#exponential moving average in zerodha

Explore tagged Tumblr posts

Text

Exponential Moving Average Formula Made Easy

Exponential Moving Average Formula: The Simplest Guide for Everyone

Introduction

Ever tried spotting patterns in the stock market? It’s kind of like watching waves at the beach — some are small and quick, others are long and powerful. Traders use something called the Exponential Moving Average (EMA) to track those waves. Whether you’re just curious or diving into algo software or evaluating algorithmic trading software price, understanding EMA can be your golden key. Don’t worry if you’re not a math genius — we’ll break it down in plain, human-friendly language.

Learn exponential moving average in simple terms. Discover its role in algo software, automated trading software & algorithmic trading software price.

What is an Exponential Moving Average (EMA)?

EMA is a type of moving average that gives more weight to recent prices. Think of it as a way to track the most current trend of a stock, currency, or any traded asset. Unlike a Simple Moving Average (SMA), which treats all data points equally, EMA pays more attention to what's happening right now.

Why Do Traders Use EMA?

Traders love EMA because it reacts faster to price changes. Imagine driving a car — SMA is like checking your average speed over a whole trip, while EMA is checking your current speed. Which one would you trust to avoid speeding? Yep, the EMA!

Faster signals for entry and exit

Better trend detection

Helps in algo software for real-time strategies

EMA vs. Simple Moving Average (SMA)

Feature

EMA

SMA

Sensitivity

More sensitive to recent data

Less sensitive

Reactiveness

Quick to respond

Slower response

Usage

Active traders, algo systems

Long-term analysis

Key Takeaway: Use EMA if you want a nimble, quick-response indicator.

The Exponential Moving Average Formula

Let’s get to the formula — but don't panic. It’s easier than it looks:

EMA = [Close - EMA(previous day)] × Multiplier + EMA(previous day)

Where:

Multiplier = 2 ÷ (N + 1)

N = Number of days (e.g., 10-day EMA)

So, for a 10-day EMA:

Multiplier = 2 ÷ (10 + 1) = 0.1818

EMA Calculation: Step-by-Step Example

Let’s say you want to calculate the 10-day EMA of a stock. Here’s how:

Start with a 10-day SMA as your first EMA.

Use the formula with each new day’s closing price.

Apply the multiplier to adjust the weighting.

Example:

Day 11 Close = ₹102

Day 10 EMA = ₹100

Multiplier = 0.1818

EMA = (102 - 100) × 0.1818 + 100 = ₹100.36

Each new day's EMA uses the previous day's EMA. Like a rolling snowball, it keeps growing and adapting.

How EMA Reacts to Market Movements

When the market moves suddenly:

EMA adjusts faster than SMA.

It captures short-term reversals, helping traders avoid late entries.

It's a favorite for automated trading software, as it helps systems "feel" the market.

EMA Settings: 9, 12, 26, 50, or 200?

You’ve probably seen these numbers thrown around. Here’s what they mean:

9-day/12-day EMA: For quick trades or short-term scalping.

26-day EMA: Good for mid-range trend spotting.

50-day EMA: Balances short and long-term signals.

200-day EMA: Trusted for big-picture decisions.

Tip: Use shorter EMAs for fast trades and longer ones for investment decisions.

EMA in Algo Software and Automated Systems

Modern algo software relies heavily on indicators like EMA. Why?

Real-time adaptability: EMA updates with every tick.

Fast execution: Algorithms don’t wait — they act.

Data-driven logic: EMA helps remove emotion from decisions.

If you’re looking into automated trading software, check if it allows customizable EMA inputs.

How EMA Influences Automated Trading Software

EMA isn’t just a pretty chart line — it’s an action trigger.

Here’s how it works:

When the short EMA crosses above a long EMA, the system buys (bullish signal).

When it crosses below, it sells (bearish signal).

This crossover technique is built into many algorithmic trading software platforms.

Key Insight: The algorithmic trading software price often depends on features like advanced EMA handling, backtesting, and custom triggers.

Real-Life Analogy: EMA as a Memory Filter

Imagine your brain could remember only the most recent and relevant things — like forgetting old passwords but remembering your latest one. That’s EMA!

SMA = Like your memory of every past phone number. EMA = Like your speed dial — focused and current.

This analogy helps understand why traders love it: it keeps focus on what's important now.

EMA in Day Trading vs. Long-Term Investing

Day Traders: Use 5 to 20-period EMAs for scalping and intraday strategies.

Swing Traders: Prefer 20 to 50-period EMAs.

Investors: Trust the 100 or 200-day EMA for spotting market phases.

Best Practice: Match your EMA settings to your trading time frame.

Common Mistakes with EMA

Even a great tool like EMA can be misused:

Relying solely on EMA without other indicators

Over-optimizing (changing settings too often)

Ignoring market context — EMA is a guide, not gospel

Pro Tip: Combine EMA with volume and price action for smarter decisions.

EMA + Other Indicators: A Smart Combo

EMA works best when paired with:

MACD (Moving Average Convergence Divergence)

RSI (Relative Strength Index)

Bollinger Bands

These combinations make your algo software smarter and more precise.

Choosing the Right Algorithmic Trading Tool

When picking automated trading software, look for:

EMA customization

Backtesting with EMA strategies

Real-time charting

User-friendly interface

Reasonable algorithmic trading software price

Some platforms even let you set triggers based on EMA crossovers.

Final Thoughts and Tips

EMA isn’t just for pros. It’s a beginner-friendly tool that becomes more powerful the more you use it. Whether you're trying to manually trade or automate your strategy through algo software, EMA is your friend.

Learn the basics

Practice with paper trading

Test with EMA settings

Integrate with automated systems

Trading without EMA is like driving without rearview mirrors — you can do it, but why take the risk?

Conclusion

The Exponential Moving Average formula might sound technical, but at its heart, it’s just a smart way to follow trends and make better trading decisions. Whether you're exploring automated trading software, analyzing algorithmic trading software price, or just want to dip your toes into the markets, EMA is an essential tool that makes complex markets easier to understand.

Remember, it’s not about predicting the future — it’s about following the trend with eyes wide open.

Frequently Asked Questions (FAQs)

1. What is the difference between EMA and SMA? EMA gives more weight to recent prices, making it faster and more responsive than SMA, which treats all data points equally.

2. Is EMA suitable for beginner traders? Yes, EMA is great for beginners because it’s easy to understand and very effective in spotting trends.

3. Can I use EMA in automated trading software? Absolutely! Most modern algo software uses EMA as a key signal for entries and exits.

4. What is a good algorithmic trading software price to expect? Prices vary from free to ₹50,000+ depending on features like real-time data, EMA customization, and automation capabilities.

5. Which EMA settings work best? It depends on your style — short EMAs (9, 12) for quick trades, long EMAs (50, 200) for long-term investing.

#exponential moving average formula#exponential moving average#exponential moving average in zerodha#ema formula

0 notes

Text

📉 Complete Guide to VWAP: How Smart Traders Use This Powerful Indicator

If you've been trading without VWAP, you're probably missing what many institutions use to execute billion-dollar trades. Whether you're an intraday scalper in the Indian markets or a swing trader in the U.S., Volume Weighted Average Price (VWAP) is a game-changer. And this isn’t just theory—it’s backed by real market action.

Let’s break it all down in a clear, clean, and practical guide you can actually use.

🧠 What Exactly is VWAP and Why Smart Money Watches It Closely

VWAP stands for Volume Weighted Average Price. It’s not just a moving average—it’s a price point that reflects the average price a stock has traded at, weighted by volume.

📍 Think of it this way: VWAP answers the question, “At what price did most trading actually happen?” Unlike a Simple Moving Average (SMA) or Exponential Moving Average (EMA), VWAP takes volume into account, which adds depth and accuracy.

In Indian markets like NSE and BSE, institutional desks rely on VWAP to determine if they are buying below or above the market’s average cost. For example, if HDFC Bank is trading above its VWAP on high volume, institutions might hold off on fresh buying.

⚙️ How VWAP Really Works – Without the Math Overload

Don’t worry—here’s the formula in plain English:

🔸 VWAP = (Cumulative Price × Volume) ÷ Cumulative Volume

Every candle during the day (on a 1-min, 5-min chart, etc.) is considered. This means VWAP resets every trading day—that’s why it’s great for intraday analysis.

💡 Example: In a 5-minute chart of Infosys, if the stock rallies above VWAP on increasing volume, traders often see that as confirmation of strength. VWAP acts like a magnet for price. Price may move away from it, but often reverts to it during the session.

🔍 VWAP vs EMA and SMA – What’s the Real Edge?

Here’s where most retail traders go wrong—they treat VWAP like just another moving average. Big mistake.

🔸 SMA and EMA: Lagging indicators based on closing prices 🔸 VWAP: Intraday real-time price benchmark based on volume

📈 In 2023, a study by Zerodha Varsity showed that using VWAP in combination with RSI improved win rates in intraday setups by up to 17% compared to using moving averages alone.

🚀 VWAP doesn’t just follow price—it reflects how important price levels are. A breakout above VWAP on Nifty 50 with strong volume? That’s something even FIIs (Foreign Institutional Investors) will notice.

🎯 Proven VWAP Strategies That Work in Indian Intraday Trading

Ready to get tactical? Let’s use real market examples from Strike Money, a powerful Indian charting tool that supports dynamic VWAP overlays.

👉 VWAP Reversion: Used by scalpers trading Bank Nifty Futures. When price spikes far above VWAP with low volume, it often pulls back to VWAP. This fade strategy works well during sideways sessions.

👉 VWAP Breakout: During high-impact news days (like RBI rate decisions), Reliance Industries may consolidate under VWAP. A breakout above VWAP with volume = momentum ignition.

👉 VWAP Bounce: Price retracing to VWAP and bouncing is seen as confirmation of intraday trend. For example, when ICICI Bank dropped post-earnings but bounced cleanly from VWAP, it signaled strong demand.

📊 Platforms like Strike Money now allow you to combine VWAP with Anchored VWAP, making these setups even more powerful.

💼 Why Institutions and Algo Traders Rely on VWAP

This isn’t just a retail tool. VWAP is a benchmark execution metric for mutual funds, hedge funds, and prop desks.

🚨 For instance, when an institution wants to buy ₹500 crores worth of Tata Motors, they aim to do it around the day’s VWAP to avoid market impact. If they buy too high, they risk moving the price unfavorably against them.

In fact, Paul Tudor Jones famously noted that “Price means nothing without volume.” VWAP embodies this principle.

📉 Research published by CFA Institute confirms that VWAP execution reduces slippage and maintains price neutrality for large trades.

📌 Anchored VWAP vs Standard VWAP – When to Use Which

While standard VWAP resets daily, Anchored VWAP lets you select a specific starting point—a gap up, earnings, or even a trend reversal.

🔍 For example, anchoring VWAP from the March 2020 COVID bottom on Nifty gives you an institutional support zone that’s still respected today. This insight can’t be replicated with a regular VWAP.

🎯 Many pro traders use Anchored VWAP from breakout candles or budget day candles on stocks like Adani Ports, allowing smarter entries and exits.

🚀 Tools like Strike Money let you anchor VWAP with a single click—giving you an edge without needing custom code.

🖥️ How to Add VWAP in Strike Money, TradingView & MetaTrader

Adding VWAP is quick, but powerful:

💡 In Strike Money: Just search “VWAP” in the indicators menu. Enable “VWAP” and also try “Anchored VWAP” from the options panel.

💡 In TradingView: Use built-in VWAP from the indicators list. For Anchored VWAP, look up “anchored VWAP by @LazyBear” or similar.

Whether you're charting TCS, Infosys, or even Midcap stocks, VWAP helps you see real activity, not just price noise.

🚫 Top VWAP Mistakes That Kill Profits

Let’s clear out the common traps:

❌ Using VWAP blindly as support/resistance VWAP can act as support/resistance, but only when confirmed by volume.

❌ Holding positions when price is far from VWAP The farther price drifts from VWAP without volume, the higher the odds of mean reversion. Don’t get trapped.

❌ Ignoring time of day VWAP works best after the first 30 minutes of the session, when volatility stabilizes. Early signals can be fakeouts.

In the Indian context, avoid initiating VWAP trades during pre-RBI event days, where volume is unusually skewed.

📈 Real VWAP Case Study: Winning Setup on Axis Bank

📅 Date: Feb 1, 2024 (Union Budget Day) 🧠 Setup: Axis Bank gaps up 2.5% but opens below VWAP 📊 Action: Consolidates for 20 mins, breaks above VWAP on 3X volume ✅ Result: Rallies 4.2% intraday

This move was flagged early on Strike Money charts using a VWAP + Anchored VWAP setup from the previous earnings day. That’s how smart traders ride momentum with conviction.

🧐 Is VWAP Right For You? Here’s the Bottom Line

If you're an intraday trader, VWAP is almost non-negotiable. It gives you a volume-confirmed price benchmark that’s impossible to ignore.

If you’re a swing trader, Anchored VWAP helps define long-term support and resistance, way more effectively than just trendlines.

And if you’re an investor, VWAP can help you time entries that match institutional behavior—giving you better risk-adjusted returns.

🚀 Platforms like Strike Money now integrate VWAP, Anchored VWAP, and real-time volume overlays—making it easier than ever to trade like the pros.

✅ Final Thoughts: Trade Smarter with VWAP in Your Toolkit

VWAP is more than just a line—it’s a price truth serum. It shows where real volume met real price. Whether you’re trading Reliance, HDFC, or the Nifty 50, mastering VWAP gives you a serious edge.

Add it to your chart. Start using it today. Because while others chase noise, you’ll be trading where the smart money already is.

Want a VWAP trading checklist or a pre-built VWAP layout for Strike Money? Let me know—I’ll hook you up with a custom trading tool guide 🔥

0 notes

Text

The Complete Guide to Swing Trading: Strategies, Indicators & Pro Tips

Swing trading is one of the most popular trading styles for retail traders in India. Unlike day trading, which requires constant monitoring of charts, swing trading allows traders to hold positions for a few days to weeks, making it ideal for working professionals.

This guide covers everything you need to know about swing trading, including strategies, technical indicators, risk management, and real-world examples from the Indian stock market.

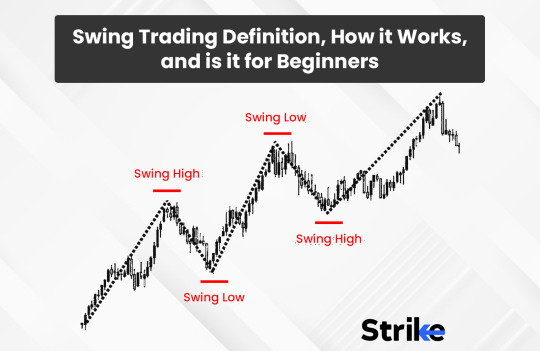

What is Swing Trading & How Does It Work?

Definition of Swing Trading

Swing trading is a short-to-medium-term trading strategy where traders capture price swings in stocks, forex, or crypto. The goal is to buy at support levels and sell at resistance.

How Swing Trading Differs from Other Styles

Best Markets for Swing Trading in India

Stocks: Nifty 50, Bank Nifty, Midcap stocks

Futures & Options (F&O): NSE derivatives

Forex: INR/USD, INR/EUR pairs

Cryptocurrency: Bitcoin, Ethereum on WazirX

How to Get Started with Swing Trading

1. Choosing the Right Brokerage & Charting Tools

To execute swing trades effectively, you need a good brokerage platform and charting tool like:

Strike.money – Advanced charting with indicators

Zerodha Kite – Best for low brokerage fees

Upstox Pro – Fast execution for swing trades

2. Selecting the Right Stocks for Swing Trading

Characteristics of Good Swing Trading Stocks

✅ High trading volume (liquidity) ✅ Clear price trends (uptrend/downtrend) ✅ Volatility for strong price movements

Example: Swing Trade in Reliance Industries

Entry: ₹2,400 (bounce from support)

Exit: ₹2,600 (near resistance)

Profit: ₹200 per share in 7 days

3. Setting Up Your Trading Account

Open a Demat & trading account with a discount broker

Ensure access to technical analysis tools

Learn to use stop-loss & take-profit orders

Best Swing Trading Indicators & Chart Patterns

1. Moving Averages (SMA & EMA)

Moving averages smooth out price action to identify trends.

Simple Moving Average (SMA) – Good for long-term trends

Exponential Moving Average (EMA) – Reacts faster to price changes

📌 Example: Using EMA for Swing Trading in HDFC Bank

50-day EMA as support → Buy at ₹1,500

Price bounces up → Sell at ₹1,650

2. Relative Strength Index (RSI) – Identifying Overbought/Oversold Levels

RSI above 70 → Stock is overbought (sell signal)

RSI below 30 → Stock is oversold (buy signal)

📌 Example: Swing Trade in TCS using RSI

RSI drops to 28 → Buy at ₹3,000

RSI reaches 65 → Sell at ₹3,250

3. Bollinger Bands – Volatility Indicator

Stock touches lower band → Buy signal

Stock touches upper band → Sell signal

📌 Example: Using Bollinger Bands for Swing Trading in Infosys

Stock hits lower band at ₹1,400 → Buy

Price moves to ₹1,550 (upper band) → Sell

4. Fibonacci Retracement – Identifying Support & Resistance

Common Fibonacci levels: 38.2%, 50%, 61.8% 📌 Example: Swing Trading SBI

Stock retraces 50% of previous uptrend → Buy opportunity

5. Volume Indicators – Confirmation of Trend Strength

High volume on breakout → Strong trend

Low volume on breakout → Weak trend

Top Swing Trading Strategies That Work

1. Trend Following Strategy

Buy stocks in an uptrend (higher highs, higher lows)

Sell when trend reverses

📌 Example: Titan Swing Trade

Uptrend confirmed above 200-day EMA → Buy at ₹2,500

Sell near resistance at ₹2,800

2. Breakout Trading Strategy

Enter when stock breaks above resistance

Use volume confirmation for stronger breakouts

📌 Example: Breakout in Bank Nifty

Resistance: 44,000

Breakout above 44,000 with high volume → Buy

Target: 45,500

3. Mean Reversion Strategy

Buy when the stock drops to support levels

Sell when it reverts to the mean

📌 Example: Mean Reversion in Bajaj Finance

Falls to ₹6,800 (support) → Buy

Rebounds to ₹7,200 (resistance) → Sell

Risk Management: How to Minimize Losses in Swing Trading

1. Use Stop-Loss Orders

Swing trading rule: Risk 1-2% of capital per trade

Example:

Entry: ₹1,500

Stop-loss: ₹1,450 (3% risk)

2. Risk-Reward Ratio (RRR)

Ideal RRR: 1:2 or 1:3

If risking ₹500, aim for ₹1,000 profit

3. Avoid Common Swing Trading Mistakes

🚫 Overtrading – Taking too many trades at once 🚫 Ignoring stop-loss – Leads to heavy losses 🚫 Trading without a plan – No clear entry/exit

Swing Trading Psychology: Mastering the Trader’s Mindset

1. Controlling Emotions in Trading

Avoid fear & greed

Stick to predefined strategies

2. Handling Losses Like a Pro

Accept small losses → Part of trading

Don't revenge trade → Leads to emotional decisions

3. Developing Patience & Discipline

Follow your trading plan

Avoid impulsive entries

Best Markets & Stocks for Swing Trading in India (2024)

1. Best Stocks for Swing Trading

✔ Reliance Industries ✔ TCS ✔ Infosys ✔ HDFC Bank ✔ SBI

2. Most Volatile Stocks for Quick Gains

✔ Adani Enterprises ✔ Tata Motors ✔ DLF ✔ JSW Steel

3. Best Sectors for Swing Trading

✔ Banking: High liquidity, volatility ✔ IT: Strong momentum trends ✔ Pharma: Defensive plays

Swing Trading Case Studies: Real-Life Examples

📌 Case Study: Swing Trade in Tata Steel

Entry: ₹125 (support)

Exit: ₹145 (resistance)

Profit: ₹20 per share in 5 days

📌 Case Study: Bank Nifty Swing Trade

Breakout: 44,500 level

Exit: 45,500 level

Profit: 1,000 points in 3 days

FAQs About Swing Trading

✅ How much capital do I need for swing trading? Start with ₹50,000 - ₹1,00,000 for stocks, ₹2-5 Lakhs for F&O.

✅ Can swing trading be profitable? Yes, with proper risk management & strategy.

✅ What time frame is best for swing trading? 1-hour & daily charts work best for swing traders.

Final Thoughts: Is Swing Trading Right for You?

Swing trading is ideal for traders who: ✔ Want short-term profits without daily screen time ✔ Have patience to hold trades for a few days ✔ Follow risk management & strategies

🚀 Ready to start swing trading? Use Strike.money for powerful charting & trade analysis!

0 notes