#finllect

Explore tagged Tumblr posts

Photo

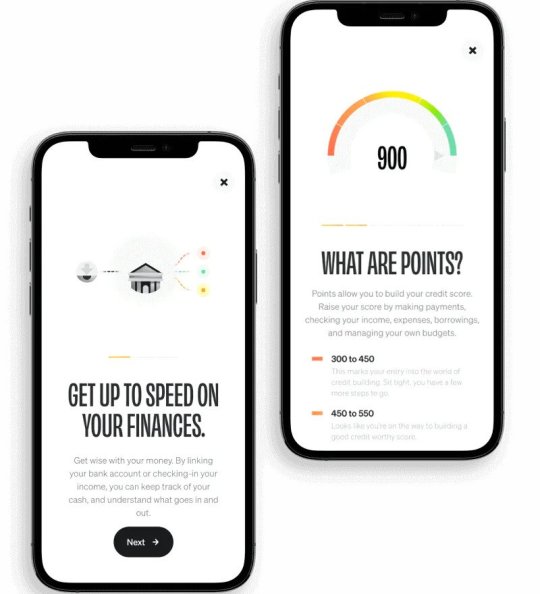

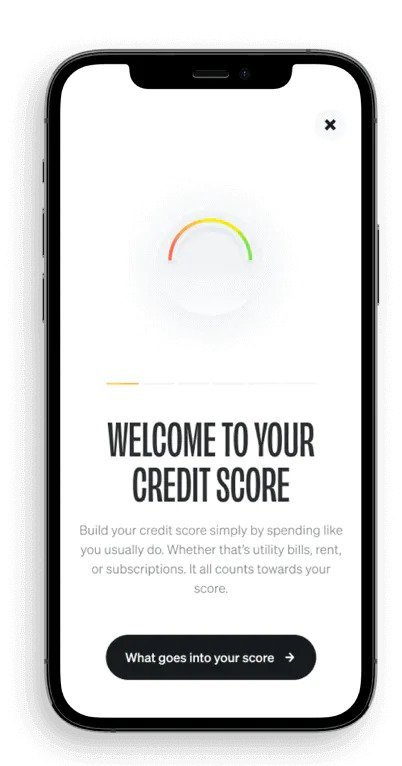

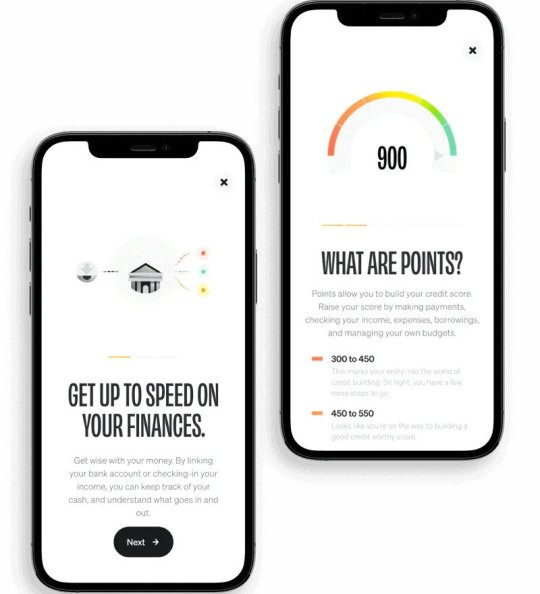

Finllect is the choice of the next-generation to build a credit score and prequalify for credit. Finllect enables thin file or no file consumers to build credit using recurring micro-payments and their ability to meet budgets.

0 notes

Video

tumblr

Build your credit score, prequalify for financial services, automate your finances, and raise your finance game, all on one app. Download from Play Store and App Store now!

1 note

·

View note

Text

Finllect launches the first alternate credit score for the credit invisible in the MENA region

Finllect launches the first alternate credit score for the credit invisible in the MENA region

Finllect has kickstarted a credit revolution that enables thin credit or no credit consumers to build a credit score through open banking and unlock better access to credit by owning their payments. Building credit has never been straightforward or easy. Good credit scores are a gatekeeper to “get in” on all major financial opportunities – whether it’s a car, home, education, or monthly credit…

View On WordPress

0 notes

Link

Finllect is an application for consumers who are new to financial services or do not have a pre-existing credit history to build credit, prequalify for financial services, and automate their finances. Instead of analysing income, credit history, or credit utilisation, Finllect enables thin file or no file consumers to build credit using recurring micro-payments and their ability to meet budgets.

0 notes

Link

Finllect is an application for consumers who are new to financial services or do not have a pre-existing credit history to build credit, prequalify for financial services, and automate their finances. Instead of analysing income, credit history, or credit utilisation,

0 notes

Link

Finllect enables thin file or no file consumers to build credit using recurring micro-payments and their ability to meet budgets.

0 notes

Link

Finllect has kickstarted a credit revolution that enables thin credit or no credit consumers to build a credit score through open banking and unlock better access to credit by owning their payments.

0 notes