & Reporting

Gain access to detailed transaction data, customizable reports, and real-time insights with Itio Innovex’s built-in analytics dashboard—so you can make smarter business decisions.

🚀 Why Itio Innovex is Your Ideal White Label Payment Partner

With a track record of innovation, compliance, and customer-centric design, Itio Innovex enables businesses to unlock new revenue streams, enhance user experience, and scale globally—all under their own brand.

Whether you're a SaaS provider, eCommerce platform, fintech startup, or enterprise, our white label payment gateway solution provides everything you need to lead the payment game.

📞 Ready to Elevate Your Payment Infrastructure?

Partner with Itio Innovex today and launch your own branded, secure, and scalable payment gateway in no time.

👉 Contact Us to get started.

For more info: www.itio.in

Email Id: [email protected]

Contact No: +919266722841

#WhiteLabelGateway#PaymentSolutions#Fintech#ItioInnovex#BrandedGateway#SecureTransactions#DigitalPayments#PaymentInfrastructure

1 note

·

View note

Text

What Are the Costs Associated with Fintech Software Development?

The fintech industry is experiencing exponential growth, driven by advancements in technology and increasing demand for innovative financial solutions. As organizations look to capitalize on this trend, understanding the costs associated with fintech software development becomes crucial. Developing robust and secure applications, especially for fintech payment solutions, requires significant investment in technology, expertise, and compliance measures. This article breaks down the key cost factors involved in fintech software development and how businesses can navigate these expenses effectively.

1. Development Team and Expertise

The development team is one of the most significant cost drivers in fintech software development. Hiring skilled professionals, such as software engineers, UI/UX designers, quality assurance specialists, and project managers, requires a substantial budget. The costs can vary depending on the team’s location, expertise, and experience level. For example:

In-house teams: Employing full-time staff provides better control but comes with recurring costs such as salaries, benefits, and training.

Outsourcing: Hiring external agencies or freelancers can reduce costs, especially if the development team is located in regions with lower labor costs.

2. Technology Stack

The choice of technology stack plays a significant role in the overall development cost. Building secure and scalable fintech payment solutions requires advanced tools, frameworks, and programming languages. Costs include:

Licenses and subscriptions: Some technologies require paid licenses or annual subscriptions.

Infrastructure: Cloud services, databases, and servers are essential for hosting and managing fintech applications.

Integration tools: APIs for payment processing, identity verification, and other functionalities often come with usage fees.

3. Security and Compliance

The fintech industry is heavily regulated, requiring adherence to strict security standards and legal compliance. Implementing these measures adds to the development cost but is essential to avoid potential fines and reputational damage. Key considerations include:

Data encryption: Robust encryption protocols like AES-256 to protect sensitive data.

Compliance certifications: Obtaining certifications such as PCI DSS, GDPR, and ISO/IEC 27001 can be costly but are mandatory for operating in many regions.

Security audits: Regular penetration testing and vulnerability assessments are necessary to ensure application security.

4. Customization and Features

The complexity of the application directly impacts the cost. Basic fintech solutions may have limited functionality, while advanced applications require more extensive development efforts. Common features that add to the cost include:

User authentication: Multi-factor authentication (MFA) and biometric verification.

Real-time processing: Handling high volumes of transactions with minimal latency.

Analytics and reporting: Providing users with detailed financial insights and dashboards.

Blockchain integration: Leveraging blockchain for enhanced security and transparency.

5. User Experience (UX) and Design

A seamless and intuitive user interface is critical for customer retention in the fintech industry. Investing in high-quality UI/UX design ensures that users can navigate the platform effortlessly. Costs in this category include:

Prototyping and wireframing.

Usability testing.

Responsive design for compatibility across devices.

6. Maintenance and Updates

Fintech applications require ongoing maintenance to remain secure and functional. Post-launch costs include:

Bug fixes and updates: Addressing issues and releasing new features.

Server costs: Maintaining and scaling infrastructure to accommodate user growth.

Monitoring tools: Real-time monitoring systems to track performance and security.

7. Marketing and Customer Acquisition

Once the fintech solution is developed, promoting it to the target audience incurs additional costs. Marketing strategies such as digital advertising, influencer partnerships, and content marketing require significant investment. Moreover, onboarding users and providing customer support also contribute to the total cost.

8. Geographic Factors

The cost of fintech software development varies significantly based on geographic factors. Development in North America and Western Europe tends to be more expensive compared to regions like Eastern Europe, South Asia, or Latin America. Businesses must weigh the trade-offs between cost savings and access to high-quality talent.

9. Partnering with Technology Providers

Collaborating with established technology providers can reduce development costs while ensuring top-notch quality. For instance, Xettle Technologies offers comprehensive fintech solutions, including secure APIs and compliance-ready tools, enabling businesses to streamline development processes and minimize risks. Partnering with such providers can save time and resources while enhancing the application's reliability.

Cost Estimates

While costs vary depending on the project's complexity, here are rough estimates:

Basic applications: $50,000 to $100,000.

Moderately complex solutions: $100,000 to $250,000.

Highly advanced platforms: $250,000 and above.

These figures include development, security measures, and initial marketing efforts but may rise with added features or broader scope.

Conclusion

Understanding the costs associated with fintech software development is vital for effective budgeting and project planning. From assembling a skilled team to ensuring compliance and security, each component contributes to the total investment. By leveraging advanced tools and partnering with experienced providers like Xettle Technologies, businesses can optimize costs while delivering high-quality fintech payment solutions. The investment, though significant, lays the foundation for long-term success in the competitive fintech industry.

2 notes

·

View notes

Text

Why a Cryptocurrency Exchange Script Is the Smartest Way to Launch Your Crypto Business

The cryptocurrency market continues to evolve at lightning speed, offering exciting opportunities for businesses to enter the space. For entrepreneurs looking to launch their own crypto trading platform, a Cryptocurrency Exchange Script is the smartest, most efficient solution. But what exactly is it and why is it so valuable?

What Is a Cryptocurrency Exchange Script?

A Cryptocurrency Exchange Script is a ready-made, customizable software solution that allows you to build and deploy a crypto exchange platform quickly and cost-effectively. These scripts come with pre-built features such as a trading engine, wallet integration, user dashboard, admin panel, and KYC/AML modules; everything you need to run a secure and scalable exchange.

Why Choose a Cryptocurrency Exchange Script?

1. Faster Time-to-Market

Developing an exchange from scratch can take months or even years. A ready-made script shortens that time dramatically, allowing you to go live within weeks.

2. Cost-Effective

Custom development can be expensive. Scripts offer a budget-friendly alternative without compromising on essential features and security.

3. Highly Customizable

Modern scripts are modular and can be tailored to your specific business model — whether it’s spot trading, P2P, derivatives, or a hybrid platform.

4. Advanced Security

Top providers ensure the script is built with enterprise-grade security features like two-factor authentication, data encryption, DDoS protection, and anti-phishing modules.

5. Scalable Architecture

As your user base grows, the script can scale to handle increased trading volume and traffic without downtime or lag.

Key Features to Look For

Real-time trading engine

Multi-currency wallet integration

Admin and user dashboards

KYC/AML compliance modules

Multi-layer security

Mobile responsiveness

Who Should Use a Cryptocurrency Exchange Script?

Whether you’re a startup looking to disrupt the market or an enterprise aiming to expand into crypto, a cryptocurrency exchange script is perfect for:

Fintech startups

Blockchain development firms

Financial service providers

Entrepreneurs entering the crypto space

Final Thoughts

A Cryptocurrency Exchange Script is not just a shortcut — it’s a strategic tool. With the right development partner, you can launch a secure, feature-rich exchange platform tailored to your business goals. At The Crypto Ape, we provide industry-leading crypto exchange scripts that help you go live faster, safer, and smarter.

1 note

·

View note

Text

🔍 Scraping Stock Market, Crypto & Lending Platforms for Aggregators – Why It Matters More Than Ever!

in today’s fast-paced digital economy, real-time financial data is a critical asset. Whether you're an aggregator, fintech company, or data-driven enterprise, gaining access to reliable and timely data from stock markets, crypto exchanges, and lending platforms can give you a significant competitive edge.

At Actowiz Solutions, we specialize in advanced web scraping services that empower aggregators to:

✅ Monitor stock trends in real time ✅ Track cryptocurrency prices & market volume ✅ Extract lending platform data for interest rates & offers ✅ Build intelligent dashboards with clean, structured data ✅ Enhance predictive models and market strategies

Our robust, scalable scraping solutions are tailored to handle complex data environments while ensuring compliance and quality. With automation and intelligent data pipelines, we help businesses turn raw financial data into actionable insights.

📘 Explore our latest blog to discover how scraping is transforming data aggregation in the financial space.

1 note

·

View note

Text

Building Smart Solutions: How Custom Software Development Drives Business Growth

With a world going digital first, off-the-shelf software has limitations when it comes to addressing the specific requirements of a business. Enter a custom software development company that proves invaluable. From early-stage ventures to major corporations, customized software solutions enable businesses to run smoothly, grow with confidence, and address real-world challenges with accuracy.

In contrast to generic platforms, custom software is designed to cater to particular processes, user experience, and long-term objectives. Whether you want to automate internal processes, improve customer experiences, or create an entirely new digital product—custom development guarantees each feature contributes value.

For startups, speed and agility matter most. Successful software developers for startup sgrasp this fact. They are not coders—they're product thinkers who understand how to balance scalability, functionality, and market readiness. Startups enjoy quick prototyping, MVP building, and iterative expansion that mirrors changing user requirements. These developers collaborate with founders, providing UX insights, technology stack, and product roadmap recommendations.

Why is custom software a good investment for startups?

Flexibility: Adds or improves features as the company grows

Ownership: Complete authority over the direction, security, and data of the product

Integration: Clean integration with tools, APIs, and other systems

Differentiation: Something different that allows standing out in the crowd

At the same time, larger enterprises face a different range of issues. That is where enterprise software development steps in. Enterprises need secure, scalable, and stable platforms that handle thousands of users and interface with sophisticated systems. From ERP and CRM systems to workflow automation and data intelligence dashboards, enterprise-class software assists in ensuring operational excellence between departments.

A seasoned custom software development companydoesn't only create code— they build ecosystems. They consider business requirements, legacy applications, regulatory mandates, and future expansion. The end result? Enduring solutions that adapt with the business, not against.

These are what companies need to be on the lookout for when bringing on a development partner:

Deep experience in startup and enterprise domains

Clear, nimble development process

Specialized teams on next-gen tech (React, Node.js, Python, Java, etc.)

Strong UX/UI design competency

Post-launch assistance and ongoing refinement strategies

If you're an upstart startup debuting your first app or a Fortune 500 corporation refining internal processes, bespoke software affords unparalleled agility and command.

The prosperity of businesses in all industries—from healthcare and fintech to logistics and retail—has been increasingly fueled by clever digital platforms. And driving those platforms are organizations who know not only code, but business strategy as well. Having the right development partner can be the key to unlocking the next level of growth. Visit now: https://www.dreamzdigitalsolutions.com/

1 note

·

View note

Text

Launch a Trading Platform Fast with Fintech360’s White Label Brokerage Technology

In today’s fast-paced financial landscape, launching your own trading platform doesn't have to take years or millions in development costs. With white label brokerage technology from Fintech360, businesses can enter the trading market quickly, offering a fully-branded platform for forex, crypto, CFDs, and other financial instruments.

What is White Label Brokerage Technology?

A white label brokerage platform is a ready-made, customizable trading system that you can brand as your own. Fintech360 provides all the essential tools—including trading terminals, back-office solutions, liquidity integrations, and compliance modules—so you can start operating a brokerage business without building from scratch.

Whether you're a financial institution, fintech startup, or entrepreneur, Fintech360's white label solution offers a low-risk, high-reward path into online trading.

Why Choose Fintech360?

Fintech360 stands out by offering:

Fully branded and customizable platforms

Multi-asset trading support (Forex, Crypto, Indices, Stocks, and more)

Real-time execution with top-tier liquidity providers

Integrated KYC/AML compliance tools

Affiliate and partner management systems

Cloud-based architecture for low latency and global access

Their solution is ideal for those seeking a crypto brokerage solution, forex white label platform, or a multi-functional fintech platform to support trading operations.

Who Is It For?

Fintech360’s white label technology is designed for:

Entrepreneurs launching a brokerage brand

Financial companies expanding into online trading

Crypto communities monetizing their networks

Influencers building niche financial products

The Future of Brokerage is White Label

As digital assets and decentralized finance gain momentum, having a scalable, secure, and user-friendly trading platform is critical. Fintech360 ensures your brokerage is future-ready with mobile access, real-time analytics, and continuous platform updates.

If you’re ready to launch a trading platform without technical barriers, Fintech360’s white label brokerage technology offers everything you need to get started—quickly, affordably, and professionally.

Start your journey today with Fintech360—where innovation meets opportunity.

1 note

·

View note

Text

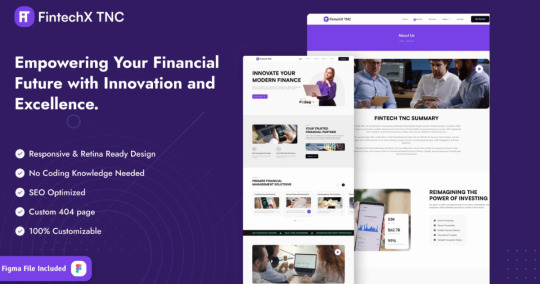

Unlocking the Power of Fintech Web Design with FintechX TNC

In today’s fintech startups, they need more than just a great product — they need a visually stunning, trustworthy, and high-converting website. That’s where the FintechX TNC Webflow template steps in. Whether you’re launching a neobank, a crypto exchange, a digital wallet, or a financial SaaS platform, FintechX TNC has everything you need to create a credible and engaging digital presence right out of the box.

FintechX TNC is ideal for

🚀 Fintech startups looking to launch fast with a professional and scalable website. 💳 Neobanks, digital wallets, and payment platforms that want sleek design + trust. 🧠 Finance-related SaaS companies in need of lead-generation landing pages. 🌐 Crypto and DeFi platforms seeking a futuristic, trustworthy web presence. 💼 Financial consultants and B2B fintechs needing clean, conversion-focused design. If your project deals with digital finance and you want to stand out, this template has your name on it.

Key Features of the FintechX TNC Webflow Template

Here’s what makes this template a top pick for fintech founders, marketers, and designers:

✔️ 13 Beautifully Crafted Pages From landing pages to pricing and FAQs, all essential pages are ready to go.

✔️ Responsive Design Looks amazing on mobile, tablet, and desktop — no extra work required.

✔️ CMS-Driven Blog Share your financial insights and industry updates with ease using Webflow’s CMS.

✔️ Clean and Modern UI Designed with a sharp, minimalist aesthetic that reflects professionalism and trust.

✔️ Custom Interactions & Animations Micro-interactions add a polished feel without overwhelming the user.

✔️ Fast-Loading & SEO-Optimized Built to perform well on search engines and load lightning-fast.

✔️ Global Styles for Easy Customization Change fonts, colors, and layout elements globally to match your brand quickly.

✔️ Contact & Newsletter Forms Ready-to-use forms for lead capture and communication.

✔️ Light & Dark Mode Give users the choice — both modes look equally sleek.

✔️ Figma File Included Perfect for teams who want to iterate or customize further before development.

Why Choose a Webflow Template for Fintech?

Time is money in the fintech world. Using a Webflow template like FintechX TNC saves you:

⏱️ Development Time — No need to code from scratch.

💰 Budget — No need to hire a full design/dev team early on.

⚙️ Hassle — Everything just works, and updates are smooth.

Plus, Webflow’s visual editor means your marketing team can edit copy, launch pages, and tweak CTAs without relying on developers.

Beautiful Design Meets Conversion Strategy

It’s not just about aesthetics — FintechX TNC is designed to build trust, guide the user journey, and drive signups or conversions. Subtle animations and call-to-actions are placed exactly where you need them, so users naturally navigate toward your key actions.

The typography is elegant, the layout is airy, and the color palette is designed to inspire trust — a crucial factor in fintech.

Final Thoughts

If you’re serious about scaling your fintech idea and need a site that communicates innovation, credibility, and modern financial design, then yes — FintechX TNC is absolutely worth it.

👉 Check it out on TNCFlow: FintechX TNC Template

#webflow#webflowtemplates#websitetemplate#template#web design#businesswebsite#ui ux design#webflowdesign#web development#degital marketing#financial#banking#investments

1 note

·

View note

Text

Build Your Cash App Clone: An Online Payment App

Online transactions have become the backbone of financial exchanges in today's fast-paced digital economy. With mobile payment apps like Cash App revolutionizing the way people send and receive money, businesses and entrepreneurs are keen to develop their own cash app clone to tap into this lucrative market. But what does it take to build an app like Cash App? What features are essential, and how can you ensure a seamless, secure, and user-friendly experience?

In this guide, we’ll explore the key aspects of developing a cash app clone app, the technical requirements, and the strategic steps to create a successful mobile payment solution.

Why Develop a Cash App Clone?

With millions of users relying on mobile payment apps for everyday transactions, the demand for seamless peer-to-peer (P2P) payment platforms is growing exponentially. A cash app clone presents a golden opportunity to enter the fintech space and offer users a convenient way to manage their money.

Here’s why launching an app like Cash App makes sense:

Expanding Market Potential: Digital wallets are gaining traction worldwide, with a projected market value of $12.06 trillion by 2027.

User Convenience: People prefer apps that allow quick money transfers, bill payments, and even cryptocurrency transactions.

Revenue Generation: Through transaction fees, premium features, and business integrations, a cash app clone app can be highly profitable.

Brand Differentiation: You can introduce unique features that set your app apart from existing payment apps.

Key Features of a Cash App Clone

A successful cash app clone should incorporate essential features that ensure seamless transactions, security, and user engagement. Here are the must-have functionalities:

1. Secure User Authentication

To build trust, your cash app clone app should implement multi-factor authentication (MFA), biometric login (fingerprint or facial recognition), and OTP verification. Security is paramount, especially when dealing with financial transactions.

2. Instant Money Transfers

The core function of an app like Cash App is the ability to send and receive money instantly. Whether users are transferring funds to family members or paying for goods and services, your app should support real-time transactions.

3. Bank Account & Card Linking

Seamless integration with bank accounts, debit/credit cards, and digital wallets ensures users can fund their accounts and withdraw money effortlessly. Supporting multiple banking networks enhances the app’s usability.

4. QR Code Payments

QR-based transactions are becoming increasingly popular. Your cash app clone should allow users to generate and scan QR codes for quick, contactless payments.

5. Cryptocurrency Transactions

Apps like Cash App have ventured into cryptocurrency trading. Integrating a secure cryptocurrency exchange feature can attract tech-savvy users looking to invest or trade digital assets.

6. Bill Payments & Recharges

Offering bill payments, mobile recharges, and subscription management within the app enhances user engagement and provides additional revenue streams.

7. Peer-to-Peer (P2P) Lending

Innovative P2P lending options can set your cash app clone app apart. Users can lend or borrow money within the platform, ensuring a dynamic financial ecosystem.

8. Spending Insights & Budgeting

Users appreciate financial tools that help them track expenses, set budgets, and analyze their spending patterns. AI-driven insights can improve financial literacy and engagement.

9. Customer Support & Dispute Resolution

Live chat, chatbots, and in-app support ensure users get timely assistance for transaction disputes, account issues, and general inquiries.

Technical Stack for a Cash App Clone

Developing a cash app clone requires a robust technology stack that ensures high performance, security, and scalability. Here’s what you need:

Front-End Development: React Native, Flutter, Swift (iOS), Kotlin (Android)

Back-End Development: Node.js, Python, Ruby on Rails

Database: PostgreSQL, Firebase, MongoDB

Security: AES encryption, SSL/TLS protocols, biometric authentication

Payment Gateway Integration: Stripe, PayPal, Razorpay

Cloud Storage: AWS, Google Cloud, Azure

Steps to Develop Your Cash App Clone

1. Define Your Unique Value Proposition

While the idea is to create an app like Cash App, your application should offer something different. Identify a niche or a set of features that will make your app stand out.

2. Partner with an On-Demand App Development Company

A specialized on-demand app development company can help you build a secure, scalable, and feature-rich app. Choosing the right development partner ensures a smoother journey from concept to launch.

3. UI/UX Design for a Seamless User Experience

User-friendly design plays a significant role in customer retention. Your app’s interface should be intuitive, visually appealing, and easy to navigate.

4. Development & Integration

Once the designs are finalized, the development phase begins. This includes:

Coding the front-end and back-end

Integrating APIs for payment gateways and banking services

Implementing security features

Testing functionalities before deployment

5. Compliance & Security Regulations

Financial apps must adhere to regulations like PCI-DSS, GDPR, and KYC norms. Compliance ensures that your app meets industry standards and avoids legal complications.

6. Testing & Quality Assurance

Before launching your cash app clone app, thorough testing is crucial. Security audits, load testing, and performance testing help identify and fix vulnerabilities.

7. Deployment & Marketing Strategy

Once the app is ready, deploying it on app stores (Google Play and Apple App Store) is the final step. A strong marketing strategy, including social media promotions and influencer partnerships, will help attract users.

How to Monetize Your Cash App Clone

While the core service of an app like Cash App is free, you can generate revenue through:

Transaction Fees: Charge a small fee on instant transfers or premium services.

Premium Features: Offer subscription-based advanced features such as investment tools.

Merchant Payments: Facilitate business transactions and take a commission.

In-App Advertisements: Partner with brands for promotional content.

Final Thoughts

Building a cash app clone is a promising venture in the ever-evolving fintech industry. With the right strategy, cutting-edge features, and a secure infrastructure, your app can become a trusted payment solution for users worldwide. Partnering with an experienced on-demand app development company will help you turn your vision into reality and compete with leading digital wallets in the market.

Now is the perfect time to step into the digital payment space and build an innovative cash app clone app that meets modern users' demands. Ready to transform the way people transact? The fintech revolution awaits!

1 note

·

View note