#payroll software solutions

Explore tagged Tumblr posts

Text

Small Business Payroll Made Simple with Smart Software

Managing payroll shouldn’t be a headache—especially for small businesses. Finding the best payroll for small business means choosing a solution that’s easy to use, accurate, and takes the hassle out of taxes and compliance.

At Pingaksho Technologies, a leading software development company, we don’t just build software—we solve real problems. From custom payroll systems to full business automation, we create tools that help you work smarter, not harder.

Let us help you streamline your payroll and grow with confidence.

#best payroll for small business#payroll software solutions#small business automation#software development company#custom payroll software

0 notes

Text

How To Simplify Tax Compliance With An HR Payroll And Accounting System

Managing tax compliance can be a daunting task for businesses of all sizes. The complexities of staying up-to-date with tax regulations, ensuring accurate deductions, and filing timely returns can become overwhelming. However, with the right HR Payroll and Accounting System in place, these challenges can be significantly simplified. At Ignite HCM, we specialize in providing innovative solutions that streamline your business operations, including tax compliance.

In this blog, we’ll explore how an HR Payroll and Accounting System can make tax compliance more efficient and stress-free while improving overall business performance.

The Challenges of Tax Compliance

Before diving into the solution, let’s look at some common challenges businesses face with tax compliance:

Complex Regulations: Tax laws frequently change, and keeping up with federal, state, and local requirements can be difficult.

Human Errors: Manual payroll processing increases the risk of miscalculations and missed deadlines.

Time-Consuming Processes: Filing taxes involves gathering data, cross-checking records, and ensuring every deduction is accounted for.

Penalties and Fines: Non-compliance due to errors or delays can result in costly penalties.

These challenges emphasize the need for an efficient, automated system to handle tax compliance seamlessly.

What is an HR Payroll and Accounting System?

An HR Payroll and Accounting System is a technology solution that integrates payroll, HR management, and accounting functions into one platform. This system ensures accurate employee compensation, tracks financial data, and simplifies tax reporting processes. At Ignite HCM, we offer tailored HR Payroll and Accounting Systems designed to meet the unique needs of businesses in various industries.

How an HR Payroll and Accounting System Simplifies Tax Compliance

Automated Tax Calculations One of the most significant advantages of using an HR Payroll and Accounting System is its ability to automate tax calculations. These systems are programmed to:

Calculate federal, state, and local taxes based on current regulations.

Automatically adjust tax rates for employees in different locations.

Apply the correct deductions for Social Security, Medicare, and other contributions.

By automating these processes, businesses eliminate manual errors and ensure precise calculations every pay period.

2. Real-Time Updates on Tax Regulations Tax laws and regulations can change frequently. Keeping track of these updates manually can be both time-consuming and risky. HR Payroll and Accounting Systems from Ignite HCM are equipped to handle these changes in real-time.

The system automatically updates tax rates and compliance requirements.

Alerts notify HR and accounting teams of upcoming changes or deadlines.

This ensures your business always stays compliant without the need for constant manual monitoring.

3. Seamless Integration of Payroll and Accounting Integrating payroll with accounting is critical for accurate tax reporting. An HR Payroll and Accounting System streamlines this integration by:

Automatically transferring payroll data to accounting ledgers.

Ensuring deductions, bonuses, and benefits are accurately recorded.

Simplifying financial audits with centralized data storage.

This level of integration reduces the chances of discrepancies and makes tax filing more straightforward.

4. Comprehensive Reporting and Documentation Tax compliance requires thorough documentation. With an HR Payroll and Accounting System, generating and organizing these documents is effortless.

Generate W-2s, 1099s, and other tax forms with just a few clicks.

Access historical payroll data for audits or tax filing purposes.

Create custom reports to analyze payroll and tax trends.

At Ignite HCM, our systems provide robust reporting tools to ensure you have all the necessary information for tax compliance at your fingertips.

5. Ensuring Timely Tax Filings Missing tax deadlines can result in hefty fines and penalties. HR Payroll and Accounting Systems help businesses stay on track by:

Setting up automated reminders for tax deadlines.

Scheduling payroll runs to align with tax filing schedules.

Filing taxes directly through the system in some cases.

This reduces stress for HR and accounting teams and ensures compliance with minimal effort.

6. Enhanced Security for Sensitive Data Tax data includes sensitive employee and financial information. HR Payroll and Accounting Systems are designed with robust security features to protect this data.

Encryption ensures secure storage and transmission of information.

Role-based access controls limit data visibility to authorized personnel.

Regular backups protect against data loss.

With Ignite HCM, your tax data is safeguarded, giving you peace of mind during tax season.

Why Choose Ignite HCM for Your HR Payroll and Accounting System?

At Ignite HCM, we understand the unique challenges businesses face when managing payroll, accounting, and tax compliance. Our solutions are:

Customizable: Tailored to your specific business needs.

User-Friendly: Intuitive interfaces that simplify complex processes.

Scalable: Designed to grow with your business.

Supportive: Backed by a dedicated support team to assist you every step of the way.

Our HR Payroll and Accounting Systems empower businesses to focus on growth while we handle the complexities of tax compliance.

Additional Benefits of an HR Payroll and Accounting System

Apart from simplifying tax compliance, these systems offer numerous other benefits:

Improved Employee Satisfaction: Accurate and timely payroll processing leads to happier employees.

Cost Savings: Automation reduces the need for extensive manual labor and minimizes errors.

Better Decision-Making: Centralized data provides valuable insights into workforce and financial trends.

Regulatory Compliance: Beyond taxes, these systems help businesses adhere to labor laws and other regulations.

Conclusion

Tax compliance doesn’t have to be a source of stress for your business. By leveraging an advanced HR Payroll and Accounting System from Ignite HCM, you can simplify tax calculations, ensure timely filings, and maintain compliance with ease.

With the right tools in place, your business can save time, reduce errors, and avoid penalties, allowing you to focus on achieving your organizational goals. Let Ignite HCM be your trusted partner in streamlining HR, payroll, and accounting processes.

Are you ready to take the next step toward hassle-free tax compliance? Contact Ignite HCM today to learn more about our solutions and how they can transform your business operations.

Website : https://www.ignitehcm.com/

Email : [email protected]

Phone : +1 301-674-8033

#HR Payroll System#Accounting And Payroll#Payroll Software Solutions#HR And Accounting Integration#Tax Compliance Solutions#Business Payroll Management

0 notes

Text

Unveiling the Power of INTERAC Payroll Suite: Beyond Payroll Management

In the dynamic landscape of business operations, efficient payroll management is crucial for organizations of all sizes. The INTERAC Payroll suite emerges as a comprehensive solution that goes beyond the traditional realms of payroll processing.

I. Tightly Integrated System:

One of the standout features of the INTERAC Payroll suite is its seamless integration. Unlike standalone payroll systems, this suite is designed to work in harmony with various accounting and management applications. This tight integration ensures a smooth flow of data across different facets of your business operations, eliminating silos and promoting a holistic view of your financial landscape. From payroll data to accounting records, the INTERAC Payroll suite streamlines the entire process, saving time and reducing the risk of errors.

II. Flexibility to Suit Your Needs:

Every organization is unique, and so are its payroll requirements. The INTERAC Payroll suite recognizes this diversity and offers a high degree of flexibility. Whether your business is a startup with a small team or a large enterprise with complex payroll structures, this suite adapts to your specific needs. Customizable features and modules allow you to tailor the system to match your organization's payroll policies, ensuring accuracy and compliance with regulatory standards.

III. User-Friendly Interface:

Navigating complex payroll and accounting systems can be daunting, but the INTERAC Payroll suite addresses this challenge with a user-friendly interface. Intuitive design and easy-to-use tools make the suite accessible to users of all levels of technical expertise. From payroll administrators to HR professionals, the user-friendly interface ensures that tasks can be performed efficiently without the need for extensive training. This not only enhances productivity but also minimizes the likelihood of errors in payroll processing.

IV. Handling Any Workforce Size:

Whether you're managing a small team or a large workforce, the INTERAC Payroll suite scales seamlessly to meet your requirements. Its robust architecture is capable of handling payroll processing for businesses with just a few employees to those with thousands. This scalability makes the suite an ideal choice for businesses experiencing growth, as it can evolve alongside the organization without compromising performance or efficiency.

For more information or assistance, feel free to contact us at 800-547-6429 or email [email protected].

Visit for more information - https://www.intersoftsystems.com/interac-payroll-solutions.html

INTERAC Payroll Processing System, payroll software solutions, interac payroll software solutions

0 notes

Text

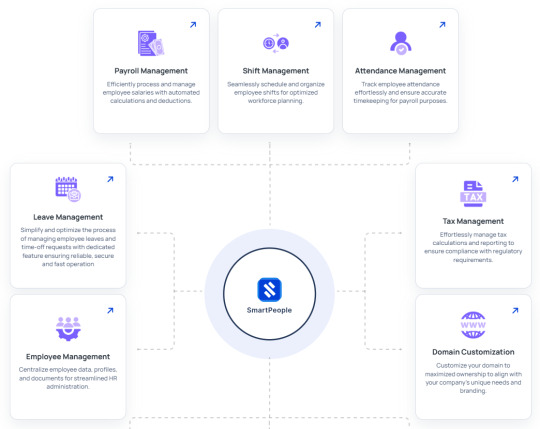

Streamline Workforce Management with SmartOffice: The Smart HR Solution

Effective workforce management is essential for success and growth in today's fast-paced business environment. SmartOffice is a cloud-based HRM solution that offers a comprehensive set of tools to meet current and future business needs. Whether managing internal growth or onboarding new hires, SmartOffice guarantees a smooth, effective, and significant HR experience.

SmartOffice unifies all crucial HR operations into a single, intuitive platform, revolutionizing the way companies handle their human resources. From hiring and onboarding to promotions and staff grouping, this one-stop shop streamlines intricate HR duties and improves overall business performance.

SmartOffice's work slot allocation feature makes onboarding easier than ever by guaranteeing that each new hire is assigned to the appropriate role right away. Productivity is increased, and new hires are able to get started quickly thanks to this strategic placement.

Employee mobility features from SmartOffice make it simple to identify and reward talent. HR professionals can highlight high performers and facilitate career advancement without administrative burden, thanks to the streamlined promotions and transitions.

Advanced access controls and employee grouping can improve security and teamwork. HR managers can assign workers to departments, roles, or projects using SmartOffice, which facilitates efficient teamwork and gives them individualized access to sensitive data.

Businesses that use SmartOffice not only stay up to date with change but also take the lead. Discover a more intelligent approach to personnel management and unleash the full potential of your company. Your doorway to effective, safe, and forward-thinking HR management is SmartOffice.

#hrm#hrmanagement#HR and Payroll Solution#HR and Payroll Software#HRMS Solution#Employee Management#employee management software#employee management system#SmartOffice#SmartPeople

3 notes

·

View notes

Text

3 notes

·

View notes

Text

Walk-in Interview For Hr Executive, Lucknow & Panchkula, salary Upto 30k, Contact Now 8188998899, 9984703333, Email- [email protected].

Visit: www.naukrihunter.com

#job#jobs#jobsearch#best jobs#job interview#career#jobs from home#hrnygirl#lucknow#hr services#hr software#hr solutions#hr management#payroll#humanresources#recruitment#hiring#job hunt#human resource management#human resource planning#human resource information system#human resource training#career company#artificial intelligence#career advice#career opportunities#career services#career center#employment#resume

2 notes

·

View notes

Text

Why Cry on Payday? Just Use Payroll Software

Payroll Is Not Rocket Science – Unless You Do It Manually

Let’s be honest: payroll is one of those things that seems easy until you have to do it. Hours to count, taxes to calculate, deductions to manage and enforce compliance. All of this leads to juggling that even circus performers would envy. For any of you who are still manually calculating numbers in spreadsheets, or worse yet, on paper, payroll is still a nightmare.

Payroll software comes to the rescue in this situation.. The unsung hero that makes payday less stressful and ensures everyone gets paid accurately and on-time (without going bald in the process).

Goodbye “Oops, I Made A Mistake”

Everyone makes mistakes. But here is the deal, in payroll even the tiniest of mistakes can spiral out of control into very large issues, probably costing your business real dollars, causing employee turmoil, and sometimes even legal trouble. Payroll software takes a way the headaches, automating the calculations and updates. If the IRS changes a tax rate, if your employee works a significant amount of overtime, if you give your employee a bonus, or if any other deductions are taken, the system handles everything.

With payroll software, "Oops, I made a mistake" becomes "Oops, I finished early today."

More Time for What Matters

Processing payroll manually is an incredible time-suck. Instead of using the hours you spent verifying hours, reconciling accounts, or fixing errors on more productive activities that help grow your company or take care of people (or maybe slip out for a quick lunch), you're doing payroll.

Payroll software takes back a lot of this time after you use it. These tools turn the tedious work of payroll into workflows that produce consistent and reliable results. It's like having the most reliable assistant who never takes a coffee break or is on social media.

Transparency and Trust with Every Paycheck

Employees want transparency in their pay. Many software providers have portals for employees (with guarantees sometimes) that allow employees to reference payslips, tax deductions, leave balances, and whatever else - all in the palm of their hand. When payroll management is transparent people trust it, there are fewer payroll questions, and most importantly, employees are happier.

When pay day comes around everyone knows what they are supposed to have paid. There are no surprises, questions, or unforeseen confusion.

Conclusion: It's Time to Stop Treating Payroll as an Unthinkable Task

Payroll is necessary for any business, but it doesn't need to be a horrific task. Best payroll software in India provides accuracy, compliance, and ease helping companies run smoothly and employees stay happy.

Still dealing with payroll manually? It may be time to reconsider your process. Make payday stress-free, accurate, and efficient with payroll software and watch your business (and your sanity) succeed.

#Best Payroll Software#Smart Payroll Software#Payroll Software#Payroll Management#Payroll#Employee Pay Software#Digital Payroll#Smart Payroll#Workplace Efficiency#Payroll Smart Solutions

0 notes

Text

No More Leave Sheets, Salary Queries – Enter HRMS

If you're still stuck in spreadsheets, juggling paper-based leave applications, or drowning in endless salary-related queries from employees — it’s time for a change. The modern workplace demands agility, accuracy, and efficiency, especially in managing human resources. That’s where a smart Human Resource Management System (HRMS) steps in.

In this blog, we’ll explore how HRMS simplifies HR operations, eliminates manual hassles, and enhances the employee experience — helping organizations save time, cut costs, and improve compliance.

What Is HRMS?

A Human Resource Management System (HRMS) is a digital solution that automates and manages core HR functions like:

Attendance tracking

Leave management

Payroll processing

Recruitment

Onboarding

Employee self-service

Appraisals

Compliance & reporting

In short, it brings every HR process under one roof – saving hours of manual effort and reducing human errors.

Goodbye Leave Sheets: Welcome Automated Leave Management

Handling leave requests manually can lead to confusion, loss of data, and compliance issues. With HRMS:

Employees can apply for leave via a web portal or mobile app

Approvals become automated with multi-level workflows

Real-time leave balances are visible to both HR and employees

Leave policies are auto-enforced, ensuring fairness and transparency

This means no more chasing down managers for approvals or updating Excel sheets for every sick day taken.

No More Salary Queries: Payroll Becomes Seamless

Salary processing is one of the most sensitive and time-consuming HR tasks. An HRMS:

Automates salary calculations based on attendance, leave, and tax rules

Generates payslips instantly

Sends auto-notifications to employees

Integrates with accounting and banking systems for seamless disbursements

Ensures statutory compliance (EPF, ESIC, TDS, etc.)

Result? Employees get paid accurately and on time. No more emails asking, "Where’s my salary slip?" or "Why was my pay deducted?"

Empower Employees with Self-Service

Modern HRMS platforms come with employee self-service (ESS) portals that reduce dependency on HR teams. Employees can:

View their attendance, leave, and salary details

Submit queries or grievances

Apply for reimbursements or loans

Update personal details or upload documents

Download payslips and tax forms

This autonomy not only reduces HR workload but also improves employee satisfaction and trust.

One System, Multiple Insights

Beyond automation, an HRMS is a powerful analytics engine. It provides:

HR dashboards with real-time workforce metrics

Insights into absenteeism, attrition, and productivity

Appraisal and performance data for decision-making

Statutory reports to ensure legal compliance

With data at your fingertips, HR leaders and management can make faster, smarter decisions.

Mobile-First HR: HRMS on the Go

In today’s hybrid work culture, HRMS platforms often offer mobile apps that allow:

Field employees to check-in/check-out with selfies and geotags

Managers to approve leaves or claims from anywhere

Remote teams to stay connected with HR processes

Mobility ensures that no matter where your team is, HR is just a tap away.

Who Needs an HRMS?

If you’re a growing business with even 20+ employees, or a large enterprise with multiple branches — HRMS brings structure, efficiency, and scalability to your HR operations. It’s especially useful for:

Manufacturing units

FMCG companies

Retail franchises

IT & service-based firms

Food & beverage brands

Whether you manage 50 or 5,000 employees, HRMS ensures consistency, compliance, and control.

Final Thoughts: Upgrade HR, Empower People

The days of overflowing files, clunky Excel sheets, and overburdened HR teams are over. A modern HRMS transforms the HR department from an administrative hub to a strategic partner.

So, if you want to eliminate leave confusion, payroll stress, and employee dissatisfaction — enter HRMS.

Let automation handle the routine, while you focus on building a happier, more productive workplace.

Looking for a Smart HRMS for Your Brand? Explore [HREasy by BETs] – A modular, mobile-first, cloud-based HRMS platform that scales with your business. ✅ Biometric Integration ✅ Mobile Attendance & Geo-tracking ✅ Auto Payroll & Compliance ✅ Appraisal & Training Modules ✅ Employee Self-Service

👉 Book a free demo today and say goodbye to HR headaches.

To know more,

Visit Us : https://www.byteelephants.com/

0 notes

Text

The Future of HR: AI-Powered Payroll with the Best HRMS Software in Bangalore

Human Resource Management is rapidly evolving, and AI-powered payroll automation is leading the change. Businesses are moving away from manual salary processing to intelligent solutions that ensure accuracy, compliance, and efficiency.

With AI-driven payroll, companies benefit from:

Error-free salary calculations

Automatic tax and compliance updates

Fraud detection and anomaly checks

Time-saving automation for HR teams

Platforms like PeopleWorks, recognized as the best HRMS and payroll software, integrate payroll with other critical HR functions. Using smart HRMS Software, businesses can manage recruitment, onboarding, attendance, and performance reviews all in one place.

Features like Geo Attendance allow real-time tracking of remote employees, ensuring accurate payroll processing. The recruitment and onboarding software automatically syncs new hires into the system, reducing manual data entry and errors.

In Bangalore’s tech-driven environment, companies are quickly adopting future-ready solutions. PeopleWorks stands out as the best HRMS software in Bangalore, offering AI-powered payroll, compliance management, and scalable modules for organizations of all sizes.

As we move into 2025, AI will make HR processes fully automated and data-driven. Businesses leveraging platforms like PeopleWorks will enjoy smarter workforce management and a competitive advantage.

Transform your HR today with PeopleWorks → Explore Now

#software development#payroll software#payroll services#hrms solutions#hr software#hr services#hrms payroll software#hrms systems#hrms software#payroll#hrmsindia#hr management

0 notes

Text

Employee Scheduling Management

#employee scheduling software#workforce management system#staff shift planning#affordable scheduling solution#free payroll integration#30SGD scheduling software#employee roster management#staff scheduling tool

0 notes

Text

Fingerprint Time Attendance Software

#fingerprint attendance system#digital time clock software#low cost attendance tracking#biometric employee management#1SGD attendance solution#payroll and attendance software#smart time tracking#employee attendance software

0 notes

Text

INTERAC Payroll Software Solutions

A fully integrated, comprehensive suite of Payroll processing software applications.

The INTERAC Payroll suite is much more than just payroll. It is a tightly integrated, flexible, user friendly suite of accounting and management applications which will handle all your payroll requirements, whether you have a few, hundreds, or even thousands of employees to manage.

Payroll & Human Resources Manager INTERAC Payroll is a robust application with the flexibility to accommodate a wide variety of client needs. It includes:

Electronic tax filing

Direct deposit (to multiple bank accounts)

Payroll supports multi-state, union, prevailing wage (certified)

User defined deduction and other pay categories

Human Resources Manager is an excellent tool for those who respond to client inquiries, making it very quick and easy to get to the wealth of information in the payroll system. It may also be used to provide clients with the same easy access to their employee information.

Document Management Automatic copies of checks, direct deposit statements, W2's and 1099's are generated directly to the employee master record. Keep an electronic employee file with all sorts of employee information.

Employee Deduction Management The integration with Accounts Payable will simplify and automate the process of collecting and disbursing employee payroll deduction to the appropriate taxing agencies and vendors.

Integrated Reporting INTERAC features integrated report writing tools and each of the core applications comes with a set of report templates, which makes getting the management information you need from the system easy. Report Manager can provide clients with their own customized list of reports in a simple point and click interface, eliminating the need for them to call every time they need an updated report

Selecting the Right System We welcome the opportunity to introduce the INTERAC Payroll Processing System and share our 30 years of experience supporting our diversified user base across the country.

For more information or assistance, feel free to contact us at 800-547-6429 or email [email protected].

Visit for more information - https://www.intersoftsystems.com/interac-payroll-solutions.html

Tags - INTERAC Payroll Processing System, Payroll processing software, Payroll Software Solutions

0 notes

Text

What Are IT Services? Defining, Designing, Delivering, & Supporting IT Solutions

The modern enterprise grapples with twin challenges:

Ensuring their organization stays ahead through innovation.

All while maintaining their existing products and processes sustainably and efficiently.

Achieving this requires well-managed IT services that are now seen as critical enablers for organizational success, with most businesses firmly entrenching digital transformation as one of the priority strategic objectives.

In this article, we will explore what IT services are, and how to manage them effectively.

What Are IT Services?

In simple terms, IT services refer to the application of technical expertise and business knowledge to help organizations create, manage, and optimize their information and business processes.

These services include everything your business uses to operate efficiently, such as:

Website Development & Maintenance

Custom Software Development

SEO & Digital Marketing

Graphic Design & Branding Solutions

eCommerce Website Development

WordPress & Open Source Development

Payroll and Business Automation Systems

Why Are IT Services Important?

From customer service portals to transaction processing and logistics management, almost every modern business operation relies on IT services. This reliance means:

IT service providers must understand the business value their solutions deliver.

Services should be delivered in an agile, secure, and cost-effective manner.

Risks affecting performance or availability must be actively mitigated.

Categories of IT Services

1. Development Services

Development services involve designing and building scalable websites, eCommerce platforms, applications, and custom software tailored to business goals. These services cover everything from creating dynamic websites and secure online stores to developing business automation tools and mobile or web applications with robust architecture and clean, maintainable code.

2. Digital Marketing & SEO

Digital marketing and SEO services focus on increasing a brand’s visibility and driving organic growth. These services typically include on-page SEO to optimise website content and structure, as well as strategic social media campaigns designed to strengthen a brand’s digital presence.

3. Design Services

Design and branding services create visual assets that effectively communicate a brand’s story while maintaining consistency across all platforms.

4. Business Solutions

These services include developing and integrating payroll systems and automation tools to streamline processes, enhance efficiency, and minimise errors.

Delivering & Supporting IT Services

Delivering IT services involves more than implementation; effective support is essential. This includes:

✔️ Request Catalogues & Support Portals – capturing, prioritising, and fulfilling user requests efficiently. ✔️ Issue Resolution Workflows – logging, assigning, and resolving issues promptly and transparently. ✔️ Continuous Communication – providing clear updates on timeframes and progress to maintain transparency.

The State of IT Services Today

Almost every business interaction today depends on IT services. They are here to stay, evolve, and expand.

At VeravalOnline Pvt Ltd, our approach to IT services goes beyond coding and design – it focuses on defining, designing, delivering, and supporting solutions that drive growth, innovation, and operational excellence for your business.

Looking to transform your business digitally? Contact VeravalOnline Pvt Ltd, today to discuss how our IT services can help you achieve your goals efficiently and sustainably.

#IT services#IT services for businesses#website development services#software development company#SEO and digital marketing services#graphic design services#business automation solutions#payroll management system development

0 notes

Text

How Geo Attendance and Cloud HRMS Are Transforming Workforce Management in 2025

As the workforce shifts to hybrid and remote-first environments, traditional HR practices are being redefined. Businesses today are not just looking for automation—they’re seeking smart, flexible, and scalable solutions that align with modern work culture. One such evolution is the growing use of Geo Attendance and cloud-based HRMS Software for seamless workforce management.

In major business hubs like Bangalore, companies are quickly realizing the need to digitize their human resource processes. The best HRMS software in Bangalore is no longer limited to handling just payroll or attendance—it’s now an intelligent system that integrates recruitment, onboarding, employee engagement, and real-time tracking into one platform.

🌍 Geo Attendance: A Must-Have in the Hybrid Era

Geo Attendance has emerged as a crucial tool for businesses managing distributed teams. It uses GPS technology to help employees check in and out from any approved location, offering HR departments better control, transparency, and trust. With the rise in field roles, sales-based teams, and remote professionals, having this feature is no longer optional—it's essential.

The added benefit? Accurate time data that directly feeds into payroll processing, ensuring error-free salary management. This is one of the many reasons businesses are shifting to the best HRMS and payroll software with built-in Geo Attendance and location intelligence.

💡 Why Smart Businesses Are Upgrading Their HRMS Stack

Modern HRMS platforms are offering more than attendance tracking—they come with features like AI-powered recruitment, digital onboarding workflows, performance management, and advanced analytics. All of this is accessible through mobile-friendly dashboards and self-service portals, empowering both employees and managers.

When evaluating vendors, many companies look for solutions that are cloud-based, secure, and designed for Indian compliance standards. That’s why organizations increasingly prefer platforms that qualify as the best HRMS software in Bangalore—known for blending functionality with flexibility.

🔄 Final Thoughts

As we move deeper into 2025, the companies that lead in digital transformation will be those that invest in intelligent HR tools. From automated onboarding to Geo Attendance and payroll compliance, an integrated HRMS solution isn’t just a tech upgrade—it’s a strategic move.

#hrms software#hrms solutions#hrms payroll software#hrms and payroll software#employee onboarding software#hr onboarding software#hrms

0 notes

Text

Need a Perfect HRMS Solution?

Managing a growing workforce doesn’t have to be complex. TrueTym is built to simplify HR oprations for businesses of all sizes—especially those in fast-moving, high-volume industries. i) Real-time attendance tracking ii) Automated payroll calculations iii) Shift & leave management iv) Compliance-ready reports v) Mobile-friendly & easy to use Whether you're handling 50 or 5,000 employees, TrueTym adapts to your needs with precision and ease. Power your HR with automation, insights, and control—without the hassle. Let’s talk about how TrueTym can transform your workforce management. Book a demo -- https://shorturl.at/bKiAc For Further info [email protected] +1 (502) 512-3595

#hrms management#hrms solutions#hrms software#hrms payroll software#hrms systems#hr services#hr management

0 notes

Text

Oh Great, Another Payday Panic? Maybe It’s Time for Payroll Software

Welcome to the Payroll Menace

Let's paint a picture we all know too well: It's the end of the month. Tension is building. The HR team looks like they haven't slept for days. Someone's Excel just crashed - again. There are voices in the ether about missing deductions, and tax slab omissions. And somewhere in the whirlwind? The most revered event in any office: payroll.

Here's the kicker - this circus exists.single. month.

If you've been in HR, you know that running payroll without marked systems is like trying to put together IKEA furniture with your hands tied, and muddled instructions. You'll get there, but it won't be without sweaty, swearing, and possibly, broken versions of what started as a simple process.

Why Is Payroll So Hard?

Because it's not just paying people.

It involves paying employees accurately, consistently, and on schedule.

In payroll software there's tax calculations, statutory deductions, bonuses, leave, reimbursements, compliance documentation, and a myriad of little variables that always seem to arrive at the most inconvenient of times.

One little miscalculation? That's not just a mathematical mistake. That's an irritated email. Quite possibly worse - that's a team who's lost trust.

Here comes Payroll Software – Not the Hero We Want, But The Hero We Need

Let’s be honest, smart payroll software is an undervalued product. It just sits in the background, crunches numbers, applies rules, organizes documents, and saves you from a spreadsheet blow up on a Friday morning over a mistake you made two weeks ago.

Better than that, it’s made for human beings, not just financial geniuses. Whether you’re in HR, operations, or a small business owner doing everything in the business—smart payroll software speaks your language.

Imagine being able to perform tax computations in a matter of seconds.being able to click once to send pay stubs. Being able to file returns without having to scroll through your PDF at 2am. Freedom!

Not a Tool – A Trust Builder

With payroll management employees will always remember things like the freebies, all the parties, and how the pizza tasted, but also remember when their salary payments came in five days late, or worse still when the salary didn't come in all!

Reliable payroll is, more than just keeping records, it is also building trust.

It allows your team to see you value their time, efforts, and peace of mind. If you ask us, knowing they are valued is worth more than you can pay them in a year-end bonus.

Conclusion

Best Payroll software in India and system outcomes are not customization.

It is a need in a society that lacks time and precision. If you're fed up with the last minute chaos of doing payroll, or just tired of dreading the 30th of each month...(not to mention the 1st of the month!)!

If you're doing payroll the hard way, you need to stop; you deserve better. Your team deserves better! Say goodbye to the panic, the mess--and let payroll software do what it was intended to do--to make payday easy, simple, and happy.

#best payroll software#smart payroll software#payroll management#smart pay solution#Smart Payroll#Modern Workplace#Business Tools#employee salary payroll software

0 notes