#compare cpe platforms

Explore tagged Tumblr posts

Text

CPE Chip Market Analysis: CAGR of 12.1% Predicted Between 2025–2032

MARKET INSIGHTS

The global CPE Chip Market size was valued at US$ 1.58 billion in 2024 and is projected to reach US$ 3.47 billion by 2032, at a CAGR of 12.1% during the forecast period 2025-2032. This growth trajectory aligns with the broader semiconductor industry expansion, which was valued at USD 579 billion in 2022 and is expected to reach USD 790 billion by 2029 at a 6% CAGR.

CPE (Customer Premises Equipment) chips are specialized semiconductor components that enable network connectivity in devices such as routers, modems, and gateways. These chips power critical functions including signal processing, data transmission, and protocol conversion for both 4G and 5G networks. The market comprises two primary segments – 4G chips maintaining legacy infrastructure support and 5G chips driving next-generation connectivity with higher bandwidth and lower latency.

Market expansion is being propelled by three key factors: the global rollout of 5G infrastructure, increasing demand for high-speed broadband solutions, and the proliferation of IoT devices requiring robust connectivity. However, supply chain constraints in the semiconductor industry and geopolitical factors affecting chip production present ongoing challenges. Major players like Qualcomm and MediaTek are investing heavily in R&D to develop advanced CPE chipsets, while emerging players such as UNISOC and ASR are gaining traction in cost-sensitive markets. The Asia-Pacific region dominates production and consumption, accounting for over 45% of global CPE chip demand in 2024.

MARKET DYNAMICS

MARKET DRIVERS

5G Network Expansion Accelerates Demand for Advanced CPE Chips

The global transition to 5G networks continues to drive exponential growth in the CPE chip market. As telecom operators roll out next-generation infrastructure, the demand for high-performance customer premise equipment has surged by over 40% in the past two years. Modern 5G CPE devices require specialized chipsets capable of supporting multi-gigabit speeds, ultra-low latency, and massive device connectivity. Leading chip manufacturers are responding with integrated solutions that combine baseband processing, RF front-end modules, and AI acceleration. For instance, Qualcomm’s latest 5G CPE platforms deliver 10Gbps throughput while reducing power consumption by 30% compared to previous generations.

IoT Adoption Creates New Growth Avenues for CPE Chip Vendors

The proliferation of Internet of Things (IoT) applications across smart cities, industrial automation, and connected homes is generating significant opportunities for CPE chip manufacturers. With over 15 billion IoT devices projected to connect to networks by 2025, telecom operators require CPE solutions that can efficiently manage diverse traffic patterns and quality-of-service requirements. This has led to the development of specialized chipsets featuring advanced traffic management, edge computing capabilities, and enhanced security protocols. Recent product launches demonstrate this trend, with companies like MediaTek introducing chips optimized for IoT gateways that support simultaneous connections to hundreds of endpoints while maintaining reliable performance.

Remote Work Infrastructure Investments Fuel Market Expansion

The permanent shift toward hybrid work models continues to stimulate demand for enterprise-grade CPE solutions. Businesses worldwide are upgrading their network infrastructure to support distributed workforces, driving a 25% year-over-year increase in CPE deployments. This trend has particularly benefited manufacturers of chips designed for business routers and SD-WAN appliances, which require robust performance for VPNs, unified communications, and cloud applications. Leading semiconductor firms have responded with system-on-chip solutions integrating Wi-Fi 6/6E, multi-core processors, and hardware-accelerated encryption to meet these evolving requirements.

MARKET RESTRAINTS

Supply Chain Disruptions Continue to Challenge Production Stability

Despite strong demand, the CPE chip market faces persistent supply chain constraints that limit growth potential. The semiconductor industry’s reliance on advanced fabrication nodes has created bottlenecks, with lead times for certain components extending beyond 12 months. These challenges are compounded by geopolitical tensions affecting rare earth material supplies and export controls on specialized manufacturing equipment. While the situation has improved from pandemic-era shortages, inventory levels remain below historical averages, forcing many CPE manufacturers to implement allocation strategies and redesign products with available components.

Rising Component Costs Squeeze Profit Margins

Escalating production expenses present another significant restraint for CPE chip suppliers. The transition to more advanced process nodes has increased wafer costs by approximately 20-30% across the industry. Additionally, testing and packaging expenses have risen due to higher energy prices and labor costs. These factors have compressed gross margins, particularly for mid-range CPE chips where pricing pressure is most intense. Manufacturers are responding by optimizing chip architectures, consolidating IP blocks, and investing in yield improvement initiatives, but these measures require significant R&D expenditures that may take years to yield returns.

Regulatory Complexity Slows Time-to-Market

The CPE chip industry faces growing regulatory scrutiny that delays product launches and increases compliance costs. New spectrum regulations, cybersecurity requirements, and equipment certification processes have extended development cycles by 3-6 months on average. In particular, the automotive and industrial sectors now demand comprehensive safety certifications that require extensive testing and documentation. These regulatory hurdles disproportionately affect smaller chip vendors who lack dedicated compliance teams, potentially limiting innovation and competition in certain market segments.

MARKET CHALLENGES

Technology Complexity Increases Design and Validation Costs

Modern CPE chips incorporate increasingly sophisticated architectures that pose significant engineering challenges. Designs now routinely integrate multiple processor cores, AI accelerators, and specialized radio interfaces, requiring advanced simulation tools and verification methodologies. The associated R&D costs have grown exponentially, with some 5G chip development projects now exceeding $100 million in budget. This creates a high barrier to entry for potential competitors and forces established players to carefully prioritize their product roadmaps. Furthermore, the complexity makes post-silicon validation more difficult, potentially leading to costly respins if critical issues emerge late in the development cycle.

Talent Shortage Constrains Innovation Capacity

The semiconductor industry’s rapid expansion has created intense competition for skilled engineers, particularly in critical areas like RF design, digital signal processing, and physical implementation. CPE chip manufacturers report vacancy rates exceeding 30% for certain technical positions, with hiring cycles stretching to 9-12 months for specialized roles. This talent crunch limits companies’ ability to execute aggressive product roadmaps and forces difficult tradeoffs between projects. While firms are investing in training programs and academic partnerships, the pipeline for experienced chip designers remains insufficient to meet current demand.

Standardization Gaps Create Integration Headaches

The evolving nature of 5G and edge computing technologies has led to fragmented standards across different markets and regions. CPE chip vendors must support multiple protocol variants, frequency bands, and security frameworks, complicating both hardware and software development. This fragmentation increases testing overhead and makes it difficult to achieve economies of scale across product lines. While industry groups continue working toward greater harmonization, interim solutions often require additional engineering resources to implement customized features for specific customers or geographies.

CPE CHIP MARKET TRENDS

5G Network Expansion Accelerates Demand for Advanced CPE Chips

The rapid global deployment of 5G networks is significantly driving the CPE (Customer Premises Equipment) chip market, with the segment projected to grow at over 30% CAGR through 2032. Telecom operators worldwide invested nearly $280 billion in 5G infrastructure in 2023 alone, creating substantial demand for compatible CPE devices. Chip manufacturers are responding with innovative solutions featuring multi-band support and improved power efficiency, with next-generation modem-RF combos now achieving throughputs exceeding 7Gbps. While 4G CPE chips still dominate current installations, representing about 65% of 2024 shipments, 5G solutions are rapidly gaining share due to superior performance in high-density urban environments.

Other Trends

Smart Home Integration

The proliferation of IoT devices in residential settings, expected to reach 29 billion connected units globally by 2027, is creating new requirements for CPE chips that can handle simultaneous broadband and IoT traffic management. Modern gateway solutions now incorporate AI-powered traffic prioritization and mesh networking capabilities to maintain quality of service across dozens of connected devices. Semiconductor vendors have responded with system-on-chip (SoC) designs integrating Wi-Fi 6/6E, Bluetooth, and Zigbee radios alongside traditional cellular modems. North America leads this adoption curve, with over 75% of new home internet subscriptions in 2023 opting for smart gateway solutions compared to just 32% in 2020.

Edge Computing and Network Virtualization Impact Chip Designs

Emerging virtualization technologies are reshaping CPE architectures, creating demand for chips with enhanced processing capabilities beyond traditional modem functions. Virtual CPE (vCPE) solutions now account for 18% of business installations, requiring chipsets that can efficiently run containerized network functions (CNFs) while maintaining low power envelopes. The enterprise segment has proven particularly receptive, with large-scale adoption in multi-tenant office buildings and smart city applications. Meanwhile, silicon designed for edge computing applications is increasingly incorporating hardware acceleration blocks for AI inference, allowing real-time processing of video analytics and other bandwidth-intensive applications at the network periphery. This evolution has prompted traditional chip vendors to expand their portfolios through strategic acquisitions in the FPGA and specialty processor spaces.

COMPETITIVE LANDSCAPE

Key Industry Players

Innovation and Partnerships Fuel Growth in the CPE Chip Market

The global CPE (Customer Premises Equipment) chip market remains highly competitive, characterized by technological innovation and aggressive expansion strategies. Qualcomm dominates the market with its extensive portfolio of 4G and 5G chipsets, capturing approximately 35% revenue share in 2024. The company’s leadership stems from its strong foothold in North America and strategic partnerships with telecom operators.

MediaTek and Intel follow closely, collectively accounting for 28% market share, owing to their cost-effective solutions for emerging markets and industrial applications. These players continue investing heavily in R&D, particularly for energy-efficient 5G chips catering to IoT deployments and smart city infrastructure.

Chinese manufacturers like Hisilicon and UNISOC are rapidly gaining traction through government-supported initiatives and localized supply chains. Their aggressive pricing strategies and custom solutions for Asian markets have enabled 18% year-over-year growth in 2024, challenging established western players.

Meanwhile, specialized firms such as Eigencomm and Sequans are carving niche positions through innovative chip architectures optimized for low-power wide-area networks (LPWAN) and private 5G deployments. Their collaborations with network equipment providers have become crucial differentiators in this evolving landscape.

List of Key CPE Chip Manufacturers Profiled

Qualcomm Technologies, Inc. (U.S.)

UNISOC (Shanghai) Technologies Co., Ltd. (China)

ASR Microelectronics Co., Ltd. (China)

HiSilicon (Huawei Technologies Co., Ltd.) (China)

XINYI Semiconductor (China)

MediaTek Inc. (Taiwan)

Intel Corporation (U.S.)

Eigencomm (China)

Sequans Communications S.A. (France)

Segment Analysis:

By Type

5G Chip Segment Dominates the Market Due to its High-Speed Connectivity and Low Latency

The CPE Chip market is segmented based on type into:

4G Chip

5G Chip

By Application

5G CPE Segment Leads Due to Escalated Demand for High-Performance Wireless Broadband

The market is segmented based on application into:

4G CPE

5G CPE

By End User

Telecom Operators Segment Dominates with Growing Infrastructure Investments

The market is segmented based on end user into:

Telecom Operators

Enterprises

Residential Users

Regional Analysis: CPE Chip Market

North America The mature telecommunications infrastructure and rapid 5G deployments in the U.S. and Canada are fueling demand for high-performance 5G CPE chips, particularly from vendors like Qualcomm and Intel. With major carriers investing over $275 billion in network upgrades, chip manufacturers are prioritizing low-latency, power-efficient designs. However, stringent regulatory scrutiny on semiconductor imports creates supply chain challenges. The region also leads in IoT adoption, driving demand for hybrid 4G/5G chips in smart city solutions and enterprise applications. Local chip designers benefit from strong R&D ecosystems but face growing competition from Asian suppliers.

Europe EU initiatives like the 2030 Digital Compass (targeting gigabit connectivity for all households) are accelerating CPE chip demand, though adoption varies across nations. Germany and the U.K. lead in 5G CPE deployments using chips from MediaTek and Sequans, while Eastern Europe still relies heavily on cost-effective 4G solutions. Strict data privacy laws and emphasis on open RAN architectures are reshaping chip design requirements. The region faces headwinds from component shortages but maintains steady growth through government-industry partnerships in semiconductor sovereignty programs.

Asia-Pacific Accounting for over 60% of global CPE chip consumption, the region is driven by China’s massive “5G+” infrastructure push and India’s expanding broadband networks. Local giants HiSilicon and UNISOC dominate low-to-mid range segments, while South Korean/Japanese firms focus on premium chips. Southeast Asian markets show explosive growth (20%+ CAGR) due to rural connectivity projects. However, geopolitical tensions and import restrictions create supply volatility. Price sensitivity remains high, favoring integrated 4G/5G combo chips over standalone 5G solutions in emerging economies.

South America Limited 5G spectrum availability keeps the market reliant on 4G LTE chips, though Brazil and Chile are early adopters of 5G CPEs using ASR and MediaTek solutions. Economic instability and currency fluctuations hinder large-scale infrastructure investments, causing operators to prioritize cost-effective Chinese chip suppliers. The lack of local semiconductor manufacturing creates import dependency, but recent trade agreements aim to improve component accessibility. Enterprise demand for industrial IoT routers presents niche opportunities for mid-tier chip vendors.

Middle East & Africa Gulf nations (UAE, Saudi Arabia) drive premium 5G CPE adoption through smart city projects, leveraging Qualcomm and Eigencomm chips. Sub-Saharan Africa depends on affordable 4G solutions from Chinese vendors, with mobile network operators deploying low-power chips for extended coverage. While underdeveloped fiber backhaul limits 5G potential, satellite-CPE hybrid chips are gaining traction in remote areas. Political instability in some markets disrupts supply chains, though rising digitalization funds (like Saudi’s $6.4bn ICT strategy) indicate long-term growth potential.

Report Scope

This market research report provides a comprehensive analysis of the global and regional CPE Chip markets, covering the forecast period 2025–2032. It offers detailed insights into market dynamics, technological advancements, competitive landscape, and key trends shaping the industry.

Key focus areas of the report include:

Market Size & Forecast: Historical data and future projections for revenue, unit shipments, and market value across major regions and segments. The global CPE Chip market was valued at USD million in 2024 and is projected to reach USD million by 2032.

Segmentation Analysis: Detailed breakdown by product type (4G Chip, 5G Chip), application (4G CPE, 5G CPE), and end-user industry to identify high-growth segments and investment opportunities.

Regional Outlook: Insights into market performance across North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, including country-level analysis where relevant. Asia-Pacific currently dominates the market due to rapid 5G adoption.

Competitive Landscape: Profiles of leading market participants including Qualcomm, UNISOC, ASR, Hisilicon, and MediaTek, including their product offerings, R&D focus, and recent developments.

Technology Trends & Innovation: Assessment of emerging technologies in semiconductor design, fabrication techniques, and evolving industry standards for CPE devices.

Market Drivers & Restraints: Evaluation of factors driving market growth such as 5G rollout and IoT expansion, along with challenges including supply chain constraints and regulatory issues.

Stakeholder Analysis: Insights for chip manufacturers, network equipment providers, telecom operators, investors, and policymakers regarding the evolving ecosystem.

Related Reports:https://semiconductorblogs21.blogspot.com/2025/06/fieldbus-distributors-market-size-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/consumer-electronics-printed-circuit.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/metal-alloy-current-sensing-resistor.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/modular-hall-effect-sensors-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/integrated-optic-chip-for-gyroscope.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/industrial-pulsed-fiber-laser-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/unipolar-transistor-market-strategic.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/zener-barrier-market-industry-growth.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/led-shunt-surge-protection-device.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/type-tested-assembly-tta-market.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/traffic-automatic-identification.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/one-time-fuse-market-how-industry.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/pbga-substrate-market-size-share-and.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/nfc-tag-chip-market-growth-potential-of.htmlhttps://semiconductorblogs21.blogspot.com/2025/06/silver-nanosheets-market-objectives-and.html

0 notes

Text

Private 5G Network Market Size, Share, Analysis, Forecast, and Growth Trends to 2032: Disrupting Traditional Wireless Networks

Private 5G Network Market is experiencing rapid transformation driven by increasing demand for ultra-reliable, low-latency communication and enhanced data security across industries. Enterprises across manufacturing, energy, logistics, and healthcare are increasingly shifting towards private 5G networks to gain more control, reliability, and bandwidth compared to public alternatives. As digital transformation accelerates, the market is witnessing adoption from both large corporations and mid-sized enterprises aiming to future-proof operations with smart automation, AI, and IoT integrations.

Private 5G Network Market continues to expand as organizations seek scalable, high-speed solutions to support mission-critical operations. Governments and regulatory bodies are also actively promoting private network deployments to enhance national digital infrastructure and support Industry 4.0 goals. With the convergence of cloud computing, edge networks, and AI, private 5G networks are becoming integral in unlocking industrial productivity and data-driven decision-making.

Get Sample Copy of This Report: https://www.snsinsider.com/sample-request/3964

Market Keyplayers:

Nokia (AirScale Baseband, Digital Automation Cloud)

Ericsson (Ericsson Private 5G, Radio Dot System)

Huawei Technologies (5G CPE Pro, 5G Core Network)

Qualcomm Technologies, Inc. (FSM100xx Platform, Snapdragon X75 5G Modem)

Samsung Electronics Co., Ltd. (Compact Core, Massive MIMO Solutions)

Cisco Systems, Inc. (Cisco Ultra-Reliable Wireless Backhaul, Catalyst 5G Routers)

ZTE Corporation (5G Radio Access Network, ZTE's Digital Core)

Juniper Networks, Inc. (Mist AI for 5G, Contrail Networking)

Dell Technologies (Dell EMC PowerEdge Servers, Dell Open RAN Solutions)

Hewlett Packard Enterprise (HPE) (HPE Edge Orchestrator, HPE Aruba)

Market Analysis

The private 5G network market is characterized by high strategic collaborations, innovation-driven investments, and a rising number of pilot deployments across industrial sectors. Telecommunications providers, network equipment vendors, and hyperscalers are forming key partnerships to address diverse enterprise needs. With increasing spectrum liberalization and availability of shared or unlicensed bands, the entry barriers for private 5G deployment are lowering, enabling broader market participation.

Verticals such as manufacturing, ports, energy, mining, and smart campuses are early adopters capitalizing on private 5G to replace legacy connectivity models. These sectors benefit from enhanced control over latency, bandwidth, and data sovereignty, which are vital in process automation and remote operations.

Market Trends

Increased adoption of Industry 4.0 initiatives driving demand for private networks

Expansion of enterprise edge computing accelerating network customization

Surge in spectrum allocation for private use by regulatory bodies

Collaboration between telecom operators and cloud providers

Rising focus on cybersecurity integration in 5G architecture

Emergence of network-as-a-service models for SMEs

Greater investment in Open RAN for flexible and cost-effective deployments

Market Scope

High Precision Operations: Supporting robotics, drones, and real-time analytics

Secure Enterprise Communication: Enabling data isolation and regulatory compliance

Mission-Critical Applications: Empowering industries with uninterrupted connectivity

Campus-Wide Coverage: Suitable for industrial parks, ports, and remote facilities

Vertical-Centric Customization: Tailored solutions for specific industry needs

The scope of private 5G is not limited to large enterprises. As the ecosystem matures, SMEs are gaining access through network slicing and service-based models, expanding the total addressable market. With a focus on low-latency, high-throughput, and reliable connections, the technology is reshaping how organizations design their operational infrastructure.

Market Forecast

The private 5G network market is poised for a dynamic growth trajectory driven by digital-first enterprise strategies and technological maturity. Ongoing innovation, robust regulatory frameworks, and increasing awareness about the benefits of private networks are setting the stage for widespread global adoption. Market players are actively investing in R&D, infrastructure partnerships, and ecosystem development to cater to diverse business environments and accelerate time-to-market. As deployments scale from pilot to production, the market is expected to evolve into a mainstream pillar of enterprise connectivity strategies.

Access Complete Report: https://www.snsinsider.com/reports/private-5g-network-market-3964

Conclusion

Private 5G is no longer a futuristic concept—it’s today’s strategic asset for enterprises looking to unlock efficiency, security, and innovation. As industries navigate the complexities of digital transformation, private 5G networks offer a robust foundation for growth, agility, and resilience.

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Contact Us:

Jagney Dave - Vice President of Client Engagement

Phone: +1-315 636 4242 (US) | +44- 20 3290 5010 (UK)

#Private 5G Network Market#Private 5G Network Market Scope#Private 5G Network Market Share#Private 5G Network Market Trends

0 notes

Text

Is Influencer Marketing Worth It in 2025?

In 2025, the digital space is busier-and more competitive-than ever. Companies across industries invest heavily in online visibility, engagement, and conversions. SEO, PPC, and social media remain strong pillars, but influencer marketing has emerged as a game-changer. Is it still worth the investment? The latest reports from top digital marketing agencies in India, including insights from a leading digital marketing agency in Mumbai, point to the data.

As digital platforms evolve, so do consumer behaviours. Partnering with influencers is now a key part of many digital marketing strategies. Whether it’s a nano-influencer or a mega-celebrity with millions of followers, success depends on alignment, authenticity, and analytics.

What the Numbers Say?

According to an Influencer Marketing Hub report, global influencer marketing spending will cross $35 billion in 2025. In India alone, the sector is growing at a CAGR of 25% and is expected to reach ₹3,000 crore this year (Business Insider India, 2024). Companies are shifting budgets from traditional ads to digital platforms-especially influencer collaborations.

A Nielsen survey shows that 92% of consumers trust influencer recommendations more than traditional ads. This is especially valuable for digital strategy agencies aiming to build trust-based campaigns.

Why Influencer Marketing Works

Authenticity and Relatability: Influencers build communities, not just audiences. Their messages feel personal and unscripted.

High Engagement Rates: Micro-influencers (10k–100k followers) often see up to 60% more engagement than mega-celebrities (HypeAuditor, 2024).

Niche Targeting: Unlike broad PPC campaigns, influencers help brands reach targeted and niche audiences based on interests and behaviour.

Multi-Platform Reach: From YouTube and Instagram to newer platforms like Lemon8 and Threads, influencers operate across channels that social media agencies may struggle to reach organically.

Performance Metrics That Matter

For brands, ROI is everything. In 2025, marketers are focusing more on performance metrics like:

Engagement Rate

Cost Per Engagement (CPE)

Click-through Rate (CTR)

Conversion Rate

Customer Acquisition Cost (CAC)

Statista (2025) reports that 89% of marketers believe influencer marketing delivers ROI equal to or better than other digital marketing channels-a significant increase from five years ago.

Influencer Strategy vs. Traditional Digital Channels

A top SEO firm in Mumbai recently ran a case study comparing influencer marketing, SEO, and PPC.

Key findings:

Influencer campaigns drove 47% more short-term traffic.

SEO efforts delivered robust long-term visibility.

PPC ads (handled by a PPC agency in Mumbai) converted faster but had a higher cost per lead.

The takeaway? Influencer marketing works best with SEO and other digital services, not as a replacement.

Best Practices from Top Digital Agencies

Define clear KPIs

Carefully vet influencers

Prioritize micro and nano influencers

Diversify across platforms

Integrate with your social media marketing strategy

Real-World Impact: A Case Study

A Mumbai-based skincare brand worked with an influencer marketing agency and a PPC agency on a 3-month Gen Z campaign.

Results included:

120% increase in website traffic 4.3x ROI from influencer-driven sales 3.7% average engagement rate on Instagram 35% drop in CAC compared to previous PPC-only campaigns

The hybrid approach delivered results that neither tactic could achieve alone.

What’s Next in Influencer Marketing in 2025?

The influencer space is evolving rapidly.

Here’s what’s hot right now!

AI-Generated Influencers: Virtual personalities like Lil Miquela appear in campaigns due to their reach and low overhead.

Affiliate-Based Compensation: More brands use commission-based models, similar to performance marketing.

Live Commerce: Influencers doing live demos and Q&As on Instagram Live, YouTube Live, and Amazon India Live are seeing higher conversion rates.

Long-Term Partnerships: Brands are replacing one-off posts with ambassador programs to build consistency and strengthen brand loyalty.

So, Is It Worth It?

Yes, influencer marketing in 2025 is worth it-if done strategically. Partnering with a digital marketing agency in India or a full-service digital strategy agency ensures alignment of influencer efforts with your overall digital approach, including SEO, PPC, and social media.

For businesses looking to future-proof their growth, the right digital marketing services-a balanced mix of influencer outreach, content marketing, and performance analytics-can deliver outstanding ROI.

#digital marketing#influencer marketing#social media marketing#digital marketing agency#social media marketing agency#influencer marketing agency#search engine optimization agency#ppc agency

0 notes

Text

Measuring the ROI of Billboard Advertising: What You Need to Consider

In the realm of advertising, measuring return on investment (ROI) is critical to understanding the effectiveness and efficiency of different marketing strategies.

When it comes to billboard advertising—a longstanding and visually impactful method—evaluating ROI can be more challenging compared to digital platforms. Let's delve into what factors need consideration when measuring the ROI of Billboard Advertising.

Defining Billboard ROI Metrics

Billboard ROI isn't solely about immediate sales conversion but extends to brand visibility and recall. Traditional metrics like cost per thousand (CPM) impressions and cost per engagement (CPE) provide insights into reach and interaction. However, understanding how billboards contribute to overall brand lift and consumer behaviour requires a nuanced approach.

Attribution Challenges

Unlike digital ads with direct tracking mechanisms, billboards operate in the physical world, making direct attribution difficult. A consumer might see a billboard and later make a purchase, but linking the two events is complex. Surveys, geo-targeting data, and consumer interviews become valuable tools to bridge this gap.

Brand Impact and Recall

Billboards excel in building brand recognition and recall. Metrics such as aided and unaided brand recall surveys can gauge how well consumers remember your brand post-exposure. Consistent and strategic billboard placement can reinforce brand associations over time.

Foot Traffic and Location Data

Proximity to your business location matters. Analysing foot traffic patterns using location intelligence tools helps correlate increased traffic with billboard presence. This data is especially crucial for retail and local businesses aiming to boost store visits.

Digital Integration and Call-to-Action

Integrating digital elements like QR codes or unique URLs on Digital Signage enables better tracking. Monitoring website visits or specific landing page conversions attributed to billboard views provides tangible ROI data. Additionally, compelling calls-to-action prompt immediate consumer response, facilitating easier ROI measurement.

Strategies for Effective ROI Measurement

To enhance the effectiveness of billboard advertising ROI measurement, consider the following strategies:

Controlled Experiments

Implement controlled experiments by placing billboards in specific locations and comparing against areas without billboards. Analyse sales or website traffic differences to isolate the impact of billboards.

Consumer Surveys

Conduct post-campaign surveys to assess brand recall, purchase intent, and overall consumer sentiment. Link responses with geographic and demographic data for deeper insights.

Geo-Fencing and Mobile Tracking

Employ geo-fencing technology to track mobile devices exposed to billboards. Monitor changes in consumer behaviour, such as store visits or online interactions within the geofenced area.

Long-Term Brand Studies

Invest in longitudinal studies to track brand health metrics over time. Measure shifts in brand perception and market share to gauge the sustained impact of billboard campaigns.

Conclusion

While measuring the ROI of advertising billboards presents unique challenges, innovative approaches and evolving technologies offer promising solutions.

By combining traditional metrics with digital integration and consumer insights, businesses can gain a comprehensive understanding of how billboards contribute to their marketing objectives. Remember, billboard ROI isn't just about immediate sales—it's about building enduring brand connections that drive long-term success.

0 notes

Text

How to Measure the Effectiveness of Influencer Marketing Software Campaigns

Introduction

In today's digital age, influencer marketing has emerged as one of the most powerful strategies for brands to reach their target audience and build brand awareness. To enhance the efficiency of influencer marketing campaigns, marketers are increasingly turning to influencer marketing software. These tools help streamline the process of identifying, managing, and measuring the impact of influencer collaborations. In this blog, we will explore how to measure the effectiveness of influencer marketing software campaigns and discuss the best influencer marketing software available in the market.

Understanding Influencer Marketing Software

Influencer marketing software platforms are designed to simplify and optimize influencer campaigns. They offer a range of features, such as influencer discovery, audience analytics, campaign management, and performance tracking. By leveraging these tools, marketers can efficiently find the right influencers, monitor campaign progress, and measure the results.

Key Metrics to Measure Campaign Effectiveness

1. Reach and Impressions: These metrics indicate the total number of people who have seen the influencer's content and how many times the content has been viewed. Tracking reach and impressions helps gauge the campaign's overall exposure and potential impact.

2. Engagement: Engagement metrics include likes, comments, shares, and saves on influencer posts. High engagement rates suggest that the content resonated well with the audience, increasing the likelihood of conversions.

3. Conversions and Sales: Ultimately, the success of any marketing campaign lies in its ability to drive conversions and sales. Influencer marketing software can help track the impact of influencers on website visits, sign-ups, and purchases.

4. Audience Demographics: Understanding the demographics of the audience reached by the influencers allows marketers to ensure they are targeting the right customer segments.

5. Brand Mentions and Sentiment: Monitoring brand mentions and analyzing sentiment around those mentions provides valuable insights into how the audience perceives the brand after exposure to the influencer's content.

6. Cost per Engagement (CPE) and Return on Investment (ROI): Calculating CPE and ROI helps measure the campaign's efficiency and compare its performance with other marketing efforts.

Choosing the Best Influencer Marketing Software

To maximize the effectiveness of influencer marketing campaigns, selecting the right influencer marketing software is crucial. Here are some top features to consider when choosing the best influencer marketing software:

1. Influencer Discovery: Look for a platform that offers advanced search filters to identify influencers who align with your brand's values and target audience.

2. Data Analytics: The software should provide comprehensive data and analytics on influencer performance and audience demographics.

3. Campaign Management: An effective tool should facilitate seamless communication and collaboration between brands and influencers.

4. ROI Tracking: The software should allow for accurate tracking of campaign performance and provide insights into ROI.

5. Sentiment Analysis: Look for software that can analyze audience sentiment around your brand and products.

6. Integration Capabilities: Ensure the software can integrate with other marketing tools to streamline your workflow.

Conclusion

Influencer marketing software has revolutionized the way brands approach influencer collaborations. Measuring the effectiveness of influencer marketing campaigns is essential for optimizing future strategies and allocating resources wisely. By focusing on key metrics such as reach, engagement, conversions, and audience demographics, marketers can gain valuable insights into campaign performance.

Remember to choose the best influencer marketing software that aligns with your brand's objectives and provides the necessary tools to measure and analyze campaign success effectively. With the right software and a well-executed influencer marketing strategy, your brand can harness the power of influencer marketing to drive substantial growth and engagement within your target audience.

Must read: From Macro to Micro: Finding Influencers at Every Level of Influence

0 notes

Link

Find out the real surgent CPE reviews with the help of CPE Compare. We provide the full surgent CPE solutions reviews based on direct user experience and published data. We have described the CPE – solid and dated courses, features platform, cost, user experience, pros and cons of the surgent CPE platform. Visit our website to compare CPE platforms now!

#compare cpe platforms#cpe comparison website#CPE Compare#continuing professional education website reviews#surgent cpe reviews#surgent cpe platform#surgent cpe solutions reviews#surgent cpe full platform reviews

0 notes

Text

Advantages of 5G over 4G

What is 5G?

As the planned successor to the 4G networks, 5G is the fifth generation technology standard for broadband cellular networks, which has been deployed worldwide from 2019 to achieve rapid speed, low latency, massive connection, wide coverage and flexible deployment. By now, there are many successful 5G commercial cases in the world.

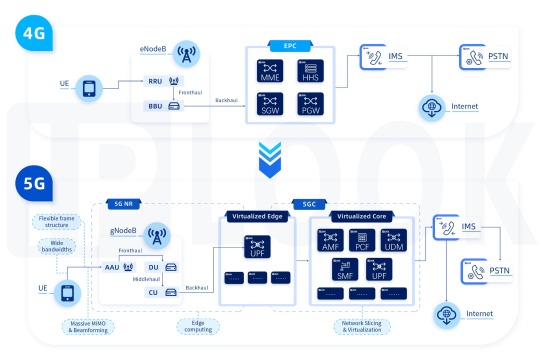

The difference between 4G architecture and 5G architecture

Compared to the architecture of 4G, 5G has these features in general (as below figure). 1. The introduction of edge computing to deploy service anchors and computing capabilities to mobile edge nodes. 2. The split architecture of CU/DU is introduced in 5G RAN. The CU is placed in the center or aggregation point of the county, saving the number of data centers and reducing costs. 3. The introduction of network slicing in 5GC (5G core network) to achieve on-demand customization of services and networks to meet the diverse vertical industry needs in the 5G era.

4G architecture vs 5G architecture

Advantages of 5G over 4G

Based on the evolution of architecture, 5G has these advantages: · Flexible frame structure · Wide bandwidths · Massive MIMO & Beamforming

How 5G works in application?

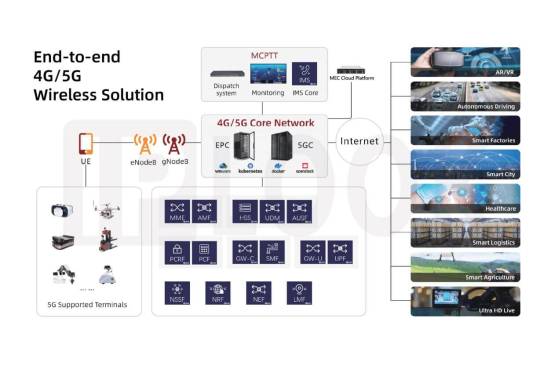

Based on Cloud Native Platform, IPLOOK provides a fully integrated end-to-end 5G wireless solution, that includes integrated Radio Access, high capacity 5GC (5G Core Network), high reliability 5G MEC cloud platform, 5G CPE, Artificial Intelligence and other digital technologies, supporting multiple network access models for diverse application scenarios. IPLOOK can offer one-stop delivery services such as pre-sales consultation, solution design, platform development, system delivery, and data operation. Keeping on exploring pragmatic 5G products and solutions, IPLOOK has already accumulated many commercial cases: · IPLOOK End-to-end 4G/5G Wireless solution

· IPLOOK 5G network slicing

· Private 5G network solution · IPLOOK 5G/6G satellite converged solution · IPLOOK 5GC solution including 5G SA and 5G NSA networks as well as its network elements

What will 5G bring to our lives?

As the three major application scenarios of 5G (eMBB, mMTC, URLLC) concluded, 5G supports a range of new services for Operators, Enterprises and Governments. It can be applied in diverse scenarios with flexible architecture and expanded applications: · AR/ VR Gaming · Smart city · Smart factories · Smart office · Health care · Autonomous driving Let’s keep our eyes on the development of 5G!

1 note

·

View note

Text

How Much Do Facebook Ads Cost in 2022? Are They Still Worth It?

With over 2.89 billion active users logging in every month, Facebook is at present the leading social media platform in the world. Facebook additionally has the evenest user distribution, compared to other social networking platforms such as LinkedIn and Instagram. Without a doubt, Facebook ads can provide an excellent chance for your brand to generate awareness and engagement effectively. So regardless of whether you’re simply venturing into Facebook marketing or hunting for ways to make the best of your marketing budget, you must understand the nitty-gritty details of Facebook ads cost.

What are the expenses of Facebook ads?

Facebook ads costs rely upon your preferred bidding models, such as

cost-per-click (CPC)

cost-per-thousand impressions (CPM), or

cost-per-engagement (CPE).

As indicated by the stats shared by Revealbot, the average cost of Facebook advertisements for Cost Per Click (CPC) across all campaign objectives and industries was $1.01 in July 2021. The charge for CPM throughout all industries was $12.9 as of July 2021. Likewise, the average charge for CPE across different industries was $0.114 as of July 2021. Read more about Facebook Ads Cost……….

0 notes

Text

Get Ready for the Coming Oil Crisis (SBOW, VKIN, CPE, RRC, XOM, CVX, SM, CEI, OIH)

The landscape is in place for a coming supply shortage crisis in the oil market, and the only place to hide for investors may be in small-cap oil stocks. The world is adjusting to the next chapter – the post-pandemic period – and global oil demand is recovering powerfully, on pace to hit new all-time highs by early next year. At the same time, non-OPEC oil supply is falling, down over 2 million barrels per day from its 2019 peak. Even more to the point, non-OPEC oil supply growth will turn negative over coming years, according to new forecasts from the IEA. That inflection will foster a gap between supply and demand with structural implications. By just 12 months from now, demand will encroach on total production potential for the first time in 160 years – since we first started ramping up the oil industry in the 19th century. This may well become the most important investment theme over coming years. But it won’t just impact the fortunes of the world’s major integrated producers like Exxon Mobil Corporation (NYSE:XOM) and Chevron Corporation (NYSE:CVX). It will define the landscape for the entire market, and the biggest beneficiaries will likely be the small-cap oil players now trading at cheap levels. With that in mind, we take a look at a few of the more interesting names in the space and cover some recent catalysts. SilverBow Resources Inc (NYSE:SBOW) is a growth-oriented independent oil and gas company in the dead-center of what you might call the small-cap growth niche in the US shale energy space. The company engages in the acquiring and developing assets in the Eagle Ford Shale. SilverBow Resources Inc (NYSE:SBOW) recently announced it has entered into definitive agreements to acquire oil and gas assets in the Eagle Ford from an undisclosed seller. Acquisition Highlights include: All stock Transaction for approximately $33 million, consisting of approximately 1.5 million shares of SilverBow common stock, 45,000 total net acres in the Eagle Ford, bolstering SilverBow’s gas position in McMullen and Live Oak counties, while adding new oil positions in Atascosa, Lavaca, and Fayette counties, and April 2021 net production of approximately 1,580 barrels of oil equivalent per day, 39% liquids. Net oil production of 569 barrels per day Sean Woolverton, SilverBow’s Chief Executive Officer, commented, "We continue to execute on accretive opportunities and bolster our balanced oil and gas portfolio. This marks the second acquisition we have announced since the beginning of August. Our first deal increased our high-return Eagle Ford and Austin Chalk locations, as well as incremental working interest in producing wellbores, in our La Mesa position. Today’s announcement expands our gas portfolio in the Western Eagle Ford, while also adding oil acreage in three new counties. Each transaction is accretive to Adjusted EBITDA and further reduces our pro forma leverage ratio(1) via the assets’ incremental cash flow. Our ability to use stock as consideration reflects the constructiveness of Eagle Ford partners to share in SilverBow’s long-term value creation." The stock has suffered a bit of late, with shares of SBOW taking a hit in recent action, down about -9% over the past week. Shares of the stock have powered higher over the past month, rallying roughly 13% in that time on strong overall action. SilverBow Resources Inc (NYSE:SBOW) managed to rope in revenues totaling $69.9M in overall sales during the company's most recently reported quarterly financial data -- a figure that represents a rate of top line growth of 181.2%, as compared to year-ago data in comparable terms. In addition, the company is battling some balance sheet hurdles, with cash levels struggling to keep up with current liabilities ($2.1M against $101.9M, respectively). Viking Energy Group Inc (OTC US:VKIN) is an emerging small-cap player in the oil and gas space with assets located in North America in Kansas, Missouri, Texas, Louisiana, and Mississippi. Viking also has firm financial backing from its majority owner, Camber Energy Inc (NYSEAMERICAN:CEI), which recently raised $15 million in non-toxic financing that is convertible well above current share pricing. That suggests Viking has a lot of expansion opportunity here as well, which is a big factor in presenting the stock. Shares have started to heat up as it gets involved in carbon capture technology, which is a very nice addition to the narrative. Viking Energy Group Inc (OTC US:VKIN), to expand on that point, recently entered into an Exclusive Intellectual Property License Agreement with ESG Clean Energy regarding ESG’s patent rights and know-how related to stationary electric power generation, including methods to utilize heat and capture carbon dioxide. This has the potential to catapult VKIN into a key position in the clean energy space. According to the release, the ESG Clean Energy System is designed to generate clean electricity from internal combustion engines and utilize waste heat to capture ~ 100% of the carbon dioxide (CO2) emitted from the engine without loss of efficiency, and in a manner to facilitate the production of precious commodities (e.g., distilled/ de-ionized water; UREA (NH4); ammonia (NH3); ethanol; and methanol) for sale. James Doris, President and Chief Executive Officer of Viking, commented, “In my view this transaction positions us as an industry leader in terms of being able to assist with the power generation needs of commercial and industrial organizations while at the same time helping them reduce their carbon footprint to satisfy regulatory requirements or to simply follow best ESG-practices. We are excited to be able to use the platform of Simson-Maxwell Ltd., our recently acquired majority-owned subsidiary, to promote the ESG Clean Energy System.” Viking Energy Group Inc (OTC US:VKIN) is a small but growing oil play with improving financial metrics, and it should be taken seriously as a player in a space that could be heading for a major windfall. The company recently posted double-digit growth in revenues, current assets, and EBITDA for its calendar Q2, and its move to gain exposure to the carbon capture theme is likely to help it gain greater visibility, as evidenced by the stock’s recent 200% multi-week rally. Callon Petroleum Company (NYSE:CPE) engages in the exploration, development, acquisition and production of oil and natural gas properties in the United States. The company focuses on unconventional oil and natural gas reserves in the Permian Basin. Callon Petroleum Company (NYSE:CPE) recently announced an agreement to acquire the leasehold interests and related oil, gas, and infrastructure assets of Primexx Energy Partners and its affiliates. Primexx is a private oil and gas operator in the Delaware Basin with a contiguous footprint of 35,000 net acres in Reeves County and second quarter 2021 net production of approximately 18,000 barrels of oil equivalent per day ("Boe/d") (61% oil). The cash and stock transaction is valued at approximately $788 million, representing a headline purchase price multiple of approximately $43,800 per Boe/d, based on second quarter production. Callon President and Chief Executive Officer Joe Gatto commented: "The Primexx transaction checks every operational and financial box on the list of compelling attributes of consolidation. The asset base adds substantial current oil production and a top-tier inventory to our Delaware portfolio, and fits squarely into our model of scaled, co-development of a multi-zone resource base. Our integrated, future development plans will benefit greatly from the combined Delaware scale and we expect to generate approximately 30% more adjusted free cash flow from the third quarter of 2021 through year-end 2023 under our conservative planning price assumptions. The infusion of over $550 million of equity from the acquisition and Kimmeridge's exchange further heightens the overall benefits, immediately reducing leverage metrics and creating a visible path to net debt to adjusted EBITDA of below 2.0x next year." And the stock has been acting well over recent days, up something like 7% in that time. Shares of the stock have powered higher over the past month, rallying roughly 22% in that time on strong overall action. Callon Petroleum Company (NYSE:CPE) managed to rope in revenues totaling $440.4M in overall sales during the company's most recently reported quarterly financial data -- a figure that represents a rate of top line growth of 180.1%, as compared to year-ago data in comparable terms. In addition, the company is battling some balance sheet hurdles, with cash levels struggling to keep up with current liabilities ($3.8M against $813.8M, respectively). Other key stocks in the small-cap oil space include Range Resources Corp. (NYSE:RRC), Exxon Mobil Corporation (NYSE:XOM), Chevron Corporation (NYSE:CVX), SM Energy Co (NYSE:SM), and VanEck Oil Services ETF (NYSEARCA:OIH). Read the full article

0 notes

Link

Are you looking for a legal, tax and accounting professional services or something like the global new platform? Don’t worry CPE Compare is here to help you better. We give checkpoint learning solution reviews. This platform is a compelling option with a robust on-demand course library and a large number of live webinars, as well as micro-certifications, and multi-tier package choices. To know more, visit the website now!

#cpe for cpa comparison#compare cpa cpe online courses#webce customer reviews#checkpoint learning solution reviews#illumeo solution reviews#aicpa cpexpress solution reviews#surgent cpe platform#quick comparison grid of cpe solutions#CPE Compare

0 notes

Text

Leap in FWA: a market of opportunities

The development of the worldwide network fuels the rapid increase of the network demands from subscribers. While in some scarcely populated areas, where Fixed Wireless Access (FWA) can be an alternative to offer services that fiber-optic network doesn't reach.

What is FWA?

Fixed Wireless Access (FWA), uses cellular data (LTE/5G) to provide broadband internet, without the need for cables.

It's an established means of providing network access to homes or enterprises through the deployment of FWA solution. With Customer Premise Equipment (CPEs) converting the cellular signal to Wi-Fi Signal, subscribers can achieve high-quality and stable network services.

FWA solution is suitable for a range of different fields where fiber is unavailable or very expensive to build, like rural and suburban area. For operators and enterprises, this solution can better meet the demand of growing customers with simplified network deployment at a low CAPEX. It delivers a fast and reliable LTE/5G network services to subscribers in a cost-effective way.

Enhanced FWA by 5G technology

5G FWA is able to support more application scenarios with enhanced network capacity. With 5G technology, the customer experience is greatly improved. Since this solution has the advantages of massive capacity, lower latency and rapid deployment, many applied cases were launched with expanded service coverage and boost adoption.

According to Huawei report, the global 5G FWA market size is projected to account for 27% of the total FWA market in 2025, compared with 5% in 2021. The deployment of FWA is clearly about to get bigger, which brings a potential market of opportunities. The ability to offer 5G services can stimulate demand for 5G FWA services as well as enable operators to grow revenue.

Current deployments with IPLOOK FWA Solution

FWA solution gathers many operators together. As a member of GSA (Global mobile Suppliers Association), IPLOOK continues to innovate and seek opportunities in FWA, and launched a complete end-to-end FWA solution including CPE, Base Station, Core Network, and Management Platform.

Typically, Service Providers or Wireless Internet Service Providers (WISPs) install a few radio equipment and deploy IPLOOK's 4G core network (EPC) or 5G core network (5GC) in central locations around a community, with connections back to the Internet. Our solution is highly scalable with a roadmap to 5G, enabling operators of all sizes to provide high-quality network services for subscribers.

View more successful use cases here: https://www.iplook.com/info/press-releases

1 note

·

View note

Text

Introducing Facebook Page Analyzer And Facebook Pages

Tutorials and tips on Content and Video Marketing.

Origins and Caudalie have seen between 250 – 650 engagements surrounding their giveaway content — approximately 120% above their average engagement count.

This is a clear content opportunity for other skincare brands to take advantage of on Facebook.

Work out the cost of your content efforts

You can also use the content post engagement data in this report to project the cost and ROI of your content efforts.

For example, let’s imagine you’ve decided to do a giveaway worth $100.

If you know from your competitor analysis that your giveaway is likely to receive 650 engagements, the cost of this content activity will be $0.15 per engagement (ie. 100 / 650 = 0.15).

So for as little as $0.15 per interaction, you could build some pretty impressive organic engagement.

Spot ROI opportunities

From there you can calculate an approximate ROI to justify your content decisions, by comparing organic Cost Per Engagement (CPE) against the cost of paid advertising.

According to AdEspresso, Cost Per Like (CPL) on Facebook’s advertising platform equated to $0.20 for the first three quarters of 2020.

If you subtract the $0.15 CPE of your giveaway from this paid $0.20 CPL, you’d achieve a minimum cost saving of $0.05 per engagement, or a grand total of $32.50 – if you’re aiming for 650 engagements overall.

We say minimum here because an organic giveaway campaign has greater potential to generate more than just likes.

If competitor performance is anything to go by, it can encourage shares and comments too, which are even better forms of engagement.

What’s more, the amount of feed based impressions that will be generated by this trio of engagements will likely far surpass what could be achieved for the same price via paid advertising.

So there you have it. A pretty easy way to calculate the ROI of your content decisions on Facebook using data from the Facebook Page Analyzer.

This post “Introducing Facebook Page Analyzer And Facebook Pages” was provided here.

I trust you found the post above of help and interesting. Similar content can be found on our main site: superspunarticle.com/blog Let me have your feedback in the comments section below. Let us know which topics we should cover for you in the future.

youtube

0 notes

Text

At 199 million, Twitter logs 20% user growth as pandemic posts surge

Twitter now has 199 million average monetisable daily active users (mDAU), a 20 per cent growth (year-on-year), driven by ongoing product improvements and global conversation around the pandemic.

The micro-blogging platform reported $1.04 billion in revenue for the Q1 2021, up 28 per cent (on-year), and a net income of $68 million. The advertising revenue reached $899 million, an increase of 32 per cent.

"People turn to Twitter to see and talk about what's happening, and we are helping them find their interests more quickly while making it easier to follow and participate in conversations," Twitter CEO Jack Dorsey said in a statement late on Thursday.

Total ad engagements increased 11 per cent year-over-year while cost per engagement (CPE) increased 19 per cent year-over-year.

While US revenue reached $556 million, international revenue totalled $480 million, an increase of 41 per cent.

"Advertisers continue to benefit from updated ad formats, improved measurement, and new brand safety controls, contributing to 32 per cent year-over-year growth in ad revenue in Q1, said Ned Segal, Twitter's CFO.

The mDAU were 199 million for Q1, compared to 166 million in the same period of the previous year and compared to 192 million in the previous quarter.

Average international mDAU were 162 million for Q1, compared to 133 million in the same period of the previous year and compared to 155 million in the previous quarter.

"We are attracting more great people to Twitter than ever before and investing in our highest priorities to deliver on our long-term goals across consumer product, revenue product, and platform," the company said.

Read Complete Article

0 notes

Text

Virtual Customer Premises Equipment Market: By Product Type, Industry Challenges, Development & Innovation, Verticals

According to Market Research Future (MRFR), the global virtual customer premises equipment market is expected to reach USD 3 billion with 43% CAGR from 2016 to 2022 (forecast period). The report includes a COVID-19 analysis of the global virtual customer premises equipment market. It provides a broad review of market segments, recent developments, growth, market forecasts, and challenges for analyzing current growth opportunities.

Virtual Customer Premises Equipment is to simplify the network and its administration by transferring from home or business to the network, where it can be operated by a commodity server under the control of a network operator. As a flexible network operator, it can minimize costs, dynamically deliver network functions, and offer agile new service. Through using V-CPE, network providers can simplify and speed up service delivery and also configure and manage devices remotely. For instance, using these equipment’s network operators can virtualize IP functions for subscriber and service management, Dynamic Host Control Protocol (DHCP), virtualize Network Address Translation (NAT), or firewall services.

Market Dynamics

Growing mobility needs, rising demand for virtual networking infrastructure solutions, and services, along with varying traffic patterns, are some of the main drivers for the growth of the V-CPE industry. Virtual Customer Premises Equipment also offers improved physical networking infrastructure that can be transmuted into sharable virtual resources. These can also be obtained from anywhere without using a lot of networking hardware. Moreover, the high demand for private clouds among businesses to support cloud-based applications is accelerating the growth of the market for virtual customer premises equipment.

However, the growing demand for security concerns about virtual architecture, the issues of reliability, and the lack of a qualified workforce impede the market’s growth for virtual customer premises equipment.

Moreover, the virtualization of technology is expected to lead to the exchange of information, group discussions, and online programs that will drive the demand over the forecast period.

Get Free Sample Copy Report @ https://www.marketresearchfuture.com/sample_request/2397

Market Segmentation

The global market for virtual customer premises equipment has been segmented on the basis of solutions, services, and end-users.

On the basis of solutions, the global virtual customer premises equipment market has been segmented into virtual switches, controller & application platform, virtual routers, security, compliance, orchestration, infrastructure management, and others.

On the basis of services, the global virtual customer premises equipment market has been segmented into managed and professional.

On the basis of end-users, the global virtual customer premises equipment market has been segmented into BFSI, healthcare, retail & e-commerce, among others.

On the basis of services, the global virtual customer premises equipment market has been segmented into managed and professional. Out of these, professional held the largest market share majorly due to the adoption of network virtualization among enterprises that has raised the demand for network function virtualization (NFV) technology, which helps to increase the demand for V-CPE infrastructure.

Regional Analysis

Region-wise, the global virtual customer premises equipment market has been segmented into North America, Europe, Asia Pacific, and RoW.

North America held the most substantial market share in the global market for virtual customer premises equipment, while the Asia Pacific is projected to rise steadily over the 2016-2022 forecast period.

North America held the largest market share, especially in countries such as the United States, primarily due to the existence of a vast number of V-CPE service providers offering customized solutions to multiple end-users.

The Asia Pacific region is projected to grow over the forecast period 2016-2022, particularly in countries like China and Japan, mainly due to massive investment in the development of NFV and V-CPE technologies with the increasing adoption of software-defined technologies.

Access Complete Report @ https://www.marketresearchfuture.com/reports/virtual-customer-premises-equipment-market-2397

Key Players

The key players in the global virtual customer premises equipment market include Hewlett Packard Enterprise (U.S.), VMWare Inc. (U.S.), ALTEN Calsoft Labs (U.S.), IBM Corporation (U.S.), NEC Corporation (Japan), Juniper Networks Inc. (U.S.), Versa Networks (U.S.), Cisco Systems Inc. (U.S.), Ericsson Inc (Sweden), Telco Systems (U.S.) and others.

About Market Research Future:

Market Research Future (MRFR) is an esteemed company with a reputation of serving clients across domains of information technology (IT), healthcare, and chemicals. Our analysts undertake painstaking primary and secondary research to provide a seamless report with a 360 degree perspective. Data is compared against reputed organizations, trustworthy databases, and international surveys for producing impeccable reports backed with graphical and statistical information.

We at MRFR provide syndicated and customized reports to clients as per their liking. Our consulting services are aimed at eliminating business risks and driving the bottomline margins of our clients. The hands-on experience of analysts and capability of performing astute research through interviews, surveys, and polls are a statement of our prowess. We constantly monitor the market for any fluctuations and update our reports on a regular basis.

Contact: Market Research Future 528, Amanora Chambers, Magarpatta Road, Hadapsar Pune – 411028, Maharashtra, India Email: [email protected]

0 notes

Text

5 Ways to Measure Your Influencer Marketing

It’s easy to get overexcited when a hot digital trend emerges – and influencer marketing is no exception. Since last year we’ve seen a huge boom in conversations around influencers, and the buzz continues to grow. Though brands now have a wide selection of different influencers from micro to macro they are still struggling with proving ROI. Read on to find out how you can measure the success of your influencer campaign!

Outline the Goals You Want to Achieve with Influencer Marketing

Before you partner up with an influencer, be sure to take a step back and really think about the end goal. It’s not enough to be on-trend with influencer marketing, you need to develop a data-driven approach which will help you define success.

Set clear goals for yourself on what you want to accomplish. Make sure that your goals are measurable and specific. Luckily, with access to a wide variety of social media metrics, you can easily keep track and report on your goals.

Influencers can be used at every stage of the buyer’s journey. As a result, the goals you set up will be different depending on which stage of the funnel you want to nurture. For example, let’s say you want to collaborate with an influencer to increase brand awareness. In this case, analyzing the reach and engagement of your campaigns would be the most effective. If you’re looking to target a ready-to-buy audience then driving sales is likely to be your goal. The best way to keep tabs on your influencer sales would be to monitor your UTM conversions.

Here are some examples of goals you can set with influencer marketing:

Increase web traffic by X% in 2 months

Increase following on (insert platform) by X amount every week

Increase brand mentions on social media by X% in one month

There is no shortage of different goals you can set for yourself. These are just a few examples out of many to help point you in the right direction. Now let’s get more specific and dive into different ways you can measure the success of your influencer partnership based on your goals.

If You Want to Track Content Effectiveness: Measure Engagement Rate

Engagement rate is most likely going to be one of your go-to goals when it comes to influencer marketing. Keeping tabs on engagement is made easy with social media marketing tools. Get granular and track every single influencer post that is related to your brand. If the tool you use has labels, be sure to tag all of the influencer posts so you can compare them side by side. If you aren’t using a social media marketing tool or yours doesn’t have labeling capabilities you can give ours a try here for free.

Of course, the engagement metrics you measure will differ according to the platforms you are evaluating. Be sure to measure engagement post by post so you can keep a close eye on what’s working. To put the effectiveness of your influencer posts in-context you can also analyze their non sponsored content along with sponsored posts from previous partnerships to benchmark your performance. Since there is no magic number for what a “good engagement” rate should look like, you can use this analysis as a way to put your engagement rate into context.

To get to the nitty gritty you can measure CPE or Cost per Engagement of your influencer marketing. Similar to Cost per Action CPE breaks down how much you are paying for engagement: likes, comments, clicks etc. To get to this number simply divide your total influencer budget by the number of engagements.

If You Want to Earn Media Space: Track Number of Mentions and Hashtag Frequency

If you’re looking to see if your influencer marketing campaigns are sparking conversations you can easily find out with any social media listening tool. Dive into the conversations taking place across social media and find out if your brand is appearing more frequently. To take your analysis even further you can segment these mentions based on sentiment. After all, you’ll need to make sure that your collaboration is having a positive impact on your brand – not a negative one.

Aside from brand mentions, setting up a unique hashtag is also a great way to measure success. If you are creating a campaign with an influencer you can assign a specific hashtag to that campaign and monitor if it’s gaining any traction.

Anastasia Beverly Hills is an Influencer marketing pro. To strengthen their brow game they have created the hashtag #anastasiabrows, using it throughout their posts in addition to posting it on their bio. The brand cleverly cooperates with influencers using their talent to help spread the word. Both Anastasia Beverly Hills and their influencers post content around the topic incorporating the hashtag. By integrating the power of influencers in their strategy Anastasia Beverly Hills is able to reach new audiences that have an interest in cosmetics. To measure the success of this particular campaign they could easily track if there is an increase in #anastasiabrows outside of their influencer program. If so, they’ve just hit the user-generated content jackpot!

If You Want to Track Conversions: Setup UTM Parameters

UTM Parameters are tags that exist within a URL. The data that is collected when one of these links is clicked can be seen in your Google Analytics account. When it comes to influencer marketing there are several different ways you can set up UTM parameters to track success. Let’s say you are collaborating with more than one influencer and would like to know which one is raking in the most website conversions. In this case, you would prescribe a different link with a tailored tag to each of your influencers.

To take your measurement a step further set up goals in Google Analytics. This will enable you directly measure which links are contributing to your specific conversions.

If You Want to Track Sales: Prescribe and Measure Special Promo Codes

Creating specific promo codes for your influencers works like a charm. These personalized codes allow you to pinpoint exactly where your sales are coming in from taking you straight to the bottom of the funnel. As a result, you can calculate ROI with ease – seeing exactly how many sales your influencer brought in.

Bonus: Compare the number of your influencer’s promo code sales versus your own, who is in the lead? Always track your influencer campaigns alongside your other marketing initiatives so you can benchmark success. Influencer campaigns can be costly and time intensive which means you need to identify if they’re not working early on. This way, you can readjust your strategy or experiment with a different influencer to relay your message.

In this post, we can see a fashion brand sporting this promo code strategy with an influencer on Instagram. The brand took a unique approach by actually personalizing the promo code. Rather than creating something generic like SPRING15 they used the influencers first name Hannah15. This approach makes the promo code look more authentic and far less salesy. Plus using the influencer’s first name over something more cryptic will make the analysis that much smoother.

The Takeaway

Partnering with the right influencer can help amplify your reach – earning you authentic visibility with new audiences. But before you dive head-first into influencer marketing you need to do some prep work. Do some digging and analyze your current audience to make sure you’re going after the right influencer. There should be huge similarities between the audience you have and the one you want to target. Once you’ve found the perfect match you can start exploring the marketing goals you want your influencer to help set in motion.

Keep in mind there is a multitude of different ways you can measure ROI when it comes to influencer marketing. If you have well-defined and measurable goals already in place coming up with numbers to defend your influencer campaign will be a sinch.

If you’re still wondering if influencer marketing is the right move for your brand you may want to check out our piece 9 Reasons Why You Need to Embrace Influencer Marketing.

https://growinsta.xyz/5-ways-to-measure-your-influencer-marketing/

#free instagram followers#free followers#free instagram followers instantly#get free instagram followers#free instagram followers trial#1000 free instagram followers trial#free instagram likes trial#100 free instagram followers#famoid free likes#followers gratis#famoid free followers#instagram followers generator#100 free instagram followers trial#free ig followers#free ig likes#instagram auto liker free#20 free instagram followers trial#free instagram followers no#verification#20 free instagram likes trial#1000 free instagram likes trial#followers instagram gratis#50 free instagram followers instantly#free instagram followers app#followers generator#free instagram followers instantly trial#free instagram followers no survey#insta 4liker#free followers me#free instagram followers bot

0 notes

Text

A Conversation with Tasmin Waley-Cohen

Described by the Guardian as a performer of "fearless intensity", the recipient of 2016-2017 ECHO Rising Stars Awards Tamsin Waley-Cohen joined by pianist Huw Watkins released a new CD exploring folk-inspired Bohemia from before the First World War. It features works by Antonin Dvořák, Josef Suk and Leoš Janáček. Primephonic’s Rina Sitorus had a chance to talk to Tamsin about it.

Congratulations on your newest recording, Bohemia. What is the idea behind it? Thank you very much. I’ve always really loved the music of Antonin Dvořák, and Leoš Janáček. In fact some of my earliest memories of playing chamber music was playing Dvořák quartet. The idea actually sits at the beginning of a series of albums I’ve done over the past few years, which between them, tell the story of the twentieth century. I wanted to do something which comes before the 1917 album. Although the Janáček is the latest work on this album, written right before the outbreak of the first World War, I wanted to do an album which in a way encapsulated the incredibly cultured world of central Europe, which was completely lost after the first World War.

How would you describe your collaboration with Huw Watkins? Huw and I have been working together for many years. I premiered his Concertino when I was 15. He is my long time partner in violin and piano recitals and chamber music. We’ve recorded quite a lot together so it was only natural that we recorded Bohemia together. Actually it was his idea to include the Suk pieces. They fit perfectly. The works are very beautiful but quite strange and unexpected. There’s something about them which is a bit uncomfortable. They fit very well with the idea of a world that is disappearing. What are the highlights of Bohemia that people may not yet be so familiar with?

Well, I think in fact the Dvořák sonata is almost never played, it is quite early, from before he had achieved his great fame. It has this almost fresh naivety about it and I think it's very charming. Many people may not know that. And the works from Suk are a gems which are not played at all these days, but they were very popular 50 years ago. Another highlight could be the four romantic pieces by Dvořák which he wrote later on when he went back to his country house in Bohemia. He was writing these melodies inspired by the music of the countryside.

Are you happy with how the recording turned out?

As a musician you’re always learning and improving. It doesn’t mean that something I did last year was not good, but I might do it differently.The thing with recordings is that they are snapshots of a few days. You put your heart and soul in these few days, you do your best in a recording. Of course later there will be things which I want to change or do differently, but I do feel that this is a very good representation of the works. I absolutely stand by what we did. And since recordings will be there forever, I’ll always make sure that I know from every note what I want and why I want it that way. And it comes from a lot of thoughts, analysis and reflections, so nothing is happening by chance.

I’m also very happy to work with producer Nick Parker and engineer Mike Hatch. They understood what we wanted, something tactile and intimate to go for the warmness of Janáček for example and tenderness for other moments.

How do you prepare a recording?