#paycheckprotectionprogram

Explore tagged Tumblr posts

Link

#AmericaFirstPolicy#CentralizationofPowerintheBidenAdministration.EconomicGrowth#PaycheckProtectionProgram#theCARESAct#TrumpAdministrationeconomist

0 notes

Text

Sage 50 US Payroll Reporting for the Cares act hr 748 PaycheckProtection Program

The CARES Act and the Paycheck Protection Program (PPP) have been a lifeline for many small businesses during these challenging times. As business owners navigate through the intricacies of the PPP, having reliable payroll reporting software becomes essential. That's where Sage 50 US Payroll steps in to save the day! In this blog post, we'll explore Sage 50 US Payroll Reporting for the Cares act hr 748 PaycheckProtection Program and ensuring compliance with PPP requirements. So get ready to discover how this powerful tool can simplify your life and help you secure those much-needed funds.

Overview of Sage 50 US Payroll Reporting

Sage 50 US Payroll Reporting is an essential tool for businesses looking to navigate the complexities of the CARES Act and the Paycheck Protection Program (PPP). With its user-friendly interface and comprehensive features, Sage 50 US Payroll makes it easy for small businesses to generate accurate payroll reports in compliance with PPP requirements.

One key feature of Sage 50 US Payroll Reporting is its ability to calculate eligible payroll expenses. This includes wages, salaries, tips, commissions, and other compensation paid to employees during the covered period. By accurately tracking these expenses, businesses can ensure they are maximizing their loan forgiveness potential.

In addition to calculating payroll expenses, Sage 50 US Payroll also allows users to generate detailed reports that provide a clear overview of their financials. These reports include information on employee wages and hours worked, tax withholdings, deductions, and more. Having access to this data not only helps with PPP compliance but also enables businesses to make informed decisions about their payroll processes.

Key Features of Sage 50 US Payroll for PPP

1. Automated Calculation and Tracking: With Sage 50 US Payroll, you can easily calculate and track the payroll costs required for your PPP loan forgiveness application. The software automatically calculates eligible payroll costs based on predefined rules, saving you time and reducing the risk of errors.

2. Customizable Reporting: Sage 50 US Payroll allows you to generate customizable reports specifically tailored to meet the requirements of the CARES Act and PPP program. These reports provide detailed information on payroll expenses, including employee wages, benefits, taxes, and more.

3. Integration with Accounting Software: One of the key features of Sage 50 US Payroll is its seamless integration with accounting software such as QuickBooks or Sage 50cloud Accounting. This integration ensures that all your financial data is synchronized accurately across different platforms, making it easier for you to prepare financial statements required for PPP reporting.

4. Compliance Monitoring: To ensure compliance with changing regulations related to the CARES Act and PPP program, Sage 50 US Payroll continuously monitors updates from government authorities and automatically adjusts calculations accordingly. This feature helps you stay up-to-date with any changes in guidelines while minimizing potential risks.

5. Secure Data Storage: Protecting sensitive employee information is crucial when dealing with payroll reporting for PPP applications. Sage 50 US Payroll provides secure data storage options that allow you to store confidential employee records securely within encrypted databases or cloud-based storage solutions.

6. Time-Saving Tools: Sage 50 US Payroll streamlines various aspects of managing payroll tasks by offering a range of time-saving tools such as automated tax filing services, direct deposit options for employees' paychecks, electronic W-2 forms generation,and automatic calculation of federal tax deposits.

This enables small businesses to focus their energy on strategic growth instead of getting tangled in complex administrative processes.

#sage50uspayrollreporting#thecaresacthr748#paycheckprotectionprogram#paycheck#payrollreporting#accountingadvice#accountingsoftware

0 notes

Photo

Hinge presents an anthology of love stories almost never told. Read more on https://no-ordinary-love.co

3K notes

·

View notes

Text

Who is Not Eligible for a PPP Loan? Everything You Need to Know

Who is Not Eligible for a PPP Loan? Everything You Need to Know #PaycheckProtectionProgram #PPP #CARESAct #SmallBusinessSupport #BusinessLoans #LoanEligibility #FinancialAssistance #SmallBusiness #PPPIneligibility #SBA #EconomicRelief #BusinessCompliance #FinancialGuidance #COVID19Relief #Entrepreneurship #BusinessFunding #LoanApplication #PPPLoan #SmallBiz #BusinessGrowth #NonProfitEligibility #IndependentContractors #FinancialRecords #LegalCompliance #BusinessDocumentation #PPPFAQs #FundingOpportunities #BusinessAdvice #FinancialLiteracy

The Paycheck Protection Program (PPP), introduced as part of the CARES Act, provides essential financial support to small businesses. However, not all businesses or individuals are eligible for a PPP loan. Understanding the ineligibility criteria is crucial for ensuring compliance and avoiding potential legal or financial setbacks. Below, we’ll explore who is not eligible for a PPP loan in great…

#Business Loan Restrictions#COVID-19 Relief#Paycheck Protection Program#PPP Loan Eligibility#Small Business Financing

0 notes

Video

instagram

Great news!!! PPP deadline extended through May 31, 2021 Yessss!!! The Federally funded Paycheck Protection Program (PPP) has been approved for a 2nd distribution via SBA.gov, and partners such as KServicing (for Kabbage) and various banking institutions are currently accepting application. 🚨 IMPORTANT 🚨 In a nutshell, you qualify for 2nd draw PPP if: 👉🏾 You have fewer than 20 employees (for Independent Contractors & Sole Proprietors), and 300 or less employees (for all other business entities) 👉🏾 You previously received 1st draw PPP loan and will or has used it all for its intended purpose(s) 👉🏾 You can demonstrate/show at least a 25% reduction in gross receipts between comparable quarters in 2019 and 2020 👉🏾 You operate a Small business within the United States Funds can be used to pay mortgage interest, rent, utilities, worker protection costs related to COVID-19, uninsured property damage costs caused by looting or vandalism during 2020, and certain supplier costs and expenses for operations. One of our very own, Gillian received her 2nd draw PPP loan 1 week after applying, and she was able to have her application prepared and submitted by @apobookkeeping who provides a variety of services outside of bookkeeping and accounting. Feel free to reach out to them for assistance with your PPP application. NOTE: The 1st draw PPP loan is also still available, and the criteria has changed to include more businesses Visit SBA.gov for more detailed information about both loans and instructions to apply. :: :: :: Follow us @BlacksConverge #ppp #pppprogram #paycheckprotectionprogram #helpapplyingforppp #federallyfundedppp #blackbusinessowner #blackbusinesses #helpforblackbusinesses #blackbusinessloans #loansforblackbusinesses #freemoney #sbaloans #financialhelp #smallbusinessowner #blackentrepreneurs #shopblackbusinesses #financialhelpforblackbusinesses #getyourmoney #loanforgiveness #blackconvergence #blacksconverge (at Long Island, New York) https://www.instagram.com/p/CNVMrcoFoxi/?igshid=khw8ukz2nupu

#ppp#pppprogram#paycheckprotectionprogram#helpapplyingforppp#federallyfundedppp#blackbusinessowner#blackbusinesses#helpforblackbusinesses#blackbusinessloans#loansforblackbusinesses#freemoney#sbaloans#financialhelp#smallbusinessowner#blackentrepreneurs#shopblackbusinesses#financialhelpforblackbusinesses#getyourmoney#loanforgiveness#blackconvergence#blacksconverge

1 note

·

View note

Link

On Monday, US President Donald Trump teased about big announcements soon on both a coronavirus vaccine and drugs to treat the virus affected people.

#stéphane bancel#PaycheckProtectionProgram#PaneraBread#DrugtoTreatcoronavirus#Covid19vaccine#CoronavirusVaccine

1 note

·

View note

Photo

Payroll, mortgage interest, rent or lease and utilities are the four general uses for PPP lone. The loan should mostly be used for payroll. Quiqloans offers PPP loans for small business Los Angeles.

#smallbusinessloan#ppploans#credit#financialfreedom#loan#employeeretentioncredits#ppp#paycheckprotectionprogram

0 notes

Photo

Did You Know ❓❓❓ Hanging over the $800 billion Paycheck Protection Program, one of the government’s most expensive pandemic relief efforts, is a simple question. Did it work? New research, drawing on millions of wage and payroll records, suggests a complicated answer: Yes, but at an extraordinarily high cost. One new analysis found that only about a quarter of the money spent by the program paid wages that would have otherwise been lost, partly because the government steadily loosened the rules for how businesses could use the money as the pandemic dragged on. And because many businesses remained healthy enough to survive without the program, another analysis found, the looser rules meant the Paycheck Protection Program ended up subsidizing business owners more than their workers. #ppp #paycheckprotectionprogram #entrepreneurspirit #ownyourdreams #startupadvice #businessownership #business101 #businessformations #businesssurvival #llc #llccompany #llcmember #llcs #buildingabusiness #businessowner #supportphillybusiness #smallbusinessadvice #smallbusinessgrowth #smallbusinessconsultants #businessconsultants https://www.instagram.com/p/CZhF2zCuV9R/?utm_medium=tumblr

#ppp#paycheckprotectionprogram#entrepreneurspirit#ownyourdreams#startupadvice#businessownership#business101#businessformations#businesssurvival#llc#llccompany#llcmember#llcs#buildingabusiness#businessowner#supportphillybusiness#smallbusinessadvice#smallbusinessgrowth#smallbusinessconsultants#businessconsultants

1 note

·

View note

Photo

Banking internship provides dual major inside look into local economics

By Jaime North, digital marketing specialist

Dylan Kraus was eager to get a taste of the financial world, not waiting until his senior year at Bloomsburg University before landing an internship with one of Pennsylvania’s leading community banks.

The junior economics and political science dual major spent the summer interning with Centric Bank — headquartered in Harrisburg with seven financial centers located throughout central Pennsylvania. Kraus worked with multiple teams in finance, credit, and compliance.

“This internship was fantastic at exposing me to the intricacies of the Paycheck Protection Program and how capable banks were one of the major determinants of success for the program by efficiently issuing numerous PPP loans to their communities,” Kraus said. “I was interested to know how a bank and its customers were affected due to the COVID-19 pandemic and the protocols brought forth by it.”

He added, “Specifically, the Paycheck Protection Program, which helped many businesses stay afloat during the worst of the pandemic by applying for an SBA-backed loan allowing their employees to keep receiving paychecks.”

According to Kraus, some of the projects he was involved in included conducting annual reviews of outstanding loans, manipulating data into useful spreadsheets for accounting and analysis purposes, and researching legislation that may affect one or many of Centric Bank’s financial services.

Kraus was also given the opportunity to work on and present a case study based on a hypothetical loan request to a local dentist.

“My partner and I were tasked with analyzing the request, then doing a presentation on our findings and providing a recommendation on whether to move forward with the loan or not,” Kraus said. “This included reviewing financial statements for the business and its owner, the individual’s credit worthiness, details about the loan package itself, and the current state of the economy.”

Kraus said the internship exposed him to a lot of aspects of banking and finance. All of which he was ready for.

“Taking economics courses helped prepare me for this internship by introducing me to basic terms and concepts related to the financial services sector,” Kraus said. “The theories allowed me to have a foundation of understanding why certain aspects of the economy behave a certain way.”

He added, “The accounting courses in the business economics track also helped prepare me through learning the meaning of different parts of financial statements, the different parts of each type of financial statement, and the basic ratios for them too.”

Overall, Kraus said he came away with not only a valuable learning experience with Centric Bank but also got more clarity on his future career pursuits.

“The part of this internship that spoke to me is being able to work and learn at a respected community bank in Pennsylvania,” Kraus said. “Also, knowing you get to be a part of work that’s essential for your community’s wellbeing, as well as working on projects that are important to local entrepreneur’s operations made this internship opportunity fulfilling.”

#HuskyUnleashed#ProfessionalU#LiberalArts#economics#PoliticalScience#internship#banking#PaycheckProtectionProgram#CentricBank

0 notes

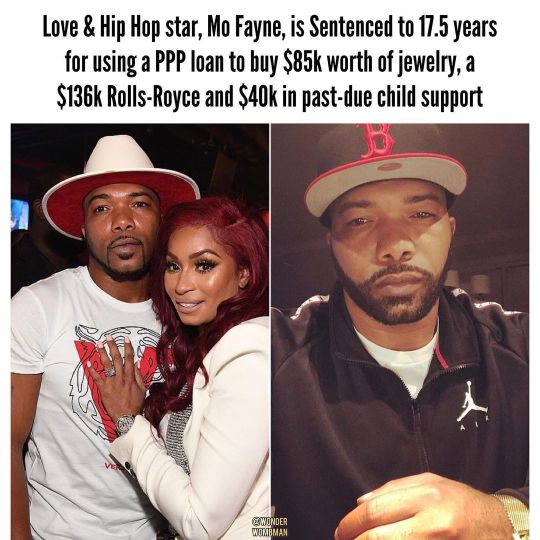

Photo

#Love&HipHop: Atlanta star and rapper #MoFayne has been sentenced to 17.5 years in prison and must pay $4,465,866 in restitution for his role in a federal bank fraud. The 38-year-old reality TV personality pleaded guilty to six counts, including bank and wire fraud, after funding an over-the-top lifestyle during the pandemic with money from the #PaycheckProtectionProgram (#PPP). The money was meant to help small businesses and employees gravely impacted by C-19 keep their workers and maintain payroll. Fayne submitted a fraud $3.7million PPP loan application falsely claiming his trucking business - Flame Truckinig - had 107 employees and an average monthly payroll of $1,490,000, He used the money to buy $85,000 worth of jewelry; a $136,000 Rolls-Royce; $40,000 in past-due child support; and $90,000 to start a new business in #Atlanta, according to TMZ. Fayne cut a plea deal with prosecutors who agreed to drop 14 other charges and recommended he spend 151 months behind bars. On Wednesday a judge ruled 210 months in prison instead. If he didn't cut the plea deal the reality star faced a 30-year sentence for making the false statement to a federally-insured financial institution and money laundering, in addition to wire fraud in connection with a Ponzi scheme. Fayne first made headlines when he was arrested back in May 2020 for the crime. He was indicted in Georgia by a federal grand jury a month later. Authorities said that Fayne's Ponzi scheme involved him posing as the owner of Flame Trucking, a profitable trucking company, from August 2014 through May 2020. The business, however, never actually made enough money to cover its expenses, according to the US Attorney's Office. During that time, Fayne supposedly managed to get 20 people to invest over $5million in the company, promising to use the money to purchase and operate his trucks. Instead, authorities said, he used the money to 'pay his personal debts and expenses, and to fund an extravagant lifestyle for himself'. #SWIPELEFT https://www.instagram.com/p/CT3cvVqgPfn/?utm_medium=tumblr

0 notes

Photo

Restaurants Brace For Federal Aid To Run Dry Before They Get Help MILWAUKEE, Wis. — The American Rescue St... Read the rest on our site with the url below https://worldwidetweets.com/restaurants-brace-for-federal-aid-to-run-dry-before-they-get-help/?feed_id=14230&_unique_id=60a15007af2f1 #americanrescueplan #Milwaukee #paycheckprotectionprogram #Restaurants #smallbusinessadministration

0 notes

Photo

Restaurants Brace For Federal Aid To Run Dry Before They Get Help MILWAUKEE, Wis. — The American Rescue St... Read the rest on our site with the url below https://worldwidetweets.com/restaurants-brace-for-federal-aid-to-run-dry-before-they-get-help/?feed_id=14229&_unique_id=60a150068a50f #americanrescueplan #Milwaukee #paycheckprotectionprogram #Restaurants #smallbusinessadministration

0 notes

Photo

Hinge presents an anthology of love stories almost never told. Read more on https://no-ordinary-love.co

508 notes

·

View notes

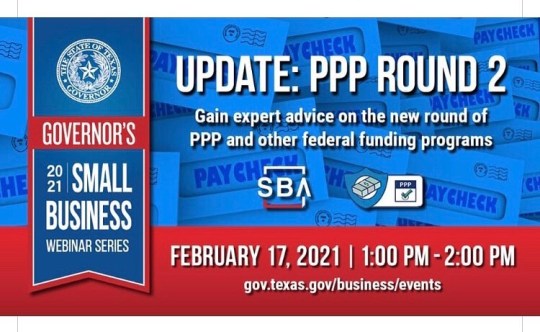

Photo

Upcoming Governor’s #SmallBusiness Webinar Feb. 17 Hear from a panel of experts on the new round of #PaycheckProtectionProgram funding and other assistance through the U.S. Small Business Administration. Register here: https://bit.ly/3730KOl #MoreThanHome #StrongerTogether #PPP https://www.instagram.com/p/CLKu6nQlqkQ/?igshid=ybfs4xttql6b

0 notes

Link

#paycheckprotectionprogram#loansforpayroll#completefunding#employeebenefitloans#completefundinggroup

0 notes

Link

Trump administration and US congressional negotiators are too close to reaching a deal in order to approve $300 billion more for lending small business programs.

#us treasury secretary#StevenMnuchin#PaycheckProtectionProgram#Democrats#congressionalnegotiators#ChuckSchumer#CARESAct

1 note

·

View note

Photo

Quiqloans Gives PPP Loans For Small Business In Los Angeles.

The PPP loan provided assistance in refunding lost business expenses. Payroll might also be done with it. That was the paycheck protection program's main objective. If your need a PPP lone for your small business in Los Angeles, Quiqloans is providing PPP lone for your small business. Also we are providing Personal Credit cards, Term Loan, Business Credit Card, Bank Roll and Flex Pay Business Loans.

#loan#smallbusinessloan#ppploans#credit#financialfreedom#employeeretentioncredits#paycheckprotectionprogram#ppp

0 notes

Photo

Hinge presents an anthology of love stories almost never told. Read more on https://no-ordinary-love.co

2K notes

·

View notes

Photo

DEADLINE IS TODAY FOR SBA PPP! Paycheck Protection Program #SBA #PPP #PaycheckProtectionProgram #Apply #Deadline #DeadlineDay #Today #SBALOAN #loans #lender #bank #money #loan #fund #funding #SmallBusiness #Emergency #Assistance #support #help https://www.instagram.com/p/CCEZzGujsyK/?igshid=1v3c7twmczfpz

#sba#ppp#paycheckprotectionprogram#apply#deadline#deadlineday#today#sbaloan#loans#lender#bank#money#loan#fund#funding#smallbusiness#emergency#assistance#support#help

0 notes