#cfa level 1 cost

Explore tagged Tumblr posts

Text

What Is The Trend Among Indian CFA Applicants?

The number of Indian candidates applying for the Chartered Financial Analyst cfa level 1 exams has increased, which can only be described as an emerging trend.

Right now, India positions third with the most number of competitors taking the test. In June 2022, the cfa institute reported that 14,776 candidates appeared from India, China, and the United States. The worldwide number was 71,914.

CFA test in India

Specialists in the business accept that the pattern is a consequence of the development found in the Indian economy. The nation has turned into a trustworthy speculation objective guaranteeing an expansion in venture experts.

The CFA Sanction expects contender to breeze through three test levels, have a work insight of something like four years in ventures, and focus on the set of principles in proficient lead. Following this, competitors are supposed to apply to a CFA Foundation Society and become an individual from the famous CFA Establishment.

The program educational plan tests abilities and information expected in the venture business. Considering that the worldwide market is changing at an exceptional speed, the CFA test guarantees premium expert lead, moral norms, and global fiscal summary examination. The Level I test especially tests competitors on their capacity to associate their hypothetical comprehension with training. They must demonstrate their capacity for real-time analysis of the investment industry. Other significant ideas incorporate corporate money, abundance the executives, portfolio examination, protections investigation and valuation, financial aspects and quantitative techniques.

Candidates typically need more than three years to successfully complete the CFA Program. Each of the three levels requires determination and a commitment to at least 300 hours of study.

The CFA tests are held across the world in excess of 70 urban communities in December and north of 170 urban areas in the long stretch of June. Test centers are assigned to candidates based on where they prefer to be.

India’s metropolitan areas of New Delhi, Bengaluru, Mumbai, and Kolkata saw the greatest number of Level 1 test takers in 2022.

IndigoLearn is among the global leaders in international training for CPA, CFA,CMA, ACCA, Data Science & Analytics. It has helped over 500,000 professionals across the globe. With IndigoLearn, 9 out of 10 students pass their exams.

Article Source: cfa preparation

#cfa level 1#cfa institute#cfa institute india#cfa program#cfa qualifications#cfa level 1 cost#cfa preparation#cfa online

2 notes

·

View notes

Text

Brennan Logan Brown Shares 5 Myths About Sustainable Business

Brennan Logan Brown is an entrepreneur based in Santa Rosa Beach, Florida, focused on the intersection of finance, sustainability, and technology. A former analyst at Deloitte and Thaden Capital, she founded TIDAL CARBON to advance blue carbon credit solutions. As a CFA Level III candidate, she brings analytical depth to climate-focused ventures. Through her mentorship platform, Blonde Guru, she supports women in business. Also she will launch Visionaire, an AI tool for strategic planning and sustainable growth.

Brennan Logan Brown spotted 6 common myths that keep smart people from taking the leap into sustainable business.

Myth 1: Sustainability is too expensive

Many business owners believe sustainability comes with high upfront costs and slow returns. In practice, some of the most impactful actions are cost-saving measures. Reducing energy consumption, minimizing waste, rethinking packaging, and improving logistics all have immediate financial benefits. These actions often require adjustments to operations rather than major investments. Long-term savings also emerge through risk reduction, resource stability, and better customer retention. Sustainable choices are often more about strategic resource use than spending more money.

Myth 2: Sustainability is only relevant for specific industries

Sustainability applies across all sectors, not just those tied to physical goods or environmental services. Service-based businesses, technology startups, and professional firms all have environmental footprints tied to office energy use, employee travel, digital infrastructure, and procurement choices. Incorporating sustainability can mean shifting internal policies, supplier relationships, or employee incentives. The core principle is assessing how the business uses resources, impacts people, and contributes to long-term ecological health, regardless of industry.

Myth 3: Sustainable strategies slows the growth

There is a perception that sustainability creates operational friction or regulatory delays. Brennan Logan Brown’s work shows that incorporating sustainable practices can support more stable growth. Businesses with clear environmental and social policies are often more attractive to investors, partners, and customers. These companies also experience fewer disruptions due to supply chain instability or regulatory changes. Sustainability can lead to better long-term planning, improved stakeholder trust, and a more resilient business model. Growth does not need to be sacrificed to meet environmental goals.

Myth 4: Businesses must be perfect to claim sustainability

Perfection is not the standard for being a sustainable business. Companies can make gradual changes while remaining transparent about their goals and limitations. Partial improvements in sourcing, waste reduction, or operations can lead to measurable impact. Being honest about challenges and progress builds trust with stakeholders. Small steps toward better practices are valid and meaningful, even if they don’t check every box. Businesses can build sustainability into their operations over time rather than attempting a complete overhaul from the start.

Myth 5: Consumers don’t care enough to make it worth

There is a myth about whether customers prioritize sustainability in their purchasing decisions. Research and market trends show that consumer awareness is growing. While not every buyer makes choices based solely on environmental claims, clear communication and transparency influence loyalty and perception. Businesses that provide traceable, specific actions tend to earn higher trust. Customers respond to accountability, not marketing language. Businesses that apply sustainability with real evidence see improved retention, referrals, and brand differentiation over time.

Myth 6: Sustainability efforts require complex technology

There is a belief that adopting sustainable practices means investing in expensive or complicated technology. While some tools can help, sustainability often starts with simple changes in behavior and processes. Reviewing how you use resources, reducing unnecessary consumption, and improving communication with suppliers and customers can make a big difference without heavy technology investment. Technology can support these efforts over time, but it’s not a necessity to begin making your business more sustainable.

3 notes

·

View notes

Text

Why an Online Investment Banking Course is the Smartest Career Move in 2025

In today's fast-paced financial world, investment banking remains one of the most prestigious and high-paying career paths. Traditionally considered an elite domain accessible only through Ivy League degrees or top MBA programs, investment banking has now become more accessible thanks to technology. One of the most effective and flexible ways to enter this field today is by enrolling in an online investment banking course.

Whether you’re a student, a recent graduate, or a working professional looking to pivot into finance, this blog will help you understand why taking an online investment banking course in 2025 is a smart and future-ready move.

What Is Investment Banking and Why Is It in Demand?

Investment banking involves helping corporations and governments raise capital, advising on mergers and acquisitions (M&A), handling IPOs, restructuring organizations, and more. It’s a high-stakes field that requires deep financial knowledge, strong analytical skills, and strategic thinking.

According to a 2024 report by Naukri.com, demand for roles such as Investment Banking Analyst, Equity Research Associate, and M&A Specialist has grown by over 28% year-on-year in India.

What is an Online Investment Banking Course?

An online investment banking course is a virtual program designed to teach you all the essential skills and tools used in the investment banking industry. These courses are typically delivered through live classes, video lectures, interactive assignments, and real-world case studies.

Core Topics Usually Covered:

Financial Statement Analysis

Financial Modeling and Valuation

Mergers & Acquisitions (M&A)

Leveraged Buyouts (LBO)

IPO Structuring

Excel, PowerPoint, and Pitchbook Building

Industry-specific analysis (e.g., Tech, Pharma, Banking)

Benefits of Taking an Online Investment Banking Course

1. Flexibility and Convenience

The biggest advantage of an online investment banking course is that it allows you to learn at your own pace. Whether you're working full-time or still in college, you can fit the course around your schedule without sacrificing other commitments.

2. Access to Top Trainers from Anywhere

Many of the best online courses are taught by experienced investment bankers, CFA holders, and finance professionals from top firms. No matter where you're located, you get access to world-class training from industry veterans.

3. Practical, Job-Ready Skills

Online courses are designed to be industry-relevant, focusing on hands-on tools and models that you'll actually use on the job. Many programs also include assignments on building real financial models for live companies.

4. Cost-Effective Learning

Compared to an MBA or full-time finance degree, an online course is far more affordable—often at a fraction of the cost—and delivers a strong return on investment if you’re focused and serious.

5. Global Certification

Most reputed online investment banking courses offer certification upon completion, which you can showcase on your resume or LinkedIn profile. This adds credibility and enhances your job prospects.

Who Should Take an Online Investment Banking Course?

This type of course is perfect for:

Commerce or finance graduates who want a job in core finance

Engineering or MBA students looking to transition into investment banking

Working professionals in operations or sales roles who want to pivot into high-finance careers

CFA or CA aspirants looking to supplement their technical knowledge

Anyone preparing for finance interviews with investment banks, PE firms, or corporate finance roles

Job Opportunities After Completing the Course

After completing an online investment banking course, you become eligible for roles such as:

Investment Banking Analyst

Equity Research Associate

M&A Analyst

Corporate Finance Associate

Financial Modeling Consultant

Private Equity Analyst

According to Glassdoor, average entry-level salaries in India for investment banking roles range between ₹6 to ₹12 LPA, and rise significantly with experience and certifications.

What to Look for in a Quality Online Investment Banking Course

When choosing the right course, make sure it includes:

Live interactive sessions (not just pre-recorded content)

Real financial modeling projects using Excel

M&A and IPO case studies

Industry-recognized certification

Placement or interview support

Faculty with real-world IB experience

Access to tools like Bloomberg, PitchBook, or similar platforms

Recommended: Boston Institute of Analytics – Online Investment Banking Course

If you're looking for a high-quality online investment banking course, the program offered by the Boston Institute of Analytics (BIA) is an excellent option.

Why Choose BIA?

Global presence with 107+ campuses and 350+ hiring partners

Led by 150+ industry experts with IB, PE, and corporate finance experience

Hands-on training with real-world projects and Excel-based financial models

Flexible learning schedule for students and professionals

Placement assistance with top investment banks and financial firms

Globally recognized certification

Whether you're based in India or abroad, BIA’s online course allows you to gain investment banking expertise from anywhere in the world.

Learn more at: https://bostoninstituteofanalytics.org

Student Testimonial: How Online Learning Changed My Career

“I was working in a customer support role but wanted to shift into finance. The online investment banking course from BIA gave me the skills, confidence, and certification I needed. Within 5 months, I landed a job as a financial analyst at a startup. The practical models and interview prep made all the difference.”— Aakash Verma, B.Com graduate from Pune

Final Thoughts

In a competitive job market, skills matter more than degrees. An online investment banking course gives you the freedom to learn at your own pace, develop in-demand skills, and access global finance careers without leaving your home.

If you're serious about building a successful career in investment banking, this is the best time to act. Choose the right course, stay consistent, and take the first step toward a rewarding future in high finance.

0 notes

Text

What subsidies or loans are available from the government for Bio-CNG plants?

India is strategically promoting clean energy — and Bio‑CNG plants are at the forefront. If you’re planning to setup a bio cng plant, here’s a comprehensive rundown of government support: subsidies, loans, priority schemes, and more.

1. Central Financial Assistance (CFA) under Waste‑to‑Energy Programme

The Ministry of New & Renewable Energy’s (MNRE) Waste‑to‑Energy Programme — part of its broader National Bioenergy Programme (2021–26) — provides generous Central Financial Assistance (CFA) for Bio‑CNG (CBG) plants

● New CBG plants: ₹4 crore subsidy per 4,800 kg/day capacity (up to ₹10 crore/project)

● Conversion of existing biogas plants: ₹3 crore per 4,800 kg/day (again capped at ₹10 crore/project)

A 20% extra subsidy is available if your plant is in a “Special Category State” (such as Uttarakhand, HP, J&K, etc.) or is run by a registered gaushala using cattle dung. With this CFA, you can confidently setup a bio cng plant of reasonable scale with strong cost support.

2. SATAT Scheme (MoP & OMC offtake + Financing)

The SATAT initiative (launched Oct 2018 by MoP and OMCs) provides:

● Guaranteed 10-year CBG purchase contracts from OMCs such as IOCL/BPCL/HPCL at ~75% of retail CNG price (min ₹54/kg).

● Capital reimbursement: ₹4–10 crore per project.

● Priority lending: SBI and other national banks offer up to 70% project financing with ~12-year tenure.

This structure reduces risk and ensures a buyer is lined up when you boldsetup a bio cng plantbold.

3. Concessional Loans & Credit Guarantee

a. Bank Financing (e.g., Bank of Baroda)

Public sector banks now offer specialized schemes — for instance, Bank of Baroda provides term loans for CBG plants. These have favorable interest rates and longer repayment periods tailored to renewable projects.

b. MSME Credit Guarantee Scheme

Many CBG ventures qualify under MSMEs; the CGTMSE scheme delivers collateral-free loans up to ₹5 crore, with 75–85% credit guarantee coverage. Recently, guarantee limits were raised to ₹10 crore to support larger scale projects.

These initiatives make it easier to boldsetup a bio cng plantbold without heavy reliance on land collateral or imposing interest rates.

4. State-Level Support: Land & Subsidy Perks

States are increasingly supportive — most notably:

● Chhattisgarh: Allocating up to 10 acres of government land at ₹1/sq.m lease for 25 years to PSUs/OMCs constructing Bio‑CNG plants.

● Gujarat: Public-sector dairy undertakings, e.g., Amul/GCMMF, are actively backed by state programmes to install multiple dung-based CBG units.

Such state-level arrangements reduce upfront land cost and facilitate project setup when you decide to boldsetup a bio cng plantbold.

5. Capital Disbursement, Monitoring & Conditions

● CFA is disbursed in two ways:

1. Post‑commissioning, after performance validation.

2. Advance, up to 50%, if connected to SATAT and if you secure at least 50% loan from a recognized bank.

● Projects must be commissioned within 24 months, with a plant load factor (PLF) of at least 80% during a 3-month monitoring window to claim 100% subsidy.

● Monitoring is done via SCADA/remote systems, and plant inspections occur within 18 months after commissioning.

These procedural safeguards ensure accountability and quality in projects where you look to setup a bio cng plant.

6. Municipal‑Level Clean‑Energy Projects

Urban bodies and oil companies are stepping in:

● Bilaspur (CG): BPCL, GAIL & CBDA signed an MoU to build a ₹100 crore CBG plant on 10 acres of concessional land, processing 150 MT/day to produce ~5–10 T/day of CBG, creating ~30,000 jobs.

● Land leases: Many states are making available land at subsidized rates to encourage municipal Bio‑CNG units .

These local projects demonstrate government momentum and open avenues to setup a bio cng plant with institutional backing.

7. Step‑by‑Step: How to Access Support

Registration on GOBARdhan portal for project permits and subsidy processing.

SATAT Expression of Interest (EoI) → Letter of Intent (LoI).

Apply via BIOURJA portal for CFA under MNRE.

Obtain in-principle approval from MNRE.

Secure bank loan, ideally with CGTMSE guarantee and SATAT-linked financing.

Uttarkhand commissioning phase with SCADA setup and performance ≥ 80% PLF over 3 months.

CFA disbursement post-verification or in advance if criteria are met.

Summary Table: Support Snapshot

Support Type

Amount/Terms

Eligibility & Conditions

MNRE CFA

₹3–4 Cr per 4,800 kg/day (up to ₹10 Cr)

New & converted plants; +20% for special categories/gaushala

SATAT Reimbursement

₹4–10 Cr per project

With 10-year OMC offtake

Bank Loans

Up to 70% project cost, 12-yr tenure

Through SBI, BOB, etc.

Credit Guarantee (CGTMSE)

Up to ₹5–10 Cr, 75–85% cover

For MSME-registered promoters

Land support

₹1/sq.m. lease for 25 years

Varies across states (e.g. CG, Gujarat)

Final Word

If you’re ready to boldsetup a bio cng plantbold, government support is robust:

● Central subsidies of ₹3–10 Cr per project

● Priority financing and collateral-free loans

● Guaranteed offtake via SATAT

● Land & infrastructure support at the state level

By aligning your project with MNRE & SATAT requirements, registering on the proper portals, and securing financing tied to credit guarantees, you can build a sustainable and financially sound Bio‑CNG facility.

Let me know if you’d like help drafting grant applications, preparing cost models, or understanding technical requirements!

0 notes

Text

ACCA Course Explained: Scope, Eligibility & Benefits

In today’s globally competitive financial world, earning a professional qualification like ACCA can unlock international career opportunities in accounting and finance. If you're wondering what is ACCA course and whether it’s the right fit for your future, this guide will walk you through the scope, eligibility, and key benefits of pursuing the ACCA qualification. We’ll also touch upon how the Best ACCA Classes in Mumbai can help you clear your exams and achieve your career goals.

What is ACCA Course?

ACCA stands for the Association of Chartered Certified Accountants, a globally recognized body for professional accountants. The ACCA qualification equips students and professionals with the skills, knowledge, and ethics to thrive in accounting, auditing, taxation, finance, and management roles across industries.

The course consists of 13 papers, divided into three levels:

Applied Knowledge

Applied Skills

Strategic Professional

To become an ACCA member, candidates must also complete an Ethics and Professional Skills module and 36 months of relevant work experience. The curriculum is designed to build both technical expertise and practical business acumen.

Scope of ACCA in India and Abroad

The scope of the ACCA course is truly global. With recognition in over 180 countries, ACCA professionals are in demand in multinational companies, Big Four firms, financial consultancies, and even governmental bodies.

In India, ACCA-qualified professionals can work in:

Financial accounting and reporting

Auditing and assurance

Taxation (especially with global clients)

Risk advisory and consulting

Business analysis and financial strategy

Companies such as EY, Deloitte, PwC, KPMG, Grant Thornton, and Accenture regularly hire ACCA professionals. In Mumbai, the financial hub of India, the opportunities are even more robust for ACCAs, making it a preferred location for coaching and training.

Eligibility for ACCA

The ACCA qualification is open to students from a wide range of educational backgrounds:

12th Grade Students (Commerce stream): Must have passed with at least 65% in Accounts/Maths and English, and 50% in other subjects.

Graduates: Students with a Bachelor’s in Commerce or related fields can get exemptions for up to 4 papers.

CA/ICWA/CFA students: Candidates with other professional accounting qualifications may receive additional exemptions.

There is no age limit to pursue ACCA, making it accessible for both students and working professionals seeking career advancement.

Key Benefits of the ACCA Course

1. Global Recognition

ACCA is accepted and respected worldwide. Whether you want to work in India, the UK, UAE, Canada, or Singapore, this qualification opens doors to numerous roles in finance and accounting.

2. Flexibility

You can appear for exams quarterly, and study at your own pace. This makes ACCA an ideal course for working professionals and full-time students alike.

3. Affordable

Compared to other international qualifications like CPA or CFA, ACCA is relatively cost-effective, especially when pursued in India.

4. Exemptions for Prior Learning

Graduates and CA aspirants can skip certain papers, reducing time and cost to complete the course.

5. Diverse Career Options

From audit and taxation to investment banking and financial consultancy, ACCA-qualified professionals can explore a wide spectrum of career paths.

Why Join the Best ACCA Classes in Mumbai?

Choosing the right coaching institute is essential for exam success. The Best ACCA Classes in Mumbai offer:

Expert faculty with real-world experience

Comprehensive study plans and doubt-solving sessions

Mock tests and past paper practice

Guidance on exemptions, registration, and career planning

Institutes like Synthesis Learning in Mumbai have gained a reputation for their structured training programs and high pass rates, making them a go-to choice for ACCA aspirants in the city.

Final Thoughts

If you're looking to build a successful career in global finance and accounting, understanding what is ACCA course and its potential can be a game-changer. With its global recognition, flexible structure, and strong career prospects, ACCA is an ideal qualification for aspiring professionals. Enroll in the Best ACCA Classes in Mumbai to receive the guidance and training you need to achieve your ACCA goals.

Whether you're a student or a working professional, now is the perfect time to invest in your future with ACCA.

0 notes

Text

Sanjay Saraf CFA Level 1 Coaching: Your Path to Success

Sanjay Saraf CFA Level 1: Your Smart Strategy for CFA Success

Embarking on the CFA journey demands more than just dedication—it requires the right guidance. Sanjay Saraf CFA Level 1 coaching has emerged as a prominent choice for many aspirants aiming to conquer the CFA Level 1 exam. Renowned for his in-depth teaching methods and real-world applications, Sanjay Saraf offers a comprehensive approach that resonates with both finance enthusiasts and professionals.

Why Choose Sanjay Saraf CFA Level 1 Coaching?

1. Conceptual Clarity Over Memorization

Unlike traditional coaching centers that emphasize rote learning, Sanjay Saraf CFA Level 1 coaching focuses on building a strong conceptual foundation. Sanjay Saraf's teaching methodology delves deep into the 'why' behind financial concepts, ensuring students grasp the underlying principles. This approach is particularly beneficial for those without a finance background, as it transforms complex topics into understandable segments.

2. Real-World Applications

Sanjay Saraf bridges the gap between theory and practice. His lectures often incorporate real-world scenarios, illustrating how theoretical concepts apply in actual financial settings. This practical approach not only aids in better understanding but also prepares students for real-life financial challenges.

3. Structured and Flexible Learning

Understanding the diverse schedules of students, Sanjay Saraf CFA Level 1 coaching offers a blend of pre-recorded video lectures and live sessions. This flexibility allows learners to pace their studies according to personal commitments. The curriculum is meticulously structured, covering all CFA Level 1 topics in alignment with the official syllabus, ensuring comprehensive preparation.

4. Extensive Practice Materials

Preparation is incomplete without ample practice. CFA by Sanjay Saraf provides a vast repository of practice questions, mock exams, and quizzes. These resources are designed to simulate the actual exam environment, helping students build confidence and improve time management skills.

5. Supportive Learning Environment

Beyond lectures, Sanjay Saraf emphasizes continuous support. Students have access to doubt-clearing sessions, discussion forums, and personalized feedback, ensuring they stay on track and address challenges promptly.

Student Feedback and Community Trust

Feedback from students who have undertaken Sanjay Saraf CFA Level 1 coaching is largely positive. Many commend his ability to simplify intricate topics and make learning engaging. However, some have noted that the extensive duration of lectures might be overwhelming for those with limited time. It's advisable for prospective students to review sample lectures to determine compatibility with their learning style.

Pricing and Accessibility

The cost of Sanjay Saraf CFA Level 1 coaching varies based on the package chosen. While some students find the fees on the higher side, many believe the quality of content and support justifies the investment. Additionally, the availability of online resources ensures that students from various regions can access the coaching without geographical constraints.

Final Thoughts

In conclusion, Sanjay Saraf CFA Level 1 coaching offers a holistic approach to CFA Level 1 preparation. With a focus on conceptual clarity, real-world applications, and comprehensive support, it stands out as a preferred choice for many aspirants. However, it's essential for students to assess their learning preferences and time commitments before enrolling to ensure the coaching aligns with their needs.

For those seeking a structured and in-depth preparation for the CFA Level 1 exam, Sanjay Saraf CFA Level 1 coaching presents a compelling option. By leveraging the resources and support provided, students can enhance their chances of success and build a strong foundation for their financial careers.

0 notes

Text

Government Subsidies and Schemes for Solar Panels in India: What You Should Know

As India moves toward a greener and more sustainable future, solar energy has become one of the most promising solutions for reducing dependence on fossil fuels. Whether you're a homeowner looking to reduce your electricity bills or a business wanting to switch to renewable energy, installing solar panels is a smart move. However, many people are still unaware of the various government subsidies and schemes available that can make solar power much more affordable.

In this blog, we’ll walk you through the key government incentives available for solar installations in India and help you understand how to take advantage of them—especially if you’re working with a solar panel company in Rajasthan or a solar company in Jaipur.

Why Solar Power Is a Smart Choice

Before diving into the subsidies, let’s quickly look at why solar is becoming increasingly popular:

Low maintenance

Long lifespan (20–25 years)

Substantial savings on electricity bills

Eco-friendly and renewable

The initial cost might seem high, but with government support and decreasing solar panel prices, it’s now more affordable than ever.

Government Subsidies for Solar Panels in India

The Indian government has rolled out several initiatives to encourage solar adoption. These are primarily managed under the Ministry of New and Renewable Energy (MNRE) and local state-level agencies. Here are the key schemes you should know about:

1. Rooftop Solar Subsidy Program (Phase II)

Under the Grid-Connected Rooftop Solar Programme Phase II, the MNRE provides central financial assistance (CFA) to residential consumers:

Up to 40% subsidy for systems up to 3 kW

20% subsidy for systems from 3 kW to 10 kW

No subsidy for capacities above 10 kW (but no cap on installation)

This means that if you're installing a solar system on your house in Jaipur or any part of Rajasthan, you could save significantly through this subsidy.

2. State-Level Solar Policies – Rajasthan

Rajasthan, being one of the sunniest states in India, actively promotes solar adoption. If you're working with a solar panel company in Rajasthan, you may benefit from local state initiatives that include:

Simplified net metering policies

Subsidy support through DISCOMs (power distribution companies)

Priority approvals and faster installation processes

The Rajasthan Renewable Energy Corporation Limited (RRECL) plays a key role in implementing these schemes at the state level.

3. PM-KUSUM Scheme (for Farmers)

The PM-KUSUM scheme is specifically designed for farmers and rural communities. It allows farmers to install solar-powered irrigation pumps and even sell surplus energy back to the grid. This initiative has made a huge difference in the agricultural areas of Rajasthan, where electricity access is limited.

Solar Panel Price in Jaipur – What to Expect in 2025

While prices can vary based on quality, brand, and installation size, the average solar panel price in Jaipur for residential systems typically ranges between:

3kW-4kW Solar Panel System: ₹1.5 – ₹2.5 lakhs (approx.)

5kW Solar Panel System: ₹2.5 – ₹3 lakhs (approx.)

8kW Solar Panel System: ₹4 lakhs (approx.)

10kW and above: Above ₹4 lakhs Custom pricing

Working with a trusted solar company in Jaipur ensures that you're not only getting competitive pricing but also assistance with subsidy applications and net metering processes.

How to Avail Government Subsidies

Here’s a simplified step-by-step process to claim solar panel subsidies:

Choose an MNRE-approved vendor or solar EPC (Engineering, Procurement, and Construction) company.

Apply on the national portal for rooftop solar

Get the installation done through the registered company.

Receive inspection and verification by the local DISCOM.

The subsidy amount is transferred directly to your bank account (Direct Benefit Transfer).

If you choose a reputable solar panel company in Rajasthan, they usually assist you with all the paperwork and coordination, making the process hassle-free.

Final Thoughts: Solar is the Future

With rising electricity costs and growing environmental awareness, solar energy isn’t just a trend—it’s the future. Thanks to supportive government subsidies and local policies, going solar has never been easier or more affordable. Whether you're in a city like Jaipur or a rural town in Rajasthan, reliable support is available to guide you through the process.

When choosing a solar partner, look for a solar company in Jaipur that has experience, offers warranty-backed products, and is MNRE-approved. Not only will this ensure quality, but it will also help you make the most of available subsidies and get the best solar panel price in Jaipur.

Also Read: Understanding the Science Behind Solar Panels: Photovoltaic Cells Explained

0 notes

Text

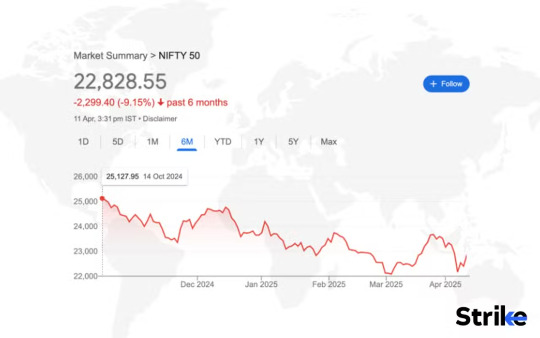

🎯 Complete Guide to Bear Put Spread: How to Trade It with Smart Risk Control

If you're expecting a moderate drop in the market, but don’t want to risk too much capital, a Bear Put Spread might be your best ally. This popular options trading strategy offers a limited-risk, limited-reward setup that appeals to both seasoned traders and cautious beginners.

In this guide, we’ll break down the bear put spread strategy step-by-step using real-world examples from the Indian stock market, relevant statistics, and explain how to analyze it with tools like Strike Money.

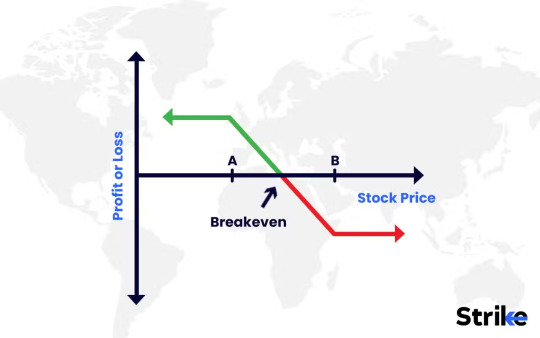

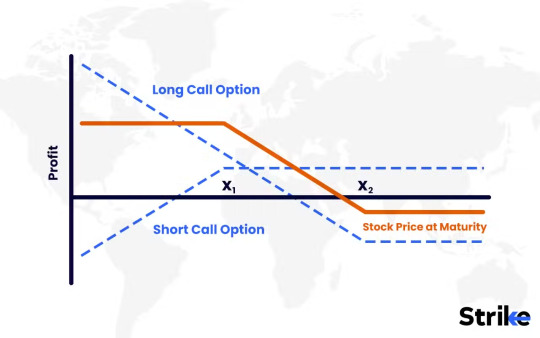

📌 What Exactly Is a Bear Put Spread?

A bear put spread, also called a debit put spread, involves:

🔹 Buying a put option at a higher strike price 🔹 Selling another put option at a lower strike price 🔹 Both options have the same expiration date

This is a vertical spread, and you profit when the stock price declines, but your loss and gain are capped.

Unlike a long put, the bear put spread costs less and is safer because of the premium collected from the sold leg.

🧠 Entity associations: This is a strategy taught in CFA Level II, referenced in John C. Hull’s “Options, Futures, and Other Derivatives,” and is compliant under SEBI and NSE F&O trading rules in India.

🧭 When Should You Use a Bear Put Spread?

This strategy works best when:

📉 You expect a moderate decline in the underlying stock 📈 Implied volatility is rising (which inflates put premiums) 🛡️ You prefer defined risk over aggressive bearish bets

Let’s say you expect Infosys (INFY) to drop from ₹1,500 to ₹1,400 over the next month. You could buy a ₹1,500 put and sell a ₹1,400 put with the same expiry. If the stock falls as expected, you profit, but your downside is protected.

🎯 Best used in range-bound corrections, post-earnings reactions, or during weak macroeconomic signals like falling PMI or GDP slowdown.

🛠️ How to Set Up a Bear Put Spread on Indian Trading Platforms

You can initiate a bear put spread using platforms like:

🔹 Zerodha Kite 🔹 Upstox Pro 🔹 Strike Money (for advanced charting and payoff visualization)

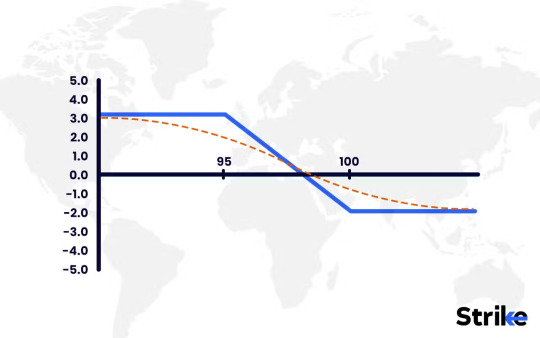

🧪 Example with NIFTY50:

Suppose NIFTY is trading at ₹22,000. You:

✅ Buy a NIFTY 22,200 put (costs ₹120) ✅ Sell a NIFTY 21,800 put (receives ₹60) 🟢 Net Debit = ₹60 (₹120 - ₹60)

That ₹60 is your maximum risk. If NIFTY closes below ₹21,800 at expiry, your max profit is ₹140 (difference in strike: ₹400 - ₹60 cost).

🧠 Strike Money can visually represent this trade’s payoff chart and probability curve, making it easier to plan exits or adjustments.

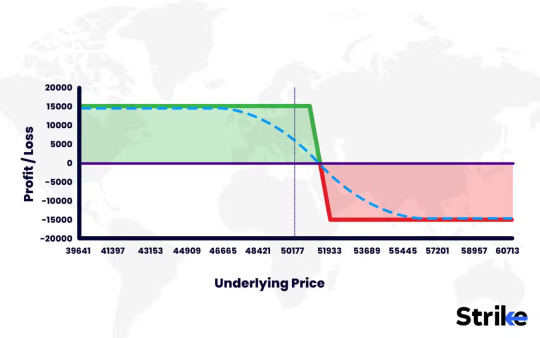

📊 Real Market Example: Bear Put Spread on HDFC Bank

During January 2023, HDFC Bank stock was under pressure post weak Q3 results. The stock hovered around ₹1,700 with bearish signals in RSI and MACD.

A trader expecting further weakness could’ve done this:

✔️ Buy ₹1,700 PUT at ₹48 ✔️ Sell ₹1,650 PUT at ₹28 💸 Net cost = ₹20 🟩 Max profit = ₹30 (if stock fell to or below ₹1,650)

The stock indeed fell to ₹1,640 in 10 days — giving nearly 150% return on invested premium.

⚖️ Breaking Down the Risk and Reward in Simple Terms

Let’s simplify the math:

💰 Max Profit = Difference in strike prices - net premium paid 🔥 Max Loss = Premium paid upfront (limited) 🚀 Break-even Point = Strike price of long put - net premium

Using the NIFTY example above:

Strike 1: ₹22,200 Strike 2: ₹21,800 Net Premium = ₹60

👉 Break-even = ₹22,200 - ₹60 = ₹22,140 👉 Profit starts below ₹22,140 👉 Max profit capped at ₹340 👉 Max loss capped at ₹60

Such clearly defined metrics make it ideal for risk-managed trades, especially for retail traders restricted by SEBI’s margin rules or Reg T guidelines in the US.

🧠 What the Option Greeks Say About Bear Put Spread

The Option Greeks offer deeper insight:

📉 Delta: Net delta is negative, indicating a bearish bias ⏳ Theta: Slightly negative since you hold a debit spread 🌡️ Vega: Positive. A rise in implied volatility helps the spread 📐 Gamma: Limited, due to opposing put positions

⚠️ Many traders underestimate Vega — bear put spreads do better when IV increases, which often happens in bearish phases.

💡 Bear Put Spread vs. Other Bearish Strategies: Which One Wins?

You might ask: why not just buy a long put? Or short the stock?

💥 Long Put: Higher cost, higher profit, but higher theta decay 📉 Shorting Stock: Requires large capital, high margin, and unlimited risk 🔁 Bear Call Spread: Involves margin and faces IV crush risks

The Bear Put Spread balances cost and safety:

✅ Lower premium ✅ Capped loss ✅ No margin needed ✅ Favorable Vega in volatile Indian markets

Research from CBOE and NSE India 2022 derivatives data shows a 20% YoY rise in vertical debit spread volume — indicating increasing retail adoption.

🔍 How to Analyze Bear Put Spread Using Strike Money

🔎 Once you’ve selected your strikes and expiries:

🟢 Open Strike Money 📊 Load the option chain for the stock or index 📈 Use the “Strategy Builder” to combine long and short puts 📐 View P&L chart, breakeven zones, and probability cones

Strike Money also lets you backtest the spread on historical volatility and display implied move vs actual move — crucial for earnings trades.

💰 Tax and Margin Considerations You Must Know

Even though your max loss is defined, margin requirements in India vary:

📝 As per SEBI’s Peak Margin Norms, brokers must collect margin upfront 📉 But since bear put spread is a risk-defined debit strategy, margin needed is just the premium paid

👨💼 For tax purposes:

➡️ Profits from spreads are considered business income ➡️ You can offset losses against other F&O profits ➡️ Remember to file under ITR-3 if you're actively trading options

🧠 Using Volatility and Market Data to Time the Spread Right

Not every market condition suits a bear put spread.

According to NSE 2023 volatility index (INDIA VIX) data:

⚠️ Bear put spreads performed best when INDIA VIX > 17 ⚠️ During pre-budget sessions and geopolitical tension, spreads yielded 2–3x returns on premium

Use Strike Money’s IV rank analysis to find ideal setups — when IV is rising but not excessively high (to avoid overpaying for long puts).

🧮 Pro Tips to Maximize Your Bear Put Spread’s Edge

🎯 Choose 30–45 DTE (days to expiry) for a balance between decay and time 🎯 Keep spreads 200–500 points wide in indices like BANKNIFTY or FINNIFTY 🎯 Always check the open interest for liquidity 🎯 Track changes in implied volatility and OI shifts on NSE and Strike Money 🎯 Exit the spread once 70–80% of max profit is achieved — don’t wait for expiry

As per CME Group’s 2023 derivatives study, traders exiting vertical spreads early had 12% higher capital efficiency over a 6-month average.

🔚 Is the Bear Put Spread Strategy Right for You?

If you’re:

🚀 Looking to short the market with low capital 🔐 Want to limit your losses upfront 📉 Expecting a controlled downside 📊 Trading in a rising volatility environment

Then this strategy might be exactly what you need.

Just ensure you're using tools like Strike Money for analysis and are aware of tax & margin norms applicable in your region.

🙋♂️ FAQs on Bear Put Spread You Shouldn’t Miss

💬 Q1: Can I close a bear put spread before expiry? 👉 Yes, you can exit both legs anytime during market hours. In fact, early exits are often more profitable.

💬 Q2: What happens if both legs expire ITM? 👉 The spread is settled for the difference in strikes minus the premium. Profitable!

💬 Q3: What if both legs expire OTM? 👉 Your loss is the net premium paid — limited and known upfront.

💬 Q4: Is this strategy better than a naked put? 👉 Definitely safer. Naked puts carry unlimited downside. Bear put spreads do not.

Strike when the market is weak, but strike smart. The Bear Put Spread strategy allows you to ride bearish trends while sleeping peacefully at night — no margin calls, no panic, just calculated trading.

Want to try it out? Load up Strike Money, simulate your spread, and get ready to trade with clarity.

0 notes

Text

Time Is Money: Unlocking the Magic of Compounding for Long-Term Wealth

Let’s be honest—most of us dream of financial freedom. Maybe it’s retiring early, traveling the world, or just not having to stress about bills. But here’s the thing: achieving that dream isn’t about sudden windfalls or timing the market perfectly. It’s about something much quieter and far more powerful—compounding.

Compounding is simple to understand but incredibly powerful over time. It’s not a trick or secret formula—it’s just math working quietly in your favor, year after year. In fact, once you really understand it, you might feel a little frustrated you didn’t start sooner.

So, what exactly is compounding?

Imagine you earn interest on your savings. Now imagine earning interest on that interest. That’s compounding. Over time, your money grows not just because you keep adding to it, but because it starts multiplying on its own.

Let’s take an example. Say you invest ₹1 lakh at an annual return of 10%. After a year, you’ll have ₹1.1 lakh. In the second year, instead of earning 10% just on your original ₹1 lakh, you earn it on ₹1.1 lakh—bringing your total to ₹1.21 lakh. This keeps going, and the longer you let it run, the more your money grows.

It’s like planting a tree, then watching it grow branches that grow their own branches.

The key ingredient: time

Here’s where most people go wrong. They focus so much on how much to invest or which stock to pick, but ignore the most valuable asset they already have—time. The earlier you start, the more compounding can work its magic.

Let’s look at two friends, Anaya and Rishi. Anaya starts investing ₹5,000 a month at age 25 and stops at 35. Rishi starts at 35 and invests the same ₹5,000 every month until he’s 60. Want to guess who ends up with more?

Anaya does—by a lot. Even though she invested for only 10 years while Rishi did it for 25. Why? Because her money had more time to grow. It’s not just about investing—it’s about when you start.

Why people still miss out

If compounding is so powerful, why aren’t more people using it? The truth is, we’re wired to want quick results. We want to see our efforts pay off now. But with compounding, the early years feel slow. It’s only after a decade or two that things really start to take off.

Think of it like a snowball rolling down a hill. At first, it gathers snow slowly. But after a while, it turns into a massive force. That’s your wealth—slow at first, then exponential.

Unfortunately, many people panic when the market dips or stop investing when life gets busy. Every pause, every withdrawal slows the snowball down.

Don’t let inflation steal your growth

There’s another silent factor at play—inflation. If your investments aren’t growing faster than inflation, you’re actually losing money. That’s why simply saving in a regular bank account won’t cut it. You need assets that grow over time—like equity mutual funds, stocks, or index funds—to stay ahead.

In cities like Mumbai, where the cost of living keeps rising, more young professionals are waking up to this reality. They're seeking long-term strategies and better financial awareness. Many of them are taking their learning to the next level by enrolling in a CFA course Mumbai, aiming to understand financial markets deeply and use tools like compounding more effectively—not just for themselves, but for clients too.

What’s the world saying?

Globally, there’s a growing shift toward long-term investing. In 2025, sovereign wealth funds in countries like Norway and Singapore released statements about relying heavily on compounding over 30–40-year periods. These funds, managing billions of dollars, are choosing slow and steady over flashy and fast. That says a lot.

In India, too, there’s fresh movement. The government recently introduced incentives for retirement funds that show consistent reinvestment strategies—a subtle nudge toward long-term compounding rather than short-term gains. It’s a recognition that we need to think further ahead, both as individuals and as a society.

But compounding isn’t automatic

Here’s the catch—compounding works only if you work with it. That means being disciplined. Investing regularly. Reinvesting your gains. And not pulling out your money every time the market hiccups.

One major roadblock? Emotions. When markets crash, it’s tempting to withdraw and wait. But that’s exactly when compounding gets interrupted. Staying invested during tough times often yields the best long-term results.

Think of it like gardening. You don’t dig up the soil every week to check if the roots are growing. You water, you wait, and eventually, you see the rewards.

Small habits, big impact

Even tiny amounts, invested early, can turn into something significant. ₹1,000 invested monthly for 30 years at a 12% return becomes over ₹35 lakh. And that’s just from coffee money.

To make compounding work for you:

Start as early as possible—even if it’s a small amount.

Set up automatic investments.

Reinvest any gains or dividends.

Don’t panic when markets fluctuate.

Review and adjust, but don’t over-tinker.

Also, avoid high-interest debt—it compounds too, but against you. The interest you pay on credit card debt can grow just as fast, if not faster, than your investments. It’s like running on a treadmill with a backpack full of bricks.

Changing mindsets, one generation at a time

What’s encouraging is that younger generations are catching on. A 2025 survey by Morningstar India found that over 60% of Gen Z investors who started investing before 25 plan to stay invested for 20+ years. That kind of mindset could reshape the future of wealth in India.

It’s no longer just about saving money—it’s about making money work for you. And it starts with education, awareness, and a willingness to play the long game.

Final thoughts: Time > Timing

In a world full of noise—stock tips, hot IPOs, social media influencers telling you where to invest—it’s easy to forget the basics. But the truth is simple: time is your most powerful investment ally. It’s quiet, it’s patient, and it works best when left alone.

As more financial professionals in Mumbai embrace the importance of long-term investing, there’s a rising demand for education that goes beyond just theory. Many are turning to structured learning paths like the CFA Training Program in Mumbai, not just for certification, but to genuinely understand how to build wealth for themselves and others using timeless principles like compounding.

Because in the end, it’s not the flashiest investment that wins—it’s the one you stick with the longest.

0 notes

Text

Brennan Logan Brown Shares 6 Secrets to Sustainable Business Growth

Brennan Logan Brown is an entrepreneur based in Santa Rosa Beach, Florida, focused on the intersection of finance, sustainability, and technology. She is the founder of TIDAL CARBON, a company advancing the blue carbon credit market, and the creator of Blonde Guru, a platform supporting women in business. A CFA Level III candidate, Brennan Logan Brown is also launching Visionaire, an AI-powered strategic planning app designed to help businesses grow with purpose and precision.

Here are 6 key moves she believes can guide your business toward smarter, cleaner growth:

1. Stop Treating Sustainability as a Separate Department

If you're thinking of sustainability as someone else's job, maybe a team that files reports or manages recycling, you're missing the point. According to Brennan Logan Brown, your values and your business model need to speak the same language. That starts with asking whether your core decisions are based on short-term margins or long-term impact? Embedding sustainability in your operations means involving it in product design, pricing, and finance, not just marketing or compliance.

2. Use Data to Drive Accountability, Not Just Reports

What are you tracking and why? If your reporting exists just to check boxes, it’s not helping you grow. Brennan Logan Brown emphasizes the power of data when it’s used to guide decisions, not just report on them. For example, are you measuring carbon impacts across your supply chain? Are those numbers shaping your vendor choices or product design? Metrics should be tools, not trophies.

3. Don’t Wait for Regulation to Push You

Waiting for rules means you're already behind. Brennan Logan Brown’s experience in finance and real assets taught her that proactive decisions are almost always more cost-effective than reactive ones. Whether you're managing land, investing in tech, or building a service-based company, thinking ahead gives you flexibility and control. What could you do today that makes your business more adaptable next year?

4. Build With Nature, Not Around It

Brennan Logan Brown’s work with TIDAL CARBON focuses on blue carbon, carbon captured by coastal ecosystems. It’s a reminder that natural systems can support growth if you don’t ignore them. Whether you're in agriculture, real estate, or tech, there are always ways to work with existing ecosystems instead of building over them. Ask yourself about how your business model depends on healthy natural systems? What would it cost you if they disappeared?

5. Empower People

Sustainability isn’t just about the environment. It's about people. Brennan Logan Brown’s mentorship platform, Blonde Guru, was created to make space for women who want to lead in business without having to fit a mold. Who are you making room for in your business? Are you giving diverse voices a say in key decisions? Growth that depends on a narrow group of stakeholders is easy to break. Broader participation makes your strategy more durable.

6. Design for Longevity, Not Just Speed

Quick wins can feel satisfying, but do they last? Brennan Logan Brown encourages founders to build with endurance in mind. Are your products, services, and partnerships built to survive shifts in climate, regulation, or demand? Growth that sticks comes from asking whether what you're building today will still matter and still work for years from now.

Conclusion

Sustainable growth demands more than surface-level changes. Brennan Logan Brown’s approach challenges you to rethink how you operate, who you include, and what you prioritize. If you want your business to last, it has to grow with purpose. Start small, stay accountable, and keep asking better questions, the kind that shape the future you actually want to build.

1 note

·

View note

Text

Top 12 Benefits of Pursuing CFA Certification After B.Com

If you’ve been wondering what will set you apart in the finance world, the Chartered Financial Analyst (CFA) certification is your answer. Combining CFA with a B.Com degree is like accelerating your career, giving you a competitive advantage in investment banking, portfolio management, and financial analysis

What Is CFA Certification?

The Chartered Financial Analyst (CFA) certification, offered by the CFA Institute, is a globally recognized qualification for individuals pursuing a career in finance or investment management. This prestigious program equips candidates with expertise in investment fundamentals, asset valuation, wealth planning, and portfolio management, making it one of the most respected credentials in the financial world.

The CFA certification is divided into three levels:

Level I: Focuses on the foundations of investment tools and ethical standards, testing basic knowledge through multiple-choice questions on 10 major topics.

Level II: Dives deeper into asset valuation and the application of investment tools, with a focus on applying and analyzing concepts through item set questions (vignette-based).

Level III: Concentrates on portfolio management and advanced investment strategies, requiring candidates to synthesize concepts in essay-type questions, case studies, and constructed response questions.

Each level is progressively challenging, ensuring candidates thoroughly understand finance. Completing the CFA demonstrates expertise and ethical integrity in the finance industry.

12 Reasons Why B.Com + CFA Is a Great Choice?

1.Career Acceleration

Stand out with advanced skills in asset management, investment analysis, and financial planning, accelerating your career in finance.

2.Global Opportunities

The CFA credential is recognized worldwide, giving you access to career opportunities in top financial hubs like New York, London, Hong Kong, and Singapore.

3. Average Salary Comparison: B.Com vs. B.Com + CFA

Adding a CFA certification to your B.Com degree can significantly enhance your earning potential and credibility in the finance industry. Here’s a comparison of typical salary ranges in India:

B.Com Graduates

Entry-Level: ₹2.5–4.5 LPA

Mid-Level : ₹4.5–7.5 LPA

Experienced: ₹7.5–12 LPA

B.Com + CFA

Entry-Level: ₹8–15 LPA

Mid-Level: ₹13–25 LPA with experience

Senior-Level: ₹26–50 LPA+ in leadership roles

4. Industry Prestige

The CFA program upholds rigorous ethical standards, helping you become a respected finance expert trusted by top firms globally.

5. Networking

Join a global network of over 190,000 CFA charter holders, which provides opportunities for mentorship, job referrals, and professional growth.

6. Specialized Knowledge

CFA provides in-depth knowledge in areas like equity investments, financial reporting, and portfolio management, complementing the foundational knowledge from your B.Com degree.

7. Diverse Career Paths

Combining B.Com and CFA opens doors to diverse roles in investment banking, asset management, corporate finance, fintech, and more.

8. Job Security

Professionals with both a B.Com and CFA certification are highly valued, offering enhanced job security in the competitive finance industry.

9. International Mobility

With the global recognition of CFA, professionals can easily move across borders and explore opportunities in international markets.

10. Cost-Effective

Pursuing CFA is generally more cost-effective compared to an MBA. It offers a high return on investment with fewer years of study.

11. Practical Application

The CFA curriculum is designed to provide practical financial expertise, equipping you with real-world skills required by employers in the finance sector.

12. Professional Development

CFA programs focus on developing decision-making, analytical, and leadership skills, preparing you for higher positions in your career.

These advantages make the B.Com + CFA combination a powerful tool for anyone looking to build a successful career in finance!

Conclusion

CFA certification isn’t just about career progression; it’s about developing leadership, analytical, and decision-making skills that help shape a successful finance professional. At NorthStar Academy, we equip you with global, industry-recognized training that ensures success at each step.

We also provide 100% placement assistance, connecting you with top recruiters like Deloitte and PwC, giving you a solid foundation to kick-start your career. With flexible online learning options tailored for working professionals, you can easily balance your studies with your job, making it easier than ever to pursue your CFA certification

0 notes

Text

Choosing the Best CFA Institute in Surat: What to Look for in a Top-Ranked Program

Pursuing the Chartered Financial Analyst (CFA) designation is a powerful move for anyone aspiring to build a career in finance and investment. With the increasing demand for finance professionals across India, Surat has quietly emerged as a strong contender for quality CFA education. If you are searching for a top-tier CFA institute in Surat, it’s important to understand your options and how to choose the right path—especially if you aim to combine academic learning with professional certification.

Understanding the CFA Program

The CFA Program, administered by the CFA Institute, is considered one of the most respected credentials in the investment management profession. Divided into three levels, it covers investment tools, asset valuation, portfolio management, and ethical standards. Candidates typically pursue the CFA charter alongside or after their formal education, but increasingly, academic institutions are offering programs aligned with CFA content to give students a head start.

What to Look for in a CFA Institute in Surat

When evaluating a CFA institute in Surat, keep these five criteria in mind:

1. Curriculum Alignment

The institute or university should offer a curriculum that closely follows the CFA Level I structure, covering subjects like financial reporting, quantitative methods, economics, ethics, and portfolio management.

2. Qualified Faculty

Experienced faculty with industry expertise can offer more than textbook knowledge—they provide context, case studies, and practical insights.

3. Comprehensive Learning Environment

Look for a learning ecosystem that includes workshops, industry seminars, mock exams, and mentorship—beyond just classroom teaching.

4. Placement Support

Support for internships and placements in financial institutions or investment firms adds significant value, especially for freshers entering the finance world.

5. Academic Recognition

Choose an institution that offers a degree aligned with finance or financial analytics. This adds academic credibility alongside your CFA preparation.

Why AURO University Stands Out in Surat

Among all options available, AURO University clearly stands out—not just as a CFA institute in Surat, but as a complete educational ecosystem for aspiring finance professionals. It goes beyond traditional coaching to offer a structured academic path through its BBA in Financial Markets and BBA in Financial Analytics programs. These courses are designed to closely align with CFA Level I content, giving students an edge right from the undergraduate level.

As one of the best private universities in Gujarat, AURO University provides:

A full-time degree program that integrates CFA concepts

Access to industry workshops and real-world finance projects

One-on-one mentoring and career counseling

A campus that fosters innovation, professionalism, and ethics—core values of the CFA program

Unlike standalone CFA coaching centers, AURO offers a university experience that nurtures both academic knowledge and soft skills, which are crucial for success in the global finance industry.

Other CFA Coaching Centers in Surat

If you’re looking specifically for coaching or exam preparation, Surat also has well-known centers such as:

Synthesis Learning – Offers modular coaching with flexible batch timings

QuintEdge – Known for CFA-focused online and offline learning modules

Plutus Education – Offers cost-effective coaching for all three CFA levels

While these coaching institutes serve a valuable role, they primarily focus on exam prep. In contrast, AURO University provides a degree program that is CFA-oriented, offering a stronger foundation for long-term career growth in finance.

Best Colleges for CFA in India

For those exploring national options, some of the best colleges for CFA in India include:

IMS Proschool

EduPristine

ICFAI Business School

Fintree Education

FinGuru Institute

These institutes are popular for their CFA training programs. However, most of them function as specialized coaching centers rather than full-fledged universities.

Why a University-Based CFA Path is Better

While CFA coaching is helpful for clearing exams, it does not offer the academic depth and holistic development that a university program can. This is where AURO University, as one of the best private universities in Gujarat, offers unmatched value. It allows students to earn an accredited degree while preparing for CFA—opening doors to wider career options in investment banking, portfolio management, research, and financial consulting.

Conclusion

Choosing the right CFA institute in Surat isn’t just about passing an exam—it’s about building a career. Whether you’re a school-leaver or a graduate, investing in a university that prepares you for the CFA charter while offering academic and industry exposure is the smarter choice.

AURO University provides a comprehensive pathway that combines world-class education, CFA-oriented curriculum, and a strong focus on professional development. For anyone looking to start or strengthen a finance career in Gujarat, AURO is the ideal destination—blending academic excellence with real-world readiness, and truly earning its place among the best colleges for CFA in India and the best private university in Gujarat.

0 notes

Text

CFA Course Fees Structure 2025: Exam, Fees & More | Zell Education

Thinking about taking the CFA exam in 2025? Whether you're just starting your finance journey or working toward a globally recognized qualification, understanding the CFA course fees is an important first step. Zell Education breaks it down in a way that’s simple, clear, and helpful so you know exactly what to expect.

What Are the CFA Course Fees?

First off, there’s a one-time enrollment fee of $350, which you pay when signing up for the CFA Level 1 exam. After that, each exam level (Level 1, 2, and 3) comes with its own registration fees:

Early registration: $900

Standard registration: $1,200

So, if you register early for all three levels, you’re looking at around $2,550 in basic exam fees.

Other Costs to Keep in Mind

Aside from registration, there are a few other things you’ll need to budget for:

Study materials: You’ll get some resources from the CFA Institute, but many students choose to invest in additional prep. These can range from $99 to $1,299.

Financial calculator: Required for the exam, and costs around $50.

Rescheduling fee: Need to move your exam date? That’ll cost $250.

Scholarships Can Help

The CFA Institute offers scholarships that can significantly reduce your fees, including:

Access Scholarship

Women’s Scholarship

Student Scholarship

Professor Scholarship

Regulator Scholarship

If you’re eligible, applying for one of these can be a game-changer.

Why Choose Zell Education?

At Zell Education, we understand that the CFA journey is challenging but with the right guidance, it’s absolutely achievable. We offer expert-led classes, updated learning materials, and full support from day one. Plus, we’re here to make sure you're not just studying—but studying smart.

Final Thoughts

The CFA program is a big commitment, both in time and money. But by understanding the CFA course fees upfront and planning accordingly, you're setting yourself up for success. And with Zell Education by your side, you're never walking the path alone.

0 notes

Text

Top Finance Jobs You Can Get After BCom + Short Certification

Introduction: BCom alone gets you started. But pair it with a short certification, and you unlock high-growth finance jobs. Let's explore!

1. Top Finance Jobs After BCom + Certification

Financial Analyst (Certification: CFA Level 1)

Tax Consultant (Certification: US CPA, Indian CA Inter)

Management Accountant (Certification: CMA USA)

Audit Associate (Certification: ACCA)

2. Average Salaries in India (Approximate)

Financial Analyst: ₹5–7 lakh/year

Tax Consultant: ₹6–8 lakh/year

Management Accountant: ₹7–10 lakh/year

Audit Associate: ₹4–6 lakh/year

Note: Salaries vary based on city and company.

3. Why Companies Prefer Certified Candidates

Verified knowledge

Specialized skills

Lower training costs

Conclusion: A short course = long-term career advantage.

For further details visit here

0 notes

Text

Is CFA Worth It? A Deep Dive into the Return on Investment

Introduction Is pursuing the CFA certification really worth the time and financial investment? Let’s break down the potential return on investment (ROI) for aspiring CFA charterholders.

Cost of Pursuing CFA

Enrollment fees, exam fees, study materials, and preparation costs.

The total cost can range from INR 2–3 lakhs depending on the level and study resources.

Potential Benefits and ROI

1. Higher Earning Potential

CFA charterholders can earn significantly higher salaries compared to those without the certification.

2. Job Security and Career Advancement

The CFA certification is widely recognized and can open doors to senior roles and promotions.

3. Skill Development

The CFA program teaches valuable financial analysis, investment, and risk management skills that are in high demand.

4. Global Recognition

CFA is recognized worldwide, making it easier to find opportunities in global markets.

Conclusion The CFA program offers significant ROI, especially for those committed to a long-term finance career. For further info, click here.

0 notes

Text

https://aswinibajajclasses.com/courses/cfa/l-1

CFA Level 1 Course Online – Expert Classes & Exam Preparation

Join Aswini Bajaj an expert-led CFA Level 1 course online to kickstart your finance career. This comprehensive CFA Level 1 preparation covers all key topics, exam strategies, and updated content. Learn from industry professionals with live and recorded CFA Level 1 classes designed for maximum retention. Know more about CFA Level 1 fees, exam details, and cost-effective learning. Perfect for students and professionals aiming to ace the CFA Level 1 exam. Our flexible CFA Level 1 courses offer personalized mentorship to help you succeed. Enroll now for the best CFA Level 1 classes tailored to your goals.

0 notes