#number 1 unemployed vs number 1 employed

Explore tagged Tumblr posts

Text

Globe Mackay vs. Court of Appeals

Facts:

Private respondent Tobias was employed by petitioner Globe Mackay as a purchasing agent and administrative assistant.

He discovered fictitious purchases for which it lost several thousands of pesos and reported them on November 10, 1972.

After that day, petitioner Henry confronted him by stating that he was the number one suspect and ordered him to take a one week forced leave.

After 1 week of his forced leave, Henry went up to him and called him a crook and swindler. Tobias was also ordered to take a lie detector test. He was also instructed to submit specimen of his handwriting, signature and initials for examination.

Manila Police investigators submitted a laboratory crime report clearing private respondent of participation in the anomalies.

Not satisfied, petitioners hired a private investigator who submitted a report finding Tobias guilty.

Petitioner issued a memorandum suspending Tobias from work preparatory to the filing of criminal charges against him.

Lt. Dioscoro Tagle submitted a second laboratory report reiterating his previous findings that Tobias is not responsible for the anomalies.

Tobias received a notice from petitioners that his employment has been terminated. Tobias filed a complaint for illegal dismissal but the labor arbiter dismissed the complaint.

Unemployed, Tobias sought employment with the Retelco. However, petitioner wrote a letter to the Retelco stating that Tobias was dismissed by Globe Mackay due to dishonesty.

Tobias filed a civil case for damages. RTC Manila rendered judgement in favor of Tobias.

The main issue here is whether or not petitioners are liable for damages to private respondent.

The court held that they are liable for damages under the provisions of civil code. He violates the Art. 19, 20, and 21 of the civil code. Their actions of illegal dismissal, the baseless imputation of guilt, the harassment during the investigation, the defamatory language , the poison letter sent to RETELCO, and the malicious filing of criminal complaints are immoral and the amount of damages awarded to Tobias was reasonable under the circumstances.

0 notes

Text

I went down a bit of a rabbit hole on Victorian inequality.

I posted about this recently in the context of Dorian Gray, but it keeps cropping up in the literature of the 1890s, as we meet a series of characters with deep inequalities of wealth and income.

In Dracula, inequality ranges from Jonathan, a middle-class solicitor who was probably earning around £100 annually while he was still a clerk, to Arthur, an nobleman whose income is at least £5,000 annually. (My post on that).

In the Beetle, inequality ranges from Robert Holt, a middle-class clerk, currently unemployed, but otherwise subject to the same pay scale as Jonathan without the promotion, to any of the other main characters: Sydney, Marjorie, Paul and the newly introduced Hon. Augustus Champnell. We don't know any of the wealthier characters' incomes but those who work do so by choice rather than necessity. I think we're talking four-figure incomes for all of them.

In the Picture of Dorian Gray, so far, inequality ranges from the Vane family, for whom £50 is a lot of money, to Lord Henry, who is another nobleman, with another four or even five-figure income.

Inequality warps the world that these characters live in. OK, not so much the world of the Beetle, because Richard Marsh isn't a good enough writer to recognise it. But Arthur smoothes the way for the Crew of Light simply by throwing around colossal amounts of money. And Dorian's relationship with Sibyl is immediately defined by the fact that he is so much richer than she is.

So what I've been trying to figure out is, just how unequal was Victorian Britain? How much of this impression of inequality is because all three novels include nobleman - the Victorian 1% - vs reflecting the reality of the society their authors lived in?

First step was trying to find some comparable data. This tremendously helpful article estimates a Gini coefficient of wealth inequality of 94 in Great Britain in 1890. (100 would be total inequality; 0 total equality). That's higher than any of the 25 countries for which they provide data for 2010 (the most recent date given). Great Britain comes in at 69 in 2010, compared with Poland at 58 at the lowest of the countries listed, and the USA at the highest at 88.

The same article also looks at share of wealth of the wealthiest 10%. For Great Britain in 1890, that's estimated at 89%, compared with 54% in 2010. Across the other countries listed, Poland is again lowest at 37% (go Poland!) and the USA highest at 73%.

So very crudely, the gap in wealth equality between Victorian Britain and modern Britain is pretty similar to the gap in wealth equality between Poland and the USA today.

I also had a bit of a look at raw income numbers to see how this might feel in practice. £1,000 a year is about the top end of middle-class salaries and the bottom end of what a member of the aristocracy might expect to live off. (Jonathan might well earn that much on inheriting Mr Hawkins' estate and legal practice). It's enough to employ three or four servants, though it's certainly a lot less than any of the wealthy characters I listed at the start of this post are living off. It's nearly 20x the adult male average salary of £56 a year, and more than 20x the average salary for all workers in the UK, which was £42/14/- in the mid-1880s.

In the UK today, the median salary for full-time workers is £33,000. (I know I'm comparing means with medians and so on, but I've got to make do with what I've got, and I suspect it wouldn't make that much difference anyway). By the same ratio, our wealthy characters would consider themselves just scraping by on what - by comparison with a normal worker - is an income of £660,000 annually, and based on my best guess for their actual income, is more like the equivalent of £33m per year. Or roughly the annual income of Lady Gaga, one of the 100 top-earning celebrities in the world.

So that's what this level of income inequality feels like. Sibyl Vane is like a normal actor who has Lady Gaga flirting with her, with comparable implications for how much this could transform her life.

75 notes

·

View notes

Text

GS4 vs AJ:AA - Episode 1, Part 1

Look, guys! I’m being productive again! Hooray, it feels exhausting just as I remember it did!

As done before, every post I make will contain differences between the source Japanese and localized English versions of the same game, as well as further details about them, up to the following “To be continued...” screens and eventually the ending credits. As always, there are so many ways the localization can dress up certain lines in the original script to make them into jokes or at least more colorful, so I’m not going to pick out every one. It would take us an eternity longer than my hiatuses to finish otherwise.

To think it took a freakin’ indie game that's like Mafia but with astronauts and tasks to bring me back to the Ace Attorney community and back to my blog’s roots. Is this what they mean by “Circle of Life”? All I know is that I’m constantly running around in circles, both metaphorically and literally.

--

> Court Lobby

<Kristoph> やれやれ。ずいぶんカタくなってる みたいだね。 You look tense, Justice. Wound up tight.

<Apollo> そ。そんなコトないです! カン���ンに大丈夫ですから、オレ! W-Wound up, sir? No! I'm loose! I'm fine!

<Kristoph> 声がウラ返ってるよ‥‥ まあ。ムリもないかな。 That screeching noise... Is that your voice? I suppose it's to be expected...

初めての法廷が、殺人事件とは。 まさしく“オドロキ”ってヤツだね。 Your first trial, and it's a homicide. I guess "Justice" doesn't start small, eh?

Enter Apollo's signature "I'm fine!" catchphrase, or as it's originally known, "Daijobu desu!"

In the third box, "ウラ返ってる" from 裏返る (uragaeru) in this context is translated fairly, though it specifically refers to a "crack in falsetto" kind of squeak or screech. (Yes, squeaky Apollo.) Now, it's interesting to note uragaeru in a different context can also mean "to double-cross". To be fair, it's also a common phrase, like being "betrayed" by your own cracking voice, but the foreshadowing power...

In the fourth box, yes, they changed the name puns to suit the localized name. Kirihito (Kristoph) is just saying what a "surprise" it is for his first trial to be a murder case.

>

<???> たしか、きみは‥‥ So, you're...

<Apollo> あ、ハイ! オレ、大丈夫ですッ! Fine! I-I'm fine!

<???> ああ‥‥“大丈夫くん”か。 Ah... Mr. Fine, is it?

<Apollo> え。 Uh.

<???> 変わった名前だとは覚えていた。 I did remember you having an odd name.

<Apollo> (さっそく、ゴカイされちまった) (Well, we're off to a great start.)

I'm just putting this here to assure everyone that Nick does first call him "Daijobu-kun".

>

<???> そろそろ時間だ。‥‥行こうか。 It's time. Shall we?

<Apollo> は、はいッ! Y-Yes, sir!

<Apollo> (‥‥そうさ。 今は、とにかく集中するんだ) (...OK. I need to focus.)

(オレの‥‥王泥喜 法介の、 初めての法廷に!) (First trial, here comes Justice!)

I want to comment on how catchy Apollo's other lesser-known catchphrase is. Poor Odoroki doesn't have anything as cool as this.

> Courtroom

<Kristoph> 弁護士は、依頼人の希望を最優先 させなければなりません。 A defense attorney must always cede to his client's wishes.

この王泥喜くんは、依頼人の ご指名なのですよ。 And my client specifically requested Mr. Justice.

<Judge> ふむう‥‥わかりませんな。 Well, of course he wants justice!

現在、最高の弁護士と言われる 牙琉 霧人(がりゅうきりひと)。 But to entrust his case to this greenhorn... Why?

それをさしおいて、 こんなワカモノがねえ‥‥ I do not exaggerate when I say that you're the best defense attorney in town, Mr. Gavin.

<Apollo> (だ、大丈夫。発声練習の量なら、 先生にも負けないさ!) (OK, so Gavin's got trial experience, fine. But does he have Chords of Steel!?)

I just love this line from Apollo. Perfect timing and delivery. Odoroki's line is good too, though comes off as a tad more innocent: "I-It's fine. When it comes to vocal training, even Sensei can't beat me!" Though I have to say the image of Kristoph screaming during voice training is too funny to pass up.

> Enter Defendant

<Judge> まことにザンネンです。 This is truly an unfortunate turn of events.

ひさしぶりの対面が、 このようなカタチになるとは。 I'm sorry we had to meet again under these circumstances.

‥‥成歩堂 龍一 (なるほどうりゅういち)くん。 Long time no see, Mr. Wright.

<Phoenix> 忘れてほしいですね、 ムカシのことは。 Let's put the past behind us, shall we?

今のぼくは‥‥そう。 しがないピアニスト、ですから。 These days, I'm merely Phoenix Wright, piano player.

I may have mentioned it before, but I'll make a note here that the Hobohodo meme has its own version in the JP fandom: "ピアニート" (piani-to or pia-NEET), which is portmanteau of pianist and NEET, the most famous of Japanese government welfare programs for the unemployed. It's also slang for "hobo".

>

<Payne> これが、被害者の命を奪った凶器。 ‥‥グレープジュースのボトルです。 This is the weapon that took the victim's life. A bottle of grape juice.

彼のお気に入りで、 いつも飲んでいるようですな。 Grape juice is apparently our defendant's drink of choice.

Many of you already know, but just in case: The localizers never censored Nick's fave drink. It was the JP devs who had to work with such censors back home, but eventually they just kept it as a running gag to put non-alcoholic fruit juices in fancy wine bottles. It wasn't until SoJ when the devs could get away with featuring a bit of alcohol. Their previous game was slapped with a CERO-C (15+) due to graphic images, so Eshiro and co. were pleasantly surprised to see SoJ get the classic CERO-B (12+) again.

Not to mention, very expensive high-quality fancy fruit juices do exist in Japan and can cost way more than your usual middle-grade wines. Japan and their fancy fruit culture and all. (I forget exactly, but I recall there were plenty of group pictures of the devs on their blogs and Twitters over the years where someone had gotten them fancy bottles of fruit juice as Christmas gifts. The memes live on.)

> After 1st testimony, decline tutorial

<Apollo> 先生が出るにはおよびません! ここは、オレでじゅうぶんッ! No need for help here, sir! I think I've got this one covered!

<Kristoph> ‥‥“手下”みたいなセリフだね。 大丈夫ですか? I think you'd better do more than think. You know it, or you do not.

<Apollo> (大丈夫! 発声練習は積んできた!) (I'm fine! The Chords of Steel are ready for battle!)

The differences here are subtle enough that I hesitated on including this, but Kirihito straight-up calls out Odoroki: "Sensei, you won't need to step up here. I'm enough for this!" "...Sounds like something someone unreliable would say. Are you going to be fine?"

> Press 4th statement

<Judge> ふむう‥‥ Hmm...

ポーカーといえば、5枚のカードで “役”を作って勝負するゲーム。 As I recall, in poker you make five-card "hands".

たしかに、イカサマが 起こりやすいのでしょう。 I can see how it would be easy to cheat.

<Phoenix> フッ‥‥ “役”を作るゲーム、ねえ‥‥ Heh... Yes. A game of "hands".

<Apollo> ‥‥? ...?

Now that I find this dialogue again, it's even deeper than I'd ever thought. In both JP and EN, Phoenix's line works just as well as the other despite having different double entendres. In EN, he makes a pun between the poker hands and people's hands; while in JP, the term used is "yaku", which is normally used to refer to hands in a card/mahjong game, but in more general cases, it means "role" or "responsibility". Naturally, in this case, there are a lot of hands and roles being exchanged rather quickly.

This case is dang amazing and I regret forgetting so much of what made it spectacular.

> Press 5th statement

<Phoenix> 賭けていたのは、ただひとつ。 おのれの“プライド”だけだよ。 The only thing at stake in our game... was pride itself.

<Judge> ほほう。 なんだか、カッコイイですな! Ho ho! Well put, Mr. Wright.

私も“ポーカー”で ヒト勝負したくなってきま��た。 I've got a mind to play a hand of poker myself...

<Judge> あなたの“有罪”を賭けてッ! The stakes: your fate!

<Apollo> (“ヒト勝負”感覚で 決められてたまるかッ!) (Um... Can we get back to the trial now?)

For once, I'm gonna go with Odoroki's line as the cooler one: "(As if we're going to decide this trial like a game of "life-or-death"!)"

> 1st witness, before testimony

<Olga> 逆居 雅香(さかいまさか) ‥‥と申します。 My name... is Olga Orly.

レストラン《ボルハチ》で ウエイトレス‥‥していますの。 I am employed as waitress in Borscht Bowl Club restaurant.

<Judge> しかし‥‥なぜ、カメラを? Then... why the camera?

<Olga> もちろん、《ボルハチ》ジマンの ボルシチもお運びいたします。 Of course, it is my pride to serve borscht that is naming restaurant.

でも、ワタシ。他にも、いろいろ サービスをいたしますのよ。 But I also perform -- how it is said? Other service.

Just making a note here on how well Olga's lines are written. They really make it obvious that she's "not a native speaker" (for now). While in EN, they just made her English a little broken, in JP, she speaks in a very stiff and formal Japanese, as she is a waitress, but also on the occasion can sound a little off to a native speaker without being broken, per se. She also has a distinct "watashi" among a few other common words that are written in katakana to show a sort of accent.

>

<Payne> さて、証人。 事件当時は、どこに‥‥? Now, witness. Where were you at the time of the murder?

<Olga> ワタシ、あの部屋にいたんです。 ‥‥《ナラズモの間》。 I was in room. The Hydeout, we call it.

<Apollo> “ならずものま”? Excuse me? The Hydeout?

<Olga> 伝説のギャング“ナラズモ”が タイホされたというお部屋。 It is room where famous gangster "Badgai" was arrested.

‥‥事件があった小部屋ですの。 Is room where murder took place.

<Apollo> なんだってェェェ! Whaaaaat!?

<Olga> ‥‥そのビックリしたカオ、 ステキです。 Your look of utter surprise... It is lovely.

あとで法廷の前に 張り出しておきますので‥‥ I will post by courtroom door later for you!

ほしい写真の番号を、みなさま お書きくださいね。 Dah, dah, photos will be numbered, and you will write which ones you want copy of.

Okay, everyone knows how bad/obvious/cringe the name puns can be in Khura'in or certain ones from AAI, but please, does anyone not remember "Badgai" here? (Tbf, I forgot too, so I'm not one to talk...)

Btw, his original name is "Narazumo", literally "ruffian", and it's completely in katakana, which makes me think it's a codename or alias. She also specifies that he was a "gangster", not yakuza as we'd assume. Japanese gangs are a bit closer to gangs that we know of in the West, especially that they're more known for foreign influence to their styles than the much more traditional yakuza.

Also, I'm disappointed there was no Odoroki pun here. Sure, she doesn't know him, so it wouldn't make sense, but still a missed opportunity. Also also, she actually talks to the rest of the court when she says "you", so she's selling photos of Apollo's freakout to everyone. Classy...

> 1st Witness Testimony, press 3rd statement

<Apollo> “ロケット”‥‥? His "locket"...?

<Olga> あのお客さまにとっては 大切な“お守り”のようでした。 I believe it was good-luck charm, dah?

何度か握りしめながら、 勝負をされていましたから。 He gripped it many times as he played that night.

<Judge> なるほど‥‥大空へ飛び立つ チカラがみなぎるのでしょう。 Yes, he must have felt as though it might carry him to the moon and the stars!

なにしろ《ロケット》ですからな。 Though if it were small enough to fit around his neck, it wouldn't have much lift...

<Apollo> ‥‥あの。ちなみに “ロケット”というのは‥‥ Um... The defense would like a clarification: this is a locket we're talking about?

写真を入れたペンダントのコト、 なんですけどね。 I mean, a pendant with a picture in it, right? Not a "rocket"?

<Judge> 知ってます! Of course! I knew that!

ロケットのカタチをした アレでしょう。 It was probably a pendant shaped like a rocket. That's why she called it that.

<Apollo> ちがいますよ! カタチはカンケイないんです No, a locket's a locket! It doesn't matter what shape it is!

<Kristoph> ‥‥深追いしてはいけない。 それが、社会のルールです。 It's considered bad form to poke fun at the hard-of- hearing in our society.

<Apollo> (モヤモヤするなあ) (Hard of hearing, or hard of understanding?)

This entire conversation is just a joke on how "locket" and "rocket" are written the same way in Japanese, and I'm surprised how well it still works in English.

To clarify, Kirihito's line at the end is a bit different: "...Refraining from pursuing a line too far is a well-known rule in our society." "(Doesn't make me feel any better.)"

> After 1st Present, just before new statement added

<Apollo> (ヤレヤレ‥‥ 慎重すぎるんだよな、先生は) (There's such a thing as thinking too much...)

(イシバシを叩いて コワすタイプ?) (This horse is dead, let's stop beating it!)

<Kristoph> 聞こえてますよ、オドロキくん。 There's such a thing as thinking aloud too much, too.

It's conversations like this that make me wonder if characters can actually hear what the MC is saying/whispering or if they're breaking the 4th wall to hear their thoughts. Here, it's even more ambiguous in JP than the usual between Nick and Maya in prior games. Or are they suggesting that even when Apollo is thinking, he's still loud?

> After 2nd Witness Testimony, before cross-exam

<Judge> なるほど‥‥ Ah, how many times have I heard these words:

『むしゃくしゃしてやった。 今は後悔している』‥‥ "I done it in a fit of anger, Yer Honor, and now I regret what I done".

‥‥の、パターンですな。 ...A common tale, but true.

<Apollo> (成歩堂さんは、ハッキリ言った。 『7年間、負けたことがない』) (Methinks the judge watches too many old court movies.)

(‥‥この証言には、ゼッタイ “何か”あるはずだ!) (Mr. Wright said he hasn't lost in seven years, so this testimony must be wrong!)

I don't usually include entries for examples where the localizers dress up the text from the original, but this one here really bugs me. I'm not sure if it's a reference to some classic film or just a tip of the hat to classic American court drama movies in general.

If someone could help me pinpoint this one, please do.

> Press 2nd statement, press further

<Apollo> チップについて、くわしく 話していただけますか? Maybe you could explain a bit about these "chips"?

<Olga> そ。そう言われましても‥‥ E-Explain? What is there to be explained?

<Objection!>

<Payne> チップはチップです。 Poker chips are poker chips.

いつまで待っても‥‥ キップにはなりませんぞ! They're not fish and chips, not a chip off the old block, not a motorcycle cop, not a...

Okay, the "motorcycle cop" bit got me. I swear this was a popculture reference (was it a song? It sounds so familiar), but I don't remember exactly where it was from! Someone plz help.

As for the original script, Auchi makes a silly pun. "[Poker] chips are [poker] chips. No matter how long you wait... they won't become tickets!" (chips = chippu, ticket = kippu)

>

<Apollo> ‥‥はあ。 ...Thanks.

(セッカクだ。 なにか聞かないとソンだな) (Now that I've pressed her I'd better ask something...)

たとえば‥‥そのチップ。 “円”ですか? “ドル”ですか? What are these chips worth? Are they in dollars? Or rubles, even?

<Olga> ‥‥あの。 先ほども申しましたけれど‥‥ ...Nyet. As I have been saying before, it was game, not gambling.

ギャンブルでは ございませんでしたから‥‥ Hard perhaps for capitalist to understand.

<Olga> “1000点”と “100点”の2種類。 Two types of chip: 100 points chip and 1,000 points chip.

おカネではございませんの。 It is not money, dah.

<Kristoph> ‥‥オドロキくん。 ...Justice.

<Apollo> はいッ! Sir!

<Kristoph> 今の証言‥‥ ちょっと、おもしろいですね。 Don't you find her comment... interesting?

<Apollo> え‥‥ In more ways than one, sir.

<Kristoph> 私ならば‥‥そう。 証言に加えていただくところですが。 I'd have it added to her testimony, myself.

As funny as that capitalist line is, it's not found in the source, sorry, guys. Her text in Japanese is very formal, so it takes an extra box just to complete her sentence.

Also, worth to note that Odoroki here mentions yen and dollars, but not rubles, despite the restaurant being Russian-themed. Whether it's writer oversight or just Odoroki being uncultured will remain a mystery.

Lastly, Apollo's last line here makes him seem quite confident, but in the original, he seems just as confused as ever. This is made clearer when Apollo later presses the new statement.

> Press new statement

<Apollo> あの。小さい方が100点、 大きい方が1000点‥‥ Um. The small ones are 100, and the big ones 1,000...

で、いいんですよね。やっぱり。 Uh? Right? Right. Of course.

<Payne> フン! 聞くまでもないでしょう。 Hah! Don't waste our time!

<Apollo> はあ‥‥ *sigh*

‥‥‥‥‥‥‥‥‥ ...

<Judge> 終わりですか? それで。 Is that all?

<Apollo> ええ、まあ。 Um... Yeah. *gulp*

(くそ。牙琉先生のせいで ハジをかいちまったぞ‥‥) (Great. Mr. Gavin made me stop her, and now I'm the one who looks dumb.)

<Kristoph> オドロキくん。 Oh, Justice?

<Kristoph> 私にハジをかかせないで もらえますか? Please try not to embarrass me like that.

<Apollo> え! オレがですか! Huh? Who? Me!?

The subtleties of this joke conversation were lost in translation. After Apollo wastes time with that question, he grumbles to himself: "(Damn. Thanks to Garyu-sensei, I've made a fool of myself.)" "Odoroki-kun. Would you please not pin this embarassment on me?" "Huh! Me!?"

> After Present, select "Number of chips"

<Apollo> おかしいのは、チップの枚数‥‥ ですよね、先生? The odd thing here is the number of chips... Right, Mr. Gavin?

<Kristoph> ‥‥なぜ、私に? ...Why are you asking me?

<Apollo> その。念のため、というか! Uh... Just in case?

<Kristoph> ‥‥オドロキくん。 もう少し、キチンと考えましょう。 Justice... It's your case I'm concerned about.

チップなら、写真を見れば すべて、写っています。 If you're wondering about the chips, just look at the photograph. It's all there.

老眼の裁判長さんでも カンタンに数えられますよ。 Even our judge with his failing eyesight could count them.

<Apollo> (‥‥あの裁判長なら、それでも まちがえるような気がする‥‥) (That's not the only thing failing the judge.)

Damn, what a burn. Odoroki in the OG script simply went: "(...Knowing this judge, he could get even that wrong...)" which is a fair effort, but not a wildfire level of damage.

> 3rd Witness Testimony, press 4th

<Apollo> 口論の内容は、おぼえてますか? Do you recall what the men were arguing about?

<Olga> そうですね。たしか‥‥ Dah, I believe so...

被害者サマが『イカサマだッ!』と 叫びましたの。それに対して‥‥ The victim, he shouts, "you are cheater!" and then...

“異議がある”というようなコトを 被告人さまが‥‥ ...the defendant shouts something like, "I have objection!"

<Payne> ‥‥出ましたな。 おトクイの《異議あり!》が。 Shouting objection, eh? Old habits are hard to break!

まったく‥‥ハッタリづくしの 人生ですからな。被告人は。 First he bluffed his way through the courtroom, now he bluffs his way through life!

<Objection!>

<Apollo> しかし! 勝負の結果は、 成歩堂さんが“負けている”! However! Mr. Wright lost the hand!

むしろ、アヤシイのは、 勝った被害者・浦伏さんでしょう! That seems to cast the shadow of doubt on Mr. Smith!

<Olga> “イカサマをやった上、 勝負にも負けた”‥‥ Humiliation from losing even when cheating...

そのクツジョクが、被告人の方の ココロに、火をつけたのですの。 That is what set fire to defendant's heart!

<Judge> ‥‥そして、火のついた 被告人は、どうしたのですかな? So what did the flaming defendant do next?

Oh my God, as soon as I saw that "異議がある" (igi ga aru) my mind flashed back to those ridiculous Google Translated trailers of Gyakuten Saiban & Kenji on Nico Douga. Imagine if the devs at the time decided to play with Google Translate to see how "異議あり!" would look after switching it from Japanese to English and back. It would be one of the biggest brain plays by a game developer ever... which probably means it wasn't how it went, but it's fun to think about.

Anyway, I also like this snippet of dialogue for the judge's "flaming defendant", clearly alluding to "Phoenix" Wright. In JP, the bit about setting fire to his heart is just a common idiom in the first place, but who knows? “Phoenix Wright: Ace Attorney” had been selling fast in the West, so they could have been inspired.

> After Present, point out on the cards, examine victim's hand

<Apollo> 裁判長! 見てください! 被害者のカードには、1枚‥‥ Your Honor! Look at this! One of the victim's cards...

ウラの色がちがうカードが まぎれこんでいますッ! The back is a different color!

<Payne> え‥‥ええええッ! Eh...? Ehhhhhh!?

<Olga> そ。そんなバカなッ! Th-That's impossible!

アタシがシカケたのは、 成歩堂のほうなのに‥‥ But I put that card in Wright's hand...

あッ! Ack!

<Kristoph> ‥‥今、なんと言いましたか、証人。 ...What was that, Ms. Orly?

<Olga> い‥‥いえ‥‥その。 アタシ‥‥わ、私は、ええと‥‥ No... Ny-Nyet! Er, I merely said, eh... Dah, I have, eek!

It's at this point when Olga's cover is blown, and in JP, it's more obvious because she stammers between using "atashi" vs "watashi". It's not very common to hear beginner Japanese students refer to themselves as the cutesy "atashi", though one who's a bit more well versed in the language or in anime may pick up on it.

> After Phoenix takes over the court, select when the cards were swapped, select "Olga Orly" who swapped them

<Phoenix> たしかに、あのゲームでは赤・青の 2種類のカードを使っていた。 Mixing a card from the wrong deck... when the backs are different colors?

しかし‥‥逆居 雅香は、 カードを配っていた張本人。 Remember that you're talking about Olga Orly... She was the dealer.

‥‥そんなミスを すると思うかい? Do you really think she would make such a novice mistake?

<Apollo> (まあ‥‥オレでも まちがわないだろうな) (Actually, I have trouble imagining even the judge making that mistake.)

This is another case of the localizers dressing it up. Odoroki says here: "(Well... even I wouldn't make such a mistake.)" as if implying that he's the lowest common denominator here, haha!

> Back to Court Lobby

<Phoenix> 人間の思考・感情というものは ‥‥かならず。 Try as they might to conceal it, everyone reveals their true thoughts in the end.

身体から“情報”として 発信されている。 Their body language can become a valuable source of information.

<Apollo> そ。そんなバカな‥‥ You're kidding!

<Phoenix> たとえば。あの証人‥‥ 逆居 雅香を思い出してごらん。 That witness, for instance, Ms. Orly.

<Phoenix> 彼女は、ある証言をするとき‥‥ かならず“首筋をさする”。 She would touch the back of her neck during certain parts of her testimony.

‥‥気がついていたかい? Did you notice?

<Apollo> い。いえ‥‥ (それどころじゃないよ、フツー) Uh... No. (C'mon, who'd notice that!?)

<Phoenix> “クセ”“コトバ”‥‥ それらが発する情報を読み解くこと。 Words, habits, twitches... It's all information for the reading.

それが、勝負に勝�� “鉄則”だよ、オドロキくん。 That's the secret to winning, Apollo.

まあ‥‥ぼくも“ある人物”に 教わったんだけどね。 Someone taught me, and now, I pass the secret on to you.

It's this quiet moment between the two of them that really parallels with how Mia used to talk with Phoenix, and it's beautifully poetic. And I'd like to note that even Phoenix's speech pattern throughout this convo is quite reminiscent of how Mia talked, but with a bit of Phoenix's own style. Though in that last line, he could possibly have meant Mia, but more likely meant a certain someone with a similar power to Apollo. Ya'll know who I mean, (W)right?

>

<Phoenix> ああ。それから、もうひとつ。 今回の事件だけどね。 Ah, almost forgot. One more thing. About this case...

ぼくはまだ、誰にも “本当のコト”を話してないんだよ。 You should know, I haven't told the truth to anyone yet.

<Apollo> えええええッ! (や、やっぱり‥‥) Whaaaaaaaa--!? (I knew it!)

<Phoenix> もちろん、“理由”がある。 これからアキラカになるだろう。 I have my reasons, of course. All shall be revealed.

そして、ぼくの作戦には‥‥ きみが必要なんだよ。 And Apollo... I need you to be there, defending me.

きみの“能力”が、ね。 I need your power.

<Apollo> オレの、のうりょく‥‥ (声のデカさ、か‥‥?) My, um, power? (I had no idea my Chords of Steel were that special...)

The translation here is close enough, really, but Odoroki specifically describes it as the "intensity" of his voice and it's only the best answer.

--

Welp, I guess it’s back to the drafting board again and I may make this out as a daily or every-other-daily upload. We’ll see. I assure you, you won’t be waiting until next month, though!

21 notes

·

View notes

Text

Long Term Financing Goals: 5 Simple Steps For 2020

Long term financing goals... Doesn't sound as exciting as long term stay at the beach, does it? Truth is, long term financial goals don't offer immediate rewards. Rather, you have to look at them like seedlings turning into a robust vineyard. If you want to stop working at some point or avoid a potential crisis when unemployment hits, then you simply have to embrace certain types of financial goals as friend, not foe. When the COVID crisis hit, over 14 million Americans faced the unemployment line. How many of those Americans do you think had six months' worth of income stashed away? Not many. Most of us live paycheck to paycheck, with little to no savings and zero retirement planning. That's not living on the edge. That's living in the quicksand. If you're still gainfully employed during these tenuous times, we encourage you to embrace five financing goals that will leave you well-positioned to tackle anything from dental trouble to a million-dollar retirement savings plan. Let's take a look.

1. Diminish Debt

Debt is like a revolving door. If you can never seem to get out of it, then you're doing something wrong. Credit cards come with a ton of great perks, like cashback on purchases, airline miles, and more. But, it's not wise to carry a huge revolving line of credit. It's also unwise to merely pay the minimum balance each month and allow interest payments to accrue. If you can't pay your card off at the end of each month, you probably don't want to keep swiping it. The thing about credit card debt is it's kind of like pouring sand into a jar with a hole in the bottom. It prohibits people from saving for them because, how can they build a savings fund when they're so far in the hole to someone else? So, if debt's your problem, the first thing you want to do is stop accruing more debt. Then, it's time to see how you can scale the mountain. Here's the best way to armor up and take down debt:

Track your spending (down to the penny). See where you're wasting money that can be directed toward your "get out of debt" plan. A daily dollop of self-control can stack up greatly in the monthly scheme of things. Consider your convenience store runs, coffee stops, and weekly lunch dates to start.

Create a budget. Allocate every penny of your weekly or bi-weekly paycheck. Hold yourself accountable to that budget. If you need to eliminate the vacation fund for a year, do it. If you need to forego your $50/week restaurant budget, do it. Releasing yourself from the burden of debt is worth tightening the budget for at least a year.

Check your interest rates. Things like student loans and mortgage payments typically come with low interest rates. It's not uncommon to see anywhere from 3% to 5%. Credit cards, however, can soar upwards of 19%. That's why you're going to want to go after those kinds of debt first. Paying too much interest is like throwing away money each month. So, that high-interest rate card needs to be tackled first.

Check your balances. The other factor that matters is your balance. Once you know which cards have the highest interest rate, you're going to want to tackle them in order from worst to best. Sometimes, the impulse is to get rid of the cards with small balances first. But, you actually want to go in the opposite direction and take down the biggest offenders first.

Why does this work? Well, let's look at the numbers. Say you have three major debts. If you're able to up the ante and allocate 20% of your monthly income to this endeavor, you're looking at a pretty good strategy. For someone who earns $3,000/month, that's about $600/month. What you want to do is direct $100 to one, $100 to another debt, and $400 to the largest debt. As you pay off one, maintain that same $600 and use it to attack the remaining two, then the last one, and then... dare we say it... you're free.

2. Spend Less, Save More

We know, we know. How cliché. But, the thing about clichés is that they're often repeated because they're often true. If you're still living paycheck to paycheck, be afraid, be very afraid. Given the tenuous times we live in, families need to have an emergency fund set aside for at least six months. If you and your spouse have things like restaurants and pocket money in the budget, slash them right away. Make 2020 the year that you feel proud that you've been able to account for every dollar in your budget. What else can you do to spend less and save more?

Stop the unnecessary shopping. If you need to delete the Amazon app form your phone, do it. If you remove the instant gratification temptation from your fingertips, you may be more successful. Stop "hunting for bargains," too. We tell ourselves we actually saved money when we spent $25 on a sweater that was marked down from $75 (when we didn't even need the sweater).

Pay with cash only. If you need to drive down to the local Walmart or Target to pick up a few household items, limit yourself to a certain amount of cash. This will do a couple of things. First, it will prohibit the impulsive shopping. Second, it'll force you to only buy the things you need. Plus, there's something psychological about handing over cash vs. swiping a card. You feel it more and will be, in a perfect world, less tempted to go overboard.

Shop Smarter. Whether you're a household of two or seven, grocery shopping is expensive. So, it's time to shop smarter in this arena. Shop according to the sales ad and don't be afraid to clip your coupons and use them at the checkout line. Fifty cents here and twenty cents there adds up to tens of dollars over the course of a month and guess where that can go? To that debt you're trying to eliminate.

With the ability to save more, you're opening yourself up to a host of scenarios that will give you tremendous peace at night. First, you can establish a thousand-dollar emergency fund. This is for anything from dental work to ductwork in the house. It's also for the four new tires your vehicle is going to need at some point. Second, you can establish a safety net. COVID has been a major wakeup call for those of us who live paycheck to paycheck. Imagine you were able to save six months' worth of income? That would make the nail-biting stop almost instantly. If you pull down $3,000/month, that's $18,000 and no small feat. But, if the worst thing were to happen, and you become unemployed, you don't have to drop down into panic mode. Instead, can sit pretty on nearly $20,000 that can be economically balanced if tough times hit.

3. Get Ready for the Golden Years

The days of pensions are fading further and further into the distance. And Social Security was never designed to be someone's primary source of income upon retirement. So, that needs to be supplemented if you want to be able to enjoy your retirement more fully. An IRA is the standard way to meet your retirement goals. And there are two different options here:

Traditional IRAs offer tax-deferred growth. That is, like an HSA, your contributions are tax-deductible in the year you make them.

Roth IRAs allow you to withdraw funds without a tax burden. So, if you think you'll need to withdraw from your IRA sooner than later, then you might want to pay your taxes upfront and have access to it whenever necessary.

We used 20% as a viable example of getting out of debt. So, what's a good goal for an IRA? Well, let's start with the best-case scenario. Right now, the IRS caps the maximum contributions to traditional and ROTH IRAs at $6,000/year, or $500/month. Folks over the age of 50 are allowed to save $7,000/year. If you've shoveled out of all your debt and have the wherewithal, definitely opt for $500/month because, in retirement, how long do you think you'll go on soaking up the sun and playing with your grandchildren? Twenty years? Thirty years? Well, in 30 years, if you earn $3,000/month, that's just over one million dollars. See why it's smart to start young and go hard? Of course, $500/month simply isn't a viable option for many families. We love to play around with IRA calculators to see what's right for people. But, remember, the sooner you start, the more wiggle room you'll have. If you're ready to start making waves in a retirement fund, then contact us today to open your very own IRA.

4. Hinder Your Healthcare Burden

Have you ever considered a health savings account (HSA)? It's a portable savings account that allows you to nestle away money for healthcare completely tax-free. The money you deposit into an HSA rolls over each year, alleviating any sort of "use it or lose it" stress. It's completely controlled by you, not your employer and you get to call all the shots on how the money is allocated. Some people liken HSAs to "medical IRAs." That is, you grow the account slowly over time and only take it out whenever you see fit. If, ten years down the line, there's a major medical expense, an HSA can help prevent you from sinking into tremendous debt. But, even in the day-to-day as you're saving, there's an immediate benefit to an HSA. Whatever contributions you're able to deposit into your account, they're completely tax-deductible. If you work for a company that's willing to contribute, their contributions are not included in your taxable income, either. These amounts are capped, however, at $3,550 for individuals and $7,100 for families. However, when you hit 55, you're allowed to squirrel away an extra $1,000, free and clear. If you think this is right for you, feel free to download our HSA application today.

5. Consider a Side Hustle

If you're ready, willing, and able to tackle debt and save more but simply don't have the finances for it, then make 2020 your year of the side hustle. In the days since the COVID pandemic, more and more people are starting to work from home. Is there something you can do on the nights and weekends from the comfort of your own home? Sure there is! If numbers are your game, then you should know there's a real need for virtual bookkeepers. If organization is your talent, then you should also scan the online ads for virtual assistant positions. If your fingers type as fast as fingers can go, then you may be able to work as a transcriptionist from home on nights and weekends. Teaching English online is another viable option. Also, the almighty Amazon posts remote jobs to their Career Services page and customer service, as a whole, lends itself to the remote lifestyle. If you have time to binge watch Netflix, then you have time to earn a few extra hundred each month.

Long Term Financing Goals You Can Meet

Each of the goals listed above are considered long term financing goals because they can't be achieved with the swipe of a card or the deposit of a singular paycheck. But, that's okay! It's like planting a garden. You start with a tiny, little seed and then, over time, harvest six-foot sunflowers. There's no way around it, you simply have to diminish your debt first. For some, that may be a three-year endeavor. And that's okay! This is a goal and it's not meant to be met in three or four months. Then, once you get your personal savings and retirement plan up and running, you're truly going to feel wonderful. This feeling of satisfaction doesn't carry the same punch as a new pair of high heels or a new golf club. It carries a better punch because you'll be proud of yourself as you watch something grow. If you're looking to start an IRA, money market account, personal savings account, or HSA, we hope you'll get in touch with us today! We'll pair you with just the right tool to meet your long-term financial goals. Here at iThink Financial, we've built ourselves on this motto: people helping people. We're a credit union that fosters healthy financial management and wants to see our customers flourish, not drown in faulty debts and loans. Come join us for any one of our webinars and seminars where we help people do just that! Whether you need to build a better budget, save for a home, or want to plan for financial crises, we're here to help you formulate the best game plan and use all the resources at your disposal.

Get more information here about Atlanta Georgia Credit Union.

1 note

·

View note

Text

There’s A Vacancy In You.

By the mercy of God and his Grace upon my life I will be enlightening you about the above topic. what is vacancy, the importance of it. And also why you should discover it, including the dangers that will come up if you fail to discover it.

What is VACANCY?. It’s an unoccupied or an empty area of space, a place without an occupant, a place void of activities.

Now there’s no place today in the world where there’s vacancy for you to work but still yet we have so many businesses so many companies running here and there, unemployment is on the increase everyday. As at 09/06/2020 - The OECD unemployment rate increased by an unprecedented 2.9 percentage points in April 2020 to 8.4%, compared to 5.5% in March, reflecting the impact of Covid-19 containment measures. The number of unemployed people in the OECD area increased by 18.4 million to 55 million in April. The United States accounted for the main part of this increase, with a rise in unemployed of 15.9 million. When you come to so many countries in Africa the unemployment rate is high.

But the truth is “There’s A Vacancy In You That Has Be Designed To Employe You”. That’s just the mystery.

Let’s go the Bible Genesis 21 : 20, And God was with the boy as he grew up in the wilderness of Paran. He became an expert archer.

The bitter truth is that this vacancy has been there ever since the day you were born, it’s a vacuum inside of you, a lot of people don’t either understand or pay attention to it, you were born with it. Meanwhile God deposited it there for you to make the discovery. One of the reasons why God deposited it is that you will seek him for it. Because He’s the maker of us all. Read Genesis 1 vs 26 - 28. Acts 17 vs 27 -28.

From the first bible text, is a story of a young boy who refuse to be frustrated by his ugly condition. He went into discovering the vacant that is residence in him. After He had discovered it He became extraordinary in life. When you don’t act like the young man you have yourself to blame another person we look into is Daniel and his three (3) friends who were carried away as captives to Babylon they went there and became extraordinary with great exploits Read Daniel 1 vs 17 - 20. 5 vs 10 - 12. Listen to me whatever condition you finds yourself don’t ever in your life think of committing suicidal I mean don’t kill yourself. Any place you are in life either for good or bad, understand this 👉 “You’re There To Make A Discovery Either Of Something Or For Yourself”. Because the world is eagerly waiting for your manifestation. Make no mistake about it.

When you fail to discover the vacant in you, you will be employed to work for somebody else who has discovered the vacant in him. It’s not a sin to work for somebody but you will regret it, he’s not better than you but the difference is 👉 He was so determined to discover the vacant in him and filled it up while you were busy complaining of no work and no job. That’s why you’re working for him.

If there’s no vacancy in the world today it’s doesn’t matter because there’s a vacancy residing in you the only responsibility you have, is to make the discovery yourself and work towards it. Everyone has been employed by God. In the process of discovering the vacant in you God will always be with you. When He see that you are in the process to bring out what He has deposited inside of you, He will supply you with all the necessary equipment that you need to make this discovery successful. God is always committed to see you succeed in life.

There are so many people like you today who are in the graveyard crying 😢 so bitterly. So many potentials lying in the morgue because they failed to discover this. They never pay much attention to it. This are the class of people that always says “ it doesn’t matter “ don’t be among such people if you really want to be extraordinary in life. If you want to be a Voice to reckoned with. If truly you want to be an Ambassador of Signs And Wonders one earth. If truly you want to be an Agent of Positive Change. If truly you want to impart your generation take a decision today to discover the vacant in you and be blessed for ever.

NB: In my next topic I will be sharing with you the pathway of discovering the vacancy in you, how it can be discovered and achieved.

Like and share comment if you will...

Follow us on our FB, Twitter, Instagram, Tumblr, Medium.

Thanks 🤝

God Bless You👈

IKEMUEFULA D CLEMENT.✍️

Email: [email protected]

FB: @houseofthesupernaturalminds.

Twitter: @houseOfThesupe1

Instagram:houseofthesupernaturalminds1

Tumblr:houseofthesupernaturalminds01

Medium:Houseofthesupernaturalminds

0 notes

Text

The Economic Imperative of Immigration

Our immigration policy is a mess. It has been for years. Historically, our land borders were virtually uncontrolled but that was largely by design since we wanted people to cross them and help fill our vast unpopulated wilderness. Even today we have no effective way of enforcing the length of stay on tourist visas. As a result, we currently have an estimated 11.8 million undocumented individuals living in the U.S., including an estimated 1.8 million who came here as children with their parents. And we are about to make it much worse than it is, because our politicians are going to “fix” it. From the very beginning of his campaign Donald Trump improbably understood the Democrats’ vulnerability on immigration and he rode this issue along with its ideological companion, the off shoring of manufacturing jobs, to the slenderest of electoral victories. The issue enabled the Republican party to pry enough of the blue-collar workers from the Democratic candidate to elect a billionaire who has gone on the reward his fellow plutocrats with riches while leaving his hard-won blue collar supporters with a trickle-down tax cut.

Now a year into his presidency, the immigration issue remains polarized and unresolved, splintering us and our politicians into factionalized battle lines that are largely at war with the underlying philosophies of their respective parties. Logically the Democratic Party should be against the illegal immigration that has displaced blue collar workers and suppressed wage growth among existing minority citizens for the last three decades. And Republicans should be in favor of retaining the lower cost supply of labor that illegal immigrants provide to business. Immigration, legal and illegal is driven by economics. Immigrants come seeing economic opportunity, and business wants a lower cost labor supply. The willingness of business to hire undocumented workers created the “pull” that drew illegals to our shores and created the problem we have today. If they had not been hired, they would not have come. Meanwhile, American consumers reap the benefits in the form of lower priced goods. Unemployed and under employed lower skilled citizen workers were victimized in the process.

My own experience is a case in point. Building homes in the Atlanta area in the early 1990’s we relied largely on labor from rural Georgia and northern Alabama. These workers were relatively expensive, not particularly reliable and dwindling in supply. It was hard to get a house built during deer season. When Mexican crews appeared on the scene, they proved to be less expensive and more reliable than the crews they replaced. We didn’t ask about citizenship, they showed up every day and they worked hard. We only needed an Employer Identification Number (EIN) and a place to send the check. Soon, more Mexican crews showed up and in they became the construction worker market in the Atlanta metro area. We didn’t ask, but we knew they weren’t citizens. If we hadn’t hired that initial wave of crews, there wouldn’t have been a second, and a third, and so on. Our new work force broke the law in coming here the way that they did, but we were complicit in the crime by employing them.

Donald Trump did a masterful job of tapping into the resentment of underutilized lower skilled workers from largely rural areas that had seen their manufacturing jobs go overseas while illegals supposedly filled the jobs that opened up. Never mind that far more manufacturing jobs were lost to automation than ever moved overseas. Or that thousands of manufacturing jobs requiring technical skills went unfilled. Or that the openings that were occurring didn’t happen to be where they lived. Or that the unemployed blue-collar workers wouldn’t do the jobs that immigrants did, and certainly not for what they were paid. Resentment over illegal workers is real and it is justified. How the Democratic Party allowed the issue of illegal workers to come between it and blue-collar workers who had been a core constituent for the last 75 years is one of the mysteries of contemporary politics. But it took Donald Trump to move it from an economic issue to a social issue to a defining political issue. Sadly, immigration policy is far too important to leave to the politicians.

First, let’s establish that we should control immigration, in quantity and quality. Our government should determine who gets to come here. It just shouldn’t be our elected officials. Second, people who have come to our country years ago, built lives, contributed to their communities and have not committed crimes other those necessarily connected to their illegal status, should be encouraged to stay and be given a path toward citizenship. After that it gets complicated. Immigration is a complex economic issue, and Congress can’t even do simple very well, much less complex.

Our continued prosperity as a nation depends on the consistent growth of our economy. We also happen to need it to have any hope of funding our existing future obligations to social security recipients. Gross Domestic Product (GDP) is the measure of our economic output that we use to measure our economic growth. It is the simple product of two numbers: total employment and average productivity. The growth of our economic output depends on the growth of one or both of these factors. Growth in productivity tends to come in fits and starts and is difficult to predict. It depends largely on education, experience and innovation. Employment is simple, more workers generally leads to higher output. The natural increase of our population (births minus death) is about 1.6 million per year, or about one half of one percent. If we assume a constant labor participation rate, we would have to increase our average productivity by 2.5% per year (vs. the 1.2% average post WWII) to achieve consistent 3% annual growth in GDP. For all of 2016, productivity increased by 0.5% and in 2017 it increased by 1%. Most economists agree that there is no basis currently to project long term productivity growth rates in excess of 1.5% under any reasonable circumstances, particularly as we approach full employment (which usually has a negative impact on average productivity.)

To get to our target economic growth rate we must either have immigration to make up the difference, or to increase our native birth rates…by a lot, not just to make up for the original difference but also to make up for the workers who would withdraw from the workforce to care for larger families. So, immigration must make up the difference if we are ever to achieve our economic growth objectives. How much immigration? Depends on native birthrates and labor participation rates. Who should we be letting in? Depends on what skills and education the economy needs and will need in the foreseeable future. These are issues of demographics and economics and they should be addressed by demographers and economists who have the knowledge to do so, not our politicians who have no such knowledge and have given us no indication that they will put in the effort to acquire it any time soon.

Here are some radical ideas. First stop illegal immigration. Track visitors in the U.S. on tourist or other temporary visas who overstay and punish employers who hire undocumented workers. (We don’t need a wall, we need to address the pull factor.) Second, take decisions on immigration away from our elected officials and put them in the hands of a board of experts serving staggered 5-year terms who are selected by Republicans and Democrats. Let them make rational decisions about our economic needs. Finally, beg those here already to stay if they have built productive lives, raised families and contributed to their communities. This is not only just under the circumstances but makes economic sense for us all. Think of the disruption to our economy of the loss of approximately 3.5% of our population and 8 million workers heavily concentrated in labor intensive occupations that most U.S workers don’t want. Think of the loss of $11 billion in annual tax revenue. Let them all live their dream with us.

2 notes

·

View notes

Text

8 Radical Suggestions to Jump Start Canada’s Job Growth After COVID19

With all the free time you now find yourself with, I am sure you have been scrolling through social media feeds. Have you noticed posts asking along the line of, How much longer can we keep our economy shutdown? Last moth #EndTheShutdown was trending on Twitter.

People are starting to get unnerved by the economic fallout; especially when it comes to their personal finances.

COVID19, and the resulting rapid economic downturn, is being compared to the 1918 Spanish flu, the Great Depression, SARS and the 2008 financial crisis. While comparisons can be made, the fact is the world is navigating uncharted waters. Our reaction to COVID19 has created a double edge sword… shutting down the economy, with the exception of what is deemed to be “essential”, in an attempt to control the spreading of a virus. Health vs. money.

If the shutdown goes on much longer, the economic damage, if not so already, will be irreparable in the short-term. We already have globalization, automation, robotics, AI eating away at jobs. Now COVID19 comes along and for better or for worse we bring the entire economy to a crawl, even decimating entire industries such as hospitality, food service and retail.

When we talk about economic recovery we are talking about reversing the enormous increase in unemployment created by shutting down Canada’s economy. Hoping, with crossed-fingers Canada’s economic recovery will be as fast as the fall is wishful thinking. Imagine you fell off a steep cliff. Climbing out, if you are uninjured and physically in shape to do so, will take much longer than it took you to fall in.

To be expected, post-COVID19 business models will be leaner. Employees will need to work harder, be more engaged in their employer’s success and keep their sense of entitlement in check.

So far, there is no date when the shutdown of non-essential businesses will be lifted. When this happens, we will see what businesses remain standing. It will not be pretty. Discussions how to kick start Canada’s post-COVID19 economy should be happening now. It is not too early to talk about how the Canadian government, and our individual consumerism, will be instrumental in restarting Canada’s economy (READ: Get unemployed Canadians back to work ASAP.), which just five weeks ago was robust.

To start the discussion here are eight radical suggestions (suggestions some will find politically incorrect or be offended by), or maybe not so radical, to jump-start Canada’s job growth after COVID19:

1. Mandatory retirement at 65.

I will begin with my most radical suggestion, mandatory retirement at 65.

According to Statistics Canada, in 2015, 1 in 5 Canadians, over the age of 65, reported working during the year. That is almost 1.1 million Canadian seniors!

We need to make room for younger workers, especially recent graduates. Youth unemployment has always been on the higher side of the national average, According to Trading Economics, the youth unemployment rate in Canada increased to 16.80% in March, from 10.30% in February of 2020. You can expect youth unemployment to skyrocket unless steps are taken now.

Making retirement at 65 mandatory for those who are on a company payroll (business owners, those self-employed, contractors, would be exempt, as would be certain professions such as doctors and nurses) would immediately open up jobs. I see this as a low hanging fruit. This will come across as being harsh, but someone who has worked 35 – 40 years has had their chance to earn a living, to create their financial future. The number of jobs available is finite. By default when someone retires they are giving another person the same opportunity they had. With unemployment now at the height it is this make makes economic and social sense.

As a caveat Canada’s Old Age Security (OAS) pension should not be taxable.

2. Consumer tax on items that can be manufactured or grown in Canada.

When applied strategically taxes can guide consumer spending.

Jobs are created when demand for a business’s products or services supports the requirement for employees. The more demand a company has for its offerings, the more employees needed. Bottom-line: Canadians supporting Canadian businesses, via their spending, creates jobs.

Consumers purchasing foreign-made goods because it is “cheaper” is the reason Canada imports so many products that can be manufactured or grown in Canada. Consumers paying a nominal tax upon purchasing imported goods that can be produced or grown in Canada would create revenue for the government. However, the core purpose of this tax would be to have Canadian consumers gravitate towards “Grown in Canada” and “Made in Canada.” Of course, there would be exceptions. Fruits such as oranges, bananas and pineapples would be exempt from this tax, while garlic from China, or blueberries from Chile, would have an import tax consumers would pay upon purchasing..

3. Cross border tax.

Canadians travelling within Canada, thus spending their money within the country supporting local businesses, creates jobs.

A nominal cross border tax, for non-essential travel, creates revenue for the government and makes Canadians think twice about which economy they are supporting. Imagine if just 30% of Canadians deferred their travel from outside the country to within Canada how much of an economic boost that would be to Canadian businesses.

4. No income tax on the first $35K earned.

The more money Canadians have in their pocket, the more they will spend (hopefully locally). Since purchases are taxed, the income tax not collected would be made up via the increased taxes collected on the increased spending.

5. Lower payroll tax.

An employer’s most significant expense is their payroll. Make it as inexpensive as possible to hire employees.

6. Long-term interest-free business loans.

Businesses hire employees. They spend money on supplies, rent, and utilities. Upon providing a solid business plan, and a passing a credit check, offer a business loan of up to $250K to be paid back, interest-free, in monthly installment starting in 5 years. Canadians starting businesses inevitably will lead to job creation.

7. Those currently employed cannot apply for a new job outside their company.

When COVID19 finally passes the objective should be to have unemployed Canadian get back to work as fast as possible. Those who were fortunate enough to have kept their job throughout the pandemic should remain in their current job/company (you can move within your organization) until January 1, 2022. Finding work in the best of times is difficult. To apply for a position post-COVID19, you need to show you are currently unemployed. Removing the added competition from candidates who are employed, which employers end to gravitate towards, will go a long way helping those who are unemployed find work quickly.

8. Offer tax incentives to industries (sectors of the economy).

In 2009 Jim Flaherty, Canada’s federal Minister of Finance (2006 – 2014), introduced in the Federal Budget a temporary Home Renovation Tax Credit for eligible home renovations and alterations. Basically the HRTC provided a 15% tax credit to individuals for eligible expenditures in excess of $1,000 but not more than $10,000 made in respect of eligible dwellings. I often wondered why this type of tax credit was not continued. To assist various industries a tax credit similar to the HRTC could be implemented with various industries. One year there’s a tax credit for home renovations, the next year for automobiles, the following for appliances, and so forth. Such a tax credit, the eligibility requirement focusing as much as possible on “Made in Canada”, would stimulate spending which inevitably would create jobs.

All I have offered here are rough suggestions, which can be temporary with a hard stop date, can be adjusted to consider seasons (Importing strawberries in January has merit to warrant not having an import tax.) and resources constraints.

The objective is to start the discussions around how will we get back as many Canadians to work. There will inevitably be business closures. Sectors of the economy, which depend on discretionary spending ( Sports, entertainment and the hospitality sector rely on people going out and spending what disposable income they have.) will not be recovering in the near future. There will be opportunities for new businesses to start up.

How do you envision Canada’s employment recovery post-COVID19?

0 notes

Text

06th June 2020 Current affairs & Daily News Analysis

Sixth mass extinction may be one of the most serious environmental threats

The ongoing sixth mass extinction may be one of the most serious environmental threats to the persistence of civilisation, according to new research published in the journal Proceedings of the National Academy of Sciences of the United States of America (PNAS) About: Names: This ongoing extinction of species, which coincides with the present Holocene epoch is known as Holocene extinction, Sixth extinction or Anthropocene extinction. Background: In the history of Earth we’ve had five major extinction events in the history of life.The five mass extinctions that took place in the last 450 million years have led to the destruction of 70-95 % of the species of plants, animals and microorganisms that existed earlier. The most recent was about 65 million years ago when an asteroid crashed into the Yucatán and took out the dinosaurs, changing the climate dramatically. Important Info : Sixth extinction vs earlier five extinctions This ongoing extinction of species is a result of human activity. Earlier extinctions were caused by “catastrophic alterations” to the environment, such as massive volcanic eruptions, depletion of oceanic oxygen or collision with an asteroid.The current rate of extinction of species is estimated at 100 to 1,000 times higher than natural background rates.This large number of extinctions spans numerous families of plants and animals, including mammals, birds, amphibians, reptiles and arthropods. Source : Indian Express (Environment) Best UPSC Civil Services Current affairs The Times Higher Education (THE) Asia University Ranking for 2020 was launched recently

About: Times Higher Education (THE) is a weekly magazine based in London, reporting specifically on news and issues related to higher education. The Times Higher Education (THE) Asia University Rankings 2020 use the same 13 performance indicators as the THE World University Rankings. The universities are judged in four core areas: (1) Teaching, (2) Research, (3) Knowledge Transfer and (4) International Outlook. Key Findings: China is home to the continent’s top two universities for the first time this year, as Tsinghua University is ranked 1 and Peking University is ranked 2. With eight institutes in the top 100, India is the third most represented country in the Ranking. The Indian Institute of Science (IISc) Bangalore retains its top position in the country by attaining the 36th spot globally. Eight Indian Institutes of Technology (IITs) have also been featured in the top 100. Source : Indian Express (Education) Best UPSC Civil Services Current affairs At the virtual UK-hosted Global Vaccine Summit 2020, Prime Minister Narendra Modi announced that India will contribute $15 million to an international vaccine alliance, GAVI

GAVI GAVI, officially Gavi, the Vaccine Alliance, is a public–private global health partnership with the goal of increasing access to immunisation in poor countries. GAVI has observer status at the World Health Assembly. It was founded in 2000 and is located at Geneva, Switzerland. The Vaccine Alliance brings together developing country and donor governments, the World Health Organization, UNICEF, the World Bank, the vaccine industry, technical agencies, civil society, the Bill & Melinda Gates Foundation and other private sector partners. Important Info : Global Vaccine Summit 2020 London At the summit, GAVI launched the ‘Gavi Advance Market Commitment for COVID-19 Vaccines (Gavi Covax AMC)’, a new financing instrument aimed at incentivising vaccine manufacturers to produce sufficient quantities of eventual COVID-19 vaccines, and to ensure access for developing countries.The Gavi Covax AMC is being launched with an initial goal of raising US$ 2 billion. Source : Times of India (International Relations) Best UPSC Civil Services Current affairs The Ministry of Statistics and Programme Implementation released the latest Periodic Labour Force Survey (PLFS). The survey was conducted during July 2018-June 2019

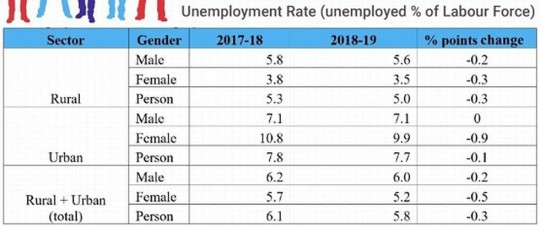

Key Findings: India’s unemployment rate improved from the 45-year high of 6.1% in 2017-18 to 5.8% in 2018-19. Women’s unemployment fell from 5.7% to 5.2%, while male unemployment only fell from 6.2% to 6%. Urban unemployment was still at a high of 7.7% in 2018-19, a marginal drop from 7.8% in 2017-18, while rural unemployment fell from 5.3% to 5%. The Labour Force Participation Rate (LFPR) also improved marginally, from 36.9% in 2017-18 to 37.5% in 2018-19. Unemployment rate, however, rose among Scheduled Castes to 6.4 % from 6.3 %, and for Scheduled Tribes to 4.5 % from 4.3 %. But unemployment rate among Other Backward Classes inched lower to 5.9 % from 6 %. In 2018-19, unemployment rate for youth in the 15-29 years age bracket was 17.3 %, as against 17.8 % a year ago. Unemployment rate among urban youth was higher than the all-India number at 20.2 % as against 20.6 % a year ago. Important Info : Labour Force Participation Rate (LFPR) is defined as the percentage of persons in labour force (i.e. working or seeking or available for work) in the population.Worker Population Ratio (WPR) is defined as the percentage of employed persons in the population.Unemployment Rate (UR) is defined as the percentage of persons unemployed among the persons in the labour force. Source : Indian Express (Economy) Best UPSC Civil Services Current affairs Retirement fund body, Employees' Provident Fund Organisation (EPFO) said it has released Rs 868 crore pension along with Rs 105 crore arrear on account of restoration of commuted value of pension

About: The government, had, in February this year notified the restoration of full pension after 15 years of retirement for pensioners who have commuted part of their pension at the time of retirement. This has resulted in a substantial increase in pension for those EPFO pensioners who retired before September, 26, 2008 and had opted for partial commutation of pension. Commutation of pension will cost the government Rs 1500 crore. The higher pension benefit will be restored after 15 years from the date of receiving commuted pension at the time of retirement. This means an individual who retired on April 1, 2005, would be eligible to receive the benefit of higher pension after 15 years i.e. from April 1, 2020. Important Info : As per Employees' Pension Scheme (EPS) rules, an EPFO member who retired before September 26, 2008 could get maximum one-third of pension as lump-sum i.e. commuted pension and remaining two-thirds was paid as monthly pension to an employee for his/her lifetime. As per current EPF rules, EPFO members do not have an option to receive the commutation benefit.EPFO is an organisation under labour ministry that administers EPF and EPS schemes. Source : Economic Times (Economy) Best UPSC Civil Services Current affairs Union Electronics and IT Minister announced three schemes, with a ₹48,000-crore outlay, for setting up of large number of electronic and mobile manufacturing units in the country

Production Linked Incentive Scheme (PLI) for Large Scale Electronics Manufacturing (outlay of nearly ₹41,000 crore) The PLI Scheme shall extend an incentive of 4% to 6% on incremental sales (over base year) of goods manufactured in India and covered under the target segments, to eligible companies, for a period of five years subsequent to the base year. Scheme for Promotion of Manufacturing of Electronic Components and Semiconductors (SPECS) (outlay of about ₹3,300 crore) The SPECS shall provide financial incentive of 25% on capital expenditure for the identified list of electronic goods, i.e., electronic components, semiconductor/ display fabrication units, Assembly, Test, Marking and Packaging (ATMP) units, specialized sub-assemblies and capital goods for manufacture of aforesaid goods. Modified Electronics Manufacturing Clusters (EMC 2.0) Scheme (about ₹3,800 crore) The EMC 2.0 shall provide support for creation of world class infrastructure along with common facilities and amenities, including Ready Built Factory (RBF) sheds / Plug and Play facilities for attracting major global electronics manufacturers, along with their supply chains. Important Info : Benefits The Schemes will help offset the disability for domestic electronics manufacturing and hence, strengthen the electronics manufacturing ecosystem in the country.The three new schemes are expected to attract substantial investments, increase production of mobile phones and their parts to around 10 lakh crore by 2025. It will also generate around five lakh direct and 15 lakh indirect jobs. Do you know? According to Union Electronics Minister, India’s global share in electronics has risen form 1.3 % in 2012 to 3 % in 2018. India has become the second largest manufacturer of mobile phones in the world. From just two mobile manufacturing factories, the country has now 200 such units. Source : All India Radio (Economy) Best UPSC Civil Services Current affairs Russian President Vladimir Putin declared a state of emergency after 20,000 tonnes of diesel oil to spilled into Ambarnaya river, turning its surface crimson red

About: Ambarnaya is a shallow river in Siberia, Russia which flows in a northerly direction into Lake Pyasino. On leaving Lake Pyasino, the waters emerge as the Pyasina River. The Ambarnaya river is part of a network that flows into the environmentally sensitive Arctic Ocean. Important Info : May 2020 Diesel spill On May 29, 2020, an estimated 20,000 tonnes of Diesel oil leaked into the river following the collapse of a power plant owned by Norilsk Nickel.With a 12 km stretch of river seriously affected, Russia's president Vladimir Putin declared a state of emergency within Russia’s Krasnoyarsk Region, located in the Siberian peninsula. Source : Indian Express (Geography) Best UPSC Civil Services Current affairs Supreme Court ordered that a plea to change India’s name exclusively to ‘Bharat’ be converted into a representation and forwarded to the Union government, primarily the Ministry of Home Affairs, for an appropriate decision About: The petition, seeks an amendment to Article 1 of the Constitution, to change India’s name exclusively to ‘Bharat’. It wants ‘India’ to be struck off from the Article. Bharat and India are both names given in the Constitution. India is already called ‘Bharat’ in the Constitution. Article 1 of the Constitution, says “India, that is Bharat, shall be a Union of States”. Important Info : Arguments By Petitioner: ‘India’ is a name of foreign origin. The name can be traced back to the Greek term ‘Indica’. Instead, The word ‘Bharat’ is closely associated to our Freedom Struggle. The cry was ‘Bharat Mata ki Jai’.”This will ensure citizens of this country to get over the colonial past and instil a sense of pride in our nationality. It will also justify the hard fought freedom by our freedom fightersThere should be uniformity in the name of the nation. There are many names of India like Republic of India, Bharat, India, Bharat Ganarajya, etc, thus creating confusion. Arguments against: The Supreme Court had dismissed a similar petition in 2016. Then CJI T.S. Thakur had said that every Indian had the right to choose between calling his country ‘Bharat’ or ‘India’.The name India derives ultimately from Sanskrit Síndhu which was the name of the Indus River as well as the country at the lower Indus basin. Source : Times of India (Polity & Goverance) Best UPSC Civil Services Current affairs Prime Minister Narendra Modi condoled the death of veteran filmmaker Basu Chatterjee, the torchbearer of Hindi ‘middle-of-the-road’ cinema. He passed away due to age-related illness at the age of 90

About: Basu Chatterjee (1930 – 2020) was an Indian film director and screenwriter. Through the 1970s and 1980s, alongwith filmmakers such as Hrishikesh Mukherjee and Basu Bhattacharya, he was the torchbearer of Hindi middle-of-the-road cinemae. the light-hearted, middle class, family dramas that emerged as a parallel narrative to the more mainstream Angry Young Man movies. He is best known for his films Chhoti Si Baat, Chitchor, Rajnigandha, Ek Ruka Hua Faisla etc. He directed the TV Series Byomkesh Bakshi and the popular Rajani (TV series) for Doordarshan both of which were successful TV serials. Source : The Hindu (Person in News) Best UPSC Civil Services Current affairs Pangong Tso is the site of eye-to-eye confrontation between Indian and Chinese troops, following a scuffle in early May. Both sides have ramped up their troop presence but "disengagement" process is also underway About: Pangong Tso is a long narrow, deep, endorheic (landlocked) lake situated at a height of about 4,350 m in the Ladakh Himalayas. It is 134 km long and 5 km wide at its broadest point. In the Ladakhi language, Pangong means extensive concavity, and Tso is lake in Tibetan. The brackish water lake freezes over in winter, and becomes ideal for ice skating and polo. It is not a part of the Indus river basin area and geographically a separate landlocked river basin. The lake is not a Ramsar site yet. It is in the process of being identified under the Ramsar Convention as a wetland of international importance. Important Info : Line of Actual Control (LAC) and Pangong Tso lake The disputed boundary between India and China, also known as the Line of Actual Control (LAC), mostly passes on the land, but Pangong Tso is a unique case where it passes through the water as well.The points in the water at which the Indian claim ends and Chinese claim begins are not agreed upon mutually. As things stand, 45 km-long western portion of the lake is under Indian control, while the rest is under China’s control.By itself, the lake does not have major tactical significance. But it lies in the path of the Chushul approach, one of the main approaches that China can use for an offensive into Indian-held territory. Fingers in the lake: The barren mountains on the lake’s northern bank, called the Chang Chenmo, jut out like a palm and the various protrusions are referred to as 'fingers.'While India claims that the LAC starts at Finger 8, China claims that it starts at Finger 2, which is presently dominated by India. India physically controls area only up to Finger 4. Source : Indian Express (Geography) Best UPSC Civil Services Current affairs Daily Current affairs and News Analysis Best IAS Coaching institutes in Bangalore Vignan IAS Academy Contact Vignan IAS Academy Enroll For IAS Foundation Course from Best IAS / IPS Training Academy in Bangalore

Latest Current affairs

Read the full article

#bestiascoachingcentreinbangalore#bestiascoachinginbangalore#BestIASCoachinginHSRLayoutBangalore#IASCoachinginHSRLayout#TopRankedIASCoachinginBangalore

0 notes

Text

You Probably Have Missing Data

Here’s a Guide on When to Care

Strategies to address missing data¹

At Indeed, our mission is to help people get jobs. Searching for a job can be stressful, which is one reason why Indeed is always looking for ways to make the process easier and our products better. Surveys provide us with an ongoing measure of people’s feelings about Indeed’s products and the job search experience.

We realize that when someone is looking for a job (or has just landed one), answering a survey is the last thing they want to do. This means that a lot of the survey data that Indeed collects ends up with missing data. To properly analyze user satisfaction and similar surveys, we need to account for potential missing patterns to ensure we draw correct conclusions.

I’d like to discuss identifying and handling missing data. I’m inspired by my training in the University of Michigan’s Program in Survey Methods. I’ve also wanted to apply the theories about data sets that I learned in academia to Indeed’s terabyte-sized data.

I recently worked on a project that dealt with missing data. I learned a lot from the analysis. Walking through this process can show how Indeed collects survey data, illustrate the difference between non-response rate and non-response bias, and provide examples of why “randomness” in non-response bias is a good thing.