#payroll solution

Explore tagged Tumblr posts

Text

Looking for reliable and efficient payroll services? Unison Globus offers comprehensive payroll solutions tailored to CPAs, accounting firms, and businesses across the globe. From accurate payroll processing to compliance management, we ensure your workforce is paid on time, every time. Contact Unison Globus for a consultation and discover how our expert payroll services can save you time and money.

#Payroll services#payroll outsourcing#payroll#payroll services for small business#outsourced payroll processing for cpas#payroll management#payroll processing#payroll solution#global payroll solutions#payroll for CPAs#accounting payroll services#Unison Globus

0 notes

Text

All-in-One HR and Payroll Solutions for Growing Organizations

Coastal Payroll offers smart, efficient HR and payroll solutions built to support businesses of all sizes. You might be a startup or scaling enterprise, our all-in-one system streamlines payroll, automates compliance, and simplifies workforce management.

Enjoy real-time reporting, seamless tax filing, benefits tracking, and more; all from one powerful platform. Save time, reduce errors, and focus on growing your business while we handle the heavy lifting behind the scenes. Coastal Payroll is your trusted partner in modern business operations.

0 notes

Text

Effortless Payroll Management for Your Business! Managing payroll shouldn’t be a challenge. With our advanced technology, automate payroll processes, reduce errors, and improve efficiency. Stay ahead in business with smooth payroll operations!

📞 Call Us Today: 011 4084 8888 🌐 Learn More: www.starlinkindia.com

0 notes

Text

Why Your Business Needs Professional Bookkeeping Services

Bookkeeping is the cornerstone of any successful business, providing a clear picture of financial health and ensuring compliance with regulations. However, managing books in-house can be time-consuming and prone to errors, especially for small and medium-sized enterprises (SMEs). This is where professional bookkeeping services come into play, offering a reliable, efficient, and cost-effective solution.

In this blog, we’ll explore the importance of bookkeeping services, the benefits they offer, and how to choose the right service for your business.

What Are Bookkeeping Services?

Bookkeeping services involve the systematic recording, organizing, and managing of a company’s financial transactions. These services ensure that every financial activity such as sales, purchases, receipts, and payments is accurately recorded in the company’s books.

Professional bookkeeping services often include:

Recording day-to-day transactions.

Managing accounts payable and receivable.

Reconciling bank statements.

Generating financial reports.

Preparing for audits and tax filings.

The Importance of Bookkeeping Services

Accurate Financial RecordsKeeping precise records is essential for understanding your business’s financial position. Professional bookkeeping ensures no detail is overlooked, reducing the risk of errors that could lead to financial discrepancies.

Compliance with RegulationsIn the UK, businesses must adhere to strict accounting standards. A professional bookkeeping service ensures compliance, minimizing the risk of penalties or legal issues.

Informed Decision-MakingAccess to accurate financial data allows business owners to make strategic decisions, such as budgeting, investing, and managing cash flow.

Time SavingsManaging books in-house can be time-consuming, diverting focus from core business activities. Outsourcing this task to a bookkeeping service allows you to concentrate on growth and innovation.

Benefits of Outsourcing Bookkeeping Services

Cost-EffectiveHiring a full-time in-house bookkeeper can be expensive. Outsourcing bookkeeping services offers access to professional expertise at a fraction of the cost.

Expertise and AccuracyProfessional bookkeeping services employ experts trained in the latest accounting software and standards. This ensures accuracy and efficiency in managing your financial records.

ScalabilityAs your business grows, your bookkeeping needs will evolve. Professional services can easily scale their offerings to match your requirements.

Data SecurityReputable bookkeeping services prioritize the security of your financial data, using advanced software and encryption to protect sensitive information.

Access to Advanced ToolsBookkeeping service providers often use sophisticated accounting software such as QuickBooks, Xero, or Oracle, offering features like automated data entry, real-time reporting, and tax preparation.

Signs Your Business Needs Bookkeeping Services

Not sure if your business needs a professional bookkeeping service? Here are some telltale signs:

Frequent errors in financial records.

Difficulty keeping track of income and expenses.

Missed tax deadlines or penalties.

Limited understanding of cash flow and financial performance.

Struggles with financial planning or budgeting.

If you’re experiencing any of these challenges, it’s time to consider outsourcing your bookkeeping needs.

How to Choose the Right Bookkeeping Service

With so many options available, selecting the right bookkeeping service for your business can be overwhelming. Here are some key factors to consider:

Experience and ExpertiseChoose a service provider with experience in your industry and a proven track record of delivering accurate results.

Technology and ToolsEnsure the bookkeeping service uses reliable accounting software compatible with your business needs.

CustomizationLook for a service provider that offers tailored solutions to meet your specific requirements, such as cash flow management or tax preparation.

TransparencyThe service provider should be upfront about pricing, processes, and communication to avoid misunderstandings.

References and ReviewsCheck client testimonials and online reviews to gauge the reputation and reliability of the service provider.

Conclusion

Professional bookkeeping services are more than just a way to manage financial records they’re an investment in your business’s success. By outsourcing this crucial task, you can save time, reduce costs, and gain access to expert insights that help your business grow.

Whether you’re a startup, SME, or established company, partnering with a trusted bookkeeping service like Quality Brains can streamline operations and give you peace of mind knowing your finances are in capable hands.

At Quality Brains, we specialize in providing tailored bookkeeping services designed to meet the unique needs of businesses across various industries. From day-to-day transactions to preparing financial reports, our team ensures accuracy, compliance, and efficiency every step of the way.

If you’re ready to take your financial management to the next level, explore our professional bookkeeping services today and unlock your business’s full potential. Contact Quality Brains now, and let us guide you to a brighter financial future!

FAQs About Bookkeeping Services

Q1: What’s the difference between bookkeeping and accounting?Bookkeeping involves recording and organizing financial transactions, while accounting focuses on analyzing, interpreting, and reporting financial data. Bookkeeping is the foundation for effective accounting.

Q2: Can small businesses benefit from bookkeeping services?Absolutely. Small businesses often lack the resources to hire in-house bookkeepers, making professional bookkeeping services a cost-effective solution.

Q3: What software is commonly used in bookkeeping services?Popular software includes QuickBooks, Xero, FreshBooks, and Sage. These tools streamline financial management and ensure accuracy.

Q4: How much do bookkeeping services cost?The cost varies depending on the scope of services, the size of your business, and the service provider. Many providers offer customizable plans to suit different budgets.

Q5: Are bookkeeping services secure?Reputable bookkeeping services prioritize data security, employing encryption, secure servers, and regular backups to protect your financial information.

0 notes

Text

Payroll Services - Your Payroll Solution

At Monk Tax Solutions, we understand the challenges that come with managing payroll. Our goal is to offer a comprehensive payroll solution that takes the stress out of the process, ensuring your employees are paid accurately and on time, every single pay cycle.

0 notes

Text

youtube

Payroll Management Software in India

A payroll solution insinuates programming or administration used by associations to direct and deal with representative pay rates, compensation, rewards, and derivations. These worker pay rates, compensation, rewards, and allowances various pieces of the payroll cycle, saving time and diminishing mistakes.

#payroll management software#best payroll management system#payroll solution#payroll system in india#payroll management software in vadodara#Youtube

0 notes

Text

Top Workforce Management and EOR Service Providers in India

Optimize your business with our comprehensive remote Workforce Management Solution. Enhance your organization's agility and productivity today.

Top Notch Services by Wage Out Global

Workforce Management: Wage Out Global offers end-to-end solutions for managing your workforce efficiently. From talent acquisition and onboarding to performance management, they handle it all, allowing you to focus on your core business operations.

EOR Expertise: As an EOR service provider, Wage Out Global takes on the legal and administrative responsibilities of an employer. This enables you to tap into talent from various parts of India without the complexities of establishing a legal entity.

Payroll Solutions: Smooth and timely payroll management is critical for employee satisfaction and operational harmony. Wage Out Global's Payroll services ensures accurate and compliant payment processing, freeing you from the intricacies of payroll management.

https://www.wageoutglobal.com/

1 note

·

View note

Text

Ways to efficiently structure your company's payroll function

Organizational structure is an essential component of every company, whether consciously acknowledged or not. It serves as the framework for assigning roles, responsibilities, job functions, accountability, and decision-making authority within the organization. Similar to the overall organizational structure, the structure of the payroll function is equally important. It should be designed to align with the company's goals and objectives to ensure efficient payroll management and overall organizational success.

Managing payroll involves various tasks, such as calculating employee hours, processing payments, tax withholding, and maintaining accurate financial records for your business. The intricacies of payroll management, from handling sensitive employee data to tax calculations and fund transfers, can be complex and carry legal responsibilities. It is crucial to ensure compliance with legal requirements when managing payroll. Additionally, structuring the payroll function is vital to any organization's payroll strategy. So, let's discover ways to structure your company's payroll for better efficiency and employee satisfaction. Also, find the 7 FAQs when it comes to the ideal payroll solution for your organization.

Why do you need to structure your payroll function?

Structuring your company's payroll function is crucial for many reasons. By investing in well-designed payroll processing, organizations can effectively manage one of the most critical aspects of their operations while supporting overall business success.

Here are a few reasons why you must consider structuring your organizational payroll.

· Accuracy and timeliness

A well-structured payroll function ensures accurate and timely payment to employees. Organizations can minimize errors in calculations, deductions, and tax withholdings by establishing transparent processes, roles, and responsibilities and leveraging technology. This, in turn, helps build trust and maintain positive employee relations.

· Compliance with laws and regulations

Payroll structuring ensures organizations comply with various labor laws, tax regulations, and reporting requirements. By staying up-to-date with changing regulations, implementing internal controls, and conducting periodic audits, companies can avoid penalties, legal issues, and reputational damage associated with non-compliance.

· Efficiency and productivity

Structuring payroll optimizes efficiency and productivity within the organization. By automating manual processes, integrating systems, and streamlining workflows, payroll staff can focus on value-added tasks instead of repetitive administrative work. This frees up time for strategic initiatives and enhances overall productivity.

· Cost savings

Effective payroll processing can lead to cost savings in multiple ways. Automation reduces manual labor and associated costs, while accurate calculations and compliance prevent costly errors and penalties. Moreover, streamlined processes reduce administrative burdens, allowing staff to work on other critical areas.

· Employee satisfaction and retention

Timely and accurate payment is crucial to employee satisfaction. A well-structured payroll function ensures employees receive their wages and benefits without delays or errors, fostering a positive work environment. This contributes to higher employee morale, engagement, and retention.

· Data security and confidentiality

Payroll structuring emphasizes secure data management practices, protecting sensitive employee information. Organizations can mitigate the risk of data breaches and maintain confidentiality by implementing appropriate safeguards, encryption measures, and access controls.

· Reporting and decision-making

Structured payroll systems provide accurate and comprehensive reporting capabilities. This enables management to access key payroll data, such as labor costs, tax liabilities, and benefits expenses. Such data support informed decision-making, financial planning, and strategic resource allocation.

How to structure your payroll?

A well-functioning payroll department is crucial for maintaining high employee satisfaction and improving overall organizational productivity and efficiency. Employees have a rightful expectation that their organizations will consistently and accurately compensate them according to their employment contracts.

However, a slow, overly complex, or error-prone payroll process can strain employee and employer relationships and waste valuable time for HR teams. To avoid such challenges and achieve efficiency, compliance, and timely payment, it is essential to structure the payroll function effectively.

Determining the structure of the payroll function is a key component of any organization's payroll strategy, regardless of its global or domestic operations. The structure primarily depends on two factors: the concentration of payroll activities and the desired level of outsourcing versus in-house management of these activities. In the following sections, we will guide you through the considerations for each of these factors.

· Degree of concentration in payroll activities

As a company expands its operations across different states, provinces, or national borders, the workforce grows in size and diversity. Consequently, the payroll function becomes more intricate due to the diverse regulations and laws in each specific region.

Initially, companies often opt to establish separate payroll departments for each business unit or location, which usually leads to inconsistent processes, duplication of tasks, and inefficiencies. However, best practices suggest adopting a centralized model for administrative and transactional finance activities, including payroll.

According to a survey, 77% of businesses have implemented centralized payroll systems.

In the case of large global organizations, centralization is typically implemented regionally, as relying on a single centralized team may not suffice for the entire global workforce.

In an optimal scenario where organizations have well-developed payroll departments, they aim to create a Payroll Center of Excellence (COE) responsible for overseeing governance, policies, processes, continuous improvement, standards, technology, automation strategy guidance, and establishing performance metrics for the entire organization's payroll operations. Subsequently, these policies and guidelines can be customized as per the specific requirements of individual regions or locations.

Moreover, assigning a global process owner who can oversee the entire payroll processing is beneficial, ensuring dedicated governance and focused attention to the process.

For organizations with a wide geographical presence, exploring the option of establishing regional payroll shared services centers may be beneficial. These centers promote the growth of process knowledge, standardization, improved reporting and analysis capabilities, enhanced compliance oversight, and eliminate redundant tasks.

· Level of activities managed in-house vs. outsourced

Typically, businesses opt to outsource non-core tasks or those that external parties can perform more effectively. This decision is driven by factors such as cost reduction, improved efficiency, adherence to regulations, and access to specialized knowledge.

Payroll processing can be intricate and challenging, especially considering the dynamic nature of rules and regulations across industries and countries. It is not surprising that many businesses opt to outsource their payroll operations, either partially or entirely, to external providers. This approach offers several advantages, making it a popular choice for organizations. Here are some of the key reasons why businesses choose payroll outsourcing:

Saves time

Minimizes payroll errors

Improves security

Maintains compliance

Integrates data

Facilitates employee self-service

Typically, experts suggest considering a comprehensive payroll outsourcing solution that seamlessly integrates various components of workforce management with the payroll system. This inclusive platform covers the entire spectrum, encompassing recruitment, benefits, performance evaluation, and more. By consolidating these functions into a unified system, businesses gain advantages such as generating comprehensive reports, improving efficiency by replacing multiple platforms with a single one, fostering effective communication between employees and employers, and other benefits.

How to Manage an Effective Payroll Department

Managing an effective payroll department is crucial for any organization's financial stability and employee satisfaction. A well-run payroll department ensures accurate and timely payment processing, compliance with tax regulations, and seamless communication with employees. This section will explore essential strategies and best practices to manage a payroll department efficiently. From establishing streamlined processes to leveraging technology and prioritizing compliance, these insights will empower businesses to optimize payroll operations, reduce errors, and enhance overall organizational effectiveness.

· Have a standardized and streamlined payroll system

· Ensure payroll integration with other business functions

· Update payroll software

· Stay up-to-date on the latest employment laws

· Establish a payroll calendar

· Have a backup

· Outsource your payroll process

· Perform regular audits

· Hire qualified staff

Choosing the Right Payroll System - 7 FAQs

1. What features should I look for in a payroll system?

When evaluating payroll solutions, key features to consider typically include automated payroll calculations, tax management, direct deposit capabilities, benefits administration, reporting and analytics, compliance support, and integration with other HR or accounting systems.

2. Should I opt for an in-house or cloud-based payroll system?

Both in-house and cloud-based payroll systems have their advantages. In-house systems provide more control and customization, while cloud-based systems offer accessibility, scalability, and automatic updates. Consider your organization's size, IT infrastructure, budget, and data security requirements when making this decision.

3. How do I ensure data security and compliance?

Data security and compliance are paramount in payroll management. Look for payroll solutions that employ strong encryption, data backups, access controls, and compliance features for tax regulations and labor laws. Additionally, consider the system's track record for security breaches and their measures to address them.

4. Can the payroll system handle my organization's specific needs?

Evaluate whether the payroll system can accommodate your organization's unique requirements, such as multi-state or international payroll, complex compensation structures, timekeeping integration, employee self-service portals, or specific reporting needs. Ensure the system is flexible enough to adapt to your evolving payroll demands.

5. What level of customer support is provided?

Consider the availability and quality of customer support the payroll solution provider offers. Look for prompt assistance, training resources, user forums, and a responsive support team that efficiently addresses your inquiries or troubleshoots issues.

6. How much does a payroll system cost?

Payroll system costs can vary depending on factors like the size of your organization, the number of employees, and the complexity of your payroll processes. Consider both upfront costs, such as software licenses or implementation fees, as well as ongoing fees for maintenance, updates, and support. Evaluate the system's return on investment (ROI) regarding time savings, reduced errors, and improved efficiency.

7. Can the payroll system scale with my organization's growth?

Ensure that the chosen payroll solution can accommodate your organization's growth and future needs. Assess its scalability, ability to handle an increasing employee count, and compatibility with expanding business operations. Consider long-term partnerships and whether the system can adapt as your organization evolves.

Conclusion

Outsourcing payroll management to third-party service providers has emerged as a prominent trend in the business world. This trend is observed among companies of various sizes, as they recognize the significant cost savings achieved through outsourcing. Particularly for small business owners lacking the necessary resources to develop or update their payroll systems, opting for a professional, comprehensive payroll management company offers a strategic and economically viable solution.

47% of companies have chosen payroll outsourcing for their operations.

Exela HR Solutions provides highly effective, end-to-end payroll solutions that are customized to meet the unique requirements of businesses. Our comprehensive platform assists organizations in automating payroll processing and offers self-service tools for seamless payroll management by employees. Reach out to our experts at Exela HR Solutions today and discover our range of payroll services!

DISCLAIMER: The information on this site is for general information purposes only and is not intended to serve as legal advice. Laws governing the subject matter may change quickly, and Exela cannot guarantee that all the information on this site is current or correct. Should you have specific legal questions about any of the information on this site, you should consult with a licensed attorney in your area.

Source & to read more: https://ow.ly/EQRW50Pauzw

Contact us for more details: https://ow.ly/FutP50OUQVK

#Payroll Function#Payroll Processing#Payroll Outsourcing#Payroll Solutions#Payroll Solution#Global Payroll Processing#HR Outsourcing#Payroll#Payroll Management#Payroll Outsourcing Service#HR Services#Exela HR Solutions

1 note

·

View note

Text

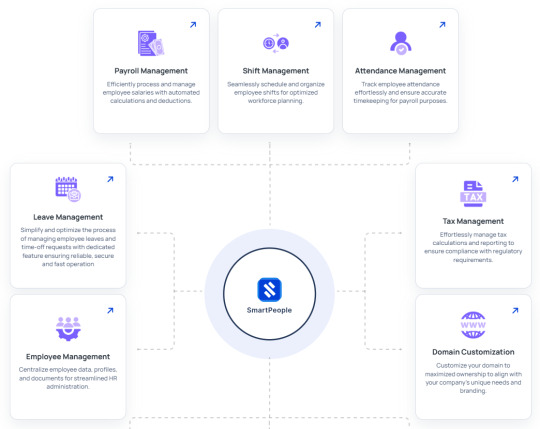

Streamline Workforce Management with SmartOffice: The Smart HR Solution

Effective workforce management is essential for success and growth in today's fast-paced business environment. SmartOffice is a cloud-based HRM solution that offers a comprehensive set of tools to meet current and future business needs. Whether managing internal growth or onboarding new hires, SmartOffice guarantees a smooth, effective, and significant HR experience.

SmartOffice unifies all crucial HR operations into a single, intuitive platform, revolutionizing the way companies handle their human resources. From hiring and onboarding to promotions and staff grouping, this one-stop shop streamlines intricate HR duties and improves overall business performance.

SmartOffice's work slot allocation feature makes onboarding easier than ever by guaranteeing that each new hire is assigned to the appropriate role right away. Productivity is increased, and new hires are able to get started quickly thanks to this strategic placement.

Employee mobility features from SmartOffice make it simple to identify and reward talent. HR professionals can highlight high performers and facilitate career advancement without administrative burden, thanks to the streamlined promotions and transitions.

Advanced access controls and employee grouping can improve security and teamwork. HR managers can assign workers to departments, roles, or projects using SmartOffice, which facilitates efficient teamwork and gives them individualized access to sensitive data.

Businesses that use SmartOffice not only stay up to date with change but also take the lead. Discover a more intelligent approach to personnel management and unleash the full potential of your company. Your doorway to effective, safe, and forward-thinking HR management is SmartOffice.

#hrm#hrmanagement#HR and Payroll Solution#HR and Payroll Software#HRMS Solution#Employee Management#employee management software#employee management system#SmartOffice#SmartPeople

3 notes

·

View notes

Text

How to Pick a Payroll Service That Fits Your Needs

Payroll is crucial for any business, whether it’s a large enterprise or a small business. While big organizations have decent budgets to invest in good payroll software, small businesses have the option of hiring third-party payroll providers.

Finding the best payroll provider is like finding a needle in a haystack. There are so many options that may leave anyone confused about how to select the right one. If you’re looking for your payroll partner, we have this little guide where we’ve curated 8 tips that will help you choose the best payroll service provider.

For more info visit: How to Choose the Best Payroll Provider for Your Small Business

#Best payroll provider for small business#Payroll services for small business#Small business payroll solutions#Payroll outsourcing for small businesses#Payroll provider comparison#Small business payroll management#Payroll compliance services#Tips for selecting payroll services for small business#Questions to ask before hiring a payroll provider#Cost-effective payroll service options for SMEs#Secure and compliant payroll services for businesses

1 note

·

View note

Text

The financial landscape is changing fast. Stay ahead with Unison Globus, your go-to partner for tax, accounting, and bookkeeping solutions tailored for CPAs, EAs, and accounting firms in the US.

Why Unison Globus?

Expert Support: Access top-notch professionals with deep expertise.

Streamlined Operations: Achieve efficiency, accuracy, and compliance effortlessly.

Cost-Effective Solutions: Simplify your tax season with our bundled services.

Equip your firm for the challenges of 2025 and beyond. Focus on what truly matters—your clients and strategic growth.

Connect with Us Today!

📩 Email: [email protected] 📞 Call: +1-407-807-0100 🌐 Visit: https://unisonglobus.com/

#Tax Preparation Services#Accounting Solutions#Bookkeeping Services#CPA Support#EA Services#Financial Compliance#Payroll Management#Tax Filing Assistance#Management Consulting#IRS Compliance#Business Tax Solutions#Small Business Accounting#Tax Deduction Optimization#Financial Record Keeping#Tax Season Preparation#Expert Tax Advice#Professional Accounting Services#tax accountant#tax advisor#accounting#tax preparation#tax services#outsourced accounting services#accounting services#accounting firms

1 note

·

View note

Text

Simplify your payroll management with Coastal Payroll’s all-in-one HR management software. Our automated payroll solution will ensure payments are processed correctly and on time for the team; it will make payment the same day and provide real-time reporting. Integrate with a general ledger system; tax management; accruing benefits; handling garnishments-that is a payroll with no complication for you. Enjoy support from a real person whenever you may need it. From small to large, Coastal Payroll's technology and services work for you!

0 notes

Text

Best Recruitment Services Agency | Global HR Solution

website :https://globalhrsolutions.in/recruitment-services

#hr solutions#human resource solution#hr#hrm#temporary staffing#contractual recruitments#contractual staffing#outsourcing service#outsourcing taxation#outsourcing accounting#outsourcing finance#business consulting#staffing#contractor#placement consultancy#placement agency#human resources#recruitment#hrmanagement#payroll#hiring#talent acquisition#corporate compliance#executive search#global hr solutions#b2b services#b2b lead generation#b2bmarketing#outsourcing#onlinebusiness

2 notes

·

View notes

Text

Online Payroll Management Software - Get 15 Days Free Trail

Payroll Management Software is wanted to modernize your cash strategy and make it quieter than any time in memory to deal with your resources. Through modernizing in every practical sense, all piece-related undertakings, this payroll system guarantees consistency with charge rules and other monetary guidelines of India. It is easy to utilize and has every one of the highlights you would anticipate from a cash objective, making it a staggering propensity for affiliations, all things considered.

With the assistance of this thing, you can at first get a free demo starter for 15 days.

#payroll system#payroll management software#best payroll management system#payroll solution#online payroll management software for india

0 notes

Text

Unlocking Business Efficiency with ERPNext HR & Payroll Services by Sigzen Technologies

In the fast paced landscape of contemporary business, the role of technology in enhancing Human Resources functions has become paramount. Sigzen Technologies emerges as a frontrunner in this revolution, offering cuttingedge ERPNext HR & Payroll services that redefine how organizations manage their workforce. Let’s delve into the key modules and features that make Sigzen’s solution a…

View On WordPress

2 notes

·

View notes

Text

3 notes

·

View notes