#payroll calculation

Explore tagged Tumblr posts

Text

AI Time Clock automates time calculations, tracks hours and breaks accurately, and integrates with Kronos, ensuring precise payroll processing. It eliminates manual errors and enhances efficiency in timekeeping for HR professionals.

#ai in hr#artificial intelligence#workforce management software#payroll calculation#UKG#CloudApper AI TimeClock

0 notes

Text

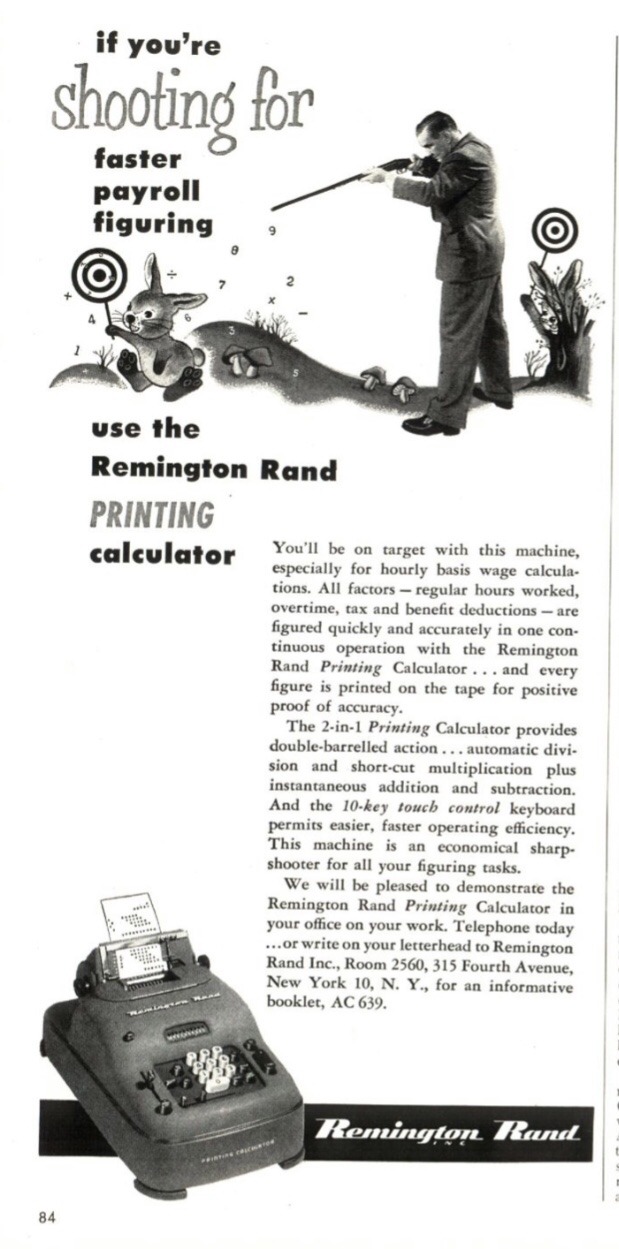

1953 Remington Rand Printing Calculator

#1953#Remington Rand#calculator#office#payroll#vintageadsmakemehappy#vintage magazine#vintage advertising#magazine#advertising#1950s#50s

35 notes

·

View notes

Text

If your employer fires you without cause you can file for unemployment benefits! Which probably most people know, but what people DON’T know is that former employees claiming unemployment benefits can make the employer have to pay higher taxes. Not like, a ton, but still—you get to hit back just a little bit.

#I’m a payroll person and not an HR person so this is most of what I know about unemployment claims#states do annual reviews of how much unemployment benefits had to be paid out to former employees of a company#and they use that to calculate the rate of unemployment insurance tax the employer has to pay#rates can be really low for responsible employers#but even when they’re super high it’s usually just like 6% of the first 12k of taxable wages#12k being a VERY general number#some states cap taxable wages for SUI at 7k (same as federal unemployment tax)#and OTHERS (looking at you Washington…always making trouble…)#some of them have taxable wage bases of over 60k#which is insane#it’s pretty much all western states with higher wage based#anyways this has been Payroll Tax with your favorite Rogue Xenolith

1 note

·

View note

Text

Calculating payroll hours is an important task to ensure employees are paid correctly and on time. Many managers and business owners find it tricky to track work hours and handle payroll without errors. In this article, readers explore a simple step-by-step guide to calculate payroll hours accurately and efficiently. The guide breaks down the process in easy terms to help avoid mistakes and save time. It is a helpful resource for anyone managing employee work hours and payroll responsibilities.

0 notes

Text

Reliable Payroll Services for Australian Businesses | Collab Accounting

Streamline your payroll process with expert support from Collab Accounting. Our team offers efficient, compliant, and fully managed Payroll Services tailored to Australian businesses. From salary processing and payslip generation to superannuation and STP (Single Touch Payroll) reporting, we ensure your employees are paid on time accurately and hassle-free. Let us simplify your payroll so you can focus on growing your business.

#payroll services Australia#Collab Accounting#managed payroll#STP compliance#payslip processing#salary calculation#employee payroll#payroll outsourcing#superannuation reporting#payroll management for businesses

0 notes

Text

The Ultimate Guide to Choosing the Right 1040 ES Form Creator

The IRS requires these payments using Form 1040-ES, which can be complex and time-consuming to prepare manually. A 1040 ES Form Creator automates much of this process by calculating your tax due, generating accurate forms, and tracking your payments.

#1040 ES Form Creator#Free Payslip Generator Online#Salary Slip Generator#Online Payslip Generator#Salaried Pay Stub#Payroll Generator#Real Paycheck Stubs#Paycheck Now#How To Make Check Stubs#Make Check Stubs#Check Stubs#Paystub Maker Online#Direct Deposit Check Stub#Pay Check Generator#Check Stub Maker Online#Checkstub Generator#Generate Paystub#Generate W2 Form#Create W2 Form Online#Make W2 Online Free#Generate 1099 Misc Online#Free 1099 Generator#Free W4 Generator#W4 Generator Calculator#Free W9 Generator#W9 Generator Calculator#W7 Maker Online#Free W7 Form Generator#Generate 1099 C Form Online#Online 1099-C Form Generator

0 notes

Text

How ELDs Impact Trucking Payroll Calculations?

Electronic Logging Devices (ELDs) have transformed the way the trucking industry tracks hours of service (HOS), improving safety and compliance with federal regulations. But beyond their primary role in monitoring driving time, ELDs also significantly impact trucking payroll calculations. These devices provide real-time, automated data that streamline payroll processes, reduce errors, and enhance overall operational efficiency. Understanding how ELDs affect payroll is essential for both trucking companies and drivers alike.

Accurate Tracking of Hours Worked

Before ELDs became mandatory under the FMCSA’s ELD mandate, many trucking companies relied on paper logs or manual time tracking to calculate pay. These methods were prone to human error, intentional manipulation, and inconsistencies. ELDs, however, offer a reliable and tamper-resistant way to log a driver’s hours on the road and during rest periods.

With ELDs, companies can accurately calculate how long a driver has been working each day, including drive time, on-duty not driving, and rest breaks. This precision ensures that drivers are paid correctly according to their pay structure—whether it’s hourly, per mile, or by the load. It also helps companies comply with labor laws related to overtime and rest requirements.

Streamlining Payroll Processing

One of the key benefits of ELDs in payroll management is automation. Since ELDs are connected directly to the vehicle’s engine, they record data in real time and can integrate with payroll systems. This automation reduces the administrative burden of manual entry, lowers the chances of discrepancies, and speeds up the payroll process. For example, if a driver is paid by the mile, ELDs can provide exact mileage reports to calculate pay quickly and accurately.

By automating the collection of critical data, ELDs also reduce disputes between drivers and employers over hours worked or compensation earned. This transparency builds trust and ensures that everyone is on the same page.

Compliance and Auditing

ELDs play a critical role in maintaining compliance with federal labor and tax regulations. Inaccurate or incomplete payroll records can trigger audits and result in fines. ELDs maintain detailed logs that serve as reliable documentation for payroll and compliance purposes. If an issue arises, these logs provide concrete evidence to support payroll calculations.

The Role of Experts in Trucking Payroll Services

While ELDs provide valuable data, interpreting and applying that data correctly for payroll purposes can still be complex—especially for multi-state operations or companies with a mix of pay structures. That’s where experts offering trucking payroll services become indispensable. These professionals know how to integrate ELD data into payroll systems, ensure compliance with regulations, and optimize payment processes to benefit both the company and its drivers.

They also help tailor payroll systems to reflect the unique requirements of the trucking industry, including handling per diem, overtime, bonuses, and multi-jurisdictional tax rules. Their expertise ensures that payroll runs smoothly, accurately, and legally.

Conclusion

ELDs have revolutionized how trucking companies calculate payroll, making the process more accurate, efficient, and compliant. By leveraging the detailed data ELDs provide and working with experts in trucking payroll services, companies can ensure fair compensation for drivers while reducing administrative burdens and legal risks.

0 notes

Text

GOD it is so satisfying when I have to calculate something at work and it's correct. Makes me feel very powerful

#alek talks#this is so funny because im an english major. my whole life I've been like#doing humanities or liberal arts whatever you call it#in middle school i barely passed math in high school#well i actually liked it more cause i liked algebra#but because im dyslexic i would always mix up numbers in long equations so the method was right but the answers were wrong#and i just kinda#accidentally and gradually wormed myself into working in payroll just by the virtue of 1) speaking english 2) just being generally#good at problem solving or whatever. im missing the english word equivalent here (which is a shame its a good word)#and now i calculate people's taxes?#really goes to show like what you do at school and what you do for college/university has so little meaning. lol

1 note

·

View note

Text

Efficient Payroll Management Solutions for Accurate and Timely Employee Compensation

Efficient payroll management is essential for maintaining employee trust and ensuring compliance with financial regulations. Payroll software simplifies the process by automating salary calculations, tax deductions, and payment scheduling. This technology reduces errors, saves time, and provides detailed reports for compliance and transparency. A modern payroll solution integrates seamlessly with other HR functions, offering scalability and customization to meet the unique needs of businesses. Streamline your payroll process to enhance accuracy, reduce administrative burden, and ensure timely employee payments.

More info: https://ahalts.com/solutions/hr-services/complete-payroll

#Payroll Management#Payroll Software#Salary Processing#Tax Deductions#Employee Compensation#Wage Calculation#Automated Payroll#Compliance Reporting#Payment Schedules#HR Payroll Solutions

0 notes

Text

Payroll Tax vs Income Tax: A Comprehensive Comparison Guide

Uncover the critical differences between payroll tax and income tax in this detailed comparison. Payroll tax vs income tax explains how these taxes are calculated, who pays them, and their impact on both employees and employers. This guide simplifies complex tax concepts, helping you understand their roles in the U.S. tax system and how they affect your paycheck and business operations.

0 notes

Text

Excel Magic Trick 885: Calculate Payroll Penalty For Every 15 Minute Late QUOTIENT & MOD

Download Excel Start File: … source

0 notes

Text

Step-by-Step: How to Use a Washington Paycheck Calculator and Paystub Creator for Accurate Payroll

ensuring accurate payroll is critical for both employers and employees. It’s not just about getting the numbers right; it’s about transparency, trust, and compliance with state regulations. For businesses in Washington state, there are unique tax requirements and deductions that must be taken into account. Thankfully, tools like the Washington Paycheck Calculator and Paystub Creator can make this process much easier.

This blog will take you through the step-by-step process of using a Washington paycheck calculator and a paystub creator to ensure accurate payroll, while also highlighting some key features and benefits of free paystub generators.

Why Accuracy Matters in Payroll

Before diving into the technical steps, it's important to understand why payroll accuracy is so vital:

Employee Trust: Employees rely on their paycheck to reflect the correct hours worked, wages, and deductions.

Legal Compliance: Incorrect payroll can lead to penalties, fines, and even lawsuits if not handled properly. Washington, like many states, has its own set of labor laws and tax requirements that need to be adhered to.

Record-Keeping: Accurate payroll records are critical for tax filing, audits, and ensuring compliance with both state and federal laws.

Understanding Washington Payroll Taxes

Washington state has no income tax, but it does have other deductions that must be considered when calculating payroll:

Federal Income Tax: Based on the employee’s W-4 form, the federal income tax must be deducted from each paycheck.

Social Security and Medicare: Employers must withhold 6.2% for Social Security and 1.45% for Medicare from an employee’s wages.

State-Specific Deductions: Washington has unique deductions like the Paid Family and Medical Leave (PFML) program and workers' compensation insurance, which employers need to account for.

L&I Contributions: Washington businesses also contribute to the Department of Labor & Industries (L&I) for worker safety programs and insurance.

Given the complexity, a Washington paycheck calculator can help you get these numbers right.

Step 1: Gather Essential Payroll Information

Before using any calculator or paystub generator, gather all relevant payroll information:

Employee’s wage: Whether hourly or salaried, you need to know the employee’s rate of pay.

Hours worked: For hourly employees, accurate tracking of hours worked is key.

Overtime (if applicable): Washington follows federal guidelines for overtime pay, which is 1.5 times the regular rate for any hours worked beyond 40 in a week.

Deductions: Know the specific deductions that apply to your employees, such as federal taxes, Medicare, Social Security, PFML, and L&I contributions.

Step 2: Using the Washington Paycheck Calculator

Now that you have the necessary information, it’s time to use a Washington paycheck calculator.

Find a Reliable Calculator: A simple online search will bring up several Washington paycheck calculators. Make sure to choose one that’s up-to-date with state tax regulations. A free paycheck calculator will work just as well as any paid version.

Input Basic Information:

Enter the employee’s gross income (either hourly rate multiplied by hours worked or monthly salary).

Input the pay frequency (weekly, bi-weekly, monthly).

Choose the correct tax filing status based on the employee’s W-4.

Add Deductions:

Input the correct amounts for federal income tax, Social Security, and Medicare.

Make sure to also input Washington-specific deductions like PFML and any L&I insurance contributions.

Calculate: Once all fields are filled, click "calculate" to get the net pay. The calculator will provide a breakdown of all taxes and deductions, ensuring an accurate paycheck amount for the employee.

Step 3: Generating Accurate Paystubs with a Paystub Creator

Once you’ve used the Washington paycheck calculator to determine net pay, it’s time to generate paystubs. Paystubs are not just a record of earnings but are also crucial for employees to track their income, taxes paid, and deductions. If you run a small business or work as a freelancer, using a paystub creator can simplify this process.

Here’s how to use a paystub creator effectively:

Choose a Free Paystub Generator: There are many online paystub generators that offer free services. A paystub generator free of charge can still provide all the essential details you need for an accurate and professional-looking paystub.

Enter Employee Information: Fill in basic employee details such as name, address, and Social Security number (or Taxpayer ID).

Input Employer Information: Enter your business details, including the company name, address, and employer identification number (EIN).

Add Earnings and Deductions:

Input the employee’s gross wages as calculated from the paycheck calculator.

Add the taxes and deductions (Social Security, Medicare, PFML, etc.) to ensure that the net pay matches what was calculated earlier.

Review and Generate: Review the paystub to ensure all information is correct, then click “Generate” to create the paystub. Most free paystub generators allow you to download or email the stub directly.

Benefits of Using a Paystub Creator

Using a paystub creator, especially one that’s free, has several benefits for business owners and freelancers:

Time-Saving: A paystub creator automates the process, so you don’t need to manually input all the data or create your own paystubs from scratch.

Professionalism: Automatically generated paystubs look professional and include all the necessary details, such as employer and employee info, earnings, and deductions.

Compliance: Paystub creators ensure that you’re including all legally required deductions and information, helping you stay compliant with state and federal laws.

Record-Keeping: Digital paystubs can be saved for future reference, providing a simple and efficient way to maintain accurate payroll records.

Step 4: Double-Check for Accuracy

Once you’ve created the paystubs using the generator, it’s always a good idea to double-check for any mistakes. Payroll errors can be costly and time-consuming to correct, so ensuring accuracy upfront can save you a lot of hassle.

Here’s a quick checklist to review:

Ensure all employee information is correct (spelling of names, addresses, SSNs, etc.).

Double-check earnings, deductions, and net pay amounts match what was calculated in the paycheck calculator.

Make sure the dates and pay periods are correct.

Step 5: Distribute Paystubs to Employees

Once everything has been reviewed and finalized, you can distribute the paystubs to your employees. Most paystub creators offer options to download the stubs as PDFs, email them directly, or even print them for distribution.

Why Use a Free Paystub Generator?

For small businesses or freelancers, investing in expensive payroll software might not be feasible. That’s where free paystub generators come into play. A paystub generator free of charge offers a cost-effective solution without compromising on quality or compliance.

Some benefits of using a free paystub generator include:

Cost Savings: You don’t have to spend money on software or subscription fees, which is ideal for small businesses and freelancers working with tight budgets.

Easy to Use: These tools are designed for simplicity, allowing you to generate paystubs in just a few steps.

Compliant: Even free generators ensure that your paystubs meet legal requirements, especially with deductions and tax breakdowns.

Conclusion

Accurate payroll is essential for any business, and using tools like the Washington Paycheck Calculator and Paystub Creator can streamline this process. Whether you’re a small business owner, freelancer, or part of a larger organization, these tools help ensure that you’re compliant with Washington state’s tax laws and provide your employees with clear, accurate paystubs. By using a paystub generator free of charge, you can manage payroll efficiently without breaking the bank.

#Washington Paycheck Calculator#paystub generator#paystub creator#check stub generator#free paystub generator#paystub generator free#check stub maker#pay stub generator#paystub maker#check stub creator#pay stub generator free#paycheck generator#free paystub maker#paycheck stub maker#free pay stub generator#pay stub creator free#paycheck generator free#paycheck stub generator free#check stubs maker#free check stub maker#free pay stub template with calculator#paystubs generator#payroll stub generator free#generate check stubs

0 notes

Text

Explore our transparent pricing at Black Piano, designed to give businesses clear and competitive options when building and managing remote teams. Our flexible pricing structure caters to various needs, whether you're hiring virtual employees, IT staff, or outsourcing administrative tasks. We believe in offering straightforward, no-hidden-cost plans that ensure you get the best value while maintaining full control over your workforce. Let us help you scale efficiently with a pricing model that fits your business goals.

#employee cost calculator#true cost of an employee#w#business#employment#offshoring#employer of record#outsourcing#uk business#payroll services

0 notes

Text

Top 10 Features To Look For In An Accounting Calculator For Salary Tax

Navigating the intricate landscape of payroll management and salary tax calculation can be daunting for businesses of all sizes.

0 notes

Text

Recent Updates And Changes In Singapore's Company Tax Rate: What Businesses Need To Know

Singapore is widely recognised for its advantageous taxation policies for businesses, playing a pivotal role in its reputation as a premier global business hub. The corporate tax framework is strategically crafted to bolster business growth while fairly balancing the tax load.

Administered by the Inland Revenue Authority, corporate tax rates in Singapore apply to foreign-sourced income only when remitted into the country. This underscores the city-state's territorial approach to taxation. This brief overview lays the groundwork for comprehending the recent modifications to companies' fiscal obligations and the ensuing ramifications for businesses within Singapore.

Recent Changes In Singapore's Taxation For Companies

To maintain its competitive edge and adapt to the evolving economic climate worldwide, the government has judiciously revised policies of corporate tax in Singapore. These alterations are a testament to the government's dedication to nurturing a conducive business climate and to its foresight in financial stewardship.

The updated fiscal responsibilities are a critical consideration for businesses as they devise their fiscal strategies and operational expenditures.

What Are The Reasons Behind These Changes?

The rationale for amending the tax policies is multifaceted. The primary objective is to stay in step with international tax reforms and to remain competitive in the global market. Furthermore, the revisions are intended to encourage investments and spur innovation within the national economy, cementing Singapore's appeal as a hub for both well-established and burgeoning businesses. By fine-tuning the fiscal rates, the government showcases its ability to swiftly respond to economic currents and its unwavering commitment to fostering a dynamic business ecosystem.

Impact On Different Business Structures

The recent recalibration of the company tax rate in Singapore has far-reaching effects on various business entities. From the compact operations of SMEs to the sprawling networks of MNCs, the tax revisions call for a meticulous reassessment of fiscal responsibilities and potential advantages.

So, you must examine how the new tax rates affect businesses of various sizes and organisational structures, revealing the strategic considerations that corporate decision-makers must navigate in this evolving fiscal landscape. It aims to provide insight into the impact of the new tax environment on corporate decision-making processes.

Comparative Analysis

You must evaluate Singapore's refreshed company tax rates side-by-side against those of other principal economies around the globe. By analysing tax regimes' variances and parallels, you can better understand Singapore's position in the worldwide tax arena. This analytical exercise is invaluable for MNCs contemplating a foray into Singapore or entities aiming to calibrate their tax approaches to a standard that meets global competitiveness.

Implications For Business Planning And Strategy

In the wake of Singapore's company tax rate modifications, it's incumbent upon businesses to revisit and refine their fiscal forecasts and strategic blueprints. This discourse will investigate the ways in which the updated tax rates might sway corporate structuring, investment scheming, and the overarching strategic direction.

Firms must factor in these tax-related nuances to fine-tune their operations and capitalise on possible tax-related boons. Furthermore, the tax rate alterations could sway liquidity management, prompt a rethinking of pricing schemas, and instigate a reassessment of financial estimations. It's paramount for business leaders to keep abreast of these tax transformations and assimilate this intelligence into their strategic foresight to sustain a competitive posture.

Compliance And Reporting Requirements

In light of the recent revisions to Singapore's company tax rate, it has become essential for businesses to grasp the nuances of the new compliance and reporting mandates that have emerged. This aims to elucidate the revised regulatory duties organisations must now fulfil.

Adhering to the current tax regulations is vital for companies to sidestep fines and uphold their reputable status with the Inland Revenue Authority of Singapore (IRAS). The tax rate adjustments have led to alterations in the reporting protocols, requiring companies to familiarise themselves with these changes. It's essential to ensure that tax submissions remain accurate amidst these adjustments. Subsequent subsections will elaborate on the essential actions and documents that businesses must procure to stay compliant within this altered tax landscape.

Expert Insights And Recommendations

To adeptly navigate the recent changes to Singapore's company tax rate, specialists recommend an active stance in reassessing fiscal and taxation plans. For businesses operating within the dynamic Singaporean economy, understanding the implications of the company tax rate Singapore adjustment is crucial. Companies are encouraged to seek guidance from tax experts to fully comprehend how the new tax rates may impact their daily operations.

Additionally, companies must explore any available tax reliefs and deductions that the revised tax framework may offer. Experts also emphasise staying current with ongoing tax reforms and policy shifts, as these could significantly affect business planning and strategic decision-making. By leveraging expert knowledge, companies can better adjust to the evolving tax environment, ensuring they remain compliant and abreast of the latest statutory obligations.

Future Outlook

In anticipation of what lies ahead, Singapore's business community must remain alert and flexible in the face of continuous global tax dynamics. The recent recalibration of the company tax rate underscores the government's commitment to preserving Singapore's status as a competitive business environment while also catering to economic demands.

It will delve into expected future movements in tax policy, the potential rollout of novel tax incentives or measures, and the overarching fiscal strategies that may influence the corporate tax framework in Singapore. By staying forward-looking, businesses can gear up for upcoming shifts and secure a robust stance to tackle forthcoming tax changes.

#open company in singapore#starting a business in singapore as a foreigner#company tax rate singapore#corporate tax singapore#singapore tax calculator#loc application#business license singapore#payroll services singapore

0 notes

Text

Why Check Stub Maker Online Is Great Tool In These Days?

You know what, choosing a good Check Stubs maker offers professionally designed templates. It means, this can be customized to match your brand. Further, it is effortless to add your business logo, select the format, and input the necessary information.

#Check Stub Maker#How To Make Check Stubs#Make Check Stubs#Direct Deposit Check Stub#Online Paystub Generator#Pay Generator#Checkstub Generator#Salary Slip Generator#Free Payslip Generator Online#Salaried Pay Stub#Payroll Generator#Real Paycheck Stubs#Paycheck Now#W2 Generator Calculator#Free 1099 Generator#Make W4 Online#Generate W9 Online#Online W7 Form#Generate 1099 C Form Online#Make 8809 Forms#Free SS 4 Generator#8995 Form Maker#Schedule B Form 941 Instructions#Online 1099-Div Form#1099 OID Example#Generate 1099 INT Form#Generate 1099 G Form Online#Create 1040 Form Online#Online 1099 NEC Form#Online 1099 R Form

0 notes