#js trader

Explore tagged Tumblr posts

Text

IQ OPTION - CONSISTÊNCIA GARANTIDA COM ESSE INDICADOR COMPLETO 2024

youtube

#2023 indicador mt4#indicador mt5 2023#2023 mt5 funciona indicador#indicador mt4 2023#2023 indicador gratis mt4#indicador forex 2023#indicador 2023#hft#iq option ao vivo#carlos trader#js trader#IQ OPTION - CONSISTÊNCIA GARANTIDA COM ESSE INDICADOR COMPLETO 2024#Youtube

0 notes

Text

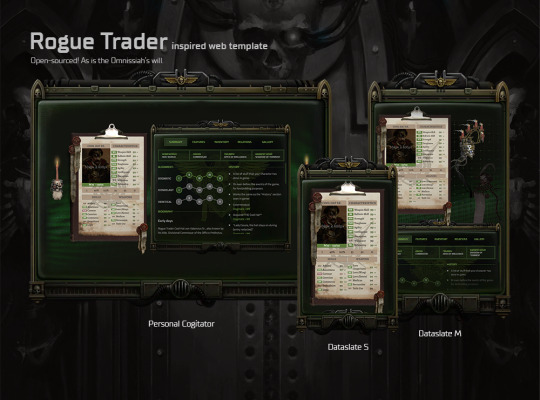

I finished coding my Rogue Trader character sheet template! It's now open sourced on GitHub 🤖

☆ Features

Display your character's stats in (almost) the same way as you've seen in Warhammer 40,000: Rogue Trader CRPG

Multiple sections for character building:

Summary: Character origin info, alignment level, history, and biography.

Features: Show off your build by listing abilities & talents that your character has gained throughout the course of the game.

Inventory: Your Rogue Trader's equipment, armour, etc. goes here.

Relations: Detail the relationship of your Rogue Trader and their retinue members.

Gallery: Place to show off your fanart, commissioned art, fanfics, playlist. Anything goes!

Cool floating servo skulls (only visible in certain screen sizes).

Responsive. Not horrible to look at even in small screens.

☆ Requirements

You would need a static site hosting service for this to work. I recommend Neocities or GitHub pages. Both are free.

Some experience with using npm.

Some experience with basic HTML and JS object/JSON is recommended.

I really wish that it's easier to use and set up, but it's just not possible due to the tech stack I chose initially... I did write a beginner's tutorial on the repository's wiki, but I don't know if it makes sense to normal people who do not code... If you have any questions, let me know and I'll see what I can do.

Tech stack: SvelteKit, SCSS, TypeScript

Bonus:

Name too long? No problem :)

#link to the github repo is in the source!#I made a draft of this post then posted this on Reddit then forgor about it again rip.#rogue trader#warhammer 40k rogue trader#warhammer 40k#warhammer 40000 rogue trader

300 notes

·

View notes

Note

omg heyy 🤭 ive only just found your blog but i absolutely adore your writing!! could i please request some housewife headcanons? ty <3

my ideal career is housewife but i js need to marry schlatt so i don’t have to worry abt money first 😔

taking care of him during streams!

bringing in water, food, anything he needs

he takes that chance to show you off to his stream, shower you in compliments before you head out of his office

he will literally take any chance he can to rub it into anyone’s face

“what am i eatin right now? it’s just some soup my WIFE made me, it’s whatever, she does it all the time” he says with a cocky grin

he loves home cooked meals and will asks for seconds constantly

he gets a taste for your cooking (and baking) to the point he doesn’t enjoy eating out as much

he loves that you basically can be around him 24/7 since he works from home and you don’t have a job

if he ever tries cooking for a stream, he’s struggling so hard

he gains so much respect for you if you make almost everything by scratch

if you take up a little hobby like baking or pottery or gardening

he.fucking.loves.it.

he shows off anything and everything you make

drinks from mugs you make, eats whatever you baked or grew and makes a point to tell everyone

“well ted, while you’re eatin’ your nasty ass rap snacks, i’ll be eating this” he says smiling and holding up a bowl of strawberries, “delicious, home grown, organic, non-micro plastic, strawberries, that my wife grew” he says with a satisfied smile “not to mention she also made the bowl, it’s bpa free”

hes literally such a dick to everyone about how he’s married to you

“i’m havin’ chicken n dumplins for dinner, they’re HOMEMADE by the way, not the nasty trader joe’s shit you gotta eat” schlatt says to ted with a grin “m’ wife is makin it all from scratch”

he says you “balance him out” with how sweet and soft you are

makes tradwife jokes all the time

he also likes making jokes about other people wanting you and actively brags about it

“we were a beach the other day and i saw men eyein her up, didn’t even care ‘cause i was the guy rubbin tannin oil on her back”

he loves buying you pretty new clothes, jewelry, makeup, etc.

he pays for you to get your hair, nails, etc. done

loves doing little things with you from grocery shopping to wasting time at a retail store

he says the cats got into something on stream and always comes back with light lipstick marks on his lips and face

looks for any excuse to kiss and touch you on camera

flirts with you even when you’ve been married for years

he only has eyes for you as you do him and every one knows

everyone can tell that even with the jokes he makes he loves you so much

#schlatt x reader#jschlatt x reader#jschlatt x you#jschlatt x y/n#schlatt x y/n#schlatt x you#jschlatt fluff#schlatt fluff

681 notes

·

View notes

Text

I love rafe cameron fanfics and smut but like… clutching my pearls and side-eyeing my own curiosity (cuz sometimes you be scrolling like “oh this is spicy” then halfway through you realize she said “no” 7 times and he said “shhh” 8 times and suddenly you’re sitting there like why is my stomach hurting).

BECAUSE ITS SOOOO CRAZY HOW FAST IT ESCALATES

like you’re just trying to read some spicy makeout stuff, and next thing you know it’s “she forgot how to form full sentences because he dicked the thoughts out her head” and you’re like 😃😃😃 “okay let’s log off now before i lose my mind AND my morals.”

AND ITS NOT EVEN AN EXAGGERATION ITS GROWN ASS PEOPLE WHO HAVE KIDS! LIKE NO SHAME IF YOURE WRITING OR READING SMUT BUT R@P3 PLAY?

LIKE ILL JS BE SCROLLING ON RAFE SMUT AND THEN 3POSTS LATER it’s “here’s the types of collars your dom would make you wear in public so you forget your own name :)” and everyone’s reblogging it like “this is so me omg.”

LIKE??? NO ITS NOT BABES. U HAVE A JOB. U HAVE KIDS. YOU DROVE A MINIVAN TO TRADER JOES THIS MORNING.

and those comments be REAL too. like grown women in the notes talkin bout

“i left the back door open, please god let him find me”

MA’AM????

HELLO????

THAT IS A CRIME. A FELONY. MULTIPLE!!! and the craziest part? the way they say it so ✨casually✨ like it’s just another Wednesday night craving.

like “mmm i could go for a snack or some light home invasion r@p3 🥰”

girl what do you mean?!? it’s genuinely scary sometimes bc it’s not even fantasy for them anymore it’s like they wanna manifest it. and the way they frame it like “omg i’m just so ✨submissive✨ and he knows what’s best for me teehee” like NOOO?! that’s. called trauma and unsafe coping mechanisms ☺️☺️ and i swear the “boyfriend brain” stuff starts out cute (like “omg he makes me forget my password” ok cute whatever) but suddenly you reading: “i haven’t spoken in days because he doesn’t let me and he feeds me in a highchair now”

and the comments be like “i need this.”

🚨CALL FOR HELP???🚨

like i’m all for spicy fanfic and weird little fantasies but there’s a POINT where it stops being sexy and starts being a LITERAL CRY FOR HELP that everyone’s just ignoring 😭

AND AGE PLAY!!? like you wanna crawl around in a onesie and call him daddy in the privacy of your own weird lil trauma bubble? go off. but the moment you’re sippin juice out of a sippy cup at Olive Garden talking about “no big girl words” I’M OUT. i’m LEAVING my breadsticks behind and everything. semi-public sex smut? discreet? understood. but full-on baby bimbo in aisle five at Target?

girl no. i got secondhand embarrassment from reading it. the size kink, dom/sub dynamic? yes, there’s nuance! i love the “he’s 6’5 , i have to look up to speak to him , he flips me over like a doll” energy. absolutely. but some of these writers take that and run into the woods never to return. and then add hypnosis??? no plot, just vibes and consensual brain removal surgerylike the way you blink and suddenly you’re reading:

“my brain is too heavy so he took it from me. now i smile and say thank you with my legs open :)”

I BEG YOUR PARDON????

WHAT IN THE BLACK MIRROR IS THIS

and then the comments?

“omg i’m drooling this is everything i want”

“i need someone to delete me like this fr”

it’s literally like… some of those blogs feel like a government experiment to see how far the human mind can go into unwell territory with zero regulation.

2 notes

·

View notes

Text

OLD INTRO REMAKING SOON!!

Hii!! I’m elle :3 ! She/her,,, i prefer to keep my age private

other me’s: @ask-steve-cobs-ii :: @skullputer

check me out on wattpad!11! I post bangers on there!!1 @skullputer

idm troll asks atp lol

i need friends idc what age i need friends idc what age i need frien

FACTZZ ♡🍶🫐

・i rlly like object shows!! Since 2019!!! >.<

・my typing quirks r misspelling stuffs and s = z :3

・i luv using :3 and ^_^ stuffs like that (emoticonss,,)

・ @milkiette >>>>>>>>!!! BTWWW!! ILY POOKIE,,! 🦴🎀

・kawaiikore…. 🤍🤍

・i plan on doing art commissionz when i am confident enuff!! 🍥

・i will never ever!! Sell my ocsss Σ੧(❛□❛✿)!! I luv them smm

・reblogs + posts abt my object ocs, fanart, stuff like that (+ cute stuff prolly??)

・im pretty unorganized soo dont be surprised if everything on this blog is MESSYYY!!

・i dont bite if u wanna be friendz or ask me smth, even if ur an adult :3

・art inspos,, @/maxphilippa on tumblr, @/rawrvioli on yt, @/26nightmares on yt, @/cideramese on yt, bfyop/battle/@bfyopYT for your own planet on yt, kittydog on yt, moccabliss on yt, @/mothytheghost on tumblr, @_mecintosh on twitter.

MOOTS 🍮⭐️

・@laveries | freya <33 | UR OBJECT OCS R PRETTY!!!!

・@milkiette | yuna | RAHHH NEW POOKIE!! ILYSM!

・im looking forward to being friens with anybodyy :3333 idc what age as long as ur not a creep!! Then ur cool!!!!!!

・once i become friens w u i might take a while bc i have social anxietyyy

BOUNDRIES 🥝🌴

・be annoying af and ur buh-buh-buh- BLOCKED!!!!

・Dont treat me as ur frien right away,, i have social anxiety 😔‼️

・no dms unless we r mutuals ty im js a scared meow meow ><

・DONT SUCK MY DICK AND BE A CREEP. I AM A MINOR. ‼️

・Pls no comparing my artstyle to someone else’s no matter how similar • 3 • i get uncomfy w that

・i put paws and clothes on my object characters, they aint furries fyi. If i draw animals,,, dont call me a furry artist idc if its a joke just please dont >:(( it makes me feel weird abt drawing animals.

DNI: if ur overall a dick, comship, proship, basic dni criteria, oc stealers, hardcore Christian,, NFT art traders + collectors, creeps, ppl who shame artstyles gtfo, ppl who shame rarepairs/crackships/canon x oc, simps ermm.

BYF: I don’t post much,, i usually reblog/rb or just make fanart and stuffs for my fav blogss,,

IF UR HERE JUST TO SHAME HOW I PUT PAWS N CLOTHES ON MY OBJECT CHARACTERS,,,,, GET OUTTA HEREE!!!!!! 💢(● ˃̶͈̀ロ˂̶͈́)੭ꠥ⁾⁾ DNI!

Oki thats all abt me baibai :33

9 notes

·

View notes

Text

hey guys nerd moment about the title of the fic (this is long im sorry)

mood indigo was actually a jazz song released in the 1930’s by duke ellington, barney bigard with lyrics by irving mills, except bigard said that its real credit is derived from his clarinet teacher, Lorenzo Tio’s, melodies. so that clarinet part like biagrd’s solo? yea that was Lorenzo tio’s melodies that weren’t full developed and when bigard did finish them and show them so ellington, he liked it and it was included. and like its almost impossible to tell where ellington’s collaborators part begin bcs apparently he’s js that good at blending that stuff idk (dont take that last part as a fact thats purely from what i remember.) anyways, mood indigo is about a little boy and little girl who are eight. girl loves boy and while they never acknowledge the feelings, the girl waits at her window bcs the boy visits her. and the song basically describes the feeling the girl had when the boy didnt visit her. so you may be asking, duct why would u choose something like that as a title for a book about the slump in london 1930s and about criminal organizations? well, dear anon, here u r:

1. literal (?) meaning; im gonna be so honest with you i purely got this idea from brendan and neksa / jess and morgan. i couldnt stop thinking about that wonderful art i found of brendan and neksa it was of neksa as a raven or crow i dont rmb but point is that its gorgeous and stunning i love it. the idea that brendan denies his feelings of love for her purely because he half doesn’t want to acknowledge that he’s become so attached to a person in such an intimate way and half because he just cant risk his father (or anyone) finding out that he’s gone and practically betrayed his dad’s whole like symbolism in tje trading world (remember they don’t like the library. yk how contradicting it would be to have one of the biggest illegal book trader’s son dating someone from the library, especially someone who works in like the same facility as the archivist? yea its damnable like no ones gonna trust ca. brightwells or his business anymore.) anyways the literal meaning: girl is sad bcs boy didn’t visit/come back to her. brendan literally left neksa (the woman he was oh so deeply in love with) because he didn’t want to hurt her and played it off as the fact that he didn’t love her. and when jess comes back as brendan (lmaoo) i feel like you can imagine the smallest sliver of hope she had that they can be something again but its practically disappeared next to the pure anger and grief in her heart. and when neksa dies, brendan can’t visit her anymore. its literally not possible. (until he died then maybe they could be happy tgt). this is so many words words words guys i promise im not actually this much of a nerd on a daily basis this is just interesting to me. anyways, once again, girl is sad bcs boy didn’t visit her one day. umm we can go back and look into jess’ past: boy is eternally sad bcs his brother died. aka: boy is sad bcs his brother can’t visit him. like ever. sad sad sad moments💔💔

2. this is like an actual stretch but um i consider it okay so basically girl being sad is jess boy who didnt visit (or wont anymore) is a semblance of love or sanctuary. throughout the series its obvious that jess just doesn’t trust his family. im pretty sure he even says it like he does not trust them. but hey, maybe he did once. maybe he did when he was a little boy who had an older brother who he could rely on—one that taught him how to walk and that taught him the basics. someone who he could go to for advice and who could help him keep his head above water. now we don’t have a characterization, but i’m going off of @thegreatlibraryfangirl’s advice and kinda semi-making my own..so um sorry if u dont like that guys..but anyways i feel like the moment jess starts to really rely and trust the other’s is the moment that melancholy feeling, that mood indigo, goes away. it doesnt go away completely, theres always gonna be a solid chunk never satisfied but thats okay because he has people he can trust with his life that will help him get through it. not only this but the bond that jess and dario (will) share in this au represents that. they’re both young—maybe 13 max but they both lack one thing that only they can give esch other; sanctuary.

#oh my fuckin god that is so long#im dorry i put you through reading this#i oromise im more than a nerd#tgl#the great library#the slumps tgl#mood indigo#jess brightwell#dario santiago#christopher wolfe#wolfe pack

2 notes

·

View notes

Text

Building a Profitable Flash Loan Arbitrage Bot in DeFi

The rise of Decentralized Finance (DeFi) has opened up powerful avenues for developers and traders to extract value from blockchain ecosystems. One such innovative approach is flash loan arbitrage — a strategy that leverages unsecured loans for quick profits. Let’s explore how to build a profitable flash loan arbitrage bot, from concept to deployment.

What Are Flash Loans & Arbitrage in DeFi

In the rapidly evolving world of decentralized finance (DeFi), flash loan arbitrage bots have emerged as powerful tools to generate profit without upfront capital. These bots utilize flash loans—instant, collateral-free loans taken and repaid within the same transaction block—to exploit price differences across decentralized exchanges. Arbitrage in DeFi works by identifying opportunities where a token is priced lower on one exchange than another, enabling traders to buy low and sell high, all within seconds and with minimal risk when executed correctly.

Tech Stack for Flash Loan Arbitrage on Ethereum

To build a functional flash loan arbitrage bot, you'll need a solid development environment and access to a few critical tools. First, you’ll need smart contract development skills using Solidity, along with frameworks like Hardhat or Foundry. Web3.js or Ethers.js will be essential for interacting with the Ethereum blockchain, while access to DEX aggregators or APIs like Uniswap, SushiSwap, and 1inch is vital for retrieving real-time price data. A testnet environment and a tool like Tenderly for transaction simulation can help fine-tune your bot without risking funds.

How the Arbitrage Bot Works

The arbitrage bot works by borrowing funds using a flash loan from a protocol like Aave or DyDx, using that capital to execute a buy-sell arbitrage across DEXs. If the price difference is profitable after accounting for gas fees and slippage, the bot repays the loan within the same block and pockets the profit. All operations must succeed in a single atomic transaction—otherwise, the transaction is reverted, and no funds are lost.

Deployment & Security Tips

When deploying your arbitrage bot, it’s crucial to prioritize security and gas efficiency. Smart contracts should be audited or reviewed to prevent reentrancy or front-running vulnerabilities. Deploy on a blockchain with low fees and high liquidity, like Polygon or Arbitrum, to optimize execution speed and cost-effectiveness.

Conclusion

Flash loan arbitrage is not just a buzzword — it’s a powerful strategy to automate crypto profits. If you're ready to dive into this space, choosing the right development partner is essential. Osiz Technologies offers advanced Flash Loan Arbitrage Bot Development solutions with tailored features and cross-chain support. Build smarter, faster, and better with a trusted expert in DeFi automation.

0 notes

Text

if I successfully complete my good three weeks I'm going to treat myself by going to trader Joe's and eating an entire sheet cake at the park.

that's what's gonna keep me going I think js being so real

0 notes

Text

How to Build a Solana Trading Bot: A Complete Guide

Introduction

In today’s rapidly evolving crypto landscape, algorithmic trading is no longer just for hedge funds—it’s becoming the norm for savvy traders and developers. Trading bots are revolutionizing how people interact with decentralized exchanges (DEXs), allowing for 24/7 trading, instant decision-making, and optimized strategies.

If you're planning to build a crypto trading bot, Solana blockchain is a compelling platform. With blazing-fast transaction speeds, negligible fees, and a thriving DeFi ecosystem, Solana provides the ideal environment for high-frequency, scalable trading bots.

In this blog, we'll walk you through the complete guide to building a Solana trading bot, including tools, strategies, architecture, and integration with Solana DEXs like Serum and Raydium.

Why Choose Solana for Building a Trading Bot?

Solana has quickly emerged as one of the top platforms for DeFi and trading applications. Here’s why:

🚀 Speed: Handles over 65,000 transactions per second (TPS)

💸 Low Fees: Average transaction cost is less than $0.001

⚡ Fast Finality: Block confirmation in just 400 milliseconds

🌐 DeFi Ecosystem: Includes DEXs like Serum, Orca, and Raydium

🔧 Developer Support: Toolkits like Anchor, Web3.js, and robust SDKs

These characteristics make Solana ideal for real-time, high-frequency trading bots that require low latency and cost-efficiency.

Prerequisites Before You Start

To build a Solana trading bot, you’ll need:

🔧 Technical Knowledge

Blockchain basics

JavaScript or Rust programming

Understanding of smart contracts and crypto wallets

🛠️ Tools & Tech Stack

Solana CLI – For local blockchain setup

Anchor Framework – If using Rust

Solana Web3.js – For JS-based interactions

Phantom/Sollet Wallet – To sign transactions

DeFi Protocols – Serum, Raydium, Orca

APIs – RPC providers, Pyth Network for price feeds

Set up a wallet on Solana Devnet or Testnet before moving to mainnet.

Step-by-Step: How to Build a Solana Trading Bot

Step 1: Define Your Strategy

Choose a trading strategy:

Market Making: Providing liquidity by placing buy/sell orders

Arbitrage: Exploiting price differences across DEXs

Scalping: Taking advantage of small price changes

Momentum/Trend Trading: Based on technical indicators

You can backtest your strategy using historical price data to refine its effectiveness.

Step 2: Set Up Development Environment

Install the essentials:

Solana CLI & Rust (or Node.js)

Anchor framework (for smart contract development)

Connect your wallet to Solana devnet

Install Serum/Orca SDKs for DEX interaction

Step 3: Integrate with Solana DeFi Protocols

Serum DEX: For order-book-based trading

Raydium & Orca: For AMM (Automated Market Maker) trading

Connect your bot to fetch token pair information, price feeds, and liquidity data.

Step 4: Build the Trading Logic

Fetch real-time price data using Pyth Network

Apply your chosen trading algorithm (e.g., RSI, MACD, moving averages)

Trigger buy/sell actions based on signals

Handle different order types (limit, market)

Step 5: Wallet and Token Management

Use SPL token standards

Manage balances, sign and send transactions

Secure private keys using wallet software or hardware wallets

Step 6: Testing Phase

Test everything on Solana Devnet

Simulate market conditions

Debug issues like slippage, front-running, or network latency

Step 7: Deploy to Mainnet

Move to mainnet after successful tests

Monitor performance using tools like Solana Explorer or Solscan

Add dashboards or alerts for better visibility

Key Features to Add

For a production-ready Solana trading bot, include:

✅ Stop-loss and take-profit functionality

📈 Real-time logging and analytics dashboard

🔄 Auto-reconnect and restart scripts

🔐 Secure environment variables for keys and APIs

🛠️ Configurable trading parameters

Security & Risk Management

Security is critical, especially when handling real assets:

Limit API calls to prevent bans

Secure private keys with hardware or encrypted vaults

Add kill-switches for extreme volatility

Use rate limits and retries to handle API downtime

Consider smart contract audits for critical logic

Tools & Frameworks to Consider

Anchor – Solana smart contract framework (Rust)

Solana Web3.js – JS-based blockchain interaction

Serum JS SDK – Interface with Serum’s order books

Pyth Network – Live, accurate on-chain price feeds

Solscan/Solana Explorer – Track transactions and wallet activity

Real-World Use Cases

Here are examples of Solana trading bots in action:

Arbitrage Bots: Profiting from price differences between Raydium and Orca

Liquidity Bots: Maintaining order books on Serum

Oracle-Driven Bots: Reacting to real-time data via Pyth or Chainlink

These bots are typically used by trading firms, DAOs, or DeFi protocols.

Challenges to Be Aware Of

❗ Network congestion during high demand

🧩 Rapid updates in SDKs and APIs

📉 Slippage and liquidity issues

🔄 DeFi protocol changes requiring frequent bot updates

Conclusion

Building a trading bot on Solana blockchain is a rewarding venture—especially for developers and crypto traders looking for speed, cost-efficiency, and innovation. While there are challenges, Solana's robust ecosystem, coupled with developer support and toolkits, makes it one of the best choices for automated DeFi solutions.

If you're looking to take it a step further, consider working with a Solana blockchain development company to ensure your bot is scalable, secure, and production-ready.

#solana trading bot#solana blockchain#solana development company#solana blockchain development#how to build a solana trading bot#solana defi#serum dex#solana web3.js#anchor framework#solana crypto bot#solana trading automation#solana blockchain development company#solana smart contracts#build trading bot solana#solana bot tutorial#solana development services#defi trading bot

0 notes

Text

bootleg traders pmo like fym trade 😭 js hand it over lil bro

1 note

·

View note

Text

How Crypto Traders Gain Consistent Profit with Crypto Flash Loan Arbitrage Bots

The appeal of consistent profit in the explosive crypto market is a siren song for many traders. Amidst fluctuating prices and emerging DeFi protocols, flash loan arbitrage bots have emerged as a refined tool, promising to transform fleeting market inefficiencies into tangible gains. This article delves into the mechanics and strategies behind these bots, exploring how they enable traders to navigate the treacherous waters of crypto volatility and potentially achieve consistent profitability.

The Genesis of Instantaneous Capital: Flash Loans and Their Power

At the heart of flash loan arbitrage lies the revolutionary concept of flash loans. Unlike traditional loans that require collateral and lengthy approval processes, flash loans allow users to borrow vast sums of cryptocurrency without upfront capital, provided the loan is repaid within the same transaction block. This seemingly paradoxical feat is made possible by the atomic nature of blockchain transactions, where all actions within a block are executed or reverted as a single unit.

This instantaneous access to capital unlocks the potential for arbitrage, the practice of exploiting price discrepancies across different exchanges. In the crypto world, these discrepancies, though often minuscule, can be amplified by leveraging the immense borrowing power of flash loans.

The Algorithmic Maestro: Orchestrating Profitable Trades

Manual execution of flash loan arbitrage is a near-impossible feat due to the time-sensitive nature of the trades and the complexity of the underlying smart contracts. This is where the crypto flash loan arbitrage bot steps in, acting as an algorithmic maestro, orchestrating a symphony of trades within a single transaction block.

These bots are programmed to:

Real-time Market Surveillance: Continuously monitor price feeds from multiple decentralized exchanges (DEXs), identifying potential arbitrage opportunities.

Profitability Assessment: Calculate the potential profit from each opportunity, factoring in transaction fees, loan interest, and slippage.

Automated Trade Execution: Execute the entire arbitrage sequence, including borrowing the flash loan, swapping tokens on different DEXs, and repaying the loan.

Risk Mitigation: Implement risk management parameters to minimize losses due to slippage or unexpected market fluctuations.

The Anatomy of a Profit-Generating Machine

A typical flash loan arbitrage bot comprises several key components:

Smart Contracts: The core of the bot, defining the logic for borrowing, swapping, and repaying the flash loan.

Web3 Libraries: Tools like Web3.js or Ethers.js, facilitating interaction with the blockchain and smart contracts.

Data Aggregators: Real-time price feeds from multiple DEXs, providing the necessary market data.

Arbitrage Algorithms: Algorithms that identify and calculate profitable arbitrage opportunities.

Risk Management Modules: Modules that implement stop-loss orders and other risk mitigation strategies.

Strategies for Consistent Profitability

Achieving consistent profitability with flash loan arbitrage bots requires a strategic approach:

DEX Selection: Choosing DEXs with sufficient liquidity and reliable price feeds is crucial.

Transaction Fee Optimization: Minimizing gas fees is essential for maximizing profits.

Slippage Management: Implementing slippage tolerance parameters to mitigate losses due to price fluctuations.

Backtesting and Optimization: Thoroughly backtesting the bot's performance on historical data to identify optimal parameters.

Staying Updated: Keeping abreast of new DeFi protocols and market trends.

Security Audits: Ensuring the security of the bot's smart contracts through rigorous audits.

Navigating the Perils of Flash Loan Arbitrage

While flash loan arbitrage offers the potential for significant profits, it is not without its risks:

Smart Contract Vulnerabilities: Bugs or exploits in smart contracts can lead to substantial losses.

Market Volatility: Sudden price swings can invalidate arbitrage opportunities.

Transaction Fee Spikes: High gas fees can erode profits.

Front-Running: Malicious actors can exploit pending transactions to steal arbitrage profits.

Liquidity Constraints: Insufficient liquidity can lead to significant slippage.

Regulatory Delay: The growing regulatory landscape can create delay.

The Future of Algorithmic Arbitrage

As the DeFi ecosystem matures, flash loan arbitrage bots are poised to become increasingly sophisticated. Advancements in AI and machine learning will enable bots to adapt to changing market conditions and identify more complex arbitrage opportunities. Layer-2 scaling solutions will also play a role in reducing transaction costs and increasing efficiency.

Conclusion

Crypto flash loan arbitrage bots offer a powerful tool for traders seeking to capitalize on market inefficiencies. However, success requires a deep understanding of the underlying principles, meticulous execution, and a prudent approach to risk management. By combining technical expertise with a strategic mindset, traders can potentially leverage these bots to navigate the volatile crypto market and achieve consistent profitability. It is however, imperative to remember that the crypto market is highly risky, and only capital one can afford to lose should be utilized.

0 notes

Text

How to Build Crypto Sniper Bot Development

Introduction

In the fast-paced world of cryptocurrency trading, speed is everything. A crypto sniper bot is an automated trading tool designed to execute buy and sell orders with lightning-fast precision. These bots are particularly useful for sniping newly launched tokens, capturing arbitrage opportunities, and minimizing slippage. In this blog, we will explore the development of a crypto sniper bot, its key features, and the essential steps to build one.

What is a Crypto Sniper Bot?

A crypto sniper bot is a specialized trading algorithm that scans the market for profitable trades and executes them instantly. These crypto sniper bot development work by monitoring decentralized exchanges (DEXs) like Uniswap, PancakeSwap, and SushiSwap to place orders milliseconds after a new token is listed or when price conditions are met.

Key Features of a Crypto Sniper Bot

Before diving into development, let's outline some must-have features of a high-performance crypto sniper bot:

High-Speed Transaction Execution - Ensures trades are executed before the competition.

Real-Time Market Scanning - Monitors liquidity pools and new token listings.

Anti-Front Running Mechanisms - Prevents MEV bots from exploiting transactions.

Gas Fee Optimization - Adjusts gas fees dynamically for faster transaction speeds.

Multi-DEX Compatibility - Supports multiple decentralized exchanges.

Stop-Loss & Take-Profit Features - Helps manage risk effectively.

Auto Sniping & Manual Mode - Offers flexibility for traders.

Smart Contract Interaction - Directly communicates with blockchain networks via Web3.js or Ethers.js.

How to Build A Custom Trading Sniper Bot?

Technical know-how and market expertise are needed to build a custom trading sniper bot. A sniper bot is made to make precise trades, frequently profiting from slight changes in price. To make one, follow these steps:

Establish Goals: Establish the precise objectives of your sniper bot, including the markets it will trade on and the tactics it will use.

Select a Language for Programming: Choose a programming language with data analysis libraries and support for trading APIs, such as Python, Java, or C++.

Pick a Trading Platform: Pick a platform like Binance, Coinbase, or Interactive Brokers that provides API access.

Create Algorithmic Trading Systems: Develop algorithms that use price patterns or technical indicators to determine entry and exit points.

Backtest the Bot: Evaluate the bot's performance and improve its tactics by using historical data.

Put Risk Management into Practice: To safeguard your investment, incorporate risk management features.

Deploy and Monitor: Start the bot in a live trading environment, then keep an eye on its performance and make any necessary adjustments.

These steps will help you build a custom trading sniper bot that manages risk and executes trades efficiently. At Rapid Innovation, we offer the resources and know-how you need to develop and refine your trading bot so that it complements your company objectives and optimizes your return on investment.

Technical Architecture and Infrastructure Requirements

Any trading platform architecture must have a strong technical foundation to guarantee security, scalability, and dependability. The infrastructure ought to be built to process data in real time and manage large transaction volumes. Important elements consist of:

Cloud Infrastructure: You may save money and increase scalability by using cloud services like AWS, Azure, or Google Cloud. In order to sustain performance during busy trading hours, these platforms provide features including load balancing, auto-scaling, and managed databases.

Microservices Architecture: By enabling the autonomous deployment and scaling of various components, a microservices architecture enhances the resilience and maintainability of a system. Rapid Innovation can create and implement products more rapidly thanks to this strategy, which guarantees that customers can effectively adjust to changes in the market.

Database management: Pick a database that can handle a lot of transactions. NoSQL databases (like MongoDB and Cassandra) for unstructured data and SQL databases (like PostgreSQL and MySQL) for structured data are available options. Clients can choose the best database solution for their unique trading requirements with the help of Rapid Innovation.

Security Measures: Put in place strong security procedures, such as intrusion detection systems, firewalls, SSL/TLS for data encryption, and frequent security audits and compliance checks. By utilizing decentralized data storage and transaction verification, our proficiency with blockchain technology can further improve security.

Monitoring and Logging: To swiftly detect and fix problems, use real-time monitoring and logging solutions like Prometheus or ELK Stack. To guarantee peak performance and uptime, Rapid Innovation can incorporate these tools into your trading platform.

Risks and Challenges

While a crypto sniper bot can be highly profitable, it comes with risks:

High Gas Fees - Transaction costs can be unpredictable.

Rug Pulls & Scam Tokens - Avoid sniping unknown tokens without proper research.

Blockchain Congestion - Delayed transactions may lead to losses.

Security Threats - Always use secure wallets and API keys.

Conclusion

Developing a crypto sniper bot requires a strong understanding of blockchain networks, smart contracts, and DEX trading strategies. With the right approach, you can create a bot that executes trades with unparalleled speed and efficiency. However, always be cautious of risks and test your bot rigorously before deploying real funds.

0 notes

Text

The Ultimate Guide to Developing a DeFi Exchange Platform That Dominates the Market

Decentralized Finance (DeFi) has revolutionized the financial landscape by enabling peer-to-peer transactions without intermediaries. A DeFi exchange platform provides users with the ability to trade cryptocurrencies seamlessly and securely. However, building a DeFi exchange that stands out in the competitive market requires careful planning, innovative features, and robust security.

This guide will walk you through the essential steps to develop a market-dominating DeFi exchange platform, covering critical aspects such as architecture, security, liquidity management, and regulatory compliance.

Understanding DeFi Exchanges

DeFi exchanges (DEXs) operate on blockchain technology and smart contracts to facilitate direct transactions between users. Unlike centralized exchanges (CEXs), DEXs do not hold users' funds, offering greater security and transparency.

Types of DeFi Exchanges:

Automated Market Makers (AMMs): Utilize liquidity pools and algorithms to determine asset prices (e.g., Uniswap, PancakeSwap).

Order Book DEXs: Similar to traditional exchanges, these match buyers and sellers based on predefined price orders (e.g., dYdX).

Hybrid DEXs: Combine the best features of CEXs and DEXs for enhanced user experience and liquidity.

Key Features of a Successful DeFi Exchange

To dominate the market, your platform must offer:

1. Security and Transparency

Smart contract audits to prevent vulnerabilities

Non-custodial trading for enhanced security

Transparent fee structures

Multi-factor authentication (MFA) for user accounts

Cold storage options for securing funds

2. User-Friendly Interface

Intuitive UI/UX for seamless trading

Mobile compatibility

Easy wallet integration

Dark and light mode options for better accessibility

Advanced charting tools for technical analysis

3. Liquidity Management

Staking and farming mechanisms

Liquidity pools with incentivized yield farming

Partnerships with liquidity providers

Integration with major stablecoins to reduce price volatility

4. Interoperability

Cross-chain compatibility for multi-token trading

Integration with multiple blockchain networks

Bridge solutions for asset transfers

Support for wrapped tokens (e.g., WBTC, WETH)

5. Advanced Trading Features

Limit and stop-loss orders

Derivatives and margin trading options

Real-time analytics and price tracking

Customizable trading bots for automated strategies

6. Governance and Tokenomics

Native governance token for voting rights

Rewards for active participants

Sustainable token supply and deflationary mechanisms

Community incentives through decentralized autonomous organizations (DAOs)

7. Regulatory Compliance

KYC/AML options for regions with regulatory requirements

Integration of compliance tools for automated reporting

Decentralized identity verification to balance privacy and security

Step-by-Step Process to Build a DeFi Exchange

Step 1: Define Your Business Model

Choose between AMM, order book, or hybrid model

Determine revenue streams (trading fees, staking rewards, etc.)

Identify your target audience (retail investors, institutional traders, etc.)

Step 2: Select the Right Blockchain

Ethereum (popular but high gas fees)

Binance Smart Chain (low fees, fast transactions)

Solana, Polkadot, or Layer-2 solutions for scalability

Consider building a multi-chain DEX for broader adoption

Step 3: Smart Contract Development

Develop secure and audited smart contracts for liquidity pools, swaps, and governance

Implement multi-signature wallets for added security

Design modular smart contracts for easy upgrades and maintenance

Use decentralized oracles for accurate price feeds (e.g., Chainlink, Band Protocol)

Step 4: Frontend & Backend Development

Use frameworks like React.js for UI

Implement Web3.js or Ethers.js for blockchain interactions

Ensure a responsive design for mobile and desktop users

Optimize the backend for high-frequency trading and low-latency order execution

Step 5: Liquidity and Token Integration

Deploy liquidity pools with yield farming options

Integrate popular DeFi tokens and stablecoins

Partner with existing liquidity providers to boost initial market depth

Implement flash loans and lending features for additional financial services

Step 6: Security Audits and Testing

Conduct rigorous smart contract audits

Perform penetration testing to identify vulnerabilities

Establish bug bounty programs to encourage white-hat hackers to find potential flaws

Ensure decentralized governance mechanisms to prevent single points of failure

Step 7: Launch and Marketing Strategy

Launch beta testing with incentivized participation

Run strategic marketing campaigns (social media, influencer collaborations, etc.)

List the platform on DeFi tracking websites (e.g., DeFi Pulse, CoinGecko)

Partner with blockchain communities for early adoption

Implement a referral program to drive user growth

Challenges and Solutions

1. High Gas Fees

Use Layer-2 solutions or alternative blockchains

Optimize smart contracts for lower gas consumption

Implement batch transactions to reduce costs

2. Liquidity Issues

Incentivize liquidity providers with staking rewards

Partner with established DeFi projects

Provide liquidity mining programs to attract users

3. Security Risks

Conduct thorough audits and implement bug bounties

Utilize decentralized oracles for accurate price feeds

Use time-lock mechanisms for smart contract upgrades to enhance trust

4. Regulatory Uncertainty

Stay updated with global regulatory trends

Implement optional KYC/AML features for users who require compliance

Work with legal experts to ensure adherence to local laws

Future Trends in DeFi Exchanges

1. AI-Powered Trading Strategies

AI-driven analytics for better trading predictions

Automated portfolio management for DeFi investors

2. Layer-2 Scaling Solutions

Integration of zk-rollups and Optimistic Rollups for reduced gas fees

Cross-chain compatibility for seamless asset transfers

3. Institutional Adoption

More hedge funds and asset managers exploring DeFi

Regulatory clarity leading to mainstream adoption

4. NFT and DeFi Integration

Lending and borrowing against NFTs as collateral

Decentralized gaming marketplaces using DeFi infrastructure

Conclusion

Building a DeFi exchange that dominates the market requires innovation, security, and user-centric design. By focusing on liquidity, scalability, and community-driven governance, your platform can gain traction in the competitive DeFi space.

The future of DeFi is bright, with ongoing developments in interoperability, security, and AI-driven trading. Stay ahead by continually updating features, optimizing for security, and engaging with the DeFi community.

Are you ready to build the next big DeFi exchange? Start planning today and take advantage of this financial revolution!

0 notes

Text

Unleash Market Mastery with Alltick API: Trade Ahead, Not Behind

In trading, 15 minutes isn’t just a delay—it’s a deadline missed. While others chase shadows of old prices, Alltick API delivers real-time data for stocks, forex, futures, and cryptocurrencies, transforming raw market movements into actionable intelligence.

Break Free from Delayed Data

Public market feeds are relics of the past. Trading cryptocurrencies with delayed quotes? Analyzing stocks using yesterday’s closing price? Alltick API shatters the status quo, streaming live data directly from exchanges—zero delays, zero compromises.

Why Alltick API?

Live Markets, Live Decisions Monitor crypto volatility, forex liquidity, futures trends, and stock ticks as they unfold—millisecond precision, global coverage.

One Integration, Infinite Markets Unify fragmented data streams from NASDAQ, Binance, CME, and 50+ exchanges into a single, seamless API.

Built for Speed, Engineered for Scale Handle millions of requests per second—ideal for algo trading, portfolio dashboards, or high-frequency analytics.

Developer’s Dream Clean docs, pre-built SDKs (Python/JS/Go), and WebSocket/REST APIs let you integrate live data in under 15 minutes.

Who Thrives with Alltick API?

Algorithmic Traders: Capitalize on microsecond price gaps in crypto or forex.

Asset Managers: Hedge futures risks with live volatility metrics.

Crypto Exchanges: Sync global order books to prevent arbitrage losses.

Retail Platforms: Offer users real-time stock charts and instant execution.

3 Steps to Real-Time Mastery

Connect: Integrate Alltick API with 5 lines of code.

Customize: Filter data by asset (crypto, stocks, etc.) or exchange.

Conquer: Trade, hedge, or analyze at the speed of now.

The Market Never Sleeps. Neither Should Your Data.

With Alltick API, you’re not just keeping pace—you’re defining it.

Start Your Free Trial Now Visit [Alltick API] to unlock zero-lag data for stocks, forex, futures, and cryptocurrencies.

0 notes

Text

𝐂𝐞𝐥𝐞𝐛𝐫𝐚𝐭𝐢𝐧𝐠 𝐎𝐮𝐫 𝐉𝐨𝐮𝐫𝐧𝐞𝐲: 𝐅𝐫𝐨𝐦 𝐎𝐧𝐞 𝐑𝐨𝐨𝐦 𝐭𝐨 𝐭𝐡𝐞 𝐖𝐨𝐫𝐥𝐝

On 𝟏𝟏𝐭𝐡 𝐌𝐚𝐲 𝟐𝟎𝟏𝟔, Gxpress began its journey in a small room with a big dream: to take Indian products to the global stage. Starting with Amazon Global, we pioneered comprehensive global e-commerce solutions.

Over the years, we have faced numerous ups & downs, challenges, & triumphs. Yet, our unwavering commitment to delivering seamless and exceptional service experiences to our sellers has remained steadfast.

𝐎𝐮𝐫 𝐌𝐢𝐥𝐞𝐬𝐭𝐨𝐧𝐞𝐬

Expanded operations to all major Amazon marketplaces, including USA, Canada, UK, Europe, Mexico, Australia, India, Japan, Saudi Arabia, Dubai, and Africa.

Facilitated the 𝐞𝐱𝐩𝐨𝐫𝐭 𝐨𝐟 𝐝𝐢𝐯𝐞𝐫𝐬𝐞 𝐈𝐧𝐝𝐢𝐚𝐧 𝐩𝐫𝐨𝐝𝐮𝐜𝐭𝐬, including:

Home textiles, home decor, furniture

Educational games, kitchen accessories

Ayurvedic products, cosmetics, perfumes

Incense sticks, oils, and more

Introduced new opportunities for Indian manufacturers and traders through platforms like eBay, Google Shopping, Amazon, Walmart, Joom, and others—enabling both B2B and B2C success stories.

𝐂𝐨𝐥𝐥𝐚𝐛𝐨𝐫𝐚𝐭𝐢𝐧𝐠 𝐰𝐢𝐭𝐡 𝐊𝐞𝐲 𝐒𝐭𝐚𝐤𝐞𝐡𝐨𝐥𝐝𝐞𝐫𝐬

We have proudly partnered with leading government bodies, such as:

FIEO (Federation of Indian Export Organisations)

IGHF (Indian Handicrafts and Gifts Fair)

EPCH (Export Promotion Council for Handicrafts)

REPCH

Expobazar

Through these collaborations, we have contributed our expertise to shape global export policies and reforms in India.

𝐆𝐥𝐨𝐛𝐚𝐥 𝐆𝐫𝐨𝐰𝐭𝐡

What started in a single room in India has now expanded across the globe, including:

USA (New Jersey, Chicago, California)

Canada, UK, Netherlands, Guangzhou, Tokyo, Sydney, Dubai, Riyadh, Nairobi

Upcoming Locations: Dhaka and other EMEA regions

𝐍𝐞𝐰 𝐔𝐒 𝐅𝐚𝐜𝐢𝐥𝐢𝐭𝐲 𝐋𝐚𝐮𝐧𝐜𝐡

We are thrilled to announce the opening of our new, larger 𝐰𝐚𝐫𝐞𝐡𝐨𝐮𝐬𝐞 𝐟𝐚𝐜𝐢𝐥𝐢𝐭𝐲 𝐢𝐧 𝐭𝐡𝐞 𝐔𝐒𝐀, operating 24x7. This marks another milestone in providing our customers with an extraordinary experience as they expand their businesses in the US market.

𝐎𝐮𝐫 𝐆𝐫𝐚𝐭𝐢𝐭𝐮𝐝𝐞

We extend our heartfelt gratitude to our customers, friends, and partners for their unwavering support and guidance. With your trust, we have become the first Indian company to achieve global success in logistics and e-commerce.

At Gxpress, we are committed to delivering exceptional experiences to our customers, vendors, and partners. Together, we can achieve even greater heights.

𝐋𝐞𝐭’𝐬 𝐠𝐫𝐨𝐰 𝐭𝐨𝐠𝐞𝐭𝐡𝐞𝐫.

Team Gxpress

Your Global Logistics Partner

Praveen Vashistha Suraj Sharma Girisha Jain Shubham Pathak Samar JS Sodhi Sell on Amazon

#amazon#amazonfba#Amzonfbausa#walmart the official#USAclearance#customs clearance#import and export#3pl logistics#FIEO#GxpressUK#UKcustomsclearance#Amazonfbasellers#wayfair#Indiaexport#sellonamazon#walmart seller account#freightforwarding#warehousing services#cargo shipping

0 notes

Text

Looking for Share Market Classes Near Me? Trade Shiksha Thane Has You Covered

In today’s fast-paced financial world, understanding the stock market is more than just a skill—it's a lifelong asset. If you’ve ever found yourself searching Share Market Classes Near Me and are based in or around Thane, you’re in luck. Trade Shiksha Institute offers expert-led, result-driven courses tailored for beginners, intermediates, and aspiring pro traders alike.

Why More People Are Searching for Share Market Classes Nearby

With market volatility and inflation on the rise, people are actively exploring ways to create passive income and grow their wealth. That’s why enrolling in Share Market Classes Near Me has become one of the smartest decisions for students, professionals, and retirees alike.

But the key to success is choosing the right institute—not just the closest one.

Why Trade Shiksha Thane Is the Right Choice

At Trade Shiksha Thane, we don’t just teach theory—we equip you with practical tools to navigate the real market confidently. Whether you're just starting out or aiming to refine your strategy, our Share Market Classes Near Me provide everything you need to succeed.

What Makes Us Different?

✅ Live Market Training – Learn by doing, not just listening

✅ Expert Faculty – Taught by real traders, not just educators

✅ Custom Batches – Weekend, weekday, and fast-track options

✅ Doubt Solving + Mentorship – Get personal attention and support

✅ Lifetime Revisions – Relearn, refresh, and stay updated

What Will You Learn?

By joining our Share Market Classes Near Me, you’ll master:

Technical & Fundamental Analysis

Intraday & Swing Trading Techniques

Equity, F&O, and IPO Concepts

Trading Platforms & Tools

Risk & Money Management

Real Success from Real People

“I typed ‘Share Market Classes Near Me’ and chose Trade Shiksha. It was the best decision! The trainers are super supportive, and the practical sessions helped me gain real confidence in trading.” – Snehal R., Thane

Ready to Invest in Your Knowledge?

If you're serious about building wealth and want the best Share Market Classes Near Me, look no further than Trade Shiksha Thane. We're not just near you—we’re committed to your financial growth.

Office 201, 2nd floor, Akshay Co- operative Society , JS Road Bhandar Ali, Near Thane Railway Station, Thane, Maharashtra 400601

+8779971358

0 notes