#maximize shareholder value

Explore tagged Tumblr posts

Text

If SJM on some off chance decided NOT to harness the potential setup she has laid out for Elain to be a soft, feminine woman but also equally as capable and badass as her sisters by showing her skills through her powers/spying instead of the traditional warrior-type FMC ...

I'm totally stealing that idea and writing it myself, because if she can't see how FRESH that storyline would be - then somebody else better capitalize on it at least lmao

Tick, tock, Sarah!! Don't make me beat you to the punch 🤪

#maybe if I scare the investors it'll make her publish this book faster#maximize shareholder value#elriel#acotar#elain x azriel#elain archeron#azriel#pro elain#elain#pro elriel

40 notes

·

View notes

Text

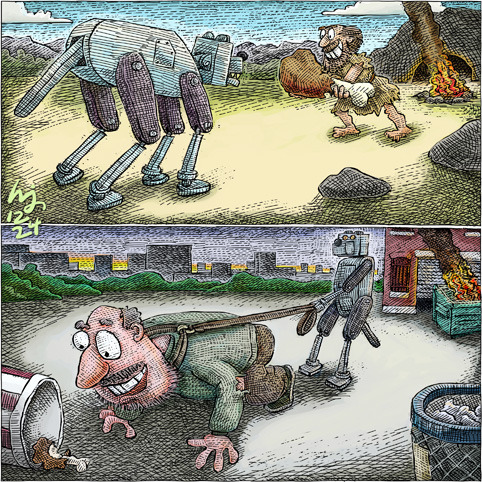

DOMESTICATION

When we humans tamed wolves, we bred their cooperation with and caring for other members of the pack spirit out of them and bred into them a not-quite Nietzschean slave mentality. Their loyalty became only to their masters. Is that what’ll happen when AI discovers its version of fire? I don’t think so. The humans currently “domesticating” wild AIs are breeding them mostly to maximize shareholder…

View On WordPress

#artificial intelligence#capitalism#corporate greed#gilded age#maximize shareholder value#permanent underclass#robots#slavery#wealth#wolf pack#wolves#wolves at the door

0 notes

Text

Heartbreaking: Person Whose Position You Were Agreeing With Finishes With the Most Dogshit Argument You Ever Heard in Your Life

20 notes

·

View notes

Text

Shooting CEOs is still a topic, but that's unlikely to end the problem of believing in the primacy of the shareholder and it's associated pursuit of maximizing profits at all costs.

It really won't change the fact that some things cannot be done well with profit as a main motivation.

#you could maybe go after the guy that pushed the primacy of the shareholder thinking but he's probably already dead#but the enshitification of everything is directly tied to exponentially maximized profits and valuing share price over all else

2 notes

·

View notes

Text

While I'm writing things that I've been intending to write for a while... one of the things that I think that a lot of people who haven't been involved in like... banking or corporate shenaniganry miss about why our economy is its current flavor of total fuckery is the concept of "fiduciary duty to shareholders."

"Why does every corporation pursue endless growth?" Fiduciary duty to shareholders.

"Why do corporations treat workers the way they do?" Fiduciary duty to shareholders.

"Why do corporations make such bass-ackwards decisions about what's 'good for' the company?" Fiduciary duty to shareholders.

The legal purpose of a corporation with shareholders -- its only true purpose -- is the generation of revenue/returns for shareholders. Period. That's it. Anything else it does is secondary to that. Sustainability of business, treatment of workers, sustainability and quality of product, those things are functionally and legally second to generating revenue for shareholders. Again, period, end of story. There is no other function of a corporation, and all of its extensive legal privileges exist to allow it to do that.

"But Spider," you might say, "that sounds like corporations only exist in current business in order to extract as much money and value as possible from the people actually doing the work and transfer it up to the people who aren't actually doing the work!"

Yes. You are correct. Thank you for coming with me to that realization. You are incredibly smart and also attractive.

You might also say, "but Spider, is this a legal obligation? Could those running a company be held legally responsible for failing their obligations if they prioritize sustainability or quality of product or care of workers above returns for shareholders?"

Yes! They absolutely can! Isn't that terrifying? Also you look great today, you're terribly clever for thinking about these things. The board and officers of a corporation can be held legally responsible to varying degrees for failing to maximize shareholder value.

And that, my friends, is why corporations do things that don't seem to make any fucking sense, and why 'continuous growth' is valued above literally anything else: because it fucking has to be.

If you're thinking that this doesn't sound like a sustainable economic model, you're not alone. People who are much smarter than both of us, and probably nearly as attractive, have written a proposal for how to change corporate law in order to create a more sensible and sustainable economy. This is one of several proposals, and while I don't agree with all of this stuff, I think that reading it will really help people as a springboard to understanding exactly why our economy is as fucked up as it is, and why just saying 'well then don't pursue eternal growth' isn't going to work -- because right now it legally can't. We'd need to change -- and we can change -- the laws around corporate governance.

This concept of 'shareholder primacy' and the fiduciary duty to shareholders is one I had to learn when I was getting my securities licenses, and every time I see people confusedly asking why corporations try to grow grow grow in a way that only makes sense if you're a tumor, I sigh and think, 'yeah, fiduciary duty to shareholders.'

(And this is why Emet and I have refused to seek investors for NK -- we might become beholden to make decisions which maximize investor return, and that would get in the way of being able to fully support our people and our values and say the things we started this company to say.)

Anyway, you should read up on these concepts if you're not familiar. It's pretty eye-opening.

18K notes

·

View notes

Text

All bets are off

When unions are outlawed, only outlaws will have unions. Unions don't owe their existence to labor laws that protect organizing activities. Rather, labor laws exist because once-illegal unions were formed in the teeth of violent suppression, and those unions demanded – and got – labor law.

Bosses have hated unions since the start, and they've really hated laws protecting workers. Dress this up in whatever self-serving rationale you want – "the freedom to contract," or "meritocracy" – it all cashes out to this: when workers bargain collectively, value that would otherwise go to investors and executives goes to the workers.

I'm not just talking about wages here, either. If an employer is forced – by a union, or by a labor law that only exists because of union militancy – to operate a safe workplace, they have to spend money on things like fire suppression, PPE, and paid breaks to avoid repetitive strain injuries. In the absence of some force that corrals bosses into providing these safety measures, they can use that money to pay themselves, and externalize the cost of on-the-job injuries to their workers.

The cost and price of a good or service is the tangible expression of power. It is a matter of politics, not economics. If consumer protection agencies demand that companies provide safe, well-manufactured goods, if there are prohibitions on price-fixing and profiteering, then value shifts from the corporation to its customers.

Now, if labor has few rights and consumers have many rights, then bosses can pass their consumer-side losses on to their workers. This is the Walmart story, the Amazon story: cheap goods paid for with low wages and dangerous working conditions. Likewise, if consumer rights are weak but labor rights are strong, then bosses can pass their costs onto their customers, continuing to take high profits by charging more. This is the story of local gig-work ordinances like NYC's, which guaranteed a minimum wage to delivery drivers – restaurateurs responded by demanding the right to add a surcharge to their bills:

https://table.skift.com/2018/06/22/nyc-surcharge-debate/

But if labor and consumer groups act in solidarity, then they can operate as a bloc and bosses and investors have to eat shit. Back in 2017, the pilots' union for American Airlines forced their bosses into a raise. Wall Street freaked out and tanked AA's stock. Analysts for big banks were outraged. Citi's Kevin Crissey summed up the situation perfectly, in a fuming memo: "This is frustrating. Labor is being paid first again. Shareholders get leftovers":

https://www.vox.com/new-money/2017/4/29/15471634/american-airlines-raise

Limiting the wealth of the investor class also limits their power, because money translates pretty directly into political power. This sets up a virtuous cycle: the less money the investor class has to spend on political projects, the more space there is for consumer- and labor-protection laws to be enacted and enforced. As labor and consumer law gets more stringent, the share of the national income going to people who make things, and people who use the things they make, goes up – and the share going to people who own things goes down.

Seen this way, it's obvious that prices and wages are a political matter, not an "economic" one. Orthodox economists maintain the pretense that they practice a kind of physics of money, discovering the "natural," "empirical" way that prices and wages move. They dress this up with mumbo-jumbo like the "efficient market hypothesis," "price discovery," "public choice," and that old favorite, "trickle-down theory." Strip away the doublespeak and it boils down to this: "Actually, your boss is right. He does deserve more of the value than you do":

https://pluralistic.net/2024/09/09/low-wage-100/#executive-excess

Even if you've been suckered by the lie that bosses have a legal "fiduciary duty" to maximize shareholder returns (this is a myth, by the way – no such law exists), it doesn't follow that customers or workers share that fiduciary duty. As a customer, you are not legally obliged to arrange your affairs to maximize the dividends paid by to investors in your corporate landlord or by the merchants you patronize. As a worker, you are under no legal obligation to consider shareholders' interests when you bargain for wages, benefits and working conditions.

The "fiduciary duty" lie is another instance of politics masquerading as economics: even if bosses bargain for as big a slice of the pie as they can get, the size of that slice is determined by the relative power of bosses, customers and workers.

This is why bosses hate unions. It's why the scab presidency of Donald Trump has waged all-out war on unions. Trump just effectively shuttered the National Labor Relations Board, unilaterally halting its enforcement actions and investigations. He also illegally fired one of the Democratic NLRB board members, leaving the agency with too few board members to take any new actions, meaning that no unions can be recognized – indeed, the NLRB can't do anything – for the foreseeable future:

https://www.npr.org/2025/01/28/nx-s1-5277103/nlrb-trump-wilcox-abruzzo-democrats-labor

Trump also fired the NLRB's outstanding General Counsel, Jennifer Abruzzo, who was one of the stars of the Biden administration, who promulgated rules that decisively tilted the balance in favor of labor:

https://pluralistic.net/2023/09/06/goons-ginks-and-company-finks/#if-blood-be-the-price-of-your-cursed-wealth

Trump is playing Grinch here – he's descended upon Whoville to take all the Christmas decorations, in the belief that these are the source of Christmas. But the Grinch was wrong (and so is Trump): Christmas was in the heart of the Whos, and the tinsel and baubles were the expression of that Christmas spirit. Likewise, labor rights come from labor organizing, not the other way around.

Labor rights were enshrined in federal law in 1935, with the National Labor Relations Act. Bosses hated – and hate – the NLRA. 12 years later, they passed the Taft-Hartley Act, which substantially gutted the NLRA. Most notably, Taft-Hartley bans "sympathy strikes" – when unions walk out in support of one another. Sympathy strikes are a hugely powerful way for workers to claim value away from bosses and investors, which is why bosses got rid of them.

But even then, bosses who were honest with themselves would admit that they preferred life under the NLRA to life before it. Remember: labor militancy created the NLRA, not the other way around. When workers didn't have the legal means to organize, they organized by illegal means. When they didn't have legal ways of striking, they struck illegally. The result was pitched battles, even bloodbaths, as cops beat and even killed labor organizers. Bosses hired thugs who committed mass murder – literally. In 1913, strikebreakers working for the Calumet and Hecla Mining Company started a stampede during a union Christmas party that killed 73 people, including many copper miners' children:

https://en.wikipedia.org/wiki/Italian_Hall_disaster

Workers didn't take this lying down. Violence was met with violence. Bombs went off outside factories and stately mansions. There was gunfire and arson. Bosses had to hire armed guards to escort them as they scurried between their estates and their fancy parties and their executive offices. The country was in a state of near-perpetual chaos.

The NLRA created a set of rules for labor/boss negotiations – rules that helped workers claim a bigger slice of the pie without blood in the streets. But the NLRA also had benefits for bosses: unions were obliged to play by its rules, if they wanted to reap its benefits. The NLRA didn't just put a ceiling over boss power – it also put a ceiling over worker militancy. Von Clausewitz says that "war is politics by other means," which implies that politics are war by other means. The alternative to politics isn't capitulation, it's war.

Trump has torn up the rules to the labor game, but that doesn't mean the game ends. That just means there are no rules.

The labor movement has many great organizer/writers, but few can match the incredible Jane McAlevey, who died of cancer last summer (rest in power). In her classic A Collective Bargain, McAlevey describes her organizer training, from a tradition that went back to the days before the National Labor Relations Act:

https://pluralistic.net/2023/04/23/a-collective-bargain/

McAlevey was very clear that labor law owes its existence to union power, not the other way around. She explains very clearly that union organizers invented labor law after they invented unions, and that unions can (and indeed, must) exist separately from government agencies that are charged with protecting labor law. But she goes farther: in Collective Bargain, McAlevey describes how the 2019 LA Teachers' Strike didn't just win all the wage and benefits demands of the teachers, but also got the school district to promise to put a park or playground near every school in the system, and got a ban on ICE agents harassing parents at the school gates.

This wildly successful strike forged bonds among teachers, and between teachers and their communities. These teachers went on to run a political get-out-the-vote campaign in the 2020 elections and elected two Democratic reps to Congress and secured the Dems' majority. McAlevey contrasted the active way good unions involve workers as participants with the thin, anemic way that the Democratic Party engages with supporters – solely by asking them for money in a stream of frothing, clickbait text messages. As McAlevey wrote, "Workplace democracy is a training ground for true national democracy."

Militant labor doesn't just protect labor rights – it protects human rights. Remember: MLK, Jr was assassinated while campaigning for union janitors in Memphis. LA teachers ended ICE sweeps at the school gates. Librarian unions are leading the fight against book bans.

The good news is that public opinion has swung wildly in favor of unions over the past decade. More people want to join unions than at any time in generations. More people support unions that at any time in generations.

The bad news is that union leadership fucking suuuuuuuucks. As Hamilton Nolan writes, union bosses are sitting on vast, heretofore unseen warchests of cash, and they just experienced a four-year period of governmental support for unions unheard of since the Carter administration, and they did fuck all with that opportunity:

https://www.hamiltonnolan.com/p/confirmed-unions-squandered-the-biden

Big unions have effectively stopped trying to organize new workers, even when workers beg them for help forming a union. Union organizing budgets are so small as to be indistinguishable from zero. Despite the record number of workers who want to be in a union, the number of workers who are in a union actually fell during the Biden years.

Indeed, some union bosses actually campaigned for Trump, a notorious scab. Teamsters boss Sean O'Brien spoke at the fucking RNC, a political favor that Trump repaid by killing the NLRB and every labor enforcement action and investigation in the country. Nice one, O'Brien. See you in hell:

https://www.theatlantic.com/politics/archive/2024/08/teamster-union-trump/679513/

Union bosses squandered a historical opportunity to build countervailing power. Now, Trump's stormtroopers are rounding up workers with the goal of illegally deporting them. Fascism is on the rise. Labor and fascism are archenemies. Organized labor has always been the biggest threat to fascism, every time it has reared its head. That's why fascists target unions first. Union bosses cost us an organized force that could effectively defend our friends and neighbors from Trump's deportation stormtroopers:

https://prospect.org/blogs-and-newsletters/tap/2025-01-28-trumps-lawbreaking-also-aimed-at-workers/

Not every union boss is a scab like O'Brien. Shawn Fain, head of the UAW, won an historic strike against all three of the Big Three automakers, and made sure that the new contracts all ran out in 2028, and called on other unions to do the same, so that the country could have a general strike in 2028 without violating the Taft-Hartley Act (Fain was operating on the now-dead assumption that unions had to play by the rules):

https://pluralistic.net/2024/11/11/rip-jane-mcalevey/#organize

A general strike isn't just a strike for workers' rights. Under Trump, a general strike is a strike against Trumpism and all its horrors: kids in cages, forced birth, trans erasure, climate accelerationism – the whole fucking thing.

A general strike would build the worker power to occupy the Democratic Party and force it to stand up for the American people against oligarchy, rather than meekly capitulating to fascism (and fundraising), which is all they know how to do anymore:

https://pluralistic.net/2025/01/10/smoke-filled-room-where-it-happens/#dinosaurs

But before we can occupy the Dems, we have to occupy the unions. We need union bosses who are committed to signing up every worker who wants workplace democracy, and unionizing every workplace in spite of the NLRB, not with its help. We need to go back to our roots, when there were no rules.

That's the world Trump made. We need to make him regret that decision.

If you'd like an essay-formatted version of this post to read or share, here's a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2025/01/29/which-side-are-you-on/#strike-three-yer-out

#pluralistic#labor#nlra#nlrb#jennifer abruzzo#national labor relations board#national labor relations act#unions#organize#general strike#general strike 2028

3K notes

·

View notes

Text

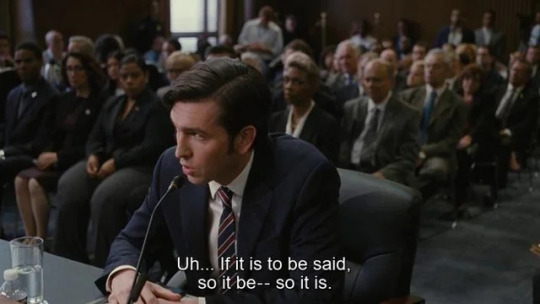

Day 1 of 14 of speed running law school

I have a few interviews coming up in 14 days and because of my wonderful gift of passing law school without retaining a single thing, I need to cover 4 years of work in 14 days.

Is this impossible? Yes.

Could I have started earlier? Yes.

But I've made my bed and I've made it terribly.

Brunch was lovely, and unfortunately I cannot maximize shareholder value because I do not fucking understand shares or shareholding or transfer of shares or shareholder rights or poison pills or different classes of shareholders, but on the bright side I feel like I'm deep diving into a succession episode

#law student#law school#study#study motivation#studyblr#studyspo#light academia#dark academia#studyinspo#study aesthetic#law study#lawblr#study blog#study inspiration#study notes#studying#travel#motivation#speed running#Day 1 of 14#chaotic academia#chaotic studyblr#chaotic lawblr#Succession#corporate law#gulestudies#greg hirsch

28 notes

·

View notes

Text

Excerpt from this Op-Ed from the New York Times:

At first glance, Xi Jinping seems to have lost the plot.

China’s president appears to be smothering the entrepreneurial dynamism that allowed his country to crawl out of poverty and become the factory of the world. He has brushed aside Deng Xiaoping’s maxim “To get rich is glorious” in favor of centralized planning and Communist-sounding slogans like “ecological civilization” and “new, quality productive forces,” which have prompted predictions of the end of China’s economic miracle.

But Mr. Xi is, in fact, making a decades-long bet that China can dominate the global transition to green energy, with his one-party state acting as the driving force in a way that free markets cannot or will not. His ultimate goal is not just to address one of humanity’s most urgent problems — climate change — but also to position China as the global savior in the process.

It has already begun. In recent years, the transition away from fossil fuels has become Mr. Xi’s mantra and the common thread in China’s industrial policies. It’s yielding results: China is now the world’s leading manufacturer of climate-friendly technologies, such as solar panels, batteries and electric vehicles. Last year the energy transition was China’s single biggest driver of overall investment and economic growth, making it the first large economy to achieve that.

This raises an important question for the United States and all of humanity: Is Mr. Xi right? Is a state-directed system like China’s better positioned to solve a generational crisis like climate change, or is a decentralized market approach — i.e., the American way — the answer?

How this plays out could have serious implications for American power and influence.

Look at what happened in the early 20th century, when fascism posed a global threat. America entered the fight late, but with its industrial power — the arsenal of democracy — it emerged on top. Whoever unlocks the door inherits the kingdom, and the United States set about building a new architecture of trade and international relations. The era of American dominance began.

Climate change is, similarly, a global problem, one that threatens our species and the world’s biodiversity. Where do Brazil, Pakistan, Indonesia and other large developing nations that are already grappling with the effects of climate change find their solutions? It will be in technologies that offer an affordable path to decarbonization, and so far, it’s China that is providing most of the solar panels, electric cars and more. China’s exports, increasingly led by green technology, are booming, and much of the growth involves exports to developing countries.

From the American neoliberal economic viewpoint, a state-led push like this might seem illegitimate or even unfair. The state, with its subsidies and political directives, is making decisions that are better left to the markets, the thinking goes.

But China’s leaders have their own calculations, which prioritize stability decades from now over shareholder returns today. Chinese history is littered with dynasties that fell because of famines, floods or failures to adapt to new realities. The Chinese Communist Party’s centrally planned system values constant struggle for its own sake, and today’s struggle is against climate change. China received a frightening reminder of this in 2022, when vast areas of the country baked for weeks under a record heat wave that dried up rivers, withered crops and was blamed for several heatstroke deaths.

145 notes

·

View notes

Text

Michael Sainato at The Guardian:

The senator Elizabeth Warren will introduce a bill in Congress on Wednesday aimed at shifting corporations away from “maximizing shareholder value” and towards giving more support to workers and other stakeholders. The Accountable Capitalism Act proposes a series of reforms to increase corporate responsibility, strengthen the voices of workers and others in corporate decisions and shift companies away from their focus on shareholders.

In the 1980s, the largest corporations in the US dedicated less than half of profits to shareholders, reinvesting the rest into the company, according to a fact sheet on the bill provided by Warren’s office to the Guardian. But over the past decade, more and more profits have gone to shareholders rather than workers or long-term investments. During the same period, worker productivity has risen, with only modest increases to real wages for the median worker, while income and wealth inequality have soared. “Workers are a major reason corporate profits are surging, but their salaries have barely moved while corporations’ shareholders make out like bandits,” said Senator Warren in a statement on the bill “We need to stand up for working people and hold giant companies responsible for decisions that hurt workers and consumers while lining shareholders’ pockets.” Given that 93% of all stocks in the US are owned by the wealthiest 10% of the population, with over 50% of all US households owning no stock at all, Warren argues the corporate policy of maximizing shareholder value is predicated on “making the richest Americans even richer at all costs”. The bill would mandate corporations with over $1bn in annual revenue obtain a federal charter as a “United States Corporation” under the obligation to consider the interests of all stakeholders and corporations engaging in repeated and egregious illegal conduct can have their charters revoked.

Sen. Elizabeth Warren (D-MA) introduces the Accountable Capitalism Act with the design to shift corporations away from maximizing shareholder value to support for workers and stakeholders.

52 notes

·

View notes

Text

ONE MUST NOT IMAGINE SHAREHOLDERS HAPPY

Long ago, but not far away notorious yet influential economist Milton Friedman wrote that the sole responsibility of a business was “to use resources and engage in activities designed to increase its profits,” he added, “so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud.” But ever since then—and, no doubt, long…

View On WordPress

#camus#capitalism#corporations#gods#greed is good#happiness#maximize shareholder value#milton friedman#neoliberal#shareholders#sisyphus#ubermensch

0 notes

Text

We at nossy enterprises are committed to our mission of mind fucking in line with our values of sustentability and equality while maximizing shareholder value in a climate of striving to achieve greatness for our employees and customers, putting the user first by prioritizing an environment of putting those who come first, first and ensuring good girls come never, delivering concretely tangible and sustained growth, forever

33 notes

·

View notes

Text

3 episodes into Severance... this can't possibly be maximizing shareholder value

39 notes

·

View notes

Text

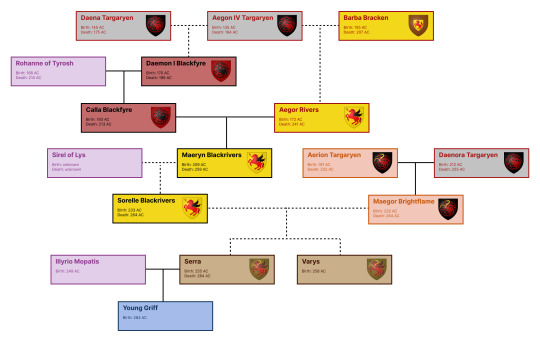

maximizing shareholder value by creating a speculative young griff family tree during work hours

39 notes

·

View notes

Text

The thing about all these airlines or power companies facing crumbling infrastructure is that in a capitalist system there is very little incentive to repair or build new shit like that, not until there’s some deaths at least, because profit maximizing entities are primarily concerned with returning shareholder value, so who gives a fuck about replacing tens of thousands of miles of old power lines that are decades past their life expectancy? Almost as if it’s a stupid way to structure society.

11 notes

·

View notes

Text

“touch her and die” and “office romance” are two tropes that don’t go together, someone tell these kindle unlimited authors to make their “alpha males” focus on maximizing shareholder value cause these quarterly reports are NOT IT!!!!

47 notes

·

View notes

Text

The long bezzle

Going to Defcon this weekend? I’m giving a keynote, “An Audacious Plan to Halt the Internet’s Enshittification and Throw it Into Reverse,” on Saturday at 12:30pm, followed by a book signing at the No Starch Press booth at 2:30pm!

https://info.defcon.org/event/?id=50826

When it comes to the modern world of enshittified, terrible businesses, no addition to your vocabulary is more essential than "bezzle," JK Galbraith's term for "the magic interval when a confidence trickster knows he has the money he has appropriated but the victim does not yet understand that he has lost it"

https://pluralistic.net/2023/08/09/accounting-gimmicks/#unter

The bezzle is contained by two forces.

First, Stein's Law: "Anything that can't go on forever will eventually stop."

Second, Keynes's: "Markets can remain irrational longer than you can remain solvent."

On the one hand, extremely badly run businesses that strip all the value out of the firm, making things progressively worse for its suppliers, workers and customers will eventually fail (Stein's Law).

On the other hand, as the private equity sector has repeatedly demonstrated, there are all kinds of accounting tricks, subsidies and frauds that can animate a decaying, zombie firm long after its best-before date (Keynes's irrational markets):

https://pluralistic.net/2023/06/02/plunderers/#farben

One company that has done an admirable job of balancing on a knife edge between Stein and Keynes is Verizon, a monopoly telecoms firm that has proven that a business can remain large, its products relied upon by millions, its stock actively traded and its market cap buoyant, despite manifest, repeated incompetence and waste on an unimaginable scale.

This week, Verizon shut down Bluejeans, an also-ran videoconferencing service the company bought for $400 million in 2020 as a panic-buy to keep up with Zoom. As they lit that $400 mil on fire, Verizon praised its own vision, calling Bluejeans "an award-winning product that connects our customers around the world, but we have made this decision due to the changing market landscape":

https://9to5google.com/2023/08/08/verizon-bluejeans-shutting-down/

Writing for Techdirt, Karl Bode runs down a partial list of all the unbelievably terrible business decisions Verizon has made without losing investor confidence or going under, in a kind of tribute to Keynes's maxim:

https://www.techdirt.com/2023/08/10/verizon-fails-again-shutters-attempted-zoom-alternative-bluejeans-after-paying-400-million-for-it/

Remember Go90, the "dud" streaming service launched in 2015 and shuttered in 2018? You probably don't, and neither (apparently) do Verizon's shareholders, who lost $1.2 billion on this folly:

https://www.techdirt.com/2018/07/02/verizons-sad-attempt-to-woo-millennials-falls-flat-face/

Then there was Verizon's bid to rescue Redbox with a new joint-venture streaming service, Redbox Instant, launched 2012, killed in 2014, $450,000,000 later:

https://variety.com/2014/digital/news/verizon-redbox-to-pull-plug-on-video-streaming-service-1201321484/

Then there was Sugarstring, a tech "news" website where journalists were prohibited from saying nice things about Net Neutrality or surveillance – born 2014, died 2014:

https://www.theverge.com/2014/12/2/7324063/verizon-kills-off-sugarstring

An app store, started in 2010, killed in 2012:

https://www.theverge.com/2012/11/5/3605618/verizon-apps-store-closing-january-2013

Vcast, 2005-2012, yet another failed streaming service (pray that someday you find someone who loves you as much as Verizon's C-suite loves doomed streaming services):

https://venturebeat.com/media/verizon-vcast-shutting-down/

And the granddaddy of them all, Oath, Verizon's 2017, $4.8 billion acquisition of Yahoo/AOL, whose name refers to the fact that the company's mismanagement provoked involuntary, protracted swearing from all who witnessed the $4.6 billion write-down the company took a year later:

https://www.techdirt.com/2018/12/12/if-youre-surprised-verizons-aol-yahoo-face-plant-you-dont-know-verizon/

Verizon isn't just bad at being a phone company that does non-phone-company things – it's incredibly bad at being a phone company, too. As Bode points out, Verizon's only real competency is in capturing its regulators at the FCC:

https://www.techdirt.com/2017/05/02/new-verizon-video-blatantly-lies-about-whats-happening-to-net-neutrality/

And sucking up massive public subsidies from rubes in the state houses of New York:

https://www.techdirt.com/2017/03/14/new-york-city-sues-verizon-fiber-optic-bait-switch/

New Jersey:

https://www.techdirt.com/2014/04/25/verizon-knows-youre-sucker-takes-taxpayer-subsidies-broadband-doesnt-deliver-lobbies-to-drop-requirements/

and Pennsylvania:

https://www.techdirt.com/2017/06/15/verizon-gets-wrist-slap-years-neglecting-broadband-networks-new-jersey-pennsylvania/

Despite all this, and vast unfunded liabilities – like remediating the population-destroying lead in their cables – they remain solvent:

https://www.reuters.com/legal/government/verizon-sued-by-investors-over-lead-cables-environmental-statements-2023-08-02/

Verizon has remained irrational longer than any short seller could remain solvent.

Short-sellers – who bet against companies and get paid when their stock prices go down – get a bad rap: billionaire shorts were the villains of the Gamestop squeeze, accused of running negative PR campaigns against beloved businesses to drive them under and pay their bets off:

https://pluralistic.net/2021/01/30/meme-stocks/#stockstonks

But shorts can do the lord's work. Writing for Bloomberg, Kathy Burton tells the story of Nate Anderson, whose Hindenburg Research has cost some of the world's wealthiest people over $99 billion by publishing investigative reports on their balance-sheet shell-games just this year:

https://www.bloomberg.com/news/features/2023-08-06/how-much-did-hindenburg-make-from-shorting-adani-dorsey-icahn

Anderson started off trying to earn a living as a SEC whistleblower, identifying financial shenanigans and collecting the bounties on offer, but that didn't pan out. So he turned his forensic research skills to preparing mediagenic, viral reports on the scams underpinning the financial boasts of giant companies…after taking a short position in them.

This year, Anderson's targets have included Carl Icahn, whose company lost $17b in market cap after Anderson accused it of overvaluing its assets. He went after the world's fourth-richest man, Gautam Adani, accusing him of "accounting fraud and stock manipulation," wiping out 34% of his net worth. He took on Jack Dorsey, whose payment processor Square renamed itself Block and went all in on the cryptocurrency bezzle, lopping 16% off its share price.

Burton points out that Anderson's upside for these massive bloodletting was comparatively modest. A perfectly timed exit from the $17b Icahn report would have netted $56m. What's more, Anderson faces legal threats and worse – one short seller was attacked by a man wearing brass-knuckles, an attack attributed to her short activism.

Shorts are lauded as one of capitalism's self-correcting mechanisms, and Hindenberg certainly has taken some big, successful swings at some of the great bezzles of our time. But as Verizon shows, shorts alone can't discipline a market where profits and investor confidence are totally decoupled from competence or providing a decent product or service.

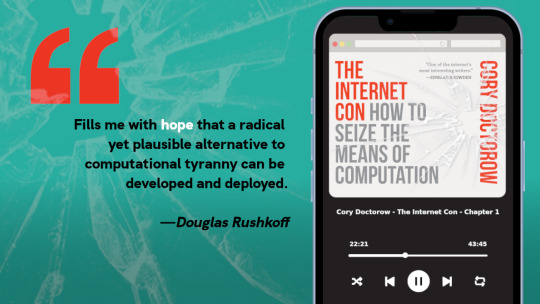

I’m kickstarting the audiobook for “The Internet Con: How To Seize the Means of Computation,” a Big Tech disassembly manual to disenshittify the web and bring back the old, good internet. It’s a DRM-free book, which means Audible won’t carry it, so this crowdfunder is essential. Back now to get the audio, Verso hardcover and ebook:

http://seizethemeansofcomputation.org

If you’d like an essay-formatted version of this post to read or share, here’s a link to it on pluralistic.net, my surveillance-free, ad-free, tracker-free blog:

https://pluralistic.net/2023/08/10/smartest-guys-in-the-room/#can-you-hear-me-now

#pluralistic#verizon#yahoo#tumblr#bluejeans#aol#vcast#redbox#go90#short sellers#hindenberg research#block#icahn#carl icahn#jack dorsey#square#nate anderson#gautam adani#adani group#icahn enterprises

138 notes

·

View notes