#mql4

Explore tagged Tumblr posts

Text

Forextrading #SELL trade #USDJPY H4 Timeframe. Live Trade with Indicator Hunter Pearl Edition setup based in last Signal.

🎓 https://www.HunterForexIndicator.com Powerfull Non Repaint signals to make constant profits. Lifetime License of HUNTER Forex Indicator. . The image of this trade was taken via the EagleFX broker screen copy. In other brokers the signals may have a very small variation. . 💲 The Hunter Forex Indicator for Metatrader4 is a Fixed and No Repaint signals send/mabe by calculations inside the market capable of antecipating forces of moviments in EXAUSTED ZONES of the trends inside MT4 charts. This Is one of the Best modern Indicator concept.

🔊 Sound Alerts with 🔊Visual Popup alerts email 🔊 alerts actvation option. This Power indicator help you open your trades with maximum eficiency. Start catch the best moment of the Forex Pairs Market to open your trades and take better decisions.

Forextrading #SELL trade #USDJPY H4 Timeframe. Live Trade with Indicator Hunter Pearl Edition setup based in last Signal.

🎓 https://www.HunterForexIndicator.com Powerfull Non Repaint signals to make constant profits. Lifetime License of HUNTER Forex Indicator. . The image of this trade was taken via the EagleFX broker screen copy. In other brokers the signals may have a very small variation. . 💲 The Hunter Forex Indicator for Metatrader4 is a Fixed and No Repaint signals send/mabe by calculations inside the market capable of antecipating forces of moviments in EXAUSTED ZONES of the trends inside MT4 charts. This Is one of the Best modern Indicator concept.

🔊 Sound Alerts with 🔊Visual Popup alerts email 🔊 alerts actvation option. This Power indicator help you open your trades with maximum eficiency. Start catch the best moment of the Forex Pairs Market to open your trades and take better decisions.

#forex#forex trading#forexindicator#forexindicators#forex indicators#forextrader#forex signals#forex signal#forexsignals#hunter forex indicator#forex forum#forex factory#forexfactory#mql4#mql5#metatrader4#metatrader5

2 notes

·

View notes

Text

Unleash Your Trading Potential: Hire an MQL4 EA Programmer

In the dynamic world of financial markets, traders are constantly seeking innovative solutions to optimize their trading strategies and gain a competitive edge. One such solution gaining popularity among traders is the development of Expert Advisors (EAs) for MetaTrader 4 (MT4) platform. These EAs, written in the MQL4 programming language, automate trading processes, execute trades, and manage positions with precision and efficiency. However, to harness the full potential of MQL4 EAs, traders often turn to the expertise of MQL4 EA programmers. In this detailed blog, we'll delve into the world of hire an MQL4 EA programmer, exploring the benefits, considerations, and steps to empower traders to elevate their trading game.

MQL4 Expert Advisors are automated trading systems designed to operate within the MetaTrader 4 platform, allowing traders to execute trades automatically based on predefined rules and criteria. These EAs analyze market conditions, identify trading opportunities, and execute trades with speed and accuracy, eliminating the need for manual intervention. By leveraging the capabilities of MQL4 EAs, traders can streamline their trading operations, minimize emotional biases, and capitalize on market opportunities more efficiently.

The Benefits of Hiring an MQL4 EA Programmer:

Customization: Hiring an MQL4 EA programmer enables traders to develop custom EAs tailored to their specific trading strategies, preferences, and objectives. This level of customization ensures that the EA aligns perfectly with the trader's vision, incorporating their preferred indicators, risk management rules, and execution parameters.

Expertise: MQL4 EA programmers are skilled professionals with expertise in the MQL4 programming language and algorithmic trading principles. They possess the knowledge and experience to develop robust, efficient, and reliable EAs that perform optimally in different market conditions.

Optimization: MQL4 EA programmers can optimize EAs for performance, efficiency, and profitability through rigorous testing and refinement. They can fine-tune parameters, adjust risk management rules, and implement advanced trading algorithms to maximize returns and minimize risks.

Ongoing Support: Hiring an MQL4 EA programmer often includes ongoing support and maintenance services, ensuring that the EA remains up-to-date, compatible with platform updates, and responsive to changing market conditions. This ongoing support provides peace of mind for traders and allows them to focus on their trading strategies.

Considerations When Hiring an MQL4 EA Programmer:

When hiring an MQL4 EA programmer, careful consideration of several factors is essential to ensure a successful collaboration and the development of a high-quality Expert Advisor (EA). Here are the key considerations to keep in mind:

1. Experience:

Look for MQL4 EA programmers with a solid track record of success and extensive experience in developing EAs for the MetaTrader 4 platform. Consider the following aspects of their experience:

Proven Track Record: Seek programmers who have a history of delivering successful projects and achieving positive results for their clients.

Expertise in MQL4: Ensure that the programmer possesses a deep understanding of the MQL4 programming language, as well as proficiency in algorithmic trading principles and strategies.

Experience with MT4 Platform: Verify that the programmer has significant experience specifically with the MetaTrader 4 platform, as this will ensure they are familiar with its capabilities and limitations.

2. Portfolio:

Review the programmer's portfolio to evaluate the quality of their work and assess their capabilities. Consider the following aspects of their portfolio:

Quality of Work: Examine the complexity and sophistication of the EAs developed by the programmer. Look for evidence of well-designed and robust solutions that meet the client's requirements.

Performance of EAs: Evaluate the performance of the EAs developed by the programmer, including their profitability, risk management capabilities, and consistency over time.

Successful Backtesting and Live Trading Results: Look for evidence of successful backtesting using historical market data, as well as live trading results that demonstrate the effectiveness of the EAs in real-world trading environments.

3. Communication:

Effective communication is essential for ensuring that the EA meets your expectations and requirements. Consider the following communication factors:

Clear Communication: Choose a programmer who communicates effectively and clearly understands your trading objectives, preferences, and specifications.

Responsive Communication: Ensure that the programmer is responsive to your inquiries and provides timely updates throughout the development process.

Listening Skills: Look for a programmer who listens attentively to your feedback and incorporates your suggestions into the EA's development process.

4. Testing and Optimization:

Thorough testing and optimization are crucial to ensure that the EA performs effectively and consistently in live trading. Consider the following testing and optimization practices:

Backtesting: Ensure that the programmer conducts comprehensive backtesting using historical market data to evaluate the performance of the EA under various market conditions.

Forward Testing: Verify that the programmer performs forward testing in demo accounts to validate the EA's performance in real-time market conditions.

Stress Testing: Ensure that the programmer conducts stress testing to assess the robustness and stability of the EA under extreme market scenarios and adverse conditions.

By considering these factors when hiring an MQL4 EA programmer, traders can increase the likelihood of developing a high-quality and effective Expert Advisor that aligns with their trading objectives and maximizes their chances of success in the financial markets.

Conclusion:

Hire an MQL4 EA programmer offers traders a strategic advantage in optimizing their trading strategies and achieving consistent results in financial markets. By collaborating with a skilled programmer, traders can develop custom EAs that reflect their unique trading vision and objectives, streamline their trading operations, and capitalize on market opportunities more effectively. However, it's essential for traders to conduct thorough research, evaluate potential programmers carefully, and communicate their requirements clearly to ensure a successful collaboration. With the expertise and support of an MQL4 EA programmer, traders can unlock the full potential of automated trading and elevate their trading game to new heights.

#black tumblr#automate trading bots#auto trading bots#black art#black history#black literature#black fashion#custom bot ea#custom bots#custom bots trading#Hire an MQL4 EA programmer

0 notes

Text

Advanced Strategies for Using Forex Robots

Forex robots, also known as Expert Advisors (EAs), are automated software programs designed to help traders make decisions in the foreign exchange market. While basic EAs can perform well in certain market conditions, leveraging advanced features can significantly enhance their effectiveness. In this article, we'll explore advanced strategies for using forex robots, focusing on custom indicators, algorithmic strategies, and the combination of robots with manual trading.

Leveraging Advanced Features

Forex robots can be highly effective when integrated with advanced features. These features can help you refine your trading strategies and improve your overall performance in the forex market.

Custom Indicators

One of the most powerful ways to enhance your forex robot is by incorporating custom indicators. Custom indicators are specialized tools created to provide unique insights into market conditions. They can be designed to measure various aspects of the market, such as volatility, momentum, or trend strength.

Developing Custom Indicators: To develop custom indicators, you need a solid understanding of programming and market analysis. Many trading platforms, such as MetaTrader 4 and 5, offer built-in tools and scripting languages like MQL4 and MQL5 for creating custom indicators.

Integrating Custom Indicators: Once you've developed your custom indicators, you can integrate them into your forex robot. This allows the robot to make more informed decisions based on the specific criteria you've defined.

Algorithmic Strategies

Algorithmic trading involves using complex mathematical models to execute trades. By leveraging algorithmic strategies, you can optimize your forex robot's performance and adapt to various market conditions.

Machine Learning Algorithms: Machine learning algorithms can analyze vast amounts of data to identify patterns and predict market movements. Integrating machine learning into your forex robot can help it learn from historical data and improve its decision-making process over time.

Genetic Algorithms: Genetic algorithms are optimization techniques inspired by natural selection. They can be used to fine-tune your forex robot's parameters, ensuring it operates at peak efficiency. By simulating evolution, genetic algorithms can identify the most effective trading strategies and discard less profitable ones.

Combining Robots with Manual Trading

While forex robots can operate independently, combining them with manual trading can create a more robust and flexible trading strategy. This hybrid approach leverages the strengths of both automated and human trading.

Hybrid Strategies

Hybrid strategies involve using forex robots for routine tasks and manual trading for more complex decisions. This approach allows you to benefit from the speed and precision of automated trading while retaining the flexibility and intuition of manual trading.

Routine Tasks: Forex robots excel at performing routine tasks, such as monitoring market conditions and executing trades based on predefined criteria. By delegating these tasks to a robot, you can free up time to focus on higher-level analysis and decision-making.

Complex Decisions: Manual trading is essential for making complex decisions that require human intuition and experience. By combining robots with manual trading, you can ensure that your overall strategy is adaptive and responsive to changing market conditions.

Best Practices

To maximize the effectiveness of your hybrid trading strategy, it's important to follow best practices. These guidelines can help you maintain a balanced approach and minimize potential risks.

Regular Monitoring: Even though forex robots can operate autonomously, regular monitoring is crucial. Ensure that your robot is performing as expected and make adjustments as necessary. Monitoring can help you identify and resolve issues before they impact your trading performance.

Risk Management: Effective risk management is essential for any trading strategy. Set clear risk parameters for both your forex robot and manual trades. This includes defining stop-loss levels, position sizes, and risk-reward ratios.

Continuous Learning: The forex market is constantly evolving, and staying informed about new developments is crucial. Continuously educate yourself on advanced trading techniques and update your forex robot accordingly. This can help you maintain a competitive edge and adapt to changing market conditions.

Conclusion

Using advanced strategies can significantly enhance the performance of your forex robots. By leveraging custom indicators, algorithmic strategies, and combining robots with manual trading, you can create a robust and flexible trading system. Following best practices such as regular monitoring, effective risk management, and continuous learning will further optimize your approach, helping you achieve long-term success in the forex market. For more insights and strategies, visit Trendonex and stay ahead in the world of forex trading.

3 notes

·

View notes

Text

التداول باستخدام MT4 و MT5

التداول باستخدام MT4 و MT5

MT4 و MT5 هما منصتان للتداول الإلكتروني تقدمهما شركة MetaQuotes Software Corp. تم تطوير منصة MT4 (MetaTrader 4) في الأصل في عام 2005، بينما تم إصدا�� منصة MT5 (MetaTrader 5) في عام 2010 كتطور لمنصة MT4. وإليك ملخصًا لكل منهما:

MetaTrader 4 (MT4):

تعتبر MT4 منصة تداول شهيرة وشائعة، وتستخدم على نطاق واسع في جميع أنحاء العالم.

توفر MT4 واجهة بسيطة وسهلة الاستخدام للمتداولين من جميع المستويات.

تتضمن MT4 مجموعة متنوعة من الأدوات والمؤشرات التقنية للتحليل الفني وإجراء الصفقات.

تدعم MT4 استخدام الخوارزميات والتداول الآلي عبر الخوارزميات المبرمجة باستخدام لغة البرمجة MQL4.

MetaTrader 5 (MT5):

يُعتبر MT5 تطورًا لمنصة MT4، وهو يوفر ميزات متقدمة أكثر وتنوعًا.

بالإضافة إلى الأدوات والمؤشرات التقنية، يتضمن MT5 أيضًا تحليل أساسي واقتصادي متقدم.

يدعم MT5 أيضًا التداول عبر مجموعة متنوعة من الأسواق بما في ذلك الأسهم والعقود مقابل الفروقات (CFDs) والعملات والسلع.

تم تحسين الأداء وزيادة سرعة التنفيذ في MT5 مقارنة بـ MT4.

يتيح MT5 للمبرمجين استخدام لغة البرمجة MQL5 لتطوير الخوارزميات والروبوتات التداولية.

الفرق بين التداول باستخدام MT4 و MT5

هناك عدة اختلافات بين التداول باستخدام MT4 و MT5، وفيما يلي أهم الفروق بينهما:

الميزات والوظائف:

MT5 يتضمن ميزات متقدمة أكثر من MT4، بما في ذلك التحليل الأساسي والاقتصادي والتداول عبر مجموعة متنوعة من الأسواق.

MT5 يوفر ميزات تنفيذ محسنة وسرعة أسرع مقارنة بـ MT4.

الأدوات والمؤشرات:

MT5 يحتوي على مجموعة متنوعة من الأدوات والمؤشرات التقنية والأساسية، بينما قد تكون MT4 أكثر تركيزًا على التحليل الفني.

MT5 يتضمن ميزات جديدة مثل الرسوم البيانية الطبقية (Market Depth) التي تظهر العرض والطلب على مستويات الأسعار المختلفة.

دعم الأصول والأسواق:

MT5 يتيح التداول عبر مجموعة متنوعة من الأسواق بما في ذلك الأسهم والسلع والعملات والعقود مقابل الفروقات (CFDs)، بينما قد تكون بعض هذه الأصول غير متاحة في MT4.

لغة البرمجة:

يمكن للمبرمجين استخدام لغة البرمجة MQL4 في تطوير الخوارزميات والروبوتات التداولية في MT4، بينما يستخدمون لغة البرمجة MQL5 في MT5.

الانتشار الجغرافي:

قد يكون هناك اختلاف في توافر MT4 و MT5 على مستوى الوسطاء والبورصات في مختلف الدول.

3 notes

·

View notes

Text

EMail Me: [email protected]

Exploring EX4 and MQ4 Decompiler Tool 2024:

Understanding EX4 Files:

EX4 files are compiled binaries utilized within the MetaTrader 4 (MT4) trading platform. They encapsulate trading strategies, expert advisors, and indicators in a format that the platform can efficiently execute. These files are not designed for human readability, as they are in a machine code format, optimized for rapid and efficient execution within the MT4 environment.

Defining MQ4 Files:

MQ4 files represent the editable source code written in the MQL4 programming language. These files are human-readable and provide the blueprint for trading algorithms and indicators. They allow traders and developers to modify, enhance, and customize trading strategies to meet specific requirements or preferences, offering flexibility and control over the trading process.

Advantages of Converting EX4 to MQ4

Converting EX4 files back into the MQ4 format offers several practical benefits:

Customization and Personalization: Enables users to tailor and modify trading strategies or indicators to better fit their unique trading styles and needs. Customizations might include tweaking parameters, adding new features, or integrating with other systems.

Performance Optimization: Provides an opportunity to refine and enhance the code for improved efficiency and performance. By optimizing the MQ4 code, traders can achieve faster execution times and potentially better trading results.

Educational Insights: Allows for a deeper understanding of the underlying logic and mechanics of trading algorithms. By examining and studying the MQ4 code, users can gain valuable knowledge and insights into how specific trading strategies operate.

#ex4 to mq4#ex4 to mq4 decompiler#ex4 to mq4 converter online#ex5 to mq5#ex4 to mq4 decompiler online free

1 note

·

View note

Text

mql4 parabolic sar: A Beginner's Guide to Forex Success

mql4 parabolic sar is essential for Forex trading success, helping traders identify trends and reversals for better decisions. The mql4 parabolic sar is a popular tool in Forex trading that helps traders identify potential trends and reversals in price movements. It stands for Parabolic Stop and Reverse, and it visually places dots on a price chart to indicate when to buy or sell. Understanding…

0 notes

Text

How to create custom indicators & scripts for Forex trading

Introduction

Telegram Channel

https://secretindicator.com/product/non-repaint-m1-m5-scalping-indicator-for-mt4/

In the dynamic and highly competitive world of Forex trading, success hinges not only on strategy but also on tools. Custom indicators and scripts can dramatically enhance a trader's edge by providing tailored functionality that standard tools cannot. This article walks you through how to create custom indicators and scripts for MetaTrader 4 (MT4) and MetaTrader 5 (MT5), even if you're a beginner. Whether you're an aspiring coder or a trader wanting to automate your edge, this guide will empower you with the knowledge needed to build, test, and deploy your own tools.

What Are Custom Indicators and Scripts?

1. Custom Indicators

Custom indicators are user-defined technical analysis tools coded in MQL4 or MQL5. Unlike default indicators like RSI or MACD, custom indicators are built to meet specific trading needs, offer unique visualizations, or combine multiple data points into one display.

Examples:

A moving average combined with RSI and volume alerts.

Buy/sell arrows based on price action.

Non-repaint support/resistance zones.

2. Scripts

Scripts are single-execution pieces of code that perform a specific task. Unlike indicators or Expert Advisors (EAs), scripts do not run continuously.

Examples:

Close all trades with one click.

Place multiple pending orders at once.

Change all chart timeframes with one button.

Why Create Custom Tools?

Benefits of Custom Indicators:

Tailored signals for your trading strategy.

Cleaner charts by combining multiple functions.

Proprietary tools give you a competitive edge.

Benefits of Scripts:

Save time with automation.

Eliminate repetitive manual actions.

Increase accuracy by reducing human error.

Prerequisites

To build custom indicators and scripts, you’ll need:

MetaTrader 4 or MetaTrader 5

MetaEditor (comes with MT4/MT5)

Basic knowledge of MQL4/MQL5 programming

A trading strategy or logic to automate

Understanding MQL (MetaQuotes Language)

There are two versions:

MQL4 for MetaTrader 4

MQL5 for MetaTrader 5

While both are similar to C/C++ in structure, they are designed specifically for trading operations such as:

Getting price/time data

Plotting objects

Placing/modifying/deleting orders

Creating a Custom Indicator – Step-by-Step

Let’s create a simple custom indicator that:

Plots a moving average.

Changes color when the slope is upward/downward.

Alerts when the price crosses above/below the MA.

Step 1: Open MetaEditor

From MetaTrader → Tools → MetaQuotes Language Editor

Click New → Select Custom Indicator

Name it: Colored_MA_Alert

Step 2: Basic Code Structure

mql4Copy

Edit

#property indicator_chart_window #property indicator_buffers 2 #property indicator_color1 Blue #property indicator_color2 Red extern int MA_Period = 14; extern int MA_Method = MODE_SMA; extern int Applied_Price = PRICE_CLOSE; double UpBuffer[]; double DownBuffer[]; int OnInit() { SetIndexBuffer(0, UpBuffer); SetIndexBuffer(1, DownBuffer); return(INIT_SUCCEEDED); }

Step 3: OnCalculate Function

mql4Copy

Edit

int OnCalculate(const int rates_total, const int prev_calculated, const datetime &time[], const double &open[], const double &high[], const double &low[], const double &close[], const long &tick_volume[], const long &volume[], const int &spread[]) { for (int i = rates_total - 1; i >= 0; i--) { double MA1 = iMA(NULL, 0, MA_Period, 0, MA_Method, Applied_Price, i); double MA2 = iMA(NULL, 0, MA_Period, 0, MA_Method, Applied_Price, i + 1); if (MA1 > MA2) { UpBuffer[i] = MA1; DownBuffer[i] = EMPTY_VALUE; } else { DownBuffer[i] = MA1; UpBuffer[i] = EMPTY_VALUE; } // Price cross alert if (i < rates_total - 1 && Close[i] > MA1 && Close[i + 1] < MA2) { Alert("Price crossed above MA at ", TimeToString(Time[i])); } } return(rates_total); }

Step 4: Compile

Click the Compile button. If no errors, the indicator will be available in your MT4 navigator.

Creating a Custom Script – Step-by-Step

Let’s build a script that closes all open trades.

Step 1: Open MetaEditor → New → Script

Name it: CloseAllOrders

Step 2: Basic Script Code

mql4Copy

Edit

void OnStart() { int total = OrdersTotal(); for (int i = total - 1; i >= 0; i--) { if (OrderSelect(i, SELECT_BY_POS, MODE_TRADES)) { int ticket = OrderTicket(); bool closed = false; if (OrderType() == OP_BUY) { closed = OrderClose(ticket, OrderLots(), Bid, 3, clrRed); } else if (OrderType() == OP_SELL) { closed = OrderClose(ticket, OrderLots(), Ask, 3, clrBlue); } if (closed) { Print("Closed order: ", ticket); } else { Print("Failed to close order: ", ticket); } } } }

Step 3: Compile and Use

After compiling, drag the script onto your chart. All trades will be closed instantly.

Advanced Custom Indicator Example: Trend Reversal Indicator

This indicator combines:

RSI < 30 + bullish engulfing → Buy Signal

RSI > 70 + bearish engulfing → Sell Signal

It shows arrows and gives alerts.

Key Logic:

mql4Copy

Edit

// Detect Engulfing pattern bool isBullishEngulfing(int i) { return (Close[i] > Open[i]) && (Close[i + 1] < Open[i + 1]) && (Open[i] < Close[i + 1]) && (Close[i] > Open[i + 1]); }

mql4Copy

Edit

// RSI condition double rsi = iRSI(NULL, 0, 14, PRICE_CLOSE, i); if (rsi < 30 && isBullishEngulfing(i)) { ObjectCreate("BuyArrow"+Time[i], OBJ_ARROW, 0, Time[i], Low[i] - 10 * Point); ObjectSetInteger(0, "BuyArrow"+Time[i], OBJPROP_COLOR, clrGreen); Alert("Buy signal on ", Symbol(), " at ", TimeToString(Time[i])); }

Tips for Successful Custom Tool Development

Start Simple – Build basic tools before trying complex strategies.

Use Built-in Functions – Leverage iMA, iRSI, iMACD, etc.

Use Buffers Efficiently – Up to 8 buffers can be used for plotting.

Debug with Print Statements – Output values during backtests.

Backtest Before Going Live – Use MT4 strategy tester.

Popular Custom Indicator Ideas

Non-repaint Support/Resistance Zones

Smart Trend Line with Alerts

Order Block Detection

Volume Spike Warning System

Multi-Timeframe Signal Scanner

Dashboard Indicators for Entry Confirmation

Turning Indicators into Expert Advisors

Once you have a working custom indicator, you can integrate it into an Expert Advisor (EA) for fully automated trading.

For example:

mql4Copy

Edit

if (iCustom(NULL, 0, "YourIndicator", param1, param2, ..., 0, 0) > 0) { // Signal detected, place order }

Resources for Learning MQL

MQL5 Docs

YouTube Tutorials (e.g., JimDandy, ForexSignalsTV)

Forex Factory (Code Base Section)

Udemy MQL Programming Courses

Books: "Expert Advisor Programming" by Andrew Young

Security & Licensing Your Indicators

To prevent unauthorized sharing or use:

Use AccountNumber() to restrict access to licensed users.

Hide logic in .ex4 or .ex5 compiled files.

Add expiration date features.

Selling or Sharing Your Indicators

If you plan to share or sell:

Offer a .ex4 version only.

Use platforms like:

MQL5 Market

TradingView (Pine Script if cross-platform)

Gumroad / Payhip

Create documentation and video tutorials.

Provide support and regular updates.

Conclusion

Creating custom indicators and scripts in MT4 or MT5 is a game-changer for traders who want to personalize their approach or automate profitable strategies. Whether you're simplifying your workflow with scripts or building sophisticated custom indicators for better signals, the process is well within reach—even for beginners.

By combining technical knowledge with trading logic, you can design tools that are more aligned with your style, risk tolerance, and goals. And if you go a step further, your creations could even become profitable digital products sold to other traders worldwide.

https://secretindicator.com/product/non-repaint-m1-m5-scalping-indicator-for-mt4/

#forex market#forex factory#forex online trading#forex broker#forex education#forex ea#forex news#forex#forex indicators#crypto#bitcoin#blockchain#cryptonews#stablecoins#defi

0 notes

Text

Double Moving Averages With Fibonacci - indicator MetaTrader 4

Double Moving Averages With Fibonacci is a custom MQL4 indicator designed for traders seeking a combination of trend-following and support/resistance tools in a single package. It utilizes two customizable moving averages to generate buy and sell signals based on their crossover points. When the faster moving average crosses above the slower one, a buy signal is indicated with a visual arrow;…

0 notes

Text

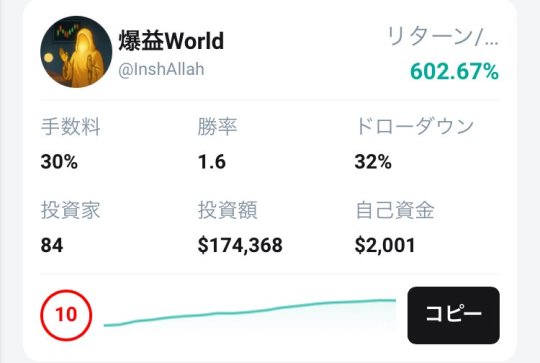

人気コピトレ配信者⑥

半年前から自動売買EAの代理店をしています。 グループで最強のEAができたのでXMでコピトレ配信開始しました。

ただ、私のEA以外にもすごいコピトレ配信者がいっぱいいます! 今日はそんなお勧め配信者をご紹介します。

この安全運転安心ですね。 ぜひフォローしてみてください。https://social.xmtrading.com/s/ZwbZ27b8

XMTrading Social Trading Trade Like an Expert social.xmtrading.com

投資家口座を作るときは パートナーコード「3XW3F」を入力してから口座をつくってください。 今後とも自動売買やコピトレの質問などにお答えできるかと思います。 相談などしたい方は公式LINEまでご連絡ください。 https://line.me/R/ti/p/@341yddlr?oat_content=url&ts=07012255 あなたの資金構築を応援いたします。

以下、私のEAもお見知りおきを。 <超安定複利型EA> EAの名前は Wave of Growth(WOG) HEDG 読み方: ウェーブ・オブ・グロウス 意味: 成長する富みの波浪

2025年4月29日 バージョンアップしました!

【EA概要】 本EAは、EUR/USDの5分足をベースに、完全放置運用が可能な自動売買システムです。

これはギャンブルではありません。 現役プロトレーダー設計の“資産形成に特化した本物の投資EA”です。

【(複利運用)バックテスト実績】 ⏱ 24時間365日、完全稼働のテスト 指標や時間停止なし 期間:2023/11/3 ~ 2025/4/22 (1年半) 初期証拠金:1,000,000円 最終資産:+21,364,677円(+2136.47%) 増加資産:100万円が2136万円に‼️ 平均月利:118.69%※複利で増加 平均DD:136,874円(1.63%) 平均ナンピン数:1.29段※脅威の低ナンピン

この最強EAをXMでコピトレ配信開始です。

コピーには口座の紐づけが必要なため パートナーコード

「3XW3F」

を入力してから口座をつくってください。公式LINEにてパスワードをお伝えします。

バックテストのデータを見たい方も公式LINEまでご連絡ください。 https://line.me/R/ti/p/@341yddlr?oat_content=url&ts=07012255

自分でEAを設定して運用したい方は以下を読んでください。

<設定等> standard口座のみ 推奨は有効証拠金10万あたり初期ロット0.01の複利です。 通貨ペア:ユーロドル(EURUSD) 時間 5分足

ゴールドEAや他の通貨ペアをされてる方のリスクオフになるのでかなりおすめです! セットファイルで完全放置できますので お仕事でチャートが見れない、 チャートが見れないと不安になる方にもおすすめです! トランプ関税や雇用統計も難なくクリアの優秀EAです。

証拠金10万/0.01であれば 【初期ロット:0.01】 (例①) 現金40万円のみで運用=初期ロット0.01 現金20万円+ボーナス30万円で運用=初期ロット0.04 現金部分は初期ロット0.01で勝手に10万円あたりで調整してくれます。

prisetファイルを読み込めば、BTの数値に簡単に変わります。セットファイルは、 ファイル→データフォルダ��開く→MQL4→Presets、こちらに挿入して下さい! その後、パラメーターの入力画面の右に「読み込み」からファイルを読み込めば数値が自動的に変更されます。 セットファイルは ファイル→データフォルダを開く→MQL4→Presets、こちらに挿入して下さい

運用には口座の紐づけが必要なため パートナーコード

「3XW3F」

を入力してから口座をつくってください。

口座開設後、公式LINEまでご連絡ください。 https://line.me/R/ti/p/@341yddlr?oat_content=url&ts=07012255

あと自動売買ではなく、手動でFXしたい方はこちらをご利用ください。 https://is.gd/WJdBdR

#副業 #老後 #学生 #主婦 #家計 アフリエイト Twitter ツイッター インスタグラム 動画 コピトレ

1 note

·

View note

Text

Unleashing the power of MQL4: Explore the Best Programming Services

In the realm of algorithmic trading, where milliseconds can make or break a trade, having a robust and efficient trading strategy is paramount. This is where MQL4 programming services come into play, offering traders the ability to automate their strategies and execute trades with precision and speed. In this blog post, we'll delve into the world of MQL4 programming services, exploring what they offer and highlighting some of the best options available.

Understanding MQL4 Programming Services:

MQL4, short for MetaQuotes Language 4, is a programming language specifically designed for developing trading strategies within the MetaTrader 4 (MT4) platform. It provides traders with a powerful set of tools and functionalities to create custom indicators, scripts, and expert advisors (EAs) that can automate trading processes.

MQL4 programming services encompass a range of offerings, including:

MQL4 programming services offer a diverse range of solutions tailored to meet the needs of traders in the dynamic world of algorithmic trading. Here's a breakdown of the key offerings:

Custom Indicator Development: Indicators serve as invaluable tools for traders, providing insights into market dynamics and potential trading opportunities. MQL4 programmers specialize in creating custom indicators that are finely tuned to specific trading strategies and preferences. These indicators can be designed to analyze various aspects of market data, such as price movements, trends, volatility, and volume, aiding traders in making informed decisions.

Expert Advisor (EA) Development: Expert Advisors, commonly referred to as EAs or trading robots, are automated trading systems designed to execute trades on behalf of traders based on predefined rules and conditions. MQL4 programmers excel in developing EAs that implement sophisticated trading strategies and algorithms. These EAs can execute trades with precision and speed, allowing traders to capitalize on market opportunities while minimizing human error and emotion.

Script Development: Scripts in MQL4 are single-function programs that perform specific tasks to streamline various aspects of trading. MQL4 programming services can create custom scripts tailored to meet the unique needs of traders. These scripts can automate tasks such as opening or closing trades, calculating indicators, managing positions, and executing custom trading strategies. By automating routine tasks, traders can save time and focus on analyzing market trends and refining their trading strategies.

Optimization and Backtesting: Optimization and backtesting are essential steps in the development and refinement of trading strategies. MQL4 programmers can assist traders in optimizing their strategies by fine-tuning parameters to maximize performance and profitability. Additionally, they can conduct thorough backtesting to assess the robustness and effectiveness of trading strategies across historical market data. By analyzing past performance, traders can gain valuable insights into the viability of their strategies and make informed decisions about their trading approach moving forward.

The Quest for the Best MQL4 Programming Services:

When seeking MQL4 programming services, traders should consider several factors to ensure they choose the best provider for their needs. Here are some key considerations:

Experience and Expertise: Look for MQL4 programmers with extensive experience in developing trading solutions and a deep understanding of market dynamics. Check for reviews, portfolios, and testimonials to gauge the programmer's proficiency.

Customization Capabilities: Opt for programming services that offer tailored solutions to align with your unique trading strategy and objectives. The ability to customize indicators, EAs, and scripts according to your specifications is crucial for success.

Reliability and Support: Choose a programming service provider known for reliability, prompt communication, and ongoing support. You'll want assurance that your trading systems will function smoothly and that assistance is available when needed.

Security and Confidentiality: Ensure that the programming service provider prioritizes security and maintains strict confidentiality regarding your trading strategies and sensitive information.

Top MQL4 Programming Services Providers:

While numerous MQL4 programming services exist, a few stand out for their exceptional quality, reliability, and customer satisfaction:

MQLStudio: Known for its experienced team of MQL4 programmers and comprehensive range of services, MQLStudio delivers custom solutions tailored to individual trader requirements. They emphasize transparent communication and timely delivery.

EA Coder: With a focus on innovative solutions and personalized support, EA Coder offers expert advisor development, indicator customization, and optimization services. Their team comprises skilled programmers with a track record of delivering high-quality solutions.

FXDreema: FXDreema provides a user-friendly platform for designing and automating trading strategies without requiring programming expertise. Their drag-and-drop interface simplifies the process of creating EAs and indicators, making it accessible to traders of all levels.

MQL4Programming.com: Specializing in MQL4 programming services, this provider offers custom indicator and EA development, optimization, and backtesting solutions. Their team of programmers is committed to delivering efficient and reliable trading solutions.

Conclusion:

In the fast-paced world of algorithmic trading, MQL4 programming services play a crucial role in enabling traders to automate their strategies and gain a competitive edge in the markets. By choosing the best programming service provider, traders can unlock the full potential of the MetaTrader 4 platform and execute trades with precision, efficiency, and confidence. Whether you're a seasoned trader looking to optimize your strategies or a novice seeking to automate your trading process, investing in quality MQL4 programming services can yield significant returns and propel your trading journey to new heights. Choose wisely, and embark on a journey towards trading success with the power of MQL4 at your fingertips.

#custom bots trading#custom bots#custom bot ea#black literature#black history#black fashion#automate trading bots#black art#auto trading bots#black tumblr#MQL4 programming services#MQL4 programming#MQL4 programmer

0 notes

Text

Understanding the Smart Analyzer Pro Indicator for MT4

Introduction to Trading Indicators

Technical indicators are critical for traders aiming to make data-driven decisions in financial markets. The Smart Analyzer Pro indicator MT4 free download is a powerful tool designed to simplify price action analysis and deliver reliable trading signals. Built for the MetaTrader 4 (MT4) platform, this indicator caters to traders of all levels, offering a user-friendly interface and advanced features to enhance trading performance.

What is the Smart Analyzer Pro Indicator?

The Smart Analyzer Pro is a non-repainting indicator that leverages price action strategies to generate accurate buy and sell signals. It uses a unique averaging candle system without wicks, providing a clearer view of market direction by filtering out noise. The indicator supports multiple trading styles—scalping, day trading, and swing trading—and includes a multi-timeframe filter to align trades with broader market trends. Traders often seek to download the Smart Analyzer Pro indicator for MT4 free from reputable sources to integrate its advanced capabilities into their charts.

Benefits of Using the Indicator

The Smart Analyzer Pro indicator for MT4 free download offers several key advantages:

Clear Signals: Displays arrows for trade entries (blue for buy, white for sell) with a three-way alert system (email, mobile, or pop-up), ensuring traders never miss opportunities.

Noise Reduction: Uses special candlesticks to simplify chart reading, eliminating confusing patterns like doji candles or consolidation zones.

Versatility: Works across all currency pairs, timeframes (M1 to D1), and assets like stocks, commodities, and cryptocurrencies.

Risk Management: Suggests stop-loss and take-profit levels to protect capital and lock in profits.

By opting to download the Smart Analyzer Pro indicator for MT4 free, traders gain access to a tool that streamlines analysis and boosts efficiency.

How to Download and Install the Indicator

To use the Smart Analyzer Pro on MT4, follow these steps:

Find a Trusted Source: Search for the indicator on reliable platforms like trading forums or websites such as ForexCracked or ForexFactory. Ensure the files include .ex4 or .mq4 formats and templates.

Download the Files: Save the indicator files and any accompanying templates or manuals. Be cautious of unverified sources to avoid malware.

Install on MT4: Copy the indicator files to the “MQL4” > “Indicators” folder and templates to the “Templates” folder in MT4’s data directory. Restart MT4.

Apply to Chart: Open a chart, select a template (e.g., Scalping, Day Trading, or Swing Trading) from the template menu, and customize settings like alert preferences or timeframes.

Always verify the source when you download the Smart Analyzer Pro indicator for MT4 free to ensure safety and functionality.

Practical Applications

The indicator supports various trading strategies:

Scalping: Use the “Smart – Scalping” template on lower timeframes (M1–M15) for fast, high-risk trades.

Day Trading: Apply the “Day Trading” template on M15–H1 for intraday opportunities with balanced risk.

Swing Trading: Select the “Swing Trading” template on H1–D1 for longer-term trades with filtered signals.

Tips for Effective Use

To maximize the indicator’s potential:

Combine with other tools like RSI or support/resistance levels to confirm signals.

Backtest on a demo account to optimize settings for your trading style.

Avoid trading during high-impact news events to minimize false signals.

Practice proper money management to mitigate risks.

Conclusion

The Smart Analyzer Pro indicator for MT4 free download is a versatile and powerful tool for traders seeking to enhance their market analysis. Its noise-filtering candlesticks, clear signals, and risk management features make it ideal for scalping, day trading, or swing trading. By choosing to download the Smart Analyzer Pro indicator for MT4 free from trusted sources, traders can elevate their strategies and improve profitability. With disciplined use and thorough testing, this indicator can be a game-changer in navigating dynamic markets.

0 notes

Text

半年前から自動売買EAの代理店をしています。 グループで最強のEAができたのでXMでコピトレ配信開始しました。

ただ、私のEA以外にもすごいコピトレ配信者がいっぱいいます! 今日はそんなお勧め配信者をご紹介します。

投資家口座を作るときは パートナーコード「3XW3F」を入力してから口座をつくってください。 今後とも自動売買やコピトレの質問などにお答えできるかと思います。 あなたの資金構築を応援いたします。

以下、私のEAもお見知りおきを。 <超安定複利型EA> EAの名前は Wave of Growth(WOG) HEDG 読み方: ウェーブ・オブ・グロウス 意味: 成長する富みの波浪

2025年4月29日 バージョンアップしました!

【EA概要】 本EAは、EUR/USDの5分足をベースに、完全放置運用が可能な自動売買システムです。

これはギャンブルではありません。 現役プロトレーダー設計の“資産形成に特化した本物の投資EA”です。

【(複利運用)バックテスト実績】 ⏱ 24時間365日、完全稼働のテスト 指標や時間停止なし 期間:2023/11/3 ~ 2025/4/22 (1年半) 初期証拠金:1,000,000円 最終資産:+21,364,677円(+2136.47%) 増加資産:100万円が2136万円に‼️ 平均月利:118.69%※複利で増加 平均DD:136,874円(1.63%) 平均ナンピン数:1.29段※脅威の低ナンピン

この最強EAをXMでコピトレ配信開始です。

コピーには口座の紐づけが必要なため パートナーコード

「3XW3F」

を入力してから口座をつくってください。公式LINEにてパスワードをお伝えします。

バックテストのデータを見たい方も公式LINEまでご連絡ください。 https://line.me/R/ti/p/@341yddlr?oat_content=url&ts=07012255

自分でEAを設定して運用したい方は以下を読んでください。

<設定等> standard口座のみ 推奨は有効証拠金10万あたり初期ロット0.01の複利です。 通貨ペア:ユーロドル(EURUSD) 時間 5分足

ゴールドEAや他の通貨ペアをされてる方のリスクオフになるのでかなりおすめです! セットファイルで完全放置できますので お仕事でチャートが見れない、 チャートが見れないと不安になる方にもおすすめです! トランプ関税や雇用統計も難なくクリアの優秀EAです。

証拠金10万/0.01であれば 【初期ロット:0.01】 (例①) 現金40万円のみで運用=初期ロット0.01 現金20万円+ボーナス30万円で運用=初期ロット0.04 現金部分は初期ロット0.01で勝手に10万円あたりで調整してくれます。

prisetファイルを読み込めば、BTの数値に簡単に変わります。セットファイルは、 ファイル→データフォルダを開く→MQL4→Presets、こちらに挿入して下さい! その後、パラメーターの入力画面の右に「読み込み」からファイルを読み込めば数値が自動的に変更されます。 セットファイルは ファイル→データフォルダを開く→MQL4→Presets、こちらに挿入して下さい

運用には口座の紐づけが必要なため パートナーコード

「3XW3F」

を入力してから口座をつくってください。

口座開設後、公式LINEまでご連絡ください。 https://line.me/R/ti/p/@341yddlr?oat_content=url&ts=07012255

#副業 #老後 #学生 #主婦 #家計 アフリエイト Twitter ツイッター インスタグラム 動画 コピトレ

0 notes

Text

How to Create Your Own Software for Forex Trading?

Forex trading, or foreign exchange trading, is the act of buying and selling currencies to make a profit. Many traders today use software to automate trading, analyze market trends, and execute trades quickly. Creating software for forex trading can be a great business idea or personal project if you're interested in both finance and technology.

In this blog, I’ll explain to you the key steps involved in creating your own forex trading software. Whether you're a beginner or someone with some coding experience, this blog will help you understand what it takes to build a working solution.

1. Understand the Forex Market

Before writing any code, it's important to understand how the forex market works. Forex is the largest financial market in the world, operating 24 hours a day, five days a week. Traders exchange currency pairs like EUR/USD (Euro vs US Dollar), GBP/JPY (British Pound vs Japanese Yen), and many others.

Prices in the forex market change very quickly, often within seconds. This means trading software needs to react fast and process data in real-time.

Learn the basic terms such as:

Bid and Ask Price

Pip (percentage in point)

Leverage and Margin

Stop Loss and Take Profit

Technical Indicators (like RSI, MACD, Bollinger Bands)

Understanding these terms will help you know what features your software should include.

2. Choose Your Type of Trading Software

There are different types of forex trading software you can build, depending on your goals:

Manual Trading Platforms: These help traders make decisions based on real-time charts, news, and analysis, but they place trades manually.

Automated Trading Systems (also called bots or expert advisors): These can place trades based on predefined rules and market signals.

Hybrid Platforms: These combine both manual and automated trading features.

Decide what kind of tool you want to build. If your goal is to help users trade faster or with more accuracy, then automation might be the way to go.

3. Select a Programming Language

Forex trading platforms are often built using the following languages:

Python: Great for data analysis and creating trading algorithms.

C++ or C#: Fast and reliable, often used in high-frequency trading.

JavaScript/Node.js: Useful for building web-based trading platforms.

MQL4/MQL5: Languages used for MetaTrader platforms.

Choose the one that matches your skills or the platform you want to build on. For example, if you’re building a bot for MetaTrader 5, you’ll need to learn MQL5.

4. Pick a Trading API or Broker Integration

To execute real trades, your software must connect to a broker or trading platform. Many brokers offer APIs (Application Programming Interfaces) that let your software read market data and place trades.

Some popular brokers with APIs include:

MetaTrader 4/5 (via MQL)

OANDA

IG

Alpaca

Interactive Brokers

Study the documentation provided by the broker’s API to understand how you can send orders, get price feeds, and check account balance or trade history.

5. Plan Your Features

Think about what features your forex trading software should have. Here are some common ones:

Real-time Price Charts

Technical Indicators

Trade Execution

Risk Management Tools (stop-loss, take-profit, lot size settings)

Backtesting Engine (test strategies on past data)

Strategy Builder (for users to create custom strategies)

Start with a simple version (also called an MVP—Minimum Viable Product) and improve over time based on user feedback.

6. Build and Test Your Software

Once you have your plan and tools ready, start building your software step-by-step.

Front-end: Design a simple, easy-to-use interface. You can use frameworks like React, Angular, or even a simple HTML/CSS layout if it's a desktop app.

Back-end: This is where the trading logic lives. Write code that connects to the broker’s API, handles trading signals, and manages orders.

Testing: Never skip testing. First, test your software with demo accounts. Most brokers offer demo accounts with fake money so you can test safely. Check for bugs, delayed orders, or unexpected results.

Backtesting: Use historical data to test how well your strategy would have performed in the past. This helps improve performance before going live.

7. Add Security and Compliance

Security is very important when dealing with money. Make sure your software uses encrypted connections (HTTPS or SSL) and stores sensitive data safely. Don’t save passwords or API keys in plain text.

Also, if you plan to release your software to others, check local laws and financial regulations. You might need licenses or need to follow certain rules depending on your country.

8. Keep Improving and Updating

The forex market changes all the time. A good trading software should keep up with market conditions. Keep improving your software by:

Fixing bugs

Adding new indicators

Improving speed and accuracy

Listening to user feedback

Also, stay updated on news about brokers, API changes, or new trading techniques.

Final Thoughts

Building your own forex trading software takes effort and time, but it can be a rewarding project. Whether you're a trader looking to automate your strategy or a developer looking to build a useful tool, the key is to start simple, learn as you go, and keep testing your ideas.

Focus on making the software smooth, user-friendly, and secure. Once you have the basics down, you can always add advanced features later. Good luck building your forex trading software!

0 notes

Text

Estratégia de Negociação Para Opções Binárias Swing Man A estratégia de negociação para opções b... https://theciranda.com/estrategia-negociacao-opcoes-binarias-swing-man?feed_id=34776&_unique_id=67d4fffb6adfb

0 notes

Text

most profitable forex indicator mt4

Introduction

https://secretindicator.com/product/non-repaint-m1-m5-scalping-indicator-for-mt4/

Telegram Channel

In the ever-volatile world of forex trading, the right tools can significantly enhance your trading edge. Among these tools, technical indicators stand out as indispensable instruments for identifying market trends, entries, and exits. While there are numerous indicators available for MetaTrader 4 (MT4), some consistently outperform others in terms of profitability and reliability. This article will explore the most profitable forex indicator for MT4, how it works, and how traders can use it for maximum gain.

Why Forex Indicators Matter

Before diving into the specifics of the most profitable indicator, it’s essential to understand the role indicators play:

Predict Market Direction: Indicators help forecast the movement of currency pairs.

Manage Risk: They help define stop-loss and take-profit levels.

Build Strategies: Indicators are building blocks for algorithmic and manual trading strategies.

Enhance Confidence: When used correctly, they provide confirmation for trade setups.

The challenge lies in choosing the right indicator—one that avoids repainting, performs well in all market conditions, and is easy to interpret.

The Criteria for a Profitable Indicator

To define an indicator as “profitable,” we look for:

Non-repaint nature: It should not change past signals.

Consistency: It should work across various pairs and timeframes.

Real-time alerts: It should offer timely entry/exit signals.

Simplicity: It should be easy to understand and trade.

Accuracy: High win rate with low false signals.

With these factors in mind, let’s reveal the most profitable forex indicator for MT4.

The Winner: The TDI (Traders Dynamic Index)

What is the TDI?

The Traders Dynamic Index (TDI) is a hybrid indicator that combines multiple tools into one powerful forex trading signal generator. Developed by Dean Malone, it fuses the Relative Strength Index (RSI), Moving Averages, and Bollinger Bands into a single interface.

Components:

RSI Line (Green): Shows momentum and trend direction.

Signal Line (Red): Acts like a moving average of the RSI.

Volatility Bands (Blue): Derived from Bollinger Bands showing market volatility.

Market Base Line (Yellow): Long-term trend indication.

Why TDI is the Most Profitable Forex Indicator

1. Combination Power

TDI removes the need to use multiple separate indicators. It combines:

Trend Detection

Volatility Analysis

Momentum Confirmation

2. Early Signals

TDI gives early trend change alerts by analyzing shifts in momentum before the actual price reacts.

3. Accuracy in All Markets

Whether you're scalping, day trading, or swing trading, TDI adapts to every style and time frame (especially M15, M30, H1, and H4).

4. Low False Breakouts

Compared to moving average crossovers and MACD, TDI filters out false breakouts with its multiple confirmation layers.

5. No Repainting

TDI is a non-repaint indicator. Once a signal appears, it doesn’t change after a candle closes—critical for live trading.

How to Use TDI on MT4

Step 1: Install the TDI Indicator

You can download the TDI indicator for free from most forex forums or request a custom version.

To install:

Copy the .ex4 or .mq4 file to MQL4 > Indicators.

Restart MT4.

Apply the TDI to your chart from the “Navigator” panel.

Step 2: Understand the Signals

Buy Signal: Green RSI line crosses above Red Signal line and both are above the Yellow Market Base Line.

Sell Signal: Green RSI crosses below Red Signal line and both are below the Yellow line.

Avoid Trades: When the green and red lines are flat or overlapping.

Step 3: Entry and Exit Rules

Buy Example:

Price above 50 EMA (trend filter).

TDI Green crosses Red from below.

Both above Yellow.

Confirmed by a bullish candle.

Exit:

Opposite cross.

RSI goes above 68 (overbought).

Sell Example:

Price below 50 EMA.

TDI Green crosses Red from above.

Both below Yellow.

Confirmed by a bearish candle.

Exit:

RSI below 32 (oversold).

Opposite cross appears.

TDI in Multi-Timeframe Strategy

One of the most effective methods is using TDI in a multi-timeframe setup:

H4 for Trend Direction

H1 for Confirmation

M15 for Entry

This top-down approach increases the win rate significantly and filters out weak signals.

Best Settings for TDI

Here are the optimal parameters:

RSI Period: 13

RSI Price: Close

Volatility Band Period: 34

Signal Smoothing: 2

Use Price Action with Candlestick Patterns (like pin bars or engulfing) for stronger setups.

Proven TDI Strategy: “The TMS Method” (Trading Made Simple)

This strategy was made famous on Forex Factory and is responsible for consistent profitability for thousands of traders.

Rules:

Trade only in the direction of the H4 trend.

Entry on the H1 TDI cross.

Confirm with price action and candle close.

Place SL below recent swing.

Aim for 1:2 risk-to-reward or more.

This system has delivered win rates of 65–80% consistently for disciplined traders.

Example Trades (Live Setup)

Trade 1 – EUR/USD H1:

H4 trend: Bullish.

H1: Green crosses Red above Yellow.

Entry at 1.0950.

Exit at 1.1020.

Profit: +70 pips.

Trade 2 – GBP/JPY M15:

Trend: Down.

M15 Green crosses Red below Yellow.

Entry: 192.40.

Exit: 191.80.

Profit: +60 pips in 40 minutes.

https://secretindicator.com/product/non-repaint-m1-m5-scalping-indicator-for-mt4/

#forex market#forex factory#forex online trading#forex education#forex broker#forex news#crypto#forex#forex indicators#forex ea

0 notes

Text

Estratégia de Negociação Para Opções Binárias Swing Man A estratégia de negociação para opções b... https://theciranda.com/estrategia-negociacao-opcoes-binarias-swing-man?feed_id=34775&_unique_id=67d4fff9c5f99

0 notes