#instantpay API Integration

Explore tagged Tumblr posts

Text

InstantPay API Integration by Infinity Webinfo Pvt Ltd

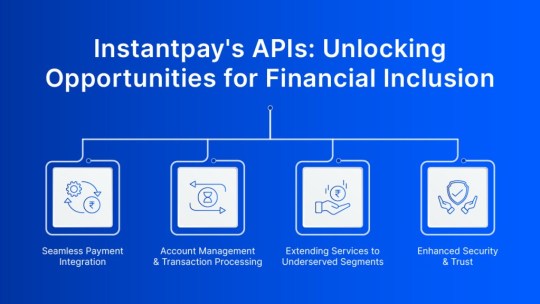

In the ever-evolving digital payment landscape, InstantPay has emerged as one of the most robust platforms for handling financial transactions. By offering a comprehensive API suite, businesses can now process payments with enhanced speed, security, and flexibility. Infinity Webinfo Pvt Ltd, a trusted name in IT solutions, takes this service to the next level with expert API Integration, ensuring a seamless experience for businesses.

Instantpay API Integration by Infinity Webinfo Pvt Ltd

What is API Integration?

API Integration involves connecting software applications through their APIs (Application Programming Interfaces). It allows different systems to communicate, share data, and function together effectively. For example, a business can integrate a payment gateway like InstantPay into their website or app, providing users with an embedded, real-time payment solution.

API Integration offers several benefits:

Automated processes: Reduces manual intervention and improves efficiency.

Real-time data sharing: Ensures smooth communication between systems.

Scalability: Facilitates increased transaction volumes without manual adjustments.

Customization: Tailored to specific business needs, providing a flexible solution.

InstantPay Overview

InstantPay is a digital financial platform that enables businesses and individuals to perform a wide range of financial services, including bill payments, money transfers, and more. It is widely known for its Business Payment Solutions and is often used as a secure way to handle transactions like salary disbursements, utility payments, and vendor payouts.

Key Features of InstantPay:

Multiple Payment Methods: InstantPay supports various payment modes including:

UPI (Unified Payments Interface): One of the most popular payment methods in India.

IMPS (Immediate Payment Service): Ensures that payments are processed instantly.

NEFT/RTGS: Bank transfer methods for larger transactions.

Debit/Credit Cards: Supporting payments through all major cards.

Instant Payouts: The InstantPay API provides the ability for businesses to transfer funds instantly to a beneficiary’s bank account, wallet, or UPI ID. This is especially useful for salary payments, refunds, and vendor payouts.

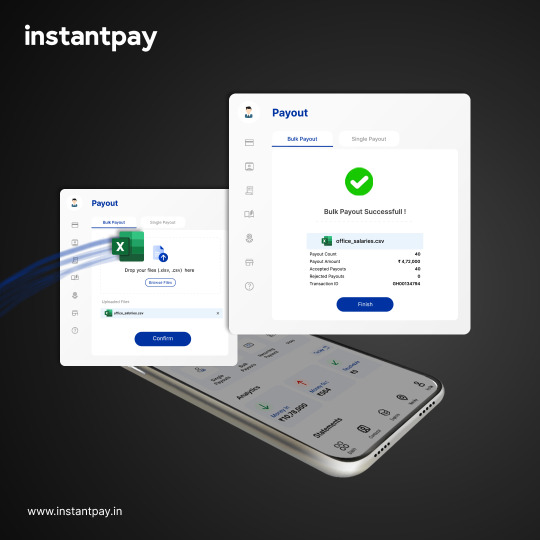

Bulk Payment Processing: Businesses often need to process multiple transactions at once. InstantPay’s bulk payment feature makes it easy to send payments to thousands of recipients in a single go.

Comprehensive Transaction Reports: The platform offers detailed insights into transactions, ensuring businesses can monitor and track payments efficiently.

Security: InstantPay is designed with multiple layers of security to protect against fraud and unauthorized transactions. Features include:

Data Encryption: Ensures all payment information is secure.

Multi-factor Authentication (MFA): Adds an extra layer of security for sensitive operations.

Tokenization: Protects card information during processing.

Compliance with Financial Regulations: InstantPay adheres to the highest compliance standards set by financial regulators like the Reserve Bank of India (RBI), ensuring all transactions meet regulatory guidelines.

Infinity Webinfo Pvt Ltd: The API Integration Experts

With an ever-growing demand for digital payments, businesses must integrate platforms like InstantPay effectively into their existing systems. This is where Infinity Webinfo Pvt Ltd excels. With years of experience in API Integration, Infinity Webinfo Pvt Ltd ensures that your business can leverage all the features of the InstantPay API smoothly.

Benefits of API Integration by Infinity Webinfo Pvt Ltd:

Custom Development: Infinity Webinfo Pvt Ltd customizes the InstantPay API integration to meet the specific needs of your business, whether it's integrating with e-commerce platforms, mobile apps, or ERP systems.

Streamlined Onboarding: Setting up InstantPay through Infinity Webinfo Pvt Ltd is quick and hassle-free. They handle everything from obtaining API keys to configuring the system, ensuring you’re ready to process payments immediately.

Technical Support & Maintenance: Post-integration, Infinity Webinfo Pvt Ltd provides ongoing technical support to ensure the system runs smoothly. Any issues are resolved quickly, and updates or patches are applied to keep the system secure and functional.

Enhanced Security: API integration through Infinity Webinfo Pvt Ltd comes with added security layers, including encryption and tokenization, ensuring that every transaction is secure.

Testing & Quality Assurance: Before the integration is rolled out, Infinity Webinfo Pvt Ltd runs rigorous tests to ensure the system works as expected. They identify any bugs or issues and ensure everything is operating at peak performance before going live.

Step-by-Step Process of InstantPay API Integration

The process of integrating InstantPay’s API with Infinity Webinfo Pvt Ltd is simple yet thorough:

Initial Consultation: Understanding your business needs—whether it’s online payments, bulk payouts, or fund transfers. Infinity Webinfo Pvt Ltd ensures that the API integration will fit seamlessly with your current processes and infrastructure.

API Documentation: Infinity Webinfo Pvt Ltd reviews InstantPay’s extensive API documentation to map out the necessary endpoints and functions required for your business.

Development: The team at Infinity Webinfo Pvt Ltd builds a customized solution based on your business requirements. This may involve setting up payment gateways, customizing workflows, or integrating with other applications like CRMs or ERPs.

Testing: Before the final implementation, Infinity Webinfo Pvt Ltd conducts rigorous testing in a secure environment to ensure the system is reliable, secure, and functions smoothly.

Security Protocol Implementation: To safeguard against any potential vulnerabilities, Infinity Webinfo Pvt Ltd implements additional encryption and security protocols. This ensures that the transaction data is protected throughout the process.

Launch: Once testing is complete, the system is deployed, and you can begin processing payments via InstantPay. Infinity Webinfo Pvt Ltd offers support during the initial stages to ensure everything works smoothly.

Ongoing Monitoring and Support: Post-launch, Infinity Webinfo Pvt Ltd continues to monitor the integration, providing any necessary updates or troubleshooting to ensure smooth operation.

Advantages of InstantPay API Integration

By integrating InstantPay with the help of Infinity Webinfo Pvt Ltd, businesses can enjoy several key advantages:

Speed & Efficiency: Instant payments and simplified processes lead to quicker transactions.

Scalability: Whether you’re processing a handful or thousands of transactions, InstantPay scales effortlessly.

Security: Robust security features ensure your transactions are safe from fraud and other security threats.

Cost-Effective: Reduces transaction fees and operational costs through automation and bulk processing.

Enhanced Customer Experience: Provide a seamless, fast, and secure payment experience for your customers.

Conclusion

For businesses looking to streamline and enhance their payment operations, the integration of InstantPay API by Infinity Webinfo Pvt Ltd offers a comprehensive solution. With advanced features, robust security, and a smooth integration process, InstantPay ensures efficient and reliable transactions for businesses of all sizes. Infinity Webinfo Pvt Ltd further enhances this by delivering custom, secure, and scalable solutions that cater to specific business needs.

By choosing InstantPay through Infinity Webinfo Pvt Ltd, businesses can future-proof their payment systems and remain competitive in the fast-paced digital economy.

Contact us on :- +91 9711090237

#instantpay#instant payment gateway#payment gateway api integration#payment gateway integration#instantpay API Integration#api integration developer#api integration#infinity webinfo pvt ltd

1 note

·

View note

Text

Why Every Business Needs UPI QR Collection

Why Every Business Needs UPI QR Collection

UPI QR collection simplifies how payments are accepted—no POS, no cards, just a QR. With sprintnxt, businesses can collect money via UPI using static, dynamic, or merchant-level QR codes. It not only reduces payment delays but also boosts customer trust through instant confirmation. This powerful API integration is ideal for industries like retail, delivery, and education that depend on quick payment turnovers.

#sprintnxt #QRPayment #DigitalUPI #BusinessAPIs #InstantPay

0 notes

Text

How Instantpay Aadhaar Verification API Works: A Comprehensive Guide

Aadhaar verification has become a cornerstone of identity verification processes in India and is integral to numerous administrative and financial transactions. With over a billion people enrolled, the Aadhaar system is the world's most extensive biometric ID system. This guide provides a detailed understanding of Aadhaar verification, its benefits, and the verification process, focusing on how the system works.

What is Aadhaar?

Aadhaar is a 12-digit unique identification number issued by the Unique Identification Authority of India (UIDAI). Introduced in 2009, Aadhaar is designed to provide a single, robust, and easily verifiable identity document for residents of India.

Need for Aadhaar Verification

Aadhaar verification, also known as Aadhaar authentication, involves validating an individual’s identity using their Aadhaar number. This process is crucial for ensuring that services, subsidies, and benefits reach the correct recipients, thereby reducing fraud and enhancing security across various sectors such as banking, telecom, and government services.

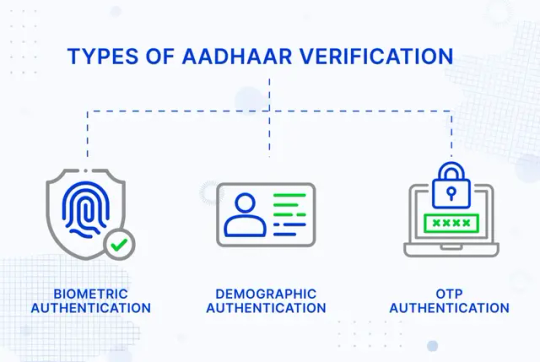

Types of Aadhaar Verification

1. Biometric Authentication

To verify identity, biometric authentication uses an individual’s unique physical characteristics, such as fingerprints, iris scans, or facial recognition. This method is highly secure as these biometric traits are unique to each individual and difficult to replicate.

Process:

The individual provides their Aadhaar number.

Biometric data (fingerprints, iris scans, or facial images) is captured using a biometric device.

The captured data is sent to UIDAI for verification against the stored biometric data.

UIDAI responds with a "Yes" or "No" indicating whether the biometrics match the Aadhaar number provided.

2. Demographic Authentication

Demographic authentication verifies an individual's identity using basic demographic information such as name, address, date of birth, and gender. This method is often used in conjunction with biometric authentication to enhance security.

Process:

The individual provides their Aadhaar number along with demographic information.

This information is sent to UIDAI to be verified against the data stored in the UIDAI database.

UIDAI responds with a "Yes" or "No" indicating whether the demographic details match the Aadhaar number provided.

3. OTP Authentication

One-Time Password (OTP) authentication involves sending a unique code to the individual’s mobile number registered with Aadhaar. This method adds an extra layer of security to the verification process.

Process:

The individual provides their Aadhaar number.

An OTP is sent to their registered mobile number.

The individual enters the OTP to complete the verification process.

UIDAI verifies the OTP and responds with a "Yes" or "No".

Learn More:

Everything You Need To Know About Aadhaar Verification

The Role of Aadhaar-PAN Linkage in Securing Identity & Compliance Across Industries

Identity Verification - How to Check PAN Aadhaar Linking Status with API

Aadhaar Verification Using API

What is an API?

An Application Programming Interface (API) is a set of protocols and tools that enable different software applications to communicate and interact with each other. APIs allow systems to share data and functionalities seamlessly, facilitating integration and automation. In the context of Aadhaar verification, APIs serve as a bridge between an organization's application and the UIDAI's Aadhaar database. This connection allows real-time verification of an individual's identity by cross-referencing the provided Aadhaar number and associated data with the UIDAI's records.

How are APIs used?

APIs can be used in numerous ways to enhance various processes across different industries. For instance, an API can retrieve essential information from a database, such as names and addresses, based on specific input criteria. On the other hand, more advanced APIs can provide comprehensive details, including biometrics or transaction histories, using multi-factor authentication methods like OTPs. These APIs ensure secure, quick, and reliable data exchange, making them invaluable tools for banking, telecommunications, healthcare, and e-commerce sectors. By integrating APIs, organisations can streamline operations, improve user experience, and maintain high security and efficiency standards.

Critical Key Terms in APIs

1. Request

The request is the message sent by the client to the server to perform an action (like retrieving or sending data)

2. Response

The response is the message sent back from the server to the client, indicating the result of the request.

3. API Endpoint

A specific URL where the API can access a resource or perform an action.

Example: Aadhaar Verification API

4. API HTTP Methods

Defines the type of operation the client wants to perform:

GET: Retrieve data.

POST: Create new data.

PUT: Update existing data.

DELETE: Remove data.

5. Header

Part of the request and response carries additional information such as content type, authentication tokens, and other metadata.

6. Parameters

Data is sent with the request to specify details or modify the request.

7. Authentication

Methods to verify the client's identity, make the request, and ensure they have the correct permissions. Standard methods include API keys, tokens, and Auth.

What is a REST API or RESTful?

A REST API (Representational State Transfer API) is a web service architecture that uses standard HTTP methods (GET, POST, PUT, DELETE) to interact with URL-identified resources. REST APIs are stateless, meaning each request contains all the information needed for processing. They are known for their simplicity, scalability, and flexibility in handling various data types.

What is API Testing and How Do We Test It?

API testing ensures APIs meet functionality, reliability, performance, and security expectations. Key methods include:

1. Unit Testing: Testing individual endpoints.

2. Integration Testing: Ensuring multiple API calls work together.

3. Performance Testing: Checking response times and load handling.

4. Security Testing: Protecting against unauthorised access.

What is an API Key and Why is it Important?

An API key is a unique identifier used to authenticate a client requesting an API. It ensures only authorised users can access resources, helps track usage, manage quotas, and prevent abuse.

What is Web API and Why is it Beneficial?

A Web API is an API accessed via the web using HTTP protocols. It allows different applications to communicate and exchange data over the internet. Benefits include:

1. Integration: Seamlessly connects systems and applications.

2. Accessibility: Accessible from any internet-connected device.

3. Scalability: Handles increasing loads and user demands.

4. Reusability: Leverages existing functionalities without rebuilding.

What is API Integration?

API integration connects different applications and systems via APIs, enabling them to share data and work together. It automates processes, improves data accuracy, and enhances functionality, creating efficient and scalable digital ecosystems.

Aadhaar Verification APIs on Instantpay

Instantpay offers seamless integration of Aadhaar verification through its APIs, making the verification process efficient and secure for businesses.

1. Aadhaar Demographics API

The Aadhaar Demographics API provides basic demographic information using only the Aadhaar number as input. This API is useful for simple identity verification where detailed information is not required.

Technical Workflow:

Request: The client system sends an HTTP request to the Aadhaar Demographics API endpoint with the Aadhaar number.

Processing: UIDAI processes the request and retrieves demographic details.

Response: The API returns a JSON response containing the demographic information (e.g., name, address, date of birth, gender).

2. Aadhaar offline e-KYC API

The Aadhaar offline e-KYC API provides comprehensive details but requires both the Aadhaar number and an OTP sent to the Aadhaar-linked mobile number. This ensures thorough verification for services needing extensive identity details.

Technical Workflow:

Request: The client system sends an HTTP request to the Aadhaar OKYC API endpoint with the Aadhaar number.

OTP Generation: UIDAI sends an OTP to the registered mobile number.

OTP Verification: The client system captures the OTP and sends it back to the API.

Processing: UIDAI processes the request, fetching both demographic and biometric details.

Response: The API returns a detailed JSON response containing all relevant information (e.g., name, address, date of birth, gender, photograph).

Step-by-Step Guide to Aadhaar Verification on the Instantpay Dashboard

Step 1: Log in to the Instantpay Dashboard and Navigate to Verification Suite. (If this isn't visible, please get in touch with [email protected] to enable it.)

Step 2: Click on the Verify Data Tab

Step 3: Choose Aadhaar Demographic API

Step 4: Download and fill template for Bulk Verification

Or If you want to try out the API click the button below

Step 5: Enter the Aadhaar Number you want to Verify

Step 6: Enter your iPin for authentication

Step 7: Congratulations, you have successfully retrieved the Aadhaar Demographic Data

Step 8: You can view and download the bulk verification files by clicking on the “Download” Button

Who Can Use Aadhaar Verification APIs?

Aadhaar Verification APIs can be utilised by a various organisations and sectors to streamline their identity verification processes. These APIs provide a reliable and secure way to verify the identities of individuals, ensuring that only genuine people can access services and benefits. Here are five examples of entities that can benefit from using Aadhaar Verification APIs:

1. Banks and Financial Institutions

Banks and financial institutions can use Aadhaar Verification APIs to verify customers' identities during account opening, loan applications, and other financial transactions. This ensures compliance with KYC (Know Your Customer) regulations and helps prevent identity fraud.

Example A bank uses the Aadhaar Offline EKYC API to verify the identity of a new customer applying for a savings account. The customer provides their Aadhaar number and OTP, allowing the bank to quickly and securely verify their details and open the account.

2. Telecom Companies

Telecom companies can utilise Aadhaar Verification APIs to authenticate customers when new SIM cards or mobile connections are issued.This process helps prevent fraudulent activities and ensures that mobile connections are issued to legitimate users.

Example: A telecom company uses the Aadhaar Demographics API to verify a customer's identity when they apply for a new SIM card. By entering their Aadhaar number, the company can instantly retrieve and verify the customer's demographic information.

3. Government Agencies

Government agencies can use Aadhaar Verification APIs to authenticate beneficiaries of various schemes and services. This ensures that subsidies and benefits are disbursed to the right individuals, reducing the risk of fraud and providing efficient service delivery.

Example

A government welfare department uses the Aadhaar Verification API to verify the identity of individuals applying for a social welfare scheme. This helps ensure that only eligible beneficiaries receive the benefits.

4. E-commerce Platforms

E-commerce platforms can leverage Aadhaar Verification APIs to verify the identities of sellers and buyers, enhancing trust and security in online transactions. This helps prevent fraudulent activities and builds trust among users.

Example

An e-commerce platform uses the Aadhaar Demographics API to verify the identity of a new seller registering. This ensures that only legitimate sellers can list their products, improving the platform's credibility.

5. Educational Institutions

Educational institutions can use Aadhaar Verification APIs to verify students' identities during admissions and examinations. This helps maintain the integrity of the admission process and ensures that only eligible students are enrolled and assessed.

Example

A university uses the Aadhaar offline - KYC API to verify the identity of applicants during the admission process. Using the Aadhaar number and OTP, the university can authenticate the students' details and ensure that only genuine applicants are admitted.

These examples illustrate the versatility and utility of Aadhaar Verification APIs by Instantpay across various sectors. By integrating these APIs, organisations can enhance security, improve efficiency, and ensure that services and benefits are delivered to the right individuals.

Conclusion

By focusing on how Aadhaar verification works and its implementation through APIs, this guide aims to provide a comprehensive understanding of the process and its significance in various sectors. For detailed API documentation, visit Instantpay Developer Portal, and for further assistance, contact support at [email protected].

0 notes

Text

Explore The Power of Identity Verification with Instantpay's RC Verification in 2024

In today's digital age, identity verification has become integral to various online transactions and services. Whether opening a bank account, applying for a loan, or accessing online platforms, verifying one's identity is crucial for security and compliance. With the advancement of technology, identity verification methods have evolved, offering more efficient and secure solutions.

Understanding Identity RC Verification

Simply put, RC verification involves checking the legitimacy of an RC issued by a regional transport authority (RTA) against official records. This process validates the vehicle's existence, ownership details, and other crucial information, reducing the risk of fraud and promoting transparency in transactions.

Instantpay, a leading modern business banking company, offers a cutting-edge identity verification solution called Identity RC Verification. This innovative solution leverages advanced technology to streamline identity verification while ensuring the utmost security and accuracy.

Why is RC Verification Important?

The importance of RC verification cannot be understated. Here are some key benefits it offers:

Fraud Prevention: Verifying RCs helps safeguard against fraudulent activities like using stolen vehicles or falsifying ownership documents. This mitigates financial losses and protects your business reputation.

Regulatory Compliance: Many industries, including automotive and logistics, are subject to regulations that mandate RC verification for specific transactions. A reliable verification system ensures compliance with these regulations and avoids legal repercussions.

Streamlined Operations: Manual RC verification can be time-consuming and error-prone. Automating the process through an API like Instantpay's RC Verification API significantly speeds up operations and improves efficiency.

Enhanced Customer Experience: Ensuring accurate and timely verification provides a smoother and more secure experience for your customers, fostering trust and satisfaction.

Key Features of Identity RC Verification

Instantpay's Identity RC Verification harnesses the power of artificial intelligence (AI) to conduct real-time identity verification. This ensures the verification process is swift, seamless, and without any delays.

The system can analyze and process vast amounts of data rapidly through AI integration, allowing for instant verification results.

The platform offers advanced document verification capabilities, allowing users to upload various identity documents, such as passports, driver's licenses, and ID cards.

Utilizing optical character recognition (OCR) technology, the system can extract relevant information from uploaded documents accurately and efficiently.

Identity RC Verification incorporates facial recognition technology to match the individual's facial features with the photo on their identity document.

Biometric matching algorithms compare biometric data, such as fingerprints or iris scans, against stored records to verify the person's identity accurately.

The platform implements multi-factor authentication (MFA) mechanisms to bolster security, requiring users to provide multiple verification forms before accessing the system.

MFA may include a combination of factors such as passwords, SMS codes, biometric data, or security questions, adding layers of protection against unauthorised access.

Identity RC Verification offers customisable verification workflows, allowing businesses to tailor the verification process to their specific requirements.

Administrators can define rules and criteria for identity verification, such as the documents accepted, the sequence of verification steps, and the threshold for approval.

The platform conducts comprehensive compliance checks to ensure adherence to regulatory standards such as KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations.

By automating compliance checks, businesses can mitigate the risk of regulatory violations and penalties while maintaining compliance with industry standards.

Identity RC Verification is designed to easily handle high volumes of verification requests, making it suitable for businesses of all sizes.

The platform's scalability ensures it can accommodate growing verification needs without compromising performance or reliability.

For transparency and accountability, Identity RC Verification maintains detailed audit trails of all verification activities, including timestamps, user actions, and verification outcomes.

Administrators can generate comprehensive reports and analytics to gain insights into verification trends, compliance metrics, and system performance.

The platform offers cloud-based deployment options, enabling businesses to access identity verification services securely over the Internet.

Additionally, Identity RC Verification provides robust API integration capabilities, allowing seamless integration with existing systems, applications, and third-party services.

Leveraging machine learning algorithms, Identity RC Verification continuously learns and adapts to new verification patterns, emerging threats, and evolving regulatory requirements.

This ensures that the platform remains effective and up-to-date in detecting and preventing fraudulent activities while maintaining high accuracy and reliability.

Instantpay's Identity RC Verification offers a comprehensive suite of features and capabilities to streamline identity verification, enhance security, and ensure compliance with regulatory standards. By leveraging advanced technologies such as AI, biometrics, and machine learning, businesses can achieve efficient, accurate, and reliable identity verification outcomes while delivering a seamless user experience to their customers and clients. Read more on Instantpay's comprehensive suit of Identity verification - https://blog.instantpay.in/2023/10/12/introducing-instantpay-identity-verification-a-complete-guide/

Functionalities of the Vehicle RC Verification API

[wptb id=2780]

The API is a valuable tool for various industries and use cases, such as insurance companies, law enforcement agencies, vehicle buyers, and sellers, as it enables them to quickly and accurately verify the authenticity and status of a vehicle's registration. By integrating the Vehicle RC Verification API into their applications or systems, users can streamline processes related to vehicle information retrieval and enhance their decision-making processes.

Enhanced Security Measures:

Identity RC Verification employs advanced security measures to safeguard sensitive information and prevent unauthorised access. Businesses can significantly reduce the risk of identity theft, fraud, and data breaches by implementing robust encryption protocols, multi-factor authentication, and biometric verification.

With stringent security measures, Identity RC Verification provides peace of mind to businesses and their customers, ensuring that confidential information remains always protected.

Streamlined Compliance Processes:

Compliance with regulatory standards such as KYC (Know Your Customer) and AML (Anti-Money Laundering) regulations is essential for businesses operating in regulated industries. Identity RC Verification helps streamline compliance processes by automating identity verification procedures and ensuring adherence to regulatory requirements.

By automating compliance checks and maintaining comprehensive audit trails, businesses can demonstrate compliance with regulatory standards and mitigate the risk of non-compliance penalties.

Real-Time Verification:

Identity RC Verification offers real-time identity verification capabilities, allowing businesses to verify customer identities instantly. This eliminates the need for manual verification processes, reducing delays and improving operational efficiency.

With real-time verification, businesses can onboard customers quickly, accelerate transaction processing times, and deliver a seamless user experience.

Cost Savings and Operational Efficiency:

By automating identity verification processes, Identity RC Verification helps businesses save time and resources, leading to cost savings and improved operational efficiency. Manual verification processes are labor-intensive and time-consuming, requiring significant workforce and resources.

With Identity RC Verification, businesses can automate repetitive tasks, reduce manual errors, and streamline verification workflows, resulting in lower operational costs and increased productivity.

Improved Fraud Detection and Prevention:

Identity RC Verification utilizes advanced fraud detection algorithms and machine learning techniques to detect and prevent real-time fraudulent activities. The platform can identify suspicious behaviour and flag potentially fraudulent transactions by analysing patterns, anomalies, and risk factors.

By leveraging predictive analytics and behavioural biometrics, Identity RC Verification helps businesses stay ahead of emerging threats and protect against financial losses due to fraud.

Scalability and Flexibility:

Identity RC Verification is designed to scale seamlessly to accommodate growing verification needs and evolving business requirements. Whether businesses are processing a few hundred verifications per month or millions, the platform can scale up or down effortlessly to meet demand.

Additionally, Identity RC Verification offers flexibility in deployment options, allowing businesses to choose between cloud-based or on-premises deployments based on their preferences and infrastructure requirements.

Enhanced Customer Experience:

By providing a seamless and user-friendly verification experience, Identity RC Verification enhances the overall customer experience. Simplified verification processes, intuitive user interfaces, and quick response times increase customer satisfaction.

With Identity RC Verification, businesses can reduce customer friction during onboarding, improve conversion rates, and foster long-term customer loyalty and retention.

Identity RC Verification offers businesses a wide range of benefits, including enhanced security, streamlined compliance processes, real-time verification, cost savings, improved fraud detection and prevention, scalability, flexibility, and enhanced customer experience. By leveraging advanced technologies and automation from Instantpay, businesses can achieve efficient, accurate, and reliable identity verification outcomes while strengthening operational efficiency and customer satisfaction.

How Vehicle RC Verification API Works

Integration with Transport Authority Databases: The Vehicle RC Verification API integrates with databases maintained by transport authorities or regulatory bodies responsible for vehicle registration and documentation. These databases contain comprehensive records of registered vehicles, including their registration details, ownership information, and compliance status.

Input Parameters: Developers can interact with the Vehicle RC Verification API by passing specific input parameters, typically the vehicle's registration number, through their application or system. The registration number is the unique identifier for the car whose details are being verified.

Real-Time Validation: Upon receiving the input parameters, the Vehicle RC Verification API initiates a real-time validation process by querying the connected transport authority database. The API utilises secure communication protocols to retrieve the relevant information associated with the provided registration number.

Data Extraction: The API retrieves and extracts the corresponding information from the transport authority database based on the input parameters provided. This information typically includes the vehicle's make and model, registration date, chassis number, engine number, owner's name, address, and registration status.

Seamless Processing: The vehicle RC verification process facilitated by the API is seamless and efficient, ensuring minimal latency and quick response times. The API's streamlined workflow and optimised data retrieval mechanisms enable developers to integrate vehicle verification capabilities into their applications or systems seamlessly.

Instant Results: Upon successful validation and data extraction, the Vehicle RC Verification API returns the verified information to the requesting application or system in real time. This instant feedback lets users access accurate vehicle details promptly, facilitating informed decision-making and enhancing operational efficiency.

Secure Communication: The Vehicle RC Verification API prioritizes data security and privacy throughout the verification process. It employs robust encryption protocols and certain communication channels to safeguard sensitive information exchanged between the API and the transport authority database. This ensures that confidential vehicle details remain protected against unauthorised access or tampering.

Scalability and Reliability: The API is designed to accommodate varying levels of usage and traffic demands, ensuring scalability and reliability. Whether processing a few requests or handling high volumes of verification queries, the API maintains consistent performance and availability to meet user needs effectively.

The Vehicle RC Verification API streamlines the process of verifying vehicle registration details by seamlessly integrating with transport authority databases, accepting input parameters, initiating real-time validation, extracting relevant information, and delivering instant results. Its secure, efficient, and scalable architecture empowers developers to incorporate robust vehicle verification capabilities into their applications or systems, enhancing operational efficiency and facilitating informed decision-making.

Challenges in Implementing Vehicle RC Verification API

Data Availability and Integration: Accessing comprehensive and up-to-date vehicle registration databases from transport authorities or regulatory bodies can pose a significant challenge. Integration with these databases requires establishing partnerships and protocols to ensure seamless data exchange. Additionally, inconsistencies in data quality and accessibility across different regions may further complicate the integration process.

Data Privacy and Security: Handling sensitive vehicle information, including registration details and ownership records, necessitates robust data privacy and security measures. Implementing stringent encryption protocols, access controls, and authentication mechanisms is crucial to safeguarding against unauthorised access, data breaches, and identity theft. Compliance with regulatory standards such as GDPR (General Data Protection Regulation) adds another layer of complexity to ensuring data security and privacy.

Standardisation: Coordinating with multiple transport authorities or regulatory bodies to maintain a standardised data structure and format poses a significant challenge in API implementation. Each source may have its own data schema, terminology, and design for storing vehicle registration information, leading to consistency and interoperability issues. Establishing uniform standards and protocols for data exchange and integration is essential to ensure seamless interoperability and compatibility across different systems and jurisdictions.

Data Accuracy and Reliability: Ensuring the accuracy and reliability of the data retrieved from vehicle registration databases is paramount for the effective functioning of the API. Challenges such as outdated or incomplete records, data duplication, and inconsistencies in data entry can compromise the reliability of verification results. Implementing data validation mechanisms, error handling protocols, and periodic data updates is essential to mitigate these challenges and maintain data integrity.

Scalability and Performance: As the volume of verification requests increases, ensuring the scalability and performance of the API becomes crucial. Scaling infrastructure resources, optimising query processing algorithms, and implementing caching mechanisms are essential strategies to handle spikes in demand and maintain optimal response times. Balancing scalability with cost-effectiveness and resource utilisation adds complexity to API implementation and management.

Regulatory Compliance: Adhering to regulatory requirements and compliance standards governing vehicle registration data collection, storage, and processing poses additional challenges. Compliance with regulations such as the Motor Vehicles Act, data protection laws, and industry-specific guidelines requires thorough legal and regulatory analysis and ongoing monitoring and updates to ensure compliance with evolving requirements.

User Experience and Accessibility: Providing a seamless user experience and ensuring accessibility across various platforms and devices is essential for the widespread adoption of the API. Designing intuitive user interfaces, optimizing API endpoints for performance, and supporting multiple authentication methods are critical considerations to enhance usability and accessibility for developers and end-users.

Implementing a Vehicle RC Verification API entails overcoming various challenges related to data availability and integration, data privacy and security, standardisation, data accuracy and reliability, scalability and performance, regulatory compliance, and user experience.

Addressing these challenges requires a comprehensive approach encompassing technical, regulatory, and operational considerations to ensure the successful deployment and operation of the API.

Instantpay's RC Verification API is a powerful tool to simplify and streamline your RC verification process.

Here's what it offers:

Comprehensive Data Retrieval: The API facilitates comprehensive data retrieval by extracting key information from the Registration Certificate (RC). This includes vehicle details such as make, model, year of manufacture, engine specifications, owner information, registration status, and more. By providing access to a wide range of data points, the API offers users a holistic view of the vehicle's registration status and ownership details, enabling informed decision-making and regulatory compliance.

Real-time Verification: Users can leverage the API to perform real-time verification of the RC against official Regional Transport Authority (RTA) records. By accessing up-to-date data directly from the RTA database, the API delivers instant results on the validity of the RC, minimising delays and enabling prompt decision-making. This real-time verification capability enhances operational efficiency and reduces the risk of relying on outdated or inaccurate information.

Nationwide Coverage: The API provides national coverage, allowing users to verify RCs issued by any RTA across India. This ensures comprehensive coverage and accessibility regardless of the vehicle's location or the issuing authority. Whether the RC originates from a metropolitan city or a rural area, the API offers seamless verification capabilities, facilitating nationwide compliance and operational consistency.

Seamless Integration: With its seamless integration capabilities, the API can easily integrate with existing systems and applications. Whether it's a web-based platform, mobile app, or enterprise software, the API's flexible architecture allows quick and effortless implementation. By seamlessly integrating with existing workflows and processes, the API enhances operational efficiency and user experience, minimising disruptions and maximising productivity.

Security and Compliance: Instantpay prioritises security and compliance by adhering to stringent security standards and data privacy regulations. The API ensures the safe and ethical handling of sensitive information, including vehicle registration and owner information. By implementing robust security measures such as encryption, access controls, and audit trails, Instantpay safeguards data integrity and confidentiality, earning users' trust and confidence in the platform's reliability and compliance posture.

Financial Services: Banks, fintech companies, and other financial institutions can use Identity RC Verification to onboard customers, verify identities for loan applications, and comply with regulatory requirements.

E-commerce: E-commerce platforms can implement Identity RC Verification to verify customers' identities during registration and checkout, reducing the risk of fraudulent transactions.

Healthcare: Healthcare providers and telemedicine platforms can utilize Identity RC Verification to verify patients' identities, ensuring secure access to medical records and health services.

Gaming and Entertainment: Online gaming and entertainment platforms can integrate Identity RC Verification to verify users' identities, preventing underage access and unauthorised activities.

The use cases for Instantpay's RC Verification API are diverse, benefiting businesses across various industries. Here are some real-world examples:

Car dealerships: Instantly verify customer-provided RCs during vehicle purchases, preventing fraud and streamlining transactions.

Rental companies: Ensure the legitimacy of RCs submitted by car renters, providing peace of mind and mitigating theft risks.

Logistics providers: Verify vehicles' ownership and registration status before accepting them for transport, ensuring compliance and safety.

Finance companies: Conduct due diligence on vehicle ownership during loan applications, minimising financial risks and fraudulent activities.

Traffic Authorities: Traffic police and law enforcement agencies can instantly employ the API to retrieve vehicle information during routine checks or investigations.

Insurance Companies: Insurance providers can integrate the API into their claims processing systems to validate vehicle information and prevent fraud.

These are just a few examples, and the possibilities are endless. By integrating Instantpay's RC Verification API, businesses can achieve:

Reduced Fraud: By verifying the authenticity of RCs, businesses can significantly reduce the risk of fraud and associated financial losses.

Increased Efficiency: Automating the verification process saves time and effort, allowing employees to focus on other critical tasks.

Improved Compliance: Adhering to regulations becomes easier with instant and accurate verification, eliminating compliance concerns.

Enhanced Customer Satisfaction: Faster and more secure transactions lead to happier customers who trust your business practices.

Instantpay's Identity RC Verification offers a sophisticated and reliable solution for businesses seeking to streamline their identity verification processes. With its advanced features, robust security measures, and compliance capabilities, Identity RC Verification is poised to revolutionise how businesses verify identities in the digital age. By leveraging this innovative solution, companies can enhance security, improve efficiency, and deliver a seamless user experience to their customers and clients.

0 notes

Text

Demystifying Bank Account Verification APIs in 2024

BANK ACCOUNT VERIFICATION API- In this era where technological advancements have guided in unprecedented opportunities through the years. They have also brought forth new avenues for deception and illicit activities or what we call in simpler terms fraudulent activities.

Throughout business operations, safeguarding against frauds stands as a paramount concern, particularly when it comes to verifying the authenticity of bank accounts belonging to customers or partners.

READ - https://blog.instantpay.in/2023/10/12/introducing-instantpay-identity-verification-a-complete-guide/

During the first half of the ongoing fiscal year 2023-2024, the banking sector witnessed a significant surge in fraudulent activities, with reported cases totalling 14,483, marking a notable increase. However, despite this rise in the number of incidents, the financial impact amounted to only 14.9 percent of the previous year's total.

According to the Reserve Bank of India's "Trends and Progress of Banking in India 2022-23" report, there's a pressing necessity to safeguard both the banking system and the payments infrastructure against the looming threats posed by cyber fraud and data breaches.

The reported fraud cases amounted to Rs 2,642 crore during this period, compared to 5,396 cases involving Rs 17,685 crore in the corresponding period of the preceding year.

Let’s paint a picture of the perspective of an e-commerce platform striving to guarantee the legitimacy of bank account details provided by sellers for payout purposes, or envision a financial service provider tasked with verifying the bank information of clients to facilitate secure transactions. In both scenarios, ensuring the accuracy and validity of bank account information emerges as an indispensable measure, serving not only to prevent potential fraud but also to mitigate errors and uphold the bedrock of trust upon which successful business relationships are built.

Given the gravity of this endeavor, a meticulously crafted plan of action is imperative. This plan must encompass a multifaceted approach that leverages cutting-edge technological solutions while adhering to rigorous verification protocols. At its core, such a strategy would involve the deployment of sophisticated identity verification mechanisms capable of scrutinising bank account details with unparalleled precision. This could entail the utilisation of advanced algorithms to cross-reference provided information against authoritative databases, thereby validating the authenticity of bank accounts with a high degree of accuracy.

Furthermore, the plan would necessitate the implementation of stringent verification procedures, encompassing robust authentication measures such as two-factor authentication (2FA) and biometric identification. By incorporating these layers of security, businesses can fortify their defenses against fraudulent activities while instilling confidence among stakeholders regarding the integrity of their financial transactions.

India has seen a subsequent rise in the overall fraud through the years

In order to prevent frauds, bank account verification APIs come into play. These powerful tools enable businesses to seamlessly Verify Bank Account details, Ensuring Accuracy and Security in Financial Transactions.

In this blog, we'll delve into the world of bank account verification APIs, exploring their benefits, functionality, and how they revolutionise banking and business operations.

What is Bank Account Verification API?

Bank Account Verification API is a sophisticated application programming interface that enables businesses to verify the authenticity and validity of bank accounts in real-time. It acts as a bridge between businesses and financial institutions, allowing seamless communication and verification of crucial banking information.

Understanding Bank Account Verification APIs

Bank account verification APIs offer a streamlined solution for businesses to validate the authenticity of bank account information provided by customers or partners. These APIs leverage advanced algorithms and access to banking databases to verify the accuracy of account numbers, account holders' names, and other relevant details. By integrating with these APIs, businesses can automate the verification process, saving time and resources while enhancing security measures.

Why do we need a Bank Account verification API

Verifying bank accounts plays a pivotal role in both Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures.

The necessity for this verification stems from several key reasons.

[wptb id=2719]

Instantpay - A Trusted API Partner

In the realm of bank account verification APIs, Instantpay emerges as a standout provider, offering businesses a comprehensive solution to streamline their verification processes. With its cutting-edge technology and user-friendly interface, Instantpay empowers businesses to verify bank account details with unprecedented speed and accuracy.

Instantpay's API is designed with the needs of businesses in mind, offering a range of features and customisation options to suit diverse requirements.

From getting bank lists to verifying UPI Handle, Instantpay's API provides businesses with the flexibility and reliability they need to ensure the integrity of their financial transactions.

Moreover, Instantpay's commitment to security and compliance sets it apart as a trusted partner in the realm of bank account verification. With robust encryption protocols and adherence to regulatory standards, Instantpay ensures that businesses can verify bank account details with confidence, knowing that their data is protected and their operations are compliant with relevant regulations.

In addition, Instantpay distinguishes itself through its dedication to customer satisfaction. With responsive support and ongoing updates and improvements, we work closely with businesses to address their needs and enhance their verification processes.

Overall, Instantpay stands out as a leading provider of bank account verification APIs, empowering businesses to verify bank account details with speed, accuracy, and confidence. With its advanced technology, commitment to security, and focus on customer satisfaction.

Use Cases and Examples

1. E-commerce Platforms:

E-commerce platforms play a crucial role in facilitating online transactions between buyers and sellers. By integrating bank account verification APIs, these platforms can enhance trust and transparency in their transactions.

Through the use of bank account verification APIs, e-commerce platforms not only verify the authenticity of sellers' bank account details but also streamline the payout process, ensuring sellers receive their funds securely and promptly.

Moreover, the integration of Bank List APIs allows these platforms to offer a wide range of payment options to their users, enhancing convenience and flexibility in bill payments, subscription renewals, and other financial transactions.

2. Financial Services:

Banks, fintech companies, and other financial institutions often deal with crucial data, and by leveraging bank account verification APIs they enhance the reliability and efficiency of their services. Whether it's opening a new account, initiating fund transfers, or conducting routine transactions, verifying customer bank account details is essential to prevent fraud and ensure compliance with regulatory standards.

By integrating bank account verification APIs into their systems, financial service providers can automate and streamline the account verification process, reducing manual errors and enhancing the overall customer experience. This not only improves operational efficiency but also instils confidence among customers in the security of their financial transactions.

3. Subscription Services:

Subscription-based businesses rely on recurring payments to sustain their revenue streams and provide continuous access to their services. However, managing subscription payments efficiently while preventing fraudulent activities can be challenging.

Bank account verification APIs offer a robust solution for subscription-based businesses to verify the authenticity of customer payment methods. By validating bank account details during the subscription signup process, these businesses can ensure that only legitimate customers can access their services. Moreover, by periodically re-verifying bank account information, they can prevent unauthorized access and minimize revenue leakage due to failed payments or chargebacks.

Additionally, integrating bank account verification APIs can streamline the subscription billing process, reducing administrative overhead and improving cash flow management for the business. This enables subscription-based businesses to focus on delivering value to their customers while maintaining the integrity and security of their payment systems.

Conclusion

As we look ahead, the role of bank account verification APIs will only continue to grow in significance. With advancements in technology and increased adoption across industries, these APIs will empower businesses to navigate the complexities of financial transactions with confidence and ease. By leveraging the power of automation, data integrity, and regulatory compliance, businesses can forge ahead into a future where secure transactions are not just a necessity but a cornerstone of success.

As we've explored throughout this blog, we have come to understand that bank account verification APIs represent more than just a technological tool—they symbolise a commitment to transparency, reliability, and trustworthiness in the digital realm. As businesses strive to innovate and adapt to changing landscapes, the adoption of these APIs will undoubtedly remain at the forefront of their strategies for sustainable growth and success.

Instantpay is your reliable API partner, offering comprehensive Financial Verification APIs tailored to meet your business requirements. Our commitment to innovation drives us to redefine how businesses verify bank account information and facilitate secure financial transactions seamlessly.

Get Started Today !

FAQ

How to Verify a Bank Account Using an API

Bank account verification through APIs offers a streamlined and secure method for businesses to authenticate bank account details. By integrating with a bank's API, businesses can verify account ownership, validity, and other pertinent details in real-time, ensuring accuracy and reliability in financial transactions.

What are the benefits of Bank Account Verification API

1. Enhanced Security: Bank account verification APIs provide robust authentication mechanisms, minimizing the risk of fraudulent activities and unauthorized access to financial resources. By ensuring the accuracy of bank account details, businesses can safeguard against potential breaches and protect sensitive information.

2. Improved Operational Efficiency: Automation of the verification process via APIs reduces manual intervention, leading to faster processing times and improved operational efficiency. Businesses can streamline workflows, allocate resources effectively, and focus on core activities, thereby enhancing productivity and performance.

3. Cost Savings: API-driven bank account verification eliminates the need for manual verification processes, reducing overhead costs associated with labor and administrative tasks. By minimizing errors and optimizing resource utilization, businesses can achieve significant cost savings and allocate resources more efficiently.

4. Regulatory Compliance: Compliance with regulatory standards such as Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations is facilitated through API-based verification processes. By ensuring adherence to regulatory requirements, businesses can mitigate compliance risks and maintain a favorable reputation within the industry.

5. Enhanced Customer Experience: Accurate and secure bank account verification enhances the overall customer experience by instilling trust and confidence in financial transactions. By prioritizing data integrity and security, businesses can cultivate long-term relationships with customers, driving loyalty and retention.

What are the fraud detection Mechanisms Used by Banks?

Banks employ sophisticated fraud detection systems that utilise advanced algorithms and machine learning techniques to identify suspicious activities. These systems analyse transaction patterns, including frequency, amount, and geographic location, to detect anomalies and potential fraudulent behavior. By leveraging data analytics and real-time monitoring, banks can proactively mitigate fraud risks and protect both customers and financial institutions.

What is API Verification?

API verification involves the use of application programming interfaces (APIs) to authenticate and validate user data or transactions. In the context of bank account verification, APIs enable seamless communication between businesses and banking systems, allowing for real-time verification of account details. Through API integration, businesses can access secure and reliable verification services, enhancing the accuracy and efficiency of financial transactions.

0 notes

Text

Top 5 Payment Processing Challenges For SMEs

Payment processing is a critical aspect of any business operation, and for small and medium-sized enterprises (SMEs), overcoming challenges in this domain is crucial for sustaining growth and ensuring financial stability. Managing cash flow and payment processing often comes with its set of challenges, particularly for online and small businesses. Late payments pose a significant hurdle, disrupting regular cash flow and hindering operational capabilities. Ensuring payment security against fraud is a constant concern, necessitating robust measures to protect customer data and prevent unauthorised transactions. The time-consuming process of reconciling payments with invoices can lead to errors, impacting financial reporting.

In this blog, we'll delve into the intricate world of payment processing challenges faced by SMEs and explore how innovative solutions, such as Instantpay, can help businesses tackle these obstacles head-on.

Small and Medium Enterprises (SMEs) face several challenges and pain points when it comes to handling finances.

What are these challenges that can impact the efficiency, growth, and overall financial health of the business ❓

Avoid Them All With Instantpay

Instantpay emerges as a comprehensive solution to the myriad challenges faced by SMEs in payment processing. Our modern, integrated banking prioritise security, technology, and customer service, enabling businesses to optimise online payment processing and access multi-channel payments effortlessly.

[wptb id=2699]

Best Practices

To navigate the intricate realm of digital transactions effectively, businesses must adhere to best practices that not only safeguard financial transactions but also optimise the customer experience.

1. Thorough Research and Choosing the Right Payment Processor:

Selecting a payment processor is a critical decision for small businesses. Instantpay stands out with its proven track record of reliability and competitive rates, making it a top-tier choice. Before making a decision, businesses should thoroughly research and align their specific needs with the features offered by Instantpay.

2. Fortifying Security Measures:

Security is non-negotiable in the digital transaction landscape. Instantpay takes this seriously by incorporating advanced security features, ensuring a secure environment for both businesses and its clientele. By choosing Instantpay, businesses can transact with the confidence that their financial data is well-protected.

3. Expanding Payment Options:

Today's customers have diverse preferences when it comes to payment methods. Instantpay recognises this and supports a broad range of payment options, including credit cards, digital wallets, and more. This flexibility allows businesses to cater to a diverse customer base, enhancing customer satisfaction and increasing conversion rates.

4. Streamlining Integration Processes:

Integration shouldn't be a headache for businesses. Instantpay offers a user-friendly dashboard for payment processes and API plugins that simplify the integration process. This streamlining not only reduces the complexity for businesses but also ensures a seamless connection between payment systems and existing operations.

5. Continuous Learning and Staying Informed:

The payment processing landscape is dynamic, with technologies and trends evolving rapidly. Instantpay goes beyond its role as a payment processor by providing businesses with valuable educational resources. By staying updated on industry trends, businesses can make informed decisions, ensuring they remain competitive and adaptable in the ever-changing marketplace.

Conclusion

In a world where small businesses navigate the challenges of payment processing, Instantpay emerges as a reliable ally. By addressing the top five challenges and offering a robust, secure, and versatile payment processing solution, Instantpay empowers businesses to thrive in the digital economy.

We not only provide a reliable and cost-effective solution for payment processing but also contribute to the overall success of businesses by addressing key challenges and fostering continuous improvement through education and innovation

Connect with our financial experts to delve into the world of Instantpay. Whether you're dealing with one-time transactions or recurring payments, Instantpay has got you covered.

Discover the benefits of swift and secure payment processing. Our team is ready to guide you through the features that make Instantpay the ideal solution for your payment needs.

Say goodbye to the complexities of payment processing and embrace a streamlined and secure solution with Instantpay.

Frequently Asked Questions

How does a payment processor work?

When a customer makes a purchase, the payment processor verifies the transaction details, authorizes the payment, and transfers funds from the customer's account to the merchant's account. This process typically involves encryption for security and various communication channels.

What types of payment methods do processors support?

Payment processors support a wide range of payment methods, including credit cards, debit cards, digital wallets (like PayPal, Apple Pay, or Google Pay), bank transfers, and other alternative payment methods.

What is PCI compliance, and why is it important for payment processors?

PCI compliance refers to adherence to the Payment Card Industry Data Security Standard. It is crucial for payment processors to comply with these security standards to protect sensitive cardholder information and ensure secure transactions.

Differentiating Between Payment Gateways and Payment Processors.

Now, Many businesses often find themselves perplexed when it comes to understanding the roles of payment gateways and payment processors. This confusion can lead to inefficiencies and challenges in managing payment transactions. Let’s demystify these crucial components of business transactions to help you make informed decisions for your business.

Often Payment gateways and payment processors work together to enable smooth transactions, understanding their distinct roles is essential for SMEs to optimise their payment processes effectively. Empowering businesses to make informed decisions when selecting payment service providers and ensures a seamless and secure payment experience for their customers

Payment Gateway:

A payment gateway acts as a bridge between the merchant's website or application and the financial institutions involved in the transaction. Its primary function is to facilitate the communication of payment information securely. Here's a breakdown of the key roles of a payment gateway:

Transaction Initiation: When a customer purchases an online platform, the payment gateway is responsible for initiating the transaction process.

Encryption and Security: The payment gateway encrypts the sensitive information provided by the customer, such as credit card details, to ensure a secure transfer of data over the internet.

Authorisation Request: The encrypted information is sent to the payment processor and the respective credit card network or issuing bank to request authorisation for the transaction.

Transaction Response: Once the authorisation is obtained, the payment gateway receives the response and communicates it back to the merchant's website, indicating whether the transaction was approved or declined.

User Experience: Payment gateways also play a role in enhancing the user experience by providing a seamless and secure payment process, which includes features like a checkout page hosted by the gateway.

In summary, a payment gateway facilitates the flow of information between the customer, the merchant, and the financial institutions involved in processing the payment.

Payment Processor:

While the payment gateway focuses on the communication and authorisation aspects, the payment processor is responsible for the actual movement of funds. Here's a breakdown of the key roles of a payment processor:

Transaction Settlement: Once the payment gateway receives authorisation, the payment processor takes over and settles the transaction by moving funds from the customer's account to the merchant's account.

Funds Transfer: The payment processor handles the movement of money between the customer's bank or credit card account and the merchant's account.

Risk Management: Payment processors often include risk management features, such as fraud detection and prevention, to ensure the security of transactions.

Record Keeping: Payment processors maintain records of transactions, making it easier for merchants to reconcile their accounts and manage financial reporting.

Thus, a payment processor deals with the financial aspects of the transaction, ensuring that the funds are transferred securely and efficiently between the customer and the merchant.

Understand the difference between Payment Gateway & Payment Processor better

https://blog.instantpay.in/2023/03/21/know-the-difference-between-a-payment-gateway-and-a-payment-processor/

How Payment Gateways Interact with Payment Processors?

Transaction Initiation: When a customer makes a purchase, the payment gateway collects the payment information and sends it securely to the payment processor.

Encryption and Authorization: The payment processor decrypts and validates the payment details, checking for available funds and ensuring security. If authorized, the payment processor sends the approval back to the payment gateway.

Transaction Completion: The payment gateway receives the approval and communicates it to the merchant's website or system, allowing the transaction to be completed.

How long does it take for funds to be transferred to a merchant's account? The time it takes for funds to reach a merchant's account can vary depending on the payment processor, the type of transaction, and the banking system. At Instantpay the payment is processed in real time.

0 notes

Text

3 Ways Neobanks are Reshaping Banking for Small Businesses

Recently, the surge in popularity of neobanking and digital banking in India has reshaped the financial services landscape. Fuelled by increased awareness, specialised offerings, and a remarkable adaptability to evolving business needs, neobanks have emerged as the preferred choice for today's businesses.

In this comprehensive blog, we will delve into three pivotal aspects that highlight the profound benefits neobanks bring to small business banking. Let's delve into the details!

Revolutionising Financial Services for Speed and Simplicity

Neobanks redefine the banking experience with streamlined and expedited financial services. Unlike their traditional counterparts, online banking with neobanks involves minimal and simplified procedures. Whether it's opening a new account, processing payments, or reconciling transactions, everything happens in real-time.

The time and effort saved through their uncomplicated infrastructure and swift services are invaluable to businesses. Collaborations with traditional banks further enhance their offerings, providing small and medium enterprises (SMEs) with cutting-edge financial products. A prime example is Instantpay, which consolidates multiple accounts into a unified digital dashboard or mobile app, offering a seamless experience for managing business finances.

Empowering Financial Control with Intuitive Tools

Beyond providing a fully digital banking experience, neobanks equip businesses with powerful tools for enhanced financial control. These include features for easy money movement tracking, insights into incoming and outgoing payments, and efficient employee expense management. The intuitive banking dashboard acts as a centralised hub for managing various financial tasks simultaneously. This capability allows businesses to streamline their financial operations, resulting in improved overall efficiency. Neobanks empower businesses with the tools they need to take charge of their financial well-being.

Automation Throughout Financial Processes

Neobanks offer SMEs cost-effective access to corporate banking services, with a strong emphasis on automating financial operations. From digital onboarding to simplified loan application processes and expedited payment processing, neobanks drive efficiency across the board. Business owners can leverage automation to handle diverse financial aspects, including vendor payments, expense management, and payment collections. Application Programming Interfaces (APIs) facilitate the integration of banking and financial features into company ecosystems, with the option of custom branding for a personalised touch.

The Pros of Neobanks

Convenient Access

Neobanks allow customers to handle most of their banking needs on a website or smartphone app 24/7, without visiting a branch. Top neobanks have highly-rated apps that make banking a breeze, like Instantpay.

Opening an account with a neobank can also be simpler than at traditional banks. Some neobanks don't review banking histories, meaning your application is more likely to be approved even if you've had accounts closed previously.

Lower Expenses, Competitive Returns

Like traditional banks, neobanks don't have the overhead of maintaining physical branches, and some pass the savings to customers through low or no monthly fees and strong interest rates on savings.

Superior User Experience

Neobanks don't provide novel banking services by themselves. Their offerings resemble traditional banks, but with a streamlined and personalized user experience. Compared to old-school banks, neobanks have leaner business models and superior technology, enabling seamless account opening, 24/7 chatbot customer service, near real-time international transfers, and AI/ML-powered automated accounting, budgeting and treasury services.

Automated Offerings

In addition to basic banking services, neobanks provide automated, near real-time accounting and reconciliation for tasks like bookkeeping, statements, and tax services including GST-compliant invoicing, payment tracking and reconciliation, all through user-friendly mobile platforms at affordable rates.

Transparency

A major appeal of Neobanks is their commitment to transparency in all operations. Rather than hiding behind fine print, they provide customers with real-time notifications and unambiguous explanations for any fees, charges or penalties applied to their accounts. Neobank users enjoy an unprecedented level of clarity regarding how much they are paying and why, with no hidden costs or surprise gotchas. This refreshing openness helps build trust and confidence in neobanks.

In-Depth Insights

Most Neobanks offer intuitive dashboards and easy-to-understand, valuable insights into services like payments, payables, receivables and bank statements. For businesses with significant expenditures and personnel, these insights can reduce costs, boost productivity and revenue.

Developer-Friendly APIs

Most neobanks provide easy-to-implement and user-friendly APIs to integrate banking services into accounting and payment systems.

Before signing up, review the provider's policies. Some neobanks charge fees for premium services or require a certain transaction volume each month to earn the best interest rates. Make sure the offer aligns with your spending and savings goals.

How Do Neo Banks Work?

Neo banks represent a new breed of financial institutions distinct from traditional and digital banks. Without costly physical branches and large staffs, neo banks efficiently deliver cutting-edge digital banking services.

At their core, neo banks partner with established banks to gain access to capital and regulatory approvals. The neo bank then develops the interface and products, while handling acquisition, service, and the end-to-end customer experience.

This allows neo banks to focus on innovation and customer satisfaction. Their sleek apps and data analytics provide personalised offerings tailored to user behaviors and needs.

Many Neo banks offer attractive accounts with no monthly fees, catering to first-time earners. They also provide lending to businesses looking to expand their operations or build something new.

Leveraging agile development and continuous customer insight, neo banks will shape finance around individuals and businesses like never before.

The Rising Popularity of Neobanks

The digital revolution has disrupted the banking industry, giving rise to a new breed of financial services - Neobanks. These virtual banks are gaining traction globally, especially among tech-savvy millennials and Gen Z.

Convenience and ease of use are huge selling points. Neobanks provide seamless mobile banking with intuitive interfaces. Account opening and money transfers happen in minutes, not days. Customers enjoy 24/7 access and minimal paperwork. The streamlined digital experience attracts digitally native generations.

Transparency is another key advantage. Neobanks have lower fees and no hidden charges compared to traditional banks. Their business models center around customer needs, not profit margins. The transparency builds trust and loyalty.

Innovation is in Neobanks' DNA. They leverage cutting-edge technology like AI, ML, biometrics and blockchain to offer hyper-personalised services and top-notch security. This constant innovation delivers a superior banking experience.

The responsive customer service also scores big. Neobank users have access to real-time support and instant resolution of queries. The human touch blended with digital convenience is a big draw.

In summary, neobanks are winning over customers globally by transforming banking into a seamless, secure and personalised digital experience. Their innovations cater to shifting consumer preferences - the need for speed, transparency and convenience. This perfect storm makes neobanking the future of financial services.

Way Forward

Neobanks have attracted many millennials with their user-friendly online services and excellent accessibility. A smartphone app or desktop is all you need to conduct financial transactions anywhere, anytime. They utilise biometrics and AI technologies to provide advanced products and services to users. With encryption and two-factor authentication, banking is safe and convenient for everyone.

Neobanks are not just financial institutions; they are catalysts for innovation, offering tailored experiences that redefine the landscape of small business banking. With their user-friendly interfaces, cutting-edge technologies, and commitment to security, neobanks like Instantpay are ushering in a new era of accessibility and efficiency in financial services.

Business owners looking to modernise their financial processes can confidently turn to Instantpay for an innovative and effective banking solution. As the neobank revolution continues, the future of small business banking looks more dynamic and promising than ever.

FAQs

What is a Neobank?