#error reduction in AP

Explore tagged Tumblr posts

Text

Why Outsourcing Accounts Payable Improves Financial Control

Accuracy and efficiency are critical to a successful accounts payable process. Errors in vendor payments, duplicate invoices, and late payments can cost businesses time and money. Accounts payable outsourcing helps eliminate these issues by bringing in specialized expertise and automation.

With outsourced AP services, companies benefit from streamlined workflows and dedicated teams who ensure invoices are processed correctly and on schedule. Automation tools used in outsourcing significantly reduce human error and increase processing speed.

One of the most overlooked advantages of accounts payable outsourcing is the ability to generate real-time financial reports and analytics. These insights help companies track cash flow, monitor performance, and make informed financial decisions.

Moreover, outsourced providers ensure strict compliance with regulatory standards, minimizing the risk of audits or penalties. They also use secure systems to handle sensitive data, reducing the likelihood of fraud.

By enhancing the accuracy and speed of financial processes, AP outsourcing improves overall financial health. It allows internal teams to shift focus from data entry to strategic activities, such as budgeting and financial planning. In short, accounts payable outsourcing is an investment in operational excellence.

#AP process efficiency#error reduction in AP#automated invoice processing#outsourced AP benefits#financial process optimization

0 notes

Text

Why Every CFO Should Consider Accounts Payable Transformation

Accounts Payable Transformation is the process of reengineering how a business manages its outgoing payments, with a focus on automation, cost reduction, and accuracy. At Rightpath GS, this transformation is a key offering designed to improve financial workflows and vendor relationships.

By moving away from manual, paper-based processes and implementing digital tools, Accounts Payable Transformation helps organizations reduce errors, improve payment cycles, and gain visibility into cash flow. Rightpath GS uses data analytics and technology integration to create an agile, scalable AP function.

The benefits of this transformation include lower operational costs, improved compliance, faster approvals, and better supplier management. For any business aiming for financial excellence, partnering with experts like Rightpath GS ensures a smooth and effective Accounts Payable Transformation journey.

0 notes

Text

Level Up Your Finance Strategy with Outsourcing

Financial departments today are expected to do more than just manage books—they must drive strategy, ensure compliance, and support growth. One of the most effective ways to meet these expectations is through financial planning and analysis powered by clean, real-time financial data.

To build this foundation, businesses often begin by improving their core financial operations through accounts payable outsourcing. AP outsourcing streamlines invoice processing, automates approvals, and ensures timely vendor payments. This not only minimizes errors but also improves relationships with suppliers and enhances cash flow control.

Payables outsourcing provides standardization and visibility. By outsourcing repetitive and compliance-sensitive tasks, businesses reduce risks and free up internal resources to focus on high-level strategy.

But managing outflows is just one piece of the puzzle. Timely revenue collection is just as critical. That’s why companies also embrace accounts receivable outsourcing—a strategic move that ensures prompt invoicing, consistent follow-ups, and efficient dispute resolution.

When organizations outsource receivables, they benefit from expert teams that improve collection rates and reduce Days Sales Outstanding (DSO). This creates a stable revenue stream and strengthens working capital.

Together, outsourced AP and AR processes produce reliable data that fuels better financial planning and analysis. Your FP&A team can use this data to forecast cash flow, evaluate investments, manage budgets, and support executive decisions with precision.

Outsourcing also provides the scalability modern businesses need. As your company grows, your finance operations can scale without disruption—no additional headcount or infrastructure required.

Ultimately, outsourcing isn’t just about cost reduction—it’s about gaining a strategic edge. With accurate financial insights and efficient operations, your business will be well-equipped to adapt, compete, and grow in any market environment.

0 notes

Text

Improve AP with Rightpath Outsourcing

Introduction

In the dynamic world of business finance, managing payables efficiently is essential for maintaining a healthy cash flow. However, for many businesses, the accounts payable (AP) process becomes a time-consuming, error-prone task that drains resources. Enter accounts payable outsourcing—a strategic move that allows companies to reduce costs, improve accuracy, and focus on core operations.

This blog explores what accounts payable outsourcing entails, its key benefits, and why Rightpath is a trusted partner for finance transformation.

What is Accounts Payable Outsourcing?

Accounts payable outsourcing is the delegation of your AP functions—like invoice processing, vendor payments, compliance checks, and reporting—to a third-party service provider. Instead of handling everything internally, companies partner with specialized firms like Rightpath, who bring technology, expertise, and scalability to the table.

This approach is particularly beneficial for businesses dealing with high invoice volumes, international vendors, or limited finance staff.

Key Benefits of Accounts Payable Outsourcing

1. Cost Reduction

Maintaining an in-house AP team means recurring costs—salaries, training, technology, and infrastructure. Outsourcing transforms these into a predictable monthly service fee, significantly reducing operational expenses.

2. Improved Accuracy and Compliance

Outsourcing firms use automation tools and trained personnel to ensure accurate data entry, 2-way and 3-way invoice matching, and timely payments. Rightpath also ensures compliance with tax regulations, audit requirements, and data privacy laws.

3. Faster Invoice Processing

Manual AP processes can delay payments and damage vendor relationships. By automating invoice capture and approval workflows, Rightpath ensures faster processing and on-time payments—often within 24 to 48 hours.

4. Scalability

As your business grows, your AP workload increases. Outsourcing partners scale effortlessly with your business needs, managing seasonal spikes and global expansions without compromising service.

5. Real-Time Visibility

Outsourcing doesn’t mean losing control. With Rightpath, clients access real-time dashboards, automated reports, and detailed audit trails to monitor every transaction from invoice to payment.

Typical Accounts Payable Outsourcing Workflow

Invoice Capture: Invoices are scanned, emailed, or submitted through vendor portals.

Validation & Matching: Rightpath performs 2-way or 3-way matching with purchase orders and receipts.

Approval Routing: Invoices are routed to authorized personnel for approval based on predefined workflows.

Exception Handling: Discrepancies are flagged and resolved quickly.

Payment Processing: Vendors are paid via secure, automated methods.

Reporting & Analytics: Clients receive detailed reports for reconciliation and compliance.

Why Rightpath is a Trusted Accounts Payable Partner

✔ Domain Expertise

Rightpath has served clients across industries—manufacturing, retail, logistics, healthcare, and IT—offering customized AP solutions tailored to industry-specific challenges.

✔ Technology-Driven Approach

From OCR scanning to AI-powered approval workflows, Rightpath leverages the latest tools to eliminate errors and delays.

✔ Strong Vendor Management

We handle vendor communication, dispute resolution, and payment status updates, building stronger supplier relationships on your behalf.

✔ Data Security & Compliance

Our systems are ISO-certified, GDPR-compliant, and built with robust encryption protocols.

Case Study: Retail Chain Transformation

Client: Mid-size Indian retail company Problem: Overwhelmed finance team, late payments, invoice backlogs Solution: Rightpath introduced automated invoice capture, approval workflows, and centralized payment processing. Outcome:

Invoice processing time reduced by 60%

Late payments dropped to near zero

Finance team freed up for strategy and planning

Conclusion

Outsourcing your accounts payable is not just about cutting costs—it’s about unlocking efficiency, transparency, and growth. Whether you're a small enterprise or a large corporation, Rightpath's end-to-end AP outsourcing services ensure your payables process is fast, accurate, and fully optimized.

For more information visit: - https://rightpathgs.com/

0 notes

Text

Accounts Payable Outsourcing vs In-House: What Works Better?

In today’s competitive landscape, aligning outsourcing and procurement processes can drive major gains in efficiency and cost savings. One powerful way to do this is through accounts payable outsourcing.

AP outsourcing helps businesses handle vendor invoices, payment processing, and reconciliations with speed and accuracy. When paired with streamlined procurement, it creates an end-to-end system that improves vendor relations and financial control.

Top accounts payable outsourcing companies offer automation, error reduction, and real-time visibility into payables. They integrate seamlessly with procurement platforms, ensuring purchase orders and payments match perfectly—reducing disputes and delays.

Outsourcing both procurement tasks and AP functions frees your internal team to focus on vendor strategy, budgeting, and planning—while experts manage the execution.

For growing companies, this combination offers a smarter, scalable, and cost-effective solution to financial operations—built for long-term success.

0 notes

Text

Revolutionizing Manufacturing with Advanced Planning and Scheduling Software

In the fast-paced world of manufacturing, staying ahead requires more than just hard work—it demands smart planning. Advanced Planning and Scheduling (APS) software offers a transformative approach to production management.

Key Features:

Real-Time Scheduling: APS systems provide up-to-the-minute updates, allowing manufacturers to adapt swiftly to changes.

Finite Capacity Scheduling: Ensures that production plans align with actual resource availability, preventing overloading.

Scenario Planning: Facilitates the evaluation of different production scenarios to identify the most efficient path forward. planettogether.com

Benefits:

Enhanced Efficiency: Automates scheduling processes, reducing manual errors and optimizing resource utilization.

Improved Customer Satisfaction: Accurate scheduling leads to timely deliveries, fostering trust and loyalty.

Cost Reduction: Minimizes waste and lowers operational costs through optimized planning. investopedia.com

Implementing APS software is a strategic move towards a more efficient and responsive manufacturing operation.

Explore our Advanced Planning and Scheduling Software to streamline your manufacturing processes.

#production planning software#shop floor scheduling#supply chain optimization#ERP integration#real-time production control#manufacturing scheduling tools

0 notes

Text

Why Accounts Payable Outsourcing is a Game-Changer for Modern Businesses

In today’s rapidly evolving business landscape, companies are continually looking for ways to cut costs, boost efficiency, and focus on core competencies. One of the key areas where organizations are finding success is through accounts payable outsourcing.

Understanding Accounts Payable Outsourcing

Outsourcing the accounts payable (AP) function means handing over invoice processing, vendor management, and payment approvals to a third-party provider like Right Path Global Solutions, which specializes in managing finance and accounting workflows.

Benefits of Payables Outsourcing

Cost Efficiency: Reduces overhead, hiring, and technology costs associated with maintaining an in-house AP team.

Improved Accuracy: Expert teams use automated tools and validation processes to reduce invoice errors.

Faster Processing Time: Automated workflows and dedicated staff speed up invoice approvals and payments.

Fraud Reduction: Stringent internal controls and audit trails reduce the risk of duplicate or fraudulent payments.

Vendor Satisfaction: Timely payments and clear communication enhance supplier relationships.

Integration with Other Finance Functions

Companies that outsource AP often combine it with:

Accounts receivable outsourcing

Procurement outsourcing

General Ledger services

BPO accounting process

This leads to end-to-end finance and accounting outsourcing which enhances transparency, accuracy, and scalability.

Why Right Path?

Right Path Global Solutions offers tailored AP outsourcing solutions using secure cloud platforms, real-time dashboards, and AI-driven automation to optimize working capital management.

0 notes

Text

Revolutionizing Accounts Payable: How Data Analytics Drives Efficiency and Reduces Costs

In today’s fast-paced business environment, accounts payable (AP) is a crucial function in financial management.

For property managers, real estate companies, or businesses across industries, managing AP efficiently is essential for maintaining healthy cash flow, improving vendor relationships, and avoiding costly mistakes. However, many companies still rely on traditional manual processes, which can lead to inefficiencies and errors.

Enter data analytics: a powerful tool that can help optimize AP management by offering insights, reducing errors, and streamlining processes. Whether you manage AP in-house or outsource your AP services, embracing data analytics can transform the way you handle payments and financial tracking.

Why Data Analytics Matters in Accounts Payable Management

The role of data analytics in optimizing AP management cannot be overstated. By leveraging data analytics, property managers and financial teams can make better-informed decisions, track payments more effectively, and enhance operational efficiency. Here’s why data analytics is so vital for AP optimization:

1. Improved Payment Accuracy

Manual data entry is prone to human error, which can lead to duplicate payments, missed payments, or incorrect invoice processing. Data analytics helps to automate and verify invoice matching, ensuring that only accurate and legitimate invoices are processed for payment. This not only reduces errors but also saves valuable time for accounting teams.

2. Cost Reduction

Late payments or incorrect invoice processing can incur additional costs, such as late fees or penalties. By utilizing data analytics, businesses can track payment due dates, manage early payment discounts, and ensure payments are made on time. This helps to optimize cash flow and reduce unnecessary costs.

3. Better Cash Flow Management

With data-driven insights, businesses can gain visibility into outstanding invoices, upcoming payments, and cash reserves. By analyzing historical payment patterns and supplier preferences, property managers can make more informed decisions about when and how to pay, ensuring that they maintain a healthy cash flow and avoid cash shortages.

For those who outsource AP services, working with a partner that uses data analytics tools can significantly enhance cash flow management and AP efficiency.

Key Challenges in Accounts Payable and How Data Analytics Helps

Property managers and businesses that handle AP management face a range of challenges that can hinder their financial operations. These include invoice discrepancies, late payments, and lack of visibility. Here’s how data analytics addresses these challenges:

1. Identifying Payment Trends and Opportunities

Data analytics can help uncover trends in supplier payments and identify patterns such as missed early payment discounts or recurring payment delays. With this information, businesses can optimize their payment schedules and take advantage of discounts, thus reducing operational costs.

2. Improved Vendor Relationship Management

Data analytics also provides valuable insights into vendor performance, helping businesses identify which vendors offer the best terms and services. By analyzing payment histories, businesses can ensure that they build strong relationships with suppliers while maintaining timely and accurate payments.

3. Fraud Detection

One of the biggest risks in AP management is fraud. Data analytics allows businesses to spot unusual payment patterns, duplicate invoices, and discrepancies that could indicate fraudulent activity. By applying data analytics, businesses can safeguard against financial losses and ensure that all transactions are legitimate.

When you outsource AP services, leveraging data analytics helps detect and prevent fraud early, saving you from costly financial disruptions.

How Data Analytics Enhances Accounts Payable Management

Here are some specific ways data analytics can optimize your AP management:

1. Automation of Invoice Matching

Data analytics tools automate the matching of invoices to purchase orders and contracts, ensuring that only valid invoices are processed for payment. This reduces the risk of human error and ensures compliance with contracts, reducing disputes and rework.

2. Streamlined Payment Approvals

With data analytics, payment approval workflows can be optimized and automated. The system can flag high-priority payments and provide alerts when payment deadlines are approaching, ensuring that payments are made on time. This minimizes delays and avoids late fees.

3. Real-Time AP Reporting

Data analytics tools offer real-time reporting and insights into your accounts payable. Property managers can view detailed reports that track outstanding invoices, upcoming payments, and vendor performance. This visibility helps businesses manage their AP processes more efficiently and make data-driven decisions.

For businesses looking to outsource AP services, working with a provider who uses advanced data analytics ensures that you have access to real-time data, improving overall financial management.

4. Risk Mitigation and Compliance

Data analytics tools can also help businesses maintain compliance by monitoring payment histories and ensuring that the correct taxes and fees are applied to invoices. Analytics can detect any anomalies or discrepancies that could lead to compliance issues, enabling businesses to address them before they become significant problems.

Why Outsourcing AP Services with Data Analytics Makes Sense

When property managers or businesses outsource accounts payable services, choosing a provider that integrates data analytics into their AP processes is key to optimizing efficiency and reducing costs. Springbord, a trusted provider in outsourced AP services, leverages cutting-edge data analytics tools to offer:

Automated invoice matching and validation

Real-time payment tracking and reporting

Early payment discounts and cash flow optimization

Fraud detection and risk management

By partnering with Springbord, you gain access to a team that understands the intricacies of property accounting and is equipped with the best data analytics tools to streamline your AP processes, saving you time and money.

Conclusion: Unlock Efficiency with Data Analytics in Accounts Payable

Data analytics plays a crucial role in enhancing accounts payable management by providing actionable insights, reducing errors, and improving cash flow management. Whether you manage AP internally or outsource your AP services, utilizing data-driven solutions can optimize your processes and ensure that your payments are accurate and timely.

To learn more about how Springbord's outsourcing services can help you harness the power of data analytics for your accounts payable management, contact us today. Let us help you streamline your AP processes and improve your financial performance.

0 notes

Text

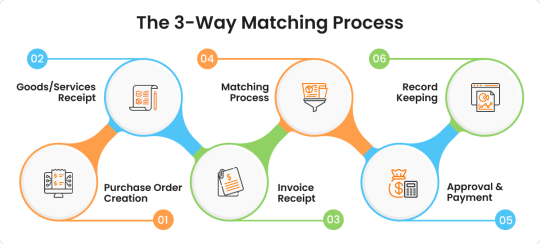

Understanding the 3-Way Matching Process in Accounts Payable: A Complete Guide

In the world of finance and procurement, accuracy and fraud prevention are non-negotiable. That’s where the 3-way matching process in accounts payable comes into play. It's a vital step that ensures your business only pays for what it has actually ordered and received. In this guide, we’ll explore what 3-way matching is, why it’s important, and how it can improve your accounts payable (AP) workflow.

What Is 3-Way Matching in Accounts Payable?

3-way matching is a verification process used by the accounts payable department to ensure that a purchase is legitimate and accurate before issuing payment. The process compares three critical documents:

Purchase Order (PO) – Details of the goods or services ordered.

Goods Receipt Note (GRN) – Confirmation of the goods received.

Supplier Invoice – The bill submitted by the supplier for payment.

When all three documents align—quantity, price, and product—the transaction is considered valid and ready for payment.

Why Is 3-Way Matching Important?

Implementing a 3-way matching system in accounts payable brings several benefits:

Fraud Prevention: Prevents unauthorized or duplicate payments.

Error Reduction: Identifies discrepancies between the invoice and received goods.

Cost Control: Ensures you’re not overpaying for items or paying for undelivered products.

Audit Readiness: Maintains clean records for compliance and internal audits.

How Does the 3-Way Matching Process Work?

Here’s a step-by-step breakdown of how 3-way matching typically works in an accounts payable workflow:

Purchase Order is Created A PO is generated and sent to the supplier, detailing the products, quantities, and agreed-upon prices.

Goods Are Received and Inspected The receiving department verifies and records the delivery. A Goods Receipt Note is created to confirm the items were received as ordered.

Supplier Invoice is Received The supplier sends an invoice, which is then forwarded to the AP department.

Matching Begins The AP team (or software system) compares all three documents. If quantities, prices, and item descriptions match, the invoice is approved for payment.

Exception Handling If discrepancies are found, the issue is flagged for review. It may involve reaching out to the supplier or procurement team for clarification.

Challenges in 3-Way Matching

While the 3-way matching process is effective, it’s not without its challenges:

Manual Data Entry: Increases the risk of errors and delays.

Time-Consuming: Matching documents manually can slow down the AP cycle.

Lack of Integration: Disconnected systems make it hard to track and compare data.

How Accounts Payable Software Can Help

Modern accounts payable automation software can streamline the 3-way matching process by:

Automatically pulling data from integrated systems.

Using AI and OCR to match documents in real-time.

Flagging discrepancies instantly for review.

Reducing human error and processing time.

Popular AP solutions also provide dashboards and reporting tools to help monitor and optimize your financial workflows.

youtube

Final Thoughts

The 3-way matching process in accounts payable is a critical internal control that ensures payment accuracy, reduces fraud, and improves vendor relationships. By understanding and implementing this practice—especially with the help of automation tools—your business can build a more secure and efficient procurement process.

If you're looking to streamline your AP operations, start by evaluating your current workflow and explore software options that support automated 3-way matching.

SITES WE SUPPORT

Skill Test Automation -

SOCIAL LINKS Facebook Twitter LinkedIn

1 note

·

View note

Text

Modernizing Finance: The Shift Toward Outsourced AP Services

As businesses strive to keep pace with the evolving financial landscape, accounts payable outsourcing has emerged as a powerful tool to streamline operations, enhance efficiency, and drive cost savings. With the increasing complexity of financial management, more companies are turning to outsourcing to stay competitive and future-proof their operations.

One of the driving factors behind the rise of AP automation is the need for faster and more accurate processes. Automation reduces manual errors, accelerates invoice approvals, and improves the overall efficiency of the accounts payable process. As businesses grow, automation ensures that AP tasks are scalable without sacrificing accuracy or speed.

Vendor payments management is another area where outsourcing shines. Companies can rely on specialized providers to ensure timely and accurate payments to vendors, minimizing the risk of disputes and strengthening supplier relationships. This reliability is crucial in an environment where businesses need to optimize their cash flow while maintaining strong partnerships.

Another reason accounts payable outsourcing is gaining popularity is its role in cost reduction. By eliminating the need to hire and maintain an in-house AP team, businesses can significantly reduce overhead costs. Outsourcing also allows companies to access advanced technologies and expertise without having to invest in expensive software or additional staff.

Furthermore, outsourced finance services offer scalability, which is essential for businesses planning to expand. As your business grows, outsourcing partners can quickly adapt to increased volumes, allowing you to focus on strategic initiatives rather than managing an expanding finance department.

In conclusion, accounts payable outsourcing is more than just a trend—it’s the future of finance. By embracing AP automation, improving vendor payments, reducing costs, and scaling with ease, companies are positioning themselves for long-term success.

#accounts payable outsourcing#digital finance transformation#AP trends#business outsourcing#future of work

0 notes

Text

AP transformation for multinational corporations

AP transformation is rapidly becoming a strategic priority for CFOs and finance leaders. As companies expand, legacy systems and fragmented workflows can create friction, leading to delays, errors, and missed opportunities. AP transformation is about more than automation—it's about end-to-end redesign of the accounts payable function to make it faster, smarter, and future-ready.

Rightpath approaches AP transformation through a structured, phased methodology. It begins with understanding the client's current-state processes, mapping out inefficiencies, and defining business objectives. They analyze invoice volumes, exception rates, vendor pain points, and integration gaps. This baseline becomes the foundation for a customized transformation plan.

Technology is central to success. Tools like OCR reduce manual entry, while RPA automates matching and approvals. Rightpath integrates these tools into clients’ ERP ecosystems to streamline processing, improve data accuracy, and accelerate payment cycles. AI-powered analytics bring additional value by forecasting cash requirements and identifying anomalies.

However, technology alone isn’t enough. AP transformation also involves organizational change—training staff, redefining roles, and introducing new governance models. Rightpath supports clients through this journey, ensuring change is well-managed and stakeholders are engaged.

Measuring the success of AP transformation is critical. Key metrics include DPO, invoice processing time, early payment discounts, and reduction in exceptions. Rightpath provides real-time dashboards for visibility, enabling finance teams to track progress and take corrective action.

AP transformation doesn’t just cut costs—it adds strategic value. It strengthens supplier relationships, enhances compliance, and supports working capital optimization. With an experienced partner like Rightpath, businesses can ensure their AP function evolves into a high-performing engine of financial efficiency.

In a world where agility and accuracy matter more than ever, AP transformation is no longer a luxury—it’s a business imperative.

0 notes

Text

The Benefits of Outsourcing Accounts Payable for Small Businesses

For many small businesses, managing accounts payable in-house can be a time-consuming and resource-intensive task. It involves handling invoices, verifying data, securing approvals, and ensuring timely payments—all of which demand accuracy and efficiency. As small business owners juggle multiple responsibilities, outsourcing accounts payable can offer a smart solution that enhances operational performance while reducing costs. This approach not only streamlines financial processes but also provides several strategic advantages.

Cost Savings and Efficiency

One of the most compelling reasons for outsourcing accounts payable is the potential for cost reduction. Hiring full-time staff to manage payables, along with investing in accounting software and office resources, can be expensive. Outsourcing eliminates the need for a dedicated AP department, lowering overhead costs and freeing up capital for core business activities. Service providers often operate with advanced technologies and optimized workflows, delivering greater efficiency at a lower price point than internal teams.

Access to Expertise and Technology

Outsourced AP providers specialize in financial processes and bring a high level of expertise to the table. These professionals are well-versed in industry best practices, regulatory compliance, and efficient invoice processing techniques. Additionally, they utilize sophisticated accounting platforms that small businesses may not be able to afford on their own. These tools offer features like automated invoice matching, duplicate detection, real-time reporting, and secure payment processing. Access to such resources enhances accuracy and minimizes the risk of errors or fraud.

Improved Cash Flow Management

Efficient accounts payable management contributes directly to better cash flow control. Outsourcing firms often provide detailed reports and analytics that give small businesses a clearer picture of their financial commitments. With timely payment scheduling and early payment discount tracking, business owners can make informed decisions about their working capital. This visibility ensures that the company avoids late payment penalties and maintains strong relationships with suppliers.

Scalability and Flexibility

As a small business grows, its financial needs evolve. Managing a growing volume of invoices can become overwhelming for an internal team. Outsourcing accounts payable allows businesses to scale their operations without the need to hire additional staff or invest in new infrastructure. Providers can easily accommodate increases in invoice volume and adjust services based on seasonal fluctuations or changes in business demands, offering a flexible and scalable solution.

Enhanced Compliance and Reduced Risk

Regulatory compliance is a critical aspect of accounts payable. Accounts payable outsourcing providers stay updated on tax regulations, reporting requirements, and data security standards. Their systems are designed to ensure that payments are made accurately, on time, and by legal guidelines. This reduces the risk of non-compliance, which can lead to fines or reputational damage. Furthermore, outsourcing partners often perform regular audits and implement fraud detection mechanisms to safeguard against financial mismanagement.

Conclusion

Outsourcing accounts payable offers small businesses a strategic way to improve efficiency, reduce costs, and access high-quality expertise and technology. It provides the flexibility to scale operations, the tools to enhance cash flow management and the assurance of regulatory compliance. By delegating this critical function to a reliable provider, small business owners can focus more on growth and innovation, confident that their financial processes are in capable hands.

0 notes

Text

Benefits of Outsourcing Accounts Payable

Introduction

As finance functions evolve, more businesses are turning to accounts payable outsourcing companies to enhance efficiency, ensure compliance, and gain better control over their finances. But with so many providers in the market, how do you choose the right partner? In this blog, we break down the key factors businesses must consider while selecting the best AP outsourcing firm—like Rightpath.

Understanding the Role of AP Outsourcing Companies

An accounts payable outsourcing company manages your invoice processing, vendor payments, exception handling, compliance checks, and reporting. Their main objective is to simplify complex AP workflows and reduce the administrative burden on your internal teams.

These companies offer services such as:

Invoice imaging and digitization

PO matching and exception handling

Vendor communication and query resolution

Payment processing (ACH, check, wire)

Monthly reporting and audit support

Checklist: What to Look for in an AP Outsourcing Partner

Proven Track Record and Industry Experience Choose a company with a demonstrated history of successful AP transformations. Look at their client base, years of operation, and case studies.

Technology Stack and Automation Capabilities The best companies leverage AI, OCR, machine learning, and workflow automation tools to reduce manual intervention and errors.

Security Standards Ensure the provider complies with international data protection laws (GDPR, SOC 2, ISO 27001) and uses encrypted environments for transactions.

Scalability The company should support your current volume and be able to scale up as your business grows or enters new markets.

Customizable Solutions Avoid one-size-fits-all approaches. Your AP needs should be matched with a tailored solution.

Integration Capabilities Seamless integration with your existing ERP systems like SAP, Oracle, QuickBooks, or NetSuite is a must.

Reporting and Transparency Look for partners that provide real-time analytics, dashboards, and audit trails to maintain full visibility and control.

Cost Transparency Ask for detailed pricing models—transaction-based, fixed-fee, or hybrid—and understand what is included.

Why Rightpath Stands Out Among AP Outsourcing Companies

100% Process Transparency Clients get access to every stage of invoice lifecycle through intuitive dashboards.

Domain Expertise With decades of experience across industries, Rightpath understands the unique AP challenges of each sector.

White-Glove Onboarding and Support We offer a dedicated transition team to ensure a smooth migration of your AP function.

Flexible Engagement Models From full-service AP outsourcing to specific support services, Rightpath lets you choose what you need.

Continuous Process Improvement We don’t just replicate your existing AP process—we optimize and improve it through data analysis and AI.

Client Success Story: A Case Study

Company: Mid-size Retail Chain in India Challenge: Overwhelmed by 30,000+ invoices/month, high error rate, delayed vendor payments Solution: Rightpath implemented an OCR-driven AP automation platform, trained their internal team, and set up a ticketing system for exceptions. Result:

75% faster invoice processing

40% reduction in overhead costs

0 missed payment deadlines in 6 months

Risks of Choosing the Wrong Provider

Poor data protection and security breaches

Lack of process ownership and accountability

Incompatibility with internal systems

Cost overruns due to unclear pricing

Frustrated vendors due to slow payments

Conclusion

Choosing the right accounts payable outsourcing company is a crucial decision that impacts your financial health and business reputation. Don’t settle for a vendor—partner with a firm like Rightpath, who becomes an extension of your team, committed to your success. With the right guidance and tools, we help you unlock efficiency, reduce costs, and build trust with your vendors.

For more information visit: - https://rightpathgs.com/

0 notes

Text

How AP Automation Improves Cash Flow Management

In today’s fast-paced business world, managing cash flow efficiently is crucial for the success and sustainability of a company. One of the most effective ways to improve cash flow management is through Accounts Payable (AP) automation. AP automation helps businesses streamline the process of managing and paying invoices, which can lead to significant improvements in cash flow control. This article explores how AP automation works and how it can positively impact your business’s cash flow.

What is AP Automation?

AP automation is the use of technology to automate the process of managing, processing, and paying supplier invoices. Traditional AP processes often involve manual work such as handling paper invoices, data entry, and sending checks for payment. This can be time-consuming and prone to errors. AP automation uses software tools to handle these tasks, making the process faster, more accurate, and more efficient.

1. Reducing Late Payments and Missed Discounts

One of the most immediate benefits of AP automation is the reduction in late payments. Manual invoice processing can lead to missed deadlines, which may result in late fees and strained supplier relationships. With automation, invoices are tracked and processed faster, ensuring that payments are made on time.

Furthermore, many suppliers offer early payment discounts as an incentive for businesses to pay sooner. If a company misses these early payment windows, it loses out on these valuable discounts. With AP automation, the system can automatically flag invoices that qualify for early payment discounts, ensuring that businesses take advantage of these opportunities and improve their cash flow.

2. Improved Visibility and Control

AP automation provides businesses with better visibility into their financial obligations. With a digital system, invoices are automatically recorded and categorized, making it easier to track due dates, payment status, and remaining liabilities. This level of visibility helps business owners and finance teams make informed decisions regarding cash flow management.

Moreover, AP automation allows companies to set up payment schedules and workflows that align with their cash flow needs. For example, businesses can prioritize payments to suppliers who offer favorable terms or hold off on payments until they have enough cash on hand to cover them. This increased control allows companies to better manage their available cash and avoid unnecessary financial stress.

3. Streamlined Workflow and Reduced Operational Costs

Traditional AP processes often involve multiple steps, including manual data entry, routing invoices for approval, and printing checks. Each of these tasks requires time and resources, and the longer the process takes, the harder it becomes to manage cash flow. AP automation streamlines these tasks by automating the workflow, which helps reduce operational costs.

With fewer manual processes in place, businesses can reduce the number of staff hours required for invoice processing. This frees up valuable time for employees to focus on other important tasks, such as business development and strategic planning. In turn, businesses can allocate their resources more efficiently and improve their overall financial health.

4. Minimizing Errors and Fraud

Manual data entry is prone to human error, and errors in AP processing can lead to costly mistakes. For instance, paying the wrong amount, paying the same invoice twice, or missing a payment altogether can all disrupt cash flow. AP automation reduces these risks by ensuring that data is captured accurately and processed consistently. The software can match invoices with purchase orders and receipts to verify the accuracy of amounts, reducing the chances of mistakes.

Additionally, AP automation helps protect businesses from fraud. With paper invoices, it’s easier for fraudsters to submit fake or duplicate invoices. AP automation provides added security features such as invoice approval workflows, which require multiple people to review and approve payments before they are made. This additional layer of security helps safeguard the company’s finances and ensures that funds are being allocated properly.

5. Better Financial Forecasting

A key aspect of effective cash flow management is having accurate financial forecasts. AP automation provides businesses with real-time data on outstanding invoices and payments. This allows companies to forecast their cash flow more accurately, as they can predict when payments are due and how much money they will need to pay.

By having better insights into their financial obligations, businesses can plan for future expenses, avoid shortfalls, and make strategic decisions about when to invest in growth opportunities or save for future needs. In essence, AP automation helps businesses gain better control over their finances, making it easier to predict and manage cash flow.

6. Enhancing Supplier Relationships

Managing supplier relationships is crucial for any business, and AP automation plays an important role in improving these relationships. Suppliers are more likely to continue working with businesses that pay on time and honor payment agreements. By automating AP processes, businesses can ensure that they pay suppliers promptly, which builds trust and fosters long-term partnerships.

Good supplier relationships also come with benefits such as more favorable payment terms, discounts, and priority access to products or services. By improving cash flow management through AP automation, businesses can strengthen their supplier relationships and enjoy these advantages.

Conclusion

In conclusion, AP automation offers numerous benefits that can significantly improve cash flow management. By automating the accounts payable process, businesses can reduce late payments, take advantage of early payment discounts, and gain better control and visibility over their financial obligations. Moreover, automation helps reduce errors, minimize fraud, and streamline operations, all of which contribute to better financial management.

As businesses continue to face economic uncertainty and increased competition, implementing AP automation can be a key factor in ensuring financial stability and growth. By improving cash flow management, businesses can not only meet their financial obligations but also position themselves for future success.

0 notes

Text

Unlocking Efficiency with Accounts Payable Automation: A Game-Changer for Your Business

In today’s fast-paced business world, efficiency and accuracy are paramount. As companies scale, managing financial transactions becomes increasingly complex, and manual processes often slow down operations. One key area where automation can have a significant impact is in Accounts Payable (AP). By embracing AP automation, businesses can streamline processes, reduce errors, save time, and enhance overall financial management. Here’s why AP automation is a game-changer for your business and how it can unlock new levels of productivity and financial control.

What is Accounts Payable Automation?

At its core, Accounts Payable automation is the use of technology to streamline and automate the process of managing a company’s outstanding bills and payments. The goal is to replace manual tasks—such as data entry, invoice approval, and payment processing—with automated workflows powered by software. AP automation helps businesses capture, process, and pay invoices with minimal human intervention, making the entire process faster, more accurate, and more transparent.

Top Benefits of Accounts Payable Automation

1. Time Savings and Increased Productivity

Manual AP processes can be time-consuming. Invoices have to be manually entered, checked for discrepancies, approved, and then processed for payment. With AP automation, these tasks are simplified and handled by the software, freeing up your finance team’s time to focus on more strategic activities. No more sifting through piles of paper invoices or chasing down approvals—everything is streamlined and efficient.

2. Cost Reduction

While it might seem like an upfront investment, AP automation pays off in the long run by reducing labor costs, minimizing errors, and preventing late payment fees. Automated systems allow for better invoice matching, reducing discrepancies and ensuring that you only pay for what you owe. Additionally, with fewer resources needed for manual tasks, businesses can reallocate funds toward more valuable initiatives.

3. Enhanced Accuracy and Reduced Errors

Manual data entry is prone to human error—whether it’s a typo, misread invoice, or missed approval. These small mistakes can lead to big financial problems, including overpayments, missed discounts, or damaged vendor relationships. AP automation drastically reduces the risk of these errors by using intelligent software to match invoices with purchase orders and contracts. This ensures that every payment is accurate, on time, and in full compliance.

4. Improved Visibility and Control

Automating accounts payable provides businesses with greater visibility into their financial operations. With real-time data and analytics, finance teams can quickly track the status of invoices, payments, and cash flow. Reports and dashboards offer insights into spending patterns, outstanding invoices, and upcoming payments, helping businesses make informed decisions and maintain better control over their financial situation.

5. Faster Payments and Stronger Vendor Relationships

Paying invoices on time is crucial for maintaining good relationships with your vendors. AP automation can help businesses stay on top of due dates and even take advantage of early payment discounts. With automated workflows, you can set reminders for upcoming payments and ensure that your company consistently pays on time, improving vendor trust and loyalty.

Scalability and Flexibility

As your business grows, so does the volume of invoices and payments. Manual AP processes can become increasingly burdensome and inefficient at scale. AP automation software can easily accommodate increased transaction volumes without the need for hiring additional staff or overburdening existing employees. Furthermore, automation platforms are highly customizable, allowing businesses to adjust workflows and processes as their needs evolve.

How AP Automation Works

The process of automating Accounts Payable is relatively straightforward. Here’s how it typically works:

Invoice Receipt: Invoices are captured through multiple channels, such as email, PDF files, or directly from suppliers through electronic data interchange (EDI).

Data Extraction: The automation software extracts relevant information from the invoice, such as the amount, due date, and vendor details, and inputs it into the system.

Approval Workflow: The software routes the invoice for approval based on pre-set rules. Managers can approve or reject invoices from their mobile devices, ensuring quick decision-making.

Payment Processing: Once approved, the payment is processed automatically, either by issuing a check, initiating a bank transfer, or even making electronic payments through a payment gateway.

Record Keeping: The system stores all invoice and payment details in a secure cloud repository, making it easy to track and retrieve data for future reference.

Overcoming Challenges with AP Automation

While the benefits are clear, the transition to AP automation can be challenging for some businesses. It’s important to consider factors such as integration with existing financial systems, employee training, and vendor adoption. However, most modern AP automation solutions are designed to integrate seamlessly with existing Enterprise Resource Planning (ERP) systems and accounting software, making the transition smoother.

To ensure success, businesses should carefully evaluate their needs, choose the right automation tools, and establish clear implementation timelines. Additionally, training staff on the new process and ensuring that vendors are onboard with digital invoicing are key steps to overcoming any challenges.

The Future of Accounts Payable Automation

As technology continues to advance, the future of AP automation looks even brighter. Artificial intelligence (AI) and machine learning (ML) are becoming more integrated into AP automation software, enabling systems to learn from past behavior and make even smarter decisions. For example, these technologies can predict payment dates, detect fraudulent invoices, and offer insights into optimizing cash flow management.

With the rise of cloud-based platforms and the increasing shift towards digital-first businesses, the adoption of AP automation is expected to grow exponentially, transforming the way businesses handle their financial operations.

Conclusion: Transform Your Accounts Payable Today

AP automation isn’t just about reducing paperwork—it’s about transforming the way your business manages its financial processes. By automating routine tasks, you can save time, reduce costs, improve accuracy, and gain greater control over your financial data. Whether you’re a small business looking to streamline operations or a large enterprise seeking scalability, accounts payable automation is a smart, strategic investment that can drive efficiency and growth.

Ready to take your accounts payable to the next level? Embrace automation today and unlock a more efficient, cost-effective, and error-free future for your business!

Original Source: accounts payable automation

0 notes

Text

The Hidden Risk CFOs Face by Ignoring AP and Procurement Integration

CFOs are always looking for ways to optimize business operations and enhance financial management. However, many overlook one of the most critical connections in their organizations—the relationship between Accounts Payable (AP) and Procurement. A lack of coordination between these two departments can lead to inefficiencies, financial errors, and ultimately higher operational costs. In this article, we’ll explore the consequences of ignoring the link between AP and Procurement and how businesses can benefit from greater alignment.

The Disconnect Between AP and Procurement

Accounts Payable is responsible for ensuring timely and accurate payments to vendors, while Procurement focuses on purchasing goods and services and managing vendor relationships. Ideally, these departments should work hand in hand, but often they operate independently. Without coordination, AP can face unexpected invoices, duplicate payments, and missed opportunities for discounts. Procurement, on the other hand, may not have visibility into payment trends or issues, leading to procurement inefficiencies.

Risks of Disjointed AP and Procurement Operations

When AP and Procurement are not aligned, several risks and challenges emerge:

Unpredictable Invoices: AP departments frequently receive invoices without prior approval or visibility into the purchase, leading to delays and confusion.

Error-Prone Processes: Manual reconciliation and data entry between AP and Procurement increase the risk of errors, such as duplicate payments or incorrect billing amounts.

Missed Cost Savings: A lack of alignment means AP cannot access procurement data that could help them negotiate better payment terms or early payment discounts.

Tense Vendor Relations: Late or incorrect payments, driven by process inefficiencies, can strain vendor relationships and lead to higher costs or service disruptions.

The Case for Integration

To avoid these challenges, CFOs must prioritize integrating AP and Procurement processes. An integrated approach delivers several key benefits:

Real-Time Spend Tracking: Both AP and Procurement teams can monitor spending and purchasing in real-time, preventing overspending and ensuring all purchases are approved.

Improved Accuracy: Automation reduces the need for manual intervention, reducing the chances of errors in payment processing and improving budget accuracy.

More Effective Spend Control: Integration allows CFOs to proactively manage expenses by gaining a full view of the procurement process, from requisition to payment.

Faster, More Efficient Workflows: With streamlined processes and reduced manual work, both teams can focus on more strategic tasks rather than spending time reconciling discrepancies.

The Role of Procure-to-Pay (P2P) Systems

Implementing Procure-to-Pay (P2P) software is one of the most effective ways to align AP and Procurement. P2P systems connect the entire procurement process, from requisition to payment, into a single, unified platform.

Benefits of P2P Software:

Centralized Spending: P2P systems offer a consolidated view of company spending, which allows for better management of budgets and vendor relationships.

Error Reduction: P2P software automates the matching of purchase orders, receipts, and invoices, significantly reducing the potential for mismatched or erroneous payments.

Better Compliance: The software maintains a transparent audit trail, ensuring compliance with internal policies and external regulations.

Stronger Vendor Partnerships: By ensuring timely payments and offering more flexible payment terms, P2P systems help strengthen relationships with suppliers.

Steps to Achieving Successful AP and Procurement Integration

For a successful integration, CFOs can adopt several strategies:

Choose the Right P2P Solution: Invest in comprehensive P2P software that connects AP and Procurement seamlessly.

Promote Cross-Department Collaboration: Encourage AP and Procurement teams to communicate regularly and collaborate on training and process development.

Clarify Roles and Processes: Develop clear workflows and define responsibilities at each stage of the procurement cycle to avoid confusion and delays.

Harness Data Insights: Utilize analytics tools to monitor spending, track vendor performance, and identify areas for potential savings.

Track Key Metrics: Regularly monitor KPIs to measure the success of integration and identify areas for continuous improvement.

Conclusion

Ignoring the connection between AP and Procurement can result in inefficiencies, missed savings, and strained relationships. By integrating these functions and adopting tools like P2P software, CFOs can streamline operations, enhance financial control, and foster stronger supplier partnerships. In today’s competitive business environment, this integration is not just an advantage—it’s a necessity for organizations looking to thrive.

Let SpendEdge Guide Your Integration Process

SpendEdge specializes in helping businesses streamline procurement and AP processes. Our tailored solutions help organizations achieve better control over spending, enhance vendor relationships, and reduce costs. Contact SpendEdge today to begin your journey toward seamless AP and Procurement integration.

Click here to talk to our experts

0 notes