#optical crm software

Explore tagged Tumblr posts

Text

#opticalsoftware#optical#software#optical crm software#optical pos software#optical software#optician#relinksys#youtube#google search#google#google seo#microsoft#privacy#github#computing#googlesearch#smartphones#wattpad#facebook

4 notes

·

View notes

Text

instagram

The trusted solution for over 4,000 optical stores worldwide. Request a Free Demo today!

It’s hassle-free, cost-effective, and designed exclusively for optical businesses like yours.

📌 Call/WhatsApp: +91 8147420462 📌 Learn more: www.opticalcrm.com

#opticalcrm#software#CRM#optical#opticalretail#retailsoftware#eyewearstore#features#opticalbusiness#optics#optometry#unlimitedusers#feature#instagood#post#knowledge#softwaredevelopment#Instagram

0 notes

Text

Bank Statement Parser Tool: Automate Financial Data Extraction with AI

In today’s digital world, financial institutions, fintech platforms, and lending companies face a common challenge—processing large volumes of bank statements quickly and accurately. Manual extraction is time-consuming, prone to error, and not scalable. That’s where a smart bank statement parser tool becomes essential.

With advancements in artificial intelligence and machine learning, an AI bank statement parser can automatically extract, analyze, and organize financial data from bank statements in seconds, enabling faster decisions and better customer experiences.

What is a Bank Statement Parser?

A bank statement parser is a software tool that extracts key financial data—such as transaction details, account balances, income, and spending patterns—from PDF, scanned, or digital bank statements.

An AI bank statement parser goes a step further by using machine learning to understand different formats, classify transactions, and detect anomalies or patterns that may be relevant for credit analysis, underwriting, or fraud detection.

Benefits of Using a Bank Statement Parser Tool

1. Speed and Scalability Manually reviewing hundreds of bank statements is inefficient. An automated bank statement parser can handle thousands of files in a fraction of the time, allowing your team to scale without increasing operational load.

2. Accuracy and Consistency AI reduces the risk of human error and delivers consistent results, even when processing complex or non-standard statement formats.

3. Format Flexibility Bank statements vary widely between banks. A smart bank statement parser tool adapts to multiple layouts, languages, and currencies.

4. Real-Time Insights Instantly extract transaction data and generate insights for credit scoring, budgeting, fraud detection, or income verification.

5. Seamless Integration Connect your bank statement parser to CRMs, underwriting tools, loan origination systems, or financial dashboards via APIs.

How an AI Bank Statement Parser Works

Upload: Users upload a bank statement (PDF, scanned image, or digital file).

OCR Processing: Optical Character Recognition converts visuals into text.

Data Extraction: The parser identifies and extracts account numbers, balances, and all transaction data.

Classification: Transactions are categorized (e.g., income, utilities, rent, loans).

Export: Data is exported into structured formats like JSON, CSV, or Excel—ready for analytics or integration.

Use Cases for a Bank Statement Parser Tool

Industry

Use Case

Lending

Income verification, credit scoring, and eligibility checks

Fintech

Expense tracking, budgeting tools, and digital onboarding

Accounting

Reconciliation, cash flow analysis, and audit prep

Insurance

Claims verification and financial assessment

Real Estate

Tenant income verification and rental applications

Why Choose an AI Bank Statement Parser?

Traditional rule-based parsers can’t keep up with evolving document formats. An AI bank statement parser is trained on hundreds of templates and learns continuously, making it resilient, flexible, and future-proof.

With machine learning, it doesn’t just extract data—it understands the context, detects suspicious activity, and adapts to new layouts automatically.

Makezai’s Automated Bank Statement Parser Tool

At Makezai, we’ve built an automated bank statement parser that simplifies financial data extraction for businesses of all sizes. Our tool offers:

Support for over 200+ bank formats

Intelligent OCR and layout detection

Auto-classification of transactions

One-click export to Excel or JSON

API integration for real-time processing

Whether you're building a lending app, fintech product, or internal tool, Makezai helps you process bank statements faster, smarter, and more accurately.

Final Thoughts

Financial document processing shouldn’t slow down your business. With a robust bank statement parser tool, you can automate data extraction, accelerate decision-making, and unlock deeper financial insights—all without manual effort.

If you're ready to transform the way you handle bank statements, it’s time to switch to an AI bank statement parser.

0 notes

Text

Digital Document Repository Software

In today’s fast-paced digital age, efficient document management is essential for organizations of all sizes. Paper-based processes are not only time-consuming but also susceptible to misplacement, damage, and security breaches. To combat these challenges, Digital Document Repository Software has emerged as a revolutionary tool for businesses looking to digitize, organize, and securely store their critical records. PDMPL (Pridex Data Management India Pvt. Ltd.), a trusted name in the document management space, offers cutting-edge digital document repository solutions tailored to meet diverse industry needs.

What Is Digital Document Repository Software?

A Digital Document Repository Software is a centralized platform that allows organizations to store, retrieve, and manage documents electronically. It acts as a secure digital archive, where users can organize and access documents based on metadata, categories, or custom tags. This software supports various document formats such as PDFs, Word files, images, and scanned copies, ensuring a comprehensive and structured storage system.

From human resources and finance departments to legal firms and healthcare providers, digital document repositories cater to all sectors by simplifying document storage, enhancing accessibility, and ensuring compliance.

Key Features of PDMPL’s Digital Document Repository Software

1. Centralized and Organized Storage: PDMPL’s software provides a centralized repository that eliminates the chaos of scattered files. All documents are stored in structured folders with intuitive naming conventions and metadata tagging, making it easy to locate any file within seconds.

2. Role-Based Access Control: Security is a top priority. PDMPL integrates robust user permission settings, ensuring only authorized personnel can access or modify specific documents. Admins can define roles and monitor document interactions to maintain data integrity.

3. High-Speed Document Retrieval: With advanced search filters including keywords, dates, and document types, users can retrieve files quickly. PDMPL’s repository software also supports OCR (Optical Character Recognition) to extract and index content from scanned images or PDFs.

4. Seamless Integration and Scalability: PDMPL ensures its software integrates smoothly with existing enterprise tools like ERP systems, CRMs, or HRMS platforms. The repository is also scalable, adapting to growing data needs without compromising performance.

5. Regulatory Compliance and Audit Trails: Organizations are required to maintain documentation in line with various regulatory standards. PDMPL’s digital document repository helps businesses stay compliant by maintaining comprehensive audit trails and ensuring documents are retained securely for required durations.

6. Data Backup and Disaster Recovery: PDMPL’s system comes equipped with automatic backups and a robust disaster recovery plan, ensuring data is safe even in unforeseen situations like hardware failures or cyberattacks.

Why Choose PDMPL for Your Digital Document Repository?

1. Industry Expertise: With years of experience in document management, PDMPL understands the unique needs of different industries and crafts customized solutions that align with client objectives.

2. End-to-End Services: From document scanning and indexing to repository setup and training, PDMPL offers a complete suite of services under one roof. This ensures a smooth transition from physical to digital storage without any disruptions.

3. Cost-Efficiency: By eliminating paper-based filing systems and reducing storage space requirements, PDMPL’s software brings significant cost savings in the long run. Moreover, reduced manual labor and enhanced efficiency result in improved ROI.

4. Eco-Friendly Approach: Going digital is not just smart, it’s sustainable. By adopting digital document repository software, companies contribute to reducing paper usage and environmental impact—something PDMPL strongly advocates.

Applications Across Industries

Healthcare: Securely store patient records, lab reports, and insurance documents with quick access and compliance with health regulations.

Legal Firms: Maintain case files, contracts, and legal correspondences in a tamper-proof digital vault.

Finance & Banking: Archive sensitive financial records, customer data, and regulatory documents with high-end encryption.

Manufacturing: Store design documents, safety manuals, invoices, and quality control reports efficiently.

Government & Education: Digitize administrative files, student records, and compliance paperwork for quick retrieval and better transparency.

The Future of Document Management is Digital

As businesses continue to embrace digital transformation, the need for reliable and secure document storage solutions is becoming increasingly crucial. A Digital Document Repository Software is no longer a luxury but a necessity for maintaining operational efficiency, data security, and regulatory compliance.

With PDMPL’s expertise, businesses can confidently transition into a paperless environment and enjoy the benefits of a streamlined, organized, and secure digital ecosystem. The company’s commitment to innovation, customer support, and tailored solutions makes it a leading choice for digital document repository services in India and beyond.

Final Thoughts

Managing documents doesn't have to be a burden. With the right tools and trusted partners, it can become a strategic asset. PDMPL’s Digital Document Repository Software empowers organizations to take control of their data, enhance productivity, and ensure peace of mind through advanced digital archiving and management features.

If your business is still navigating the challenges of physical document storage or outdated systems, it’s time to make the smart switch. Partner with PDMPL and unlock the power of digital document storage today.

0 notes

Text

Invoice OCR API for KYC & Compliance: A Hidden Powerhouse

In the fast-paced digital era, businesses face increasing pressure to streamline operations while ensuring regulatory compliance. One emerging yet often underutilized tool in this space is the Invoice OCR API—a technological powerhouse that significantly simplifies Know Your Customer (KYC) and compliance workflows. This advanced tool enables organizations to automate invoice data extraction, reduce manual errors, and accelerate customer onboarding and verification processes.

What is an Invoice OCR API?

An Invoice Optical Character Recognition (OCR) API is a software interface that leverages machine learning and artificial intelligence to extract structured data from unstructured invoice documents. Whether it’s a scanned PDF, an image, or a digital file, this API reads and interprets key invoice fields such as invoice numbers, dates, vendor names, tax amounts, and totals.

By integrating this technology into backend systems, businesses can automate data capture at scale, eliminating the need for tedious manual entry and reducing human error.

Why Invoice OCR Matters in KYC and Compliance

KYC and compliance requirements demand accurate and up-to-date documentation to verify identities and assess risks. In industries like banking, fintech, insurance, and telecom, verifying business transactions through invoices is essential for fraud prevention and regulatory reporting.

Here’s how an Invoice OCR API enhances KYC and compliance workflows:

Accelerates Document Verification: Automated extraction shortens the time taken to validate invoices during customer onboarding.

Ensures Regulatory Adherence: Automatically captures and logs data required for audits and compliance reports.

Reduces Human Error: Enhances accuracy in document review and recordkeeping.

Supports AML Processes: Helps in tracking and verifying financial transactions, aiding Anti-Money Laundering (AML) measures.

Core Benefits of Using Invoice OCR API

1. Streamlined Data Extraction

Manual data entry is time-consuming and prone to errors. With Invoice OCR APIs, businesses can automate the extraction of relevant invoice data, ensuring speed and consistency across operations.

2. Scalable KYC Document Processing

Whether dealing with hundreds or millions of invoices, OCR APIs provide scalable solutions that grow with your business. The automation allows for real-time verification at any volume, which is essential for enterprises processing high KYC traffic.

3. Enhanced Accuracy and Reduced Risk

The intelligent data parsing mechanism of OCR APIs reduces errors that can lead to compliance violations. With high accuracy rates, businesses gain confidence in their KYC verification results.

4. API Integration for Seamless Workflows

Modern Invoice OCR APIs are designed for easy integration with CRMs, ERP systems, and custom compliance platforms. This interoperability ensures that invoice data flows seamlessly between applications, making end-to-end automation possible.

5. Real-Time Fraud Detection and Compliance Alerts

Some OCR APIs come equipped with anomaly detection features, which flag suspicious invoices or data mismatches instantly. This capability allows compliance teams to act swiftly and mitigate risks.

Key Features to Look for in a KYC-Focused Invoice OCR API

When selecting an OCR API for compliance use cases, consider the following features:

Multi-format Support: Ability to process PDFs, images, and scans from various sources.

AI-Powered Accuracy: Leveraging deep learning for smarter field recognition.

Data Privacy & Security: End-to-end encryption and compliance with data protection laws like GDPR.

Custom Field Mapping: Flexibility to extract unique or industry-specific fields.

Multi-language Support: Useful for businesses operating in diverse linguistic regions.

Use Cases Across Industries

Banking & Financial Services

Banks use Invoice OCR to validate vendor documents during loan processing, enabling faster disbursement with minimal manual intervention.

Fintech & Digital Lending

Fintech companies automate customer verification and transaction recordkeeping, reducing onboarding time from days to minutes.

E-Commerce Platforms

Marketplaces use OCR APIs to verify seller invoices for product listings, returns, and vendor payments.

Telecom Sector

Telecom providers streamline onboarding by verifying user-submitted invoices during KYC, ensuring regulatory compliance with ease.

Future of Invoice OCR in Compliance Automation

As global regulations continue to evolve, the reliance on automation and intelligent document processing will only increase. Invoice OCR APIs are at the forefront of this revolution, empowering organizations to operate at speed while maintaining ironclad compliance.

With advances in natural language processing (NLP) and AI, the future holds promise for even more accurate, multilingual, and context-aware OCR tools that don’t just extract data—but interpret it.

Conclusion

The Invoice OCR API is no longer just a backend utility—it is a strategic asset for any organization aiming to simplify KYC processes and maintain robust compliance. By automating invoice verification, companies gain a competitive edge through operational efficiency, reduced risks, and faster decision-making.

As digital transformation accelerates, integrating smart OCR APIs into your compliance infrastructure is not just a choice—it’s a necessity.

1 note

·

View note

Text

The Power of Electronic Data Capture Software for Streamlined Data Collection

In the digital era, businesses and organizations are dealing with an increasing amount of data from various sources, such as customer forms, surveys, invoices, and other documents. Manual data entry is no longer efficient or accurate enough to meet the demands of modern businesses. This is where electronic data capture (EDC) software comes into play. EDC software enables organizations to capture, process, and store data electronically, eliminating the need for manual input and significantly improving efficiency, accuracy, and security.

Electronic Data Capture software automates the process of collecting data from paper documents or digital inputs, converting it into a usable electronic format. This technology is commonly used across industries such as healthcare, finance, retail, and research, where quick and accurate data collection is essential. By using EDC software, organizations can digitize paper-based forms, streamline workflows, and ensure that data is entered with minimal human intervention, reducing errors and delays.

One of the key advantages of electronic data capture software is its ability to increase accuracy. When data is manually entered, it is susceptible to human errors, such as misinterpretation, typographical mistakes, or missing information. EDC software, however, can automatically extract data from scanned documents using Optical Character Recognition (OCR) or other technologies, ensuring that information is captured accurately and without discrepancies. This not only improves data integrity but also reduces the time spent on error correction.

Moreover, electronic data capture software helps businesses save time and resources. Manual data entry is a tedious and time-consuming process that requires significant labor. By automating this task, businesses can reduce the workload on employees, allowing them to focus on more strategic tasks that add value to the organization. Additionally, the software speeds up the data collection process, allowing organizations to access real-time data and make more informed decisions quickly.

Another benefit of electronic data capture software is its ability to enhance data organization and accessibility. Instead of storing physical documents in filing cabinets or relying on spreadsheets, organizations can store collected data electronically in centralized databases or cloud storage. This not only makes it easier to manage and retrieve data when needed, but it also ensures that information is safely backed up and protected against loss due to accidents or disasters.

For industries like healthcare, where sensitive patient information must be securely stored and protected, electronic data capture software provides a vital security advantage. Many EDC systems come equipped with advanced security features, such as data encryption, access controls, and compliance with regulatory standards (such as HIPAA in healthcare or GDPR in Europe). This ensures that sensitive data is protected against unauthorized access and that businesses remain compliant with industry-specific regulations.

Furthermore, electronic data capture software offers improved reporting and analytics capabilities. By converting raw data into a digital format, organizations can easily analyze and generate reports that provide valuable insights. With built-in analytics tools, businesses can quickly identify trends, track performance, and make data-driven decisions that improve operations, customer satisfaction, and profitability.

Electronic data capture software can also integrate with other business systems, such as customer relationship management (CRM) software, enterprise resource planning (ERP) systems, and accounting platforms. This integration ensures that captured data flows seamlessly across different departments and systems, improving overall efficiency and eliminating the need for manual data transfers between systems.

In conclusion, electronic data capture software is a vital tool for businesses looking to enhance efficiency, accuracy, and data security. By automating data collection processes, organizations can streamline workflows, reduce errors, and improve decision-making. Whether used for digitizing paper-based documents, collecting survey responses, or processing invoices, EDC software provides significant benefits that help businesses stay competitive in today’s data-driven world. With its ability to capture, store, and analyze data seamlessly, EDC software is becoming an essential component of modern business operations.

0 notes

Text

How to Automate Document Processing for Your Business: A Step-by-Step Guide

Managing documents manually is one of the biggest time drains in business today. From processing invoices and contracts to organizing customer forms, these repetitive tasks eat up hours every week. The good news? Automating document processing is simpler (and more affordable) than you might think.

In this easy-to-follow guide, we’ll show you step-by-step how to automate document processing in your business—saving you time, reducing errors, and boosting productivity.

What You’ll Need

A scanner (if you still have paper documents)

A document processing software (like AppleTechSoft’s Document Processing Solution)

Access to your business’s document workflows (invoices, forms, receipts, etc.)

Step 1: Identify Documents You Want to Automate

Start by making a list of documents that take up the most time to process. Common examples include:

Invoices and bills

Purchase orders

Customer application forms

Contracts and agreements

Expense receipts

Tip: Prioritize documents that are repetitive and high volume.

Step 2: Digitize Your Paper Documents

If you’re still handling paper, scan your documents into digital formats (PDF, JPEG, etc.). Most modern document processing tools work best with digital files.

Quick Tip: Use high-resolution scans (300 DPI or more) for accurate data extraction.

Step 3: Choose a Document Processing Tool

Look for a platform that offers:

OCR (Optical Character Recognition) to extract text from scanned images

AI-powered data extraction to capture key fields like dates, names, and totals

Integration with your accounting software, CRM, or database

Security and compliance features to protect sensitive data

AppleTechSoft’s Document Processing Solution ticks all these boxes and more.

Step 4: Define Your Workflow Rules

Tell your software what you want it to do with your documents. For example:

Extract vendor name, date, and amount from invoices

Automatically save contracts to a shared folder

Send expense reports directly to accounting

Most tools offer an easy drag-and-drop interface or templates to set these rules up.

Step 5: Test Your Automation

Before going live, test the workflow with sample documents. Check if:

Data is extracted accurately

Documents are routed to the right folders or apps

Any errors or mismatches are flagged

Tweak your settings as needed.

Step 6: Go Live and Monitor

Once you’re confident in your workflow, deploy it for daily use. Monitor the automation for the first few weeks to ensure it works as expected.

Pro Tip: Set up alerts for any failed extractions or mismatches so you can quickly correct issues.

Bonus Tips for Success

Regularly update your templates as your document formats change

Train your team on how to upload and manage documents in the system

Schedule periodic reviews to optimize and improve your workflows

Conclusion

Automating document processing can transform your business operations—from faster invoicing to smoother customer onboarding. With the right tools and a clear plan, you can streamline your paperwork and focus on what matters most: growing your business.

Ready to get started? Contact AppleTechSoft today to explore our Document Processing solutions.

#document processing#business automation#workflow automation#AI tools#paperless office#small business tips#productivity hacks#digital transformation#AppleTechSoft#business technology#OCR software#data extraction#invoicing automation#business growth#time saving tips

1 note

·

View note

Text

Key Trends in Document Digitization Software to Watch in 2025

As the world embraces remote work, cloud technology, and paperless operations, the demand for document digitization software continues to skyrocket. From small businesses to large enterprises, organizations are shifting away from traditional filing systems and investing in tools that not only digitize paper documents but also automate, organize, and secure them.

With 2025 on the horizon, the landscape of document digitization software is evolving rapidly. Here are the key trends that are shaping the future of document management and digital transformation.

1. AI and Machine Learning Are Revolutionizing Data Capture

One of the most significant developments in document digitization software is the integration of artificial intelligence (AI) and machine learning (ML). These technologies allow systems to go beyond simple scanning and optical character recognition (OCR).

Now, AI-powered tools can:

Auto-classify documents based on content

Detect errors or anomalies in scanned data

Extract structured data from unstructured formats

Improve accuracy over time through learning algorithms

This reduces the need for manual data entry and speeds up document processing, especially in industries like banking, legal, and healthcare.

2. Cloud-Based Digitization Is Becoming the Norm

With the rise of hybrid and remote work models, cloud-based document digitization software is no longer a luxury—it's a necessity. Organizations are moving away from on-premise setups and opting for cloud platforms that offer:

Real-time access from anywhere

Automatic software updates

Scalable storage solutions

Built-in backup and disaster recovery features

Cloud-native systems also allow easier collaboration across departments and geographies, making workflows more agile and integrated.

3. Focus on Data Security and Compliance

As digital document repositories grow, so do the risks associated with unauthorized access, data breaches, and non-compliance. In 2025, security will be a core component of any serious document digitization software.

Key features in demand include:

End-to-end encryption

Role-based access controls

Audit trails and activity logs

Compliance support for regulations like GDPR, HIPAA, and SOC 2

Vendors are increasingly offering compliance-specific solutions tailored to industries such as healthcare, finance, and government.

4. Seamless Integration with Business Applications

Gone are the days when document management existed in isolation. The best document digitization software in 2025 will offer deep integrations with CRM, ERP, HRMS, and other enterprise tools.

For example, a digitized invoice can be automatically routed to an accounts payable system, or a client contract can sync directly with a CRM. This integration creates a unified digital workspace and eliminates bottlenecks caused by siloed systems.

5. Mobile-First Document Digitization

With smartphones and tablets becoming everyday business tools, mobile compatibility is a top priority. Modern document digitization software now includes mobile apps that allow users to:

Scan documents using phone cameras

Upload and access files on the go

Approve workflows and tasks from mobile devices

This flexibility ensures that digitization and document access aren’t confined to desktop environments.

6. Enhanced User Experience and Low-Code Platforms

User-friendly interfaces are no longer optional. Developers are focusing on intuitive UI/UX design and providing low-code or no-code options for setting up automation rules, workflows, and templates.

This democratizes the digitization process, allowing non-technical users to customize the software to their needs without IT intervention.

Conclusion

As businesses continue to embrace digital transformation, document digitization software is evolving into a smarter, more integrated, and secure solution. In 2025, organizations that stay ahead of these trends—AI-powered automation, cloud-based access, tight security, seamless integration, mobile functionality, and user-friendly platforms—will not only streamline their operations but also gain a competitive edge.

If your organization is still relying on traditional document handling, now is the time to explore the cutting-edge features offered by modern document digitization software. The future of efficient, secure, and intelligent document management is already here.

0 notes

Text

What Are The Reasons of The jpg to excel converter

The Reasons for Using a JPG to Excel Converter

In today’s data-driven world, businesses and individuals constantly seek ways to streamline workflows and maximize productivity. One such innovation is the JPG to Excel converter, a tool that translates image-based content into editable spreadsheet data. JPG (or JPEG) is a common image format used to capture everything from photographs to scanned documents. Excel, on the other hand, is a powerful tool for data organization, analysis, and computation. Converting a JPG file into an Excel spreadsheet may seem like a niche task, but there are many compelling reasons why people and organizations use JPG to Excel converters. These reasons span across convenience, accuracy, automation, data extraction, and beyond.

1. Data Extraction from Scanned Documents

One of the most common reasons to use a JPG to Excel converter is to extract information from scanned documents. Businesses often digitize invoices, receipts, financial statements, or customer records by scanning them into JPG images. These scanned images, while easy to store, are not readily usable for analysis or calculations. A converter extracts the data from the image and places it into Excel, making it easy to sort, analyze, and manage.

2. Time Efficiency

Manually transcribing data from an image into a spreadsheet is not only tedious but also time-consuming. Imagine a scenario where an employee must extract hundreds of rows of financial figures or product details from scanned documents. A JPG to Excel converter can automate this task in seconds, significantly reducing labor time and allowing employees to focus on higher-value work. Time efficiency is crucial in fast-paced environments like finance, logistics, and retail where data updates occur frequently.

3. Minimizing Human Error

Manual data entry is prone to mistakes, especially when large volumes of numbers or text are involved. Errors in data entry can lead to flawed analytics, incorrect financial records, or bad business decisions. JPG to Excel converters reduce this risk by using Optical Character Recognition (OCR) technology, which reads characters from an image and translates them into digital text. While OCR isn’t always 100% perfect, especially with poor-quality images, it still significantly lowers the rate of error compared to manual transcription.

4. Data Organization and Analysis

Once data is extracted from a JPG and placed into Excel, users can immediately leverage Excel’s full suite of features—formulas, pivot tables, charts, conditional formatting, and more. For example, if a business receives daily sales reports as scanned images, converting these into Excel allows them to compile and analyze trends, forecast sales, and manage inventory efficiently. In educational or research settings, data extracted from images such as tables in textbooks can be organized for easier study and comparison.

5. Integration with Business Systems

Many modern business systems—from ERP (Enterprise Resource Planning) to CRM (Customer Relationship Management)—rely heavily on structured, digital data. When data exists only in image format, it becomes an isolated silo. JPG to Excel converters allow businesses to digitize and integrate legacy data into their modern systems. For example, supplier price lists received in printed format can be scanned and converted into Excel, then imported into procurement software for seamless use.

6. Improved Accessibility and Editing

Information trapped in an image is difficult to modify or repurpose. Once it is in Excel format, however, it becomes fully editable. Users can update figures, correct typos, add new entries, or reformat the layout to meet specific requirements. This is particularly useful when dealing with old records or standardized forms that need to be updated periodically.

7. Archiving and Record Keeping

Government agencies, legal firms, and healthcare providers often need to keep extensive records of transactions, cases, or patient data. Many of these records are initially captured as scans (JPGs) of paper forms. Converting these into Excel spreadsheets ensures that the data is stored in a searchable, sortable format. This makes long-term archiving more functional and accessible when records need to be retrieved or analyzed later.

8. Language and Global Use Cases

JPG to Excel converters are valuable in multilingual environments. Modern OCR tools can recognize multiple languages, allowing businesses to convert foreign-language documents into a usable Excel format. This is crucial for international trade, customer service, and multinational corporations that deal with paperwork in various languages.

If you need any kind of information on this article related topic click here JPG to Excel

9. Enhancing Digital Transformation

As businesses shift towards digital operations, converting legacy data becomes a necessity. Paper-based and image-based records don’t align with the needs of automation, AI, or advanced analytics. JPG to Excel conversion supports digital transformation initiatives by unlocking previously static data and making it available for digital tools and strategies.

10. Cost Efficiency

By automating data extraction from images, companies can significantly cut down on labor costs associated with manual data entry. Additionally, reducing errors and improving data accessibility helps minimize operational risks, which can also lead to cost savings. In small businesses or startups, using free or affordable JPG to Excel converters can eliminate the need to hire additional staff for data management tasks.

Conclusion

The utility of JPG to Excel converters goes beyond simple convenience. These tools play a pivotal role in transforming static, image-based information into dynamic, editable data that can be organized, analyzed, and integrated into broader business processes. Whether it’s for minimizing errors, enhancing productivity, or supporting digital transformation, the reasons for using JPG to Excel converters are numerous and compelling. As technology continues to evolve, we can expect these tools to become even more accurate, accessible, and essential in the modern digital workspace.

0 notes

Text

AI-Powered Bookkeeping: The Future of Financial Management

In today’s fast-paced digital economy, businesses are constantly seeking smarter, faster, and more accurate ways to manage their finances. That’s where AI powered bookkeeping steps in revolutionizing the traditional approach to accounting and making financial management more efficient than ever.

What is AI-Powered Bookkeeping?

AI-powered bookkeeping leverages artificial intelligence and machine learning algorithms to automate and optimize accounting tasks such as data entry, transaction categorization, reconciliation, and financial reporting. It reduces manual effort, eliminates human error, and allows businesses to focus on strategic growth.

Key Features of AI Bookkeeping

1. Automated Data Entry

AI bookkeeping can extract and record financial data from invoices, receipts, and bank statements without human input. Optical Character Recognition and Natural Language Processing technologies help scan, read, and input data in real-time.

2. Smart Categorization

AI tools learn how to classify transactions based on past patterns and industry rules. Over time, they become more accurate in identifying and assigning expenses or income to the right categories.

3. Real-Time Reconciliation

Instead of waiting for monthly reviews, AI can match transactions with bank records instantly, helping businesses spot discrepancies and fraud early.

4. Predictive Insights

AI doesn’t just process numbers, it analyzes them. These tools can generate forecasts, cash flow predictions, and financial trends, allowing for better decision-making.

5. Seamless Integrations

AI-powered bookkeeping platforms easily integrate with bank accounts, payroll software, CRMs, and tax tools, creating a centralized financial ecosystem.

Benefits of AI in Bookkeeping

Time Savings: Reduces the hours spent on manual bookkeeping tasks.

Cost Efficiency: Cuts down on labor costs and minimizes errors that could lead to financial penalties.

Accuracy: AI ensures consistent and error-free recordkeeping.

Compliance Ready: Stay updated with tax laws and financial regulations through automated updates.

Scalability: Whether you're a solopreneur or a growing company, AI systems adapt to your volume of transactions.

Use Cases

Small Business Owners: Gain financial visibility without hiring a full-time accountant.

Bookkeeping Professionals: Automate routine tasks and focus on high-value advisory services.

Startups: Manage tight budgets with affordable and efficient bookkeeping solutions.

Popular AI Bookkeeping Tools

QuickBooks Online with AI features

Xero

Zoho Books

Is AI Replacing Human Bookkeepers?

No but it is transforming their roles. Instead of spending time on data entry, bookkeepers can now focus on interpreting financial data, offering strategic advice, and ensuring compliance. AI is a tool, not a replacement it enhances human capabilities and opens the door for smarter work.

Final Thoughts

AI powered bookkeeping is not just a trend it’s a transformation. As businesses move toward automation and data-driven decision-making, adopting AI in bookkeeping is becoming a necessity rather than a luxury. Whether you're a business owner or a bookkeeping professional, embracing AI can streamline your operations, cut costs, and give you a competitive edge in today’s market.

0 notes

Text

Optical Software for Retail and Wholesale optical Shops

Increase Your Business With Us

Optical Software includes all of the features, modules, and tools you’ll need to expand your retail and wholesale business more quickly than ever before. It is the most widely used and trusted Optical Software on the market.

Call For Free Demo

+91-9766666248

#youtube#opticalsoftware#software#optical crm software#optical pos software#relinksys#googleranking#aziracrow#goth#gothic#ebony goddess#ineffable husbands#crowley#baduk#google seo#youtube shorts#youtube video#youtube channel#xiao cang zong he che liangsenta#infographic show

1 note

·

View note

Text

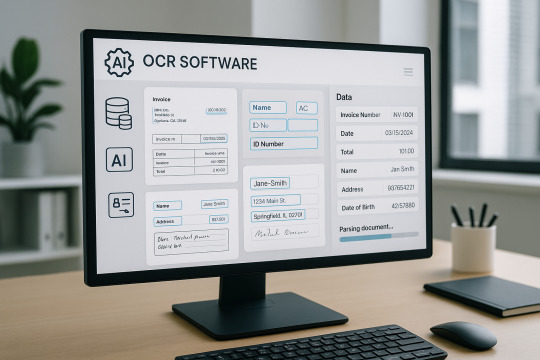

Intelligent OCR Software: The Smart Way to Automate Document Processing

In a world where businesses are generating and handling thousands of documents every day, traditional Optical Character Recognition (OCR) is no longer enough. Enter Intelligent OCR Software — a smarter, faster, and more accurate way to extract data from scanned documents, PDFs, handwritten notes, and images.

Whether you're dealing with invoices, ID cards, contracts, or forms, AI-powered OCR helps automate the document workflow with unmatched efficiency and precision.

What is Intelligent OCR Software?

Intelligent OCR software goes beyond basic text recognition. It uses machine learning (ML), natural language processing (NLP), and artificial intelligence (AI) to understand the context of the text, recognize complex patterns, and make decisions based on the document’s structure.

Unlike traditional OCR, which simply converts images into text, smart OCR solutions can:

Extract structured and unstructured data

Understand tables, fields, and layouts

Recognize handwriting and low-quality scans

Classify document types automatically

Why Businesses Need AI-Powered OCR

Here’s why companies across industries are turning to AI-powered OCR:

1. Speed & Scalability Process thousands of documents in minutes without compromising accuracy.

2. Higher Accuracy OCR with machine learning improves over time, reducing errors from misreads or poor-quality scans.

3. Contextual Understanding Unlike rule-based systems, intelligent OCR understands the document's layout and meaning.

4. Automation-Ready Seamlessly integrates into document automation workflows to reduce manual labor and operational cost.

Key Features of a Smart OCR Solution

AI & ML-Powered Engine: Learns from patterns and corrections to enhance accuracy.

Handwriting Recognition: Reads cursive and printed handwriting accurately.

Multi-language Support: Processes documents in multiple global languages.

Template-Free Processing: No need for predefined formats—ideal for variable forms.

Cloud & API Access: Easily integrates with ERPs, CRMs, and cloud storage.

Use Cases of Intelligent OCR Across Industries

Industry

Use Case

Finance

Invoice and receipt digitization, KYC verification

Healthcare

Patient form processing, insurance claims

Legal

Contract digitization and clause extraction

Education

Exam sheet scanning, student enrollment forms

Retail

Order forms, delivery notes, payment receipts

Makezai’s Smart OCR Solution

At Makezai, we offer a state-of-the-art intelligent OCR software that combines machine learning, AI, and natural language processing to help businesses:

Extract data from diverse document types

Automate end-to-end processing workflows

Reduce manual errors

Improve compliance and audit readiness

Whether you're a small business or a large enterprise, our smart OCR solution is designed to scale with your needs.

Future-Proof Your Document Processing

As digital transformation accelerates, businesses that adopt intelligent OCR software will lead the way in automation, efficiency, and cost savings. By investing in a smart OCR solution, you’re not just digitizing documents—you’re unlocking real-time data, improving accuracy, and creating smarter workflows.

Ready to automate your documents with AI?

Contact Makezai today to discover how our AI-powered OCR can revolutionize your document processes and take your operations to the next level.

0 notes

Text

Workflow Automation: A Technical Guide to Streamlining Business Processes

In an era where digital transformation is crucial for business success, workflow automation has emerged as a key strategy to enhance efficiency, eliminate manual errors, and optimize processes. This guide provides an in-depth technical understanding of automating workflows, explores the architecture of automation tools like Power Automate workflow, and highlights the benefits of workflow automation from a technical perspective.

What is Workflow Automation?

Workflow automation is the process of using software to define, execute, and manage business processes automatically. These processes consist of a sequence of tasks, rules, and conditions that dictate how data flows across systems. The goal is to reduce human intervention, improve speed, and ensure process consistency.

Automation can be applied to various workflows, including:

Document Management – Automating approvals, storage, and retrieval.

Customer Relationship Management (CRM) – Auto-updating customer data, triggering notifications, and assigning tasks.

IT Operations – Automating system monitoring, log analysis, and incident responses.

Financial Processes – Invoice processing, payment reconciliations, and fraud detection.

Key Components of Workflow Automation

A typical workflow automation system consists of:

Trigger Events – Initiate automation based on user actions (e.g., form submission, email receipt) or system changes (e.g., new database entry).

Condition Logic – Defines rules using conditional statements (IF-THEN-ELSE) to determine workflow execution.

Actions and Tasks – The automated steps executed (e.g., sending emails, updating records, triggering API calls).

Integrations – Connections with third-party applications and APIs for data exchange.

Logging and Monitoring – Capturing logs for debugging, performance monitoring, and compliance tracking.

Technical Benefits of Workflow Automation

1. API-Driven Workflows

Modern automation tools rely on RESTful APIs to integrate with external applications. For example, Microsoft Power Automate workflow uses connectors to interact with services like SharePoint, Salesforce, and SAP.

2. Event-Driven Architecture

Automation platforms support event-driven models, allowing workflows to respond to real-time changes. Technologies like AWS Lambda, Azure Logic Apps, and Kafka enable scalable automation based on event triggers.

3. RPA and AI Integration

Robotic Process Automation (RPA) enhances traditional automation by using AI-powered bots to handle tasks like document scanning, data extraction, and decision-making. AI-based automation tools leverage:

Optical Character Recognition (OCR) for processing scanned documents.

Natural Language Processing (NLP) for sentiment analysis in customer feedback.

Machine Learning (ML) for predictive analytics in workflow decision-making.

4. Security and Compliance Considerations

When implementing automating workflows, businesses must ensure:

Role-Based Access Control (RBAC) – Ensures only authorized users can modify automation rules.

Audit Trails – Logs all workflow activities for compliance and troubleshooting.

Data Encryption – Protects sensitive information during automation.

5. Serverless Automation

Serverless computing platforms like AWS Step Functions and Azure Logic Apps enable serverless workflow execution, reducing infrastructure costs while improving scalability.

How to Implement Workflow Automation?

Step 1: Process Identification

Identify repetitive and rule-based processes suitable for automation. Use process mining tools like Celonis or UIPath Process Mining to analyze workflows.

Step 2: Selecting the Right Automation Platform

Choose a tool based on business requirements:

Microsoft Power Automate workflow – Best for enterprises using Microsoft 365.

Zapier – Ideal for no-code integrations between cloud apps.

UiPath, Blue Prism – Suitable for RPA-based automation.

Step 3: Workflow Design & Configuration

Define triggers (e.g., email receipt, API call).

Configure actions (e.g., database updates, message notifications).

Set conditions (e.g., decision logic, approval steps).

Step 4: Integration with Enterprise Systems

Use APIs, Webhooks, and middleware (e.g., Mulesoft, Apache Kafka) to connect automated workflows with CRM, ERP, and HRMS systems.

Step 5: Testing & Deployment

Unit Testing – Validate each step of the workflow.

Integration Testing – Ensure proper data exchange across systems.

Performance Testing – Assess automation speed and efficiency.

Step 6: Monitoring and Optimization

Utilize monitoring tools like Splunk, ELK Stack, or Azure Monitor to analyze workflow performance and optimize automation rules.

Future of Workflow Automation

Hyperautomation – The combination of RPA, AI, and ML for end-to-end business process automation.

Blockchain for Workflow Security – Smart contracts ensuring transparent and tamper-proof workflows.

Edge Computing in Automation – Bringing automation closer to IoT devices for real-time decision-making.

Conclusion

Workflow automation is revolutionizing business operations by enabling intelligent, data-driven decision-making. Leveraging automating workflows through tools like Power Automate workflow, businesses can achieve greater efficiency, accuracy, and scalability. The benefits of workflow automation extend beyond cost savings, impacting compliance, security, and business agility.

Investing in the right automation technology will ensure a future-proof and competitive business environment. Start implementing workflow automation today to drive innovation and efficiency!

0 notes

Text

Data Extraction Software: Transforming Accounting Efficiency

In today's fast-paced digital world, businesses need efficient tools to manage their data. Data extraction software has become a critical asset for organizations of all sizes. Whether you're handling financial records, customer information, or inventory lists, extracting and organizing data efficiently is vital. When paired with accounting software, data extraction software enables businesses to streamline their accounting processes, improve accuracy, and reduce the time spent on manual data entry. Let’s dive into how this innovative technology is transforming the accounting industry.

What is Data Extraction Software?

Data extraction software is designed to automatically extract information from various data sources, such as documents, databases, websites, and other platforms. By utilizing technologies like optical character recognition (OCR) and machine learning, data extraction software can pull specific data points from a variety of formats, including PDFs, Excel sheets, and images. This software eliminates the need for manual data entry, ensuring that information is gathered quickly, accurately, and without human error.

In the context of accounting, this technology has proven especially beneficial for automating tasks like invoice processing, financial reporting, and data integration across different systems.

The Role of Data Extraction Software in Accounting

Data extraction software plays a pivotal role in modern accounting by reducing human errors and enhancing operational efficiency. Let's explore some of the key benefits this software brings to accounting software systems:

1. Automating Invoice Processing

In accounting, managing invoices is a routine yet time-consuming task. Data extraction software can automatically extract key information from invoices, such as vendor details, invoice numbers, and amounts due, and transfer that information directly into your accounting software. This automation reduces manual input errors and speeds up the invoicing process, leading to faster payments and improved cash flow management.

2. Enhancing Financial Reporting

Financial reports are essential for making data-driven business decisions. Data extraction software can streamline the process of collecting financial data from various sources, including spreadsheets, email attachments, and documents, and inputting them into accounting software. This not only saves time but also ensures that financial reports are accurate and up-to-date, enabling business leaders to make informed decisions.

3. Facilitating Data Integration Across Systems

One of the most common challenges in accounting is ensuring that data flows seamlessly between different platforms. Whether you're using a CRM system, inventory management tool, or payroll system, data extraction software can extract and integrate data from these platforms into your accounting software. This seamless integration allows for real-time financial updates and ensures consistency across all systems.

4. Reducing Manual Errors

Manual data entry is prone to human error. Small mistakes, like typos or incorrect numbers, can lead to major financial discrepancies. By automating data extraction, businesses can significantly reduce the risk of errors in their accounting software. The result is more accurate financial records and fewer issues during audits.

Key Features to Look for in Data Extraction Software

When selecting data extraction software for your accounting needs, there are several essential features to consider. These features can help you make the most of your software and improve your overall workflow.

1. Multi-Format Support

Accounting data often comes in various formats, from paper invoices to digital spreadsheets. A good data extraction software should support multiple file types, including PDFs, Excel, Word, and even scanned documents. This ensures that no matter how your data is received, it can be processed quickly and accurately.

2. Machine Learning Capabilities

The power of machine learning in data extraction software lies in its ability to improve over time. By learning from historical data and user input, the software becomes better at identifying patterns and extracting relevant information. This makes it a valuable tool for accounting professionals, as it continuously adapts to new document formats and changing data structures.

3. Integration with Accounting Software

A key feature of data extraction software is its ability to integrate seamlessly with your existing accounting software. Whether you're using popular platforms like QuickBooks, Xero, or FreshBooks, integration ensures that the extracted data can be automatically fed into your accounting system. This eliminates the need for manual data entry and enhances the accuracy of your financial records.

4. Cloud-Based Accessibility

Cloud-based data extraction software offers the advantage of remote accessibility, allowing you to manage and extract data from anywhere, at any time. Cloud-based solutions also enable better collaboration across teams, as multiple users can access the same data simultaneously, ensuring that everyone is on the same page.

How Data Extraction Software Streamlines Accounting Software Operations

Efficient data extraction is not only about making processes faster; it's also about increasing the accuracy and productivity of your accounting software. Below are some of the ways data extraction software works in harmony with accounting software:

1. Automates Repetitive Tasks

Accounting tasks can be repetitive and time-consuming. With data extraction software, you can automate tasks such as transaction categorization, invoice entry, and bank reconciliation. By automating these routine processes, your accounting team can focus on more strategic activities, like budgeting, forecasting, and financial analysis.

2. Real-Time Data Entry

Manual data entry often leads to delays in the accounting process. By integrating data extraction software with accounting software, businesses can input data in real-time, ensuring that financial information is always up-to-date. This feature is particularly valuable during audits, as real-time data entry ensures that you have accurate and timely records to present.

3. Improves Decision Making

By automating the data extraction process, you gain more reliable and consistent data in your accounting software. The cleaner and more accurate your financial data, the better decisions you can make regarding cash flow management, expense reduction, and investment strategies. Accurate data extraction enables faster decision-making and a more strategic approach to business growth.

Choosing the Right Data Extraction Software for Your Accounting Needs

When selecting data extraction software for your business, it’s crucial to consider your specific needs. Some businesses may need a simple solution for invoice management, while others may require a more comprehensive tool that integrates data from multiple platforms. Here are a few tips to help you choose the right software:

1. Assess Your Business Requirements

Before purchasing any software, take a close look at the types of documents and data your accounting team handles daily. Do you deal with mostly paper invoices, or are most documents digital? Understanding your unique needs will help you select a data extraction software that suits your business and integrates well with your accounting software.

2. Consider Scalability

As your business grows, your data extraction and accounting needs may change. Choose a data extraction software that is scalable, so you can easily upgrade your plan or add features as your requirements evolve. This will ensure that your software can grow with your business.

3. Evaluate Ease of Use

The usability of data extraction software is crucial for ensuring smooth adoption by your team. Choose software that is user-friendly and offers good customer support. A steep learning curve can hinder productivity, so ensure that your chosen software provides ample resources, tutorials, and responsive support teams.

4. Look for Customization Options

Every business is different, so you may need a data extraction software that can be customized to meet your specific requirements. Whether it’s setting up custom extraction fields or integrating with a unique accounting software, look for options that allow flexibility.

Conclusion: Embrace the Power of Data Extraction for Smarter Accounting

In conclusion, data extraction software is transforming the way businesses manage their finances. By automating tedious tasks, improving accuracy, and integrating seamlessly with accounting software, this technology helps companies save time, reduce errors, and make smarter financial decisions. With the right data extraction software, businesses can unlock the full potential of their accounting software, optimizing workflows and driving efficiency.

Now is the time to embrace the benefits of data extraction software and take your accounting software to the next level. By automating data extraction and integrating it with your accounting systems, you can focus on what truly matters—growing your business and making data-driven decisions.

Are you ready to improve the way you manage your accounting tasks? Start exploring the power of data extraction software today.

0 notes

Text

Your Trusted IT & Technology Partner

At WiseGTech, we provide cutting-edge IT solutions, managed services, and digital transformation strategies that empower businesses to operate more efficiently, securely, and profitably. From cloud computing, network security, VoIP solutions, and cybersecurity services to business IT support, we help you stay ahead in an ever-evolving digital world.

Our Core IT Services

✅ Managed IT Services

• 24/7 remote IT support, on-site IT services, and network management

• IT infrastructure optimization for small businesses and enterprises

• Server monitoring, patching, and disaster recovery solutions

✅ Cybersecurity & Data Protection

• Cyber threat detection, penetration testing, and firewall management

• Ransomware protection, data encryption, and multi-layered security protocols

• Security compliance consulting (HIPAA, GDPR, PCI-DSS)

✅ Cloud Computing & Digital Transformation

• Cloud migration services, AWS & Microsoft Azure solutions

• SaaS application integration and custom cloud development

• Business continuity planning and cloud backup solutions

✅ Telecom & VoIP Solutions

• VoIP business phone systems, PBX installation, and UCaaS solutions

• POTS to VoIP transition, VoIP gateway configuration, and video conferencing solutions

• VoIP providers like RingCentral, Vonage, Zoom, Ooma, Nextiva support

✅ Network & Infrastructure Services

• Enterprise network design, structured cabling, and fiber optic installation

• Router, switch, and firewall configuration for secure networking

• WiFi installation, hotspot setup, and 5G business connectivity

✅ IT Consulting & Digital Strategy

• Custom IT roadmaps, business technology consulting, and digital strategy development

• Enterprise software solutions, ERP consulting, and CRM implementation

• AI automation, machine learning solutions, and big data analytics

✅ Business IT Support & Helpdesk Services

• On-demand IT helpdesk, troubleshooting & diagnostics, and remote support

• POS system repair, computer & printer support, and hardware replacement

• Software installation, patch management, and OS upgrades

✅ Security Camera & Alarm Systems

• CCTV camera installation, remote surveillance solutions, and video monitoring

• Biometric access control, alarm system integration, and smart home security

• IoT security solutions, low voltage wiring, and enterprise surveillance

✅ E-Commerce & Digital Marketing IT Solutions

• Website development, SEO optimization, and e-commerce solutions

• Data-driven marketing automation, lead generation, and programmatic SEO

• Social media management, PPC campaigns, and conversion rate optimization

________________________________________

Why Choose WiseGTech?

✔️ 20+ years of IT excellence

✔️ Certified IT professionals & industry experts

✔️ 24/7 nationwide support & rapid deployment

✔️ Tailored IT solutions for SMBs, enterprises & startups

✔️ Competitive pricing & cost-effective IT plans

Get a Free IT Consultation Today!

Let’s transform your IT infrastructure with scalable, secure, and future-proof solutions. Contact WiseGTech for a custom IT strategy tailored to your business needs.

📧 Email: [email protected]

📍 Address: 12004 Courtyard Glen Pl, Richmond, VA 23233

📞 Call Us: +1 (804) 799-0808

🚀 WiseGTech – Smart IT Solutions for a Connected World!

0 notes

Text

How to Optimize Your Networking with a Free Business Card Scanner App

In today’s digital world, staying organized and efficient is crucial, especially when it comes to networking. Traditional methods of exchanging business cards can be cumbersome and inefficient, especially when trying to remember or organize the many contacts you meet. This is where a free business card scanner app comes into play. A free business card scanner app allows you to scan and digitize business cards quickly, ensuring you never lose contact information again. This guide will explore how you can make the most out of this app and improve your networking efforts.

Why You Need a Free Business Card Scanner App

Business cards are a powerful tool for making a lasting impression, but the process of organizing and managing them can become overwhelming. A free business card scanner app simplifies this process by allowing you to instantly digitize the contact information from a business card and store it in an organized digital format.

Save Time and Avoid Mistakes

One of the biggest advantages of using a free business card scanner app is the time-saving aspect. Instead of manually entering contact details into your phone or computer, the app does it for you. With optical character recognition (OCR) technology, the app accurately captures the text from business cards, reducing the chances of human error. You can store names, phone numbers, email addresses, and even job titles in seconds, ensuring you don’t miss any vital details.

Keep Your Contacts Organized

When you use a free business card scanner app, all of your contacts are neatly organized in a digital format, making it easy to search and retrieve information at any time. Most apps allow you to add tags, notes, or categories to contacts, enabling you to filter them by location, industry, or event. This organizational feature ensures that you never waste time searching through a stack of physical business cards again.

Key Features to Look for in a Free Business Card Scanner App

When choosing the right free business card scanner app, it’s essential to look for key features that will enhance your experience. Here are some features that can make a significant difference:

1. Accurate Scanning Technology

Look for an app that uses OCR (Optical Character Recognition) technology to ensure accurate and quick scanning. The app should be able to recognize a variety of fonts, designs, and layouts, so you can scan cards from different professionals without worrying about errors.

2. Cloud Integration

A good free business card scanner app should allow you to back up your contacts to the cloud. This ensures that your contact information is safe and accessible from multiple devices. Cloud integration also makes it easier to sync your contacts across platforms, whether you use a smartphone, tablet, or desktop computer.

3. Customizable Features

Customizability is another important factor to consider. Look for an app that allows you to add notes, tags, and categories to each contact. Some apps even let you edit the information after scanning, which is useful in case of any mistakes or discrepancies in the recognition process.

4. Export and Share Options

If you need to share your contacts or export them to other tools like CRM software or spreadsheets, ensure that the app offers these features. A free business card scanner app should have export options to popular formats such as CSV, VCF, or Excel.

How to Use a Free Business Card Scanner App Effectively

Now that you know the features to look for in a free business card scanner app, let’s go over how you can use the app effectively to streamline your networking efforts.

Step 1: Download and Set Up the App

Start by downloading a reliable business card scanner app from your device’s app store. Follow the setup instructions and grant the necessary permissions to allow the app to access your camera and contacts.

Step 2: Scan Your Business Cards

Once the app is set up, it’s time to start scanning your business cards. Simply open the app, align the card within the frame, and let the app capture the details. Most apps automatically detect the card’s edges and focus, making the scanning process quick and efficient.

Step 3: Review and Edit Contact Information

After scanning, review the contact information. The free business card scanner app will automatically populate the details, but you may want to verify the accuracy. Edit any incorrect or missing information before saving the contact.

Step 4: Organize Your Contacts

Take advantage of the organizational features within the app. Categorize your contacts by industry, event, or priority. Add tags or notes to help you remember key details about each individual.

Step 5: Backup and Sync

Finally, make sure to back up your contacts to the cloud and sync them across your devices. This way, you’ll always have access to your contacts, no matter where you are.

Conclusion

A free business card scanner app is a game-changer for anyone looking to streamline their networking process. With the ability to quickly capture, organize, and store contact information, these apps help you save time, reduce errors, and keep your connections at your fingertips. By choosing the right app and utilizing its features to their fullest potential, you can enhance your networking experience.

At Bizconnectus, we understand the importance of building and maintaining professional relationships. Our platform offers tools to help you grow and manage your network effectively, so you never miss out on an opportunity. Try using a free business card scanner app today and see how it can transform the way you manage your contacts and grow your professional network

0 notes