#nand flash memory chip

Explore tagged Tumblr posts

Text

https://www.futureelectronics.com/p/semiconductors--memory--flash--nand/emmc04g-wt32-01g02-kingston-2181962

Flash memory programming, programmable flash memories, nand flash memory chip

EMMC04G-WT32-01G02 4GB I-temp eMMC 5.1 (HS400) 153FBGA 4GB5.1 11.5x13x0.8

#Memory ICs#Flash Memory#Nand Flash Memory#EMMC04G-WT32-01G02#Kingston#non-volatile storage#Flash memory programming#Flash drives#What is NAND flash memory#storage#programmable flash memories#nand flash memory chip

1 note

·

View note

Text

OSAT firm Aptos files for bankruptcy amid prolonged losses

June 27, 2025 /SemiMedia/ — Semiconductor packaging firm Aptos Technology has filed for bankruptcy, with total liabilities reaching NT$1.058 billion, as prolonged losses and weakening memory demand continue to weigh on the company. Established in 2006, Aptos specialized in packaging solutions for MicroSD and NAND Flash products, leveraging proprietary technologies to serve global clients such as…

#Aptos Technology#electronic components news#Electronic components supplier#Electronic parts supplier#Memory chips#MicroSD#NAND Flash#semiconductor packaging#SiP packaging#SSD demand

0 notes

Text

Supraproducția de Cipuri NAND Flash: Impactul Asupra Pieței de Stocare și Prețurilor

După criza globală a cip-urilor din perioada post-COVID, în care cererea pentru semiconductori a depășit oferta, acum ne aflăm într-o situație diametral opusă. Producătorii de soluții NAND Flash au anticipat eronat o scădere semnificativă a cererii, iar acum se confruntă cu o supraproducție, care generează o prăbușire a prețurilor. În acest articol, vom analiza cum a evoluat piața și ce impact…

#2024#2025#AI demand#AI technologies#bam#cerere AI#cerere scăzută#chip manufacturers#chips#cipuri#demand drop#demand reduction#diagnosis#diagnoza#dispozitive de stocare#economii globale#flash memory#global economy#livrări PC#livrări smartphone#lower prices#memorie flash#NAND Flash#neamt#overproduction#PC shipments#PC-uri#PCs#prețuri scăzute#producători de cipuri

0 notes

Text

https://www.futureelectronics.com/p/semiconductors--memory--flash--norflash--serial/s25fl256sagmfi003-infineon-3057273

Micron nor flash, SPI nor flash, memory card, Compact flash memory

S25FL256S Series 256 Mb (32M x 8) 3.6 V SMT SPI Flash Memory - SOIC-16

#Flash Memory#Serial NOR Flash (SPI) Memory#S25FL256SAGMFI003#Infineon#micron nor flash#spi nor flash#memory card#Compact#nand vs nor flash#Memory ICs#USB flash memory storage#Winbond SPI Flash#flash memory card#memory chip

1 note

·

View note

Text

https://www.futureelectronics.com/p/semiconductors--memory--flash--norflash--nor/sst39sf040-70-4c-nhe-microchip-6467633

What is flash memory, flash memory chip, Flash Memory, Multi-Purpose Flash

SST39SF Series 4 Mbit 512 K x 8 5 V Multi-Purpose Flash - PLCC-32

#Microchip#SST39SF040-70-4C-NHE#NOR Flash Memory Parallel#NOR Flash Memory#non-volatile storage technology#nor flash memory chip#nand flash memory#flash memory chip#Flash Memory#Multi-Purpose Flash#storage#USB flash drive

1 note

·

View note

Text

https://www.futureelectronics.com/p/semiconductors--memory--flash--nand/emmc04g-ct32-01g10-kingston-5177876

What is flash memory, USB flash memory storage, flash memory drive

EMMC 5.1 INTERFACE,153-BALL FBGA,3.3V,-25C-+85C

#Kingston#EMMC04G-CT32-01G10#Memory ICs#Flash Memory#Nand Flash Memory#chip#programmable flash memory#USB flash drives#USB flash memory storage#flash memory drive#Nand flash drive#flash memory#flash memory chip#memory card#flash memories

1 note

·

View note

Text

https://www.futureelectronics.com/p/semiconductors--memory--storage--embedded-storage/emmc04g-m627-e02u-kingston-8130398

eMMC storage drives, emmc storage upgrade, eMMC multimedia cards

4GB eMMC v5.1 3.3V 153-ball BGA Operating Temp - 25C to +85C

#Kingston#EMMC04G-M627-E02U#Memory ICs#Storage#eMMC#NAND flash controller#data transfer speeds#NAND gate#embedded memory device#flash memory#Emmc speed laptop#eMMC chips#upgrade#eMMC multimedia cards

1 note

·

View note

Text

https://www.futureelectronics.com/p/semiconductors--memory--storage--embedded-storage/emmc04g-mt32-01g10-kingston-2180413

IC Flash Memory EMMC Memory Chips, Compact flash memory for computer

EMMC04G-MT32-01G10

#Memory ICs#Storage#eMMC#EMMC04G-MT32-01G10#Kingston#compact storage solution#single-chip MMC controller#NAND flash memory#SD card#IC Flash Memory EMMC Memory Chips#Compact flash memory for computer#storage#chip#isolated circuits

1 note

·

View note

Text

Memory chip prices surge amid tariff concerns and tighter DDR4 supply

June 2, 2025 /SemiMedia/ — Global memory chip prices extended their rally in May, driven by tariff-related stockpiling and a shrinking supply of DDR4 products. The average price for an 8GB DDR4 chip rose to $2.10, marking a 27% increase from April and a continued rise from $1.37 in March. The surge follows heightened concerns over U.S. trade policy. Although a 90-day grace period was granted…

#DDR4 chip supply#DRAM pricing trends#electronic components news#Electronic components supplier#Electronic parts supplier#Memory chip market#NAND flash cost#semiconductor inventory#Trump tariffs

0 notes

Text

China Claims New Memory Chip is 10,000× Faster than Today’s Tech

From William Huo:

Scientists claim a new memory chip that’s 10,000× faster than today’s tech, with near-zero power and 100-year retention. If true, this isn’t just a tech breakthrough—it’s a global power play. This new memory tech isn’t just faster, it could make your RAM and SSD look like floppy disks. Nanosecond speeds 100+ year data retention 10M+ rewrite cycles. All with near-zero power. Conventional flash memory is bulky, slow, and energy-hungry. This new memory traps electrons in an atomic layer using quantum tunneling. It reads/writes in billionths of a second—with no need for refresh. In simple terms: Faster than DRAM More durable than SSDs Uses a fraction of the power This could kill the RAM vs storage divide. One chip does both. It's a working prototype from Shanghai tech University. The researchers claim over 10 million cycles of stable performance—and data retention for a century. China has always lagged in memory chips, blocked from advanced NAND and DRAM tech by U.S. sanctions. This leapfrogs all that. No Micron, no Samsung, no SK Hynix needed. These 2D materials can be fabricated on legacy fabs. China doesn’t need ASML’s EUV. They can build this on 28nm lines with domestic tools. Expect responses: Export bans on deposition tools. Lawsuits over IP. U.S. agencies calling it “dual-use” military tech When you can store battlefield AI models in nanoseconds, it's not just commercial. Zoom out: this is part of China’s broader post-silicon push. Graphene batteries Photonic chips Neuro morphic computing They’re not trying to copy Intel. They’re trying to skip the entire Western roadmap. If this memory scales, it could power: Instant-on phones AI edge devices with zero latency Memory-in-logic chips for quantum/space/military apps We’re not just talking speed, we’re talking about architectural collapse.

This all assumes China is telling the truth, which it often does not. Further, some argue this wouldn't really affect AI since solutions to AI bottlenecking have already been designed by 4DS Memory’s ReRAM.

5 notes

·

View notes

Text

Semiconductors: The Driving Force Behind Technological Advancements

The semiconductor industry is a crucial part of our modern society, powering everything from smartphones to supercomputers. The industry is a complex web of global interests, with multiple players vying for dominance.

Taiwan has long been the dominant player in the semiconductor industry, with Taiwan Semiconductor Manufacturing Company (TSMC) accounting for 54% of the market in 2020. TSMC's dominance is due in part to the company's expertise in semiconductor manufacturing, as well as its strategic location in Taiwan. Taiwan's proximity to China and its well-developed infrastructure make it an ideal location for semiconductor manufacturing.

However, Taiwan's dominance also brings challenges. The company faces strong competition from other semiconductor manufacturers, including those from China and South Korea. In addition, Taiwan's semiconductor industry is heavily dependent on imports, which can make it vulnerable to supply chain disruptions.

China is rapidly expanding its presence in the semiconductor industry, with the government investing heavily in research and development (R&D) and manufacturing. China's semiconductor industry is led by companies such as SMIC and Tsinghua Unigroup, which are rapidly expanding their capacity. However, China's industry still lags behind Taiwan's in terms of expertise and capacity.

South Korea is another major player in the semiconductor industry, with companies like Samsung and SK Hynix owning a significant market share. South Korea's semiconductor industry is known for its expertise in memory chips such as DRAM and NAND flash. However, the industry is heavily dependent on imports, which can make it vulnerable to supply chain disruptions.

The semiconductor industry is experiencing significant trends, including the growth of the Internet of Things (IoT), the rise of artificial intelligence (AI), and the increasing demand for 5G technology. These trends are driving semiconductor demand, which is expected to continue to grow in the coming years.

However, the industry also faces major challenges, including a shortage of skilled workers, the increasing complexity of semiconductor manufacturing and the need for more sustainable and environmentally friendly manufacturing processes.

To overcome the challenges facing the industry, it is essential to invest in research and development, increase the availability of skilled workers and develop more sustainable and environmentally friendly manufacturing processes. By working together, governments, companies and individuals can ensure that the semiconductor industry remains competitive and sustainable, and continues to drive innovation and economic growth in the years to come.

Chip War, the Race for Semiconductor Supremacy (2023) (TaiwanPlus Docs, October 2024)

youtube

Dr. Keyu Jin, a tenured professor of economics at the London School of Economics and Political Science, argues that many in the West misunderstand China’s economic and political models. She maintains that China became the most successful economic story of our time by shifting from primarily state-owned enterprises to an economy more focused on entrepreneurship and participation in the global economy.

Dr. Keyu Jin: Understanding a Global Superpower - Another Look at the Chinese Economy (Wheeler Institute for Economy, October 2024)

youtube

Dr. Keyu Jin: China's Economic Prospects and Global Impact (Global Institute For Tomorrow, July 2024)

youtube

The following conversation highlights the complexity and nuance of Xi Jinping's ideology and its relationship to traditional Chinese thought, and emphasizes the importance of understanding the internal dynamics of the Chinese Communist Party and the ongoing debates within the Chinese system.

Dr. Kevin Rudd: On Xi Jinping - How Xi's Marxist Nationalism Is Shaping China and the World (Asia Society, October 2024)

youtube

Tuesday, October 29, 2024

#semiconductor industry#globalization#technology#innovation#research#development#sustainability#economic growth#documentary#ai assisted writing#machine art#Youtube#presentation#discussion#china#taiwán#south korea

7 notes

·

View notes

Text

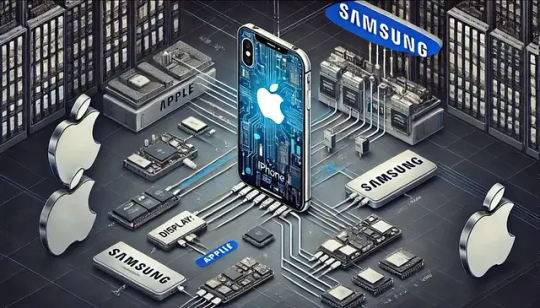

How Apple Relies on Samsung for iPhone Production

Apple and Samsung are two big rivals in the technology industry, and are often portrayed as rivals in the smartphone market. Behind the scenes, however, Apple relies on Samsung for key components used in its flagship product, the iPhone. This relationship may seem odd, but it illustrates the complex nature of global supply chains in the technology sector. In this blog we will examine how Apple trusts Samsung and why this relationship is so important to the creation of the iPhone.

1. The OLED Displays: Samsung’s Technological Edge

One of the most critical components in modern iPhones is the OLED (Organic Light-Emitting Diode) display. These displays are known for their vibrant colors, deep blacks, and energy efficiency, significantly enhancing the user experience compared to older LCD technology. Samsung Display, a subsidiary of Samsung Electronics, is the world’s leading manufacturer of OLED screens.

When Apple transitioned to OLED screens with the iPhone X in 2017, it turned to Samsung due to the company’s unparalleled expertise and production capacity in OLED technology. While Apple has since diversified its suppliers, with LG Display and others entering the fray, Samsung remains the largest provider of OLED screens for iPhones. Samsung’s dominance in this sector gives Apple little choice but to collaborate with its competitor.

2. Chips and Semiconductors: More Than Just Displays

Apple designs its own A-series chips, but the actual production of these chips relies on external manufacturing. While companies like TSMC (Taiwan Semiconductor Manufacturing Company) handle most of Apple’s chip production, Samsung has also played a role in this arena. Samsung is one of the few companies with the technological prowess and manufacturing capabilities to produce advanced semiconductor components.

In previous iPhone generations, Samsung produced the A-series chips that powered these devices. Although TSMC has since become Apple’s primary chip manufacturer, Samsung’s semiconductor division remains a key player in the global chip market, offering Apple an alternative supplier when needed.

3. Memory and Storage: Another Piece of the Puzzle

In addition to displays and semiconductors, Samsung provides memory components such as DRAM (Dynamic Random-Access Memory) and NAND flash storage for the iPhone. These memory components are essential for the smooth operation and storage capacity of iPhones. With its dominance in the memory market, Samsung is one of Apple’s main suppliers, providing the high-quality memory needed to meet the iPhone’s performance standards.

Apple has worked to reduce its reliance on Samsung for memory, but the reality is that Samsung’s market share in the memory and storage sectors is so substantial that avoiding them entirely is nearly impossible. Furthermore, Samsung’s advanced manufacturing techniques ensure that its memory components meet the rigorous standards required for the iPhone.

4. Why Apple Sticks with Samsung Despite the Rivalry

Given their rivalry in the smartphone market, one might wonder why Apple doesn’t completely break away from Samsung. The answer lies in the intricate balance between quality, capacity, and supply chain stability.

Quality: Samsung’s components, particularly OLED displays and memory, are some of the best in the industry. Apple has always prioritized quality in its products, and Samsung’s technological capabilities align with Apple’s high standards.

Capacity: Samsung has the production capacity to meet Apple’s enormous demand. With millions of iPhones sold each year, Apple needs suppliers that can manufacture components at scale without compromising quality. Samsung’s factories are among the few capable of handling such volume.

Supply Chain Risk: Diversifying suppliers is a strategy Apple uses to reduce risk. However, removing Samsung from the supply chain entirely would expose Apple to greater risk if another supplier fails to meet production needs or quality standards. By maintaining Samsung as a key supplier, Apple can ensure a more stable and reliable supply chain.

5. Apple’s Efforts to Reduce Dependency

While Apple remains dependent on Samsung in several areas, the company has made moves to reduce this reliance over the years. For instance, Apple has invested in alternative display suppliers such as LG Display and BOE Technology, as well as expanded its collaboration with TSMC for chip production. Additionally, Apple has explored developing its own in-house components, such as its rumored efforts to create proprietary display technology.

Despite these efforts, it’s unlikely that Apple will be able to completely eliminate Samsung from its supply chain in the near future. Samsung’s technological leadership in key areas, especially OLED displays and memory, ensures that Apple will continue to rely on its competitor for critical components.

Conclusion: A Symbiotic Rivalry

The relationship between Apple and Samsung is a fascinating example of how competition and collaboration can coexist in the tech industry. While they are fierce competitors in the smartphone market, Apple depends on Samsung’s advanced manufacturing capabilities to produce the iPhone, one of the most iconic devices in the world. This interdependence shows that even the most successful companies cannot operate in isolation, and collaboration between rivals is often necessary to bring cutting-edge products to market.

For Apple, the challenge lies in maintaining this balance — relying on Samsung for essential components while exploring new avenues to reduce dependency. For now, however, Samsung remains a crucial partner in the making of the iPhone, demonstrating how complex and interconnected the global tech supply chain has become.

4 notes

·

View notes

Text

So this flash drive was made in the form of a single monolithic element (why the spider board says "for monolith"). This means that, unlike other forms of memory storage devices, it cannot be unsoldered and read on a particular hardware reader. [Tangent: USB flash drives and SD memory cards may or may not be monolithic, but all MicroSD flash drives are.]

To connect to a memory chip on monolithic flash drives, data recovery specialists need to strip the printed circuit board of the flash drive and connect to the necessary contacts using a special PC-3000 Spider Board device.

The PC-3000 Spider Board is designed to perform switching with technological outputs of drives in monolithic memory cards. Data can be recovered with the Spider Board from a variety of damaged memory cards, including Monolithic USB Flash Drive, MicroSD, SD, and others. The PC-3000 Flash Spider Board Adapter is an all-purpose way to safely restore monolithic data without tedious soldering.

The PC-3000-Flash software reads the ROM (read-only memory) of the device that is having its data recovered by directly accessing NAND chips. [Tangent: Flash memory is an electronic non-volatile computer memory storage medium that can be electrically erased and reprogrammed. It is a semiconductor that stores data and is used in smartphones and many other electronic devices around us. The two main types of flash memory, NOR flash and NAND flash, are named for the NOR and NAND logic gates. KIOXIA invented the world’s first NAND flash memory in 1987 and remains one of the leading companies conducting flash memory development and manufacturing.] The connection is carried out through the PC3000 Spider Board adapter, which allows connection to the process pins of the NAND Flash chip without soldering due to 25 movable needle contacts.

My sources (which I quoted verbatim as well as paraphrased):

Have you ever wondered how tech technicians recover data from faulty flash and memory whose data cannot be recovered by normal methods.

55K notes

·

View notes

Text

Multi Chip Module Packaging Solution Market 2025-2032

MARKET INSIGHTS

The global Multi Chip Module Packaging Solution Market size was valued at US$ 2,930 million in 2024 and is projected to reach US$ 5,470 million by 2032, at a CAGR of 9.2% during the forecast period 2025-2032.

Multi Chip Module (MCM) Packaging Solutions integrate multiple semiconductor dies within a single package, enabling enhanced performance while reducing footprint and power consumption. These advanced packaging technologies include NAND-based and NOR-based configurations, catering to applications ranging from consumer electronics to aerospace and defense systems. The solutions optimize interconnect density and thermal management while supporting heterogeneous integration of logic, memory, and analog components.

The market growth is driven by increasing demand for compact, high-performance electronics across industries. While consumer electronics dominates application share at 38%, automotive applications are growing fastest at 11% CAGR due to vehicle electrification trends. However, supply chain constraints for advanced substrates pose challenges. Key players like Samsung and Micron Technology are investing in 3D packaging innovations to address these bottlenecks, with Samsung announcing a USD 17 billion investment in new packaging facilities in 2023.

Access Your Free Sample Report Now-https://semiconductorinsight.com/download-sample-report/?product_id=97704

Key Industry Players

Semiconductor Giants Leverage Advanced Packaging Technologies for Market Dominance

The global multi-chip module (MCM) packaging solution market features prominent semiconductor manufacturers competing through technological innovation and strategic partnerships. Samsung Electronics leads the market with its cutting-edge 3D IC packaging technologies and robust manufacturing capabilities across Asia and North America. The company’s 2023 investment of $230 million in advanced packaging R&D demonstrates its commitment to maintaining technological leadership.

Micron Technology and SK Hynix collectively hold approximately 28% market share in memory-based MCM solutions as of 2024, primarily driven by growing demand for high-density memory packaging in AI and data center applications. Their technological expertise in NAND and NOR flash packaging provides significant competitive advantages in consumer electronics and automotive segments.

Meanwhile, Texas Instruments dominates the analog MCM packaging segment, accounting for nearly 18% of analog multi-chip solutions worldwide. The company’s proprietary packaging technologies combined with its vertically integrated manufacturing approach helps maintain quality consistency across automotive and industrial applications.

Several key developments are reshaping the competitive landscape:

Infineon Technologies’ acquisition of Cypress Semiconductor expanded its automotive MCM capabilities

Palomar Technologies’ strategic partnership with Apitech enhanced its precision packaging solutions

Macronix’s new Taiwan-based packaging facility increased its monthly production capacity by 40%

Emerging players are focusing on niche applications such as medical devices and aerospace, where specialized packaging requirements create opportunities for differentiation. Established manufacturers are responding by increasing R&D investments in those high-growth segments.

List of Leading Multi-Chip Module Packaging Solution Providers

Samsung Electronics (South Korea)

Micron Technology (U.S.)

SK Hynix Semiconductor (South Korea)

Texas Instruments (U.S.)

Infineon Technologies (Germany)

Macronix International (Taiwan)

Apitech (Finland)

Cypress Semiconductor (U.S.)

Palomar Technologies (U.S.)

Tektronix (U.S.)

Segment Analysis:

By Type

NAND-Based Segment Leads the Market Due to High Demand in Data Storage Applications

The market is segmented based on type into:

NAND-Based Multi Chip Module Packaging

NOR-Based Multi Chip Module Packaging

Others

By Application

Consumer Electronics Dominates Due to Increasing Adoption in Smart Devices and Wearables

The market is segmented based on application into:

Consumer Electronics

Automotive

Medical Devices

Aerospace and National Defense

Others

By Packaging Technology

2.5D Packaging Gains Traction for High-Performance Computing Solutions

The market is segmented by packaging technology into:

2D Packaging

2.5D Packaging

3D Packaging

By End-User Industry

IT & Telecommunications Shows Strong Growth Potential

The market is segmented by end-user industry into:

IT & Telecommunications

Industrial

Healthcare

Automotive

Others

Download Your Complimentary Sample Report-https://semiconductorinsight.com/download-sample-report/?product_id=97704

FREQUENTLY ASKED QUESTIONS:

What is the current market size of Global Multi Chip Module Packaging Solution Market?

-> Multi Chip Module Packaging Solution Market size was valued at US$ 2,930 million in 2024 and is projected to reach US$ 5,470 million by 2032, at a CAGR of 9.2% during the forecast period 2025-2032.

Which key companies operate in Global Multi Chip Module Packaging Solution Market?

-> Key players include Samsung, Micron Technology, Texas Instruments, SK Hynix, Infineon Technologies, and Macronix, among others.

What are the key growth drivers?

-> Key growth drivers include increasing demand for compact electronic devices, advancements in semiconductor packaging technologies, and growing adoption in automotive and IoT applications.

Which region dominates the market?

-> Asia-Pacific dominates the market with over 45% share, driven by semiconductor manufacturing hubs in China, South Korea, and Taiwan.

What are the emerging trends?

-> Emerging trends include 3D packaging technologies, heterogeneous integration solutions, and development of advanced materials for thermal management.

About Semiconductor Insight

Established in 2016, Semiconductor Insight specializes in providing comprehensive semiconductor industry research and analysis to support businesses in making well-informed decisions within this dynamic and fast-paced sector. From the beginning, we have been committed to delivering in-depth semiconductor market research, identifying key trends, opportunities, and challenges shaping the global semiconductor industry.

CONTACT US:

City vista, 203A, Fountain Road, Ashoka Nagar, Kharadi, Pune, Maharashtra 411014

[+91 8087992013]

0 notes

Text

4-Channel vs. 8-Channel Industrial SSDs: A Comprehensive Comparison

23/06/2025 by Norman Schmidt

In my latest blog post, I compare 4-channel and 8-channel SSDs. First, I outline the pros and cons. Then, I address specific issues, such as performance in edge servers. Finally, I highlight suitable products from Swissbit. Finally, I share my conclusion.

Introduction

Industrial Solid-State Drives (SSDs) are pivotal in modern computing environments, especially in edge computing and data centers. A critical aspect influencing their performance and efficiency is the number of NAND channels—commonly 4 or 8. This article delves into the distinctions between 4-channel and 8-channel industrial SSDs, examining their advantages, disadvantages, and suitability for various applications.

Understanding NAND Channels in SSDs

In SSD architecture, a "channel" refers to a data pathway between the SSD controller and the NAND flash memory. The number of channels determines how many NAND chips the controller can communicate with simultaneously. Typically, low-end SSDs feature 2 or 4 channels, while high-end SSDs boast 8 or more channels.

Advantages and Disadvantages of 4 Channel and 8 Channel SSDs

4-Channel SSDs

Advantages:

Power Efficiency: Fewer channels result in lower power consumption, making 4-channel SSDs ideal for energy-sensitive applications.

Cost-Effectiveness: Simpler architecture leads to reduced manufacturing costs.

Compact Form Factor: Suitable for devices with space constraints, such as embedded systems.

Disadvantages:

Limited Performance: Lower parallelism can restrict data throughput and IOPS (Input/Output Operations Per Second).

Scalability Constraints: Not ideal for applications requiring high storage capacities or rapid data access.

8-Channel SSDs

Advantages:

Enhanced Performance: Increased channels allow for higher data transfer rates (especially in sequential write applications) and better multitasking capabilities.

Greater Capacity: Supports more NAND chips, enabling higher storage capacities

Disadvantages:

Higher Power Consumption: More channels can lead to increased energy usage.

Increased Cost: Complex architecture may result in higher production costs.

Performance in Edge Servers

Edge servers operate in environments where space, power, and cooling are limited. In such scenarios, 4-channel SSDs offer benefits in terms of power efficiency and thermal management. However, for applications demanding high-speed data processing, 8-channel SSDs provide the necessary performance boost.

💡 Learn more about Swissbit storage solutions for Data Centers and Enterprise Solutions.

Power Efficiency in PCIe/NVMe Storage

Power efficiency is crucial in industrial applications. Swissbit's 4-channel SSD, such as the N3000 series, are designed for low power consumption while delivering high throughput. Conversely, some 8-channel SSDs, like Swissbit's A1200, have been performance optimized. The performance of an SSD in an embedded system depends on the workload, air temperature, and airflow. At temperatures above 40°C, it is important to ensure sufficient airflow to cool the "engine" of an SSD, the NAND controller. As with an internal combustion engine, the efficiency and thermal characteristics strongly depend on the achievable performance under all environmental conditions. Key criteria include the number of NAND channels (4 vs. 8) and the architecture of the firmware and hardware.

Advantages of NVMe 4-Channel SSDs

NVMe (Non-Volatile Memory Express) enhances SSD performance by reducing latency and increasing parallelism. 4-channel NVMe SSDs benefit from:

Lower Power Consumption: Ideal for battery-powered or energy-sensitive devices.

Reduced Heat Generation: Simpler architecture leads to less heat, aiding in thermal management.

Cost Savings: Fewer channels can translate to lower manufacturing and end-user costs.

Thermal Considerations

Thermal management is vital for SSD longevity and performance. 4-channel SSDs typically generate less heat due to their simpler design. However, 8-channel SSDs, with proper cooling solutions, can maintain optimal operating temperatures even under heavy workloads.

Highlight Products by Swissbit

Industrial 8 Channel SSDs like the A1200 Series provide highest sustained performance but require adequate cooling e.g airflow and/or heatsinks.

A1200 – Peak Performance

✔ M.2 form factor 2280 ✔ PCIe Gen4 / NVMe 1.4 / four lanes ✔ 3D NAND eTLC up to 1.92 TB ✔ Temperature range 0°C to 70°C (A1000: -25°C to 85°C) ✔ 1 DWPD Endurance ✔ AES256 Encryption / TCG Opal 2.0 ✔ Crypto erase / Secure Boot erase / Secure Boot

Applications:

Boot drive, storage, datalogging or buffer in routers, servers, edge AI or industrial type of applications that require highest, sustained write performance and lowest latency.

Industrial 4 Channel SSDs like the N3000 Series provide relatively modest, but very consistent sustained performance, even at very litte to no airflow.

N3000 for Edge Servers and Boot Drives

A leading AMR manufacturer selected Swissbit N3000 M.2 2280 SSDs for seamless intralogistics automation. Why did they choose Swissbit N3000? ✔ Drive for OS boot purpose ✔ Reliable performance at higher temperatures ✔ Small, low power and low capacity, reliable, high retention. ✔ Secure boot, encryption, remote management, power fail protection

Applications:

Critical, embedded systems that must provide adequate minimum performance even at very hot ambient conditions and with a limited power budget (Fanless systems, Industrial PCs, edge servers, telecom equipment, critical devices). Applications where data loss or corruption are not an option.

Conclusion

When choosing between 4-channel and 8-channel industrial SSDs depends on specific application requirements. For energy-efficient, cost-sensitive, and space-constrained environments, 4-channel SSDs are suitable. In contrast, applications demanding high performance and capacity may benefit from 8-channel SSDs. Understanding the trade-offs between these options ensures optimal system design and performance.

Swissbit original post : link

Contac us :

Phone: +55 11 5507-2627

Email: [email protected]

0 notes

Text

Micron Stock Forecast: Earnings and Market Outlook for 2024–25

📈 Micron Stock at a Glance

Micron (MU) is a global leader in the manufacture of computer memory and storage products, including DRAM and NAND flash memory. Founded in 1978 and headquartered in Boise, Idaho, the company has evolved into the only U.S.-based manufacturer of memory chips.

As of recent market data:

Current Price: $127.25

52-Week Range: $61.54–$144.07

Market Cap: $142.21 Billion

P/E Ratio: 30.76

Annual Dividend Yield: 0.36%

#allnewtrending#usa#trending#technology#stock market#mu stock#micron stock#micron earnings#micron stock forecast#micron#micron technology#semiconductor#earnings#investing#DRAM#NAND#AI chips#future of tech

1 note

·

View note